Asset recovery annual statistical bulletin: background context note

Published 9 September 2021

Applies to England, Northern Ireland and Wales

This note provides useful legislative background and definitions to enhance the statistics published in the Annual Statistical Bulletin for Asset Recovery.

This report is regularly reviewed and updated annually to reflect additions, and changes that are relevant to the statistics.

Statistical information on the Bulletin can be found in the accompanying Methodology and Quality Report.

Legislation on Asset Recovery

An overview of the legislative process and the legislative powers applied by law enforcement agencies under the two main systems for asset recovery are outlined below.

Legislative Background on the Proceeds of Crime Act

The Proceeds of Crime Act (POCA) 2002 outlines the statutory framework used to enable the investigation and prosecution of crimes relating to benefit from criminal conduct; or crimes relating to property obtained through unlawful conduct or which is intended to be used in unlawful conduct. It is also used to deprive criminals of their money or other property connected to criminal activity.

Main Systems for Asset Recovery

The asset recovery powers in POCA to deprive and recover the proceeds of crime or other property connected to criminal activity can be applied through criminal confiscation, forfeiture, civil recovery, and taxation. Part 2 of POCA makes provision for the confiscation of a person’s benefit from criminal conduct, following a criminal conviction. If the relevant statutory conditions are satisfied, the court must decide the recoverable amount for that person and make an order (a Confiscation Order) requiring him to pay that amount.

Civil Powers

-

Forfeiture powers enable the seizure, detention and forfeiture of cash, monies in relevant accounts or listed assets, which is determined to be or to represent property obtained through unlawful conduct or property intended for use by any person in unlawful conduct

-

Civil Recovery Order powers enable an enforcement authority to recover property which is determined to be or to represent property obtained through unlawful conduct and applications are made in civil proceedings before the High Court

-

Taxation is a legislative power which sits with the National Crime Agency (NCA) and HM Revenue and Customs (HMRC), enabling the NCA and HMRC to tax income using revenue powers, where there are reasonable grounds to suspect that the income is the proceeds of crime

Changes Introduced Under the Criminal Finances Act (CFA) 2017

Legislative changes introduced to amend the POCA legislation include the provisions described below.

The Criminal Finances Act 2017 (CFA) amended POCA, most notably introducing two new forfeiture powers and an investigative tool to give Law Enforcement (LE) and partners new powers for tracing and recovering: the proceeds of crime; property obtained through unlawful conduct; or property intended for use in unlawful conduct. The prominent powers which came into force from 31 January 2018 include Unexplained Wealth Orders (UWOs) and Account Freezing Orders (AFOs). They improve significantly the ability of LEs to tackle economic crime.

Definitions for the different civil and criminal powers can be found below.

Definitions of POCA Powers

Definitions of the POCA legislative powers are outlined below. An illustrative example of the proceedings system is given in the supplementary figures of the Asset Recovery Process by criminal confiscation powers and civil powers in Appendices A to D.

Criminal Confiscation Powers

Restraint Orders

Restraint Orders are part of the criminal confiscation powers in POCA, which grant the prosecutor the ability to apply to the court for an order freezing “realisable property” so that it may be used to settle a potential Confiscation Order at a later date. A Restraint Order prevents a defendant from disposing their property.

A Restraint Order can be sought in respect of realisable property by the prosecutor as soon as a criminal investigation has started. The order can be granted by a court provided the statutory conditions for the making of an order are fulfilled.

There is no limit on the value of property that can be restrained, but the value will usually be equal to the amount by which a defendant has been determined to have benefitted from his crimes.

Confiscation Orders

When the relevant statutory conditions for the making of a Confiscation Order are met, the court must make a Confiscation Order. The defendant will then be liable to pay the full amount by a date set by the court. This payment may come from proceeds of crime restrained using a Restraint Order, or from other assets, whether determined to be the proceeds of crime or not. If a Restraint Order was in place, this will not end when a Confiscation Order is granted but will instead end when the full amount has been paid by the defendant.

Civil Powers

Cash Seizures

The Cash Seizure powers in POCA enable the seizure of cash with a minimum value of £1,000, which can then be followed by a civil process in the Magistrates court, for the detention and forfeiture of that property. This does not require a criminal prosecution or conviction. As a result, the cash seizure, detention and forfeiture provisions effectively prohibit anyone from accessing or using cash during the period up to the completion of the application to forfeit on the basis that there are reasonable grounds to suspect that the cash is recoverable property or property that is intended for use in unlawful conduct.

Any cash which is seized can initially be detained for a 48-hour period, but this detention period can be extended to six months following approval at a magistrates’ court. The maximum amount of time which cash can be seized for is two years.

Account Freezing Orders

Account Freezing Orders are part of the CFA 2017 amendments to POCA powers. It provides that senior HMRC officers, constables, SFO officers and accredited Financial Investigators have the power to apply to the court for the freezing of money in a relevant account with a minimum value of £1,000. As for cash, this is a civil process, which does not require criminal prosecution or conviction. As in the case of cash, this prevents any persons from accessing or otherwise using the money in the account during the period up to the completion of the application to forfeit on the basis that there are reasonable grounds to suspect that the cash is recoverable property or property that is intended for use in unlawful conduct.

Non-senior enforcement officers can exercise this power with prior approval from a judicial officer, or a senior officer. Account Freezing Order applications can be made without giving the affected parties notice if notice of the application would prejudice any steps to secure forfeiture of money. The order can remain in place for a maximum of two years.

Listed Asset Orders

Listed Asset Orders are part of the CFA 2017 amendment to POCA powers. A Listed Asset Order grants HMRC officers, constables, SFO officers or accredited Financial Investigators the power to seize personal property, such as precious metals and precious stones, watches, artistic works, face-value vouchers and postage stamps worth a minimum value of £1,000. Property can be seized if there are reasonable grounds to suspect that it is recoverable property or intended for use in unlawful conduct.

Any seized property can initially be detained for a 6-hour period, but this detention period can be extended by a further 42 hours with the approval of a Senior Officer. Following an order by a magistrates’ court the property may be detained for six months, extended for a maximum period of up to two years.

Forfeiture Orders

A Forfeiture Order can be made by a magistrates court following an application by HMRC officers, constables, SFO officers or accredited Financial Investigators for the forfeiture of cash, monies held in a relevant account or certain listed assets that have been seized and detained under POCA. There are three types of Forfeiture Orders:

-

Cash Forfeiture Order: While cash is detained, an application order may be made for the forfeiture of cash or any part of it to a magistrates’ court or to the sheriff, and where an application is made, the cash is detained (and may not be released under any power) until any proceedings in pursuance of the application (including any proceedings on appeal) are concluded

-

Account Forfeiture Order: While money held in a relevant account is frozen, an application may be made for an order for the forfeiture of this money to a magistrates’ court or to the sheriff, and where an order is made, the institution maintaining the frozen account must transfer that amount of money into an interest-bearing account nominated by the enforcement officer

-

Listed Asset Forfeiture Order: While certain listed assets are detained, an application may be made to a magistrates’ court or to the sheriff (by HRMC officers, constables, SFO officers or accredited Financial Investigators) for an order forfeiting all or part of the property

Unexplained Wealth Order

Unexplained Wealth Orders (UWOs) were introduced as part of the CFA 2017 amendments to POCA powers. They can be granted to specific agencies such the National Crime Agency (NCA), The Crown Prosecution Service (CPS), The Financial Conduct Authority (FCA), the Serious Fraud Office (SFO), and HM Revenue and Customs (HMRC). In Scotland, the Civil Recovery Unit, acting on behalf of, and with the authority of Scottish Ministers, make decisions on whether to apply for a UWO. This order requires an individual or company to provide an explanation on the origin of assets in cases where the value of these assets appear disproportionate to their known income. The legislation states that a UWO can be enforced on assets which have a value greater than £50,000.

UWOs may be granted in respect of individuals or companies suspected of being involved in or having links with serious crime. This power can also be applied to foreign politicians or officials from a state outside the European Economic Area (EEA), their family members or close associates, as such people may pose a particularly high corruption risk. A UWO made in relation to a non-EEA Politically Exposed Persons (PEP) does not also require suspicion of serious criminality. This power can only be exercised pursuant to an order of the High Court. If an individual or company subject to a UWO does provide the information sought, it could result in the applicant for the UWO proceeding to make an application for a Civil Recovery Order.

An Interim Freezing Order can also be applied for alongside a UWO to prevent property being dissipated during the proceedings.

Civil Recovery Order

In England and Wales or Northern Ireland, proceedings for Civil Recovery Orders may be taken by the enforcement authority in the High Court against any person who the authority thinks holds recoverable property. In Scotland, proceedings for a recovery order may be taken by the enforcement authority in the Court of Session against any person who the authority thinks holds recoverable property. This is done through a civil process and requires no criminal prosecution or conviction.

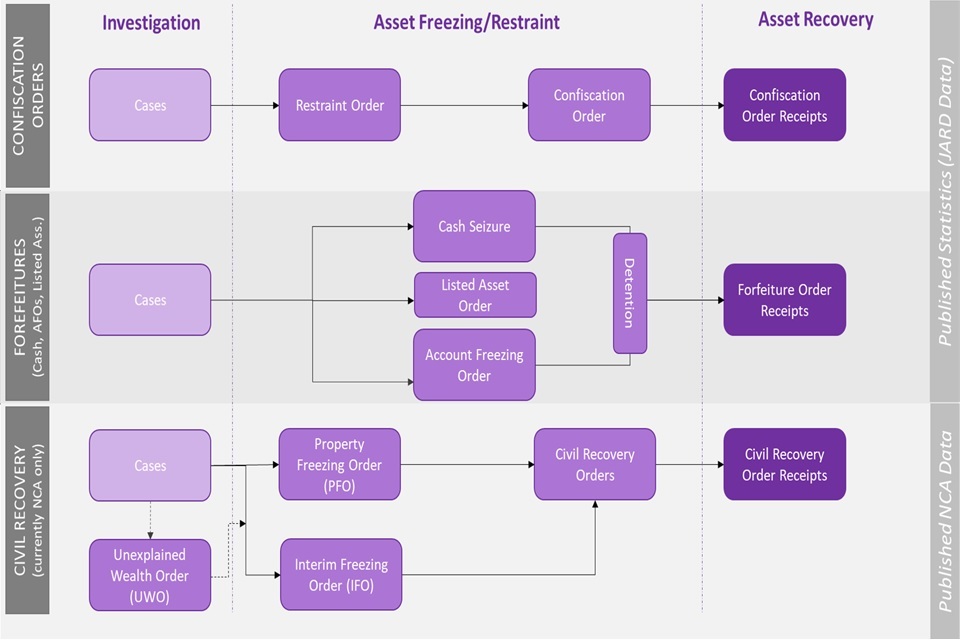

Figure 15: Appendix A: Overview of the Process of the Asset Recovery System for Proceeds of Crime under POCA

The chart in Figure 15 shows an overview of the process of the asset recovery system for the proceeds of crime under POCA using the criminal confiscation system and the civil system.

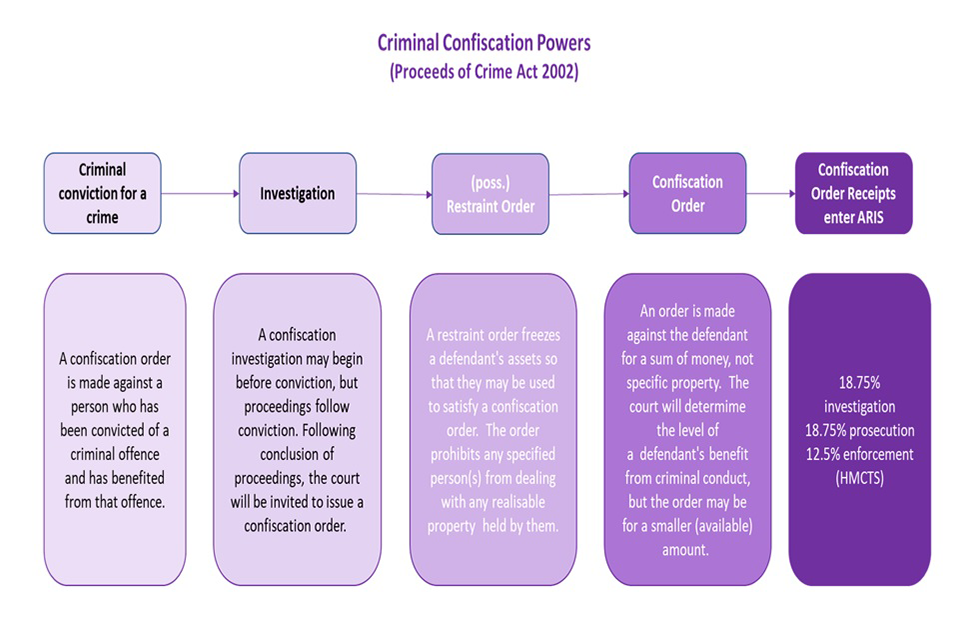

Figure 16: Appendix B: Overview of the Criminal Confiscation System Process for Proceeds of Crime under POCA

The chart in Figure 16 shows an overview of the criminal confiscation system process of the asset recovery system for the proceeds of crime under POCA.

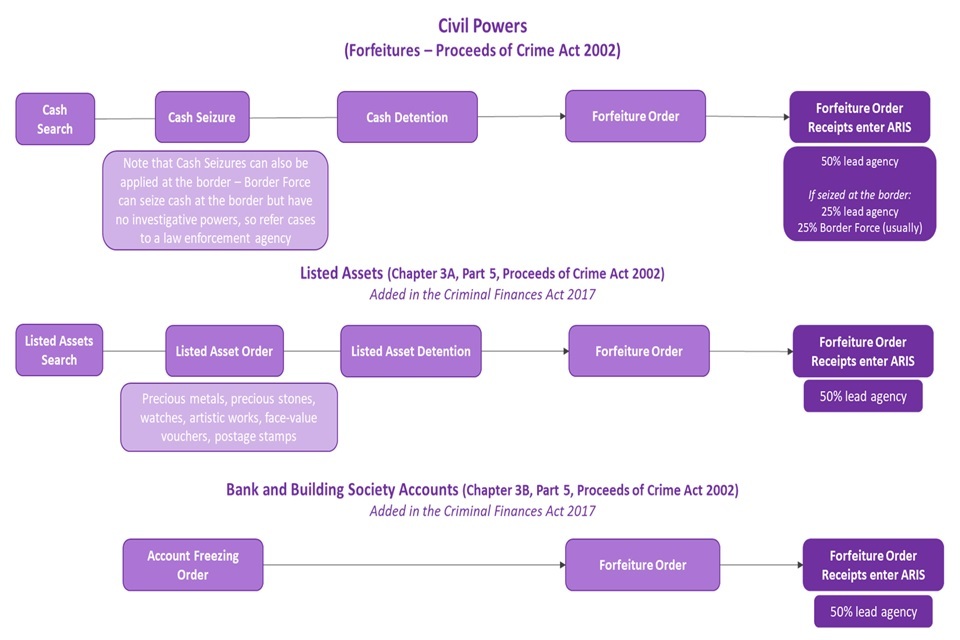

Figure 17: Appendix C: Overview of the Civil System Process for Proceeds of Crime – Forfeitures under POCA

The chart in Figure 17 shows an overview of the civil system process of the asset recovery system for the proceeds of crime under POCA using Forfeiture powers.

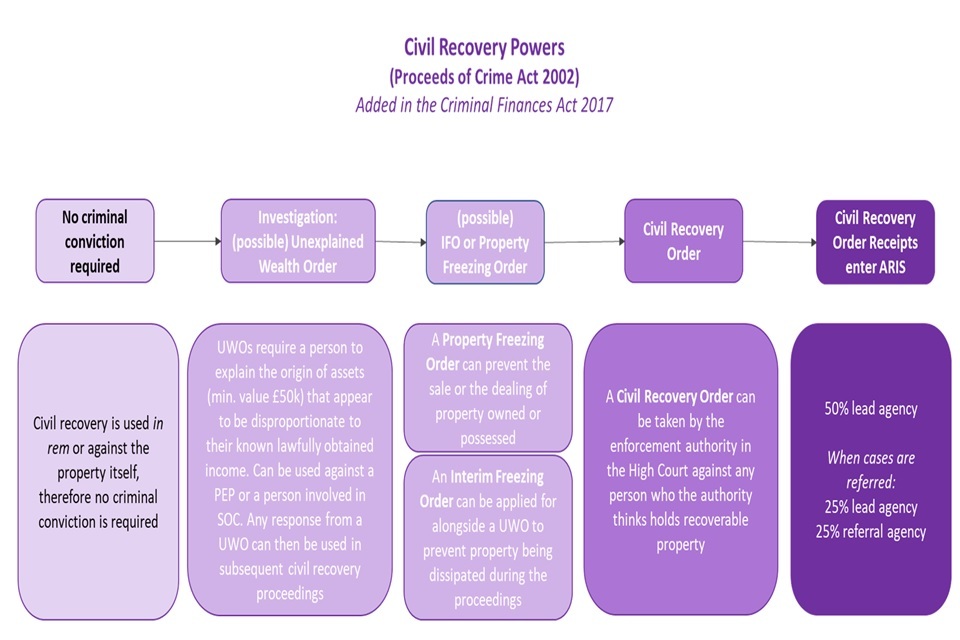

Figure 18: Appendix D: Overview of the Civil System Process for Proceeds of Crime – Civil Recovery under POCA

The chart in Figure 18 shows an overview of the civil system process of the asset recovery system for the proceeds of crime under POCA using Civil Recovery powers.