UKHSA Advisory Board: finance report

Updated 3 November 2022

Title of paper: Finance report

Date: Thursday 29 September 2022

Sponsor: Andrew Sanderson, Director General, Finance, Commercial and Corporate Services

Purpose of the paper

This paper gives an overview of the UK Health Security Agency’s (UKHSA) finances and the in-year position as at Month 4 financial year 2022 to 2023 (the end of July 2022).

At the time of submitting, the Month 5 (end August) figures were being finalised.

Recommendation

The Advisory Board is asked to note UKHSA’s financial position.

Overview and context

UKHSA is an agency of the Department of Health and Social Care (DHSC), so our budgets are allocated from and consolidated into the wider health funding settlement.

UKHSA’s funding is in 3 parts:

- a ring-fenced budget for COVID-19 response

- the core agency budget

- a ring-fenced budget for vaccines and countermeasures which is managed by DHSC

UKHSA budgets for financial year 2022 to 2023 were only agreed in March and were formally confirmed for one year. We are working with DHSC to secure committed future funding for both the core agency and the future COVID-19 strategy. As in other areas of public spending, high inflation will be a challenge.

Following the Month 4 forecast submission, DHSC formally requested £285 million to be deducted from the UKHSA COVID-19 budget to offset wider departmental pressures (in addition to £90 million already transferred for flu camaign). As the £285 million is in line with Month 4 forecast underspend, UKHSA have agreed, though have highlighted potential risks.

The COVID-19 budget covers NHS Test and Trace activity, which transferred from DHSC when UKHSA took on its full functions in October 2021. COVID-19 funding has been reduced from an original £15 billion budget last year to £2.4 billion this year, in line with the ‘Living with COVID-19’ strategy published in February. That strategy included cessation of free universal testing, and targeted testing, linked to epidemiology, for groups at higher risk, particularly in adult social care and the NHS.

The strategy also provided funding to continue the large-scale Office for National Statistics (ONS) surveillance survey; to keep lab capacity available (mainly in the Rosalind Franklin ‘mega-lab’), so that polymerase chain reaction (PCR) testing can be scaled up quickly to respond to a new COVID-19 variant; and to maintain some essential operations such as the technology systems that support testing. There are few precedents for a budget reducing from one financial year to the next on this scale (85%); delivering it safely is a major financial priority for UKHSA this year.

The core budget provides funding for the ongoing functions of the agency – though recognising that UKHSA is a new organisation, with a science and national security remit still under definition. The 2022 to 2023 resource budget, for day-to-day spending, is £456 million. We also rely on generating an additional £150 million of external income.

The capital budget is £135 million. Core UKHSA funding was only confirmed at the end of March, so we carried out a business planning process from April to July to decide how to allocate funding to priorities, alongside developing UKHSA’s 3-year strategy.

Our aim has been to preserve key capabilities that were built up during the pandemic, including expanded health protection operation teams, greater expertise on data, analysis and technology, and a stronger commercial function; as well as strengthening UKHSA’s scientific and clinical functions. For capital, the priorities are to invest in the maintenance and development of UKHSA’s specialist laboratory sites, and in modernising data and technology systems.

The ring-fenced budget for vaccines and countermeasures[footnote 1] is currently forecast to spend £0.9 billion this year. For non-COVID vaccines and countermeasures, UKHSA accounts for the purchase costs and is responsible for managing the supply chain and distributing vaccines to the NHS. However, funding decisions are made by DHSC, which adjusts the budget to match the expenditure.

For COVID-19 vaccines, UKHSA is responsible for the costs of supply and distribution in the same way, but the purchasing is currently done by the Vaccines Taskforce. From October that responsibility and budget will transfer to UKHSA. A memorandum of understanding is being developed with DHSC to set out roles and responsibilities, including on financial decisions. An update on the transfer will be sent early next month to the Audit and Risk Committee.

The table above shows resource and capital departmental expenditure limits (RDEL and CDEL), split by the 3 parts of core agency, COVID-19, and vaccines and countermeasures. It shows year-to-date budget and spending for April to July, and budget and forecast outturn for the full year.

COVID-19 budget

COVID-19 spending to July in resource DEL was £178 million lower than plan, with a £285 million forecast underspend for the year. Rapid demobilisation of testing sites and operations, driven by effective UKHSA oversight, has contributed to this, by taking out cost faster than expected; but a significant driver is that lateral flow device testing in the NHS has been lower than predicted.

The forecast is likely to vary as testing demand fluctuates over the year. On COVID-19 capital, the forecast is for a credit (negative spend) of £157 million, as testing supplies that were purchased last year are used this year. (Under budgeting rules set by HM Treasury, test supplies are treated as capital when purchased; but, when they are consumed, the cost is reversed from capital and shown as a resource expense instead.)

Besides the inherent volatility of testing demand, there are pressures, risks and opportunities around the forecast. But on current trends, actual spend, driven by epidemiological reality, is on a lower trajectory than the allocated budget. Forecast financial headroom in UKHSA can help offset COVID-related and other pressures in the wider health group, and we are working closely with DHSC on this, while maintaining constant focus on changes in pandemic requirements.

Core budget

The year-to-date figures show a slight overspend on resource DEL, some of which relates to COVID-19 expenditure being incorrectly charged to core budgets. The current full-year forecast is to spend to budget. The overall direction on resource spend is more likely to be a trajectory towards underspend than a pressure, especially given that UKHSA restructuring (see below) and wider Civil Service recruitment controls may slow our ability to spend. The core budget is shown net of external income; currently the agency is on track to hit its income assumptions.

Capital core

The delays in setting budgets have contributed to slow progress in capital spend so far, with only £20 million spent in the first 4 months. There is a significant risk of underspend. We are working to accelerate delivery of capital projects and to identify additional opportunities for investment, including priority maintenance work on our estates.

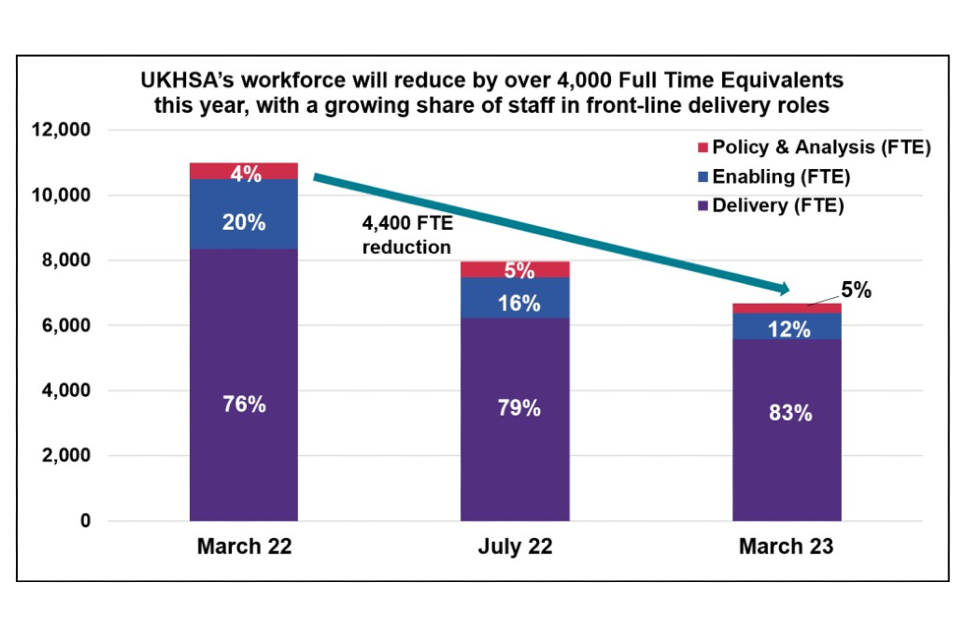

As outlined in the People Strategy paper, UKHSA is reducing its workforce from around 11,000 full-time equivalent staff (FTE) in March 2022 to around 6,700 FTE by end-March 2023 as part of our COVID-19 ramp down. This primarily involves rolling off agency staff and contractors, and the natural expiry of fixed term contracts. Each UKHSA group has developed plans to achieve these reductions, and we are on track to achieve the end-year position.

At the same time as implementing our overall reduction, UKHSA needs to recruit skilled roles into science, laboratory, clinical and medical vacancies in order to provide our front-line delivery services and build an enduring organisation.

This autumn, around 85 staff will join UKHSA from the Department for Business, Energy and Industrial Strategy, as part of the transfer of the Vaccines Taskforce.

Other financial issues

Accounts 2021 to 2022

The first annual report and accounts for UKHSA is due to be published at the end of 2022. Normally, accounts would be produced in the summer, but the complexities of COVID-related spending mean that the timetable is later than usual. The audit of 2021 to 2022 is currently under way, but it is virtually certain that the first UKHSA account will have a modified audit opinion from the National Audit Office (NAO), in particular relating to Test and Trace inventory.

At the height of the pandemic, the Test and Trace programme (then part of the central DHSC) rapidly created a supply chain capable of storing and distributing billions of pounds worth of inventory, including PCR test kits and lateral flow tests.

Working at unprecedented speed and scale, it was not possible to implement gold- standard inventory systems that integrated with DHSC finance systems. As a result, while the department was successful in securing test kits sufficient to supply the UK, it was left with incomplete records of what had been used and the location, condition and quality of the remaining items at the year end.

This led to the NAO limiting the scope of its audit opinion on the inventory balances and inventory transactions in the DHSC 2020 to 2021 account. It is almost certain that the NAO will apply the same limitation to the inventory transferred to UKHSA in October 2021. There may also be a limitation relating to vaccines and other stock transferred to UKHSA from Public Health England (PHE), as it was not possible to undertake full stock-takes at the end of September 2021 in some warehouses without endangering public health.

Losses and special payments

The annual report will show that, in 2021 to 2022, UKHSA recognised over £100 million of losses and special payments on Test and Trace activity: for example, through disposal of assets and materials that were no longer required for the COVID-19 response, or settlements with suppliers.

These nearly all relate to contracts that pre-dated UKHSA’s formation, intended to mitigate the risk of not having sufficient resources and goods to respond to the developing pandemic. They should be seen in the context of the unprecedented circumstances of the pandemic and over £25 billion expenditure on Test and Trace across 2020 to 2021 and 2021 to 2022. The annual report will provide further details.

There can be a timing difference between when an arrangement is entered into and when a loss crystalises in the accounts. So it is likely that further losses will be recorded in 2022 to 2023 and beyond, following the ramp-down of testing activity under Living with COVID-19.

Porton Biopharma Limited (PBL). PBL is a company and subsidiary of UKHSA, which was spun out of PHE in 2015 as a separate legal entity. PBL’s main product is Erwinaise, a specialist childhood leukaemia drug which it produces and sells on a commercial basis.

It also produces the strategic Anthrax Vaccine which is sold to the Ministry of Defence. There is currently a strategic review of the company following material changes to the US market. As such, the valuation of PBL is a significant item in UKHSA’s accounts

-

UKHSA maintains a stock of medical countermeasures for responding to chemical, biological, radiological and nuclear incidents, as well as some stocks of anti-venoms and anti-toxins. ↩