The Self-Employment Income Support Scheme (SEISS) final evaluation July 2023 (HTML)

Published 24 April 2024

1. The Self-Employment Income Support Scheme (SEISS) final evaluation July 2023

The policy and key statistics:

- The SEISS was a central part of the government’s response to the COVID-19 pandemic.

-

SEISS aimed to support self-employed individuals whose businesses were adversely affected by COVID-19 restrictions.

- It aimed to: Quickly support individuals reliant on self- employed income; Enable self-employed people to remain in business; and Provide support broadly equivalent to the Coronavirus Job Retention Scheme.

- Delivered as a series of 5 grants between May 2020 and September 2021, with policy adjustments based on changes in COVID-19 restrictions.

- A total of 2.9 million eligible self-employed individuals claimed SEISS grants, totalling £28.1 billion.

2. Methodology

The evaluation includes:

- A process evaluation which assessed how effectively the scheme was designed and delivered.

- An impact evaluation which covers the impacts across all SEISS grants and assesses the scheme’s VFM.

- A quasi-experimental approach was taken, using a Fuzzy Regression Discontinuity Design (RDD). The cut-off point was at £50,000 average trading points.

A Value for Money (VFM) approach was used, which followed the ‘4 Es’: economy, efficiency, effectiveness and equity. It considered:

- Social value: considering the scheme’s value to society (e.g. effect on public welfare).

- Exchequer value: considering direct effects on public finances.

3. Findings

- Good VFM was found with a net benefit to society of £14.2bn and a social benefit to cost ratio 3.8:1.

-

Helped support trading profits and incomes for many self-employed people who were most affected by COVID-19.

- The SEISS was designed and implemented swiftly. The scheme was easy to understand, and the claim process was simple.

- Within 12 days of the scheme opening, 88% of claims for the first grant were paid.

- Total benefits are estimated to be worth £19.3bn.

Error and fraud were effectively managed throughout the lifetime of the SEISS. Final estimate of overall error and fraud estimated to be 5.2% which compares favourably with overall UK tax gap for Self Assessment which is estimated to be 11.2% in 2021 to 2022.

- SEISS helped businesses continue trading in the short term. However, long term impacts less clear due to lag in self assessment data.

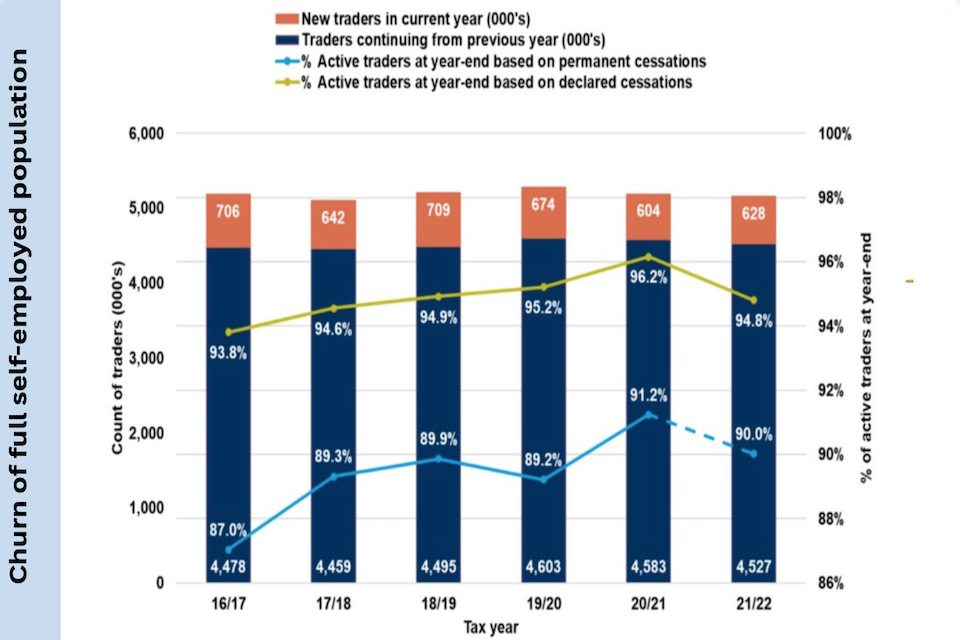

- Eligible claimants were 2.8 percentage points more likely to remain trading in 2020-21 than those assessed as ineligible at the scheme’s £50,000 average trading profits eligibility threshold.

- The SEISS supported demand in the wider economy, providing some macroeconomic benefit.

- A lesson learned from the SEISS is that improved data and more timely reporting of self-employed profits could have led to improved targeting of the scheme, a reduction in deadweight and the inclusion of some groups who were not able to access the scheme.

Churn of full self-employed population graph.

4. Impacts

This programme succeeded in ensuring most self-employed people were protected from a significant drop in income that they may otherwise have experienced.

The analysis also shows that the SEISS helped support businesses to continue trading.