The Programme and Project Partners Supply Chain Strategy

Published 14 September 2021

1. Executive Summary

The Programme and Project Partners model is changing the way we deliver projects at Sellafield and creating a lasting legacy through long-term partnerships.

Four world class organisations have come together to enable Sellafield Ltd to achieve its mission, safely and securely.

The new approach will support faster, more effective project delivery, stability in design and construction supply chains, greater workforce flexibility, and local economic benefit.

This document outlines the engagement principles, how the Programme and Project Partners is structured and what we expect our supply chain to deliver over the next 18-year period.

It is anticipated that this strategy sets out the near term (2 year) horizon and the partnership will measure performance and update the strategy to ensure we achieve a robust and collaborative supply chain.

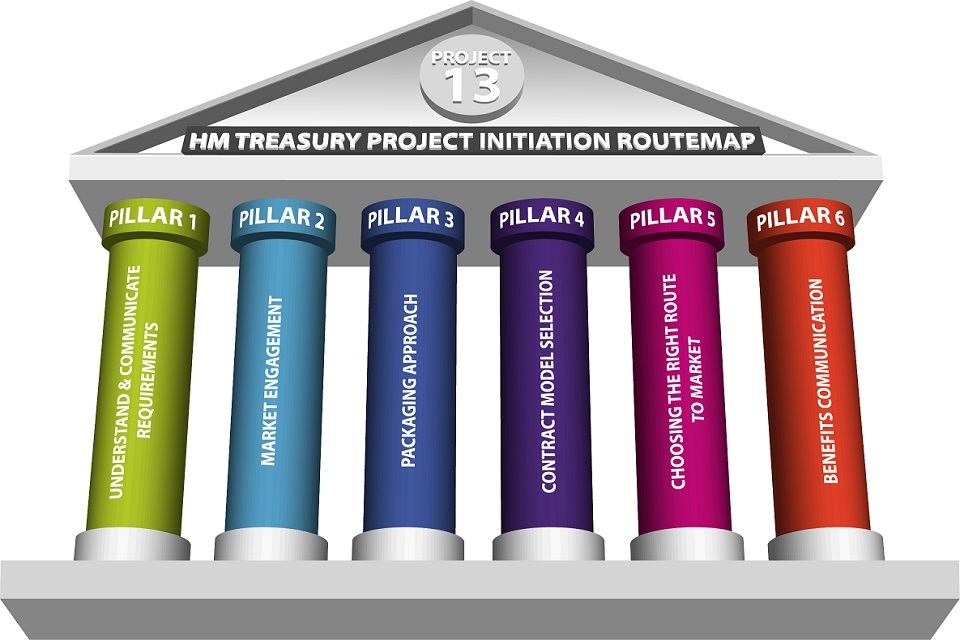

The Programme and Project Partners approach to supply chain aligns and enforces the best practice principles contained within HM Treasury Routemap, Project 13 and the Construction Playbook.

The supply chain strategy seeks to foster long-term relationships with the supply chain who, given equitable contracting terms, detailed opportunity visibility and aligned incentivisation will jointly deliver the portfolio of works and therefore directly contribute to the 5 Programme and Project Partners critical success factors.

Further details on each critical success factors are presented in this document.

The strategy starts with the 6 pillars approach as defined within the procurement module of HM Treasury Routemap.

This structured process defines each of the critical steps required to deliver a robust supply chain.

In turn, the Programme and Project Partners has described specific initiatives which we will implement under each pillar, where each activity represents an innovative and more collaborative approach to contracting in order to realise wider benefits above and beyond successful project delivery.

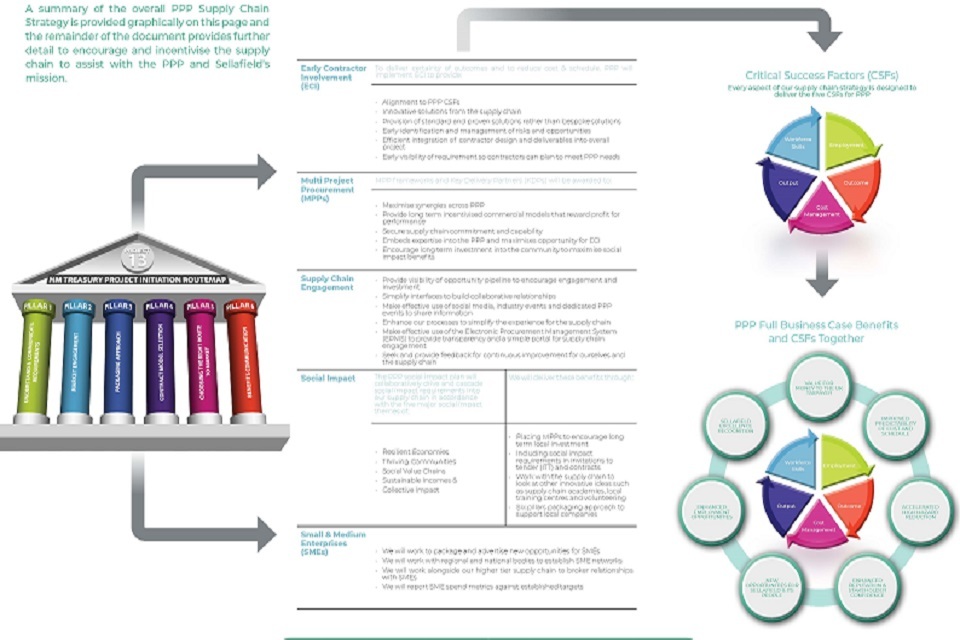

A summary of the overall Programme and Project Partners Supply Chain Strategy is provided graphically on this page and the remainder of the document provides further detail to encourage and incentivise the supply chain to assist with the Programme and Project Partners and Sellafield Ltd’s mission

A summary of the overall PPP Supply Chain Strategy

2. Programme and Project Partners model

Sellafield Ltd is the organisation responsible for the safe operation and clean-up of the Sellafield site in Cumbria, UK, as a wholly-owned subsidiary of the Nuclear Decommissioning Authority (NDA).

The Programme and Project Partners model is changing the way we deliver projects at Sellafield and creating a lasting legacy through long-term partnerships.

The approach will support the transformation of the company from a nuclear operator into a world leader in environmental remediation.

The Programme and Project Partners will play a pivotal role in the delivery of the overarching Sellafield Ltd mission through provision of best in class programme and construction management services across a 20 year programme portfolio of projects.

2.1 Who are the programme and project partners

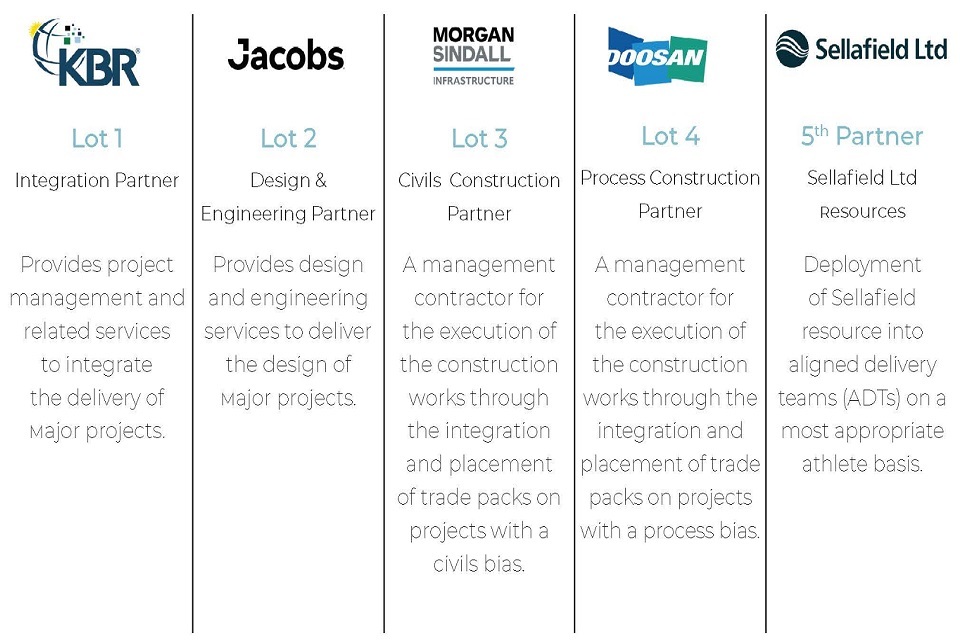

The partnership is made up of 4 ‘lots’ and Sellafield Ltd as 5th Partner, to help deliver the site’s decommissioning programme:

- Kellogg Brown and Root Ltd (KBR) - integration partner

- Jacobs - design and engineering partner

- Morgan Sindall Infrastructure - civil construction management partner

- Doosan Babcock Ltd - process construction management partner

| Name | Lot | ||

|---|---|---|---|

| KBR | Lot 1 | Integrated partner | Provides project management and related services to integrate the delivery of major projects |

| Jacobs | Lot 2 | Design and engineering partner | Provides design and engineering services to deliver the design of major projects |

| Morgan Sindall Infrastructure | Lot 3 | Civil construction management partner | A management contractor for the execution of the construction works through the integration and placement of trade packs on projects with a civils bias |

| Doosan Babcock Ltd | Lot 4 | Process construction management partner | A management contractor for the execution of the construction works through the integration and placement of trade packs on projects with a process bias |

| Sellafield Ltd | 5th partner | Sellafield Ltd resources | Deployment of Sellafield resource into aligned delivery teams (ADTs) on a most appropriate athlete basis. |

Who the programme and project partners

3. Opportunity pipeline

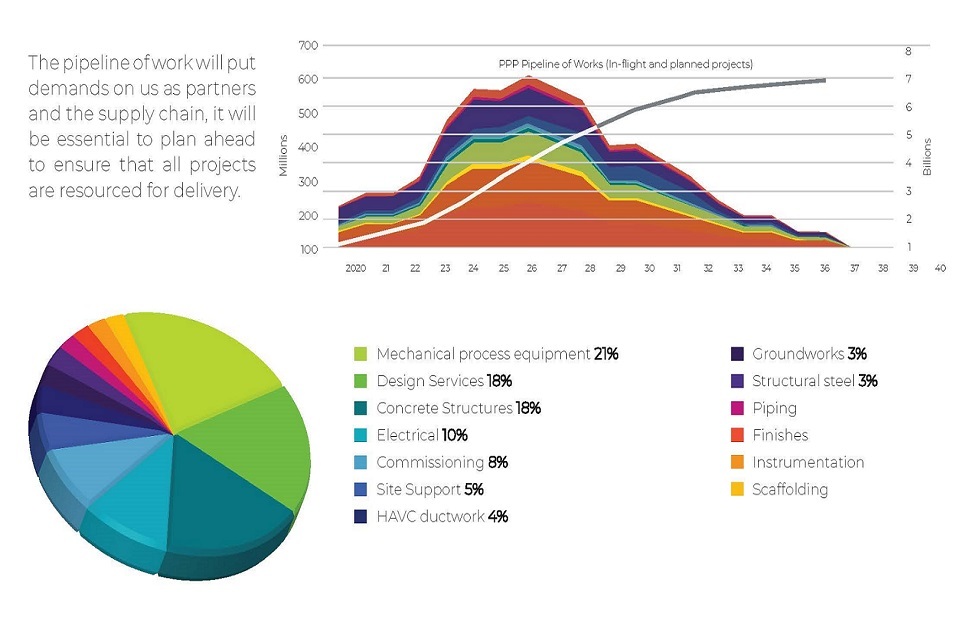

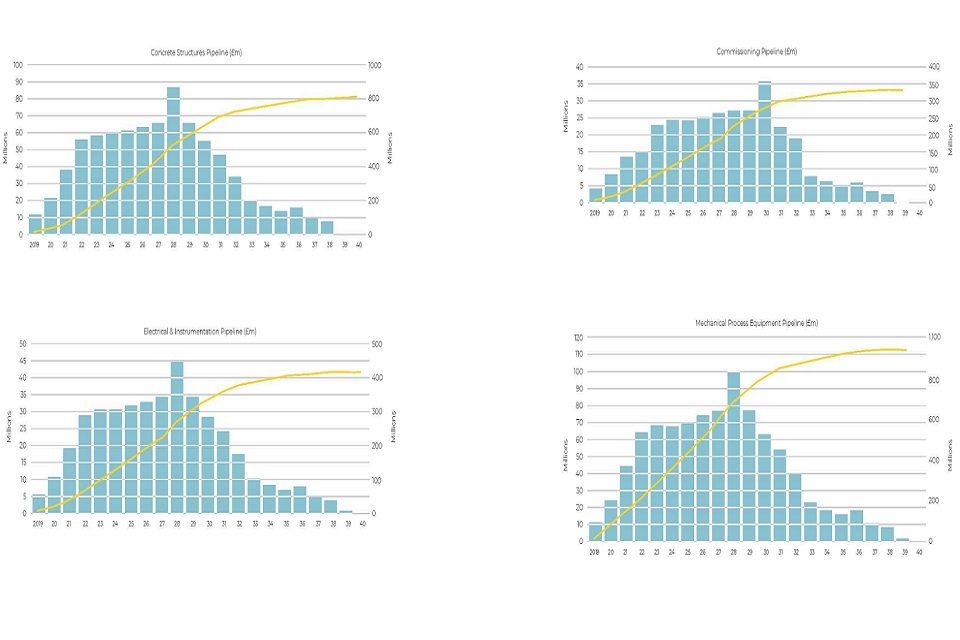

We have looked at the Programme and Project Partners programme of works to identify the spend profile over time for each project as well as the key trades, this in turn gives a draw-down of supply chain resources required for the 20-year duration of the partnership.

If we look at those key trades required to deliver each project and combine this across the projects, the picture of aggregated demand starts to emerge, plotting this across overall spend we can identify the spend and duration of key trades.

The pipeline of work will put demands on us as partners and the supply chain, it will be essential to plan ahead to ensure that all projects are resourced for delivery.

Portfolio/Future

- First Generation Magnox Storage Pond Sludge Handling and Export Plant - £195 million

- Interim Storage Facility 2 (ISF 2) - £30 million

- Low Level Waste (LLW) sort/segregate (LLW and sub LLW treatment) Site Ion Exchange Effluent Plant (SIXEP) Waste Management - £55 million

- BUFT capability/enterprise fuel study (EFS) and the Sellafield Product and Residues Store (SPRS 2) - £1,535 million

- Package to Box Transfer Facility (BTF) and Box Encapsulation Plant Product Store (BEPPS 3) - £ 1,105 million

- VPS Replacement Waste Treatment Complex (WTC 2) - £275 million

- Box Encapsulation Plant Product Store (BEPPS 4) - £190 million

- Lightly Shielded Store (LSS2) - £40 million

- Sellafield Product and Residues Store (SPRS 3) - £270 million

- Pile Fuel Cladding Silo (PFCS) Waste Treatment Plant (WTP) - £270 million

- Engineered Drum Stores (EDS 4/EDS 5) - £4 million

PPP pipeline of work

4. Opportunity pipeline

Opportunity Pipeline

The values shown are indicative only based on current assumptions and are subject to change by PPP and/or Sellafield Ltd.

5. Our principles

Early contractor involvement

We recognise that by contracting and involving the supply chain at the earliest stage, we will be able to optimise design, incorporate best practice and consider methodology.

Innovation

The supply chain is best placed to highlight innovative products and processes to the projects, it is the Programme and Project Partners goal to incentivise the championing of this innovation.

Collaboration

Core to the Project and Project Partners mission is collaboration at all levels of the project and the supply chain.

Benefits sharing/incentivisation

Sharing success also means sharing the benefits that come with it, behavioural change can be achieved by shared reward mechanism.

Risk identification and mitigation

Early warnings and robust risk mitigation will reduce the risk to secure project outcomes.

Outcome and output driven contracting

This starts with performance rather than product driven project specifications allowing the supply chain to incorporate best practice and innovation, without compromising quality or performance.

Social impact targets through all supply chain tiers

We can use the multiplier effect of increased social impact reach by incorporating social impact goals throughout the supply chain. We see this as mutually beneficial to the supply chain as well as the community.

Performance measurement

Without establishing a baseline and regularly reviewing progress, we will not be able to understand how we are performing and it will also allow us to set structured improvement targets.

Contract forms/Terms

By developing and implementing equitable, appropriately balanced and recognised forms of contract, underpinned with targeted prompt payment mechanisms, the Programme and Project Partners will become a client of choice for the supply chain.

Our principles

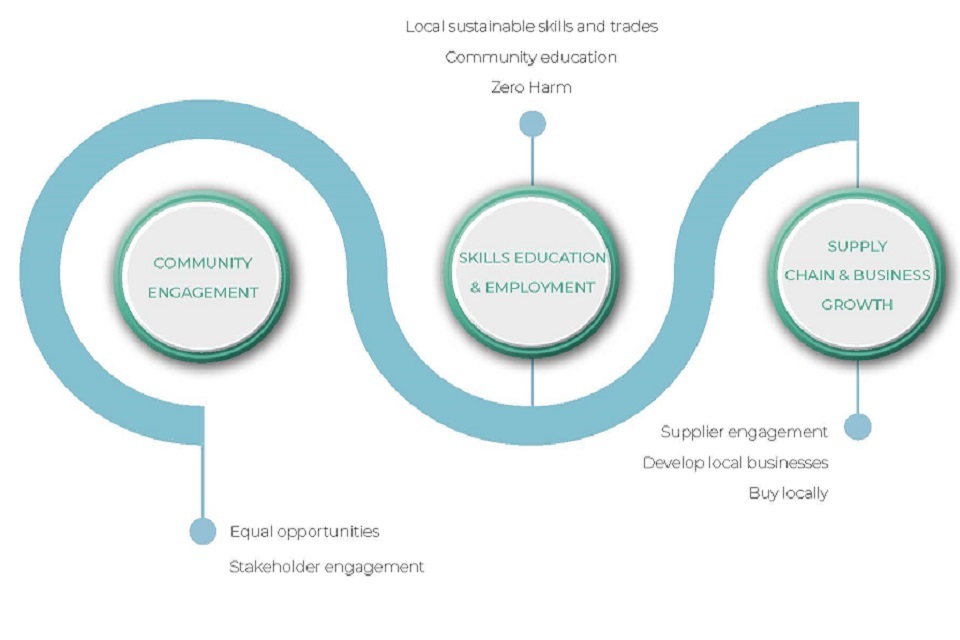

6. Social impact

Social impact commitments in contracts

The Programme and Project Partners is committed to delivering on its full business case benefits and critical success factors, particularly in regard to those which maximise social impact and provide improvements to the local area, creating a lasting and sustainable legacy.

The Sellafield mission will last into the next century and there is a legal, moral and ethical responsibility to maximise social impact for current and future generations.

With more than £7 billion of projects identified to pass through the partners, a collaborative, joined-up approach to sustainability, inclusive of social impact, economic and environmental agendas will be essential to enable its success.

Social impact is at the heart of everything we do with regards our supply chain and underpins each of the 6 pillars discussed in this strategy.

The multi projects procurements described elsewhere in this strategy have been specifically created to maximise social impact benefit and the partners see these as the key drivers to delivering for the local community and businesses.

However, social impact requirements will form part of every single invitation to tender (ITT) issued and contract package awarded by Programme and Project Partners with very few exceptions.

All procurements will have early social impact involvement, procurement specific tender questions, contracting of commitments and defining outcomes.

Social impact requirements will have been tested during market engagement and stipulated at pre-qualification questionnaire stage, allowing further discussion and definition with suppliers prior to final objectives being included in the ITT documents.

The supply chain will be expected to deliver on agreed social impact targets with regular social impact reporting and performance measurement forming part of the overall project reporting requirements.

Examples of potential social impact requirements within the ITT packages include but are not limited to:

Localisation

In the context of the Programme and Project Partners, localisation is primarily focussed on West Cumbria. All companies involved in the work will be encouraged to support this agenda, through location of their businesses and long- term employment of local people.

Suppliers will benchmark their current state and declare targeted states throughout their involvement in the project.

Local development

Alongside direct localisation support, suppliers will be encouraged to develop local supply companies including reciprocal opportunities for diversification, mentoring and support to the partnerships local supply chain academy.

These initiatives will be supported using contract driven requirements.

Opportunity

The Programme and Project Partners and its supply chain will provide enhanced employment opportunities for people in West Cumbria and/or Warrington.

We will support return to work and get into work schemes alongside internship, apprenticeship and graduate programmes. Providing employment opportunities alongside training opportunities; particularly for known skills shortages.

Engagement

Engagement with local schools and training providers. Supporting educational attainment that address skills gaps and result in recognisable qualifications. Supporting aspirations in young people is important, special attention should be given to those from disadvantaged backgrounds.

Volunteering

Volunteering in a coordinated way is a simple and easy way to support some of our social impact initiatives.

The expectation is that the supply chain will make available as a minimum, the equivalent of 2 days of volunteering time per annum per person targeted towards key Programme and Project Partner initiatives.

These activities will be monitored and coordinated via the timebank.

Stakeholder engagement

Embedded

Embedded impact is as a direct consequence of day-to-day operations and the opportunities we set out to create.

Who we employ, how we employ, what we buy and from who are prime examples. This is about doing more with the same.

Examples include the partnership creating enhanced employment opportunities for local people and creating opportunities for local entrepreneurs, supporting economic growth and business creation.

Embedded social impact typically aligns to the partnerships business case benefits and critical success factors.

Added

Added impact is about what we do beyond our immediate mission. It’s supporting activities that go beyond the core mission of the business or project.

Tackling social issues at root cause or volunteering to support local community organisations being 2 prime examples.

Social impact commitments will form a significant part of the invitation to tender evaluations and bidders will be expected to demonstrate how they intend to commit to and deliver the maximum social impact possible.

A clear set of requirements and corresponding social impact evaluation model will be implemented for each package, with responses to social impact requirements being assessed by the social impact team.

Successful bidders will be expected to introduce opportunities to the local supply chain across their wider businesses therefore allowing organisations around West Cumbria to grow and prosper in the area.

Social value is one way of driving innovation through procurement by encouraging employment opportunities, developing skills and improving environmental sustainability.

The key elements of the Programme and Project Partner’s social impact and supply chain strategies support Sellafield Ltd’s Social Impact Multiplied (SiX) Strategy.

Resilient Economies

Enabling inclusive growth in the capacity, diversity and capability of the economies local to Sellafield sites. the partnership will contribute by supporting local growth in the nuclear sector and increase the scale, diversity and development of other economic sectors.

Thriving Communities

Assisting West Cumbrian communities to thrive by supporting activities that create self-reliance and independence, the partnership will align its activities with stakeholders, organisations, and community activity that are addressing critical social and environmental issues.

Social Value Chains

Enabling and using the partnerships supply chain to increase the scale and duration of our supply chain activity to support the development of inclusive local economies.

Sustainable Incomes

The Programme and Project Partners will use its delivery mechanism and resources to develop and support skills, knowledge, to create new employment and income generation opportunities beyond those offered by Sellafield Ltd.

Collective Impact

The Programme and Project Partners will operate intelligently and effectively to focus our resources into interventions that are appropriate to our corporate skills and talent.

This will require us to develop deeper relationships with stakeholders and organisations to fully understand how, when and why our resources can be deployed for maximum benefit.

Our objectives

7. Six pillars approach

The Programme and Project Partners Supply Chain Strategy has been framed around The Project Initiation Routemap (HM Treasury, 2016).

The routemap and its associated procurement module identifies the following 6 pillars characteristic of good practice in procurement decision making:

The 6 pillars

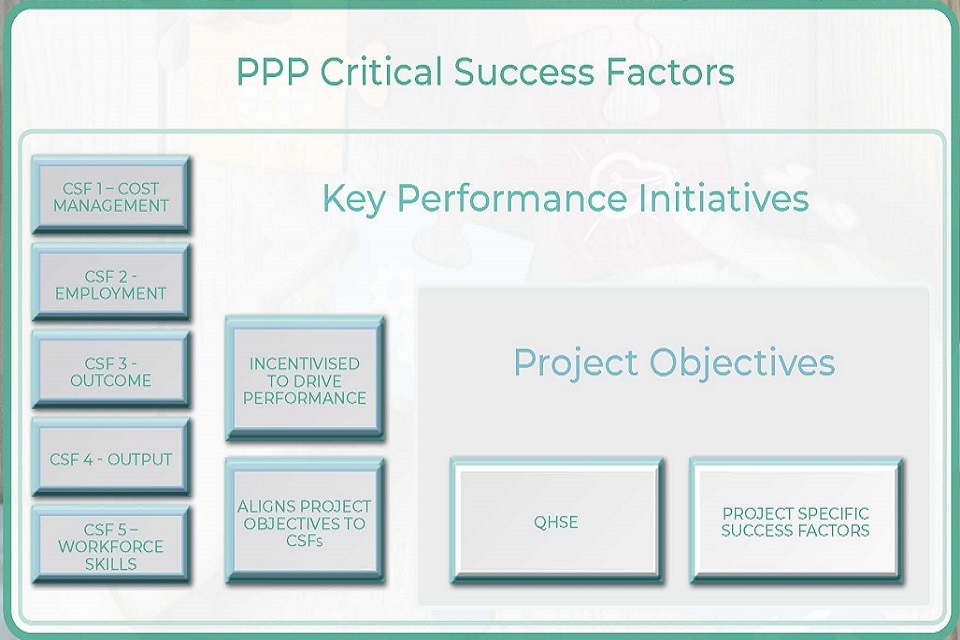

7.1 Pillar 1 - Understand and communicate requirements

The intent of Pillar 1 under the routemap is to ensure that the desired project objectives, outcomes and outputs over the lifecycle of the project or programme (from inception to in-service operation) are tangible and clear and used to motivate teams and inform decisions.

Specifically, for the Programme and Project Partners, the outcomes extend far beyond the traditional parameters of cost and schedule delivery.

To understand outcomes and communicate requirements, the success of the partnership will be measured by 5 critical success factors.

All desired objectives, outcomes and outputs will translate directly to each of the 5 critical success factors.

The critical success factors are contractual obligations which are applied across all aspects of the partnership, including the supply chain, to ensure a holistic view of success is achieved using a triple bottom line assessment which considers people, profit and the planet.

Supply chain is a key enabler to deliver on all 5 of the critical success factors and therefore it is imperative that these are understood and communicated across the supply chain who will be an integral part of the Programme and Project Partners delivery.

The Programme and Project Partners will deliver to the supply chain scopes of work and invitation to tender/contract packages that clearly define our requirements at both project and enterprise level.

Through clearly setting out the expectations early and through a detailed market engagement process, the supply chain will play an integral part in assisting the partnership to deliver the desired outcomes.

Understand and communicate requirements

Output and outcomes

7.2 Critical success factor 1 - Cost management

A sharp focus on cost and project lifecycle forecasting to bring cost certainty and double digit percentage savings on project outturn costs based on the employer’s approved major project total price.

What the Programme and Project Partners aims to deliver and what it needs from the supply chain

Where appropriate, the application of Project 13 enterprise philosophy (an industry led initiative to create a new way of delivering infrastructure projects) of supply chain management will be used.

This will be alongside the Programme and Project Partners innovation and existing arrangements of best practice from cross sector global businesses and associated learning from experience from previous projects.

-

the supply chain will be required to provide robust delivery strategies that are outcome driven and present best value for money, covering everything from concept design through to contract closure as part of their requirements to the partnership.

-

using the supply chain and adopting early contractor involvement, the supply chain’s expertise will be used to help bring best practice and innovation to areas of design, buildability, construction methodology and materials.

Same metrics to measure success

- project/programme savings register

- project cost avoidance/value engineering register

- data to demonstrate contract entry cost vs exit cost

- sample project costs measured against business benchmarks

7.3 Critical success factor 2 - Employment

The longevity of the relationship and subsequent confidence to invest within the workforce and the local areas. Investment in training and apprentices leading to a significant reduction in agency supplied workers at all levels of the employer’s supply chain.

-

The supply chain team will identify the forward portfolio of project works together with inflight requirements. This will be communicated to the supply chain to allow more robust business planning and ‘readiness’ in the business community.

-

By establishing contracts stretching across multiple projects, the supply chain will have more confidence to invest in longer term training and development, ultimately leading to a more sustainable employment structure. This may be localised to the Cumbria/Warrington areas but may also be measured in other areas.

The Programme and Project Partners will:

-

Identify key areas of skills shortage and supply chain gaps relating to the upcoming programme of works. The partnership will collaborate with the supply chain in order to develop joint plans and strategies focused around upskilling of the workforce, investment in training/apprenticeships and mobilisation of resources in order to determine how best to fulfil these gaps/shortages with a view to ensuring mutual long term benefit. The supply chain will require to align their resource solution to that of the partnerships social impact plan, which addresses the requirement to future-proof the local workforce beyond the Programme and Project Partners.

-

Flexible transition between the partnership and the supply chain by using initiatives such as ‘All Together Cumbria’.

-

All supply chain activities will have clear alignment to the partnerships social impact plan with social impact initiatives and deliverables contractualised in the award of supply chain contracts.

Sample metrics to measure success

- project/programme awards showing range and diversity of supply chain (geographic and demographic)

- number of resources/people engaged on the partnership per supplier

- location/home base of resources/people

- supply chain engagement events held and locations/attendance

- social impact and success stories of exported

7.4 Critical success factors 3 - Outcome

The achievement of aligned rewards through the collective successful delivery of major project outputs.

What the Programme and Project Partners aims to deliver and what it needs from the supply chain

-

Increased certainty of outcome aligns with identification and management of risk. Behaviours from partners and the supply chain are also driven by a fair distribution of rewards. From a supply chain perspective, this can be translated to identifying the correct supply chain members and using their strengths and input to secure positive outcomes, coupled with fair, equitable and potentially incentivised contracts.

-

the partnerships approach to engagement with supply chain is through securing the support of subject matter experts, the nuclear sector supply chain and also appropriate industry federations and associations, as well as the small to medium enterprise supply chain. This collective supply chain, as well as companies from other sectors with transferable skills into nuclear, will be used to define equitable contract forms and apportion both risk and reward terms.

-

Where appropriate (according to risk profile and strategic importance of the trade package), creation of integrated working across the supply chain will be established. Key strategic trade package contractors and suppliers will be selected and together with the partnerships lot partners, will work as one team. Contracts will be incentivised based with risk/reward/profit based on value added to outcomes (performance based) and not on time spent based contracts. In doing so we hope to promote and foster behaviours to deliver projects with increased efficiency of schedule.

-

The Programme and Project Partners will establish a baseline of incentivised and mandatory goals, including such elements as performance, benefits, whole life costing and capital cost. The key supply chain will be incentivised to better the baseline through utilisation of innovation, best practice, and economies of scale and drive efficient and timely project delivery. Underlying these initiatives will be the ethos of collaborative working.

Sample metrics to measure success

- supply chain incentivisation model

- identify which supply chain members/sectors will give the best results from incentivisation

- performance key performance indicators (KPIs) of the identified supply chain members

7.5 Critcal success factors 4 - Output

Early contractor involvement from project conception ensuring the right project is executed and creating more certainty of achieving the outputs.

What the Programme and Project Partners aims to deliver and what it needs from the supply chain

- The partnership recognise the valuable contribution the supply chain can make in ensuring the right project is executed. Accordingly, the partnership will engage the supply chain at the earliest possible point in the design process in order to provide an opportunity for the supply chain to influence areas of design that are within their areas or expertise.

The supply chain will be encouraged through the contracts that are awarded to bring innovation, market availability, product and process expertise into the project. The supply chain will have the ability to bring an understanding of the innovation, market availability, product and process expertise and delivery mechanisms to the partnership.

- Other models of design diversification should also be explored with the supply chain, design and build contracting models would incentivise leaner designs and the use of modern construction techniques such as off-site fabrication and modular construction should be explored with the supply chain.

Sample metrics to measure success

- benchmarked design and pre-construction man-hour usage

- innovation/value engineering register

- off-site construction driving reduced site-based labour

- output build cost on design and build contracts benchmarked against traditional design/bid/build construction

- project / programme savings register

- procurement plan/monthly supply chain report

7.6 Critical success factors 5 - Workforce skilling

Upskilling of the employer and supply chain capability through porosity and longevity of the relationship. Investing in training and apprentices.

What the Programme and Project Partners aims to deliver and what it needs from the supply chain

-

This factor aligns very closely with critical success factor 2 - employment; as the future portfolio of works are shared with the supply chain through a consolidated communications plan; skills gaps and opportunities will be identified by the supply chain, thereby creating the motivation to the supply chain to develop suitable skills to match programme demand.

-

The enabler to this will be the social impact plan which will identify any specific key performance indicators and targets and how this is delivered locally, regionally or nationally.

The Programme and Project Partners supply chain team will then work closely with Social Impact to implement the plan and establish SMART (specific, measurable, achievable, realistic and timely) targets and objectives.

- The Multi Project Procurement Strategy detailed later in this document is a key mechanism in encouraging long term investment and associated opportunities to upskill the local workforce through employment opportunities and training.

Sample metrics to measure success

- supply chain engagement events held and locations/attendance

- social impact reporting

- ethical

- enabling

- entrepreneurial

- receptive and communicative

Underpinning the above critical success factors are the mandatory performance measures in health, safety, security and quality compliance expected of the supply chain– described as absolute requirements.

The critical success factors will be translated into specific performance measures within each of the packages we award through the use of key performance indicators (KPIs).

The KPIs will be developed in order to fully align the performance targets of the supply chain to demonstrable outcomes for Sellafield Ltd that mirror and directly translate to each of the critical success factors.

Each KPI will have a clear link to a selected outcome and form the basis of incentivised profit for performance models for the contracts placed by the Programme and Project Partners.

PPP Critical success factors

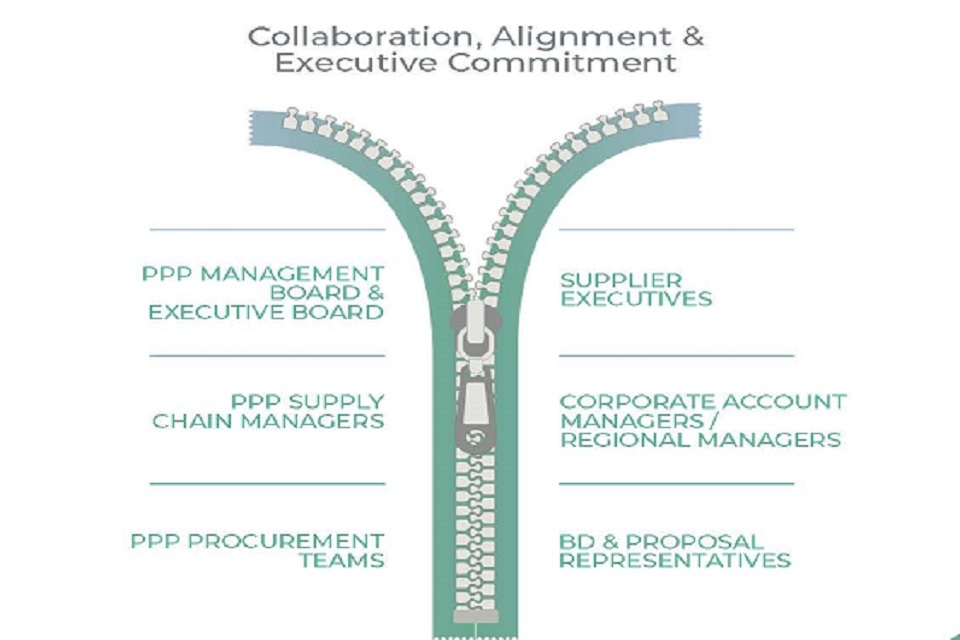

7.7 Pillar 2: Market engagement

Supply chain involvement is an integral and critical aspect of the overall Programme and Project Partners Strategy to deliver the critical success factors and defined outcomes for the programme.

In order to achieve this, to raise the profile of the partnership with the prospective supply chain and to reach new suppliers, we will communicate and improve visibility/accessibility of the portfolio.

The Programme and Project Partners will enable this engagement through a variety of methods and at the appropriate levels within the partnership and supply chain organisations.

The intent of the engagement is to act as a 2- way street between the partnership and the supply chain. It will afford an opportunity for the partnership to fully explain the pipeline of opportunity to the supply chain to assist in building relationships through the various tiers and to encourage participation and commitment on a longer term basis.

It also affords the opportunity for the supply chain to feedback to the partnership in terms of our thinking and for this feedback to be used wherever possible to drive continuous improvement.

For clarity, while purchase contracts will be placed directly by individual Programme and Project Partner companies, the overall market engagement and strategy will be as a single Programme and Project Partners, with maximum collaboration between partners to present a single Programme and Project Partners interface with the supply chain.

Typical engagement activities will include:

- The use of the Programme and Project Partner wide Enterprise Procurement Management System (EPMS) to engage suppliers and allow initial registration and document information flow between the partnership and the supply chain. EPMS will also be used as the main system throughout the procurement lifecycle and for all transactional related matters.

- Utilisation of social media to communicate upcoming opportunities, events or general non tender specific information such as design maturity, schedule robustness and constructability.

- Industry network events and dedicated Programme and Project Partner supply chain events.

- A Programme and Project Partners annual supply chain conference and annual supply chain safety day.

- participation in the wider Sellafield supply chain events.

- The market engagement will be used to forge relationships within the supply chain and to understand the capacity and capability available to deliver the partnership objectives. Through the engagement, the intent is to build a collaborative and highly efficient supply chain, moving away from a traditional transactional model to one focused on the fundamentals of Project 13.

- Forging the relationships during market engagement to foster long term collaboration and success is only the start and the partnership will implement strong supplier relationship management (see Pillar 6) to ensure ongoing performance in a collaborative and constructive manner.

Collaboration, alignment and executive commitment

7.8 Pillar 3: Packaging Strategy

Specific projects will utilise the broader market engagement and supply chain knowledge to create a balance between the market for the products or services in question, the ability to achieve the stated outcomes and to demonstrate effective risk management.

As mentioned elsewhere in this strategy, the intent of packaging of works will include maximising social impact and small to medium enterprise contribution to the partnership.

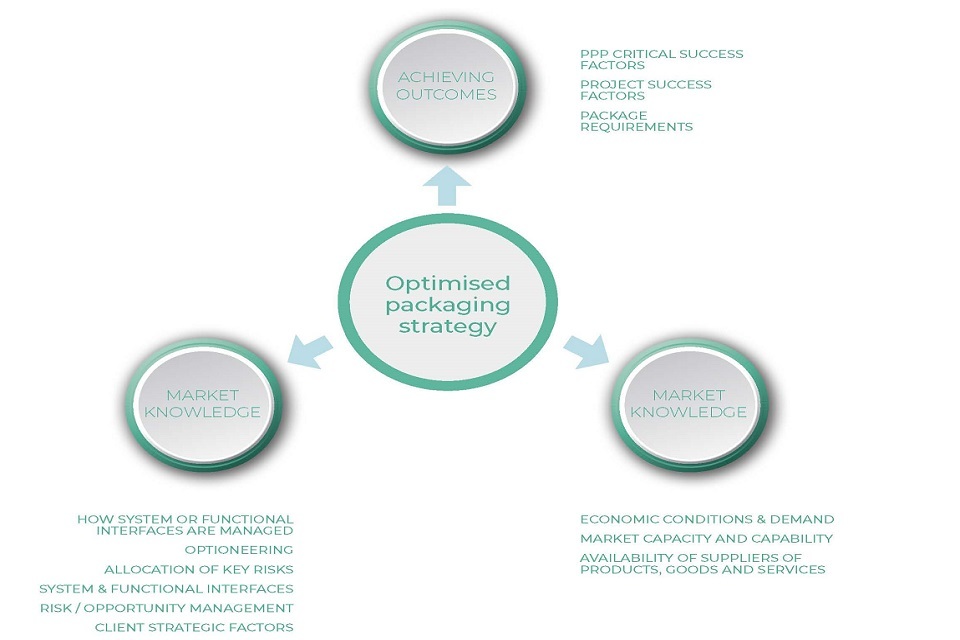

Optimised packaging strategy

Packaging and scoping will be based upon the use of knowledge gained through detailed market engagement and further defined through consideration of:

- Scope of work – civils, MEICA (mechanical, electrical, instrumentation, control and automation) etc.

- Complexity of package – not too big or too small for the supply chain

- Financial value

- Synergy across the partnership and Sellafield Ltd, including the use of Multi Project Procurements (MPPs) (described elsewhere in this strategy)

- Extant Sellafield Ltd, category management and Programme and Project Partners Multi Processing Procedure frameworks which offer strategic benefits

- Constructability

- Programme constraints

- Early contractor involvement requirements – design maturity, schedule, cost and constructability

- Interfaces with other packages

- Social value/small to medium enterprises (SME) considerations. The partnership will actively engage with local SMEs directly and via higher tiers, to encourage and support their involvement in the programme through a formalised matchmaking process. SME targets will be established through market engagement and in alignment with the overall Programme and Project Partner Social Impact Plan.

The packaging strategy will also identify key interface risks which will be carefully managed across the supply chain to ensure delivery of the critical success factors and defined outcomes for the partnership.

The approach to de-risking will follow the process below:

- Select supply chain partners who satisfy the required capability and capacity

- Ensure early engagement to test the design and constructability of the scope and to identify all interface risks

- Collaboratively plan how best to de-risk any interfaces that may risk a successful outcome

- Formulate key performance indicators (KPI) that will encourage and reward strong performance

- In cases where the same interface risk(s) affects more than one supply chain partner; e.g. MEICA supply chain partners working adjacent to each other, consideration will be given to KPIs that link multiple parties to deliver a collaborative strong performance.

7.9 Multi Project Procurement Packaging Strategy

Sellafield Ltd has set out a bold and forward-thinking strategy in the creation of the Programme and Project Partners model, applying the Project 13 model; an industry led response to failing infrastructure delivery models.

Project 13 and Sellafield Ltd’s vision moves away from transactional project driven procurements, to an enterprise model whereby sophisticated long-term relationships are created with success based on enterprise outcomes.

Those outcomes have been defined in the partnership by Sellafield Ltd by way of the critical success factors as described earlier in this strategy document.

In order to maximise the benefits of a programme wide enterprise approach, the partnership has assessed the pipeline of projects to establish synergies in procurement requirements across the 20-year programme lifecycle that would be best leveraged through the use of long term strategic framework agreements, or in the Programme and Project Partners terminology, Multi Project Procurements (MPPs).

MPPs suppliers will be preferred suppliers of the partnership for their scope and may be engaged by and interface with more than one of the Programme and Project Partners lot partners.

Multi Project Procurements will maximise supply chain benefits through:

- Attractiveness to suppliers due to long term commitments and an attractive incentivisation model

- Allowing successful suppliers to invest, especially locally, in order to maximise social impact and sustainability for the local community

- Creating an environment whereby SMEs will be afforded opportunity either directly or as part of a wider collaboration with higher tier suppliers

- Leveraging economies of scale through an 18-year pipeline of projects

- Standardisation and progressive learning across goods and services

- Creating the ability for early contractor involvement and for the Multi Project Procurements (MPP) suppliers to be part of the wider partnership team in order to enhance project delivery

The Multi Project Procurements consist of 2 broad categories:

-

Key delivery partners to deliver common construction elements such as civils, steelwork, mechanical, electrical, HVAC and other key trade packages, with the intent of the model to create exclusive frameworks for the maximum available duration (up to 18 years) and reflect the profit for performance ethos of the Programme and Project Partners. It is envisaged that there will be approximately 10 categories of key delivery partner.

-

Goods supply, works and services agreements to appoint preferred supplier to the Programme and Project Partners to provide particular goods, works and services over a set term based on demand and the nature of the goods, works or services.

It is envisaged that there will be approximately 25 categories of goods, works or service agreements. For each of the Multi Project Procurements (MPPs), an individual MPP strategy document will set out the demand requirements, the supply chain strategy and the commercial strategy, which will seek to optimise performance against outcomes and the critical success factors.

As a cornerstone of our supply chain strategy, MPPs will be discussed in further detail throughout this document.

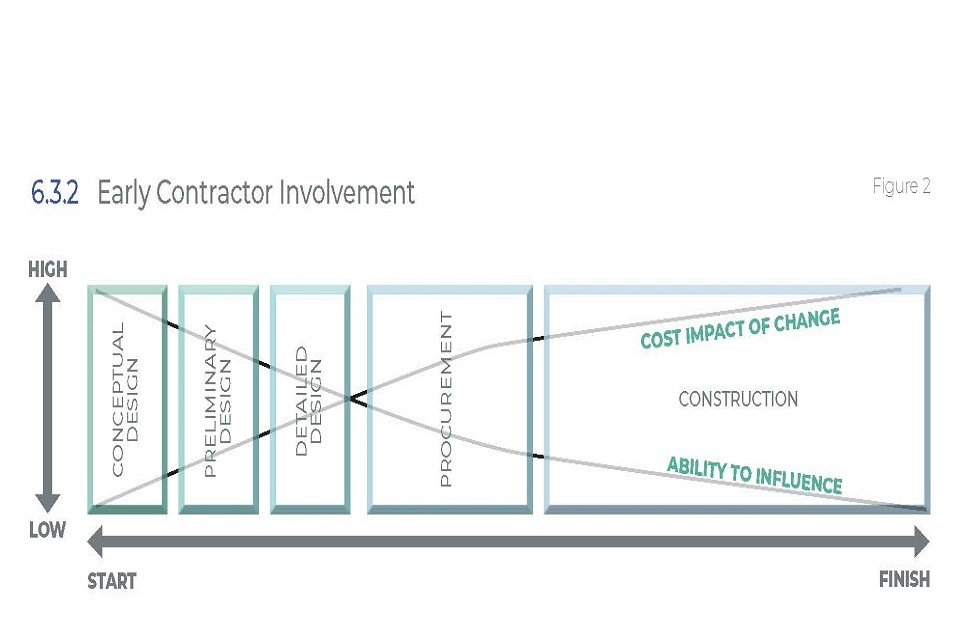

7.10 Early contractor involvement

Early contractor involvement

The Programme and Project Partners packaging strategy will also be influenced by the need for early contractor involvement (ECI) and the partnership is committed to maximising the ECI benefits available.

It is well known that the greatest ability to influence the overall outcome of a project occurs early in the project lifecycle and that supplier engagement during these early stages provides significant benefit.

Benefits are foreseen from:

- Alignment to the Programme and Project Partners critical success factors

- Innovative solutions from the supply chain

- Provision of standard and proven solutions rather than bespoke solutions

- Early identification and management of risks and opportunities

- Efficient and efficient integration of contractor design and deliverables into the overall project

- Early visibility of requirement such that contractors can plan to meet the partnership needs

- Certainty of major project total price schedule and constructability.

- A detailed early contractor involvement (ECI) mechanism is being developed to solicit engagement and test certain key criteria in order to embed the specific supply chain knowledge into the overall project procurement strategy.

The formal process will allow ECI benefits to be maximised based upon the specific scope and the level of design, schedule and constructability maturity.

Key matters covered as part of the ECI process will be:

-

Is the functional specification achievable, efficient and in line with industry good practice?

-

Does the current design support an efficient manufacturing / construction methodology?

-

Does the design meet the requirements of the functional specification and site licence conditions?

-

Are changes possible to specifications to allow an off the shelf procurement, thus reducing cost and schedule?

-

Are there any issues around specification that may lead to not achieving the required quality?

-

Does the design create any unwanted interface(s) that could be mitigated?

-

Is the design compliant, effective and represent best value to the project?

-

Is the sequencing of manufacturing/ construction optimum?

-

What rare skills or long lead items are required and how will they be secured?

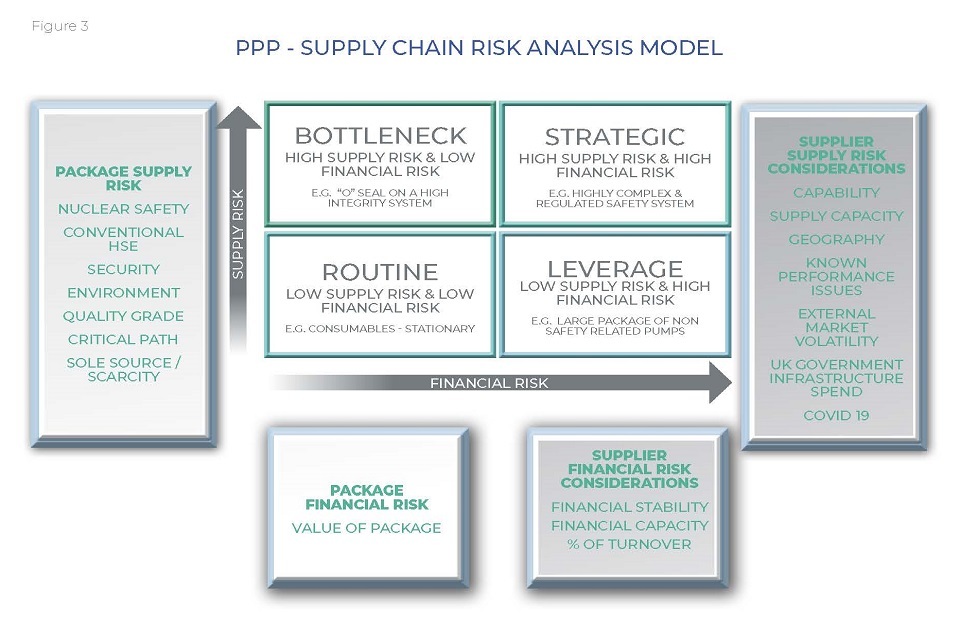

7.11 Package risk considerations

Programme and Project Partners is highly focused on de-risking our procurement activities in order to drive certainty in outcomes.

We will achieve this through:

- Leveraging long term commitments where possible that create stability, learning, improvement, increased social impact and shared reward/risk.

- Implementation of early contractor involvement to ensure understanding of requirements on key packages along with close, supportive and proactive quality management of the supply chain through their lifecycle on the project.

- Deliberate, targeted long-term collaborative relationships with incentives that are ‘outcome’ focused

- Balancing risk/ reward to be attractive to the market

- Flow down of partner’s T&Cs to supply chain for mutual benefit in reward to create in it together culture and encourage collaboration

- The Programme and Project Partners applies the internationally recognised Kraljic matrix to ascertain and apportion risk to individual procurement packages. This risk allocation model is an effective tool for the partnership to analyse proposed packaging decisions and to determine the route to market and associated commercial model for packages based on varying degrees risk classification.

PPP - Supply Chain risk analysis model

7.12 Pillar 4: Contract model

Subsequent to risk classification and packaging philosophy a package specific contract strategy document will be created (for high risk packages) that fully assesses the key commercial risks and interfaces to inform the key clauses, requirements and provisions for each package.

In keeping with the principles of Project 13, the partnership intends to offer a contract model that offers an incentivised set of terms that attract interest from the supply chain and offers fairer balance in respect to risk, thus ensuring both parties are actively involved in achieving a successful outcome.

In relation to key aspects associated with contractual terms the following outlines some of the more proactive approach that the partnership intends to adopt to encourage supply chain interest and support a collaborative relationship with the supply chain:

- Adoption of the government’s prompt payment code

- No withholding of retention that material impacts a supplier’s business cashflow

- Support supplier chain sustainability by offering cash neutral payment arrangements

- Request insurance cover levels that reflect the true risk associated with the scope

- Only request surety commitments which fairly reflect financial stability and scope complexities

- Set pain/gain mechanisms that fairly balance risk and encourages a collaborative working relationship that support achieving a successful outcome for all

- Where interface risks are identified actively work with the supply chain to set KPIs that incentivise strong performance to mitigate risk and support a successful project outcome.

An appropriate form of new engineering/engineering and construction contract will be used dependent on the characteristics of the specific package.

Contracts will be drafted to reflect the profit for performance and collaborative ethos of the Programme and Project Partners.

If the commercial model is going to drive the right behaviours it must be meaningful to deliver teams. It will only impact on behaviours if the teams and individuals can see how it will only relate to them.

The focus should be on simplicity and alignment.

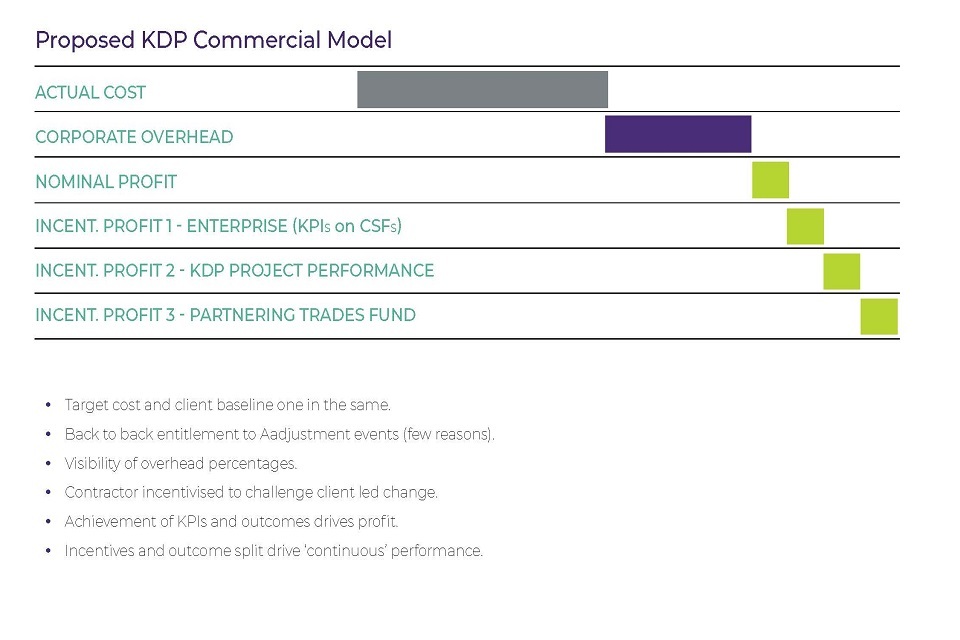

From the Project 13 Commercial Handbook

For the key delivery partners (KDPs) we are proposing a truly innovative outcome based commercial and contract model whereby:

- Each KDP drives a profit for performance approach at enterprise level and not solely project performance

- Long term relationships are created that give the entire supply chain the confidence to invest in the enterprise

- Performance is defined by outcomes and incentives, with key delivery partners always reimbursed on an actual cost basis with no delay damages, with loss of potential to earn profit and general liabilities and insurances as remedies

- Each key delivery partner may constitute a collaboration of one or more supply chain members, small to medium enterprises and/or the totality key supply chain members likely to be needed to achieve the objectives for each KDP framework

- The key delivery partners must set out a clear, tangible roadmap for success

- The guidance set out in the P13 Commercial Handbook is followed to define, deliver and procure based on value for the enterprise

Key delivery partners will be incentivised to drive behaviours and to encourage outcome based performance. The intent of the outcome-based model is to move away from traditional, adversarial, margin based contracting

The model aims to drive a change in culture, increased collaboration and fundamentally (including through early contractor involvement) mitigate potential changes before they arise; incentivise performance to the baseline and not the traditional model of contractors looking to drive up their own individual target costs.

Final commercial models and terms will be discussed at package level but the incentive mechanism and commercial model will broadly fall in line with the following:

- Actual cost plus corporate overhead, with allowable and disallowable cost schedules mirroring the partnerships lot contracts.

- Nominal profit

- Incentivised profit

- Partnering trades fund

- Goods supply agreements for the supply of goods (such as cranes, accommodation, and equipment). The strategy for each package will be unique, but with the term of these arrangements generally a fixed term appropriate to the specific category with options to extend.

- Works agreements for works that may be required on an ad-hoc basis (such as piling) where the contractor can contribute to achievement of some of the critical success factors, but the demand profile or type of works doesn’t warrant the key delivery partners status.

- Commercial models will be unique to each category, with contracts based on a new engineering contact/framework contract with professional services contracts and engineering and construction contracts to let individual packages.

- Service frameworks for the provision of services, either term services for works or professional services (such catering, testing and professional services).

- Commercial models will be unique to each category, with contracts based on the new engineering contract framework contract with professional services contract and term services contract.

Transactional commercial models often create divisive behaviours where commercial interests destroy overall programme value.

Project 13 Commercial Handbook

Proposed KDP commercial model

7.13 Pillar 5: Route to market

There are numerous routes to market for the Programme and Project Partners. The majority of the packages will be competitively tendered following selection of bidders who are competent and capable to deliver to the required cost, schedule and quality.

All tendering activities will be publicised using the electronic procurement management system and will follow a traditional procurement process from expression of interest through prequalification questionnaire, invitation to tender and award.

Although following a traditional procurement process, the partnership intends to award more innovative and incentivised profit for performance arrangements to ensure a collaborative and engaged supply chain, committed to delivering the critical success factors.

Multi Project Procurements (MPPs)

As described earlier and in order to maximise value to Sellafield Ltd and the local community, long term strategic procurements in the form of multi project procurements (MPPs) will be the preferred option. The MPPs cover scopes that will be utilised across multiple projects for the full duration of the partnership.

Existing Sellafield Ltd category management

Where the partnership has a requirement that falls under an existing Sellafield Ltd category management, the partnership will consider the use of these agreements unless there is a compelling quality, programme or commercial reason not to do so.

The partnership will need to check the capacity of the existing arrangements to ensure that long term programme demands can be achieved, and not impact on delivery of any other non Programme and Project Partners deliverables.

Project Transaction

Where a project has a specific requirement that does not fall into the category of Multi Project Procurements or an Sellafield Ltd category management, then the project will competitively tender that scope under a traditional new engineering contract approach.

In certain exceptional circumstances the partnership may suggest a single or sole source award. It should be noted that this route is very much an exception and will only be used if all other procurement routes have been exhausted or there is a compelling requirement.

Such an award will require full approval and sign off by Sellafield Ltd, supported by a full sole/single source justification.

7.14 Pillar 6: Realising the benefits

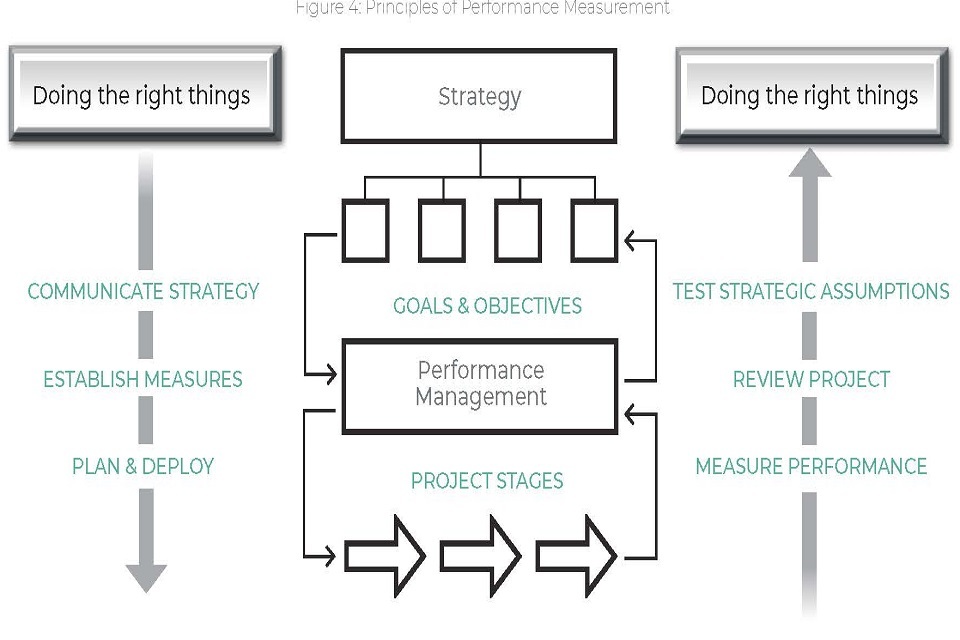

As illustrated in Pillar 1, to realise the anticipated benefits and demonstrate they have been achieved, it will be necessary to create a framework of measures and associated key performance indicators with the supply chain.

Measures and key performance indicators for each package will be the subject of each specific package acquisition strategy, detailing how performance will be monitored whilst maintaining alignment and focus on the big picture objectives.

This approach is illustrated below:

Principles of performance measurement

The Programme and Project Partners will use the following listing as part of the development of specific work package acquisition strategies ensuring that the key aspects of each work package to be procured identifies those drivers that could impact on the successful delivery of a project and/or achieving the critical success factors.

- Accountability for deliverables

- How success is quantified

- The contribution to overall project deliverables and outcomes

- Defining key performance indicators in a consistent manner so that performance can be reviewed across packages

- Setting targets to promote continuous improvement

- Clearly linking out-performance to incentivisation

- Including the soft indicators of performance such as cultural and behavioural measures

- The use of benchmarks that set realistic and measurable goals, including accurate and timely forecasting of schedule and cost reporting

- Regular health checks on financial stability and capability of our supply chain partners

The project team will aim to embed the above into the contracts we award, demonstrating an alignment between package level performance and the targeted outcomes.

Measures to be adopted will be specific, measurable and align to a measure of time but will be structured to gain supply chain interest, generate collaboration and encourage good performance whilst de-risking the deliverables.

Monitoring of performance against key performance indicators together with a formalised risk management programme and collaborative supplier relationship management system will allow for the partnership to have a clear assessment of the overall health of the supply chain.

We will assess the health of the supply chain through various measures on a regular basis and will work together to address any areas of concern and to make improvements together.

Feedback and continuous improvement of the partnership/supply chain relationship and performance will therefore be a key aspect of the overall Programme and Project Partners Strategy. The partnership will grade suppliers according to response to the pre-qualification process and previous history.

At the end of each year, the Programme and Project Partners supply chain team in consultation with the project commercial team shall perform an evaluation of registered suppliers performance based on the following criteria:

- Service performance

- Quality of goods and services supplied

- Adherence to contractual obligations

- Social impact

- Timekeeping (schedule adherence)

- Accuracy (billing, documentation etc)

- Value for money

A formal 2 way feedback process will be implemented to highlight what is working well and to drive corrective improvements where necessary.

The Programme and Project Partners success is based heavily on the supply chain performance and a collaborative and relationship based approach, with aligned commitment to long term goals is of paramount importance.

7.15 Six pillars summary

The six pillars approach to procurement is a cornerstone of HM Treasury Project Initiation Routemap and has been adopted by the Programme and Project Partners.

This approach provides the partnership and the supply chain with a clear map and understanding of how to effectively communicate and deliver the ultimate objectives of the Programme and Project Partners, all of which clearly translate to the critical success factors.

The six pillars approach above can be summarized as follows:

The six pillars approach

8. Stakeholder Commitments

The Programme and Project Partners recognises that we have a number of internal and external stakeholders who may have competing or complementary expectations on the delivery of the Programme and Project Partners supply chain.

NDA

- Provide clear governance and engagement structure of the Programme and Project Partners supply chain

- Develop a resilient and long term supply chain to support the nuclear sector

Sellafield Ltd

- Deliver secure outcome and output from a ready and resourced supply chain

- Supporting the long term business transition map

External supply chain

- Provide visibility of opportunities for long term pipeline of works

- Provide fair, equitable contracts

Our internal stakeholders

- Provide a clear, measured approach to supply chain management

- Provide structured and long term agreements focussed on delivery

Our local community

- Provide opportunities to support Sellafield Ltd’s long term transition

- Provide diversified future for local supply chain, resources and people.

The Programme and Project Partners Supply Chain Strategy 2021

Contact us through our central email address PPPSupply.Chain@sellafieldsites.com.

or scan the QR code below:

QR code for further information