Small Pots Delivery Group Report

Published 24 April 2025

Ministerial Foreword

One of my key priorities is how the government can support pension savers to get the best possible outcome from their workplace pensions, to support them with their retirement planning and achieve financial security in later life.

That is why in the Kings Speech, the government included the Pension Schemes Bill. This Bill will introduce a package of reforms to ensure that savers are enrolled into pension schemes that are of high quality, support opportunity for investment in UK productive markets and have appropriate options for them at retirement, helping savers to achieve better outcomes.

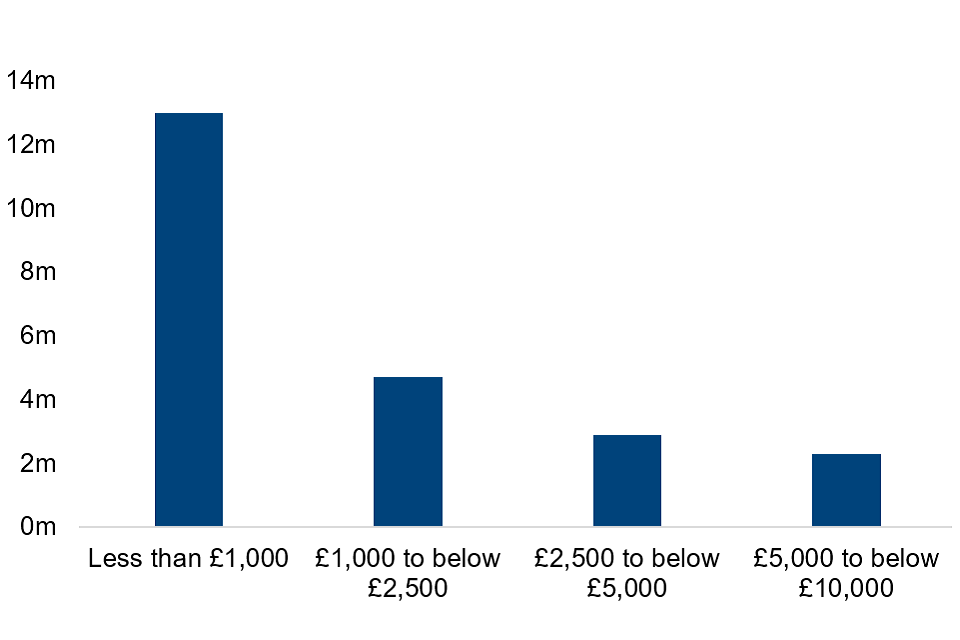

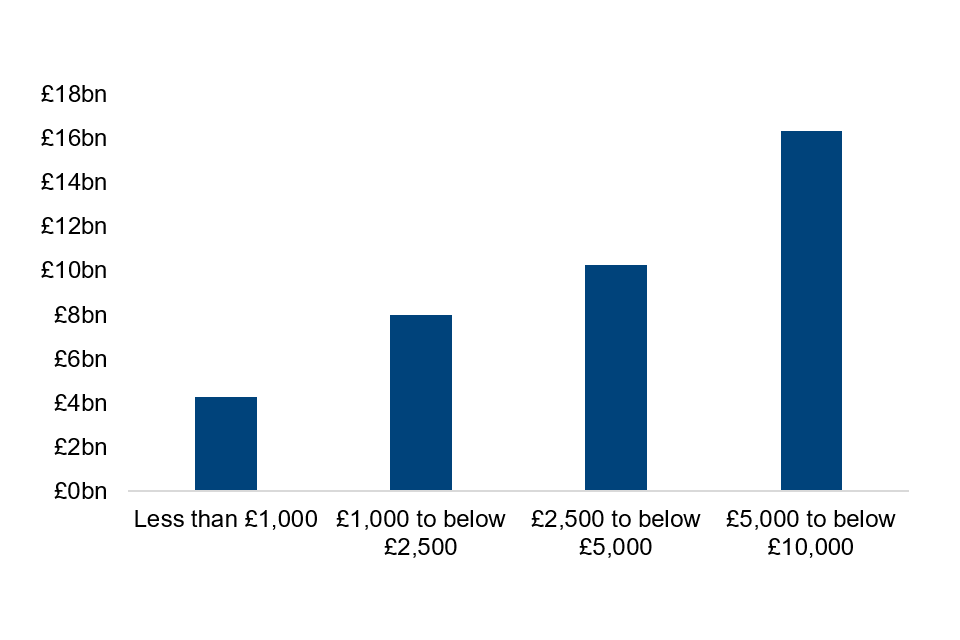

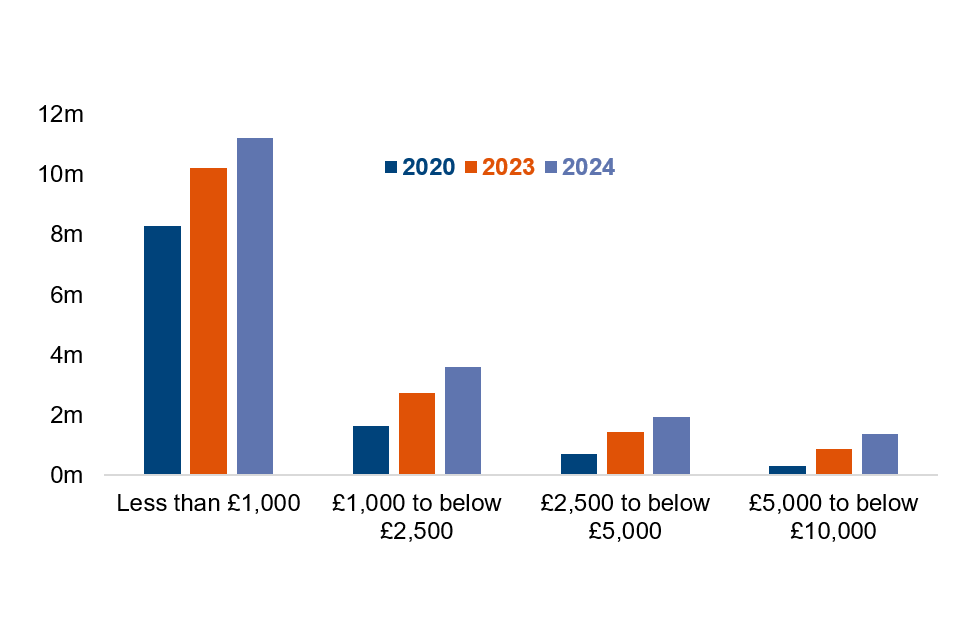

Enabling savers to maximise good retirement outcomes will only work if we make it easier to keep track of and consolidate pensions pots over a working life. As people change jobs they are enrolled into a new pension, often into a new pot - resulting in more and more small pots being created and making it harder to keep track of pension savings. I want to ensure savers are connected with these pots at retirement and that waste is reduced wherever possible. Our Bill will ensure that we can address the growing issue of deferred small pots, and we will introduce a duty on schemes to enable the consolidation of over 13 million pension pots, starting at those that are worth £1,000 or less.

I am hugely grateful to the Small Pots Delivery Group, for the support that they have offered to my department in considering the policy design choices required as part of the solution to address multiple small pots. This report demonstrates the significant progress that this Group has made in a short period of time, which in turn will support the government to make progress with implementation of the solution in the coming years.

Our focus now moves towards legislation, delivery and operation of this solution, to ensure that the deferred small pots which are currently plaguing the workplace pension market are eliminated – supporting a more efficient and effective landscape where saver outcomes are at the heart of decision making.

This is the starting point for future of workplace pension pot consolidation, providing the foundations for consolidating greater numbers of larger pension pots. The Pension Schemes Bill and the ongoing Pensions Review will result in changes to the pensions landscape. In the coming months, I will say more about our expectations in terms of sequencing and timing as I am aware of the amount of reform and the need to make it work. I look forward to our continued partnership with the pensions industry as we move together on this journey, to support savers to achieve the best possible retirement outcomes.

Torsten Bell MP

Minister for Pensions

Chapter 1: Introduction

Background

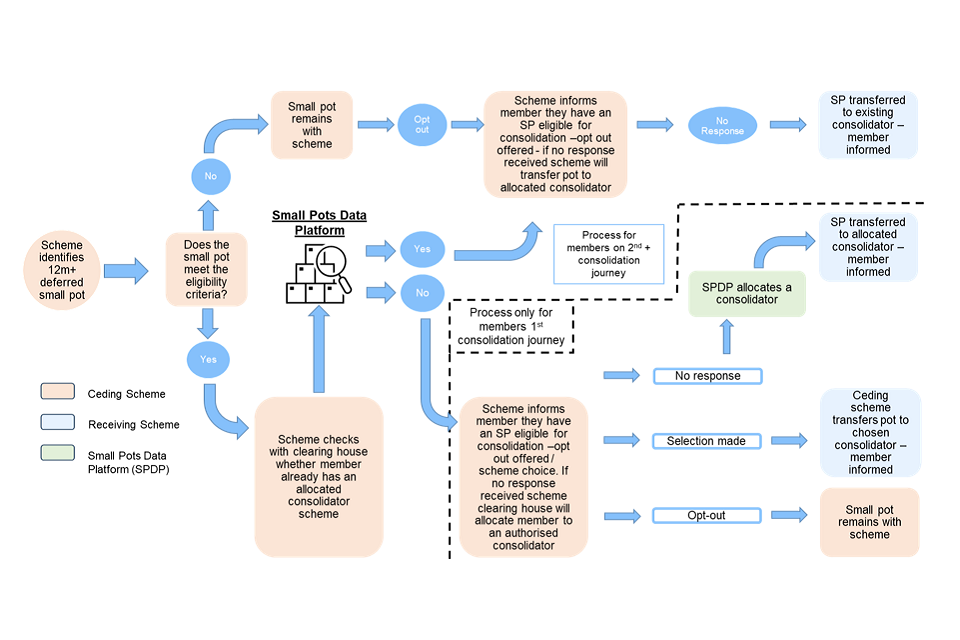

1. On 22 November 2023, a response to the DWP consultation ’Ending the proliferation of deferred small pots’[footnote 1] was published. The response set out a proposal to address the challenge of deferred small pots through establishing authorised default consolidators with a regime for automated large-scale consolidation of small pots. As part of the framework, the consultation set out that:

- schemes would be required to transfer eligible pots to one of the multiple default consolidators, with an opportunity for the member to choose their desired consolidator scheme or opt-out of consolidation. Eligible pots were confirmed as those that:

- were created since the introduction of Automatic Enrolment (AE) (including contractual enrolment)

- are within AE workplace pensions market within charge-capped default funds (including sharia compliant funds), excluding pots with guarantees

- have had no active contributions made for a period of at least 12 months

- must be valued at equal to or less than £1,000. This threshold will be kept under review as we monitor impacts

- Alongside this, the following requirements were proposed to implement the policy:

- a central infrastructure (this is discussed in more detail at Chapter 2 and 3) to underpin and support the multiple default consolidator approach, acting as a central point within the consolidation process, enabling communication between the ceding and receiving pension schemes

- an authorisation and supervisory regime to enable pension schemes to act as consolidators

2. The Small Pots Delivery Group was formed to support the Department with developing and designing the multiple default consolidator policy. Following the announcement of Pension Schemes Bill in the Kings Speech, the government continued the Small Pots Delivery Group to ensure that this measure was ready for inclusion in the Bill, given the important impact this measure will have in improving member outcomes.

Structure of the Delivery Group

3. The Small Pots Delivery Group (the ‘Group’) was established on 7 February 2024, which included a wide range of stakeholders covering multiple sectors, interested parties and representative bodies. A list of the attendees can be found at Annex A.

4. At the top of the Group structure is the Core Steering Group. The Core Steering Group was supported in its endeavours by two expert panels: a Pension Provider Expert Panel and an Administration and Technical Expert Panel. These expert panels explore topics and make recommendations on a range of policy design questions for the core steering Group to consider. The Department chaired each of the groups.

Purpose of the Delivery Group

5. The Delivery Group was asked to support the Department with the development of a viable, efficient, automated consolidation process for ceding and receiving pension schemes, whilst ensuring value for money for members, industry and taxpayers. The Group were asked to provide recommendations for the government to consider on how best to implement the proposed automated multiple default consolidator model, as set out in the 2023 consultation response[footnote 2]. The specific focus was to obtain advice and context to enable the Department to develop and implement the necessary primary legislation framework required to enact the multiple default consolidator approach.

6. The government set out that to achieve the desired levels of consolidation a solution would need to be developed that met the following objectives:

- a reduction in the wasted administration costs that deferred small pots currently present to pension schemes – which limits the value for money that schemes can pass onto their members – therefore the solution should result in a net benefit for members and the pension’s industry

- remains fit for the future, and is not just solely focussed on addressing the immediate problem, enabling for future enhancements to be made, recognising the wider aim of improving security in retirement for all

- has a tolerance of risk acknowledging that the initial pots in scope are £1,000 or less

Chapter 2: Interaction with Pensions Dashboards

Background and key areas to consider

7. Pensions dashboards will enable members to engage with their pension savings by accessing their pension information online, securely, and all in one place. The Pensions Dashboards Programme (PDP) is responsible for designing and implementing the central digital architecture that will make dashboards work. It is also responsible for developing data standards, which will provide the rules and controls that will facilitate the ongoing connection to the pensions dashboards ecosystem.

8. Once implemented, pensions dashboards will provide a step forward in enabling members to have a greater visibility of their total pension benefits and where these pots are located. This may result in an increase in member-led consolidation. However, as set out in the 2020 Small Pots Working Group report[footnote 3], relying solely on member-led consolidation is not expected to significantly change the dial on the small pots problem. Given the development of the digital infrastructure that forms the pensions dashboards ecosystem, it may be the case that there will be crossover between what has been created there, and what is needed to develop the default consolidator framework – in part, within the required central digital infrastructure design.

9. In the DWP Call for Evidence[footnote 4] and subsequent consultations the primary infrastructure required to underpin the multiple default consolidator approach has been referred to as the Clearing House. This will now be referred to as the Small Pots Data Platform. It has been determined that the term Small Pots Data Platform would be a more accurate description of the form and functions required from the infrastructure. The Small Pots Data Platform will act as a central hub to undertake data matching and identity verification on behalf of pension schemes, it will have no role in members and employer contributions – due to this it was considered that the name ‘Clearing House’ was less appropriate. The role and remit of the Small Pots Data Platform is discussed further at Chapter 3.

10. A number of stakeholders across the Expert Panels and the Core Steering Group had significant knowledge and experience of working with the PDP. As such, an initial focus for the Group was to explore and understand what potential benefits and lessons could be learnt from work already undertaken on pensions dashboards; given that both the pensions dashboards and the multiple default consolidator model are underpinned by a central infrastructure that is responsible for matching member records across multiple schemes. The Group considered as a starting point what could be replicated or replicated from the pensions dashboards eco-system alongside what lessons could be learnt from the delivery of pensions dashboards; and how this could be utilised for the development of the default consolidator approach in the longer term.

Discussion by the Delivery Group

11. One of the overarching principles agreed by the Group when considering interactions with pensions dashboards is that anything we do to address the challenge of deferred small pots should complement and not come at the expense of delaying the delivery of pensions dashboards. Therefore, the Group focussed their discussions on the following areas:

- how far the infrastructure that has been developed for pensions dashboards could be replicated to support pot consolidation

- whether the approach to data standards and matching taken for pensions dashboards is suitable for pot consolidation

- the overall lessons learnt in the design and delivery of pensions dashboards

Infrastructure

12. The Group broadly agreed with the statement made within the consultation response[footnote 5], that the infrastructure for pensions dashboards, being member initiated, is significantly different to what would be required from the infrastructure needed under the multiple default consolidator model, where action is taken by the pension scheme without requiring member involvement. However, the Group was keen to note that there are specific elements within the pensions dashboards ecosystem which could be replicated within the small pots design, specifically the use of Integrated Service Providers (ISPs), which pension schemes have partnered with in preparedness for the launch of the pensions dashboards.

13. Whilst some schemes will communicate with pensions dashboards directly, the majority of schemes are expected to choose to facilitate their connection through ISPs, and this could be replicated to support tracing and transfers for the purpose of pot consolidation.

14. Alongside this, the Group felt that it would be useful to examine the data sharing approach undertaken by the Pension Finder Service, which is part of the pensions dashboards central digital architecture. This sends out an instruction to all pension providers and schemes to search for a user’s pensions. However, the Pension Finder Service is built in a way that the transactions are on an individual member basis, whereas the multiple default consolidator infrastructure (the Small Pots Data Platform) is likely to process large numbers of eligible pots in bulk. Therefore, the current Pension Finder Service infrastructure, may not have sufficient capacity to undertake the finding function at the bulk levels required by the Small Pots Data Platform, to support small pot consolidation at scale. However, the Group identified that further exploration should be undertaken to consider how far the Pension Finder Service infrastructure could have the capacity to manage with this scale, or whether this model could be replicated to support the default consolidator approach.

15. The Group also considered that exploration should be given to how far the Identity Verification Service approach within the pensions dashboards ecosystem could also support the design of the default consolidator approach providing capabilities to verify data. Data verification creates user confidence that only verified individuals can access pensions data and protect consumers from its theft. The PDP uses the GOV.UK One Login Service to verify that certain biographical data relates to the user. This will allow appropriate data matching by pension schemes relying on the verified information supplied by the member. Whilst it is acknowledged that in the multiple default consolidator approach the member will not be involved in the process of data verification and data matching there may be opportunities to utilise processes already developed for the PDP.

Data matching and data standards

16. One of the key areas of overlap between pensions dashboards and the future consolidator system, is the need for pension schemes and the Small Pots Data Platform to be able to successfully match records held on a single member across a range of schemes. However, unlike pensions dashboards where the member verifies data, pension schemes and the Small Pots Data Platform will need to be sure that the data held on a member is correct for the purpose of a transfer out. A clear set of data matching standards will therefore be required for ceding schemes to initiate a pot transfer to the Small Pots Data Platform.

17. For this to be successful, it will be important that scheme data is of high quality – reducing the risk of mismatches, to limit the potential for erroneous transfers resulting in member detriment. The Group explored how far the approach to data matching for pensions dashboards could provide a suitable basis for the similar challenge within the pot consolidation process. This is discussed in further detail in Chapter 4.

Learnings from the Pensions Dashboards Programme

18. The Group discussed the importance of learning from the PDP, given the similarities in the complexity between the development and implementation of both policies. It was considered vital that learnings taken from pensions dashboards are actively considered throughout the policy design phase of the consolidator model, to ensure an effective solution is developed; with delivery of the consolidator solution done in an efficient manner.

19. DWP will continue to engage the PDP and other experts with knowledge of pensions dashboards to ensure ongoing collaboration and learning from the approach taken to the design and project management of PDP.

Delivery Group summary and recommendations

20. The Group was in agreement that a starting point for any decision on the potential interactions between pensions dashboards and small pots ecosystems is that pensions dashboards should not be delayed to accommodate the delivery of the small pots solution. Moreover, it was felt that the Group should not solely rely on the infrastructure for pensions dashboards, to avoid limiting the design of the Small Pots Data Platform given we should be open to exploring and utilising new technologies.

21. However, there are a number of components developed for pensions dashboards which could potentially be replicated to reduce the cost of the delivery of the Small Pots Data Platform. It was therefore felt that once the role and remit of the Small Pots Data Platform has been considered (discussed in Chapter 3), DWP should commission a Digital Systems Feasibility Review to consider the digital infrastructure required to implement the multiple default consolidator approach and how far the elements and learnings from pensions dashboards identified by the Group could be replicated to simplify this process.

Recommendation:

A Digital Systems Feasibility Review should analyse the pensions dashboards ecosystem to determine how far the elements identified by this group (namely, the ISP network, Pension Finder Service and Identity Verification Service) can be replicated to support the delivery of the multiple consolidator approach, specifically in relation to the role and remit of the Small Pots Data Platform.

Government conclusion

22. The government agrees with the importance of undertaking a Feasibility Review to scope out the necessary operating structure and digital requirements of the Small Pots Data Platform to ensure its successful design and delivery. The next steps for this Feasibility Review are discussed at Chapter 11.

Chapter 3: Role and remit of the Small Pots Data Platform

Background and key areas to consider

23. As set out in Chapter 2 the Small Pots Data Platform will be the primary infrastructure required to support pension schemes to transfer millions of eligible deferred small pots automatically on behalf of their members. At present, a pension scheme seeking to transfer out a pot is not able to see where that member has other deferred or active pots. The response to the consultation[footnote 6] set out how a Small Pots Data Platform would provide a central point to support pension schemes and members through the consolidation process and could act independently in allocating members to a consolidator scheme in cases where a member does not make an active choice.

24. Learnings from international evidence from countries with similar pension systems in the UK show that a central platform increases the success of consolidation approaches, whilst reducing the burden[footnote 7], with several countries adopting a centralised approach to facilitate the consolidation process.

25. Within the multiple default consolidator approach, the Small Pots Data Platform will be central to the overall design and delivery of the solution. However, it is hugely important that we are able to ensure that the design and remit of the Small Pots Data Platform is correct, given the scale of the small pot problem now and into the future; ensuring that costs are proportionate to the issue that it is addressing and remains deliverable. As such, a large part of the discussion of the Group has been focussed on the Small Pots Data Platform’ role, and function within the multiple default consolidator model.

Discussion by the Delivery Group

26. The Group focussed on what the core role and remit of the Small Pots Data Platform should be taking into account, the need to ensure that the Small Pots Data Platform approach remained streamlined and where possible technology and market innovations are utilised. As set out in Chapter 2, the Group strongly held the view that the development of the Small Pots Data Platform as part of the wider consolidator approach should not impede or delay the delivery of pensions dashboards, but once a clearer understanding of the role and remit of the Small Pots Data Platform is decided then the potential interactions with pensions dashboards should be investigated through a Digital Systems Feasibility Review.

27. The discussion of the Group therefore focussed on a several key areas, related to the core role and remit of the Small Pots Data Platform, including:

- structure of Small Pots Data Platform

- facilitation of the Consolidation Process

- data matching and Data Verification

- storage of data within the Small Pots Data Platform

- member Communication

Structure of the Small Pots Data Platform

28. In order for the Small Pots Data Platform to independently administer its functions, there was a preference across the Group that the Small Pots Data Platform should be a non-commercial (not for profit) entity within a Government Body working in the best interest of pension savers and the pensions industry, however agreed that a full analysis of the delivery options should be undertaken before final decisions are taken.

29. However, as set out above, it was felt that the solution should avoid looking to recreate infrastructure and capabilities that can already be delivered within the current landscape; and therefore, where possible the role of the Small Pots Data Platform should be minimised to reduce costs and complexity. Given the costs involved with the design, build and ongoing maintenance associated with the Small Pots Data Platform, the Group (including both expert panels) discussed and proposed that it may be most appropriate to fund this through the General Levy to ensure that costs are shared across the pensions industry, given there will be cross-industry benefits arising from the successful delivery of this policy. The Group noted, particularly the pension provide panel, that consideration would need to be given to the Levy structure to ensure there was a fair balance of costs across schemes.

Facilitation of the transfer process

30. Facilitation of the transfer process involves a check for previous consolidation to identify the current authorised consolidator for the member, allocation of a new consolidator for members going through the consolidation process for the first time and informing the ceding pension scheme of the authorised consolidator for the member’s pot to be consolidated into.

31. To ensure the most effective method of pot consolidation, the Group discussed what role could be undertaken by the Small Pots Data Platform in the transfer process. This ranged from a more active role whereby the Small Pots Data Platform would be responsible for holding and managing the pot transferred from the ceding scheme until it has been allocated to a consolidator or alternatively playing a more passive role supporting the ceding scheme to obtain the missing data to update a member’s record.

32. Currently, there are several different transfer mechanisms within the pensions industry and the Group discussed whether or not the Small Pots Data Platform could insert itself into one of these mechanisms more efficiently. It was determined that by adding an additional entity in the transfer process this could increase the time to make the transfer and add friction to the process. It was also thought that a system of consumer protection and redress would need to be developed in instances should an error be made and member detriment has occurred. Having examined the additional complexities, it was decided that the Small Pots Data Platform should not actively be involved in the transfer process itself and will not have responsibility for holding or transferring the members assets. This will remain the responsibility of the ceding pension scheme.

33. Alongside this it was thought that the Small Pots Data Platform should be responsible for undertaking a check to determine if the member has a pot with a consolidator or has previously chosen (made an active choice) to move an eligible pot into one of the authorised consolidators. This is because the Small Pots Data Platform could act as a central point to identify the authorised consolidators rather than the ceding scheme having to contact each of the consolidators each time a small pot is identified. If the member makes a decision to opt out of the automated transfer process, the Small Pots Data Platform could also undertake that central function to inform the ceding pension scheme that no further action is to be taken.

Data verification and data matching

34. As part of the Small Pots Data Platform role in facilitating the consolidation process, the Group discussed whether the Small Pots Data Platform should have a role in verifying data, to ensure that transfers that are occurring are eligible under the criteria set out in the consultation response.

35. To successfully deliver the multiple default consolidator approach, it is vital that the Small Pots Data Platform is able to successfully match a member’s pension records across multiple schemes. The Group discussed various approaches to data matching, including who should retain responsibility for the process. On balance, however, it was considered that given the other elements of the Small Pots Data Platform role – including allocating members to consolidators - it would be most appropriate for the Small Pots Data Platform to take an active role in data matching and data verification. However, as discussed further in Chapter 4, in cases where the data is of poor quality resulting in the Small Pots Data Platform being unable to match records, the ceding scheme would retain responsibility for improving that data.

36. The Group discussed whether it would be appropriate to legislate for data standards to ensure all schemes operate in the same way. However, it was considered that this may result in a greater burden for schemes. It was also discussed that the same outcomes could be achieved by creating a Terms of Service within the Small Pots Data Platform model. That approach will not require schemes to change how their data is stored but would require them to communicate with the Small Pots Data Platform in line with agreed standards.

Member communications

37. The Group considered whether it would be appropriate for the Small Pots Data Platform to assume responsibility for member communications throughout the consolidation process. This would ensure complete standardisation of member communications and a streamlining of the process. It would also allow for all communications to be processed by one organisation, potentially resulting in reduced overall communication costs. Additionally, some felt that it could streamline the process, improve the likelihood of the member receiving the information. Some felt that having an independent organisation responsible for communications would allow for members to recognise the process as legitimate more easily.

38. However, it was also accepted that if the Small Pots Data Platform was to act as a central hub for member communications, then it would be required to have the infrastructure to deal with and respond to member queries which could result in it having more significant build and operating costs.

39. On the other hand, some members of the Group advocated for initial communications to members being carried out by the ceding pension scheme. Given schemes already had in place systems and processes to deal with member queries, alongside the view that they would have an established relationship with the member.

40. If the ceding scheme has this role, then given that the first communication to members is vital to the consolidation process, it would be important to standardise the approach to ensure a) consistency across the market; and b) that all the options open to members are clearly communicated at once. This would include identifying who the selected default consolidator will be unless a member opts out or chooses another consolidator. The Group felt that the standardisation of the approach would need to be clearly set out, and that government should therefore explore whether statutory guidance would be an appropriate option for this, similarly to the approach which was taken with ‘Simpler Annual Benefit Statements’.

41. It was felt by the Group, that at this stage neither approach should be ruled out and that this should be considered further as part of the Digital Systems Feasibility Review to examine the costs and benefits of this in more detail. In addition to this it was suggested that DWP could explore undertaking member research to understand member preferences on this.

Storage of data

42. As a result of the consolidation of deferred small pots a huge amount of data will be exchanged, and it is vital that records are kept of the transfers that are undertaken to ensure that future member queries can be addressed adequately. The Group considered how far there may be benefits of the Small Pots Data Platform establishing its own database, to store this information centrally, but also building efficiencies by avoiding the need to contact consolidator schemes when a member returns to the consolidation process for a subsequent deferred pot.

43. The Group discussed how far the storage of this data was necessary and beneficial, considering the additional costs it would present. It was felt that the Small Pots Data Platform being able to collect and store member data to perform its functions effectively would offer some potential benefits such as the ability to identify the member and capture their chosen or allocated consolidator. However, a large database raises the potential of security risks. It was felt that at a minimum, the Small Pots Data Platform should reduce the data that is stored, whilst having strict retention periods to protect member data.

44. If the Small Pots Data Platform were to store data, this would result in the need to invest in more enhanced data security to ensure that members’ personal details are protected. It would also have a responsibility to keep records up to date, increasing the initial build and ongoing operational costs.

45. It was suggested by the Group that further exploration should be undertaken to consider whether storing data was an effective approach to increase efficiency, or whether it would result in greater cost and burden for the overall approach. The efficiency and benefit of storing data could be significantly reduced depending on the number of authorised consolidators operating in the market.

46. Alternatively, a federated database system was suggested which would enable the Small Pots Data Platform to be able to interrogate the consolidators’ records to identify previously allocated members. Both approaches have their merits, but also present complications in terms of build and costs – therefore, it was felt that this would benefit from greater exploration as part of the Digital System Feasibility Review.

47. There is an acknowledgement that any such data held by the Small Pots Data Platform could be an attractive target for fraud and scams and therefore the requirement for additional data security would increase the cost. There would also be additional General Data Protection Regulation (GDPR) requirements for the Small Pots Data Platform to ensure that the data is maintained and kept up to date increasing costs further.

Examples of data that it was considered necessary to collect and store (whether by the Small Pots Data Platform or Consolidator) included:

Personal data: to verify the member/individual, make contact and the paperwork pertaining to the member responses and evidence of communications to the member and ceding schemes for future reference.

Consolidation: details of the small pot or pots eligible for consolidation, a history of past transfers, details of the existing members consolidator and reasoning for the decision on consolidation allocation (active choice or carousel).

Delivery Group summary and recommendations

48. The Group has made significant progress on what the minimum requirements of the Small Pots Data Platform should be, including: data matching; data verification; and facilitation of the consolidation process.

49. However, the overarching principle that the Small Pots Data Platform model should remain as streamlined as possible to reduce the cost and minimise build challenges, has led us to consider whether the Small Pots Data Platform function is more that of a Central Verification and Information Service as opposed to the typical Clearing House model as seen in other countries such as Australia.

50. There remain a few areas that need further exploration, with the benefit of the industry-led Digital Systems Feasibility Review, to consider whether they should sit within the remit of the Small Pots Data Platform or would be more effectively placed under the responsibility of either the ceding scheme or the consolidators.

Recommendations:

- The Small Pots Data Platform should be responsible for the following key roles as part of the multiple default consolidator approach:

- Data verification (including correct member data, contact details, confirmation scheme has followed process, and pot is eligible)

- Data matching (using information provided by the ceding scheme to match a member to a previously consolidated pot within an authorised consolidator)

- Facilitation of the consolidation process (checking for previous consolidation to identify consolidator for member, allocation of consolidators for new members, informing ceding schemes of end location for member to be consolidated into – but not actively involved in the transfer of assets)

- The Digital Systems Feasibility review should consider these key roles, and the additional areas of member communications and data storage, to build a specification and operating model for the Small Pots Data Platform assessing the relevant benefits and risks, in order to design an effective system.

Government conclusion

51. The government agrees with the Group recommendations that the remit of the Small Pots Data Platform should include data verification, data matching and facilitation of the consolidation process, and that a decision on whether or not the Small Pots Data Platform should hold and maintain data records should be examined in the Feasibility Review before a final decision is made.

52. While the Group recommended that further research should be undertaken, prior to final decisions being made in regard to the ownership of member communications, the government has decided that member communications should be the responsibility of the ceding and receiving pension scheme, rather than the Small Pots Data Platform. This is to reduce cost and complexity in the design and running of the Small Pots Data Platform, while also leveraging existing capabilities within schemes.

53. As part of the development of the multiple default consolidator approach, there are various delivery approaches available in regard to the build and implementation of the Small Pots Data Platform, the Feasibility Review, will provide more detailed understanding of the digital infrastructure that is required to ensure that a cost-effective solution is built, assessing what the best operating model for the Small Pots Data Platform approach and the strengths / weaknesses of different approaches. This will enable the department to understand the costs, benefits and risks of these delivery options, supporting the department in making decisions on the optimum delivery approach, including who is best placed to delivery this function, as well as a more detailed understanding of the digital infrastructure that is required to ensure that a cost-effective solution is built. The next steps for the Feasibility Review are discussed further at Chapter 11.

Chapter 4: Data matching and unique identifiers

Background and key areas to consider

54. Given that one of the key principles of the multiple default consolidator approach is that it can be delivered without the direct involvement of a member verifying their data, it is vital that data matching standards are sufficiently robust to ensure a high level of accuracy – to reduce the risk of erroneous transfers. However, as a result of poor record keeping by some pension schemes and low member engagement with pensions overall, member records are often out of date. This increases the challenge of successfully matching member records to enable pot consolidation.

Discussion by the Delivery Group

55. As discussed in Chapter 2, the Group considered that the industry’s preparation for the introduction of pensions dashboards provides a foundation on which to approach pot matching. However, it was felt that a more standardised approach across the pensions industry, supported by statutory guidance, would be required to reduce the risk of matching errors and partial matches. Variability and inconsistency of data remain an issue to be overcome. As pension schemes prepare for the introduction of pensions dashboards, data standardisation and quality of records are likely to improve. As outlined in Chapter 3, it has been recommended that the Small Pots Data Platform should assume responsibility for data matching.

56. As part of the discussion the Group focussed on a few key areas, including:

- interaction with pensions dashboards

- the appropriate data sets for matching

- risk tolerance and data cleansing

- the need for a unique identifier

Interaction with Pensions Dashboards

57. As discussed in Chapter 2, the Group explored areas of interaction with pensions dashboards, one of the areas the Group explored was how far the data matching approach could be replicated for the purpose of small pot consolidation. However, a key difference with pensions dashboards is that the trigger for the process commencing is initiated by the member, whereas pot consolidation will be an automated process undertaken on their behalf. Members will access a pensions dashboard service and send their personal data to a verification service provider; which will undertake identity verification; with the member requesting their pensions information to be displayed.

58. To mandate an approach to matching was not an approach taken by pensions dashboards as it was thought this would reduce pension scheme matching capabilities overall and increase burden on schemes. It was suggested that the same approach should be taken for the multiple default consolidator solution, and therefore there are no plans to legislate for specific data matching standards. However, as the Small Pots Data Platform will be solely responsible for data matching a more standardised approach to matching will naturally result, and in effect be mandated.

The appropriate data sets for matching

59. Within pensions dashboards, members will be required to provide a minimum set of data which will support providers to match them to their member records. As a minimum it is expected that members will be required to provide their first name, surname and date of birth. The Group agreed that this was a helpful starting point but that the additional data type of the National Insurance Number (NINo) would be necessary to secure the levels of pot matching required to create an effective automated consolidator solution. However, it was noted that the use of NINo, cannot be made mandatory as there will be some pots where employers have not provided the employee’s NINo.

60. Alongside this, it was discussed whether the use of supplementary data types could be included to improve data matching rates, as the Group considered that it is highly likely that personal details such as email addresses will remain the same over a period of time.

61. However, it is acknowledged that the initial benefits of this supplementary data may be limited given that most coverage of mobile numbers or email addresses within schemes is currently low, as this information is not required under Automatic Enrolment legislation. The Group therefore considered that the following data sets should form the basis for data matching.

Primary Data Set – First Name, Surname, Date of Birth and NINo (where this has been provided by the employer).

Supplementary Data Set – Mobile Number, Email Address and Previous Addresses and Post Codes.

62. Further consideration needs to be given to how these standards are enforced, but the Group felt it was important to strike the right balance between being clear on the expectations of schemes in terms of data standards, whilst being able to amend those standards if future data types that increase matching capabilities become available such as a unique reference identifier .Therefore, it was felt that, as discussed in Chapter 3, the optimum approach may be for the data standards to be set out within the Terms of Service that the Small Pots Data Platform operates within. Schemes will be required to comply with this in order to meet their wider obligations to consolidate eligible pots. However, other approaches to enforcing standards are available, such as statutory guidance.

63. The work undertaken by the Group will continue to be informed by ongoing developments in the pensions industry based on findings and research.

Risk tolerance and data cleansing

64. The Group discussed the need to set and agree an appropriate level of risk tolerance to obtain the levels of pot matching required to achieve consolidation. In order to reduce mismatches, one approach suggested that the Small Pots Data Platform could look to other data sources (such as government databases) to improve and cleanse poor / out of date data to improve matching. In cases where this does not result in a match, this could be referred back to the ceding pension scheme to undertake further tracing activity in an attempt to update the member’s pension record.

65. Additional measures were identified by the Group, including the Small Pots Data Platform potential use of government databases, credit reference agencies and tracing services should be explored further to determine if this would achieve the level of matching required to achieve sufficient levels of member pension pot consolidation.

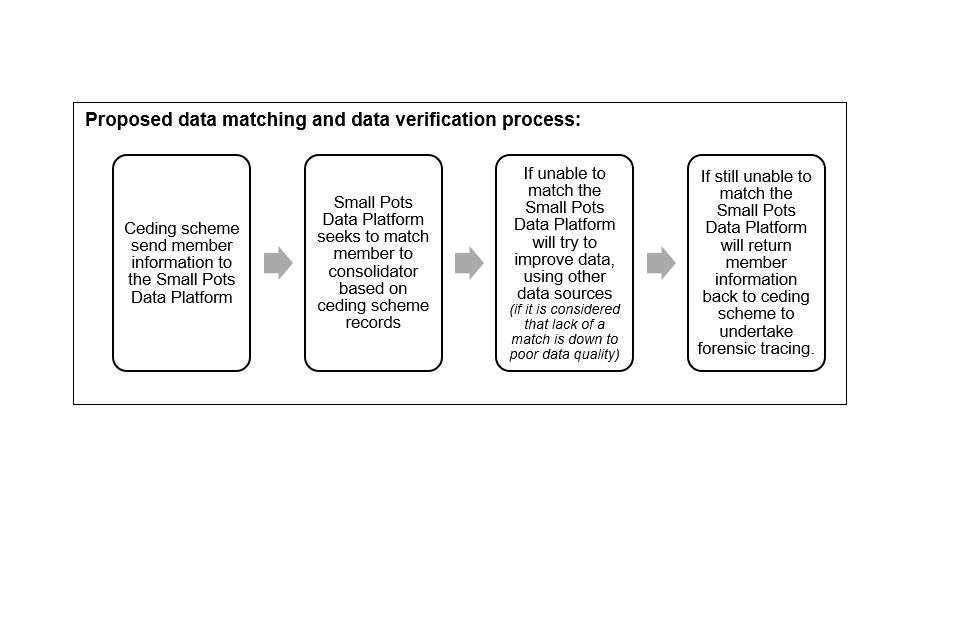

Proposed data matching and data verification process:

-

Ceding scheme send member information to the Small Pots Data Platform

-

Small Pots Data Platform seeks to match member to consolidator based on ceding scheme records

-

If unable to match the Small Pots Data Platform will try to improve data, using other data sources (if it is considered that lack of a match is down to poor data quality)

-

If still unable to match the Small Pots Data Platform will return member information back to ceding scheme to undertake forensic tracing.

Flow diagram highlighting the proposed data matching and data verification process, including the steps taken by ceding schemes and the Small Pots Data Platform

A unique identifier

66. Previous industry groups have considered the benefits of a unique identifier to support with pot matching as part of the consolidation process, given that building successful data matching capabilities lies at the heart of developing an effective consolidation solution. As such, some members of the Group initially were strong supporters of developing a unique identifier as part of the development of the multiple default consolidator approach, as they felt this would reduce complexity, increase efficiency and reduce administrative costs for pension schemes given the volume.

67. Whether or not a unique identifier should be a mandatory requirement was discussed, with some members of the Group considering that this would be the optimum approach to obtain accurate data matching and overcome issues with inaccurate and incomplete member personal details and that it could potentially save costs over the longer term.

68. There was agreement that use of unique identifiers could create potential benefits for the pensions industry, in addition to small pot consolidation. However, it would likely require significant investment and take many years to successfully implement. It was also considered that a unique identifier alone would not solve the matching challenge for the current stock of deferred small pots, given industry would still need to develop a matching capability to match each pot to a newly allocated unique identifier.

69. The Group therefore concluded that data matching for the multiple default consolidator approach should be designed with no dependency on a unique identifier. However, it should be designed with the capability to be retrofitted into the process in the future if one became available.

Delivery Group summary and recommendations

70. The Group has therefore considered that the current data types available provide a sufficient basis for us to build a matching capability – building out from the work developed to support the implementation of pensions dashboards. This can be enhanced further by using supplementary data sets where available to increase matching capabilities.

Recommendations:

- As a basis for matching, schemes will need to share the primary data sets with the Small Pots Data Platform and provide supplementary data where possible to improve matching capabilities. These data sets include the following:

- Primary Data Set - First Name, Surname, Date of birth and NINo (where this has been provided by the employer).

- Supplementary Data Set - Mobile Number, Email Address and Previous addresses and post codes.

- A risk-based approach should be taken in relation to partial matches based on the value of the pension pot. Action should be taken to determine how data quality can be improved for partial matching through the use of forensic tracing services such as credit agencies and government databases.

- The development of the multiple default consolidator model should not be delayed to allow for the implementation of a unique identifier for data matching. Data cleansing, forensic tracing and the use of government databases will improve accuracy to obtain the levels of consolidation required. However, the solution should be built to enable the use of a unique identifier to be retrofitted into the solution if one does emerge in the future.

Government conclusion

71. The government agrees that it will be necessary for data standards to be established and maintained, and depending on overall delivery decisions these could be administered by the Small Pots Data Platform, through terms of service agreements.

72. Pension schemes must comply with these standards to consolidate eligible small pots within their scheme. The final set of data standards will be agreed and undertaken through secondary legislation supported by statutory guidance subject to further consultation with industry. The Department will continue to undertake learnings from pensions dashboards in addition to other industry initiatives such as the PPI Pensions Data Project[footnote 8].

73. To ensure that a member’s pot is allocated to the correct place the government agrees that a high-risk tolerance will be set for partial matches, while balancing the need to achieve strong levels of consolidation. To ensure that all members can benefit from consolidation of their small pots pension providers will be required to take reasonable steps to improve their data, as part of the consolidation process. The government encourages pension providers to undertake this activity in advance of the introduction of legal duties in preparation for implementation of the multiple default consolidator approach.

74. The government has considered the advantages and disadvantages outlined by the Delivery Group in relation to the use of a unique identifier number and agrees with the recommendation outlined by the Group.

Chapter 5: Member communications

Background and key areas to consider

75. Clear communication to members is a cornerstone of this policy. Any organisation involved in communication with members must ensure that all communications are received and understood to the highest possible level. Members should not be induced to act in any particular way but should be clearly informed of what is happening to their pension pot and where they will be able to locate their pot once consolidation has taken place.

76. In the consultation response[footnote 9], we acknowledged that members’ trust and confidence in the consolidation process is vital. This should come from clear, comprehensible and standardised communications – potentially sponsored by government.

77. It is proposed that part of the authorisation regime to become an authorised consolidator will be that the pension provider can show evidence of high-quality communication and engagement with their current membership. This will ensure that post-consolidation, members are clearly informed of where their pension pot is located and where/how they can engage with their new pension provider. However, it is acknowledged that the effectiveness of any communication is limited by the engagement of the receiver of the communication, and it is therefore important that any communication is proportionate.

78. Given the importance of getting communication within the consolidator approach right, the Group focussed their discussion on the following questions:

- What are the key touch points for member communications during the consolidation process, and what information needs to be provided to members at each point?

- Who is best placed to deliver communication to members?

- Should communications be sent out by electronic and/or paper-based methods, and what are the risks and benefits of both approaches?

Discussion by Delivery Group

Aim of communication with members

79. To bring clarity to the design of the communication process, the Group first discussed the aim of any communications with members. It was decided that, although member engagement in all aspects of pensions saving is important, in this case the aim of communicating with members is to simply inform them of the process and of any options they may have to opt out.

80. The communications will not intend to induce any particular behaviours or actions as inactivity and inertia may be in the best interests of members, allowing for their pots to be more efficiently and effectively consolidated, given the benefits this will provide them.

Touchpoints and responsibilities

81. The Group considered the question of how many communication touchpoints would be appropriate for this process, given the above stated objective. It was agreed that two touchpoints – at the beginning and end of the process – would be the most appropriate. Having more touchpoints would increase the cost of the process and members would be the ones that ultimately pay for this.

82. The Group considered that, having two prescribed communication touchpoints would streamline the process and ensure that all members get the same, efficient service. It would also allow for those members that wish to engage with the process to get all the information needed in one primary communication upon which to make a decision. The Group have also agreed the key elements of each point of communication.

83. Prior to consolidation, communications to members should include an explanation that the pot has been identified as eligible for consolidation; an explanation of the consolidation process that will take place; timeframes; information on the opt-out process; information on consolidator options, including which consolidator will be used in the absence of a decision from the member; and contact details for obtaining any further information needed. As set out in Chapter 2, the government has decided that it is for the ceding pension scheme to undertake the initial communication with members.

84. The Group agreed that before the first communication with the member, the ceding scheme should find out who the consolidator will be – through the Small Pots Data Platform. This may come either from previous consolidation, or as a result of the member not making a choice and being allocated via the carousel system. While the Group considered this would result in an extra layer of the process for schemes, it would enable the initial communication to contain all the relevant information a member would need to make an informed decision.

85. It was suggested that for larger schemes, it is not too difficult to have a two-way interface with the Small Pots Data Platform and a process for communicating with members. However, smaller ceding schemes may struggle with regulatory change, performing all the actions in the process, and communicating with all members within the appropriate time and at low cost, so further consideration would need to be given to ensuring the process was proportionate.

86. There was agreement from the Group that the communication post-consolidation should come from the receiving scheme, so the member is clearly informed that the transfer has been completed, and they have all the relevant information on their new scheme.

Paper-based vs. digital communication

87. The Group discussed the advantages and disadvantages of both digital and paper-based communications. From this discussion, there was an overall preference for digital communications (e.g. via email / secure website / app etc.) as this form of communication can be undertaken with little to no cost and engagement can be more easily measured.

88. However, there are barriers to this, mainly an incomplete coverage of email address data and a lack of engagement with online services and software applications, especially for members who have different needs. It was therefore considered that it should be left to schemes to have discretion about how best to communicate with their particular members, but they must be confident that the communications will be received and understood.

89. It was agreed by the Group that both postal and email addresses will need to be up to date for member communications to work effectively. Frequent high-quality data cleansing, by providers and/or the Small Pots Data Platform, will be a vital part of the consolidation process and pension providers will need to ensure that the data they keep is maintained and updated frequently. It has also been suggested by the Group that DWP explore if the Small Pots Data Platform may act to cleanse member data using government databases.

Role of Automatic Enrolment

90. As set out above, the use of digital methods of communication when contacting members is preferred, but this is difficult to achieve due to a current lack of email address data held by providers; some members being unable to access digital resources; and a lack of online engagement from members that do have access. Therefore, the Group considered how this could be improved by considering mandating the provision of email address data as part of the AE process.

91. However, it was felt by the Group that this would be going too far and could impact negatively on the automatic enrolment process. Instead, it was suggested that DWP should explore putting more onus on employers to routinely collect and provide this information to pension providers but not mandating the presence of this data to undertake their enrolment duties.

Delivery Group summary and recommendations

92. As set out above, the Group has agreed that the aim of all communication with members throughout the small pots consolidation process should clearly inform them of the process and of any decisions they may wish to take as part of that. Members should not be induced to act in any particular way but rather they should be informed and reassured of what will happen regardless of their interaction with the process. To ensure that communications throughout the process are effective and proportionate, the Group made several recommendations which are outlined below.

Recommendations:

- There should be two standardised touchpoints of communication with members as part of the consolidation process. The first touchpoint will be when the pot has been identified as eligible for consolidation, and the second once the pot has been consolidated.

- There is yet to be a consensus as to whether the ceding scheme or Small Pots Data Platform provides the initial communication to members, decisions on this should wait for the outcome of the Digital Systems Feasibility Review, which will weigh up costs, benefits, and risks of holding this responsibility. DWP may explore the benefits of member research into preferences of communication methodology.

- Whilst guidance will show a preference for digital communication, this will not be prescribed in regulations and providers will be able to choose the method in the best interests of their membership.

- DWP should explore potential amendments to AE legislation to mandate the collection, maintenance of and provision to, providers of member email addresses, where possible. This should not interfere with whether an employee is automatically enrolled but it should normalise access to members’ email addresses by providers.

Government conclusion

93. The government agrees with the majority of the recommendations made by the Group but as set out in Chapter 3, it is considered most appropriate that initial communications within the consolidation process are undertaken by the ceding scheme – and not the Small Pots Data Platform.

94. This would result in the Small Pots Data Platform incurring additional costs to establish the infrastructure to deal with member queries which would result in the need to establish a contact centre, recruit and train staff in addition to ongoing property and maintenance costs. The recommended touchpoints within the member journey process will be sufficient to provide the necessary information and safeguards for members.

95. The government also agrees that a decision on whether to issue digital or paper-based communications will be a retained decision for pension providers, however the content of those communications will be in a prescribed standardised format.

96. The government encourages employers to provide up to date data on behalf of their employees to their pension provider. In particular, efforts should be made to obtain their personal email address. We will explore introducing greater duties on employers, as part of the upcoming primary legislation, to ensure that employers provide updated information to the pension provider when available.

Chapter 6: Allocation of a member to a consolidator

Background and key areas to consider

97. In the consultation response[footnote 10], the following approach to small pot allocation to default consolidators was set out. It was as follows:

- if a member already has a deferred pot with a consolidator scheme, this scheme should be allocated as the member’s consolidator

- in cases where a member has pots with multiple schemes that are authorised consolidators, their deferred pots could be allocated to the consolidator scheme that holds their largest deferred pot

- in cases where a member does not have a pot with an authorised consolidator, we would look to allocate members to an authorised consolidator based on a carousel approach that would divide pots at an equal proportion between the authorised consolidators

98. This was revisited by the Group as part of discussions surrounding the role and remit of both the Small Pots Data Platform and the consolidators, to ensure that the allocation process was effective.

99. Similarly to the responses received to the consultation, some members of the Group continued to feel strongly that a pot should always be consolidated into the members’ largest active pot, if that active pot is with an authorised consolidator, rather than the largest deferred pot – in the first instance. They felt this could increase member engagement and allow for the active pot to grow. However, it would also enable the consolidators to have greater business stability in the initial period, which could result in the acquisition of a significant number of unprofitable pots.

Discussion by Delivery Group

100. Initial discussions within the Group focussed on what the overall aim of the allocation process would be – with agreement that it should fairly, effectively and efficiently allocate deferred small pots to authorised consolidators so that members’ small pots can be consolidated and not lost or eroded by costs. But an overarching aim should be to avoid creating new pots within the consolidators – and therefore the carousel should only be used as a last resort.

Active vs. deferred pots

101. As set out above, some members of the Group considered that it would be more appropriate to allocate a member to an active pot in the first instance. This would only happen for the first time the member went through the process, and the receiving scheme would then become the members consolidator pot going forwards, regardless of future active pots being created.

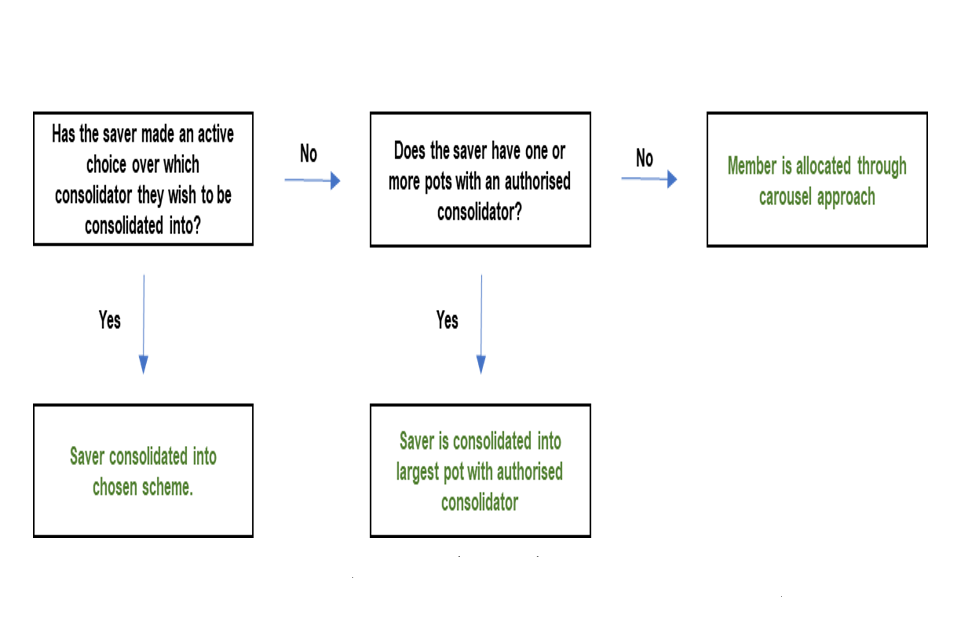

102. The process for active pot consolidator allocation would be as follows:

-

Has the saver made an active choice over which consolidator they wish to be consolidated into? If no, go to step 2. If yes, go to step 3.

-

Does the saver have one of more active pots with a registered consolidator? If no, go to step 4. If yes, go to step 5.

-

Saver consolidated into chosen scheme.

-

Does the saver have one of more deferred pots with a registered consolidator? If no, go to step 6. If yes, go to step 7.

-

Saver consolidated into scheme with largest active pot.

-

Saver consolidated on carousel basis.

-

Saver consolidated into scheme with largest pot.

Flow chart showing the process of allocating members to a consolidator scheme based on members being allocated to an active pot in the first instance. The flow chart highlights the process depending on whether an active member choice is made.

103. It was considered that there were a number of benefits of allocation to the active pot, as opposed to the largest deferred pot – these included:

- member experience and engagement - there is potentially a current relationship already formed with that pension provider

- stability – members are less likely to lose track of their pots if they know that they are being consolidated into their active pot

- choice - members would retain the option to select an alternative consolidator or provider of their choice, whether or not they hold an active pot there

104. On the other hand, some members of the Group raised concerns with this approach and felt that it presented the following risks:

- complexity and cost - consolidating into the active pot creates an additional level of process which may result in confusion and be more costly

- higher fees - charges would need to be considered with this approach as different structures exist for active and deferred pots. There are also variances in charging structures across pension providers

- deferral – depending on when transfer takes place, at the point of the transfer, the consolidator pot may no longer be active and may not be the largest pot held by a member

- market bias - if deferred small pots are moved into active pots held with consolidators, there could be a significant impact on the future AE market and competitiveness

105. It was suggested by the Group that member research should be explored to assist in further consideration of this. Members may have a preference as to where their pot is consolidated, but it may not be strong enough to outweigh the risks of either approach to consolidation. Any research would need to consider the risks and benefits, with a decision being based on what is in the best interest of members, while ensuring a streamlined and deliverable policy.

106. It was also suggested that that as a compromise, and potentially in the best interests of members, that small pots should be consolidated into a members’ largest pot with a consolidator (whether it is active or deferred).

Carousel process

107. As proposed in the consultation[footnote 11], the Group agreed that members should be able to choose from a list of authorised consolidators. The Group also agreed that where the member does not make an active decision, they should be allocated consolidator from a carousel system, unless they already have a pot with a consolidator, then this will automatically become their allocated consolidator.

108. It was considered that members allocated on the carousel basis should be shared proportionally across the consolidators that are part of the carousel.

Delivery Group summary and recommendations

109. The recommendation from the Group is that a decision on pot allocation should not be made at this stage and that DWP should instead continue to explore the benefits and risks of consolidation into active pots, largest deferred, and/or overall largest pots.

Recommendations:

- Further analysis should be undertaken on the benefits and risks of consolidation into active pots and/or largest pots, before final decisions are made. This should include exploring the merits of undertaking member research to understand their preferences.

- The carousel system is appropriate for members that do not already have a pot with an authorised consolidator and decide not to choose a consolidator themselves.

Government conclusion

110. The government has considered the benefits and risks of the approaches of allocation to the members active or largest pot and has decided that consolidation under the multiple default consolidator approach should be allocated to the member’s largest. This is because it is thought that this will benefit the majority of members in the longer term and will reduce complexity in the process but will also result in members being consolidated into larger pots which will better support the overall aim of members having fewer pension pots.

111. Members will therefore be allocated to a consolidator as follows:

-

Has the saver made an active choice over which consolidator they wish to be consolidated into? If no, go to step 2. If yes, go to step 3.

-

Does the saver have one or more pots with an authorised consolidator? If no, go to step 4. If yes, go to step 5.

-

Saver consolidated into chosen scheme.

-

Member is allocated through carousel approach.

-

Saver is consolidated into largest pot with authorised consolidator.

Flow chart showing the chosen process to allocate members to consolidator schemes based on members being allocated to their largest pot where applicable. The flow chart highlights the process depending on whether an active member choice is made.

112. The government encourages competition in the market to obtain better value for members and agrees that a carousel system should be implemented for members that do not currently have a pot with a consolidator.

Chapter 7: Authorisation and supervision

Background and key areas to consider

113. The November 2023 consultation response set out that DWP would work with TPR and FCA as regulators to introduce an authorisation regime for consolidator schemes as part of the small pots solution. The Group discussed this area, with the view to developing an appropriate authorisation and supervisory regime for trust-based schemes to act as consolidators and examine options for a similar framework for contract-based schemes, working with the FCA, with the aim of ensuring parity within the requirements.

114. The Group focused on the framework that will be required for the authorisation process to become a consolidator and what parameters should be in place for their ongoing supervision by regulators.

Discussion by the Delivery Group

115. Within the trust-based market, Master Trusts are already authorised to a high standard. Rather than creating a new authorisation and supervisory regime specifically for consolidators – which would heavily duplicate the existing Master Trust Authorisation Framework - the proposed approach to authorisation was that the existing Master Trust framework should be amended to include additional requirements that would have to be met to become authorised as a consolidator. This does not mean that all Master Trust schemes will need to act as a Default Consolidator.

116. There was consensus within the Group that this approach was sensible and proportionate.

Additional criteria for authorised consolidators

117. Whilst the existing criteria necessary for Master Trust authorisation is appropriately stringent, it became apparent during discussions with stakeholders that the authorisation of consolidators should have another level of scrutiny to ensure that, potentially loss-making, small pots are entrusted to fewer, larger, better-run schemes with the strongest financial sustainability.

118. The additional criteria we intend to require for the authorisation of consolidators, above the current Master Trust Framework include:

Already an AE qualifying scheme – schemes must already meet the requirements for AE and must offer a Sharia Fund.

The group agreed with the principle that schemes acting as a consolidator must be able to demonstrate that they would meet the test to act as a qualifying AE scheme. Also, given the intention to include pots within Sharia compliant funds in scope of the solution, it would be necessary that any consolidator would be capable of respecting those ethical beliefs and therefore would also need to offer a Sharia compliant fund.

Specific value of (Assets Under Management) AUM – schemes must have a specified level of scale to provide economies and tolerate loss making pots initially; or have a clear business plan authenticated by regulators that shows the scheme will be of scale within 3 years.

It was discussed that to ensure financial stability of the provider and value for money for members, pension providers would need to demonstrate the necessary economies of scale to become a consolidator. This was largely accepted by the Group, although there were differing views as to what AUM would constitute being “at scale”.

This criterion also ties into the first phase of the Pensions Investment Review, where consultation with industry is considering measures designed to help enable scale in the DC market are desirable in the evolution of the DC market. The government is clear that the future landscape of the workplace DC market lies in fewer, bigger, better run schemes, with the scale and capability to invest in a wide range of asset classes that can deliver better returns for savers long term and boost investment in the UK.

Provide ongoing VFM – schemes must demonstrate that they are providing good levels of value for their members, using copies of their VFM reports [for their relevant default] over the past 3+ years.

During the Group discussion, the concern that there could be regulatory duplication between the proposed VFM Framework and the additional authorisation criteria was raised. We intend to work closely with our colleagues within DWP and the regulators to avoid duplication in regulation or requirements on pension providers. Both proposed policies are part of the upcoming Pension Schemes Bill and are being developed in tandem. The group agreed that, depending on implementation timings of both policies consideration would need to be given to the appropriate time period required for schemes to demonstrate VFM in order to be authorised as a consolidator scheme.

Protection from flat fees above the current level of the de minimis – to protect members from flat fee charges that put them at detriment.

This was agreed as an appropriate safeguard for members subject to involuntary consolidation. Authorised consolidators should have the financial sustainability to take on deferred small pots without having to charge these members flat fees.

The limit of the protection was discussed, with £1000 being suggested to mirror the small pot eligibility criteria. This will be further analysed by DWP.

Same-scheme consolidation – Schemes must demonstrate that they already consolidate their members into one pot.

Some members of the Group asked for further clarity on same-scheme consolidation criteria – giving a number of examples involving guarantees and protected benefits where this would not be possible or in a member’s interest. It was confirmed that pots with guarantees and protected benefits would be exempt from this requirement.

It was widely accepted by the Group that same-scheme consolidation was an appropriate duty to place on authorised consolidators, ensuring that consolidated members only pay one set of fees to their provider and can easily see the value of their pot.

Deauthorisation

119. Although unlikely, it is possible that regulators will need the power to be able to deauthorise consolidator schemes. This would only happen in exceptional circumstances where a consolidator falls outside of the acceptable parameters for authorisation. This could happen if the scheme loses scale, financial sustainability, or is not providing ongoing VFM. If the scheme is willing to undertake an improvement plan, this will be supervised by the regulator. The scenarios and process for deauthorisation were discussed by the Group.

120. It was proposed that if a consolidator is found by regulators to have fallen outside the authorisation criteria at any point, it will have to submit an improvement plan to be supervised by regulators, eventually becoming deauthorised as a consolidator if the improvement plan fails. This was seen as fair and appropriate by the majority of the Group.

121. Furthermore, it was proposed that if a consolidator falls outside of the required VFM standard, it will, at least temporarily, not be allowed to take new members. There would be a cooling off period before this comes into force, and it would still be allowed to consolidate pots for existing members. If a scheme falls outside of the VFM standards and cannot demonstrate a credible means for improvement, they will be required to wind up or consolidate all pots under the VFM Framework, so all pots will be moved anyway.

122. This approach was accepted by the Group as appropriate, although there were still some concerns about the simplicity of the VFM rating system. DWP explained that this is still under review by the relevant DWP and regulatory teams, and that the small pots policy will adapt to reflect any changes to VFM proposals.

Two-tier authorisation approach

123. Some pension providers expressed an interest in becoming member-only consolidators, citing financial risk to their scheme as a primary factor under the whole-of-market approach. A two-tier approach to consolidator authorisation whereby schemes can apply to become either a member-only or whole-of-market consolidator was discussed by the Group.

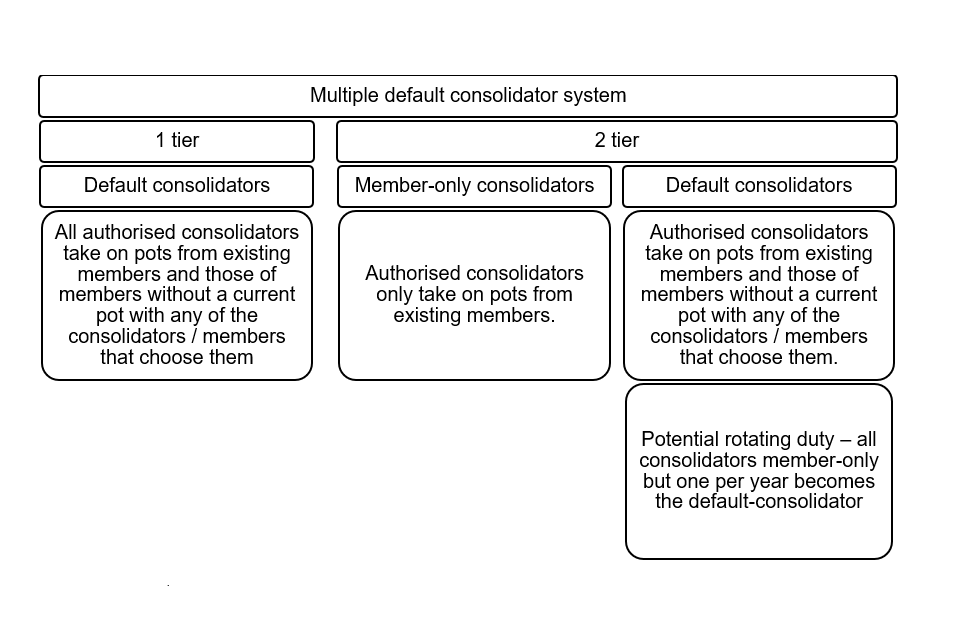

Multiple default consolidator system

1 tier

Default consolidators: All authorised consolidators take on pots from existing members and those of members without a current pot with any of the consolidators / members that choose them

2 tier

Member-only consolidators: Authorised consolidators only take on pots from existing members.

Default consolidators: Authorised consolidators take on pots from existing members and those of members without a current pot with any of the consolidators / members that choose them.

Potential rotating duty – all consolidators member-only but one per year becomes the default-consolidator

A table that outlines the potential different authorisation approaches of a multiple default consolidator system, including a one tier default consolidators approach and a two-tier approach with a mix of member-only consolidators and default consolidator schemes.

124. Some members of the Group favoured the two-tier approach as it was thought that this would encourage more pension providers to apply to become a consolidator. It was also stated that this would highly likely reduce the amount of transfer volumes required for consolidation and would reduce the number of referrals to the Small Pots Data Platform to be allocated to the carousel which could reduce costs. This would also simplify the member experience resulting in an improvement in member engagement.

125. It was also flagged that given the view it is important that members are consolidated into existing pots where possible, the two-tier approach may better support that, if it results in more schemes seeking authorisation to act as a consolidator scheme. Whereas some of the Group argued that the two-tier approach would be uneconomic for Master Trusts, which hold the majority of small pots, and could create financial sustainability issues for some schemes. Concerns were raised that this approach would add complexity on the basis that the two-tier approach would create a 3-tier approach due to the multiple options for Master Trusts to become a member only or whole of market consolidator. It was suggested that members could also become confused by the multiple ways their pot may be consolidated if the two-tier approach is used.

126. Concerns were raised by the Group that this could have a significant impact on the implementation of this approach as it would reduce the economies of scale that could be achieved by the consolidators when compared to the whole-of-market consolidator approach. This is because consolidation of deferred small pots would occur in a greater number of providers which could limit the opportunities for creating economies of scale as a result of acting as a consolidator scheme. A two-tier approach could also make it less attractive for pension providers to apply to become a whole-of-market consolidator, especially for schemes that currently hold the majority of deferred small pots.

Delivery Group summary and recommendations

127. As set out above, the Delivery Group agreed that there needs to be a more stringent authorisation process for consolidators within the multiple default consolidator framework than currently exists for Master Trusts. The extra criteria to be met by default consolidators should include an AUM threshold, ongoing VFM ratings, protection for members against flat fees (above the current level of the de minimis) and mandatory same-scheme consolidation.

128. There was no consensus on whether there should be a whole of market or two-tier system approach to authorisation, although general opinion tended to be against the two-tier system. There were valid concerns from some schemes as to their viability to act as a whole of market consolidator. Taking on potentially unprofitable small pots can have an impact on the sustainability of schemes, especially the smaller Master Trusts. On the other hand, some other schemes expressed that their interest in becoming consolidators hinged on the equity that would come from all consolidators being whole of market consolidators.