SLC Annual Report and Accounts 2022 - 2023

Published 11 January 2024

1. Chair’s Statement

There was a significant development in the year when Paula Sussex left after four years as CEO and was succeeded by Chris Larmer. This development was followed by a number of other movements in the senior leadership team. I would like to record my gratitude to Paula for her hugely successful tenure as Chief Executive of SLC and to the wider executive team who have maintained SLC’s course over the past year. My thanks also to our shareholders and my non-executive colleagues for supporting the leadership transition and to all colleagues in SLC for their commitment, hard work and contribution to our achievements this year.

Improving customer experience is one of my key objectives as Chair and I’m pleased that we delivered a range of improvements across our online services in FY2022-23. Our digital channels have matured, with smoother customer journeys and greater digital functionality. Customer satisfaction with Live Chat is particularly high, underlining this as a channel of choice for customers. Overall, we have achieved well above target customer satisfaction.

Our repayment’s function continues its strong performance too, this year achieving the highest ever number of verified customers. This is not just good administration, it is important because the better we do on maintaining accurate records of customers, the higher the repayments will be of student loans to the Government.

The enhanced ability for SLC customers to self-serve means that we can spend more time supporting customers with additional needs. We have this year taken significant steps in our journey towards improving Disabled Students Allowance (DSA) to provide a straightforward ‘single point of contact’ service. SLC is focused on ensuring a smooth transition to the new service and delivering service improvements in the coming year.

SLC is committed to providing great value for taxpayers’ funding. Our Evolve programme has delivered estimated benefits of £345.6m benefits against £139.4m invested [footnote 1]. This is well in excess of projected business case benefits. Over the last year, in line with financial service industry best practice, we established SLC’s first Financial Crime Prevention Unit. This strengthened company-wide risk assessment, data and gap analysis and fraud-prevention which will help us to maximise and safeguard the taxpayer pound.

Looking ahead we continue to face significant challenges. Cyber threats are increasingly sophisticated, and we have to maintain strong defences; high inflation erodes the amount we have to invest in new systems and we need to maintain an unrelenting focus on the customers we serve.

At its core, SLC is a technology enabled business. We continue to implement our Technology Strategy - to simplify and consolidate our technology platforms - to provide the best possible service to customers and shareholders. A priority in delivering the strategy is ensuring SLC can support the changes required for the new Lifelong Loan Entitlement (LLE). We are mobilising to deliver this generational shift in the provision of student finance, and student opportunity, with detailed discovery work being carried out in the coming year aligned to the ongoing upgrading and modularisation of our technology platforms.

With a new leadership team, we are moving into the 2023-24 financial year with strengthened ambition to deliver even more for our customers, shareholders and colleagues.

Peter Lauener,

Chair

2. Chief Executive’s Foreword

I am delighted to introduce the Annual Report and Accounts as Chief Executive of the Student Loans Company (SLC), having taken over from Paula Sussex in December 2022. Paula led the transformation of SLC over four years, creating a step change in our customer experience, digital capability and in our reputation as a trusted delivery partner to our shareholders. I would like to put on record my gratitude to Paula, and to my SLC colleagues, leadership team, Board and Government sponsors for ensuring that SLC continued to deliver for our customers, shareholders and for each other through a year of transition.

SLC’s purpose, to enable people to invest in their future, is evident in everything we do. We have driven customer improvement through better customer engagement and experience, colleague improvement through development and recognition, and shareholder benefit through increased efficiency and safeguarding of taxpayer money.

In 2022-23, we delivered tangible customer and colleague benefits as a result of the investments we made to transform SLC into a digital, future-focused organisation. Colleagues have been able to access full customer data more easily and in one place through our Customer Engagement Management (CEM) platform and our customers have been able to seamlessly self-serve, which alongside our more modern and resilient technology, mean we have been able to ‘flatten the processing peak’ for the first time.

With teams across SLC working together, task queues peaked at just 92k in July 2022, compared to 228k in the previous year. This resulted in speedier processing for customers, up-skilled and cross-skilled colleagues operating in a more efficient environment, and student finance paid on time, all of which met shareholder priorities.

We recorded increased customer satisfaction levels across all of our frontline services, with well above target satisfaction in Operations and an improving picture in Repayments. The Repayments service has maintained its excellent performance with the highest ever results achieved for customers in a repayment channel and direct collection.

All of these improvements and benefits are made possible by SLC’s colleagues. We are committed to building a positive, supportive, and inclusive workplace where everyone is treated fairly and we are proud to have Investors in Diversity accreditation. At our People Star Awards, we celebrated success and recognised excellence across a broad range of categories. This included the new Inclusive Champion category which recognised colleagues who care passionately about creating and promoting an inclusive culture.

We continue to invest in colleague progression and growth with Career Pathways now established for all parts of the business and bespoke leadership development in Operations. We are also introducing greater flexibility and increasing our in-office presence as we embed new ways of working post- pandemic. For our Glasgow-based colleagues, this aligns with our move to a new purpose-built office at 10 Clyde Place in late 2023, which provides a working space to support collaboration and colleague interaction.

I am always delighted when our collective successes and the efforts of our employees are recognised externally. The Evolve transformation programme achieved an Infrastructure and Projects Authority Green rating, recognising successful delivery to time, cost and quality. Evolve is a major programme of investment in technology to modernise SLC’s systems. It has delivered substantial improvements including our new Customer Engagement Management platform, our enhanced Online Repayments System and digital channels that enable customers to interact with SLC more easily. Over the last year, we have continued to reduce our technical debt and, as Evolve concludes and we fully execute the Technology Strategy, we will ensure that SLC’s technology continues to underpin shareholder policy aims.

The UK Government’s education policy – Lifelong Loan Entitlement (LLE) – is central to that focus. The approach to LLE has been characterised by co-design with our UK Government shareholder, Department for Education (DfE), which has enabled SLC’s delivery expertise to actively shape policy development. We have also demonstrated that SLC is a trusted partner with our collaborative approach to counter fraud activity which has been driven by our Financial Crime Prevention Unit.

SLC is an organisation that I am immensely proud to lead. We are a complex organisation undergoing significant transformation at a time of financial and capacity constraints. But we have a strong, dedicated new Executive Leadership Team in whom I have huge confidence and together, we have the pleasure of working with colleagues who demonstrate resilience, purpose and commitment to continually improving how we enable student opportunity every single day.

Chris Larmer

Chief Executive Officer

18 July 2023

3. Strategic Report

3.1 About SLC

SLC is a UK public sector organisation established to provide and administer student funding (in the form of loans and grants) to approximately two million new and returning students annually in Higher and Further Education across England, Northern Ireland, Scotland, and Wales.

It is a non-profit making organisation. The company is wholly in public ownership. Shareholders are the Department for Education (DfE) and the Devolved Administrations of Scotland, Wales, and Northern Ireland (DAs). Since 1996 SLC has been classified as an Executive Non-Departmental Public Body (NDPB).

As one of HM Government’s (HMG) key strategic delivery partners and DfE’s largest partner organisation by headcount, HMG relies on SLC to assess new and returning students and learners eligibility for student finance each year; manage a growing loan book of £203bn* on their behalf (£178.5bn at 31 March 2022); work in partnership with HMRC to collect repayments; and manage a total customer base of 9.4 million applicants, students and repayors. SLCs future developments, including the implementation of the Governments flagship policy on Lifelong Loan Entitlement, are set out more in our vision statement.

*The value of the Loan Book represents the face value of the total loan book at 31 March 2023, and not the value in accounting terms which is included in the DfE Consolidated Annual Report and Accounts, and not within the SLC Annual Report and Accounts

SLC, in conjunction with HMRC through whom most repayments are collected, services the entire loan book. The loan book is largely owned by HMG with a modest amount owned by private investors. The value of loans owned by HMG is recorded in the accounts of DfE.

SLC operates from four offices across the UK: these are in Glasgow city centre, nearby Hillington, Darlington and Llandudno Junction.

Key Facts

9.4m customers at 31 March 2023, including:

-

5.9m with loans in repayment;

-

2.0m with loans but not yet in repayment

-

1.1m sponsors; and

-

0.4m with applications but not yet paid

Circa 2.0m applications were processed in the 2022/23 Academic cycle.

SLC paid out £22.8 billion during the 2022-23 financial year, comprising:

-

£10.3 billion maintenance loans;

-

£0.05 billion maintenance grants;

-

£11.5 billion tuition fee loans;

-

£0.2 billion tuition fee grants; and

-

£0.7 billion other grants.

Number of learning providers receiving payments:

-

631 HE providers;

-

432 Advanced Learner Loan providers (FE England); and

-

449 schools and colleges (FE Wales and NI) for Education (payments directly to students).

Uptake of digital channels:

-

4.3m customers registered for Online Repayment Services;

-

1.4m customers entered Chatbot;

-

128k live chats were handled with 92.5% customer satisfaction rating; and

-

122k secure messages were worked with 78% customer satisfaction rating.

Executive Leadership Team

SLC’s Chief Executive Officer leads a team of seven Executive Directors – the Executive Leadership Team (ELT) – each of whom lead a Directorate with a mix of employees from across SLC’s offices in England, Scotland, and Wales.

Chief Executive Officer

-

Chris Larmer - Since 28 November 2022

-

Paula Sussex - Until 27 November 2022

Deputy CEO and Chief Customer Officer

- David Wallace - Throughout year

Chief Financial Officer

- Audrey McColl - Throughout year

Chief Information Officer

- Stephen Campbell - Throughout year

Business Operations

-

Executive Director - Chris Larmer - Until 27 November 2022

-

Interim Executive Director - Jacqueline Currie - Since November 28 2022

Repayments and Customer Compliance

-

Executive Director - Bernice McNaught - Until December 2022

-

Interim Director Repayments and Customer Compliance (then changed to Change, Data and Repayments) - David Beattie - Since January 2023

Executive Director HE/FE Reform

- Derek Ross - Throughout year

People

-

Executive Director - Morven Spalding - Until December 2022

-

Interim Executive Director (previously CEO until 27 November 2022) - Paula Sussex - Until 22 December 2022

-

Interim Executive Director - Chris Cooke - Since 12 December 2022

These directorates work collaboratively to ensure the effective delivery of shareholder and core business priorities.

Apply-to-Pay (“A2P”) Services

SLC provides a range of different services for students throughout the UK which vary according to the policy and operational requirements of each of the four Government administrations/shareholders.

For England and Wales, SLC manages the full end-to-end apply, assess, pay and repay process for undergraduates and postgraduates studying on a full-time and part-time basis. SLC provides the payment and repayment services for Scotland and Northern Ireland. Additionally, SLC also provides a contact centre service for Northern Ireland’s Education Authorities. They also use SLC-developed systems for assessing their students’ applications. In recent years, England, Wales and Northern Ireland have each developed varying finance products for postgraduate students, covering both master’s and doctoral degrees. These have added to the range of and complexity of loan products delivered by SLC.

SLC also manages a growing range of products for students in further education. These too are tailored to the differing requirements of individual shareholders – from Advanced Learner Loans in England, through to the Welsh Government Learning Grant. Northern Ireland and Wales both continue to offer an Education Maintenance Allowance.

SLC administers various targeted support grants designed to enable people with disabilities, childcare responsibility, adult dependants or other needs to overcome barriers to participation in higher and further education.

Additionally, SLC pays bursaries to students on behalf of many UK higher education providers.

During 2022-23, SLC paid out £11.5bn in tuition fee payments to universities and colleges on behalf of students and £10.3 billion in maintenance loans for living costs and grants directly to students and learners. These payments are made on behalf of the Devolved Administrations.

Repayment Services

SLC administers repayment services on behalf of all four UK administrations.

SLC services a growing loan book of “income-contingent repayment” (ICR) loans and works in partnership with HMRC to collect repayments through PAYE and self-assessment; the company directly collects repayments from those borrowers outside the UK tax system. SLC also provides a direct debit option for all customers, and actively encourages those borrowers who are nearing the end of their repayment term to use this facility, as it allows customers to manage their remaining balance in real- time and thus removes the risk of incorrect PAYE deductions which could otherwise result in customers over-repaying their loans.

SLC’s Vision Statement

SLC is widely recognised as enabling student opportunity and delivering an outstanding customer experience in the efficient delivery of the four UK Governments’ further and higher education finance policies.

This vision, set by the Board in 2019, is underpinned by five strategic goals:

-

deliver an outstanding customer experience.

-

be leaner, better, doing more for less.

-

be a great place to work.

-

be an enabler of opportunity.

-

be a trusted delivery partner.

The vision and the five strategic goals aimed to succinctly describe the organisation that SLC sought to become over the medium-term, and since 2019, they underpinned SLC’s delivery of its annual mission “to enable people to invest in their futures through further and higher education by providing trusted, transparent, flexible and accessible student finance services.”

Our vision, mission and strategic goals have endured since we launched the Evolve Transformation Programme in 2019. The stability in strategic direction has underpinned SLC’s transformation, and delivered tangible benefits for customers, shareholders and colleagues.

Evolve has delivered £345.6m of cashable and non-cashable benefits for DfE and HMT against the £139.4m invested, via new technology platforms. Cashable savings are those which lead to a direct reduction in budget, non-cashable benefits do not deliver cashable savings, but will increase quality or avoid future expenditure. These include:

-

Customer Engagement Management (CEM) which has resulted in 132 million pieces of customer data now being collated in one place and 12.5 million customers logging on to self- serve.

-

Online Repayment System (ORS) which has been accessed by 6.3 million customers and resulted in 500,000 fewer telephone calls.

During 2023, SLC plans to launch a review of its strategic framework, including the associated vision and mission statements, goals and lenses. Our purpose, set by shareholders, will remain constant – to enable opportunity in order to help generations to fulfil their potential.

An Outstanding Customer Experience

Our goal is to deliver intuitive, supported and trusted service throughout our customers’ experience so that the vast majority of customers can easily progress their journey without having to contact SLC. We are delivering this through our CEM system and by providing our customers with the means to self- serve through guided choice, to enable them to use the best channel to meet their needs.

As we mature this system, CEM will cover more products and more customers. Increasingly, we will use CEM’s advanced customer analytics capability to develop a deeper understanding of customers’ needs, to predict trends and to continually improve our service based on feedback and understanding. As CEM and our capability to manage customer cases develops, we will be able to introduce case ownership to provide more specialist and tailored support to customers who need additional support.

A further aspect of tailored support is the improvements we are making to the DSA service to provide a ‘one stop shop’ for customers. As the DSA service is transformed over the coming years, customers will have a single point of contact for all elements of the service, enabling a simpler and smoother application process.

We aim to ensure that customers have access to trusted student finance expertise, and clear, comprehensive and easily accessible information, advice and guidance. We therefore maintain a strongly engaged and collaborative relationship with higher and further education providers, and other partners - such as the Office for Students (OfS) and the Universities and Colleges Admissions Service (UCAS).

We will continue to review the content and information on our systems so that all customers can access what they need to complete their applications easily, whatever their circumstances.

Our application and payment systems will ensure that customers are able to interact with us and self- serve in a fully informed way. If customers need help to progress their journey, they will have access to a greater range of resources and if they need to get in touch, they will be guided to the most appropriate channel.

As our customers enter the repayment phase of their journey, we aim to make it as simple and intuitive as possible for them to manage and repay their loans by providing an up-to-date online view of their account. We will provide this alongside online facilities that enable customers to manage their repayments easily.

Leaner, Better, Doing More for Less

Given the challenging fiscal environment, the need for SLC to do more for less has never been more important. Our goal is to deliver student finance safely through flexible, sustainable and secure technology to optimise delivery, reduce costs and help protect SLC and our customers’ data from cyber- attacks.

Last year, we saw continued growth in demand through all channels, with customers using new self- service options but also contacting us through traditional channels. To be able to do more for less, we need to help our customers to self-serve where possible which is why we are focusing on ensuring

channel optimisation. We increasingly need to drive efficiencies in our operating cost base to withstand the combined impact of increasing demand and complexity and escalating inflationary costs which, like all public sector bodies, we need to absorb.

Alongside increasing productivity and continuing to focus on controlling headcount, we are using intelligent systems and automation to drive further efficiency. We are building on business process automation capabilities like robotics, continuing to develop frontline LEAN capabilities and building on our approach to benefits-tracking.

SLC is increasingly building longer-term strategic relationships with technology delivery partners. As we further de-couple and modularise our systems, we will have increasing scope to ensure contracts with these partners deliver specific outcomes for us.

We aim to increase the accuracy and integrity of our data and use it to improve operational efficiency and performance and also to drive up repayment collections and hence yield. We will continue to drive a culture of continuous improvement and automate high volume, low complexity activity. We have created a Data Centre of Excellence which has responsibility for data across the organisation. This will enable greater analysis of our data to provide insight, helping to increase loan book yield, and deliver better value for the taxpayer.

A Great Place to Work

Developing SLC as an inclusive and diverse Employer of Choice is vital in achieving our corporate objectives, especially given the challenging recruitment market we operate in and the ongoing economic challenges.

SLC strives to maintain a skilled, motivated and engaged workforce, aligned to current and future organisational needs. Key building blocks of our People Strategy are Career Pathways and increased flexibility, through which we aim to enhance colleague experience, and opportunity.

SLC also strives to maintain robust engagement and organisational health. Our colleagues are engaged – 2,500 colleagues responded to the last Employee Engagement Survey in November 2022 and many take the opportunity to connect through colleague networks. However, colleague feedback is robust on the areas we need to improve, with pay being an issue which dominated feedback. We are clear that if we are to retain and recruit the people we need, we must create fair pay and reward at SLC. This will be a multi-year undertaking and we will continue to work with colleagues in DfE to develop our pay case.

Core to maintaining a skilled, motivated and engaged workforce is a focus on our Equality, Diversity and Inclusion (EDI) objectives including our aim to close our Gender Pay Gap. We aim to build and maintain a diverse and inclusive workforce, to cultivate and promote a workplace culture where everyone is included, and to work together towards an empowered and engaged workforce. This is another multi- year undertaking and in 2023-24 we will revise and refresh our EDI strategy.

We will relocate within Glasgow city centre to a new, purpose-built office during 2023-24. This will provide a modern working environment with the space configured to suit flexible working, with fewer fixed desks and more collaboration space. Importantly, it will also help us progress towards our net zero ambitions.

Enabler of Opportunity

Our goal is to be recognised as an enabler of student opportunity, delivering strong social value on behalf of our shareholders. This will continue to be based on a clear understanding of our objective to provide student finance reliably and securely, helping customers to invest in their futures and supporting the long-term economic growth of the UK economy. Enabling opportunity for our customers who need additional support is particularly important and is why we are focusing on making the greatest improvements for this customer group.

The most significant change that we will deliver to enable opportunity is LLE. From 2025, LLE will provide eligible English individuals with a loan entitlement to the equivalent of four years of post-18 education to use over their lifetime. It will be available for both modular and full-time study at higher technical and degree levels (levels 4 to 6), in colleges and universities from 2025. This flagship Government policy will fundamentally change learning in England. As noted above, DfE will be working with SLC as a trusted delivery partner, asking us to put in place the student finance systems to support the new LLE accounts that will underpin these new learning opportunities.

Enabling opportunity by providing access to student finance each year is dependent on reliable and secure technology. As part of the Evolve Strategy, SLC began a major programme of investment in technology to modernise its systems. We are now seeing substantial progress, including the delivery of Online Repayment System and Customer Engagement Management.

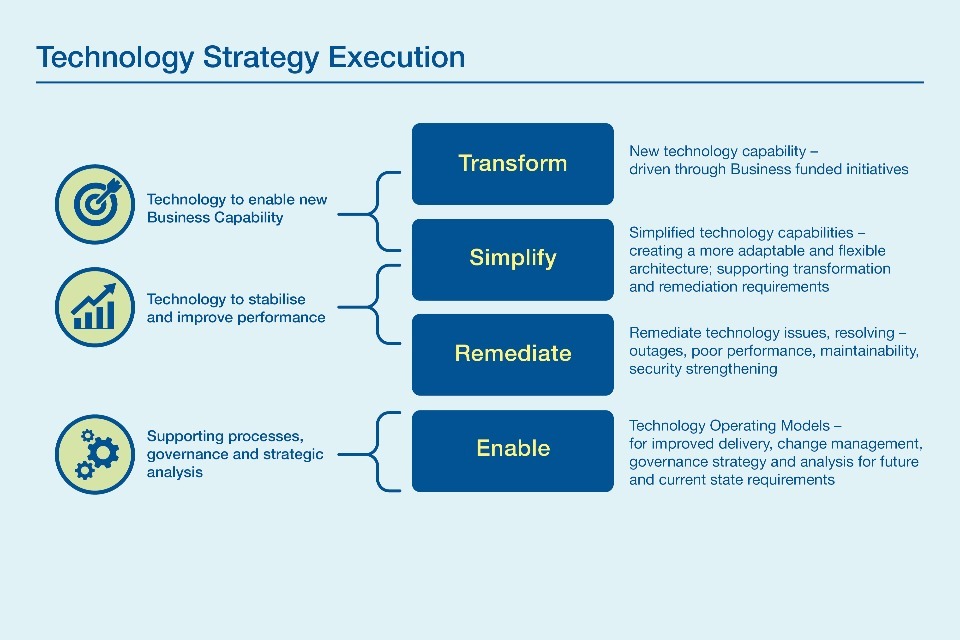

All of our customer improvements are technology-enabled, and executing the Technology Strategy – to transform, simplify, remediate and enable our IT estate – is central to underpinning our ability to fulfil our mission, both now and in the future.

Trusted Delivery Partner

Our goal is for shareholders to see us as a trusted partner in the efficient and agile delivery of Government policy and for taxpayers to trust us with their money.

SLC and the policy teams within DfE and the Devolved Administrations increasingly work in a collaborative and joined-up way. This is underpinned by robust governance of the policy development and commissioning process tied to clearer, achievable delivery timelines. Closer collaboration enables fuller consideration of the practical dimensions of delivering new policies cost-effectively, on-time and with the intended outcomes both for our shareholders and for our customers. We will continue to support shareholders in simplifying and rationalising the policy landscape wherever possible, better aligning policy intent with efficient and effective delivery that is aligned to tested and hence proven user needs.

We will continue this successful co-design approach with LLE, leveraging the opportunity LLE provides to simplify products and rationalise policy, as we continue to press the case for simplification.

SLC and DfE will continue to work towards greater autonomy, as outlined in the 2022 Framework Document, with the Board continuing to enhance its assurance role. We will work to increase SLC’s ability to make decisions which make a difference for, customers, shareholders and colleagues, including by extending CEO discretion to act in cases where students have been incorrectly assessed as qualifying for support.

In delivering our core mission, our goal is to be competent in ensuring we maximise the use of, and safeguard, the taxpayer pound. To deliver value for money for the taxpayer, in the year ahead and beyond we are focusing on operational efficiency to reduce costs, consistently driving best value from commercial activity and fully embedding our new Financial Crime Prevention Unit (FCPU) to minimise loss from fraud.

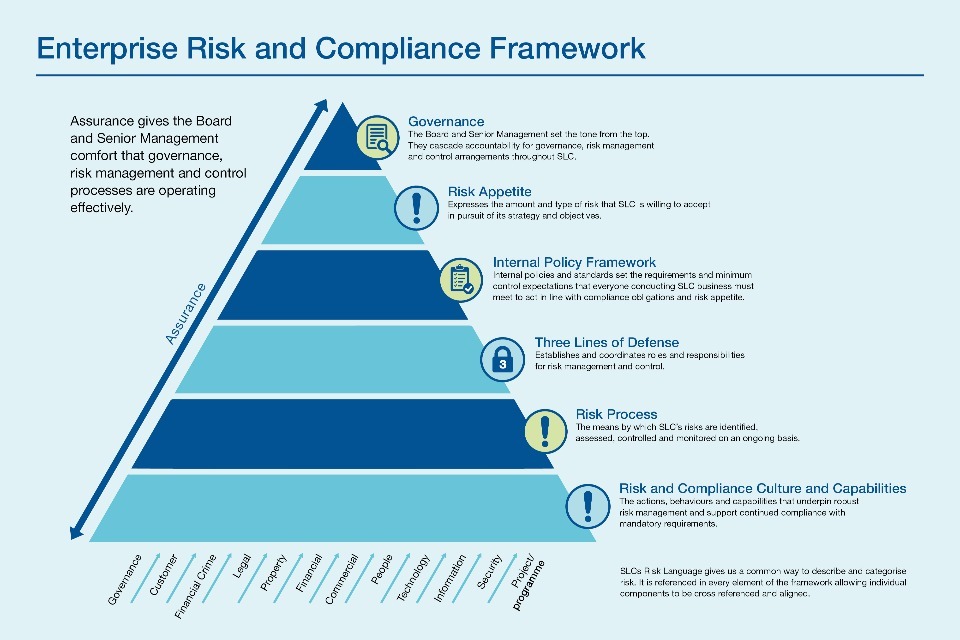

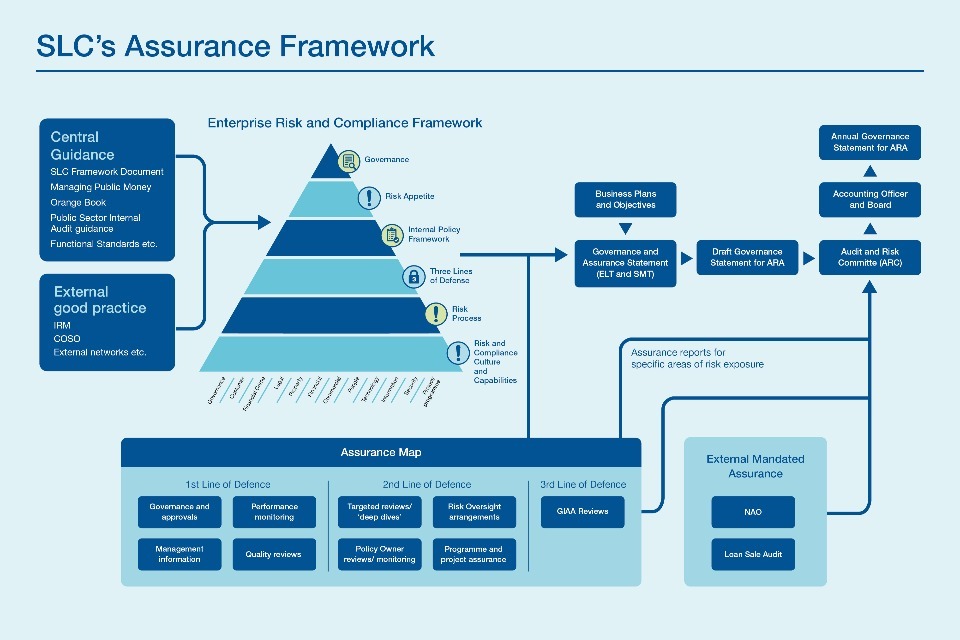

Also core to safeguarding the taxpayer pound is ensuring that we manage risk effectively, not just within our own business but in third-party suppliers and across the student finance system. SLC’s risk framework has continued to mature as our Enterprise Risk and Compliance team embed our three lines of defence model. The Annual Business Plan provides further detail on the outcomes that we want to achieve in FY2023-24.

Our Future Strategy

SLC’s Corporate Plan outlines our strategic objectives and how we plan to achieve our vision of widely enabling student opportunity while efficiently delivering the four UK Governments’ further and higher education finance policies.

The strategy continues to execute our five strategic objectives. Chief amongst these is to deliver an outstanding customer experience by continuing the deployment of CEM and the Customer Experience (CX) strategy. As capacity comes free through increasing automation, we will increasingly focus on customers who need additional support.

SLC will continue to reduce the company’s technical debt as the Evolve transformation programme concludes and SLC continues to implement the technology strategy. Crucially, by 2024-25, we must build the systems that will underpin the UK Government’s flagship education policy LLE, which will replace the current offer to Student Finance England customers studying in FE or HE undergraduate, part-time or full-time, with a new, single, streamlined system of student finance which will be available over the normal working lifetime of most individuals. SLC is the Department’s key delivery partner and is actively co-designing the policy and implementation plan with DfE.

From 2024-25, SLC will be laying the foundations for a revised three-year strategy based around driving organisational efficiency and capitalising on the transformation that has been successfully achieved to date.

Developments in our Business and External Environment

Alongside increases in customer numbers and greater complexity of customer applications, we continue to experience a range of factors which make it a challenging environment to deliver better customer, shareholder and colleague outcomes.

Whilst the post-COVID recruitment market has stabilised, we continue to experience recruitment and retention issues which we are seeking to address, in part, through a multi-year pay strategy. Delivering fair pay, on a cost neutral basis, is an imperative for SLC to ensure we retain the corporate knowledge and skills we need to continue to drive the positive outcomes of our transformation.

But pay alone is not enough and we continue to position ourselves as an employer of choice by offering flexible and, like many other progressive organisations, attractive hybrid working practices, career development and progression and colleague benefits including generous pension provision. A key aspect of being an Employer of Choice relates to EDI – we will set a new strategy and objectives for 2023-2026 which will build on the progress we have made and seek to accelerate further.

The challenge to drive efficiency and reduce costs is ever-present and is a core focus. For SLC, reducing cost enables us to be leaner and more effective overall by reducing the cost to serve our customers and increasing value for taxpayers. It also enables us to free up resource to support those customers who need us most.

For SLC, the introduction of LLE will ultimately represent a fundamental change to our business and technology model, which is currently centred around products, as we develop a new model shaped much more around a customer’s personal account.

LLE will be introduced progressively from 2025, providing individuals with a loan entitlement to the equivalent of four years of post-18 education to use over their lifetime. It will be available for both individual modules and for full years of study at higher technical and degree levels (levels 4 to 6). This will facilitate flexible study – allowing individuals to space out their studies, transfer credits between FE and HE institutions, take up more part-time study and retrain throughout their lives to respond to market demand for skills.

Key Risks and Issues

SLC has detailed plans to remediate its most complex and pervasive risks, these are captured in the Governance Statement. Risks are discussed in each directorate and collectively by the Executive at the Executive Risk Forum five times a year. Consolidated risk reports and assurance reports covering specialist risk categories are provided to the Audit and Risk Committee four times a year. They journey for each significant risk is summarised as follows:

Post Covid-19 Pandemic Operating Model Risk Description

Failure to identify and implement an effective employee proposition and operating model in a post-covid environment.

2022-23 Journey

Following the successful completion of the initial phase of hybrid working and the return of colleagues to the office in 2022, the risk has reduced to within target levels. Focus, however, remains on ensuring that the model continues to support staff wellbeing and organisational cohesion.

Information and Data Handling Risk Description

Inappropriate handling and processing of data may lead to a breach of legislative or regulatory requirements.

2022-23 Journey

The risk remains stable, with material progress to a more mature compliance position ongoing.

Cyber Security Risk Description

A successful cyber-attack may lead to data loss and business disruption.

2022-23 Journey

SLC continues to monitor threats and build/maintain mitigants via an ongoing programme of work in response to the constantly evolving threat landscape which makes this an enduring key risk.

Systems Access Management Risk Description

We fail to maintain our ability to mitigate and prevent user error, malicious activity or internal fraud across SLC systems.

2022-23 Journey

The risk reduced in the year following the successful completion of a project to improve associated controls.

Staff Attraction and Retention Issue Description

Challenges retaining subject matter experts with deep knowledge and key technical skills may compromise SLC’s ability to deliver against key business objectives.

2022-23 Journey

Staffing levels across the frontline have improved following a period of targeted recruitment. Retention and recruitment of specialist and technical roles, however, remain a significant challenge with impacts across the business.

In addition, we continue to assess the scale and complexity of building the LLE service and focus on building our resilience and capability to respond to financial crime risks.

3.2 Performance Analysis

SLC measures performance against a set of key financial and non-financial performance indicators.

Shareholders confirm SLC’s role, core responsibilities and priorities each year in the Annual Performance and Resource Agreement (APRA). This also confirms the company’s annual budget and outlines a set of key performance measures and targets which shareholders expect SLC to meet – the APRA measures and targets.

Despite a growing number of customers, a growing loan book and an ever more complex set of tailored finance products, SLC has yet again achieved a significant level of success against the APRA targets set by shareholders.

3.2.1 Operational Performance

A range of improvements have been delivered across online services throughout 2022-23, as SLC builds on the foundations laid by CEM.

The introduction of CEM has helped colleagues to provide customers with more detail around the status of their application and helped them to provide clearer guidance on the next course of action a customer is required to take and to successfully manage customer expectations. This, along with improvements in the identification and verification through the introduction of one-time passcodes and a more streamlined Interactive Voice Response experience has contributed to improved satisfaction on the telephony channel.

In addition, services such as Chatbot, Live Chat and Secure Message have provided alternative channels of communication for customers, expanding choice and encouraging self-service as well as automated routes in response to customer demand.

SLC has continued to focus on finding new ways to improve and simplify the customer experience and journey: to be better for customers, better for colleagues, better for shareholders and to deliver tangible outcomes and value.

Case Study: Reducing the Evidence Burden for Customers

SLC introduced the Evidence Reduction Working Group in 2022. The remit is to fundamentally and holistically consider opportunities to remove or reduce the evidence burden for customers submitting applications for student finance.

During 2021 the company received approximately 89,000 birth certificates, (an increase from 57,000 in 2020). SLC’s customer panel and user-research demonstrated that many customers perceive the need to send physical evidence documents by mail as antiquated and not in line with other modern day financial services. Other government bodies are also moving towards digital evidence and improved data sharing. Additional issues had arisen from customers not renewing their passports, due to the pandemic travel restrictions or economic reasons.

In July 2022, SLC implemented digital upload changes for UK nationals supplying birth certificates for England and Wales. Since then, 75% of these documents have been provided by digital upload rather than by post. This has reduced the risk of security breaches and reduced handling costs to both the customer and SLC.

Customer Satisfaction APRA Target Results

SLC commissions independent surveys of customer opinion on a variety of topics each month. As part of each survey, customers are regularly asked to rate the company’s overall service with a mark out of ten. These scores are aggregated as a 12-month rolling average and expressed as a percentage.

| 2022-23 Target | 2022-23 Result | Comment | |

|---|---|---|---|

| How applicants and students and their sponsors rated the company’s overall service | 75% | 81.4% Green | Applicants, students and their sponsors’ satisfaction significantly improved during 2022-23, up from 79.1% in 2021-22. |

| How those in repayment rated the company’s overall service | 62% | 54% Red | Repayers’ satisfaction also improved (from 54% in 2021-22) but remains below target. Analysis shows that a high number of those repayment respondents who provide the lowest scores also use the survey as a vehicle to express dissatisfaction with the terms and conditions of their loans, something that is not within SLC’s control, and a trend that has become more prominent this year as the cost- of-living has increased. The repayment service itself has remained highly efficient and performed well during 2022-23 in reducing contact demand, complaints, and exception work. SLC has plans for further service improvements that may support incremental increases in repayment customer satisfaction over the coming year. |

Frontline Lens

This lens covers SLC’s two customer-facing services, application processing (Apply-to-Pay) and repayments.

Apply-to-Pay

SLC has again delivered for our customers and shareholders with another successful student finance application processing cycle for the academic year 2022/23.

SLC paid out £22.8 billion on behalf of the Devolved Administrations to students and learning providers during the 2022-23 financial year, comprising: £10.3 billion in maintenance loans, £0.05 billion in maintenance grants, £11.5 billion tuition fee loans, £0.2 billion tuition fee grants and £0.7 billion other grants; (‘other grants’ includes various targeted support products such as Disabled Students’ Allowance and Childcare Grants).

This year we handled over 2.5m customer contacts, approximately 10% more than the previous cycle. We handled around 5m customer tasks – 7% higher than in AY 2021/22 – and the average time for task completion improved by approximately 3 days.

Case Study: Flattening the Peak

For the first time ever, SLC ‘flattened the peak’ with task-queues peaking at just 92k in July 2022, compared to 228k in the previous year. This was achieved through collaborative action across the organisation, aligned to the dynamic allocation of resource:

For the 2022/23 academic cycle, SLC established a shared resource model between its Operations and Repayments Directorates, aligned to the design of the then new “Student Finance Officer” role. This was a significant change to how resources are optimised flexibly across the business. It provided the ability to augment operational capacity by up to 70 FTE, delivering additional application processing capacity from June to October.

CX Interventions focused on improving the customer experience and reducing cost by driving up self- serve. Key achievements were improving the online experience, creating self-serve channels, reducing customer effort and burdensome evidence requirements, enhancing self-service functionality, increased self-help guidance and delivering targeted communications to influence customer behaviour.

Over one million targeted communications were sent across AY2022/23 to support, guide, and retain customers within self-service. Some prompted customers to complete outstanding actions, for example, providing their National Insurance number, bank details or eligibility evidence. These contributed to the overall achievement of having more students in a ‘ready to pay’ position by September than in any previous academic year.

SLC’s People Directorate reviewed the onboarding process and ensuring that staff are successful in transitioning into their new roles through effective training, maximising the speed-to-competence. SLC’s Technology Directorate also contributed, successfully implementing a consolidated set of activities and enhancements which significantly improved the resilience and stability of systems and technology services during the peak processing period both for our frontline Operations colleagues and for our customers (more on this below).

The ‘three pillar’ operating model that SLC introduced in 2021 for the Operations Directorate has continued to mature and evolve, as we build a modern, responsive, and sustainable customer operation. The two new support pillars (“Operational Resource Planning and Support” and “Operational Service Excellence”) are successfully deploying core capabilities and owning activities that enable the key “Operational Delivery” pillar to focus on achieving an outstanding service to our customers. An extensive process of consultation has been completed to significantly rationalise over 100 different customer-facing roles into three streamlined and consistent positions; these enable greater flexibility for multiskilling and career development while laying the foundations for the transition from task- to case- management.

The quality of the outcomes provided to customers who had a task processed or who contacted SLC has remained strong and above APRA targets, and this is reflected in significantly improved customer satisfaction scores (as reported in the Customer Lens above).

Apply-To-Pay APRA Performance Metrics

| Target | 2022-23 Result |

|---|---|

| Right First Time - Processing Quality to be ≥ 92% | 92.2% Green |

| Right First Time - Contact (non-outsourced only) Quality to be ≥ 92% | 95.4% Green |

| Comment |

|---|

| Both Quality Assurance targets were again exceeded, against a backdrop of extensive ongoing change within the Operations Directorate |

Repayments

A key goal is to ensure that all repayments due are returned to HM Treasury, by making sure that customers who are due to repay comply with their terms and conditions and by ensuring that fraud and error are minimised.

Against a backdrop of a challenging operating environment and increasing number of customers, SLC has again exceeded its repayments targets for 2022-23.

Efforts to increase the number of customers who have verified their residency and employment status have been successful, with the final percentage of verified customers for 2022-23 reaching 91.5% against a target of 90%, the highest percentage that SLC has ever recorded. Each 1% increase in this rate equates to circa 60k additional customers being verified and an additional circa £27m being repaid to the Exchequer.

SLC takes a responsible approach to all debt collection activity and is mindful that customers may find themselves in difficult circumstances. The company strives to ensure fair and supportive treatment of customers with additional needs and those facing financial hardship. During the year, all frontline colleagues undertook training to support customers with additional needs. SLC has provided a new service enabling customers to set up direct debits online. Over 37,000 customers set up direct debits in 2022-23 with over 70% using the new online service rather than the telephone channel option. A further new service now enables customers to update their bank account online – with approximately 1,300 customers using this facility since its launch in August 2022.

These improvements have contributed to an overall inbound call reduction as more customers have been able to self-serve: calls reduced to 801,000 (from over 1.2m prior to the online repayment service being available).

Repayment Performance Metrics

| Target | 2022-23 Result | Comment |

|---|---|---|

| Percentage of borrowers from past cohorts who are compliant with their repayment obligations. (“Past cohorts” means all Income- Contingent Repayment (ICR) borrowers with an SRDD* before April 2023) to be ≥ 90% | 91.5% Green | A second record year for Repayments’ performance. |

*Statutory Repayment Due Date: the date when former students become liable to potentially begin repaying (contingent upon their income). This date is usually the start of the tax-year that follows the end of their studies.

Corporate Lens

Managing Change

One of SLC’s strategic goals is for shareholders to see us as a trusted partner in the efficient and agile delivery of Government policy and for taxpayers to trust us with their money.

SLC and the policy teams within DfE and the Devolved Administrations increasingly work in a collaborative and joined-up way. This is underpinned by robust governance of the policy development and commissioning process tied to clearer, achievable delivery timelines. Closer collaboration enables fuller consideration of the practical dimensions of delivering new policies cost-effectively, on-time and with the intended outcomes both for our shareholders and for our customers. We will continue to support shareholders in simplifying and rationalising the policy landscape wherever possible, better aligning policy intent with efficient and effective delivery that is aligned to tested and hence proven user needs.

We will continue this successful co-design approach with LLE, leveraging the opportunity LLE provides to simplify products and rationalise policy, as we continue to press the case for simplification.

SLC manages an overall change agenda which is comprised of seven portfolios, namely Policy, Technology, Repayments, Corporate, Evolve, Operations and HE / FE Reform.

Each portfolio submitted a “RAG status” to the relevant portfolio board for approval on a month-by-month basis, and subsequently reported this to the Executive Leadership Team and Board.

Change Portfolios

The overall assessment of the performance over the full year for two of SLC’s seven portfolios, Policy and Evolve, were set as APRA targets:

| 2022-23 Portfolio Annual Rating | Comment | |

|---|---|---|

| Policy Portfolio | Green | Online services for the 2022/23 academic cycle were all launched on- time, including scheme changes relating to customers facing hardship as a result of the invasion of Ukraine. Several services for the 2023/24 cycle also launched before the financial year-end. The DSA Reforms Procurement project was also a significant success this year (see Case Study below). |

| Evolve Portfolio | Amber | Several CEM projects, eg extending and increasing self-service capability to postgraduate customers were successfully delivered during 2022-23. The amber status reflects that due to capacity and funding constraints, not all projects have progressed to schedule, including a delay to the Sponsor Journey Redesign project. Nevertheless, Evolve came close to its benefits realisation target for 2022-23 with a total of £79.1m realised (£27.1m DfE Cashable and £52.0m HMT Cashable) against the target of £82.0m (£27.4m DfE Cashable and £54.6m HMT cashable). |

Case Study: Disabled Students’ Allowance (DSA) Reforms Project

Every year SLC helps millions of people realise their ambition of going to college or university, including more than a quarter of million students with a disability. DSA is crucial for helping disabled people participate in higher education, but it can be challenging for them to access. SLC is in the process of making the DSA application journey easier with a number of significant improvements.

Last year, SLC undertook one of the most complex procurements in its history in order to provide a more straightforward ‘single point of contact’ service for customers in receipt of DSA. We also, for the first time, introduced contractual controls to ensure consistent quality of service – one DSA supplier in each region managing the end-to-end support.

It was imperative that some legacy suppliers were able to form part of any future DSA supply-chain to help maintain continuity to the DSA service provision. The commercial strategy was designed to ensure inclusiveness for SMEs, hence the use of a procurement mechanism open to all suppliers and a Lot structure that segmented the service into areas more accessible for smaller entities. The robust commercial process ensured no challenges were made during the procurements and resulted in a successful completion and conditional award to two suppliers, each covering two lots.

Technology

2022-23 was the second year of the execution phase of SLC’s Technology Strategy. The strategy set out the roadmap to a target enterprise architecture. This will simplify and consolidate existing platforms and decouple the architecture to reduce total cost of ownership, increase flexibility and to enable long term sustainability.

Technology Strategy Execution

Historically SLC developed systems directly in response to policy-need on top of existing software. These legacy systems have increased cost and limited the ability to support the needs of a modern digital business.

The Technology Strategy underpins the shift from a product to customer centric organisation and is being delivered through four key areas:

Transform, Simplify, Remediate and Enable.

A strategy diagram with four key actions - Transform, Simplify, Remediate, Enable - each linked to an aspect of technology improvement and supported by three corresponding icons.

In 2017, SLC identified legacy risk across ten key business applications. Since then, work has been undertaken and is ongoing as part of the technology strategy to remediate this risk. Significant progress has been made in the execution of the Strategy through both technology-led and business transformation activity:

- The core technology building blocks are now in place;

- Improvements to skills, processes and governance have been implemented;

- The risk associated with legacy systems has been managed effectively;

- Significant portfolio deliveries have been supported; and

- The strategic design has commenced.

Strategic Partner Programme and New Ways of Working

SLC has adopted a change in approach to how we work with our suppliers. During the last 12 months the Strategic Partner Procurement Programme has successfully completed, with the final two (of four) strategic partner contracts awarded to: Tata Consultancy Services (TCS) who were appointed in April 2022 to deliver a range of technology change and integration services, and Eviden (was Atos) who were appointed in October 2022 to deliver a range of customer software delivery services. We now have 3 strategic partners of scale on long term contracts (TCS, Eviden, Capgemini), that are aligned to our platforms and technologies. The Partners provide a range of technical services and capabilities that are being used to deliver and support new technologies; deliver enhancements to critical business applications and services; uplift or decommission of legacy services; support the delivery of improvements to SLC’s digital services and customer interface and the associated technology infrastructure; and streamline processes and change the way we deliver and support some technology services, thus ensuring that we deliver long-term value and efficiencies for SLC. This is all part of our wider Operating Model enhancement work, with continued investment in our people at the core, to build and develop the necessary technical skills and capabilities SLC needs for the future.

Case Study: Providing Systems Stability During Peak

In response to the SLC’s cross cutting Business Objective ‘Flattening the Peak’, for the academic 2022/23 cycle, a consolidated set of activities and enhancements were implemented. These were aimed at improving the resilience and stability of technology services during the processing peak period (late summer into Autumn) and driving improvement in how services are delivered for Operations colleagues and customers. Particular focus was placed on enhancements to key legacy systems which had the highest incident volumes in 2021. This combined with newly introduced technologies resulted in significant reductions both in the number of system incidents logged during peak and also in contact-centre lost hours. Contact-centre lost hours were 92% down year on year, and also 69% lower than in 2018-19 when the majority of staff were office based.

Monthly Systems Incidents Logged By Operations During Peak

| 2021 | 2022 | |

| July | 1738 | 209 |

| August | 2,414 | 175 |

| September | 2,290 | 185 |

Cyber Security

SLC established a new Cyber Assurance Team in August 2022 to ensure that technical and security controls are applied to new and upgraded technology services from their introduction and throughout the life of the services. Additionally, a new Security Major Incident team was formed in November to remediate enterprise impacting incidents, and SLC completed cyber-security incident response exercises with the Business Continuity Team.

SLC remains vigilant in light of the cyber-attack threats following UK Government guidance in response to the challenging global context and has enhanced monitoring in place to assess this and other potential threats.

Technology Performance

Last year, SLC‘s Technology Group began reporting monthly on the number of green service days – that is days on which there were no priority incidents or system outages – as a percentage of the total number of days. The percentage for the whole of 2021-22 across the business was 88.5% (up by 2% on 2020-21), and has now further increased, to 89.8% for 2022-23.

| Target | 2022-23 Result | Comment |

|---|---|---|

| Percentage green service days to be ≥ than 87% | 89.8% Green | Above target, and improving on 2021-22, itself an improvement on 2020-21 |

Public Money

SLC works within the budget agreed with shareholders and has budget variance metrics against the three standard Government budget classifications of administration, programme and capital.

SLC has further strengthened financial discipline, introducing quarterly financial challenge meetings and a risk-based forecasting model to help manage volatility in expenditure to within APRA tolerances.

SLC met the target for two of its three APRA measures for budget variance, with both Administration and Programme within “green” tolerance. The 12% underspend against the Capital budget meant that SLC missed this target, however the result is a clear improvement on 2021-22, when the underspend was 41%.

Budget Variance APRA Targets (non ringfenced cash)

| 2022-23 Target | 2022-23 Result | |

|---|---|---|

| Administration Budget Variance | Between a 2% underspend; no overspend | £0.3m (0.8%) underspend against £42.2m budget - Green |

| Programme Budget Variance | Between a 5% underspend to 1% overspend | £1.4m (0.7%) underspend against £213m budget - Green |

| Capital Budget Variance | Between a 5% underspend to a 5% overspend | £4.4m* (12.3%) underspend against £36m budget. - Red |

*The capital underspend arose due to SLC having fewer capital projects planned for FY 22-23 than originally anticipated at the time of the last Government Comprehensive Spending Review.

Case Study – Commercial

To safeguard the taxpayer pound, SLC has strengthened the Commercial Team and its working practices. With the appointment of a new Commercial Director, SLC centralised all commercial activity and resources and created a network of Commercial Business Partners.

The implementation of the new Operating Model and business partnering has brought all commercial activity together under one function. The refreshed approach has driven a step change in recent audit ratings (Government Internal Audit Agency (GIAA) and National Audit Office (NAO)) and improved credibility with our shareholders.

This year the Cabinet Office Capability benchmarking score for SLC increased to Good and is now working towards Better.

Better for Colleagues – the creation of a Commercial specialism has enabled us to focus on the implementation of the Commercial Career Pathway, improving skills and capability and developing a talent pipeline.

Better for Customers - improved alignment between the business and commercial teams has led to improved outcomes in support of key milestone dates within customer-improvement projects. The introduction of the Commercial Business Partner model has increased the level of expertise available to support the business.

Better for Shareholders (and Taxpayers) – improving the internal control environment within which Commercial operates ensures SLC third party expenditure meets public sector regulations, and can demonstrate fairness, transparency, and value. A collaborative approach has led to significant savings in supplier negotiations.

Risk Management

SLC established a new FCPU in 2022-23, aligned to the Three Lines of Defence model, strengthening company-wide risk assessment, gap analysis and fraud-prevention. Strong links are being built with external stakeholders and new technology will deliver ongoing monitoring of customers and payments.

The launch of the Governance, Risk and Control (GRC) Enterprise Risk Management module began this year with the Operations Directorate running a pilot in March 2023. Output and learnings from this will be used to inform the subsequent phased launch for remaining directorates from May 2023. The roll- out will deliver more accurate and timely risk and control information and will help the company to make better and more precise decisions, saving money, generating efficiencies and being able to demonstrate ongoing compliance.

The Key Control Questionnaire (KCQ) was successfully brought in-house in early 2023, enabling improvements in both the design of the question set and data quality, in conjunction with policy owners. The KCQ supports the Governance Statement within this year’s Annual Report and Accounts.

People

During 2022-23, SLC has built a strong internal talent acquisition capability. The creation of an internal team of recruitment specialists supports the transition of SLC’s recruitment to be focused on candidate journey and a strong employer brand. Since inception the team have filled 927 roles; the Emerging Talent Programmes have recruited 62 participants bringing the total to 102.

The company continued a strong focus on learning and development for colleagues during 2022-23, with management courses including Managing Effectively in a Blended Way, Management Essentials, Building Better Together, Active Management and Workday. Around 470 current or future leaders received tailored courses to build the skills, knowledge and behaviours to deliver for colleagues, customers and shareholders.

SLC received the highest level of recognition under the Government’s Disability Confident scheme – “Disability Confident Leader”. The accreditation process involved several assessments, including independent validation by an external organisation, where the company was commended for improving

support for colleagues through its remote mental health first-aid service, and for continually reviewing policies to ensure they are inclusive, accessible, and allow for discretion to help break down potential barriers and facilitate the development of colleagues with disabilities.

As a Disability Confident Leader, SLC has an opportunity to progress and strengthen its commitment to developing an environment and a culture that enables colleagues with disabilities or long-term conditions to thrive in the workplace.

The company has an established commitment to EDI, and publishes an EDI Annual Report alongside the statutory gender pay gap report, both at www.gov.uk/slc. Gender analysis on SLC Board Members, Directors and staff is included within the Remuneration and Staff Report.

APRA Target – Employee Engagement

| 2022-23 Target | 2022-23 Result | |

|---|---|---|

| Annual Survey Result (Employee Net Promote Score) | > 6.6 | 6.1 - Red |

SLC’s employee engagement survey took place in November 2022. The Employee Net Promote Score as established by the question ‘How likely is it you would recommend SLC as a great place to work is 6.1 for 2022-23. This is lower than the target of 6.6, and a reduction in the 2021 score of 7.0. Analysis of the data has identified the most significant driver for the reduction in overall sentiment to be pay and reward.

3.2.2 Financial Performance and Position

SLC is primarily funded through Grant-in-Aid, received from DfE as SLC’s sponsor department. DfE receives appropriate apportionments of this funding from the three Devolved Administrations:

- The Welsh Government

- The Scottish Government

- Department for the Economy, Northern Ireland

This funding is also analysed through the “parliamentary lens” – that is, by Admin, Programme and Capital, as defined in HM Treasury’s Consolidated Budgeting Guidance (CBG).

DfE confirmed SLC’s budget in the APRA letter, which provided analysis of the funds through both the business and the parliamentary lenses.

Grant-in-Aid Funding

As part of the Government’s Budgeting Framework, Grant-in-Aid funding is allocated each year from the original Departmental Expenditure Limit (DEL). This consists of two separate budgets: net resource spending (resource DEL) split into Administration and Programme expenditure; and net Capital expenditure (capital DEL).

Resource DEL is further split into cash and non-cash. The cash element for Resource DEL in 2022-23 was £255.2m (2021-22: £232.8m). The non-cash element covers items such as depreciation and amortisation. The non-cash element of funding amounted to £43.0m in 2022-23 (2021-22: £44.0m).

Grant-in-Aid Funding for Delivery of SLC Core Activities and Change Projects

| 2022-23 DEL Administration £’000 | 2022-23 DEL Programme £’000 | 2022-23 DEL Capital £’000 | 2022-23 Total £’000 | |

|---|---|---|---|---|

| Non-ringfenced (Cash) | 42,174 | 213,000 | 36,000 | 291,174 |

| Ringfenced (Non-cash) | 10,750 | 32,250 | - | 43,000 |

| Total | 52,924 | 245,250 | 36,000 | 334,174 |

| 2021-22 DEL Administration £’000 | 2021-22 DEL Programme £’000 | 2021-22 DEL Capital £’000 | 2021-22 Total £’000 | |

|---|---|---|---|---|

| Non-ringfenced (Cash) | 40,706 | 192,059 | 39,995 | 272,760 |

| Ringfenced (Non-cash) | 11,000 | 33,000 | - | 44,000 |

| Total | 51,706 | 225,059 | 39,995 | 316,760 |

In addition to DEL funding, SLC receives Grant-in-Aid funding for Annually Managed Expenditure (AME). This covers expenditure which cannot be fully controlled. The AME element of funding granted from DfE amounted to £1.4m charge (2021-22: £1.1m charge). This excluded any budget in anticipation of the final outcome of the pension valuations post transfer to the Civil Service Scheme, due to the difficulty with estimation of the outcomes.

The Grant-in-Aid of £291.2m is the budgeted figure for FY 22-23 this is £7.6m more than the £283.6m shown in Changes in Tax Payers Equity which reflects actual expenditure ( £6.2 lower than planned ) and excludes the AME charge of £1.4m above.

AME Expenditure

| 2023 £’000 | 2022 £’000 | |

|---|---|---|

| AME recognised in SOCNE | ||

| Pension service (income) | - | - |

| Gain on settlement at transfer of pension fund (see note 15) | - | |

| Pension interest charge/ (income) | (50) | 58 |

| Pension administration expenses | 431 | 628 |

| Provisions movements | 1,098 | 426 |

| Impairment | - | 9 |

| 1,479 | 1,121 |

Non-Grant-in-Aid Funding

SLC continued to receive other income amounting to £1,132,000 (2021-22: £993,000) from those universities and colleges that choose to have SLC administer their bursaries and scholarship payments under the Higher Education Bursary and Scholarship Scheme. Further income was received from third parties in relation to the historic sales of Mortgage Style Loans; this amounted to £85,000 (2021-22: £103,000).

Year-End Outturn

The overall outturn was £321.4m (2021-22: £293.0m), an underspend of £6.2 against our non- ringfenced cash (2021-22: £14.8m) and an underspend of £6.6m ( 2021-22: £8.7m) against our ringfenced cash, a total of £12.8m ( 2021-22: £23.7m) against the APRA budget, as shown below:

Final budget outturn position of net expenditure

| 2022-23 Budget £’000 | 2022-23 Outturn £’000 | 2022-23 Variance £’000 | |

|---|---|---|---|

| Non-Ringfenced (Cash) | 291,174 | 284,960 | 6,214 |

| Ringfenced (Non-cash)* | 43,000 | 36,413 | 6,587 |

| Total DEL | 334,174 | 321,373 | 12,801 |

The non-ringfenced cash underspend consists of a small underspend against our administration budget of £0.4m, an underspend on programme of £1.4m (this is within agreed tolerances as set out in SLC’s APRA where permission to incur additional expenditure may be sought to maintain performance), and an underspend of £4.4m on capital as noted in section 3.2.1.

Ringfenced non-cash budgets were underspent by £6.5m. This aligns to the underspend in capital budget and reflects a lower number of projects being capitalised than had originally been anticipated.

The table below reconciles the net expenditure for the year as shown in the Statement of Net Expenditure with the outturn for the year, as noted above, in respect of our budget position as reported to DfE.

Reconciliation to Statement of Comprehensive Net Expenditure (to the nearest £100,000)

| Reconciliation to Financial Statements | 2023 | |

|---|---|---|

| £’000 | ||

| Total Expenditure per SOCNE: | ||

| Staff and restructuring costs | 129,400 | |

| Depreciation, amortisation and impairments | 36,600 | |

| Other administrative expenses | 126,400 | |

| 292,900 | ||

| Non Grant-in-Aid income (note 3) | (1,500) | |

| Capital Expenditure | 31,700 | |

| Add back: AME income recognised on SOCNE | (1,700) | |

| Total Outurn | 321,400 |

Staff and Restructuring Costs

Total Staff costs have increased by £9.2m (7.9%) of which £4.2m relates to the pay awards for October 2021 and October 2022 and a slight increase in average headcount. £3.9m of the increase, relates to changes (+2.3%) in Employer’s National Insurance and Pension contributions and a further £1.4m relates to an additional non-consolidated payment made to staff in October 2022 to help alleviate cost- of-living pressures. More successful recruitment has seen a reduction in Agency costs, £1.0m (2021-22 £1.9m)

The use of contractors decreased by £0.8m mainly in the Technology Group (TG) Directorate; this is the result of the cost efficiencies being driven from the TG Strategic Supplier partner programme and less reliance on contractors due to more successful recruitment of TG resources as a consequence of the Digital Data and Technology (DDAT) pay framework.

Depreciation, Amortisation and Impairments

Depreciation charges of £36.6m (2021-22 £38.6m) are in line with capitalisation policies on both existing assets and additions net of disposals in 2022-23. There is a reduction of £2.0m in the charge for the year reflecting a lower asset base.

Other Administrative Expenses

Technology underpins SLC’s ability to support its customers. Technology service delivery costs have increased by £4.7m compared to 2021-22. This is due to a continued increase in the use of Cloud technology and the need to secure specialist technical skills not available in-house. Technology, Licences, Voice & Data costs increased by £5.4m. This was due to both price and volume increases across licences, software and hardware maintenance costs to deliver and maintain core SLC operating systems. For example, with the core Customer Engagement System, customer usage volumes have been increasing, driving additional cost. Another example is the company’s core ERP system as more third- party suppliers require access to complete timesheets.

Professional services increased by approximately £0.4m. The majority of this related to increased spend on debt collection agencies which recovered £7m more student debt.

In total, our premises costs have increased by £1.7m compared to 2021-22. Utilities costs increased significantly from April 2022 and are partially offset by savings from Service Charges and Property Maintenance Costs.

Financial Risks and Challenges

Ongoing external pressures such as inflationary fluctuations have created a significant gap between the total funding required to manage SLC operations and to deliver shareholders’ priorities for 2023-24, and the amount of funding that has been formally allocated to SLC by DfE in the APRA letter. We are reviewing our priorities on an ongoing basis and are engaging with DfE regularly on our in-year financial performance. To mitigate the risk of overspending, we have put in place additional budget and spending controls.

3.2.3 Summary of key items from the Financial Statements

Pension Scheme

As stated in the Remuneration and Staff Report, SLC is a member of the Civil Service Pension Arrangements and makes the Alpha and Partnership schemes available to all its employees. The pension schemes are unfunded, that is, no financial liabilities or asset management rests with SLC for these Schemes. Employee contributions are salary related. Details of the scheme can be found at www.civilservicepensionscheme.org.uk

Transfer arrangements from the previous SLC scheme are not yet complete, therefore in the 2022-23 financial statements the pension surplus of £2m as at 31 March 2022 has been revalued as at 31 March 2023 reflecting the latest actuarial valuation issued by Mercer on 19 April 2023. This now shows a deficit of £16.9m. This change has been caused mainly by an increase in discount rates along with decreases in deferred benefit revaluation and inflation. Note 15 also summarises the agreed future funding arrangements for this scheme. The transfer has now formally been agreed by all parties to proceed in FY23-24 (Nov 23) - after which the SLC scheme will cease to have any assets or liabilities and be wound up in due course.

Special Payments (audited)

Each year, SLC has a specific delegated authority of up to £150,000 for special payments against running costs. These are most frequently ex-gratia compensatory payments relating to customer service. These payments are limited to £500 per case for ex-gratia special payments (or £5,000 for direct financial losses) SLC remained within this delegated limit, incurring costs of £107,248. Four of these related to ex- gratia payments which includes 3 payments SLC was required to make after appraisal by an Independent Assessor (IA). The remaining payment related to a court order.

IAs are appointed by the UK and Welsh governments to consider appeals and complaints by student finance customers where SLC’s process has been exhausted.

Special payments more than £500 or direct financial losses over £5,000 require specific approval from DfE and sit outside of SLC’s delegated authority limit. Payments totalling £133,832 were made in FY22-23. Of these, one fruitless payment of £55,104 related to a supplier who went into liquidation and voluntary exit payments totalling gross £68,086 (net £54,000) were paid.

Fees and Charges (audited)

SLC does not receive any fees and charges other than those relating to supporting the bursary and scholarship schemes as detailed in note 3 to the accounts.

Contingent Liabilities (audited)

At the year-end there is one personal injury claim that has not been fully litigated. The best estimate for this claim is £5,000. As of 31 March 2023, SLC had a legal case estimated at £0.1m which is included within the legal provision, this case was dismissed by a court order dated 25 April 2023 and is now deemed a contingent liability.

Remote Contingent Liabilities (audited)

Under IFRS, contingent liabilities that are considered to be remote are not disclosed, but their narrative disclosure is required by the FReM. Remote contingent liabilities occur where the possibility of future settlement is very small.

At the year-end SLC had no remote contingent liabilities.

3.2.4 Performance against key non-financial requirements

Supplier Payment Policy

SLC aims to comply with the Government’s Better Payment Practice Code for the prompt payment of SMEs. 94% (2021-22: 91%) of all invoices including SMEs were paid within the normal trading terms of 30 days, with 44% (2021-22: 35%) being paid within 5 days.

Environment, Sustainability and Corporate Responsibility

SLC will publish their sustainability strategy and targets during 2023-24, we will use this as a platform to broaden and enhance reporting that helps demonstrate SLCs commitment to sustainability and ensures we conform the requirements of FReM. This new sustainability strategy will set reduction targets and objectives for the company for the next 3 years and will be supported by SLC’s Sustainability Working Group.

SLC has already adopted several energy and carbon reduction projects over the last five years, such as replacement of the water-cooling towers in Bothwell Street, replacement of data centre chilling

equipment with chillers which provide free air cooling when the ambient outside air temperature is below 15 degrees and fitting new LED lights and new lighting controls across parts of our estate.

In late 2023 SLC will relocate within Glasgow city centre to a new, purpose-built office at 10 Clyde Place, providing a working environment configured to suit SLCs post Covid-19 ways of working. It will also support SLC’s net zero carbon aspirations as the building is net zero carbon and rated BREEAM (Building Research Establishment Environmental Assessment Method) excellent by design.

Energy Use

Energy use, energy savings and associated carbon emissions data for 2022-23 are detailed below. SLCs Gas and Electricity consumption is captured from electricity and gas bills, our resultant emission figures are calculated by the GCC annual return spreadsheet provided to us, waste figures come from our Total Facilities Management provider (including percentage of waste recycled or converted to energy) as part of their monthly reporting. Business travel data is provided by SLC commercial and finance and comes from expenditure and contract detail/analysis.

| Estate Energy Use | 2022-23 KwH | 2021-22 KwH | 2020-21 kWH | Year-on-year % movement (2021-22 to 2022-23) | Year-on-year % movement (2020-21 to 2021-22) |

|---|---|---|---|---|---|

| Electricity | 5,550,598 | 5,222,439 | 5,051,904 | 6% | 3% |

| Natural Gas | 3,942,188 | 6,338,731 | 5,771,143 | -38% | 10% |

| Total Estate | 9,492,786 | 11,561,170 | 10,823,047 | -18% | 7% |

Energy use across SLC’s estate has decreased by 18% this year compared to 2021-22. This is mainly due to replacing ageing inefficient heating and cooling systems in Darlington. Gas powered air conditioning was swapped for electricity powered air conditioning.

Emissions

More detailed figures are now available than in previous years. SLC’s figures for 2022-23, as provided in its Greening Government Commitments (GGC) return, are shown below.

| Estate Emissions | 2022-23 CO2 tonnes | 2021-22 CO2 tonnes | Year-on-year % increase (2021-22 to 2022-23) |

|---|---|---|---|

| Electricity | 1,171 | 1,207 | -3% |

| Natural Gas | 722 | 1,161 | -38% |

| Total Estate | 1,893 | 2,368 | -20% |

| Fugitive Emissions * | 0.04 | 0.07 | -43% |

*Fugitive emissions are gases and vapours that are accidentally released into the atmosphere such as emissions from air conditioning units.

| Business Travel Emissions | 2022-23 Km travelled | 2022-23 CO2 tonnes | 2021-22 Km travelled | 2021-22 CO2 tonnes |

|---|---|---|---|---|

| Fleet | 140,480 | 24.51 | 113,062 | 21.93 |

| Non-Fleet | 60,947 | 10.14 | 20,158 | 3.72 |

| Public Transport | 364,165 | 12.92 | 61,953 | 4.24 |

| Domestic flights | 110,726 | 14.40 | 10,625 | 0.87 |

| Total Business Travel | 676,318 | 61.97 | 205,798 | 30.76 |

Business travel emissions have increased by 229% compared to 2021-22 as business travel starts to return to pre-pandemic levels. The total cost of business travel in 2022-23 was £273,000 including accommodation costs, which is an increase of £197,000, 259% from 2021-22.

Waste Minimisation and Management