Sector risk profile 2019

Updated 6 March 2020

Applies to England

Contents

Executive summary:

- Health and safety compliance

- Stock condition and asset management

- Market sales exposure

- Reputational risk

- Rent

- New business entrants

Introduction

Strategic risks:

- Consumer issues and health and safety

- Reputational risk

- Fraud

- Data integrity and technological risks

Operational risks - existing stock:

- Existing stock quality

- Counterparty risk

- Rents and rental market exposure

- Welfare reform

- Supported housing

- Costs and inflation

Operational risks - development:

- Low cost home ownership and market sales

- Diversification

Financial and treasury management risks:

- Existing debt

- New debt

- New business models - equity structures, lease structures and real estate investment trusts

- Pensions

Executive summary

Over recent years the sector has benefited from a generally benign economic climate. However, issues such as the potential for significant uncertainties around Brexit and the need to respond to evolving requirements following the Grenfell Tower fire mean risk in the sector is growing. The need for effective risk management and assurance in the sector must keep pace.

The United Kingdom’s departure from the European Union, could affect the cost of goods and services, funding and investments and it may also have implications on those organisations that are reliant on the EU for staff. It is more important than ever that all providers test and understand the implications for their business to ensure the best possible outcome in a new environment. We expect all boards to have well-developed mitigation strategies in place should there be a material macro-economic shock in the event of exiting the EU without a deal.

In this report we seek to highlight the most significant risks that providers are exposed to. The breadth of the risks demonstrates the challenges and complexities that boards must manage and mitigate. The most important risks covered in this report include:

Health and safety compliance

Providers must understand and fully meet all their existing obligations in relation to tenants’ health and safety, as well as preparing for increased expectations and changing requirements, particularly for high rise buildings. We expect boards to have strong and appropriate oversight of decisions around stock quality and health and safety compliance. The safety of all tenants, especially the most vulnerable, should be of primary importance for all providers. We also expect boards to comply with all health and safety statutory requirements; this includes having up-to-date and relevant policies in place that are regularly managed and monitored by the board, effective compliance reporting and good quality data.

Stock condition and asset management

Over the last year the importance of ensuring that stock meets high standards for health and safety and overall stock condition has been increasingly identified as a major issue for many providers. As part of a well-integrated, strategic approach to asset management, providers should understand the overall condition of their stock, including areas where additional investment is required. This should be based on professionally sourced up-to-date data. The necessary investment should be reflected in the organisation’s long-term business plans with delivery monitored and recorded.

Market sales exposure

A small number of providers use substantial market sales revenues to fund their social development programmes. This increases the risk of cash flow pressure and overtrading, should receipts fall short of expectations. Providers must consider the market cycle and the impact that the current slowdown in London and the South East may have on the rest of England. In the wake of the last housing downturn, impairment write-offs affected providers with large-scale land and sale stock holdings. Boards must closely monitor any developing impact on the financial and property markets and the implications for their business.

Reputational risk

The sector’s reputation is affected by its business decisions and performance across all areas of operation. Boards are reminded of their duties to stakeholders and how they and their executives conduct themselves. Ultimately it is for boards to safeguard the reputation of their organisation and have regard to the expectations of their stakeholders in their decision-making.

Rent

The Government has confirmed the end of the four-year rent reductions from April 2020, when rents will be able to increase in line with inflation again. While this new deal will provide the sector with income certainty for the next five years, boards must also consider the extent to which their strategies and business plans could cope with changes in housing policy and related areas including welfare reform.

New business entrants

Most investment in the sector continues to be debt funding from banks and the capital markets rather than equity. However, the last two years have seen increasing interest in equity or structured finance investment in the sector, using models including for-profit providers, and leasing and management agreements. This dynamic brings its own set of inherent risks around meeting responsibilities to tenants and residents, ensuring their rents are compliant and maintaining returns to investors. Providers entering into the sector or providers entering into agreements with equity-based funders should ensure that they have the right skills and capacity to manage the risks that these could pose to their continued viability, while equity-led organisations must ensure that they meet their regulatory and statutory obligations.

Boards should ensure that they understand the particular risks that could affect their own organisations. Assessing providers’ understanding of the main risks they face and how they are managing them remains a key element in the In Depth Assessment process. As part of that process, the regulator will consider the quality of providers’ stress testing and internal control systems and will reflect its level of assurance in its published judgements.

Introduction

1 - The purpose of this publication is to highlight common strategic and operational risks that may pose a threat to the successful delivery of providers’ strategic objectives and which boards should be alert to. The Sector Risk Profile describes risks that most providers are likely to face, as well as some which will only affect a minority of providers.

2 - The regulator remains firmly committed to a co-regulatory approach and expects boards to have appropriate risk and control frameworks in place to deal with risks as and when they arise – this applies to all providers. The regulator’s main focus is to seek assurance from providers that they are meeting its economic and consumer standards. It has set out its expectations of providers’ risk management in the [Governance and Financial Viability standard]https://www.gov.uk/guidance/regulatory-standards) and associated [Code of Practice]https://www.gov.uk/government/publications/value-for-money-code-of-practice).

3 - The regulator will continue to monitor the financial performance and risk profile of the sector through the data collected in its quarterly survey, annual accounts and financial forecast returns. The analysis of this data also allows the regulator to closely monitor the financial health and resilience of providers at both an individual and aggregate level. However, it is the role of each board to assess its own risks in the round and satisfy itself that appropriate strategies are in place to mitigate them. The regulator will challenge a provider where a risk that has been identified as material through our analytical work is not captured in a provider’s risk and control framework.

4 - This report draws on provider forecast data provided to the regulator and presents risks in four main sections:

- Strategic risks

- Operational risks – existing stock

- Operational risks – development

- Finance and treasury management risks

5 - Although at the time of writing, the Government has not published its response to the Social Housing Green Paper consultation, we have reflected the potential impact of emerging policy changes upon the wider sector where these have been confirmed.

Strategic risks

6 - Boards are required to make fundamental strategic decisions about the delivery of their organisation’s objectives, including the markets that their business operates in. Boards must consider their risk appetite and ensure that there is a measured approach to managing risks as an integral element of their business planning framework.

Consumer issues and health and safety

7 - Failure to comply with all relevant statutory health and safety requirements puts tenants’ lives at risk. All providers have an obligation to act to ensure the homes they provide are safe. Providers must also fulfill their legal duty of care to their staff and seek to understand their tenants’ needs.

8 - Our Consumer regulation review reiterates the importance for providers to have systems in place to provide assurance to the board that the consumer standards (which apply to both private registered providers and local authorities) are being met. Providers are expected to meet a range of statutory health and safety obligations including gas, electrical and fire safety as well as the management of asbestos, legionella and lifts. Increasingly, there is recognition that ensuring tenants’ homes are safe goes beyond complying with specific pieces of legislation. It is important for providers to engage with tenants to understand their circumstances and their needs, as well as the stock they are responsible for, regardless of whether they are leased or managed properties.

9 - Providers must understand the costs associated with replacement material and any implications on other planned major repairs expenditure, particularly for large and complex buildings. Providers affected by tower blocks with Aluminium Composite Material and High Pressure Laminate cladding will need to remove such cladding and ultimately invest in the replacement of the material. They will also need to ensure that remediation plans are in place once solutions are confirmed to complete all affected buildings.

10 - The fundamental importance of keeping tenants safe is reflected in the Building Safety consultation which followed the Hackitt review; this includes proposals to establish a new building safety regulator. While detailed changes to building regulations are not yet known, boards must actively ensure that there are comprehensive and effective building safety systems and programmes in place that provide assurance that buildings and their tenants remain safe. Further detail on risks associated with repairs expenditure is set out later in this report.

11 - Providers who do not have good quality data on the condition and compliance position of their stock risk failure to comply with statutory requirements and placing their tenants in danger. We have recently dealt with cases where providers are unable to evidence whether required work has been carried out to time and quality, or even at all. The recent rise in merger activity increases this risk as integration of data systems is often challenging. The regulator’s expectation is that all providers will have assurance on the quality and integrity of their stock data as part of its requirements on asset and liability records.

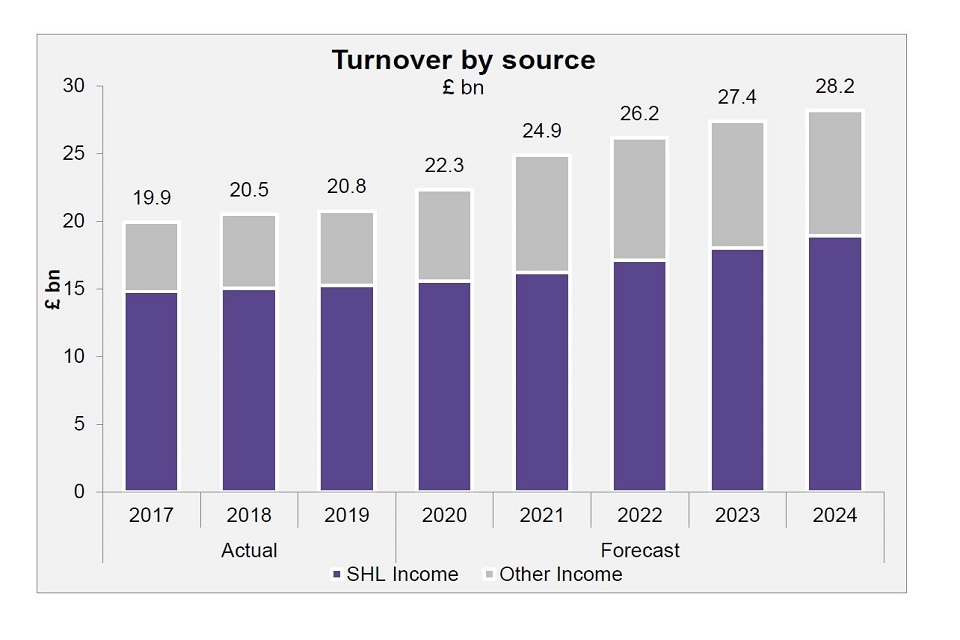

12 - The Government has also consulted on proposals to increase the accountability of providers in the Social Housing Green Paper. While the Government’s response to the consultation has not yet been finalised, the regulator expects providers to be actively engaging with tenants and implementing improvement strategies that address key identified areas of underperformance. The Green Paper proposed the introduction of consumer key performance indicators to enable tenants to hold their landlord to account. This could include performance indicators on stock quality, services to tenants and customer complaints. In light of this, it is important that providers have considered the level of assurance they currently have on the accuracy and reliability of their performance data.

13 - Failure to provide accommodation that is of appropriate quality, or to effectively respond when issues relating to stock quality arise, can have significant implications for tenants’ trust and confidence in their landlord. It can also be expensive to rectify and can significantly damage a provider’s reputation.

Reputational risk

14 - Boards must make fundamental strategic decisions in order to meet their objectives. This means that they need to deal with a range of sometimes competing demands from different stakeholders. They should consider the impact that strategic decisions will have on different stakeholders and be prepared to explain the factors that influence their decisions. Failure to have regard to stakeholders’ expectations can have serious ramifications for a provider’s own reputation and that of the sector as a whole. The requirements of the Value for Money Standard enable providers to articulate their performance, what they are trying to achieve and how they performed against their targets.

15 - Reputational risk is inextricably linked to all risks of an organisation. As organisations with a social purpose and most with charitable status, providers’ actions will continue to be scrutinised by a range of stakeholders such as Government, tenants, private investors, lenders and media.

16 - Tenant safety failures, excessive pay and pay-offs, poor quality new homes and disposal of tenanted social housing stock have all led to recent criticism from stakeholders including the media, Government and tenants. It is imperative that boards have effective mitigating strategies in place to manage reputational risk across their activities and business interests. In particular, managing the risk of adverse external perceptions and delivering the right outcomes is an integral part of establishing and maintaining effective relationships with stakeholders.

Fraud

17 - Providers are exposed to fraud through the provision of services and supply. This can have a significant negative impact on organisations through disruption to their services or undermining the achievement of their objectives. Where fraud occurs, it is reputationally damaging and can have significant implications for viability and delivery of strategic objectives. Providers should ensure that they have robust control procedures in place, and seek appropriate professional advice when fraud is identified.

Data integrity and technological risks

18 - Integrity of data is fundamental and permits good board decision-making. Failure to manage data integrity risk is indicative of a poor control framework. Integrity can be lost due to poor technology or when data is processed incorrectly. Erroneous data can be costly to fix and can damage the reputation of an individual provider. Accurate data and up-to-date information will assist in areas such as compliance with rent setting, maintenance of providers’ asset management strategies and in the preparation of KPIs.

19 - From time to time the regulator has called into question the integrity of providers’ data. The regulator continues to rely on accurate and timely data, which is important to the work it undertakes. As well as being able to meet statutory data protection requirements, providers need to ensure that they meet the regulator’s requirements for reporting of data. Failure to provide timely and accurate data will be reflected in the judgement of a provider’s compliance with the regulatory standards.

20 - All providers must comply with the Data Protection Act 2018 which came into force in 2018. The Act incorporates the EU General Data Protection Regulation into law in the UK and supplements its provisions. The Act provides a comprehensive and modern framework for data protection in the UK, with punitive fines for malpractice. The Act also sets new standards for protecting general data in accordance with the GDPR, giving people more control over use of their data, and providing them with new rights to move or delete personal data. Failure to abide by the requirements of the Act could lead to penalties for the landlord, and also lead to the potential for a breach of trust between the landlord and its stakeholders.

21 - Evaluating governance around cybersecurity is an associated risk in meeting the new standards for protecting data. Cloud-based services can be cost beneficial and have grown in popularity. But the number of attacks on customers’ cloud-based accounts has also risen. Boards must seek assurance that their IT security function is safe and secure and the provider understands where its data is stored and that it continues to be accessible following departure from the EU.

Operational risks – existing stock

22 - The core business for the sector is the provision of social housing. These homes generate an annual income (predominantly rent and service charge income), of approximately £15 billion. This income must cover day-to-day running costs, service debt and meet major repair liabilities. Boards therefore have an important role in seeking assurance that the financial and operational risks associated with their day-to-day operations are well managed. For the majority of housing providers, these risks will relate to the effective management of their existing stock. This chapter will focus on some of the key risks that could pose a threat to providers meeting a range of standards as well as the ability to achieve their strategic objectives.

23 - The regulator expects boards to scrutinise their organisation’s performance and management and make informed decisions about their priorities. Providers should have policies to measure, monitor and manage their organisation’s operational risk. Planning ahead enables organisations to identify potential problems and take action to prevent them. Providers need to be able to detect when things are going wrong so that they can react quickly and put them right.

24 - The Governance and Financial Viability Standard requires providers to carry out detailed and robust stress testing against combinations of risks across a range of scenarios and put appropriate mitigations in place as a result. As part of their risk management approach, providers should stress test their plans against different scenarios across the whole group and demonstrate those effects against cash, covenants and security. Failure to meet this requirement risks breaching the regulatory standard.

25 - Boards need to consider their appetite for risk in the light of economic and political uncertainties, and maintain sufficient financial strength to cope with combinations of adverse circumstances. The Bank of England’s November 2018 EU Withdrawal Scenarios [^6 ] examines the potential impact of a hypothetical adverse scenario on the resilience of the banking system. Providers can use this test as part of their analysis to determine and understand the challenges they could face in the event of the UK leaving the EU without a deal and encompass the outcomes based on the ‘worst case’ into their risk monitoring framework.

Existing stock quality

26 - Boards are responsible for safeguarding their tenants. As noted above, failure to adequately invest in existing stock may put tenants’ health and their lives at risk. However, failure to understand stock quality and invest adequately can also potentially affect viability over the longer term. The Home Standard requires providers to ensure that tenants’ homes meet the requirements of the Decent Home Standard. They must also ensure that they provide a cost-effective repairs and maintenance service to homes and communal areas.

27 - Many providers have recently identified cases where remediation work is required to improve safety and quality. As part of a well-integrated, strategic approach to asset management, providers should understand the overall condition of their stock, including areas where additional investment is required. This should be based on professionally sourced up-to-date data. The necessary investment should be reflected in the organisation’s long-term business plans with delivery monitored and recorded.

28 - Where providers are developing new homes, poor build quality and a failure to ensure that properties meet the required standards (including meeting statutory health and safety requirements) can adversely affect tenants and, consequently also represent a reputational risk for providers. Where things have gone wrong it is often the case that systems have been poorly designed, poorly implemented or both.

Counterparty risk

29 - Many providers enter into contracts with third parties including funders, insurers and pension providers. These can be effective ways to deliver key services, such as repairs, management and housing development functions. But entering into contracts with third parties can also increase the exposure to counterparty risk.

30 - High-profile business failures such as Carillion and Lakehouse have demonstrated that third-party risk management requires proper attention, though the social housing sector did not have significant exposures to these firms. However, in recent months some of Britain’s most significant housing maintenance contractors and construction firms have issued profit warnings. With the economy facing further uncertainty, contractors operating with falling profit margins have heightened the risk of third-party failures, with consequent effects for delivery of repairs and maintenance services.

31 - Boards must have assurance that there is adequate management of all outsourcing arrangements in place, including monitoring of contractor robustness. It would also be prudent for boards to consider contingency plans where the provider depends on a limited number of contractors for maintenance and development.

32 - It is the responsibility of boards to ensure that their organisations conform to all relevant policies, standards and law when outsourcing to third-party organisations. As part of that effective governance, they should seek assurance that where contracts are entered into with third parties that the management conducts due diligence which includes a review of any potential conflicts that could breach regulation, legislation or policy.

Rents and rental market exposure

33 - From April 2020, rent controls will transition from being governed by the Welfare Reform and Work Act 2016 to a new Rent Standard based on an annual inflation increase of no more than Consumer Price Index (CPI), plus 1% over five years. For the first time, the new Rent Standard will apply to local authorities as well as PRPs.

34 - The 2020 Rent Standard will follow the Government’s Direction to the regulator and a comprehensive policy statement that covers rent setting in both private registered providers and local authorities. Regulatory data requirements will reflect these new rent rules – the 2020/21 Statistical Data Return for providers will be amended and local authorities will be required to submit a Local Authority Data Return (LADR) to the regulator for 2019/20.

35 - It is important that all providers have a comprehensive understanding of the rent rules and these are applied correctly across the organisation. In particular, it is important that providers accurately record and apply formula rents over time, apply rules to fair rent properties correctly and note changes in requirements on re-basing of Affordable Rent on re-let units. Where rent exceptions are being applied, boards should seek assurance that these are appropriate. Failure to apply the correct rent formula can lead to over-charging tenants and, potentially, undermine business plans.

36 - Rent compliance will be a continued area of scrutiny for the regulator, and boards should ensure that they have adequate assurance on the quality of their organisation’s internal controls on rents.

37 - From April 2020, the Government’s policy statement reconfirms that providers should also endeavour to limit any increases in service charges to CPI +1%. Boards should ensure that they understand the expectations with regard to service charges. This includes the requirements around Affordable Rent and that they have appropriate controls in place to ensure compliance with all relevant law, particularly the Landlord and Tenant Act, which sets the principle that service charges should only cover identified costs. Failure to manage service costs can adversely affect affordability and cause reputational damage.

38 - Some providers have diversified into the private rented sector. As with other forms of non-social housing investment, it is important that boards should have assurance that the level of return is commensurate with the level of commercial risk involved. While this can provide additional income, PRS stock has the potential to increase cash flow volatility as rent levels fluctuate more than in social rentals.

39 - Boards will need to understand and ensure that the risk of falling market rents and any knock-on effects on Affordable Rents can be mitigated. They must also understand different regional and product markets they operate in and the expectations of different tenants before making investment commitments. The regulator will seek assurance that boards appreciate the opportunity cost and risk of entering into this activity.

Welfare reform

40 - Welfare reform has been a feature of Government spending decisions in recent years. Since many providers’ tenants receive Housing Benefit, the potential impact of existing welfare reform measures will need careful management in order to protect social rental income.

41 - Universal Credit, in particular direct payment of housing costs to tenants, remains the welfare reform with the greatest potential risk for most providers. Universal Credit has been rolled out to all new benefit claimants across Great Britain since December 2018, and by June 2019 there were just over two million live claims across all tenures compared to an expected total of around seven million claims at full roll-out.

42 - While most providers have invested and prepared for the roll-out of Universal Credit since its announcement, the majority of eligible tenants are not yet in receipt of Universal Credit. The transition of significant numbers of existing claims to Universal Credit has not yet begun. It started on a pilot (geographic area) basis in July 2019 and is set to be complete by 2023. Where an area moves to Universal Credit, there is often an increase in arrears for a period. Failure to anticipate and manage this increase in arrears would adversely affect cash flow and potentially interest cover.

43 - The majority of providers have undertaken extensive preparations for the roll-out of Universal Credit, but it would be prudent to keep these preparations under review and to test them in the light of learning from the areas where Universal Credit has already rolled out.

Supported housing

44 - Total supported housing accommodation makes up 15% of the sector’s social stock. It accounts for almost half (43%) of the stock held by small providers (less than 1,000 units). However, the majority of supported housing is held by a small number of large providers.

45 - In its response to the consultation on the [Future Funding of Supported Housing]https://www.gov.uk/government/consultations/funding-for-supported-housing-two-consultations), the Government announced in August 2018 that current Housing Benefit rules for supported housing would remain in place. This has provided some certainty around future funding. The Government has also committed to reviewing how support is funded and the relationship between support and service charges, to better understand how housing and support currently fit together.

46 - However, supported housing, particularly with care, is inherently a low-margin business and is therefore more susceptible to economic changes and changes to Government policy. The main risk to supported housing income continues to be the variability in support contract funding (for example Supporting People funding). Providers who deliver support services are also at risk of a shortage of care workers in the event of a less open migration policy following the UK’s exit from the EU.

47 - Pending further announcements, it is important that providers with significant supported housing operations understand the risks of funding mechanisms such as lease-based models and impact of loss of contracts could have on their business. They are also reminded of their obligation to comply with both social housing and care regulatory standards and statutory requirements.

48 - In April 2019 we published an addendum to the 2018 Sector Risk Profile highlighting specific risks around specialised supported housing provided on a leased basis. The risks identified continue to be a significant concern, both in terms of the viability of some of the businesses operating predominately or exclusively on this model, given tight margins between net rents and lease costs, and in governance failures leading to poor services and stock quality, as well as a lack of assurance about compliance with rent requirements.

Costs and inflation

49 - Many providers have made significant savings to offset reductions in rental income over the past four years. However, costs are forecast to rise, in part due to increasing remedial works on existing buildings and in anticipation of changes to building regulations. Failure to manage the cost base effectively can lead to reducing free cash flow, margins and interest cover, and therefore impact on business resilience. It is therefore important that boards fully understand their cost base, and ensure that a range of inflation assumptions are factored into their stress tests. This includes having plans in place to absorb rising inflation if currency fluctuations cause import costs to rise following the UK’s departure from the EU.

Social housing letting costs [^5]

| Management costs | £3.1bn |

| Interest payable | £3.1bn |

| Maintenance costs | £2.7bn |

| Major repairs (inc capitalised) | £2.4bn |

| Other costs | £2.5bn |

| TOTAL | £13.8bn |

|---|

50 - The outlook for inflation is strongly tied with the eventual Brexit outcome as set out in the scenarios in the BoE’s August 2019 Inflation Report [^11]. The latest stress test report shows that inflation is forecast to rise as a result of higher import prices. Under the BoE’s core forecast, inflation would rise to about 2.4% from a current level of 2.1% in three years. The BoE’s November 2018 EU Withdrawal Scenarios [^12] publication states that in the event of a ‘disorderly’ no deal Brexit, CPI inflation could feasibly rise to 6.5%.

51 - While the sector has made significant cost savings since 2015, there is a growing risk that upward pressure on costs could rise above rent inflation. In particular, where registered providers are relying on ambitious cost savings in the delivery of its outcomes, it is important that these can be delivered and mitigations are put in place if they cannot be achieved. It is equally important that boards do not simply cut costs but seek to optimise the best use of their assets, which enables investment in new and existing stock and safeguards the delivery of services to tenants.

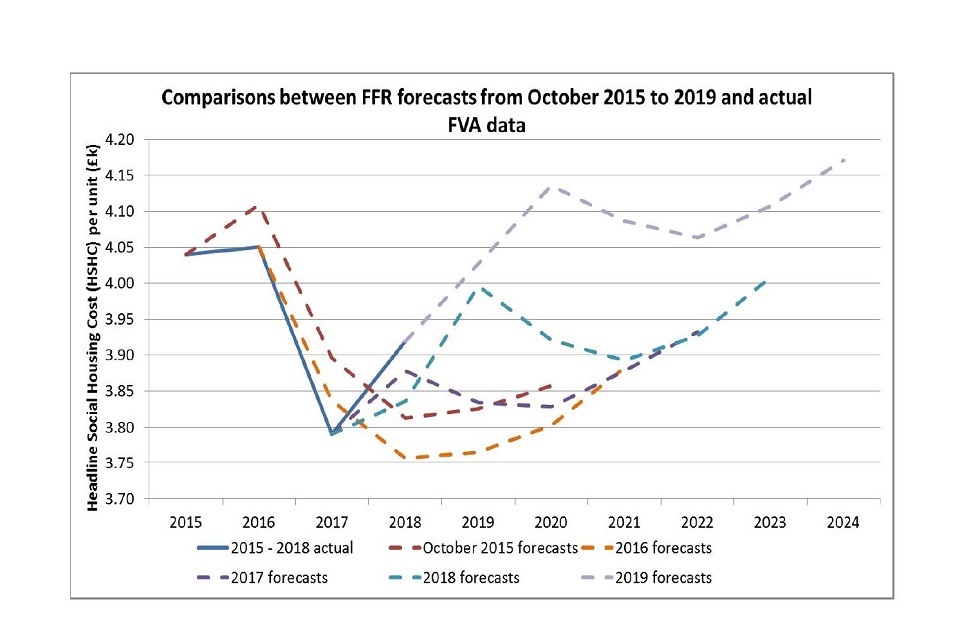

52 - The 2019 FFR projections indicate that the average (mean) Headline Social Housing Costs per unit [^13] are expected to rise by 2.7% to £4,150 by March 2020 before falling back to £4,080 per annum in 2022. The outlook for the next five years shows that the HSHC per unit is forecast to rise by 3.6%, compared to a forecast [^14] rise in CPI of 10.3%. The increase in total forecast expenditure is predominately driven by a rise in major repair expenditure. While the real-term reduction in costs has remained stable compared with 2018 projections, it is crucial that financial plans are based on reasonable, informed assumptions in order that providers can meet their targets.

Comparisons between FFR forecasts from October 2015 to 2019 and actual FVA data

53 - The CPI for August 2019 was 1.7%. This compares to 2.7% in August 2018 and 2.1% growth for the year to December 2018 [^15]. The latest estimates from the Office of National Statistics show that the unemployment rate remained at 3.8% [^16], close to a 45-year low. Average weekly earnings increased by 3.8% on a year earlier (not adjusted for price inflation), excluding bonuses, and by 4.0%, including bonuses [^17]. In real terms (after adjusting for inflation) total pay is estimated to have increased by 1.9% [^18] compared with a year earlier. This in part is due to the introduction of the new Living Wage rate (4.9% higher than the 2018 rate) and National Minimum Wage rates.

54 - Interim Construction Output Index (OPI) figures for all construction also showed that costs increased by 3% in the year to June 2019 [^19]. To help boards improve the quality of their decision-making they should take into account a range of different outcomes for different categories of inflation in their stress tests so that they can critically assess the delivery of their plans.

Operational risks - development

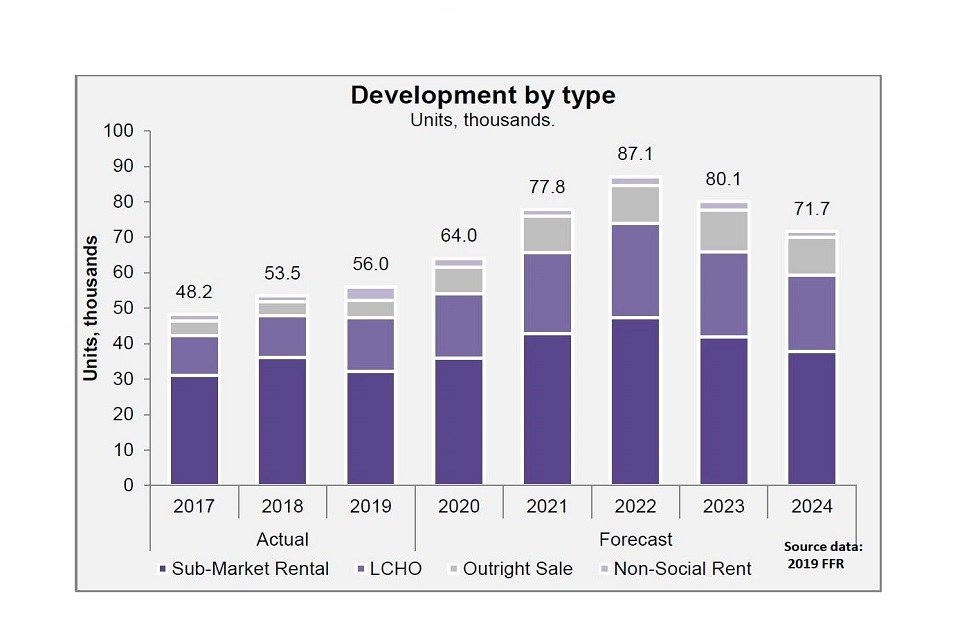

55 -The sector forecasts significant growth across all tenures, contributing towards the Government’s target of delivering 300,000 new homes per annum. The latest announcements from the Government suggest that there will be an increased focus on home ownership.

56 - Market-facing development continues to increase rapidly in order to cross subsidise social housing supply. This includes market rent, shared ownership and outright sales. The latest outturn performance in the first quarter of the year shows that the number of Affordable Home Ownership homes unsold for more than six months increased by 56%. The increased focus on sales income, both from shared ownership and outright sale, makes it increasingly important that providers understand the markets in which they operate and can effectively mitigate the risks of a slowdown in sales or reduction in market prices. In particular, there is increased risk of overtrading and cash shortages if there is a shortfall in market receipts.

57 - Modern methods of construction are an approach being adopted by the sector with some providers creating their own modular housing factories. They are proving increasingly attractive to landlords given the potential to deliver additional new homes at pace and increase market resilience. This new method includes the construction of homes off-site which can be fully supplied with insulation and external cladding. While this new approach of house-building can be advantageous in terms of speed and efficiency, these modern methods can also introduce new risks. Boards have a duty to ensure that quality and safety remains very much at the forefront of all homes constructed off-site and they meet all relevant standards. They should also consider the risk that some modular homes cannot currently be used as mortgage security.

Development by type [^5]

Graph showing development by type

Total development

| Year | Units, thousands | |

|---|---|---|

| Actual | 2017 | 48.2 |

| 2018 | 53.5 | |

| 2019 | 56.0 | |

| Forecast | 2010 | 64.0 |

| 2021 | 77.8 | |

| 2022 | 87.1 | |

| 2023 | 80.1 | |

| 2024 | 71.7 |

58 - While projected development plans demonstrate a significant increase in aspiration, the majority of projected development expenditure is not contractually committed. It is forecast that around two-thirds of total development plans to be delivered to 2021 is contractually committed and by 2022 this reduces to around one third.

59 - The latest forecasts indicate that the sector is expected to generate £13 billion of sales revenues by 2021. As at March 2019 the balance sheet value of unsold properties and work in progress was approximately £7 billion. This indicates that half of the properties that are expected to be delivered over the next two years are already under construction. While there is some flexibility in the medium term to manage the risk of a housing market downturn, providers should be aware of the lead time required to slow or stop development programmes.

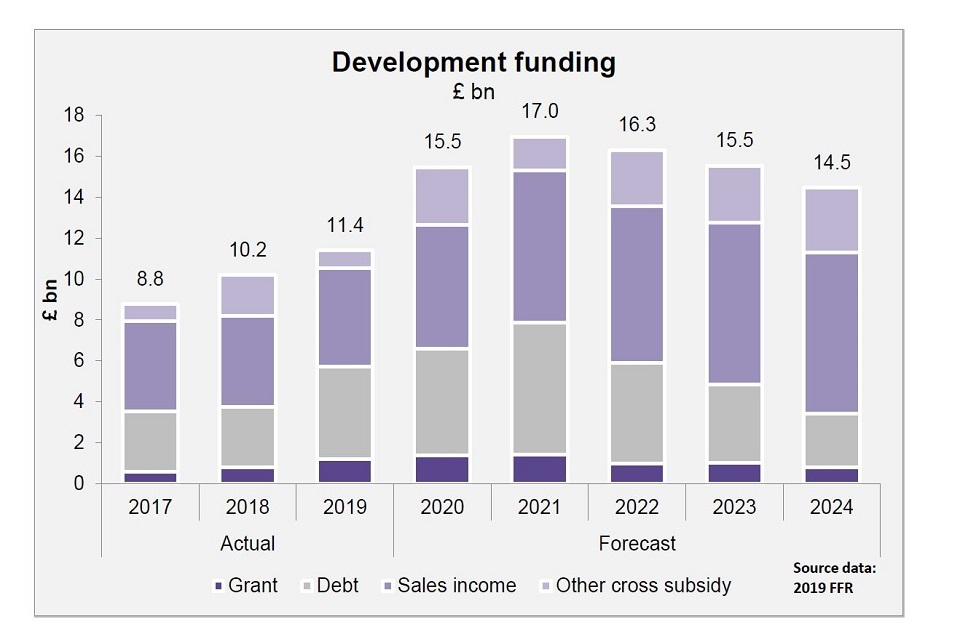

Development funding [^5]

Graph showing development funding

Total development funding

| Year | Units, thousands | |

|---|---|---|

| Actual | 2017 | 8.8 |

| 2018 | 10.2 | |

| 2019 | 11.4 | |

| Forecast | 2010 | 15.5 |

| 2021 | 17 | |

| 2022 | 16.3 | |

| 2023 | 15.5 | |

| 2024 | 14.5 |

60 - The sector has forecast that it will invest £79 billion (2018: £74 billion) in its development programme across all tenure types. This includes both committed and uncommitted development expenditure over the next five years. The most significant source of funding for delivering this level of development is receipts from outright sales, sales and receipts from first tranche shared ownership units of £37 billion (2018: £39 billion) though only the profit element of these receipts is used to support social development.

61 - Providers have projected that income from grant and new and existing debt to fund development will increase in comparison to the 2018 forecast. Some of the development will be funded through existing loan facilities. Once repayments of existing debt are factored in, the sector will need to draw £36 billion to finance its development programme over the next five years.

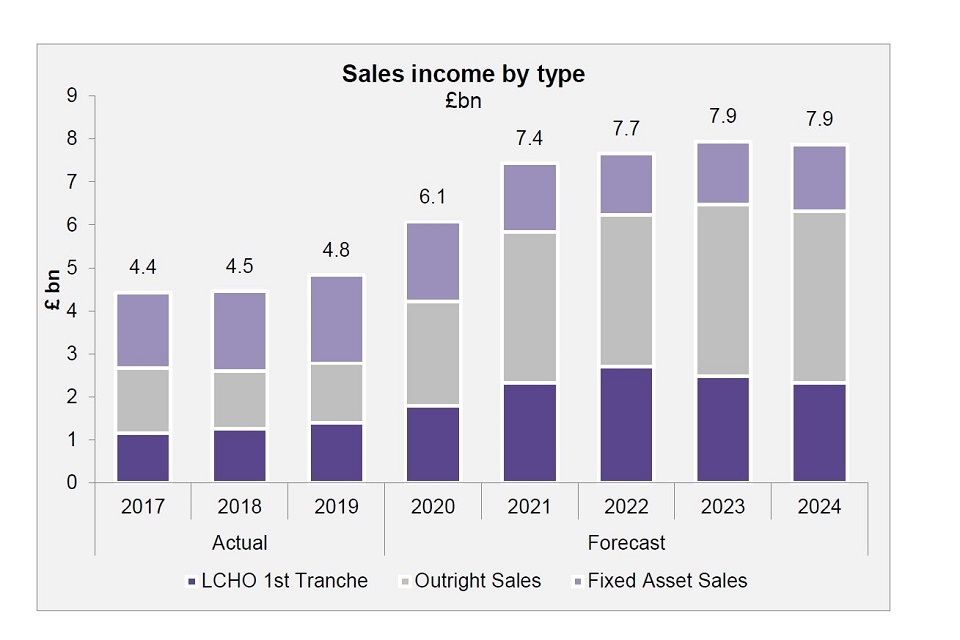

Low cost home ownership and market sales

62 - The latest forecasts show that there is a growing number of small to medium diverse providers that use shared ownership and outright sales income to fund their development programme. Some of those providers have limited previous experience of such an approach. Providers are reminded of the last economic downturn in 2008-09 when sales of shared ownership properties failed to materialise and prevented the cross-subsidy of social housing activities. The latest House Price Index [^21] shows that while house prices increased on average by 0.4% over the past year in England, prices in London and the South East fell by 1.4% and 2.0%, respectively.

Sales income by type

Graph showing sales income, by type 2017 to 2024

Total sales income

| Year | £bn | |

|---|---|---|

| Actual | 2017 | 4.4 |

| 2018 | 4.5 | |

| 2019 | 4.8 | |

| Forecast | 2010 | 6.1 |

| 2021 | 7.4 | |

| 2022 | 7.7 | |

| 2023 | 7.9 | |

| 2024 | 7.9 |

63 - As noted above, the latest quarterly survey for the first quarter of the 2019-20 financial year, demonstrates that the number of unsold homes was at its highest level in 10 years. Boards must have clear plans in place for alternative options if sales of shared ownership or outright sales are not delivered in line with business planning assumptions. Boards should include identifying mitigations to sudden and significant market change as part of their stress testing exercise.

64 - There are also growing signs of an increased level of impairment charges in the sector as the market value of new units and land in some areas continues to depreciate. Impairment affects profitability and hence potentially covenant compliance.

65 - While some providers have agreements in place with their lenders that excludes impairment charges from their financial covenants, there are a number of providers which this will not apply to. It remains important that boards understand the extent to which the business could be impacted by impairment, for example through investment in joint ventures. Boards must understand the risk of default and factor the risk of impairment into their investment decision-making process. The regulator will maintain a sharp focus on those providers where there is evidence of reliance on asset sales to meet current and future interest payments.

Diversification

66 - Diversification is an important mechanism by which providers can bolster their turnover and supplement their rental income and grant funding. It also enables providers to invest back into core activity of building and managing affordable and social rented homes and enhance services to tenants. However, diversification can introduce a different range of risks, and may put social housing at risk if financial performance is poor.

67 - Diversification can include for example market sales, specialist care, student housing and commercial property. Around a quarter of annual revenue is now derived from non-social housing letting activity and this trend is forecast to accelerate over the next five years. However, the consequences of getting diversification wrong can be detrimental financially and damage the reputation of the organisation.

Turnover, by source

Graph showing turnover, by source 2017 to 2024

Total turnover

| Year | £bn | |

|---|---|---|

| Actual | 2017 | 19.9 |

| 2018 | 20.5 | |

| 2019 | 20.8 | |

| Forecast | 2010 | 22.3 |

| 2021 | 24.9 | |

| 2022 | 26.2 | |

| 2023 | 27.4 | |

| 2024 | 28.2 |

68 - Diverse activities are commonly undertaken by non-registered or joint venture entities. As at March 2019, 145 (2018:142), providers had investment in, or were lending to, non-registered subsidiaries, joint venture companies and special purpose vehicles. The total indebtedness to these companies was £8 billion, a 26% increase on £6.4 billion reported in 2018. Boards must understand the potential risks associated with the finance and funding structures of non-social housing activities. We expect boards to have appropriate governance structures and ring-fencing arrangements in place to ensure that social housing assets are not put at risk by guarantees or impairment relating to non-social assets.

69 - Providers are also reminded that diverse initiatives should have a clear strategic role in meeting their organisation’s purpose and objectives. The regulator will seek assurance that the risks associated with non-social housing activities are commensurate to the reward that they achieve.

Financial and treasury management risks

70 - Boards have a responsibility for oversight of liquidity, capital structures and supporting the strategies that generate value for all stakeholders. It is important that funding is available for the organisation’s immediate cash flow requirements and provisions are in place to mitigate against reasonable adverse scenarios. Boards should also set parameters that manage liquidity and ensure access to funds and security is readily available.

71 - Boards must understand the trade-offs and compromises involved when financial decisions are taken. All financial products carry a certain degree of risk. It is crucially important that boards understand the merits and risks of all financial products they employ and that they are right for the organisation in meeting its future obligations. They are also reminded of the importance of relationships and communication with funders and for those with bond financing to adhere to the guidelines outlined by the Investment Association.

Existing debt

72 - Since August 2018 the BoE Monetary Policy Committee has maintained its base rate at 0.75%. While this has risen from its historic low of 0.25%, these low rates are forecast to remain in place up to 2022, with the market implied path for the Bank Rate now pricing in a 0.25% reduction in the next year. [^22].

73 - EBITDA MRI interest cover, which is a key indicator for liquidity and investment capacity, remains strong. The latest forecasts indicate that the aggregate cover for the sector over the next five forecast years is 181% (2018: 190%). The dip in forecast is due to a fall in outright sales projections. At March 2019 the proportion of fixed-rate debt (greater than one year), comprises 76% (2018: 73%), of the sector’s drawn borrowings. The remaining debt is made up of floating or fixed rates for less than one year or otherwise exposed to fluctuation through inflation linking or callable/cancellable options. The sector’s exposure to interest rate risk is relatively low.

74 - The regulator engages with providers that have low liquidity indicators or are forecasting drawdowns from facilities not yet agreed or secured. The exposure of individual providers to refinancing risk is covered by routine regulatory engagement. It is also the responsibility of providers’ boards to ensure that arrangements are in place for the effective management of refinancing risk.

New debt

75 - Providers vary in size and their strategic purpose and aims differ. Boards must consider the right funding options available which will often depend on an organisation’s risk appetite.

76 - The primary sources of funding in the sector remain relatively unchanged. These include:

- Banks – mainly revolving or short-term facilities – typically less than 10 years

- Bonds – public traded, Euro Medium Term Notes, aggregators or private placements

- Other – leases, index-linked products, equity funds and similar.

77 - Over the last two years there has been an increase in revolving credit facilities and short-term borrowing, which will require renegotiation or retendering on a frequent basis, increasing refinancing risk.

78 - The regulator does not favour any one funding approach over another but it does expect to see evidence that a critical assessment has been undertaken with use of independent, impartial, specialist external advice, as appropriate, especially when considering innovative and/or complex funding structures. It is also imperative that boards have the skills and expertise to be able to understand and challenge the advice received.

79 - In 2017 it was announced that London Inter-bank Offered Rate would be phased out at the end of 2021. The funding industry including the BoE are working towards formulation of a replacement measure, but at the time of writing there are no transitional arrangements in place nor is there certainty that a direct replacement for existing tenors will be available. Some renegotiation of loan documentation is likely to be required in the near future, and providers should consider seeking appropriate advice when these negotiations begin.

80 - Credit ratings in the sector are clustered in the low-single A band, with many having moved down one or two notches in the last year as the ratings agencies have taken a more cautious view on market sale exposure. Provider ratings are closely linked to the sovereign rating. There is a risk that future increases in market sale commitments will push individual ratings down further, while a reduction in the sovereign rating would also be passed on to provider ratings. If ratings fall into the low investment grade or further, funding costs would rise and the range of potential investors would change.

New business models – equity structures, lease structures and real estate investment trusts

81 - The last year has seen significant growth in investors seeking to use equity models in the sector. These include establishing for-profit providers to own and manage homes with leasing and management agreements. These approaches bring their own risks in addition to those applicable to all providers.

82 - Providers that deliver their landlord services through contracts have a different risk of failure to provide adequate services from the providers that provide those services directly. Responsibility for delivery of services and maintenance of properties remains with the provider, and the regulator will expect such providers to have appropriate contract monitoring and resolution processes in place.

83 - The returns demanded by equity are often higher than those required from non-distributing organisations, while the restrictions on rents are the same. This creates a risk that expenditure – including long-term investment – and services are reduced to maintain returns, or increased levels of sale are expected.

84 - All providers, regardless of ownership or funding structure are required to comply fully with the regulator’s standards. The Consumer Standards, and requirements of the Home Standard – including decency, health and safety and repair services, must be met over the long term. Where the properties are intended for use as supported housing, it is important that they are appropriate for that purpose, with suitable aids and adaptations for the client group, as well as the provision of support required to meet tenants’ needs.

85 - Boards are also reminded of their co-regulatory duty with the regulator and all it entails. In other words, the onus is on providers to demonstrate their compliance to the regulator. Where providers do not supply the requisite assurance, this will be reflected in our published regulatory judgements.

86 - It is for boards to assess the risks associated with any new types of funding they take on. Counterparty risk arising from exposure to banks and other financial counterparties must be considered as part of a providers’ treasury risk management function. This can include exposures by individual group subsidiaries and exposure to derivative contracts.

87 - As noted above, the risks identified in the addendum to the 2018 Sector Risk Profile regarding lease-based specialised supported housing providers still apply. Most of these organisations have very limited balance sheet capacity, cash or other assets that they can call upon if there are any interruptions to their cash-flows. These providers must be able to respond to both economic changes and those influenced by Government policy. These changes can leave their business plans vulnerable to rapid deterioration if any of the core assumptions underpinning their business plans turn out to be erroneous.

Pensions

88 - Employer payments towards pension provision are today a standard part of most sector employees’ overall remuneration. All schemes have membership and legal obligations. The balance of financial risk will vary depending on whether schemes are defined contribution or defined benefit.

89 - Many providers, however, have legacy defined benefit schemes where the financial obligations have to be re-measured on a triennial basis creating a risk of increasing costs to make up for past deficits. Following FRS102, this obligation will be reflected in the provider’s accounts, which currently demonstrate that the majority of schemes are materially under-funded. Additional cash payments will be required from exposed providers over an agreed period to close the deficit. The additional contributions required, will, however, vary from one provider to another. In particular, those most affected are likely to be organisations that run low-margin operations such as care and support. Although most providers have taken a proactive approach to managing this risk, boards should seek independent legal advice, where appropriate, to understand their risk exposure and impact on cash flow arrangements.

© RSH copyright 2019

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. Any enquiries regarding this publication should be sent via enquiries@rsh.gov.uk or call 0300 124 5225 or write to:

Regulator of Social Housing

Level 2

7-8 Wellington Place

Leeds LS1 4AP