Reporting of costs, charges and other information: guidance for trustees and managers of occupational schemes – effective from 21 October 202

Updated 21 October 2022

Summary of changes

We have updated the statutory guidance to take into account the introduction of new collective money purchase schemes. This will be effective from 21 October 2022 and replaces the previous guidance that came into effect on 1 October 2021.

Index of changes

This amends the previous version as follows:

- paragraphs 6, 21 and 35 have been added; and

- paragraphs: 15, 22, 23, 24, 25, 28, 29, 36, 80, 82, 84, 86, 89, 94 and 95 have been amended.

Background

About this guidance

1. From 6 April 2018 the Occupational Pension Schemes (Administration and Disclosure) (Amendment) Regulations 2018 (“the 2018 Regulations”) introduce requirements relating to the disclosure and publication of the level of charges and transaction costs by the trustees and managers of a relevant scheme[footnote 1].

2. The 2018 Regulations amend the Occupational Pension Schemes (Scheme Administration) Regulations 1996[footnote 2] ("the Administration Regulations") and the Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013[footnote 3] ("the Disclosure Regulations") to reflect these new requirements.

3. From 1 October 2019 the Pension Protection Fund (Pensionable Service) and Occupational Pension Schemes (Investment and Disclosure) (Amendment and Modification) Regulations 2018 (referred to in this guidance as "the Amending Regulations") introduce requirements relating to the disclosure and publication of the Statement of Investment Principles, alongside other related material. The Amending Regulations amend, amongst other Regulations, the Disclosure Regulations and the Occupational Pension Schemes (Investment) Regulations 2005[footnote 4].

4. The Occupational Pensions Schemes (Investment and Disclosure) (Amendment) Regulations 2019 ("the 2019 Regulations") introduce requirements relating to the disclosure and publication of the Statement of Investment Principles and other related material for non-relevant schemes. The 2019 regulations amend the Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 to reflect these new requirements.

5. The Occupational Pension Schemes (Administration, Investment, Charges and Governance) (Amendment) Regulations 2021 ("the 2021 Regulations") introduce requirements relating to the reporting of net returns and the assessment of value for members offered by a specified scheme[footnote 5].

6. The Occupational Pensions (Collective Money Purchase Schemes) (Modifications and Consequential and Miscellaneous Amendments) Regulations 2022 (“the 2022 Regulations”) amend the Disclosure Regulations to introduce requirements relating to the publication of information by a collective money purchase scheme[footnote 6].

7. Some of the duties inserted by the 2018 Regulations and the Amending Regulations and 2019 and the 2021 Regulations require trustees and managers to have regard to guidance issued from time to time by the Secretary of State in complying with the relevant requirements of those Regulations.

8. It is up to trustees and managers of occupational pension schemes to decide how, consistently with their legal obligations, to implement the requirements of the legislation based on the needs of their scheme's membership.

Expiry or review date

9. This guidance will be reviewed as a minimum every 3 years, from the date of first publication, and updated when necessary.

10. This document makes reference to a range of assumptions used in Actuarial Standards Technical Memorandum 1 (AS TM1) issued by the Financial Reporting Council (FRC), and used by the Financial Conduct Authority (FCA) in the Conduct of Business Sourcebook (CoBS).

11. In broad terms, the intention is to allow schemes to use the current assumptions set out for the production of illustrations in:

- CoBS[footnote 7] as at 12 April 2021

- version 4.2 of AS TM1, published in October 2016[footnote 8]. Subsequent references to CoBS and AS TM1 in this guidance should be taken to refer to these versions

12. When relevant assumptions in AS TM1 or in CoBS are updated, our intention is to consult in good time to ensure that, where appropriate, alignment between this guidance, AS TM1 and CoBS is maintained.

13. The guidance does not take precedence over, or try to direct, CoBS or AS TM1 in relation to the production of other projections.

14. When we review the guidance, we will also consider, for possible inclusion, lessons from established and emerging best practice and user testing of the way in which cost and charge information is presented.

Audience

15. This Guidance is for trustees and managers of trust schemes[footnote 9] and relevant occupational pension schemes – namely relevant schemes and collective money purchase schemes - (broadly, money purchase schemes (and hybrid schemes in relation to their money purchase benefits).

16. So far as this guidance covers publication requirements for relevant schemes, it is not relevant to:

- schemes where the only money purchase benefits offered arise from Additional Voluntary Contributions (AVCs)

- relevant small schemes[footnote 10]

- executive pension schemes[footnote 11]

- schemes that do not fall within paragraph 1 of Schedule 1[footnote 12] (description of schemes) to the Disclosure Regulations – most commonly single member schemes, schemes which are not tax registered and schemes which provide only death benefits

- public service pension schemes, as defined by section 318 of the Pensions Act 2004[footnote 13]

18. In addition, so far as this guidance covers publishing requirements relating to the Statement of Investment Principles it is not relevant to:

- schemes with fewer than 100 members (this exemption does not apply to a default SIP)

- schemes established under an enactment or guaranteed by a public authority

- schemes not established under a trust

When this guidance should be followed

19. The amendments made by the 2018 and the 2021 Regulations require occupational pension schemes which offer money purchase benefits (subject to the small number of exceptions above at paragraph 16) to, among other things:

- provide an illustrative example of the cumulative effect of costs and charges[footnote 14] incurred by the member as part of the Chair’s Statement

- publish that and certain other parts[footnote 15] of the Chair’s Statement (or all, if a scheme wishes to do so) on a website for public consumption

20. The amendments made by the Amending Regulations require trustees of schemes with 100+ members offering money purchase benefits (subject to the exceptions in paragraph 17) to, among other things:

- from 1 October 2019, publish the Statement of Investment Principles (SIP)

- from 1 October 2020, publish an implementation statement on how they acted on the SIP

21. The amendments made by the 2022 Regulations, amongst other things, require trustees of collective money purchase schemes specifically to publish:

- their scheme rules;

- a scheme design statement;

- a valuation and benefit adjustment statement; and

- the model used for the calculation of future benefit illustrations.

22. Trustees and managers of occupational pension schemes which are covered by the Regulations listed above must have regard to this Guidance, where applicable, on meeting these legislative requirements.

Legal status of this guidance

23. This statutory Guidance is produced under section 113(2A) of the Pension Schemes Act 1993 (“the 1993 Act”) for trust schemes and relevant occupational pension schemes and section 46(3) of the Pension Schemes Act 2021 for collective money purchase schemes.

24. From 21 October 2022 this Guidance replaces the previous Reporting of costs, charges and other information: guidance for trustees and managers of occupational schemes statutory guidance, which became effective in October 2021.

Compliance with this guidance

25. For occupational pension schemes, The Pensions Regulator (“TPR”) monitors compliance with the legislation and provides guidance about what employers and people running schemes need to do. The Department for Work and Pensions (“DWP”) is responsible for answering questions about the policy intentions behind the legislation. Neither DWP nor TPR can provide a definitive interpretation of the legislation which is a matter for the courts.

26. Trustees, managers and service providers should consider the Regulations referred to in this guidance to determine whether the requirements apply to them, taking advice where necessary. Where the requirements apply, trustees and managers should seek to demonstrate that they have had regard to this guidance for example by providing reasons for any divergence.

27. Where the trustees or managers do not comply with a relevant legislative requirement of the Administration Regulations or the Disclosure Regulations, including by virtue of a failure to have regard, or to have proper regard, to this guidance, the Pensions Regulator may take enforcement action which includes the possibility of a financial penalty.

28. Enforcement of Part V of the Administration Regulations, including the production and content of the Chair’s Statement, is currently provided for in Part 4 of the Occupational Pension Schemes (Charges and Governance) Regulations 2015[footnote 16]. Regulation 5 of the Disclosure Regulations sets out the penalties for failure to comply with any other requirement under those Regulations, including any failure to publish costs, charges and other relevant information in accordance with regulations 29A and 29B of those Regulations, respectively, for relevant schemes and collective money purchase schemes.

Production of an illustration

Overview

29. This section of the Guidance sets out the matters to which trustees and managers of relevant schemes must have regard when producing an illustration in accordance with regulation 23(1)(ca) of the Administration Regulations, as inserted by the 2018 Regulations. It also sets out the matters to which trustees and managers of collective money purchase schemes must have regard when producing an illustration in accordance with regulation 23(1)(cza) of the Administration Regulations, as inserted by the Occupational Pensions (Collective Money Purchase Schemes) Regulations 2022.

30. The purpose of the illustrations is to communicate simply and clearly to members the impact of cost and charges on their pension pots, and the compounding effect of small differences in charges over the long term.

31. To show the effect of a range of charging levels, the illustrations should identify all default arrangement(s), (regardless of how or when they became default arrangements) and the lowest charging and highest charging self-select fund in which members are invested. The illustrations should highlight to scheme members the difference in the compounding effect of the charges of each such fund in which assets relating to members are invested during the scheme year.

32. If the charging levels or the defaults vary by employer, then each part of the scheme with a different default or charging level should be treated as a separate scheme, for the purposes of producing default illustrations. This is to ensure that each employee who is interested can see the compounding effect of costs and charges on their default arrangement and a sample of other funds, regardless of the pension scheme’s pricing model. The illustrations for the highest and lowest self-select funds should be at scheme level; it is not necessary to illustrate them by employer.

33. Trustees and managers should present the costs and charges typically paid by a member as a figure in pounds, or pounds and pence.

34. Illustrations should be produced for the following:

- each default fund (that are not retirement date funds) – schemes with more than one default or a default whose price varies with employer should produce an illustration for each

- lowest charging self-select fund – at scheme level

- highest charging self-select fund – at scheme level

- if any default fund is a retirement date fund, then separate illustrations need not be produced for each retirement date fund. However, an illustration should be produced for each investment stage shown for the retirement date funds. If the highest or lowest charging self-select fund is a retirement date fund, then an illustration of all investment stages should be produced

- if any of the above funds are pooled funds, trustees should use the average of the transaction costs for the underlying funds, but should also state that they are using an average and explain how this affects the illustration.

35. However, as collective money purchase schemes will only have one arrangement or fund into which contributions will be paid they do not need to identify a default arrangement, the illustration will be in respect of the collective money purchase fund and should reflect the relevant design of the fund under the scheme rules.

36. The illustration required under regulation 23(1)(ca) or (cza) of the Administration Regulations should be produced having regard to the Guidance, providing realistic and representative figures for the following elements:

- savings pot size;

- contributions;

- real-terms investment return, gross of costs and charges;

- adjustment for the effect of costs and charges; and

- time

37. The examples below do not seek to be wholly prescriptive. Schemes are free to go further in the disclosure of additional illustrations based on the characteristics and diversity of their scheme membership, the fund or arrangement offerings where they feel an inclusion of these characteristics will improve the quality of the illustration.

38. When trustees and managers are deciding how best to present this data, they should consider the needs and preferences of their membership. Schemes are free to use a variety of different approaches which they believe to be more suitable for particular groups of members.

Examples

39. An example of how an illustration can be prepared which is consistent with this guidance is shown below. This example uses assumptions which are based on the FCA’s Conduct of business sourcebook (CoBS)[footnote 17] as at 6 April 2021.

Figure 1: Projected pension pot in today's money

| Years | Default arrangements before charges and costs | Default arrangements after all charges and costs deducted | Highest Charging Self Select Fund before charges and costs | Highest Charging Self Select Fund after all charges and costs deducted | Lowest Charging Self Select Fund before charges and costs | Lowest Charging Self Select Fund after all charges and costs deducted |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 3 | ||||||

| 5 | ||||||

| 10 | ||||||

| 15 | ||||||

| 20 | ||||||

| 25 | ||||||

| 30 | ||||||

| 35 | ||||||

| 40 |

Notes

1. Projected pension pot values are shown in today's terms, and do not need to be reduced further for the effect of future inflation. 2. The starting pot size is assumed to be £10,000 and total contributions (including tax relief) are £1000 per year. 3. Inflation is assumed to be 2.0% each year. 4. Contributions are assumed from age 22 to 68 and increase in line with assumed earnings inflation of 2.5% each year 5. Values shown are estimates and are not guaranteed 6. The projected growth rate for each fund or arrangement are as follows:

- default arrangement: 2.5% above inflation

- highest Charging Employee Self Select Fund: 3% above inflation

- lowest Charging Employee Self Select Fund: 1% above inflation

40. An example of how an illustration can be prepared for schemes with multiple defaults or variable charges which is consistent with this guidance is shown below.

Figure 2

Projected pension pot in today's money

| Years | Default – Employer Group A before charges and costs | Default – Employer Group A after all charges and costs deducted | Schemes Highest Charging Self Select Fund before charges and costs | Schemes Highest Charging Self Select Fund after all charges and costs deducted | Schemes Lowest Charging Self-Select Fund before charges and costs | Schemes Lowest Charging Self-Select Fund after all charges and costs deducted |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 3 | ||||||

| 5 | ||||||

| 10 | ||||||

| 15 | ||||||

| 20 | ||||||

| 25 | ||||||

| 30 | ||||||

| 35 | ||||||

| 40 |

Projected pension pot in today's money

| Years | Default – Employer Group B before charges and costs | Default – Employer Group B after all charges and costs deducted | Schemes Highest Charging Self Select Fund before charges and costs | Schemes Highest Charging Self Select Fund after all charges and costs deducted | Schemes Lowest Charging Self-Select Fund before charges and costs | Schemes Lowest Charging Self-Select Fund after all charges and costs deducted |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 3 | ||||||

| 5 | ||||||

| 10 | ||||||

| 15 | ||||||

| 20 | ||||||

| 25 | ||||||

| 30 | ||||||

| 35 | ||||||

| 40 |

41. This simple example is a scheme with only two default pricing structures. When producing the illustrations all defaults offered by the scheme should be included. For example, if the scheme had 20 employer default funds, all of which were different, they should produce 22 illustrations in order to be consistent with this guidance.

42. In relation to the self-select fund this example is of a typical scheme with variable charges which offer all the self-select funds at standard prices, possibly, less an employer specific discount. The identity of the lowest charging and highest charging self-select fund should be at scheme level, rather than for each employer using the scheme.

43. All members must be able to identify which employer group they are in, and should be clearly pointed at where to find this information e.g. in their Annual Benefit Statement.

44. It is particularly important for members who didn't make an active choice as to which fund they have been placed in by their employer to see a costs illustration, as they are bearing the costs of being invested in that respective fund. Therefore, it is important that they are able to see what they are likely to pay in costs over a saving lifetime as a result. Members of schemes with multiple defaults or variable charges have the same right to this information as those with a single price for employees of all employers.

45. However, if default fund charges vary between employers the illustrations for each respective employer group do not need to be presented alongside each other in the Chair's Statement. Alternatively, trustees can provide members with a publicly accessible link to the illustration for their specific employer group.

Required elements

Savings pot size

46. Schemes should use one or more typical savings pot sizes to illustrate the long-term effects of charges. These sizes should be broadly representative of the actual pot sizes of members of the scheme. For example, if trustees and managers chose to use just one pot size, the median pot size in the scheme could be used as a benchmark by which to set the value of the savings pot used in the illustration.

47. Schemes should also consider the age of members and other such factors when determining the pot size used to demonstrate the compounding effect of charges to members. For example, if the average member age is low with a zero/low savings pot size at the point of joining, schemes should consider whether this should be reflected in the pot size used for the illustrations. Trustees should also consider average contribution rates and investment returns.

48. For schemes with multiple defaults or variable charges this should simply be a median across the whole scheme rather than producing a median for each default, or for each employer using the scheme.

49. The pot size assumption should be clearly stated.

Contributions

50. Many members will be contributing to the pension scheme, and it is, therefore, often most meaningful for the illustration to show the effect of further contributions to the scheme. Contributions will generally increase in nominal terms, as they are typically a percentage of salary. Where salaries increase faster than inflation, there will be real-terms growth in contribution levels.

51. Where trustees and managers include further contributions to the scheme, the assumed initial future contribution level should be broadly representative of the overall level of contributions (including employer and employee contributions, and tax relief) and should be stated.

52. Future contribution level increases may currently be assumed to be zero in real (inflation-adjusted) terms, unless statute, scheme provisions or recognised practice require otherwise.

53. Real-terms contribution growth of 1.5% or more, taking into account expected real terms salary increases, may alternatively be assumed.

54. Where it is both disproportionately burdensome for schemes to show the effect of future contributions, and the scheme features no charges levied on contributions, trustees and managers may assume that no further contributions to the scheme will be made. This assumption should also be stated. Where the scheme levies a charge of any kind on contributions, an illustration including contributions should be shown for each affected default fund, and if no default funds are affected, at least one illustration including contributions should be shown.

Real-terms investment return gross of costs and charges

55. In line with AS TM1, we expect the real-terms investment return to take account of the expected returns, from the current and anticipated future investment strategy of each fund or arrangement over the period to the retirement date.

56. Alternatively, trustees and managers may, if they wish, use as a basis theintermediate rate real-terms investment return assumption currently permitted by CoBS. However, they should indicate whether they are using CoBS or AS TM1.

57. An unrealistic expected rate of return should not be presented to the member, as this could weaken the illustration of the compounding effect of costs/charges. Schemes therefore should not use assumed rates of real terms investment returns gross of costs and charges which are higher than both those set out in CoBS or for AS TM1.

58. Both AS TM1 and CoBS refer to a category of costs named ‘dealing costs’. The CoBS investment return assumption is gross of charges, but the charges do not include dealing costs[footnote 18]. For schemes not subject to FCA rules on projections, the AS TM1 nominal investment return assumption is the ‘accumulation rate’ – the expected returns before the deduction of charges and other expenses – but again those charges and expenses exclude any dealing costs[footnote 19].

59. Neither the FRC nor the FCA define dealing costs, but for the purposes of producing these illustrations this guidance treats them as equivalent to transaction costs.

60. Therefore, if the CoBS as at April 2021[footnote 20] investment return assumption is used, a maximum gross real-terms return of 3% plus the transaction costs may be used.

61. If AS TM1 is used, a maximum gross investment return of the ‘accumulation rate’ plus the level of transaction costs but minus the ‘inflation rate’ may be used.

62. For the assumed level of transaction costs, see paragraph 65.

63. The real-terms investment return assumption only needs to be shown for each fund or arrangement for which an illustration is provided.

Allowing for the effect of costs and charges

64. The effect of charges should be determined by an adjustment inclusive of all the charges, including performance fees, and transaction costs, which will have been taken from a member’s pot.

65. Where trustees choose to smooth performance fees over multiple years, as permitted by The Occupational pension schemes (Administration, Investment, Charges and Governance) (Amendment) Regulations, the smoothed fees should be used for the purposes of cumulative illustrations. It follows that it is only where the smoothed level of fees differs that a default fund should be treated as having a different charging structure solely because of variations in performance fees.

66. When demonstrating the impact of performance fees on a member's pot in a cumulative illustration, where smoothing is being applied, trustees should use the fee notionally paid, i.e. accrued, by the member even if no performance fee is paid by the scheme to the fund manager at that time i.e. crystallised. In other words, if performance fees are being smoothed, trustees should demonstrate the impact of the smoothed amount on the member's pot, not the underlying in-year performance fee. This is in line with the 2021 Regulations that permit smoothing as a charging mechanism not just a reporting mechanism.

67. The transaction costs, as defined in regulation 2(1) of the Occupational Pension Schemes (Charges and Governance) Regulations 2015, should be based on an average of the previous 5 years' transaction costs or, where data is available for less than 5 years, an average of transactions costs over the years for which data is available.

68. The charges (similarly defined in regulation 2(1) of the Charges and Governance Regulations) should be forward-looking and take into account all of those a client will, or may, expect to be taken after investment into the product. The percentage rate (or pound amount, in the case of flat fees) used should be stated.

69. Any forecast change in flat fee in future should be taken into account. Where this is set to increase in line with inflation a figure of 2.0% (for Consumer Prices Index) or 3.0% (for Retail Prices Index) can be used.

70. Where trustees and managers choose to report the transaction costs associated with entering, exiting and switching between funds or arrangements, they should also show these effects in the illustration.

71. Where the scheme offers funds or arrangements set at a range of different charges/total charge and cost levels, trustees and managers should again use a representative range of charges and costs, illustrating the default(s) and lowest and highest charging self-select funds. It is not necessary to include every individual fund or arrangement offered by the scheme in the illustration.

Time

72. The illustration should show the cumulative effect of the charges and transaction costs on the value of a typical member's savings pot over time. This should reflect the approximate duration that the youngest scheme member enrolled has saving, until they reach the scheme’s Normal Pension Age set out in scheme rules.

73. Trustees and managers are only expected to present one starting point as a minimum. However, if the presentation method allows this to be easily understood, a scheme may also choose to present additional starting points depending on the generational demographic of the scheme membership. Trustees and managers should seriously consider presenting alternate start points if the level of costs and charges varies significantly by age – for example if younger members’ contributions are invested in a low-cost allocation of assets, but those members pay significantly more the closer they are to retirement.

Optional elements

74. Trustees may choose to provide additional illustrations where they believe these would be useful for members – for example, for different time periods or contribution rates.

75. They may also choose to add extra information to the illustration and to present data in a more disaggregated format.

76. Examples of additional information trustees and managers may provide include:

- historic performance data about the funds or arrangements in which members are invested (although it should be made clear that this is no guide to the future)

- future charges data, if charges are expected to change

- percentage of gross investment returns lost over time

- percentage of the pot lost to costs and charges compared with a situation where no costs and charges were incurred. Where there are ‘negative transaction costs’ the trustees should provide an explanation[footnote 21].

77. Examples of greater disaggregation which may be provided include:

- a breakdown of charges into investment and administration costs

- a breakdown of transaction costs – for example into explicit costs (such as broker commission, settlement fees, and custody ticket fees) and implicit costs (slippage)

78. Where this additional or disaggregated information is provided, trustees and managers should carefully consider whether they believe that members would benefit from the information and whether it would prove distracting.

79. Provision of data in a more disaggregated form does not remove the expectation to also display it in aggregated form.

Publication of costs, charges and other information

80. This section of the Guidance sets out the matters to which trustees and managers of relevant occupational pension schemes and certain other trust schemes must have regard when publishing information under regulation 29A or 29B of the Disclosure Regulations[footnote 22].

81. Trustees and managers should consider the 2021 Regulations to determine when the new publishing requirements are applicable to them. These Regulations introduce requirements to publish:

- the net return on investments for all relevant schemes

- the results of the additional value for members assessment (where applicable) and explanation of this assessment

Required and optional elements

Presenting the information

Required elements

82. The information that must be published under regulation 29A and 29B of the Disclosure Regulations, does not necessarily have to be published as a single web-page or PDF document. This information can be published over a number of pages, including:

- for relevant schemes, their

- Statement of Investment Principles;

- relevant sections of the Chair’s Statement (charges and transaction cost information and illustrations, the explanation of the value for members assessment, the report on investment returns, default SIP and information about its review);

- relevant section of the Annual Report, (the implementation statement); and

- for collective money purchase schemes specifically, their:

- scheme design statement;

- scheme rules;

- valuation and benefit adjustment statement; and

- model used for the calculations of benefit illustrations.

83. It should also be noted that it is notnecessary for schemes to publish a signed version of documents. Although signatures are still required in line with current regulations, the manuscript signature can be removed before publishing.

Presenting the information – Optional elements

84. Trustees and managers can choose to publish the full Chair’s Statement if they wish. Pension schemes may additionally wish to publish the information which they are required to make publicly available under regulation 29A and 29B of the Disclosure Regulations in other locations, such as on the password-protected online servicing sections of their website. However, this does not remove the requirement to publish the information online in such a way that all can find the information without registration or entering any personal details.

85. An example of how documents in the annual report and accounts could be presented as a series of linked web-pages or PDF documents which is consistent with regulation 29A is below:

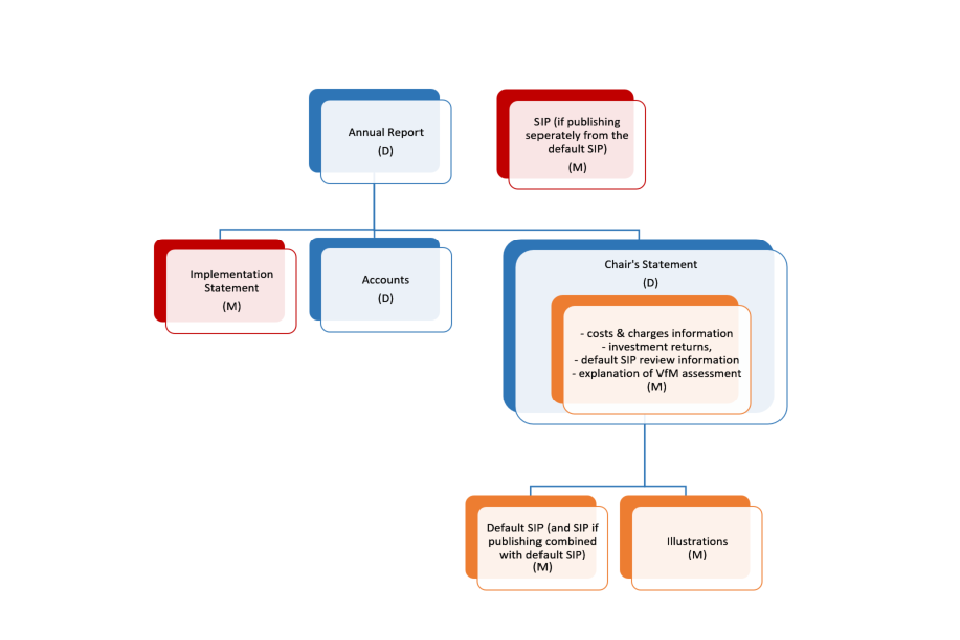

Figure 3 – Illustration of a document chain which is consistent with Regulation 29A of the Disclosure Regulations

""

Illustration Notes

- Figure 3 depicts a flow chart showing how the documents can be presented. Collectively all the documents referenced in the separate boxes of the flow chart are the Annual Report and Accounts.

- At the top of the flow chart is a box labelled ‘Annual Report’.

- Flowing out of this box are boxes labelled ‘Implementation Statement’, ‘Accounts’ and ‘Chair’s Statement’.

- This illustrates that trustees can provide links to the Accounts, Implementation Statement and Chair’s Statement from their Annual Report and present them separately.

- The Chair’s Statement box includes reference to costs and charges, default SIP review, investment returns and explanation of the VFM assessment under regulation 23 (1) which must be stated / explained in the Chair’s Statement.

- Flowing out of the box labelled Chair's Statement are two additional boxes, labelled ‘Default SIP (and SIP if publishing combined with default SIP’), and ‘Illustrations’,

- This illustrates that trustees can provide a link to their Default SIP (and SIP if publishing combined with default SIP), and the compounding illustrations, from their Chair’s Statement and present them on separate web-pages. These pages must be accessible to all.

- Directly to the right of the flow chart is a box labelled SIP (if publishing separately from the default SIP). This is to illustrate the SIP can be presented separately from the default SIP.

- The boxes labelled ‘Default SIP (and SIP if publishing combined with default SIP)’, ‘Illustrations’ all have an additional label (M). The reference to the Costs and Charges information, default SIP review, investment returns and VFM assessment information, which must appear in the Chair’s Statement, also has this label.

- (M) stands for ‘Mandatory publishing requirement’. This label represents information which is required by law to be made publicly available on a website, free of charge. Most of this information comprises extracts from the Chair’s Statement - the exceptions are the Implementation Statement and the SIP (if published separately from the default SIP).

- The boxes labelled ‘Annual Report’, Accounts’ and ‘Chair’s Statement’ have an additional label (D).

- (D) stands for ‘Discretionary publishing requirement’. This illustrates that there is no legal requirement to publish the entirety of the documents labelled (D), even though some of the information included within them may have to be published (e.g. the specified extracts from the Chair’s Statement).

Finding and accessing the information

86. Whether produced as one document or separated out, the information required to be made publicly available under regulation 29A and 29B of the Disclosure Regulations must be published on a publicly available website. The information should be published in a manner which allows for the content to be indexed by search engines:

- if published on the scheme’s or employer’s website, it should not include text which prevents the page from being indexed, and it should be linked to other pages which are found by web search engines;

- if published via another website – for example, via a social media site, a blogging tool or a repository offered by a search engine provider – appropriate boxes should be selected to ensure that the document is public and can be indexed.

87. Persons wishing to view the information should not be required to do so by:

- entering a specific user name and/or a specific password;

- providing any other personal information about themselves.

88. The Disclosure Regulations also require that a specific web address for the location of the published materials on the internet be included in a member’s Annual Benefit Statement. The web address should be appropriately titled so that members can readily re-type it into a web browser, and should clearly describe the information to be found at the location.

Needs of disabled people

89. Trustees and managers should satisfy themselves that they have adequately taken account of the needs of disabled people in publishing the information under regulation 29A and 29B of the Disclosure Regulations.

90. Examples of factors they should take into account include, but are not limited to:

- whether screen reading software used by visually impaired and blind people can read the content and in a logical sequence

- whether the text can be enlarged, and whether the contrast in the pages is adequate so it can be read by visually impaired people

- whether the text is simply and clearly written for the benefit of cognitively-impaired users

91. Standards which trustees and managers may wish to take account of, in verifying that the content takes account of the requirements of disabled people are:

- the web content accessibility guidelines (WCAG) 2.0[footnote 23], published by the Web Accessibility Initiative[footnote 24], established by the World Wide Web Consortium (W3C)

- BS 8878:2010 Web accessibility. Code of practice, published by the BSI Group

92. Section 29 of the Equality Act 2010[footnote 25] makes it unlawful for service providers to discriminate against people with disabilities. The "Services, public functions and associations: statutory code"[footnote 26] published by the Equality and Human Rights Commission to accompany the Act highlights that websites may in themselves constitute a service covered by the Act, for example, where they are delivering information to the public.

93. Although this section of the guidance is about publishing information, the attention of trustees and managers is drawn to new regulation 29A (4) of the Disclosure Regulations concerning the provision of information in hard copy. Where the person has a disability which means that they are less able to access information on a website, this should be a key factor in deciding to provide that information in a different format.

Storage or printing of the information

94. The information under regulation 29A and 29B of the Disclosure Regulations, whether published on a single page or across more than one page, should be published on a webpage in a way which enables the information displayed to be printed by the reader using widely used web browsers, using the menus available via the browser or functionality on the page itself.

95. In addition, the webpage on which the information is displayed should be such that the information under regulation 29A and 29B of the Disclosure Regulations should be capable of being downloaded and stored using a modern web browser, again either via the browser menus or the page’s functionality.

-

Relevant scheme is defined by reference to the Administration Regulations - see paragraph 16 for more information about the scheme types which are excluded from the definition of “relevant scheme”;. ↩

-

The Occupational Pension Schemes (Scheme Administration) Regulations 1996 ↩

-

The Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 ↩

-

The Occupational Pension Schemes (Investment) Regulations 2005 ↩

-

A ‘specified scheme’ is defined by regulation 25(5) of the Occupational Pension Schemes (Scheme Administration) Regulations 1996, inserted by regulation 2(3)(c) of the 2021 Regulations. ↩

-

‘Collective money purchase scheme’ is defined by section 1 of the Pension Schemes Act 2021 ↩

-

CoBS 13 Annex 2 Projections Refer to updates published 12/04/21 ↩

-

Actuarial Standard Technical Memorandum: AS TM1 Current Versions ↩

-

Trust scheme is defined in section 124(1) of the Pensions Act 1995 - see paragraph 18 for more ↩

-

Also known as ‘Small Self-Administered Schemes (SSASs)’, a relevant small scheme is an occupational pension scheme with fewer than 12 members where all the members are trustees of the scheme or all the members are directors of a company which is the sole trustee of the scheme ↩

-

Executive Pension Scheme means an occupational pension scheme in relation to which a company is the only employer and the sole trustee; and the members of which are either current or former directors of the company and include at least one third of the current directors ↩

-

The Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 ↩

-

In practice, we are aware of no such schemes which meet this definition and offer money purchase benefits other than those attributable to AVCs. ↩

-

‘Transaction costs’ and ‘charges’ are defined in the Occupational Pension Schemes (Charges and Governance) Regulations 2015 ↩

-

Regulation 5 of The Occupational Pension Schemes (Administration, Investment, Charges and Governance) (Amendment) Regulations 2021 defines the new publishing requirements. ↩

-

The Occupational Pension Schemes (Charges and Governance) Regulations 2015 ↩

-

CoBS 13 Annex 2 paragraph 2.6 (1) and (2) ↩

-

C2.4 and C2.9 of Actuarial Standard Technical Memorandum 112341234 ↩

-

CoBS 13 Annex 2 Projections Refer to updates published 12/04/21 ↩

-

An example explanation could be: "A zero cost has been used where there are negative transaction costs (i.e. an overall gain was made on the transaction, which can happen as a result of changes in the pricing of the assets being bought or sold). It is not expected that transaction costs will always be negative". ‘It is important to note that using a negative or zero cost during any one scheme year may not accurately represent the actual transaction costs a member may expect to see in any future scheme year’. The wording used should be easy for members to understand. ↩

-

Regulation 29A, which applies to trustees and managers of relevant schemes, was inserted by the 2018 Regulations, and amended by the Amending Regulations, the 2019 Regulations and the 2021 Regulations. Regulation 29B, which applies to trustees and managers of collective money purchase schemes, was inserted by the 2022 Regulations ↩

-

Services, public functions and associations Statutory Code of Practice ↩