Renewable Transport Fuel Obligation Annual Report 2018 - web version

Published 1 June 2020

1. Executive summary

1.1 Introduction

This report has been produced to ensure transparency in the financial reporting of the Renewable Transport Fuel Obligation (RTFO). It is not reported within the Department for Transport’s Annual Report and Accounts as its inclusion would not be compliant with the Government’s Financial Reporting Manual.

The RTFO is one of the Government’s main policies for reducing greenhouse gas (GHG) emissions from road transport in the UK. It requires that a certain percentage of road transport fuel supplied is renewable and meets minimum GHG sustainability criteria.

Previously, the RTFO operated on a financial year basis starting each year on the 15 April. However, on 1 January 2019 the RTFO moved to a calendar year basis, therefore 2018 (year 11 of the RTFO) was a short year (April to December).

1.2 Outturn for 2018

The total value of the RTFO for 2018 is £399.8 million. This is calculated as the difference between the cost of renewable fuels supplied and the fossil fuels they have replaced.

1.3 Forecasts

The forecast total value of the RTFO for 2019 is £924.9 million. The RTFO outturn for 2020 is forecast at £1,068.0 million. This increase is in part due to an increase in the RTFO obligation after April 2018.

1.4 Scheme outcomes

In 2018, the average GHG saving from the renewable fuels supplied under the RTFO was 78% compared to fossil fuels, representing a total saving of 2.88 million tonnes of CO2 equivalent (eq.). If this was extrapolated to a full calendar year it would represent a total saving of 3.99 million tonnes of CO2 eq. This full year estimate is equivalent to taking approximately 1.8 million cars off the road.

The RTFO is meeting its objective of reducing GHG emissions from road transport. All the renewable fuels rewarded under the RTFO meet the mandatory sustainability criteria. The RTFO is designed and managed to ensure a high level of compliance with its requirements.

1.5 Signature and audit

This report is signed by the Permanent Secretary, Department for Transport. The outturn figure for 2018 has been audited by the National Audit Office (NAO) on behalf of the Comptroller and Auditor General.

2. Introduction

2.1 Purpose of this report

This report has been produced to ensure transparency in the financial reporting of the Renewable Transport Fuel Obligation (RTFO). The transactions generated by the RTFO are not income or expenditure attributable to the Department for Transport and the RTFO is not reported within the Department’s Annual Report and Accounts as its inclusion would not be compliant with the Government’s Financial Reporting Manual.

This report gives an outturn figure for the value of the RTFO for the 2018 short year (April to December) alongside the outcomes for the scheme. Forecasts are also given for the 2019 and 2020 RTFO years. The National Audit Office (NAO) on behalf of the Comptroller and Auditor General has audited the 2018 outturn data within this report: the audit opinion is included on page 8.

2.2 The RTFO

The RTFO is one of the Government’s main policies for reducing greenhouse gas (GHG) emissions from road transport in the UK. The RTFO requires that a certain percentage of fuel is renewable and provides a valuable incentive for the renewable transport fuel industry which contributes towards meeting this obligation. The scheme started in 2008 and was amended in 2011 to implement mandatory sustainability criteria for the renewable fuels supplied.

The RTFO operates with tradable certificates. These are called Renewable Transport Fuel Certificates (RTFCs) and are awarded to suppliers of renewable transport fuel that meet the sustainability requirements. To be awarded, suppliers must provide evidence to the RTFO Administrator which demonstrates that their fuel is sustainable. This information must be independently verified.

Obligated fuel suppliers to the UK market are required to demonstrate that renewable transport fuel has been supplied for a set proportion of their total obligated fuel supply. For the 2018 year, this proportion was 7.25%. Suppliers can meet this obligation by redeeming certificates that they have received for their own renewable transport fuel supply, or by redeeming certificates that they have bought from other suppliers of renewable transport fuel.

Suppliers also have the option to buy out of their obligation, paying 30 pence per litre of renewable transport fuel for which they have not redeemed an RTFC. This protects consumers from excessive increases in fuel prices by setting a maximum value for RTFCs. As of April 2018, the Treasury would receive any revenue from suppliers that buy out.

Fuel suppliers can meet up to 25% of their obligation with certificates issued in the previous year. This reduces the impact of unexpected events and provides some protection against year to year volatility of fuel prices. An exception to this is in 2020, when there can be no carry over from 2019 to 2020. This is because, under the Renewable Energy Directive, the renewable energy target for 2020 must be met by fuel that is provided in 2020. Any RTFCs issued in 2019 may be carried over into the year 2021.

2.3 Recent Amendments to the RTFO

In 2018 the RTFO was amended to set out increasing renewable fuel volume targets to 2032, introduced a crop cap from 15 April 2018, and to introduce a target for a specific sub-set of advanced fuels termed ‘development fuels’.

The development fuel target takes into account the fuel type, production pathway and feedstock, and aims to incentivise those fuel pathways which need greater support and fit the UK’s long term strategic needs. Eligible fuels include aviation fuel, drop in fuels, hydrogen and synthetic natural gas. It was introduced on 1 January 2019, and requires that obligated suppliers provide a proportion of their total obligated fuel supply as development fuels. For 2019 this proportion is 0.1% and development fuels will be issued separate development fuel RTFCs (dRTFCs).

Another policy that runs parallel with the RTFO is the GHG Reporting Regulations, which were introduced on 1 January 2019 and will end on 31 December 2020. These implement the reporting requirements from Directive 98/70/EC of the European Parliament and of the Council relating to the quality of petrol and diesel (known as the Fuel Quality Directive (FQD)). The GHG Reporting Regulations are not included in the outturn for 2018, however forecasts are provided for 2019 and 2020.

The GHG Reporting Regulations are a key measure for reducing GHG emissions from the fuel supplied for use in transport, and requires that suppliers of fuels for use in road transport and non-road mobile machinery to achieve at least a 6% reduction in life cycle GHG emissions from the transport fuel that they supply in 2020, relative to the EU average life cycle GHG emissions from fossil fuels in 2010. Renewable aviation fuel, low carbon fossil fuels, upstream emission reductions (UERs) and electricity supplied to vehicles may also contribute to a suppliers’ GHG reduction targets. GHG credits will be awarded to each kg of CO2 eq. saved, for fuels that have a GHG intensity below the GHG target level for the relevant year.

Previously, the RTFO operated on a financial year basis starting each year on the 15 April. From 1 January 2019 the RTFO moved to a calendar year basis. To transition to calendar years, 2018 (this report) was a shorter obligation period running from 15 April 2018 to 31 December 2018. Thereafter, obligation periods will run from 1 January to 31 December each year.

3. Sign-off of report

As Accounting Officer for the Department for Transport I am responsible for ensuring that there is a high standard of financial management, including a sound system of internal control and effective financial systems. This responsibility includes the Renewable Transport Fuel Obligation (RTFO). I am content that appropriate financial controls over the RTFO are in place and that sufficient checks and reviews have been made to produce accurate and reliable financial data within this report. The audit by the National Audit Office, on behalf of the Comptroller and Auditor General, relates to the 2018 outturn. I have taken all reasonable steps to be aware of and provide necessary information to the auditors and I am not aware of any additional relevant information.

Bernadette Kelly

March 2020

Permanent Secretary and Accounting Officer

Department for Transport

Great Minster House

33 Horseferry Road

London

SW1P 4DR

4. Assurance report

4.1 Renewable Transport Fuel Obligation Annual Report - Assurance Report 2018

Assurance report to the Secretary of State for Transport in relation to the disclosure of the additional cost of renewable transport fuel supplied under the renewable transport fuel obligation.

I have evaluated through a reasonable assurance engagement the disclosure of the outturn related to the additional cost of renewable transport fuel supplied under the Renewable Transport Fuel Obligation (RTFO) included as section 4 in the Renewable Transport Fuel Obligation Scheme Annual Report for the year ended 31 December 2018.

4.2 Subject matter, criteria and limitations

The Secretary of State for Transport is required by HM Treasury direction, as an imputed tax and spend measure, to prepare an annual report in respect of the RTFO scheme established under the Renewable Transport Fuel Obligations Order 2007 (as amended). Included within this report, at section 4, is a disclosure of the outturn related to the additional cost of renewable transport fuel supplied under the RTFO scheme for the period 15 April 2018 to 31 December 2018. This disclosure is derived from a model designed by the Department for Transport, with observable inputs.

I have reviewed the output of the model and considered the adequacy with which the model derives a figure for the additional cost of renewable transport fuel supplied under the RTFO scheme. I have not considered alternative measurement or evaluation methods. I have considered whether the disclosure has been properly prepared in accordance with HM Treasury direction.

My review extended only to providing assurance on the disclosures made for the period 15 April 2018 to 31 December 2018. My historic evaluation is not relevant to future periods due to the risk that the model may become inadequate because of changes in conditions.

4.3 Specific purpose of this assurance report

This report has been prepared to provide the Secretary of State with reasonable assurance over whether section 4, the outturn related to the additional cost of renewable transport fuel supplied under RTFO, gives a true and fair view for the period 15 April 2018 to 31 December 2018.

4.4 Responsibilities

The Permanent Secretary on behalf of the appointed administrator, the Secretary of State for Transport, is responsible for preparing section 4, the outturn related to the additional cost of renewable transport fuel supplied under RTFO, and for being satisfied that this note is true and fair. My responsibility is to gather appropriate evidence to support an opinion on section 4, the outturn related to the additional cost of renewable transport fuel supplied under RTFO, in accordance with International Standards on Assurance Engagements 3000, Assurance Engagements Other than Audits or Reviews of Historical Financial Information.

Performance of the engagement in accordance with International Standards on Assurance Engagements 3000, Assurance Engagements Other than Audits or Reviews of Historical Financial Information:

I performed a reasonable assurance engagement in accordance with the principles of International Standards on Assurance Engagements 3000, Assurance Engagements Other than Audits or Reviews of Historical Financial Information issued by the International Auditing and Assurance Standards Board. The objective of a reasonable assurance engagement is to perform such procedures as to obtain information and explanations which I consider necessary in order to provide me with sufficient appropriate evidence to express a positive conclusion on the disclosure. No other section of the annual report has been evaluated under this engagement.

4.5 Quality control and compliance with ethical standards

I apply International Standard on Quality Control 1, Quality Control for Firms that perform audits and reviews of Financial Statements, and other Assurance and Related Service Engagements. Accordingly, I maintain a comprehensive system of quality control including documented policies and procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

I have complied with the independence and other ethical requirements of the Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants, which is founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour.

4.6 Summary of work performed

The additional cost of renewable transport fuel is estimated using a cost model. My assurance work included an examination of this cost model, to confirm that this is consistent with its intended function and that its inputs are consistent with the underlying source data. I also made enquiries with management as to the controls surrounding the collection of data where it was from internal sources.

4.7 Conclusion

In my opinion, section 4 of the RTFO annual report, showing the outturn related to the additional cost of renewable transport fuel supplied under the RTFO scheme for the period 15 April 2018 to 31 December 2018, is both fairly stated and properly prepared in accordance with HM Treasury direction.

Matthew Kay

Director

29 April 2020

National Audit Office

157-197 Buckingham Palace Road

Victoria

London

SW1W 9SP

5. Outturn (audited) for 2018

5.1 RTFO outturn

- RTFO outturn for 2018 (partial year): £399.8 million

Table 1 RTFO outturn 2018

6. Cost estimation methodology and data sources

The RTFO requires road transport fuel suppliers to blend a certain volume of renewable fuels into fossil fuels. The most significant renewable fuels deployed through this mechanism are bioethanol (36% of renewable fuel supply in 2018), which is blended into fossil petrol and biodiesel (59% of renewable fuel supply in 2018), which is blended into fossil diesel.

Renewable fuels have historically been more expensive than fossil fuels. Fuel suppliers/retailers are likely to pass some of these additional costs onto the final consumer. Renewable fuels also have lower energy content per litre, so the use of renewable fuels increases the cost of motoring.

This price difference between fossil fuels and renewable fuels can be observed in the market. The Department receives renewable fuels market price data that is produced weekly by ‘Argus Media’, a leading global provider of market data .

We have estimated the cost imposed by the RTFO using monthly volumes of renewable fuels as reported through the RTFO statistics and price differentials as reported through Argus Media’s market reports. To take account of the lower energy content of renewable fuels, we compare fuel costs in terms of £/MJ and not £/litre, based on energy density factors quoted in the Renewable Energy Directive .

Since the biodiesel price varies depending on the feedstock, we have generated separate estimates for biodiesel from different feedstocks. For bioethanol, there is just one market price and no distinction between feedstocks. For the remaining 4% of renewable fuels that are not bioethanol or biodiesel, pricing information is not readily available. We have used proxies for these small-volume fuels, based on their closest substitute fuels.

The 2018 RTFO reporting year runs from 15th April 2018 to 31st December 2018. We have not attempted to adjust for this short year. From 2019 reporting will be on an annual basis.

7. Forecasts

7.1 Future RTFO value

- RTFO forecast for 2019: £924.9 million

- RTFO forecast for 2020: £1,068.0 million

- GHG Reporting Regulations forecast for 2019: £143 million

- GHG Reporting Regulations forecast for 2020: £228 million

Table 2 Future RTFO value

8. Cost estimation methodology and data sources

8.1 RTFO Forecast for 2019

The forecast for 2019 (£924.9 million) has been modelled using the same methodology and data sources as the outturn for 2018, with the following exceptions:

- actual fuel supply volumes for 2018 have been used (currently available figures for 2019 are incomplete and unrepresentative) adjusted for the longer reporting period, the increase in obligation from 7.25% to 8.5% and 1% drop in total demand based on BEIS’ energy and emissions projections

- actual price data for the months January - March 2020 has been used and rolled forward to the end of the reporting period. This period would have captured some lower fossil fuel prices seen in 2020 due to the COVID-19 pandemic, which would increase the RTFO forecast for 2019

8.2 RTFO Forecast for 2020

The forecast for 2020 (£1,068.0 million) has been modelled using the same methodology and data sources as the forecast for 2019, with the following exceptions:

- actual fuel supply volumes for 2018 have been used adjusted for the increase in obligation and 3% drop in total demand based on BEIS’ energy and emissions projections

- the 2019 forecast price data has been adjusted for inflation and used for the 2020 forecast, therefore some effects of the COVID-19 pandemic on fossil fuel prices are captured by the current 2020 forecast

The 2019 and 2020 cost estimates include £38m and £56m respectively as the maximum cost of meeting the development sub-target, based on the cost of buy-out occurring for the full obligation (47m and 70m litres respectively at £0.80). The actual cost is likely to be less than this but we currently are unable to estimate it.

An estimate was also made using a variety of price estimates and assumptions about fuel supply volumes and feedstock mixes. This predicted that the RTFO forecast for 2020 would range from £874 million to £1,212 million, with a central price estimate (reflecting recently observed market prices) of £1,068.0 million. The broad range reflects that there is some uncertainty about the fuel supply volumes and feedstock mix and very high uncertainty around future fuel prices.

8.3 GHG Reporting Regulation Forecast for 2019

The forecast for 2019 (£143 million) for the GHG Reporting Regulations has been modelled by:

- projecting the GHG savings required to meet the GHG Reporting Regulations Target in 2019 and 2020, and the GHG savings from the RTFO in 2019 and 2020 (using 2018 fuel-specific GHG emission factors)

- the GHG emission saving ‘gap’ between the RTFO forecast GHG savings and the projected GHG emission savings by the GHG Reporting Regulations is calculated

- the GHG emission saving ‘gap’ is then multiplied by the GHG Reporting Regulation buyout price (£74/t CO2 eq.) to calculate the maximum compliance cost required to cover the GHG savings gap

- the maximum pump price impacts have been estimated by dividing the maximum compliance cost of the GHG Reporting Regulations by the total obligated fuel supply

8.4 GHG Reporting Regulation Forecast for 2020

The forecast for 2020 (£228 million) has been modelled using the same methodology and data sources as the forecast for 2019.

9. Scheme outcomes

9.1 Introduction

The main policy objective of the RTFO is to reduce GHG emissions from transport. It requires that a certain percentage of road transport fuel is renewable and meets minimum GHG sustainability criteria.

9.2 Greenhouse gas savings

The increased RTFO Obligation (introduced in April 2018) is reflected by an increase in renewable fuel supplied as a proportion of total fuel (4% vs. 3.1% in 2017/18). This represents a supply of 1.52 billion litres equivalent (eq.) of renewable fuels in 2018. Figure 1 shows the total CO2 eq. savings and cars removed from the road if the 2018 short year was extrapolated to represent a full calendar year.

This volume includes 1.48 billion litres of liquid fuel and a small volume (15.6 million kg, or 27.9 million litres eq.) of transport gases (biomethane and biopropane). Biodiesel and bioethanol represent 59% and 36% of the total volume of renewable fuels, respectively, with other fuels accounting for the remaining 5%.

Greenhouse gas (in carbon dioxide equivalent) savings per year achieved by the RTFO since 2008. Also shows the equivalent number of cars that these emissions represent.

Figure 1 Greenhouse gas savings from the RTFO

Note: Figure 1 has been updated with the most recent (2017) estimate for the average GHG emissions per car per year (2.17t CO2eq./year according to BEIS’s GHG Inventory).

In 2018, the average GHG saving from the renewable fuels supplied under the RTFO was 78% compared to fossil fuels. This represents a total saving of 2.88 million tonnes of CO2 eq. If this were extrapolated to a full calendar year it would represent a total saving of 3.99 million tonnes of CO2 eq. This full year estimate is equivalent to taking approximately 1.8 million cars off the road (Figure 1).

In recent years the level of GHG savings have gradually increased, which are likely due to the increasing proportion of waste-derived renewable fuels (69% vs. 65% of all renewable fuels in 2017-18). The RTFO awards double RTFCs to waste-derived renewable fuels as they do not have ILUC implications and generally have greater GHG emissions savings than crop-derived renewable fuels.

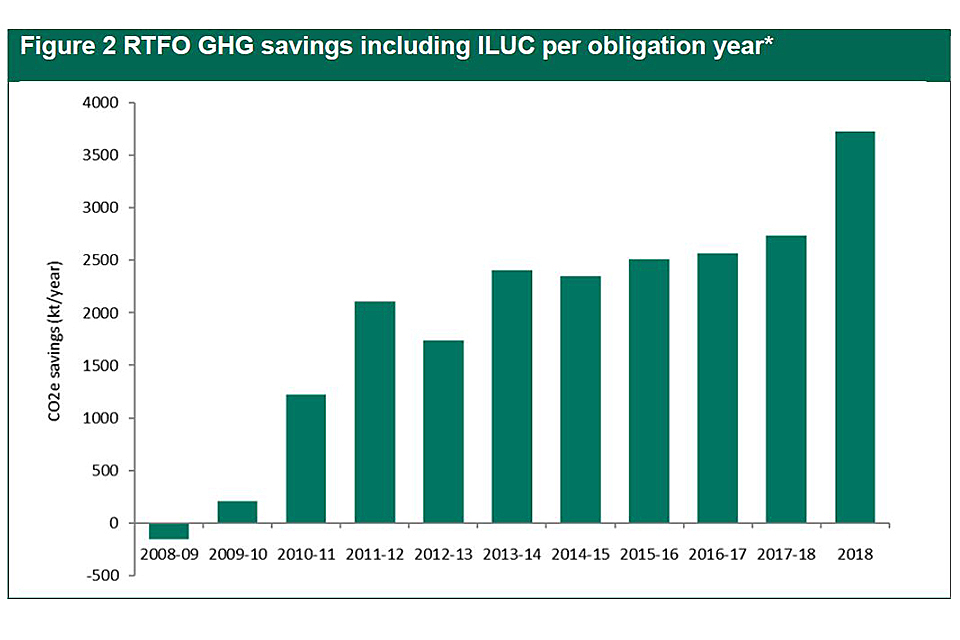

9.3 Indirect land use change

When agricultural land is used to grow a feedstock for renewable fuel production, there may be a ‘knock-on’ effect on expansion of agricultural land use into other areas. This is called ‘indirect land use change’ (ILUC). ILUC may involve expansion onto areas of high carbon stock which leads to additional GHG emissions. The RTFO accounts for these GHG emissions.

After accounting for ILUC, in 2018, the total GHG saving from the RTFO was 2.69 million tonnes of CO2 eq., or 3.73 million tonnes of CO2 eq. if extrapolated to represent a full calendar year (Figure 2).

Figure 2 shows that in the early years of the RTFO, there was a high proportion of crop-based feedstocks. The total GHG emission savings for these years were low, and even negative after accounting for the risk of ILUC from these crops. Since 2011 there has been additional incentives for renewable fuels from waste-based feedstocks, and now (in 2018) 69% of UK renewable fuels were made from waste.

Bar chart showing the greenhouse gas (in carbon dioxide equivalent) per year since 2008 after indirect land use change was taken into account.

Figure 2 RTFO GHG savings including ILUC per obligation year. The GHG savings are shown if the 2018 short year was extrapolated to represent a full calendar year.

9.4 Renewable transport fuel sustainability and sources

To receive RTFCs suppliers must be able to provide evidence that their renewable fuels meet the sustainability requirements. For 2018, renewable fuels must meet a minimum GHG saving of 50% if the installation in which they were produced was operating on or before 5 October 2015, and 60% if produced in an installation that was in operation after that date.

Suppliers must ensure that growing crops as a feedstock for renewable fuels does not lead to a loss of biodiversity or loss of high-carbon stock land such as forest or peatland. In 2018 these sustainability requirements were met for 100% of the renewable transport fuel supplied into the UK.

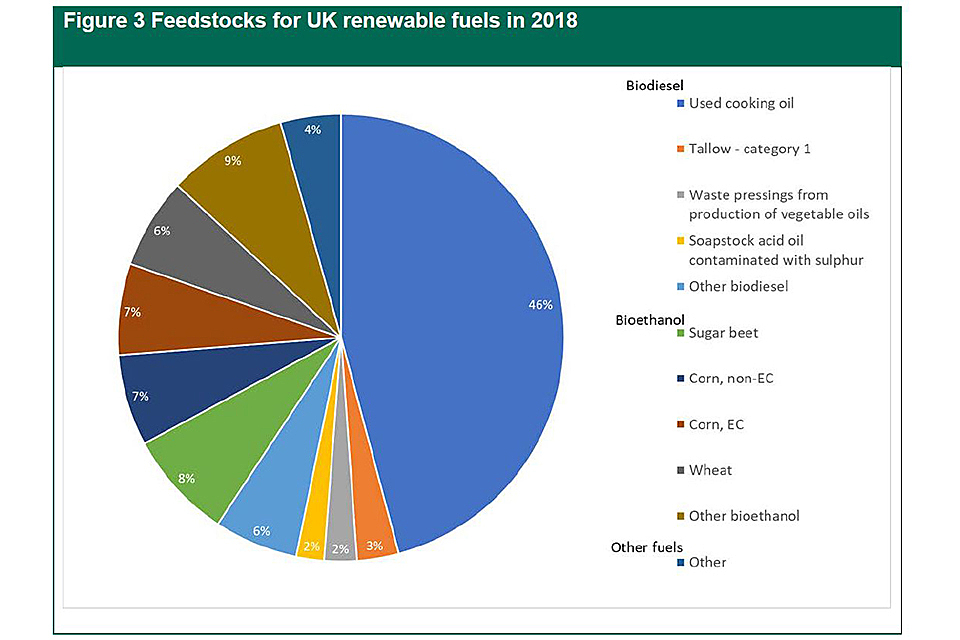

A total of 33 different feedstocks made up the renewable fuel supply in 2018, 21 of which are wastes. Figure 3 shows the main feedstocks from which the UK’s renewable fuels were made in 2018. “Other fuels” represent a mix of 6 renewable fuels including biomethanol, biomethane and biopropane.

The top five waste feedstocks are used cooking oil, low grade starch slurry, food waste, category 1 tallow and waste pressings from vegetable oils.

Some new renewable fuel feedstocks emerged in 2018, such as palm, which represented a small (but significant) volume of renewable fuel (2.6%). A small volume of methanol was produced using geothermal energy, which is the first instance of the RTFO awarding a renewable transport fuel of non-biological origin (RFNBO).

Pie chart showing breakdown of the feedstocks used for renewable fuel production in 2018. This is split between biodiesel, bioethanol and other renewable fuels.

Figure 3 Feedstocks for UK renewable fuels in 2018

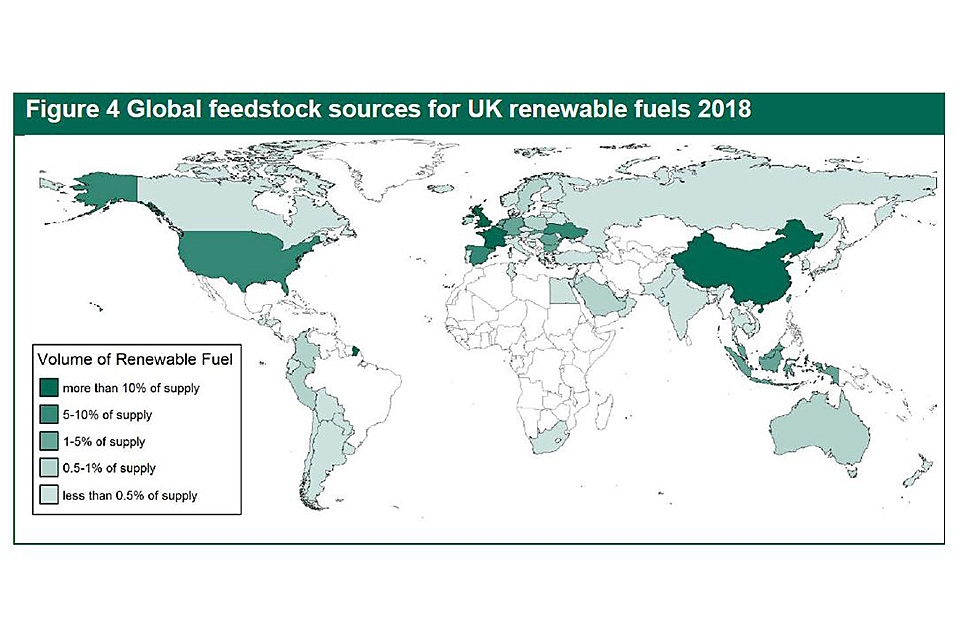

A total of 76 countries supplied renewable fuel to the UK, compared to 18 when the RTFO began in 2008-09. The five top supplying countries are UK, France, China, Spain and the USA (Figure 4). Last year (2017-18) the ranking was UK, France, the USA, China and Ukraine, so there is a slight reordering, and entrance of Spain into the top five in the last year. The proportion of renewable fuels supplied by the UK has decreased to 16% compared to 23% in 2017-18.

Map showing countries supplying renewable fuel, split between more than 10% of the supply, 5-10% of the supply, 1-5% of supply, 0.5-1% of supply and less than 0.5% of supply.

Figure 4 Global feedstock sources for UK renewable fuels 2018

9.5 Meeting the 2018 obligation

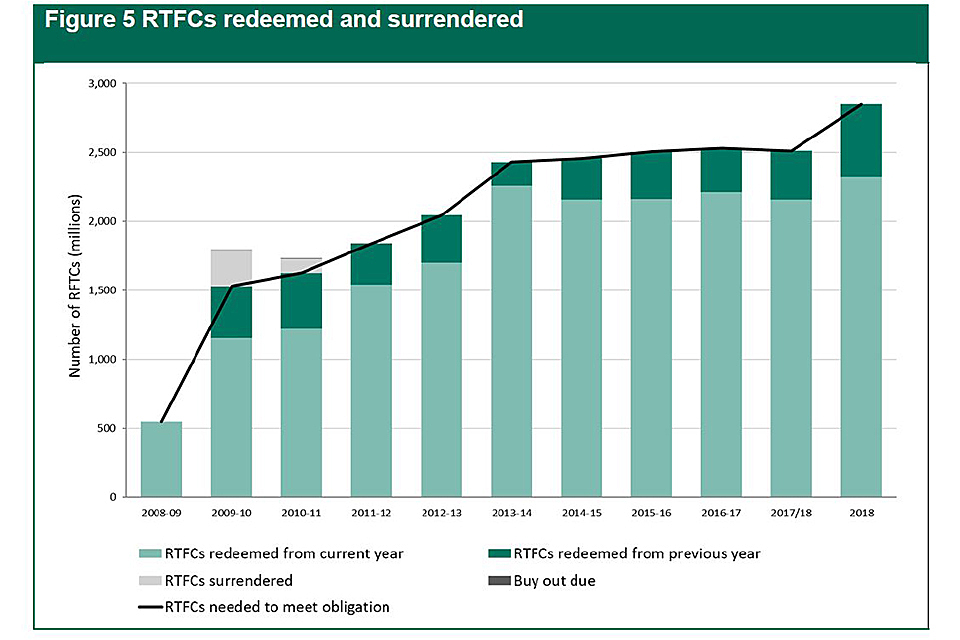

After double counting renewable fuels produced from waste feedstocks, and carry-over of RTFCs from the previous year, the total obligation for 2018 (7.25%) was met by suppliers.

In 2018, 2,317 million RTFCs were redeemed, of which 529 million, or 23%, related to fuel supplied in the previous year. Figure 5 shows the number of RTFCs redeemed and surrendered each year.

As the Administrator of the RTFO, DfT operates systems and processes designed to prevent and detect inaccurate or fraudulent applications for RTFCs. It also has powers to impose civil penalties if certain requirements of the RTFO Order are not complied with. In 2018, 4 million RTFCs were revoked due to inaccurate applications made that year. No civil penalties were imposed.

9.6 Modelled RTFC prices

We have modelled certificate prices for the 2018 obligation year using market price data for fuels (since RTFC price data is not publicly available). For this purpose, we assume used cooking oil biodiesel is the marginal fuel supplied under the RTFO and therefore it is the price differential between diesel and used cooking oil biodiesel which determines the RTFC price. We estimate that RTFC prices in 2018 ranged from £0.11 per RTFC to £0.16 per RTFC, with a mean value of £0.13 per RTFC.

Bar chart showing how obligated suppliers met their RTFO Obligation between 2008 and 2018, split between redeeming RTFCs from either a current or previous year, or buy out.

Figure 5 RTFCs redeemed and surrendered

9.7 Conclusion

The RTFO continues to meet its objective of reducing GHG emissions from road transport. All the renewable fuels rewarded under the RTFO meet the mandatory sustainability criteria. The RTFO is designed and managed to ensure a high level of compliance with its requirements.