Gigabit infrastructure subsidy guidance: wholesale access and pricing

Updated 26 July 2024

1. Introduction

This document provides guidance to suppliers, BDUK/implementing bodies and other stakeholders on the requirement and application of price controls in broadband projects needed to comply with the relevant Subsidy Control guidelines applying to broadband interventions. This guidance is applicable to all projects approved under the Gigabit Infrastructure Subsidy (GIS) scheme. The guidance relates to the contractual requirements placed on successful GIS bidders as well as access requirements under the Access to Infrastructure Code of Conduct which is part of the bidding process. For clarity, returns made under BDUK’s Open Market Review and Public Review processes do not carry an open access requirement.

Projects seeking approval to BDUK’s National Competence Centre (NCC) for Subsidy Control will need to demonstrate that they have incorporated a mechanism to benchmark and control prices of products offered by the supplier in receipt of the aid in their contract with that successful supplier.

Such controls should ensure that a supplier of gigabit-capable services is neither able to exploit its position to charge too much nor undercut other providers by charging too little, relative to relevant benchmarks.

The approach to benchmarking set out in this document has been developed by BDUK through lessons learned through implementation of the previous National Broadband Schemes, further market engagement and applied in the implementation of the GIS scheme.

Suppliers must identify suitable benchmarks for all the specified wholesale access products[footnote 1] to be offered across the subsidised infrastructure. For the purposes of this guidance, “subsidised infrastructure” refers to both infrastructure subsidised directly and to existing infrastructure used in the deployment of the subsidised services in the intervention area.

Wholesale access products will include both broadband products and non broadband products (e.g. voice services or business connectivity/leased lines). The appropriate benchmark for those products must therefore consider the nature of the wholesale access product (specification) and the handover point for wholesale access upon the subsidised infrastructure. The appropriate wholesale access handover point is likely to vary depending on factors such as geography and the technology involved. Therefore, the benchmarking approach will need to consider and take account of a number of factors that may result in a justified price differential for wholesale products (see Identifying appropriate benchmark products).

The rules applicable to the benchmarking of non broadband products are broadly similar to the rules applicable to broadband products. However, additional conditions apply (see NonNGA / nonbroadband services).

The benchmarking requirement detailed in this note will be adhered to for the term of the contracts with successful suppliers.

2. Requirement for price control mechanism

The inclusion of a price control mechanism is a requirement of the GIS scheme to ensure that the wholesale prices charged on the subsidised networks basis of fair and reasonable pricing. As such, BDUK must ensure that this requirement is satisfied by all projects approved under the scheme.

The price benchmarking exercise has two main objectives:

-

To ensure that public funds are used in a manner that minimises distortion to a commercially functioning market.

-

To ensure that the pricing of wholesale access to the publicly funded service is effective, in particular ensuring that as a minimum replicates the prevailing wider commercial conditions in more competitive areas of the UK or other European markets.

2.1 GIS scheme requirement

All GIS scheme projects will include a benchmarking pricing mechanism in their contract with the successful supplier. This mechanism, including the benchmarking criteria, will be set out clearly in the tender / contract documents issued to tenderers.

Such a mechanism must set out the framework applicable to the specified wholesale access products (see Open Access Wholesale Requirements guidance. These products must be made available for any electronic communications purpose (including broadband, voice services, and business connectivity).

Suppliers will need to identify appropriate gigabit capable broadband and lesser bandwidth broadband benchmarks (as appropriate). Wholesale access prices should then be constrained with reference to those benchmark prices.

In most of the areas where broadband projects under the GIS scheme are planned, the commercial market has already delivered NGA broadband services and/or services in other markets. Publicly funded gigabit capable broadband services will therefore compete with these existing commercially funded NGA broadband services.

In order to minimise distortions of competition, it is essential that the publicly funded services are not provided at a price which is “too low” compared with the likely outcome in a commercially driven market. One way to achieve this is to require the prices for publicly funded services to not be lower than commercial benchmarks for comparable services in more competitive / commercial areas (unless objectively justified). In practice this will mean that the minimum price for publicly funded gigabit capable services will usually be set by reference to the price of comparable services which are being provided by the commercial market in other areas.

The GIS scheme aims to minimise potential distortions by ensuring that prices for publicly funded services are not set at a lower level than those that prevail in other comparable, more competitive areas (unless objectively justifiable).[footnote 2] It will also ensure that the aid granted replicates market conditions like those prevailing in other competitive broadband markets. There is a presumption that all products shall have a floor price equal to that of benchmark products. In the case of broadband products, there may be limited variation below and above benchmark if well justified. Such justification would need to incorporate: support for the need for the variation in price, e.g. low population density, scattered villages, difficult clustering and associated failure to attract ISPs; or demonstration that alternative commercial mechanisms have been considered first. The variation in price is limited in time e.g. until establishment of the first major ISP or until there is any significant change in the bidder’s ability to attract users onto the network. Where there is clear divergence against the benchmark, then BDUK will instruct the supplier to adjust its prices accordingly in order for the project to remain compatible with the GIS. In the case of nonbroadband products (i.e. secondary to the market that is being targeted), there are not expected to be any circumstances that would justify variation below benchmarks.

The ability for allowing limited and justified higher wholesale access pricing is to facilitate a sustainable business model but not to limit access to services in a way that allows for wider market distortion. For example, if the price was allowed to be set at a level significantly in excess of comparable competitive markets without objective justification, it may unnecessarily limit access to Gigabit capable broadband services if consumers are ultimately unwilling to pay. This approach will also ensure that the access to publicly funded assets will replicate the prevailing commercial conditions in other competitive broadband markets. In most commercial models this is likely to be self regulating due to the price elasticity of demand for broadband service. This is consistent with the current regulatory approach of Ofcom that allows [DN: providers with Significant Market Power] a fair return across fibre broadband (providing higher bandwidth services) to incentivise investment in the extension of and building of new networks.

3. BDUK’s recommended approach to benchmarking

The GIS scheme sets out the following approach to price benchmarking:

(a) Every wholesale access product (“product”) made available under the intervention will be under benchmark controls;

(b) There will be a presumption that all products shall have a floor price equal to that of benchmark wholesale access products in commercial areas with similar characteristics (“benchmark products”);

(c) Unless the supplier can demonstrate that such prices are necessary for a sustainable business model and that this will not lead to the customer being overcharged (see further (d) below);

(d) There may be limited variation below and above the benchmark if well justified. Such justification would need to incorporate:

(i) Support for the need for the variation in price, e.g. low population density, scattered villages, difficult clustering and associated failure to attract internet service providers (ISPs);

(ii) Demonstration that alternative commercial mechanisms have been considered first;

(iii) The variation in price is limited in time, e.g. until establishment of first major ISP, until a set number of years into the contract (to be determined in the course of the tender process), or until there is significant change in the supplier’s ability to attract users on to the network;

(e) BDUK will facilitate implementing bodies to benchmark suppliers’ actual prices annually against industry data (supported by Ofcom as described below). Supplier actual prices will be subject to a degree of tolerance against the data point;

(f) Where there is clear divergence against the benchmark, the supplier is required to bring its pricing back in line, or otherwise the implementing body will escalate the matter to BDUK as the National Competence Centre, as a possible breach of Subsidy Control rules.

BDUK recognises that the detailed application of these benchmarking principles will need to be conducted on a case by case basis due to the potential variability in approaches to the delivery of Gigabit capable broadband by different bidders (e.g. different access points, inclusion of nonbroadband services etc). BDUK will seek to update this guidance note as projects begin rolling out to ensure lessons are shared with other stakeholders. BDUK may also seek technical advice from Ofcom where appropriate should novel or different benchmarking mechanisms be proposed.

4. Identifying appropriate benchmark products

A key part of the benchmarking mechanism is identifying appropriate benchmark products. Appropriate benchmark products will be a factor of both the relevant product and the relevant wholesale access point.

Appropriate products will be wholesale access products (or a basket of wholesale access products) in those areas where broadband is commercially provided with similar characteristics to the access product(s) (or basket of access products) that will be provided using the subsidised infrastructure.

However, as noted above, the relevant benchmark will also depend on the specific point of wholesale access on the subsidised infrastructure. In principle the wholesale access point should be positioned as far upstream as possible whilst facilitating effective and sustainable downstream competition. Thus, a wholesale access point positioned any further upstream would not achieve effective and sustainable downstream competition whilst a wholesale access point positioned further downstream would be forgoing some aspects of competition. In practice the optimum wholesale access point is likely to vary depending on factors such as geography/location, size of the project and the technology involved. This implies that the benchmarking exercise might suggest a number of price ranges that would vary according to the position of the wholesale access point in the broadband supply chain. As a result, the appropriate benchmark product to use will need to be considered on a case by case basis, taking the other principles set out above into account.

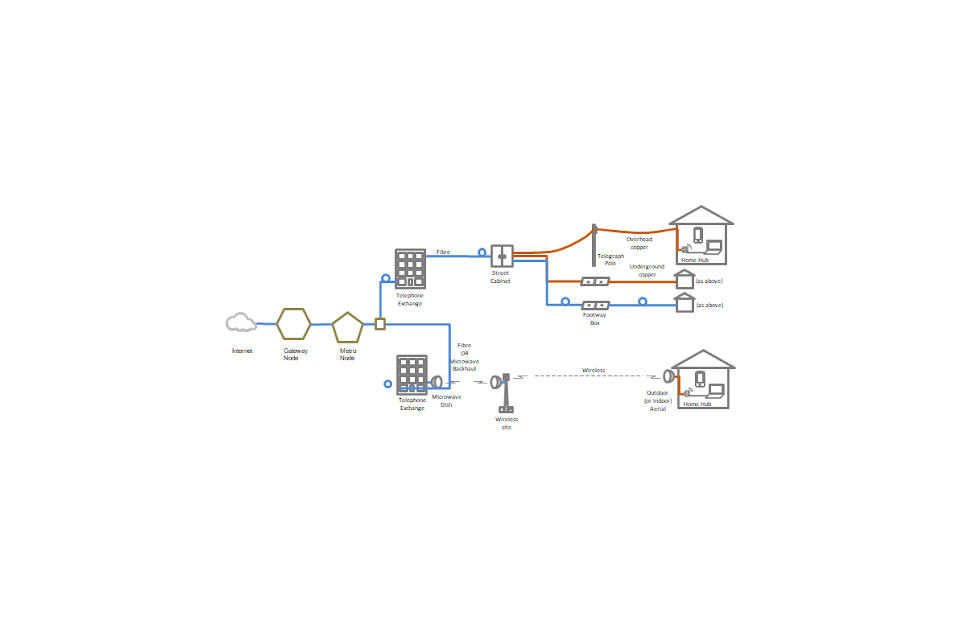

In order to illustrate the potential range of access points which may be used as appropriate product benchmarks, Figure 1 shows, as an example, network diagram with various forms of access in different network configurations.

Figure 1

In practice, Openreach’s regulated wholesale access products are likely to make good benchmark products, as their prices are published and they generally represent what is happening in the commercial market. However, other suitable benchmarks may also be available, e.g. the products/prices on alternative commercial subnational or local networks and those network operators that have received subsidy via previous BDUK programmes e.g. Gigaclear. Airband and Fibrus.

It may be the case that no suitable benchmarks are available and in such cases the prices should be developed following the principle of cost orientation. However, in this situation it may also be possible to use some aspects of existing wholesale access products. For example, to the extent that there is an overlap between the products required by a contract that involves the provision of subsidy and existing wholesale access products it may be possible to benchmark this overlap and then adjust it accordingly.

It is important that the commercial pricing structure is recognised and properly captured in any benchmarking exercise. For instance, some commercially provided broadband services are provided on the basis that they are incremental to a telephone line rental service. Essentially the line rental is the cost for maintaining the connection to the premises irrespective of whether voice services are taken or not. Thus, consumers need to purchase line rental as well as the broadband service as the service is provided over the same connection. This would need to be considered when comparing broadband products that are standalone but are unlikely to be offered commercially at a discount due to the fact that a similar physical connection is still required.

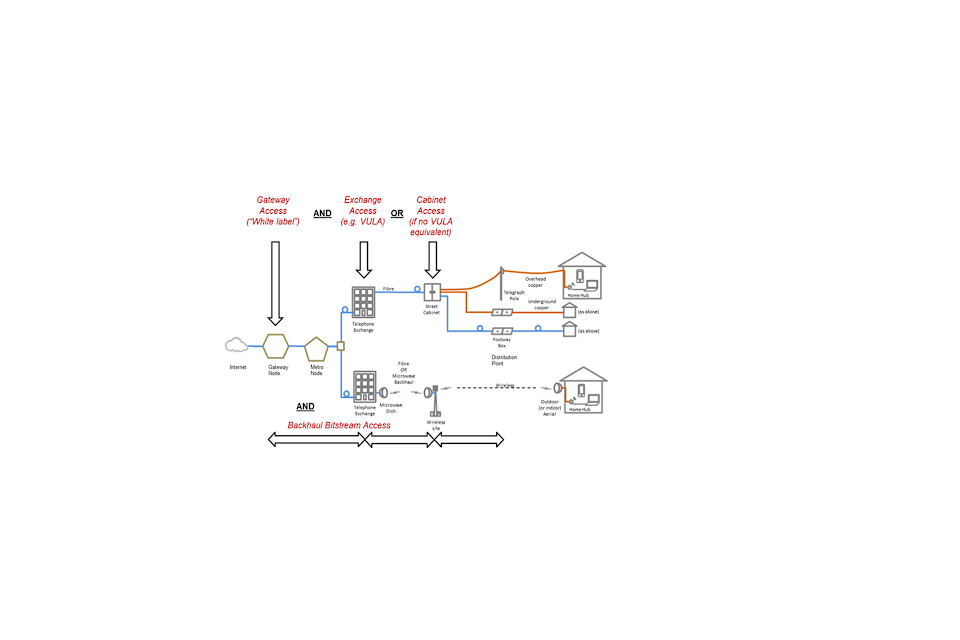

In addition to line rental, the point of interconnect of the broadband service also needs to be taken into account to ensure that all appropriate comparison is made when comparing benchmarks. For example, see Figure 2 that details the various ways that an active broadband service can be provided over the network with possible interconnects at either Gateway Node, Exchange or at a cabinet.

Figure 2

In comparing say for example Openreach’s GEA products that handover at a telephone exchange with another operators active service that handover at say the Gateway Node, the comparison would need to also include allowance for an operators backhaul cost from the Exchange to the Gateway Node.

5. NonNGA / nonbroadband services

The GIS Scheme requires that wholesale access be made available for any electronic communications purpose. As a result, BDUK’s approach to benchmarking reflects the full range of services that may be offered using the subsidised broadband infrastructure.

In relation to the benchmark product to be used, BDUK has considered the potential distortions that the provision of nonbroadband products could have on commercially provided services and how to minimise these potential distortions.

As discussed above, one way of minimising the distortion is to require the prices for publicly funded services not to be lower than commercial benchmarks for comparable services.

The following conditions will apply regardless of the nonbroadband product sold:

(a) Deployment will be limited to the white areas targeted by the deployment of the subsidised broadband infrastructure. It will not be possible in build out into black or grey areas, even if such extension were funded by private sector investment;

(b) Prices of the nonbroadband products must also be set in a manner consistent with this price benchmarking guidance note;

(c) Wholesale access to the subsidised infrastructure must be permitted to other access seekers in line with the Guidance on Wholesale Open Access Network Requirements in order to enable them to offer the same nonbroadband products on equivalent terms;

(d) Additional nonbroadband revenues beyond the forecast levels will contribute towards the identification of excess subsidy as part of the clawback mechanism.

6. Benchmarking and the implementing body’s role Project design

BDUK has designed the tender and contract documentation to ensure that these meet the requirements for compliance of the GIS with UK Subsidy Control requirements. An integral part of this is ensuring compliance with the benchmarking requirement as detailed in this guidance note both in the evaluation of bids and in life during the term of any awarded contracts. BDUK will seek to ensure that the wholesale products and pricing offered by a supplier is aligned to the recommended approach set out in this guidance to enable initial approval under the GIS.

BDUK has been clear about the benchmarking parameters in the tender documentation. This includes those parameters set out in paragraphs 3.1-3.2 above including the implications of departure from agreed benchmarking principles. The period that benchmarking is required is aligned to the requirement for the provision of wholesale access as set out in the GIS which is a minimum of seven years (noting that passive access is required in perpetuity).

Other Implementing bodies seeking to utilise the GIS should follow, in so far as possible, BDUK template documentation to ensure compliance with the requirements of the GIS Scheme Accepting benchmarking points

During the procurement process, bidders should submit their wholesale product pricing along with the relevant benchmarks. The supplier should set out a comparison of the wholesale product prices against the benchmark data, justifying and providing evidence of any deviation to the implementing body, and setting out proposals for changes to the pricing to bring in line with the benchmarks.

The implementing body will need to assess the supplier’s justification for any price variations using the guidance set out in this document and with the support of BDUK.

Supplier bids should include the benchmark data for their wholesale products. This needs to be agreed by the implementing body.

Approval under the GIS

In the assessment of a projects compliance with the GIS, BDUK’s NCC will cross check compliance of a bid/contract to ensure that it has fully complied with the benchmarking requirement (i.e. the requirement set out in the GIS Overview document and elaborated upon in this guidance note). More specifically, this means that BDUK/implementing bodies will have to:

(a) Confirm that they have followed the recommended approach to benchmarking set out in Section 3 of this guidance note.

(b) If not, explain the extent to which the process has departed from it, reasoning for that approach, and how that alternative approach complies with the benchmarking principles set out in the GIS and this guidance note.

(c) Provide relevant extracts from the tender and contract documentation setting out the benchmarking requirements.

(d) Provide a copy of the relevant contract extract showing the benchmarking mechanism agreed with the successful supplier, including detail of the benchmark products (for all NGA, nonNGA, and nonbroadband products) and pricing policy.

In the event that the proposed approach is novel or different the NCC may seek technical advice from Ofcom in terms of the appropriateness of the wholesale benchmark pricing points and pricing policy proposed.

Reviewing wholesale product pricing

During the contract term, the supplier shall conduct an annual benchmarking review of the wholesale product prices against the benchmark data. The supplier should set out a comparison of the wholesale product prices against the benchmark data, justifying and providing evidence for any deviation to the implementing body, and setting out proposals for changes to the pricing to bring it back in line with the benchmarks.

Where a supplier is obliged to conduct this review on the same products against the same benchmark data for multiple contracts/implementing bodies, BDUK will coordinate the process in a way to minimise effort for all parties.

BDUK will need to assess the supplier’s justification for any price variations using the guidance set out in this document and with the support of BDUK’s NCC.

Where the benchmark review identifies prices that are higher or lower than the benchmarks and the supplier is unable to provide reasonable justification for the deviation, then the supplier will be required to adjust their pricing to better align with the benchmark data as soon as reasonably practical under the terms of the Contract and/or report such deviation to BDUK NCC should amendment not be made.

Management of complaints

It is expected that any complaints in relation to access pricing will be directed in the first place to the successful supplier. For that reason, BDUK/implementing bodies must ensure that their contracts require the supplier to notify them immediately if any such complaint is received. In most cases it is expected that the matter will be able to be resolved operationally and as part of normal contract management with suppliers to determine whether the supplier is actually delivering what it promised to under the contract and that it is not departing from those terms. Should it not be possible to resolve the matter at that level, it must be escalated by BDUK/implementing body to BDUK’s NCC. BDUK NCC will intervene as appropriate to resolve the dispute. It will also seek technical advice from Ofcom if required to resolve the dispute, if required.

Reporting and compliance

BDUK has required suppliers to report certain information to it on a regular basis to allow the monitoring of the delivery of the l projects approved under the GIS and, crucially, their ongoing compliance with the GIS scheme conditions. Subsidy Control compliance must be ensured throughout the life of contract with the successful supplier. Any other implementing bodies letting contracts under the GIS will need to report to BDUK on benchmarking on an annual basis, in particular:

(a) Any variations to the benchmarking provision.

(b) Any challenges (e.g. Subsidy Control or public procurement related) lodged with the implementing body or relayed to the implementing body in relation to the project. Such challenges could relate to access pricing.

-

For a list of specified wholesale access products, see Guidance: Wholesale Open Access Network Requirements. ↩

-

See Paragraph 8.9.9 of the Gigabit Infrastructure Scheme Detailed Overview Document ↩