Project Gigabit Delivery Plan - spring update

Published 30 May 2022

Man and woman eating breakfast in their kitchen whilst using laptop

Ministerial foreword

Rt. Hon. Nadine Dorries, Secretary of State for the Department of Digital, Culture, Media and Sport

This government is delivering the biggest broadband upgrade in UK history. We are investing £5 billion in providing reliable, lightning-fast connections across the length and breadth of the UK. Some places are very difficult to connect, and these may require creativity and innovation to deliver cost-effective upgrades to their digital infrastructure. But we’re determined that no-one is left behind and taxpayers’ money is used to level up communities that would otherwise miss out. This Project Gigabit Spring Update shows our progress in delivering for communities across the UK.

I’m pleased to share the news that a further four procurements have been launched since the February publication of the Winter Update - two regional procurements in Norfolk and Suffolk and two local procurements in Cornwall. These target homes and businesses that are not included in broadband suppliers’ commercial plans, with different procurement sizes designed to ensure that suppliers of any size have the opportunity to bid. In addition, we have completed consultations with the market on upcoming procurements in more than 20 locations.

In April, we passed the significant milestone of 100,000 Gigabit Broadband Vouchers issued, with 65,000 of these vouchers claimed so far. An innovative and impactful scheme, vouchers typically suit areas not immediately in line for wide-scale procurements. They empower communities to work with local suppliers to find solutions for overcoming local obstacles, such as a remote location or challenging topography.

In March, I visited one such community in the village of Kirkoswald near Penrith, where Broadband for the Rural North (B4RN) was hard at work laying the infrastructure to connect nearby homes. I chatted with local people who have, through their own hard work and commitment, helped to get their voucher-funded project up-and-running. I enjoyed hearing about the hugely positive change this is going to make to their lives, and it was great to see first-hand how Project Gigabit, with its range of interventions, can be adapted depending on the needs of a particular area.

Nadine Dorries, Secretary of State, with Broadband for the Rural North (B4RN) in the village of Kirkoswald near Penrith

Kirkoswald’s challenging terrain is a good illustration of the need for innovative solutions like those provided by B4RN and other local suppliers. But despite its rural location, it’s not nearly as remote as Burravoe Primary School in the Shetlands, another place which has recently benefited from our support. Closer to Norway than it is to the Scottish mainland, the school is one of 20 public sector sites in the Shetlands that have been connected through the UK government’s Local Full Fibre Network (LFFN) programme. All pupils can now be online at the same time and teachers have moved to paper-free planning and lesson preparation, saving an enormous amount of time. BDUK has produced a compelling short film about the school, which can be seen here.

Watch video about Burravoe Primary School

The LFFN programme which delivered broadband to Burravoe has now concluded, with 39 projects connecting more than 5,000 public buildings including schools, hospitals and community centres. That’s 2,700km of fibre and 1,100km of new ducting laid, mostly in hard to reach areas, thanks to a government investment of £164 million.

All this is contributing to a rapidly-expanding gigabit-capable broadband network, with UK-wide coverage now at more than two thirds (68%) of homes and businesses. In Northern Ireland it’s even higher; 85% of premises now have access to some of the fastest speeds in the world - more than any other UK nation. This is in part due to the UK government’s £172 million investment in Project Stratum and measures to bust barriers to commercial roll out.

Of course there is a lot still to do. To meet its next challenges, BDUK will now benefit from its new status as an Executive Agency of my Department. As such, it has a new corporate governance structure and a new Head Office in the heart of vibrant Manchester, boosting the city’s status as a leading digital tech hub. This is the most efficient and effective way of ensuring we build on the excellent progress to date, creating a fully gigabit nation and delivering on the Prime Minister’s promise to level up communities across the UK.

Rt Hon. Nadine Dorries MP

Secretary of State for Digital, Culture, Media and Sport

Summary

This is the first quarterly update since BDUK became an Executive Agency, and presents an opportunity to set out the progress that has already been made in delivering fast and reliable connectivity to homes and businesses across the UK.

A total 68% (ThinkBroadband 12/05/2022) of UK premises can now access gigabit-capable broadband, continuing a rate of incremental growth in line with meeting the target of at least 85% gigabit-capable coverage across the country by 2025.

Key achievements for BDUK in the last quarter include:

BDUK reached a milestone of over 100,000 broadband vouchers issued, worth more than £185 million, with 65,000 claimed to date to support households and businesses with the additional costs of securing gigabit-capable connections.

The Local Full Fibre Networks programme concluded on 31 March 2022, having delivered gigabit connectivity to more than 5,000 public buildings and 500 public assets, including schools, hospitals and community centres, with a government investment of £164 million.

BDUK launched new regional procurements in Norfolk and Suffolk and two local supplier procurements in Cornwall, extending gigabit-capable connectivity to up to around 190,000 premises.

BDUK has now completed over 20 market engagement exercises across the UK: Leicestershire and Warwickshire (Lot 11), Nottinghamshire and West of Lincolnshire (Lot 10), West Yorkshire and parts of North Yorkshire (Lot 8), South Yorkshire (Lot 20) and Scotland (Lot 39) Herefordshire (Lot 15), Lincolnshire and East Riding (Lot 23), Cheshire (Lot 17), Gloucestershire (Lot 18), Oxfordshire and West Berkshire (Lot 13), Kent (Lot 29), Buckinghamshire, Hertfordshire and East of Berkshire (Lot 26), Staffordshire (Lot 19), West Sussex (Lot 1), East Sussex (Lot 16), Bedfordshire, Northamptonshire and Milton Keynes (Lot 12), Derbyshire (Lot 3), Wiltshire and South Gloucestershire (Lot 30), Lancashire (Lot 9) and Surrey (Lot 22) and Wales (Lot 42).

On 1 April 2022 BDUK launched as a new Executive Agency of DCMS to deliver Project Gigabit and the Shared Rural Network.

BDUK is now an Executive Agency of DCMS

The establishment of BDUK as an Executive Agency on 1 April 2022 marked an important moment in the delivery of the UK’s digital infrastructure. Our Corporate Plan, sets out the key strategic objectives for 2022-23, including for Project Gigabit, and details how BDUK will drive the expansion of gigabit connectivity to all parts of the country.

A new governance structure has been put in place to provide expert advice and independent oversight, and an interim independent Chair and additional interim Non-Executive Director have been appointed while permanent Board members are recruited. The BDUK Board will comprise an independent Chairperson, three Non-Executive Directors, the BDUK Executive Leadership team, and representatives of DCMS.

BDUK’s Corporate Plan, alongside updates to our programmes and leadership, can be found on our new website.

Progress towards a gigabit UK

To help provide clarity on the rate and breakdown of gigabit-capable broadband growth, this update provides information on coverage across the devolved nations and regions, in urban and rural areas, by supplier, and by residential and commercial premises. This information is based on two broadband coverage data sources:

-

Ofcom data collected in January 2022 for its Connected Nations May 2022 report, which is the most up-to-date source of coverage broken down by residential and business premises, as well as rural and urban premises; and

-

Independent website ThinkBroadband.com, which provides the most up-to-date information on national coverage, and is used to provide national and regional coverage statistics. This was sourced between 06/05/2022 and 12/05/2022 and represents the latest coverage snapshot up to that date.

Gigabit coverage across the UK continues to grow with 68% of premises now able to access gigabit-capable broadband [ThinkBroadband 12/05/22].

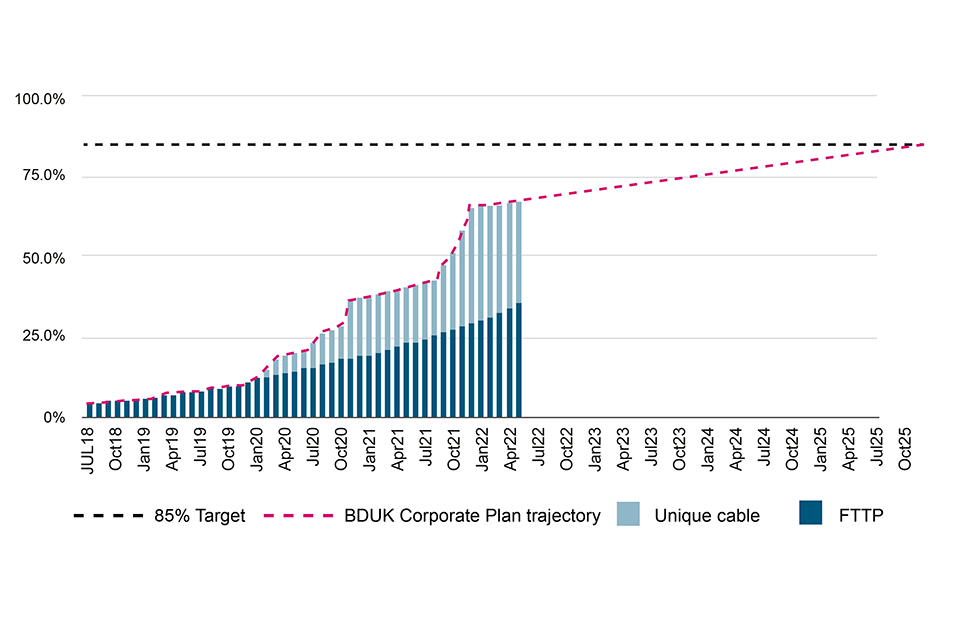

The graph below shows how gigabit coverage has increased since July 2018. Premises passed by gigabit-capable broadband are measured through fibre and cable availability (though other technologies may be used to provide gigabit-capable connections, these are not currently widespread). The dark blue bars show the percentage of premises passed by full fibre in the UK, while the light blue bars show the percentage of premises passed by cable - such as DOCSIS 3.1. Both show a steady increase in coverage since the publication of the Future Telecoms Infrastructure Review in 2018.

While there has been an increasing rate of growth in premises passed by commercial fibre to the premises (FTTP) - following the deployment of fibre in the ground - we can see that the improvement of speeds provided over cable has come in waves, as Virgin Media O2 (VMO2) upgraded their existing cable infrastructure to gigabit capability. This upgrade is now complete. Other large suppliers’ major build efforts are still in early phases. Installing fibre is much more labour intensive than upgrading existing cable infrastructure, therefore the growth rate in premises passed by gigabit-capable broadband will continue at a slower rate between now and 2025 compared to previous years.

UK Gigabit-capable coverage by type with trajectory set out in the BDUK Corporate Plan 2022-23 (Source: DCMS analysis, ThinkBroadband. Data is accurate as of 07/05/2022.)

Bar graph to show UK Gigabit-capable coverage by type with trajectory set out in the BDUK Corporate Plan 2022-23

Premises passed by supplier

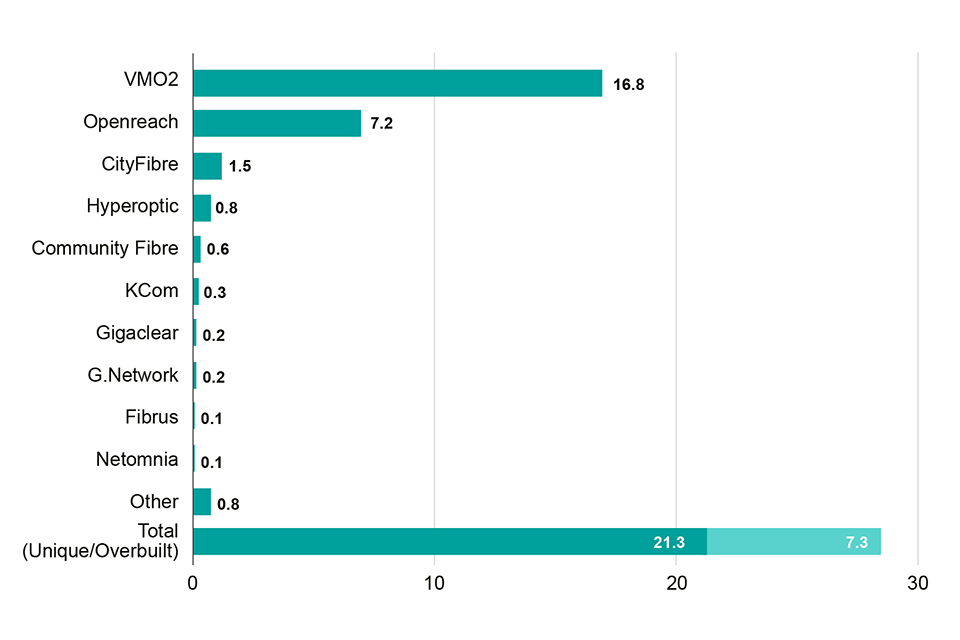

The chart below shows the number of premises passed by supplier. The chart shows that VMO2 provides the largest number of premises passed at 16.8million. VMO2 provides gigabit-capable connections through the recent upgrade of its existing cable network (although it has a smaller full fibre footprint). Other suppliers’ current gigabit-capable connectivity is all full fibre.

Premises passed (million) by a gigabit-capable network, broken down by supplier [Source: Supplier reports. Data accurate as of 12/05/2022 Q3][footnote 1]

Graph to show premises passed (million) by a gigabit-capable network, broken down by supplier

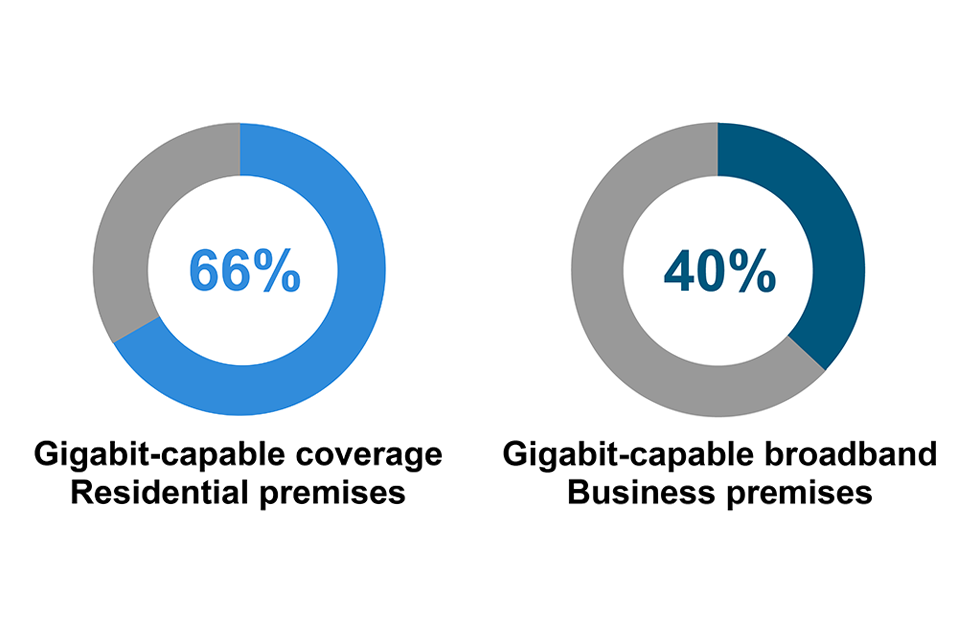

Coverage for homes and businesses

An increasing number of both homes and businesses are being passed by gigabit-capable connectivity. The chart below shows how in January 2022 (the latest date for which this information was collected by Ofcom), 66% of residential premises and 40% of businesses premises had access to gigabit capability. This is up from 37% for residential premises and 26% for business premises in January 2021.

Businesses often use bespoke business connectivity services such as dedicated ethernet and service-level agreements (SLAs) over copper lines, which provide high-quality and ultrafast connectivity services even if not classified as gigabit-capable by Ofcom. These services can be expensive and are not directly comparable to household services.

Gigabit-capable coverage by residential and business premises [Source: Ofcom, Connected Nations Report, May 2022. Premises passed data accurate as of January 2022]

Graph to show gigabit-capable coverage by residential and business premises

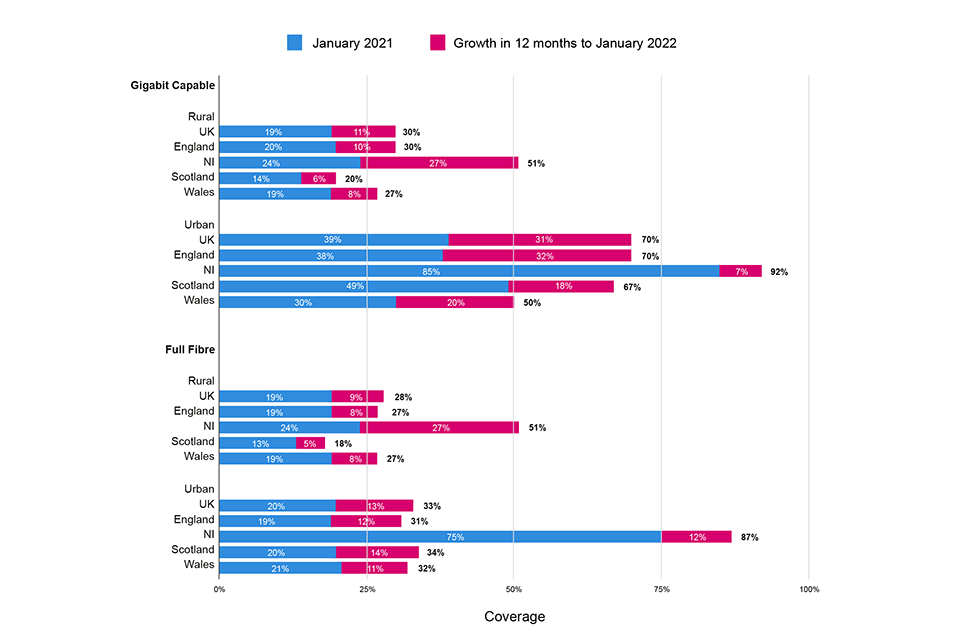

Coverage for rural premises

In January 2022, 70% of urban premises across the UK had access to gigabit-capable connections, along with 30% of rural premises. This is compared to January 2021 where urban premises had 39% coverage and rural areas had 19% coverage.

While the gap between urban and rural gigabit-capable coverage has grown recently, the steep increase in urban gigabit-coverage is largely due to the one-off upgrade to VMO2’s cable network, which is predominantly in urban areas and is not widespread in more rural areas.

Future incremental growth in gigabit-capable coverage across all areas will come from the building of full fibre networks by the rest of the market.

The availability of full fibre networks has grown at a relatively similar pace in both urban areas (13% points) and rural areas (9% points) across the UK. In Northern Ireland, full fibre growth in rural areas (27% points) was over double that of urban areas (12% points). The extent of deployment in rural areas reflects the wide breadth of rural-focussed suppliers across the marketplace, deploying both with commercial investment and with the support of public subsidy through vouchers and superfast contracts.

Gigabit-capable coverage growth in the previous 12 months by rurality [Source: Ofcom, Connected Nations Report, May 2022. Data accurate as of January 2022]

Graph to show gigabit-capable coverage growth in the previous 12 months by rurality

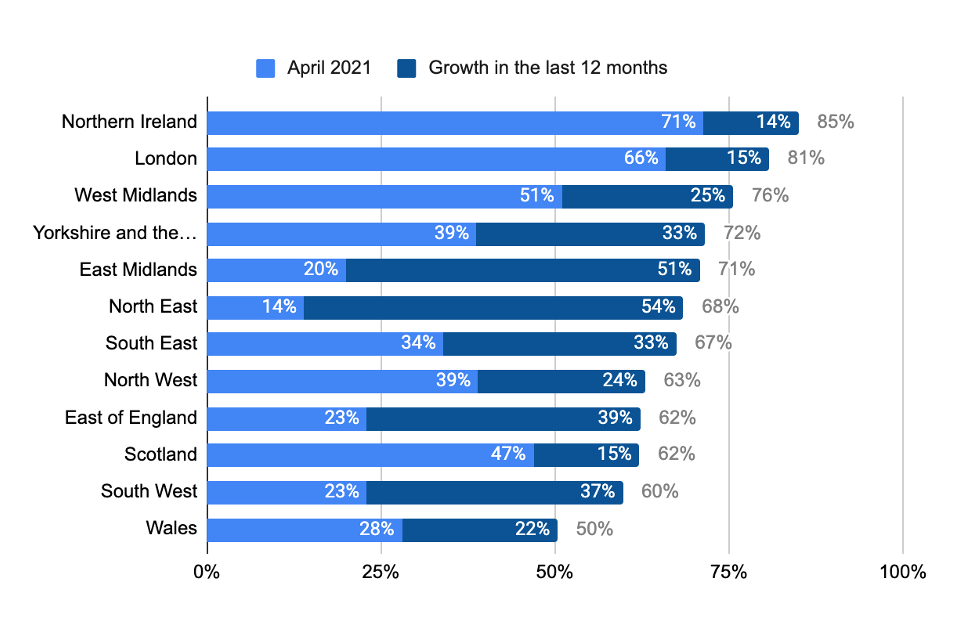

Breakdown of coverage by region and devolved nation

Northern Ireland has the highest level of gigabit-capable coverage at 85%, based on the success of publicly-funded roll out delivered by Fibrus via Project Stratum, and commercial deployment undertaken by Fibrus, VMO2 and Openreach (with some of these suppliers supported by vouchers subsidy helping to stretch their commercial deployment further). The lowest level of gigabit-capable coverage is in Wales, where 50% of premises can now access gigabit-capable broadband, due to the lower level of coverage of VMO2’s cable network when compared to other parts of the UK.

Regions such as the East Midlands and North West, have seen substantial gigabit-capable coverage growth in the last 12 months. This is mostly due to VMO2 upgrading their cable network to gigabit standard in these areas. In London, the high level of gigabit-capable coverage is a result of significant commercial gigabit delivery, led by suppliers such as Hyperoptic, Community Fibre, G.Networks and Openreach.

The growth in gigabit-capable broadband across the UK over this time period has helped decrease the variance in coverage across regions. In April 2021, the gap between the region with the lowest level of coverage (North East, 14%) and the region with the highest level of coverage (Northern Ireland, 71%) was 57%. As of April 2022, the gap between the region with the lowest level of coverage (Wales, 50%) and the region with the highest level of coverage (Northern Ireland, 85%) is now lower at 35%.

Gigabit-capable coverage by region and devolved nation, previous 12 months growth (Source: ThinkBroadband. Data accurate as of 07/05/2022.)

Bar graph to show gigabit-capable coverage by region and devolved nation, previous 12 months growth

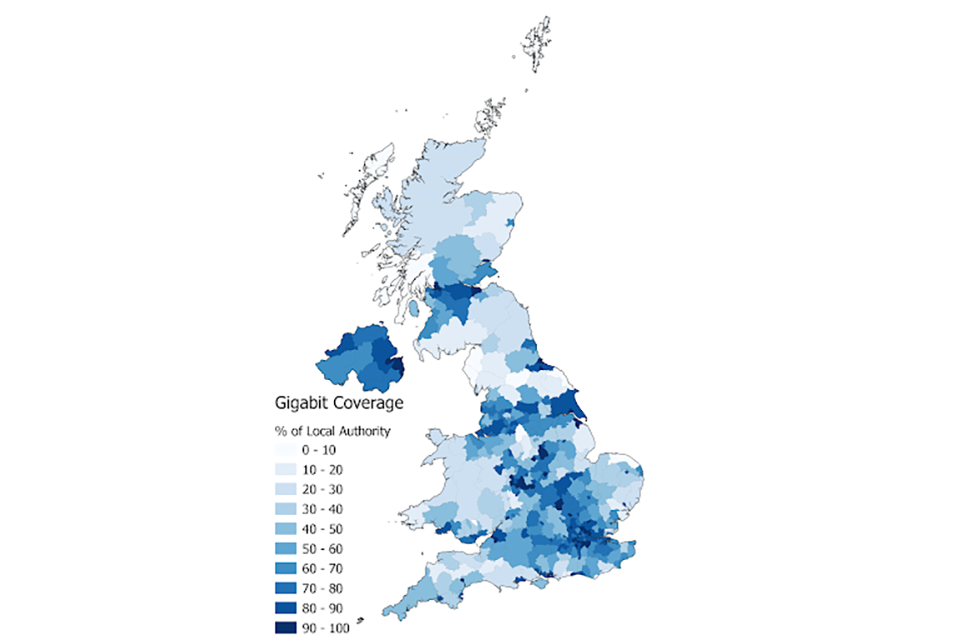

Gigabit-capable coverage by local authority (Source: ThinkBroadband. Data received 06/05/2022)

Map to show Gigabit-capable coverage by local authority

Source: Thinkbroadband data taken on 06/05/2022

Update on Project Gigabit Delivery Plans

Gigabit Infrastructure Subsidy (GIS) procurements

In previous updates, we have provided full details of the pipeline of procurements showing our current view of procurement sizes, dates and values. Given the dynamic nature of this information, we have now moved to a live, searchable source of procurement information alongside other DCMS procurement opportunities at GOV.UK. A full list of live and upcoming procurements can also be found in the Annex.

The UK’s broadband infrastructure market remains highly dynamic. In the last three months suppliers have announced over £1 billion of new investment to extend their commercial plans to deliver gigabit-capable coverage to more areas (see Update on commercial investment in UK gigabit infrastructure), including to many locations originally expected to require public funds. An increasingly active commercial market is welcome as it means more premises will benefit from fast, reliable connections more quickly than previously expected, and without recourse to public funds.

However, it also highlights why BDUK’s interventions must flex to respond to suppliers’ changing commercial plans. It is critical that BDUK understands and listens to the market to minimise the risk of subsidising projects to reach areas that are likely to be served commercially, achieving value for money without undermining market activity or stifling competition. In January, we launched a rolling national Open Market Review (OMR) to ensure we receive up-to-date information on suppliers’ existing and planned build for the next three years. Through the OMR we have received more responses than before, demonstrating the market’s growth and interest. A second round of data collection was launched on 3 May 2022 to an even larger set of suppliers.

In the last quarter, we launched two local procurements in Cornwall and two regional procurements in Norfolk and Suffolk. In total, we have now launched five local procurements and five regional procurements, and we have begun the pre-procurement process for around three-quarters of expected procurements.

We are now releasing more procurements than originally planned, splitting some regional procurements into smaller local contracts to reflect suppliers’ commercial plans in these areas and ensure we deliver the targeted intervention needed. In Cornwall, pre-procurement market engagement with suppliers showed that the extent of commercial plans across the area were not compatible with launching a regional procurement at this stage, owing to the risk of using subsidy to connect to commercially viable premises. Based on this information, combined with knowledge from the local authority, we have split Cornwall into two smaller local contracts. We have postponed the proposed regional supplier contract until later in the pipeline.

We are continuing soft market testing and pre-procurement market engagement in Shropshire and Hampshire, where the level of interest from the market in procurements is uneven. This may lead to further deferrals in launching procurements for Shropshire.

Alongside delivering more procurements, and with greater experience of the process, the significant volume of data being provided by suppliers means we have needed to adjust the timings in our pipeline of upcoming procurements. We have added in some necessary additional steps to ensure that our approach remains robust and our interventions are credible and provide evidence-based value for money, and the dates for some future procurements have been adjusted accordingly. The projects already in procurement are progressing well and are expected to conclude within the planned timeframes. BDUK will continue to work with suppliers to streamline processes without compromising the integrity and accuracy of our procurements. Dates will be brought forward wherever possible.

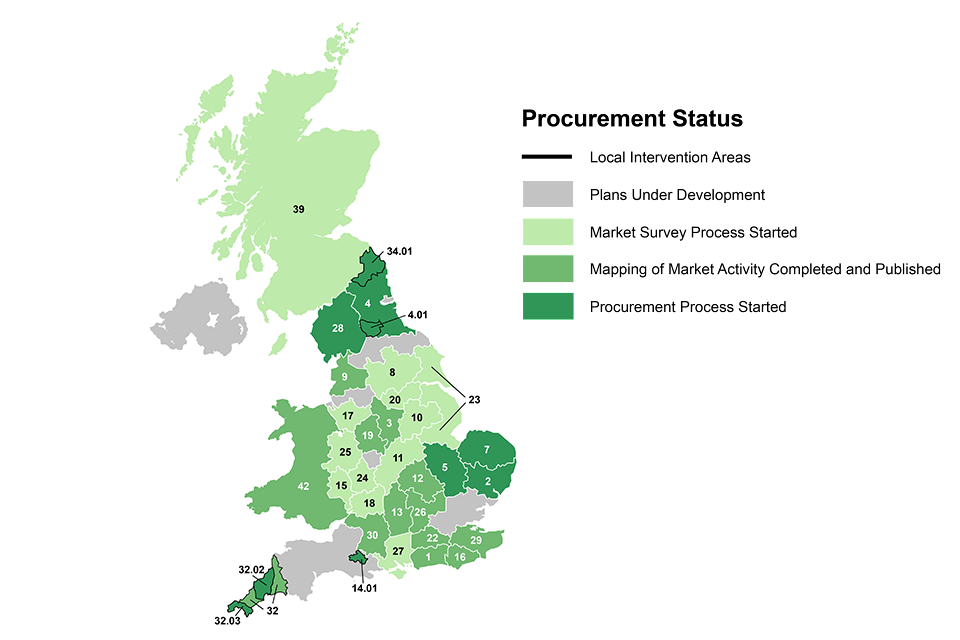

Open Market Reviews have now been completed in Leicestershire and Warwickshire (11), Nottinghamshire and West of Lincolnshire (10), West Yorkshire and parts of North Yorkshire (8), South Yorkshire (20) and Scotland (39). In April, OMRs were launched in Herefordshire (15), Lincolnshire and East Riding (23), Cheshire (17) and Gloucestershire (18) and have now closed.

Public Reviews have now completed for Oxfordshire and West Berkshire (13), Kent (29), Buckinghamshire, Hertfordshire and East of Berkshire (26), Staffordshire (19), West Sussex (1), East Sussex (16), Bedfordshire, Northamptonshire and Milton Keynes (12), Derbyshire (3), Wiltshire and South Gloucestershire (30), Lancashire (9) and Surrey (22). The Welsh Government launched the Public Review for Wales (42) in April which is now closed.

Project Gigabit Intervention Areas

Map to show Project Gigabit Intervention Areas

The numbers in this map correspond with the lot numbers in the procurement tables in the Annex.

Gigabit Vouchers

With more than 7,000 vouchers issued in the last quarter, the Gigabit Broadband Voucher Scheme, along with previous iterations, has now issued over 100,000 vouchers worth more than £185 million. Over 65,000 of these vouchers have been claimed to date.

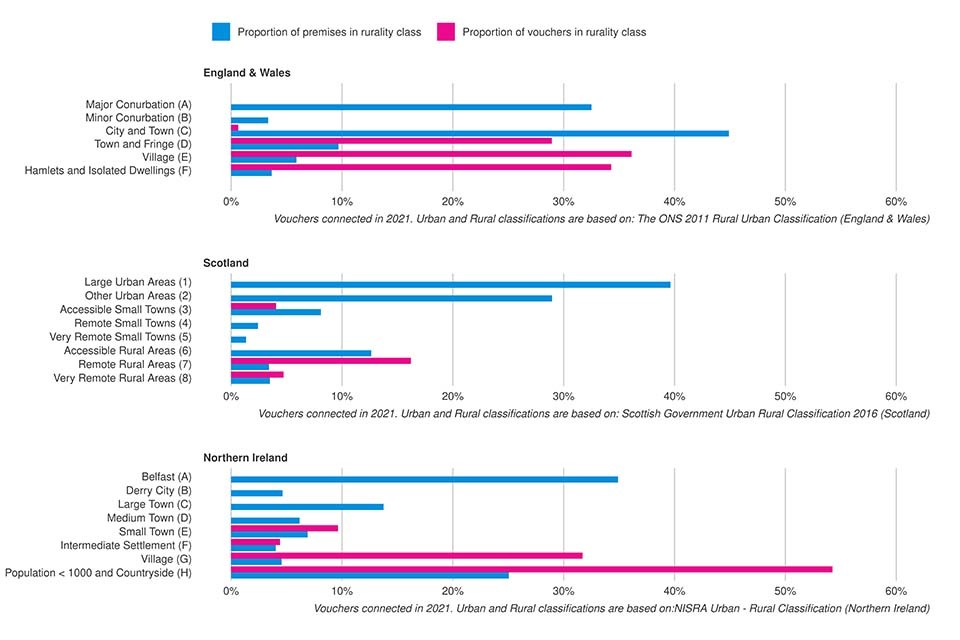

Vouchers have been an effective way of supporting the deployment of gigabit-capable broadband to some of the more remote rural parts of the country.

The pink bars in the charts below show the proportion of vouchers that have been issued to the different classifications of rurality. [footnote 2] For context, we have also shown the proportion of premises that are in each classification in blue ie the more urban the area the more premises it has. Current data shows that a greater proportion of vouchers are delivered in some of our most rural areas.

Rurality of vouchers issued across the nations over the last year (Source: BDUK. Data sourced 22/04/2022)

Bar graph to show rurality of vouchers issued across the nations over the last year

Project Gigabit in action: Gigabit Vouchers in Meopham, Kent

The bustling village of Meopham in Kent lies on the dip slope of the North Downs, and is home to local shops, businesses and a thriving community. Yet despite the availability of fibre broadband from eight exchanges in and around Meopham, and the close proximity of the green telecoms cabinet, the broadband connection for a number of residents came via a telephone line coming into their house - over old copper wire attached to a telegraph pole.

Working full-time from home and with two young adults in the house watching TV, gaming and streaming YouTube, Netflix and iPlayer, local resident Gavin Davies and his family were struggling to get sufficient bandwidth to suit their needs at any time of the day.

The national average for a fibre to the cabinet connection is around 50 megabits per second (Mbps), but Gavin’s top speed was nearer to 20Mbps. Following a knock on the door from local supplier, Call Flow (now trading as Trooli), Gavin found out about gigabit broadband and the government’s Gigabit Broadband Voucher Scheme. Having rejected the idea previously, it was the voucher scheme that convinced Gavin to get the faster, more reliable connection installed.

Once the simple application process had taken place, the physical connection was straightforward and the service from the provider was exceptional. Gavin commented: “I signed up to a 300Mbps fibre broadband package and regularly check the speed. We are future-proofed in that if we require an even faster connection we can renegotiate our contract up to as high as 1,000 megabits per second, but for now we now have sufficient bandwidth for streaming, gaming and working. We are even using Facetime for calls rather than the landline.”

Public Sector Hub upgrades

Our work to connect public sector buildings to gigabit-capable broadband is continuing to help transform the delivery of rural and remote public services, as well as catalyse the expansion of gigabit infrastructure to the hardest-to-reach parts of the country. Since the last update, we have connected more than 700 hubs including schools, GP surgeries and libraries, bringing the total number of public sector hubs connected by BDUK subsidies since the launch of Project Gigabit in April 2021 to over 4,500.

Project Gigabit in action: Burravoe Primary School, Yell

Burravoe Primary School is situated on Yell, one of the North Isles of Shetland, closer to Norway than Scotland, and known as one of the most remote locations in the UK. The island has a population of around 800 people and Burravoe Primary School consists of only 10 pupils. Until recently, it had an appalling internet connection.

Pupils at the school have the extraordinary opportunity to learn in a small classroom where the teachers can provide nearly one-to-one learning. However, being situated in such a remote location also meant their broadband connection was unreliable, sometimes not connecting at all. Pupils were missing out on the opportunity of online learning and resources, and wasted time staring at buffering wheels.

In March 2020, Burravoe Primary School was connected with gigabit-capable broadband thanks to Shetland Telecom/Shetland Islands Council, as part of the UK government’s Local Full Fibre Network (LFFN) programme. In fact, the school is one of 20 public sector sites in the Shetlands that has been connected through the LFFN programme.

The school now has a far more reliable connection that can support every pupil being online with their own personal laptop at the same time. The children now have access to resources all over the world, enhancing their education and widening their horizons. The school has even been able to set up online Mandarin lessons with a teacher in China.

Head teacher Katy Hay has also noticed the massive benefits for the teachers, who have been able to move to paper-free planning, allowing all preparation, resources and collaboration to be online without any disruption, saving an enormous amount of time.

Project Gigabit across the Union

Scotland

BDUK continues to work closely with the Scottish Government on the opportunities to roll out Project Gigabit in Scotland. An Open Market Review was launched by the Scottish Government in February 2022 and closed on 21 March 2022, with results currently being analysed. This will allow for the production of up to date intervention areas for Scotland.

Since the Winter Update, a number of projects have now been completed, including two fibre projects in the Highland region. In March, BDUK met Highland Council and regional partners at Lochaber High School in Fort William to mark the conclusion of the Highland LFFN project. This project involved £4.3 million of BDUK funding combined with £3.4 million from regional partners to connect 152 public sector buildings across Inverness, Fort William, Thurso and Wick. Since the project was initiated, the contracted supplier, CityFibre, has also committed a further £24.5 million to provide gigabit-capable connections to almost every property in the City of Inverness.

Phase 2 of the Rural Gigabit Connectivity (RGC) project with Highland Council and partners also completed in March. This project connected a further 10 public buildings in some of the most remote parts of the Highlands and Islands including Staffin Primary School on Skye, Bower Primary School in Wick, and Nature Scotland’s Forvie National Nature Reserve in Aberdeenshire.

Following the successful delivery of the RGC project in Dumfries and Galloway, which connected 35 rural primary schools, the local council has undertaken a voucher stimulation programme, directing residents and businesses towards the Scottish Government’s Broadband Voucher Scheme (SBVS). BDUK has notified suppliers of this activity in the region, as premises may also be eligible for the UK Gigabit Voucher to top-up the SBVS funding, up to a total of £6,500 for residential premises or £8,500 for businesses.

The Tay Cities LFFN Public Sector Building Upgrade project, in partnership with Angus Council and Perth & Kinross Council, also completed in March. This project saw £2.7 million of BDUK investment, combined with £530,000 of Tay Cities Region Deal funding, connect 154 public buildings, including schools, libraries, hospitals and community centres, so that they can benefit from speeds up to 1Gbps. BT, the contracted supplier, went on to connect more than 650 homes and businesses across the region.

Finally, Phase 2 of the NHS Scotland project has now launched, connecting 36 sites in addition to the 48 phase 1 sites connected in 2021. These sites span across the length and breadth of Scotland and include hospitals, GP surgeries, health centres and day centres, contributing to the future resilience of the NHS in rural and remote areas of Scotland.

Wales

BDUK continues to work closely in partnership with the Welsh Government on Project Gigabit in Wales. As part of the Open Market Review on suppliers’ gigabit-capable broadband infrastructure plans last year, the Welsh Government identified just over 327,000 premises that either do not have access to gigabit qualifying infrastructure, or are not in plans to provide such infrastructure over the next three years. Not all of these will be in scope of Project Gigabit, and the initial BDUK modelling, which identified 234,000 premises, will be refined following the recently closed Public Review to identify where suppliers are planning to build in the next three years and therefore help confirm the premises eligible for public investment. BDUK encourages all suppliers and relevant stakeholders to take part in the consultation.

By early March, all four of the projects upgrading public sector sites in Wales were completed. Over 600 sites, including GP surgeries and libraries, have been connected to gigabit-capable broadband, not only greatly improving public services in Wales, but also making a tangible difference to those communities in which they are situated.

Across North Wales over 300 public siteswere upgraded with £6.5 million UK funding. The sites are located across six local authorities, and include the areas of Colwyn Bay, Rhuddlan, Rhyl, Llandudno, and Wrexham as well as smaller towns and villages like Betws-y-Coed and Cerrigydrudion.

Project Gigabit in action: Caerffynnon GP surgery, Dolgellau

On 11 March 2022, the Secretary of State for Wales visited Caerffynon GP surgery in Dolgellau - one of the sites connected by BDUK’s Local Full Fibre Networks programme .

Before the programme, the Surgery only had access to 10Mbps download speed which made delivering health services in the local area very difficult. Following its connection, the Practice Manager said that: “Having better broadband connection means that we have been able to….add services such as video conferencing to help patients remotely, which has made a huge difference to many of our patients, especially those who are most vulnerable.”

In Pembrokeshire, the project reached 68 public sites, and resulted in some sites, such as Milford Haven Library, moving from four megabits per second to 150 megabits per second. This has helped the library’s users, many of whom would visit to use the computers for job searches and would complain about the slow speed of the internet.

In the Cardiff Capital Region £2.5 million UK funding connected 166 public sites, across its 10 local authorities.

A further 76 public sites in rural parts of Anglesey, Carmarthenshire, Ceredigion, Conwy, Denbighshire, Flintshire, Gwynedd, Neath Port Talbot, Pembrokeshire, Powys, and Swansea are now connected to gigabit-capable infrastructure utilising just under £1 million of UK government funding.

The Superfast Cymru programme has already provided access to gigabit-capable connections for 77,000 premises on top of the 646,000 premises with access to superfast connections in Wales. The remaining delivery under Superfast Cymru will provide up to a further 39,000 premises with access to gigabit-capable infrastructure by the end of 2022.

Finally, as of 4 May 2022, nearly 2,700 vouchers have been issued to help communities in the hardest-to-reach parts of Wales. This is on top of almost 2,300 vouchers that have already connected homes and businesses in the hardest-to-reach parts of Wales between 2018 and March 2022.

Northern Ireland

Northern Ireland’s gigabit-capable broadband coverage continues to grow with the delivery of over 29,000 premises under Project Stratum. Fibrus has managed risks associated with Covid-19 to complete their first full year of delivery 10% ahead of target. At the time of publication, gigabit-capable coverage across Northern Ireland stands at 85%.

The LFFN project managed by Armagh, Banbridge, Craigavon (ABC) Borough Council concluded in December 2021. The project had £2.6 million of BDUK funding used to deliver gigabit-capable infrastructure to 66 public buildings in the ABC council area.

BDUK projects with a combined funding of £24 million completed delivery in March 2022, including the Full Fibre Northern Ireland (FFNI) project. This has resulted in approximately 900 gigabit-capable sites being connected throughout the country, including hospitals, GP surgeries, fire stations and other council facilities.

Dialogue continues with the Department for Economy (DfE) on the rollout of Project Gigabit in Northern Ireland. DfE has submitted a strategic outline case to the Northern Ireland Executive in support of the current telecoms team’s capacity to contract for Project Gigabit.

Relevant policy, legislative and regulatory updates

Very Hard To Reach Premises

While our procurements will maximise the coverage of gigabit-capable infrastructure, we know that it will be unaffordable to provide gigabit coverage to all premises in the UK.

For those Very Hard to Reach (VHTR) premises that will not be reached through the Project Gigabit procurements or by a commercial supplier, DCMS is currently assessing policy options to understand how best to address these premises. This is the first step in delivering improved connectivity to these premises following the publication of the government response in February to the call for evidence on ‘Improving broadband for Very Hard to Reach Premises’.

As part of its assessment process, DCMS will consider all available solutions and technology types and will publish further details later this year. The department will also engage with stakeholders to understand how these technologies can best address Very Hard to Reach premises.

Cost of Living

In the current context of the increasing pressures on household spending, consumer affordability of fixed-broadband, mobile and landline services remains a high priority. DCMS are working closely with Ofcom to monitor the affordability of telecommunication services, in particular for those on low incomes.

A range of low-cost, fixed-broadband social tariffs for households in receipt of Universal Credit and other certain means-tested benefits, such as Income Support, Pension Credit, and Housing Benefit are currently available from BT, Virgin Media O2, Hyperoptic, CommunityFibre, Kcom, and G Networks. These offers start at £10 per month and are available in 99% of the UK.

In April 2022, the Secretary of State for Digital, Culture, Media and Sport wrote to providers asking them to do more to promote their social tariffs and ensure low-income households are aware of the support available to them. DCMS is also working with charities, consumer groups, as well as other government departments including the Department for Work & Pensions, and the Department for Education, to support efforts to engage households who may be eligible for support.

DCMS continues to encourage all fixed-line suppliers to do all they can to support their customers and provide assistance to low income households to access the connectivity they need.

Barrier Busting

DCMS’s Barrier Busting Taskforce identifies and addresses the barriers preventing the fast, efficient and cost-effective deployment of gigabit-capable broadband and improved mobile coverage, including next generation 5G technology. Over the last quarter, the Taskforce has continued its work busting barriers.

The Product Security and Telecommunications Infrastructure Bill has been introduced to Parliament, and Committee Stage in the House of Commons has been completed. The Bill includes key measures such as the ability for suppliers to upgrade and share underground apparatus installed before 2017, a procedure for dealing with non-responsive landowners and Alternative Dispute Resolution measures which will enable disputes to be resolved more quickly and cheaply.

The Taskforce also continues to host the Access to Land Workshops, which bring together a variety of stakeholders including network operators and landowner representative groups, as well as legal professionals and surveyors. The workshops aim to encourage greater collaboration in relation to Electronic Communications Code negotiations and agreements, identifying and implementing better ways of working.

A statutory technical consultation on legislative proposals to ensure that new homes are future-proofed and built with fast, reliable and resilient broadband was published in December 2021. The consultation closed on 28 February and included measures that will ensure the construction of new homes includes requirements for the installation of gigabit infrastructure and connectivity. Responses are being analysed and a government response will be published in due course, with legislation to follow when parliamentary time allows.

DCMS is working closely with DfT on their proposals regarding changes to the permitting system and street works (such as the definition of major works so fewer road closures are needed, enabling faster rollout). Trials testing these changes are being monitored and expanded to more areas and use cases.

The Digital Connectivity Infrastructure Accelerator is making it easier and quicker to deploy mobile equipment on local authority buildings.

Finally, The Telecoms Infrastructure (Leasehold Property) Act (TILPA) - which gained Royal Assent in 2021 - will create a process to allow operators to make an application to the courts to gain access to a block of flats in situations where they are faced with a repeatedly unresponsive landlord and a tenant requesting a service. A consultation on the implementing regulations for TILPA closed in August 2021. Supplementary questions were sent to consultation respondents in March 2022 to gain insight on an outstanding issue. The consultation response to TILPA will be published in due course, with regulations laid as soon as parliamentary time allows. Once these regulations are made, the 2021 Act can take effect.

Fibre in Water

The outcome of the DCMS-led Fibre in Water competition was announced on 7 April. Yorkshire Water is leading a consortium to trial a Fibre in Water solution in the Barnsley - Penistone area, with a total grant of £3.2 million. Working with Arcadis and the University of Strathclyde, the project will trial using the drinking water network to connect some of the hardest-to-reach premises in the UK and reduce the amount of water leakage in the area.

The project will also test if the fibre deployed can be used as an alternative means to the Public Switched Telephone Network (PSTN) and 2G/3G systems in the water networks, as well as other applications to modernise the UK’s Water Network. Finally, the project will also enrich the Geospatial Commission’s National Underground Asset Register andl run up to March 2024.

The Fibre in Water project is led by DCMS and supported by the Department for Environment, Food and Rural Affairs and the Geospatial Commission.

Update on commercial investment in UK gigabit infrastructure

The country’s vibrant broadband infrastructure market is helping drive coverage of gigabit-capable broadband across the towns and cities of the UK, and is also stretching deeper into rural areas. Over the last three months, the market has attracted new investment, announced further locations for deployment and reached new premises passed milestones.

Since the winter update, Openreach (7.2 million), CityFibre (1.5 million), Hyperoptic (825,000), Community Fibre (500,000), Netomnia (130,000) and Brsk (27,000) released their latest premises passed figures. There have also been over 30 announcements of commercial deployments by suppliers including from BeFibre, Community Fibre, Connect Fibre, County Broadband, Digital Infrastructure, Fibrus, Freedom Fibre, Full Fibre, Gigaclear, Giganet, GoFibre, Hampstead Fibre, Hyperoptic, Jurassic Fibre, Lightspeed, LilaConnect, Lit Fibre, Marykirk, MS3, Netomnia, Ogi, Openreach, Quickline, Stix, Swish Fibre, The 4th Utility, Toob, Trooli, Truespeed, Virgin Media O2, Wildanet, YouFibre, YesFibre and Zzoomm.

The demand for faster and more reliable coverage has established digital infrastructure as an attractive asset for investment and since the Winter Update over a billion pounds of new funding has been announced by CityFibre (£300 million), County Broadband (£100 million), CTG (£125 million), Fibrus (£220 million), Hyperoptic (£200 million), ITS (£100 million), KCOM and Voneus (part of a wider UK investment announcement by Macquarie Infrastructure) and Netomnia (£295 million).

New entrants continue to apply to Ofcom for Code Powers to deploy fibre infrastructure including 4th Utility, Axione, Brightstar, Energy Assets Fibre Networks Limited, Global Reach Networks, Go Internet, Latos Data Centre, Open Infra Plan, RunFibre and Urbanfibre.

As highlighted in our Winter Update, we continually monitor a range of market dynamics and potential impacts on commercial deployment and our coverage objectives. Although recent global events have created cost pressures across international markets, we have not seen a significant impact on broadband infrastructure deployment. We maintain regular communications with the breadth of the market to understand issues as and when they develop.

Annex

Gigabit Infrastructure Subsidy (GIS) procurement pipeline

Live procurements:

| Local or Regional Supplier procurement | Area/Lot Number | Procurement start date | Estimated contract award date subject to change | Estimated number of uncommercial premises in the procurement area subject to change | Indicative Contract Value subject to change |

|---|---|---|---|---|---|

| Local | North Dorset (Lot 14.01) | 05/01/2022 | Aug 2022 | 7,100 | £11.0 million |

| Local | North Northumberland (Lot 34.01) | 11/01/2022 | Aug 2022 | 3,900 | £7.3 million |

| Local | Teesdale (Lot 4.01) | 11/01/2022 | Aug 2022 | 4,100 | £6.6 million |

| Local | Cornwall (Lot 32.03) | 17/03/2022 | Oct 2022 | 9,750 | £18 million |

| Local | Cornwall and Isles of Scilly (Lot 32.02) | 28/04/2022 | Jan 2023 | 9,500 | £18 million |

| Regional | Cumbria (Lot 28) | 20/10/2021 | Sept 2022 | 60,800 | £109.2 million |

| Regional | North East England (Lot 4) | 18/01/2022 | Nov 2022 | 61,800 | £89.6 million |

| Regional | Cambridgeshire and adjacent areas (Lot 5) | 07/01/2022 | Nov 2022 | 49,700 | £68.6 million |

| Regional | Norfolk (Lot 7) | 28/04/2022 | Mar 2023 | 86,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | 28/04/2022 | Mar 2023 | 87,200 | £100.4 million |

Upcoming procurements:

The table below shows the procurements in the pipeline posted on the GOV.UK website, alongside DCMS’s other upcoming commercial opportunities. This pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded. The low and high contract values represent a possible range of funding; actual contract values are likely to be spread across the range for each lot. This pipeline is subject to change based on emerging data and feedback, following open market reviews, public reviews and market engagement.

| Local or Regional Supplier procurement | Area/Lot Number | Procurement start date | Estimated contract award date subject to change | Estimated number of uncommercial premises in the procurement area subject to change | Indicative Contract Value subject to change |

|---|---|---|---|---|---|

| Regional | Lot 27 Hampshire* | June - Aug 2022 | Apr - Jun 2023 | 99,000 | £120 million - £215 million |

| Regional | Lot 25 Shropshire* | June - Aug 2022 | Apr - Jun 2023 | 42,600 | £40 million - £75m |

| Regional | Lot 24 Worcestershire | Sep - Nov 2022 | Jul - Sep 2023 | 45,600 | £50 million - £84 million |

| Regional | Lot 13 Oxfordshire and West Berkshire | Sep - Nov 2022 | Jul - Sep 2023 | 67,000 | £67 million - £114 million |

| Regional | Lot 29 Kent | Sep - Nov 2022 | Jul - Sep 2023 | 109,500 | £119 million - £203 million |

| Regional | Lot 26 Buckinghamshire, Hertfordshire and East of Berkshire | Sep - Nov 2022 | Jul - Sep 2023 | 137,100 | £140 million - £237 million |

| Regional | Lot 19 Staffordshire | Sep - Nov 2022 | Jul - Sep 2023 | 70,800 | £72 million - £123m million |

| Regional | Lot 1 West Sussex | Sep - Nov 2022 | Jul - Sep 2023 | 56,700 | £66 million - £112 million |

| Regional | Lot 16 East Sussex | Dec 2022 - Feb 2023 | Oct - Dec 2023 | 41,200 | £49 million - £83 million |

| Regional | Lot 12 Bedfordshire, Northamptonshire and Milton Keynes | Dec 2022 - Feb 2023 | Oct - Dec 2023 | 81,300 | £84 million - £144 million |

| Regional | Lot 3 Derbyshire | Dec 2022 - Feb 2023 | Oct - Dec 2023 | 57,000 | £64 million - £110 million |

| Regional | Lot 30 Wiltshire and South Gloucestershire | Dec 2022 - Feb 2023 | Oct - Dec 2023 | 84,800 | £85 million - £145 million |

| Regional | Lot 9 Lancashire | Dec 2022 - Feb 2023 | Oct - Dec 2023 | 82,000 | £90 million - £153 million |

| Regional | Lot 22 Surrey | Dec 2022 - Feb 2023 | Oct - Dec 2023 | 99,400 | £101 million - £171 million |

| Regional | Lot 11 Leicestershire and Warwickshire | Feb - Apr 2023 | Nov 23 - Jan 24 | 112,900 | £114 million - £194 million |

| Regional | Lot 10 Nottinghamshire and West of Lincolnshire | Feb - Apr 2023 | Nov 23 - Jan 24 | 89,700 | £90 million - £152 million |

| Regional | Lot 8 West Yorkshire and parts of North Yorkshire | Feb - Apr 2023 | Nov 23 - Jan 24 | 125,200 | £128 million - £218 million |

| Regional | Lot 20 South Yorkshire | Feb - Apr 2023 | Nov 23 - Jan 24 | 56,800 | £59 million - £103 million |

| Regional | Lot 17 Cheshire | Apr - Jun 2023 | Jan - Mar 24 | 74,300 | £85 million - £144 million |

| Regional | Lot 6 Devon and Somerset | Apr 2023 | Jan - Mar 24 | 159,600 | £198 million - £337 million |

| Regional | Lot 15 Herefordshire | Apr - Jun 2023 | Jan - Mar 24 | 23,700 | £30 million - £60 million |

| Regional | Lot 18 Gloucestershire | Apr - Jun 2023 | Jan - Mar 24 | 44,700 | £40 million - £80 million |

| Regional | Lot 23 Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding | Apr - Jun 2023 | Jan - Mar 24 | 105,700 | £106 million - £180 million |

| Regional | Lot 14 Dorset | Jul - Sep 2023 | Apr - Jun 2024 | 56,500 | £62 million- £105 million |

| Regional | Lot 21 Essex | Jul - Sep 2023 | Apr - Jun 2024 | 78,400 | £79 million - £135 million |

| Regional | Lot 31 Northern North Yorkshire | Jul - Sep 2023 | Apr - Jun 2024 | 28,200 | £25 million - £42 million |

*Areas under consultation with the market about the suitability of further local supplier procurements that could complement the regional supplier procurements.

If you are a supplier who wishes to view and/or register interest for any of the GIS opportunities under Project Gigabit, all details can be found online here. The procurement documents are available for unrestricted and full direct access, free of charge, at https://bduk.force.com/s/Welcome.

Additional information can be obtained from the above-mentioned address.

Tenders or requests to participate must be submitted to the above-mentioned address.

Gigabit Vouchers Issued/Claimed

| Year | Vouchers Issued | Vouchers Issued + Claimed | Total |

|---|---|---|---|

| 2017/18 | 1,024 | 41 | 1,065 |

| 2018/19 | 7,815 | 7,009 | 14,824 |

| 2019/20 | 11,346 | 16,213 | 27,559 |

| 2020/21 | 14,999 | 18,659 | 33,657 |

| 2021/22 | 23,902 | 23,130 | 47,032 |

| Total | 59,086 | 65,051 | 124,137 |

Source: BDUK - as of May 2022

*Where a voucher has been issued but the connection has not been confirmed by the customer, and so the voucher is yet to be claimed

Public Sector Hubs

| Year | Rural Gigabit Connectivity | LFFN | Gigahubs | Total |

|---|---|---|---|---|

| 2017/18 | 0 | 0 | 0 | 0 |

| 2018/19 | 0 | 0 | 0 | 0 |

| 2019/20 | 21 | 0 | 0 | 21 |

| 2020/21 | 219 | 1691 | 0 | 1910 |

| 2021/22 | 770 | 3862 | 7 | 4639 |

| Total | 1010 | 5553 | 7 | 6570 |

Source: BDUK - as of May 2022

Glossary

| Cable (coaxial cable) | Telecommunications infrastructure which uses cable networks, such as Data Over Cable Service Interface Specification (DOCSIS) networks. This is gigabit-capable. |

| DOCSIS | Data Over Cable Service Interface Specification (DOCSIS) is an international telecommunications standard that enables high-bandwidth data transfer via coaxial cable (such as that used to originally supply cable television). It is used by many cable operators to provide internet access over existing coaxial cable infrastructure. DOCSIS 3.1 is the latest standard deployed in the UK, enabling gigabit speeds over the coaxial cable. |

| Executive Agency | An Executive Agency is a clearly designated (and financially viable) business unit within a government department that is responsible for undertaking the executive functions of that department. It has a clear focus on delivering specified outputs within a framework of accountability to Ministers. |

| Full Fibre | Telecommunications infrastructure which uses optical fibre from the local exchange to the end user’s living or office space. This is a telecommunications access network, also known as Fibre to the Premise (FTTP). This is gigabit-capable. |

| Fibre to the Premises (FTTP) | See ‘Full Fibre’. |

| Gigabit | Broadband speeds of at least 1 Gigabit per second (1000 Mbps) download. For example, it is feasible to download a full 4K film (100GB) in under 15 minutes. Gigabit gives greater reliability and is future proofed as more high demand services are developed. |

| Gigabit-capable | Telecommunications infrastructure that enables broadband speeds that are at least 1 Gigabit per second (1000 Mbps) download. Technical guidance for suppliers on the requirements of gigabit-capable connections is available on our UK Subsidy Advice page. |

| Gigabit Broadband Voucher Scheme | Government has made up to £210 million available to give people in eligible rural areas immediate financial help to get gigabit-capable speeds. The scheme is accessible through broadband service providers that have registered to provide connections through the scheme. Vouchers worth up to £1,500 for homes and £3,500 for businesses help to cover the costs of installing gigabit broadband to people’s doorsteps. You can check if you’re eligible for a voucher at your address on the Gigabit Broadband Voucher Scheme website. |

| Gigabit Infrastructure Subsidies Procurement | As part of Project Gigabit, BDUK is launching phased contracts to those hard to reach parts of the UK that will need government support towards the cost of gigabit-capable broadband. The latest timeline for the procurement of these contracts can be found above. There are currently two types of procurements that are live: • Local supplier procurements target smaller areas (typically 1,000 - 10,000 uncommercial premises) most suitable for smaller, localised suppliers in the programme, including those who specialise in building networks in rural and remote areas. • Regional supplier procurements target large areas (typically 30,000 - 150,000 uncommercial premises) most suitable for suppliers with substantial operational capacity and financial backing. Procurement roles in the Devolved Administrations will be confirmed following greater understanding of the intervention areas. |

| GigaHubs | Government has made up to £110 million available to connect public sector buildings - such as GP surgeries, libraries and schools - in hard to reach parts of the UK. |

| Intervention Area | These are geographical areas that BDUK has assessed as eligible for support for subsidised infrastructure build. Before launching Project Gigabit contract procurements, BDUK undertakes a comprehensive assessment of the market’s commercial plans in each part of the country. These assessments make up the ‘Open Market Review’ and later the ‘Public Review’ stages (see Market Engagement below). Given the scale of commercial gigabit delivery and the number of suppliers now active in the market, this is a significant endeavour for each area and can take months to conduct. The results of these reviews form the basis of BDUK Intervention Areas. |

| Local Full Fibre Networks (LFFN) | Local Full Fibre Networks was a previous voucher and hub programme run by DCMS (via BDUK) to stimulate commercial investment in full fibre networks across the whole of the UK. Including rural and urban locations, LFFN used approaches that encouraged additional private investment, making sustainable commercial deployments viable. |

| Lot | This describes the area available for procurement under BDUK’s Gigabit Infrastructure Subsidy. |

| Market Engagement | To identify premises to target with subsidy, we carry out a review of existing broadband coverage and invite telecommunications providers, and other stakeholders to contribute to this to help define the intervention area where government subsidised investment would be most valuable. |

| Open Market Review | The first stage of the process is an Open Market Review (OMR). BDUK and its local authority partners ask broadband network builders about their existing or planned commercial gigabit-capable broadband in hard to reach areas identified for potential government subsidy. A separate OMR will be launched for each potential government subsidy area known as a ‘Lot’ which could incorporate part or all of one or more local authority areas. Each OMR takes place over a specified time period and will either originate or be replicated on the corresponding county council’s broadband web pages. These reviews are not open to the public. All current and closed Open Market Reviews can be found on the Project Gigabit Programme: Open market reviews page. |

| Public Review | Once an OMR has closed and the data from it evaluated, BDUK will seek views from the public and other stakeholders about the existing and planned commercial gigabit-capable broadband coverage identified from the OMR through a Public Review (PR). BDUK will also seek confirmation from the broadband network builders in the area, either through an update to their original OMR submission, or if they did not respond to the OMR, by providing a further opportunity for them to contribute information at this stage. This is to ensure the gaps in coverage that the OMR identified are correct so that BDUK can confidently use them to shape an intervention area for a potential government subsidised infrastructure delivery contract. A separate PR will be launched for each potential government subsidy area known as a ‘Lot’ which could incorporate part or all of one or more local authority areas. Each PR will take place over a specified time period and will be replicated on the corresponding county council’s broadband web pages. All areas currently open for public review can be found on the UK Gigabit Programme: public reviews page. |

| National Rolling OMR | In January 2022, we launched a rolling national Open Market Review (OMR) to ensure we receive up-to-date information on suppliers’ existing and planned build for the next three years. |

| Premises Passed | A premises passed means that gigabit-capable infrastructure is available to the premises without the need for significant additional connection costs. |

| Project Gigabit | Project Gigabit was launched in March 2021, building on successful legacy programmes such as Superfast and Rural Gigabit Connectivity. Up to £1.2 billion of spending has been committed until the end of 2024-25, out of a £5 billion commitment over the lifetime of the programme. Project Gigabit will deliver gigabit-capable connectivity to at least 5% of premises across the UK in hard to reach areas by the end of 2025, supporting the government’s target of at least 85% gigabit coverage across the UK by the same date. |

| Project Stratum | Project Stratum is a £197m project delivering gigabit-capable broadband to 84,657 premises by March 2025. |

| Rural Gigabit Connectivity programme (RGC) | The Rural Gigabit Connectivity (RGC) programme was a pilot to test ways in which the government could stimulate the market and provide targeted investment in hard to reach areas of the UK. |

| Rurality classifications | The Rural Urban Classification is used to distinguish rural and urban areas. The Classification defines areas as rural if they fall outside of settlements with more than 10,000 resident population. |

| Supplier | A company that owns telecommunications infrastructure which is used to deliver internet services. |

| Very Hard to Reach Premises | Premises which are unlikely to be connected to gigabit-capable infrastructure due to a combination of their location, the availability of existing infrastructure or appropriate technologies and the cost of delivery. These are within the final 1% (F1) of premises. |

-

The reported levels of coverage is from each supplier’s company reports and therefore includes overbuild. This is where multiple suppliers connect the same premise with a gigabit-capable line. There is no data available on where suppliers overbuild each other and it therefore difficult to estimate how many unique connections suppliers provide. For ease of reference, we have added a marker showing unique premises passed (21.1million) and the additional premises (7.2million) built as overbuild to to total line. ↩

-

The nations use different rural classifications. Voucher eligibility across these classifications is as follows: (a) in England and Wales, premises classifications D-F inclusive as defined within the Office for National Statistics publication “The 2011 Rural-Urban Classification For Small Area Geographies”; (b) in Northern Ireland, premises classifications E-H inclusive as defined by the Review of the Statistical Classification and Delineation of Settlements, Northern Ireland Statistics and Research Agency (as updated from time to time); (c) in Scotland, premises classifications 3-8 inclusive as defined within Scottish Government Urban Rural Classification 2013-2014 (as updated from time to time). ↩