Annexes to OTS Property income review

Published 1 November 2022

Annex A: Recommendations in Chapter order

Chapter 2 The general tax regime for properties

- HMRC should consider working with relevant third parties on how to improve awareness of UK tax obligations regarding overseas property income and provide better signposting to guidance.

- The OTS recommends that HMRC guidance relating to Class 2 National Insurance is updated to reflect the current law.

-

The OTS recommends that the government consider adopting a simplified approach that property letting income can in no circumstances make taxpayers eligible for Class 2 National Insurance contributions.

- The OTS recommends that HMRC guidance adopts a consistent interpretation where possible of the word ‘business’ in relation to property across its instances in the tax statutes – and uses different words in statutes where there are different meanings.

- The OTS proposes that if government are of the view that support be made available to secure UK agricultural production, then HM Treasury and HMRC work with the Department for Environment, Food & Rural Affairs (Defra) to explore the potential for a ‘Rural Business Unit’ or similar regime for tax, with a view to simplifying the obligations on relevant parties and reducing the complexity of rules applying to diverse rural businesses.

Chapter 3 Ownership and financing

- The OTS recommend that the government should consider removing the anachronistic 50:50 rule for spouses and civil partners and aligning treatment to that of other joint owners and to the position for spouses under Capital Gains Tax and Inheritance Tax. To prevent abuse, the default beneficial ownership position should not be capable of being displaced.

- The government may also wish to consider removing the ability for joint owners to decide on a split other than beneficial ownership.

- The OTS recommends that the government improve the existing guidance in relation to mortgaging and re-mortgaging so that it is clearer and more consistent.

- The OTS recommends that the government consider whether the rules for restricting the level of interest relief when the cash basis is used add unnecessary complexity, and whether the rules should be consistent with those applying when the accruals basis is used.

Chapter 4 Allowances and reliefs

- The OTS recommends that the guidance on the interaction between the property allowance and the finance cost reduction is clarified, including illustrative examples, in particular to cover the complex comparison necessary where brought forward reduction relief interacts with the property allowance, where it can be hard for taxpayers to understand what is the best choice for them.

- The OTS recommends that HMRC ensure the guidance relating to record keeping for the property allowance is consistent with that for Rent a Room relief and enable a means for taxpayers to confirm the amounts received are below the limits, to avoid risk of penalties.

- The OTS recommends that HMRC should clarify whether rent a room relief applies if the taxpayer is temporarily away from the home - for example where the whole property is let for a short period during sporting events – and to make this clear in guidance.

Chapter 5 Treatment of certain expenses

- The OTS suggests HMRC improve the guidance showing how the adjustment for private use could be made, by way of case study examples for common situations.

- The OTS suggests HMRC improve the guidance to aid landlords’ better understanding of the replacement of domestic items concept with case study examples.

- The OTS recommends that HMRC should enhance the guidance in respect of the boundary between repairs and improvements to include clear examples of common situations, perhaps using flow-charts to lead towards case-by-case answers.

- The boundary between capital and revenue costs is not always easy to follow and the rules on replacements and improvements are also hard to interpret, particularly as building standards change over time. The OTS recommends that the government considers introducing a broader immediate income tax relief for all property costs - other than where work is clearly part of the capital cost of the building, such as the initial fit-out on properties bought in a dilapidated state and structural work such as extensions to the property. This would be simpler for landlords and HMRC to administer and would also support the government’s objective in improving the environmental standards of rented property, by offering certainty of tax relief for those costs.

Chapter 6 Furnished holiday lettings

- The OTS recommends that the government consider whether there is continuing benefit to the UK in having a separate tax regime for furnished holiday lettings.

- If the furnished holiday lettings regime is abolished the OTS recommends that the government consider whether certain property letting activities subject to Income Tax should be treated as trading and whether it would be appropriate to introduce a statutory ‘brightline’ test to define whether a property trading business is being carried on.

-

Should the government conclude that the furnished holiday lettings regime be retained, the OTS recommends that the government then consider:

- removing the current distortion of allowing the regime for properties in the European Economic Area, either by permitting worldwide properties to qualify, or by limiting the regime to UK properties.

-

restricting the regime to properties used for commercial letting by removing the potential for personal occupation. This would permit a simpler approach to defining the regime.

-

The government should consider:

- providing clear guidance and improving the tax return form to show how non furnished holiday lettings losses can be set off against furnished holiday lettings profits, with case study examples

- undertaking a review of each set of guidance on day count rules for furnished holiday lettings to ensure all refer to the different rules for business rates purposes in the various parts of the UK

Chapter 7 Making Tax Digital for Income Tax

-

The OTS recommends that HMRC should establish a system to deal with MTD for Income Tax for jointly owned properties, for example by making a jointly owned property the MTD filing entity.

-

HMRC needs to be able to authorise MTD for Income Tax filing agents alongside tax agents. This is needed because letting agents and bookkeepers will maintain digital records and may support quarterly submissions on behalf of some landlords. Specific professional standards and responsibilities will be needed for MTD for Income Tax filing agents.

-

The OTS recommends that MTD for Income Tax should not apply to landlords until these major points have been dealt with by HMRC and by a range of software providers. Time will be needed to test new systems before adoption.

-

The OTS recommends that HMRC give consideration to increasing the minimum gross income threshold for MTD for Income Tax for landlords above £10,000, at least for the medium term.

-

The OTS recommends that HMRC should publish comprehensive detailed guidance on the practicalities of MTD for Income Tax for taxpayers and agents, in good time before the implementation deadline. The current guidance is limited and contains inconsistencies.

Chapter 8 Ownership by non-UK residents

- The OTS recommends that HMRC update the Government Gateway process so it is easier for non-UK residents to obtain the relevant ID and password and manage their affairs online. This could include increasing the length of time the activation code takes to expire for non-UK residents.

- The OTS recommends that HMRC review whether the provision of online Self Assessment tax return filing can be expanded so that non-UK residents no longer need to complete a paper form or file using commercial software.

- The OTS recommends that HMRC improve guidance around claiming a Personal Allowance as a non-UK resident; the ability to claim this when submitting a Self Assessment tax return rather than completing a Form R43 is not clear in several areas on GOV.UK

- The OTS suggests that HMRC should make it clearer on the paper tax return guidance when and how taxpayers can expect to hear back from HMRC when they submit a paper tax return.

- The OTS recommends introducing online options for the quarterly reporting (Form NRLQ) which can currently only be filed as a paper report. The OTS also recommends that the paper option for the year-end reporting (NRLY) can be completed on-screen for example by providing an editable PDF.

- The OTS recommends that the government consider reviewing the policy of tenant withholding given the potential burden and its effectiveness for residential tenants. If tenant withholding is retained, the government could consider raising the threshold, making the withholding obligation on tenants clearer in guidance and finding ways to raise awareness, and clarifying the process to rectify matters if tenants initially do not withhold.

Annex B - Recommendations on where property income guidance can be improved

| Chapter | Subject | Current guidance and how it can be improved |

|---|---|---|

| 2 | UK tax obligations regarding overseas property income. | HMRC should consider working with relevant third parties on how to improve awareness of UK tax obligations regarding overseas property income and provide better signposting to guidance. |

| 2 | Definition of business | The OTS recommends that HMRC guidance adopts a consistent interpretation where possible of the word ‘business’ in relation to property across its instances in the tax statutes – and uses different words in statutes where there are different meanings. There are currently differing interpretations within, for example, NIM23800, CG65715 and PIM2010 which could be aligned. |

| 2 | Class 2 National Insurance contributions | The OTS recommends that guidance relating to the liability to Class 2 NIC is updated to reflect current law. https://www.gov.uk/renting-out-a-property/paying-tax, NIM23800 |

| 3 | Interest relief on mortgaging and re-mortgaging | The OTS recommends that HMRC improve the existing guidance in relation to mortgaging and re-mortgaging so that it is more clear and consistent. Guidance at BIM45700 et seq should be considered reviewed in the light of this recommendation: BIM45700 - Specific deductions - interest: Withdrawal of capital from a business - HMRC internal manual - GOV.UK (www.gov.uk). Also the more general guidance at: Work out your rental income when you let property - GOV.UK (www.gov.uk) |

| 4 | Property allowance | Interaction between the property allowance and the finance cost reduction. The OTS recommends that the guidance on the interaction between the property allowance and the finance cost reduction is clarified, including illustrative examples, in particular to cover the complex comparison necessary where brought forward reduction relief interacts with the property allowance, where it can be hard for taxpayers to understand what is the best choice for them. This could be added to ‘When you cannot use the allowances’ within Tax-free allowances on property and trading income - GOV.UK (www.gov.uk) |

| 4 | Property allowance and record keeping | The GOV.UK guidance suggests individuals with income below £1,000 need to keep records, with penalties for failure to do so. This is not consistent with the guidance on Rent a Room which indicates that where receipts are below the £7,500 threshold there is no need to keep anything. Ensure the guidance relating to record keeping for the property allowance is consistent with that for Rent a Room relief and enable a means for taxpayers to confirm the amounts received are below the limits, to avoid risk of penalties. HMRC should ensure the guidance is consistent between: Tax-free allowances on property and trading income - GOV.UK (www.gov.uk) and Letting rooms in your home: a guide for resident landlords - GOV.UK (www.gov.uk). The latter guidance should include specific reference to record keeping requirements to enable a means for taxpayers to confirm the amounts received are below the limits to avoid risk of penalties. |

| 4 | Rent a Room relief | Position if the taxpayer is temporarily away from the home for example where the whole property is let for a short period during sporting events. Clarify whether rent a room relief applies if the taxpayer is temporarily away from the home - for example where the whole property is let for a short period during sporting events – and to make this clear in guidance. Examples could go within this guidance: Letting rooms in your home: a guide for resident landlords - GOV.UK (www.gov.uk) |

| 5 | Private use | The wholly/exclusively rule is relaxed to enable a proportion of expenditure to be allowed where the expense has part private use. The consultation demonstrated a commonly held view that this is not calculated consistently. The OTS suggests guidance is improved showing how the adjustment for private use could be made, by way of case study examples for common situations. Guidance could go within this guidance: Work out your rental income when you let property – GOV.UK or within HS253 Furnished holiday lettings (2022) - GOV.UK (www.gov.uk) |

| 5 | Replacement of domestic items | Taxpayer understanding of the replacement concept. Improve the guidance to aid landlords’ better understanding of the replacement concept with case study examples. Examples could go on page Work out your rental income when you let property - GOV.UK (www.gov.uk) and also be referred to within PIM3210 - Furnished lettings: Replacement of domestic items relief: 2016-17 onwards - HMRC internal manual - GOV.UK (www.gov.uk) |

| 5 | Capital/repair boundary (to include EPC) | Taxpayer understanding of the boundary between capital and repair. The OTS recommends that the guidance in respect of the boundary between repairs and improvements should be enhanced to include clear examples of common situations, perhaps using flow-charts to lead towards case-by-case answers. Examples could go on page Work out your rental income when you let property - GOV.UK (www.gov.uk) and also within PIM2030 - Deductions: repairs: is it capital? - HMRC internal manual - GOV.UK (www.gov.uk) |

| 6 | Furnished holiday lettings | The furnished holiday lettings regime has a day count, as do business rates (which can apply when a furnished holiday lettings property is being used commercially). Many respondents reported confusion or that landlords would misunderstand and use one measure for all purposes. The government should consider: providing clear guidance and improving the tax return form to show how non furnished holiday letting losses can be set off against furnished holiday lettings profits, with case study examples; undertaking a review of each set of guidance on day count rules for furnished holiday lettings to ensure all refer to the different rules for business rates purposes in the various parts of the UK. Guidance to be reviewed could include HS253 Furnished holiday lettings (2022) - GOV.UK (www.gov.uk) and HS253 Furnished holiday lettings (2019) - GOV.UK (www.gov.uk) |

| 7 | Making Tax Digital | Comprehensive detailed guidance on the practicalities of MTD for taxpayers and agents should be published in good time before the implementation deadline. The current guidance is limited and contains inconsistencies. Using Making Tax Digital for Income Tax - GOV.UK (www.gov.uk), Making Tax Digital for Income Tax for individuals: step by step - GOV.UK (www.gov.uk) |

| 8 | Non-resident landlords reporting UK property income – paper returns | HMRC should make it clearer on the paper tax return guidance when and how taxpayers can expect to hear back from HMRC when they submit a paper tax return. How to fill in your tax return (publishing.service.gov.uk) |

| 8 | Non-resident landlords - guidance around form R43. | Depending on an individual’s circumstances when they are non-resident, they may be entitled to a Personal Allowance. It is not clear from the guidance whether an individual is entitled to a Personal Allowance to offset against their property income and if so, how they claim it. Improve guidance around claiming a Personal Allowance as a non-UK resident; the ability to claim this when submitting a Self Assessment tax return rather than completing a Form R43 is not clear in several areas on GOV.UK. The Personal Allowance can be claimed on the tax return using boxes 15-17 on SA109 and a Form R43 is not needed. This could be done in the following: Claim personal allowances and tax refunds if you’re not resident in the UK - GOV.UK (www.gov.uk). This Form R43 guidance page does not mention that you do not need to complete the form if you need to complete a self-assessment tax return. This could be made explicit. Guidance notes for form R43 (2020) (publishing.service.gov.uk) could be made clearer by making the information about not needing to complete a tax return more prominent as there is currently only a small reference on page 7 under ‘C3 Property in the UK’. Tax on your UK income if you live abroad: Personal Allowance - GOV.UK (www.gov.uk). This should explain that a claim can be made on a tax return instead of Form R43 where the individual is required to file because they have property income. |

| 8 | Non-resident landlord scheme – tenant withholding | The OTS recommends that the government consider reviewing the policy of tenant withholding given the potential burden and its effectiveness for residential tenants. If tenant withholding is retained, the government could consider raising the threshold, making the withholding obligation on tenants clearer in guidance and finding ways to raise awareness, and clarifying the process to rectify matters if tenants initially do not withhold. Landlord and tenant rights and responsibilities in the private rented sector - GOV.UK (www.gov.uk) |

Annex C - Results of the OTS survey

3,559 stakeholders contributed evidence to this review through the online survey, which is the highest ever response to an OTS Survey. The OTS is grateful for this evidence, which is summarised below.

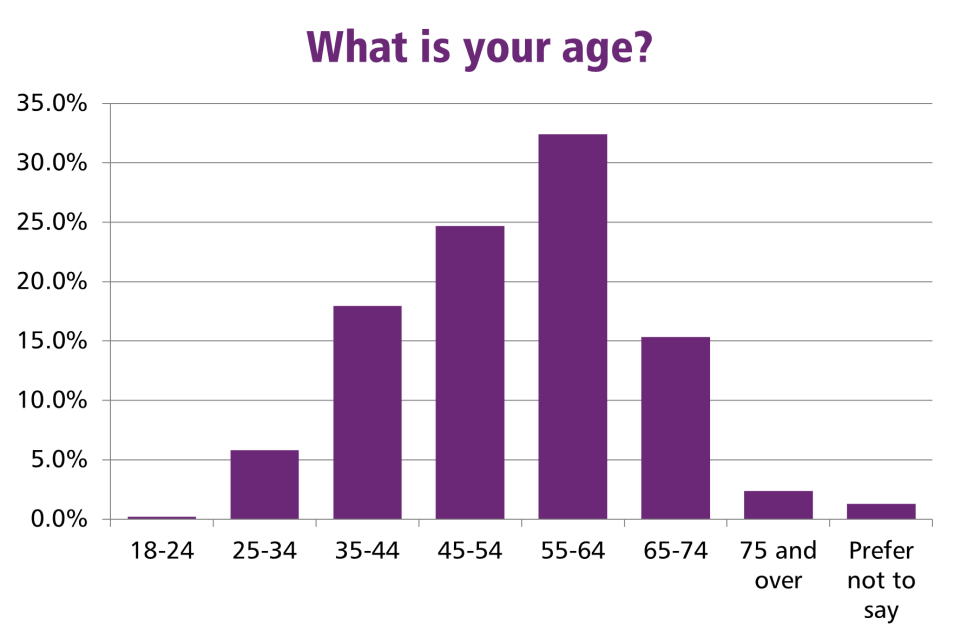

Q1. What is your age?

3,519 respondents answered this question, as shown in the graph and table below.

| Age range | 18-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65-74 | 75 and over | Prefer not to say |

|---|---|---|---|---|---|---|---|---|

| Percentage | 0.2% | 5.8% | 18% | 24.7% | 32.4% | 15.3% | 2.4% | 1.3% |

Q2. Are you UK resident?

Of the 3,511 respondents that answered this question, 96.8% said they are UK residents, while 1.9% said they are not UK residents. 1.3% preferred not to say.

Q3. Do you receive income from letting out residential property?

Of the 3,521 respondents that answered this question, 95.4% said they received income from letting out residential property. Some 4.6% of respondents said they did not receive income from letting out residential property and exited the survey.

Q4. Do you let your property/properties on a short term (e.g holiday lettings) or longer term basis?

Of the 3,367 respondents that answered this question, 40.5% said they let property on a short term basis while 38.1% let property on a long term basis. The remaining 21.4% respondents let property on both a long and short term basis.

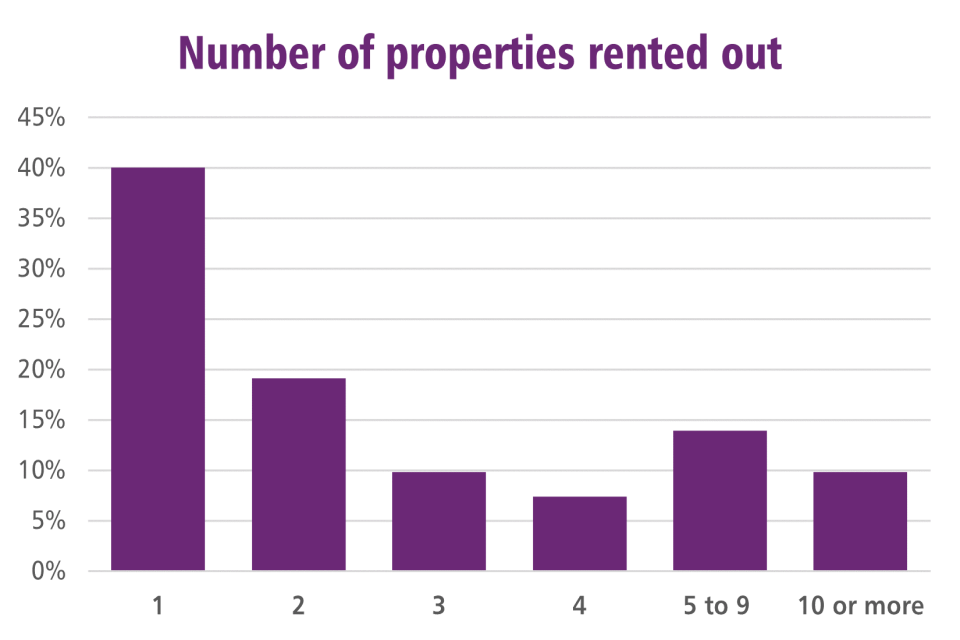

Q5. How many properties do you let out?

3,361 respondents answered this question, as shown in the graph and table below.

| Number of rented properties | 1 | 2 | 3 | 4 | 5 to 9 | Ten or more |

|---|---|---|---|---|---|---|

| Percentage | 40% | 19% | 10% | 7% | 14% | 10% |

Q6. Are the property/properties you let situated in the UK or overseas?

Of the 3,361 respondents that answered this question, 97.2% said they only let property in the UK while 0.1% only let property overseas. The remaining 2.7% let property in both the UK and overseas.

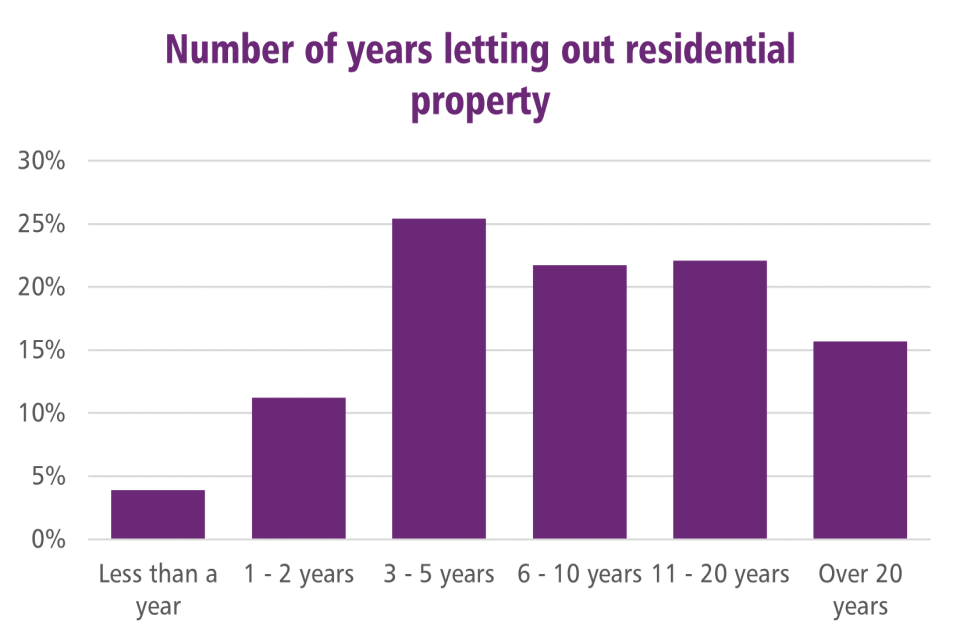

Q7. How long have you been letting out residential property?

3,361 respondents answered this question, as shown in the graph and table below.

| Number of years letting residential property | Less than one | 1 to 2 | 3 to 5 | 6 to 10 | 11 to 20 | Over 20 |

|---|---|---|---|---|---|---|

| Percentage | 4% | 11% | 25% | 22% | 22% | 16% |

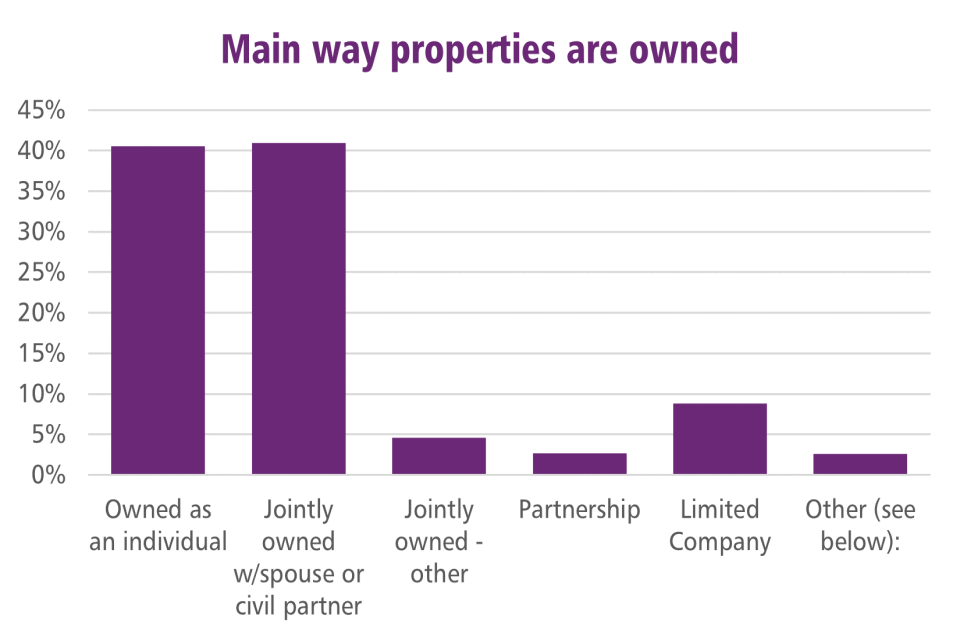

Q8. Which of the following describes the main way you own the properties that you let out?

3,362 respondents answered this question, as shown in the graph and table below.

| Main way properties are owned | As an individual | Jointly with spouse or civil partner | Jointly owned other | Partnership | Limited company | Other |

|---|---|---|---|---|---|---|

| Percentage | 41% | 41% | 5% | 3% | 9% | 3% |

Of those that answered ‘other,’ most explained how they owned several properties, with many owning properties both as an individual and through a company.

Q9. Is the company incorporated in the UK or overseas [for those who answered ‘Limited Company’ to Q8]?

Of the 301 respondents that answered this question, 98% said the company is incorporated in the UK. The remaining 2% said the company was incorporated overseas.

Q10. What was the main factor in deciding to hold the property through a company?

Of 298 respondents that answered this question, some 39.9% said the main factor in deciding to hold the property through a company was professional advice. 27.2% said the mortgage interest restriction for individual owners was the main reason, while 12.8% said the ability share ownership or income more flexibly and 10.7% said limited liability.

Of the remaining 9.4% that answered ‘other’ around half noted they thought holding property through a company would reduce costs, including their tax liabilities.

Q11. Have you encountered any difficulties understanding the way taxable profits are allocated between you? Please explain.

Of the 1,219 respondents that answered question, 68.9% said no. A further 14.7% said no, but this was because they used an accountant or tax adviser.

Others felt it can be challenging to:

-

calculate mortgage interest tax relief

-

allocate profits in complex circumstances, for example where two people legally owned half a property each, but then in practice one has a larger beneficial interest or does more work to maintain the property

-

apportion expenses, including where an expense could be a repair, an energy efficiency requirement or an enhancement.

Q12: Which of the following describes the main way you acquired the property/properties you let out?

Of the 3,353 respondents that answered question, 27% said they originally purchased their rental property as their main home while 54.8% said they purchased additional property as an investment or pension. Some 4.9% of respondents said they inherited or were gifted additional property, while 0.4% of respondents said their property was transferred from a spouse.

Of the 12.9% of respondents that answered ‘other,’ many were letting an annex to their main home while others had converted outbuildings or self-built.

Q13. Did you borrow money in order to purchase the property?

Of the 2,749 respondents that answered this question, 77.9% said yes, they did borrow money to purchase the property while the remaining 22.1% said no.

Q14. Have you encountered any difficulties understanding the relief available on mortgage interest paid? Please explain.

Of the 1,619 respondents that answered this question, 34.8% said they encountered difficulties and a further 11.1% used an accountant (so many said they did not need to know the rules themselves). Another 2.9% said they were not aware mortgage interest tax relief was available. 51% said they did not encounter difficulties but 2% within the 51% were not aware that any relief was available.

Of those that experienced difficulties, many felt mortgage relief reform had increased complexity and costs for landlords. One said they did not claim the relief due to the complexity. Several respondents:

-

felt the changes had been poorly communicated

-

suggested HMRC’s guidance could be improved

-

felt mortgage interest should be considered a business expense

Q15. Are you aware of the £1,000 property allowance?

Of the 3,349 respondents that answered this question, 54.6% said they were not aware of the £1,000 property allowance. Of the remainder, 37.5% said they were aware but did not claim it because their expenses were higher, while 7.9% said they were aware and did claim it.

Q16. Are any of the properties that you let out, taxed under the furnished holiday lettings regime (a specific tax treatment for properties let on a short term basis, provided they meet certain conditions, such as the availability of the property and number of days it is let)?

Of the 3,355 respondents that answered this question, 31.1% said yes while 14.9% said they were unsure. The remaining 54% said no.

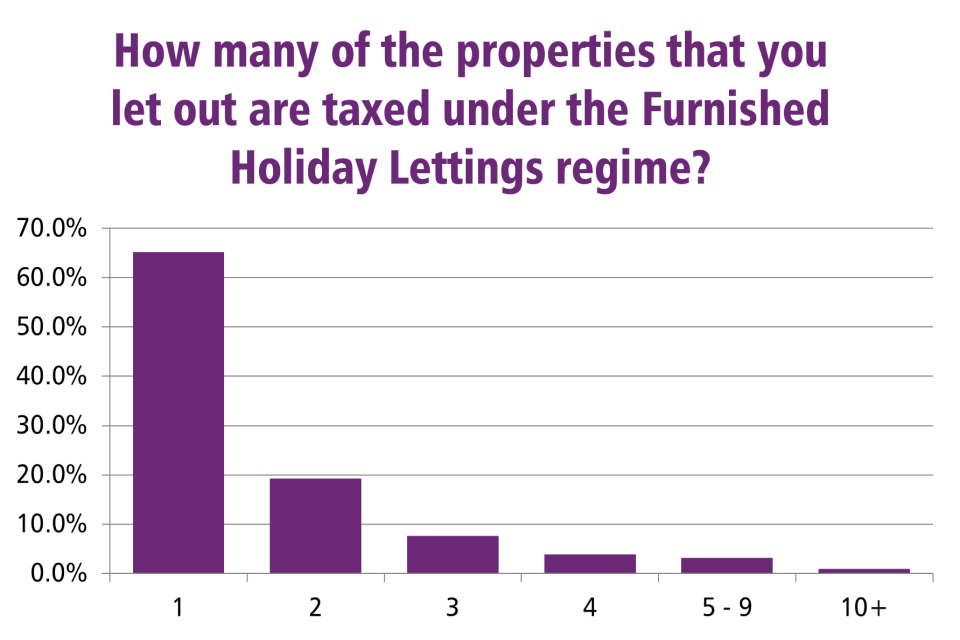

Q17. How many of the properties that you let out are taxed under the furnished holiday lettings regime?

1,044 respondents answered this question, as shown in the graph and table below.

| Number of let properties taxed under Furnished Holiday Lettings regime | 1 | 2 | 3 | 4 | 5-9 | 10 or more |

|---|---|---|---|---|---|---|

| Percentage | 65.2% | 19.3% | 7.6% | 3.8% | 3.2% | 1% |

Q18. Do you personally make use of the property/properties?

Of the 1,045 respondents that answered this question, 39.7% said yes while 60.3% said no.

Q19. Are they in the UK or overseas?

Of the 1,047 respondents that answered this question, 96.9% said the property was in the UK while 0.9% said the property was solely overseas. The remaining 2.2% of responses said they had properties in both in the UK and overseas. The location of overseas properties, where provided, is shown below.

| Location of overseas properties within the EEA | Location of overseas properties outside the EEA | ||

|---|---|---|---|

| Location | Number of properties | Location | Number of properties |

| Croatia | 1 | Barbados | 1 |

| France | 6 | Switzerland | 1 |

| Greece | 2 | USA | 1 |

| Republic of Ireland | 2 | ||

| Portugal | 1 | ||

| Spain | 6 |

Please note the furnished holiday let regime only applies to properties in the UK and the EEA.

Q20. How do you manage your lettings (tick all that apply)?

1,044 stakeholders answered this question, and some noted they use several approaches to let their property. 58.5% said they used an international platform to manage their lettings while 31.9% said they used a UK based platform. 17.5% said they used a short term lettings company.

20.9% responded ‘other,’ and these respondents noted they manage and advertise the properties themselves, even if they advertise with agencies too.

Respondents noted all the answers that apply, so percentages add up to more than 100.

Q21. Are there any particular areas of the furnished holiday lettings regime that cause you difficulty?

Of the 572 respondents that answered this question, 61.0% had no major difficulties.

Of the 39.0% that did have difficulties, some:

- felt the area was complex, and it was difficult to find clear guidance

- highlighted concerns around property tax obligations, including distinguishing between when a property is liable for Business Rates or council tax or the liability where the owner resides in one part of the UK with a property in a devolved administration

- the ‘number of days’ rules could be challenging, especially the 105 day rule, especially when tenants cancel at the last minute or demand is seasonal, and the 28 day suggested maximum occupancy rule as some tenants would prefer medium term furnished accommodation (for example, young people starting new careers, contractors)

Others questioned whether it is appropriate that furnished holiday lets are subject to a separate tax regime to other types of property, and whether small business rates relief should apply to single furnished holiday let properties.

Q22. How would you describe the way you let and manage your property? (Please tick all that apply)

2,310 respondents answered this question, as detailed below.

| Response | Share of responses |

|---|---|

| Obtaining bookings through one or more digital platforms | 38.9% |

| Let and managed through a lettings agent | 27.6% |

| Let through a lettings agent but managed personally | 19.7% |

| Let and managed personally | 34.4% |

| Other (please specify) | 1.9% |

Respondents noted all the answers that apply, so percentages add up to more than 100%.

Of those who responded ‘other,’ most said they used a mix of the methods provided.

Q23. Have you ever used the Rent a Room scheme (this lets you earn up to a threshold of £7,500 per year tax-free from letting out furnished accommodation in your home)?

Of the 3,354 respondents that answered this question, 79.3% had not used the Rent a Room scheme while 13.1% currently use the scheme. Of the remainder, 4.9% had used the scheme but no longer qualify and 2.7% had used the scheme but chose to opt out.

Q24. How do you make use of the Rent a Room relief

437 respondents answered this question, as detailed below.

| Response | Share of responses |

|---|---|

| My income from property is less than £7,500 so the exemption applies automatically | 50.6% |

| My income from property is over £7,500, so I pay tax on the income over this amount | 45.8% |

| Unsure | 3.7% |

Q25. Where do you go to obtain tax advice? Please tick all that apply.

3,351 respondents answered this question, as detailed below.

| Response | Share of responses |

|---|---|

| Accountant/tax adviser | 72.0% |

| Friends/family | 11.8% |

| HMRC (including GOV.UK) | 43.4% |

| Websites (other than GOV.UK) | 27.2% |

| Letting agent | 4.4% |

| Platforms | 13.1% |

| Tax charity/citizens advice and similar | 1.6% |

| Other (please specify) | 5.1% |

Respondents noted all the answers that apply, so percentages add up to more than 100%

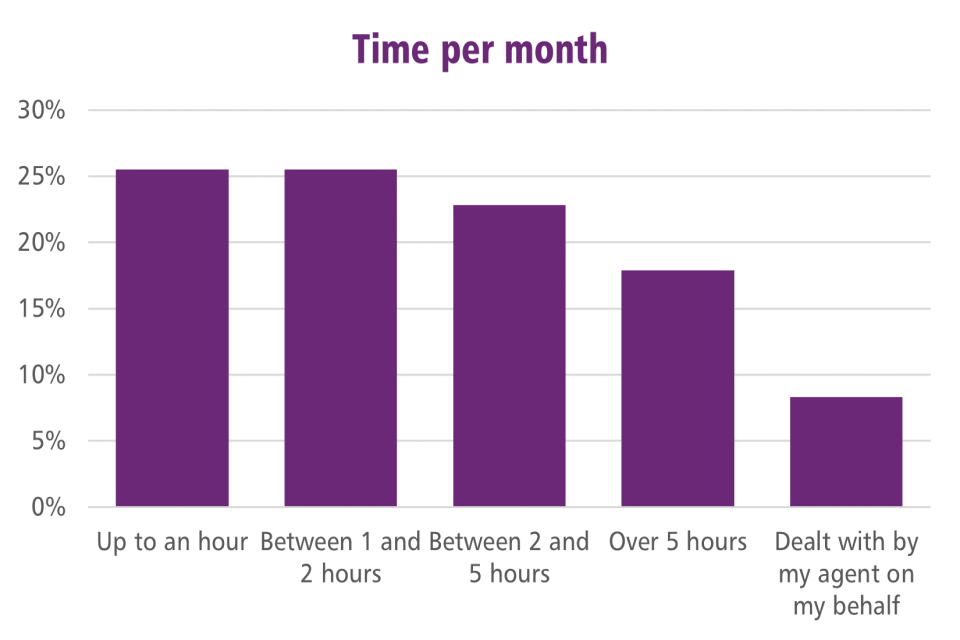

Q26. How much time a month do you spend on keeping accounting and tax records for your property business?

3,347 respondents answered this question, as shown in the graph and table below.

| Time spent per month | Up to an hour | 1 to 2 hours | 2 to 5 hours | Over 5 hours | Dealt with by agent on my behalf |

|---|---|---|---|---|---|

| Percentage | 26% | 26% | 23% | 18% | 8% |

Q27. How do you keep your accounting and tax records? (Please tick all that apply)

3,342 respondents answered this question, as detailed below.

| Response | Share of responses |

|---|---|

| Spreadsheet | 61.7% |

| General accounting software | 18.0% |

| Paper records | 39.8% |

| Specific accounting software for landlords | 4.6% |

| Electronic records | 26.1% |

| An app on a smartphone | 5.4% |

Respondents noted all the answers that apply, so percentages add up to more than 100%

Q28. Do you have a specific bank account used just for your property income and expenses?

Of 3,344 responses to this question, 63.7% said yes while the remaining 36.3% said no.

Q29. Making Tax Digital for Income Tax starts in April 2024 and mandates quarterly electronic updates for most individuals with turnover of over £10,000 for their property (and business) income. How aware are you of these reporting obligations?

Of the 3,352 respondents that answered this question, 16.9% said they were aware and prepared while 31.1% said they were aware but unprepared. The remaining 52.0% of respondents said they were unaware.

Q30. Do you pay for an accountant or bookkeeper to help administer your property business tax affairs?

Of the 3,350 respondents that answered this question, 56.8% said they pay for an accountant while 1.6% said they pay for a bookkeeper. 4.8% said they pay for both, while the remaining 36.8% said they pay for neither.

Q31. Do you report your residential property income for tax purposes on the cash basis (that is on the basis of the money you receive and pay, rather than taking debtors and creditors into account)?

Of the 3,352 respondents that answered this question, 65.7% said they use the cash basis while 8.3% said they did not. The remaining 26.0% were unsure.

Q32. Why don’t you use the cash basis?

Of the 286 respondents that answered this question, 23.1% said they did not use the cash basis because rents are over £150, 000 per year.

Of the remaining 76.9% that answered other, some said they prefer to use the accruals basis due to their preference, training or software requirements. Some felt it would give more accurate results in their circumstances. Others felt that the cash basis was not suitable for them, in some cases due to apparent misunderstandings of what it involved.

Q33. Do you use your HMRC online Personal/Business Tax Account?

Of the 3,336 respondents that answered this question, 36.8% said yes and they find it helpful while 17.1% said yes but they do not find it helpful. The remaining 46.1% said no.

Q34. On a scale of 1 (Easy) to 10 (Difficult), if you needed to register with HMRC for self-assessment when you started to receive property income, how easy or difficult did you find this? Leave as zero if question is not applicable.

2,479 responded to this question. 33.7% felt this was reasonably easy (scoring 1,2, or 3) and 31.0% difficult (scoring 8, 9, or 10).

Q35. On a scale of 1 (Easy) to 10 (Difficult), how easy or difficult do you find understanding and navigating HMRC guidance on the taxation of property income?

2,786 responded to this question. 18.3% felt this was reasonably easy (scoring 1,2, or 3) and 40.4% difficult (scoring 8, 9, or 10).

Q36. On a scale of 1 (Easy) to 10 (Difficult), how easy or difficult do you find understanding the expenses you are able to deduct from your rental income?

2,767 responded to this question. 23.7% felt this was reasonably easy (scoring 1,2, or 3) and 36.5% difficult (scoring 8, 9, or 10).

Q37. How do you find the process of filing returns and paying tax? Please tick all that apply.

3,322 responded to this question, as detailed below.

| Response | Share of responses |

|---|---|

| It’s dealt with by my accountant | 52.0% |

| Easy to find relevant help/guidance | 12.3% |

| Time consuming | 33.5% |

| High level of predictability about my tax liability | 10.4% |

| Easy to understand my responsibilities | 24.8% |

| Easy to navigate the process | 17.9% |

| Difficult to navigate the process | 19.6% |

| Difficult to understand my responsibilities | 14.5% |

| Difficult to find relevant help/guidance | 18.3% |

| My software deals with it | 3.2% |

| High level of uncertainty over my tax liability | 12.3% |

| Other (please specify) | 4.4% |

Respondents noted all the answers that apply, so percentages add up to more than 100.

Of the 4% that responded ‘other,’ around a third stated they used an accountant. Others referred to the difficulties of understanding the forms and accessing relevant guidance.

Q38. Would you find it helpful to be able to make more regular payments throughout the year towards your final tax bill?

Of the 3,340 respondents that answered this question, 61.7% said no while 19.6% said yes. The remaining 18.7% said they don’t know.

Q39. Would it be helpful to you if third parties such as platforms, holiday rental agents or letting agents could provide HMRC with data, which you could use to help fulfil your tax obligations?

Of the 3,338 respondents that answered this question, 61.2% said no while 17.3% said yes. The remaining 21.5% said they don’t know.

Q40. Please provide any further comments you have on taxation of property income.

1,176 responded to this question, sharing views on a range of issues. These include:

-

How third parties, including letting agents and online platforms, could help improve compliance and reduce administrative burdens by sharing data with HMRC. Some agreed this would be helpful, and one proposed third parties could also withhold tax on the landlord’s behalf. However, many others felt third party involvement could increase complexity. Several highlighted the risk that third parties may provide HMRC with inaccurate data or a partial picture of their business, especially if they used several third parties or needed to offset expenses.

-

The tax treatment of private landlords compared to corporate landlords and those within the furnished holiday lettings regime. Many felt these activities should not be taxed as unearned income. Some underlined concerns around the impact of mortgage interest tax relief reform on complexity and profitability, or the challenges in reaching the ‘number of days’ thresholds required for the furnished holiday lettings regime.

-

The impact of Making Tax Digital and quarterly reporting, including the risk that burdens may be disproportionate for smaller businesses and the impact on the digitally excluded or those requiring digital assistance. This was an area of concern for many respondents.

Annex D - Examples relating to the text

Chapter 3 -the effect of interest restrictions

Example 3A

Eliza owns a property which is let on a long term rental.

Eliza’s income for each year is:

| Net rents after expenses | 20,000 |

| Mortgage interest | 11,000 |

| Other income – employment income | 35,000 |

The table below compares the position for 2022-23 if the restriction did not apply (in which case the interest would be fully deductible) and the position with the interest relief restriction.

| 2022-23 if full relief given | 2022-23 with interest restriction | ||||

|---|---|---|---|---|---|

| Net rents | 20,000 | 20,000 | |||

| Less: interest | -11,000 | ||||

| Net income | 9,000 | 20,000 | |||

| Other income | 35,000 | 35,000 | |||

| Total income | 44,000 | 55,000 | |||

| Tax | 12,570@0% | 0 | 12,570@0% | 0 | |

| 31,430@20% | 6,286 | 37,700@20% | 7,540 | ||

| 4730@40% | 1,892 | ||||

| Less: basic rate reduction | 11,000@20% | -2,200 | |||

| Total tax | £6,286 | £7,232 |

In this example Eliza’s tax liability has increased by £946 and it has also had the effect of moving Eliza into the higher rate tax band of 40%.

Example 3B -limitation in the reduction

If Eliza’s other income in the example above was savings income rather than employment income, the tax reduction due would be based on the lowest of:

The finance costs for the year plus any brought forward amount - £11,000 (ignoring brought forward amounts)

The profits of the rental business - £20,000

The adjusted total income for year - £55,000 - £35,000 - £12,570 hence, £7,430

The basic rate reduction for finance costs would therefore be £7,430 at 20% ie £1,486 rather than £2,200 in the example above.

Chapter 3 -incorporation

Example 3C

The following example compares the effective rate of tax between individual ownership by basic, higher and additional rate taxpayers, and ownership through a company, using 2022-23 rates.

| Rental income | £10,000 | |

|---|---|---|

| Finance costs | £5,000 | |

| Rate of corporation tax | 19% | |

| Income tax rates | General income | Dividends |

| Basic rate of income tax | 20% | 8.75% |

| Higher rate of income tax | 40% | 33.75% |

| Additional rate of income tax | 45% | 39.35% |

Note: Assuming dividend allowance of £2,000 is used elsewhere. Dividend tax rates increased to 8.75%, 33.75% and 39.35% for 2022-23. It was announced on 23 September 2022 that the government plan to reverse this increase from 2023-24, however this was revoked on 17 October 2022.

| Individual (basic rate) | Individual (higher rate) | Individual (additional rate) | Company | |

|---|---|---|---|---|

| £ | £ | £ | £ | |

| Property income | 10,000 | 10,000 | 10,000 | 10,000 |

| Interest cost | (5,000) | (5,000) | (5,000) | (5,000) |

| Net income | 5,000 | 5,000 | 5,000 | |

| Company profit | 5,000 | |||

| Individual taxable income | 10,000 | 10,000 | 10,000 | |

| Income tax @ 20/40/45% on taxable income (before interest) | (2,000) | (4,000) | (4,500) | |

| Interest reduction at basic rate@ 20% | 1,000 | 1,000 | 1,000 | |

| Net income tax | (1,000) | (3,000) | (3,500) | |

| Corporation Tax on profits @ 19% | (950) | |||

| Post tax income /profits | 4,000 | 2,000 | 1,500 | 4,050 |

| Effective rate of tax | 20% | 60% | 70% | 19% |

*Notes - The Corporation Tax rate was planned to increase to 25% from 1 April 2023, but it was announced on 23 September 2022 that the government do not intend to make this change. However, under the original proposals a small profits rate would apply to trading companies and those letting land commercially (CTA 2010 s 18N). - ‘Effective rate of tax’ row is based on tax paid on net income of £5,000

If income is retained within the company, the lowest effective rate of tax is 19% if a company is used.

However, if post tax company income of £4,050 is paid out as a dividend, the effect is as follows:

| Dividend payable | Individual (basic rate) | Individual (higher rate) | Individual (additional rate) |

|---|---|---|---|

| 4,050 | 4,050 | 4,050 | |

| Income tax dividend rate | 8.75 | 33.75 | 39.35% |

| Income tax due | (354) | (1,367) | (1,594) |

| Post tax income | 3,696 | 2,683 | 2,456 |

| Tax paid by individual | 354 | 1,367 | 1,594 |

| Tax paid by company | 950 | 950 | 950 |

| Total tax paid | 1,304 | 2,317 | 2,544 |

| Effective rate of tax | 26.08% | 46.34% | 50.88% |

Notes Total tax paid by individual and company on net income of £5,000

As can be seen from the above examples, if income is paid out of the company, for a basic rate taxpayer the effective rate is higher at 26.08% compared to 20% if the asset is held personally.

In practice a small amount of pre-tax profits would be paid as salary but this has been ignored for simplicity.

For higher and additional rate taxpayers the effective rates are lower in these circumstances at 46.34% and 50.88% compared to 60% and 70% in personal ownership.

Chapter 6 -furnished holiday lettings and the averaging election

If one or more furnished holiday lettings properties is held which meet the conditions apart from the 105 day count letting condition it is possible to elect to average the tests across qualifying and non-qualifying properties.

Example 6A

Sophie owns two properties in Devon which she lets out as furnished holiday accommodation. During 2020-21 both properties were available for letting for 252 days. One property was let for 84 days and the other for 130 days. Averaging the days let across the two properties gives an average let period of 107 days each, so that both qualify.

If more than two properties are owned not all the properties need to be averaged, so choosing the best combination to average can add complexity.

Example 6B

Grace owns 3 properties in Devon which are let out as furnished holiday lets. During 2020-21 all three properties were available for more than 210 days, and were actually let as follows:

| A | 130 |

| B | 84 |

| C | 77 |

If all three were averaged the average let period would be 97 days and so none of them would qualify. However the averaging election can be made for properties A and B only, giving an average of 107 days so that both A and B would qualify, but property C would not qualify.

If FHLs are owned in the UK and in the EEA the averaging process must be done separately for the UK and the EEA properties.

An election for averaging must be made by the 31 January in the second year following the tax year concerned, ie by 31 January 2024 for the tax year 2021-22. It is normally made in a tax return.

Chapter 6 -furnished holiday lettings and the period of grace election

If a property meets all the conditions for a particular year, but in the following year does not meet the letting condition, despite the property being available for the qualifying number of days it is possible to make a period of grace election to continue to treat the property as an FHL. An election can also be made for the following year.

The availability condition and the pattern of availability condition must be met for all years affected. In addition there must be a genuine intention to let the property for 105 days despite this not in fact being achieved, due for example to reduced demand or other unforeseen circumstances. In 2020-21 this included circumstances where the property could not be let due to lockdown restrictions . Some more limited restrictions remained in 2021-22 but it does not seem that any concessions have been granted for that year.

Example 6C

Leo has an FHL property which meets the availability and pattern of letting conditions. The property was advertised and there was a genuine intention to let it, but the days let were as follows:

| 2018-19 | 120 |

| 2019-20 | 95 |

| 2020-21 | 100 |

| 2021-22 | 110 |

In 2019-20 and 2020-21 the property does not meet the letting condition, but Leo can make period of grace elections for both years so that it continues to qualify. In 2021-22 the letting condition is met, so the property qualifies throughout. If the letting condition was not met in 2021-22 the property could no longer be treated as an FHL from that year. The consequences of this are explained in Chapter 6

An election must be made by the 31 January in the second year following the tax year concerned, I.e. by 31 January 2024 for the tax year 2021-22. It would normally be made in a tax return.

Annex E – Non-Resident Landlord Scheme Forms

Table of Non-Resident Landlord Scheme forms

| Form | What for | Who | How | |

|---|---|---|---|---|

| Online | Post | |||

| NRL1, NRL2, NRL3 | Register landlord for scheme | Individuals, companies, trusties | Online through Government Gateway provided have a user ID | Apply by post – complete online form which can then be printed and posted |

| NRL4/NRL5 | Letting agent use to register NRL5 for branches of letting agents where they want each branch to report separately | Letting agent | Online through Government Gateway provided have a user ID | Apply by post – complete online form which can then be printed and posted |

| NRLQ | Quarterly reporting and payment. Only needed if payment due | Letting agent/tenant | No online option | Paper form sent or requested from HMRC |

| NRLY | End of year reporting | Letting agent or tenant | Online through Government Gateway provided have a user ID | Apply by post – form available to print out. Then needs to be completed by hand and posted |

| NRL6 | Certificate of tax withheld | Letting agent or tenant give to landlord | Complete online form, print it out and give to landlord |

Annex F - Scoping document

Originally published in February 2022: Review of Property Income - Scoping document - GOV.UK (www.gov.uk)

Property Income Review Scoping Document

Introduction

The primary focus of the review will be to identify opportunities for simplification of the tax and administrative treatment of individuals, partnerships or micro companies deriving income from residential property.

Background

HMRC statistics suggest that there were around 2.9m individuals and 32,000 partnerships with property businesses filing tax returns in the 2018-19 tax year. These businesses may relate to commercial or residential properties (including Furnished Holiday Lettings) either in the UK or overseas.

Income from residential property owned by individuals is taxed under one of two different regimes.

The general position for individuals with property income is that income tax will be due on the profits from renting out the property at general income tax rates, after certain allowable deductions, including general maintenance and repair and letting, legal or accounting fees. However, residential property mortgage interest relief is restricted to the basic rate of income tax, and there are no specific capital gains reliefs.

The position is different within the Furnished Holiday Lettings (FHLs) regime which applies to residential property let on short term lets within certain parameters. The regime was introduced in 1984 and means, in particular, that the income attracts some reliefs (such as forgoes in Chapter 2 interest) in a similar way to trading income. In addition, some capital gains tax reliefs are available including Business Asset Disposal Relief, holdover relief for gifts and rollover relief for reinvestment into other trading assets.

Separately, the rent a room scheme provides a tax exemption for individuals receiving up to £7,500 a year from renting out furnished accommodation within their home.

Companies are subject to corporation tax on their profits from renting property and have no restrictions on the amount of mortgage interest they can deduct. This review will consider the letting of property by micro companies, but will not examine property development or letting by larger companies or REITS.

Scope of the review

The review will consider the current regimes for the taxation of residential property held by individuals, partnerships and micro-companies, and develop recommendations for simplification and ways of addressing distortions.

The primary focus of the review will be on income received from property.

In particular, the review will consider:

- the way that the taxation of property income fits into the overall scheme of income tax, and the rationale for the similarities and differences between the treatment of property and trading income, and income from other investments, and related rules in other taxes

- the differences between the rules for residential lettings generally and those applying to Furnished Holiday Lettings, the incorporation of property businesses, including SDLT aspects

- the factors that influence the choice between using the cash basis rather than accruals accounting, where rental income is less than £150,000 a year

- reliefs and exemptions, including CGT aspects, and whether the way they operate meets policy intent

- income received from property in the UK, including by individuals living abroad

- income from property overseas, including the complexities of the definition of qualifying EEA property in relation to Furnished Holiday Lettings

- any difficulties arising in understanding the rules, or in the tax processes involved in becoming or ceasing to be a landlord

- the impact of the use of intermediaries by those letting property, and any potential for them to assist in easing administrative burdens.

The review will have regard to issues that may arise in relation to:

- the various stages in a property’s existence or as a result of changes in its use or ownership

- properties held for the purposes of a property business, or held as an investment, and related regulatory considerations

- rental properties, including buy-to-let properties, holiday accommodation, rent-a-room relief and the £1,000 de minimis allowance

- issues arising in connection with life events or family circumstances

- developments in the ways third party data could be used by HMRC to assist taxpayers

- practical, technical and administrative issues, including in relation to MTD reporting

In carrying out its review, the OTS will:

- be guided by contemporary research

- consider the likely implications of recommendations on the Exchequer, the tax gap and compliance

- take account of relevant international experience

- liaise with HMRC’s Administrative Burdens Advisory Board

- consider the implications of devolution of tax powers and different legal systems within the UK

- be consistent with the principles for a good tax system, including fairness and efficiency be mindful of the effect of taxpayer trust in the operation of the tax system

Annex G - Organisations consulted

The OTS has listed below the wide range of organisations who gave their time to provide evidence to this review. The OTS is grateful to these organisations and to the large number of individuals who gave their time to provide evidence either in writing or through the online survey. Individual names have not been published here.

Ashtons Legal

Association of Accounting Technicians

Agricultural Representative Bodies Group

Airbnb

APARI

Association of Scotland’s Self Caterers

Association of Taxation Technicians

Azets

Central Association of Agricultural Valuers

Chartered Institute of Taxation

Country Land and Business Association

Deloitte

Department for Business, Energy & Industrial Strategy

Guymer King

Hammock

Hamptons

Historic Houses

HM Revenue & Customs

HM Treasury

Institute of Certified Bookkeepers

Institute of Chartered Accountants in England and Wales

Institute of Chartered Accountants of Scotland

KPMG

London Society of Chartered Accountants’ Taxation Committee

Low Incomes Tax Reform Group

National Farmers’ Union

National Residential Landlords Association

PayProp United Kingdom

PKF Francis Clark

Propertymark

PwC

Rebecca Benneyworth Ltd

RSM

Saffery Champness

Society of Trust and Estate Practitioners

Tax Policy Advice

The Holiday Home Association

The Professional Association of Self Caterers UK

The Tourism Alliance

UK200 Group

UK Short Term Accommodation Association

Untied

Whitings LLP