Annual Report and Accounts 2020 to 2021

Updated 20 July 2021

Applies to England

Chair’s foreword

For the past 16 months, the Covid-19 pandemic has disrupted all our lives. Our responsibility to everyone who takes, uses and relies on qualifications has not changed – they need to be confident in the quality and value of those qualifications.

I pay tribute to all those in schools, colleges and training providers whose work has been upended during this period, to parents juggling work with supporting children at home and, most of all, to students and learners whose education has been so disrupted by the pandemic.

A major question for us as a country has been how to award qualifications in the absence of exams, both last summer and this year, and the challenge of the increasing unevenness of the playing field for students and learners, owing to the bumpy impact of the pandemic. Schools and colleges have worked in ways they have never had to work in before so students and learners could be issued with grades.

Exceptional arrangements were made for a wide range of qualifications. Ofqual colleagues worked with stakeholders to set up and deliver the fairest possible system for as many students and learners as possible last summer. In the end, the approach developed for GCSE, AS and A levels did not command public confidence, and Ofqual took the decision that exam boards would award centre assessment grades (CAGs) unless the standardised grade was higher. Changes to some other qualifications, such as BTECs, followed. My predecessor, Roger Taylor, apologised publicly for our part in this and set out lessons learned. Evaluation and research carried out on last summer, have informed our approach to awarding in 2021.

This year, though, has raised some extra challenges. Students’ and learners’ education and training have been affected differently due to the course of the pandemic. Following the government’s decision that it was no longer fair for exams to go ahead as planned, and mindful of the critical importance of securing public confidence, we published national consultations on proposals for awarding in January 2021 jointly with the Department for Education (DfE).

We are grateful to the 100,000-plus people and organisations who responded to our consultations. There was a high degree of consensus around the principles we proposed, which we have used to build the approaches to be taken this year for exam boards and awarding organisations to award results. We have required awarding organisations to provide structured support for teachers, schools and colleges as they determine grades for 2021, and this is accompanied by a robust quality assurance system delivered by exam boards.

To those young people, students and learners affected by the decision that exams and assessments could not go ahead fairly last year, and this year, we are doing all we can to make sure grades are awarded as fairly as is possible to help you move forward to the next stage in your lives.

Ian Bauckham CBE

Chair

8 July 2021

Performance report

Overview

In this section, we outline Ofqual’s role and provide an assessment of our performance against our goals and objectives over the reporting period.

Ofqual’s role

Ofqual is the independent qualifications regulator for England. At the end of March 2021, we regulated 161 awarding organisations, and nearly 12,000 qualifications for which certificates were issued last year. These include GCSEs, AS and A levels, Functional Skills, technical qualifications in T levels and a wide range of other qualifications. By the end of March 2021, we were providing external quality assurance (EQA) for 100 new apprenticeship assessment standards.

Ofqual has five statutory objectives, which are set out in the Apprenticeships, Skills, Children and Learning Act 2009. They are:

- to secure qualification standards

- to promote National Assessment standards

- to promote public confidence in regulated qualifications and National Assessment arrangements

- to promote awareness of the range and benefits of regulated qualifications

- to secure that regulated qualifications are provided efficiently

On 18 March 2020, the government’s announcement that exams in schools and colleges would not take place marked a significant change in the way that we were able to fulfil our role as regulator. In light of the Covid-19 pandemic, we focused on four priorities. These were:

- regulating GCSE, AS and A levels in response to Covid-19

- regulating vocational and technical qualifications in response to Covid-19

- supporting quality in regulated qualifications and assessments

- managing our people, resources and systems

Ofqual is a Non-Ministerial Department and therefore we receive our core funding directly from Her Majesty’s Treasury (HM Treasury). Where we regulate to support the government’s wide-ranging skills reform programmes, we receive additional funding from the DfE. In 2020 to 2021, our funding was secured through the 2019 Spending Round (SR19). We received funding of £23.6 million, including £4.7 million to deliver key milestones in the following programmes:

- Apprenticeships EQA

- Strengthening non-GCSE performance table qualifications at Key Stage 4

- T levels

- Digital Functional Skills

- Essential Digital Skills

- Review of qualifications at level 3 and below

Regulatory approach

Ofqual has a range of regulatory tools to secure its objectives. Each year we undertake activities targeted at the greatest risks to our statutory objectives. We talk and listen to a wide range of stakeholders so that our work is targeted well and our decisions are properly informed by those they will affect.

Ofqual controls entry to the regulated market, creates rules and provides guidance for awarding organisations to ensure regulated qualifications are fit for purpose, valid and delivered safely. Ofqual monitors qualifications as they are delivered and conducts evaluations of how qualifications function to ensure they are meeting the needs of users and are being delivered safely and efficiently. Where qualifications are not meeting users’ and learners’ needs, we have a range of enforcement tools at our disposal to make sure the situation is put right.

We monitor how awarding organisations manage incidents which might have an impact on learners, standards or public confidence, and intervene where necessary to mitigate that impact. We gather data and publish statistics to provide transparency on key features of qualifications and the qualifications market. Where appropriate, we use the reform of qualifications as an opportunity to ensure that qualifications are well designed, threats to validity are minimised, and risks to safe delivery are anticipated and mitigated.

We work with and, where possible, align our approach with the regulators in the devolved administrations in order to minimise the burden on those impacted by our regulations.

Summary of key activities

The main focus of our work in 2020 to 2021 has been our response to Covid-19 and the government’s decision that it was no longer fair for most exams and assessments to go ahead as planned. In summer 2020, awarding organisations delivered GCSE, AS and A level grades based on centre assessments, rather than exams. This unprecedented approach required a substantial and significantly different programme of work compared to our usual summer exams regulation.

For vocational and technical qualifications, we implemented an Extraordinary Regulatory Framework (ERF) to enable and support the awarding of results to learners in summer and autumn 2020. This gave awarding organisations the appropriate level of flexibility needed to adapt their qualifications in relevant ways considering public health restrictions, or to award grades based on centre assessments.

We continued our priority programmes to secure quality in regulated qualifications in the medium term alongside our immediate responses to Covid-19. We focused our work on three areas: ensuring quality in new and reformed qualifications, addressing systemic risks and promoting an efficient and effective market.

The current programme of reforms is broad, including the introduction of technical qualifications within the T level programme, the continued introduction of End-Point Assessment (EPA), the review of post-16 qualifications at level 3 and below, and developing new higher-level technical qualifications at levels 4 and 5. We are playing an active part in these reforms, working closely with the Institute for Apprenticeships and Technical Education (the Institute), to secure high quality qualifications for those who take, use and rely on them.

The Covid-19 pandemic impacted on the risks to Ofqual achieving its objectives. The pandemic created a heightened and dynamic risk environment which was managed and reported through our Audit, Risk and Assurance Committee. The Board has considered it appropriate to adopt a going concern basis for the preparation of this report.

The United Kingdom’s exit from the European Union has had no impact on Ofqual’s strategic objectives in 2020 to 2021.

Chief Regulator’s review of the year

My first working day at Ofqual was 4 January 2021, as chance would have it, the day that the Prime Minister announced that, in light of new lockdown measures, this summer’s exams could not proceed normally. This reflected the reality that much of Ofqual’s activity throughout the year from April 2020 to March 2021 has been affected by the need to plan for and respond to the challenges the pandemic has created for the public exam system.

The pandemic has had enormous repercussions in every field of life, not least education. Schools, colleges and training providers have had to move to remote learning and assessment using new technologies and approaches to teaching, a shift that would have taken years in normal times. Students and learners have experienced disruption, loss of learning, missed opportunities for social interaction and development and many have suffered from stress and anxiety as a result. Teachers have faced a significant workload, having to carry out extra tasks and duties.

Last spring, exams did not take place on public health grounds. In light of this and in response to the Secretary of State’s Direction, Ofqual put in place measures to award qualifications, seeking to maintain qualification standards for the cohort as a whole so far as possible, and to be as fair as possible to individual students and learners.

Last summer, concerns about the impact of the standardisation model for GCSEs, AS and A levels, about the appeals arrangements and a general sense of lack of student agency led to a feeling that the system was not fair, and to our decision to change the approach. We have carried out and published a wide range of evaluative work on summer 2020 awarding.

In January this year, in response to the government’s decision that it was no longer fair for exams to go ahead as planned in 2021, we carried out two wide-ranging public consultations on how qualification results should be derived this year, which we embarked on jointly with the DfE. We published our decisions from those consultations in February and in March we published the regulatory requirements that awarding organisations will be required to meet as they award grades this year. This summer’s approach to awarding will see a collective effort involving many people and organisations, many of them working in ways that would have been unfamiliar in pre-Covid times.

Awarding qualifications when exams and assessments cannot take place is in its nature problematic. Awarding last summer and for this academic year happens only with a great deal of input from stakeholders across the education and skills system, including school and college leaders, teachers, students, parents, employers, exam boards, universities, and equality and human rights groups. I thank them all.

I am also grateful to awarding organisations who, after we announced the framework for vocational and technical qualifications last year, worked hard to innovate and make adaptations so that learners could gain the qualifications they need to get work and to get on at work in the context of the pandemic. Our work with the Institute to support the introduction of T levels and the ongoing expansion of our EQA of apprenticeship EPA has continued this year, as well as supporting the DfE’s review of post-16 qualifications.

Throughout the year our staff have continued to work remotely; our people and our IT infrastructure have proved remarkably resilient. I am grateful to all Ofqual colleagues for the hard work and dedication they continue to show. Despite the ongoing disruption caused by Covid-19, our financial position at the end of the year was within budget for our net operating expenditure of £22.7 million.

We are now very actively engaged in implementing arrangements for this summer’s awarding and, more generally, for a hoped-for return to more normal conditions in the course of 2022 and beyond.

Simon Lebus

Interim Chief Regulator and Accounting Officer

8 July 2021

Performance analysis

Details about how we delivered each of our four organisational priorities in 2020–21 are provided below.

Regulating GCSE, AS and A levels in response to Covid-19

Ofqual is responsible for regulating GCSEs, AS and A levels in England, known as general qualifications. Our aims, based on our statutory objectives and duties, are set out in our Corporate Plan 2020 to 2021.

Our regulation of general qualifications in England takes place in the context of government policy. In recent years, the majority of assessments for these qualifications have been carried out at the end of students’ and learners’ courses of study. For GCSEs and A levels this usually involves exams at the end of a 2-year course. In summer 2020, due to the pandemic, exams did not take place, therefore Ofqual oversaw arrangements for exam boards to award CAGs for general qualifications.

This changed the nature of our work compared to normal, pre-pandemic years, where our focus would be on monitoring exam delivery or quality of marking and moderation. National Assessments (statutory primary assessments, also known as SATs) did not go ahead in 2020. They were not replaced by any other form of assessments and so we did not monitor or report on National Assessments as we would in a usual year.

In light of the burden on exam boards and awarding organisations, which needed to make very significant changes due to the pandemic, we put on hold work that would have created additional burden. This included work to consult on updates to our regulations, the introduction of new guidance in relation to accessible assessments and changes in how we take regulatory action.

Preparations for summer 2020

On 18 March 2020, the government took the decision that exams in summer 2020 could not go ahead fairly in light of the Covid-19 pandemic. The Secretary of State committed to students and learners that a system would be put in place so that grades would be provided in the absence of exams and assessments for an anticipated 5.3 million GCSE and 0.8 million A level grades.

Following a Direction received from the Secretary of State at the end of March 2020, Ofqual put in place a package of measures, following a consultation launched in mid-April 2020 with over 12,000 responses. The final package of measures consisted of standardised teacher assessments, known as ‘calculated grades’, an appeals process, a separate complaints process for malpractice or maladministration and the ability for students to subsequently take the exams they had been denied the opportunity to sit when it was safe again to do so. To support this process, centres were asked to provide rank orders of students, along with CAGs. CAGs were intended to represent the grade centres expected students to achieve had exams gone ahead. This package also included the approach to statistical standardisation, access for private candidates and the proposed additional autumn exam series.

To promote equality and fairness, we issued guidance to centres on how to maintain objectivity in making their judgements on ranking and grading. We also confirmed that a student who had evidence of bias or discrimination would be able to raise this with their centre and that an exam board could investigate such evidence as indicating possible malpractice or maladministration. We carried out full equalities impact assessments, and consulted on these, in relation to our proposals. Following a short technical consultation with exam boards, we introduced in early June 2020 our regulatory framework for general qualifications (GQCov), to put the required Conditions and Guidance into place.

We considered the approach to appeals carefully, given the mixed responses to our proposed approach. We provided for appeals to be made on the basis that the standardisation model had used evidence that was not appropriate for a specific centre. The appeals process was confirmed on 6 August 2020. We considered what further changes may be made to the appeals arrangements following the Secretary of State’s announcement on 11 August 2020 of a guarantee that results should be no lower than a student’s mock exam result. The parts of the appeals process that related to calculated grades (as distinct from errors in the submission of CAGs) was not, in the end, used as had been envisaged. CAGs (or the calculated grade where this was higher) were issued to students and learners, rather than calculated grades.

External Advisory Group and quality assurance

Shortly after the decision by the government that the summer 2020 exams and assessments would not go ahead, Ofqual established an External Advisory Group (EAG) to consider technical matters relating to the awarding of grades in GCSE, AS and A level qualifications in 2020 and to advise the Ofqual Board on the related issues. We appointed 10 independent members from the statistical and assessment communities to the EAG, three of whom were members of the Royal Statistical Society. Two Ofqual Board members were also on the EAG, including Ofqual’s Chair.

The EAG considered matters including the principles for grading GCSE, AS and A level qualifications in summer 2020, the approach to testing the most appropriate technical model and quality assurance of outcomes. The model that was chosen performed most accurately using test data from summer 2019. This included testing to ensure that the model did not introduce bias, which it did not.

Exam boards and Ofqual carried out a range of quality assurance processes across different stages of the process, data collection and analysis. Exam boards worked closely together to ensure a consistent approach was taken by each of them. Quality assurance activity included requiring Head of Centre declarations to confirm judgements were accurate and final quality assurance checks at ‘Maintenance of Standards’ meetings with exam boards, Ofqual and regulators in Wales and Northern Ireland. The provision of an appeals process and the autumn exam series were also important components of the process to support the provision of grades that were as accurate as possible in the circumstances.

To ensure compliance with data protection legislation and relevant guidance from the Information Commissioner’s Office (ICO), we completed a Data Protection Impact Assessment, published a privacy notice and engaged directly with the ICO. We subsequently published a privacy impact statement on our website to enable all stakeholders to understand in plain language the processing of personal data that was taking place in relation to 2020 grades. Our communications set out that grades would be awarded using a combination of human judgement (in the form of rankings and, or, CAGs) and statistical standardisation, including the data on which the standardisation process would be based.

Communications and engagement

We carried out a wide range of communications and stakeholder engagement activity to support public and stakeholder understanding of the significant change in arrangements for 2020. This informed our approach and included over 200 meetings with a wide variety of stakeholders and we held focus groups.

Our social media campaign resulted in over 9 million impressions and over 77,000 click-throughs. We also published 23 communications products mailed to over 3,000 schools and colleges, to inform a variety of groups about the approach we were taking and what it meant for them. We published two student guides with over 40,000 and 30,000 downloads respectively, including British Sign Language versions. Our detailed guidance for parents, carers, students and learners was downloaded more than 300,000 times. We published seven blogs on summer awarding with over 100,000 views in total, including one that outlined the data that would be used in the model.

Later in July 2020, we hosted a symposium to provide information about results and feedback on data received and analysed. We provided additional details of the standardisation model, including some of its limitations. We published preliminary findings of our equalities analysis, a fact sheet describing the standardisation process, a video explanation of grading in 2020 and, subsequently, a student guide.

Public confidence and results days

Following the release of Scottish Highers results on 4 August 2020, public concerns about the fairness of results generated without exams grew significantly. On A level results day, 13 August 2020, we issued an interim report on the awarding of GCSE, AS, A level, advanced extension awards and extended project qualifications in summer 2020. This set out the principles behind the decisions made, explicit details of the model used and a summary of the equalities analysis, which confirmed our initial analyses that there was no systematic bias in the process of producing calculated grades.

The exam boards issued centres with information to help centres understand how grades had been calculated for their centre.

Notwithstanding this, concerns about fairness grew significantly following A level results day, including from parents, students, teachers, tutors, schools and college leaders, stakeholders and in public opinion more widely. In response to this lack of confidence in standardised grades, the Ofqual Board took the decision to award students and learners the higher of the CAG or calculated grade for AS and A levels. GCSE results were issued on this basis on 20 August 2020. We recognised that the approach we took in summer 2020 was ultimately not widely accepted and had a detrimental impact on public trust and confidence in qualifications. Our Chair apologised publicly for our part in this and set out lessons learned, which have informed our approach to awarding grades in summer 2021. We quickly put measures in place to increase our public enquiries capacity to make sure that people could contact us, receiving over 7,000 phone calls in August alone.

Outcomes

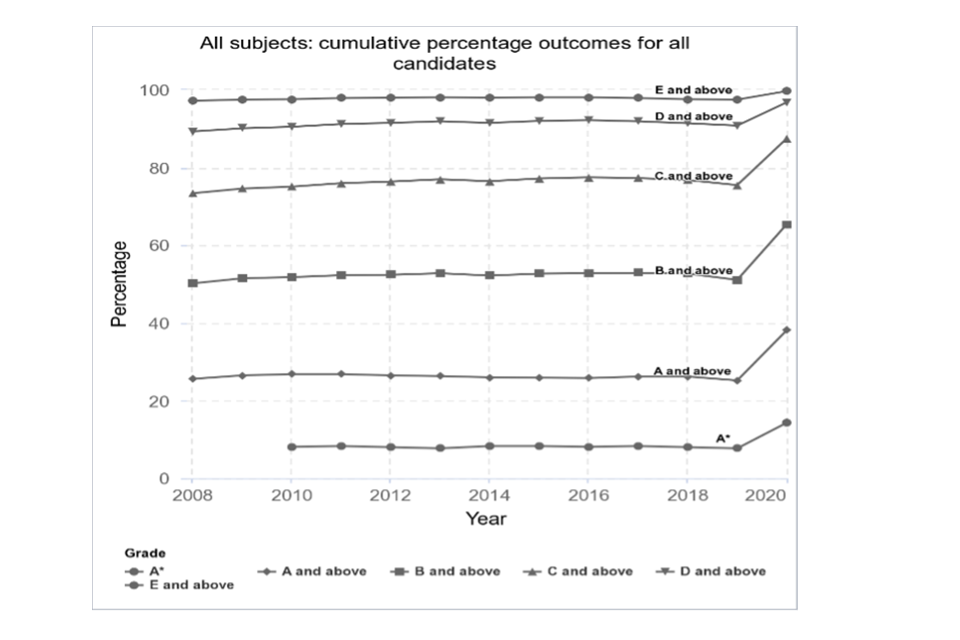

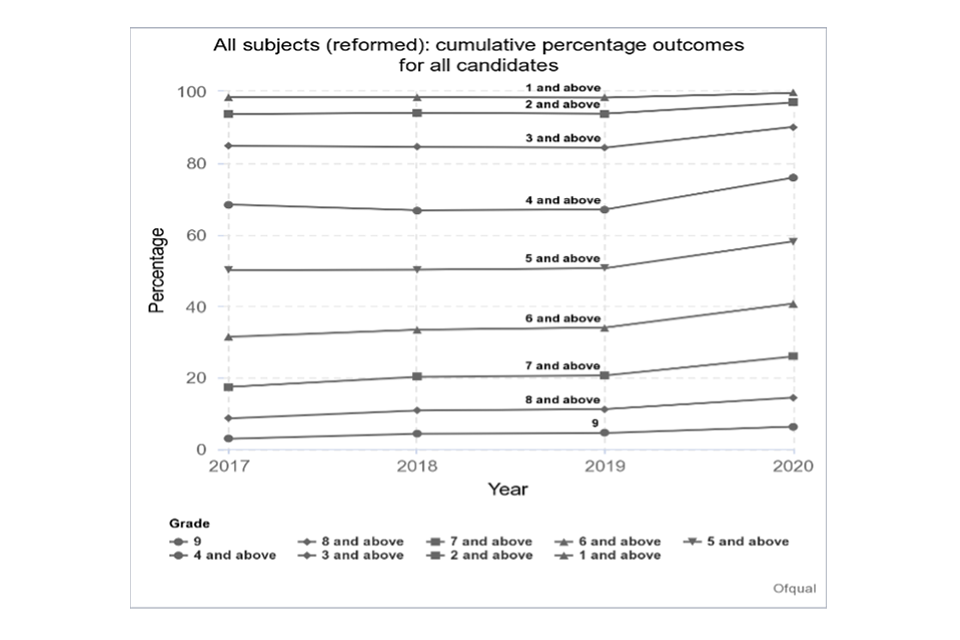

Reverting to CAGs, or the calculated grades where they were higher, meant that results in GCSE, AS and A levels were significantly higher in summer 2020 than in previous years. Overall, A level A and A* grades were up by 13 percentage points and GCSE grade 4 and above by 9 percentage points.

It is likely that this was due to a combination of factors, including the decision to issue the higher of the CAG or calculated grade, a general tendency for teachers to err on the side of generosity in borderline cases or where exam performance was difficult to predict, and inconsistency in approach between centres.

A summary of the year-on-year trend is set out in the figures below. More information and analysis of summer 2020 outcomes is available at gov.uk ‘2020 results and analysis’.

Figure 1 A level outcomes: all candidates

Graph showing the A levels grades being consistent between 2008 and 2019 and increased in 2020

Figure 2 GCSE level outcomes: all candidates

Graph showing the GCSE grades being consistent between 2017 and 2019 and increased in 2020

Evaluation

We have carried out and published a wide range of evaluative work on summer 2020 results to promote understanding of the process, support system learning and provide transparency. We published four key reports that were accompanied by interactive visualisations of the summer results:

- detailed equalities analysis, confirming the approach did not systemically disadvantage groups of students on the basis of particular protected characteristics or socio-economic status

- summer results analysis, showing the outcomes of the standardisation model including a breakdown of outcomes with CAGs, calculated grades and final grades by centre type

- standardisation of grades in general qualifications in summer 2020, looking at how we sought to identify students and learners where the standardisation model might have been unreliable. We concluded that a post-results appeal process was essential in such cases – though this was not ultimately used after CAGs, or calculated grades where they were higher, were issued

- impact of calculated grades, centre assessment grades and final grades on inter-subject comparability in GCSE and A levels in 2020, setting out a more technical analysis to help contribute to our understanding of grading in 2020, which will be used to support awarding in future years.

To allow others to review and evaluate Ofqual’s approach and support system learning and transparency we also released the computer code developed to support awarding of calculated grades in summer 2020. We initiated a data-sharing project through an independently chaired advisory board with the Deputy Chief National Statistician, the University and Colleges Admission Service, the DfE and the Office for Standards in Education (Ofsted) to give approved researchers greater access to the data used in 2020 awarding and its outcomes.

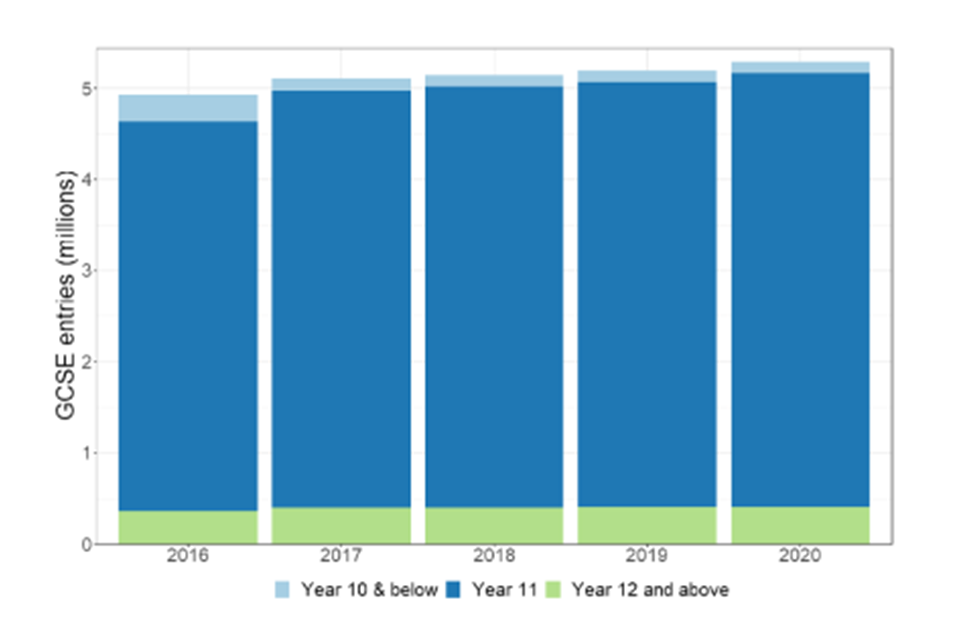

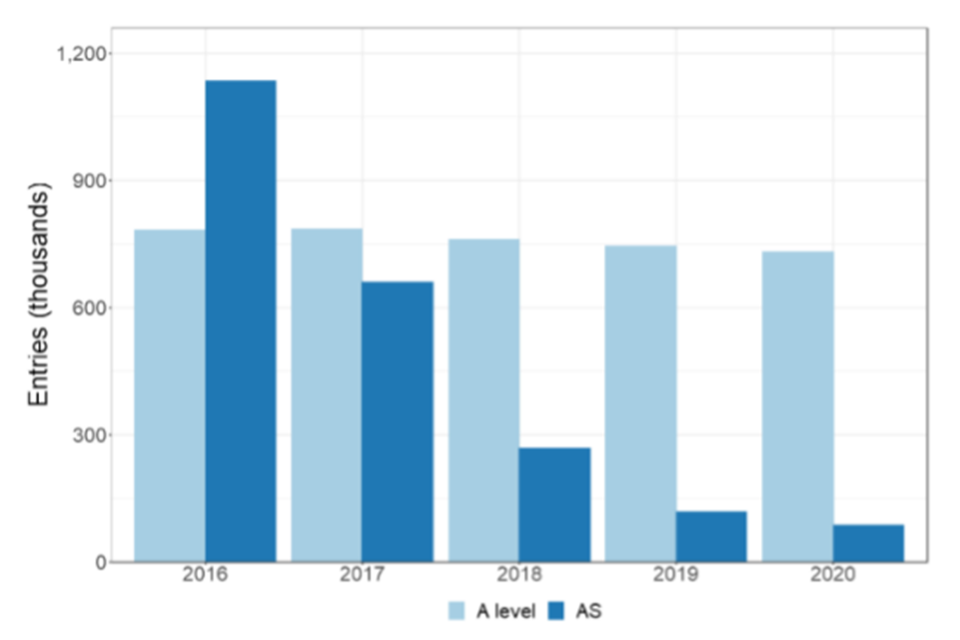

Entries for summer 2020

Students and learners had largely been entered for qualifications prior to the summer exam series not going ahead. Changes in entry numbers relative to previous years broadly reflected changes in the cohort sizes. For the summer series, GCSE entries increased by 2% to 5,281,745, mostly in entries for English Baccalaureate, or EBacc, subjects. This increase corresponds with an increase of 3% in the size of the 16-year-old cohort in 2020. Entries for the summer 2020 A level exam series decreased by 2% overall compared to 2019 (from 745,585 in 2019 to 731,855 in 2020), in line with a decrease in the size of the 18-year-old cohort, which fell by 3%. The overall entry for AS in summer 2020 decreased by 26% from 117,595 in 2019 to 86,970 in 2020. This is a continuing trend since the decoupling of AS and A levels in 2015.

Figure 3 Exam entries

Bar chart showing a steady increase in the number of GCSE entries in each year from 2018 to 2020

Bar chart showing a small decline in A level entries in each year from 2016 to 2020, and a notable decline in AS entries in the period

The largest entries for GCSE subjects were in combined sciences, maths, English language and English literature (each having more than 500,000 entries). The largest entries for A level subjects were maths, psychology, biology and chemistry (each having more than 50,000 entries). Additional information about summer 2020 entries can be found at gov.uk statistics.

Appeals

GCSE, AS and A level grades were finally awarded based on the higher of either the CAG or the calculated grade. Centres could appeal based on any of the following factors: procedural inconsistencies at the exam board, incorrect result issued by the exam board, centre error, incorrect dataset used by the exam board, error introduced by the exam board into the dataset used, or, for grades changed by the original standardisation model, an exceptional factor that undermined the assumption that using a default data set for statistical standardisation was the most likely to lead to consistent results.

Data from 2020 is not comparable with earlier years as the appeals and awarding process was very different in 2020.

In 2020, overall, 0.5% of the 6 million grades certified for GCSEs, AS and A levels were challenged, compared to 6% of exam grades in the previous year. Of the 27,560 grades challenged, 4,890 (18%) were changed. There were 2,995 appeals upheld. Only a small proportion (3%) of initial reviews progressed to an independent review. The vast majority of appeals in 2020 were made on the basis of centre error, with two-thirds of the appeals for GCSE. This included appeals on the grounds that the centre had submitted the wrong CAG for a student to the exam board as a result of an error.

Malpractice

Conclusions that can be drawn from comparisons with reported malpractice in previous years are limited, as there were no GCSE, AS or A level exams in 2020. New categories of penalty and offence were introduced in 2020 to capture malpractice cases related to the CAG process. These new categories were bias or discrimination, and negligence (types of offences), and referral to Teaching Regulation Agency (type of penalty).

There were 20 penalties issued to students and learners in 2020, representing a very small proportion of the 15,901,075 total entries this year. There were 15 penalties issued to school or college staff in 2020. These involved a very small proportion of the total number of staff in England (nearly 350,000 in state-funded secondary schools alone). There were 15 penalties issued to schools or colleges in 2020, involving less than 0.003% of centres. A small number of cases were not resolved at the point at which these official statistics were gathered.

Access arrangements

While GCSE, AS and A level exams did not go ahead in summer 2020, access arrangements are approved before candidates take an assessment. We have published figures representing access arrangements approved in advance of exams in 2019–20, including the summer exams that subsequently did not go ahead due to the Covid-19 pandemic. Figures reported to Ofqual show that there were 460,750 approved access arrangements, up 13.9% on 2018 to 2019 with arrangements put into place in just over 90% of centres. Two-thirds of those access arrangements related to 25% extra time, a similar share to the previous year. As exams were not taken, and modified papers were not used, data on modified papers was therefore not collected.

Autumn 2020 exam series

We consulted on the approach to the autumn exam series during May and June 2020 and received 3,481 broadly supportive responses. In usual years, there is an autumn series only for GCSE English language and maths, however, for 2020 we required exam boards to provide exams in all GCSE, AS and A level subjects. We set out our decisions at the end of June 2020 that included a need for exam boards to issue replacement certificates for the summer results if students requested this, in order to reflect the best result from either the summer or autumn series.

Overall, entries for the autumn series were low, particularly in comparison to the summer series. For example, for A levels, data shows 20,000 entries for autumn, compared to 700,000+ entries in a typical summer series. Nonetheless, we monitored delivery and oversaw exam boards’ compliance with the approach set out in our regulatory framework, as consulted on in May and June 2020.

We had raised issues relating to the security of question papers with exam boards ahead of the autumn 2020 series. Exam boards continued to consider risks and mitigations already identified, for example, by putting in place additional security measures originally planned to be introduced in summer 2020. Due to the small number of entries per subject in many centres, exam boards made greater use of electronic delivery in autumn 2020 and distributed exam papers in smaller batches to avoid the risk of losing multiple small packets.

National Reference Test (NRT)

One of the sources of evidence used in GCSE awarding is statistical predictions based on the prior attainment of the cohort. Each year Ofqual conducts the NRT to provide an additional source of evidence about the performance of year 11 students in English language and maths shortly before they take their GCSE exams. The test results can tell us whether student performance over time has changed because unlike exam papers it does not change from one year to the next.

The NRT 2020 was conducted between 24 February and 6 March 2020 and was largely unaffected by the pandemic. We are grateful to the nearly 13,500 year 11 students from over 330 schools who took part. In August 2020 we published the results of the test – in English, the changes compared to 2017 were not statistically significant while in maths, there was a statistically significant upward change at grade 7 and grade 4, suggesting that student performance had improved slightly. We also published a statement that set out our position in relation to the results.

On 2 February 2021, the Secretary of State determined that the NRT 2021 should be pushed back to the summer term. The outcome of the associated research will provide valuable information on learning loss in English and maths resulting from the pandemic. The 2020 results will provide an important baseline against which to compare the 2021 results. The financial impact on Ofqual of this deferral is explained in the financial review on page 40.

Sawtooth research

In November 2020 we published research and analysis on the ‘Sawtooth’ effect. This publication was designed to support the effective interpretation of assessment results, and steps that can be taken, before or after awarding, to minimise the likelihood of misinterpretation of results. It provided a comprehensive overview of the maintenance of standards as well as how different approaches are applied so that, for example, candidates are not disadvantaged by being the first cohort to take a newly reformed qualification, when we would naturally expect performance to dip, due to lack of familiarity.

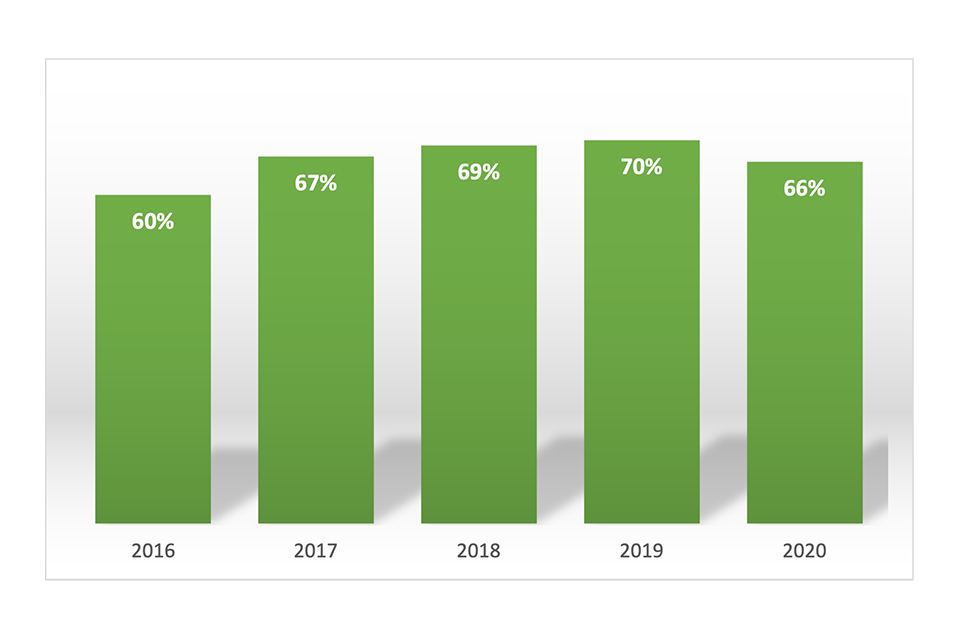

Perceptions survey – 2019 qualifications

Each year we survey a representative sample of students and learners, parents, employers, teachers, headteachers, staff in higher education institutions and the public to help us understand how qualifications are perceived and how well they are understood. Carried out prior to the exceptional arrangements in summer 2020, the survey showed that there was an increase in overall confidence in GCSEs, overall confidence in AS and A levels remained consistent, overall composite confidence was highest for AS and A level qualifications and among employers, there was an increase in confidence in both GCSEs and AS and A levels. Meanwhile, for parents there was an increase in confidence in AS and A levels while among headteachers, confidence in AS and A levels decreased.

Preparations for awarding GCSEs, AS and A levels in 2021

The Secretary of State wrote to Ofqual on 18 June 2020 setting out his policy intentions that exams should be reinstated in 2021 and that he was not minded to specify changes to the content of those qualifications. On 2 July 2020, we opened a consultation on proposed changes to GCSEs, AS and A level assessments for students and learners entering the qualifications in summer 2021. The consultation closed on 16 July and attracted 28,972 responses. On 2 August, we published our decisions, including changes to how content would be assessed in GCSE English literature, history and ancient history to help teachers and students and learners cover that content in appropriate depth, and changes to non-exam assessments and to fieldwork requirements in a number of subjects.

We continued to keep our position on exams and assessments in 2021 under review and to engage with key stakeholders, including teacher, school and college associations. In light of the continuation of the pandemic and its disruptive effects on teaching and learning into the autumn term we considered whether there was more that needed to be done to address ongoing learning loss. On 3 December, we announced our intentions in relation to further adaptations and to grading standards. This included our intention to require exam boards to carry forward the same level of generosity from summer 2020 through to summer 2021, in light of the need to promote fairness between students and learners being awarded qualifications in 2021 and those who had been awarded qualifications in 2020.

On 10 December we opened our consultation on our proposals that students and learners should be given advance information about some of the topics to be covered in the summer exam papers and additional support materials for use in the exam in some subjects. We also published research setting out the benefits and drawbacks of greater predictability and optionality in exams. We advised that we would release detailed information on adaptations for each subject in January 2021. This work was stopped due to the government’s decision that it was no longer fair for the summer 2021 exams to go ahead as planned. While decisions were not, therefore, made following this consultation, we nonetheless analysed consultation responses and published this analysis on 8 March 2021.

2021 GCSE, AS and A levels

On 4 January 2021, the Prime Minister announced that exams could not go ahead fairly in 2021, given a new national lockdown and the closure of schools and colleges to all but vulnerable students and children of key workers.

By mid-January 2021 the DfE and Ofqual had launched a joint consultation seeking views on how to award grades in summer 2021 that reflected students and learners’ performance and recognised the disruption to their education. The consultation closed at the end of January 2021 and received 100,597 responses. We read and analysed all of the responses to inform decisions about the approach to awarding in summer 2021.

At the end of February 2021 the DfE and Ofqual announced decisions on arrangements. These included that teachers would determine grades by assessing the standard at which students were performing based on a range of evidence gathered throughout their course of study. Students would only be assessed on content they had been taught.

A key element of the system was that private candidates would be able to receive a grade at the same time as other candidates through arrangements supported by the DfE and results days would be earlier than normal to allow more time for students to secure their next destination, including appeals (10 August 2021 for AS and A levels and 12 August 2021 for GCSEs).

On 25 February 2021, we published a technical consultation to enable us to set our regulatory rules so that exam boards would deliver and award qualifications in accordance with the policy decisions set out above. This consultation included draft guidance for heads of centre, heads of department and teachers about how to generate the evidence to be used to determine their students’ grades. We also sought views on the proposed rules, and the proposed ‘Information for centres about making objective judgements’. We received 242 responses, which we analysed prior to finalising and publishing our regulations and guidance on 24 March 2021. This included our regulatory framework on general qualifications awarding in summer 2021, ‘General Qualifications Alternative Awarding Framework’ and updated guidance for heads of centre, heads of department and teachers, and updated ‘Information for centres about making objective judgements’.

Throughout both planning for exams in 2021 and then for teacher assessed grades (TAGs), we have engaged intensively with stakeholders. As well as engagement with teachers, schools and college associations, we also met with student groups, universities, parent groups and equality and social mobility groups, including experts in teaching students and learners with Special Educational Needs and Disabilities.

Regulating vocational and technical qualifications in response to Covid-19

Regulating vocational and technical qualifications in the context of Covid-19 has been a significant activity this year. The vocational and technical qualifications market is complex with over 160 awarding organisations offering many different qualifications. Regulatory arrangements for this wide variety of qualifications required a flexible approach. While some qualifications could use a similar approach to that established for GCSE, AS and A levels, others required something different. These arrangements provided awarding organisations with the ability to adapt their qualifications appropriately and validly, to enable as many learners as possible to receive qualifications and progress in their lives. We monitor and adapt these arrangements to ensure that we continue to regulate effectively in light of the changing situation.

Following the announcement that the vocational and technical qualification exams and assessments could not go ahead fairly in summer 2020 and the Direction received by us from the Secretary of State on 9 April 2020, we implemented, after consultation, the necessary regulatory framework for vocational and technical qualifications. The overall aim was that students and learners taking qualifications should, wherever possible, receive a result that fairly reflected their level of attainment in line with the approach agreed for GCSE, AS and A levels. However, the Direction also recognised that we would need to adopt different approaches for vocational and technical qualifications due to the diversity of the qualifications in the sector.

Following the consultation, our regulatory framework required awarding organisations to identify their vocational and technical qualifications as being in one of three categories:

- those used for progression to further or higher education

- those signalling occupational competency

- those serving a mixed purpose

ERF

For those qualifications used for progression to further and higher education, learners received a calculated result in the same way as GCSE, AS and A levels. For qualifications signalling occupational competency, the assessments were adapted or delayed to ensure they remained valid and maintained the confidence of employers. If a qualification had a mixed purpose, the awarding organisation decided on the most appropriate approach.

To ensure clarity for learners, parents, providers and stakeholders we worked closely with awarding organisations, teachers and others in the education and skills sectors to help them understand what the ERF meant for them. Our engagement included webinars for stakeholders and we published a wide range of guidance for teachers, learners and parents. This included an interactive qualification explainer tool, which detailed the approach for each qualification. This was accessed 37,100 times between May 2020 and February 2021.

We worked with awarding organisations on their categorisation of qualifications throughout the implementation of the ERF and in the run up to summer awarding. We also engaged extensively with other regulators and stakeholders. This collaboration allowed us to develop and implement the ERF in a consistent and informed way at pace.

Despite the robustness of the ERF, the delivery of results by awarding organisations was not as smooth as we would have liked for all learners. Some learners received their final qualification-level results later than they had expected them.

In some cases, this was because the awarding organisations decided to recalculate their results in light of the decision to revert to CAGs for GCSEs, AS and A levels, in order not to disadvantage learners taking comparable vocational and technical qualifications. Recalculation was, in many cases, not a straightforward process because qualification-level results often comprise a number of unit-level results, only some of which used calculated results. In other cases, results were later than expected by learners because awarding organisations did not have all the data they needed from schools or colleges to calculate final results. Where data was available, all results were issued by 28 August 2020.

It is important to consider the delay in the issue of some results in the wider context. Results for many hundreds of thousands of vocational and technical qualifications were issued in the summer, a position achieved through the effective working of the more flexible regulatory framework and the response by awarding organisations to put in place the necessary arrangements and processes.

We worked extensively with awarding organisations to promote as much consistency as possible in the approaches they took to determining results for qualifications that were similar. However, inconsistencies did persist as awarding organisations took their own decisions in their approach. This caused difficulty for centres, who were receiving confusing information about approaches from different awarding organisations. We reflected on this and drew learning from these issues to improve the development of the subsequent Extended ERF and Vocational and Technical Qualifications Contingency Regulatory Framework (VCRF).

Centres also reported that they found the communications from awarding organisations to be confusing and sometimes contradictory, leading to a risk of inconsistency and unfair outcomes. To help resolve this, we formed a joint working group with representatives from awarding organisations, centres and the other regulators to identify where and when additional communications to centres are needed. This was to assist centres in planning and to streamline communications wherever possible. We are in regular contact with these representative organisations and their members, including holding monthly meetings to discuss upcoming requirements.

Monitoring the ERF

Each year we require awarding organisations to provide us with an annual self-assessment of compliance with our rules. We postponed the Statement of Compliance process in 2020 to allow awarding organisations to focus on delivering awarding, in compliance with the ERF, and for us to deal with the immediate priorities relating to this.

We found that the most common adaptations made by awarding organisations, in line with the ERF, were remote invigilation and remote assessment. We brought awarding organisations together to increase their awareness of malpractice risks where innovative approaches to awarding were introduced, to discuss how they might mitigate them and what the key considerations were to maintaining the security and validity of assessments.

We have initiated research to understand more about awarding organisation and learner experiences of these approaches.

As part of our monitoring of the ERF we identified a number of awarding organisations to target for ‘readiness’ checks, to understand the extent of their preparedness for delivery of the ERF in summer 2020. The awarding organisations we selected for the reviews included those that we considered the highest risk if something were to go wrong, for example, those delivering high-stakes qualifications such as performance table qualifications and those with high volumes used for progression.

Eight awarding organisations had a full readiness review. The exercise proved a valuable one in gaining assurance that these awarding organisations were sufficiently prepared to manage and mitigate the risks of Covid-19 and identify potential risks which we fed back to the awarding organisations concerned. These risks included the high level of discretion given to centres on adaptations to assessments, not giving centres sufficient clarity on new or revised processes and deadlines and not being sufficiently prepared to investigate malpractice and handle appeals.

We also undertook targeted reviews with a further 20 awarding organisations on their approach to the ERF. While we gained broad assurance across this group of awarding organisations, we identified some issues and risks that were escalated and addressed with those concerned. These included, for example, the potential impact of a large number of calculated results being outstanding from centres very close to the deadline, apparent lack of checks on learner eligibility for adapted assessment, a lack of regard to sector body requirements, and depleted cash reserves.

We required all awarding organisations to formally submit to us details of the actions they were taking to implement the ERF for their qualifications. We reviewed a sample of this information from awarding organisations and considered whether the actions proposed were sufficient to secure valid awarding in summer 2020. This review also helped us gauge whether the actions taken across awarding organisations were consistent.

Feedback was provided to all awarding organisations on their submissions and most resubmissions left us content with the awarding organisation approach. However a small number raised significant concerns which were dealt with on a case-by-case basis. In two cases where we remained concerned about the approach taken, we issued Technical Advisory Notices to awarding organisations requiring them to take further action to provide us with additional assurance.

Evaluation of the vocational and technical qualifications 2020 outcomes

As results were not issued in the same way as in previous years it was important for us to explore any changes over time to ensure that no particular groups of learners were unfairly advantaged or disadvantaged by the approaches taken this year, relative to previous years. We therefore undertook an analysis of vocational and technical qualifications outcomes in summer 2020, looking specifically at performance table qualifications, other general qualifications and Functional Skills qualifications. We collected data from a representative sample of 33 awarding organisations for 1,008 qualifications. In order to make comparisons over time we also reviewed the outcomes for the same qualifications in 2018 or 2019.

Our analysis showed that the grades awarded to those who completed vocational and technical qualifications in summer 2020 were not substantially different to those from previous years, despite the impact of Covid-19 on the assessment arrangements. The evaluation also found that, in general, attainment gaps between different demographic groups did not increase. This indicates that these grades were not unduly affected by the impact of the pandemic and that no specific groups of learners were treated unfairly.

The analysis also showed that overall grade distributions were similar to those of previous years. There was, however, a notable increase in the number of top grades being awarded for certain types of qualifications. This was largely due to the grades of many vocational and technical qualifications being moved upwards, after they were reissued, following the decision to revert to CAGs for GCSEs, AS and A levels. We will continue to evaluate the impact of Covid-19 on the outcomes in summer 2021.

Implementing the Extended ERF

Due to the ongoing impact of the Covid-19 pandemic, appropriate regulatory arrangements for vocational and technical qualifications assessments due to take place in the remainder of 2020 and 2021 were required. In June 2020 the Secretary of State confirmed his intention that exams should go ahead as planned in the 2020-21 academic year and asked us to consider how assessments could be adapted to take account of the disruption to education caused by the pandemic.

Following a consultation, the Extended ERF was established in October 2020. This gave awarding organisations unprecedented flexibility to adapt their qualifications to free up time for teaching and learning and to mitigate the effect of disruptions to teaching, learning and assessment.

Awarding organisations responded by making assessments as manageable and flexible as possible, to address the impact of compliance with social distancing or other public health guidance and to safeguard against disruption because of lockdowns or closure of facilities. As in normal times, it was for awarding organisations to decide the best action to take in relation to their own qualifications. The new framework gave them important guiderails and limits to work to – so that results remained sufficiently valid and reliable. As we made clear at every stage of our response to the pandemic, fairness for learners was a key priority. We required that learners should not be disadvantaged or advantaged compared with their peers taking GCSEs, AS and A levels.

We developed additional guidance to support the awarding organisations in delivering their 2020 – 2021 approach on adaptations ensuring as far as is possible, that awarding organisations acted consistently, particularly when delivering similar qualifications. We advised awarding organisations of the need to work with professional and sector bodies to ensure that their adaptations and the qualifications learners achieved are acceptable within the relevant sector. We facilitated discussions between 20 different awarding organisation and industry bodies representing specific industries or qualification types. These resulted in greater understanding of adaptations, and alignment on which adaptations would be permitted.

Having learnt from our approach with the ERF, we worked proactively with 15 awarding organisations through a tailored and targeted monitoring programme – focusing on their operating models, capacity, qualification adaptations and safe delivery of specific qualification suites. For the majority of awarding organisations, we put in place a range of engagements through webinars and awarding organisations communications to support compliance and understanding of the Extended ERF.

As with the ERF, we required awarding organisations to maintain a record of their decision making, regarding any adaptations they were intending to make to their qualifications or assessments. In line with our risk-based approach to regulation, we requested and reviewed information and data from awarding organisations for specific high-stakes qualifications, such as performance table qualifications and Functional Skills. Where issues were identified, the awarding organisations were expected to makes suitable revisions to their adaptations. Overall, across the ERF and Extended ERF, we reviewed 159 submissions and 359 records as part of this work.

We continued to work closely with a wide range of stakeholders to understand the impact of the pandemic on learners and centres, and to help reduce disadvantage where possible. Learning lessons from summer 2020, we were conscious that colleges, training providers and schools needed clear, consistent messages, particularly as many vocational and technical qualification assessments are spaced throughout the year. Awarding organisations were required to communicate their plans for assessments from 23 October 2020, and sector representative groups confirmed that there was constructive communication and engagement between awarding organisations and centres.

Introducing the VCRF

Following the announcement that exams and some assessments could not go ahead as planned in 2021, we consulted, jointly with the DfE, to establish the policy and regulatory framework for vocational and technical qualifications. The consultation ran between 15 January and 29 January 2021 and received over 3,200 responses.

The DfE proposed that qualifications most similar to GCSEs, AS and A levels should be in scope for the alternative arrangements, and as a starting point this should include the qualifications that were eligible for calculated results in 2020 under the ERF. They also proposed that for qualifications requiring a practical assessment to demonstrate occupational competency or proficiency, or that operate as a licence to practise, assessments should continue to take place wherever possible, subject to public health guidance.

We set out the proposals that would be needed to implement this policy, so that awarding organisations can issue results to students and learners when exams and other assessments do not take place. The consultation responses were broadly in support of our proposals and in March 2021 we introduced the VCRF. The VCRF applies to all Ofqual-regulated qualifications apart from GCSEs, AS and A levels, apprenticeship EPA, and some other general qualifications.

In the VCRF qualifications are split into two categories: qualifications for which TAGs will not play a part in the awarding and those qualifications for which TAGs will play a part in awarding. Qualifications which will not have TAGs include qualifications which attest to occupational competency or act as a licence to practise, or signal proficiency in specific skills such as performing arts graded exams.

Awarding organisations are only allowed to award qualifications in this category based on assessments which have been completed by the learner. Provisions from the Extended ERF have been carried forward to allow awarding organisations to adapt assessments so that completion and awarding of qualifications are not automatically delayed. This maintains the confidence in these qualifications while giving learners the best opportunity to complete their assessments.

For qualifications where TAGs will play a part in awarding, there are two groups:

- vocational and technical qualifications and other general qualifications most similar to GCSEs, AS and A level where it is not viable for exams and other assessments to continue as normal

- qualifications for which exams and assessments can continue but may need alternative arrangements where students and learners cannot access them, such as Functional Skills qualifications and English for Speakers of Other Languages

Engagement with stakeholders continues to be important to ensure clarity and consistency within the sector. Many webinars and over 50 individual briefings with stakeholder groups ranging from unions, equalities groups, employer representatives and representative organisations have been undertaken. Alongside this we have shared widely information and resources on our consultation and decisions.

Awarding organisations are required to keep records of the decisions they make in relation to their qualifications, setting out the approach they intend to take in their qualifications as we did in the Extended ERF and we will again be monitoring awarding organisations’ approaches including through readiness checks.

Impact of Covid-19 on Functional Skills qualifications

We have addressed several specific issues relating to Functional Skills qualifications since the pandemic began. There are over 200,000 certifications of English and maths Functional Skills qualifications every year. They are important in terms of volume and the role they play for learners. Functional Skills qualifications are taken by a wide range of learners and are a key part of apprenticeships, delivered by a range of providers and centres. Some learners take these qualifications through a college, who tend to deliver the training and invigilate the assessments at their own premises. Work-based learners, including apprentices, may take Functional Skills qualifications through independent training providers who may not have their own training or assessment facilities. Instead delivery of the training is done remotely or via visits, and administering of the assessments in the workplace. These differences have impacted on how learners have been able to access these qualifications.

Functional Skills qualifications in English and maths have recently been reformed and have been available in centres since September 2019. However, many learners are still taking the older Functional Skills qualifications which are referred to as legacy qualifications. The legacy qualifications were due to be withdrawn on 31 August 2020, but due to Covid-19-related disruptions we agreed with the DfE to an extension to 31 December 2020 and then to 31 July 2021 to provide more time for learners to complete their remaining assessments. This means that apprentices have additional time to complete their training and assessment where they are still taking the legacy qualifications.

A variety of arrangements have been permitted over 2020 and entering into 2021 for Functional Skills assessments from the provision of calculated results in the ERF to an expectation that exams and assessments can take place to TAGs where assessments cannot be accessed on public health grounds or remotely. We have encouraged awarding organisations to develop common approaches to determine when learners can access a result through these alternative arrangements.

We are monitoring awarding organisations’ approaches to the assessment and delivery, including to apprentices, of Functional Skills qualifications and have published information from each awarding organisation about the forms of Functional Skills assessment delivery it has available. This monitoring includes scrutiny of the awarding organisations’ progress to develop flexible arrangements and their rollout of remote invigilation solutions. This monitoring will continue with the expectation that learners can progress quickly to the next stage of their studies or employment this year. It will also ensure that, if they are taking an apprenticeship, they will be able to complete their apprenticeship and progress into permanent employment.

Supporting quality in regulated qualifications and assessments

We are committed to qualifications and assessments that are fair, delivered securely, and that accurately reflect the performance of those who take them. It has therefore been important that, although Covid-19 has impacted on our capacity and activities, we continued work on our priority programmes to secure quality in regulated qualifications in the medium term.

This includes our work on T levels, the EQA of apprenticeship EPA, Higher Technical Qualifications (HTQs), digital Functional Skills qualifications, and our work to support the qualifications review at level 3 and below and the strengthening of qualifications at Key Stage 4.

In some cases, work has been delayed or de-prioritised to enable focus on the Covid-19 response. Where work has been delayed or replaced by other work, this is set out in the specific updates below.

T levels

T levels are new, two-year programmes in their first year of teaching, which are intended to be equivalent to three A levels. The programme provides a mixture of classroom learning with study towards a Technical Qualification, and an industry placement with an employer. The Institute is the lead government body responsible for the T level programme. At Ofqual, our specific role is to assure consistency in assessment and awarding of the Technical Qualifications (TQs) within T levels by:

- requiring organisations that wish to deliver TQs to be recognised by Ofqual to do so

- using our regulatory powers to maintain assessment standards

We have established a quality framework with the Institute that sets out how we are working together to ensure that TQs within T level programmes meet the needs of learners and employers.

In 2020 to 2021, we said we would work with the Institute to support the introduction of TQs within T level programmes, including: reviewing applications for recognition from awarding organisations bidding to offer T levels, submissions for accreditation of the TQs they develop and agreeing joint approaches to these TQs in delivery.

This year we accredited three wave 1 TQs, which went live for first teaching in September 2020, in the following subjects:

- Design, surveying and planning for construction

- Digital production, design and development

- Education and childcare

These new TQs have been impacted by the Covid-19 pandemic and are part of the new VCRF arrangements. For T levels this means that alternative arrangements for awarding the TQs will be put in place. Alternative arrangements will apply to the whole TQ core this summer, so that students and learners can receive their core grades in August as a calculated result. This will give students and learners sufficient time in the second year to prepare for the occupational specialism assessments and to complete their industry placement.

In January 2021 we also completed the accreditation of all the wave 2 TQs. This gives centres the opportunity to familiarise themselves with the content before first teaching in September 2021. These are in the following subjects:

- Building services engineering for construction

- Digital business services

- Digital support and services

- Health

- Healthcare science

- Onsite construction

- Science

For TQs in wave 3, we have recognised the awarding organisations that secured the contract with the Institute to deliver them and are currently reviewing the submissions for accreditation of six TQs in the following subjects:

- Accounting

- Design and development for engineering and manufacturing

- Engineering, manufacturing, processing and control

- Finance

- Maintenance, installation and repair for engineering and manufacturing

- Management and administration

The procurement process for the fourth wave of T levels was launched by the Institute in autumn 2020. Our recognition process for wave 4 is conducted in parallel, with decisions due later in 2021.

In addition to this we have reviewed and provided feedback to the Institute on the outline content for all T levels and have begun the first data collection on T level entries to support effective regulation of these new qualifications.

EQA of apprenticeship EPA

This year our EQA activity has included our established EQA delivery for apprenticeship standards where we are the existing EQA provider and the work we are doing to transition the EQA from other EQA providers to Ofqual.

We are the EQA provider for 202 standards and EQA delivery continues for these standards. By the end of December 2021 this will double to over 400 standards. By the end of phase two of the programme, in autumn 2022, we will be the EQA provider for over 530 standards.

Transition of EQA

In August 2020 the Institute published the outcomes of its consultation on a simplified EQA system in apprenticeships, confirming that EQA would be undertaken by Ofqual, or the Office for Students in the case of integrated degrees. This signalled a significant change in the previous EQA system where Ofqual was one of 21 organisations approved to deliver the EQA of EPAs.

Following this announcement, we have worked with the Institute and the Education and Skills Funding Agency (ESFA) to develop a roadmap to transition EQA of over 400 standards to Ofqual. One of the key requirements of regulation by Ofqual is that all End-Point Assessment Organisations (EPAOs) must be recognised by us as this is the process by which we check organisations have the right resources, capacity and capability to design, develop and deliver quality EPAs.

We agreed with the Institute and ESFA to implement the transition in two phases. The first phase of transition involves the transfer of standards where the Institute is the current EQA provider, and this is due to be completed by December 2021. In phase two we will transition standards from the remaining EQA providers, and this is due to be completed by autumn 2022.

In phase one there are over 300 standards that will transfer to Ofqual, and at the end of March 2021 we had transferred 112 standards. We have engaged with EPAOs as part of our strategy of early engagement to familiarise EPAOs with our recognition process and requirements and encourage good applications. Six EPAOs have successfully achieved Ofqual recognition and we expect many more to secure recognition in the coming months, maximising the opportunity to achieve recognition and protect learners.

We have, of course, been mindful of the impact of Covid-19 on EPAOs and their capacity to engage with the transition process. Considering feedback from EPAOs the Institute confirmed an extension to the deadline to apply for recognition. EPAOs are now aware that they must submit their applications for recognition no later than the 1 July 2021 and must complete the recognition process by the 16 December 2021.

We have published a range of support and guidance materials including videos and webinars to ensure that our process is as transparent and accessible to EPAOs as possible. We have also attended events and webinars hosted by sector partners to support EPAOs wherever possible.

Alongside our work on transition, we have continued to provide EQA for Apprenticeship EPAs currently in delivery. We have now reviewed all assessment plans that have transitioned in to Ofqual regulation. Our regulatory approach includes the technical evaluation of EPA materials. We have published a summary of our findings from technical evaluation to support EPAOs in understanding common issues we see in assessment materials. We also continue to monitor EPAOs through our Statement of Compliance process and our new field team, which has responsibility for undertaking monitoring of EPA in delivery.

The pandemic also affected the industries and sectors in which apprentices are working and the nature of assessments that could be undertaken. Throughout the year we have worked closely with the Institute, EPAOs and employers to enable appropriate flexibilities and adaptations to be implemented. Securing a balance which retains assessment validity, while accommodating of public health and other industry requirements, and meeting employer and apprentice needs has been vital, and has enabled many apprentices to progress within their chosen industry.

HTQs

In July 2020, the government published its plans for the future of higher technical education at level 4 and 5 in England. These plans set out the government’s ambition to increase the number of learners at level 4 and 5, and the supply of skills to raise productivity.

We committed to work with the DfE, the Institute and the Office for Students to establish a co-ordinated regulatory approach for new Institute-approved HTQs at levels 4 and 5. The Institute is responsible for approving HTQs. For those that are regulated by Ofqual, we will provide advice on their quality to the Institute as part of their approval process.

The first approval process started in September 2020 and focused on qualifications in the digital route. The first qualifications will be available to learners from September 2022. We are continuing to develop our long-term approach to regulating these qualifications with the Institute and DfE.

Digital Functional Skills qualifications and Essential Digital Skills qualifications

In March 2020 it was expected that the DfE would publish subject content for digital Functional Skills qualifications and we intended to publish our technical consultation on these qualifications alongside this. However, due to the pressures on awarding organisations dealing with Covid-19, both aspects of this work were paused. We are now working with the DfE to agree a revised timeline for the introduction of these new qualifications.

On Essential Digital Skills qualifications, awarding organisations were already working on their submissions for technical evaluation when Covid-19 emerged. As this development was significantly advanced, it was determined to be prudent not to delay this work but to allow awarding organisations to submit their qualifications when ready and we would review them as planned. There are now seven technically evaluated Essential Digital Skills qualifications available to learners. We will review further qualifications as and when awarding organisations submit them. We have published details of the awarding organisations Essential Digital Skills qualifications progress so far on our website.

Review of post-16 qualifications at level 3 and below

The government is reviewing publicly funded qualifications at level 3 and below – with over 4,000 qualifications in scope at level 3 and 8,000 at level 2 and below. This programme aims to help secure the vision set out in the original Sainsbury Review. The goal is to ensure that every qualification approved for public funding has a distinct purpose, is high quality and supports progression to positive outcomes for students and learners, with the emphasis on T levels or A levels as the two preferred options. An explanation of the different qualification levels can be found on the gov.uk website.

We said we would support the DfE in its review of post-16 qualifications at level 3 and below. We formally responded to their consultation in December 2020. In our response we set out our support for ensuring that publicly funded qualifications are high-quality, have a distinct purpose and support successful progression. A key element of our role will be in strengthening our regulatory approach to secure greater assurance of the validity and reliability of qualifications at this level, initially focusing on those used in school and college accountability measures.

In our response we also stated that the system’s capacity for handling the change should be a key consideration in the reform and welcomed the DfE’s recognition that any reforms should be phased in line with T level rollout to allow for an orderly consolidation of the market. We also cautioned about the need for flexibility in the size of qualifications available. In particular, learners with Special Educational Needs and Disabilities, or those with caring responsibilities, for example, may need to study part-time or more flexibly and so may face difficulty accessing a T level which is equivalent in size to three A levels.

Strengthening Technical Award qualifications at Key Stage 4

In March 2020 the plan to review qualifications at Key Stage 4 (14- to 16-year-olds) used for accountability purposes was paused in light of the pressures on awarding organisations dealing with Covid-19.

We continued to work with the DfE to establish a process for reviewing these qualifications and ensuring that they are of the right standard. A new delivery plan was established in autumn 2020 and the submission window for awarding organisations that wanted to submit qualifications opened in December 2020 and closed on 28 January 2021. We have begun the review of 66 Technical Award qualifications from 12 awarding organisations. Only qualifications that successfully complete the process will be eligible to appear in the DfE’s performance tables from 2024.

This is a new process, where we are providing advice to the DfE about the quality of submissions at this level, reflecting particularly on the accountability context in which they will operate.. This programme of work means we are on track to complete evaluation of these qualifications in time to support the DfE’s review of performance table qualifications, for publication of the 2024 Performance Table List in September 2021. The decisions themselves about inclusion on KS4 performance tables remain the responsibility of the DfE.

Promoting an efficient and effective market

One of the ways in which we promote an efficient and effective market is by publishing data to help people better understand and navigate it.

To this end, we published new data this year about how qualifications were to be delivered and about the usual functioning of the market. This included two vocational and technical qualification apps for use in 2020 and 2021:

- an Ofqual Qualification Explainer Tool, accessed over 39,000 times in 85 countries, covering 17,000 qualifications, and providing information about which vocational and technical qualifications were being delivered through an adaptation to the usual assessment method, a calculated grade, or were being delayed

- a new Regulated Qualifications Landscape app combining providing information on the breadth of qualifications offered in different segments of the market, the demand for these qualifications, and contrasting the popularity of qualification types

In February 2021 we published our Annual Qualifications Market Report offering an overview of the market in the 2019–20 academic year. For the first time, this included data on international certifications, with additional insights into the international regulated market through an Ofqual blog. Almost 4.9 million certificates were issued for non-UK delivery across the regulated market, with over 100 awarding organisations having at least one qualification certified internationally.

New rules around awarding organisation fee transparency were introduced in January 2021 following consultation alongside Qualifications Wales and CCEA Regulation making it easier for potential purchasers of qualifications to make informed choices about the qualifications available.

Our second Qualification Price Index (QPI) was published in February 2021, covering fees for qualification delivery in 2020 on the basis that the year had gone ahead as normal. The index shows that general qualification fees rose by 3.3%, and vocational and technical qualifications rose 2.9%. Recognising that 2020 was far from a typical year, we published the QPI with a further supplementary analysis of the different activities that were necessary for qualifications to be delivered in light of the pandemic. This focused on both new and saved costs that awarding organisations and centres experienced, including the activities that were no longer required in both general qualifications and vocational and technical qualifications, and the new activities that were introduced in their place.