Office for Nuclear Regulation Annual Report and Accounts 2020 to 2021

Published 13 July 2021

Performance Report

Chair’s Foreword

I am pleased to report that we have delivered our mission to protect society by securing safe nuclear operations and made important steps to achieve our 5 year vision to be a modern, transparent regulator delivering trusted outcomes. And of course, all this in the midst of a global pandemic.

We maintained delivery of our core regulatory work, as well as focussing on specific projects and priorities, targeting the most significant hazards and risks on licenced sites.

During the year, we became the safeguards regulator, operating a domestic safeguards regime following the post-EU transition period. This was a major project and a key priority for us, setting up a whole neFw team, new processes and new systems, including a bespoke IT system.

We met all our reporting obligations under the new nuclear safeguards regulations and delivered our first full submission to the International Atomic Energy Agency early in 2021, while continuing to facilitate international inspections under international agreements.

If that wasn’t significant enough in itself, this is the year that will always be remembered as the year we’ve seen our people and our organisation face the significant challenge of COVID-19.

Overseeing our response to the global pandemic has been my Board’s key priority and challenge as we – and the industry we regulate - adapted to new ways of working.

We’ve continued to listen to, learn from and collaborate with a wide range of stakeholders across the UK and internationally, quickly adopting virtual and remote ways of engaging.

This enabled us to share good practice and learning and continue to influence improvements in nuclear safety, security and safeguards, as well as our response to the pandemic.

Internally, I was reassured that an independent effectiveness review of our Board and Audit and Risk Assurance Committee (ARAC), conducted by external consultants, concluded that ONR, our Board and ARAC displayed high levels of governance and that both were well run and well chaired.

In May and June this year, we said goodbye, with gratitude, to Bronwyn Hill and Oona Muirhead after admirable service to the Board. We welcomed Tracey Matthews, Jean Llewellyn and Janet Wilson as our new non-Executive Directors.

I announced in December that we would be restructuring our leadership team to align with other regulators across the world, with a new combined post of Chief Executive and Chief Nuclear Inspector, filled by Mark Foy.

I would like to thank Adriènne Kelbie CBE, who was Chief Executive for the period of this report, and stood down on 31 May 2021. During her time at ONR, Adriènne transformed the organisation into a mature, high performing regulator.

I have every confidence that our Board and new senior leadership team will go from strength to strength building on the work in setting the organisation’s strategic direction to 2025 and beyond, and will continue to inspire trust and confidence in our regulation.

Mark McAllister

Chair

Chief Executive and Chief Nuclear Inspector’s Foreword

I am delighted to have been appointed as Chief Executive and Chief Nuclear Inspector in our new leadership structure. I would like to recognise Adrienne’s important contribution to the work and successes outlined in this report, as Chief Executive during 2020 to 2021, and acknowledge the support I have received from her during the year.

Of course, the focus for me and our team was the considerable challenge that was posed by COVID-19 during the whole year. Our focus had to be on staff wellbeing and ensuring our staff could work at home, supplying equipment, implementing special leave arrangements and providing the tools and guidance necessary for our people to work effectively and collaboratively from remote locations across the UK, responding to the dynamic changes in guidance and public health advice.

We quickly established an Incident Management Team to direct our response, supported by our Recovery Working Group to shape and implement arrangements.

I’m proud of the work our leadership team did in response to the pandemic and the resilience and commitment shown by our staff to ensure we continued to deliver our mission, demonstrating ONR can adapt to regulate effectively in times of crisis.

We focused on the critical and essential activities that enabled us to regulate effectively, seeking assurance that dutyholders could maintain their operations safely and securely. We engaged across the industry and with other regulators, in the UK and internationally, to learn, share best practice and improve resilience now and for the future.

While COVID-19 naturally dominated our work and strategy, I’m proud we delivered successfully against our 5 priorities that were laid out in our Corporate Plan 2020 to 2021.

We continued our targeted oversight at sites that I considered needed ‘Enhanced Attention’, we focused on fully implementing our Security Assessment Principles; and we began shaping how we can further improve our transparency with our stakeholders and the public, while ensuring we engaged and communicated effectively during pandemic.

In Autumn 2020, I published my second CNI Annual Report on the safety, security and safeguards performance of Great Britain’s nuclear industry. This provided an insight into the industry’s performance, as well as our regulatory interventions.

I am pleased that we successfully separated our IT system from the Health and Safety Executive, giving us our independent infrastructure to drive forward our IT modernisation plans over the coming years. I am delighted that we have continued to make progress towards delivering our Well-Informed Regulatory Decisions (WIReD) project too.

As the Chair has noted, we also became the domestic safeguards regulator this year, a significant addition to our role, as part of our Civil Nuclear Security and Safeguards division. You can read about this – and all our other work – in more detail in this report.

This has been a difficult year for us all, and I must end by thanking our staff for the incredible resilience, commitment and capability they have shown. I am proud to be leading them.

I look forward to working with my new team and the Board to ensure the continued protection of the public.

Mark Foy

Chief Executive and Chief Nuclear Inspector

Performance overview

The overview section provides a summary of ONR’s role, our purpose, the key risks to the achievement of our objectives and how we have performed in the year.

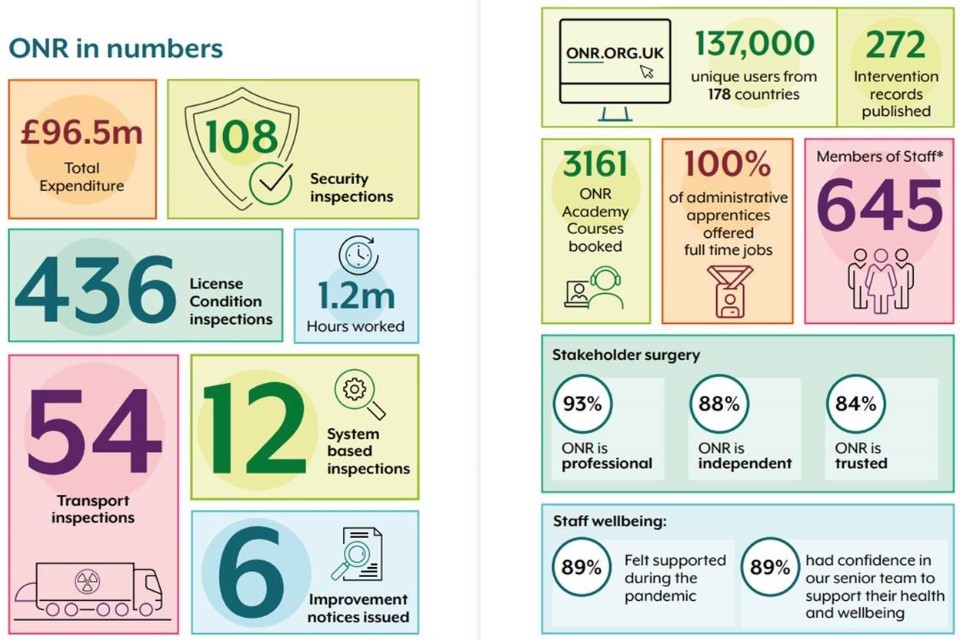

ONR in numbers – 2020 to 2021

As at 31 March 2021.

About ONR

We are the UK’s independent nuclear regulator for safety, security and safeguards.

We have the legal authority to regulate nuclear safety, nuclear security and conventional health and safety at the 36 licensed nuclear sites in Great Britain (GB). This includes the existing fleet of operating reactors, fuel cycle facilities, waste management and decommissioning sites, as well as licensed and, in part [footnote 1], authorised defence sites, together with the regulation of the design and construction of new nuclear facilities, including the supply chain..

Our nuclear security regulation ensures the adequacy of security arrangements for dealing with special nuclear material and special nuclear information within the civil nuclear industry and we also regulate the safety and security of the transport of civil nuclear and radioactive materials by road, rail and inland waterway, extending our regulation across a large number of dutyholders.

On 1 January 2021, we became the UK nuclear safeguards regulator for the domestic standards regime and began to operate the UK State System of Accountancy for and Control of Nuclear Materials (SSAC).

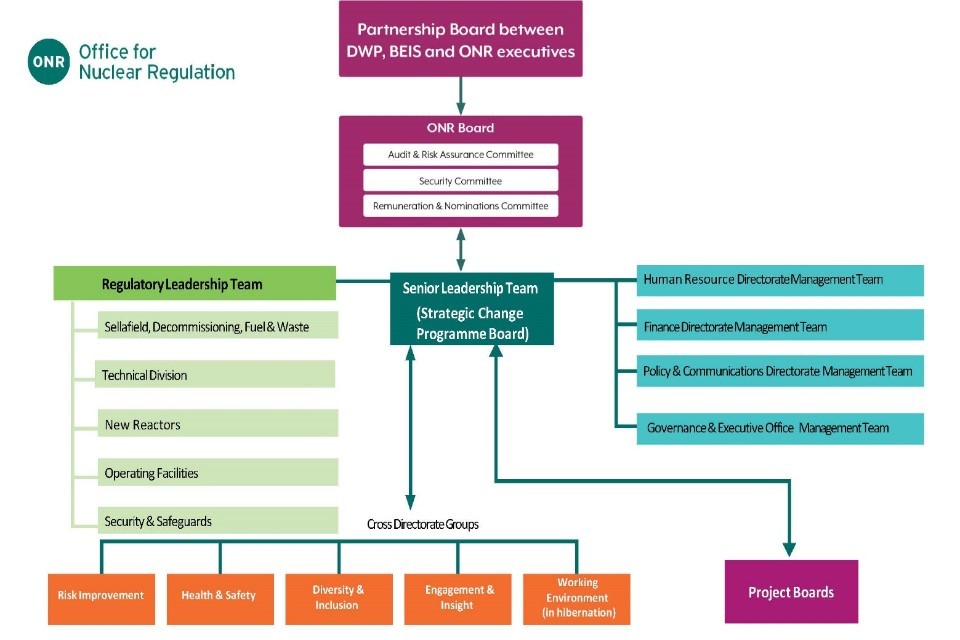

We are governed by a 10-strong unitary Board, comprising a Chair, 5 independent Non-Executive Directors from a range of backgrounds, and 4 Executive Directors.

In 2020 to 2021, the 4 Executive Directors were Adriènne Kelbie, our Chief Executive (CE), Mark Foy, our Chief Nuclear Inspector (CNI), Sarah High, our Deputy Chief Executive and Finance Director and David Caton, our HR Director.

During this year, we announced a new leadership structure for 2021 to 2022. More detail of our new structure can be found in the Directors’ report.

The Board is responsible for our strategy, provides strategic leadership and monitors resources and performance, and supports the work of over 600 staff, normally based in Bootle, Cheltenham and London. The Board also ensures that effective arrangements are in place within our organisation to provide assurance on governance, risk management and internal control.

The Chief Executive is accountable for ensuring that all ONR funds are spent in accordance with HM Treasury’s ‘Managing Public Money’, and other relevant governing guidance and instructions.

The Chief Nuclear Inspector is accountable for ensuring that our regulatory activities are targeted effectively and discharged properly; and that regulatory decisions are proportionate, consistent and are made within the legal requirements of the Energy Act 2013 and other appropriate legislation. This became a dual role on 1 June 2021.

Our Senior Leadership Team (SLT) is responsible for leading ONR in delivering its mission, vision and strategic outcomes. During 2020 to 2021, the SLT comprised 5 deputy chief inspectors leading our regulatory divisions, and our directors of finance, HR and policy and communications, as well as our CE and CNI.

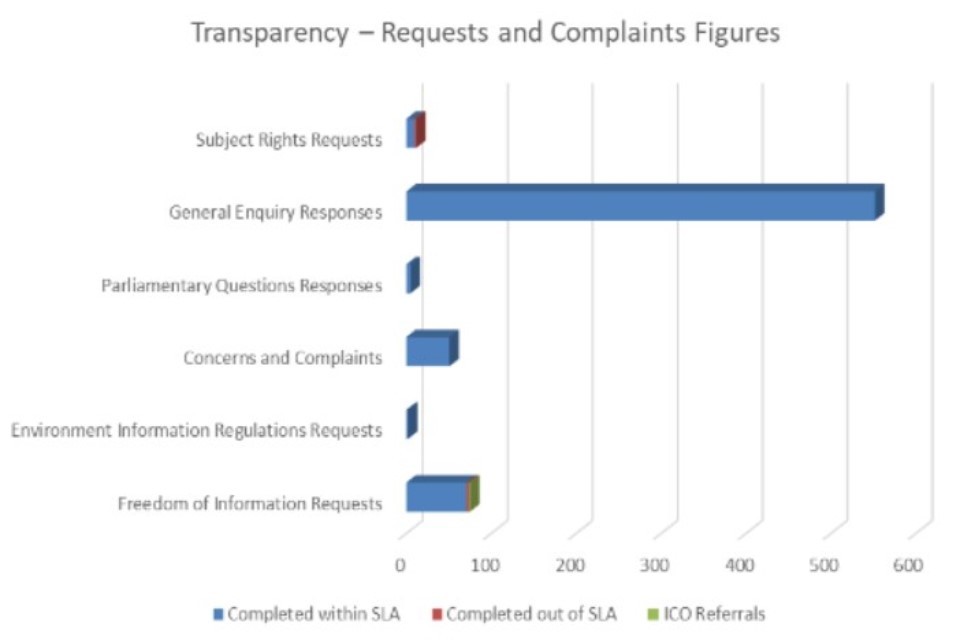

Transparency about our work is essential to build and maintain public confidence in our regulation. We provide a significant amount of information on our regulatory activities on our website and through our stakeholder engagement.

We always seek to be more open and transparent by sharing information on our activities, answering questions, exploring concerns and explaining our regulatory decisions. You can find out more about us on our website.

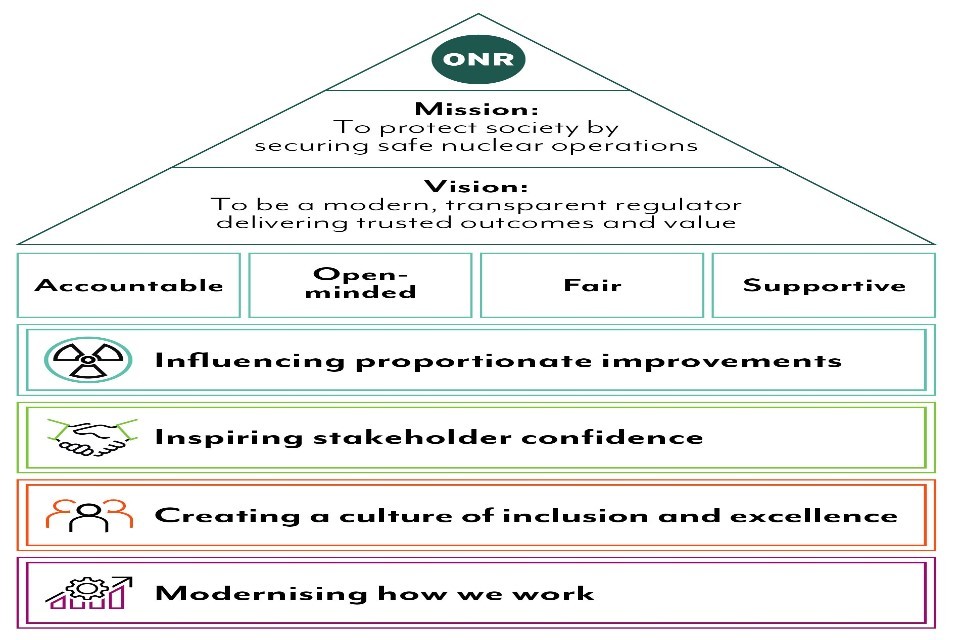

Our strategic themes

The ONR Corporate Plan 2020 to 2021, our first to deliver our Strategy 2020 to 2025, set out 5 top priorities, taking account of the actual and projected impact of COVID-19 on our regulation, staff wellbeing and internal operations.

We pared-back our approach to organisational development and change projects, to ensure we protected capacity and capability for essential and time critical activities to deliver our mission to protect society by securing safe nuclear operations.

Top 5 priorities 2020 to 2021

Strategic Theme 1: Influencing proportionate improvements

1. Maintain delivery of our core regulatory functions, holding dutyholders to account on behalf of the public. This will include targeted regulatory oversight of progress at ‘Enhanced Attention’ sites and assurance on safety and security in light of the COVID-19 pandemic.

2. Deliver an effective UK State System of Accountancy for, and Control of, Nuclear Material (SSAC) and implementation of Security Assessment Principles (SyAPs) across all dutyholders.

Strategic Theme 2: Inspiring stakeholder confidence

3. Enhance transparency through our stakeholder engagement, in line with the aspirations of our Strategy 2020 to 2025, to enable effective 2-way communications, particularly as we respond to COVID-19.

Strategic Theme 3: Creating a culture of inclusion and excellence

4. Promote the sustained health and wellbeing of our staff through effective and inclusive leadership and management, as we respond to COVID-19.

Strategic Theme 4: Modernising how we work

5. Deliver our 2 strategic change projects – separating our IT infrastructure from the Health and Safety Executive (HSE) and commencing a pilot of our Well-Informed Regulatory Decisions (WIReD) project.

Key issues and risks

Our Risk Management Framework is structured around the principles outlined in the government publication ‘The Orange Book’.

During the past year, our risk management processes have continued to develop and improve, with the introduction of an integrated Performance and Risk Information System for Managers (PRISM), including an audit and assurance module, which has delivered improvements in the quality, consistency and timeliness of our data management and information reporting in these areas.

We have reviewed and refreshed our Risk Management Framework, scheduled to be finalised during quarter one of 2021 to 2022.

The COVID-19 response has presented significant challenges, which have, and continue to be, effectively managed. Further details are provided below.

Like many organisations, cyber security and information management continue to be areas of focus, particularly due to the prevailing threat landscape. However, these risks are being managed by building on our new independent IT network infrastructure. The overall direction in our management of risk throughout 2020 to 2021 has been one of stability and improving trends.

In summary, the strategic risks we have managed effectively through the year, endorsed by our Audit and Assurance Committee (ARAC) and Board, are:

- delivering efficient and effective regulation

- informational management practices and protective security systems

- cyber security and infrastructure and the need to establish our own independent network infrastructure

- enhancing our organisational capability

- change and, or uncertainty in policies that relate to our operating environment

- commercial oversight and delivery

- ability to manage a portfolio of change

- incident management

- financial strategy – funding and charging

- onerous and complex export controls

- responding to COVID-19 pandemic

Our response to COVID-19

Our existing formal incident management arrangements, already embedded to enable us to manage events safely and effectively, were quickly initiated and our Incident Management Team (IMT) met regularly to monitor the emerging situation and respond to government’s guidance.

Organisational priorities were reviewed and re-focused where needed immediately, to ensure we provided effective focus and support for our people to deliver our core regulatory purposes, keeping workers and the public safe.

The IMT has met throughout the pandemic to manage our continued response, ensure staff health and wellbeing to deliver our mission and lead business continuity arrangements.

We established arrangements to enable every member of staff to work effectively from home, including providing the necessary equipment and support to balance work and personal responsibilities.

We also delivered training, tools and guidance to our managers, enabling them to help staff work effectively and collaboratively in a remote environment, while supporting their health and wellbeing.

We undertook significant re prioritisation of our planned regulatory work, to ensure we maintained effective regulatory oversight of the nuclear industry while protecting staff, dutyholders and wider stakeholders in line with government restrictions and guidance. Our regulation continued on a virtual and remote basis initially.

During periods of peak transmission, we only attended site if there were matters of immediate public or worker safety, security concerns or where an urgent interaction could not be undertaken remotely.

We also attended site where it was critical that we gained assurance on the safety or security of a specific undertaking, which justified the deployment of an inspector, including public reassurance.

We adopted a balanced approach to inspections, mixing both remote, desk-based and onsite inspections, while also making use of operators’ own internal assurance function where appropriate. This approach has been invaluable in enabling us to gain assurance of the ongoing safety and security of licensee and other dutyholder activities, to inform our regulatory decisions and permission appropriately.

Following the completion of the necessary risk assessments, we began to increase our on-site presence. While staff have worked predominately from home, our offices were made COVID-secure and some limited working for essential business or personal reasons has been possible throughout the pandemic. We now have plans in place for staff to return to our offices as government restrictions allow.

Regular reporting from industry on the impact of the pandemic on their sites, covering operational resilience, emergency preparedness and response and security and supply chain resilience, gave us assurance from the outset. It also informed our regulatory assurance to government, the public and international stakeholders on the continued safety and security of the industry.

An important component of our work through the year has been confirming the adequacy of health protection measures implemented by licensees and other dutyholders to ensure the health and wellbeing of their workers and the local communities.

We shared our operational experience domestically and internationally during the year, to help improve planning and to support response efforts of fellow UK regulators and international colleagues.

Our ability to respond to COVID-19 was demonstrably effective, with no detrimental impact on regulatory activity and business performance.

A government Internal Audit and Regulatory Assurance (GIAA) review of our response awarded us a ‘substantial’ assurance rating, giving confidence that our framework of governance, risk management and control was adequate and effective, and mitigates our strategic risk around Organisational Resilience and Pandemic.

As a direct consequence of the effectiveness of our response, we took the opportunity to engage collaboratively and creatively with a large proportion of our staff and dutyholders about how we could work in the future.

Our ‘New Ways of Working’ (NWoW) project undertook extensive research and engagement to identify ways of harnessing the benefits of working at home and remotely, to inform how we work better in the future.

The resulting recommendations are being assessed to take account of feasibility, prioritisation, benefit and value adding outcomes; we will be considering implementation plans, in line with our 2025 strategic intent, during 2021 to 2022.

Going Concern

We are funded primarily by charges to the nuclear industry through cost recovery from dutyholders and charges to government for specific commissioned activities, together with grant funding from our sponsoring body, the Department for Work and Pensions (DWP), which is around 2% of our budget.

The latter covers activities we are not permitted to recover from industry. The income generated from cost recovery funds the regulation of the industry.

We do not make any profit or surplus, and nuclear site licensees are charged only for the work undertaken in regulating them. The grant is agreed for the current Spending Review period and confirmed annually. For 2020 to 2021, net assets totalling £11.4m were recorded at the end of the financial year. We have no outstanding liabilities that threaten our ability to continue.

COVID-19 does not impact on our capacity to undertake regulatory activities and consequently our ability to recover associated costs is not adversely affected. Similarly, we are still able to recover any costs for work undertaken on behalf of the Department for Business, Energy and Industrial Strategy (BEIS), where appropriate to do so. DWP and BEIS have committed to funding operational costs of the UK State System of Accountancy for and Control of Nuclear Materials (SSAC) for 2021 to 2022.

Consequently, the going concern basis has been adopted for the preparation of the financial statements in this Annual Report and Accounts.

Forward look 2021 to 2022

Our Corporate Plan 2021 to 2022 was published in June 2021, which sets out the following top 5 priorities.

Performance analysis

Our Strategy 2020 to 2025 was launched in summer 2020, after extensive consultation with our staff and stakeholders, setting out our direction and priorities for the next 5 years. This report covers the performance against our Corporate Plan 2020 to 2021, which is the first year of that 5-year strategy.

Overall, we have made good progress across each of our 4 strategic themes, and delivered our 2020 to 2021 top 5 priorities, as well as respond to the pandemic.Our progress and performance is set out here, including case studies to demonstrate our work in practice.

To measure our porgress and capture our impact, we have developed our Organisational Effective Indicator (OEI) framework, which is based on the Organisation for Economic Co-operation and Development’s Nuclear Energy Agency’s 10 Characteristics of an Effective Nuclear Regulator.

This shows how we operate and regulate in a manner that delivers effective outcomes for safety, security and safeguards.

The OEIs are aligned to our 4 strategic themes and provide a broad evidence base for us to assure our Board, the government and the public of the effectiveness of our regulation and wider organisational impact.

The 10 OEIs are underpinned by sub-indicators, each with outputs and outcome-based measures. The consolidation of the outputs and outcomes indicate the extent that our Strategy 2020 to 2025 intent has been achieved, evidenced through our management information.

During 2020 to 2021, we worked to refine the framework so that the 10 OEIs fully align with the priorities in our Strategy 2020 to 2025 and present clear outcomes against each. We will be reporting against this new suite of OEIs during 2021 to 2022.

Strategic Theme 1 – Influencing proportionate improvements

Priority 1: Maintain delivery of our core regulatory functions, holding dutyholders to account on behalf of the public. This will include targeted regulatory oversight of progress at ‘Enhanced Attention’ sites and assurance on safety and security in light of COVID-19.

We continued to deliver an extensive regulatory programme across our regulatory purposes of nuclear safety, nuclear site conventional health and safety, nuclear security, transport and safeguards, as defined with the Energy Act 2013 and Nuclear Safeguards Act 2018. This included particular emphasis on support to – and targeted oversight of – sites in enhanced and significantly enhanced attention.

Where shortfalls in standards have been identified by our inspectors, we have taken action where necessary, in line with our Enforcement Policy Statement, to ensure dutyholders return promptly to compliance. Such action reflects the significance of the shortfalls and may include formal enforcement notices and, for the most significant matter, prosecution.

Site safety

Our inspections have continued to be targeted on hazard and risk reduction, informed through intelligence gathered, taking account of both domestic and international operating experience and incidents, as well as the level of regulatory attention we have assigned to each site.

Our regulatory strategies for those sites receiving enhanced levels of regulatory attention have continued to secure tangible improvements; notably at Atomic Weapons Establisment (AWE) sites (Aldermaston and Burghfield), and Devonport Royal Dockyard, driven by their improvements in safety performance and culture.

We supported AWE as it sought to make sustainable safety improvements at its Aldermaston and Burghfield sites and observed some progress. In addition, we provided advice to the Ministry of Defence (MoD) as it worked to transition AWE into a wholly-owned subsidiary. We sought assurances on the robustness of the process and the adequacy of the management of change.

We have also established enabling frameworks in support of major MoD projects including its submarine acquisition and construction programme.

Two successful prosecutions were pursued during the year, relating to electrical safety shortfalls at AWE Aldermaston and at Sellafield Ltd.

At the start of the pandemic, we oversaw the safe shutdown of non essential activities across the Sellafield site, and subsequent safe restart as the first wave subsided.

Throughout the year, we continued to enable and permission key legacy remediation work in preparation for the start of retrievals from high hazard, high risk facilities on site. This included the successful and safe commencement of Sellafield’s early waste retrieval programme for the Magnox Swarf Storage Silo.

We continued to assess EDF Energy Nuclear Generation Limited’s safety cases, supporting safe operation across the Advanced Gas-cooled Reactors (AGR) fleet. Particular emphasis was given to the consideration of the safe return to service of the reactors at Hunterston B and Hinkley Point B, where graphite core degradation is more advanced. Permission was granted for a limited duration of operation at both sites this year.

After nearly a decade of construction, we issued permission to allow Urenco UK Ltd to commence active commissioning of the Tails Deconversion Plant in the new Tails Management Facility at its Capenhurst site.

Our interventions at Dounreay have also secured sufficient assurance for the site to return to a routine level of regulatory attention from a security perspective.

At Hinkley Point C, we maintained regulatory oversight of the safety of construction, the quality of supply chain manufacture and NNB GenCo’s readiness to commence complex installation of mechanical, electrical and heating, ventilation and air conditioning equipment.

A nuclear site licence application from NNB GenCo SZC Ltd to construct and operate 2 European Pressurised Reactors (EPR) at Sizewell C in Suffolk was received this year. We began our assessment of the application, which will continue into next year.

Despite the challenges posed by the pandemic, we made good progress with the Generic Design Assessment (GDA) of the HPR1000 reactor design and we anticipate our review of the design to be completed in the next year.

Our interventions require extensive evidence to be examined to support the complex technical decision needed to issue a Design Acceptance Certificate or not. We employed innovative solutions with the requesting party to adapt substantially how we delivered remote interventions, and still acquired all the required evidence.

This will have a long-lasting benefit to the way we plan and execute regulatory interventions across international boundaries.

We also worked with the prospective licensee for the proposed Bradwell B site, overseeing the development of its capability and readiness to submit a nuclear site licence application in the future.

Civil Nuclear Security

Our focus remained on the assessment of licensee and dutyholder site security plans against our outcome-focused Security Assessment Principles (SyAPs), with significant enabling activity undertaken to support dutyholders in the development of their plans. The majority of plans have been formally approved.

Eight plans remain outstanding and the programme is on track to be completed in 2021 to 2022. Following approvals, we began compliance activity to provide assurance that the plans were implemented effectively and are being properly maintained.

A total of 52 temporary security plans and arrangements were reviewed and approved across the civil nuclear estate as a direct result of the pandemic. This allowed for COVID-19 related restrictions to be implemented while remaining compliant with statutory legislation and without compromising overall security arrangements.

We assessed the impact of a significant number of globally-identified cyber vulnerabilities, which affected systems across numerous sectors and gave us valuable intelligence about the nuclear industry’s ability to detect, respond to, and recover from such incidents.

We supported BEIS by benchmarking dutyholder arrangements ahead of the next sector-wide Civil Nuclear Cyber Security Strategy and continued our 3-year benchmarking exercise targeting holders of sensitive nuclear information across the sector’s supply chain.

Transport

In 2020 to 2021, we approved 18 radioactive material package designs and shipments, while completing 65 inspections of dutyholders, providing us with confidence in transport safety.

The Carriage of Dangerous Goods and Use of Transportable Pressure Equipment Amendment Regulations came fully into effect on 21 April 2020. The amended regulations require consignors and carriers to consider having an emergency plan in place before transporting radioactive materials.

The aim is to restrict the radiation exposure to public and workers as a result of an emergency during transport. We published guidance explaining this legal duty to help dutyholders comply with the regulations.

Cross cutting activities

Over the last 12 months, we have worked hard to improve clarity relating to the costs of our regulatory decisions and ensure they are proportionate, balanced and unbiased. We have made significant progress towards developing processes and training to enable inspectors to consider cost implications more explicitly in their interactions with dutyholders.

Meanwhile, we have sought feedback about proportionality and consistency of our regulation in our annual stakeholder survey. While this feedback signals our direction of travel is positive, further action is needed to improve proportionality and consistency across all our regulatory purposes.

This year has also seen us continue to embrace innovation, with the publication of our ‘Approach to regulating innovation’ and of new technical guidance for regulating Small Modular Reactor and Advanced Modular Reactor (SMR, AMR) technlogies.

Our modernised Generic Design Assessment process and accompanying guidance has proven to be sufficiently flexible to accommodate our assessment of SMR and AMR technologies.

As we work towards our ambition to use knowledge and experience routinely to inform more strategic and intelligence informed risk-based interventions, we have established renewed focus on sharing good practice across ONR, exemplified by a new safety alert and advice note process to share regulatory learning.

We have also continued to enhance the effectiveness of collaboration across our regulatory purposes, principally through greater alignment of intervention strategies. In this capacity, we have initiated projects to further equip our inspectors with the tools and frameworks to regulate the industry in a better integrated and more coherent manner.

Priority 2: Deliver an effective UK State System of Accountancy for and Control of Nuclear Material (SSAC) and implementation of Security Assessment Principles (SyAPs) across all dutyholders.

We became responsible for the UK’s new domestic safeguards regime, delivering the UK SSAC on 1 January 2021, when new associated legislation came into force.

Throughout this year we continued to develop and test our material accounting system and safeguards capability, providing confidence in our readiness to assume safeguards regulatory responsibility.

This meant establishing a new set of organisational arrangements that achieved the national objective to account for and control nuclear material in the UK, and an international objective to provide the basis for the application of International Atomic Energy Agency (IAEA) safeguards under a new voluntary offer safeguards and Additional Protocol agreement between the UK and IAEA, and to meet international safeguards commitments under the Nuclear Cooperation Agreements (NCAs).

We met all of the UK’s qualifying nuclear material accountancy reporting obligations, including the initial reporting required as part of the introduction of the new regime, as well as regular monthly reporting. Our first full submission was successfully delivered to the IAEA in February.

We worked with operators to ensure that Accountancy and Control Plans (ACPs) for each site were submitted to us in line with statutory requirements. We also worked with DWP and BEIS to establish appropriate funding arrangements for safeguards and the UK SSAC.

We have continued to successfully facilitate IAEA inspections and IAEA equipment installation during the year as well.

Case Study – Approach to regulating safeguards explained

Before becoming the safeguards regulator in January, our approach to safeguards was developed, complementing the approach we take for regulating nuclear safety and security. We employ compliance and systems-based inspections, assessment and enforcement as the main regulatory tools to seek and achieve compliance with the Nuclear Safeguards (EU Exit) Regulations 2019.

This is in addition to the specific methodologies needed for the provision of accounting reports to the IAEA, Nuclear Cooperation Agreements and Additional Protocol reporting.

Working in this way gives us the opportunity to utilise a fuller range of evidence captured through our regulatory activities for safeguards as well as safety and security, thereby achieving effective regulatory outcomes across all purposes.

Under the new regulations, operators must submit Accountancy and Control Plans (ACPs) to us, which is a new and powerful additional tool for our regulation of safeguards. The plans set out the operators’ systems, processes and arrangements for accountancy and control of nuclear material, including safety and security measures that contribute to demonstrating effective nuclear material control.

The assessment of these plans will reinforce our outcome-focused approach and provide evidence on operators’ leadership and management and organisational culture.

Safeguards systems-based inspections are focused on the systems and components key to ensuring nuclear material is well-controlled and accounted for, and enables us to obtain evidence that the systems are suitably maintained, adequately backed-up and operated by staff who are suitably qualified and experienced.

The inspections aim to provide assurance that these systems are proportionate and appropriate and deliver the function(s) that operators claim within their arrangements.

Our systems-based inspections are therefore targeted at sites and facilities where effective nuclear materials accountancy and control is most dependent on systems and components: for example facilities where nuclear material may be mobile and can change in its chemical or physical form.

Although system-based inspections in safeguards are new, they are a well-established part of our safety inspection regime. Adopting this approach to safeguards and aligning these with system-based inspections already conducted across our safety and security purposes promotes better coordination, and once matured, will enhance both the synergy between and the effectiveness of our interventions on site.

Strategic Theme 2 – Inspiring stakeholder confidence

Priority 3: Enhance transparency through our stakeholder engagement, in line with the aspirations of our Strategy 2020 to 2025, to enable effective 2-way communications, particularly as we respond to COVID-19.

Inspiring stakeholder confidence and our public service ethos underpin how we work. COVID-19 meant that, for 2020 to 2021, our stakeholder and public engagement took place remotely, via various online platforms, but our focus was maintained on stakeholder and public confidence.

Although different from face-to-face engagement, new ways of engaging did provide opportunities to reach others who cannot necessarily travel easily, as well as giving us an opportunity to have shorter, more direct meetings and sometimes outside of office hours.

This made them more manageable for many regular and new stakeholders, giving us the opportunity to speak to a wider, more diverse audience.

Despite these new, unplanned ways of working, our flexible approach to engagement this year has been received positively – our external stakeholder survey, conducted in January, was encouraging. We continue to be viewed as professional (93%), trusted (85%) and independent (89%).

In addition, 76% of our stakeholders believed we listened to them, with 73% agreeing that we ask for feedback proactively, and 88% confident we are delivering our mission. Specifically, on our response to COVID-19, 72% of those who responded said our regulation had been effective.

The areas where we – and our stakeholders – would like to see improvement, such as enabling innovation, efficiency and engagement on plans and priorities, align with our commitment in our stakeholder engagement strategy published in October 2020 to retain public trust by seeking to be an exemplar of transparency.

Our new Stakeholder Engagement Strategy 2020 to 2025 also sets out how we intend to collaborate and learn from our UK and international stakeholders to improve our effectiveness, help inform UK nuclear policy, engage with industry more widely to explain our enabling approach and strengthen our relationships with academia.

Collaborating with and learning from UK and international stakeholders

We continue to learn from UK and international stakeholders, while ensuring we use our influence positively. The unique circumstances of 2020 to 2021 meant that although we undertook no international travel and only urgent and, or necessary domestic travel this year, we continued to collaborate across borders – and within them – to secure safe nuclear operations and in the interests of global nuclear safety and security.

UK Health & Safety Regulators’ Network

Our CNI chairs this influential network composed of chief regulators representing – principally – health and safety regulatory bodies. His leadership has been pivotal in allowing effective approaches to the unique challenges posed by COVID-19 during the year. Although the focus of the network has been on resilience and response, it also collaborates on common themes and shares insight on major incidents in their relevant industries, allowing us to reflect and apply learning, where appropriate.

Safety Directors’ Forum

We work closely with the Safety Directors’ Forum and its associated subgroups which brings together senior representatives for licensed sites, requesting parties and supply chain on key topics for the nuclear industry. This is an important group to set direction and provide leadership on cross cutting matters across the industry, including security.

As well as concentrating on COVID-19 response and resilience, we engaged with the Forum on issues such as better regulation, innovation in the industry, proportionality and consistency of decision-making. We have also played a key facilitation role to support the insight and gathering of intelligence for the industry to produce a good practice guide for the site stakeholder groups and local liaison committees at all nuclear sites in the country, and look forward to seeing the outcomes in 2021.

Strategic Framework for International Engagement

Taking account of the Strategy 2020 to 2025, as well as our evolving operating environment, we updated our Strategic Framework for International Engagement, which also strengthens our governance arrangements, to better measure the success and impact of our international engagement.

Final report on the IRRS mission to UK

The government published its response to the IAEA’s Integrated Regulatory Review Service mission to the UK, which we hosted in 2019. This consisted of peer review of the UK’s regulatory infrastructure against international safety standards.

Overall, we were viewed as a robust and effective regulator, and we are working to implement the recommendations relevant for ONR by the time of the follow-up mission, likely to be in 2024.

Other international activity

In April, we issued a comprehensive statement to the IAEA, conveying assurances on the criteria by which we considered the industry to be demonstrably resilient to the COVID-19 pandemic.

We worked with our global regulatory leaders to benchmark responses to the pandemic through the International Nuclear Regulators’ Association. This enabled cross-fertilisation of perspective, and further assurance that the UK’s approach has been measured and effective.

We provided advice to the Western Europe Nuclear Regulators’ Association (WENRA) on how its Safety Reference Levels should apply to new nuclear technologies, ensuring they align with the UK’s ambitions and needs.

We are supporting the Nuclear Energy Agency’s development of its new strategy and for its Committee on Nuclear Regulatory Activities, ensuring it aligns with the UK’s expectations, and have been prominent in trilateral discussions on the potential harmonisation of standards for SMRs, facilitated by the Agency.

We are also playing an active role in its Working Group on Public Communications, co-leading its task to define the characteristics of a trusted nuclear safety regulator, including working with the group to design a survey seeking views on this topic from the interested and wider public. The insight gathered from the responses will inform guidance to support and enhance public trust in the future.

As part of the seventh review cycle for the IAEA’s Joint Convention on Radioactive Waste and Spent Fuel Management, we prepared the UK national report on behalf of BEIS and the UK coordinating organisations, submitted to the IAEA after ministerial approval in October.

In light of the challenge posed by COVID-19, the seventh review meeting was deferred to 2022.

Our relationship with the US Nuclear Regulatory Commission was strengthened by our participation at its Regulators’ Information Conference, where we took part in panel sessions on cyber security and innovation.

Post-EU Exit, we have worked closely with government on arrangements to ensure continued co-operation on nuclear safety matters now the UK has exited Euratom.

Seeking to be an exemplar of transparency

We began our work this year on our openness and transparency framework, which will set out our ambitions and intentions. We expect to publish this next year and have undertaken some early engagement with other regulators and public bodies to gather insight and good practice that will inform our future ambitions.

CNI report published

We published the second CNI Annual Report on Great Britain’s nuclear industry, which gives the CNI’s authoritative view on the industry’s safety, security and safeguards performance.

It provides detailed insight on our regulatory interventions and decisions, and explains where regulatory shortfalls have occurred and our associated corrective and preventative actions.

It offers a more comprehensive overview of our regulatory activities, in addition to what is provided in this report.

Our regulatory programme continues to be underpinned by the key themes identified in the CNI report, which include sustainable programmes for the management of ageing facilities, improvement in conventional health and safety performance, and delivering a holistic approach to security through the benefits of SyAPs.

Responding to the pandemic and ongoing resilience of the industry has also been prioritised in this second report to maintain focus and efforts on learning and future preparedness.

NGO engagement programme

We continued to liaise closely with Non-government organisations (NGO) representatives and local site stakeholders and responded to their questions and concerns via our NGO Forum, specific site and issue-based engagement, and individual meetings where appropriate.

We have sought feedback and views from the NGO community on our work to improving openness and transparency, new nuclear reactor design and licensing, and other issues concerning the impact of the nuclear industry on the public.

Consultation on bulk quantities

We undertook a public consultation on our revised interpretation of ‘bulk quantities’ in storage and disposal of radioactive matter in the context of licensing any future Geological Disposal Facility.

We received responses from devolved administrations, operators, the nuclear supply chain, NGO forum members and members of the public, all of whom supported separate interpretations for storage and disposal. We will be publishing the formal consultation response and clarifying our position in 2021 to 2022.

Wider stakeholder engagement

The year was, of course, influenced by the pandemic, and subsequent changes to how we worked as a team, how we engaged and how we prioritised our work.

We ensured we were clear and open about how COVID-19 affected our approach to inspection, assessment and the ways in which we worked, updating our public position regularly and responding to public concerns over social distancing, infection rates and the robustness of our regulation.

It also meant we had to work flexibly and re-assess engagement priorities throughout the year.

We continued to work positively with the media and stakeholders, responding to numerous enquiries from media, interested groups, NGO forum members and the public on matters about our regulation, including the restart of reactors at Hunterston B and Hinkley Point B and our enforcement action.

We also published reports about our work, and kept stakeholders updated on our leadership structure changes, as well as introducing our Board members and helping to build better understanding of our Board, its role and priorities.

We have improved the content of our social media channels this year, ensuring they take their place as key information channels for a diverse range of stakeholders, and to encourage better 2-way communication.

We have increased our use of infographics, animation and video content on our channels to improve accessibility and widen coverage with a direct and clear approach.

The CNI’s Independent Advisory Panel met twice this year. Topics ranged from our COVID-19 regulatory response and recovery, to our approach to innovation and our work on climate change in assessment and inspection. The panel comprises of a range of experts from academia, industry and relevant professional institutions as well as representatives from our NGO Forum.

The panel’s insights and expertise help to inform our capability, research and decision making.

Our research strategy continues to be a source of advice and expertise to inform us too. Graphite dominates our research portfolio, providing us with robust independent advice in support of our regulatory decisions regarding the ongoing operation of Advanced Gas-cooled Reactors.

On cyber security, we worked with the National Cyber Security Centre (NCSC) to gain independent, authoritative advice on specific aspects of good practice. This has enabled us to gain valuable insights into how the assurance and functional qualities of systems and components should be assessed for cyber security purposes.

In other areas, various research projects have improved our understanding of the strengths and weaknesses of modelling tools (including fire, combustible gases and fission products) used to support nuclear safety cases for existing and new build facilities.

Promote awareness and understanding of our enabling approach and regulatory innovation Our ‘Approach to regulating innovation’ sets out how we will be responsive and open to facilitating the implementation of innovative solutions, in line with our strategic commitment to embrace innovation and new approaches and technologies.

We engaged with industry and technical groups, NGOs and supply chain representatives at meetings, seminars and conferences to share this new publication and explain how we will be adaptable and flexible in our regulatory approach as a modern, transparent regulator.

Inform nuclear policy with UK government from the earliest stages

We have continued ongoing engagement with UK government (as well as devolved administrations, and regional and local government as appropriate) to inform the regulatory framework for safety, security and safeguards.

This engagement and effective working relationship delivered the new safeguards regime and enabled the development of new guidance for reporting requirements under Nuclear Co-operations Agreements.

We have been engaged in the government’s work on ANTs and associated regulatory framework development, as well as the future regulation of fusion. We have more recently begun preparations for the Post Implementation Review of Part 3 of the Energy Act 2013, which is a legal requirement and will be led by BEIS and DWP in 2021 to 2022.

Also, to mark the end of our previous 5-year strategy period, we published our Regulators’ Code Self-Assessment 2020, which shows how we meet the requirements of the Code, in how we regulate and engage with those we regulate. To complete alignment with the Code, we have developed a set of service standards to explain what dutyholders can expect from us, and these will be published in 2021 to 2022.

Case study – Hunterston B re-start decision

The management of ageing facilities is a key regulatory priority for ONR, and a key issue for many of our stakeholders. Graphite core ageing has been of particular public interest at Hunterston B in Ayrshire.

The reactors at Hunterston had been offline for more than 2 years (since 2018), and there has been high interest and high concern from a diverse range of stakeholders about any decision we would make on the future safety of the 2 reactors. Supporting the huge effort behind the scenes by our specialists, we built and maintained important relationships with local stakeholders including: campaign groups, media, NGOs, local authorities and regional and national government on this issue.

Before permissioning a limited return to service in August 2020, we met many of the representatives to ensure we explained our decision in a way that could be understood to be in the best interests of public safety.

By maintaining a proactive approach over the year, actively liaising at the time of the announcement with those who were taking a close interest in the issue, and publishing all associated reports covering many of the key concerns and questions, we had been able to anticipate stakeholder’s opinions and thoughts and were able to respond accordingly, dramatically reducing the number of enquiries from the public we received.

This approach has shown the value of proactively seeking stakeholder views and feedback and will become a model for how we communicate novel, contentious and, or important regulatory decisions in the future.

Strategic Theme 3 – Creating a culture of inclusion and excellence

Priority 4: Promote the sustained health and wellbeing of our staff through effective and inclusive leadership and management, as we respond to COVID-19.

In 2020 to 2021 our focus under this strategic theme was realigned to ensure our staff’s wellbeing during the pandemic and support them to manage the unplanned, different ways of working it brought.

Mental health and wellbeing

This year, we introduced our new Mental Health and Wellbeing Strategy, along with a Stress Management Policy, to help our leaders create a safer environment for our staff to share and discuss mental health matters and concerns, as well as support those suffering from stress.

We enhanced the role and support available from our mental health ambassadors and delivered a programme of learning, support seminars and coaching events to managers and staff that reflected the impact on wellbeing as a consequence of COVID-19. This ranged from how to work and manage teams remotely through to sessions on maintaining personal resilience and wellbeing.

While our focus on mental health and wellbeing was particularly key this year, it is a long-standing commitment and we were able to reprioritise and bring forward activity and support to meet the significant need that arose. This has been acknowledged by staff as a key factor in enabling the right balance between personal wellbeing and maintaining capability to deliver.

Our latest staff survey, conducted in February 2021, provided a wealth of evidence from staff of the impact this has had. This included 89% of staff stating that the support provided enabled them to balance work demands with personal and family responsibilities and 89% had trust in the SLT to support the health, safety and wellbeing of all.

In addition, 87% were positive that ONR had adapted well to supporting their wellbeing during the pandemic. These results, based on an 83% response rate and in the midst of the post-Christmas national lockdown, compare extremely favourably to the published benchmarking across public and private sector organisations.

Embedding our values

Given the impact of COVID-19, we amended our planned approach for further embedding our values through a range of face-to-face engagements and activities. Instead we have made them a feature of our training and regular staff engagement. For example, we have introduced a “value moment” at the start of meetings to explore how the values are being used on a daily basis to help us create an inclusive culture.

Our foundation programme for managers now has the values embedded throughout each of the 5 separate modules and we have launched our new values-based coaching programme.

This provides managers with the opportunity to build their skills and expertise in a way that fully embraces our values and enables them to provide the support and direction to staff in a way that will promote the inclusive and continuous performance improvement culture that we seek.

Our new leadership programme has now been launched and has been designed around establishing a values-based leadership culture that will reinforce the personal accountability of our leaders at all levels, and the importance of role modelling the values in creating and maintaining our cultural change in support of that.

We have continued our rolling programme of embedding the values into all our processes, but on a longer timescale than envisaged given the re-prioritisation to support staff wellbeing. We have fully embedded the values into several of our key processes, including, bullying and harassment and managing poor performance policies. This programme will continue into 2021 to 2022.

Diversity and inclusion

Embracing diversity and inclusion has remained a key priority and we are proud to continue to be accredited through the National Equality Standard and as a DWP Disability Confident Leader champion. During the past year, we have accessed support from a range of networks and external organisations to benchmark and adopt best practice.

This has led to initiatives such as a reverse mentoring scheme and the delivery of events, campaigns and training throughout the year to ensure better understanding and awareness of issues around gender, ethnicity, disability, mental health and neurodiversity.

We know we need to do more to support and empower Black, Asian and Minority Ethnic (BAME) staff in particular and to increase representation at all levels. We have begun to develop an outreach programme and have revised our Science, Technology, Engineering and Mathematics (STEM) work within local communities to provide practical steps in encouraging greater diversity in both our workforce and the wider sector.

We have also adopted the disability confident approach in all aspects of our recruitment and are currently working with a charity that supports young disabled people aged 16 to 24, helping them become self-assured and independent adults.

Having technical competence at our core

It is vital that we have the right level and degree of technical nuclear capacity and capability available across our regulatory staff and specialisms to be able to meet the regulatory demand and respond to fluctuating needs. We have enhanced our approach to developing and implementing capability maps across all of our core purposes to inform our resourcing, recruitment and learning plans and priorities.

We introduced a revised Technical Support Framework this year, to provide resilience and more flexible access to niche technical skills and competence for time-limited periods, to mitigate any short-term or unexpected capability requirements.

We adapted the approach for delivering our suite of core training remotely, and revised associated processes for warranting and re-warranting, and were able to ensure we maintained an appropriate level (87%) of full warrant inspector resource (above the targeted 80%). We continue to update our workforce planning and capability development plans.

We adapted our external and internal recruitment processes to enable remote recruitment and developed remote onboarding processes for new staff. Feedback has been extremely positive, capacity targets have been met in full, and pre-COVID-19 levels of satisfaction and timescales have been maintained or improved.

We have successfully embedded an Initial Professional Development Programme (IPDP), providing a framework for developing new inspectors through their first years and towards full warrant status.

The IPDP encompasses around 10% of our inspector cadre and brings together the development and career pathways including those on our new degree apprenticeship programme and our post-graduate nuclear development programme.

This provides comprehensive development support, including mentoring, job shadowing and skills development. Our nuclear degree apprenticeship programme, designed and delivered with strategic partners including Blackpool and the Fylde College, was shortlisted for a prestigious National Skills Academy for Nuclear (NSAN) award. We were delighted to subsequently win the award.

Developing our managers

We have focused on ensuring our managers are supported by introducing mandatory training and coaching programmes to strengthen leadership and management skills, which are available for online and remote delivery. Over two-thirds of our management cohort have completed the training, with the remaining on target to complete by the end of this year.

Feedback has been excellent, and the impact reflected in recent survey results with positive views from staff on how they are being managed and well-led, with 94% saying they continue to feel connected to their team, despite remote working.

Case Study – Developing our people managers

Our Career Development Managers (CDMs) – line managers – are vital to the work we do to create a culture of inclusion and excellence. We have focused on better engagement with them and providing them with the right level of leadership and management capability.

This year we have undertaken 2 staff surveys that have helped us identify priority areas to meet support and development needs, to test the confidence of the wider staff in our CDMs and measure any progress. These results were positive and evidenced that 89% of staff felt supported, well-led and well-managed, a significant increase compared with the 2018 to 2019 levels (55%).

Our CDMs are at the forefront of everything ONR does. Providing them with the right level of leadership and management capability has brought a noticeable cultural improvement, with staff reporting that they feel better led and well managed, but also have significant trust and confidence in the SLT to support them and their wellbeing at a time of great uncertainty and concern during the pandemic.

We have used several different tools to ensure we are equipped to provide inclusive and strong leadership, and that our management teams are capable and trusted. We have used our in-house Academy to develop and deliver a mix of mandatory training programmes and tailored courses, together with a range of coaching and leadership tools.

This has been supplemented by bespoke sessions for managers for more in-depth learning in specific areas such as managing performance, attendance and supporting resilience, health and wellbeing of teams and individuals.

We have also equipped our managers with the tools to develop understanding and awareness of diversity and inclusion issues, together with practical tools and approaches to be able to provide support. This has included bespoke training courses, staff drop-in events and access to a wide range of resources and material, so they can not only promote but take positive and meaningful action to improve inclusivity in the workplace.

The improved capability levels of our CDMs, as evidenced in our survey results, has been a key factor in enabling us to better support our staff through the pandemic, maintain delivery of our work programme, and retain high levels of staff engagement and motivation.

Strategic Theme 4 – Modernising how we work

Priority 5: Deliver our 2 strategic change projects – separating our IT infrastructure from Health and Safety Executive (HSE) and commencing a pilot of our Well-Informed Regulatory Decisions (WIReD) project.

IT Separation project

Our IT Separation project (separating our IT infrastructure from that of HSE) was successfully delivered remotely in October 2020; the project was formally closed in January 2021.

This was a significant achievement, demonstrating our ability to deliver change seamlessly, despite challenging external circumstances. It has resulted in a modern, efficient, and resilient infrastructure and established autonomy and control of our own IT strategy by providing a foundation for our IT modernisation and improved cyber resilience, which is now underway, led by our new Chief Information Officer and our Chief Information Security Officer respectively.

Well-Informed Regulatory Decisions project

Our WIReD project will modernise our regulation by providing our inspectors and dutyholders with the tools to be better informed and better connected to improve the consistency of our regulatory decision making. Phase 2 of WIReD began in November 2020.

The project is being delivered in an agile way, released to staff and dutyholders in phases to ensure user feedback and experience informs the final product. We have configured 3 out of 8 of our processes and commenced user acceptance testing, ready for initial roll out in 2021 to 2022, supported by a blended training approach.

Improving programme management office effectiveness

We have established a ‘roadmap’ to give us a clearer view of our projects across the organisation and enable better planning and prioritisation, to ensure we deliver our 2025 strategic intent.

As we continue to mature our planning functions, we also launched a new Integrated Strategic Governance Framework to align all our annual planning activity and ensure a clear line of sight between strategic priority setting, budgets, resource and strategic workforce planning.

Case Study – Creating our own IT infrastructure

The successful delivery of this complex project would be a major achievement in any year, but having to deliver it remotely as a consequence of COVID-19 meant substantial additional challenges had to be overcome.

Before ‘go live’, we undertook rigorous testing of the software and hardware, including resilience and data migration testing, and received external cyber security assurance that the new network was secure.

This change project exemplified successful delivery of a modernisation initiative with minimal business disruption and high levels of engagement. It was achieved through engendering and promoting a collaborative working environment of transparency and trust across a multi-disciplinary, multi-supplier team, to focus on delivering a mutually beneficial outcome.

In the challenging environment of COVID-19 and remote working, the virtual team demonstrated exceptional commitment, resilience, flexibility, dedication and a collaborative team spirit over a sustained period of time, with the right ethos to bring about significant change in very challenging circumstances. As a result, IT Separation was delivered safely, securely and successfully.

Accessibility was a key work-strand for the project, to ensure we made adequate provision of devices and technology for all current and future staff, through engagement, piloting and clear assessments. Staff immediately benefitted from modernised equipment as a result of the IT Separation project, to support working at home (which added another level of complexity for the team). New software was also introduced to all staff, which enhanced the quality and accessibility of our IT provision. Mobile telephones were issued to all staff, supporting business continuity, increasing connectivity and boosting remote working arrangements.

The introduction of new software meant we could offer a step-change improvement in videoconferencing services, workspace chat, file storage and application integration via Microsoft 365. This was key for our staff to adapt to remote working and allowed us to stay connected with each other and key stakeholders.

As part of the government’s ‘Cloud First’ policy, which requires public sector bodies to consider and fully evaluate potential cloud solutions before any other option, we now have secure cloud services.

In the most recent staff survey, 80% of staff agreed that the project had equipped them better with tools to do their job.

Our Financial Performance

Financial Review

For 2020 to 21, our final budgetary outturn was £96.5m (2019 to 2020: £92.3m), including capital spend of £3.2m (2019 to 2020: £5.4m). This was an overspend of £4.6m (2019 to 2020: underspend of £5.8m) compared to an initial budget of £91.9m (2019 to 2020: £98.1m). Expenditure of £93.3m (2019 to 2020: £86.9m) shown in the accounts excludes capital spend.

The Board has received regular updates on financial developments during the year to understand the impact of COVID-19 on outcomes and costs. The main reasons for the overspend and, underspends – which are primarily a result of COVID-19 impact - are set out below.

Overspends

-

£2.7m Cabinet Office security vetting charges (pass-through costs) that we could not reasonably estimate when the budget was set

-

£2.4m in IT mainly relating to IT Separation, principally due to the impact of COVID-19 and the requirement to deliver remotely, which required a 5-month extension of the project delivery timescale from May to October 2020. This was compounded by costs to address the need to source IT and cyber capability and capacity and the requirement to commission adequate technical and assurance activity prior to cutover. Despite this in-year overspend, the project delivered within £75k of its approved business case financial envelope;

-

£1.6m on Technical Support Contracts relating to the UK HPR1000. This was, in part, due to the Requesting Parties’ delivery timescales exceeding expectations and providing information sooner than anticipated to ONR

-

£1.6m increase in the accrued annual leave provision due to a build-up of leave during COVID-19. We actively encouraged staff throughout the year to utilise their annual leave entitlement to prioritise wellbeing and monitored compliance with our policy closely. However, due to the exceptional nature of the past year, and the additional burden that COVID-19 placed on resourcing, there has inevitably been a build-up of annual leave balances across the organisation.

Underspends

-

£2.2m in travel and subsistence and training and conferences directly as a result of COVID-19

-

£0.4m re-structuring fund not required

-

£0.3m from a pause to the Bootle workspace project

-

£0.4m research (reduced price and, or demand)

-

£0.3m WIReD slippage

-

£0.1m miscellaneous

We drew down the remaining £1.8m of the capital loan facility from DWP during the year. We have now drawn down the full £9.8m facility. The loan provides working capital to support the capital expenditure requirements for WIReD, IT Separation and other modernisation activities to develop and enhance our infrastructure (including improvements to IT, furniture and estate upgrades).

The loan enables us to operate on a self-sufficient basis whilst protecting cash flow. We started repaying the loan in December 2020.

Environmental and Sustainability Matters

We acknowledge and accept the responsibility we have to manage and reduce the impact that our activities as a public corporation and as a regulator have on the environment.

By reducing our consumption of resources, using those we must consume more efficiently, and where possible, balancing unavoidable emissions, we aim to minimise the environmental impacts of our operations. We will also bear in mind the need to seek fit for purpose sustainable solutions as we undertake our regulatory activities.

Our Strategy 2020 to 2025 specifically references the need to consider how we can reduce our environmental and carbon impact in line with broader government objectives for net zero. Our staff have a role to play in helping us ensure these aims and objectives are met, and we will continue to engage with our external stakeholders regarding our aspirations.

We are committed to meeting our obligations under the Greening Government Commitments as a minimum and will commence reporting against government targets during 202 to 2022.

We support the government’s aspirations regarding green transport by encouraging the use of public transport where possible for business travel (appropriate adjustments have been implemented in line with COVID-19 health measures), making advance of salary provision (on an interest free loan basis) for staff to purchase bicycles to travel from home to work, and we are making increasing use of the digital communication methods made available to us by the introduction of improved IT hardware.

We are not the majority occupier at any of our office locations but we continue to work with our respective landlords in the collation and reporting of data relating to matters such as energy emissions, carbon footprint, and waste and utilities management.

In addition, we proactively engage with landlords to ensure they have, and maintain, a responsible corporate sustainability policy. We support local office environmental policies and commitments, an example of which is the ‘nil to landfill’ policy operated at our Bootle office, and the recycling of waste into 7 waste streams (plastic, glass, metal, paper, electrical, fluorescent bulbs and miscellaneous), plus food, which goes to make biofuels.

In addition, since IT Separation and the modernisation of our IT estate, we now have greater capacity and take-up of video conferencing, reducing the need for travel to meetings and associated emissions.

When tendering contracts, we seek to engage with suppliers that adopt a positive approach to environmental and sustainability matters; for example, our furniture supplier has a very robust recycling policy, which we take active advantage of when the opportunity presents itself.

We are preparing a statement of intent in respect of our environmental policy credentials and expect to publish it later in 2021. This will signal our commitment to developing an environmental strategy by 2025 and reflect the Greening Government Commitments as appropriate.

We will be submitting a quarterly return covering transport, utilities usage and waste via our sponsor department, DWP. The statement will set out our ambitions for the next few years of our Strategy 2020-2025; for example to:

-

continuously improve our environmental performance and integrate recognised environmental management best practice into our operations in accordance with the principles of the waste hierarchy

-

limit our carbon emissions by driving energy efficiency, minimise our travel footprint where necessary, and use resources responsibly

-

ensure the consideration of environmental issues and energy performance with our landlords in the acquisition, design, refurbishment and use of our premises

-

include sustainability criteria when procuring goods and services

Mark Foy

Chief Executive and Chief Nuclear Inspector

Office for Nuclear Regulation

July 2021

Accountability Report

Corporate Governance Report

This report provides information on our governance structures and how they support the achievement of our objectives. It includes the Directors’ Report, the Statement of Chief Executive’s responsibilities and the Governance statement.

Directors’ Report

Board membership at 31 March 2021

Senior Leadership Team at 31 March 2021

NOTE: In December 2020, we announced changes to our senior leadership structure for 2021 to 2022.

With effect from 1 April 2021:

-

Sarah High’s role changed to Deputy Chief Executive.

-

Donald Urquhart became a Board member in his new role as Executive Director of Operations.

-

Mike Finnerty replaced Donald Urquhart as Director of Operating Facilities.

-

Jane Bowie became New Reactors Director.

With effect from 10 May 2021:

- Simon Coldham was appointed Chief Information Officer.

With effect from 1 June 2021:

-

Adriènne Kelbie ceased to be Chief Executive.

-

Mark Foy’s role changed from Chief Nuclear Inspector to Chief Executive and Chief Nuclear Inspector.

-

Paul Dicks was appointed as Sellafield, Decommissioning, Fuel and Waste Director as a result of Mina Golshan leaving ONR.

-

Steve Vinton was appointed as Technical Director as a result of Anthony Hart’s retirement.

A new Finance Director is due to join ONR in July 2021; Sarah High continues to act in a Finance Director capacity in the meantime.

Further details can be seen at: Office for Nuclear Regulation – ONR Board & Executive structure – August 2019

Appointment and resignation of Board members during 2020 to 2021

During the reporting period, the Board comprised 6 Non-Executive Directors (including the Chair) and 4 Executive Directors. The changes to Board membership are shown in the following table:

Table 1 – Changes to Board membership

| Name | Date | Event | Role |

|---|---|---|---|

| Janet Wilson | 1 April 2020 | Term of office commenced | Board member |

| Bronwyn Hill | 31 May 2020 | Term of office ended | Board member |

| Tracey Matthews | 1 June 2020 | Term of office commenced | Board member |

| Oona Muirhead | 30 September 2020 | Term of office ended | Board member |

| Jean Llewellyn | 1 October 2020 | Term of office commenced | Board member |

| David Caton | 31 March 2021 | Role changed from Executive Director to Observer | HR Director |

NOTE: Some changes were also made to Board membership during early 2021 to 2022 due to changes to the senior leadership team structure announced in December 2020.

With effect from 1 April 2021:

-

Sarah High’s role changed to Deputy Chief Executive.

-

Donald Urquhart became a Board member in his new role as Executive Director of Operations.

-

David Caton’s role changed from Executive Director to Observer.

With effect from 1 June 2021:

-

Adriènne Kelbie ceased to be Chief Executive.

-

Mark Foy’s role changed from Chief Nuclear Inspector to Chief Executive and Chief Nuclear Inspector.

Managing conflicts of interest

Details of the management of conflicts of interest can be found within the Governance Statement.

Personal data related incidents

Details of personal data related incidents can be found within the Governance Statement.

Statement of Chief Executive’s responsibilities

Under paragraph 21(1) b of Schedule 7 of the Energy Act 2013, ONR is required to prepare a statement of accounts for each financial year in the form and on the basis determined by the Secretary of State for Work and Pensions, with the consent of HM Treasury.

The accounts are prepared on an accruals basis and give a true and fair view of ONR’s state of affairs at the year-end and of its net income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing its accounts, ONR is required to comply with, and has complied with the requirements of the government Financial Reporting Manual (FReM), and in particular to:

-

observe the Accounts Directions issued by DWP, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis

-

make judgements and estimates on a reasonable basis

-

state whether applicable accounting standards, as set out in the FReM, have been followed and disclose and explain any material departures in the accounts

-

prepare the accounts on a going concern basis, unless it is inappropriate to presume that ONR will continue in operation.

The Chief Executive of ONR has responsibilities for the propriety and regularity of the public finances for which the Chief Executive is answerable, for keeping proper records and for safeguarding assets as set out in Managing Public Money published by HM Treasury.

Chief Executive’s statement

As the Chief Executive for ONR, I am responsible for maintaining a sound system of internal control while safeguarding the public funds and assets for which I am personally responsible, in accordance with the responsibilities assigned to me in HM Treasury’s ‘Managing Public Money’.

I confirm that there is no relevant audit information that the National Audit Office have not been made aware of and that I have taken all necessary steps to ensure access to relevant information has been given.

I confirm that this Annual Report and Accounts as a whole, and the judgement required in preparing it, is fair, balanced and understandable and that I take personal responsibility for this being so.

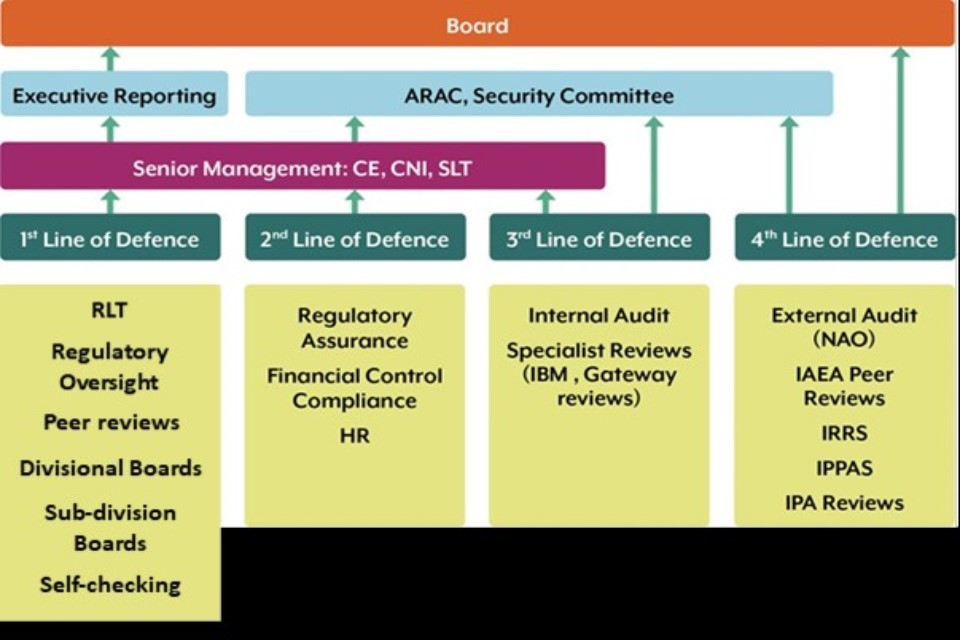

Governance statement