Office for Nuclear Regulation annual report and accounts 2019 to 2020

Published 29 September 2020

Performance report overview

Chair’s foreword

I was delighted to be appointed Chair of the Office for Nuclear Regulation (ONR) on 1 April 2019 for 5 years. I could not have joined ONR at a more stimulating time in its journey as it entered the final year of its first five-year strategy since becoming a public corporation in 2014. At the same time, the Board was about to embark on a wider, collaborative approach to setting the organisation’s strategic direction for the next 5 years to 2025. I am relishing the opportunities and challenges that lie ahead.

One of my first priorities on appointment was to get a view of ONR from all perspectives. I have spent a significant part of my first year engaging with as many stakeholders as possible from industry and the wider nuclear community through visiting licensed sites, attending ONR-led industry events, and meeting Ministers, officials, non-Governmental organisations and ONR staff at every level. I can only say how impressed and assured I have been by the overwhelmingly high regard in which ONR is held by those I have met.

I am pleased to report that we have again delivered our mission and achieved our 2020 vision. A key area of the Board’s attention over the last year has been maintaining momentum towards our 2020 strategic intent while also preparing the Strategy 2020 to 2025[footnote 1] – focussing on our operating environment, our regulatory strategy, a greater focus on regulatory assurance, our people and our organisational effectiveness. We sought assurance, and provided direction, to ensure our readiness to host the International Atomic Energy Agency’s (IAEA) Integrated Regulatory Review Service (IRRS) Mission to the UK. The Board has also paid close attention to our progress in delivering the independent UK State System of Accountancy for and Control of Nuclear Material (UK SSAC).

On 31 March, 2020, we said farewell, with thanks, to Penny Boys CB after 4 years of exemplary service to the Board. I would also like to thank my predecessor, Nick Baldwin CBE, for ensuring a seamless handover last April, and my fellow Board Members for their support throughout my first year. My thanks must particularly go to the dedicated, hard-working and unstintingly loyal staff without whom the organisation could neither flourish nor deliver its purpose to society. This was brought into sharp focus in the latter part of the year through the resilience that was shown at all levels as we responded to the impact of the coronavirus (COVID-19) pandemic while ensuring ONR maintained effective regulatory oversight.

As we look ahead, I have every confidence in ONR’s senior leadership team to see through the strategic improvement projects already underway that will enhance the organisation’s information and knowledge management system, and successfully deliver the aspirations of our new Strategy.

Mark McAllister

ONR Chair

Chief Executive’s foreword

With 4 years at the helm of ONR, it is heartening to close out our 2020 strategy in such a positive position and be looking towards an even stronger 2025.

This is, of course, tempered by the impact of COVID-19 on people around the globe. ONR took steps to work largely at home, and adjusted our annual plan to ensure focus on effective regulation while keeping our people safe and well. We explain more about this in our 2020 to 2021 Corporate Plan[footnote 2].

Our relentless focus on effective regulation has been complemented by our desire to be an exemplar of openness and transparency in how we engage with stakeholders, our commitment to develop the skills of our people and culture of our organisation, and our attention to improving our infrastructure, systems and processes.

I consider myself fortunate to work with colleagues who show unwavering commitment, public service ethos and team spirit. I have asked a great deal of them – to balance significant operational duties with also making changes that have strengthened ONR as an organisation – and they have delivered. So as we close 2019 to 2020, we also close our 2020 strategy having delivered our promises.

Of most importance, our regulation maintained a safe and secure nuclear estate across all of the 36 licensed sites and the hundreds of dutyholders, including transport carriers and hospitals, under our purview.

We learned from, and influenced, the international nuclear regulatory community by presenting our work, participating in working groups, and contributing our expertise to IRRS peer review missions. We worked more closely with UK regulators, most notably the Environment Agency (EA), producing single, joined-up advice and guidance on topics such as Generic Design Assessment (GDA).

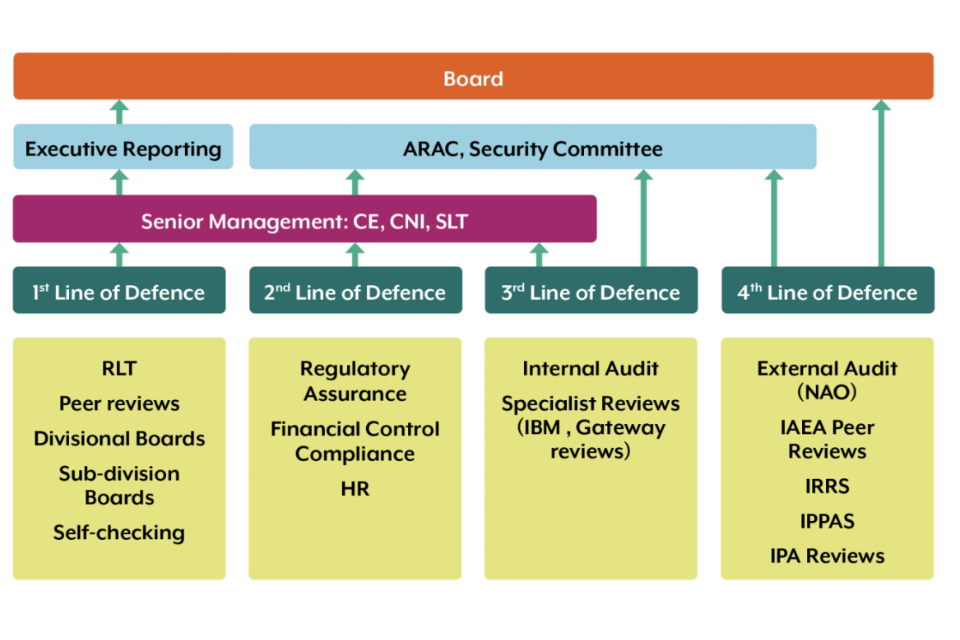

On more than one occasion our approach was highlighted as best practice, including our Security Assessment Principles, Organisational Effectiveness Indicators, Integrated Audit and Assurance model, Strategic Framework for International Engagement, our engagement with interested stakeholder groups, and our ONR Academy. Our new nuclear safeguards and nuclear material accountancy function is being seen as an exemplar.

Finally, we have successfully completed Phase One of our Well Informed Regulatory Decisions (WIReD) project. Having streamlined processes and engaged with industry, we will now build a new system and pilot it in 2021. In those areas where we did less well, notably in IT delivery and in being perceived as consistently proportionate in our regulatory decisions, we are focused on improvement and I am confident we will succeed.

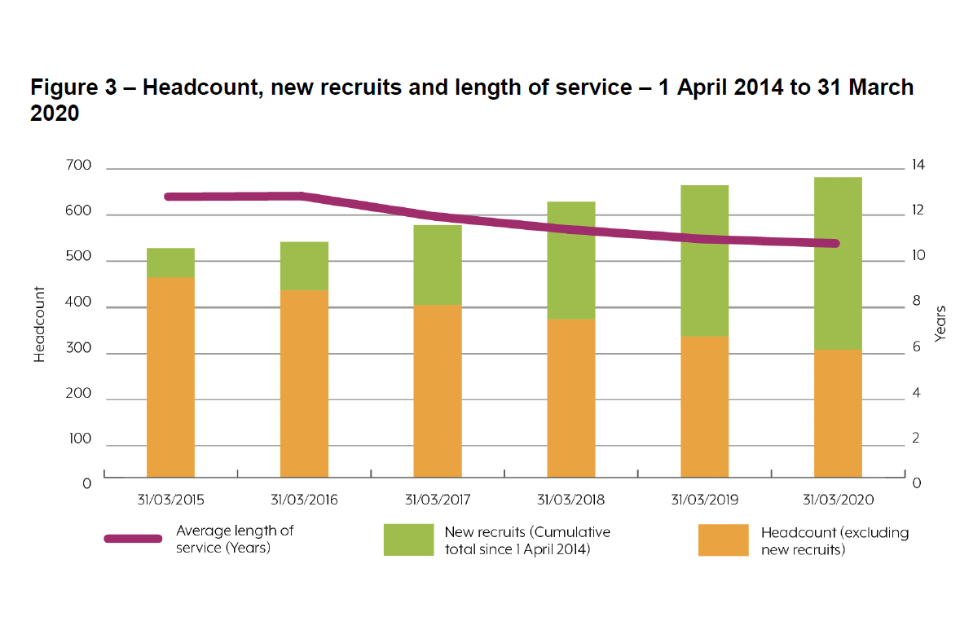

I’m delighted that ONR is an attractive employer, recruiting and retaining the very best people, who increasingly recognise ONR as a single organisation that thrives on teamwork, offers a supportive environment and places a steely focus on our purpose and outcomes.

All this has come through hard work by our teams, recognising where we needed to do better, genuinely seeking feedback to help us improve and embracing a more outwardslooking, open-minded attitude.

I thank everyone who has helped ONR become the organisation it is today.

Adriènne Kelbie

Chief Executive

Chief Nuclear Inspector’s foreword

I am fortunate to lead a dedicated and professional regulatory team that is focused on effectively delivering our core regulatory purpose. Through the evidence they have gathered, it is my judgement that the majority of Great Britain (GB) nuclear dutyholders have continued to meet the requisite high standards of safety and security to protect workers and the public. Where dutyholders have fallen short of such standards I am satisfied that their facilities remain safe and that our regulatory focus has had a positive impact on their performance.

The rapid emergence of COVID-19 prompted significant changes in how we regulate. Inspectors are carrying out as much work as possible remotely, while still travelling to sites when necessary. I am grateful for the commitment shown by our teams in gaining vital assurance that the industry remains safe and secure in such unprecedented times. Issues associated with the ageing fleet of Advanced Gas Cooled Reactors (AGRs) have again been a major focus for our inspectors. We have dedicated considerable effort assessing the impact of the cracking of the graphite cores at Hunterston B and Hinkley Point B, working with the licensee to ensure the continued safety of the reactors at these power stations. We have permissioned a number of key enabling works at Sellafield in support of major hazard and risk reduction projects. The site will remain at an increased level of regulatory attention due to the nature of the hazards and risks, but I am pleased that good progress is being made.

The GDA of the UK HPR1000 reactor design completed Step 3 in February 2020. The design has now entered the final step of the GDA process and we anticipate completing the Step 4 assessment during 2021 to 2022. ONR’s Civil Nuclear Security and Safeguards team has been busy supporting the transition to outcome-focused security regulation, assessing and approving new site security plans across the industry. We have also been further developing our capability to effectively deliver the UK SSAC.

During the year, ONR hosted the IRRS mission on behalf of the UK. I was pleased the mission team commented that ONR has a mature regulatory framework that could be emulated by other regulatory authorities to improve their understanding and implementation of IAEA safety standards. Areas for improvement were also identified and we are working with government and other UK regulators to address these.

In October 2019, I published the first Chief Nuclear Inspector’s Annual Report[footnote 3] on the safety, security and safeguards performance of Great Britain’s nuclear industry. It provides a detailed insight into industry performance and ONR’s associated regulatory interventions and, as such, complements this document. The second such report will be published in Autumn 2020.

As we embark upon our new five-year strategy, I look forward to working with the Board, Chief Executive and all of the people in ONR to deliver it efficiently and effectively, ensuring the continued protection of the public.

Mark Foy

Chief Nuclear Inspector

ONR in numbers – 2019 to 2020

- total expenditure for the year = £92.3 million

- 30 permissioning activities and determinations

- 1.2 million hours worked

- over 800 compliance inspections carried out

- 428 intervention records published

- 43 out of 56 milestones delivered (of the 13 that have slipped, 4 were impacted by COVID-19)

- 146,000 unique users from 178 countries on Office for Nuclear Regulation

- we regulate 36 licensed sites

- 3 improvement notices issued

- 55 transport dutyholder inspections

- 659 members of staff at 31 March 2020

- 21% of our leadership roles are occupied by women

- stakeholder survery:

- 89% ONR is independent

- 85% ONR is trusted

- 82% ONR is professional

Performance overview

The overview section provides a short summary of ONR’s role, our purpose, the key risks to the achievement of our objectives and how we have performed in the year.

About ONR

We are the UK’s independent nuclear regulatory body, with the legal authority to regulate nuclear safety, security and conventional health and safety at 36 licensed nuclear sites[footnote 4] in Great Britain. This includes the existing fleet of operating reactors, fuel cycle facilities, waste management and decommissioning sites, as well as licensed defence sites, together with the regulation of the design and construction of new nuclear facilities.

We also regulate the transport of nuclear and radioactive materials by road, rail and inland waterways. Our nuclear security regulation covers approval of security arrangements within the civil nuclear industry and provides regulatory oversight for the security of civil nuclear materials transportation.

We will operate the UK SSAC and a domestic safeguards regime from 1 January 2021, at the end of the transition period laid out in the Withdrawal Agreement.

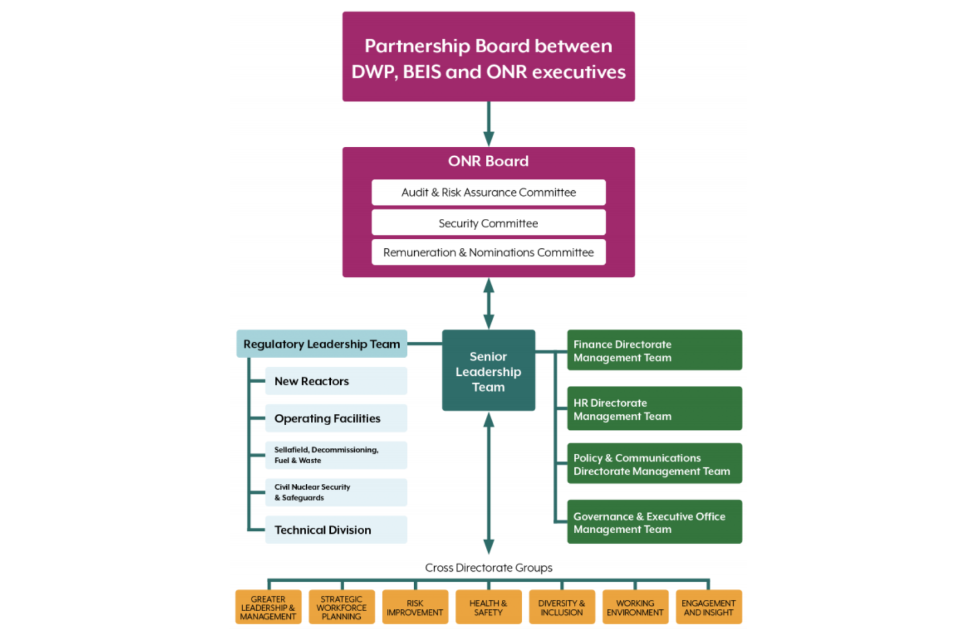

We are governed by a 10-strong unitary Board, comprising a Chair (Mark McAllister), 5 independent Non-Executive Directors and 4 Executive Directors from a range of backgrounds. The Board sets organisational and regulatory strategy and supports the work of our staff who are based in Bootle, Cheltenham and London.

Our Chief Executive, Adriènne Kelbie, leads the organisation and is accountable for ensuring all funds are spent in accordance with Parliament’s intentions, and in accordance with Her Majesty’s (HM) Treasury’s ‘Managing Public Money’ and other relevant governing guidance and instructions.

The Board has delegated all individual regulatory decisions to our Chief Nuclear Inspector (CNI), Mark Foy, who is accountable for ensuring that our regulatory activities are targeted effectively, properly discharged and that our regulatory decisions are proportionate and consistent. He provides assurance to our Board that regulatory decisions are being made appropriately within the legal requirements of the Energy Act 2013.

We disclose information on our regulatory activities, which is available on the Office for Nuclear Regulation website. We will continue to engender public trust and respect by sharing information about our activities and dealing with questions, enquiries and concerns by providing explanations of our decisions. We also routinely engage with local stakeholder groups and local liaison committees at all sites, non-government organisations (NGOs), the public, media and Members of Parliament (MPs).

Our Strategic Themes (2015 to 2020)[footnote 5]

Strategic Theme 1: Influencing improvements in nuclear safety, security and safeguards

ONR exists for this purpose. We are legally empowered and have a duty to hold industry to account on behalf of the public. Our enabling approach is key to influencing solutions across increasingly complex scenarios, and includes a well-understood, graded approach to recognise particularly challenging sites through increased regulatory attention.

Strategic Theme 2: Inspiring a climate of stakeholder respect, trust and confidence

Public confidence in our regulation of nuclear safety, security and safeguards is essential. While we are a trusted and respected regulator in the UK and internationally, we operate in an increasingly high profile environment, with heightened political, media, academic and public interest in the nuclear agenda. Openness and transparency underpin our communications approach, to help build and maintain public confidence.

Strategic Theme 3: Getting the best out of our people

Our people are our most valuable asset. They are highly professional, skilled and motivated to deliver the best outcomes for the organisation. We demand a lot from them and it is incumbent on us to provide them with a good working environment, positive culture, fair work-life balance and optimum standards of health, safety and welfare.

Strategic Theme 4: Developing a high-performing, sustainable organisation

Modernising our operating environment is a fundamental requirement to ensure we have the right staff and the right skills for our organisation, to transform the way we work, enhance our IT, manage change effectively and work smarter – supported by systems and processes that optimise delivery and ensure we are fit for the future.

Further detail of our performance can be found within the Performance Analysis section of this report.

Our website explains who we are, what we do, where we regulate and how we work with stakeholders, including government, other regulators, NGOs and international bodies.

Key Issues and Risks

We manage risk through clear lines of executive accountability and regular review and challenge by our Risk Improvement Group (RIG) and Senior Leadership Team (SLT), subject to scrutiny by our Audit and Risk Assurance Committee (ARAC) and the Board.

Our role is to regulate the nuclear industry effectively, to ensure that dutyholders observe the high standards required by UK legislation. We prioritise and focus our regulatory inspection, assessment and permissioning activities on those areas that pose the greatest risk to the public, employees and society.

Risks materialise, in most cases, with an element of uncertainty. To enable us to align internal and external risks effectively, we have linked risk to our Organisational Effectiveness Indicators (OEIs) and delivery milestones. This enables us to ensure appropriate mitigations are in place.

In summary, the strategic risks that we managed during the year, endorsed by the Board and ARAC, related to:

- delivering efficient and effective regulation

- information management practices and protective security systems to ensure we have established adequate and appropriate levels of security and control

- cyber security and infrastructure and the need to establish our own independent network infrastructure

- enhancing our organisational capability and addressing the demographic and knowledge transfer challenge, so that our recruitment, retention, staff development and talent management practices optimise the quality and effectiveness of our people

- change and/or uncertainty in policies relating to the nuclear context within which we operate, ensuring we are flexible, adaptable and capable to respond to a changing operating environment and priorities

- developing an independent UK SSAC to meet international safeguards obligations

- ability to respond effectively to the impact of EU Exit

- commercial oversight and delivery

- ability to manage an extensive portfolio of change

- incident management

- financial strategy – funding and charging

During the final quarter, we also focused our attention on mitigating the emerging risk associated with the impact of COVID-19, establishing clear priorities and developing an appropriate response that prioritised both the health and well-being of our people and maintaining the delivery of our core regulatory functions.

Going concern

We are funded primarily by charges to the nuclear industry through cost recovery from dutyholders and charges to government for specific commissioned activities, together with grant funding from our sponsoring body, the Department for Work and Pensions (DWP), which is around 2% of our budget. The latter covers activities that we are not permitted to recover from industry. The income generated from cost recovery funds the regulation of the industry.

We do not make any profit or surplus, and nuclear site licensees are charged only for the work undertaken in regulating them. The grant is agreed for the current Spending Review period and confirmed annually. For 2019 to 2020, net assets totalling £11.3 million were recorded at the end of the financial year. We have no outstanding liabilities that threaten our ability to continue.

COVID-19 does not impact our regulatory activities and consequently our ability to recover associated costs is not adversely affected. Similarly, we are still able to recover any costs for work undertaken on behalf of the Department for Business, Energy and Industrial Strategy (BEIS).

Consequently, the going concern basis has been adopted for the preparation of the financial statements.

Forward Look

Our Corporate Plan for 2020 to 2021 was published in July 2020. The following summarises our top 5 priorities for delivery and our updated strategic themes in our Strategy 2020 to 2025. (This publication reports against our strategic themes for 2015 to 2020).

Strategic Theme 1: Influencing proportionate improvements

1. Maintain delivery of our core regulatory functions, holding dutyholders to account on behalf of the public. This will include targeted regulatory oversight of progress at ‘Enhanced Attention’ sites and assurance on safety and security in light of COVID-19.

2. Deliver an effective UK SSAC and implementation of Security Assessment Principles (SyAPs) across all dutyholders.

Strategic Theme 2: Inspiring stakeholder confidence

3. Enhance transparency, through our stakeholder engagement, in line with the aspirations of our Strategy 2020 to 2025, to enable effective two-way communications, particularly as we respond to COVID-19.

Strategic Theme 3: Creating a culture of inclusion and excellence

4. Promote the sustained health and wellbeing of our staff through effective and inclusive leadership and management, as we respond to COVID-19.

Strategic Theme 4: Modernising how we work

5. Deliver our 2 strategic change projects – separating our IT infrastructure from the Health and Safety Executive (HSE) and commencing a pilot of our Well Informed Regulatory Decisions (WIReD) project.

Performance Analysis

Milestones

We delivered 43 out of 56 of our corporate milestones and targets. The majority that were not met were affected by circumstances beyond our control, including COVID-19 or updated scheduling by a dutyholder. We set an ambitious plan at the start of the year and a number of milestones have been deferred until early 2020 to 2021 or have subsequently been met outside the reporting period.

More information is provided in the sections relating to our Strategic Themes.

| Strategic Theme | Milestones met | Milestones not met | Total milestones | % met |

|---|---|---|---|---|

| Strategic Theme 1 | 12 | 2 | 14 | 86% |

| Strategic Theme 2 | 19 | 8* | 27 | 70% |

| Strategic Theme 3 | 2 | 0 | 2 | 100% |

| Strategic Theme 4 | 10 | 3 | 13 | 77% |

| All Strategic Themes | 43 | 13 | 56 | 77% |

* Includes one “partly met” milestone – see further details in Table 3.

Organisational Effectiveness Indicators (OEI)

This year we also implemented the pilot phase of our new OEI Framework; a modern framework intended to provide an improved insight into our performance and its effectiveness, which supersedes the largely output focused and efficiency-based Key Performance Indicators (KPIs) utilised in previous years.

Strategic Theme 1 – Influencing improvements in nuclear safety, security and safeguards

Headlines

In 2019 to 2020, we regulated the nuclear industry effectively and efficiently to protect the public and environment from harm, in accordance with our purposes as defined within the Energy Act 2013: nuclear safety, nuclear site conventional health and safety, nuclear security, nuclear safeguards and transport. Our regulatory framework is well established and our regulatory approach has delivered proportionate, targeted and balanced decisions in a changing nuclear environment. We continue to evolve, recognising the need to be a responsive organisation that adapts to the changing nuclear landscape and seeks continuous improvement.

During 2019 to 2020, we delivered 12 out of 14 corporate milestones as published within the Corporate Plan.

Table 1 – Strategic Theme 1 Corporate Milestones

| Strategic Theme 1 (14 milestones) | Met/Not Met | Comments |

|---|---|---|

| UK SSAC to be able, if required, to meet UK International Obligations | Met | Completed April 2019 |

| UK SSAC to be able, if required, to commence the ONR nuclear material safeguards inspection regime | Met | Completed June 2019 |

| Make decision – permission Sizewell B reactor start-up following statutory outage | Met | Completed July 2019 |

| Issue Action Plan to European Union on European Nuclear Safety Regulators Group (ENSREG) Topical Peer Review on Ageing Management | Met | Completed September 2019 |

| Complete Radiation Emergency Preparedness and Public Information Regulations (REPPIR) 2019 Approved Code of Practice consultation | Met | Completed September 2019 |

| Make Decision – permission commencement of construction of the Sellafield Product and Residue Store Retreatment Plant (SRP) at Sellafield | Met | Completed November 2019 |

| Complete annual Nuclear Security Review | Met | Completed November 2019 |

| Make decision – permission Hartlepool (R2) reactor start-up following statutory outage | Met | Completed November 2019 |

| REPPIR Approved Code of Practice ready for publication (Health and Safety Executive (HSE) to publish) | Met | Completed September 2019 |

| Make Decision – permission the start of waste retrievals from Pile Fuel Cladding Silo (PFCS) at Sellafield | Not met | This ONR milestone was revised to align with updated schedules from the dutyholder |

| Make Decision – permission commencement of Silo Emptying Plant (SEP) 2 active commissioning in Magnox Swarf Storage Silo (MSSS) at Sellafield | Not met | This ONR milestone was revised to align with updated schedules from the dutyholder |

| Make decision on completion of Step 3 and the commencement of Step 4 for GDA of the UK HPR1000 | Met | Completed February 2020 |

| Make decision on adequacy of Heysham 2 and Torness Periodic Reviews of Safety | Met | Completed February 2020 |

| Confirm fuel free verification status of Wylfa’s reactors | Met | Completed November 2019 |

The following list shows our top priorities in 2019 to 2020 relating to Strategic Theme 1.

Strategic Theme 1: Influencing improvements in nuclear safety, security and safeguards

- Maintain delivery of our core regulatory functions, holding industry to account on behalf of the public.

- Embed an independent UK SSAC to enable the UK to meet its international safeguards obligations after leaving Euratom, as a result of Brexit, and work towards a safeguards system equivalent in effectiveness and coverage to that provided by Euratom by December 2020.

- Support implementation of the emergency preparedness elements of the Euratom Basic Safety Standards Directive (BSSD) (2013), including developing a Code of Practice (and associated guidance) in support of the revised Radiation (Emergency Preparedness and Public Information) Regulations (REPPIR) (2019) and guidance to support amendments to the Carriage of Dangerous Goods Regulations and Use of Transportable Pressure Equipment Regulations (CDG) 2009.

Regulatory activity in 2019 to 2020

Our regulatory activities in the 2019 to 2020 financial year were progressed against our 3 priorities under Strategic Theme 1, as outlined in our Corporate Plan:

1. Maintain delivery of our core regulatory functions, holding industry to account on behalf of the public.

Against this priority we:

- regulated an ageing reactor fleet and implemented new strategies to secure improvements at defence sites in enhanced attention to enable them to move to routine regulatory attention in a timely manner

- regulated nuclear new build and assessed new reactor designs, including Advanced Nuclear Technologies (ANTs)

- embedded the new approach to assessing the SyAPs aligned Nuclear Site Security Plans

- influenced improvements in cyber security and information assurance and developed our own cyber security regulatory capabilities

- addressed challenges faced implementing the Nuclear Sector Deal, with specific focus on the regulation of innovation

- hosted the UK IAEA IRRS mission in October 2019, developing ONR’s response to the recommendations

2. Embed an independent UK SSAC to enable the UK to meet its international safeguards obligations after leaving Euratom as a result of Brexit, and work towards a safeguards system equivalent in effectiveness and coverage to that provided by Euratom, by December 2020.

We have continued to work to establish our safeguards inspection capability in order to deliver a domestic safeguards regime, equivalent in effectiveness and coverage to that currently provided by Euratom by the end of December 2020, as per government policy.

3. Support implementation of the emergency preparedness elements of the Euratom BSSD (2013), including developing a Code of Practice (and associated guidance) in support of the revised REPPIR 2019 and guidance to support amendments to the CDG 2009.

We supported government to implement emergency preparedness aspects of the EU BSSD and implemented improvements to ONR’s emergency response capability and incident management arrangements.

What we delivered in 2019 to 2020

Nuclear Safety

Two distinct elements of our regulatory work are associated with nuclear safety: compliance inspection and permissioning assessment. Compliance inspection involves inspectors undertaking regulatory inspections on the licensed nuclear sites to confirm compliance with the conditions attached to the nuclear site licence. These inspections are undertaken in a targeted manner and informed through intelligence gathered from our activities and from incidents that have occurred both nationally and internationally.

Where shortfalls are identified, we take enforcement action to ensure that the dutyholders are compliant. Such action reflects the safety significance of the shortfalls and may include formal enforcement notices or, for the most significant matters, prosecution.

Through requirements specified within the site licence, licensees are required to seek our permission to undertake various activities on licensed nuclear sites. Our work in granting permission involves specialist ONR inspectors performing sampling assessments and undertaking inspection of the proposed activity.

This can include approval of arrangements, agreement to modifications, or consent to commence operation of a plant or process. In 2019 to 2020, we granted 60 permissions to dutyholders/licensees.

Nuclear Site Conventional Health and Safety

Our resourcing and resilience strategy for regulation of conventional health and safety has been pivotal in addressing capability and capacity requirements. We combined this with ONR’s internal hazards discipline in order to finalise the full integration of the conventional health and safety discipline into ONR, and formed a new specialism, Nuclear Internal Hazards and Site Safety, under a single Professional Lead. These initiatives are expected to realise further benefits for co-ordinated planning, specialist staff development, and enhancing our assessment capabilities across our core purposes. Another key benefit has been a reduction in our reliance on HSE for front-line support, most notably in the key regulatory functions relating to the Control of Major Accident Hazards (COMAH), which are now delivered and co-ordinated ‘in-house’ and are fully aligned with our divisional plans for nuclear safety regulation. COVID-19 became a significant public health issue in the latter part of the reporting period and we continue to support national efforts to ensure that the risks arising on our sites are being properly assessed and mitigated. Our regulatory focus included assurance from site licensees that they are applying the public health measures introduced to reduce the spread of coronavirus, where appropriate.

Civil Nuclear Security and Safeguards (CNSS)

We have further implemented outcome-focused civil nuclear security regulation by applying our SyAPs through associated assessment and approval of security plans. This represents a significant cultural shift for both dutyholders and ONR inspectors. We focused upon strengthening governance and enabling activity through improving both dutyholder and inspector capability through provision of training, advice and guidance. The results of internal assurance activities indicate results; quality and consistency of assessment reports has greatly improved over the year.

CNSS has concluded assessment and subsequent approval of 16 from 37 (43%) security plans across the civil nuclear premises estate, including those with the most significant consequences and complexity: Sellafield, Dounreay and the older plants within the EDF fleet. Where appropriate, we requested that dutyholders provided a strategy to deliver a proportionate programme of submissions, and in response, have used the principles of enabling regulation as appropriate.

Nuclear Safeguards

We have continued to monitor safeguards performance in the UK, supporting and intervening as necessary with UK dutyholders and/or Euratom and the IAEA to ensure that safeguards obligations in the UK are met. As part of Phase 1 of the project to set up a UK SSAC, as a result of the UK exiting Euratom, we were ready to meet international obligations by end of March 2019, as required. We are now in Phase 2 of the project and we will continue to establish our safeguards inspection and nuclear material accountancy capability in order to deliver a domestic safeguards regime, equivalent in effectiveness and coverage to that currently provided by Euratom, by the end of December 2020, in line with Government policy.

Transport Competent Authority (TCA)

We are the enforcing authority for the civil transport of radioactive material by road, rail and inland waterway in Great Britain (GB). Regulation is delivered through our TCA function. The TCA is responsible for the regulation of the non-nuclear sector, transport package design assessment approvals, and oversight of all transport inspection and assessment work performed within the divisions. ONR also acts on behalf of the other Competent Authorities with respect to the issuing of transport approvals i.e. the Maritime and Coastguard Agency (MCA) for transport in UK waters; the Civil Aviation Authority (CAA) for air transport; and the Department of Agriculture, Environment and Rural Affairs Northern Ireland for road transport.

During 2019 to 2020, we published guidance for the industry on the amendments to the CDG regulations relating to emergency arrangements. We will be working with the industry during 2020 to 2021 to support compliance with these revised regulations through our inspections and working with stakeholder groups. We will also seek to influence further improvements in dutyholder compliance with the Ionising Radiation Regulations (IRR) 2017 with respect to radiation risk assessment.

Inspection and Enforcement

During 2019 to 2020, we undertook 808 compliance inspections across all our purposes. Any shortfalls found were dealt with in accordance with our internal due process, embodied in the ONR Enforcement Policy Statement (EPS). During this financial year we:

- served 3 improvement notices

- issued 29 enforcement letters

- issued one direction

During 2019 to 2020, ONR instigated the following prosecutions:

Table 2 – Summary of prosecutions instigated in 2019 to 2020

| Licensee / Dutyholder | Details of Incident and Charges | Plea | Outcome |

|---|---|---|---|

| Devonport Royal Dockyard Ltd | Prosecution for offences under Regulation 8 of the Lifting Operations and Lifting Equipment Regulations 1998, in relation to a dropped test weight event | Pleaded Guilty on 23 July 2019 | Devonport Royal Dockyard Ltd fined £666,667 and ordered to pay costs of £27,611.82 |

Performance of our Regulatory Divisions[footnote 6]

New Reactor Construction

Generic Design Assessment (GDA)

During 2019 to 2020 we published a modernised GDA process to take account of lessons learned from previous and ongoing GDAs and recent changes in the nuclear industry in the decade since GDA was originally devised. In particular, we considered the Nuclear Sector Deal (NSD) and the potential for Small Modular Reactor (SMR) designs to enter GDA.

The objective for GDA is to provide confidence that the proposed design is capable of being constructed, operated and decommissioned in accordance with the standards of safety, security and environmental protection required in GB. The revised process enhances the efficiency and flexibility of the GDA process, without lowering the high standards of safety and security required. For the requesting parties, this offers a reduction in uncertainty and project risk to be an enabler to future licensing, permitting, construction and regulatory activities.

During 2019 to 2020, China General Nuclear Power Corporation and EDF Energy, the requesting parties, through their joint venture company General Nuclear System Ltd, continued to progress the GDA of the UK HPR1000 reactor design. Step 3 (overall design, safety case and security arguments review) began in November 2018, and was completed in February 2020. This step was extended beyond the original proposed completion date of December 2019, at the request of the requesting parties, as a number of administrative matters took longer than expected. This extension did not impact on the adequacy of our assessments.

Our decision on whether to proceed to the final detailed assessment Step for this GDA was made during February 2020. Step 4 is now intended to conclude in January 2022, noting that COVID-19 may affect delivery in the 2020/21 financial year.

Advanced Nuclear Technologies (ANT)

We successfully completed the three-year Phase 1 of the government’s ANT project, sponsored by BEIS. Key achievements were:

- publication of new GDA Guidance to Requesting Parties, reflecting a modernised GDA process with improved flexibility and better suited for less mature advanced technologies. We also published GDA Technical Guidance

- provision of advice to BEIS on the potential for 7 Generation IV Advanced Modular Reactor (AMR) designs, to align with UK regulatory expectations, as input to BEIS’s AMR Feasibility and Development (F&D) project

- increased a lasting capability by continuing implementing our ANT training strategies and plans and capturing our knowledge via our well established ANT Knowledge Management process

- reviewed the applicability of our regulatory guidance to SMRs and outlined a programme to extend this review to other ANTs

- developed and implemented a programme of research and capture of operational experience (OPEX) to continue increasing our knowledge in key areas of ANT

ONR has also continued to engage with the ANT industry and overseas regulators, and to actively participate in ANT international fora such as, for example, the SMR Regulators’ Forum, IAEA activities on SMR design assessment and licensing, the Western European Nuclear Regulators Association (WENRA) and the Nuclear Energy Agency’s (NEA) Working Group on the Safety of Advanced Reactors (WGSAR).

Regulation of Operating Facilities

Operating Nuclear Power Stations

The year presented significant resource challenges due to a range of emergent issues associated with graphite ageing, affecting Hartlepool, Heysham 1, Hinkley Point B and Hunterston B power stations. Each has had the potential to affect continued operation of these sites. We subsequently issued Consent for Hartlepool Reactor 2 to restart following planned periodic shutdowns. We also issued licence instruments to allow Hinkley Point B to operate into early 2020 under Licence Condition 30. Longer-term operations at Hunterston B and Hinkley Point B remain to be determined.

Atomic Weapons Establishment (AWE) Sites

We delivered a balanced regulatory approach this year, providing enabling advice and guidance where required but also holding AWE to account as necessary. By working in a flexible manner with AWE and focussing regulatory attention on the assessment of life-extension safety cases, we have been able to permission fit for purpose safety upgrades that enable continued safe operations in a key ageing facility on the Burghfield site, pending the delivery of a delayed modern standards replacement facility.

Propulsion Sites

Our regulatory focus across the propulsion sites has focused on early engagement, advice and guidance relating to the strategic infrastructure projects required to support the existing and future submarine programme. We have established multi-party, senior-level stakeholder forums to facilitate discussion and help ensure fit for purpose solutions that are available on time. There were some challenges relating to the Astute and Dreadnought enabling programmes, and we worked in a flexible manner to help the licensees responsible for them secure safe, compliant delivery. A significant proportion of our regulatory strategy was focused on improving performance at the Devonport site.

Regulation of Sellafield, Decommissioning, Fuel and Waste Sites

Sellafield

Key regulatory achievements included regulation to enable:

- the overpacking by Sellafield Ltd of legacy Type 1 Packages, contributing to risk reduction at the facility complex

- the completion by Sellafield Ltd of civil refurbishment work on the Sellafield Special Nuclear Material North Facility

- the implementation by Sellafield Ltd of a revised safety case for the operation of an internal building crane (the east end crane) at the Magnox Swarf Storage Silo (MSSS), a key enabler for retrievals from the facility

- the completion of the consolidation of Special Nuclear Materials from Dounreay to Sellafield – a major achievement in which ONR’s contribution was commended by stakeholders

- compliance with an Improvement Notice (IN) issued to Sellafield Ltd in December 2018 following the striking of a 132kv underground cable during construction activities at the Fellside Steam Generation Plant Facility construction site

A number of deliverables remain a challenge and we continued to focus regulatory attention on these to secure timely hazard and risk reduction. These include:

- the development of safety cases and construction of facilities to receive and store waste from the Pile Fuel Cladding Silo (PFCS) and MSSS; and

- developing the capabilities for the safe treatment and long-term storage of Special Nuclear Materials at Sellafield

Decommissioning, Fuel and Waste Sites

Key achievements included regulating to enable:

- the completion of active decommissioning of Pu-containing facilities at the Low Level Waste Repository 4 years early on a 10-year programme

- the verification of the Wylfa reactors as fuel-free

- the delicensing of the GE Healthcare Cardiff Nuclear Licensed Site

Technical Division

Emergency Preparedness and Response (EP&R)

The EP&R team has delivered all planned inspections of Local Authorities and assessment of all Level 2 off-site emergency exercises. The team also provided technical support to national projects, notably the Joint Agency Modelling (JAM) and the replacement for the Radioactive Incident Monitoring Network (RIMNET), which is a key priority for BEIS. We will continue to support BEIS in the delivery of this project, which is expected to be completed during 2020.

We have also secured significant improvements to our Redgrave Court incident suite, to enhance our capability in support of national emergency arrangements. This has been achieved in parallel to our ongoing IT Separation project. We also fully delivered our work in relation to Land Use Planning by providing timely advice to local authorities in connection with proposed developments within the detailed emergency planning zones (DEPZ) around nuclear sites.

Regulatory Oversight (RO)

The RO function provides assurance to the CNI across all aspects of our regulatory activities. It seeks to ensure quality and consistency in regulatory inspection and enforcement decision-making across ONR functions and challenge inconsistency, or non-compliance, with internal process and procedures. RO activities are considered a mechanism for organisational learning and do not seek to rate individual performance or seek to undermine any element of our regulatory activities. The function performs as a ‘critical friend’ to the organisation as a mechanism for continuous improvement, and assures the CNI and Board that our purposes under the Energy Act 2013 are being discharged efficiently and effectively and in accordance with the Law. The work of Regulatory Oversight compliments the work undertaken by the Regulatory Assurance function (RA) and the Government Internal Audit Agency.

Over the course of the year, RO reviews have found a number of organisational learning points, which are being taken forward as part of our commitment to continuous improvement across our regulatory activities.

Overall, the RO reviews provided a high degree of assurance to the CNI and Board through the confirmation that we are performing our activities in accordance with our statutory duties and with our mission to provide efficient and effective regulation of the nuclear industry, holding it to account on behalf of the public.

Regulatory Research

We published a significant update to our Regulatory Research Strategy. It now outlines our research objectives, our approach to delivery, governance and engagement with national and international stakeholders, and our plans for measuring the effectiveness of the research we commission. It presents a long-term view of the UK’s nuclear landscape and identifies ONR’s strategic regulatory research needs over the period 2020 to 2040.

Strategic Theme 2 – Inspiring a climate of stakeholder respect, trust and confidence

Headlines

- publication of the first CNI Report on GB nuclear industry

- consultation on our Strategy for 2020 to 2025

- extensive stakeholder engagement associated with Hunterston B safety cases

- international peer review (IRRS Mission) of regulation of nuclear and radiological safety

- two formal consultations associated with REPPIR 2019

During 2019 to 2020, we delivered 19 out of 27 corporate milestones as published within the Corporate Plan.

Table 3 – Strategic Theme 2 Corporate Milestones

| Strategic Theme 2 (27 milestones) | Met/Not Met | Comments |

|---|---|---|

| Lay and Publish ONR Corporate Plan 2019 to 2020 | Met | Completed April 2019 |

| Hold IRRS UK 2019 Preparatory Meeting | Met | Completed April 2019 |

| Hold industry SyAPs regulatory mechanics workshop | Met | Completed April 2019 |

| Host ONR webinar (May) | Met | Completed May 2019 |

| Host Heads of the European Radiological Protection Competent Authorities (HERCA) Board Conference | Met | Completed May 2019 |

| Deliver Industry Conference | Met | Completed June 2019 |

| Publish ONR Annual Report and Accounts 2018 to 2019 | Met | Completed June 2019 |

| Publish Gender Pay Report | Met | Completed June 2019 |

| Submit 8th UK Convention on Nuclear Safety Report to BEIS | Met | Completed June 2019 |

| Participate in 63rd IAEA General Conference | Met | Completed September 2019 |

| Conduct stakeholder survey | Met | Completed October 2019 |

| Completion of IRRS UK 2019 Mission | Met | Completed October 2019 |

| Host ONR webinar (Oct) | Met | Completed October 2019 |

| Publish Chief Nuclear Inspector’s Annual Report 2019 | Met | Completed October 2019 |

| Host NGO forum (Nov) | Met | Completed November 2019 |

| Hold Autumn CNI Independent Advisory Panel | Met | Completed November 2019 |

| Achieve Disability Employer Level 3 Accreditation | Met | Completed December 2019 |

| Agree IRRS UK 2019 Mission Action Plan | Met | Completed January 2020 |

| Host ONR webinar (Jan) | Met | Completed February 2020 |

| Host NGO forum (Mar) | Not met | Cancelled due to impact of COVID-19. Other liaison opportunities have been put in place instead |

| Deliver UK presentation & participate in 8th Convention on Nuclear Safety Review Meeting | Not met | Cancelled due to impact of COVID-19 |

| Hold Spring CNI Independent Advisory Panel | Not met | Cancelled due to impact of COVID-19 |

| Present paper at US Nuclear Regulatory Commission’s Regulatory Information Conference (RIC) | Not met | Cancelled due to impact of COVID-19 |

| Submit 2020 to 2021 Corporate Plan (including Budget) to Ministers for approval | Partly met | Budget submitted in March 2020 (met). Corporate Plan timings re-planned to align with publication of ONR Strategy 2020 to 2025 |

| Produce interim report into SyAPs benefits realisation | Not met | Contractor cost considered disproportionate. Deferred in order to develop internal capability to support delivery of milestone |

| Publish ONR Strategic Plan 2020 to 2025 and consultation response | Not met | Publication re-timed to allow for wider stakeholder engagement and consultation |

| Publish ONR report on approach to the Regulation of Innovation | Not met | Re-timed to allow further consultation with key stakeholders |

The following list shows our top priorities in 2019 to 2020 relating to Strategic Theme 2.

Strategic Theme 2: Inspiring a climate of stakeholder respect, trust and confidence

4. Strengthen insight, peer review and effective two-way stakeholder engagement.

5. Lead the UK IAEA IRRS Mission 2019, working with other regulators and government to present a coherent and accurate position of how we regulate in the UK.

Openness and transparency

Public confidence in our regulation of the nuclear industry is essential. We continued to provide detailed information, as set out in our publication scheme, on how we regulate, the rationale for our regulatory decisions, our research and regulatory intelligence. We strived to improve the way we engage with all our stakeholders, inviting comments and feedback through face-to-face engagement, our digital channels and via more formal consultation (see below).

Inaugural CNI report on GB nuclear industry

In October we published the first of a new style of report, in which the CNI gave his view on the performance of Great Britain’s nuclear industry during the previous year. The report also featured details and analysis of safety events reported by dutyholders during the period, as well as ONR’s annual research statement. The CNI reported he was satisfied that overall the industry had continued to meet the high standards of safety and security required to protect workers and the public. The report was launched at an event for senior representatives from the industry, where the CNI set out a number of themes that require continued and collective focus from dutyholders. These were the management of ageing facilities, conventional health and safety performance, and delivering a holistic approach to nuclear security. The report was circulated to our wider stakeholders, including the media, and will become part of our annual reporting cycle.

IRRS Mission

The IRRS visited the UK during October. Coordinated through the IAEA, the 11-day ‘full-scope’ Mission saw a team of 18 independent experts from across the globe scrutinising the regulation of nuclear and radiological safety. The mission was formally requested by the UK government and hosted by ONR. Fifteen regulatory bodies were included within the scope of the review.

The government published the full Mission report and the UK response in July 2020[footnote 7]. We have already developed an action plan to address the findings from the mission. Some of the findings will take several years to address where solutions require time to develop, or where they relate to multiple regulators. We provided the government with technical advice for its co-ordinated response to the IAEA findings.

Engagement associated with Hunterston B

We engaged closely with a broad range of stakeholders to ensure understanding of our regulatory considerations with regard to the operation of the 2 reactors at Hunterston B in Ayrshire, Scotland. Hunterston B is displaying the most advanced symptoms of graphite core degradation in the UK operating fleet, and our decision to allow the restart of Reactor 4 in August 2019, for a period of approximately 4 months, attracted considerable stakeholder interest. Throughout this process, we engaged closely with stakeholders, including North Ayrshire Council, UK and Scottish governments, local stakeholder and nuclear-interest groups, media and the public. Similar engagement will continue in the context of future regulatory considerations affecting the operation of the AGR fleet.

Formal consultations (REPPIR 2019)

We conducted 2 formal public consultations associated with revisions in national legislation for emergency preparedness and response arrangements (REPPIR 2019). The consultations sought comments on our proposed Approved Code of Practice (ACOP) intended to assist dutyholders’ compliance with REPPIR 2019, and on updated transport-related guidance related to amendments to the CDG Regulations. The responses to both consultations helped inform the final versions of the ACOP and CDG guidance, which were published in autumn 2019.

CNI Independent Advisory Panel

The CNI’s Independent Advisory Panel met to address topics including strategic workforce planning, ONR’s response to the IRRS recommendations, delivery of ONR’s WIReD project and our approach to regulation of the supply chain. The panel comprises a range of representatives from industry, professional institutions and academia. Membership was further diversified to include two NGO representatives.

Stakeholder survey

During October and November, we conducted our third annual stakeholder survey. Acting on our behalf, the independent research organisation YouGov invited almost 1,200 stakeholders to participate in this online exercise, which heard from nuclear site licensees, other dutyholders, Government, arms-length bodies, NGOs, academia, local authorities, and others. A small number of qualitative in-depth interviews were also conducted to gather further insight.

The data was a vital source of insight into stakeholder perceptions of ONR and views of our performance, helping ensure we remain responsive and agile to external concerns and needs. Results were generally positive, with ONR performing very well in a number of areas and no significant drops in those areas where feedback had been positive in 2017 and 2018. ‘Professional’, ‘independent’ and ‘trusted’ were the attributes most strongly associated with ONR. Areas identified as requiring further attention included stakeholder perception of proportionality, consistency and responsiveness to change. The survey results were published in August 2020.

NGO engagement

In November, we held the latest of our bi-annual engagement meetings with our NGO community, comprising of local and national nuclear pressure and campaign groups. Our Chair, Mark McAllister, attended the meeting and ONR representatives addressed more than 50 questions on the day. Our second planned meeting was deferred and subsequently cancelled due to the impact of COVID-19 restrictions.

Throughout the year, we also engaged through ad-hoc topical meetings, by webinar and in person, to discuss issues, including regulation of civil nuclear new build and climate change.

We continued to attend local site-based groups to contribute a regulatory perspective to local community representatives.

Wider stakeholder engagement

During the year, we engaged and consulted extensively on our Strategy 2020 to 2025.

The Strategy sets the direction and priorities for ONR for the next 5 years, building on our strengths, continuing to focus on protecting society, and addressing the changing demands we will face as the UK’s nuclear regulator.

Our engagement to inform the Strategy 2020 to 2025 included those we regulate, senior representatives from the nuclear industry, NGOs, other regulators, Government, and our staff. For the first time, we also invited comments from the wider public as we continue to strive for openness and transparency in our regulation and in setting our direction and priorities. Comments from stakeholders were wide-ranging, and included learning and working with others, welcoming innovation and new ways of working, agility and influence – all reflected in the final strategy and detailed in the associated consultation response.

Our Industry Conference in June, under the theme ‘Open for Innovation’, was attended by almost 100 external delegates and live-streamed on our YouTube channel. Feedback was positive, describing ONR as progressive, collaborative and engaged.

Throughout 2019 to 2020 we worked positively with national and trade media, responding to almost 90 enquiries during the period. We proactively worked with journalists to promote awareness and understanding of our decision to permission the restart of Reactor 4 at Hunterston B (above), and for significant enforcement action including the prosecution of Devonport Royal Dockyard Ltd in July, and also the publication of our CNI’s report on the GB nuclear industry (above).

We have continued to develop and improve our use of social media, employing new techniques and content styles designed to improve understanding and accessibility of our regulation. This included live tweeting from events, explanatory video content, regular webinars and increased use of graphics. We have also embedded better planning and closer association with relevant national or sector-specific campaigns. The new approach has contributed to increased followers and improved engagement.

Our website remained an important communication channel on which we published 40 project assessment reports, 116 site stakeholder group reports and 428 intervention records describing specific inspection activity. Our site was visited by more than 146,000 unique users from 178 countries with USA, Canada and France being the most frequent non-UK visitors.

Working with government

Against a backdrop of political uncertainty for large periods of the year, we maintained effective working relationships with government, sharing expertise and technical knowledge to inform policy. This year we provided input to work on the regulation of new technologies including ANTs, proposals for a Regulated Asset Base (RAB) model as a possible funding model for new nuclear projects, preparations for exiting the EU, the Nuclear Sector Deal, and operational issues such as graphite degradation.

We established ONR as a leader on better regulation and innovation, working closely to align with the White Paper on Regulation for the Fourth Industrial Revolution and sharing good practice with the Better Regulation Executive.

We worked with BEIS to improve early recognition of ONR’s capability, capacity and charging needs for new work. We considered our regulatory planning assumptions with government to effectively manage our resources in a changing operating environment.

We strengthened monitoring of progress, issues and charging, reporting via the formal DWP/BEIS/ONR quarterly accountability and review sponsorship meetings. We also established more regular engagement with the Ministry of Defence (MoD) in order to establish similar regular contact to that which works effectively with BEIS and DWP.

International Regulatory Cooperation

Strategic Framework for International Engagement

We continued to support a significant portfolio of international work with key bodies including the IAEA, Nuclear Energy Agency (NEA), and other influential standardssetting bodies such as WENRA and the European Nuclear Security Regulators Association (ESNRA). This work enables us to influence globally, learn from relevant international good practice and maintain alignment with international obligations, standards and conventions, and to ensure their output takes account of UK practice/law and meets the UK’s needs.

In May 2019, we published a new Strategic Framework for International Engagement, which has been praised by the Organisation for Economic Co-operation and Development (OECD) as “a rare example of strategic thinking around International Regulatory Cooperation in a specific sector”. This is a living document, which has been updated to align with our Strategy 2020 to 2025 and to reflect ONR’s international focus following the UK’s departure from the European Union.

We also contributed to the NEA’s agenda – supporting international collaboration on regulatory matters, and openness and transparency. Our CNI chaired the Committee of Nuclear Regulatory Activities, which developed a new strategy for 2020 and beyond to shape the future direction of this NRA working group. Our Director of Policy and Communications joined the NEA’s Working Group for Public Communications, to improve openness and transparency, and took a lead role in the NEA’s Stakeholder Workshop on Risk Communication in September 2019.

Treaty and convention obligations

We fulfilled UK obligations to the Convention on Nuclear Safety (CNS), by submitting the eighth report and actively participating in the written peer review process by reviewing other countries’ reports and addressing other countries’ comments on the UK report.

The CNS Review Meeting was due to be held in March 2020, but was postponed at a late stage due to the impact of COVID-19. The preparations for the UK presentation and other aspects of the meeting were substantially complete, and have been continued so that they can be easily finalised when the meeting is rearranged to reflect the position at that time including future developments.

Multilateral and Bilateral cooperation

We:

- hosted a full scope IRRS mission to the UK (see above)

- led a peer review of the Armenian National Action Plan (NAcP) in support of the ENSREG Stress Test process

- supported IAEA International Physical Protection Advisory Service (IPPAS) missions to Belgium and Finland

- supported IRRS missions to Germany and Japan, and preparations for the forthcoming Bangladesh mission in 2020

- chaired and hosted International Nuclear Regulatory Association in the UK and in Vienna, addressing matters on innovation and leadership

- represented ONR at the 63rd General Conference in Vienna

- delivered numerous papers and presentations at the IAEA International Conference on Nuclear Security 2020 in Vienna

- continued to strengthen bilateral partner relationships (see website[footnote 8] for our Strategic Framework for International Engagement)

- renewed Information Exchange Arrangements with South Africa and China and forged a new partnership with Autoridad Regulatoria Nuclear, the Argentinian nuclear regulator, a key relationship to support our evaluation of the HPR1000 reactor designs

- hosted the Heads of the European Radiological Protection Competent Authorities in the UK in May

- played a central role in the Centrifuge Collaboration Security Working Group – an international collaboration which helps ensure the security of uranium enrichment technology

Strategic Theme 3 – Getting the best out of our people

Headlines

We have focused on enhancing our management capability, improving staff engagement, and continuing work to ensure consistent behaviours, and have maintained our capacity and capability to meet our regulatory demands over the next 5 years. The successful implementation of our management development programme for all managers and associated bite-size learning has been key to improved levels of engagement, greater alignment across core purposes and sustained high levels of motivation. This has led to exceeding our retention targets, attracting high quality candidates and sustaining levels of engagement in the upper quartile for public organisations.

During 2019 to 2020, we delivered both corporate milestones as published within the Corporate Plan.

Table 4 – Strategic Theme 3 Corporate Milestones

| Strategic Theme 3 (two milestones) | Met/Not Met | Comments |

|---|---|---|

| Conclude Pay & Grading Review | Met | Completed September 2019 |

| Approve New Organisational Values | Met | Completed November 2019 |

The following list shows our top ten priorities in 2019 to 2020 relating to Strategic Theme 3.

Strategic Theme 3: Getting the best out of our people

6. Enhance ONR’s leadership and management skills.

7. Promote a healthy organisational culture, focussing on organisational values and behaviours.

8. Provide coherent and consistent leadership of, and ensure staff engagement in, our change portfolio.

Delivery highlights included:

- developing a new set of values for the organisation

- development of a new People Strategy that will underpin our Strategy 2020 to 2025

- continued development of the Academy as a Centre of Excellence across all core purposes and for all staff

- development of a bespoke new ONR Leadership Development programme

- a review of our Pay, Reward and Grading structures

- agreeing and delivering a new ONR Pay Deal for 2019 to 2020

- piloting a new succession planning approach within Regulatory Division

- increased focus on our understanding and support for staff well-being including mental health issues and stress – with an increased number of health and wellbeing events

- implementing a revised warranting process that is inclusive for all inspector roles and responsibilities across the core regulatory purposes

- achieving Disability Confident Leader accreditation

Capability

The Academy has continued to flourish as a centre of excellence providing a modern blended and comprehensive prospectus for learning and development for all staff. This included implementing a revised warranting process that is inclusive for all Inspector roles and responsibilities across the regulatory core purposes and, working in collaboration with strategic learning partners, a refreshed programme for core skills including: influencing and persuading; building and maintaining effective relationships; managing difficult conversations; and communicating effectively. This has enabled us to build greater resilience and confidence in our ability to deliver vital regulatory work and provide the supporting professional skills required to build an effective and efficient organisation.

We have received excellent feedback for the bespoke delivery of our courses, particularly the management training programme, and have built a more diverse and targeted e-learning portfolio, including work in collaboration with IAEA, that is much more accessible and available to staff 24/7. This is an area that we will continue to grow to meet the needs of our staff and to a shorter than expected timeframe given the implications for traditional classroom learning that the COVID-19 response brings.

Leadership and Management

We developed, with an external partner, an ONR bespoke Leadership Development programme. This 18-month programme will be delivered on a cohort basis to support development in leading self, leading others and leading the organisation. It was due to be piloted early in 2020 to 2021 but has been deferred given the impact of COVID-19.

Shaping ONR leadership events were held during the year to provide our leaders with an understanding and execution of our Strategy 2020–2025 and the new organisational Values. Further events planned for the end of the year have been deferred given the challenges from the COVID-19 response.

The management development programme and the supporting bite-size learning events tailored for ONR managers continued to be welcomed with high participation rates and over 90% positive ratings. Although the classroom-based management modules were suspended from March 2020, the additional learning and events have been adapted to be delivered remotely.

Culture and Values

We continued to recognise the importance of having the right culture and consistent behaviours to being truly effective and efficient. This included support to managers in delivering the aims of our behaviour framework and addressing poor behaviours where identified. However, we recognised we needed to go further and, through significant levels of staff engagement, agreed a new set of organisational values to support delivery of our Strategy 2020 to 2025 and address longstanding behavioural and cultural challenges.

We developed a People Strategy that set out how we planned to lead and develop our staff and create the healthy, inclusive, modern and efficient workplace that will enable the delivery of our 2025 strategic intent. This encompassed what the refreshed mission, vision and organisational values will mean for staff and how our values will be embedded across our people, processes and policies.

Health and Wellbeing

Staff wellbeing remained a key focus this year. We delivered a number of events that supported more open discussion on issues such as stress in the workplace and mental health. These made clear the need to further address these issues and paved the way for launch of new strategies in the coming year. The importance of supporting mental health was further emphasised by the emergence of COVID-19 and we will continue to provide a range of assistance and support in 2020 to 2021.

Inclusion

Embracing diversity and establishing an inclusive workplace remained a focus. We achieved accreditation to Disability Confident Leader status, providing an objective assurance in our policies, approach and support to existing and prospective staff.

We implemented recommendations for further improvement around our policies and culture that arose from our National Equality Standards accreditation. This included more explicit diversity and inclusion elements to our management development modules, implementation of a Transitioning at Work policy, a buddy scheme for staff returning from maternity, paternity or adoption leave and a review and strengthening of our Confidential Support Network.

Pay and Grading

We commissioned an independent review of our pay and grading which broadly concluded that the pay, grading and wider HR reward policies functioned as intended and in line with strategic intent. It also identified a number of areas for potential improvement and opportunity to maximise the organisational benefits. This included a simplification and rationalisation of the number of pay ranges, a team-focused approach to recognition, improved application of performance management, and reward for those on the top of their pay range. This has informed considerations for future pay and reward strategy discussions.

Strategic Theme 4 – Developing a high-performing, sustainable organisation

Headlines

We focused on strengthening our infrastructure and modernising our ways of working and systems. We improved our working environment by introducing hot-desking in Bootle and extending our space in Cheltenham.

We have made significant progress with our preparations for IT Separation so we will be in a position to cutover to a new independent network in 2020 to 2021.

We also completed Phase 1 of our WIReD project.

During 2019 to 2020, we delivered 10 out of 13 corporate milestones as published within the Corporate Plan (Table 5).

Table 5 – Strategic Theme 4 Corporate Milestones

| Strategic Theme 4 (13 milestones) | Met/Not Met | Comments |

|---|---|---|

| Issue Director and Senior Responsible Officer (SRO) Letters of Delegation 2019 to 2020 | Met | Completed April 2019 |

| Publish ONR Scheme of Delegation | Met | Completed April 2019 |

| Complete WIReD Regulatory Process Review | Met | Completed September 2019 |

| Commission Corporate and Business Planning Activity for 2020 to 2021 including Budget Commission | Met | Completed September 2019 |

| Commission and Configure New Platform for Information Technology (IT) Separation | Met | Completed September 2019 |

| Publish guidance supporting updated CDG Regulations | Met | Completed October 2019 |

| Evaluate Benefits Realisation For ONR Academy (including LCMS Implementation and business as usual (BAU) Processes) | Met | Completed November 2019 |

| Cutover to New Platform (IT Separation) | Not Met | Deferred to 2020 to 2021 |

| Cutover to New Platform (Telephony) | Not Met | Deferred to 2020 to 2021 |

| Board Reviews Proposals for Budget 2020 to 2021 | Met | Completed January 2020 |

| ARAC Approves Internal Audit and Assurance Plan 2020 to 2021 | Met | Completed January 2020 |

| Complete the Organisational Effectiveness Indicator Framework Implementation | Met | Completed January 2020 |

| Board Approves 2020 to 2021 Corporate Plan, Budget and KPIs | Not Met | Completed April 2020 |

During 2019 to 2020 we increased focus on modernisation, to become more flexible and efficient, preparing for the future and developing a strong performance and governance framework. We enhanced our working environment, and delivered and progressed several change projects.

The following list shows our top priorities in 2019/20 relating to Strategic Theme 4.

Strategic Theme 4: Developing a high-performing, sustainable organisation

9. Simplify and standardise our regulatory ways of working and processes, and improve our ability to share knowledge and insight, through our WIReD project.

10. Migrate our data from the Health and Safety Executive (HSE) onto new, independent networks though our IT Separation project.

Modernisation

WIReD

WIReD will deliver leaner business processes and a step-change in knowledge management.

Phase 1 was delivered on time and within budget. With strong staff engagement, we simplified and standardised all of our regulatory processes, reducing processes from 18 to 8 and ensuring full alignment with IAEA guidance. We engaged with industry stakeholders and sought to capitalise on technological synergies through a user steering group including external stakeholders, which in turn informed our benchmarking of technology options. We established a model office featuring an end-to-end inspection process prototype.

Our plans to progress system build and commence a pilot during 2019/20 were paused to accommodate a review of the delivery approach and value for money of the next phase. Our CNI assumed SRO responsibilities for Phase 2, reflecting the significance of this project to our regulatory operations. Phase 2, including an extensive pilot led by our Operating Facilities Division, is expected to commence in the second half of 2020.

IT Separation

We made considerable progress towards separation of our IT network from HSE and the establishment of our own independent IT infrastructure and managed service. The project benefits include providing a robust, resilient and independent network infrastructure, delivering enhanced cyber security resilience and information management, and laying the foundations as a key enabler for further IT modernisation work in the future. It will provide the environment whereby we will have control over our infrastructure, systems, security devices, software, applications and IT support. It will enable us to deliver real improvements for our colleagues in terms of resilience and security, with staff being able to discharge their roles more effectively through modern, more secure and accessible platforms.

This year we have strengthened project governance, tendered our 12-month notice to HSE to cease the provision of IT services, and developed a robust delivery plan to separate from HSE in Quarter 1 2020 to 2021. The impact of COVID-19 has necessitated a deferral to our implementation plans and, as a consequence, we have had to continue our service requirements from HSE and extend to Quarter 3 2020/21. Due to the likely protracted nature of COVID-19 restrictions, we are exploring options to deliver remotely to an extended timescale. IT Separation has remained the top change initiative priority with continued focus to ensure we deliver safely, securely and swiftly.

Other Modernisation Projects

ONR Time System (OTiS)

We successfully implemented a new staff time recording system (OTiS) in 2019/20. This provided us with increased resilience, reliability and enhanced functionality and operates to modern security, accessibility and back-up standards. It is a more intuitive and flexible system with improved management information to inform decisions.

Integrated Incident Management Framework

We developed a new Integrated Incident Management Framework during the year and conducted training, testing and validation of our business continuity arrangements. To bolster the effectiveness of our response, we introduced role-specific training and coaching to ensure the Incident Management Team is fit for purpose. This activity has proved particularly beneficial to inform our response to COVID-19.

Organisational Effectiveness Indicators (OEI)

We piloted a new basic OEI Framework to measure organisational performance. This framework has modernised our approach to benchmarking and reporting organisational effectiveness and efficiency; this has evolved from a historical focus on traditional KPIs aligned to individual directorates, towards an integrated framework of quantitative and qualitative evidence-based measures of performance. The Framework aligns with the OECD NEA guidance on The Characteristics of an Effective Nuclear Regulator. During 2020 to 2021, this will be fundamental to the development of an Integrated Strategic Governance Framework.

Compliance Policy Hierarchy

We remained compliant with all statutory, legal, compliance, conduct and ethical requirements. We introduced a Compliance Policy Hierarchy in 2019/20 to set out our statutory policy requirements and associated governance structure. We continue to work closely with the internal Management Systems Information Project (MSIP) Board to develop our policy suite.

Working Environment

We redesigned our Bootle workspace, introducing hot-desking and break-out areas in August 2019. We expanded and refurbished our Cheltenham workspace to better meet staff needs with more modern, collaborative working areas.

Managing change

Commercial Management

We launched a new Commercial Governance Framework, which sets out the end-to-end procurement and our commercial governance arrangements. This aims to improve commercial management and provide assurance over service delivery, quality and value for money.

Procurement

We enhanced our in-house procurement function to provide greater resilience, rigour, and effectiveness. This will enable us to become self–sufficient in this area in 2020 to 2021, ending our reliance on HSE.

Our Financial Performance

Financial Review

For 2019 to 2020, our final budgetary outturn was £92.3 million (including capital spend of £5.4 million). This was an underspend of £5.8 million compared to an initial budget of £98.1 million. Expenditure of £86.9 million shown in the accounts on page 87 excludes capital spend. The main reasons for the underspend are:

- a reduction in capital spend of £3 million as a result of re-planning exercises for WIReD and IT Separation

- a reduction in staff-related costs of £1.3 million as a result of lower than forecast recruitment to reflect in-year changes in our operating environment

- a reduction in training and travel and subsistence costs of £1.2 million to reflect changes in our operating environment

- a reduction in technical support contract costs of £0.8 million as a result of re-planning exercises where deliverables have been moved to the 2020 to 2021 financial year

The net balance of the £5.8 million comprises spend above budget in some areas, primarily due to ONR’s contribution to the UKSV transformation project, and underspends relating to the UK SSAC project and vetting costs.