Nature Markets Framework progress update March 2024

Updated 15 March 2024

1. Introduction

Nature provides vital services for our health and wellbeing and underpins our economy. According to the World Economic Forum, over half of the world’s GDP is moderately or highly dependent on nature.

Our Environmental Improvement Plan (January 2023) set out how we plan to halt and reverse the decline of the natural environment upon which we depend. The Prime Minister has made clear our vision is for farmers to be at the forefront of the transition to sustainable agriculture. Government has a role to play in creating the conditions for farmers and land managers to access payments confidently and securely. This includes from both the public and private sector, for the environmental benefits they produce alongside food production, as set out in the Agricultural Transition Plan Update (January 2024).

Nature markets provide opportunities for land managers to sell the additional benefits they generate to others who want or need to buy them. As such, nature markets can play a role in meeting our environmental targets. As set out in the Nature Markets Framework, integrity is at the heart of this approach – both environmental and financial, with projects delivering genuinely additional environmental benefits, and organisations taking ambitious and transparent science-based actions to reduce their environmental impacts. On this basis, government encourages the use of high integrity nature markets as a legitimate and positive vehicle to finance actions to meet our environmental targets and support a wide range of benefits including a resilient economy, health and wellbeing, and food supply.

Published alongside the 2023 Green Finance Strategy, and developed in close collaboration with the devolved administrations, our Nature Markets Framework (the Framework) set out the government’s approach and vision for scaling up private investment into nature recovery and sustainable farming. We set a goal to grow annual private investment flows to nature to at least £500 million every year by 2027 in England, rising to more than £1 billion by 2030. As part of government’s commitment to support this growth, the Framework set out core principles to guide the development of nature markets so that they operate with integrity and efficiency, and clearer rules for how farmers and other land and coastal managers can access markets as an additional income stream. It also launched a new programme with the British Standards Institution (BSI) to develop a suite of high-integrity nature investment standards and identified next steps for market infrastructure and governance.

Significant action has been taken since the publication of the Framework. As committed in the Framework, we are providing an update one year on, focusing on key areas of progress, including:

- supporting farmers and other land and coastal managers to access nature markets, alongside agricultural production

- developing standards for high integrity private investment into nature through the BSI nature investment standards programme

- establishing a joint HM Treasury and HM Revenue and Customs working group with industry representatives to identify solutions that provide clarity on the taxation of nature markets where existing law or guidance may not provide sufficient clarity

- launching the Projects for Nature pilot, connecting businesses and other donors with screened nature recovery projects

- launching mandatory Biodiversity Net Gain, which requires developers to make sure that habitats for wildlife are left in a measurably better state than before development

- committing over £100 million to pump prime the growing market for nutrient mitigation credits, unlocking thousands of new homes in catchments impacted by nutrient neutrality

- growth of voluntary carbon credit schemes, including the UK Woodland Carbon Code and UK Peatland Code

- working internationally to set up the independent International Advisory Panel on Biodiversity Credits (IAPB)

- collaborating and engaging with key external stakeholders to help develop nature markets policy, including to inform our forthcoming consultation on voluntary carbon and nature markets

Going forward, we recognise there is more to do. Government remains committed to further accelerating market development and building consensus on the key trust issues holding back nature markets. As per the commitments in the 2023 Green Finance Strategy, government will consult in the coming months on further policy interventions to help grow high integrity voluntary carbon and nature markets. We will set out our next steps and proposals for developing nature markets further in this consultation. In addition, we will continue to capture findings from research and engage with stakeholders to make sure that we are focusing on the critical areas where government needs to intervene.

2. Supporting farmers, land managers, and landowners to access nature markets

Nature Markets are new, innovative, and continue to develop at pace. Government is committed to supporting and empowering farmers and other land and coastal managers - the vital stewards of our natural environment - to take advantage of nature markets as a potential additional income stream if suited to their land, ambitions and business model. We recognise there are still challenges for farmers and land managers, including lack of clarity around what constitutes a high integrity unit, market rules, and what evidence is needed; access to the tools needed to be able to participate; and complexity in getting ‘investment ready’. Alongside developing nature investment standards to drive consistency (read about standards development), this section sets out our work to help farmers overcome these important challenges.

Read the Annex for some examples of innovative projects we have funded, which are helping to build the evidence base to inform nature markets policy. For example, the Pollardine Farm Test and Trial is exploring digital solutions to support farmers in pitching their projects to potential investors.

2.1 Supporting farmer led innovation through the Natural Environment Investment Readiness Fund

Aerial photograph of green fields and a curving river, courtesy of the Lapwing Estate.

The Natural Environment Investment Readiness Fund (NEIRF) is a competitive grants scheme providing grants of between £10,000 and £100,000. It funds projects to get ‘investment ready’ through the development of models and market-based mechanisms that can produce revenue from ecosystem services to attract and repay private investment into nature projects.

The NEIRF is already supporting the development of 86 projects across England as a result of 2 previous funding rounds, some of which are transacting and securing investment. Read the first two annual independent evaluation reports on the NEIRF – along with case studies on completed projects. The third round is specifically to support farmers in accessing nature markets, alongside food production. The third round of the NEIRF will fund nature projects in England that:

- help farmers achieve one or more natural environmental outcomes from the Environmental Improvement Plan

- have the ability to help farmers produce revenue from ecosystem services to attract and repay investment

- produce an investment model that can be scaled up and reproduced by farmers

The bids received are currently being assessed, and awards to successful projects will be made in Summer 2024.

Read the Annex for some examples of previous NEIRF projects developing innovative investment models:

Combine harvester collecting wildflower seeds, courtesy of the Eden Project.

2.2 Working with the Green Finance Institute (GFI)

Defra has supported the Green Finance Institute (GFI) to convene a Farming and Finance working group, which produced a report on Financing a Farming Transition earlier this year.

Defra has also supported the GFI to develop a farmer-focussed version of their investment readiness toolkit, which has used learnings from NEIRF projects to set out an eight-step journey to investment readiness for nature project developers. The Toolkit was designed and tested with a diverse group of over 100 farmers, representing various farm sizes, agricultural sectors, ownership structures including tenant farmers, and regions. This free, independent resource, the Farming Toolkit for Assessing Opportunities in Nature Markets was published in January 2024.

2.3 Addressing barriers to completing carbon audits

Having a good understanding of a landholding’s emissions profile or environmental condition (through completing a carbon audit or environmental impact assessment), is critical for identifying opportunities for reducing emissions or environmental land management. In turn, this can reveal the opportunities to access private funding in return for delivering genuinely additional environmental outcomes. Government therefore sees carbon audits as helpful tools that can empower farmers to make informed business decisions.

However, understanding and quantifying impacts at farm level can be complicated and time consuming, and a lack of standardisation means some farmers are already being asked to report their data in different formats to different buyers. In addition, with differences in the underlying methodologies used by the tools, there is divergence in the tool outputs. Without support to make sense of the outputs of a carbon audit, it can also be difficult for farmers to see the point of completing one. Environmental considerations are just one of many factors taken into account in any farm business decision-making, and navigating the variety of funding options on offer for implementing decarbonisation actions can be complicated.

To address these barriers:

- In 2023, Defra commissioned research to assess the causes and level of divergence between market leading carbon calculators, how this divergence is affecting tool users, and consider recommendations for harmonisation. The publication of this research is already driving some convergence between the tools, with most of the calculators assessed having been updated during and since data collection, including to address some of the research recommendations

- Defra’s work on harmonisation of carbon calculators will also support the BSI’s development of standards for high integrity private investment in nature, including for natural carbon (Read section 3 for more detail)

- As mentioned in the Agricultural Transition Plan update in January 2024, learning from the success of the Farming Resilience Fund, Defra will start funding more sustainable farming advice from 2024. This will help more farmers understand what opportunities are available to them and increase adoption of tools such as for carbon audits and natural capital assessments, supported by trusted advisors

- We are currently building our understanding of these barriers further through engagement with farmers and agricultural organisations, and exploring options for tackling them through our work with the Food Data Transparency Partnership (FDTP). This includes considering how to support farmers to make the collection and sharing of data as easy and as beneficial to them as possible. Further detail on the government’s work on the Food Data Transparency Partnership will be published soon.

2.4 Market rules for combining (‘stacking’) multiple payments

Our land is finite, but with the right investment can be managed to deliver multifunctional benefits. In the Framework we set out our vision to build a policy framework that enables farmers and land managers to maximise the potential of their land to produce food as well as climate, biodiversity and other ecosystem services. We clarified current rules to enable revenue streams from different public and private finance mechanisms to be used in combination or ‘stacked’, where this can be achieved without risking the environmental integrity of the targeted outcomes. Combining revenue streams can unlock the business case for investing in more environmentally ambitious projects and land management models.

In order to support further policy development, including greater opportunities for stacking in future, we committed in the Framework to accelerate research and piloting.

Defra has commissioned research to carry out analysis to determine whether a greater degree of stacking should be permitted between ecosystem service markets. It will bring together a synthesis of the economic and empirical evidence of stacking methods, conduct interviews with key nature market stakeholders, develop a set of possible stacking scenarios and deliver an assessment of the implications of the scenarios on outcomes. The research is underway, with outputs due in the summer. The final report will be published on the Defra Science Search project site.

We have also funded Tests and Trials exploring how public and private payments could be combined, for example, for tenant farmers: read Palladium Test and Trial.

2.5 Supporting the tenant farming sector to access nature markets

A third of all agricultural land in England is tenanted; it is important that the tenant farming sector is supported to take advantage of the opportunities that nature markets provide. There are additional complexities to consider when accessing these opportunities on tenanted holdings with both landlords and tenants having rights and responsibilities that need to be considered. That is why collaboration and communication between both parties is very important to ensure both tenants and landlords can benefit. For example, Defra has worked with the tenanted sector to produce specific guidance for tenants and landlords on tree planting and woodland creation on tenanted land.

The government response to the Rock Review on tenant farming agreed with the recommendation that tenants and landlords should be rewarded for activities that improve the natural capital and ecosystem services of the holding and that guidance, standards and tools for tenants and landlords are needed to support this. To make progress on this the Defra supported GFI farmer-focussed investment readiness toolkit includes a specific section and checklist for tenants and landlords. To build on this further the joint Defra and Industry Farm Tenancy Forum, including representatives of tenants, landlords and professional advisors, has a role in developing further guidance on the management of ecosystem services on tenanted land and in showcasing best practice for approaching this within tenancy agreements. The Farm Tenancy Forum will develop this activity following the outcome of the Government’s Voluntary Carbon and Nature Markets (VCNM) consultation and the BSI’s overarching principles standard consultation to ensure sector specific guidance fits within these frameworks.

3. Standards development

3.1 Update on progress of the BSI Nature Investment Standards programme

Government is sponsoring the British Standards Institution’s (BSI’s) Nature Investment Standards Programme, which was launched in March 2023 as a key pillar of the Framework. The Programme is designed to develop, through deep collaboration with a wide spectrum of stakeholders, a functioning framework of standards that will drive high integrity nature markets for the UK and encourage the scale up of private investment into nature.

The programme is exploring markets across the full range of nature based solutions to provide rigour by way of standardisation across the wider system of schemes and projects issuing units from nature.

The key objectives of the programme are to:

- enable scaling up of high integrity markets that trade in natural capital and ecosystem services to support the flow of private sector investment into nature

- drive nature’s recovery and accelerate progress on environmental goals, including net zero and reversing biodiversity loss to create a nature positive society

- empower regulators and other expert bodies to engage with and support the development of markets that are robust, transparent, and fair

To inform the programme and shape priorities, BSI conducted an initial discovery phase, talking to over 300 stakeholders from across nature markets in order to carry out market engagement, research and scoping activity to make recommendations on the future standards activity. This resulted in identification of key priorities for standards, and the shaping of principles which should apply to all nature markets, building off and aligning with existing integrity initiatives in the UK and internationally.

The recommendations from the discovery phase are outlined in the BSI’s discovery report, published in July 2023, and initially called for:

- accelerated development of an overarching principles standard

- scoping and preparation for standards to commence in priority areas in the supply of carbon, biodiversity and nutrients

BSI also acknowledged the need for continued discovery to explore the case for additional potential standards.

BSI have created a Nature Investment Standards hub to allow for public engagement with the programme.

3.2 BSI Overarching Principles Standard consultation

BSI will shortly launch a public consultation on the first iteration of their first standard: the Overarching Principles Standard (OPS) ‘BSI Flex 701 v1.0 Nature Markets – Overarching principles and framework – Specification’.

The upcoming consultation on the Overarching Principles Standard represents a significant step towards articulating how aspects of a domestic framework for high integrity units sold in nature markets might apply in the UK.

The standard has been rapidly developed over eight months using BSI’s FLEX process, where standards are inherently iterative, market-led and consensus based. The purpose of the OPS is to set out core and overarching principles for high integrity nature markets, with the expectation that further thematic standards for the supply of units – including for Biodiversity and Natural Carbon – will go into further detail which are necessary for those markets.

This standard builds on, and draws from, a number of important areas which set the ambition for nature markets, as well as our Nature Markets Framework and extensive stakeholder engagement conducted during the discovery phase. Examples include:

- Interim Principles for Responsible Investment in Natural Capital - Scottish Government 2023

- Core Carbon Principles Part 2 - ICVCM 2023

- Standards Endorsement Review Criteria - ICROA, 2023 Governing high-integrity ecosystem markets - Reed et al, 2023

- Financing a farming transition - Key Enablers and Recommendations - Green Finance Institute, 2023

- Integrity principles for Biodiversity markets – Plan Vivo, 2023

- Voluntary Carbon Markets Integrity (VCMI) Initiative’s Provisional Claims Code of Conduct - VCMI, 2022

- Science-Based Targets Initiative (SBTi)’s Corporate Net-Zero Standard Version 1.0 - SBTi, 2021

- Greenhouse Gas Protocol’s Corporate Accounting and Reporting Standard - GHG Protocol NFU, Key Principles for the Development of Environmental Markets in Agriculture - NFU, June 2022

- ISO Net Zero Guidelines 2022

This first iteration sets the baseline for further review, discussion and improvement. The consultation process, through which we obtain the expert views of a much wider audience, will be pivotal in shaping the direction, content, purpose and use of the next iteration.

The standard is an emerging articulation of the principles for how nature markets should function on a high integrity setting and does not represent government policy. This first iteration of the standard touches on a number of complex areas where stakeholders have called for clarity, notably with regard to the use of carbon credits in claims. We will support BSI to ensure this standard is aligned and coherent with ongoing and emerging policies as it enters a further iteration. This is in line with BSI’s iterative FLEX process. In particular, we expect the evidence from government’s upcoming Voluntary Carbon and Nature Markets consultation (planned to be launched in the coming months) as well as other policy developments to inform future iterations of the OPS.

For more information on the BSI’s standards consultation process visit the Nature Investment Standards hub.

Adopting and implementing Nature Investment Standards

We intend to produce guidance with BSI that makes clear how the framework of standards for the supply of units is intended to operate, firming up how standards should be adopted and implemented, and how the framework will function.

We recognise that standards alone will be insufficient to ensure high integrity. As they are developed we will need a clear procedure for schemes and projects to demonstrate that they conform to the new standards. We aim to ensure the framework and individual standards for the supply of units are developed in a form that makes it easy for high integrity schemes and projects to demonstrate conformity, with administrative costs kept as low as possible.

We are considering options for how this procedure can be designed and the appropriate level of oversight required to maintain confidence in the system. Government is preparing to provide more detail on this and seek stakeholder views as part of the forthcoming consultation exercise on Voluntary Carbon and Nature Markets.

3.3 Working to clarify tax arrangements for nature markets

At Budget 2023, the government launched a call for evidence and consultation on the taxation of environmental land management and ecosystem service markets. Amongst other issues, this explored the tax treatment of the production and sale of ecosystem service units. The government responded to the consultation on 6 March at Budget 2024. It announced that agricultural property relief from inheritance tax will be extended from 6 April 2025 to land managed under an environmental agreement with, or on behalf of, the UK government, Devolved Administrations, public bodies, local authorities, or approved responsible bodies. The government will also monitor the ongoing development of the BSI nature investment standards and following their introduction will consider extending agricultural property relief to accredited codes and schemes. In order to address issues and evidence submitted in response to the Call for Evidence, the Chancellor also announced the creation of a new joint HM Treasury and HMRC working group with industry representatives to identify solutions that provide further clarity.

For more information, read the government consultation response on taxation of environmental land management and ecosystem service markets.

Next steps

BSI has commenced work to produce standards for biodiversity and natural carbon projects. Both of these market level standards will seek to operationalise the core requirements set out in the Overarching Principles Standard, as applicable to the supply of units, and will build on this standard, setting further criteria relevant to the context of biodiversity and carbon markets. Both of these standards were scoped as part of BSI’s initial discovery phase.

The BSI biodiversity standard is intended to focus on requirements to drive quality and consistency across the measurement, reporting and verification (MRV) of biodiversity projects developed for UK nature markets. It aims to also standardise the essential properties, characteristics, and indicators of a good quality biodiversity metric/scheme, setting measures for how change is assessed. The consultation on this standard is scheduled to commence in late Summer 2024 and will be the opportunity to shape the content and direction further.

This standard will be closely followed by a standard setting requirements for natural carbon benefits, which began development in February 2024. This standard will set specific requirements for governance, measurement, reporting and verification (MRV), aiming to go out for consultation in Autumn 2024 – through which stakeholder comment on scope and content will be obtained. The carbon standard development process will consider providing more detail on the process/outcomes that should be demonstrated for robust quantification, verification and validation; establishing common criteria for what constitutes an additional project that delivers lasting carbon benefits; and addressing carbon specific governance challenges.

4. Taking action to unlock voluntary funding for nature’s recovery

4.1 Voluntary Carbon and Nature Market consultation

Going forward, we remain committed to applying lessons learned from more mature voluntary carbon markets to nature markets, and to government’s role in building consensus on some of the key trust issues holding back the market. The work of the BSI programme to develop nature investment standards for the delivery of nature-based projects and quantification of ecosystem services will help to build trust and confidence in the integrity of units for all market participants. However, voluntary carbon markets in particular have been subject to close scrutiny over concerns of ‘greenwashing’ – where credits are being used to excuse lack of progress on net-zero aligned decarbonisation – and that credits themselves are not delivering the benefits they purport to.

To help address these issues, the UK’s COP26 Presidency saw the launch of global initiatives to develop norms for voluntary carbon market integrity: the Voluntary Carbon Markets Integrity Initiative (VCMI, focused on how corporates should use credits in net zero claims); and the Integrity Council for the Voluntary Carbon Market (ICVCM, focused on establishing ‘core carbon principles’ to provide assurance on credit quality). We welcome the excellent progress that both initiatives have made this year.

As committed in the 2023 Green Finance Strategy, government plans to consult on interventions to help grow high integrity voluntary carbon and nature markets in the coming months.

As well as responding to the integrity initiatives and considering their implications for policy and regulation, the consultation will respond to recommendations from the Climate Change Committee (CCC) and independent Net Zero Review. It will consider how to position the UK as a hub for high integrity voluntary carbon market services, building on existing capabilities in the UK financial sector and overcoming the current market impasse. We announced at COP28 that we will, through the consultation, set out our intention to endorse the work of ICVCM and VCMI and consider how their outputs could be reflected in policy, regulation, and guidance in the UK. This will include proposing user-friendly guidelines for how credits should be used in corporate claims, as well as what further information is needed to provide assurance on the quality of credits used in those claims. The generation of high integrity carbon credits is as important for the UK as it is for our partner countries, which is why the government has partnered with the BSI to develop a set of Nature Investment Standards, including a robust domestic standard for nature-based carbon credits in close collaboration with ICVCM. Beyond this we will also test demand for a labelling scheme for UK generated credits, and whether this could unlock additional finance for net zero and nature in the UK.

4.2 Projects for Nature

While nature markets continue to grow, there is scope to use corporate donations to deliver environmental benefits that are much further away from being investment ready, for example access to nature and species recovery. Projects for Nature, launched by the Secretary of State for Defra at COP28 in December 2023, aims to address this gap, connecting corporate leaders in sustainability with screened nature recovery projects. The pilot aims to determine the appetite for such a platform, by reviewing businesses who register their interest as well as land managers or NGOs who propose projects. Our first Founding Business Partner is Lloyds Banking Group, who have committed a total of £250,000 to three different projects on the platform.

A diverse portfolio of 25 projects across England has been selected for the pilot phase, with a total funding requirement of over £10 million. Given there are established markets for certain ecosystem services, the Projects for Nature catalogue focuses on projects that are much further away from, or might never provide, a financial return to investors, but are still essential components for meeting our nature recovery targets. Projects were selected for their alignment with national (for example Environmental Improvement Plan) and local ambitions (for example, draft Local Nature Recovery Strategies and Biodiversity Action Plans) for nature recovery.

Without quantified units being produced from Projects for Nature, any corporate donation must be above and beyond their work to reduce their own impacts and offset impact through nature markets. To avoid greenwashing, businesses on the platform are also screened against robust criteria to ensure the mitigation hierarchy is upheld. Businesses can use their donation to show action on restoring nature and transforming wider society, potentially contributing towards a response disclosure metric from the Taskforce on Natural-related Financial Disclosures recommendations or to the ‘Landscape Engagement’ target from the Science Based Targets Network.

The Glenderamackin catchment covers the watercourses upstream of Keswick in the Lake District National Park. Image courtesy of West Cumbria Rivers Trust.

5. Growing nature markets: key areas of progress

As above, nature markets are growing rapidly. This section provides updates on key areas of growth.

5.1 Biodiversity Net Gain

The launch of a new market for Biodiversity Net Gain was an important next step outlined in the Framework.

Biodiversity Net Gain became mandatory for major developments on 12 February 2024. This requires developers to make sure that overall habitats for wildlife are left in a measurably better state than before development.

As well as aiming to change how and where development happens, Biodiversity Net Gain aims to create a high integrity market for nature-based solutions.

It is not always possible for the 10% gain to be delivered onsite and a vibrant offsite market is also critical for development to continue. The off-site market for biodiversity units offers a new form of diversification for land managers, allowing nature recovery projects to be realised in a financially viable and ecologically sound way.

Our analysis suggests it’s likely to be worth between £135 million to £274 million annually. By requiring sites to register with the Natural England Biodiversity Net Gain register, we are overcoming the risk of double counting, and enabling the mapping of Biodiversity Net Gain sites, linked to developments.

The overall annual development rate is a key variable determining the size of the Biodiversity Net Gain market. The development rate has remained consistent over the last 20 years, and if this trend continues in the future, the size of the Biodiversity Net Gain market is unlikely to change.

Statutory Biodiversity Net Gain credit prices range from £42,000 to £650,000 per credit, with an estimated weighted average price of around £46,500. Biodiversity Net Gain credits are units supplied by Natural England, on behalf of the Secretary of State, as a last resort if the market is unable to deliver the required biodiversity units, and prices will be reviewed every 6 months. Prices are based on the cost to create, maintain, and monitor different habitat types, and credits differ by habitat type, distinctiveness, and ‘tier’ level required.

5.2 Nutrient Mitigation

Nutrient neutrality impacts 27 English catchment areas responsible for c.16,500 homes per year (c.8% of total supply). Government is continuing to unlock housing as quickly as possible in affected areas through public investment in nutrient mitigation schemes and guidance to house builders, Local Planning Authorities, and mitigation providers.

The government is investing up to £140 million in pump priming nutrient mitigation through Natural England’s Nutrient Mitigation Scheme (NMS) and Department for Levelling Up, Housing and Communities (DLUHC’s) Local Nutrient Mitigation Fund (LNMF). The NMS has already made credits available for over 4,000 homes in the Tees and Cleveland Coast catchment and will expand to other areas in the coming months. In December 2023, DLUHC confirmed the first tranche of capital funding through the LNMF with approximately £57 million awarded to the eight successful bids in Round 1. Round 2 will be open in early 2024. DLUHC will primarily assess bids based on the impact of nutrient pollution on the speed of housing delivery and the quantum of housing unlocked via mitigation measures. DLUHC is also interested in understanding how partnership working can support catchment-level solutions as well as the wider environmental benefits of the bids.

The funding will be used cyclically, reinvesting the revenue from credit sales into new mitigation, within the catchment until nutrient mitigation credits for development are no longer needed. The government’s aim is to provide certainty for house builders and local authorities and unlock housing as quickly as possible in affected areas.

Looking further ahead, the government is clear that nutrient neutrality is an interim solution, and our ambition is to restore Habitats Sites that are currently in poor condition due to excess nutrients in water. Markets could play an increasing role in funding nutrient pollution reduction and other restoration activities, which may be further enabled by a new BSI standard for nutrients.

5.3 Voluntary nature markets: updates on the growth of the UK Woodland Carbon Code and UK Peatland Code

Trends in nature markets use the latest available data as of 22 February 2024.

The markets for the Woodland Carbon Code and Peatland Code are currently the most established voluntary nature markets in the UK, and as such represent an important mechanism for helping us to deliver against our environmental targets. We are therefore providing updates on their growth.

Alongside the Woodland Carbon Code and Peatland Code there are many voluntary nature market schemes and codes in development in the private sector, many of which are or have been supported by government funding, for example through the Natural Environment Investment Readiness Fund (NEIRF), and the Facility for Investment Ready Nature in Scotland (FIRNS). The development of nature investment standards in partnership with the BSI will help to drive consistency and high integrity across new and emerging schemes issuing units to nature markets. Government will test proposals for the governance around the generation of nature market units in the forthcoming Voluntary Carbon and Nature Markets consultation. We also continue to build the evidence base to enable nature markets to reduce specific environmental challenges, for example:

There were over 2,000 projects registered with the Woodland Carbon Code by December 2023 and over 240 with the Peatland Code by February 2024. Both schemes have seen a big increase in the number of projects registered over the last year.

The Woodland Carbon Code and Peatland Code are also jointly developing the following areas through FIRNS-funded projects which will complete by March 2025:

- standardised contracts between sellers and buyers of carbon credits and other ecosystem service credits such as biodiversity and water

- a method to measure, assess, and credit the biodiversity benefits provided by Woodland Carbon Code and Peatland Code projects

During 2024, the Woodland Carbon Code team are reviewing and piloting innovative ways to measure the carbon stock of woodland projects over time using remote sensing. This could include imagery or LiDAR instruments on drones, planes or satellites. We’re considering how this can streamline the monitoring and verification process.

Forest Research are leading a consortium funded through Defra’s Nature for Climate Fund to develop woodland water credits, for water quality, flood alleviation and water cooling. These could potentially be integrated in the Woodland Carbon Code.

The Peatland Code published Version 2.0 in March 2023. Up until that point only restoration projects on bogs where eligible under the Peatland Code, but since version 2.0 fen peatlands are included. Version 2.0 also saw an update to the Emissions Factors, aligning the Peatland Code with the UK Greenhouse Gas Inventory. In March or April 2024, a public consultation on Version 2.1 is planned. This mainly deals with clarifications and minor changes.

5.3.1 UK Woodland Carbon Code: detailed market trend analysis

The number of projects in the Woodland Carbon Code in the UK has increased at an average annual growth rate of 68% since 2019. 2,037 projects are on the UK Land Carbon Registry as of December 2023, of which 590 (29%) are validated. 886 projects (43%) are in Scotland with an average project size of 74 hectares, 767 projects (38%) are in England with an average project size of 13 hectares, 251 (12%) are in Wales with an average project size of 12 hectares and 133 (7%) in Northern Ireland with an average project size of 7 hectares.

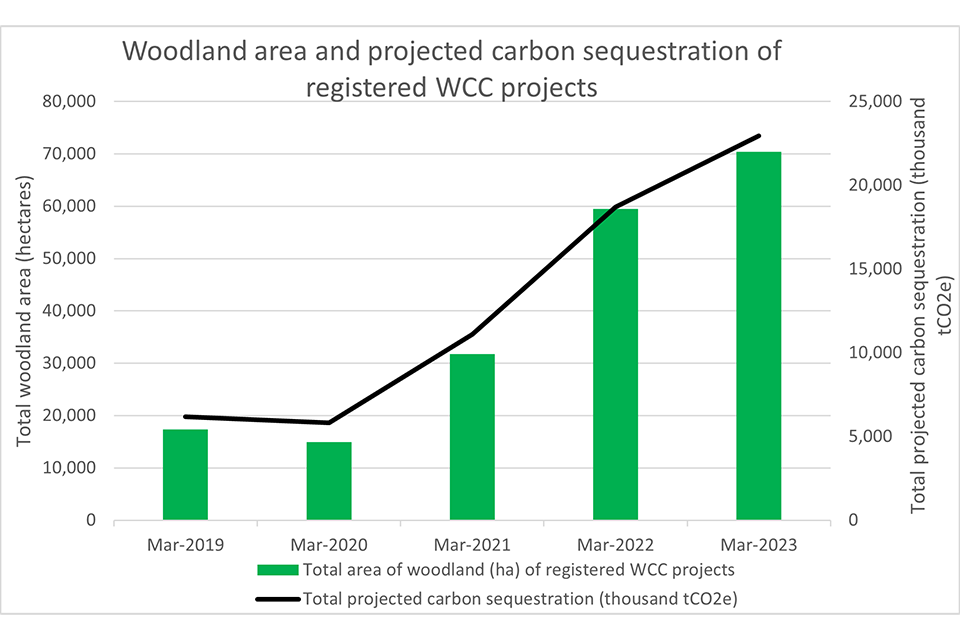

Figure 1 shows that as of December 2023, Woodland Carbon Code projects span over 79,000 hectares across the UK, an increase of around 62,000 hectares since 2019. Total projected carbon sequestration of projects over their lifetime (up to 100 years*) is estimated to be 26 million tonnes of CO2e, an increase of around 19.8 million tonnes of CO2e since 2019.

Over 4.1 million Pending Issuance Units are available for sale as of December 2023, with 3.3 million already sold. 800 Woodland Carbon Units are available for sale, with 3,500 already sold. The average price of a Pending Issuance Unit was £25.36 in 2023, a 70% increase from £14.93 in 2021. Over 99% of units transacted are Pending Issuance Units.

Figure 1: graph showing the change in total area of woodland (ha) of registered Woodland Carbon Code projects in the UK, and total projected carbon sequestration (thousand tCO2e), over time. The date range is from March 2019 to March 2023.

*The total projected sequestration of projects is assumed over their lifetime of up to 100 years and includes the amount claimable by a project plus the amount allocated to a shared ‘buffer’ in case of unanticipated losses.

5.3.2 UK Peatland Code: detailed market trend analysis

The number of projects in the Peatland Code in the UK has increased at an average annual growth rate of 190% since 2017. As of February 2024, there are 244 Peatland Code projects in the UK, of which 85 (35%) were validated. 196 projects (81%) are in Scotland with an average project size of 136 hectares, 34 projects (14%) are in England with an average project size of 137 hectares, 12 (4 %) are in Wales with an average project size of 107 hectares and 2 (1%) in Northern Ireland with an average project size of 87 hectares.

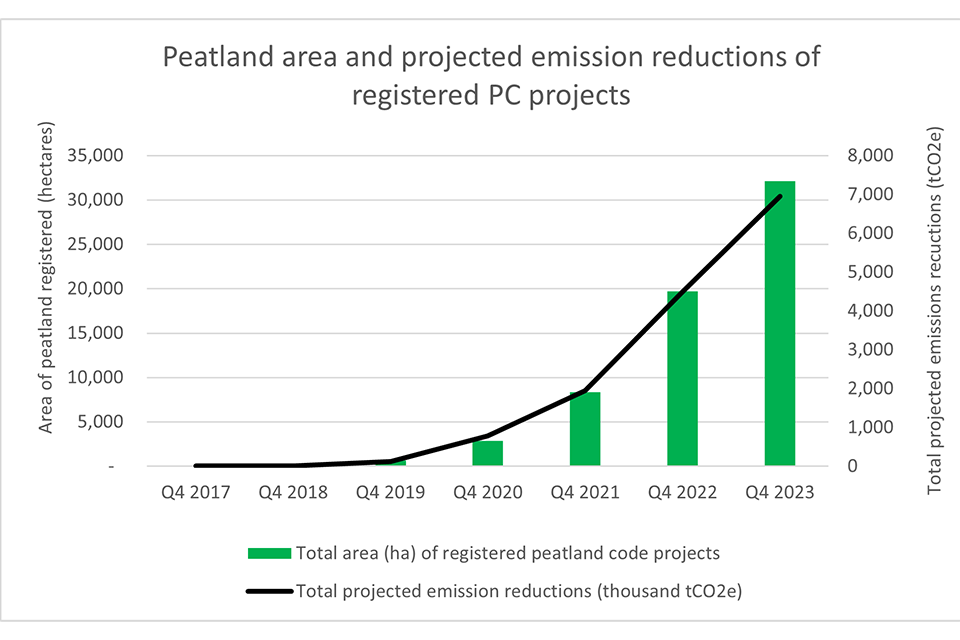

Figure 2 shows that current Peatland Code projects in the UK span over 32,000 hectares; 81% of peatland area registered is in Scotland. The projected carbon emission reductions of registered projects over their lifetime (average duration of 80 years) is around 7 million tonnes of Co2e, of which over 2.6 million tonnes of Co2e are from validated projects.

The price of a Peatland Code Pending Issuance Unit in 2022 was £23.95 and 100% of Peatland Units transacted were Pending Issuance Units.

Figure 2: graph showing the change in total area of peatland (ha) of registered Peatland Code projects in the UK, and total projected emissions reductions (thousand tCO2e), over time. The date range is from Q4 2017 to Q4 2023.

5.4 Maximising societal outcomes from nature markets

Where ecosystem service delivery is proposed in a given location, stakeholder evidence emphasises the need to consider land use, how to support delivery of the right ecosystem services in the right place, and avoid one ecosystem service being delivered to the detriment of others through nature markets.

As part of the Nature Investment Standards Programme, the BSI is considering how best to ensure local communities are proportionately engaged around nature market projects. BSI has identified this as an area where previous conventional markets have failed, and as high risk if lessons are not learned. BSI continue to explore this issue.

We are also exploring how local communities can be engaged to maximise the benefits of proposed natural capital projects, for example, through the Local Investment in Natural Capital (LINC) programme or Nature Returns project.

Local Nature Recovery Strategies (LNRS) are currently being rolled out across England and are designed to help target the creation and enhancement of habitats so that the right ecosystem services are provided in the right places. LNRS will provide an evidence base and a foundation on which nature market project pipelines can grow. Our expectation is that these pipelines will support and incentivise the right nature market projects in the right places. For example, if landowners undertake the actions mapped on their land in the LNRS, they can sell 15% more biodiversity units in the mandatory BNG market. This allows LNRS to guide coherent market delivery for nature recovery.

The LNRS preparation process is designed to be participative, and every LNRS must be consulted upon – those leading preparation are required to engage widely, including engagement of land managers and owners, environmental NGOs and local communities. LNRS will also involve the expert input of local teams across government environmental experts – Environment Agency, Forestry Commission and Natural England. As a result, LNRS are well-placed to support nature markets in maximising environmental benefits, and mitigating the risk of perverse social or environmental outcomes.

6. Working internationally

The government’s white paper on international development set our intention to support the growth of high-integrity carbon and nature markets to unlock a global estimated potential of $40 billion per year of private finance for low- and middle income countries by 2030.

Target 19 of the Kunming-Montreal Global Biodiversity Framework (KMGBF) calls for the mobilisation of $200 billion per year for biodiversity from domestic, international, public, and private sources. The target sets out that this should include: ‘stimulating innovative schemes such as payment for ecosystem services, green bonds, biodiversity offsets and credits, benefit-sharing mechanisms, with environmental and social safeguards.’ The UK is working widely to support activities designed to meet target 19 of the KMGBF, including section 19(d).

Following the agreement of the KMGBF, there has been a burst of global activity focussed on deepening nature markets. The increase in interest in biodiversity credits in particular has generated a dense and complex marketplace of ideas. Public, private, and non-profit actors are considering local, national, and international solutions. There are different models emerging across different contexts, countries, and jurisdictions.

Planned to launch in the coming months, the Voluntary Carbon and Nature Markers (VCNM) consultation will explore how the UK can best use its domestic nature market infrastructure to support the growth of international biodiversity credit markets, and how emerging international biodiversity credit markets can mutually reinforce existing carbon credit markets.

The UK and France set up an independent International Advisory Panel on Biodiversity Credits (IAPB) in June 2023 to look at ways to support the scaling-up of high integrity biodiversity credit markets.

The Panel’s aim is to support the scaling up of high-integrity biodiversity credit markets and encourage enabling policy and regulatory mechanisms to generate significant investments in nature conservation and restoration. It will do this by bringing together the latest science, data, technology, knowledge and experience from Indigenous Peoples and local communities, as well as market developments.

Our support for the development of nature markets globally, including through the IAPB, will also build on and benefit from our longstanding and continued support for the development of high integrity carbon markets. This includes the leadership role the UK played in securing agreement to global rules governing carbon markets through our COP 26 Presidency, as well as our ongoing support via our international climate finance to implement carbon pricing measures and build high integrity markets in developing countries. Beyond the Article 6 negotiations under the Paris Agreement, where the UK will continue to pursue further refinement of global rules for carbon trading, we have supported the development of international integrity principles through initiatives like VCMI and IC-VCM.

Building on these initiatives, it is important that governments and financial institutions around the world work towards a common understanding around market rules. The government will therefore continue to work with the integrity initiatives and through key international fora and negotiations to build international consensus around high integrity carbon markets. This can help provide a vital additional source of revenue in emerging economies, enabling developing countries to make a just transition to net zero and to support economic development.

We will support efforts by the integrity initiatives to ensure greater inclusion and to enhance market access for developing countries, furthering our work to build capacity and capability through our International Climate Finance (ICF) programming. As we develop our plans for future international support, we will continue to help developing countries to implement carbon pricing instruments, including through our ongoing support of the Partnership for Market Implementation Facility (PMIF) and related funds. This includes working with forest countries to scale finance for forest carbon, via results-based payments, market mechanisms, and wider efforts to mobilise the private sector. We will continue to support private sector initiatives seeking to mobilise finance to developing countries at scale, including through the Lowering Emissions by Accelerating Forest finance (LEAF) coalition.

7. Collaborating with our convening partners and stakeholders

We are very grateful to the expert stakeholders and groups who continue to share their expertise and engage with policy development. The 2023 Nature Markets Framework was developed in close collaboration with the devolved administrations and external stakeholders, recognising the shared ambition to scale up high integrity nature markets across the UK. This section outlines some key highlights:

- In developing the Framework, we worked closely with a coalition of experts from the finance, business, farming and environment sectors. This coalition was convened by the Broadway Initiative, Green Finance Institute, and Finance Earth in 2021, and was launched by the Defra Secretary of State together with the Economic Secretary to the Treasury. The Broadway Initiative are now convening a new dialogue, planned to kick off with a senior roundtable in March 2024.

- To help develop proposals for the forthcoming consultation on Voluntary Carbon and Nature Markets, officials held two roundtables to enable policy development to be informed by key stakeholder views from a cross-section of interests, and help ensure a robust and effective process, in October 2023. The outcomes of the roundtables will inform our approach and highlighted what government action stakeholders think is needed for the growth of high-integrity markets in the UK and beyond.

- In June 2023, the Defra Secretary of State convened and spoke at a Nature Finance event in Number 10 bringing together farmers and investors to explore nature market opportunities.

- Defra has regular engagement with the Farm Tenancy Forum which includes representatives of tenants, landlords and professional advisors to ensure that policy development considers the unique circumstances of tenant farmers and landlords in contributing to ecosystem services and nature markets.

- The Scottish Government has put in place a public sector partnership as a demonstration of their commitment to develop a values-led high integrity market for responsible investment in natural capital. As set out in the 2023 Programme for Government, this partnership is co-ordinating the development of a Market Framework to be published in 2024. The Market Framework will set out actions to support the market vision in Scotland. In 2024, a Community of Practice will be established to share learning on market development across the 27 investment readiness projects in Scotland awarded funds in the 1st round of the Facility for Investment Ready Nature in Scotland (FIRNS) scheme in September 2023 and those projects that receive awards in the 2nd round of FIRNS in Spring 2024. We continue to share learning from these funds across the UK.

- The Green Finance Institute’s GFI Hive initiative has convened groups and produced reports on Financing an Agricultural Transition and Financing Natural Flood Management (to be published soon). GFI have also established the Group of Financial Institutions for Nature (G-FIN) which is open to any financial institution engaged in UK nature finance. GFI chairs the Taskforce on Nature-related Financial Disclosures (TNFD) UK Consultation Group (to expand outreach and engagement on nature-related business and finance, and the TNFD framework) and the Land, Nature, and Adapted Systems Advisory Group which advises Defra on definitions of economic activities that can be defined as environmentally sustainable.

- The Ecosystems Knowledge Network brings together 3,000 members at the forefront of innovative and people-centred stewardship of land, water and nature - enabling the exchange of know-how between professionals through the power of networking and speeding up the sharing of expertise and experience. Their annual natural capital investment conference is a highlight of the nature finance calendar and their website contains a range of tools, insights, a project directory and a webinar library.

8. Annex: Supporting innovation and building the evidence base for nature markets

We continue to support nature market development through innovation, working to further build the evidence base to inform policy development. This section provides some examples from our projects, pilots, tests, and trials.

8.1 Pollardine Farm Test and Trial: exploring digital solutions to support farmers in pitching their projects to potential investors

Tests and Trials is a vehicle to work with stakeholders to explore how the new environmental land management schemes work. It’s part of our test, learn and adapt approach, providing a safe space for us to trial new approaches. We have engaged over 7,000 farmers and land managers across England in over 130 Tests and Trials. Findings from tests and trials are collated across 6 thematic areas, including innovative mechanisms and payments, helping to shape the design and delivery of new schemes.

The Pollardine Farm Test and Trial is exploring whether an online platform created by a group of twenty farmers, can act as an effective tool in showcasing land management and landscape scale plans and in facilitating blended finance. Farmers explored the development of an online platform with potential to showcase plans, create funding opportunities along with projecting a positive image of farming, and allowing farmers to tell their stories. A basic version of the online platform was developed.

Four projects for the online platform were developed with a focus on grassland restoration, habitat creation, enhancing wildflowers and hazel coppice. These projects were pitched to two potential private sector investors to determine whether the online platform is an effective mechanism for facilitating blended finance.

The Pollardine Farm Test and Trial is expected to complete in March 2024 when a final report will evaluate all project learnings.

8.2 The Lapwing Estate case study: developing an innovative business model to generate sustainable energy, food, and reduce greenhouse gas emissions

The systematic drainage of lowland peat for agricultural practices accounts for 2-3% of total UK greenhouse gases. Another key environmental challenge of agricultural practices is food supply chain emissions.

The Lapwing Estate in Nottinghamshire and South Yorkshire received NEIRF funding to ‘Rethink Farmed Peatlands’ by developing business models that abate landscape emissions through growing short rotation coppice willow on peat soils with a raised water table, known as ‘paludiculture’.

The willow is harvested and thermally decomposes, through a process called pyrolysis, producing biochar and generating high grade heat and power. The renewable energy will then be used for controlled environment agriculture, a technology-based approach to create optimal growing conditions for food production to offset the farmland being used to grow crops for pyrolysis.

The project has developed a complex and novel business model to generate sustainable energy, enhance food production, and restore degraded peatlands. It has the potential to generate income through several other streams including ecosystem services, balancing the risk of market infancies and regulatory or policy changes.

The business models for different scaled options were explored, scoping out financing opportunities and different income streams with stakeholders. Going forward, the project has three options to scale up, including to a landscape scale at 35,000 hectares which will be one of the first of its kind in the UK.

8.3 Palladium Test and Trial: exploring how public and private payments could be combined for tenant farmers

The Palladium Test and Trial engaged 14 tenant farmers from within the Yorkshire Dales National Park, along with stakeholders including the Tenant Farmers association (TFA), Countryside Land and Business Association (CLA) and National Farmers Union (NFU), in developing a model for blending public and private finance for nature restoration projects, and in designing a template agreement terms for nature restoration investment aimed at tenant farmers.

The project identified key building blocks which could be used to underpin successful blended finance payments:

- financial mechanisms and options for structuring blended payments, such as public or private top up funding, private capital funding alongside public maintenance funding, delineated payments, or the option for public sector acting as buyer of last resort or floor price guarantor. This last option was seen as aligning best with outcome-based payments for long term agreements that require long term or permanent land use change

- a limited set of bundling or stacking options and combinations that can be defined and applied across the market

- a wider set of mechanisms that can be designed to make transactions work well, such as an additionality test on the supply side.

The project included exploring the construction of long-term blended finance agreements for landowners and tenant farmers to safeguard investments in land use change and associated environment outcomes. Different agreement types were considered, with participants favouring the use of an Ecosystem Services Purchase Agreement (ESPA) to enable the stacking of ecosystem services. ESPA’s were selected as a suitable solution for all key stakeholders because they perform similarly to other commercial agreements landowners and tenant are familiar with; multiple ecosystem services can be sold under the same agreement; and because a clause can be included to make the agreement a three-way agreement between the buyer, tenant and landlord.

8.4 Local partnership-led pilot projects

Nature Returns is supported by HM Treasury’s Shared Outcomes Fund and is led by Natural England in partnership with the Environment Agency, RBG Kew and the Forestry Commission. Through Nature Returns, we have funded six local partnership-led pilot projects across England to develop nature-based solutions for mitigating climate change across diverse landscapes. We are monitoring and assessing the potential for these restored habitats to sequester and store carbon, support biodiversity and provide other benefits. We are also working with these local partnerships and their stakeholders to support their development of sustainable funding plans to deliver landscape-scale land use change, including how best to blend public and private finance and the governance structures to support this. You can find further information on the Nature Returns blog site.

8.5 Supporting development of innovative investment models

8.5.1 Hadrian Bond

Hadrian Bond was conceived as the UK’s first Environmental Impact Bond focused on regenerative agriculture. Through the NEIRF it aimed to channel impact investment to farms which seek to adopt regenerative principles and practices and restore the effectiveness of carbon, water, and mineral cycling in soils and wider ecosystems.

The NEIRF grant was used to:

- fund capacity building and access legal support around structuring outcomes-based transactions with stakeholders

- understand best practices for the ongoing measurement, verification and sale of ecological outcomes in the form of practical targets and monetisable credits from regenerative farms

- design the Hadrian Bond project to align with existing and future Countryside Stewardship and Environmental Land Management schemes

A Special Purpose Vehicle, Hadrian Bond Company Ltd. (HBC), was set up to operate a pilot project. HBC sells soil sequestered carbon units to corporates seeking to offset their emissions. Over time, approximately two thirds of revenues will go directly to farmers and the rest will be used to run the project and repay investors.

Following the pilot, Hadrian Bond aims to expand to three further farming clusters in the Midlands, English Borders, and Wiltshire, each of around 10,000ha at full capacity, with the overall aim to increase the scale of regenerative agriculture in the UK and raise further finance to support farm conversion.

8.5.2 Eden Project

The Eden Project’s National Wildflower Centre (NWC) aims to reverse the long-term loss of wildflower habitats in England by creating 100 hectares of wildflower habitat, per year, for the next 10 years.

A new company, Eden Project Wildflower Bank has been created to generate revenue through two financial mechanisms: the sale of Biodiversity Net Gain units to corporations and developers who want to offset biodiversity loss and/or meet legal requirements, and the sale of wildflower seeds harvested from those new wildflower habitats. The wildflower seeds will primarily be sold to environmental and urban restoration projects via wholesale markets and retail outlets.

NEIRF funding was used to develop the proposition, cost plan, investment model, and to consult experts beyond the Eden Project. It also allowed the NWC to create a project methodology to underpin the business plan.

Immediate next steps include the creation of a new company structure, securing capital investment, and building the landowner and buyer pipelines. Longer term the project will develop the business case, establish three regional partnerships, and a seed supply network.

8.6 Building the evidence base to enable nature markets to finance activities to reduce specific environmental challenges

8.6.1 Reducing diffuse pollution

A consortium led by Forest Research are developing components of a Woodland Water Code (WWC), a crediting mechanism to encourage private investment in woodland creation for the improvement of the freshwater environment. Woodlands provide a wide range of environmental and societal benefits, prominent among these for water are the improvement of water quality, reduction in flood flows, and ‘water cooling’. The project aims to research, develop, and undertake desk-based pilot testing of a UK-wide WWC for one or more of these water benefits by March 2025. This is primarily a development project, drawing on a sound understanding of woodland water benefits. Work to date has centred on developing a water quality methodology to help tackle the intractable issue of diffuse pollution (specifically nitrate-nitrogen, phosphorus, sediment, pesticides, and faecal indicator organisms), alongside designing the methods and rules of the code, including the key principles of additionality, permanence, and leakage. In addition, a series of stakeholder engagement seminars have taken place to engage with a wide range of key market actors and understand the barriers and opportunities for both landowners and buyers. The next phase of the project will focus on desk-based piloting of the water quality element, and development of the flood alleviation and water cooling methodologies. Further engagement activities are planned for 2024 to assess the potential market demand, collect feedback on the emerging Code and align with the emerging BSI standards framework for UK nature markets.

8.6.2 Restoring saltmarsh habitat

Building on a successful pilot study funded by the Natural Environment Investment Readiness Fund, Defra is funding the second phase of development of a UK Saltmarsh Code that will allow saltmarsh carbon to be marketed and traded as a carbon offset, whilst providing assurances to buyers that the climate benefits being sold are real, quantifiable, additional, and permanent. This model follows on from the Woodland Carbon Code and the Peatland codes already in use in the UK and will provide greater assurance to private investors looking to invest in saltmarsh habitat restoration. The project is being supported by the Environment Agency and delivered by a consortium led by the UK Centre for Ecology and Hydrology.

8.7 Local Investment in Natural Capital (LINC)

The LINC programme aims to develop a series of investible propositions within 4 local or combined authority areas. These demonstrator authorities and their partners are engaging widely in order to maximise the reach of future natural capital projects and deliver broader societal benefits. Some are engaging with landowners to gain a better understanding of their challenges and needs. Others are surveying local businesses to understand their motivations and willingness to invest in natural capital improvements. Some will test their ambitions through pilot natural capital projects, whilst others are looking to develop investment vehicles. Lessons learned from the programme will be disseminated to help local or combined authorities to lever in private finance and other innovative forms of funding to deliver their natural environment ambitions.

The wide variety of natural environments covered by the 4 authority areas:

- Cornwall

- West Midlands

- York and North Yorkshire

- Borderlands (Northumberland, Cumberland and Westmorland and Furness)

This ensures the scope of the programme includes coastal, urban and rural communities.