Monitoring businesses' awareness of Making Tax Digital

Published 9 June 2022

Quantitative research with VAT registered businesses below the VAT threshold.

HM Revenue and Customs (HMRC) Research Report 649.

Research was conducted by Yonder between June 2021 and January 2022. Prepared by Yonder (Simon Taylor and Florrie Hodgkinson) for HMRC.

Disclaimer: The views in this report are the authors’ own and do not necessarily reflect those of HMRC.

1. Executive summary

1.1 Background

Under Making Tax Digital rules, from April 2022 all VAT registered businesses, including those with an annual taxable turnover below the £85,000 VAT threshold, are required to keep business records digitally and use Making Tax Digital compatible software to submit their VAT returns.

HM Revenue and Customs (HMRC) commissioned the independent research agency Yonder to conduct research on their behalf to understand the extent of affected VAT registered businesses’ awareness of and preparedness for Making Tax Digital.

1.2 Research aims

The research tracked levels of awareness of and preparedness for Making Tax Digital and its requirements for VAT registered businesses below the VAT threshold who had not yet signed up to Making Tax Digital. The research findings have been helping inform HMRC’s approach to engaging with businesses that need to take action from April 2022.

1.3 Methodology

A quantitative Computer Assisted Telephone Interviewing (CATI) approach was used to interview 1,107 businesses. This was split across two waves, with 551 interviews in wave 1 completed in June 2021 and 556 interviews in wave 2 completed between December 2021 and January 2022. Businesses were contacted at random using samples provided by HMRC, drawn from the database of VAT registered businesses below the VAT threshold.

1.4 Awareness of Making Tax Digital and its requirements

Unprompted awareness of Making Tax Digital, either by the term or concept was high across both waves of research; it was 93% in wave 2, showing a statistically significant increase from 87% in wave 1.

However, over a quarter of the businesses (28%) aware of Making Tax Digital in wave 2 incorrectly stated the requirements of Making Tax Digital did not apply to their business (before being prompted with a definition of Making Tax Digital). Here, for over a quarter of businesses awareness of Making Tax Digital did not immediately translate into an understanding that Making Tax Digital applies to their business. This was not assessed in wave 1.

In wave 2, 36% of businesses reported they had already signed up for Making Tax Digital, a slight, but not statistically significant, increase from 30% in wave 1. However, once prompted with a definition of Making Tax Digital and asked to clarify whether they had linked their record-keeping software with HMRC, this dropped to 26%, suggesting some confusion about the specific requirements of full compliance with Making Tax Digital among these businesses.

Understanding of the specific requirements of Making Tax Digital was lower than general awareness. In wave 2, only 51% of businesses aware of Making Tax Digital by the term or concept were able to recollect at least one correct requirement, 12% provided only incorrect responses and a further 37% could not think of any requirements at all (either correctly or incorrectly). This position had not notably changed since wave 1, despite HMRC communications sent between waves and the proximity to the mandation date.

1.5 Existing tax and record-keeping processes

The digital record-keeping processes of businesses remained consistent across the two waves of research, with 75% using digital methods as their main method for record keeping in wave 2 compared to 72% in wave 1. In wave 2, 20% of businesses were still using paper as their main method, which was only a slight and not statistically significant decrease from wave 1 (24%).

Results show that businesses using paper methods were less likely to understand the requirements of Making Tax Digital. This suggests that those businesses using paper methods may have a higher risk of being less prepared for Making Tax Digital.

Businesses in wave 2 reported receiving less help with their accounts or tax (63%), a statistically significant decrease compared to wave 1 (70%). We do not know the reason why reliance on tax agents has reduced between research waves.

However, in wave 2, agents still played a vital role in helping businesses understand what they need to do to prepare for Making Tax Digital, given that 19% of businesses said they were relying on their tax agent or accountant to advise them before preparing for Making Tax Digital, and 15% claimed their tax agent or accountant was a key source of Making Tax Digital awareness.

1.6 Preparedness for Making Tax Digital

In wave 2, 32% of businesses reported that they planned to take action before or during April 2022. However, 7% said they planned to do so after April 2022. These trends are consistent with wave 1.

Further to this, in wave 2, 37% of businesses said they are waiting on others to advise (for example their agent), or do not know when they will take further action to prepare for Making Tax Digital. This was an increase (but not statistically significant) on wave 1 where 30% said they are waiting on others to advise or do not know when they will take action.

Once prompted with a definition of Making Tax Digital and a list of activities and requirements, in wave 2, 76% of businesses already aware of Making Tax Digital said they have taken action to prepare. However, this was not a statistically significant change from wave 1 at 74%, suggesting preparedness had not increased between wave 1 and wave 2.

1.7 Engaging businesses with Making Tax Digital

A range of sources drove awareness of Making Tax Digital. However, the impact of sources differed across research waves. In wave 2, a letter from HMRC seems to have been the most influential source. Twenty-eight percent of businesses recalled receiving one, a statistically significant increase on wave 1 (8%).

Businesses that recalled receiving a letter from HMRC about Making Tax Digital in wave 2 showed a slightly more rounded awareness of the requirements of Making Tax Digital compared to other sources. This suggests that letters may have been impactful in driving a broader understanding of Making Tax Digital.

In wave 2, 46% of businesses said they do not see any benefits to Making Tax Digital, a statistically significant increase on wave 1 at 38%. The benefits most commonly recognised across both waves of research were better use of agent time and the ability to access records anytime and anywhere.

Thirty-three per cent of businesses in wave 2 said they do not anticipate any barriers to implementing Making Tax Digital; this is consistent with views in wave 1. The most commonly reported concerns across both waves of research were the costs of, and time taken to, get used to Making Tax Digital compatible software.

2. Introduction

2.1 Background

Under Making Tax Digital rules, VAT registered businesses (or their agents) are required to keep business records digitally and use Making Tax Digital compatible software to submit VAT returns.

After the introduction of Making Tax Digital for businesses above the VAT threshold of £85,000 in April 2019, the Chancellor announced that all VAT registered businesses including those with a turnover below the VAT threshold would be required to follow Making Tax Digital rules for their first returns starting on or after April 2022.

HM Revenue and Customs (HMRC) commissioned independent research agency Yonder to conduct a piece of research on their behalf to track and monitor businesses’ awareness and understanding of and preparedness for Making Tax Digital.

This research was carried out across two waves during the following time periods, so that findings could inform the design and focus of communications and engagement with businesses in relation to Making Tax Digital:

-

wave 1: June 2021

-

wave 2: December 2021 to January 2022

This report details the findings from both waves of research.

At the time that wave 1 and wave 2 were conducted about a third of businesses with turnover below the VAT threshold had signed up voluntarily to Making Tax Digital. The majority of VAT registered businesses that are required to follow Making Tax Digital rules from April 2022 had not yet signed up to Making Tax Digital. The research findings have been informing a range of communications activities targeted at those businesses that need to take action in 2022.

2.2 Research aims

The research was conducted to track and monitor levels of awareness of and preparedness for Making Tax Digital and its requirements for VAT registered businesses with turnover below the VAT threshold that had not yet signed up to Making Tax Digital.

Results from wave 1 of the survey were used as a benchmark and to inform plans for communications activities (such as information and reminder letters) that were conducted in late 2021. Wave 2 of this research measured changes in awareness and preparedness levels, approximately three months before the April 2022 mandation date.

The research questions were:

-

what are businesses’ (prompted and unprompted) awareness levels and understanding of Making Tax Digital and the activities that they will be required to take?

-

what are businesses’ current tax processes and digital capabilities?

-

what is the level of preparation activity/ what activities are businesses undertaking to prepare for the changes?

-

what are the perceived benefits and barriers to making the changes that Making Tax Digital requires?

-

what is the best way to engage with businesses on Making Tax Digital?

2.3 Method

Fieldwork

This was a quantitative study comprising of, in total across the two waves of research, 1,107 interviews with businesses whose annual turnover is below the VAT threshold and who had not yet signed up to Making Tax Digital. Broken out by wave, this was 551 interviews in wave 1 and 556 interviews in wave 2. A quantitative Computer Assisted Telephone Interviewing (CATI) approach was used for the interviews, conducted by Yonder’s in-house telephone centre.

Interviews lasted 16 minutes on average across the two waves.

In May 2021, prior to the start of fieldwork for wave 1, Yonder completed cognitive interviews and a pilot phase to test and refine the questionnaire. Another brief pilot phase was conducted in November 2021 to test changes made to the questionnaire prior to wave 2 fieldwork.

Sampling

The samples used for the two waves of the survey were provided by HMRC, drawn from the database of businesses whose annual turnover was below the VAT threshold and who had not signed up to Making Tax Digital (at the time of drawing the sample). Sampled businesses were drawn at random.

Businesses located in Wales, Scotland and Northern Ireland were boosted to allow additional indicative findings to be gathered for the devolved nations. This oversampling was corrected through weighting of the final data, as defined below.

Weighting

Across both waves, data was weighted according to the latest available HMRC population data on VAT registered businesses below the VAT threshold who had not yet registered for Making Tax Digital for business turnover, region and sector. See the technical annex for tables showing the weighting profiles applied for each wave.

Report interpretation

Not all figures in this report sum to a total of 100%. This is the case if more than one response was possible; and, where all responses have been included, figures may not sum exactly to 100% due to rounding.

Data comparisons highlighted within this report are not statistically significant unless explicitly defined. Those comparisons which are statistically significant are defined at the 95% confidence interval.

3. Findings

3.1 Awareness of Making Tax Digital

The research shows that unprompted general awareness of Making Tax Digital amongst businesses was high. This was initially noted in wave 1 and increased further in wave 2, likely in part because of letters that HMRC sent to businesses in the period between the waves of research.

However, this general awareness of Making Tax Digital did not translate to a full understanding of Making Tax Digital requirements. Unprompted understanding of the specific activities needed to be compliant with Making Tax Digital was far lower than overall awareness in wave 1 and did not notably improve in wave 2, despite the proximity to the April 2022 mandation date. This suggests significant work remained for businesses to fully engage with Making Tax Digital and undertake activities to prepare.

Unprompted awareness of Making Tax Digital

Awareness of Making Tax Digital or the concept that HMRC are making changes to the way VAT registered businesses keep their accounting records and submit VAT returns, has increased over the two waves of research.

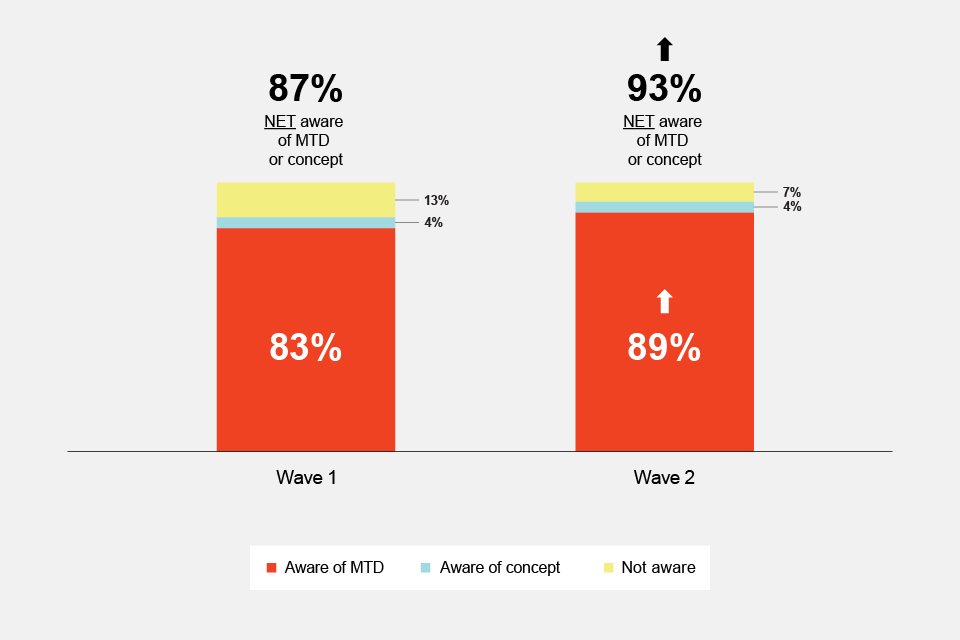

In wave 1, when asked ‘Before taking part in this survey, had you heard of Making Tax Digital for VAT?’ 83% of businesses were aware of the term. Those unaware were then asked, ‘Are you aware that HMRC is making changes to the way VAT registered businesses like yours keep their accounting records and submit VAT returns?’ 4% of businesses reported that they were aware of the concept of these changes.

Thus, in wave 1, in total close to nine in ten businesses were aware of Making Tax Digital either by the term or concept (87%). In wave 2 this increased to over nine in ten (93%), with 89% aware of the term and a further 4% aware of the concept (see Figure 1).

Figure 1: Unprompted awareness of Making Tax Digital (MTD) by term or concept

Data in figure 1 refers to the following questions: Before taking part in this survey, had you heard of Making Tax Digital for VAT? And: Are you aware that HMRC is making changes to the way VAT registered businesses like yours keep their accounting records and submit VAT returns?

Base: Total sample: Wave 2 (556), Wave 1 (551)

Significance: Statistically significant differences between waves are highlighted using up or down arrows.

Unprompted understanding of Making Tax Digital

While awareness of Making Tax Digital as a term or concept was high, unprompted understanding of specific Making Tax Digital requirements was lower. In wave 1, we asked businesses what they think they will need to do when Making Tax Digital comes into effect. Only 27% could recollect at least one of the three specific requirements. Recollection of each of the three specific requirements of Making Tax Digital was as follows:

-

15% recalled the requirement to submit VAT returns through Making Tax Digital compatible software

-

14% recalled the requirements to keep digital records

-

1% of businesses recalled the mandation date (April 2022)

Further to the above, 24% of businesses stated they would not need to do anything, 23% recalled only incorrect requirements and 26% could not recall any specific requirement (correctly or incorrectly).

In wave 2, the question was slightly different, asking businesses what they believed to be the key requirements of Making Tax Digital in general, rather than how it affects their business. The aim of this changed wording was to capture a more accurate understanding of businesses’ general knowledge of Making Tax Digital.

Just over half (51%) of businesses recollected at least one specific requirement, showing understanding of the specific requirements of Making Tax Digital was still lower than general awareness. Despite the changes in question wording, the increase in recollection of one or more Making Tax Digital requirements might suggest that understanding improved between research waves.

Recollection of the three specific requirements of Making Tax Digital in wave 2 was as follows:

-

25% recalled the requirement to submit VAT returns through Making Tax Digital compatible software

-

24% recalled the requirements to keep digital records

-

7% of businesses recalled the mandation date (April 2022)

Further to the above, 49% of businesses had no or incorrect understanding of Making Tax Digital requirements, including 12% who said they did not think they would need to do anything to be compliant.

Some businesses with similar characteristics demonstrated a better understanding of Making Tax Digital requirements. Using technology (that is spreadsheets, software or apps) as a main method to keep business records was related to a higher understanding of the requirements of Making Tax Digital.

In wave 2, digital recordkeepers had a better unprompted recollection of the requirements of Making Tax Digital, with 57% recollecting one or more requirement, compared to 36% of those using paper methods.

While the question was asked in a slightly different way in wave 1 and therefore data is not directly comparable, trends were consistent in that those using digital approaches as their main method of record keeping had a better unprompted understanding of Making Tax Digital requirements.

In wave 2, businesses that recalled receiving a letter from HMRC about Making Tax Digital showed a slightly more rounded awareness of the requirements of Making Tax Digital compared to other sources. Of those businesses that could proactively recall at least one requirement of Making Tax Digital:

-

32% recalled hearing about Making Tax Digital in a letter from HMRC

-

24% recalled hearing about Making Tax Digital on the HMRC website or GOV.UK

-

23% recalled hearing about Making Tax Digital in an email from HMRC

There is further evidence stated within this report (please see section 3.4 titled Sources of awareness of Making Tax Digital) that HMRC letters have been an influential source in raising understanding of the requirements of Making Tax Digital, so should be considered as a key source for ongoing communications.

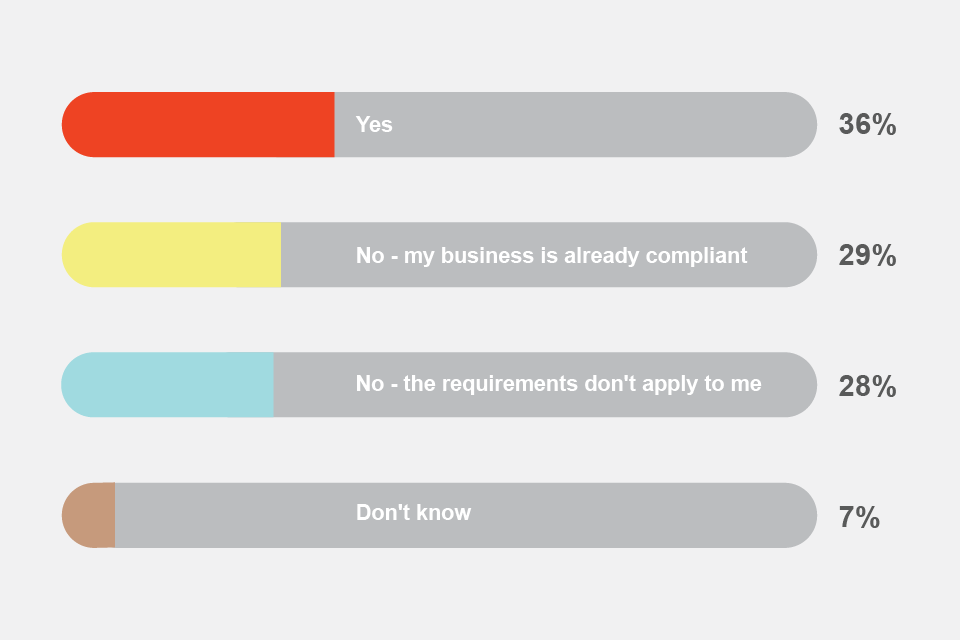

The research also showed that it was still not clear to many businesses exactly how Making Tax Digital will affect them. In wave 2, close to three in five businesses thought the requirements of Making Tax Digital either will not affect their business (28%), or that they are already compliant (29%), see Figure 2. This was a new question for wave 2, therefore no comparisons with wave 1 could be made and the remainder of this section only refers to wave 2.

Businesses with the following characteristics were more likely to think the Making Tax Digital requirements do not apply to them: in the construction sector (38%), in the East of England (41%), with a turnover below £10,000 (37%), using record-keeping software (24%), claiming to have already signed up to Making Tax Digital (22%).

Businesses already using record-keeping software were also more likely to say they are already Making Tax Digital compliant (48%). The same was true for those in other professional services (35%) and those based in Greater London (43%).

Figure 2: Understanding of the effects of Making Tax Digital requirements on business. ‘Do you think the requirements of Making Tax Digital will affect your business?’

Data in figure 2 refers to the following question: Do you think that the requirements of Making Tax Digital/ the new HMRC changes will affect your business?

Base: All respondents at wave 2 aware of Making Tax Digital or concept (521)

Perception of having signed up to Making Tax Digital

Note: The sample of businesses provided by HMRC, and therefore contacted for the research, contained only businesses that had not yet signed up to Making Tax Digital. However, for wave 2, during the period between HMRC providing the sample and the conclusion of fieldwork, 4% of businesses in the sample are known to have signed up to Making Tax Digital. This should be considered along with the data presented in this section.

The research highlighted that there was a large portion of businesses who say they are already fully compliant with Making Tax Digital rules, and this proportion of businesses seems to have increased. Before being prompted with a definition of Making Tax Digital, over a third (36%) of businesses in wave 2 said they had already signed up for Making Tax Digital. This was a slight, but not statistically significant, increase compared with wave 1 (30%).

In wave 2, two additional questions explored this topic further. Within the survey, respondents were prompted with a definition of Making Tax Digital and its requirements. They were also informed that they will need to give permission to link their record-keeping software with HMRC systems to be fully compliant with Making Tax Digital.

After each statement, in wave 2 we asked respondents to confirm whether they thought they had fully signed up to Making Tax Digital. Once prompted with a definition of Making Tax Digital, the proportion of businesses who thought they had signed up reduced from 36% to 28%. Once asked if they had given permission for their record-keeping software to be linked with HMRC, the proportion saying they had signed up reduced further to 26%.

Businesses using software as their main form of record keeping were more likely to say they are already complying with Making Tax Digital requirements even after having been provided with a description of Making Tax Digital (57%). This group of businesses were also more likely to say they had given permission for their software to be linked with HMRC’s systems (56%).

3.2 Current record-keeping processes and support

Help with accounts and tax

Fewer businesses surveyed in wave 2 were using externally paid help to support them with their accounts and tax compared with wave 1. To an extent, this might account for the lack of change in preparedness across research waves (see section 1.6), as data shows that many businesses relied on their agents to update them on relevant initiatives like Making Tax Digital.

Over six in ten (63%) businesses in wave 2 reported receiving help with their accounts or tax, a statistically significant decrease compared to wave 1 (70%). The majority of those receiving help with accounts or tax in wave 2 were receiving externally paid help (56%). Again, this number has reduced statistically significantly since wave 1 (62%).

In wave 2, only 5% of businesses said they pay a member of staff to help with accounts or tax and 3% said they receive unpaid help from a family, friend or colleague. And 37% of businesses reported receiving no help in wave 2, compared with 30% of businesses in wave 1.

Current record-keeping processes

Most businesses were using digital methods as their primary method of keeping business records. However, around a fifth of businesses were using paper methods and this showed little change across the two waves of research. Businesses in the agriculture, forestry and fishing sector and those in Northern Ireland were overrepresented among those using paper-based methods for keeping business records.

Three-quarters of businesses in wave 2 reported using digital methods as their main method of keeping business records (75% in total; 42% using spreadsheets, 31% using software and 2% using apps). This represents no statistically significant change since wave 1.

In wave 2, one in five (20%) businesses said they still use paper methods as their main record-keeping method, a slight (but not statistically significant) decrease since wave 1 (24%). This practice was more common in specific nations (40% in Northern Ireland, 36% in Wales) and industries (43% in the agriculture, forestry and fishing sector).

This is a similar pattern to wave 1, where those in Scotland (39%), Northern Ireland (48%) and in the agriculture, forestry and fishing sector (54%) were more likely to use paper as their main record-keeping method. The finding that businesses in Northern Ireland and those in agriculture, forestry and fishing consistently showed higher use of paper methods across the waves strengthens evidence that these businesses may require more support to transition to Making Tax Digital.

Method used to submit VAT returns

In wave 1, 80% said they submit VAT returns via their VAT online account on GOV.UK. In wave 2, over two-thirds (68%) of businesses said they use VAT online services to submit returns, although the question was asked in a different way to wave 1 to record more details and cannot be directly compared. Across both waves, most businesses were submitting their VAT returns digitally, but using the legacy online VAT returns submission service, as opposed to via Making Tax Digital compatible software.

The answer to the detailed question in wave 2 showed that sole proprietors (84%) and partnerships (74%) were more likely to say they submitted their VAT via online services. The same is true for those using paper-based methods (82%), or spreadsheets (84%) as a main method of record keeping. Businesses who said they do not have help with their accounts (81%) and businesses with a turnover of less than £10k per year (79%) were also more likely to submit their VAT returns online.

In wave 2, 41% of businesses who said they were already signed up for Making Tax Digital (see perception of having signed up to Making Tax Digital), also said that they used VAT online services to submit their returns. Given that the changes as a result of Making Tax Digital mean that businesses who are fully signed up will no longer use the VAT online services to submit their returns, this data suggests that at least 41% of those who claimed to be fully signed up to Making Tax Digital were mistaken.

Over a third (36%) of businesses who said they were already signed up for Making Tax Digital also said that they use Making Tax Digital compatible software to submit VAT returns. Within Making Tax Digital requirements, this 36% would have been correct.

3.3 Preparedness for Making Tax Digital

Ease of using software for record keeping

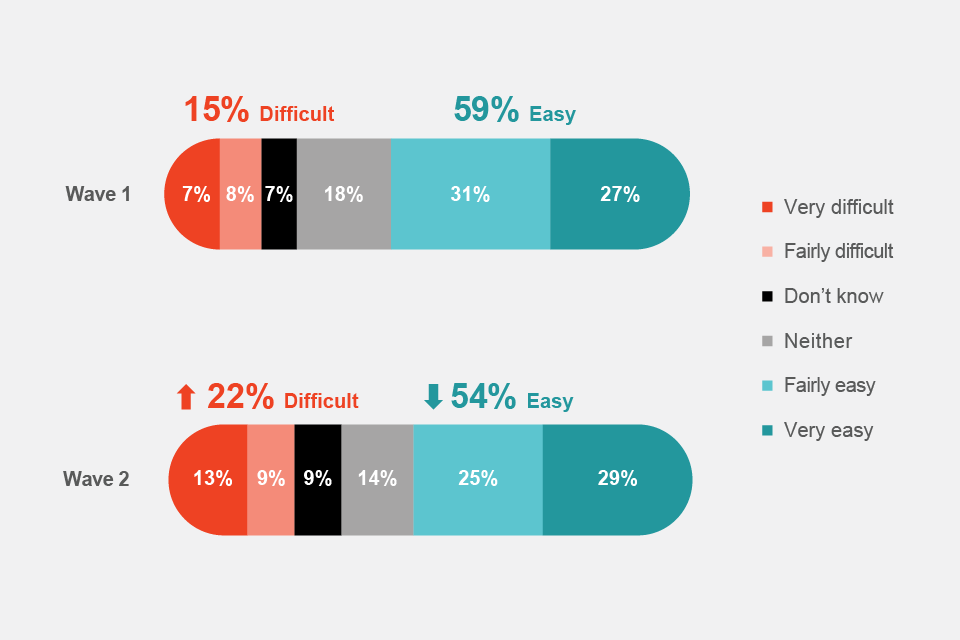

Businesses were split in terms of their perception of how easy it would be to use software for record keeping. This perception of ease appears to have been decreasing as the mandation date approached.

Those who use digital methods for record keeping were more likely to feel that it would be easy compared to those who use paper methods. As previously noted, this research also showed that businesses that use paper methods were less likely to understand the requirements of Making Tax Digital, further demonstrating that this group of businesses may be in greater need of support with the transition to Making Tax Digital.

Over half of businesses (54%) reported they will find it easy to use software for record keeping in wave 2 (see Figure 3). This was a statistically significant decrease on the proportion in wave 1 (59%). In line with this, 22% of businesses reported they will find it difficult to use software for record keeping in wave 2, compared with 15% in wave 1 (a statistically significant increase).

Certain groups were more likely to report they will find it easy or difficult to use software, notably based on their main method of record keeping. In wave 2, those who currently use digital methods for record keeping were more likely to say they will find using software easy (77%), which was consistent with wave 1 (64%). Those businesses using paper methods as their primary record-keeping method were the most likely to report it will be difficult in wave 2 (44%), which was consistent with wave 1 (24%).

Figure 3: Expected ease of using software for record keeping

Data in figure 3 refers to the following question: How easy or difficult will it be for your business to use software to keep digital records of your income and expenditure and submit VAT returns using Making Tax Digital software?

Base: Total sample: Wave 1 (551), Wave 2 (556)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

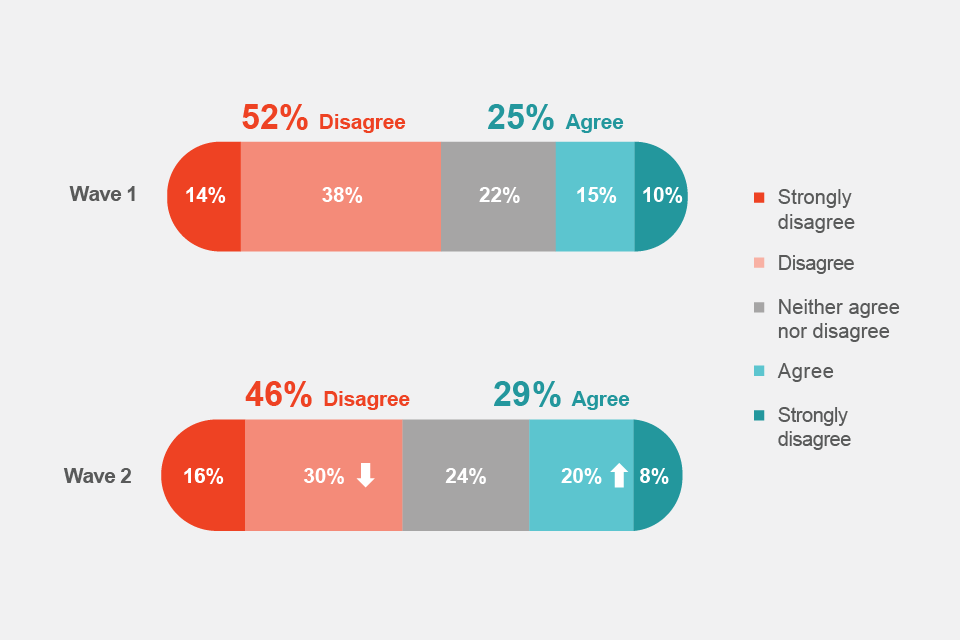

Concern regarding the security of keeping business records digitally

There seems to have been a growing concern regarding the security of keeping business records digitally. Just over a quarter of businesses in wave 2 agreed with the statement that they were worried about the security of keeping business records digitally (29%). This was a statistically significant increase from 25% of businesses agreeing in wave 1.

In wave 2, those who currently use paper-based methods as their main method of record keeping were more likely to agree they were worried about the security of keeping business records digitally (43%), as well those in Northern Ireland (41%), Wales (32%) and those who are in the agricultural, forestry and fishing sector (37%).

This was a similar pattern to wave 1, where concerns were more common among those currently using paper-based methods as their main record-keeping method (47%), those in Northern Ireland (36%), and those in the agriculture, forestry and fishing sector (48%). This consistent finding across waves strengthens evidence that these businesses may indeed have been particularly concerned about security of keeping business records digitally.

Figure 4: ‘I am worried about the security of keeping business records digitally’ - agreement

Data in figure 4 refers to the following question: To what extent do you agree or disagree with the following statement ‘I am worried about the security of keeping business records digitally’?

Base: Total sample: Wave 1 (551), Wave 2 (556)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

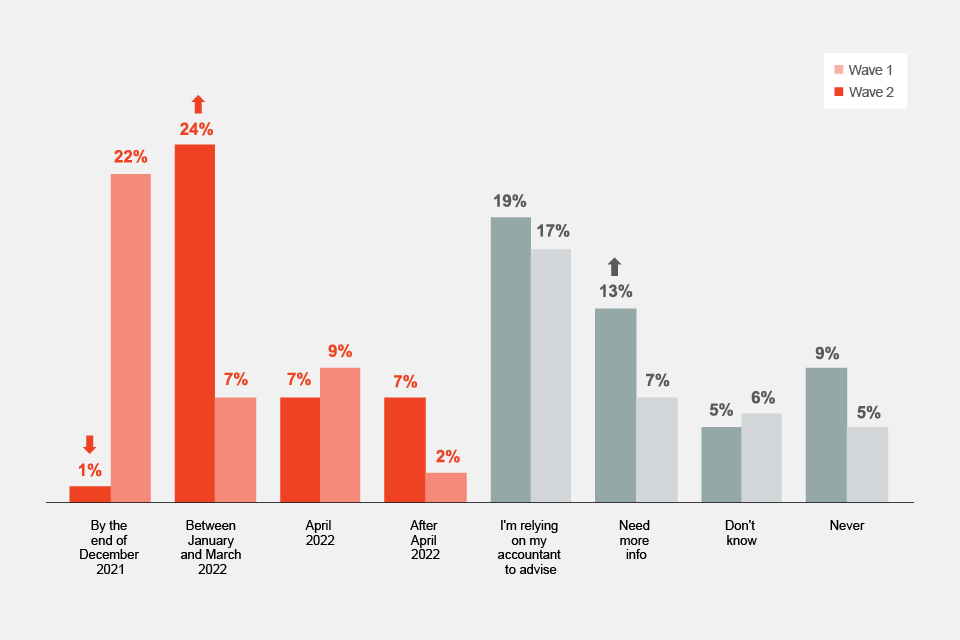

Date at which businesses plan to take action to prepare for Making Tax Digital

In wave 2 (December 2021 to January 2022), at the point of interview, just over three in ten businesses (32%) said that they planned to take action before or during April 2022 (see Figure 5). It should be noted that 1 April 2022 was not the deadline for all businesses to sign up to Making Tax Digital. Businesses are required to start keeping digital records and submit their VAT returns using Making Tax Digital compatible software for their first VAT period beginning on or after 1 April. Another 7% of businesses said that they intend to take action after April.

While there was a notable difference in proximity to the mandation date, the data from wave 1 (June 2021) shows that these trends had not notably changed, as at that point, 38% said that they planned to take action before or during April 2022 and 2% after April. Similarly, as shown in section 3.3 titled Activities completed to prepare for Making Tax Digital, below, the proportion of businesses that had completed activities to prepare for Making Tax Digital had also not changed between waves 1 and 2, suggesting that some businesses had been putting off preparation activities.

Further to the above, over one third of businesses in wave 2 (37%) said that they either do not know when they will take action or are waiting on others to advise them, which showed an increase (but not statistically significant) from wave 1 (30%). Within this group in wave 2, 19% said they were waiting on an accountant to advise them, 13% said they needed more information (a statistically significant increase from 7% in wave 1) and 5% said they did not know when they would take action.

Figure 5 shows when businesses said they will complete activities to prepare for Making Tax Digital, and how this compared across waves.

Figure 5: When businesses will take action to prepare for Making Tax Digital (prompted list)

Data in figure 5 refers to the following question: When do you think you will take action to prepare for Making Tax Digital or the new HMRC changes. Such as getting the necessary software or signing up to Making Tax Digital or submit VAT returns to HMRC digitally?

Base: All respondents aware of Making Tax Digital or the concept and think the requirements will affect their business, or don’t know or other at question 10 (wave 2: 242, wave 1: 199)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

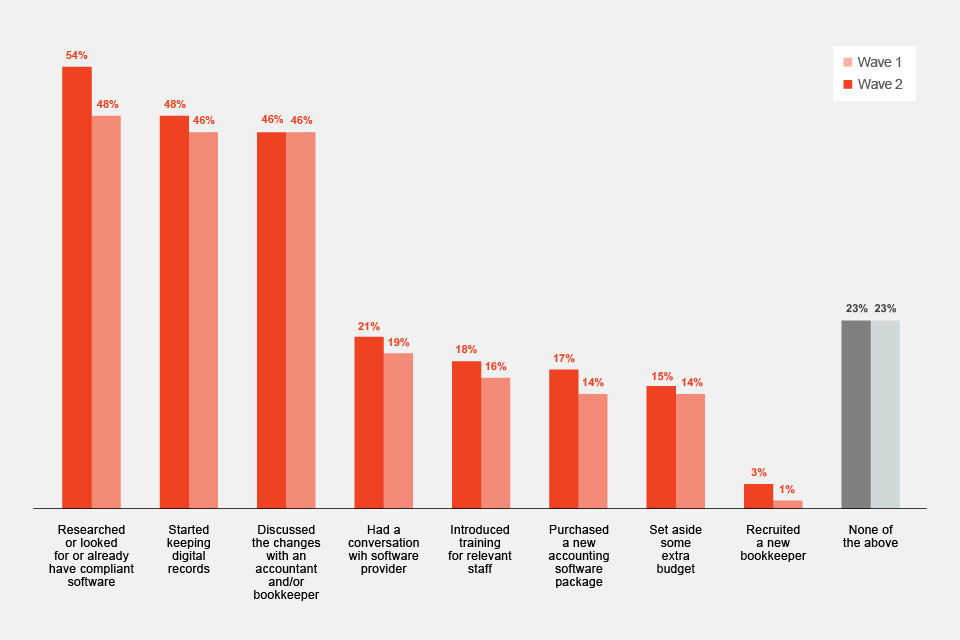

Activities completed to prepare for Making Tax Digital

Note: Data in this section is from after respondents were prompted with a description of Making Tax Digital and its requirements. The following description was read to them: “We would now like to give you a brief summary of what Making Tax Digital (MTD) for VAT is. MTD means that all VAT registered businesses will be required to keep digital records for VAT purposes, and submit their VAT returns directly to HMRC using MTD compatible software from April 2022. Businesses will be required to actively sign up in order to follow the MTD rules.”

The research showed that while the majority of businesses that had completed activities to prepare for Making Tax Digital, the proportion has not notably changed across the two waves of research. This suggests that there has been limited activity in the six months between waves, and those businesses yet to fully prepare had less time to complete the necessary actions.

In wave 2, just over three-quarters of businesses (76%) said they had done something to prepare for Making Tax Digital. This is a proportion similar to that in wave 1 (74%).

The most common activities in wave 2 were to have researched or looked for compatible software (54%), started keeping digital records (48%), and discussed changes with an accountant (46%). These were consistent with the most common activities completed in wave 1, with 48% having researched or looked for compatible software, 46% having started keeping digital records, and 46% having discussed changes with an accountant.

A lower proportion of businesses in wave 2 have had conversations with software providers (21%), introduced relevant staff training (18%), purchased new accounting software (17%), or set aside additional budget for the changes (15%). Just 3% had recruited a new bookkeeper. Again, similar trends were noted in wave 1, with only 19% having had conversations with software providers, 16% having introduced relevant staff training, 14% having purchased new accounting software and 14% having set aside additional budget for the changes.

Figure 6 details activities already taken and how this compares between wave 1 and wave 2.

Preparedness varied across different groups of businesses. In wave 2, it was highest among those who already use record-keeping software as their main record-keeping method (95%) and businesses in professional services (84%). These trends were also consistent with wave 1, where preparedness was highest among those using record-keeping software as their main record-keeping method (94%) and businesses in professional services (85%).

Preparedness was lowest among those businesses who used paper methods as their main record-keeping method (46%), those in the agriculture sector (66%) and those in Northern Ireland (57%). Again, trends were consistent with wave 1, where preparation was lowest for those who used non-digital methods for record keeping (49%) and those in agriculture (63%). This provides further evidence that these groups may need more support to transition to Making Tax Digital.

Figure 6: Activities completed to prepare for Making Tax Digital (prompted list)

Data in figure 6 refers to the following question: All VAT registered businesses will be required to comply with the Making Tax Digital changes from April 2022. Which of these activities, if any, has your business already done, or are you currently doing, to prepare for the changes that Making Tax Digital will bring?

Base: All respondents aware of Making Tax Digital or the concept: Wave 2 (517), Wave 1 (479)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

3.4 Engaging with businesses on Making Tax Digital

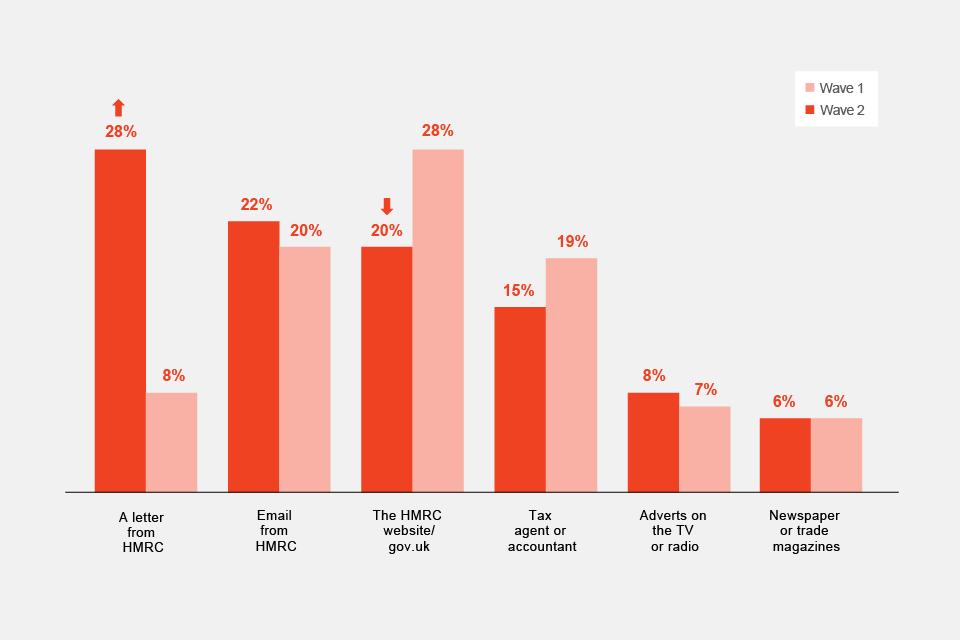

Sources of awareness of Making Tax Digital

The research shows that there were a range of sources that have influenced awareness of Making Tax Digital. Letters from HMRC are likely to have been impactful in raising general awareness of Making Tax Digital and, to an extent, the specific requirements of Making Tax Digital. However, there is limited evidence to suggest that the letters increased the level of activities completed by businesses to prepare for Making Tax Digital, given there was no change between waves 1 and 2.

In wave 2, communications from HMRC were the most cited source of awareness of Making Tax Digital. Between the two research waves HMRC sent letters publicising Making Tax Digital to businesses.

This was reflected in the findings of wave 2, with 28% of businesses citing a letter from HMRC as a source of awareness of Making Tax Digital, a significant jump from 8% in wave 1. An email from HMRC was cited by 22% of businesses, and 20% cited the HMRC or GOV.UK website (a statistically significantly lower proportion than in wave 1 (28%)). Figure 7 shows the top six sources cited in wave 2 and how these compare to wave 1.

Figure 7: Sources of Making Tax Digital awareness

Data in figure 7 refers to the following question: Where did you hear about Making Tax Digital/ the new HMRC changes?

Base: All respondents aware of Making Tax Digital or concept: Wave 2 (521), Wave 1 (478)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

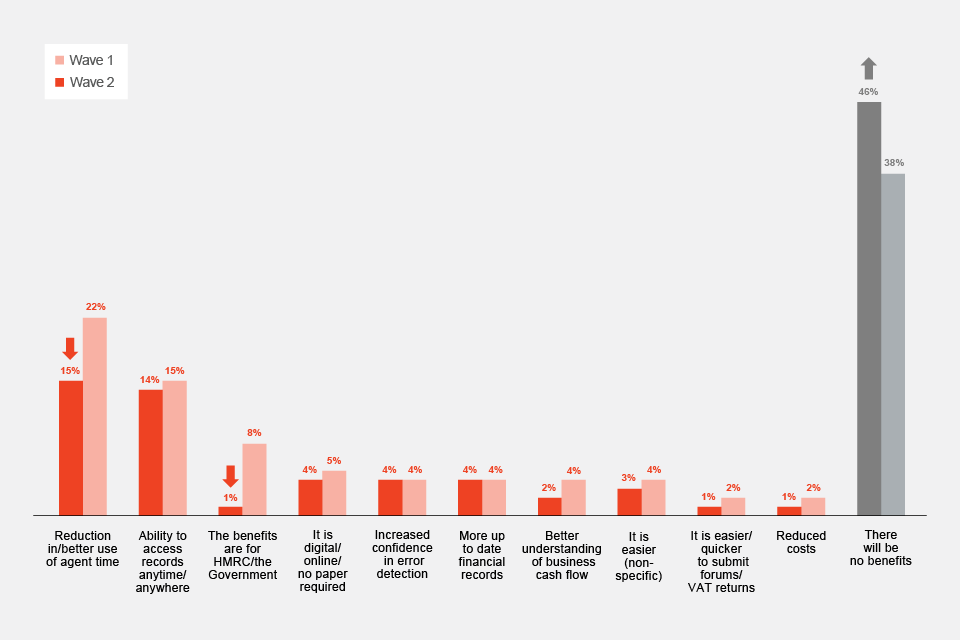

Benefits of implementing Making Tax Digital

There were mixed views among this business audience on the benefits that Making Tax Digital will bring. The research shows that businesses were less likely to perceive benefits of implementing Making Tax Digital in wave 2 compared to wave 1. After being prompted with a description of Making Tax Digital and its specific requirements, nearly half of businesses in wave 2 said they perceive no benefits to implementing Making Tax Digital (46%), which was a statistically significant increase on wave 1 (38%).

In wave 2, businesses in the agriculture, forestry and fishing sector were most likely to say there will be no benefits (54%), as well as those in the South West of England (60%). This was, however, not consistent with wave 1, where businesses using paper methods as their main record-keeping method (40%) and those based in Wales (41%) were most likely to see no benefits to Making Tax Digital, suggesting that this perception of no benefits was not confined to a specific group of businesses.

There were few benefits that businesses consistently mentioned. However, a reduction in, or better use of, agent time was perceived to be the greatest benefit to Making Tax Digital (15%), although, this showed a significant decrease since wave 1 (22%). The ability to access records anytime and anywhere was the second most cited benefit at 14% (consistent with wave 1 at 15%). This data provides evidence that these two benefits were important to businesses.

The perception that ‘The benefits are for HMRC/ the Government’ was never particularly high, but did show a statistically significant decrease from 8% in wave 1 to 1% in wave 2, suggesting that negative perceptions of Making Tax Digital purely being in the interest of HMRC and the government have almost ceased to exist.

Figure 8 details the perceived benefits of implementing Making Tax Digital and how they compared across the two waves.

Figure 8: Perceived benefits of Making Tax Digital

Data in figure 8 refers to the following question: And what do you think will be the benefits associated with implementing the changes related to Making Tax Digital?

Base: Total sample: Wave 1 (551), Wave 2 (556)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

Barriers to implementing Making Tax Digital

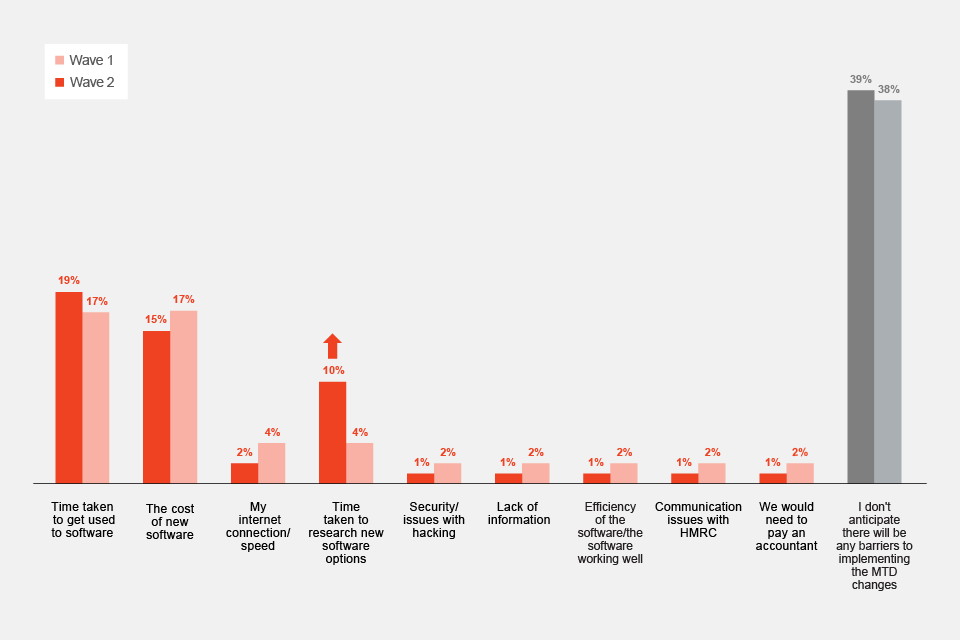

Unlike perceived benefits as seen in the section 3.4 titled Benefits of implementing Making Tax Digital, perceived barriers to implementing Making Tax Digital remained more consistent across the two waves of research, with software being perceived as the number one barrier.

After being prompted with a description of Making Tax Digital and its requirements, almost two in five businesses in wave 2 said they see no barriers to implementing Making Tax Digital (39%), which was consistent with wave 1 (38%).

For the remaining businesses, in wave 2, issues relating to the time taken to get used to software (19%) and the cost of software (15%) were the biggest perceived barriers. This finding was consistent with wave 1, where time taken to get used to new software (17%) and the cost of new software (17%) were also the top perceived barriers to implementing Making Tax Digital.

Issues relating to the time taken to research new software options (10%) showed a statistically significant increase on wave 1 (4%), however, other perceived barriers remained very similar across waves.

Figure 9 details the perceived barriers to implementing Making Tax Digital and how they compared across the two waves.

Figure 9: Perceived barriers to implementing Making Tax Digital

Data in figure 9 refers to the following question: What, if any, barriers do you anticipate you might experience when implementing the changes related to Making Tax Digital?

Base: Total sample: Wave 2 (556), Wave 1 (551)

Significance: Statistically significant differences between waves are highlighted using up and down arrows.

4. Conclusion

Findings of this research across two waves show that general awareness levels of Making Tax Digital among businesses with a turnover below the VAT threshold were high. However, the findings also indicate that as of January 2022 businesses in this population were not yet fully engaging with the requirements of Making Tax Digital. This was evidenced by a low understanding of the specific requirements and many respondents who had yet to take action to prepare to meet these requirements across waves.

Particularly, certain groups of businesses (i.e., those who use paper-based record-keeping methods, those in the agriculture, forestry and fishing sector, and those in Northern Ireland) may need more support to transition to Making Tax Digital. This finding should be further considered in the light of the finding that fewer businesses were using agents in January 2022 (compared to June 2021), meaning they may lack the traditional means of support to comply with HMRC-led changes.

5. Technical annex

5.1 Sample

For each wave of research, HM Revenue and Customs (HMRC) provided a sample of businesses to the independent research agency Yonder. While a high proportion of the sample (circa 80%), already included a telephone number, Yonder conducted a telematching exercise on the total sample to double check existing telephone numbers, and, where possible, updated those businesses where the telephone number was missing.

Following the telematching process, for each wave Yonder sent an invitation letter to all of the sample that included a telephone number. The letter was designed to inform businesses about the purpose and importance of the research, encourage them to take part and offer an option to opt-out of the research if preferred by emailing or calling a representative at Yonder. From receiving the letter, businesses were given two weeks to opt-out. On completion of the opt-out period, Yonder commenced fieldwork with the remaining sample.

5.2 Fieldwork

Given the level of respondent screening required, complexity of the topic and the limited time that business respondents will typically have, a telephone approach was perceived to be the optimal approach over an online methodology. To achieve the final sample of 551 businesses in wave 1 and 556 businesses in wave 2, the resulting strike rate was approximately 12 businesses called on average per completed interview.

The Computer Assisted Telephone Interviewing (CATI) method was administered by Yonder’s in-house team of highly experienced telephone interviewers Yonder Data Solutions. Each interview took on average 17 minutes to complete in wave 1 and 15 minutes on average in wave 2.

The questionnaire consisted of mainly quantitative closed questions, with some allowance for open-ended qualitative responses. The questionnaire used for wave 2 was largely consistent with wave 1, although some questions were amended or added to provide greater clarity to respondents and delve into broader topics.

Yonder worked with HMRC to develop the questionnaire, which included a cognitive interview phase and a full pilot stage in wave 1, to ensure the questionnaire was fully tested and refined prior to the main fieldwork wave. A brief pilot was also included in wave 2, to test those changes made since the wave 1 questionnaire.

To ensure that respondents had the appropriate knowledge to comment on levels of awareness and preparedness for Making Tax Digital on behalf of their business, the screening process ensured that only senior members of staff with knowledge and experience of the business’ finances and tax affairs were invited to take part (such as finance directors, senior managers etc).

During fieldwork for wave 2, it was noted that some of the proposed changes to the questionnaire that were agreed between HMRC and Yonder were not live in the survey. This meant that respondents were still answering the question version from the wave 1 questionnaire, as opposed to the updated versions that should have been updated for wave 2.

As soon as this error was noted, Yonder temporarily paused fieldwork to correct the questionnaire, and all surveys which used the incorrect questions were removed from the data. Once the questionnaire was corrected, fieldwork was re-started to complete the full sample size using only the correct versions of the questions for wave 2.

5.3 Devolved nations and weighting

To note, in order to enable directional analysis across all of the devolved nations, for both waves Yonder oversampled to deliver at least 50 interviews across each of Scotland, Wales and Northern Ireland within the total sample. The total data was then corrected by weighting back to population fallout across the devolved nations. Across both waves, data was weighted according to the latest available HMRC population data for business turnover, region and sector. The tables below show the weighting profiles applied for each wave.

5.4 Regional weighting

| Region | Wave 1 | Wave 2 |

|---|---|---|

| Channel Islands | <1% | <1% |

| East Midlands | 6% | 7% |

| East of England | 8% | 8% |

| Isle of Man | <1% | <1% |

| London | 19% | 19% |

| North East | 2% | 2% |

| North West | 9% | 9% |

| Northern Ireland | 6% | 6% |

| Scotland | 9% | 9% |

| South East | 14% | 14% |

| South West | 8% | 9% |

| Wales | 5% | 5% |

| West Midlands | 7% | 8% |

| Yorkshire and The Humber | 6% | 6% |

5.5 Turnover weighting

| Turnover bands | Wave 1 | Wave 2 |

|---|---|---|

| £0 | 28% | 31% |

| £1-£9,999 | 21% | 19% |

| £10,000-£19,000 | 12% | 19% |

| £20,000-£29,000 | 11% | 10% |

| £30,000-£39,000 | 9% | 8% |

| £40,000-£49,000 | 7% | 7% |

| £50,000-£59,000 | 5% | 5% |

| £60,000-£69,000 | 4% | 4% |

| £70,000-£79,000 | 3% | 3% |

| £80,000-£84,999 | 1% | 1% |

5.6 Sector weighting

| Industry | Wave 1 | Wave 2 |

|---|---|---|

| Agriculture, Forestry and Fishing | 12% | 13% |

| Mining and Quarrying | <1% | <1% |

| Manufacturing | 5% | 5% |

| Electricity, Gas, Steam, and Air conditioning supply | <1% | <1% |

| Water supply, Sewerage, Waste management and Remediation activities | <1% | <1% |

| Construction | 10% | 10% |

| Wholesale and Retail trade repair of motor vehicles etc. | 21% | 21% |

| Transportation and Storage | 8% | 7% |

| Accommodation and Food service activities | 2% | 2% |

| Information and Communication | 7% | 7% |

| Financial and Insurance activities | 1% | 1% |

| Real estate activities | 7% | 7% |

| Professional, Scientific and Technical activities | 15% | 14% |

| Administrative and Support service activities | 6% | 6% |

| Education | 1% | 1% |

| Human health and Social work activities | <1% | <1% |

| Arts, Entertainment, and Recreation | 3% | 3% |

| Other service activities | 2% | 2% |