Market Data Insights - November 2021

Published 9 December 2021

Economic summary

At COP26, global leaders met in Glasgow to discuss how to combat climate change. The term net-zero was often used as a target for countries and companies.

Net-zero refers to the act of ensuring any greenhouse gas emissions are met with removing an equal amount of greenhouse gases in the atmosphere. This means that overall greenhouse gases are not being added to the atmosphere.

COP26 commitments

Two-fifths of the world’s financial assets, $130 trillion, under the management of banks, insurers and pension funds committed to 2050 net-zero goals. This includes limiting global warming to 1.5C.

These commitments involve investing in activities that help curtail deforestation, accelerate the phase-out of coal, and promote renewable measures.

World leaders also committed to phase-out all subsidies on coal, oil, and natural gas, albeit without an agreed deadline. These subsidies often work by either giving tax breaks or cash to producers or by effectively giving price cuts to consumers. For example, the Winter Fuel Payment is a consumer subsidy.

COVID-19 variant

On 23 November, a new COVID-19 variant, Omicron, was detected in South Africa and was feared as being more contagious and resistant against vaccines than other variants. On 25 November, Health Secretary Sajid Javid announced 6 southern African countries would be added to the travel red list, mentioning the government’s Plan B for coronavirus restrictions.

This caused the FTSE 100 to drop by 3.6%, one of its biggest falls since the beginning of the pandemic. On 27 November, Omicron cases were detected in the UK and the Health Secretary responded by re-introducing mask-wearing rules for shops and public transport.

The World Health Organisation (WHO) has currently designated Omicron as a variant of concern. The WHO does not currently have a clear view on whether this variant is more transmissible or more severe than other variants, including Delta.

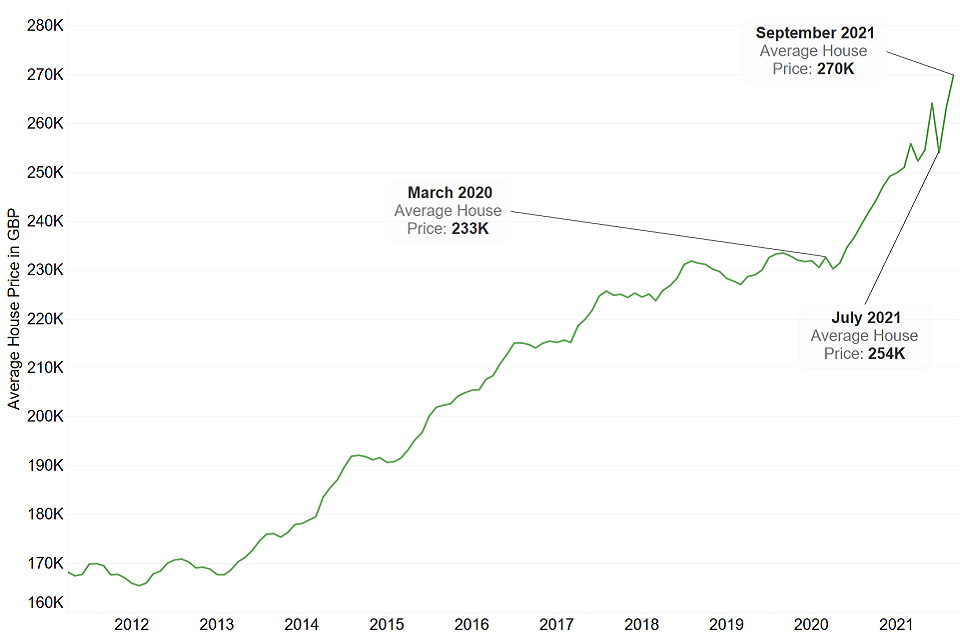

Property

Average property prices have continued to rise following a dip in July 2021, likely caused by the phased removal of the stamp duty relief which began in June.

More generally, we have seen the trend in house prices accelerate since the start of the pandemic. Increased demand from people re-evaluating their living needs due to a shift towards long-term home working being one of the key drivers in prices.

The introduction of stamp duty relief in July 2020 may also have contributed towards the increased demand.

Property

Earnings

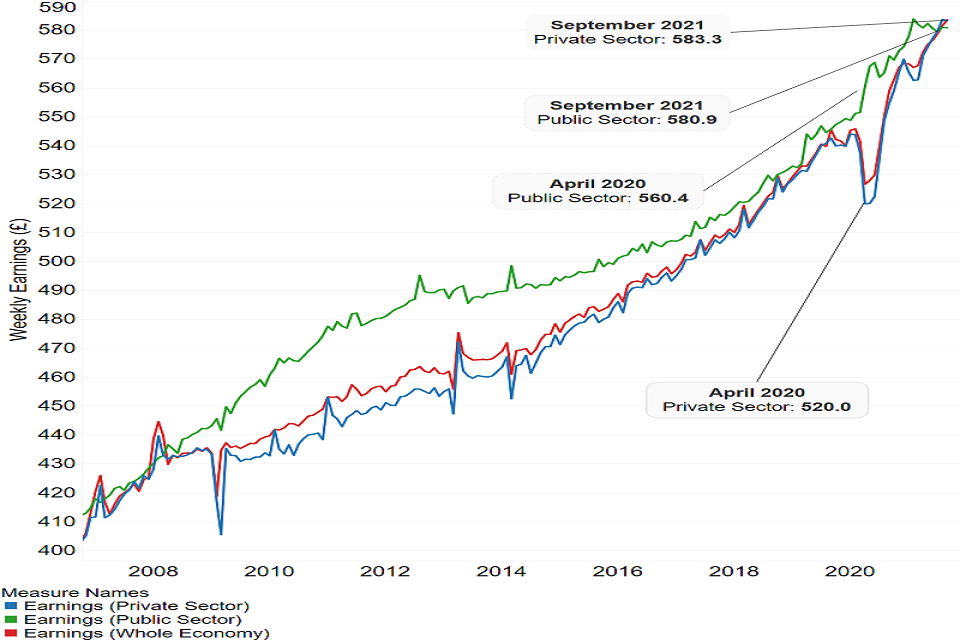

The graph below shows average weekly earnings in the UK, distinguishing between the public and private sectors.

Earnings

The private sector overtook the public sector for the first time since February 2008. This could be attributed to the public sector pay freeze which came into force in April 2021. However, the Autumn Budget and Spending Review 2021 committed to ending the pay freeze in April 2022 which should increase public sector average weekly earnings.

Unemployment

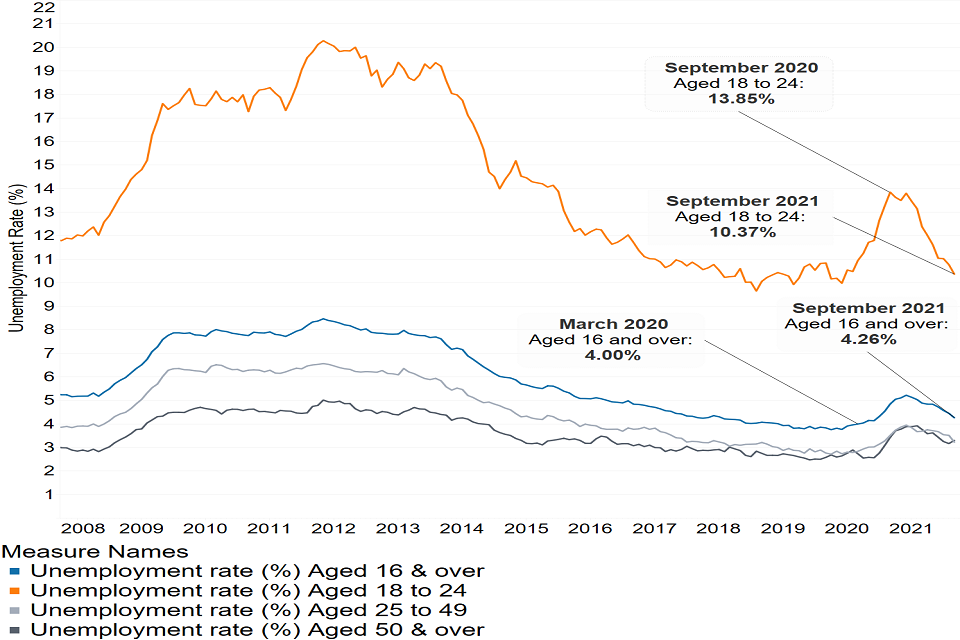

Unemployment is broadly defined as those aged 16 and above who are without work and who have actively been seeking work. The unemployment rate is defined as the number of unemployed divided by the sum of those who are either employed or unemployed.

Unemployment

Unemployment fell throughout most of 2021 as lockdown restrictions eased which allowed businesses to re-open.

The most pronounced change was observed in the 18-24 age group, which represents a strong proportion of the hospitality sector. This sector includes restaurants, pubs and nightclubs and was one of the last sectors to re-open from lockdown restrictions.

However, overall employment levels have not yet reached the levels observed at March 2020. Furthermore, data is not yet available beyond September 2021, where the Coronavirus Jobs Retention Scheme (furlough) is no longer in effect. We might see an increase the unemployment rates as employees may have been made redundant following the withdrawal of furlough.

Finally

Market Data Insights is being discontinued. This month’s bulletin is the final edition. If you have found the publication useful please contact us and we can discuss alternative approaches to provide the data or insights which you need.

Disclaimer

The information in this publication is not intended to provide specific advice. Please see our full disclaimer for details.

The Government Actuary’s Department is proud to be accredited under the Institute and Faculty of Actuaries’ Quality Assurance Scheme.

QAS Logo