Letter to the Prime Minister on investment in innovative science and technology companies, 23 September 2021 (HTML)

Updated 11 August 2023

This letter was sent to the Prime Minister on 23 September 2021.

Overview

Dear Prime Minister

At our quarterly meeting in July 2021, you asked members to establish a task force to look at the investment available to help innovative science and technology companies scale up in the UK and thus contribute to the UK’s status and economic prowess. The recommendations in this letter focus on the cultural, behavioural, and structural changes needed to help unlock scale up investment. There is a huge diversity of science and technology companies across the UK, each with different capital requirements and needs. Our advice targets investments of over £100 million where there is a significant funding gap. Addressing this gap could propel our most innovative companies to become world-leaders.

The challenge

Shifts in global financial markets and increasing global competition means the UK needs a radically new approach to supporting our most innovative science and technology (S&T) companies to scale up. Since 2020, the UK has experienced the largest net change in the number of companies in the Global Top 100, falling from 5th to 10th position, following a similar trend in preceding years[footnote 1]. However, the UK has significant strengths in its private companies, standing third in the world for the number of ‘unicorns’ behind the US and China[footnote 2]. Access to private and public capital is critical to supporting UK companies to scale, remain globally competitive, and increase their value to the economy and society.

While UK venture capital has increased more than 10 times from £0.9 billion in 2010 to over £11 billion in 2020[footnote 3], the UK remains weak compared to the US and China in scale up funding, particularly for private investment rounds above £100m. For example, the private funding available for US start-up stage ventures is 3.6 times that of UK ventures but over nine times for scale-up investments over £100m.

The challenges of funding S&T companies to scale rapidly is well understood by UK entrepreneurs but is highlighted most effectively by comparing ‘twins’ of start-up ventures with similar, high-risk or high potential technologies in other countries. The scale, speed, and scope of private investment at the over £100 million range is much larger for US ventures compared to their UK-based counterparts.

For companies who can reach public markets, the rise in new tech-driven business models means that intangible assets (such as research and development (R&D), intellectual property, software, and data) now dominate economic value creation, with eight of the top ten businesses in the world heavily reliant on intangible assets[footnote 4]. In the public markets, value has accrued to investors who appreciate this shift. US public markets (and companies that list there) have captured the benefits of this growth and have outperformed the FTSE 100 by a factor of 10. By comparison, the FTSE has remained comparatively flat for the last 20 years. Lack of recognition of intangible assets in UK markets puts UK S&T companies at a significant disadvantage and means losing out on value creation for the UK.

Most funding for UK S&T companies above £100 million comes from international investors. US-based funds represent 40 per cent of all investments between £100 and 250 million in UK R&D intensive companies, compared to 27 per cent from UK investors. For investments over £250 million, 49 per cent of investment comes from the US and 27 per cent comes from Asia, compared to only 11 per cent from UK investors. While this means that our companies are sought after by global investors, the lack of domestic growth capital holds back the ability of companies to scale up in the UK, often leading them to relocate to access global capital more easily, to sell early to foreign firms (and relocate their R&D activities)[footnote 5], or to list on capital markets elsewhere. This comes at a cost to the UK economy as the financial returns, jobs and high impact R&D created by some of our most successful entrepreneurial teams goes to overseas capital owners.

We offer initial recommendations on how to improve the skills and diversity of UK investors, and how additional public sector investment and incentives can best be deployed to increase availability of scale up investment in the UK. We would be delighted to discuss this topic in more detail with you, or your Ministerial colleagues.

This letter is copied to the Chancellor of the Exchequer; the Secretary of State for Business, Energy and Industrial Strategy; the Secretary of State for Education; the Chief Secretary to the Treasury; the Minister of State for Universities; the Parliamentary Under Secretary for Science, Research and Innovation; the Cabinet Secretary and the Permanent Secretaries of HM Treasury, and the Department for Business, Energy and Industrial Strategy, the Department for Education.

Yours sincerely,

Sir Patrick Vallance, Co-Chair

Lord Browne of Madingley, Co-Chair

Advice on encouraging scale up investment in innovative science and technology companies

Train more people in specialist investing

Recommendation one: Working with a range of industry and academic partners, the government should support the development of new specialist education and training programmes to build understanding of the value of intangible assets, S&T expertise, and entrepreneurial experience among UK investors and asset owners.

-

Developing a diverse cadre of specialist investors in the UK is critical to stimulating scale up investment and can help provide a future pipeline of finance professionals with skills beyond consulting, general finance, or investment banking. These programmes should be developed in partnership with proven experts with experience investing in S&T scale up companies to ensure sufficient scale, recognition, and reach. Programmes should have an explicit focus on promoting and increasing the diversity of finance professionals, and should catalyse the mobility of people across academia, industry, and finance, especially those with deep S&T expertise.

-

Unlocking scale up finance requires an ecosystem of diverse, skilled people from venture and private equity through to long-term asset owners and analysts. The UK’s ambition should be to develop a deep talent pool of finance professionals with the investment, technical and entrepreneurial experience to support S&T companies to scale up. The lack of such investors and asset owners with deep sector knowledge or entrepreneurial experience is a key weakness in the UK system. Finance professionals in the UK typically have experience in consulting, general finance, or investment banking[footnote 6] compared to the US, where it is commonplace to have experience in a start-up or scale up business or a PhD, MD and other S&T training. This creates a challenge for R&D intensive companies in particular, where the ‘knowledge gap’ between innovators and investors can hinder investors from adequately assessing the technical and financial viability of key technologies[footnote 7][footnote 8]. Due to this complexity many investors often prefer less risky investments, despite the wider benefits associated with investing in innovation[footnote 9].

-

We note that schemes in the US to mobilise institutional investors have a strong element of human capital development, and actively promote diversity and the mobility of people across sectors and disciplines. One such example is the Kauffman Fellowship initiative in the US that places science, technology, engineering and maths (STEM) PhDs into the venture capital sector. In the UK, the Newton Venture Programme is a rare example of training the next generation of technology investors (including VCs, Limited Partners, angel investors, accelerators or incubators, and technology transfer officers) to increase diversity in the venture landscape and investment opportunities for technology companies. We offer further actions to consider:

a. A national venture capital fellowship programme, modelled on the US Kauffman Fellowship, to encourage the flow of STEM PhDs into the venture capital sector. This should be linked to existing UK Research and Innovation (UKRI) Fellowship programmes and wider UK science PhD training programmes to increase awareness. Movement of people between academia, finance and industry provides a continuous flow of knowledge, skills, and networks[footnote 10]. People transitioning from active research would be optimal candidates for specialist investor roles.

b. Working with university business schools, Her Majesty’s Treasury (HMT) and the Department for Education (DfE) should encourage the development of focused degree programmes to produce relevantly trained graduates with in-depth sector knowledge. For example, Cambridge University and the US’s University of Pennsylvania, UC Berkeley and Massachusetts Institute of Technology or Harvard have combined life science and business degree programmes to produce graduates suitably qualified for employment in both biotech companies and in finance[footnote 11]. The UK could expand this model to other sectors of strategic importance.

c. Government should also learn from other countries such as Japan, South Korea and Singapore who have introduced state-backed schemes to educate banks, pension fund managers and commercial lenders on intellectual property value and rights[footnote 12].

d. Industry consortia should develop training courses to upskill finance and accounting professionals on how to appropriately value intangible assets, including intellectual property (in much the same way that they are supporting the valuation of actions towards Sustainable Development Goals).

e. British investors and entrepreneurs based in the US with specialist knowledge and experience in investing in scale ups could provide an advisory function to educate UK investors and asset owners and help embed cultural change over time. This could be achieved through a ‘Global Investor Advisory Group’ convened by HMT, or through expanding the No.10 Innovation Fellowships. The Office for Investment should be engaged throughout to identify investors in areas of strategic importance and to communicate government priorities.

f. Government should use the Tier 1 investor visa to encourage investors with scale-up investment expertise, and a proven track record in investing in S&T ventures, to relocate to the UK.

g. HMT should support efforts to scale up and identify best practices among programmes that aim to increase diversity of professionals in the financial sector, building on the Women in Finance Charter and learning from initiatives such as the Newton Venture Programme in the UK. Studies show that greater diversity of professionals within investment firms, including gender, ethnicity, and educational background, leads to better decision making and financial performance[footnote 13][footnote 14]. This could be an important part of the levelling up agenda and would greatly benefit our national capacity for innovation.

Develop a specialist sovereign scale up fund

Recommendation 2: HMT should work with the private sector to develop a large-scale science and technology focused ‘specialist sovereign scale up fund’ to unlock institutional finance and drive long-term investment into innovative scale up companies. The goal of this fund should be to crowd in private investment to UK S&T companies to address the £1 billion gap in capital[footnote 15] for funding rounds above £100 million. This is also an opportunity to create more UK-based global leaders and create a return on investment bringing value to UK taxpayers.

-

Government support has successfully encouraged significant investment in venture funding. Current government-owned institutions supporting innovation (such as Innovate UK, British Business Bank, and its commercial subsidiaries) have helped increase the volume of S&T companies coming through from start-up. We welcome continued government support for innovative companies as they grow, including the recent establishment of the ‘Life Sciences Investment Programme’[footnote 16] and the ‘Future Fund: Breakthrough’ programme[footnote 17]. However, we note evidence of a clear gap in support for funding above £100 million, that if addressed could catalyse companies to scale up and remain in the UK.

-

We recommend a new ‘specialist sovereign scale up fund’ focussed on private companies whose assets and ambition match the UK S&T priorities for strategic advantage. Government should front-load public sector investment to crowd in institutional finance, including from pension funds and insurers, to give investors the confidence to make long-term investments. We envision a pilot scheme, following a similar co-investment model to the Future Fund, of sufficient scale to fill the gap in capital missing at the scale up stage to catalyse private investment. The government stake would need to be sufficient to lower perceived market risk (for example 25 per cent).

-

In line with the Prime Minister’s and Chancellor’s ambition to trigger a UK ‘investment big bang’,[footnote 18] this fund is intended to spur domestic investment and incentivise companies to stay in the UK. This should see an increase in both the absolute size of domestic and overseas investment in UK scale up companies, and the proportion of scale up funding coming from UK investors.

-

To establish clear criteria for the success of the fund, Government should consider what is an acceptable gap in funding in comparison to China and the USA. Government could also set future targets on the absolute size and proportion of domestic investment desired beyond current levels (for example, from 20 per cent of over £100 million domestic funding in 2021[footnote 19] to 40 per cent by 2030).

-

The fund should be run by those with experience and expertise in investing in S&T scale up companies, potentially recruited from international innovation hubs, with clear key performance indicators and transparent accountability. Funding processes should match the speed and agility of leading private sector investors.

Convene institutional investors

Recommendation 3: Government should use its convening power to build awareness of investment opportunities and help unlock institutional finance, particularly in areas of strategic importance.

- Government can play an important role in de-risking innovation and providing clear direction, targets, and certainty to focus investments in areas where the UK has current unique strengths or areas of future strategic advantage. This could include:

a. Government convened forum for institutional investors, including pension funds, insurers, endowments, and others to share challenges, pool expertise, research, and explore opportunities to aggregate capital. We envisage that the government’s own analysis of areas of UK strategic technology advantage (and strengths to build on) would be an important area to discuss in this forum and would provide long-term signals to increase investor confidence. Through development of this forum, government can help make a stronger case for investment on a limited scale into higher risk, longer term S&T businesses that could offer much better returns for their beneficiaries.

b. Pension fund reform (and consolidation of the many local schemes): We welcome the Bank of England’s Productive Finance working group’s exploration of the role of asset managers and pension funds as levers for investment into R&D and innovation, and as actors who could stimulate a specialist analysts’ investor base. Government should reform pension guidelines to allow more risk taking and explore pension fund consolidation, learning from Canada, Australia, and New Zealand so that UK pension funds can support domestic S&T scale-ups, and international companies. This should also allow sufficient flexibility so as not to preclude the possibility to consider retail investors in the future.

c. HMT should continue to work with the London Stock Exchange Group and the Financial Conduct Authority to add structured processes for investors and shareowners to access liquidity in private markets, and provide easier investment mechanisms for intangible asset owners, in a way that the NASDAQ has done.[footnote 20] The goal should be to allow early investors and angels to exit some of their positions to recycle capital into start-ups and create structured entry-points for scale-up, domestic, and other investors into the private market.

Further work

To better understand the differences in support for S&T companies to scale up in the UK versus the US (or elsewhere in the world), we plan to undertake a further study, centred around the ‘twins’ approach (as demonstrated in Annex A) and detailed economic analysis. We hope to compare similar businesses and institutions in the UK and overseas, and examine the challenges faced across different sectors and types of S&T companies, both intangible-rich and capital-expenditure heavy. This will inform further advice over the coming year, which could serve to refine the focus and scale of the recommendations above and identify opportunities to radically change incentives and administrative processes to bring about a step-change in investment scale-up.

Acknowledgements

We are grateful to Council members for developing this advice, in particular, Saul Klein (Co-founder and Partner, LocalGlobe) and Professor Fiona Murray (Associate Dean for Innovation and Professor, Massachusetts Institute of Technology, School of Management) for leading this advice, with support from Professor Julia Black (President of the British Academy), Professor Paul Newman (Director of the Oxford Robotics Institute and BP Professor of Information Engineering, University of Oxford), Suranga Chandratillake (General Partner, Balderton Capital), and Professor Philip Bond (Professor of Creativity and Innovation at the University of Manchester).

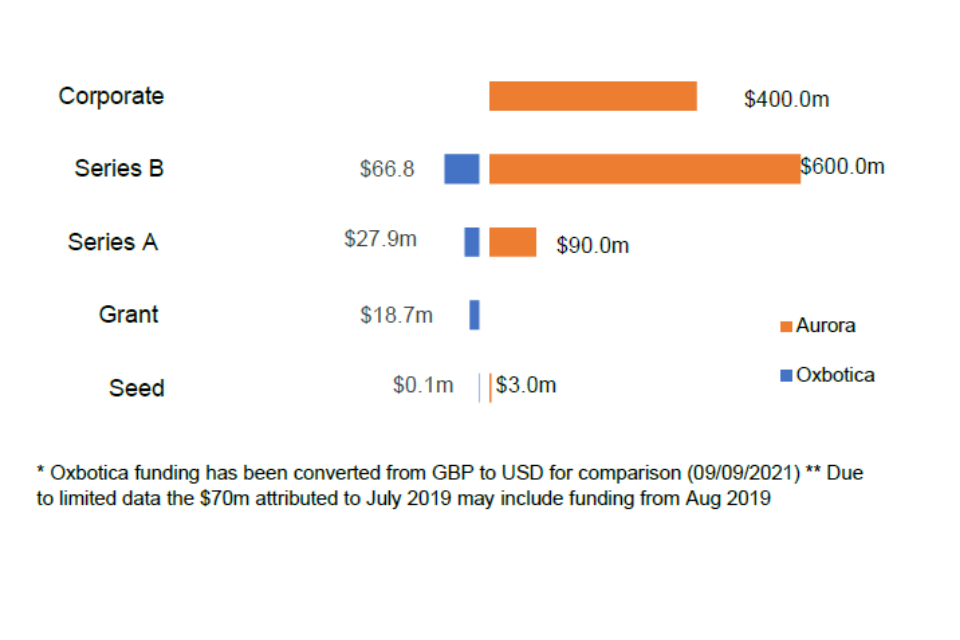

Annex A – Key details for Oxbotica and Aurora

Oxbotica

Founded in 2014 and headquartered in Oxford, United Kingdom, Oxbotica is an autonomous vehicle software company formed as a spin-out from Oxford University’s Mobile Robotics Group by Professor Paul Newman (BP Chair of Information Engineering at the University of Oxford, and Director of the Oxford Robotics Institute) and Professor Ingmar Posner (Professor of Engineering Science, Applied Artificial Intelligence, at the University of Oxford).

To date, Oxbotica has raised a total of $114.5 million over 5 funding rounds. Their latest funding was raised in April 2021 from a Series B round led by Ocado Group, as part of a partnership on hardware and software interfaces for autonomous vehicles. Oxbotica’s investors typically invest in intellectual property-rich, R&D intensive sectors; three of which are headquartered outside the UK (Tencent, Hostplus and Venture-Science).

| Date | Funding round | No. of investors | Money raised | Lead investor |

| Apr 2021 | Series B | 1 | £10 million | Ocado Group |

| Dec 2020 | Series B | 8 | £38.3 million | BP Ventures |

| Jun 2019 | Series A | 3 | £12.5 million | IP Group Plc |

| Sep 2018 | Series A | 3 | £7.7 million | IP Group Plc |

| Apr 2017 | Grant | 1 | £13.5 million | Innovate UK |

| 1 Nov 2014 | Seed | 1 | £100k | Oxford University Innovation |

Aurora

Founded in 2016 and headquartered in California, US, Aurora is an autonomous vehicle software company founded by Chris Urmson (former Chief Technology Officer of Google’s self-driving car team and technology director for Carnegie Mellon), Sterling Anderson (former Director of Tesla Autopilot), and Drew Bagnell (former autonomy architect at Uber Advance Technology centre).

To date Aurora has raised a total of $1.1 billion in funding over 5 rounds, with their most recent Corporate Round taking place in December 2020.

Aurora is funded by 15 investors, of which Uber and Millennium Technology Value Partners are most recent. Aurora has acquired three organisations: Blackmore Sensors and Analytics in May 2019; Uber Advanced Technologies Group in December 2019; and OURS Technology in February 2021. In July 2021, Aurora announced plans to go public and merge with special acquisitions company Reinvent Technology Partners. The deal represents an equity value of $11 billion for Aurora, and the combined company will be valued at $13 billion.

| Date | Funding round | No. of investors | Money raised | Lead investor |

| Dec 2020 | Corporate | 1 | $400 million | Uber |

| Aug 2019 | Series B | 1 | - | - |

| July 2019 | Series B | 1 | $70 million | Hyundai Motor Group |

| Feb 2019 | Series B | 13 | $530 million | Sequoia |

| Feb 2018 | Series A | 2 | $90 million | Greylock, Index Ventures |

| March 2017 | Seed | - | $3 million | - |

Comparison of investment in Aurora and Oxbotica at different funding rounds

-

PricewaterhouseCoopers (May 2021), Global Top 100 companies by market capitalisation ↩

-

Dealroom analysis ↩

-

Tech Nation Report, The future UK tech built, 2021 ↩

-

Stian Westlake and Jonathan Haskell, Capitalism Without Capital: The Rise of the Intangible Economy, 2017 ↩

-

The Prime Minister’s Council for Science and Technology (2019) “Investing in UK research and Development”, CST letter to the Prime Minister, October 2019 ↩

-

Diversity in UK Venture Capital, Diversity VC, 2019 ↩

-

European Investment Bank, Financing the Deep Tech Revolution: How investors assess risks in Key Enabling Technologies, 2018 ↩

-

Economics, Frontier. “Rates of return to investment in science and innovation.” A report prepared for the UK Department for Business, Innovation and Skills (BIS), 2014 ↩

-

Fernandez, Rosa et al. “The exchange of early career researchers between universities and businesses in the UK.” 2015 ↩

-

Redmile Group LLC, The potential evolution of the UK Life Sciences Sector, 2021 ↩

-

Brassell, M. and K. Boschmans (2019), “Fostering the use of intangibles to strengthen SME access to finance”, OECD SME and Entrepreneurship Papers, No. 12, OECD Publishing, Paris. ↩

-

Zarutskie, Rebecca. “The role of top management team human capital in venture capital markets: Evidence from first-time funds.” Journal of Business Venturing 25.1 (2010): 155-172. ↩

-

Young, David. River Partnership, “Diversity in Investment Management.” (2020) ↩

-

The rate of investment into megarounds in UK (relative to GDP) is approximately 0.06% less than USA. ↩

-

British Patient Capital, Life Sciences investment Programme ↩

-

Igniting an Investment Big Bang: a challenge letter from the Prime Minister and Chancellor to the UK’s institutional investors ↩

-

The Prime Minister’s Council for Science and Technology (2021) Innovation Finance Data Pack, Figure 6, Dealroom data ↩

-

Nasdaq Private Market Announces a Record 57 Liquidity Transactions in First Six Months of 2021. ↩