Innovation finance evidence pack (HTML)

Updated 11 August 2023

INCREASING THE AVAILABILITY OF SCALE-UP INVESTMENT FOR DOMESTIC INNOVATIVE SCIENCE AND TECHNOLOGY COMPANIES

Evidence pack

UK start-ups & investments grew 10 times in the last decade

In 2021 the UK became the third country in the world to pass 100 unicorns, after the US and China. The UK now has more unicorns than Germany, France and Sweden combined. The UK is also home to 153 potential future unicorns, valued over $250 million.

Figure 1: UK growth in unicorns, ‘futurecorns’ and venture capital (VC)

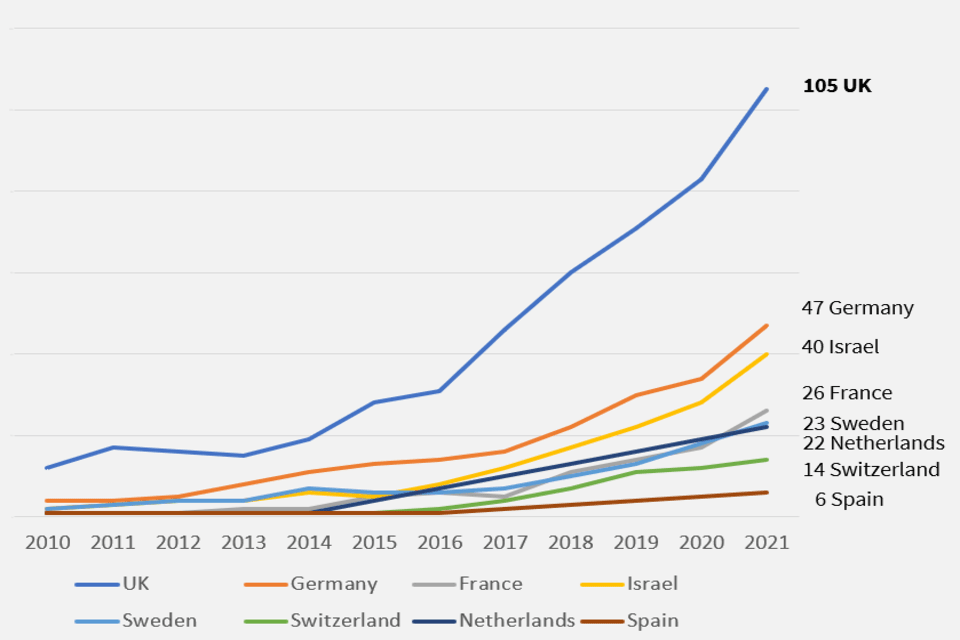

Figure 2: International comparison of cumulative unicorns and $1 billion exits

Figure 2: International comparison of cumulative unicorns and $1 billion exits

Figure 3: Breakdown of investments by funding round for select countries

The UK is ‘top 3’ for unicorns in almost every sector

| USA | China | UK | India | Germany | Israel | France |

| Unicorns and over $1 billion exits | 1,000 | 281 | 105 | 49 | 46 | 40 | 26 |

| Fintech | 183 | 36 | 37 | 14 | 7 | 4 | 6 |

| ecommerce | 177 | 85 | 31 | 30 | 26 | 4 | 11 |

| Deep tech | 294 | 69 | 21 | 5 | 5 | 19 | 4 |

| Enterprise software | 316 | 28 | 17 | 5 | 8 | 11 | 3 |

| Health | 173 | 30 | 13 | 2 | 4 | 5 | 3 |

| Food | 42 | 26 | 7 | 5 | 5 | 0 | 0 |

| Transportation | 70 | 63 | 7 | 6 | 7 | 6 | 1 |

| Energy | 37 | 15 | 4 | 0 | 0 | 1 | 1 |

| Travel | 11 | 5 | 3 | 1 | 5 | 0 | 1 |

| Marketing | 88 | 12 | 1 | 4 | 4 | 5 | 3 |

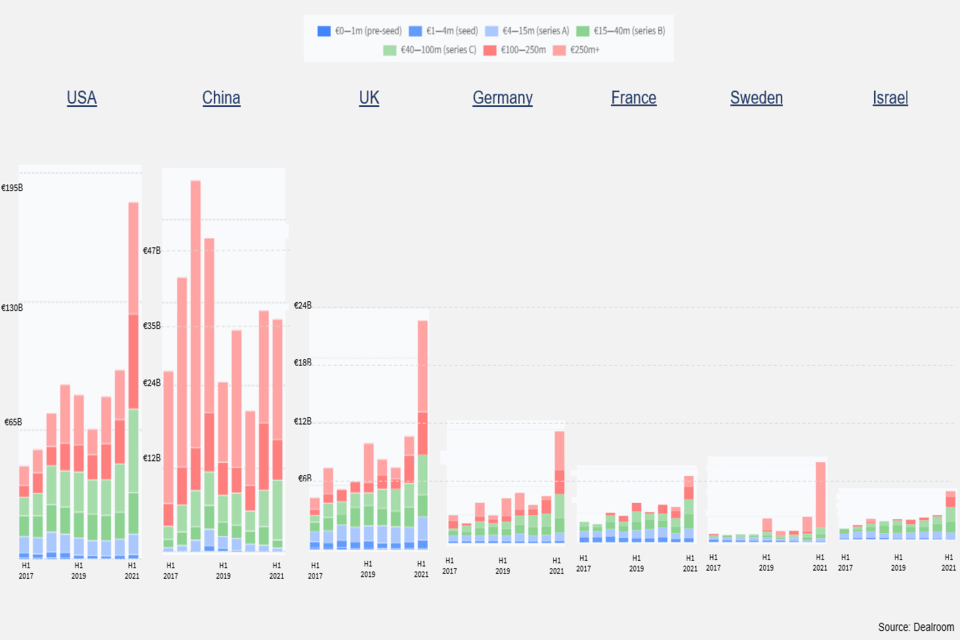

Despite being third in the world for VC investment, the UK is proportionately weak at scale up (over €100 million), particularly in comparison to the USA and China

Figure 3: Breakdown of investments by funding round for select countries

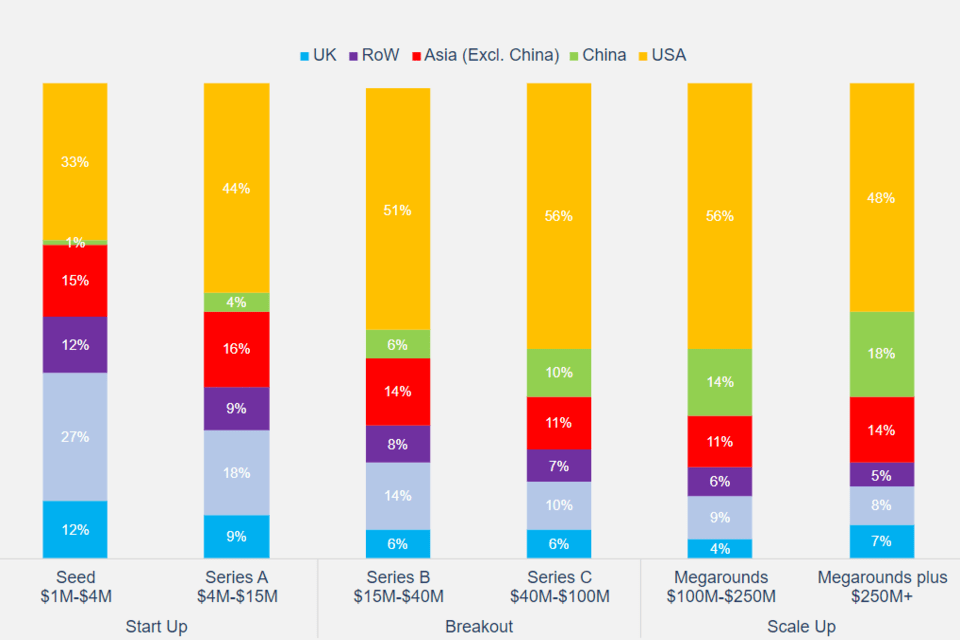

Figure 4: Percentage of global investment in 2020 to 2021 year to date by region per round size