Launch of the UK Strategic Public Investment Forum

Published 19 March 2025

Background

At the UK International Investment Summit (IIS), the Chancellor announced the launch of the new National Wealth Fund, the UK’s flagship public financial institution, designed to mobilise over £70 billion of private investment into in the UK’s growth and clean energy missions.

The new NWF is a key step towards aligning the landscape of the UK’s public financial institutions with the government’s priorities, and delivering the Plan for Change.

At the IIS, the government also committed to examining how to improve alignment further, ensuring the UK’s public financial institutions optimally operate and interact with the market, government departments and each other to drive growth.

Officials have since conducted a stocktake examining how well the UK’s public financial institutions and related organisations are positioned to deliver the government’s priorities, mobilise private investment and drive long term economic prosperity.

Headline Findings

UK’s public financial investment landscape comprises a range of institutions targeting investment opportunities as well as specific market failures and weaknesses.

The government has taken several steps recently to strengthen individual institutions and the broader public financial investment landscape, enabling them to better leverage their expertise to drive economic growth across the UK.

Changes include the Chancellor’s new statement of strategic priorities for NWF over this Parliament, building on its expanded capitalisation and new ability to implement blended finance solutions; reforms to the British Business Bank including the British Growth Partnership; and the enhanced role of the Office for Investment to support high value investors. With these changes, the UK’s public financial institutions now have even more tools in place to deliver ambitious investment impacts.

These institutions are already working together to strengthen the economy, drive business growth and advance key government priorities such as economic growth, housing, and clean energy.

As the landscape continues to evolve, so too does the need for and opportunity in better strategic coordination between institutions and with government, to increase their impact.

The stocktake concluded that, while the landscape is positioned broadly well to deliver against government priorities, there are opportunities for reform.

In particular, both government departments and public financial institutions would benefit from a formal means of collaborating on priority and emerging policy issues. This includes taking a strategic approach to identifying and addressing overlaps and gaps in the collective offer to the market, ensuring that while each institution remains aligned with its respective remit, any potential future reforms – such as changes to remits – are made with a comprehensive awareness of the broader investment landscape, driving greater efficiency and impact.

Introducing a New Strategic Public Investment Forum

In response to the stocktake, the government is today announcing the creation of a new CEO-level forum aimed at fostering greater collaboration between public financial institutions and government departments. The forum will be inaugurated by the Chancellor and chaired on a permanent basis by a HM Treasury Second Permanent Secretary.

Membership will be made up of the CEOs of public financial institutions and other relevant organisations active in the UK, as well as senior officials from related departments. In scope are the National Wealth Fund, British Business Bank, UK Export Finance, Homes England, Innovate UK, Great British Energy and the Crown Estate. Senior civil servants from relevant government departments and bodies will also attend ad-hoc.

This forum will focus on improving coordination, ensuring public financial institutions are working effectively together to deliver investment in key areas. This includes a focus on the modern Industrial Strategy and broader growth and clean energy missions.

To achieve this, the forum has been tasked to consider how to leverage the institutions’ different expertise, individually and collectively, to best support investment in priority policy areas, to share information on barriers to future collaboration or investment, and to identify opportunities for greater effectiveness and coherence in the landscape, including potential technical and operational reforms. The forum will be supported by an operational working-level group from across a range of government departments.

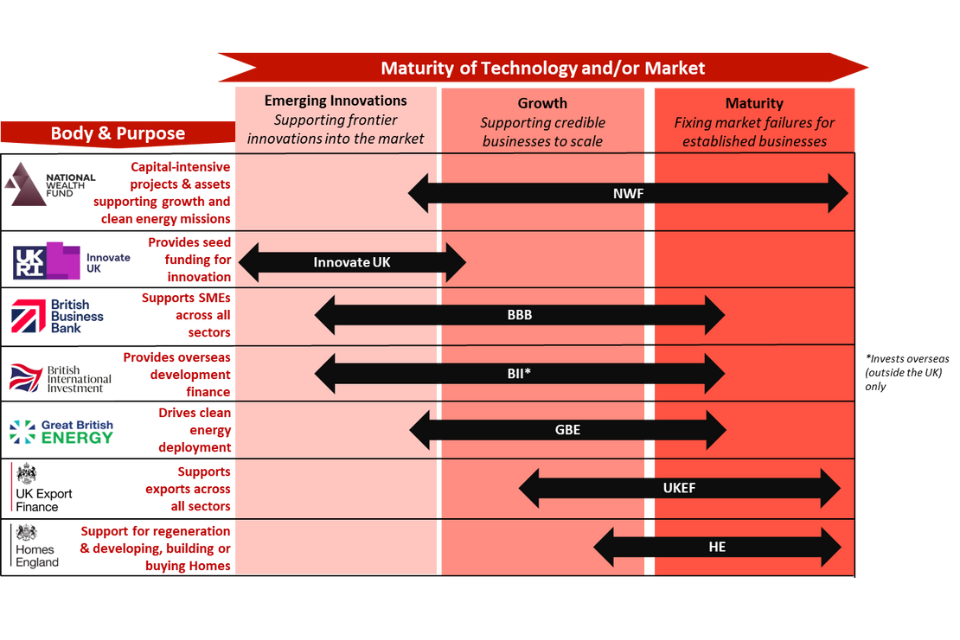

Map of UK Public Financial Investment Landscape

In addition, to improve awareness and understanding of the public financial investment landscape, the government has provided a high-level guide at Annex A, that maps each institution’s remit, the stages of commercial maturity at which they operate, and the types of support they provide.

Each of these organisations focus on addressing specific needs, including supporting investment into infrastructure, improving access to finance for SMEs, fostering cutting-edge innovation, and helping companies export into global markets.

Investors and businesses can use this as an initial indication of which body is most relevant to their financing needs. These bodies also provide a range of non-financial support, such as published guidance, market access, and technical assistance. More detailed information on the financing and non-financial offer of each organisation is available on their individual websites.

Annex

Figure 1: Mapping UK investment bodies activity by maturity of technology and market

Figure 2: Table showing the support offered by each investment body

| Body | About us | Support we offer | Who we support |

|---|---|---|---|

| National Wealth Fund | We are the UK’s flagship investor, investing in capital-intensive assets and projects supporting government’s growth and clean energy missions and help crowd in significant private capital over time. | We prioritise investment in clean energy, digital and technologies, advanced manufacturing and transport sectors, and will consider investments in dual-use technologies across these sectors which better support the UK’s defence and security. We offer investment in capital intensive assets or projects which are generally in later stage development, construction and commercialisation, and which represent opportunities to crowd in significant private capital to the sector over time. We assess deals on a case-by-case basis and have expertise to invest across the capital structure through equity, debt and guarantees. We also offer advisory services and lending to local authorities to support regional and local strategies | We support assets and projects that help achieve the government’s growth and clean energy missions, generate a financial return, and crowd in private investment over time. Examples include: Cornish Lithium: a ground-breaking lithium mining company in Cornwall, Highview Power: the World’s first commercial-scale Liquid Air Energy Storage asset located in Carrington, Ardersier Port: a redevelopment to support deployment of fixed and floating offshore wind |

| Innovate UK | We are the UK’s innovation agency. We help innovative companies to grow and scale by accessing the networks, innovation funding and expertise they need. | We help innovative UK companies grow in three ways: Inspire: making opportunity visible and compelling, Involve: bringing relevant organisations and people together, Invest: with grants and loans up to several million. | We support the best ideas from business, within technology, sector and mission themes, as determined through free and fair competition. Examples include: The worlds most advanced wind turbine testing facility in Blyth, Arbon8 Systems, a new carbon capture and use technology company, and spinout from the University of Greenwich, Renovos, which developed a novel technology for bone damage |

| British Business Bank | We are the UK’s economic development bank, ensuring small businesses can get the capital they need to start up and grow in the UK | We help the UK’s smaller businesses to start, scale and stay in the UK. We do this through investment (in funds and companies), and banking (providing debt, guarantees and loans through our commercial partners). | We work with and support the SME finance market to bring a greater range of capital to smaller businesses. Through this, we support new businesses to start-up and grow with mentoring and loans, innovative companies to scale up and grow with access to debt and equity, across the UK. Examples include: PragmatIC, a Cambridge-based designer and manufacturer of semiconductors, Sports brand Castore, Quantexa, a London-based big data intelligence and risk analysis firm, Quell Therapeutics, new medicines that could increase survival rates after organ transplantation |

| British International Investment | We are the UK’s development finance institution investing patient, flexible, capital to support private sector growth and innovation in developing countries. | We invest in businesses and projects in emerging markets and developing economies (EMDEs) to support economic growth and the energy transition. We provide impact-focused investment, advice and expertise across key sectors including infrastructure and climate, financial services, and real economy (inc. telecoms, food and agriculture, manufacturing). We work alongside other investors to increase the flow of capital to developing countries. | For us, impact and financial return go hand in hand. Examples of businesses we have supported are: Safaricom Ethiopia. A global consortium – including Vodafone – establishing the country’s first private sector telecoms provider, Kenhardt solar power plant. Located in South Africa it is Africa’s largest baseload renewable energy project, Euler Motors. An Indian manufacturer of electric three and four-wheel vehicles. |

| Great British Energy | We are the UK’s publicly owned energy company, dedicated to driving clean energy deployment. | We offer support and investment in projects across clean energy sectors. We: develop and structure clean energy projects, often with private sector partners, invest in projects developed by private sector developers, and provide capability and capacity support, alongside finance, to support local authority, mayoral combined authority, public sector, and community energy group projects. | We support private developers, public sector organisations, local authorities and community energy groups to build and develop clean energy projects, as well as their supply chains. As a strategic, connected energy specialist and an expert investor, we are an active co-development partner on projects, as well as funder. |

| UK Export Finance | We are the UK’s export credit agency. We support UK businesses, whether big or small, in all sectors to export. | We provide competitive financing, in the form of guarantees, loans and insurance, to UK businesses looking to export, to help grow the UK exporting economy. Our support ranges from multi-million pound projects involving large-scale UK exports, to tailored support for small and medium-sized UK businesses to help them to grow their international footprint. | Any UK business who export, or are looking to export, from the UK, or international businesses sourcing goods and services from the UK. Examples include: A solar energy project in Turkey which used UK suppliers, Supporting construction of the world’s largest wind monopile factory in Tees Valley, A new subsea cable manufacturing facility in Northumberland, Supplying advanced air defence missiles, made in Belfast, to Ukraine |

| Homes England | We are England’s housing and regeneration agency. Our role is to support the delivery of quality housing and placemaking, helping to create jobs and drive economic growth. Together with our partners, we’re working to accelerate the pace of house building, remediation and regeneration across the country. | We offer a wide range of support along the entire Housing development cycle. We support the market with: Land acquisition, development and release, Funding partners who can’t access finance from traditional lenders, Expert technical advice and guidance on any aspect of the housing process | We work across the whole housing market, from infrastructure providers and local authorities to master developers. We support: Affordable housing providers, Strategic and local authorities, Commercial real estate, Infrastructure providers, Institutional investors and lenders, Master developers, Private landowners, SME housebuilders |