Insolvency Service: annual report and accounts, 2017 to 2018

Insolvency Service: annual report and accounts, 2017 to 2018

Documents

Details

I am pleased to report that the Insolvency Service has had another successful year, delivering against our published objectives. We have continued to provide an efficient and effective service to the public whilst handling a number of complex high profile cases.

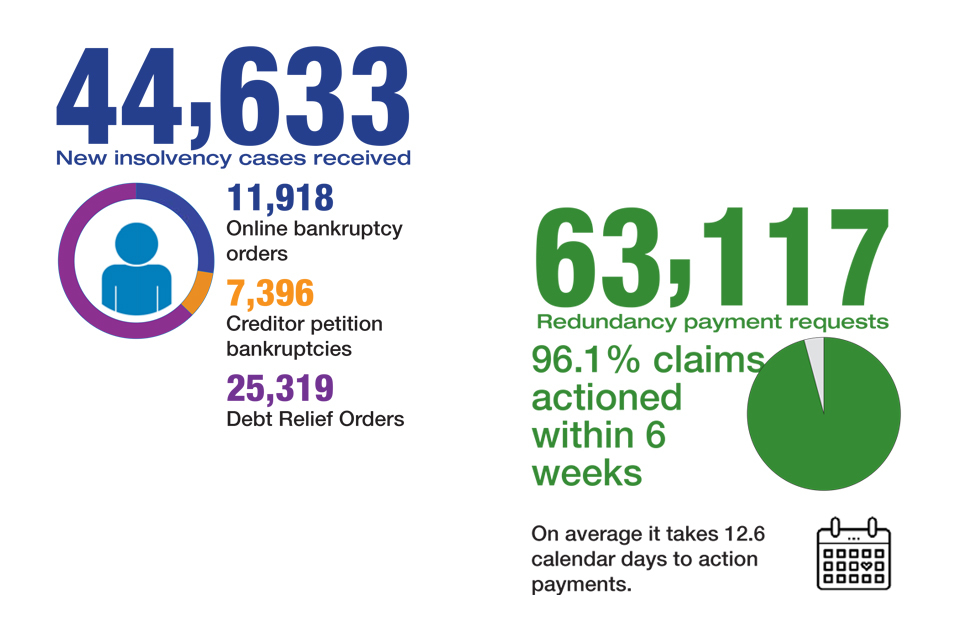

Our online bankruptcy process has become an embedded part of the bankruptcy landscape, with customers in urgent need of help providing positive feedback around the user friendly nature of the system.

I have been pleased to see the continued progress of our redundancy payments service, making payments to redundant workers when it is most needed. They have consistently met key targets whilst handling large scale redundancy cases such as Monarch Airlines.

This has been the first full year of the criminal enforcement function being part of the Insolvency Service and they have proved themselves to be a great asset in our ability to tackle financial wrongdoing. They have worked closely with colleagues from across the agency and successfully brought a number of prosecutions. Their work has also resulted in the agency’s first serious crime prevention order.

Alongside our continuing progress in the latter stages of a number of high profile investigations, we have continued the important work of investigating further cases of misconduct and this year we have disqualified 1,231 people from acting as directors.

The new Insolvency Rules, which came into force early this financial year, have been successfully implemented, streamlining key processes and reducing costs for many of our stakeholders.

We have faced our largest, most complex liquidation this year following the collapse of Carillion. I have been delighted to see staff from across the organisation working diligently to ensure the continuity of essential public services and providing much needed expedited redundancy payments to Carillion’s UK employees. The work on Carillion continues, with the Secretary of State requesting a fast tracked investigation into the conduct of the directors.

I am confident that the progress we have made in 2017-18 will ensure our ability to meet the new challenges we will face in the year ahead

Sarah Albon Chief Executive

Performance overview

Supporting those in financial distress

We administer bankruptcy and debt relief orders (DROs), debt solutions that enable people to get back on their feet financially. The online adjudicator process takes the stress of attending court out of the debtor bankruptcy process. Our redundancy payments service ensures people receive redundancy pay and other statutory entitlements when a company fails.

Together our official receivers and redundancy payment teams play a vital role in protecting people at a time when they are most financially vulnerable.

Supporting those in financial distress

Tackling financial wrongdoing

The work that our investigation and enforcement teams do to tackle individuals and companies who act against the public interest helps to retain confidence in Britain as a great place to do business.

Tackling financial wrongdoing

Maximising returns to creditors

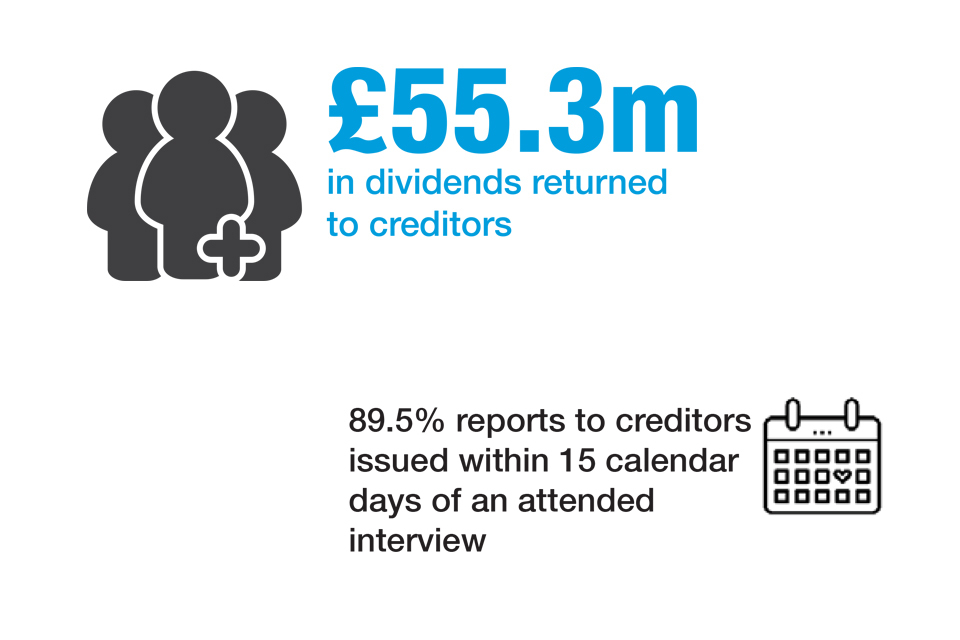

The insolvency regime enables the assets of companies in insolvency to be realised and returned to creditors more quickly than in other jurisdictions, including the US, France and Germany.

Acting as trustee and liquidator, the Insolvency Service has distributed over £55.3m to creditors this year in dividend payments, meeting the increased target which increased from £45m to £55m this year. The agency has completed 11,625 distributions in 2017-18. Our Estate Account and Scanning Services are responsible for operating the Insolvency Service Account, where insolvency practitioners lodge monies realised in cases they handle. Last year they dealt with 64,729 payment requests resulting in 107,030 payments out of the Account and processed 99.6% of payment requests within 2 days of requisition.

This year, we had an increased ministerial target to meet 85% of reports to creditors issued within 15 calendar days of an attended interview. We exceeded this target achieving 89.6%.

Maximising returns to creditors

Customer satisfaction

We make every effort to maximise our engagement with customers and stakeholders to improve our services and communications.

In 2017-18 we were again awarded the Customer Service Excellence standard which recognises our continued focus on meeting the needs of our customers. We were awarded 5 new compliance plus ratings. In total we now hold 17 compliance plus and 40 compliant ratings.

In 2017-2018 the Insolvency Service used a research agency to conduct our annual Customer Satisfaction Survey for the third consecutive year. The research used a comprehensive set of measures to assess customer satisfaction with the service provided and sought to gain a better understanding of customer expectations.

The 2017-18 survey found that 84% of customers are satisfied with the service received. This is one point below the target of 85%, and two points below the 2016-17 score of 86%. We contacted a sample of around 800 individuals across 9 customer groups, including those to whom we have made redundancy payments, and company directors which may have been disqualified following our investigations. Due to the sample size, it should be noted that fluctuations of up to -/+ 4% are not deemed statistically significant.

Customer satisfaction