Guidance for monitors

Published 26 June 2020

1. Introduction

The proposal for a free standing moratorium (it is not linked to a particular insolvency procedure) was consulted on in ‘A Review of the Corporate Insolvency Framework’ which was issued in May 2016. A summary of responses was published in September 2016 and the government issued its full response in August 2018 as part of the response to the ‘Insolvency and Corporate Governance’ consultation. The ultimate aim of the moratorium is to facilitate a rescue of the company and a return to profitable trading, which could be via a CVA, a new restructuring plan or simply an injection of new funds.

The Corporate Insolvency and Governance Act 2020 (CIGA 2020) introduced provisions to the Insolvency Act 1986 inserting a new Part A1 which came into force on 26th June 2020. The changes allow businesses in financial distress a breathing space in which to explore rescue and restructuring options, free from creditor action. By being placed upstream of formal insolvency, it will encourage companies to act earlier to restructure debt and improve a company’s chances of success.

The legislation includes some time-limited temporary changes to the moratorium measure in order to address certain specific issues concerning the Covid-19 emergency. These are explained on page 39-41 of the guidance. In order that the moratorium is operational immediately upon the legislation coming into force there are also temporary rules pending amendments being made to the Insolvency (England and Wales) Rules 2016 SI 2016/1024 (IR 2016) and the Insolvency (Scotland) (Company Voluntary Arrangements and Administration) Rules 2018 (I(S)(CVAA)R). These temporary rules cease to have effect on 30th September 2020, though regulations may make alternative provision for the temporary changes to end on an earlier date or be extended.

Entry into the moratorium requires an insolvency practitioner to consent to act as monitor in relation to the moratorium. This guide sets out what statutory tasks the monitor must undertake under the Insolvency Act 1986 (IA 1986), and the temporary rules as established by Schedule 4 of the CIGA 2020 and provides information for those insolvency practitioners acting in the capacity of monitor. References in this document are made to sections in the Insolvency Act 1986 under Part A1 unless otherwise stated. This guidance is not exhaustive and is not designed to be a manual for insolvency practitioners undertaking an appointment as monitor. Rather it attempts to set out the scheme of the moratorium process and highlights the principal duties and actions of the principal participants in the process.

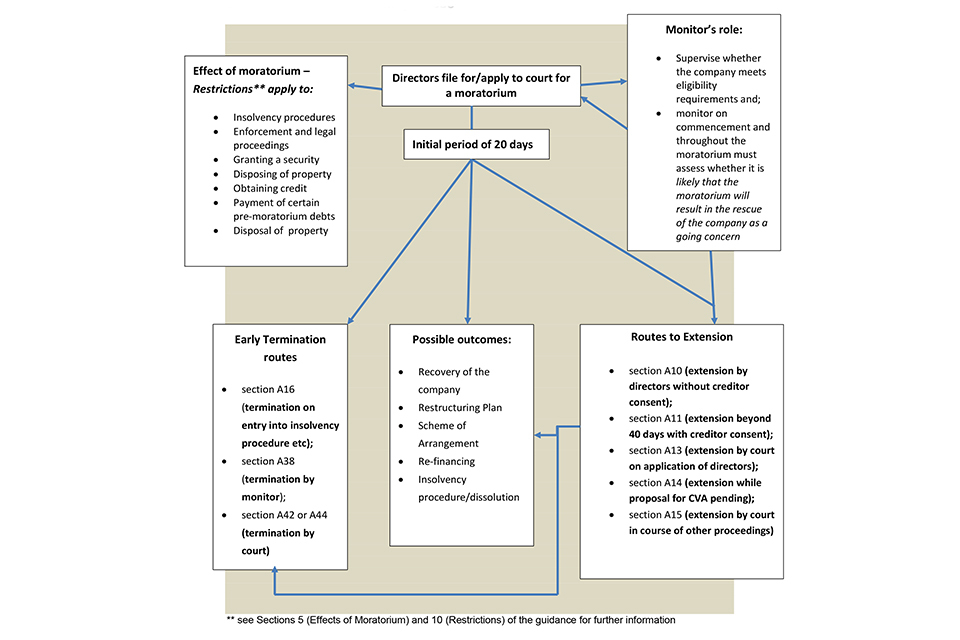

Diagram of the moratorium process

Diagram of the moratorium process

Diagram of the moratorium process

During a moratorium there are restrictions on a company paying pre-moratorium debts subject to some exceptions such as goods or services supplied during the moratorium, wages and salary and rent in respect of a period during the moratorium, or where the monitor consents. There are a number of restrictions placed on creditors taking action during a moratorium such as initiating insolvency proceedings or other legal process, exercising a right of forfeiture (or irritancy in Scotland) in respect of premises and enforcing security, though in some instances permission to do so may be given by the court. An exception is made where the legal process is an employment tribunal (or process arising out of such proceedings) which may be instituted or continued without permission of the court.

There are also restrictions placed on a company in a moratorium concerning granting of a security, obtaining credit and disposing of property.

Schedule 4 - Temporary Rules

The moratorium is currently being implemented under a temporary regime established by Schedule 4 to the Act. Schedule 4 applies specified provisions in the IR 2016 and the Scottish equivalent for the purposes of the moratorium; it also contains stand-alone provision. This guidance has been drafted with reference to the moratorium as it stands under the temporary provision. Accordingly, references to specific rules in the IR 2016 (and Scottish rules) are to those rules as they are applied to the moratorium by virtue of Schedule 4.

Our intention is that Schedule 4 will in due course be superseded by permanent provision that will sit within the IR 2016/Scottish equivalent.

2. Role and Functions of Monitor

The new moratorium under Part A1 IA 1986 is a debtor in possession process and will be overseen by a licensed insolvency practitioner acting as a monitor although the directors will remain in charge of running the business. Section 388(1) of the Insolvency Act has accordingly been amended to bring monitors within the regulatory framework that applies to insolvency practitioners acting as insolvency office-holders. The monitor also acts as an officer of the court and has a duty to act with integrity and good faith.

Prior to the moratorium the prospective monitor will need to engage with the directors and seek information about the company’s assets, liabilities and business so that they are able to assess the company’s financial position, prospects and eligibility for a moratorium. This will be a good opportunity for the prospective monitor to obtain a list of the company’s creditors, the amounts owing to them, details of any security held together with their contact details (postal and email addresses), which the monitor will need when appointed. The extent of this pre-appointment work will be for the insolvency practitioner using their professional experience and judgement to decide on and should be proportionate to the size and complexity of the company.

The Government does not wish the moratorium to be accessed by companies that have no chance of avoiding failure and/or are simply using the procedure to postpone entry into a formal insolvency procedure. The moratorium will impact significantly on the entitlements of creditors to enforce their claims against the company. To ensure the moratorium is used appropriately, there are safeguards attached to the use of the procedure in the form of eligibility criteria in addition to conditions that the company must satisfy in order to qualify for entry. After consent to the appointment (see section 4 of the guidance) the monitor’s role is to supervise that the company’s eligibility remains met at the commencement and throughout the course of the moratorium and to monitor that it is likely that the company can be rescued as a going concern.

The monitor must support the integrity of the moratorium process and ensure creditor interests are protected. To fulfill this role the legislation therefore enables the monitor to require the directors to provide any information the monitor requires for the purpose of carrying out their functions under the moratorium (section A36). This is necessary in order that the monitor can assess the company’s affairs in the short timescales available. The monitor should exercise their professional judgement to satisfy themselves of the accuracy of the information provided, and, is able to require the directors provide further information.

Director’s failure to comply with a request for information

If following a request for information the directors do not comply as soon as practicable, the monitor can file a notice at court to bring about the end of the moratorium under section A38(1)(c) (see section 6 for details about notice requirements). It is recommended that the monitor documents the steps taken to obtain information from the directors in all cases including where directors fails to co-operate with the monitor.

Communication with creditors

The legislation requires that creditors are to be notified of the start of a moratorium as well as changes to the end date, and the replacement of the monitor. Apart from those cases, there is no statutory requirement for the monitor to provide creditors with information in relation to the moratorium. However, section A42 enables a creditor to challenge a monitor’s action by way of an application to court and monitors may find it helpful on occasions to provide additional information to some creditors to forestall such action being taken.

Reporting offences to an appropriate authority

Where a moratorium has been obtained, section A47 creates a duty on the monitor to report to either the Secretary of State, or the Lord Advocate (depending on where the company is registered and if unregistered where it’s principal place of business is located) any knowledge that an officer of a company (past or present) has committed an offence in connection with the moratorium. The offences are detailed in full in Chapter 7 of Part A1. The monitor may be called upon to assist the Secretary of State in any subsequent investigation of the company under s.431 or s.432 Companies Act 1986 or where a prosecuting authority institutes criminal proceedings.

Application to Court for Directions

If at any point during the moratorium, the monitor is unclear about his functions and needs to seek clarification, an application can be made to the court for directions. The monitor should provide a copy of that application to the company. (There is no equivalent to r.1.35 in chapter 8 of Part 1 IR (applications to court) in I(S)(CVAA)R). We have however liaised with the Lord President’s Private Office in Scotland as to whether necessary changes to the Scottish Rules of Court could be made expeditiously and we will keep practitioners updated on the matter

Ethical considerations

To ensure that the monitor can carry out the role with objectivity and independence, it is vital that any conflicts of interests are avoided or managed appropriately to safeguard the interests of all stakeholders. The monitor will need to have regard to any ethical and regulatory guidelines laid down by their Recognised Professional Body and to the Code of Ethics effective from 1 May 2020.

An insolvency practitioner will also need to have regard to the Code of Ethics in relation to accepting an appointment as monitor following any pre appointment engagements or prior insolvency appointments when assessing whether the circumstances give rise to a significant professional relationship with the company that wishes to obtain a moratorium.

The monitor is not prevented from taking up a subsequent appointment subject to the insolvency practitioner making an assessment of any threats to compliance with the fundamental principles. Practitioners may find it helpful to refer to section 2520 of the Code of Ethics that deals with “Examples relating to previous or existing insolvency appointments” in terms of how any subsequent insolvency appointments following appointment as monitor (as administrator or liquidator for example) may be treated. The monitor should satisfy themselves that they have identified any threats to compliance with the fundamental principles and have been able to put in place appropriate safeguards to reduce any threats to an acceptable level.

Where two or more persons act jointly as the monitor (section A40)

Where the monitor is referenced in the legislation, that includes persons acting jointly. Where an offence of omission is committed by the monitor, each of the persons appointed to act jointly commits the offence and may be proceeded against and punished individually. Where persons act jointly in respect of only some of the functions of the monitor, the above applies only in relation to those functions.

Where more than one person is appointed to act as the monitor, each of them must make the necessary statements and their statement of consent to act must include details of which functions are to be carried out by which monitor; or whether they are to be carried out jointly.

Bonding requirements

The existence of a general bond is a prerequisite to being qualified to hold insolvency appointments and as previously noted the monitor has been added to section 388 IA 1986 which gives rise to the requirement for a bond in that role. An insolvency practitioner acting as monitor will also need to ensure they are bonded for a specific penalty sum for each appointment in that capacity. The CIGA includes an amendment to regulation 2 of the Insolvency Practitioners Regulations 2005 (IPR 2005) to include where an insolvency practitioner acts a monitor under Part A1.

Bonding requirements will be based on the total value of the assets of the company in accordance with Part II of schedule 2 of the IPR 2005. Where the monitor takes up a subsequent appointment as office-holder for the same company, the practitioner may be required to pay two premiums – one for the monitor role, and one for the subsequent capacity.

It is anticipated that only a small proportion of monitor appointments will result in a sequential insolvency procedure and making provision in the IPR 2005 to require the specific penalty sum bond for the monitor to carry over to the sequential insolvency procedure could adversely impact premiums for the majority of monitor appointments where the company does not enter another insolvency procedure at the end of the moratorium.

If practitioners have any queries in relation to bonding requirements for the role of monitor, they are advised to contact their bond provider.

Record Keeping

The requirements of regulation 13 (records to be maintained by insolvency practitioners) of the IPR 2005 apply to the office of monitor. It is therefore important that the monitor maintains records sufficient to show and explain the administration of the moratorium and decisions made by the monitor which materially affect the company.

These are likely to include:

- Dates notices were received and sent;

- Explanations as to why:

- Statements made by the monitor that it is likely a moratorium would result in the rescue of the company as a going concern, were made (see section 4).

-

Consent was given by the monitor for certain actions (e.g. grant of a security, payment of a pre-moratorium debt, disposal of the company’s property) (see section 10);

- The monitor brings a moratorium to an end (see section 7).

3. Schedule 4 - Part 3 and 4: Temporary Provisions Pending the Making of the Rules

In order that the moratorium is operational immediately upon the legislation coming into force, the following section sets out temporary rules in lieu of pending secondary legislation (amendments to the IR 2016 and I(S)(CVAA)R. The temporary rules will cease to have effect if that legislation comes into force before the 30 September 2020. The provisions (which are abridged here - for full details of the requirements under each section see Schedule 4 Part 3 and Part 4 of the CIGA) set out what is required in terms of notices and statements when a moratorium is applied for or is extended or ended as well as other more general matters. For ease of use notice requirements and timings are referenced in the relevant sections of the guidance. Where the rules refer to “days” it does not mean business days.

1. Definition of the court

For the purposes of the relevant period, the definition of the court as set out in the interpretation section (A52(1)) has effect as if “the court”, in relation to a company, means a court having jurisdiction to wind up the company.

2. Prescribed format of documents

Rule 1.4 IR 2016 and 1.5 I(S)(CVAA)R (requirement for writing and form of documents) applies for the purposes of Part A1. Rule 1.8/ 1.9 I(S)(CVAA)R (prescribed format of documents), and rule 1.9(1)/ rule 1.10 I(S)(CVAA)R (variations from prescribed documents) apply so far as relevant to a requirement imposed by Part 3 and 4 of Schedule 4. A reference in rule 1.8 or 1.9(1) (or equivalent Scottish rules) to the requirements of a rule is to be read as a reference to the requirements of the provision of Part 3 (or Part 4) Schedule 4.

3. Delivery of documents

Electronic Delivery

We acknowledge that owing to the COVID-19 pandemic, delivery by post may not present the best option and therefore encourage the use of email is as a primary method of contact. If postal delivery is used, we recommend that it is via first class delivery to ensure that documents can be received in a timely manner so that the monitor can fulfil their notification obligations without delay.

England and Wales

The following provisions of Chapter 9 of Part 1 of the IR 2016 apply for the purposes of proceedings under Part A1 as if rule 1.36(1) included a reference to such proceedings:

- rule 1.36(2) (delivery to registrar of companies);

- rule 1.40 (delivery of documents to authorised recipients);

- rule 1.41 (delivery of documents to joint office-holders);

- rule 1.42 (postal delivery of documents);

- rule 1.43 (delivery by document exchange);

- rule 1.44 (personal delivery of documents);

- rule 1.45 (electronic delivery of documents).

Electronic delivery of documents to the court in England and Wales is permitted by paragraph 47 of Part 3, Schedule 4 which applies rule 12.1 (court rules and practice to apply). Rule 12.1 applies the provisions of the Civil Procedure Rules (including any related Practice Directions) for the purposes of Parts 1 to 11 of the IA, and paragraph 47(3) provides that for the purpose of the modifications made by that paragraph any reference in the IR 2016 to Part 1 includes a reference to Part A1 of the Act and to Part 3 of Schedule 4.

Scotland

The following provisions of Chapter 9 of Part 1 of the I(S)(CVAA)R) apply for the purposes of proceedings under Part A1 as if rule 1.32(1) included a reference to such proceedings:

- rule 1.32(2) to (3) (delivery to registrar of companies);

- rule 1.36 (delivery of documents to authorised recipients);

- rule 1.37 (delivery of documents to joint office-holders);

- rule 1.38 (postal delivery of documents);

- rule 1.39 (delivery by document exchange);

- rule 1.40 (personal delivery of documents);

- rule 1.41 (electronic delivery of documents).

4. Obtaining Creditor Consent

Rule 15.31 of IR 2016 and Rule 5.28 I(S)(CVAA)R) (calculation of voting rights) has effect as if:

-

before paragraph (1) there were inserted— “(A1) In relation to a decision to consent to a revised end date for a moratorium under section A12 of the Act votes are calculated according to the amount of each creditor’s claim at the decision date.”;

-

after paragraph (2) there were inserted— “(2A) But in relation to a decision to consent to a revised end date for a moratorium under section A12 of the Act, a debt of an unliquidated or unascertained amount is to be valued at £1 for the purposes of voting unless the convener or chair or an appointed person decides to put a higher value on it.”; (c) in paragraph (6), after sub-paragraph (b) there were inserted—“(c) where the decision relates to whether to consent to a revised end date for a moratorium under section A12 of the Act.”

Rule 15.32 of IR 2016 and Rule 5.29 I(S)(CVAA)R) (calculation of voting rights: special cases) has effect as if, before paragraph (1), there were inserted— “(A1) In relation to a decision to consent to a revised end date for a moratorium under section A12 of the Act, a pre-moratorium creditor under a hire-purchase agreement is entitled to vote in respect of the amount of the debt due and payable by the company at the decision date.

(B1) In calculating the amount of any debt for the purpose of paragraph (A1), no account is to be taken of any amount attributable to the exercise of any right under the relevant agreement so far as the right has become exercisable solely by virtue of a moratorium for the company coming into force.”

5. Applications and filings to Court – England and Wales

For the purposes of proceedings under Part A1, the provisions of the IR 2016 specified by the Table in Schedule 4 Part 3 paragraph 47 apply:

- Rule 1.35 Standard contents and authentication of applications

- Rules 12.1 and 12.2 Court rules and practice to apply etc

- Rule 12.3 and Schedule 6 Commencement of proceedings

- Rules 12.39 and 12.40 (The court file)

- Rule 12.51 Enforcement of court orders

- Rules 12.58, 12.59 and 12.61 and Schedule 10 Appeals

- Rules 12.63 to 12.65 Court orders, formal defects and shorthand writers

Certain provisions of Rule 12 of the IR 2016 have been modified for the purposes of proceedings under Part A1:

- Rules 12.7 to 12.11 and 12.13 (Making applications to court: general) - Rule 12.9 Service or delivery of application has effect as if, in relation to a regulated company (within the meaning of section A48 of the Insolvency Act 1986), it also required the application to be served on the appropriate regulator (within the meaning of that section)

- Rules 12.27 to 12.29 (Obtaining information and evidence)- Rule 12.29(3) has effect as if it included a reference to the monitor in relation to a moratorium

- Rules 12.30, 12.31, 12.33 and 12.35 to 12.38 (Transfer of Proceedings) – Rule 12.36(2) has effect as if the list of office-holders included the monitor in relation to a moratorium. Rule 12.37(2) and (3) have effect as if the list of provisions included section A39.

- Rules 12.41, 12.42(5), 12.47, 12.48 and 12.50 (Costs) - Rule 12.48(2) has effect as if it required the applicant to serve a sealed copy of the application on the monitor and the company to which the moratorium relates.

- Schedule 4 IR 2016, paragraphs 1, 4, 5 and 6 - These paragraphs of Schedule 4 apply only for the purposes of the rules applied by the Table in Schedule 4 Part 3 paragraph 47.

Scotland – Rules of Court

Procedural rules for applications made in insolvency proceedings in Scotland are contained in the Rules of Court. Amendments will be made to the Act of Sederunt (Rules of the Court of Session 1994) 1994 (SI 1994/1443) and the Act of Sederunt (Sheriff Court Company Insolvency Rules) 1986 (SI 1986/2297) to accommodate the moratorium.

6. Identification details for a company

Where a provision in Part 3 or Part 4 of Schedule 4 requires a document to contain identification details for a company that is registered under the Companies Act 2006 in England and Wales or Scotland, the following information must be given:

- its registered name

- its registered number

Where a provision requires a document to contain identification details for a company that has registered particulars under section 1046(1) of the Companies Act 2006 (registered overseas companies), the following information must be given:

- the name registered by the company under section 1047 of that Act

- the number under which it is registered, and

- the country or territory in which it is incorporated

Where a provision of Part 3 and Part 4 of Schedule 4 requires a document to contain identification details for an unregistered company that does not come within sub-paragraph (2) the following information must be given:

- the company’s name, and

- the postal address of any principal place of business

7. Contacts details for a monitor

Where a provision of Part 3 and Part 4 of Schedule 4 requires a document to contain contact details for a monitor, the following information must be given:

- a postal address for the monitor; and

- either an email address, or a telephone number, through which the monitor may be contacted.

4. Entry into a Moratorium, Monitor’s Consent to Act and Appointment

Entry into a moratorium is by directors of an eligible company filing (or lodging) documents at court, or where the company is subject to a winding up petition or an overseas company by application to court. Detailed requirements as to a company’s eligibility are set out in Schedule ZA1 IA.

The moratorium is a process which has immediate effect upon the directors of the company filing (or lodging) the relevant documents at court.

Director’s Notice

The notice under section A6(1)(a) that the directors wish to obtain a moratorium must state:

- the company’s address for service, and

- the court (and where applicable, the division or district registry of that court) or hearing centre in which the documents are to be filed (in Scotland the court in which the documents are to be lodged) under section A3 or the application under section A5 is to be made

The notice must be authenticated by or on behalf of the directors. Rule 1.5 of the IR 2016 and Rule 1.6 of I(S)CVAAR applies for the purposes of authentication.

Statement by directors of insolvency

The statement by the directors under s.A6(1)(d) must state that the company is, or is likely to become, unable to pay its debts.

Statements by the Monitor

Section A6 stipulates that the documents filed include statements from the proposed monitor that:

- the monitor is a qualified person;

- the monitor consents to act as the monitor in relation to the proposed moratorium and;

- the company is an eligible company 4 the monitor holds the view that it is likely that a moratorium for the company would result in the rescue of the company as a going concern.

The statement by a proposed monitor under s.A6(1)(b) should be headed “Proposed monitor’s statement and consent to act” and contain the following:

- a certificate that the proposed monitor is qualified to act as an insolvency practitioner in relation to the company

- the proposed monitor’s IP number (number assigned to an officeholder as an insolvency practitioner by the Secretary of State)

- the name of the relevant recognised professional body which is the source of the proposed monitor’s authorisation to act in relation to the company, and

- a statement that the proposed monitor consents to act as monitor in relation to the company

The statement and consent to act must be authenticated by the proposed monitor. Rule 1.5 of the IR 2016/ Rule 1.6 of I(S)CVAAR applies for the purposes of authentication. Any statement under A6(1) must state:

- the provision under which it is given or made

- the nature of the notice or statement

- the date of the notice or statement, and

- the identification details for the company to which it relates

Timing

Each statement under section A6(1)(b) to (e) must be made within the period of 5 days ending with the day on which the documents under A6(1)(a) to (e) are filed/lodged with the court (or, if the documents are filed on different days, the last of those days). Where documents are filed on different days the moratorium comes into force on the last of those days.

Eligibility

In assessing whether the company is eligible for a moratorium, the monitor must consider whether any exclusions apply, that is whether the company falls under any of the categories below or is otherwise excluded:

- subject to a current or recent insolvency procedure (as defined by schedule ZA1(2))

- Insurers, banks or other entities listed in ZA1(1)

The statement of the proposed monitor should confirm eligibility of the company to enter a moratorium and confirm that the company meets the eligibility requirements of schedule ZA1. The monitor should consider in accordance with their own ethical and professional standards the extent to which any information provided to them by the directors can be relied upon when making the statement.

The statement must also explain that they have come to the view that it is likely that a moratorium would result in the rescue of the company as a going concern (this is analogous to the primary objective of insolvency in paragraph 3(1)(a) Schedule B1 IA 1986).

5. Effects of Moratorium

Restrictions on insolvency proceedings etc. (section A20-A23)

Except in certain circumstances, (e.g. a director presenting a winding-up petition, or a public interest winding-up petition presented by the Secretary of State), no insolvency proceedings can be commenced against the company during the moratorium period. If the directors intend to commence insolvency proceedings, they must notify the monitor. During a moratorium:

- no petition may be presented for the winding up of the company, except by the directors,

- no resolution may be passed for the voluntary winding up of the company under section 84(1)(a),

- a resolution for the voluntary winding up of the company under section 84(1)(b) may be passed only if the resolution is recommended by the directors,

- no order may be made for the winding up of the company, except on a petition by the directors,

- no administration application may be made in respect of the company, except by the directors,

- no notice of intention to appoint an administrator of the company under paragraph 14 or 22(1) of Schedule B1 may be filed with the court,

- no administrator of the company may be appointed under paragraph 14 or 22(1) of Schedule B1, and

- no administrative receiver of the company may be appointed.

Except with the leave of the court:

- No steps may be taken to enforce any security over the company’s property (unless it is security created under a financial collateral arrangement) or to repossess any goods in the company’s possession under any hire-purchase agreement.

- No other proceedings or other legal process can be commenced or continued during the moratorium, except proceedings before an employment tribunal, relating to claims between an employer and a worker, or with the court’s permission.

- A landlord may not exercise a right of forfeiture by peaceable re-entry (a right of irritancy in Scotland) in relation to premises let to the company.

Where a petition (other than an excepted petition) for the winding up of the company has been presented before the moratorium begins, section 127 (“avoidance of property dispositions etc”) of the Insolvency Act does not apply in relation to any disposition of property, transfer of shares or alteration in status made during the moratorium.

While in force the moratorium prevents a floating charge from crystallising and prevents restrictions being imposed by the charge holder on the disposal of any of the company’s property.

Security may only be given over a company’s assets during the moratorium and will only be enforceable if the monitor consented to the security being given. A monitor can only give consent where they believe that the grant of security would support the rescue of the company as a going concern.

Pre-moratorium debts

The wording used in the definition of “pre-moratorium debt” in Part A1 is intended to bring in the distinction made in Re Nortel GmbH (in administration) and related companies [2013] UKSC 52, between provable debts and expenses in administration. Following the Supreme Court’s reasoning, it is thought that liabilities such as contribution notices and financial support directions under the Pensions Act 2004 should be considered pre-moratorium debts (and, therefore, not payable during the moratorium) even if the request to pay them arises after the start of the moratorium.

Construction of references to payment holidays (section A18)

A reference to pre-moratorium debts for which a company has a payment holiday during a moratorium are to its pre-moratorium debts that have fallen due before the moratorium, or that fall due during the moratorium, except in so far as they consist of amounts payable in respect of:

- the monitor’s remuneration or expenses (which does not include remuneration in respect of anything done by a proposed monitor before the moratorium begins)

- goods or services supplied during the moratorium

- rent in respect of a period during the moratorium

- wages or salary arising under a contract of employment, (includes (a) a sum payable in respect of a period of holiday (for which purpose the sum is to be treated as relating to period by reference to which the entitlement to holiday accrued), (b) a sum payable in respect of a period of absence through illness or other good cause, (c) a sum payable in lieu of holiday, and (d) a contribution to an occupational pension scheme

- redundancy payments, (under Part 11 of the Employment Rights Act 1996 or Part 12 of the Employment Rights (Northern Ireland) Order 1996, or (b) a payment made to a person who agrees to the termination of their employment in circumstances where they would have been entitled to a redundancy payment under that Part if dismissed); or

- debts or other liabilities arising under a contract involving financial services (within the meaning set out in Schedule ZA2 of Part A1)

Publicity (section A19)

Where a business of a company is carried on and to which customers or suppliers of goods or services have access, any premises must display in a prominent position so that it may easily be read by such customers or suppliers a notice containing:

- the name of the monitor, and

- that a moratorium is in force for the company

The above information is also required to be displayed on any websites of the company and every business document issued by or on behalf of the company must state the required information. “Business document” means:

- an invoice

- an order for goods or services

- a business letter, and

- an order form, whether in hard copy, electronic or any other form

If a company contravenes the requirements set out in section A19 the company commits an offence, and any officer of the company who without reasonable excuse authorises or permits the contravention commits an offence.

6. Obligation to Notify Moratorium coming into force

Notification by directors

Directors are under a duty to notify the monitor when the moratorium comes into force. Failure to do so without a reasonable excuse is an offence under section A8(4). The moratorium takes effect when the relevant documents are filed with the court.

Directors must notify the monitor as soon as reasonably practicable of the date upon which the moratorium comes into force. Delivery may be by any of the means set out in the temporary provisions using any of the forms of delivery in r.1.42 to 1.45 IR 2016/ 1.38 to 1.41 I(S)(CVAA)R (postal, Document Exchange, personal or electronic).

Notification to employees of the company

It is important that directors have regard to the interests of employees and Government believes that all good employers will inform their employees of entry into a moratorium. To safeguard employees, when in receipt of notification from the directors that a moratorium has come into force, the monitor should ensure that the directors have informed employees of the effect of the moratorium, its initial length, its effect on their wages, salary and employment rights.

Notification by Monitor

Where directors have notified the monitor that the moratorium has come into force, the monitor is under an obligation to notify the following under section A8:

- The registrar of companies

- all creditors of the company of whose claim the monitor is aware

- in a case where the company is or has been an employer in respect of an occupational pension scheme that is not a money purchase scheme, the Pensions Regulator, and

- in a case where the company is an employer in respect of such a pension scheme that is an eligible scheme within the meaning given by section 126 of the Pensions Act 2004, the Board of the Pension Protection Fund.

As soon as reasonably practicable the monitor is to notify the registrar of companies, (and where appropriate the Pensions Regulator and the Pension Protection Fund) that a moratorium has come into force in accordance with Chapter 9 of Part 1 of the IR 2016 and I(S)(CVAA)R The notice must specify:

- when the moratorium came into force, and

- when, subject to any alteration under or by virtue of any of the provisions mentioned in section A9(3) or (4), the moratorium will come to an end.

The notice under section A8(2)(a) of the Insolvency Act 1986 to the registrar of companies must be authenticated by the monitor. Rule 1.5 of IR 2016/ Rule 1.6 I(S)(CVAA)R applies for the purposes of authentication.

The monitor is to notify creditors of the coming into force of the moratorium (as soon as reasonably practicable) and the date it will (unless extended) end. The monitor may use any of the means of delivery set out in rules r.1.42 to 1.45 IR 2016/ 1.38 to 1.41 I(S)(CVAA)R (postal, Document Exchange, personal or electronic). The notice to creditors must also explain that the moratorium may be extended with or without the consent of creditors. It would be helpful if the notice explained the effect of the moratorium on the claims of pre-moratorium debts, and, also the limits of the extensions that are permitted.

Notices to both creditors and the registrar of companies must contain the monitor’s name and address, and the capacity in which they act.

Monitors should note that failure to notify without reasonable excuse constitutes an offence under section A8(5).

Other required notifications

Where the company is a regulated company within the meaning of section A49(13) (for example an authorised person within the meaning given by section 31 of the Financial Services and Markets Act 2000), the monitor must send notice of the coming into force of the moratorium to the appropriate regulator (this will either be the Financial Conduct Authority or the Prudential Regulation Authority).

7. Termination of Moratorium by the Monitor

Unless the moratorium is extended (see next section of the guidance) the initial period for the moratorium is 20 business days which begins the business day after the date the moratorium comes into force. The monitor must bring the moratorium to an end under section A38 at any point by filing a notice with the court under the following circumstances:

- The monitor no longer thinks that the moratorium will result in the rescue of the company as a going concern;

- The monitor thinks that the objective of rescuing the company as a going concern has been achieved;

- The directors have failed to comply with a requirement under section A36; (see section on Role and functions of Monitor)

- The monitor thinks that the company is unable to pay moratorium debts of the company that have fallen due (moratorium debts and pre-moratorium debts that the company does not have a payment holiday for under section A18).

For the purposes of deciding whether to bring the moratorium to an end under section A38(1)(d) the monitor must disregard:

- any debts that the monitor has reasonable grounds for thinking are likely to be paid within 5 days of the decision, and

- any debts in respect of which the creditor has agreed to defer payment until a time that is later than the decision.

Notice to court under A38

A notice under section A38(1) of the Insolvency Act 1986 must be filed (or lodged) with the court as soon as practicable after the duty in that subsection arises.

The notice under section A38(1) of the Insolvency Act 1986 must state:

- the provision under which it is given

- the nature of the notice

- the date of the notice

- the name and contact details of the monitor

- the identification details for the company to which it relates

- the grounds on which the moratorium is being terminated

- the monitor’s reasons for concluding that those grounds are made out

- the date on which the monitor concluded that those grounds were made out, and

- the court (and where applicable, the division or district registry of that court) or hearing centre in which the notice is to be filed

The notice must be authenticated by or on behalf of the monitor. Rule 1.5 of the IR 2016/1.6 I(S)(CVAA)R applies for the purposes of authentication.

Timing

In addition, section A17(4) requires that a copy of the notice filed at court must be delivered to the company within 3 business days of the date upon which the notice to the court was filed/lodged under section A38(1) and must be accompanied by that notice. A17(4) also requires that notification be given to the registrar of companies creditors, (where appropriate the Pensions Regulator and the Pension Protection Fund) where a moratorium is terminated under A38.

Early termination

The moratorium will come to an end under section A16 if at any time the company enters into a scheme of arrangement under section 899 Companies Act 2006 or an insolvency procedure (a CVA, administration, interim moratorium or liquidation).

Notification under section A16 (Company enters into insolvency procedure etc)

A notice under sections A17(1) (notification by directors) and A17(2) (notification by monitor) must state:

- the date on which the company entered into the relevant insolvency procedure, and

- the name and contact details of the supervisor of the voluntary arrangement, the administrator or the liquidator.

The notice must also state:

- the name of the company to which it relates, and

- the provision by virtue of which the moratorium was extended or came to an end.

- identification details for the company to which it relates

Timing

The directors’ notice must be delivered to the monitor within five days beginning with the day on which the duty to give the notice arises. Delivery may be by any of the means set out in the rules using any of the forms of delivery in r.1.42 to 1.45 IR 2016/1.38 to 1.41 I(S)(CVAA)R (postal, Document Exchange, personal or electronic)

Monitor’s notice

A notice under section A17(2) or (3) of the Insolvency Act 1986 must be given within the period of 5 days beginning with the day on which the duty to give the notice arises. The notice must state:

- the provision under which it is given

- the nature of the notice

- the date of the notice

- that it is given by the monitor acting in that capacity

- the name and contact details of the monitor, and

- the identification details for the company to which it relates

A notice under section A17(2) or (3) of that is given to the registrar of companies must be authenticated by or on behalf of the monitor. Rule 1.5 of the IR 2016/Rule 1.6 of the I(S)(CVAA)R applies for the purposes of authentication.

A notice under A17(2) should where it is appropriate (the company is or has been an employer in respect of an occupational pension scheme that is not a moneypurchase scheme or the company is an employer in respect of such a pension scheme that is an eligible scheme within the meaning given by section 126 of the Pensions Act 2004) be sent to the Pensions Regulator and the Pension Protection Fund.

Section A49(3) requires that, in cases where the company is regulated company, the monitor must also notify the appropriate regulator (the Financial Conduct Authority or the Prudential Regulation Authority) of a moratorium.

Monitors should note that failure to notify relevant persons without reasonable excuse constitutes an offence under A17(7).

Duty of directors to notify monitor of insolvency proceedings etc (section A24)

The directors of a company must notify the monitor before taking any of the following steps during a moratorium:

- presenting a petition for the winding up of the company;

- making an administration application in respect of the company;

- appointing an administrator under paragraph 22(2) of Schedule B1.

Timing

The directors are to notify the monitor under A24(1) before the period of 3 days ending with the day on which the step mentioned there is taken.

The directors of a company must notify the monitor if, during a moratorium for the company, they recommend that the company passes a resolution for voluntary winding up under section 84(1)(b) IA 1986 within the period of 3 days beginning with the day on which the duty to give the notice arises.

8. Extension or End of Moratorium

A moratorium cannot be extended once it has come to an end. A moratorium under Part A1 can be extended from the initial period of 20 business days under the following provisions:

- Section A10 – Extension (for a further 20 business days) without creditor consent

- Section A11 – Extension (beyond 40 business days) with creditor consent. A moratorium may be extended more than once, subject to not being greater than one year from commencement.

- Section A13– Extension by the court on application of the directors. A moratorium may be extended under this section more than once.

- Section A14 – Extension while proposal for CVA pending

- Section A15 – Extension by court in the course of other proceedings. The court may extend the moratorium to a date specified in the order or may make such order as it thinks appropriate

There is no requirement for the monitor to notify creditors or the registrar of companies that the moratorium has ended on expiry of the initial period of 20 business days.

Notification by Directors

A notice under section A10(1)(a) or A11(1)(a) of the Insolvency Act 1986 must state:

- the company’s address for service

- the court (and where applicable, the division or district registry of that court) or hearing centre in which the notice is to be filed (in Scotland the court in which the notice is to be lodged)

A notice or statement under section A10(1), A11(1) or A13(2) of the Insolvency Act 1986 must state:

- the provision under which it is given or made

- the nature of the notice or statement

- the date of the notice or statement, and

- the identification details for the company to which it relates

Notices under these sections must be authenticated by or on behalf of the person giving the notice or making the statement. Rule 1.5 of the IR 2016 and Rule 1.6 I(S)(CVAA)R applies for the purposes of authentication.

Where the moratorium has come to an end by virtue of the company entering into a relevant insolvency procedure (see section 7 of the guidance) then the notice must identify the office-holder for that procedure and provide their contact details. It must also indicate the proposed date of entry to the insolvency procedure. Delivery of the order may be by any of the means set out in rules using any of the forms of delivery in r.1.42 to 1.45 IR 2016/1.38 to 1.41 I(S)(CVAA)R (postal, Document Exchange, personal or electronic).

Monitor’s statement

A statement by the monitor under section A10(1)(d) or A11(1)(d) must contain contact details for the monitor. The following information must be given:

- a postal address for the monitor; and

- either an email address, or a telephone number, through which the monitor may be contacted.

The statement must be authenticated by the monitor and Rule 1.5 of the IR 2016/ Rule 1.6 I(S)(CVAA)R applies for the purposes of authentication

Notification by the Monitor

The monitor must notify the registrar of companies and all creditors of the company of whose claim the monitor is aware (i.e. pre-moratorium and moratorium creditors) of an extension or end of the moratorium.

The notice to the registrar of companies must be given within 5 days of the date upon which it was received and be authenticated.

The monitor may use any of the means of delivery set out in the temporary provisions i.e. r.1.42 to 1.45 IR 2016 (postal, Document Exchange, personal or electronic) or 1.38 to 1.41 I(S)(CVAA)R.

The notice to creditors must:

- identify the provision under which it is given,

- state the nature of the notice,

- state the date of the notice, and

- contain the identification details for the company to which it relates

Other required notifications

Where the company is a regulated company within the meaning of section A49(13) the monitor must send notice of the extension or end of the moratorium to the appropriate regulator.

Monitors should note that failure to notify without reasonable excuse constitutes an offence under section A17(7).

Extension by directors without creditor consent (section A10)

On filing of the relevant documents in this section, the period of extension begins immediately after the initial period ends and the extension ends on the 20th business day after the initial period ends.

Directors’ Statements

The statement under section A10(1)(b) by the directors that all moratorium debts that have fallen due have been paid or otherwise discharged must be authenticated and dated by the person(s) making them. The statement under A10(1)(c) by the directors must state the company is, or is likely to become, unable to pay its debts and be authenticated and dated by the persons making them.

Monitor’s Statement

The statement by the monitor under section A10(1)(d) must state that they have come to the view that an extension to the moratorium is likely to result in the rescue of the company as a going concern.

The statement must also be authenticated and dated by the person making it.

Extension by directors with creditor consent (section A11)

Where directors intend to seek a decision of pre-moratorium creditors for the purpose of A11 then notice of their intention to do so must be given to creditors not less than 5 days before the date on which the decision is to be made.

In order to vote in a meeting a creditor must first have provided proof of a debt to the directors in writing before the decision is made.

Directors’ notice to monitor of extension of moratorium

The directors must notify the monitor within 5 days beginning with the day on which the moratorium was extended, and the notice must state the provision by virtue of which the moratorium was extended. In addition, the notice must:

- state the provision under which it is given

- state the nature of the notice or statement

- state the date of the notice or statement, and

- contain the identification details for the company to which it relates

Directors’ Statements

The statement under section A11(1)(b) by the directors that all moratorium debts that have fallen due have been paid or otherwise discharged must be authenticated and dated by the person(s) making them. The statement under section A11(1)(c) by the directors must state that the company is, or is likely to become, unable to pay its pre-moratorium debts and be authenticated and dated by the persons making them.

The statement under section A11(1)(e) by the directors must state that creditors’ consent was obtained, the revised end date of the moratorium and be authenticated and dated by the persons making them.

Timings

Each statement under section A10(1)(b) to (d) or A11(1)(b) to (e) must be made within the period of 3 days ending with the day on which the documents under section A10(1)(a) to (d) or A11(1)(a) to (e) are filed/lodged with the court (or, if the documents are filed on different days, the last of those days).

Creditor Consent for the purposes of section A11 (section A12)

For the purposes of the moratorium the consent of creditors is obtained by the directors rather than the monitor. The decision as to consent is to be made using a qualifying decision procedure and Part 15 IR 2016 applies (except rule 15.8(3)(f) and (g)) and Part 16 applies (proxies) (except rule 16.7). In Scotland Part 5 of I(S)(CVAA)R will apply except rule 5.8(3)(f) and (g) and Part 6 of (I(S)(CVAA)R) (except rule 6.7).

Note that neither the deemed consent nor the small debt provisions in the IR 2016 and I(S)(CVAA)R 2018 apply for the purposes of the moratorium in A1.

Directors may not be familiar with the rules surrounding decision making in insolvency procedures and whilst it is not part of a monitor’s statutory duty to assist directors in obtaining the consent of creditors they may choose to do so in an advisory capacity.

Only pre-moratorium creditors can consent to an extension of the moratorium period for the purpose of section A11. When calculating creditors’ voting power any debts that have been paid during the course of the moratorium should be excluded.

Voting requirements in England and Wales

In order to vote in a meeting a creditor must first have provided proof of a debt (rule 15.28) to the convener (the directors) in writing before the decision is made. The following qualifying conditions apply:

- the creditor has delivered to the convener a proof of the debt claimed in accordance with paragraph (3) including any calculation for the purposes of rule 15.31 or 15.32, and

-

the proof was received by the convener

- not later than the decision date, or in the case of a meeting, 4pm on the business day before the meeting, or

- in the case of a meeting, later than the time given in sub-paragraph (i) where the chair is content to accept the proof; and (iii) the proof has been admitted for the purposes of entitlement to vote.

Voting requirements in Scotland

For the purposes of pre-moratorium creditors’ entitlements to vote in Scotland, Rule 5.26 of the I(S)(CVAA)R has the following effect; “(A1) A pre-moratorium creditor is entitled to vote in a decision procedure under section A12 of the Act only if— (a) the creditor has delivered to the convener a statement of claim and documentary evidence of debt, including any calculation for the purposes of rule 5.28 or 5.29, (b) the statement of claim and documentary evidence of debt were received by the convener not later than the decision date, or in the case of a meeting, at or before the meeting, and (c) the statement of claim and documentary evidence of debt has been admitted for the purposes of entitlement to vote.” See section 3 paragraph 4 of the guidance for details on the application of rule 15.31, 15.32 (calculation of voting rights) and corresponding rules in Scotland.

Requisite majorities

Rule 15.34 of the IR 2016/rule 5.31 I(S)(CVAA)R has effect as if, before paragraph (1), there were inserted:

“(A1) Subject to paragraph (B1), a decision to consent to a revised end date for a moratorium under section A12 of the Act is made if, of those voting:

(a) a majority (in value) of the pre-moratorium creditors who are secured creditors vote in favour of the proposed decision, and (b) a majority (in value) of the pre-moratorium creditors who are unsecured creditors vote in favour of the proposed decision. (B1) But a decision to consent to a revised end date for a moratorium under section A12 of the Act is not made if, of those voting either- a majority of the pre-moratorium creditors who are unconnected secured creditors vote against the proposed end date, or a majority of the pre-moratorium creditors who are unconnected unsecured creditors vote against the proposed end date. (C1) For the purposes of paragraph (B1) a creditor is unconnected unless the convener or chair decides that the creditor is connected, and the total value of the unconnected creditors is the total value of those unconnected creditors who claims have been admitted for voting.”

Where the monitor provides assistance to the directors it would helpful that the monitor recommended that the directors kept a record of the decision.

Extension of moratorium by court on application of directors (section A13)

An application for an extension by the directors in relation to a company must state:

- that it is made under that section,

- the length of the extension sought,

- identification details for the company to which the application relates,

- the company’s address for service, and

- the court (and where applicable, the division or district registry of that court) or hearing centre in which the application is made.

The application must be authenticated by or on behalf of the directors and Rule 1.5 of the IR 2016 and Rule 1.6 I(S)(CVAA)R applies for the purposes of authentication.

Statements by directors

The statement under section A13(2)(a) by the directors that all moratorium debts of the company that have fallen due have been paid or otherwise discharged must be authenticated and dated by the persons making them. The statement under section A13(2)(b) by the directors must state that the company is, or is likely to become, unable to pay its pre-moratorium debts and be authenticated and dated by the persons making them

A statement from the directors must also be made as to whether pre-moratorium creditors (as defined by section A12(4)) have been consulted about the application and if not why not.

Statement by monitor

The statement by the monitor under section A13(2)(d) must state they have come to the view that it is likely that an extension of the moratorium would result in the rescue of the company as a going concern.

Timing

A statement under section A13(2) must be made within the period of 3 days ending with the day on which the application under that section is made.

Extension while proposal for CVA pending (section A14)

Where the moratorium is extended under this section (A14(2)(a)) or ended under section A14 (2)(b) the directors must notify the monitor within the period of 5 days beginning with the day on which the moratorium was extended or came to an end. The notice must state the provision by virtue of which the moratorium was extended or came to an end.

9. Priority of moratorium debts

A moratorium debt and pre-moratorium debt are defined in section A53. In the following paragraphs “wages or salary” have the same meaning as in section A18 of the Insolvency Act 1986.

Schedule 3 of CIGA introduces new section 174A to the Insolvency Act 1986 and a new paragraph 64A to Schedule B1 to that Act which sets the priority of payment of moratorium debts in a subsequent winding-up or administration respectively. Pre-moratorium debts include priority pre-moratorium debts as defined by 174A (2)(b).

Priority of moratorium debts etc in subsequent winding up and in subsequent administration

Where section 174A of the Insolvency Act 1986 applies (proceedings for the winding up of a company are begun within the period of 12 weeks beginning with the day after the end of a moratorium under Part A1) the following are payable out of the company’s assets in preference to all other claims in the following order of priority:

Any prescribed fees or expenses of the official receiver acting in any capacity in relation to the company; Moratorium debts and pre-moratorium debts for which the company did not have a payment holiday during the moratorium

Rules then specify that moratorium and pre-moratorium debts are payable in the following order of priority:

- amounts payable in respect of goods or services supplied during the moratorium under a contract where, but for section 233B(3) or (4) of that Act, the supplier would not have had to make that supply

- wages or salary arising under a contract of employment

- other debts or other liabilities apart from the monitor’s remuneration or expenses

- the monitor’s remuneration or expenses

Where paragraph 64A(1) of the Insolvency Act 1986 applies (a company enters administration within the period of 12 weeks beginning with the day after the end of a moratorium under Part A1) the administrator must make a distribution to the creditors of the company in respect of moratorium debts and pre-moratorium debts (for which the company did not have a payment holiday during the moratorium). That distribution is in priority to any security to which paragraph 70 of Schedule B1 applies and any sums payable under paragraph 99 of that Schedule. Rules specify that the pre-moratorium and moratorium debts rank among themselves in the same order of priority as that set out above in respect of winding-up.

10. Restrictions (Payment and Disposals of Property and others)

Restrictions on payment of certain pre-moratorium debts (section A28)

The company may make some payments in respect of pre-moratorium debts for which the company has a payment holiday, subject to certain limits. Total payments should not exceed the maximum limit set out in section A28; the greater of £5,000 or 1% of the value of the unsecured debts owed by the company at the start of the moratorium.

The monitor may give consent to the company to make payments of pre-moratorium debts for which the company has a payment holiday under section A18 above these limits but only if the monitor thinks that it will support the rescue of the company as a going concern. Where consent is given it is recommended that the monitor document the reasons for coming to that decision in line with regulation 13 of IPR 2005.

Restrictions on disposals of property (section A29)

The company may dispose of property that is not subject to a security, in the ordinary way of its business, if the monitor consents, or if the disposal is in pursuance of a court order. In addition, the monitor may give consent to the disposal only if the monitor thinks that it will support the rescue of the company as a going concern. It is recommended that the monitor document their reasons for coming to that decision with regulation 13 of IPR 2005.

In the case of property that is subject to a security interest, the company may dispose of the property if the disposal is in accordance with either section A31(1) (with the permission of the court) or the terms of the security.

Restrictions on disposal of hire-purchase property (section A30)

During a moratorium, the company may dispose of any goods in the possession of the company under a hire-purchase agreement only if the disposal is in accordance with either section A32(1) (with the permission of the court) or the terms of the agreement

Enforcement and legal proceedings (section A21)

During a moratorium a landlord or other person to whom rent is payable may not exercise a right of forfeiture by peaceable re-entry in relation to premises let to the company, except with the permission of the court.

In Scotland, a landlord or other person to whom rent is payable may not exercise a right of irritancy in relation to premises let to the company, except with the permission of the court.

No steps may be taken to enforce any security over the company’s property except:

- steps to enforce a collateral security charge (within the meaning of the Financial Markets and Insolvency (Settlement Finality) Regulations 1999 (S.I. 1999/2979));

- steps to enforce security created or otherwise arising under a financial collateral arrangement (within the meaning of regulation 3 of the Financial Collateral Arrangements (No. 2) Regulations 2003 (S.I. 2003/ 3226)), or

- steps taken with the permission of the court,

No steps may be taken to repossess goods in the company’s possession under any hire-purchase agreement, except with the permission of the court.

No legal process (including legal proceedings, execution, distress or diligence) may be instituted, carried out or continued against the company or its property except:

- employment tribunal proceedings or any legal process arising out of such proceedings,

- proceedings, not within sub-paragraph (i), involving a claim between an employer and a worker, or

- a legal process instituted, carried out or continued with the permission of the court.

The court may not grant permission for the purpose of enforcing a pre-moratorium debts for which the company has a payment holiday during the moratorium or for the purpose of crystalizing a floating charge.

Restrictions on obtaining credit (section A25)

It is an offence for the company to obtain credit to the extent of £500 or more unless that person has been informed that a moratorium is in force in relation to the company. It is also an offence for any officer of the company who without reasonable excuse, authorises or permitted) the company to obtain of credit beyond this amount in these circumstances.

The company obtaining credit includes:

- the company entering into a conditional sale agreement in accordance with which goods are to be sold to the company

- the company entering into any other form of hire-purchase agreement under which goods are to be bailed (in Scotland, hired) to the company, and

- the company being paid in advance (whether in money or otherwise) for the supply of goods or services

Restrictions on grant of securities etc (section A26)

The company may grant a security during the moratorium only if the monitor consents. It is recommended that the monitor document their reasons for coming to that decision in accordance with regulation 13 of IPR 2005. The monitor can only consent if they think the granting of the security will support the rescue of the company as a going concern.

Security granted by a company during a moratorium may only be enforced if the monitor consented to the granting of the security.

If the company grants security in contravention of this section it commits an offence and, any officer of the company who authorised or permitted the granting of security without reasonable excuse also commits an offence.

Restrictions on transactions (section A27)

If the company enters into any of the following transactions it commits an offence, and any officer of the company who without reasonable excuse authorised or permitted the company to enter into the transaction commits an offence:

- enters into a market contract (has the same meaning as in Part 7 of the Companies Act 1989)

- enters into a financial collateral arrangement (has the same meaning as in the Financial Collateral Arrangements (No. 2) Regulations 200 (S.I.2003/3226)

- gives a transfer order, (same meaning as in the Financial Markets and Insolvency (Settlement Finality) Regulations 1999)

- grants a market charge (has the same meaning as in Part 7 of the Companies Act 1989) or a system-charge, (same the meaning given by the Financial Markets and Insolvency Regulations 1996 (S.I. 1996/1469); or

- provides any collateral security (meaning as in the Financial Markets and Insolvency (Settlement Finality) Regulations 1999 (S.I. 1999/2979);

11. Permitted Disposals

Disposal of charged property free from charge & disposal of hire purchase property (sections A31 and A32)

During a moratorium, the company may, with the permission of the court dispose of property which is subject to a security (any property which is subject to a financial collateral arrangement, market charge, a system charge or a collateral security charge as defined by section A27 is excluded).

During a moratorium, the company, may with the permission of the court dispose of goods which are in the possession of the company under a hire-purchase agreement.

Where the company is a regulated company within the meaning of section A49(13), to the appropriate regulator.

12. Challenge to Directors’ actions

During the moratorium or after it has ended, a creditor or member of the company may apply to the court on the grounds that the company’s affairs, business and property are being or have been managed in a way that has unfairly harmed applicant’s interests, or that a proposed action would cause such harm. The court may make any order it thinks fit. The court’s order may, amongst other things, regulate the management of the directors, require the directors to stop taking the action complained of, or require a decision of the company’s creditors.

Where the court makes an order by virtue of section A44(4)(c) requiring a decision of a company’s creditors, Part 15 and Part 16 of the IR 2016 and Part 5 and 6 of I(S)(CVAA)R (decision making and proxies) apply for the purposes of that decision to the extent set out in the court’s order and subject to any modifications set out in the court’s order. Where the company is a regulated company, the directors must give the appropriate regulator notice of any qualifying decision procedure by which a decision of the company’s creditors is sought for the purposes of section A44(4)(c).

13. Challenge to Monitor’s actions and Replacement of Monitor by Court (or appointment of additional Monitor)

Section A42 permits a creditor, director, member of the company or any person affected by the moratorium to challenge the actions of the monitor for an act, omission or decision by an application to court. This mirrors the challenge that can be mounted against a nominee in a CVA under Part 1 IA 1986. The challenge may be brought during the moratorium or after it has ended.

Where the court brings the moratorium to an end under section A42, the directors must notify the monitor that the moratorium has come to an end (within 5 days).

The monitor must notify the registrar of companies and creditors of when the moratorium ended within the period of 5 days beginning with the day on which the monitor received the notice from the directors. The notice to creditors must:

- identify the provision under which it is given

- state the nature of the notice

- state the date of the notice, and

- contain the identification details for the company to which it relates

Section A45 provides the Board of the Pension Protection Fund the same rights to challenge the actions of the monitor as exist under A42 (as well as the same rights to challenge the actions of the company directors as exist under A44). These rights can be exercised in circumstances where a moratorium is in force in relation to a company that is an employer in respect of an eligible scheme, or is or has been in force in relation to a company that has been an employer in respect of an eligible scheme at any time during the moratorium, and the trustees or managers of the scheme are a creditor of the company.

Replacement of monitor by court or additional monitor (section A39)

A director or monitor may apply to court to replace the monitor with another insolvency practitioner or the court may make an order authorising the appointment of an additional monitor. Where the company is a regulated company then the court may only order that a person be appointed as a replacement monitor if the regulator has given consent to that person’s appointment.

A statement under section A39(4) of the Insolvency Act 1986 must be headed “Proposed monitor’s statement and consent to act” and must contain the following:

- a certificate that the proposed monitor is qualified to act as an insolvency practitioner in relation to the company,

- the proposed monitor’s IP number

- the name of the relevant recognised professional body which is the source of the proposed monitor’s authorisation to act in relation to the company, and

- a statement that the proposed monitor consents to act as monitor in relation to the company.

Timing

The statement under A39(4) must be made within the period of 5 days ending with the day on which it is filed with the court (or lodged in Scotland).

Monitor’s notice

Where the court following a hearing makes an order to replace or appoint an additional monitor the new monitor is required under A39(8) to notify the following persons as soon as reasonably practicable after they being to act as monitor:

- the registrar of companies

- every creditor of the company of whose claim the monitor isaware

- in a case where the company is or has been an employer in respect of an occupational pension scheme that is not a money purchase scheme, the Pensions Regulator, and

- in a case where the company is an employer in respect of such a pension scheme that is an eligible scheme within the meaning given by section 126 of the Pensions Act 2004, the Board of thePension Protection Fund

A notice under section A39(8) of the Insolvency Act 1986 must state:

- the provision under which it is given

- the nature of the notice

- the date of the notice

- the identification details for the company to which it relates

- that it is given by the monitor acting in that capacity, and

- the name and contact details of the monitor

The notice must be authenticated by the monitor.

Rule 1.5 of IR 2016/ Rule 1.6 I(S)(CVAA)R applies for the purposes of authentication.

Where relevant, a notice must also be sent by the monitor to the appropriate regulator as defined by section A49(13). The court may make an order under section A39(1) only if the appropriate regulator has given its written consent to the appointment of the proposed monitor.

Monitors should note that failure to comply with without reasonable excuse constitutes an offence under section A39(9).

The monitor may use any of the means of delivery set out in rules r.1.42 to 1.45 IR 2016/1.38 to 1.41 I(S)(CVAA)R (postal, Document Exchange, personal or electronic).

14. Monitor’s remuneration

The remuneration of a monitor in relation to a moratorium, including that for pre-appointment work is a contractual matter between the company and the monitor. Therefore, the parts of the IR 2016 and I(S)(CVAA)R which relate to an office-holder’s remuneration do not apply to the monitor’s fees.

However, the monitor should note that if in subsequent insolvency proceedings an administrator or liquidator of the company (that was subject to a prior moratorium) has cause to believe that the remuneration charged by the monitor was excessive, they may bring a challenge to the amount of remuneration charged by way of an application to court. Section 246ZD IA 1986 has been amended to allow for this cause of action to be assigned.

When an application under this provision is made the procedural rules governing applications to court in IR 2016 Part 12 will apply to proceedings under Part A1 in England and Wales. A time limit of 2 years is applicable for challenging the remuneration of a monitor. This period runs from the day after the day on which the moratorium ends. The permission of the court to make the application is not required. The court may order that some or all of the remuneration in question be treated as not being expenses of the moratorium. Alternatively, it may make an order for the repayment of the amount of the excess of remuneration or such part of the excess as the court may specify by the monitor, or any other order that it thinks just.

15. Schedule 4: Part 2 - GB Moratoriums: Temporary Modifications in light of Coronavirus

Schedule 4, Part 2 sets out a number of temporary modifications to the moratorium provisions in Part A1. These are set out below in summary (with details of modifications to specific sections to follow) and apply during the “relevant period” (see below).

- Companies that, within twelve months prior to filing for a moratorium have been subject to a CVA or in administration, are permitted to file for a moratorium.

- A company that has had a moratorium during the last 12 months will be permitted to file for a further moratorium.

-

The monitor’s statement has been adjusted to account for the impact of the Covid 19 pandemic

- Directors of an eligible company that is subject to an outstanding winding up petition may obtain a moratorium for the company without having to apply to court.

When these temporary modifications end then, provided that the moratorium was entered into during the time that those modifications were in effect, those modifications will continue to apply in respect of that moratorium until it comes to an end. It will not be reassessed under the unmodified/permanent provisions.

Where this is the case then eligibility for an extension, or further extension, to that moratorium will also be determined in accordance with the temporary modifications even if those temporary modifications have ceased to apply for all other purposes at the time the extension, or further extension, is sought.

Part 1 - Meaning of “relevant period”

The relevant period begins with the day on which Schedule 4 comes into force and ends on the 30 September 2020. The end date may be shortened by regulations.

Part 2 – Modifications to Primary legislation

“Eligible” company: additional exclusion

During the relevant period, a company is not eligible to obtain a moratorium for the purposes of section A3, A4 or A5 if the company:

- has permission under Part 4A of the Financial Services and Markets Act 2000 to carry on a regulated activity within the meaning of that Act, and

- is not subject to a requirement imposed under that Act to refrain from holding money for clients

Relaxation of conditions for obtaining moratorium etc

For the purposes of obtaining a moratorium under section A3 of the Insolvency Act 1986 during the relevant period:

-

A3 has effect as if subsection (1)(a) (companies subject to a winding up petition) were omitted. For the purposes of obtaining a moratorium under this section:

-

A6 has effect as if subsection (1)(e) (proposed monitor’s statement) ends with “or would do so if it were not for any worsening of the financial position of the company for reasons relating to coronavirus”

-

Schedule ZA1 has effect as if paragraph 2(1)(b) and (2)(b) (at any time during the period of 12 months ending with the filing date, the company was subject to a voluntary arrangement or the company is in administration) were omitted

-

-

A4 (obtaining a moratorium by a company subject to a winding up petition) - A moratorium may only be obtained under this section of the Insolvency Act 1986 by an overseas company. In relation to an application for a moratorium made under section A5 (Obtaining a moratorium for other overseas companies) of the Insolvency Act 1986 during the relevant period:

-

Section A6(1)(e) has effect as if at the end there were inserted “or would do so if it were not for any worsening of the financial position of the company for reasons relating to coronavirus”;

-

Schedule ZA1 to that Act has effect as if paragraph 2(1)(b) and (2)(b) were omitted.

Relaxation of conditions for extending moratorium etc

In relation to a moratorium that comes into force during the relevant period the following modifications apply:

-

Extension under A10 and A11 - these sections have effect as if subsection (1)(d) (monitor’s statement) ends with “or would do so if it were not for any worsening of the financial position of the company for reasons relating to coronavirus”.

-