HQ-UK: The international hub for your digital business (online version)

Published 10 February 2015

Welcome to HQ-UK, the international hub for your digital business.

It’s very un-British to brag, but nowhere beats the UK as an international hub for tech companies who are looking to thrive, innovate and grow.

With our dynamic and highly educated population, specialist tech capabilities, great infrastructure, and leading policies and programmes designed to help you grow your business, we are the digital capital of Europe.

We have created the best conditions for business-builders anywhere in the world. The number of people starting digital businesses here is greater than ever – and the number of companies choosing the UK for their international headquarters is also unprecedented.

We are an innovation-driven, knowledge-based economy made up of creators, innovators and ground-breakers.

Choose a UK home for your international HQ. Here’s why.

1. Tomorrow starts here

The world is changing fast for tech businesses, and now is the time to choose a UK international hub.

Structure of Birmingham Bullring centre

1.1 We embrace change

We know that the world is changing fast for digital businesses. Technology is disrupting every aspect of life and society, and the UK is at the forefront in helping great tech companies to succeed in this new environment.

At the same time, as your business grows in today’s interconnected world, managing your reputation and the public perception of your brand becomes ever more important. With global tax policy entering an era of unprecedented change, the world’s great brands have been challenged particularly on issues of tax and transparency.

Leading companies are now considering a wider range of factors in choosing an international hub location.

Big questions like:

- where do we find skilled talent and specialised sector expertise?

- how big and sophisticated is the home market?

- are visas available, and will it be easy for international workers to come and join us?

- how can I make sure my structure is both beneficial and sustainable for the long term?

- is the infrastructure world-class?

- is there a great working culture, and can we provide the kind of lifestyle that our employees want?

We have brilliant answers to all these questions. Across the board, the UK is the real deal for digital companies. We’ve reformed our corporate tax system as well, and now offer a variety of advantages for creative, digital and innovative businesses.

We can give you a complete, sustainable and transparent package, which meets the needs of all aspects of your business. Choose a location for your international HQ that you can be proud of.

1.2 The time is now

The UK is buzzing, with tech clusters thriving around the country, each with their own unique identities and strengths. But don’t just take our word for it. Hear what companies like yours are saying, and their reasons for choosing us. Find out why we’re rated the most innovation-friendly major economy in the world. And learn why more foreign direct investment is coming to the UK than anywhere else in Europe.

Whether you already have an international presence or are planning on establishing one, now is the time to think about the UK as your base from which to innovate and expand overseas.

Now’s the time to choose HQ-UK.

2. No.1 for business

A stable, sophisticated, pro-business environment, full of tech-savvy early-adopters, and the largest e-commerce market in Europe.

City office view

2.1 Top of the heap

According to the United Nations Conference on Trade and Development, the UK is number one for inward foreign direct investment (FDI) stock in Europe, and second in the world after the US. That’s quite an endorsement of our way of doing business.

In the creative and ICT sectors, the UK was the location of the third largest number of foreign direct investments made between 2003 and 2014, after China and the US. In the same period, over 10% of all US FDI in ICT came to the UK, second only to China (Financial Times, fDI Intelligence).

UK HQs

And more companies choose to base themselves here than anywhere else in Europe.

The UK was the location of choice for 43% of new inward investment projects with headquarters in Europe in 2012. That’s three times more than our nearest competitor.

2.2 Make it easy on yourself

Start here. Start now.

Stability

Politically and economically stable, the UK is a safe and friendly environment for business and investment.

Ease of doing business

It’s quick and easy to set up a business here: on average it takes 13 days, and as little as 24 hours to register a company.

Cyber security

In the UK we take cyber security seriously. The UK government’s £860 million National Cyber Security Programme is making the UK one of the safest places in the world to do business in cyber-space. Our national Computer Emergency Response Team, CERT-UK, has been set up to strengthen our response to cyber incidents and promote awareness across industry, while our Cyber-security Information Sharing Partnership enables companies and the government to share real-time information on cyber threats.

Illustration of London City skyline

Pro-business regulation

Our legal and regulatory framework is about enabling business to succeed. Our ground-breaking approach to reducing regulatory burdens is the ‘One-In, Two-Out’ rule. Any increase in the cost of regulation requires us to save twice this amount through the removal of regulations elsewhere. By removing red tape we’ve saved businesses around £1 billion since 2011.

Financial and professional services

We are world leaders in professional services that are vital to your business; services such as accountancy, law and auditing. We’re home to six of the top ten international networks of accountancy firms, and four of the ten biggest law firms.

Centre of everything

Positioned between East and West, our location and time zone make it easy to work across Asia, Europe and the Americas. On the Greenwich Meridian, in terms of time we’re at the centre of the world.

Growing economy

The UK economy grew at the fastest rate of any in the G7 in the first half of 2014.

Language

We’re the home of English, the world’s main business language – but our thriving economy welcomes everyone and all languages are spoken here.

Data protection and open data

As with all EU countries, data protection in the UK has to comply with EU law. At present, the Data Protection Act sets out the rules that must be followed when processing information about individuals, and gives rights to individuals concerning the information that is held about them, while limiting the burden on data processors. The Information Commissioner’s Office is the independent body that enforces these rights and rules, and aims to protect data privacy for individuals in a pragmatic and proportionate way.

EU data protection law is under reform, with changes currently being debated by all EU countries. In the UK, our approach is to seek an appropriate balance between the protection of consumers’ data and the needs of business, trying to avoid introducing rules that would be too much of a burden to comply with.

At the same time as protecting the rights of individuals, we champion openness wherever possible. The Open Data Institute is a global voice in encouraging a transparent and an open data culture.

And we lead the world in making use of large data sets. Plans have also been announced for a new, £42 million Alan Turing Institute for Data Science in London’s new Knowledge Quarter, with ‘spurs’ around the country. This world-class research institute, which is dedicated to British computer pioneer and Enigma code-breaker Alan Turing, will work with universities across the country to focus on new ways of collecting, organising and analysing big data.

2.3 Opportunity knocks: the UK market

With over 63 million people living in the UK, we represent a major market opportunity in our own right.

But we’re much more than that. We’re also the gateway to Europe, the world’s largest single market, with more than 500 million consumers. If you base your business in the UK you won’t pay any duties when moving goods within the EU, and you’ll benefit from free or preferential trade arrangements with many non-EU countries. We also retain important historical linkages to the Commonwealth countries.

Tech nuts: we are serious early-adopters

We Britons embrace technology with a passion.

More than 80% of adults now have household internet access, and take-up of superfast broadband is the highest in the EU’s five largest economies.

We aim to have 95% of UK homes and businesses with access to superfast broadband by 2017.

The biggest e-commerce market in Europe

This love of online technology, combined with huge market demand, makes the UK the biggest e-commerce market in Europe – and Europe is the biggest e-commerce market in the world.

Each UK household on average owns three different internet-enabled devices, and 96% of our homes have digital TV.

We also love our smartphones. In the UK, 60% of adults now own one. 64% of the total UK mobile audience uses a smartphone as their primary device. And it just keeps growing: smartphone penetration is expected to reach 74% by the end of 2014.

In short, if you’re an innovator in digital products and services, in the UK you’ve got an audience that’s eager to find out what you have to offer.

Britain leads the G20 as the most digital nation, with an expected 10% of GDP coming from the internet economy in 2015. Entrepreneur-led companies are making the greatest contribution to our economic growth and the strength of the UK economy, and we are committed to doing everything possible to support them.

Baroness Shields, Digital Economy Adviser to the Prime Minister

Case study: Box

“As we expanded in Europe and witnessed growing demand for Box, we decided that London was not just an ideal location for an office, but also a great place to establish an official headquarters for our international operations. London is a central hub in the world economy, home to a fantastic pool of talent, and the locus of a growing ecosystem of technology startups and innovators.

In addition, the UK government’s Patent Box regime and other recent economic initiatives provide us with a supportive environment for continuing to grow and expand aggressively around the world.”

David Quantrell, Senior Vice President and General Manager for EMEA, Box

Box’s mission is to make businesses of all sizes more productive, competitive, and collaborative by connecting people and their most important information.

More than 27 million people at 240,000 businesses, including 99% of the Fortune 500, use Box today to share, manage and access their content globally. Headquartered in Los Altos, CA, Box is privately held and backed by several leading venture capital firms and strategic investors.

3. Tax less taxing

With the joint lowest headline tax rate in the G20 and a fully reformed tax system, ours is a competitive proposition, with a variety of incentives for innovative businesses.

3.1 The UK’s competitive tax regime

We’ve reformed the UK tax system, including creating and improving incentives for innovative digital businesses.

When it comes to tax, in the UK you’ll find some of the most enticing rates around, and a system that gives you the stability and certainty you need for long-term planning and investment. Since 2010, the UK government has made sweeping tax reforms, based on what businesses like yours have been telling us.

From moving to a more territorial tax system and modernising our Controlled Foreign Company rules, to the introduction of our Patent Box, an improved R&D tax credit regime, tax credits for creative digital businesses, and a lower headline tax rate, the building blocks of the UK regime now add up to a great proposition.

Illustration of London City skyline

3.2 Tax matters

Whether you’re looking for a location for a holding company, a strategic management and operational hub, or an innovation centre for further development and exploitation of your IP, the UK’s tax regime makes us the ideal location.

Corporation tax

Our corporation tax rate is 20% from 1 April 2015 – that will be the lowest ever in the UK, the lowest in the G7, and the joint lowest in the G20.

But it’s not just about headline tax rates. The building blocks of the UK corporation tax regime together can provide a highly competitive and sustainable platform for your business to grow.

Territorial system

We’ve moved to a broadly territorial system for taxing UK companies, which aims to tax only profits earned in the UK. The key elements of this new approach are a dividend exemption, an elective branch exemption, and a reformed Controlled Foreign Company regime. This means that for most companies you are only taxed on the profits you generate in the UK, not those made by overseas subsidiaries.

We also don’t tax sales of shares in subsidiaries in most cases.

Standing on escalators

Patent Box

Our Patent Box can give you an effective 10% tax rate for qualifying net revenue arising from EU or UK registered patents. If your UK company owns or has an exclusive licence to just one patent, all or part of your income may qualify for this rate, depending on how your patented invention was developed, how you commercialise it, and how you use it in your business. IP regimes generally form part of the work of the OECD Base Erosion and Profit Shifting Project. In light of the OECD processes, the current UK regime will close to new entrants in June 2016, with benefits for those already in the regime applying until June 2021. The effective 10% rate will continue to be available after this date but will align benefits more closely to R&D carried out in the UK.

The Patent Box was introduced to encourage innovation and to bring high value science and technology jobs and investments to the UK. It also ensures that the jobs that are already here will stay here. This policy has been widely welcomed by businesses, and the evidence of growth is already clear.

David Gauke MP, Financial Secretary to the Treasury

Bring your IP

If you’re bringing IP with you, you can generally claim amortisation, and claim deductions for payments made under cost sharing arrangements. You can also claim deductions for licence fees if you licence your IP.

Align your structure with your business

With global tax policies going through unprecedented change, the location of key business functions, people and assets is playing an increasingly important role in determining where taxable profits arise. So, aligning your structure with your business is becoming ever more significant in today’s world.

The new Diverted Profits Tax is intended to apply to large multinationals with significant business activities in the UK who enter into arrangements to artificially divert profits from the UK – either by avoiding a UK permanent establishment, or through other contrived arrangements involving limited economic substance. The new tax will apply a 25% rate on diverted profits arising from the UK activity and applies from 1 April 2015.

R&D tax credits

We’ve made our R&D tax credit system even more generous.

If you’re a large company, you can claim our new ‘above the line’ taxable 10% credit (11% from 1 April 2015), which means you can offset the benefit of the credit against the R&D cost in your accounts – creating an immediate cost reduction. Alternatively, you can claim the ‘super-deduction’ of 130% for qualifying expenditure until 31 March 2016. And it’s refundable in cash, regardless of your tax position.

For small and medium sized companies, we give you an enhanced deduction equal to 225% (230% from 1 April 2015), with provisions for a payable tax credit where there are current-year tax losses.

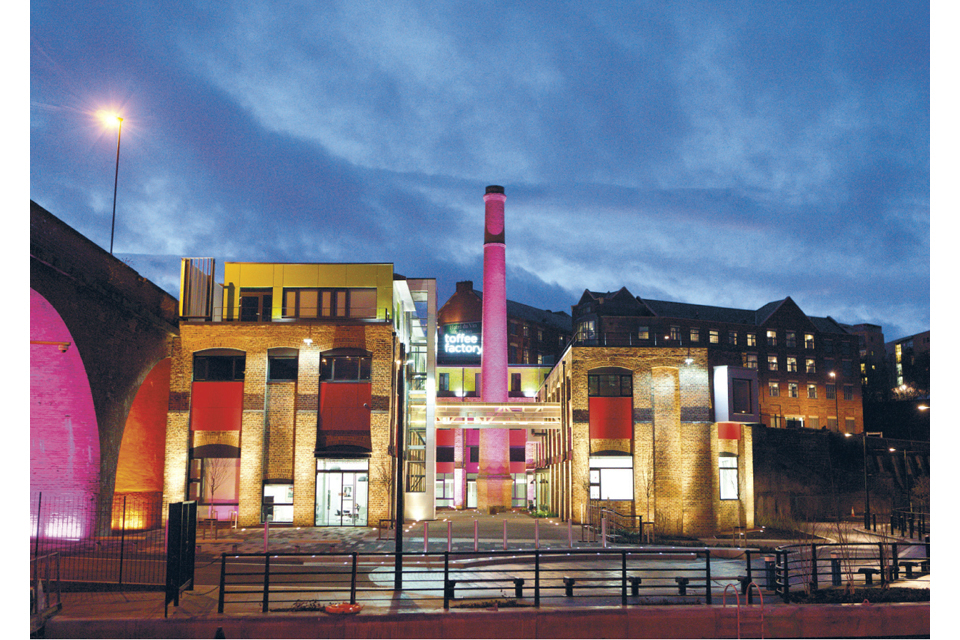

Toffee Factory building

Interest costs

We give tax relief for interest as a business expense in earning profits (subject to certain anti-abuse rules).

No dividend withholding tax

We don’t apply a dividend withholding tax in the UK, irrespective of the location of the recipient.

Creative sector tax reliefs

We’ve also introduced new tax reliefs for the animation, video games and high-end television (and shortly, children’s television) production industries. The new reliefs are modelled on our successful film tax relief scheme, and offer tax credits worth up to 25% of qualifying expenditure where productions are culturally British.

Tax treaties

The UK has one of the largest networks of tax treaties in the world, covering around 120 countries. We are well accustomed to negotiating with other countries under ‘competent authority’ provisions.

VAT

Our VAT rate of 20% is competitive in the EU. Locating in the UK allows you to take advantage of the developed VAT system throughout the EU, which has a number of simplifications to prevent unnecessary registrations and administrative burdens.

You can account for the VAT on electronically supplied services to individuals in all EU states via a single Mini One Stop Shop.

Headline tax rates comparison

Note: Effective corporate tax rates. The rates do not reflect payroll taxes, social security taxes, net wealth taxes, turnover/sales taxes and other taxes levied on income. Income tax rate selected is the highest rate payable. The United States does not levy a federal value added tax. Individual states levy sales tax at various rates subject to state-set requirements. Eg a 4% sales tax in New York is used as a proxy. Employer social security rates for France and Italy are set at the mid point of the existing range.

Source: Data from Ernst & Young 2013-14 The Worldwide Personal Guide, KPMG Global Tax Rates Online, KPMG 2014. Individual income tax rates table (online), HMRC data, gov.uk data.

Case study: SwiftKey

“We believe London is one of the best places in the world to grow and scale a business. SwiftKey has flourished as a London technology company. Our global success – our apps have been No 1 hits (in markets including the United States) on both Google Play and Android and we’ve signed licensing deals with some of the biggest mobile manufacturers in the world – has been achieved with a UK HQ as it’s an easy place from which to do business with both the US and Asia.

The UK has a pro-innovation, R&D and investment culture. For an early stage tech company where ‘cash is king’ the R&D tax credits provide a meaningful source of financing in this cash-strapped environment. Then, as businesses scale, the Patent Box regime, with its 10% corporate tax rates, is a strong incentive for highly innovative companies with patented technology.”

Richard Gibson, CFO, SwiftKey

Founded in London in 2008, SwiftKey’s mission is to build technology that makes it easy for everyone to create and communicate on mobile.

Best known for smart SwiftKey Keyboard apps which learn from you to make typing on touchscreens faster and easier. SwiftKey Keyboard apps have been consistently on global best-seller lists across mobile platforms.

We take advantage of the R&D tax credit regime which helps us fund development, and we are excited by the potential of new incentives like the Patent Box and how it could help our business grow even further in the future.

Chris Morton, Co-founder and CEO, Lyst

3.3 Your people

Employer social security costs

Employers in the UK pay lower social security contributions (what we call National Insurance) than in most countries in Europe. Our rate of 13.8% applies to earnings above £155 per week (2015/16).

Personal taxes

Personal income tax rates in the UK are highly competitive when compared to those in other European countries.

Our main income tax rates in 2015 are:

Your first £10,600 is tax-free

20%: the basic rate on £0 – £31,785

40%: the higher rate on £31,786 – £150,000

45%: the top rate over £150,000

3.4 Non-domiciles – taxation on a remittance basis

The territorial approach to the UK tax regime does not stop at corporation tax. There are also attractive income tax rules for non-domiciled individuals who relocate to the UK.

Unlike many European territories, instead of seeking to tax all of a non-domiciled individual’s foreign income and gains, the UK permits individuals to choose to be taxed on a remittance basis; taxing only on the income they remit to the UK.

City river view

Help when you need it

The UK tax authority, HMRC, operates a number of dedicated centres that can give you guidance on incentives that could benefit your business; things like R&D tax credits and Patent Box. It’s possible to obtain non-statutory clearances, dealing with specific technical questions arising from your particular situation, helping you reduce any uncertainty about your plans.

At the same time, there are senior officials at HMRC whose job it is to talk with businesses who are considering making a significant investment in the UK. Before you make a decision on setting up in the UK, or increasing an existing investment, HMRC’s dedicated Inward Investment Support team can help you confirm your business’s tax position.

HMRC represents one of the largest and most well-resourced tax authorities in the world. Not only will HMRC provide certainty on specific technical questions, but they will also actively support you in obtaining multi-lateral certainty over transactions which impact other jurisdictions.

HMRC understands that whilst certainty is helpful, it must also be timely and has committed to responding to requests for certainty within 28 days of receipt.

4. Smart cookies

We have a world-class, highly skilled workforce, with four of the world’s top six universities, plus a large number of high-impact skills providers focused on digital and creative sector skills.

4.1 Getting what you need

Access to talent is a key driver of economic growth. While many parts of the world face labour shortages, locating your headquarters in the UK means that you won’t find it hard to get people with the skills you need.

4.2 Big pool

First off, ours is a big pool to go fishing in for talent. At over 32 million people, the UK has the second largest labour market in the EU.

4.3 Attract, grow, retain

We’re also a place where talented people want to be. We are the highest-rated powerhouse economy in the Global Talent Competitiveness Index, based on our success at attracting, growing and retaining talent, alongside the quality of our skills base.

University grounds

4.4 Universities and digital skills providers

Investors choose the UK because of our breadth of skills across different industry sectors. We have a world-class, highly skilled workforce, and excellent higher education institutions, including a large number of digital and creative skills providers.

We have four of the world’s top six universities.

Our 170 universities and other higher education institutions turn out the highest number of graduates in Western Europe.

Collaboration between our universities and businesses is rated as the most effective among Europe’s major economies. Over half of business R&D expenditure in the UK comes from foreign-owned businesses, who invested £8.8 billion in R&D in the UK in 2011, up by 33% year-on-year.

We’re also the location of choice for an exciting range of alternative digital and creative skills providers, like General Assembly, the New York-born global education network for entrepreneurs, which chose London for its first international campus. Or newcomers like SAE Institute, which offers courses in audio engineering, 3D animation, multimedia and digital filmmaking, and is now the largest worldwide in these fields.

UK skills at a glance:

- the highest proportion of adults with tertiary education in Western Europe

- top rated for growing, retaining and attracting talent among the powerhouse economies

- half of Europe’s graduates who are willing to relocate to find work would choose the UK

4.5 Apprenticeships

One of the ways that we develop skills is through apprenticeships, and in the UK there is government support available for this. Small businesses can receive a £1,500 grant for taking on apprentices, government will contribute toward the cost of the training, and further funding is available to support apprenticeships that involve the development of high-level technical skills.

Our Trailblazer Apprenticeship scheme for the digital industries, meanwhile, enables companies to write their own Standards – descriptions of what an apprentice should be able to do by the end of their apprenticeship – ensuring that apprentices develop the skills that are needed in your business. From April 2016, employers will also be exempt from paying employer National Insurance contributions for apprentices under the age of 25, up to the upper earnings limit.

4.6 New degrees

A range of new government and industry-backed digital courses are also now available, to provide the skills for a wide range of digital careers. Degree Apprenticeships allow young people to complete a full university degree at the same time as having a job. E-skills UK, which is the Sector Skills Council for Business and Information Technology, is also working on behalf of employers, offering degree courses that are relevant to the digital economy. Their IT Management for Business degree, for example, has a 100% employment rate at graduation.

4.7 Digital Business Academy

Digital Business Academy is the first government-supported online platform anywhere in the world to provide digital and business skills and opportunities, for free, to anyone aspiring to start, grow or join a digital business. The Academy, which was developed by Tech City UK, is open to all UK residents, and provides access to online courses from some of the world’s leading educational institutions, such as Cambridge University’s Judge Business School and University College London, as well as opportunities such as internships and start-up support.

Digital student

4.8 Start ’em young

Coding is now included in the national curriculum, which is taught in state-funded schools throughout the UK.

4.9 Tech Partnership

Backed with £18 million of government money, the new Tech Partnership is a network of employers who aim to inspire young people to pursue technology careers, and give them the skills needed in the digital economy. With founding members including Cisco, HP and IBM, the Tech Partnership will help support school coding clubs, and provide careers advice, online courses, and industry-accredited apprenticeships and degrees.

The UK is rich in talent, both homegrown and international. British universities are among the best in the world, particularly regarding computer science and artificial intelligence, and London attracts global leaders in tech. SwiftKey’s team speaks 30+ languages between them and we’re thrilled they’ve chosen to invest their skills in the UK. We have seen a particularly strong trend across Europe as young and talented people head to London to join the growing momentum in the London tech ecosystem.

Richard Gibson, CFO, SwiftKey

5. Live UK

Culturally diverse, we’re both an ancient country with a rich heritage, and the epicentre of modernity. We offer endless leisure opportunities and a great working culture and lifestyle.

City garden

5.1 Best of British

The UK is more than just a great place for business. Culturally diverse, we’re both an ancient country with a rich heritage and the epicentre of modernity, with endless leisure opportunities, progressive ideas and cool hang-outs. We have something for everyone, meaning that this is a place that your employees will want to be.

Healthcare

The National Health Service (NHS) is the world’s largest publicly funded health service, and offers free medical treatment to all UK residents.

Commuting

The UK is quite a compact country, but with an amazing variety of options. You can choose to live in or around cities, or in smaller towns or villages in the countryside within easy commuting reach of larger settlements, all well served by public transport.

Education

We have some of the best schools in the world, including international schools that cater for specific nationalities. There are also over a hundred universities in the UK, including some of the best in the world (Oxford, Cambridge, Imperial, University College London, the London School of Economics…). We also have world-class business schools, including London Business School, the Saïd Business School at Oxford University, the Judge Business School at the University of Cambridge, and Cranfield School of Management.

And there are a growing number of non-traditional providers of vocational education, with a particular focus on the technology and creative sectors.

Culture and sports

Whether you prefer theatre or music, comedy, fashion, or fine dining, we can give you the cream of the crop. Sports too – we invented a fair few of them (from tennis to golf), and we love to watch and take part. From Wimbledon to Shakespeare’s Globe to the Glastonbury Festival, our cultural life is second to none.

The expat experience

Most UK cities have vibrant expat communities, including large numbers of people from the US. Apart from the free healthcare, the culture and the countryside, many American expats in the UK say that the traditional British pub is one of our main gifts to the world.

London calling

The UK is about much more than just our biggest city. But London is the business capital of Europe, and the continent’s epicentre in digital technology. It has also been ranked the most appealing city in the world to move to for foreign workers according to the Boston Consulting Group.

London is like all the great cities of the US rolled into one. Like San Francisco, it’s buzzing with entrepreneurs. Like New York, it has financial services and thriving art, fashion and media scenes. Like LA, it has creative industries. Like Chicago and New York, it has a vibrant advertising world. And technology is playing an increasing role in all of these sectors.

London is where you’ll meet some of the most creative people in Europe, and where the person with the talent and experience that you need is often just a Tube ride away.

East London graffiti

Investment

London is home to a buzzing investment community. In 2014, London-based tech companies attracted a total of USD 1.4 billion in funding according to CB Insights.

As TechCrunch put it:

London’s Tech City startups are a 20 minute Tube ride away from London’s equivalent of the Valley’s ‘Sand Hill Road’, an area populated by VCs. Mayfair, St James and Victoria play host to Index Ventures, Accel Partners, DFJ Esprit and Balderton capital, all major investors in UK and European tech startups, just to name a few. At the same time, smaller funds such as Passion Capital, Octopus Ventures and Techstars London have created a ‘bridge’ cluster in Farringdon between the East and West of London.

Going public

The City is a very good place to get your company listed, as it allows you to tap into one of the deepest pools of international equity assets in the world.

Look East

Tech City East London, in particular, is one of the hottest locations in the tech world right now. It is a melting pot of digital entrepreneurs, creative visionaries, accelerators and co-working spaces, working with local and global investors, companies big and small, digital skills providers and government organisations, to create a world-class connected digital destination.

London has a thriving tech hub, with a wealth of different startups growing across the city. The importance of digital to the economy has been evidenced by the number and quality of students applying to and graduating from our programmes. As a global business centre, London has a magnetism that’s unmatched anywhere else in the world. With its heritage in finance, fashion, advertising and now digital, we’ve attracted students from across the UK, Europe, and the Middle East, all looking for pathways into London’s digital ecosystem.

Jake Schwartz, Co-founder and CEO, General Assembly

6. Our tech nation

London is the digital capital of Europe, but we’re not just London. Rich tech capabilities can be found across the UK, in cities like Edinburgh, Cambridge, Belfast, Bristol and Bath, Manchester and Newcastle.

Digital mind illustration

6.1 A UK-wide ecosystem

Over the years, what was a success story in a few localised clusters has become a nationwide explosion, meaning that there is a strong ecosystem for digital businesses up and down the country. From seaside towns to major industrial cities, clusters of digital excellence have developed across the UK. Each has its own particular DNA, which is often down to local factors such as the presence of top universities in the area, or historic strengths in particular sectors of the economy. And what this translates into is competitive advantage for businesses in these sectors.

6.2 The UK digital landscape in numbers

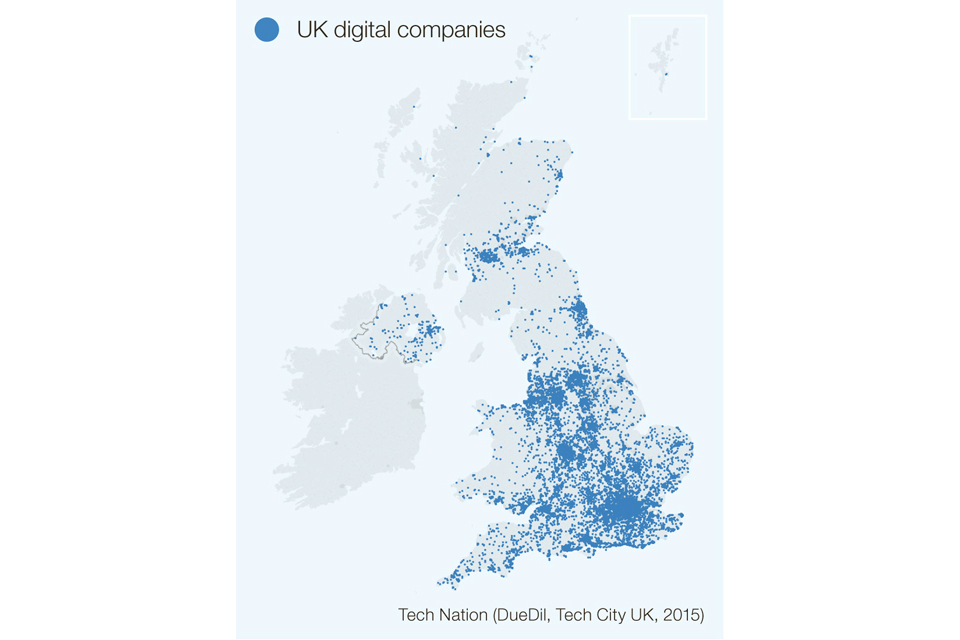

Tech City UK’s ‘Tech Nation’ report shows that 56% of UK-based digital technology companies have seen their revenue rise in the last year, and 90% expect it to grow next year.

Currently, there are more than 1.46 million digital jobs in the UK.

Tech in the UK doesn’t just mean London – 74% of our digital companies are located outside of the capital.

Two-thirds of UK digital companies describe themselves as being part of a cluster.

77% of digital businesses say that clusters provide a valuable network, over half say that being in a cluster helps attract talent, and a third says that it helps them to gain access to funding.

6.3 Some hot clusters

Digital map

Here are just some examples of areas in the UK that are hot for digital businesses. And just a taste of what makes them special, and where their strengths lie:

Birmingham

Known in Victorian times as the ‘workshop of the world’ because of its manufacturing strengths, Birmingham’s technology cluster has grown up around the ‘Silicon Canal.’ A quarter of the UK’s workforce in games development is now based here.

Bournemouth

On England’s south coast, Bournemouth is one of the UK’s fastest-growing tech clusters, with the number of its digital technology businesses more than doubling between 2013 and 2014. Its digital advertising and marketing agencies lead the way.

Brighton

A seaside town, trendy Brighton has over three times the national average of digital technology companies, giving it the highest density of digital businesses in the UK. ‘Silicon Beach’ plays host to a wide range of creative industry companies, including games developers and marketing and media companies.

Bristol and Bath

The Bristol and Bath cluster in the West of England has been described by McKinsey as ‘globally significant.’ Companies in Bristol and Bath have a long history in electronics, and the production of silicon chips in particular.

Home to the SETsquared Partnership – a collaboration between the universities of Bristol, Bath, Exeter, Southampton and Surrey, it’s one of the world’s leading incubators and has raised over £1 billion in investment for tech companies.

Join a cluster

The UK’s burgeoning clusters give you the chance to work side by side with businesses from the same industry sector, or complementary industry sectors. By coming together to form centres of excellence and innovation, you have access to a pool of expertise on your doorsteps, and valuable opportunities for collaboration.

Cambridge

The famous university town of Cambridge is one of the UK’s longest established technology hubs. Its strengths include wireless communications, electronics and components, biotechnology, engineering and medical devices.

Cambridge has been responsible for no fewer than fourteen USD 1 billion technology businesses in the past 15 years (including Aveva, Abcam and CSR), with two reaching USD 10-20 billion (Autonomy and ARM).

Edinburgh

The capital of Scotland, Edinburgh’s financial sector and world-class university courses in technology have given it particular strengths in Fintech. ‘Silicon Glen’ is also known for software development, artificial intelligence and health tech.

Greater Manchester

£3.5 billion has been invested to support Manchester’s digital technology infrastructure.

Greater Manchester’s longstanding media industry has now gone digital, helped by a strong research base and growing talent pool provided by the area’s five universities.

Established tech hotbeds include Manchester Science Park, Northern Quarter, SpacePortX, the Sharp Project, The Landing, and Media City – Europe’s first purpose-built business hub for creative and digital businesses, which hosts the BBC and ITV, amongst others.

North East

The cities of Newcastle and Sunderland form the core of this cluster, which has a strong reputation for IT-based software engineering and back-office IT support businesses, including FTSE 100 company Sage. Five universities supply local tech talent, including Newcastle University with its £2 million Cloud Computing Centre and Centre for Doctoral Training in Cloud Computing for Big Data with 50 PhD students at a time.

Northern Ireland

Northern Ireland’s digital technology cluster is concentrated in the cities of Belfast and Derry/Londonderry. The multi-million pound regeneration of Belfast’s former harbour, now the Titanic Quarter, has included the development of the Northern Ireland Science Park (NISP), where digital businesses have particular strengths in games, app, and software, development.

Oxford

With its world-famous university, the digital cluster based around Oxford has particular strengths in health tech and edtech.

Success stories from the area include the high-profile acquisitions of Circassia and NaturalMotion

Sheffield and Leeds

Sheffield is known for advanced manufacturing, and for back-office professional services.

Strengths of Sheffield’s digital technology cluster include telecommunications, artificial intelligence and machine-to-machine communications.

Sheffield is the UK home of WANdisco, which accounted for one of the biggest flotations of the last three years.

Leeds has a core specialism in data analytics and management, which underpins strengths across health analytics, and data science. As the second largest centre for financial services in the UK it has a growing Fintech sector.

South Wales

South Wales is emerging as a digital technology hub, focused on Swansea and the Welsh capital, Cardiff. The cluster has particular strengths in health tech, data management and analytics, with companies benefitting from Wales’s status as a life sciences hub.

Cardiff also has the second highest percentage of people employed in the creative industries in the UK – Doctor Who and Sherlock, for example, are filmed in Cardiff’s state-of-the-art BBC Studios.

Case study: WANdisco

“When we were looking to expand out of Silicon Valley we chose Sheffield, not London, as our UK operational hub. Whilst this has certainly raised some eyebrows, I see our success as a vindication of the talent that can be found across the country.

I’m a firm believer that to build a business you need look for the right people – ideas, talent and dedication are the vehicle for growth. In Sheffield, we found these in abundance, but our decision to have our UK headquarters in Yorkshire came about almost by chance.

Initially, we planned to hire about 10 people, but we were blown away by the quality of applicants.

When we started WANdisco, almost everyone told me there was no chance of developing major software outside London or California. There’s no denying that both are fantastic areas to start and grow a business, but there are so many other places with great potential for startups and growing businesses.”

David Richards, President, CEO and Co-founder, WANdisco

WANdisco (Wide Area Network Distributed Computing) was co-founded in 2005 by David Richards, Jim Campigli and Dr Yeturu Aahlad, and has dual headquarters in Silicon Valley and Sheffield, UK.

On 1 June 2012 the company had a highly successful IPO on the London Stock Exchange, raising over USD 24 million.

6.4 Some of our strengths

Within the technology sector, there are things that we do especially well in the UK. Here are just some of them:

Fintech

The UK is where tech and money meet. According to Accenture, together with Ireland, we are the fastest growing region for Fintech investment. Deal volumes here have been growing at 74% a year since 2008, compared with 27% globally and 13% in Silicon Valley. During the same period, the value of Fintech investment increased nearly eightfold, to USD 265 million in 2013 – a rate of 51% a year, nearly twice the global average (26%), and more than twice that of Silicon Valley (23%).

London is a world-leading centre for financial services, and the UK as a whole has excellent financial services infrastructure – with 88% of Fintech businesses reporting revenue growth in the last year. UK Fintech companies have strong expertise in developing and integrating payments infrastructure, as well as in cyber security.

Software and app development

Software and app development sits at the heart of the UK’s digital economy. Software development companies have seen a rapid growth in turnover, with 68% of companies experiencing revenue growth last year.

With app development specifically, the UK market is predicted to increase from £4 billion in 2014 to as much as £31 billion by 2025. Over a third of the revenues from app development that are generated in the EU are generated in the UK.

Advertising, marketing, media and entertainment

Building on the UK’s historic strengths as a creative nation, these sectors make up a large part of our digital economy. There are thriving communities of digital businesses in advertising and marketing, and media and entertainment across the UK. London is both a global entertainment hub and an advertising mecca, and there are particular concentrations of creative businesses in Brighton, publishing in Oxford, and marketing in Bournemouth.

Games development

The UK has a strong competitive advantage in the games industry dating back to the 1980s, with clusters across the country including Brighton, Liverpool, Edinburgh, Aberdeen and Sunderland. The UK video games development sector is the largest in Europe. UK-made games, such as Grand Theft Auto (developed by Edinburgh-based studio Rockstar North), are some of the biggest grossing in the world. UK consumers are early adopters of gaming technologies, and make up a great test bed to trial new games.

There are 34 million gamers in the UK across all platforms: you won’t find more fans of Lara Croft anywhere.

Wireless and networking

From creators of smartphone components to wi-fi networks, switches, and routers, the many UK-based companies in the wireless and networking sector help to carry the content and services generated in other parts of our digital economy. We pioneered the first generations of mobile phones, and built world-leading companies such as Vodafone and ARM. Cambridge has particular strengths in mobile and devices. Our universities are truly world-beating in terms of their wireless research, such as the dedicated 5G research centre based at Surrey University.

7. We’re connected

Whether it’s superfast broadband across the UK or travel across the world, we get your business moving. UK airports serve more destinations on a daily basis than any other country in Europe.

Building structure

7.1 Getting connected

As a fast-moving tech business with ambitions, we understand your need for speed. And the UK has the digital and transport infrastructure to give it to you.

Digital UK

We already have the best superfast broadband service of any major European economy, and we’re continuously improving it.

Digital infrastructure at a glance:

- highest coverage of superfast broadband amongst Europe’s five leading economies

- more ‘network-ready’ than any other major European economy

- the UK hosts the world’s first test bed for 5G technologies and services

- open and competitive broadband and telecoms markets mean lower prices and more choice

Our commitment to maintaining our status as a leading digital nation means that we’re aiming to have 95% of UK homes and businesses with access to superfast broadband by 2017. Coverage has already increased from around 60% at the end of 2011 to 73% by mid-2013.

Planes, trains and automobiles

Oxford Circus

We’re a small country with a large, integrated transport system: the perfect combination to help you move goods and people around quickly. With over 70 airports, 40 major ports, excellent rail links and toll-free motorways; getting to, from and around the UK is both simple and affordable.

The UK aviation sector has more seats available, and serves more destinations on a daily basis, than any other European country. We have the largest air transport system in Europe, the most improved rail network in the EU, and a seven-year investment programme to upgrade our roads.

London is a better connected city than Paris, Frankfurt and Amsterdam. Heathrow alone had over twice as many direct scheduled flights in 2013 to New York, Chicago, Los Angeles, Washington, Boston, Toronto, Dubai, Hong Kong, Mumbai, Delhi and Johannesburg.

And three of the busiest 25 private business airports in Europe are in London, with more private flights to and from our capital than any other European city.

We also have major international airports outside of the capital. From Manchester, for example, you can fly to eight US cities.

UK transport at a glance:

- the most improved rail network in the EU

- airports serve more destinations than any other European country

- London ranked top globally for the efficiency, reliability and safety of its transport network

8. Ins and Outs

We will help you bring in key personnel through our range of specialist visas (including one for exceptional talent in tech) and fast processing times.

City Airport

8.1 Opening doors

As a tech business, your success can depend on the exceptional skills of a handful of mega-talented individuals. But what if that superstar programmer or designer happens to live in another country?

We offer a number of specialist visas, to help speed up the process of bringing in the talent.

Our Exceptional Talent Visa, for example, offers a fast-track visa route for applications from highly skilled tech workers who are living overseas. Tech City UK became an official adviser on applications for the Tier 1 Visa, enabling it to make recommendations to the Home Office to help it approve visa applications from talented overseas tech workers.

Alongside the Exceptional Talent Visa, the UK government offers other types of Tier 1 Visas, including:

- General Visa Switch – to extend a Tier 1 General Visa if you have leave to remain or you’re on the Highly Skilled Migrant Programme

- Entrepreneur Visa – if you want to set up or run a business in the UK and have more than £50,000 worth of investment funds available

- Graduate Entrepreneur Visa – if you’ve been endorsed for a business idea

- Investor Visa – if you want to invest £2 million or more in the UK

To improve the application process still further for tech businesses, we have expanded our global network of visa application centres: we now have over 200 around the world, including one in the British Consulate in New York.

UK visas at a glance:

- 98% of skilled worker visa requests are granted, and the application takes only 30 minutes

- the average processing time for a visit visa is just seven days

- 96% of applications for visas other than for permanent residence (‘non-settlement visas’) are processed within 15 days

9. Unique spaces

We offer interesting places to live and work, from state of the art new development to the attraction of repurposed buildings full of fascinating history.

Digital cafe

9.1 Bricks and mortar

Finding the right physical environment for your business is an important consideration when you’re thinking of setting up an overseas operation. And there’s also the question of finding the right housing for you and your employees. An Englishman’s home is his castle (and Wales, Scotland and Northern Ireland aren’t short of them either) – we can’t promise you that, but we can offer you some of the most attractive places to live and work in Europe.

9.2 How the UK property market works

We have one of the most transparent property markets in the world, so there are always options for you if you’re a growing company. All major cities and towns have serviced office options, and in recent years co-working has expanded dramatically, including throughout the UK’s tech clusters. We also have over 50 accelerators and incubators across the UK, including international names like Google Campus and TechStars. These can help you grow your teams here, and plug into your local tech communities.

As you establish a footprint here, you can take out a license or lease on a property. Depending on the size, expect a lease length of 5 years, with optional breaks at the midway point.

We recommend that you use a tenant broker when searching for an office, as they can identify suitable options (saving you time) and negotiate the best rate and incentives for you. Typically, the cost of an office includes rent, rates and service charge. You’ll likely be asked for a security deposit and a number of months’ rent in advance on a leased space, where serviced or co-working spaces charge a monthly desk rate. This can be a more expensive option, but it gives you flexibility.

Of course, your staff will need to live somewhere too. It’s easy to find residential accommodation on an assured short-hold tenancy of 6 months across all of the UK. Again, they’ll have to pay rent and local government tax, and usually utility bills (gas, water, electricity, telephone/broadband). Mortgages are available in the UK, and purchasing property is a straightforward process. A typical mortgage length is 25 years, with deposits at 10% of the purchase price.

10. We’ll look after you

We offer a complete concierge service, which simplifies and accelerates the process of building your international HQ in the UK, and brings together all the things you need in one place.

10.1 Call us

Help is at hand

Thinking about your international expansion? Deciding on your base to grow from? We have a network of UK specialists, in your time zone, ready to meet with you.

10.2 One point of contact

Your relationship manager

We can provide you with a dedicated relationship manager, who will work with you to understand your business ambitions, connect you to our specialist support ecosystem, and provide impartial advice, helping you get to market faster. We’ll be with you every step of the way.

10.3 How we can help

Finding the perfect fit for you

You’ve now seen what we can offer you – from talent, tax incentives, and vibrant home market, to our great infrastructure, unique spaces, and pro-business regulatory environment.

As you take the important decision to set up your international HQ, we are also here to help you assess all your options.

Making connections

We can connect your top team with our network of professional advisors. Whether it’s visas, recruitment, tax advice, working with research centres, property sourcing, contacting policy specialists – or getting you to the centre of the UK’s digital scene – your relationship manager will plug you in.

Working it out

We can help you model the comparative costs and benefits of your operations, both internationally and across UK tech clusters.

Come visit

We’d love to show you around. Come and see the UK for yourself, and meet some of the people who can help your business expand, as well as other businesses who have chosen to base their HQ in the UK. We can take you to see our digital hotspots and clusters, as well as the many buzzy accelerators, incubators and low-cost collaboration hubs springing up across the UK.

We’ll go as fast as you can

We will help you navigate the process of setting-up here, and fast-track you where possible. Talk to us about your businesses needs and we’ll use our network to help you.

Some of the things we can help with:

- priority border control at UK airports

- accelerated access to UK bank accounts

- visa applications within three to five days

- company incorporation in a day

10.4 One of us

Continuing support

Once you have committed to the UK, we’ll treat you as one of our own. We’ll keep in touch with you, and we’ll be there to help you grow in and from your UK base.

As your business succeeds, we will help you to make deeper connections. We can be your first port of call for any ideas that you may like to bounce around, and we’re here to help with your expansion plans.

Export from the UK

You’ll benefit from a full suite of services to help grow your business into international markets, just as we support our home-grown firms.

We have a dedicated team of trade experts who can help you enter over 100 markets from your new UK base.

11. Working in partnership

HQ-UK is brought to you through ‘Technology is GREAT’, successfully promoting UK tech capability across the world – and the UK as a location of choice for an international hub.

Lead partners

The Department of Business, Innovation and Skills (BIS)

The Department for Business, Innovation & Skills (BIS) is the department for economic growth. The department invests in skills and education to promote trade, boost innovation and help people to start and grow a business. BIS also protects consumers and reduces the impact of regulation.

UK Trade and Investment (UKTI)

UKTI is the government department that helps overseas companies bring their high-quality investment to the UK’s dynamic economy; we help global technology businesses that are thinking of establishing an international headquarters in the UK to innovate and grow. UKTI has investment teams in over 30 countries, including nine cities in the US, who can help you to plug into the UK.

The Deaprtment for Culture, Media and Sport

The Department for Culture, Media and Sport is here to help make Britain the world’s most creative and exciting place to live, visit and do business. We protect and promote our cultural and artistic heritage and help businesses and communities to grow by investing in innovation and highlighting Britain as a fantastic place to visit.

Tech City UK

Launched by Prime Minister David Cameron in 2010, Tech City UK supports entrepreneurship in London and across different tech clusters throughout the UK. A publicly-funded organisation with a startup mentality, our aim is to accelerate the growth of digital businesses. We achieve this by connecting, informing and advancing the UK’s digital ecosystem.

With thanks to

Tech City UK Cluster Alliance

EY

MTM London

CrunchBase

DueDil

Seven Hills

6s

AngelList

London & Partners

Cushman & Wakefield

Fried Frank

Central Working

12. Contact UKTI

We’ll look after you… and guide you through the process of setting up your HQ in the UK.

We offer impartial support and advice, we will work to help you to benefit from the outstanding commercial opportunities in the UK, and we will help you to grow your business worldwide.

To find out more, please contact your local UKTI client relationship manager:

Atlanta

Ian Stewart

T +1 404 954 7700

Boston

Kirsten Chambers

T +1 617 245 4500

Chicago

Rob McNeill

T +1 312 970 3800

Houston

Haileigh Meyers

T +1 713 659 6270

Los Angeles

James Cummings

T +1 310 789 0031

Miami

Mauritz Plenby

T +1 305 400 6400

New York

Patricia Young

T +1 212 745 0200

San Francisco

Samantha Evans

T +1 415 617 1300

Washington

Zachary Zimmerman

T +1 202 588 6500