Accountability report

Published 18 July 2025

Applies to England and Wales

Corporate governance report

Directors’ report

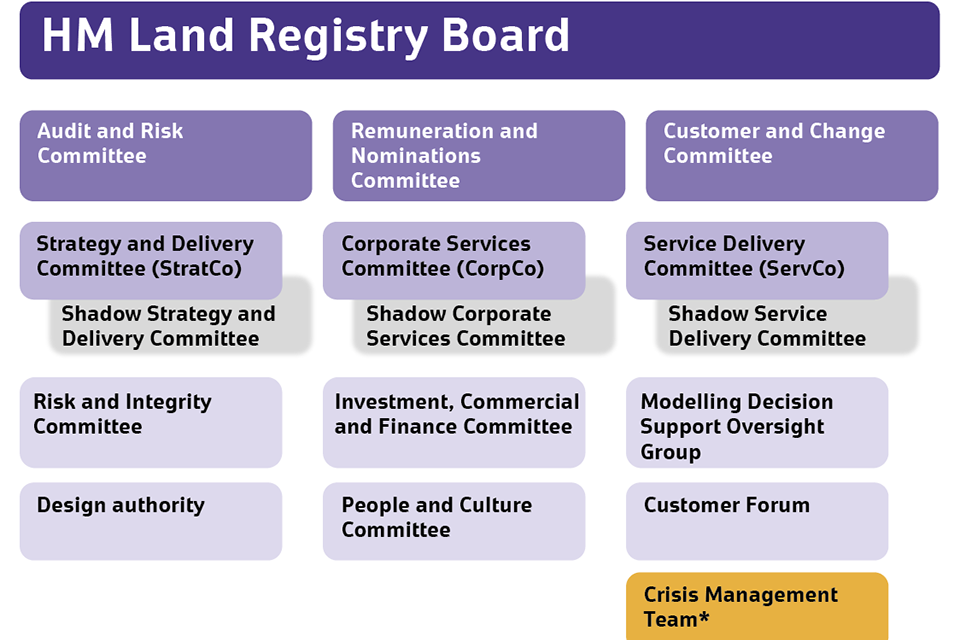

This section sets out the key membership of our main governance boards and committees and explains their responsibilities.

Our governance structure

HM Land Registry has a two-layered system of governance:

-

HM Land Registry Board (composed of non- executive board members and executive directors). Supported by:

- Audit and Risk Committee

- Remuneration and Nominations Committee

- Change Committee

- Customer Care Review Committee− HM Land Registry Senior Executive Committees

- Corporate Services Senior Executive Committee

- Service Delivery Senior Executive Committee

- Strategy and Delivery Senior Executive Committee

This structure enables Non-executive Board Members to provide appropriate challenge to the Executive Team, while enabling the Executive Team to make effective decisions on the day-to-day running of HM Land Registry.

In October 2024 HM Land Registry introduced Shadow Executive Committees to improve governance transparency across the organisation.

- The Crisis Management Team is HM Land Registry’s business continuity top tier response group, meeting as required.

HM Land Registry Board

Neil Sachdev, Non-executive Chair

Neil joined the Board in 2022. He is also currently Chair of the East West Railway Company (EWR Co), overseeing the delivery of a new direct rail link between Oxford and Cambridge, as well as Chairman of the Defence Infrastructure Organisation Board for the Ministry of Defence. He is also a Non-executive Director of Network Rail Property Limited. Neil has also previously held a variety of senior leadership positions in the energy, property and retail sectors.

Mike Harlow, Deputy Chief Executive and Director of Customer and Strategy

Mike was a member of the Board from 2018 until April 2025. He graduated from Imperial College in mechanical engineering before converting to law. He then worked as a solicitor in London for 15 years, acting for commercial property clients, and 11 years at English Heritage as its Legal Director and Corporate Secretary. He gained board-level experience of organisational change and heritage law and policy reform.

Simon Hayes, Chief Executive and Chief Land Registrar

Simon joined HM Land Registry in 2019. Previously Simon held several senior positions at the Home Office, including the UK Border Agency’s first Regional Director for the Americas, the UK Visas and Immigration (UKVI)’s International Director and finally the Director of Visas & Citizenship at UKVI. Simon’s responsibilities included setting up the EU Settlement Scheme for European citizens residing in the UK.

Ann Henshaw, Non-executive Board Member, Chair of the Remuneration and Nominations Committee and Chair of the Customer Care Committee

Ann joined the Board in 2021. She was formerly HR Director at British Land. Ann has also worked extensively in human resources and led a transformation and consulting business for over 20 years. Her experience spans multiple sectors, both in the UK and internationally. Other previous roles include Group HR Director at Clear Channel International and HR Director at EDF Energy. Ann currently serves as Chair of the Basingstoke Symphony Orchestra.

Iain Banfield, Chief Financial Officer

Iain joined in February 2019. Prior to this he spent two and a half years in the Department for International Trade, first as Deputy Director for Strategic Finance and then acting Finance Director. Previously Iain has been the Finance Director for UK Trade & Investment and held roles in the Shareholder Executive and the Department for Business, Innovation and Skills.

Jonathan Ingram, Non-executive Board Member, UKGI (nominated representative of the MHCLG Secretary of State)

Jonathan who joined the Board in 2023, is an Executive Director at UK Government Investments. Jonathan has more than 20 years’ experience of providing restructuring and insolvency advice to key stakeholders in complex distressed situations. A lawyer by background, Jonathan has worked in both national and international law firms.

Kirsty Cooper, Non-executive Board Member and Senior Independent Board Member

Kirsty, who joined the Board in 2018, was General Counsel and Company Secretary at Aviva, a member of the Aviva Leadership Team and headed the Office of the Chair. Kirsty led their legal and secretarial function and was responsible for the provision of legal services to the Group. Kirsty is also a member of the Board of Trustees of the Royal Opera House. She served as a member of the Dormant Assets Commission and was appointed the Insurance and Pensions Industry Champion for dormant assets in 2018.

Hena Jalil, Non-executive Board Member (since February 2025)

Hena joined the Board in 2025. is a technologist and currently the Chief Digital & Information Officer at BT Business. Previous to this, she has held numerous Chief Information Officer roles at BT Group and Openreach. In her current role she is accountable for digital transformation, technology strategy and execution for driving improved customer experiences and business growth. Prior to that she has worked within Energy and Retail industries through consultancies such as Accenture and LogicaCMG.

Elliot Jordan, Non-executive Board Member and Chair of Audit and Risk Committee

Elliot joined the Board in 2019. He is the CFO for Northern Data Group and has over 20 years of finance experience in consumer- facing businesses including J Sainsbury plc, ASOS plc and Farfetch, where he was Chief Financial Officer and led the company’s Initial Public Offering on the New York Stock Exchange in 2018. Previously, Elliot worked in risk and financial control roles in finance and banking in London, and provided audit and assurance services with KPMG in Auckland, New Zealand.

Enda Ridge, Non-executive Board Member (since February 2025)

Enda joined the Board in 2025. He is Senior Staff Data Scientist for Google Commerce. He leads the EMEA Data Science team and is a member of the Commerce Merchant leadership team. Previously, Enda was Chief Data Scientist at Sainsbury’s where he created their first data science and machine learning teams and jointly led their migration to Cloud computing and Agile ways of working. Enda has published a book on running data science teams efficiently and an author of peerreviewed research.

Deborah McLaughlin, Non-executive Board Member (since February 2025)

Deborah joined the Board in 2025. Deborah serves as Chair of Ashton Mayoral Development Zone and has Non-executive Director roles at Mersey Care NHS Trust and For Housing, a registered provider. Deborah was recently part of the Best Value Inspection team of Spelthorne Council. Previously, she spent three years as a Local Government Commissioner, focusing on property and regeneration at Liverpool City Council. Deborah has held several senior executive roles, including executive director roles at Homes England, Capita and Manchester City Council.

Angela Morrison, Non-executive Board Member

Angela joined the Board in 2018. Angela is Chief Operating Officer at Cancer Research UK (CRUK) where she is responsible for Finance, HR, Technology and Corporate Services. Prior to joining CRUK Angela was Retail, Supply Chain and Technology Director at Debenhams as well as holding roles at J Sainsbury plc, Direct Line Group and ASDA Walmart.

Rommel Pereira, Non-executive Board Member (since February 2025)

Rommel joined the Board in 2025. He currently serves as a Non-executive Board Member of The National Archives and as a Non-executive Director on the board’s of Supply Chain Coordination Limited, London Ambulance Service NHS Trust and Homerton Healthcare NHS Foundation Trust. Rommel has previously held a variety of senior executive positions in the central banking, not-for-profit, financial services and business services sectors.

- Board members profiled are those that were in post at the end of the 2024-25 financial year.

The role and responsibilities of the HM Land Registry Board (the LRB/the Board) are set out in the Board’s terms of reference and published Framework. Terms of references are reviewed annually. The Framework is reviewed every three to four years. An updated Framework will be published once confirmed by HM Treasury.

The purpose of the Board is to support, constructively challenge, hold to account and provide advice to the Chief Executive and Chief Land Registrar (CE&CLR) and their Executive Team. The LRB supervises the development and delivery of the agreed business strategy and ensures appropriate governance of the activities of HM Land Registry. The Board support the CE&CLR to drive continuous improvement within HM Land Registry that is sustainable in the long term and generates value for all stakeholders including customers, suppliers and colleagues.

The LRB is supported by its Audit and Risk Committee, Remuneration and Nominations Committee and Change Committee. In 2024 the Board set up a short-term Customer Care Review Committee.

The LRB contains a mix of executive directors and non- executive board members. The non-executive board members of LRB are highly skilled, with appropriate experience in relevant fields to support and challenge the Executive Board.

The non-executive board members are independent of management. All board members are required to sign an annual statement recording any potential conflict of interests and declare any new interests in the interim.

A central ‘Register of Interests’ record is retained and is shared annually with the Audit and Risk Committee. See note 17 to the accounts on page 110 for related party disclosures.

HM Land Registry is required to carry out a board effectiveness review on an annual basis with a review by external partners every three years. The last external review was concluded in July 2022 by Deloitte. Board members completed a Board effectiveness self-evaluation in June 2023 where they were invited to reflect on results and identify any barriers to Board effectiveness as well as considering opportunities for improvement. Results discussed at a strategy session in July with actions taken forward.

| LRB membership | |

|---|---|

| Non-executive | |

| Neil Sachdev | Non-executive Chair |

| Jonathan Ingram | Non-executive Board Member UKGI (nominated representative of the MHCLG Secretary of State) |

| Kirsty Cooper | Non-executive Board Member and Senior Independent Board Member |

| Ann Henshaw | Non-executive Board Member and Chair of Remuneration and Nominations Committee |

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

| Hena Jalil | Non-executive Board Member (from February 2025) |

| Deborah McLaughlin | Non-executive Board Member (from February 2025) |

| Angela Morrison | Non-executive Board Member and interim Chair of Change Committee (from November 2024) |

| Jeremy Pee | Non-executive Board Member and Chair of Change Committee (until October 2024) |

| Rommel Pereira | Non-executive Board Member (from February 2025) |

| Enda Ridge | Non-executive Board Member (from February 2025) |

| Executive | |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Mike Harlow | Deputy Chief Executive and Director of Customer and Strategy |

| Iain Banfield | Chief Financial Officer |

A year in focus

During 2023-24 matters covered by the LRB included:

- business planning and Spending Review submissions;

- refreshing the Strategy 2022+;

- conducting an independent review of the customer handling procedures and customer experiences;

- operational improvement and performance;

- new HM Land Registry fee order;

- transformation progress, prioritisation and planning, including business design and delivery vision;

- consideration of HM Land Registry’s risk appetite and security landscape;

- Environment, Social and Governance standards;

- strategic workforce planning, leadership capability and talent development within HM Land Registry;

- culture, ways of working and colleague engagement; and

- internal governance arrangements.

Board meetings

The LRB met 11 times in 2024-25 with a mixture of in-person, fully virtual and hybrid meetings. In-person meetings mostly took place at HM Land Registry local office locations and one meeting also took place at the Ministry of Housing, Communities and Local Government (MHCLG). Meetings in local offices also include opportunities for Board members to engage with colleagues outside of formal meeting time.

Engaging with stakeholders

Engaging with stakeholders is a key part of ensuring LRB members are well informed.

- The Chair and Chief Executive and Chief Land Registrar engage with Ministers at our sponsors in MHCLG.

- Quarterly meetings took place between the Chair, Chief Executive and Chief Land Registrar and Chief Financial Officer with UK Government Investments (UKGI) and the MHCLG sponsor team, including informal meetings in between, to discuss governance, financial performance and other relevant matters as set out in the Framework.

- Members of the Board engaged with their counterparts at other government departments including HM Treasury as required.

- Members of the Board regularly met market stakeholders who are members of the Digital Property Market Steering Group, Land Registry Advisory Council and Industry Forum.

Committees of the HM Land Registry Board

Audit and Risk Committee

The Audit and Risk Committee met five times in 2024-25. The Audit and Risk Committee supports the LRB and the Chief Executive and Chief Land Registrar by monitoring and reviewing the effectiveness of HM Land Registry’s risk, assurance and audit activity. The Audit and Risk Committee updates the Board on progress of the committee’s work and escalates any issues that require the Board’s attention.

At every meeting, the Audit and Risk Committee sees an overall risk report incorporating the risk register and detailed reporting on issues such as cyber security. At each meeting the committee also receives a more detailed risk management report of principal risks, so all the principal risks are reviewed over the course of the year.

During 2024-25 matters covered by the Audit and Risk Committee included:

-

oversight and input into the development of the risk and assurance framework, maturity plans, risk taxonomy and the risk appetite statement;

-

monitoring and challenge of HM Land Registry’s principal risks;

-

oversight and input into the development and monitoring of a three-year internal audit plan, refreshed annually;

-

oversight of and challenge to internal governance structures;

-

oversight of and challenge to data and register quality;

-

oversight of and challenge to the indemnity fund provision;

-

oversight of and challenge to HM Land Registry’s management of customer-related risks

-

monitoring and challenging fraud controls and the counter fraud strategy;

-

consideration and challenge of key financial judgements;

-

review of the Annual Report and Accounts and Register of Interests; and

-

review of the Independent Complaints Reviewer’s Annual Report for HM Land Registry, and HM Land Registry’s response to the report.

| Audit and Risk Committee membership | |

|---|---|

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

| Jonathan Ingram | Non-executive Board Member, UK Government Investments (nominated representative of the MHCLG Secretary of State) |

| Angela Morrison | Non-executive Board Member |

| Rommel Pereira (since February 2025) | Non-executive Board Member |

| Enda Ridge (since February 2025) | Non-executive Board Member |

| Regular attendees | |

| Iain Banfield | Chief Financial Officer |

| Emily d’Albuquerque | General Counsel, Director of Data and Register Integrity |

| Harnaik Dhillon | Head of Internal Audit |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Joanna Horrocks- Potts | Deputy Director, Risk and Assurance |

| Representative of the National Audit Office | National Audit Office |

Remuneration and Nominations Committee

The Remuneration and Nominations Committee met three times in 2024-25. The committee ensures that remuneration and nomination arrangements support HM Land Registry’s aims and oversees the recruitment, retention and performance of the executive team and other Senior Civil Servants in line with Civil Service pay policies. The Remuneration and Nominations Committee provides an update to the Board after every meeting.

During 2024-25 the main matters covered by the Remuneration and Nominations Committee included:

-

organisational performance and performance of the Chief Executive and Chief Land Registrar;

-

Senior Civil Service performance and pay;

-

senior leadership structure, development and succession planning; and

-

gender and other pay gap reporting.

| Remuneration and Nominations Committee membership | |

|---|---|

| Ann Henshaw | Chair of the Remuneration and Nominations Committee and Non- executive Board Member |

| Jonathan Ingram (until March 2025) | Non-executive Board Member, UKGI (nominated representative of the MHCLG Secretary of State) |

| Kirsty Cooper | Non-executive Board member |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Simon Morris | Director of Human Resources |

| Rommel Pereira (since February 2025) | Non-executive Board Member |

Change Committee

The Change Committee met three times in 2024-25. The committee supports the Board in ensuring that the HM Land Registry’s transformation plans remain aligned to its strategic ambitions and can be delivered effectively. At the end of 2024-25 the Board agreed to refresh this Committee as a Customer and Change Committee.

In 2024-25 the Change Committee reviewed:

-

HM Land Registry’s overarching transformation programme;

-

progress on the business design and delivery roadmap;

-

HM Land Registry approaches to Artificial Intelligence;

-

strategic design and delivery; and

-

HM Land Registry’s approach to change in Service Delivery.

| Change Committee membership | |

|---|---|

| Jeremy Pee (until October 2024) | Chair of the Change Committee and Non-executive Board Member |

| Angela Morrison (Interim Chair from November 2024) | Interim Chair of the Change Committee and Non-executive Board Member |

| Iain Banfield | Chief Financial Officer |

| Mark Gray | Chief Transformation & Technology Officer |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Abi Howarth (since October 2024) | Director of Land Registration Services |

| Jonathan Ingram | Non-executive Board Member, UK Government Investments (nominated representative of the MHCLG Secretary of State) |

| Hena Jalil | Non-executive Board Member |

| Deborah McLaughlin (from February 2025) | Non-executive Board Member |

Customer Care Review Committee

The Board commissioned a Customer Care Review Committee in 2024 to conduct an independent review of customer handling procedures and customer experiences at HM Land Registry. The Customer Care Review Committee met eight times in 2024-45 and its work concluded in February 2025.

Over the course of 2024-25 the committee:

-

reviewed HM Land Registry’s governance, policies and procedures as they relate to customer handling, including complaints;

-

commissioned a review by external legal advisers of a small number of historical complaint cases;

-

commissioned a third party to undertake and analytical evaluation and audit of complaints data at HM Land Registry; and

-

prepared a report for the Board setting out its findings and making a number of recommendations for HM Land Registry to improve its customer handling and experiences.

HM Land Registry’s response to the Customer Care Review Committee’s recommendations will be monitored by the refreshed Customer and Change Committee in 2025-26.

| Customer Care Review Committee membership | |

|---|---|

| Ann Henshaw | Chair of the Committee and Non- executive Board Member |

| Ben Alexander | Non-executive Committee Member, MHCLG appointment |

| Iain Banfield | Chief Financial Officer |

| Kirsty Cooper | Non-executive Board Member |

| Emma Ellis | Deputy Director of Customer Service Delivery |

| Helen Gillett | Non-executive Committee Member |

| Abi Howarth (since October 2024) | Director of Land Registration Services |

| Jonathan Ingram | Non-executive Board Member, UK Government Investments (nominated representative of the MHCLG Secretary of State) |

| Elliot Jordan | Non-executive Committee Member |

Attendance Schedule for Members of LRB, Audit and Risk Committee, and Remuneration and Nominations Committee, Change Committee and Customer Care Review Committee

| Name | Title | Period | Board |

Committee | |||

|---|---|---|---|---|---|---|---|

| LRB | Audit | RemCo | Change | Customer | |||

| Non-executive board members |

|||||||

| Neil Sachdev | Non-executive Chair | 11/11 | |||||

| Kirsty Cooper | Non-executive Board Member and Senior Independent Board Member | 10/11 | 2/3 | 6/6 | |||

| Ann Henshaw | Non-executive Board Member, UKGI representative |

11/11 | 3/3 | 8/8 | |||

| Jonathan Ingram | Non-executive Board Member and UKGI representative Member |

11/11 | 5/5 | 3/3 | 3/3 | 6/8 | |

| Hena Jalil | Non-executive Board Member | From Feb 2025 | 2/2 | 0/0 | |||

| Elliot Jordan | Non-executive Board Member | 9/11 | 5/5 | 7/8 | |||

| Deborah McLaughlin | Non-executive Board Member | From Feb 2025 | 2/2 | 0/0 | |||

| Angela Morrison | Non-executive Board Member | 10/11 | 5/5 | 3/3 | |||

| Jeremy Pee | Non-executive Board Member | Until Oct 2024 | 6/7 | 2/2 | |||

| Rommel Pereira | Non-executive Board Member | From Feb 2025 | 2/2 | 0/1 | 0/0 | ||

| Enda Ridge | Non-executive Board Member | From Feb 2025 | 2/2 | 1/1 | |||

| Non-executive committee members | |||||||

| Ben Alexander | Non-executive Committee Member | From Sept 2024 | 5/6 | ||||

| Helen Gillet | Non-executive Committee Member | From Feb 2024 | 6/6 | ||||

| Executive directors | |||||||

| Simon Hayes | Chief Executive and Chief Land Registrar |

11/11 | 3/3 | 1/3 | |||

| Iain Banfield | Chief Financial Officer | 11/11 | 2/3 | 8/8 | |||

| Mike Harlow | Deputy Chief Executive and Deputy Chief Land Registrar |

11/11 | |||||

| Abi Howarth | Director of Land Registration Services | From Oct 2024 | 2/2 | 5/5 | |||

| Simon Morris | Director of Human Resources | 1/1 | 3/3 | ||||

| Mark Gray | Chief Transformation & Technology Officer |

3/3 | |||||

Senior Executive Committees

HM Land Registry’s internal governance structure is made up of three Senior Executive Committees (SEC):

-

Corporate Services Senior Executive Committee

-

Service Delivery Senior Executive Committee

-

Strategy and Delivery Senior Executive Committee

The Chief Executive and Chief Land Registrar Chairs all of the SECs, which each meet once a month. The SECs were comprised of executive directors and a broader Senior Executive Team (SET). The SET has continued to work with the wider ‘Leadership Group’ to develop a broader leadership team. In April 2025 the SEC membership was reset and is now comprised of the executive directors only.

The Corporate Services SEC oversees corporate services performance delivery and takes decisions on services and organisation design specific to corporate services, ensuring alignment with Business Plan and Strategy, including pay awards and pay strategy, workplace strategy, commercial strategy, human resources policies, stewardship of the Heads of Profession and Government Functions coordination, technology services and strategies, and Environment, Social and Governance planning.

The Service Delivery SEC has responsibility for overseeing and taking decisions on service performance delivery, including casework, and takes decisions on services and organisation design specific to performance and service delivery. Service Delivery SEC identifies and resolves issues affecting HM Land Registry’s ability to meet published key performance indicators.

The Strategy and Delivery SEC provides strategic direction for HM Land Registry including the long-term fees and charging strategy and strategic workforce plan. This Committee is responsible for leading and managing the delivery of HM Land Registry’s approved Business Strategy and its impact on the economy, customers and stakeholders. The committee also oversees HM Land Registry change and transformation. On a quarterly basis Strategy and Delivery SEC reviews the principal risks of the organisation. The outcomes of these discussions are then reported to and considered by the Audit and Risk Committee of the Board.

| HM Land Registry executive directors | |

|---|---|

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Iain Banfield | Chief Financial Officer |

| Emily d’Albuquerque | General Counsel, Director of Data and Register Integrity |

| Mike Harlow | Deputy Chief Executive and Deputy Chief Land Registrar, Director of Customer and Strategy |

| Abi Howarth (since October 2024) | Director of Land Registration Services |

| Simon Morris | Director of Human Resources |

| Mark Gray | Chief Transformation & Technology Officer |

Other executive governance bodies

Other formal governance bodies reporting into the SECs are the:

-

Investment, Commercial and Finance Committee;

-

People and Culture Committee;

-

Modelling Decision Support Oversight Group;

-

Customer Forum;

-

Risk and Integrity Committee; and

-

Design Authority.

The formal governance bodies meet regularly throughout the year and report back to their respective SEC after every meeting. Membership of these bodies is composed of senior leaders from across the organisation. These bodies are further supported by a number of working groups on specific items such as diversity and inclusion, health and safety, counter-fraud and security and resilience.

In addition to the SEC and other governance bodies detailed above, HM Land Registry also has a Tactical Implementation Group. This Group meets as required, at the Senior Executive Team’s direction, to plan and implement events/activities that require cross agency coordination beyond that which is readily achievable via normal management arrangements. The group was not required to meet in 2024-25.

In October 2024, HM Land Registry introduced a Shadow Committee for each of the Senior Executive Committees. The Shadow Committees were introduced as part of work to improve governance transparency and openness across the organisation. Shadow Committee members are comprised of colleagues from all grades, offices and functional areas across HM Land Registry. The Shadow Committees review the same papers that are considered at the SECs. Shadow Committee Chairs attend SEC meetings and represent their committee, raising concerns and/ or providing support in relation to items discussed.

Security incidents

HM Land Registry’s Security Team provides oversight, guidance, and assurance on security-related matters across the organisation. The team’s responsibilities centre on establishing policy frameworks, setting expectations, monitoring compliance, and reporting on the overall security landscape in alignment with the Government Functional Standard GovS 007 – Security.

Throughout the reporting period, the Security Team has continued to support and challenge the effectiveness of security controls by delivering independent assurance to senior governance forums. Regular reports have been presented to both the Risk and Integrity Committee and the Audit and Risk Committee, offering insight into emerging threats, control maturity, and areas requiring further attention. In addition, the team contributed to the completion of key government-mandated assessments, including the Departmental Security Health Check and the annual GovAssure review, while maintaining our certification to ISO/IEC 27001:2022.

Physical security incident data for the year reflects a total of 22 reported events. All were assessed as low impact under the updated government classification model. These incidents included examples of unauthorised access, attempted break-ins, low-level criminal damage, and behavioural issues. While individually minor, the cumulative learning from these events has informed continued dialogue with operational teams to strengthen local response and prevention measures. There were 33 cyber security incidents of which 17 were assessed as low impact and 16 assessed as medium impact. These incidents included data handling issues, system vulnerabilities, and physical asset concerns, all of which prompted appropriate investigation or remediation.

Personal data-related incidents

All government departments are required to publish information about personal data-related incidents, which are required to be reported to the Information Commissioner (ICO). HM Land Registry notified the ICO of two data protection incidents during the 2024-25 reporting period. No further action was taken by the regulator on either incident.

Statement of Accounting Officer’s responsibilities

Resource accounts

Under the Government Resource and Accounts Act 2000, HM Treasury has directed HM Land Registry to prepare, for each financial year, resource accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the department during the year. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the department and of its income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirement, and apply suitable accounting policies on a consistent basis;

-

make judgements and estimates on a reasonable basis;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts;

-

prepare the accounts on a going-concern basis; and

-

confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgments required for determining that it is fair, balanced and understandable.

HM Treasury has appointed the Chief Executive and Chief Land Registrar as Accounting Officer of HM Land Registry. The responsibilities of an Accounting Officer, including responsibilities for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records, and for safeguarding HM Land Registry’s assets, are set out in Managing Public Money published by HM Treasury.

As the Accounting Officer, I have taken all the steps that I ought to have to make myself aware of any relevant audit information and to establish that HM Land Registry’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware.

Governance statement

Scope of responsibility

As the Accounting Officer for HM Land Registry I have responsibility for maintaining corporate governance structures that support the achievement of HM Land Registry’s aims, objectives and targets, while safeguarding public funds and HM Land Registry’s assets.

I was appointed Chief Executive and Chief Land Registrar from 11 November 2019. I have received a ministerial letter of appointment pursuant to the Land Registration Act 2002 and a letter from the Permanent Secretary to HM Treasury, allocating me as Accounting Officer.

HM Land Registry is a Non-Ministerial Department. My duties as Accounting Officer are set out in Managing Public Money, which are to ensure public money is safeguarded, properly accounted for and used economically, efficiently and effectively.

The main statutory duties relating to maintaining the registers HM Land Registry holds are found in the Land Registration Act 2002, the Land Charges Act 1972 and the Local Land Charges Act 1975.

Purpose of the governance framework

The governance framework is designed to give assurance that HM Land Registry carried out its duties in a manner that fulfils the appropriate standards of effective internal control and risk management. The framework is based on processes designed to identify and prioritise the opportunities and risks to the delivery of HM Land Registry’s strategy, its strategic objectives and performance targets. It aligns with our statutory duties and is designed to support the governance and strategic aims of HM Land Registry’s sponsor department. The governance of HM Land Registry and its relationship with other government bodies is set out in a Framework which was agreed with Ministers.

A revised Framework was approved by the Land Registry Board in May 2025. Once this has been confirmed with Ministers at MHCLG and HM Treasury this will be published on GOV.UK. Our approach to governance is in line with HM Treasury’s Corporate Governance in Central Government Departments: Code of Good Practice.

Central controls

My role as Chief Land Registrar is referred to in the Land Registration Act 2002, the Land Charges Act 1972, the Agricultural Credits Act 1928 and the Local Land Charges Act 1975. The Chief Executive and Chief Land Registrar is responsible for keeping those registers established for the purposes of those Acts and has all the power, responsibilities and duties conferred and imposed on the Registrar by those Acts and by the rules and other secondary legislation made under them. In carrying out those specific statutory functions, the Chief Executive and Chief Land Registrar is not subject to any ministerial control or direction. Those functions are subject to supervision by the court.

In managing its business more generally, HM Land Registry operates within the delegations framework as defined by the Cabinet Office for arm’s lengths bodies, the specific delegations authorised by officials at the Ministry of Housing, Communities and Local Government and HM Treasury and the Framework. The Framework sets out the relationship HM Land Registry has with the Geospatial Commission. Separately, there is also a requirement to work with the Government Digital Service to ensure that product releases conform to standards in terms of security, effectiveness and consistency.

Government functional standards guide people working for and with the UK Government and promote consistent and coherent ways of working. HM Land Registry has embedded relevant Government functional standards and operates a system to monitor compliance and continuous improvement.

Risk management and assurance

Our approach to risk management

To ensure we meet our strategic objectives, it’s vital that our risk management framework is operated effectively at all levels, from operational decision making on casework, through to managing change and principal risks. Risk management is embedded across HM Land Registry, with clear roles for all staff, from the LR Board downwards as set out in our Risk & Assurance policy, which we review annually. Over the past year, we have reviewed and revised our risk appetite statements to provide further clarity and guidance and improve the quality of information in the risk data set, enhancing transparency, collaboration, analysis and reporting.

All risks are managed within our risk and assurance framework, integrating data analysis with performance and strategic goals. The SET sponsors the suite of principal risks, reviewing them on a regular basis throughout the year, ensuring that plans to address them are flexible, dynamic and proportionate. A regular flow of risk reporting operates throughout the organisation, supported by visual management tools in order to drive effective risk conversations. Principal risks are regularly reviewed by the SECs and sub-committees, and reported quarterly to the Audit and Risk Committee and the Board. Organisational risks are reviewed within each group and escalated when necessary.

The Audit and Risk Committee provides independent assurance on risk management. Our sub-committees further scrutinise risk and assurance processes. Readily accessible information on our framework fosters a culture of integrated governance and continuous improvement.

HM Land Registry’s risk and assurance framework

We regularly review our risk management framework to ensure we continue to operate in line with principles set out in the Orange Book. We are an active member of the cross-government risk and assurance networks and we adopt new best practices where they are an improvement over our own existing ones.

By closely aligning with the Orange Book, we are confident that our risk management practices fully comply with the five principles for the identification, evaluation and control of risks and are following best practice in government and support its goal of consistency amongst departments. Our control framework is based on the Three Lines model, clearly defining responsibilities and accountabilities across the organisation to ensure that risks are appropriately identified, assessed, managed and reported and to strengthen oversight. This ensures our governing bodies receive appropriate assurance that HM Land Registry can successfully deliver its strategy and objectives.

Three lines model for providing assurance in HM Land Registry

- First Line: Controls in place to mitigate risks to strategic objectives and business processes

- Second Line: Assure and report on the effectiveness of controls in the First Line

- Third Line: Independently assure control effectiveness, risk management and assurance processes

Managing risks to our delivery

To protect public funds, enhance performance, and achieve our strategic objectives, we actively identify and manage our principal risks. This suite of risks is regularly reviewed to align with the modernisation of land registration and to anticipate and respond to emerging challenges.

We maintain robust proportionate controls to manage risks within appetite and to target levels, continuously assessing impacts and adapting our approach to ensure an effective strategic portfolio. Each risk is directly linked to our strategic priorities, objectives, and key performance indicators, ensuring mitigation efforts remain focused and effective. Where performance risks arise, adjustments are made to maintain alignment with our objectives.

Risk is managed and recorded through a single risk register that is reported quarterly to governing bodies, along with controls activity and timescales for mitigating the overall risk to within appetite and/or its target level.

We have conducted a further risk maturity assessment this year, building on the previous review undertaken in 2023. The latest assessment reflects a continued structured approach to risk management across the organisation. Scoring has improved in some areas compared with the previous assessment and, overall, the maturity level has been maintained. We are confident that risk management practices are now being applied more consistently across business areas. The assessment also provided clear evidence that risks are being managed effectively at all levels of the organisation.

Our appetite for risk

Our risk appetite statement sets out how we balance risk and opportunity in pursuit of achieving our objectives and desired outcomes. It forms a key element of our governance and reporting framework and is reviewed annually.

Our first concern is the availability, security and accuracy of the register information we hold. We have a low appetite for any risks that may impact upon those primary objectives.

Provided risk to those primary objectives is not heightened, we have a medium to high appetite for risks arising from developing new ways to deliver existing services and from devising new services and a high appetite for risks from releasing value out of the data we hold.

Risk profile

As part of our corporate governance activities for 2024/25, we refreshed our suite of principal risks in March 2024 to ensure continued alignment with HM Land Registry’s business plan objectives and strategic commitments. This exercise incorporated insights from both internal and external horizon scanning reports, with associated risks carefully considered. We also undertook detailed analysis of the HM Land Registry risk dataset, aggregating risks across taxonomy categories, which highlighted increasing capacity and capability pressures. An assessment and prioritisation of existing principal risks was carried out, alongside evaluation of potential new risks. In total, 13 risk themes were reviewed, with eight selected to be taken forward as principal risks for the year ahead.

Internal Audit reviewed the effectiveness of the risk management process during the transition to the refreshed suite of principal risks for 2024/25 and a rating of substantial assurance was awarded.

We have effectively managed this suite of eight risks to the delivery of our strategy and objectives throughout the year 2024/25. The risks and how they link to our strategic pillars are provided below. The risk appetite statement reflects their position at the end of the reporting period. Five of the eight principal risks were inside of appetite at the end of the year:

| Strategic pillars | |||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 |

| Providing secure and efficient land registration | Enabling property to be bought and sold digitally | Providing near real-time property information | Providing accessible digital register data | Leading research and accelerating change with property market partners | Our organisation |

| Risk | Detail | Appetite | Pillar/s |

|---|---|---|---|

| RISK 1: Improving speed of service and age of applications | Over the year, we continued to make progress in addressing speed of service and the age of applications, focusing on delivering actions from the Service Delivery Improvement Plan. Key mitigations included enhancing operational capability and capacity, strengthening performance efficiency, and refining our approach to customer expectation management. Targeted casework teams were deployed to address workload imbalances and specific service hotspots, helping to reduce both the backlog and the age of cases. Our control framework has evolved to support these improvements, incorporating strategic actions aimed at sustaining better customer outcomes through increased throughput and more responsive services. | Inside | 1,2,3,6 |

| RISK 2: Fit for purpose registers | Providing secure and efficient land registration remains a core deliverable in our Strategy, and this risk continues to safeguard that objective. Over the past year, we have made steady progress in enhancing the accuracy and integrity of the registers. We have strengthened our control framework by embedding proportionate quality control and assurance within first line operations, supported by clear operational policies and practice guidance. We have also introduced a framework for data governance and expanded our assurance over system design to support confident and secure use of automation. These improvements help ensure that system changes and outputs are robustly assured and that our registers remain accurate, reliable and fit for purpose. | Outside | 1, 2, 3, 6 |

| RISK 3: People change and performance | This year, we have made further progress in building a high- performance culture and preparing our people for ongoing change. We have strengthened our control framework by focusing on leadership capability, developing change management and continuous improvement skills across the organisation, and embedding regular, effective performance management conversations. We are working to ensure our people increasingly understand and align with our vision for HM Land Registry, and we are equipping them with the skills and mindset needed to embrace change and deliver strong performance. Engagement and communication have remained key, ensuring our workforce is involved in shaping the future and ready to seize opportunities to improve the way we work. | Outside | 6 |

| RISK 4: Technical health and performance | Technology continues to be fundamental to our operations and the delivery of our services. Over the past year, we have made strong progress in enhancing the resilience, reliability and performance of our digital estate and this has been evidenced through excellent performance against our Service Level Agreements. This includes continued investment in modern technology, successful implementation of change initiatives, and targeted improvements to the health of legacy systems. Our control framework has been reinforced through rigorous business continuity planning and testing, ensuring our services remain safe and robust in the face of operational pressures. These measures support our ambition to provide consistently high-performing and secure digital services that meet the evolving needs of our customers and colleagues. | Inside | 1, 2, 3, 6 |

| Risk | Detail | Appetite | Pillar/s |

| RISK 5: Business design and change delivery | Delivering on the commitments set out in Strategy 2022+ requires a significant volume of change activity, much of it technology driven. Over the past year, we have strengthened our control framework to support effective design and delivery, with a focus on aligning capability, funding, and prioritisation to organisational objectives. Continued development of our Business Design and the role of the Design Authority have enabled more consistent and joined-up change, supporting clearer routes from strategic intent to operational delivery. Key mitigations include improving access to the right skills and capacity, better profiling of benefits to guide prioritisation, and increased focus on realising outcomes at pace. We have made good progress in embedding these approaches, with tangible benefits beginning to emerge in service transformation and internal efficiency. | Inside | 1, 2, 3, 6 |

| RISK 6: Significant successful cyber-attack | Over the past year, we have continued to strengthen our cyber security posture to reduce the risk of a major cyber-attack. We have made further progress in improving our control framework, ensuring it remains aligned with Government policies and standards. Key developments include the continued maturing of our Security Control Library, the growth of our internal network of security champions, and greater emphasis on building a cyber- aware culture across the organisation. Additional mitigations have been introduced to improve governance, restrict unauthorised access, and secure devices, systems and information, particularly in relation to unattended portable electronic devices. Efforts to ensure only authorised individuals can access HM Land Registry hardware, software and services have also been reinforced. These actions form part of a broader, ongoing strategy to embed robust cyber security governance and maintain the resilience of our infrastructure, safeguarding our people and customers. | Inside | 5 |

| RISK 7: Customer needs and requirements | We have made significant progress in understanding and meeting customer needs in a changing market. This year, we strengthened our control framework, using actionable insights to inform service development and ensure investment at an appropriate pace. Key mitigations include improved complaints handling and the introduction of a Customer Forum, which provides governance to ensure we are delivering on customer priorities. These initiatives have enhanced our ability to meet customer expectations and drive continuous improvement. | Outside | 1,2,4 |

| RISK 8: Managing stakeholder and political expectations and financial uncertainty | We have strengthened stakeholder engagement and enhanced responsiveness to political and financial change, particularly following the change in Government. Key mitigations included close collaboration with MHCLG and UKGI, and development of a comprehensive Spending Review bid aligned to Government priorities. These measures ensured continued alignment with the Government’s Mission Led Agenda and supported funding decisions critical to delivering our strategic objectives. | Inside | 1, 3 |

Business continuity

HM Land Registry continues to strengthen its approach to business continuity to ensure operational resilience and effective risk mitigation. Our business continuity arrangements are managed centrally through the Risk & Resilience team, working closely with business areas to coordinate planning and response across the organisation. The overarching aim is to reduce operational risk and enhance our ability to respond to and recover from disruptions.

Throughout 2024/25, we have made progress in the development and maturity of our Business Continuity Management System (BCMS) and Business Continuity Management Programme. Our arrangements are aligned with ISO 22301 standards and the Good Practice Guidelines (GPG) 2018, reflecting best practice within central government. The corporate business continuity team continues to provide expert guidance and support to all sites and services and actively contributes to the Cross-Government Business Continuity Forum, promoting shared learning and consistency across departments.

Our BCMS holds a comprehensive suite of plans designed to address a wide range of incident types. These plans are regularly reviewed and validated through exercising to ensure they remain fit for purpose and effective in real-world scenarios. Over the past year, we have further enhanced our planning by reviewing the playbooks that support response to specific events such as cyber incidents, national power outages, and critical IT system failures.

HM Land Registry adopts a structured Gold (Strategic), Silver (Tactical) and Bronze (Operational) incident management model to ensure clear command, control and coordination during disruptions. In 2024/25, the incidents encountered were those relating to Silver or Bronze levels. The most significant incident involved a mains water leak at our Durham office that resulted in an extended site closure. During this period, two alternate workspaces in the local area were rapidly sourced and equipped, enabling staff to continue operations either from these locations or remotely.

Risks identified by business areas are incorporated into our corporate risk register, which informs the prioritisation of our continuity planning activities. This approach ensures we remain responsive to evolving threats and are prepared for plausible worst-case scenarios, providing reasonable assurance that the impact of any business continuity risk is effectively managed and minimised.

Performance reporting

I receive monthly financial reports from the Chief Financial Officer and I hold frequent one-to-one meetings with the Chair of the Board.

I routinely receive information on organisational performance, which is submitted monthly to the SECs for review. As laid out in the Performance section of the Annual Report, our performance framework for 2024-25 included nine key performance indicators providing a balanced scorecard across operational, financial, people and customer impacts of what we do.

On a monthly basis, the Service Delivery SEC receives data on service delivery alongside business-critical management information. Appropriate levels of management information are also provided to other key committees and to managers throughout the organisation. HM Land Registry has a dedicated analysis team which quality assures this management information. Performance data is routinely reported to the Board. Organisational performance is also reviewed on a six-monthly basis by the Remuneration and Nominations Committee. On a quarterly basis I, and other senior colleagues, meet with the Chair of the Board and senior MHCLG officials where we review operational financial and strategic performance.

The Shadow Service Delivery Executive Committee was established in October 2024 and brings together representatives from different roles, responsibilities and locations from across the organisation. This Shadow Committee reviews and challenges the same performance data shared with the SEC. The Shadow Committees have proved to be a valuable opportunity to test clarity of information, decision-taking and messaging with a wider internal audience. I, alongside my SET, routinely travel to all HM Land Registry offices to share key performance data and otherwise engage directly with colleagues in local offices.

HM Land Registry operates a number of models critical to its core business. A dedicated Modelling and Decision Support Oversight Group, which reports to the Service Delivery SEC, provides oversight and relevant challenge to our business-critical models. We make use of Aqua Book compliant ownership structures and quality assurance documentation. Similarly, we are developing appraisal, monitoring and evaluation approaches consistent with the Green and Magenta Books.

Financial performance is monitored and reported monthly to the Corporate Services SEC. There is a procedure for setting annual budgets and reviewing financial performance and full-year forecasts. Quarterly forecast reviews are in operation and give the SECs and the LRB appropriate oversight and assurance. The LRB reviews finance, performance and risk progress at every Board meeting. Financial and operational performance are discussed at least quarterly with HM Land Registry’s sponsor department, MHCLG.

I have reported to ministers in our new sponsor department on a regular basis throughout the year to discuss HM Land Registry’s progress against strategic objectives and other areas of concern. I have also met with a wide range of external stakeholders to understand their concerns and operational context.

Procurement assurance

I am assured by the Chief Financial Officer, regarding specific procurements, that procurement activities are conducted in line with procurement regulations and Cabinet Office and HM Treasury guidance, and that senior managers have complied with these and HM Land Registry-specific procurement guidelines.

The Investment, Commercial & Finance Committee (ICFC) holds responsibility for approval of contracts over £1m and advises on approvals of investment cases subject to the Cabinet Office Commercial Spend Control. HM Land Registry has had zero legal challenges to procurement exercises in 2024-25.

Every contract has a Senior Responsible Owner (SRO), whose delegations are formally set out each year along with the responsibilities of their contract managers. We continue to operate supplier financial stability monitoring for our most business-critical contracts and monitor completion of business continuity, business contingency and exit plans for these contracts. As part of our organisational assurance, we operate a rolling programme of Contract Health checks on our most business-critical contracts. ICFC also oversees the findings from these Contract Health check reviews.

We have undertaken effective readiness activities to implement the Procurement Act 2023, including completion of required training by relevant staff.

We assess and benchmark our commercial practices against good practice using the Cabinet Office Continuous Commercial Improvement Assessment Framework (CCIAF) which encompasses all of the Government Commercial Functional Standards (GovS 008). Our score of 80.9% places us in the ‘Better’ Maturity Rating. We report our progress against the standards to the Cabinet Office on an annual basis and have a Continuous Improvement Plan to increase our maturity against the key themes. We continue to participate in the Cabinet Office Contract Management accreditation programmes and have more than 100 staff that have completed the Contract Management Foundation accreditation.

Internal Audit and opinion

Through Internal Audit activity, it was confirmed that HM Land Registry has a reliable and effective framework for risk management, governance, and internal controls. The risk environment is regularly reviewed, and controls tested by the three lines for completeness and adequacy. While audit activity identified some control issues there were no significant or notable trends in control failings. The organisation continues to transform how it operates into a more digital and automated business and internal audit processes continue to evolve to meet these changing needs. The recommendation for the Annual Audit rating for the year remains Moderate and this is unchanged from the prior year.

Ongoing assurance

I can confirm that the internal controls referenced throughout this Governance Statement remain in place. Controls are regularly reviewed, to make sure they align with government best practice, as part of the assurance exercises that take place throughout the year.

Simon Hayes

Chief Executive and Chief Land Registrar

7 July 2025

Parliamentary accountability report

1. Remuneration report

Policy for senior civil servants

The remuneration of senior civil servants (SCS) is set by the Prime Minister following independent advice from the Senior Salaries Review Body.

In reaching its recommendations, the Review Body has regard to:

- the need to recruit, retain and motivate suitably able and qualified individuals to exercise their different responsibilities;

- regional/local variations in labour markets and their effects on the recruitment and retention of employees;

- Government policies for improving the public services including the requirement on departments to meet the output targets for the delivery of departmental services;

- the funds available to departments as set out in the Government’s departmental expenditure limits; and

- the Government’s inflation target.

The Review Body takes account of the evidence it receives about wider economic considerations and the affordability of its recommendations.

The salary of the Chief Land Registrar and Chief Executive is set by the Ministry of Housing, Communities and Local Government. The HM Land Registry Remuneration and Nominations Committee, acting on the authority of the Board, considers pay recommendations provided by line managers and note the annual pay strategy (including base pay, pay awards, pay gaps and, performance pay) for the executive team and other SCS staff within HM Land Registry.

Both base pay and non-consolidated performance related awards are dependent on performance, which is assessed through an annual appraisal system for senior civil servants.

During the year the members of the Remuneration Committee were Non-executive Board Members Ann Henshaw, Kirsty Cooper, Jonathan Ingram, Rommel Pereira (since joining in February 2025) and Simon Hayes as Chief Executive and Chief Land Registrar and Simon Morris as Director of Human Resources and Organisation & Employee Development.

Policy for other civil servants

Pay for HM Land Registry employees who are not in SCS grades is determined each year following negotiation and consultation between HM Land Registry and the recognised unions and is subject to approval by theSecretary of State, taking into account guidance issued by HM Treasury.

Service contracts

The Constitutional Reform and Governance Act 2010 requires Civil Service appointments to be made on merit on the basis of fair and open competition.

The Recruitment Principles published by the Civil Service Commission specify the circumstances when appointments may be made otherwise.

Unless otherwise specified, all the directors covered by this report hold appointments that are open-ended and are subject to a notice period of three months. Early termination for the directors on open-ended service contracts, other than for misconduct, would result in the individual receiving compensation as set out in the Civil Service Compensation Scheme.

Further information about the work of the Civil Service Commission can be found at www.civilservicecommission.org.uk.

Off-payroll disclosures

Off-payroll engagements as at 31 March 2025, for more than £245 per day and that last for longer than six months:

| Existing engagements as of 31 March 2025 | 2024-25 89 |

2023-24 68 |

|---|---|---|

| Of which existing: | ||

| — for less than one year at time of reporting | 47 | 26 |

| — for between one and two years at time of reporting | 17 | 33 |

| — for between two and three years at time of reporting | 21 | 9 |

| — for between three and four years at time of reporting | 4 | - |

| — for four or more years at time of reporting | - | - |

New off-payroll engagements, or those that reached six months in duration, between 1 April 2024 and 31 March 2025, for more than £245 per day and that last for longer than six months.

| New engagements, or those that reached six months in duration, between 1 April 2024 and 31 March 2025 | 54 | 39 |

|---|---|---|

| Of which: | ||

| — have been assessed as within IR35 | 54 | 39 |

| — have been assessed as outside IR35 | – | – |

| — have been terminated as a result of assurance not being received | – | – |

| Number engaged directly (via Public Sector Contract to department) and are on the departmental payroll | – | – |

| Number of engagements reassessed for consistency/assurance purposes during the year | 89 | 68 |

| Number of engagements that saw a change to IR35 status following the consistency review | – | – |

| Off-payroll engagements of board members and/or senior officials with significant financial responsibility between 1 April 2024 and 31 March 2025 | ||

|---|---|---|

| Number of off-payroll engagements of board members and/or senior officials with significant financial responsibility, during the financial year | – | – |

| Total number of individuals on payroll and off payroll that have been deemed ‘board members, and/or, senior officials with significant financial responsibility’, during the financial year. This figure includes both off-payroll and on-payroll engagements | 7 | 8 |

Expenditure on consultancy

| 2024-25 | 2023-24 | |

|---|---|---|

| £’000 | £’000 | |

| Cost of consultancy | 127 | 520 |

| Total | 127 | 520 |

Salary and performance pay – executive directors(1)(2) 2024-25

| Salary £’000 |

Performance pay £’000 |

Compensation for loss of office £’000 |

Benefits in kind To nearest £100 |

Pension benefits(2) £ | Total £’000 | |

|---|---|---|---|---|---|---|

| Simon Hayes, Chief Executive and Chief Land Registrar | 150 – 155 | – | – | – | 92,000 | 245 – 250 |

| Mike Harlow, Deputy Chief Executive and Director of Customer and Strategy | 135 – 140 | – | – | – | 91,000 | 230 – 235 |

| Iain Banfield, Chief Financial Officer | 135 – 140 | 0 – 5 | – | – | 80,000 | 220 – 225 |

- Audited.

- The executive directors reported in the table are the executive members of the Land Registry Board (Management Board) and although other executive directors may attend they are not part of the Management Board and are not required to be reported under the FReM.

- The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increases exclude increases due to inflation or any increases or decreases due to a transfer ofpension rights.

Salary and performance pay – executive directors(1) 2023-24

| Salary £’000 | Performance pay £’000 | Benefits in kind To nearest £100 | Pension benefits (2) £ | Total £’000 | ||

|---|---|---|---|---|---|---|

| Simon Hayes Chief Executive and Chief Land Registrar | 145 – 150 | – | – | 46,000 | 190 – 195 | |

| Mike Harlow General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar | 130 – 135 | – | – | 95,000 | 225 – 230 | |

| Iain Banfield Chief Financial Officer | 130 – 135 | 0 – 5 | – | 94,000 | 230 – 235 |

- Audited.

- The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increases exclude increases due to inflation or any increases or decreases due to a transfer ofpension rights.

Non-executive directors pay table(1)

| 2024-25 £’000 | 2023-24 £’000 | |

|---|---|---|

| Nilesh Sachdev, Senior Independent Board Member | 55 – 60 | 55 – 60 |

| Kirsty Cooper, Non-executive Board Member | 20 – 25 | 20 – 25 |

| Ann Henshaw, Non-executive Board Member | 20 – 25 | 20 – 25 |

| Jeremy Pee(2), Non-executive Board Member | 10 – 15 | 20 – 25 |

| Annual equivalent | 20 – 25 | – |

| Angela Morrison, Non-executive Board Member | 20 – 25 | 20 – 25 |

| Elliot Jordan, Non-executive Board Member | 20 – 25 | 20 – 25 |

| Jonathan Ingram(3), Non-executive Board Member | – | – |

| Rommel Pereira(4), Non-executive Board Member | 0 – 5 | – |

| Annual equivalent | 20 – 25 | – |

| Enda Ridge(5), Non-executive Board Member | 0 – 5 | – |

| Annual equivalent | 20 – 25 | – |

| Hena Jalil(6), Non-executive Board Member | 0 – 5 | – |

| Annual equivalent | 20 – 25 | – |

| Deborah McLaughlin(7), Non-executive Board Member | 0 – 5 | – |

| Annual equivalent | 20 – 25 | – |

- Audited.

- Jeremy Pee’s appointed ended in October 2024.

- Jonathan Ingram represented the interest of UK Government Investments (UKGI) and did not receive any remuneration from HM Land Registry.

- Rommel Pereira’s appointment started in February 2025.

- Enda Ridge’s appointment started in February 2025.

- Hena Jalil’s appointment started in February 2025.

- Deborah McLaughlin’s appointment started in February 2025.

Salary

‘Salary’ includes gross salary, reserved rights to London weighting or London allowances, recruitment and retention allowances and any other allowance to the extent that it is subject to UK taxation. The tables on pages 69 and 70 are based on accrued payments made by HM Land Registry and thus recorded in these accounts.

Benefits in kind

The monetary value of benefits in kind covers any benefits provided by HM Land Registry and treated byHM Revenue and Customs as a taxable emolument.

Performance awards

Awards are based on performance levels attained and are made as part of the performance review process as discussed and noted at the Remuneration Committee in June. The awards reported relate to the performance in the year in which they were paid to the individual. The awards reported in 2024/25 relate to performance in 2023/24.

Pension benefits(1)

| Real increase in pension and lump sum at 60 |

Total accrued at March 2025 |

Cash equivalent transfer value (CETV) at 31 March |

Real increase in CETV after adjustment for inflation and changes in investment factors |

||||

|---|---|---|---|---|---|---|---|

| Pension £’000 |

Lump sum £’000 |

Pension £’000 |

Lump sum £’000 |

2025 £’000 |

2024 £’000 |

£’000 | |

| Simon Hayes Chief Executive and Chief Land Registrar |

2.5 – 5 | 2.5 – 5 | 55 – 60 | 135 – 140 | 1,065 | 1,189 | 72 |

| Mike Harlow Deputy Chief Executive and Deputy Chief Land Registrar |

5 – 7.5 | – | 45 – 50 | – | 863 | 985 | 78 |

| Iain Banfield Chief Financial Officer |

2.5 – 5 | 2.5 – 5 | 45 – 50 | 105 – 110 | 772 | 866 | 54 |

- Audited.

Civil Service pensions

Pension benefits are provided through the Civil Service pension arrangements. From 1 April 2015 a new pension scheme for civil servants was introduced – the Civil Servants and Others Pension Scheme or alpha, which provides benefits on a career average basis with a normal pension age equal to the member’s State Pension Age(or 65 if higher). From that date all newly appointed civil servants and the majority of those already in service joined alpha. Prior to that date, civil servants participated in the Principal Civil Service Pension Scheme (PCSPS). The PCSPS has four sections: 3 providing benefits on a final salary basis (classic, premium or classic plus) with a normal pension age of 60; and one providing benefits on a whole career basis (nuvos) with a normal pension age of 65.

These statutory arrangements are unfunded with the cost of benefits met by monies voted by Parliament each year.

Pensions payable under classic, premium, classicplus, nuvos and alpha are increased annually in line with Pensions Increase legislation. Existing members of the PCSPS who were within 10 years of their normal pension age on 1 April 2012 remained in the PCSPS after 1 April 2015. Those who were between 10 years and 13 years and 5 months from their normal pension age on 1 April 2012 switch into alpha sometime between 1 June 2015 and 1 February 2022. Because the Government plansto remove discrimination identified by the courts in the way that the 2015 pension reforms were introduced for some members, eligible members with relevant service between 1 April 2015 and 31 March 2022 may be entitled to different pension benefits in relation to that period (and this may affect the Cash Equivalent Transfer Values shown in this report – see below). All members who switch to alpha have their PCSPS benefits ‘banked’, with those with earlier benefits in one of the final salary sectionsof the PCSPS having those benefits based on their final salary when they leave alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes.)Members joining from October 2002 may opt for eitherthe appropriate defined benefit arrangement or a defined contribution (money purchase) pension with an employer contribution (partnership pension account).

Employee contributions are salary-related and range between 4.6% and 8.05% for members of classic, premium, classic plus, nuvos and alpha. Benefits in classic accrue at the rate of 1/80th of final pensionable earnings for each year of service. In addition, a lump sum equivalent to three years initial pension is payable on retirement. For premium, benefits accrue at the rate of 1/60th of final pensionable earnings for each yearof service. Unlike classic, there is no automatic lump sum. classic plus is essentially a hybrid with benefits for service before 1 October 2002 calculated broadly as per classic and benefits for service from October 2002worked out as in premium. In nuvos a member builds up a pension based on his pensionable earnings during their period of scheme membership. At the end of the scheme year (31 March) the member’s earned pension accountis credited with 2.3% of their pensionable earnings in that scheme year and the accrued pension is uprated in line with Pensions Increase legislation. Benefits in alpha build up in a similar way to nuvos, except that the accrual rate in 2.32%. In all cases members may opt to give up (commute) pension for a lump sum up to the limits set by the Finance Act 2004.

The partnership pension account is an occupational defined contribution pension arrangement which is part of the Legal & General Mastertrust. The employermakes a basic contribution of between 8% and 14.75% (depending on the age of the member). The employee does not have to contribute, but where they do make contributions, the employer will match these up to a limit of 3% of pensionable salary (in addition to the employer’s basic contribution). Employers also contribute a further 0.5% of pensionable salary to cover the cost of centrally- provided risk benefit cover (death in service and ill health retirement).

The accrued pension quoted is the pension the member is entitled to receive when they reach pension age, or immediately on ceasing to be an active member ofthe scheme if they are already at or over pension age. Pension age is 60 for members of classic, premium and classic plus, 65 for members of nuvos, and the higher of 65 or State Pension Age for members of alpha. (The pension figures quoted for officials show pension earnedin PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes, but note that part of that pension may be payable from different ages.)

Further details about the Civil Service pension arrangements can be found at the website www.civilservicepensionscheme.org.uk.

Cash equivalent transfer values

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefitsin another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the Civil Service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

Reporting of Civil Service and other compensation schemes – exit packages(1)

| Exit package cost band | Number of compulsory redundancies | Number of other departures agreed | Total number of exit packages by cost band | |||

|---|---|---|---|---|---|---|

| 2024-25 | 2023-24 | 2024-25 | 2023-24 | 2024-25 | 2023-24 | |

| £0 – £10,000 | – | – | 2 | 3 | 2 | 3 |

| £10,001 – £25,000 | – | – | 1 | – | 1 | – |

| £25,001 – £50,000 | – | – | 1 | 2 | 1 | 2 |

| £50,001 – £100,000 | – | – | 3 | 3 | 3 | 3 |

| £100,001 – £150,000 | – | – | – | – | – | – |

| £150,001 – £200,000 | – | – | – | – | – | – |

| >£200,000 | – | – | – | – | – | – |

| Total number of exit packages | – | – | 7 | 8 | 7 | 8 |

| Total cost | – | – | £217,990 | £275,306 | £217,990 | £275,306 |

- Audited.

There were seven ex-gratia payments in 2024-25 totalling£217,990 (2023-24: 8, £275,306).

Compensation for loss of office

Redundancy and other departure costs have been paid in accordance with the provisions of the Civil Service Compensation Scheme, a statutory scheme made under the Superannuation Act 1972. Exit costs are accounted for in full in the year of contractual agreement to depart. Where applicable, the additional costs of buy-out of reduced pension benefit are met by HM Land Registry and not by the Civil Service pension scheme. Ill health retirement costs are met by the pension scheme and are not included in the table.

Pay multiples(1)

Reporting bodies are required to disclose the relationship between the remuneration of the highest paid director in their organisation for the lower quartile, median and upper quartile remuneration of the organisation’s workforce.

Total remuneration includes salary, allowances, overtime, non-consolidated performance-related payments and benefits in kind. It does not include employer pension contributions and the cash equivalent transfer value of pensions payments.

Table 1 – Pay multiples for total pay and benefits

| 2024-25 | 2023-24 | |

|---|---|---|

| Band of highest paid director’s total remuneration (£’000) | 150 – 155 | 145 – 150 |

| Median (£) | 38,439 | 34,379 |

| Median (remuneration ratio) | 4.0 | 4.3 |

| Lower quartile (£) | 31,090 | 29,484 |

| Lower quartile (remuneration ratio) | 5.0 | 5.0 |

| Upper quartile (£) | 45,484 | 43,128 |

| Upper quartile (remuneration ratio) | 3.4 | 3.4 |

Table 2 – Pay multiples for salary element only

| 2024-25 | 2023-24 | |

|---|---|---|

| Band of highest paid director’s total salary (£’000) | 150 – 155 | 145 – 150 |

| Median (£) | 30,958 | 29,484 |

| Median (remuneration ratio) | 5.0 | 5.0 |

| Lower quartile (£) | 30,958 | 29,484 |

| Lower quartile (remuneration ratio) | 5.0 | 5.0 |

| Upper quartile (£) | 38,427 | 36,597 |

| Upper quartile (remuneration ratio) | 4.0 | 4.0 |