New landscapes of doing business in China: Practical guidance for UK businesses selling goods and services into China

Updated 19 June 2015

Foreword

Wusi Square and May Wind Sculpture at night, Qingdao, China

Department for International Trade (DIT)

DIT is at the heart of the UK’s long-term economic plan – with success in international markets like China a cornerstone of our strategy.

The support we give to British firms as they trade around the globe and the welcome we extend to those who invest here are critical to securing our country’s long term future.

China is the great economic success story of the past 30 years. Previously an agricultural society, urbanisation reached over 52 per cent in 2013. China is the world’s second largest economy after the United States and the biggest trading partner for most Asian economies; it is the world’s largest exporter, and the single greatest destination for global direct investment.

It is a huge and expanding market for UK businesses. UK exports of goods to China have more than doubled since 2010 and increased by over 37% in the last 2 years. They were worth £12.4 billion in 2013, up by 18% from 2012.

According to China’s Ministry of Commerce (MOFCOM), UK exports to China are up 20% on the year since October 2013. China remained the UK’s seventh biggest export market in 2013. The UK is now the second biggest European exporter to China. UK’s exports to China are growing 3 times as fast as our imports from China.

But there is still much more that we should do in the UK to make the most of this exciting opportunity and reap the rewards of doing business with China.

If the last decade was all about “Made in China”, the next decade will be all about “Made for China”.

DIT helps UK-based companies succeed in the global economy, offering expertise and contacts through its extensive network of specialists in the UK, and in British embassies and other diplomatic offices around the world. Working across the UK, China and Hong Kong, UKTI helps companies in Britain increase their competitiveness through overseas trade in China.

DIT also encourages the best overseas companies to look to the UK as their global partner of choice.

In cooperation with the China-Britain Business Council (CBBC), DIT is on hand to assist you on every step of the way in doing business with China.

Whilst the rise of China is easy to acknowledge, business cannot always do it alone, but, whether selling, trading, investing or franchising, China offers opportunities in abundance to UK companies, large of small.

This guide gives useful information and points of contact to those best placed to assist your business in opening up those opportunities, giving an overview of some of the practicalities and considerations to take into account whether just starting out on the journey to selling goods and services into China or whether further along that road, to setting up a physical presence on the ground.

The UK has a wealth of financial and professional service providers who can offer expert help in doing business with China. This guide was written in collaboration with some of those experts, providing insights and a basic roadmap to doing business with China.

Britain has always been one the world’s great trading nations. By harnessing our collective expertise we can really open up exciting opportunities across the globe, creating jobs and wealth at home.

Dominic Jermey, Chief Executive, UK Trade & Investment

This was published originally by UK Trade and Investment which has since moved to the Department for International Trade (DIT).

China-Britain Business Council (CBBC)

The Chinese economy continues to expand and rebalance offering a wide range of exciting opportunities. Despite lower growth rates of around 7% p.a., in absolute value terms the economy will grow by almost 3 times the growth a decade ago. What is more, the shape of the Chinese economy is changing and that means more and more opportunities for British companies to work with Chinese business both in China and increasingly outside China too.

The changing shape of the Chinese economy is reflected in the ever-stronger UK-China trade and investment relationship. Chinese consumers are more sophisticated and more discerning. Chinese businesses are more and more sophisticated too, looking to move up the value curve and looking for partners from around the world with world-class products and services. The Chinese government continues to drive reform and opening up, including the development of Free Trade Zones across the country.

At the same time, we are seeing fast-moving developments around the internationalisation of the Chinese currency, the Renminbi (RMB). As the leading global financial centre, London has a unique role to play in this – and is very much doing so. Britain and China have agreed a series of steps that will both cement London’s role as a global offshore hub for trading the Chinese currency the RMB and act as the spring board for London to also become a hub for RMB investment into China.

In late 2014 RMB became the fifth most-used currency for global payments, according to data from SWIFT, after the value of RMB payments more than doubled in a year. But these developments are not just the domain of bankers in the City. Businesses across the length and the breadth of the UK can make effective use of RMB-denominated services and products to be more competitive and to manage risk more effectively.

So the opportunities are aplenty. But at the China-Britain Business Council we know that China is not always straight-forward. And we know that for many businesses knowing where to start and or how to proceed can sometimes be daunting.

This guide offers you practical advice on how to capitalise on the enormous business opportunities China presents. I hope you find it valuable and take the opportunity to learn from the fantastic range of expert speakers. Like the team at CBBC, they all share a passion to help and encourage British and Chinese companies to do good business together.

One thing I am sure you will read in this guide is that China requires sustained commitment. It does.

That is why day-in, day-out, more than 120 professionals at CBBC are here to support you. And if you are in any doubt whether China might be right for you, CBBC can help: we have supported companies from every conceivable sector and of every size, to realise the China opportunity. So I encourage you to contact any of CBBC’s 23 offices across the UK and China. We exist for one reason only - to help more UK companies do more business with their Chinese counterparts.

Stephen Phillips Chief Executive, China-Britain Business Council (CBBC)

About DIT

DIT is the government department that can help you achieve your international business potential.

We treat every business as an individual – that’s why we provide a tailored service with specialist support covering a wide range of industries.

In China, the China-Britain Business Council delivers the majority of DIT’s services and also now handles general enquiries. DIT and CBBC also employ a number of Business Advisers. And maintain close links with DIT in Hong Kong in order to facilitate Hong Kong as a springboard into China.

If you are interested in doing business in China, please contact either your local DIT International Trade Adviser (ITA) at www.gov.uk/ukti or your local CBBC China-Britain Business Council business adviser at www.cbbc.org.

About the China-Britain Business Council

The China-Britain Business Council (CBBC) is the leading organisation helping UK companies grow and develop their business with China.

CBBC supports British companies of all sizes and at every stage of market entry with practical in-market assistance, industry initiatives and a membership programme offering support, access and significant networking opportunities.

CBBC works closely with DIT and has a strategic partnership with the British Chamber of Commerce in Beijing, providing reciprocal membership of both organisations and access to a network of nine offices in the UK and eleven offices at key locations across China.

CBBC’s business-led Board and professional team have extensive firsthand experience of doing business in China, and with 60 years of engagement, CBBC has built up exceptional connections with government and business throughout the country.

We picked out a few questions often raised by companies and advisers. Ask yourself and see if you know the answers before you start venturing into China.

- What are the unique selling points to your business proposition? Will there be a market for your product and services?

- Are there any legal barriers to your business model?

- Where in China would you start?

- Do you have sufficient resources (management time, project finance and expenses) to fund your China projects?

- Who will be leading the project within your company?

- Do you need to work with a partner in China to succeed? Can you communicate with them effectively?

- Have you evaluated business risks (such as protecting your IP) and conducted research and due diligence?

- Do you know how to secure payment and get the right quality products?

- Would Hong Kong be a safer place to start?

- Rarely will one have answers to all the questions above, and this “knowledge gap” forms the basis of further research and investigation.

Where to Begin?

East Nanjing Road Shanghai © Oliver Slay/Crown Copyright

Researching the Market

Doing business with China can seem rather daunting for those new to the market, but taking a strategic approach is the key to making the process manageable.

Companies should conduct reliable research before venturing into business in China. Good research saves costs and improves the efficiency and impact from the start of a project.

General introductory business information concerning China is increasingly available and companies can obtain a reasonable amount of preliminary information through desk research.

DIT and the China-Britain Business Council work closely together to offer a range of support services to British businesses in the China market.

Speak to an expert

DIT provides support for UK companies through a network of International Trade Advisers (ITAs) based in the English regions. DIT services are also available to companies in Scotland, Wales and Northern Ireland.

In addition to the international trade teams across the country, CBBC has a number of China Business Advisers (CBAs) around the UK who have extensive knowledge and practical experience of doing business in China across a range of industries.

The Overseas Market Introduction Service (OMIS) is a DIT service delivered by CBBC in China and DIT in Hong Kong. This service can assist you by undertaking tailored research using our extensive network of dedicated researchers across China.

This can be used in a wide variety of ways to help your business with its particular needs when entering the Chinese market.

Possible ways in which OMIS can help your business include:

Market research and analysis

- sector reports

- market initiative

- regulatory environment

Identification of local contacts

- agents

- distributors

- suppliers

- potential partners

In-market activities

- meeting arrangements

- market initiative

- event organisation, such as work shops, seminars, promotional activities and product launches.

Overseas Market Introduction Service

Modern architecture and buildings of Pudong © Oliver Slay/Crown Copyright

DIT’s Overseas Market Introduction Service (OMIS) can help your business at any stage of exporting - from finding opportunities to setting up in another country. OMIS puts you in touch directly with DIT staff in over 100 overseas markets.

It can help you:

- access the right international contacts or partner

- find the best way to do business in a market

- achieve a successful market entry strategy

- increase profits by using effective overseas promotion

How the service works

As a first point of contact, a DIT International Trade Advisor or an adviser from Scottish Development International, Welsh Government or Invest Northern Ireland will work with you on your export plan. The adviser will then contact DIT’s local experts who will carry out research on your behalf.

Work can include:

- likelihood of success in the market and market entry strategies

- business opportunities and identification of possible partners

- advice on local conditions, including competitors, regulation and standards

- advice on accessing and influencing decision makers

- arrangements for a promotional event

The local experts will then discuss, develop and agree a quote. This can include:

- pre-visit research and support

- appointments with target customers or potential business partners or agents

- organisation of receptions, meetings or seminars for you to present your product or service

Market Visits and Trade Missions

View from Bund across to Pudong © Oliver Slay/Crown Copyright

Visiting China is an invaluable part of the process of market entry. You will experience the marketplace first-hand, and make the contacts necessary to do business. This is essential, but will be much more effective with careful planning. DIT and CBBC organise regular trade missions to China, where you can benefit from group activities in addition to your own programme.

The DIT Overseas Market Introduction Service (OMIS) can be used to support visits providing bespoke meeting arrangements with appropriate potential partners, agents and distributors or with relevant government officials.

Sell online with DIT’s e-Exporting Programme

China presents an increasingly tantalising market for brands looking to expand their e-commerce presence internationally. Chinese citizens are moving beyond being able to only afford the basics in life, and their discretionary spending is taking off, according to recent McKinsey analysis.

According to the Chinese Ministry of Commerce, China’s 302m online shoppers spent $296bn in 2013, the huge potential of the region is staggering. McKinsey forecast that the country’s online retail market will be as large as the US, Japan, UK, Germany and France combined by 2020.

UK brands have difficulty accessing the Chinese online consumer through own branded online stores, as most Chinese buy from leading e-marketplaces such as Tmall, JD.com etc. Famous brands such as Burberry, Karen Millen, Apple and Super Dry, all have their flagship stores on Tmall. The fact that this explosion of spending is taking place on e-marketplaces like Xiu. com, JD.com (Global), YHD.com, Tmall (Global) and many more, offers enormous opportunities for UK companies to access that demand.

Elsewhere in this document the complexities of establishing a corporate entity in China have been highlighted. Selling on these e-marketplaces, renders removes the need to establish a Chinese corporate entity.

Furthermore, as the urbanisation of the Chinese population continues apace and internet penetration is increasing, hundreds of millions of new consumers become accessible to UK companies.

DIT’s e-Exporting Programme

Being at the vanguard of e-commerce, UK companies are well placed to take advantage of digital opportunities that will allow them to access international markets.

DIT’s e-Exporting Programme can help UK retailers and brands accelerate their global growth via online channels in a number of ways:

- gain help and advice on building your online presence from DIT’s dedicated Digital Trade Advisers

- increase the reach of your brand globally

- receive introductions to leading e-marketplaces around the world

- set up on e-marketplaces quickly

- attend DIT’s retail/e-commerce themed events and webinars

To find out more about DIT’s e-Exporting Programme, visit gov.uk/e-exporting or speak to your local DIT office to set up a meeting.

Benefits

Demand for British goods from online consumers in China is growing fast. DIT have negotiated discounted rates for UK retailers and brands to list their products on some of the world’s major e-marketplaces. These include Amazon (US), Newegg (USA), Mercado Libre (Latin America) and Tmall (China), Laso (Japan), VIP (China), XIU (China)

To find out how you can list sell your products through global e-marketplace, book an appointment with a Digital Trade Advisor through your local DIT office. If you’re looking to sell online for the first time, you can also get help with:

- trademark registration

- website URL registration

- landed cost calculation

- packaging, shipping, payment

- tax registration

- marketing and related services

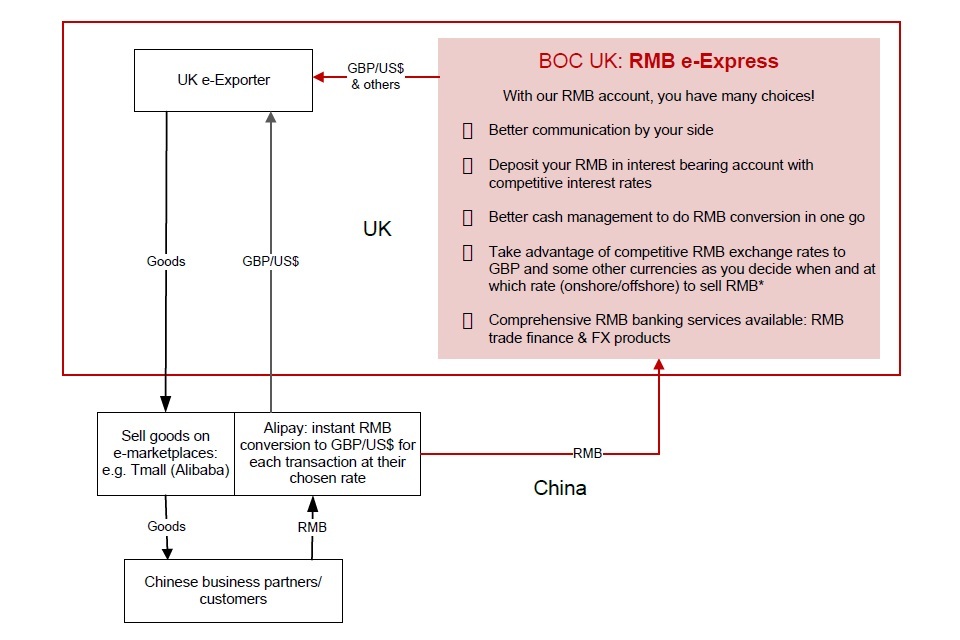

BOC RMB e-Express

Bank of China (UK) Limited – RMB e-Express solutions provide UK e-Exporters an alternative way to improve your business performance while selling your products online to the vast China market.

On top of standard sterling account services, we offer competitive RMB account services in UK.

RMB account choices

RMB Current Account

- RMB receipt and payment, remittance

- Facilitated by both Bank of China Shanghai Branch and Bank of China (HK)Ltd, support T+0 and T+1 cross-border RMB clearing;

- Bilingual (English and Chinese) payment inquiry services.

- Interest bearing account (term deposit) for surplus RMB at competitive rates[footnote 1]

- Online access to RMB account

- Required Documents (similar to those you will need to open a GBP current account in the UK)

RMB Trade Finance

- Pre-shipment finance against purchase order;

- Export invoice discounting;

- Finance against export credit insurance

- RMB Factoring (management of receivable, finance without recourse to exporter, etc)

*For instance, when you receive RMB payments from your Chinese clients, you could choose to hold it in your RMB account earning interest and convert it into GBP/US$ whenever needed.

RMB Conversions

- Deliverable RMB spot and forward[footnote 2] to hedge foreign currency exposures;

- The major currencies on-offer include: Chinese Renminbi (RMB), Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), Danish Krone (DKK), Euro (EUR), British Pound (GBP), Hong Kong Dollar (HKD), Hungarian Forint (HUF), Japanese Yen (JPY), Norwegian Krone (NOK), New Zealand Dollar (NZD), Polish Zloty (PLN), Swedish Krona (SEK), U.S. Dollar (USD), Singapore Dollar (SGD), Silver Ounce (XAG), Gold Ounce (XAU), South African Rand (ZAR), etc.

Internet Banking

- Online access to view balance, real-time exchange rate, term deposits details and transaction history

- Faster payment (in GBP): free (maximum limits £100,000 per transaction for corporate customers)[footnote 3]

Legal Disclaimer

The material included in this brochure and any associated material (collectively, the “Material”) has been prepared by Bank of China (UK) Limited ‘’the Bank’’ should be regarded as a marketing communication, and it has not been prepared in accordance with the legal and regulatory requirements to promote independence of research. It is, therefore, not independent from the interests of the Bank which may conflict with your interests. The Material has been prepared for information purposes only and no representation, warranty or assurance of any kind, express or implied, is made as to the accuracy or completeness of the information contained herein. The Material should not be regarded as a recommendation to buy, sell, subscribe to or invest in any securities and financial products or investments or to obtain finance from the Bank. People reading the Material should consult their own professional advisers before making decision to obtain banking, investments or financial products from the Bank. To the extent permitted by applicable law, the Bank disclaims liability for any error, omission or inaccuracy in the Material and shall not be responsible for any loss or damages that are incidental to or resulting from any use or reliance on the Material including any opinions expressed therein. The Material is protected by copyright. No part of it may be modified, reproduced, transmitted and distributed in any format for commercial or public use without prior written consent from the Bank.

Establishing a Presence

Given China’s sheer size, complex and changing business environment, as well as culture and language barriers, it is not an easy market to enter and exit with a quick win. To succeed in China requires careful business planning and execution.

Foreign companies need to take time to build up their business network and credentials and to demonstrate their commitment. Often this requires some sort of presence in the marketplace, whether directly through your own business operation, or indirectly, working through a strategic partnership such as an agent or distributor.

Agents and distributors

An agent is a company’s direct representative in a market and is paid commission, while a distributor sells products on to customers after buying them from the manufacturer – their income comes from the profits they make on the difference.

Market entry through working with an agent or distributor can have several advantages, such as reducing time and costs to market entry as well as gaining the local knowledge and network of the agent.

However, there are some drawbacks to this approach. Employing a third party results in an additional cost to your products and you may also lose some control and visibility over sales/ marketing. It also has implications for intellectual property rights protection, increasing the risk of your product being copied or counterfeited.

Given the above considerations, companies need to select agents and distributors carefully. Some of the frequently asked questions are in the following checklist. You should also conduct due diligence to verify this information.

Background

- Company size, history and ownership (private or state owned)

- Quality and quantity of the sales force

- Customer feedback and trade/bank references

Distribution channels

- Regional coverage

- Types of outlets covered and frequency of calling

- Transportation and warehousing facilities

Are they right for you?

- Does the agent/distributor have a genuine interest in representing your product?

- Can they benefit from actively promoting your interests (is it a win-win)?

- Do they also represent any competing companies/products?

- Can you communicate effectively with your counterpart?

Once a working relationship is established, the agent/ distributor needs to be managed actively; this may be achieved by the following:

- Visiting as regularly as is practicable at a senior management level – this shows interest in, and commitment to, the agent and the market. This will also provide you with an opportunity to learn about conditions in the market and see how your products are faring.

- Working closely with the agent to show them how they can profit from your products.

- Helping to prepare marketing and sales plans for the agent.

- Provide regular training for the sales staff and after-sales training for the technical staff in the UK.

- Linking performance to incentives and agreeing milestone targets.

Establishing a permanent presence

Although it is possible to be represented through agents or distributors, many foreign companies progress to the establishment of a permanent presence in China, as their experience and confidence grow. Having a permanent presence in-market can provide several possible benefits, including:

- Market presence – showing commitment.

- Cutting out the “middle man” – direct access to the end customer/supplier.

- Direct control over corporate strategy and activities.

- Enables trading in local currency and eases the conduct of business transactions.

- Fulfils a legal requirement to have a permanent presence (relevant in certain business activities and sectors).

UK Export Finance

London City skyscrapers © Oliver Slay/Crown Copyright

UK Export Finance (UKEF) provides trade finance and insurance solutions to support UK exporters. It is the UK’s export credit agency, helping UK exporters by providing insurance to exporters and guarantees to banks to share the risks of providing export finance. In addition, it can make loans to overseas buyers of goods and services from the UK. UK Export Finance is the operating name of the Export Credits Guarantee Department (ECGD), a ministerial department.

Responsibilities

UKEF works closely with exporters, banks, buyers and project sponsors and has 90 years’ experience of supporting exports to, and investments in, markets across the world. It does this principally by providing loans to buyers of UK goods and services and guarantees and insurance and reinsurance against loss.

It can:

- Insure UK exporters against non-payment by their overseas buyers

- Help overseas buyers to purchase goods and services from UK exporters by guaranteeing or funding bank loans to finance the purchases (including guarantees on loans in offshore Renminbi)

- Share credit risks with banks to help exporters raise tender and contract bonds, in accessing pre- and post-shipment working capital finance and in securing confirmations of letters of credit

- Insure UK investors in overseas markets against political risks

How UKEF helps

If you are planning to export goods or services from the UK then it is likely you’ll need some form of credit guarantee or insurance to protect you against non-payment or to help finance the export contract.

If you can’t get what you need from the private market, UKEF may be able to help. Working across a wide range of sectors, UKEF can consider support for exports to over 200 countries.

It has its own risk assessment framework and our focuses on helping UK exporters maximise the opportunity to do more business overseas.

It has a network of regional export finance advisers to act as local points of contact to introduce exporters and businesses with export potential to finance providers, credit insurers, insurance brokers, trade support bodies and sources of government support.

Renminbi Internationalisation and What this Means for your Business

The renminbi (RMB) – the official currency of China – is poised to join the US dollar and the euro as one of the world’s top three global trading currencies.

The renminbi (RMB) is the currency of the People’s Republic of China and the unit is the yuan. In this sense it is very similar to the use of sterling (the currency) and the pound (the unit). The terms yuan and renminbi are often used interchangeably in the West.

The Chinese government is actively seeking to internationalise the RMB to match China’s global economic status. The Chinese government policy is to promote international use of the RMB in three stages through trade, investment and as a reserve currency. This represents new opportunities for companies.

As the RMB is not yet fully convertible, the Chinese government has promoted an ‘offshore’ market where RMB can be used outside the Chinese mainland, separate from the ‘onshore’ market used by domestic companies, Chinese residents and foreign companies with a Chinese presence.

Offshore RMB markets are developing rapidly around the world with official RMB clearing banks now appointed in countries across Asia, Europe, Middle East and the Americas. Offshore borrowing and lending are market-driven and not subject to the regulations that set interest rates on the Chinese mainland. Offshore RMB is now actively used for cross-border trade, finance and direct investment while rapid and successive waves of liberalisation are opening onshore markets to trade, financing and investment.

Moves to full convertibility

China is gradually opening channels for capital to flow between the Mainland and international markets, and investors are being given greater accesses to both onshore and offshore RMB. HSBC expect full convertibility on the capital account to occur by 2017.

Trade

According to the HSBC RMB Internationalisation Survey 2015 54% of businesses expect growth in international/cross-border trading with China in the coming 12 months and 86% of existing RMB users said that import and export was the most common RMB transaction.

You could negotiate better prices and reduce foreign exchange costs on your China trade by settling trade transactions in offshore renminbi. Chinese government liberalisation has made the renminbi into a fast-growing international trading currency. Total offshore cross-border settlement in June 2014 reached RMB547 billion for the month, up by 64 per cent year on year.

Of the companies HSBC surveyed, 17 per cent already used the RMB for cross-border trade settlement, and over a quarter of those who don’t, plan to do so in the future.

Cross-border trade settlement

Invoicing in renminbi outside China is now unrestricted and your business can conduct almost all cross-border trade transactions with mainland Chinese companies in renminbi, using accounts and documentation support from HSBC. Since June 2012, all companies in mainland China with import and export qualifications can initiate and receive payments in renminbi for goods, services and other account items under China’s Renminbi Trade Settlement Scheme. HSBC also offer a wide range of renminbi trade financing and funding options.

Build your business on the Mainland with HSBC

As a registered Chinese bank, HSBC can help you establish and manage operations on the Mainland. HSBC will work with you to execute your expansion to execute your expansion strategy, providing services such as to help with capital injection and reduction; payments; investments; and shareholder loans all compliant with Mainland authorities. Dividend payments can be paid and received in renminbi and there is no restriction on the maximum amount of individual renminbi payments for trade or capital accounts.

Managing risk

With foreign exchange hedging in renminbi, companies could reduce risks in invoicing and lower the transaction costs of trade and investment.

As one of the most active participants in offshore renminbi foreign exchange and a registered dealer on the Mainland, HSBC provides companies with a comprehensive set of risk management instruments for trade and financing.

Complete renminbi hedging tools

HSBC provides deliverable forwards, options and swaps as well as access to the active non-deliverable market, which predates liberalisation of the renminbi. Offshore, HSBC clients can choose between renminbi non-deliverable forwards and options as well as an active deliverables market.

Manage risks in mainland operations

Companies wishing to transact on the Mainland can turn to HSBC to manage foreign exchange risks. HSBC are the leading foreign bank in the interbank FX spot, forward and swap markets.

HSBC provides deliverable currency and interest rate hedging tools, including swaps, options and forwards. We can help hedge all the transactions and transfers permitted by Chinese regulators, including debt and working capital repayment; income and expenses; capital injections; and income remittance.

Financing

Renminbi financing allows international businesses to participate in the growth of the Chinese economy by using China’s own currency to manage working capital, fund expansion, match receipts with payments and boost their profile in among Asian investors.

Companies can fund renminbi offshore and on the Mainland with HSBC. Offshore, HSBC offer full renminbi trade financing facilities, loans and the capability to raise bonds in a range of countries. All working capital, trade and receivables finance can be used outside China while bonds and loans raised offshore can be remitted onshore to finance business activities in China subject to approvals by the Chinese authorities.

All financing is subject to a detailed credit assessment and approval.

Shaanxi Province Xi'an, Nanguan Zheng Street © Oliver Slay/Crown Copyright

China’s Free Trade Zones accelerates wider economic reform

March 2015

The launch of China’s new Free Trade Zone (FTZ) programme is set to take the country’s financial reform journey into a new chapter.

China has a recent history of using special economic zones to experiment and act as sandboxes for future development on a national scale. In the past 30 years, the country has achieved phenomenal economic growth from an agricultural backwater to the world’s factory and second largest economy by creating Special Economic Zones (SEZs) to lead the way. These SEZs were given greater autonomy and successfully tested the market economy. However, the long-standing advantage in foreign trade stemming from cheap labour and low cost of land and resources cannot last.

China’s “next phase” of growth will partially depend on the successful development of its pilot free trade zones – a new breed of economic zone.

While the SEZs of the 1980s focused on the development of manufacturing and exports, the establishment of the free trade zones is significant progress in accelerating financial sector liberalisation which is a crucial step in taking China’s deepening economic reforms to the next level. Free trade zones will also have a major catalysing impact on cross-border trade and investment flows, whilst boosting growth in domestic services and innovation.

A number of FTZs were announced in quick succession since 2013, from Shanghai to Guangdong, Fujian and Tianjin. Each represents a zone of development intended to play to the strengths of each regional location.

China’s central government recently expanded the Shanghai free trade zone, by including sites such as the Lujiazui financial district, making it larger than any of the new FTZs. We believe the expansion will allow Shanghai to give full play to the advantages to test reform on a larger scale.

The Shanghai FTZ is seen as taking the role of creating a regulatory and operating environment for testing new initiatives and market reform.

The intention is to lessen the burden for foreign organisations wanting to conduct business in mainland China by removing certain financial and currency impediments and administrative constraints imposed on foreign investors elsewhere in China. The zone is also being used as a test-bed for new arrangements using different tools to encourage efficiency and innovation, including lower-cost financing opportunities using equity or debt solutions.

The zone in Shanghai is accelerating capital market development domestically and will also, over the longer term, contribute to the eventual operation of the renminbi as a freely convertible currency, initially in a carefully controlled area.

After Shanghai FTZ came into operation, two-way renminbi flows arising from cross-border sweeping reached more than 27.2 billion yuan, between January and August last year. We believe that the offshore borrowing for firms in the Shanghai free trade zone will be relaxed further – and that the new regulation will include banks – is a significant breakthrough.

The risks associated with the zone are proving manageable. A negative list was put in place to restrict foreign funds from investing in specific industries within the zone. This list has since been shortened, demonstrating the Chinese government’s growing level of confidence in the zone. The commercial banks are enforcing know-your-customer procedures to ensure that the funds moving in and out of China are supporting genuine trade.

Since the Shanghai FTZ was announced, more cities have launched their own FTZ plans. FTZs in Guangdong, Fujian and Tianjin will be modelled on Shanghai’s, but would rather advance a new round of the country’s opening and reform, based on their different economic and geographic locations.

We believe the expansion of the free trade zones will have a significant effect on Hong Kong, Macau and Taiwan in various aspects, especially services firms such as banks, e-commerce, foreign traders and other high-end innovative service providers. The free trade zones may prove a magnet to Hong Kong, Macau and Taiwanese investors due to their geographic proximity. Businesses in greater China need to be prepared and monitor developments of the free trade zones in tapping mainland China’s huge market.

Guangdong’s FTZ consist of three regions: Guangzhou Nansha, Shenzhen Qianhai Shekou and Zhuhai Hengqin New District. It will play a key role in deepening economic cooperation with Hong Kong and Macau to drive the liberalisation of trade in services.

A new wave of cooperation between Guangdong and Hong Kong will focus on developing an integrated regional service industry. The province’s future lies in reorienting its consumer industries towards China’s large and growing domestic market and upgrading from low-end manufacturing to develop the high-end services sector. With China’s largest and most open regional economy, Guangdong and Hong Kong can lead the way to high quality growth, with benefits flowing to both.

Hong Kong, Taiwan and Macau together contribute to over 31 per cent of Guangdong’s trade, mainly driven by Hong Kong contributing 24.6 per cent. Hong Kong is also the largest source of foreign direct investment in Guangdong, accounting for 65 per cent of Guangdong’s GDP. The investment now flowing into Guangdong has been diversified from manufacturing to the service sector. Guangdong will benefit from Hong Kong’s well established services sector and broader international standing.

We expect Qianhai to play a big role in leading financial reforms through Hong Kong-Shenzhen collaboration as efforts to bring greater convergence of cross-border business. It also takes up its intended role as an experimental laboratory for renminbi liberalisation and strengthen Hong Kong’s role as an offshore renminbi centre.

Hong Kong’s firms need to prepare for the challenges posed by the rapid development of free trade zones in China. We need to think of the position of Hong Kong when the renminbi is freely convertible. Hong Kong needs to work more closely with Guangdong province and to keep close watch on the opportunities arising from the internationalisation of renminbi.

Zhuhai can be expected to continue to foster economic links with Macau. Nansha has an existing development zone, and the local government has a stated ambition to attract more investment in manufacturing, trading, education, logistics and tourism.

Given its geographic advantage, Fujian is one of the wealthiest regions in the country and will focus on further strengthening links with Taiwan. Current major industries of both regions are geared towards electronics, petrochemicals and mechanical components.

Tianjin free trade zone is expected to focus on high-end manufacturing, financial leasing and further integration of the Bohai Bay area. It will also provide deeper connections with neighbouring Japan and South Korea.

There is much work remaining to be done. A lot of financial reforms in favour of liberalisation have been announced and are at the early stage of development. However, China has always sustained a cautious approach to financial reforms that could possibly disrupt the economy. The free trade zone chapter in China’s economic development has only just begun, and further free trade zones will initiate broader reform and growth.

Helen Wong, Chief Executive, Greater China, HSBC

Exporting to China with RMB

Top tips

Recent developments mean that China’s currency can be used for cross border trade and a range of other transactions. If you export to China, it’s worth exploring whether you could benefit from switching your trade currency to RMB. Explore the potential of RMB trade.

- If you are looking to grow your sales to China, offering to receive RMB in payment could be a smart move. Being open to receiving RMB may help you win new customers, and some Chinese buyers may be willing to offer better pricing or terms in return for the convenience of paying in their own currency. It is up to you to ask the right questions to your buyers,

for example:

- Is foreign exchange risk a concern for you? Would paying for imports in RMB help you?

- How do you finance your imports at the moment?

- Are you looking to improve your cash flow?

- If your customers currently borrow to finance their imports, you may be able to obtain better rates for RMB trade finance outside China than your customers can access in China – creating a great opportunity to negotiate a better deal for you both.

- Banks in China are often more willing to issue a long-usance letter of credit in RMB than in other currencies, in support of customers’ working capital requirements. Knowing this may help your buyers improve their cash flow by extending their payment terms under the letter of credit which may provide you with an opportunity to agree on a better price.

- Do not be surprised if your buyers are not fully familiar with RMB trade, which is still relatively new. Since mid-2012, every Chinese importer or exporter has been permitted to conduct cross-border trade in RMB, in a very similar way to trade in other currencies.

- Keeping reserves in RMB could provide you with potential gains if RMB appreciates.

- There is a range of possibilities to hedge your RMB risk. Speak to your relationship manager, who can help you explore potential options.

- If you plan to trade using RMB, consider where to open an RMB account. Three common choices are your home country; a well-established RMB Centre (I.e Hong Kong and London); or mainland China. This decision largely depends on where your key employees are located, though there are some differences in the requirements and features of these three options.

- There is a range of places to turn for advice on doing business with China, including your local chamber of commerce, government trade and investment body or embassy in China. HSBC has over 140 years of experience in China and is the largest foreign bank in the country.

Why RMB?

Trading with China

Bank of China is the most internationalised bank in China, providing a comprehensive range of financial services to customers across the mainland China as well as 42 countries and regions.

Cross-border RMB business provides enterprises with the right to use their preferred settlement currency and brings substantial benefits to enterprises as follows:

- Extend markets: exploring the business opportunities in China and sharing China’s economic growth.

- Hedge risks: reducing the dependence on one currency and hedging the exchange rate risk.

- Enhance efficiency: reducing conversion cost, shortening clearing time, and increasing the efficiency of utilisation of funds.

- Increase profits: decreasing contract price with the enhanced bargain power by using RMB as the settlement currency; making full use of on-shore and off-shore RMB markets, lowering the cost of financing and currency conversion, and making extra profits.

Investing into China

-

Extend markets: exploring the China market and leveraging on its economic growth;

-

Extend business scope: providing an alternative choice of raising funds, providing customers with cross-border RMB settlement, clearing, conversion, bond issuance and underwriting, as well as RMB investment, etc.

How to use RMB in your business

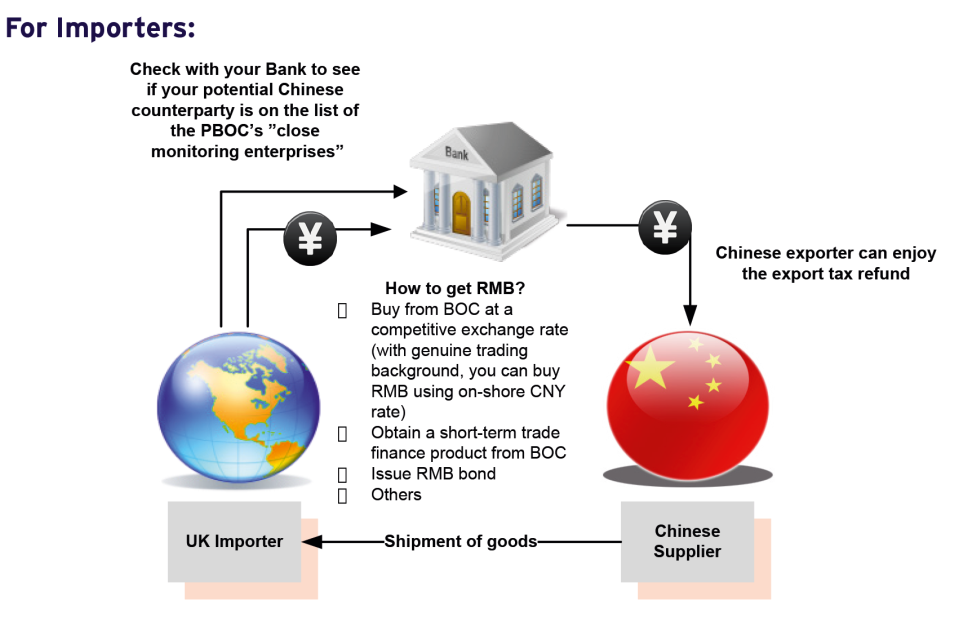

For Importers diagram

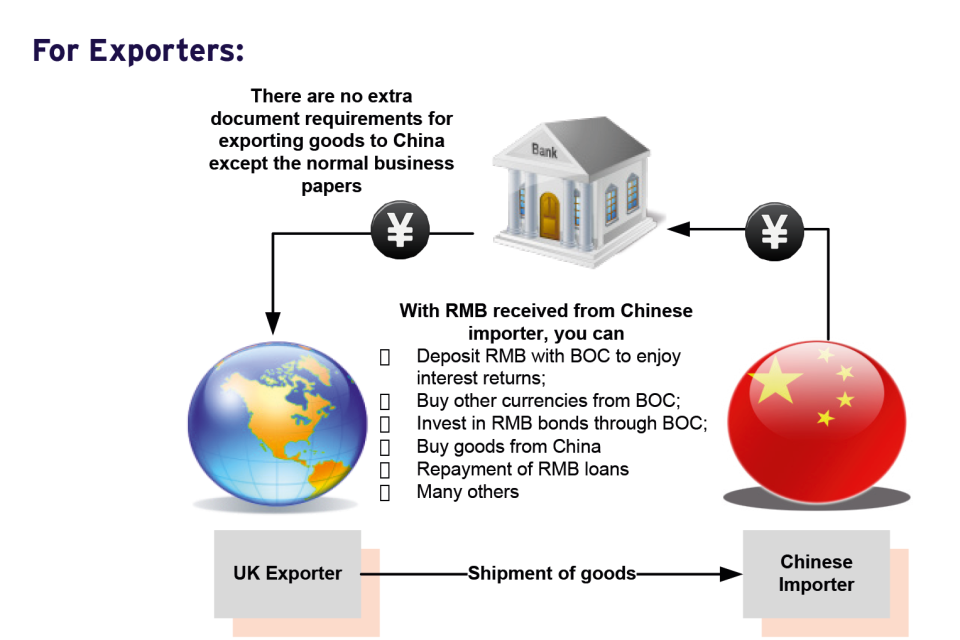

For Exporters diagram

RMB Products/Services Bank of China offer to facilitate your business

Bank of China offers a wide range of RMB banking services to business customers in the UK. From assisting you in your day to day banking operation, to borrowing money for your business, and helping you trade with China, Bank of China aims to become your trusted RMB partner to do business in the UK, China and internationally.

Account services and credit facility

Business Current Account

- Available in Sterling, US Dollar, Euro, RMB, and many more currencies

- Competitive account service charge

- Cheque book

- Cheque deposits

- Receiving and making domestic and international payments

- Available to access by Internet banking

Business Current Accounts

- Instant or fixed term deposit accounts

- Available in different currencies Borrowing

Borrowing

- Working capital

- Project Finance

- Real Estate

- M&A finance

Trade finance and settlement

Export

- L/C Advising and Confirmation

- L/C Transfer

- Export Bills for Collection

- Export Bills Advance

- Export Bills under L/C for Collection

- Negotiation/Discount of Export Bills under L/C

- Packing Loan

- Pre-shipment Financing

- Export Invoice Discounting

Import

- L/C Issuance

- Back-to-Back L/C

- Import Bills for Collection

- Import Loan

- Shipping Guarantee

- Trust Receipt Facilities

- Import Invoice Financing

Other

- Guarantee/Bond/Standby L/C

- Forfeiting

- Factoring

Foreign exchange

Similar to any other main currencies, all following products are available in RMB off-shore market including Spots, Forwards, Swaps, and Options.[footnote 2]

Internet Banking

- Easy to use

- Competitive pricing on making payments through internet banking[footnote 3]

Key Factors for Doing Business in China

China is the world’s second largest economy, and its phenomenal growth over the last decade has made it one of the most popular destinations for foreign investments. While there are many opportunities for UK investors, there are also many challenges to be faced when establishing businesses in China. Therefore, to achieve success, it is worth considering partnering with the relevant experts.

Below is a brief overview of some of the factors that need to be considered when doing business in China, according to professional services firm Deloitte:

Business Strategy

It is essential to have a well-developed business strategy when entering China that is based on up-to-date and local knowledge. The insights of partners and professional advisers can be critically important. Foreign investors are advised to carry out detailed feasibility and due diligence studies prior to committing investment into China to ensure commercial objectives can be realised.

Government Regulations

The Chinese Government places restrictions on foreign investment in certain sectors. These are itemised in its Investment Catalogue. Investment activities are categorised into four types: Encouraged, Allowed, Restricted or Prohibited. The catalogue provides specific details for all activities, with the exception of the Allowed category – all activities not specifically covered in the catalogue are categorised as Allowed. The catalogue is frequently updated and, therefore, foreign investors should review how their proposed activities in China are categorised.

Deloitte China has a law firm within its business and is ideally placed to provide legal advice to support your expansion plans.

Capital and Corporate Structure

There are several types of structural options available for multinational companies to establish an enterprise in China. This decision is particularly crucial in the initial process of setting up a business in China.

A successful company strategy cannot be implemented without establishing the right capital and corporate structure from the outset, and poor choices may lead to restrictions on future growth, difficulties in accessing finance and a lack of business flexibility.

The most common investment vehicles for foreign investors include a Joint Venture (JV). Wholly Foreign-Owned Enterprise (WFOE), Representative Office, China Holding Company (CHC) and Regional Headquarter.

Deloitte UK and China’s tax and business advisory teams have worked with many multinational companies on capital and corporate structuring to ensure that they are maximising return on their investment in China.

Location

China is a vast country and, as such, there is considerable variation in the size and business practices of local markets. Foreign investors are strongly encouraged to carefully consider the location of their operations at an early stage. Local resources vary from region to region, as does the quality of local government assistance (financial or otherwise) given to non-resident enterprises.

Deloitte China has very good relationships with government authorities across China. These relationships help UK clients to access the support they need and to understand the full range of regional benefits and incentives that may be available.

Taxation

China has a complex and rapidly-evolving tax system. Against this backdrop, the authorities are continuing to strengthen the administration of tax in relation to non-resident enterprises. China’s tax authority has launched the value-added tax pilot programme. This has been designed to gradually replace Chinese business tax by VAT, and decrease the overall tax burden of tax payers. It was initially launched in Shanghai and now reaches across China.

It is important to understand the latest rules and practices to reduce the risk of penalties and unexpected costs. This is particularly true when considering acquisitions, where thorough financial and tax due diligence can identify significant liabilities and risks that could potentially be mitigated through an appropriate acquisition structure.

Foreign Exchange Controls

China’s foreign exchange controls can lead to difficulties when making or receiving payments from China for non-resident enterprises. It is strongly recommended that business receive professional advice in advance of entering into service contracts or remitting profits from China, to ensure that cash does not become ‘trapped’ in China. Deloitte UK and China have significant experience in helping clients manage a wide range of payments scenarios.

Secondments

Non-resident enterprises will often second staff to China during the early stages of an investment to help set up their business. The complexity of secondment arrangements in China, however, can create unexpected issues and cause additional costs, particularly from a tax and immigration perspective. Significant savings can be achieved with a properly structured employment contract and remuneration package, which means the review of the proposed secondment arrangements by a professional adviser is recommended.

China’s Investment Environment

Business Models and Available Considerations

Foreign Investment in China typically occurs through establishment of a new entity on a stand-alone basis, formation of a joint venture or through merger or acquisition of an existing business.

Where foreign investment is restricted, parties may consider contractual options instead of a variable interest entity. Often the level of complexity of the business operation and the depth of integration of the business in China will dictate the type of investment vehicle and strategy.

Greenfield Projects

The main forms of foreign invested enterprises (FIE) for investing in greenfield projects are set out below.

| Type of Vehicle | Introduction | |

|---|---|---|

| 1. | Equity Joint Venture (EJV) | Joint PRC and foreign ownership. Shareholders have joint management of the company. Profit and loss are distributed in proportion with each party’s capital contribution. In certain industries, there may be restrictions on foreign ownership in EJVs. An EJV is incorporated as a legal person limited liability company. |

| 2. | Contractual Joint Venture (CJV) | Provides more flexibility in terms of what a party may contribute as registered capital, cooperative conditions, distribution of profits and liability, and return of investment, which may be agreed in the joint venture document. A CJV can be incorporated either as a legal person limited liability company or a non-legal person entity. Typically, the preferred investment vehicle for joint construction and management of hotels, commercial complexes, infrastructure and mining projects. |

| 3. | Wholly Foreign Owned Enterprise (WFOE) | A limited liability company with 100% foreign ownership. Investment vehicle of choice for most foreign investors in industries where there are no restrictions on foreign investment. |

| 4. | Representative Office (RO) | Provides basic market entry without formal legal establishment. Restrictions on direct business activities. Recent regulatory changes make ROs very unattractive as an entry vehicle. |

| 5. | Foreign Invested Partnership (FIP) | Established by two or more foreign entities or individuals with or without a Chinese partner. Profits and losses are distributed according to partnership agreement. Income tax is accessible on each partner, and not on the partnership. |

| 6. | Special FIEs | Certain industries warrant special FIEs. For example, wholesale and retail entities use foreign invested commercial enterprises (FICE), companies wishing to invest in real estate projects use foreign invested real estate companies (FIREC), and foreign invested venture capital enterprises (FIVCE) are used as private equity funding vehicles. |

| 7. | China Holding Company (CHC) | A foreign investor with substantial operations in China will be eligible to set up a CHC to hold its equity in investments in China. |

Century Avenue © Oliver Slay/Crown Copyright

Shanghai Free Trade Zone

As a priority, companies should consider whether the Free Trade Zones (FTZ) could be of benefit. Provided that the relevant industry is not delineated on the 2014 Negative List (Negative), companies can benefit from simplified filing procedures, reduced foreign investment restrictions and greater ease of operations. Parties only need to file their establishment applications with the State Administration of Industry and Commerce (SAIC) who will coordinate approvals with other government departments, thereby shrinking establishment timeframes to one week. In terms of money flows, resident FTZ companies will now, or in the near future, have,

- Simplified foreign exchange registration – open capital accounts without prolonged foreign exchange registration approvals;

- Free trade accounts – open free trade accounts (FTA) and transfer funds freely between FTAs, other offshore accounts, and onshore non-resident accounts;

- Offshore RMB loans – borrow offshore RMB funds subject to certain requirements (e.g. limits on use of such offshore RMB loans and long term);

- RMB convertibility – enjoy full convertibility of the RMB under capital accounts along with any future benefits foreign exchange reforms may present (e.g. FIEs can convert foreign exchange into RMB from day one and enjoy RMB hedging, whereas outside the FTZ an FIE must wait until there is a commercial contract requiring hard currency payment);

- Deposit rate liberalisation – enjoy higher interest rates for foreign exchange and RMB deposits with banks due to the loosening of the statutory interest rate limits; and

- Others - significant changes will benefit parties wishing to operate banking and finance, transportation, commerce and trade, culture, public and other professional services. For example, foreign investors can now invest in certain categories of value-added telecommunication services.

Considerations for Investing in China via Hong Kong

Structuring China-related investments through a Hong Kong holding company can provide the following benefits, including easing the exit strategy as discussed later in this publication:

Economic benefits

Dividends received by a Hong Kong holding company from a Mainland subsidiary are unlikely to be taxable in Hong Kong, no dividend tax is levied on the Hong Kong holding company when distributing dividends to investors, and a lower income tax is levied on the Hong Kong company compared to its Mainland counterparts;

Flexibility

Greater ability to tailor multiple investors’ rights and obligations and governance provisions in a Hong Kong holding company due to less restrictive corporate legislation; and

Funds access

Quick access to both domestic and international funds, under a stable regulatory framework.

The following section contains the recommendations that will address or at least minimise the potential impact of the risks for most investors.

A continually improving legal system

A cornerstone of the Third Plenum is to enhance rule of law by ensuring independence and fairness in prosecuting bodies and courts. The recent curbing of the Communist Party’s Political and Legal Committee’s powers, a body tasked with overseeing security services, and public pronouncements by China’s top judge on how improvements must be made to exercise judicial power independently, suggest an intention to move in a positive direction.

Overall, King & Wood Mallesons expect there will be a greater reliance on complex contracts with the growing sophistication of Chinese counterparties. Foreign firms will benefit from Chinese parties who frequently deal with Western counterparts evolving as their corporate thinking matures and becomes more refined.

Measures and supervision

To maintain oversight of investments from the point of market entry to sustaining operations, firms should undertake the following:

Due diligence

Regardless of the structure of investment, conduct thorough due diligence through fieldwork rather than relying solely on data rooms (nothing beats a random physical site inspection);

Risk assessments

Assess risks from both a legal and practical perspective to clarify and prioritise actual versus theoretical dangers;

Unique transaction

Treat each transaction as being unique and avoid wholly relying on foreign or Chinese standards;

Involve Headquarters

Keep headquarters continually involved and apprised of developments and ensure good corporate governance to maintain communication lines;

Understanding Cultural Differences

Take time to understand local customs and practices, both between China and the West, and between provinces within China; and

Post Transaction Audits

Conduct regular internal audits post-transaction to manage compliance issues proactively.

Strong compliance culture

PRC Criminal Law criminalises official bribery and commercial bribery with sanctions ranging from criminal detention to life imprisonment. China’s anti-bribery legislation applies to all PRC citizens wherever located and foreign investors and legal entities in China. While Chinese law does not require businesses to institute anti-bribery systems and controls, many businesses in China have done so in order to comply with the anti-bribery laws of foreign jurisdictions that have extra-territorial reach, such as the U.S. and UK.

Accordingly, companies should comprehensively review corruption, anti-monopoly and general compliance risks across operations and establish meaningful compliance programs.

Managing JV relationships

For those who adopt a JV structure in China, particularly those engaged in a 50-50 split, King & Wood Mallesons recommend the following to manage inherent conflicts:

How do I Protect my Investment?

Establishing a special purpose vehicle in Hong Kong is a strategic move that can generate economic benefits through a tax efficient jurisdiction, greater protection through established Hong Kong laws governing shareholders, unrestricted access to funding and a ready exit strategy. This can translate into an environment that is responsive to business needs, an incredible asset when doing business in China.

East Nanjing Road Shanghai © Oliver Slay/Crown Copyright

Know your partner

Due diligence on your JV partner is imperative;

Effective management costs

Identify and engage committed, capable hands-on management who are able to act diplomatically at all times, but assertively when needed;

Deadlock mechanisms

Ensure JV documentation specifies detailed dispute resolution and deadlock mechanisms. It can be difficult to enforce deadlock events in China due to regulatory requirements i.e. corporate actions taken by a JV must be approved by the relevant authority who in turn seeks unanimous JV partner consent prior to providing approval, which results in inability to progress matters;

Corporate governance

Ensure JV documentation expressly provides for detailed corporate governance provisions that facilitate operations;

Repatriation of profits

Clarify in JV documentation the timing and requirement to repatriate profits, how to deal with trapped cash and withholding tax issues;

Compliance

Establish a compliance committee or engage personnel to oversee compliance of domestic laws; and

Risk control

Establish a committed and professional risk control team to manage and address prevailing issues, especially as monetary damages are often insufficient and injunctive relief is rarely available.

Officers and Directors Liability Protection

Directors, senior management and/or legal representatives in an FIE are subject to statutory obligations of fidelity and diligence, and contractual duties and liabilities set out in relevant employment agreements or articles of association. Personal liability can be limited to individual actions adjudicated to be against the interests of the relevant FIE, i.e., misappropriating funds, conversion of business opportunities, and seeking improper personal benefits for him/herself.

To effectively mitigate the risk of potential liabilities, a company may:

- Purchase liability insurance;

- Clearly allocate duties and responsibilities in the articles of association;

- Establish proper internal controls and supervision to monitor business activities; and

- Educate directors or individuals in other positions of authority to expressly raise objections to any resolutions that may violate laws and record the same in relevant minutes.

Improving intellectual property protection

King & Wood Mallesons are of a view that there will be an increasing emphasis on measures to protect intellectual property, as China transitions from a low-cost manufacturing centre to a research and technology leader and innovator, and as R&D investment continues to grow in the double digits.

This has become more evident in recent reforms to the Trademark Law, including the introduction of the new invalidation proceedings, more stringent approach to combat trademark squatting, clarifications of the protection of well-known trademarks and an increase of statutory damages.

However, for now, intellectual property enforcement remains inconsistent. Accordingly, an FIE should take appropriate steps to protect itself by:

Register IP

Registering trademarks and patents by respectively submitting and designating China in its international trade mark application pursuant to the Madrid Protocol and using the Patent Cooperation Treaty application process to harness the 30-month priority period;

IP Policy

Implementing corporate policies that emphasise confidentiality obligations and other intellectual property protection measures including specifying ownership invention and inventor remuneration;

IP Ownership Structure

Considering whether it is eligible to reduce enterprise income tax under the national High and New Technology Enterprise program before centralising intellectual property ownership offshore; and

Actively Voice Concerns

Communicating any intellectual property concerns through MOC’s Mechanism of Regular Communication with FIEs.

How do I exit my investment?

Looking ahead

Given the need to factor in PRC approval requirements upon the sale of a business, the best way to prepare for a successful exit from an investment is to ensure it is structured with that potential in mind at the outset. Common exit strategies include an asset sale, equity sale or a combination of the two.

If clients are looking for short-term investments with a clear exit strategy, a special purpose vehicle in Hong Kong could be the ideal choice due to:

Ease of transfer

The ability to transfer shares in the Hong Kong holding company without the need for onshore regulatory approval under most circumstances. Such trade sales have increased in popularity given the inactive domestic IPO market; and

IPO

Favourable and efficient pre-IPO investment environment.

Structuring considerations

King & Wood Mallesons usually find that sellers generally prefer an equity sale as it attracts less tax and is more straightforward. In some circumstances, a merger may be considered given it might be eligible for tax-deferrals.

With Chinese tax authorities paying greater attention to whether related party transactions use arm’s-length pricing, parties need to ensure that a deal’s negotiated transaction price is defensible.

In 2013, we also saw clearer guidance on, but more stringent enforcement of, Circular 698, a requisite item on deal checklists. Circular 698 requires transferors to report indirect equity transfers in certain offshore transactions to Chinese tax authorities who are empowered to levy tax despite equity transfers occurring offshore and having no onshore shareholding changes.

Further, a sale of property will be subject to various taxes including income tax, value-added tax, business tax, land value-added tax, deed tax and stamp duty tax, although exemptions may apply to certain asset transfers. As such, parties must consider any tax costs and tax exposures upfront during the deal negotiation phase.

In preparing for a transaction, foreign parties should factor in longer negotiation times with any Chinese counterparties who may often wish to re-open issues.

Executing detailed minutes of each meeting will assist in recording parties’ intentions and provide a clear discussion roadmap. Companies should also settle in advance plans for employees as the sale of assets or a merger is a material change in circumstances under PRC employment laws; staff will have the right to claim for termination compensation upon the transaction taking effect even if they stay on as employees. This is often dealt with by the seller paying all severance pay prior to transfer.

Repatriating profits and unwinding an investment

Parties can repatriate dividends to their shareholders in any financial year provided that the company has met statutory financial obligations to settle previous years’ losses, pay requisite taxes, and allocate sufficient monies to its reserve fund and employee bonus and welfare fund.

In practice, dividend repatriation is made no more than once a year, as documentary requirements to convert funds into foreign currency for transfer are determined on an annual basis (i.e. tax payable, audit reports). Parties should negotiate suitable conditions and incorporate clear and detailed profit distribution terms into relevant documentation (i.e. JV contract and articles of association). If funds are not repatriated, parties may reinvest or redeploy undistributed profits inside and/or outside China.

Liquidating an FIE in China will typically take between 6 to 18 months. The tax deregistration process is the most complex and time-consuming aspect as authorities seek to verify that an entity has fully complied with its tax obligations for the three years prior to the dissolution process. Due to the nature of the liquidation process, we recommend that clients avoid establishing temporary stepping stone structures, such as representative offices, if the intention is ultimately to graduate to a more permanent FIE in the near future. Clients would be better served focusing efforts in structuring an FIE that can be scaled up for long-term plans.

Index of Useful Contacts

Bank of China

Bank of China is the most internationalised bank in China, providing a comprehensive range of financial services to customers across the mainland China as well as 42 countries and regions.

On 4th November 1929, Bank of China set up “Bank of China London Agency” in London which was the first overseas financial institution formed by any Chinese bank (later known as Bank of China London Branch).

In 2007, Bank of China established a UK subsidiary – Bank of China (UK) Limited.

For the past 86 years, Bank of China has played an important role as a bridge for Sino-British economic and trade cooperation.

- Good understanding of both Chinese and UK market with extensive global network

- The first bank to provide RMB products and services in the UK since 2009

- The only Chinese bank partnered with UKEF to help deliver the loan under the Direct Lending Facility

- DIT’s partner in UK e-Export program: BOC e-Express

For further information and services, please contact:

RMB business

| Hualin Zhang |

| +44 (0)20 7282 5879 |

| hlzhang.uk@mail.notes.bank-of-china.com |

Trade Finance

| Xiaohan(Fiona) Wang |

| +44 (0)20 7282 8888 |

| xhwang@mail.notes.bank-of-china.com |

Corporate

| Shawn Zhao |

| +44 (0)20 3192 5876 |

| Shawn.zhao@bankofchina.com |

Your local branch

London

| Jinguang Zhang |

| +44 (0)20 7282 8756 |

| jzhang@mail.notes.bank-of-china.com |

| Minggui Wang |

| +44 (0)20 7287 1057 |

| mwang@mail.notes.bank-of-china.com |

Manchester

| Linda Lin |

| +44 (0)161 236 8302 |

| llin@mail.notes.bank-of-china.com |

Birmingham

| Jing Ding |

| +44 (0)121 622 7002 |

| jing_ding@mail.notes.bank-of-china.com |

Glasgow

| Dong Wang |

| +44 (0)141 332 3354 |

| dongwang@mail.notes.bank-of-china.com |

HSBC

Founded in 1865 to finance trade between Asia and the West, today HSBC is one of the world’s largest banking and financial services organisations serving some 51 million customers.

Visit: www.hsbc.co.uk/international

Call: +44 (0)800 78 31 300 or speak to your HSBC Relationship Manager

Deloitte

Deloitte UK’s Chinese Services Group supports clients in many ways when they are seeking to expand into China whether through M&A activity or organic growth. We understand the huge potential of such opportunities, but also the practical risks. Therefore, it is vital for businesses to have the right information and expertise to plan and prepare for their international expansion.

Our support to clients in helping them expand in China and identify new business opportunities includes providing them with access to a Deloitte UK team based in China. The team is led from Shanghai and focuses on establishing and deepening relationships with major Chinese corporates, key influencers and government officials. The team brings strong connections, decades of experience, and deep knowledge of doing business in China.

UK

Ralph Adams

| National Leader |

| UK Chinese Services Group |

| London |

| +44 (0) 131 535 7234 |

| raadams@deloitte.co.uk |

Jon Lovell

| Director |

| UK Chinese Services Group |

| Direct phone: +44 161 455 6546 Mobile: +44 7825 531031 |

| jlovell@deloitte.co.uk |

Richard McDonald

| Partner |

| UK Chinese Services Group |

| London |

| +44 (0) 20 7007 3168 |

| rimcdonald@deloitte.co.uk |

Christina Chan

| Partner |

| UK Chinese Services Group |

| London |

| +44 (0) 20 7007 8118 |

| christinachan@deloitte.co.uk |

China

David Percival

| Director |

| UK Chinese Services Group |

| Shanghai |

| +86 21 6141 1221 |

| dapercival@deloitte.com.cn |

Chris Aylott

| Director |

| UK Chinese Services Group |

| Shanghai |

| +86 21 6141 2069 |

| chaylott@deloitte.com.cn |

David Fallon

| Director |

| UK Chinese Services Group |

| Hong Kong |

| +852 28526642 |

| dafallon@deloitte.com |

King & Wood Mallesons

As the first and only global law firm to be headquartered in Asia, King & Wood Mallesons is connecting Asia to the world, and the world to Asia. With unparalleled depth of both inbound and outbound capability, KWM is uniquely placed to support regional clients as they internationalise and international clients as they look to invest or expand into Asia.

Strategically positioned in the world’s growth markets and financial capitals, the firm is powered by more than 2,700 lawyers across more than 30 international offices spanning Asia, Australia, Europe, the Middle East and North America.

As a top 10 global firm by lawyer numbers and the only firm in the world able to practise PRC, Australian, Hong Kong, English, US and a significant range of European laws, KWM is providing clients with deep legal and commercial expertise, business acumen and real cultural understanding on the ground where they need it most.

UK

James Wallis

| Client Development Manager |

| +44 (0) 20 7111 5545 |

| james.wallis@eu.kwm.com |

William Holder

| Partner, Corporate |

| London |

| +44 (0)207 111 2189 |

| William.holder@eu.kwm.com |

Hong Kong

Zhang Yi

| Partner, Corporate & Securities |

| Hong Kong |

| +852 3443 8328 |

| Yi.Zhang@hk.kwm.com |

China

Stanley Zhou

| Partner, Banking |

| Shanghai |

| +86 10 5878 5186 |

| Stanley.zhou@cn.kwm.com |

Scottish Enterprise

Scottish Enterprise is Scotland’s main economic development agency and aims to deliver a significant, lasting effect on the Scottish economy. Its role is to help identify and exploit the best opportunities for economic growth. It supports ambitious Scottish companies to compete within the global marketplace and help build Scotland’s globally competitive sectors.

Scottish Development International

Scottish Development International (SDI) is the trade and investment arm of the Scottish Government, Scottish Enterprise, and Highlands and Islands Enterprise. It is a joint venture between these three partners.

SDI provides professional expert international support to Scottish businesses wishing to trade internationally and inward investors wishing to invest in Scotland. SDI is the Government’s single point of contact for all international trade and investment needs.

High Growth Markets Unit

SDI’s High Growth Markets Unit (HGMU) has been established to accelerate the internationalisation of Scottish companies and enhance the support provided by SDI in Scotland across three High Growth Markets: China, India and the Middle East.

The HGMU acts as an extension of the field offices in China, India and the Middle East and provides a first point of contact in Scotland for all matters relating to these high growth markets. The unit’s team of experienced market specialists enhances the support provided in Scotland and in-market for companies looking to engage with these high opportunity markets.

Contact details

Colin Crabbe

| International Senior Manager |

| SDI High Growth Market Unit |

| +44(0)1786 452 031 |

| colin.crabbe@scotent.co.uk |

Cissy Bullock

| International Senior Executive – China |

| SDI High Growth Market Unit |

| +44(0)131 313 6185 |

| cissy.bullock@scotent.co.uk |

China-Britain Business Council (CBBC)

The China–Britain Business Council (CBBC) is a leading British organisation promoting trade and investment between the UK and China. Our mission is to help UK companies of all sizes and sectors, whether new entrants or established operations, access the full potential of the fastest growing market in the world.

Contact your local CBBC China-Britain Business Council business adviser at www.cbbc.org or on +44 (0)207 802 2000.

UK

| Juliet Zhou |

| Head of Financial and Professional Services (UK) |

| China-Britain Business Council |

| +44 (0) 20 7802 2006 |

| +44(0)7880 195134 |

| juliet.zhou@cbbc.org |

China

| Anatole W. Pang |

| Sector Lead - Financial Services (China) |

| British Chamber of Commerce in Beijing/ |

| China-Britain Business Council |

| +86 1590 102 8266 |

| +852 9280 9904 |

| anatole.pang@cbbc.org.cn |

CBBC Regional Contacts

Mark Hedley

| South East |

| (0)20 7802 2018 |

| mark.hedley@cbbc.org |

Chris Cotton

| East of England |

| +44 (0)178 731 0245 |

| chris.cotton@cbbc.org |

Antoaneta Becker

| South West |

| +44 (0) 7984 175 318 |

| antoaneta.becker@cbbc.org |

Stewart Ferguson

| West Midlands & Wales |

| +44(0)1788 570 929 |

| stewart.ferguson@cbbc.org |

Jasmine Chambers

| East Midlands |

| +44 (0)845 052 4001 |

| jasmine.chambers@cbbc.org |

Giles Blackburne

| Yorkshire & Humber |

| +44 (0)790 822 8556 |

| giles.blackburne@cbbc.org |

Vince Cunningham

| North East & Northern Ireland |

| +44 (0)1484 325 320 |

| vince.cunningham@cbbc.org |

Nathalie Cachet-Gaujard

| North West – Manchester |

| +44 (0) 161 237 4247 |

| nathalie.cachet-gaujard@cbbc.org |

Jessica Zhang

| North West – Liverpool |

| +44 (0)151 227 1234 |

| jessica.zhang@cbbc.org |

James Brodie

| Scotland |

| +44 (0)7931 880 934 |

| james.brodie@cbbc.org |

Department for International Trade (DIT)

-

Discover how DIT International Trade Advisers can assist you at: www.gov.uk/ukti-international-trade-advisers

-

Discover how the DIT Overseas Market Introduction Service can assist you at www.gov.uk/overseas-market-introduction-service

-

Discover how the Medium-Sized Business Programme can assist you at www.gov.uk/medium-sized-business

| Email: enquiries@ukti-invest.com |

| Telephone +44 (0)207 000 9012 |