GIAA Annual Report and Accounts 2024-2025

Updated 18 July 2025

For the period 01 April 2024 to 31 March 2025

Presented to the House of Commons pursuant to Section 6 (4) of the Government Resources and Accounts Act 2000

Performance report

Performance overview

This section tells you about our organisation - who we are, our mission, vision and values and our services. It also provides a summary of our performance over the year as we progress with our strategic objectives and our approach to managing the risks that could stand in the way of our success.

About the Government Internal Audit Agency

The Government Internal Audit Agency (GIAA) leads the internal audit function and profession across central government.

We provide internal audit services and support for the UK government. Our clients include ministerial departments and many non-ministerial departments, agencies, and public bodies. Our counter fraud and investigation service supports finance professionals across government in their role as stewards of public money. We also provide assurance for the management and payment of European Commission grants for several EU funded programmes. These programmes have run for several years with the majority closing in 2024-25; a small remainder will continue to be supported by the Agency until conclusion in 2025-26.

Welcome to our Annual Report and Accounts

After a decade operating at the heart of government, our focus on client delivery remains unwavering. The pace of change is fast, and we work closely with all our clients, enabling them to identify and manage risks to their service delivery.

Our assurance and insight support the delivery of effective and efficient public services across government. Our refreshed cross-government insight programme better anticipates client needs, while our pioneering work with artificial intelligence (AI) continues to gain international recognition, placing us at the forefront of audit technology.

GIAA is the UK’s largest non-commercial provider of internal audit services. This year we completed Lord Maude’s recommendation by finalising our agreements with the Foreign, Commonwealth and Development Office and HM Revenue and Customs for their affiliate membership with the Agency. Internal audit colleagues from both departments have begun to work with GIAA, enhancing the breadth of our cross-government insight and ensuring more effective use of government funds.

As our sphere of influence grows in one area, we end our involvement in another. UK participation in many EU programmes came to an end in 2024-25 and with this we have closed the majority of our EU assurance programmes.

This year also marked the significant milestone of our successful transition to a fully fee-funded business model. Throughout this period of change we have been impressed by the ‘can do’ attitude of our people, who have embraced more efficient and productive ways of working. Their commitment to recognising what works well, identifying improvements and embracing innovation has been crucial to our operational success.

The expertise of our people continues to attract attention across government, the UK and internationally. This year our counter fraud and investigation, and internal audit colleagues have celebrated numerous awards and commendations, and our data analytics specialists have showcased their expertise at events across the world.

We remain wholly committed to our mission of delivering ‘better insights, better outcomes’ for our clients. We would like to extend our sincere thanks to all our people whose hard work, commitment and dedication has brought our mission to life. Each person’s contribution makes us successful so that, as an Agency, we are able to deliver a far greater impact than the sum of our parts. Together, we are well-positioned to continue providing and improving assurance and insight across government, supporting our clients through the challenges and opportunities that lie ahead.

Harriet Aldridge, Chief Executive GIAA and Isobel Everett MBE, Chair, GIAA Board

Our year at a glance

April 2024

HMRC and FCDO internal audit teams join GIAA as affiliate members - concluding our One GIA programme and completing Lord Maude’s recommendation for government internal audit.

May 2024

We launch our AI writing engine, to support more efficient and effective reporting-writing.

June 2024

Driving efficiency and quality through ‘the power of learning’ was the theme for our GIAA trainee and apprentice conference.

July 2024

In preparation for the UK General Election we shared our topical insight on Machinery of Government changes for government organisations.

August 2024

We launch our revised insights programme to share information, thought pieces and detailed case studies of excellence and best practice in risk control across government.

September 2024

We brought members of the Government Internal Audit Leadership Community together in person for the first time to share and discuss learnings and insights.

October 2024

We showcased GIAA’s work developing AI applications for internal audit at the Chartered Institute of Internal Audit conference.

November 2024

We brought internal audit senior leaders together across the wider public sector with the launch of our UK government internal audit leadership community.

December 2024

We presented our work on IT, AI and innovation for HM Treasury at their Innovation Day.

January 2025

We published our 2024 Insights Report and Chief Executive Opinion and Overview, sharing our analysis of strategic risk and control for the UK government for 2023-24.

February 2025

We launched our online Internal Audit Knowledge Hub to support, greater collaboration, discussion and development across the wider government internal audit community.

March 2025

We launch our first Internal Audit Function Strategy.

Our role identifying early warning signs across the public sector is highlighted in a report by the Committee on Standards in Public Life.

Our year in numbers

For 2024-25…

- we employed 471 people (full time equivalent)

- who delivered 1500 audits for 15 government departments and 130 arm’s length bodies

- our Insights team presented six full cross-government reports, nine opinion pieces and eight cross-government insights reports

- we delivered three events for UK government audit and risk assurance committee (ARAC) members and two ARAC Chair network meetings

Our clients express high levels of satisfaction with our services…

- we have a net promoter score of 8.22 out of 10 from senior civil servant clients who would recommend our internal audit services

- our counter fraud and investigation services received an average satisfaction score of 9.11 out of 10

We continue to embrace the benefits of emerging technology…

- 79% of our people have used our bespoke artificial intelligence (AI) engines

- 19 organisations have either used or are currently using one or more of our artificial intelligence ‘Engines’

We value our people and their wellbeing…

- 425 people undertook mental health awareness sessions

- we received the prestigious Mind Index Silver Award

About us

Our mission

Our mission is that people provide objective insight so that central government can achieve better outcomes and value for money for the public – better insights, better outcomes.

Our Vision 2026

Our three year ‘Vision 2026’ was launched in 2023, following a comprehensive programme of engagement with internal and external stakeholders. Our vision is focused on raising the bar in all that we do, building on our progress and stretching ourselves to achieve more.

Our vision sets out that by 2026 we will be:

- elevating our impact across government

- empowering our people to thrive, develop and deliver

- excelling in quality and professionalism

- inspired by innovation

- sustained on firm foundations

You can read our full vision document at:GIAA Vision 2026 - GOV.UK

Our strategy and plan

Our Strategy 2023-26 sets out how we will achieve our Vision 2026. For 2024-25 and every year of our strategy, we produce a one-year corporate plan that identifies the strategic priorities we will deliver during that 12-month period.

We review our strategy and corporate plan each year so that we maintain a sharp focus on achieving our priorities.

You can read our Strategy 2023-26 and Corporate Plan for 2024-25 using the following links:

-

Strategy 2023-26: Government Internal Audit Agency Strategy 2023-26 and Plan 2023-24 - GOV.UK

-

Corporate Plan 2024-25: Government Internal Audit Agency Corporate Plan 2024-25 - GOV.UK

Our values and behaviours

Our values and behaviours underpin everything we do. By living our values and embodying our behaviours every day, we will achieve our strategy and work towards realising our Vision 2026.

Values

Our GIAA values require us to be trustworthy, collaborative, principled, respectful and professional in all that we do.

Behaviours

We embody our values through our GIAA behaviours and that we are:

- quality driven

- client focused

- visionary

- (we act) in the public interest

- honest

- enabling

- inclusive

- responsible

Our services

Internal audit activities

At GIAA we support our clients to understand, manage and deliver better services. The insights we provide support government to operate more efficiently and effectively, improving outcomes for service users and ensuring better use of public funds.

Our assurance services provide independent and objective assessment of the effectiveness of our clients’ governance, risk management and control arrangements. Our consulting services advise our clients on how to improve and develop governance, risk management and control arrangements for new or emerging areas of work, where there is significant change, or where there is no system of risk management or control framework to assure.

Our specialist internal audit services are an important part of elevating our quality and impact. Our specialist services include:

- digital, data and technology

- programme and project management

- commercial and procurement

- grants

- team players

- appreciative

Audit services for European Union funded programmes in the UK

On behalf of the UK government, we provide the European Commission with independent and impartial assurance in respect of several European Union-funded programmes in England and other parts of the UK. The final year for UK participation in many EU programmes was 2024-25.

Counter fraud and investigation services

Our counter fraud and investigation service is recognised as a centre of excellence. We provide high quality and cost-effective services for our clients to enhance their counter fraud response and ensure responsible stewardship of public funds. Our specialist counter fraud and investigation services include:

- investigation

- risk assessment

- tailored counter fraud detection

- whistleblowing and raising a concern

- development of counter fraud campaigns

- supporting our clients with the implementation of the requirements of the Functional Standard (GovS013 Counter Fraud)

Innovation and data analytics

Our work developing artificial intelligence (AI) places us at the forefront of this emerging technology and its use in internal audit. Our AI tools enable a person to read hundreds of documents at speed by summarising, collating, and analysing content. Using AI in this way means that insights and data can be extracted quickly, and trends spotted. Understanding these trends, creates greater opportunities for cross-government collaboration and learning. This creates potential for improved public services, ultimately providing better value for the taxpayer. We have also made some of these tools available to other government organisations to support their efficiency and productivity efforts.

Our organisational structure

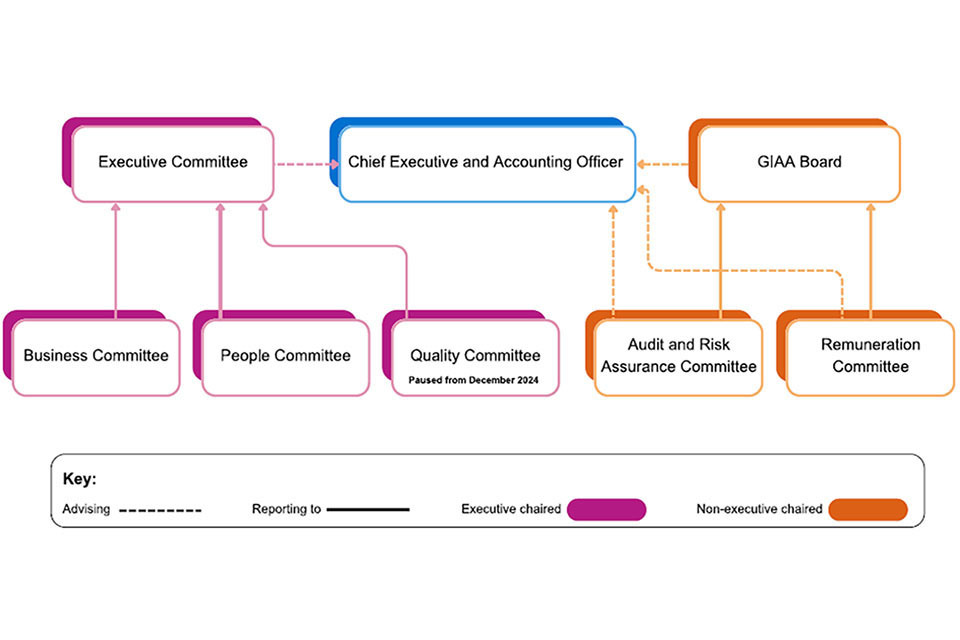

GIAA is led by a Chief Executive, who is supported by our Executive Committee (ExCo) and our Board.

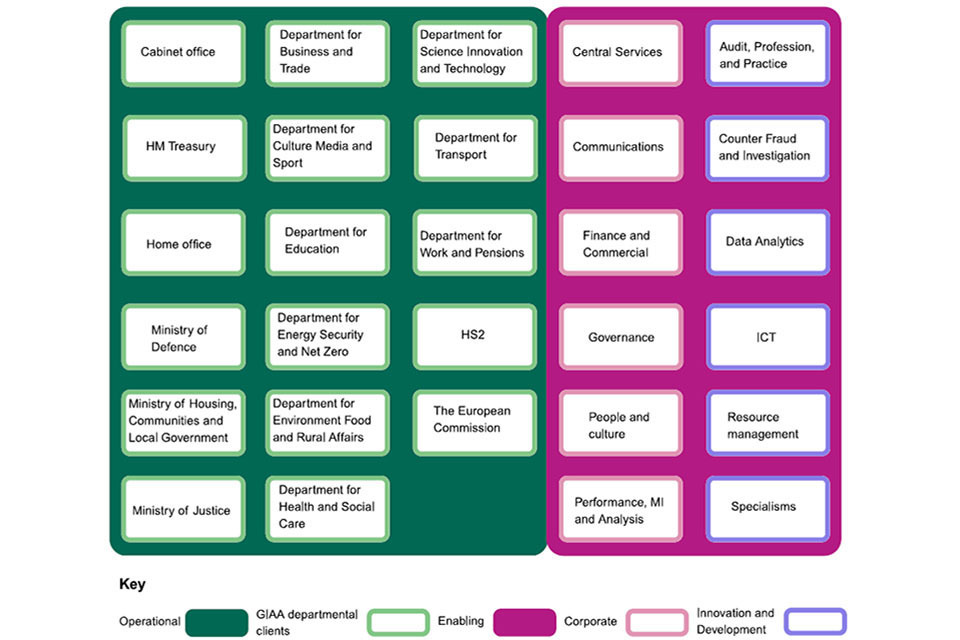

In 2024-25 our client base was 15 of the 17 main central government departments. These departments (shown in Figure 3 below) along with over 130 government arm’s length bodies are grouped into operational directorates to ensure the best outcomes for our clients. In turn, our operational directorates are supported by a small enabling function.

Our client base continues to grow and in 2024-25 we confirmed affiliate membership agreements with the Foreign, Commonwealth and Development Office ministerial department and HM Revenue and Customs organisation. With these two agreements in place we have consolidated our position to provide internal audit insight, assurance and guidance across all UK central government. Through our affiliate partnerships we have established clear ways to add even more value with greater opportunities for collaboration and sharing good practice and insight.

A full list of all clients is available on: GIAA client list - GOV.UK

GIAA operating structure 2024-25

Figure 1: GIAA Organisational Structure

Our organisation operating structure is reviewed continuously, to ensure we are in the best place possible to deliver maximum impact and benefit for all our clients.

Over 2024-25 we carried out a detailed revision of our operating structure illustrated in Figure 3. This revision supports us to be in the best place possible to deliver high quality services for all our clients.

Our new operating structure was introduced on 1 April 2025. Our new structure enables GIAA to:

- amalgamate internal audit and counter fraud and investigation client delivery under two delivery directors

- invest in our specialisms alongside our data analytics team and resource managers

- create a new cross-portfolio delivery team

- introduce a new technical directorate to focus on cross-government insight, audit profession and practice and our leadership of the government internal audit function

- enable our corporate services colleagues to better support our client facing teams

We employed 471 full time equivalent (FTE) people, with the majority working in client facing internal audit and counter fraud and investigation roles.

GIAA priority outcomes and areas of focus

The Performance Analysis section of our annual report (from page 18) outlines how we have performed against three priority areas of focus that are set out in our Corporate Plan 2024-25: our people, our quality and our financial position.

Managing our principal risks

As with all organisations, we face risks in the delivery of our strategy, corporate plan and core functions. We actively manage our strategic risks to make best use of public money, maximise our performance and achieve our objectives.

We have identified principal risks to the delivery of our strategic objectives. Details of these risks, including examples of the mitigating actions we have taken to address these are available from page 39 of the Performance Analysis section.

Going concern basis

Our financial statements have been prepared on a going concern basis in accordance with the Government Financial Reporting Manual. We operate as a going concern with our operating costs met through fee payments from our internal audit, counter fraud and investigation and European clients. In prior years, we were in receipt of Supply Funding from our sponsoring department HM Treasury that was provided to support the Agency to form and mature. We were also in receipt of monies for specific deliverables as part of our 2021 Spending Review settlement (SR21). From 2024-25 our Supply Funding was limited to legacy pension funding and a contribution to funding the Internal Audit Government Profession. Full details are available in our financial accounts on page 93. In anticipation of the reduction of our Supply Funding we developed and implemented a programme of efficiencies and smarter ways of working so that we break even and remain financially sustainable. These plans have been put in place as part of our Strategy 2023-26 and with priority actions set out in our corporate plan. Our 2025-26 Supply Funding will be of a similar value to the figure received in 2024-25.

Quality of our work

For 2024-25 our internal audit work and methodology was delivered in accordance with Public Sector Internal Audit Standards (PSIAS). This was the final year the Agency applied the PSIAS as the new Global Internal Audit Standards in the UK Public Sector (GIAS) were adopted from 1 April 2025.

We undertake regular internal quality assessments of our work with external assessments taking place every five years. Our last External Quality Assessment (EQA) was conducted in 2020-21, and we were rated as ‘Generally Conforms’, the highest possible rating. Our next EQA is scheduled for the final months of 2025-26 and will be based on the new GIAS. Similarly, we deliver our counter fraud and investigation services to clients in accordance with, and in support of, the Functional Standard for Counter Fraud (GovS013).

Continuous improvement and change

GIAA has an ambitious programme of continuous improvement and change that contributes to maintaining a fully sustainable operating model, efficient processes and more effective ways of working, so that our people can concentrate on delivering high quality products for our clients.

Our approach to change management is evidence-based, with measurable outcomes, ultimately underwriting GIAA’s mission of delivering ‘better insights, better outcomes’ for our clients. Many of our areas of focus for 2024-25 have been delivered through all parts of the Agency working closely with the organisational change team.

Performance analysis

This section tells you how we monitor our performance and the progress we have made in delivering our strategy. We also provide an analysis of the risks that could affect the delivery of our strategy and some examples of actions we have taken to mitigate these risks during the year. Finally, we have included some additional performance Information, including information we hold in relation to sustainability, our impact on the environment and the actions we have taken or plan to take to minimise that impact.

Our performance analysis includes how we:

- measure our performance against our areas of focus for our 2024-25 corporate plan

- manage our performance and progress through a suite of key performance indicators

Our corporate plan sets out the strategic changes we need to make over the following financial year to meet our ambitions and fulfil clients’ expectations. Our 2024-25 corporate plan was orientated around 3 areas of focus: our people, our quality, our financial position.

We were deliberately ambitious with the deliverables within these areas of focus, accepting that some of the work would be carried over and completed the following year. Throughout the year, progress has been monitored by our Executive Committee and Board.

Performance against the corporate plan

The information in the following tables sets out our performance against the 2024-25 priorities together with a final column demonstrating how our progress contributes to our vision strands. Below each table there is a short narrative on our areas of focus for the following year, 2025-26.

Area of focus: our people

Our priorities for 2024-25:

To develop a workforce strategy to attract, recruit, train and retain our PEOPLE at all levels and in the best locations to ensure we have the capacity and capability we need today and in the future.

We will deliver…

From 1 January 2025, a workforce strategy and operational plan that aligns with our future vision of providing internal audit and counter fraud and investigation services to government.

The progress we have made…

Work is well underway with the development of our 10-year programme for strategic workforce change has been developed. This provides us with a clear plan for building, equipping and retaining a strong, experienced, and committed workforce that is focused on delivering services both now and in the future for our clients across government.

We will deliver…

A programme of training focused on leadership and management, as well as supporting our people to further develop their professional relationships with clients and market the full range of integrated GIAA services.

The progress we have made…

The firm foundations are in place for delivery of an in-depth line management upskilling and targeted leadership development programme. This is based on comprehensive research and best practice to ensure the best package will be delivered for our people during 2025-26.

We will deliver…

Improvement in the career pathways available within the Agency and opportunities for our people to develop skills and expertise across client portfolios.

The progress we have made…

The career pathways framework has been developed and will be launched in Summer 2025. This will meet the needs of our workforce by providing opportunities for our people to develop skills and expertise working across our client portfolios and within job families.

These areas of focus supports our vision of…

Excelling in QUALITY and Professionalism Empowering PEOPLE to thrive, develop and deliver Sustained on FIRM FOUNDATIONS.

What’s next for 2025-26?

We are committed to ensure our work continues to add impact, assurance and value. For 2025-26, we have put in place a new operating structure that will enable our Agency to be in the best place possible to deliver high quality services for all our internal audit and counter fraud and investigation clients.

The next twelve months will also see further development of our workforce strategy with redesigned job descriptions and people/matrix management frameworks, a revised learning and development programme and opportunities for more varied entry routes and career pathways throughout GIAA. This will ensure we continue to attract, recruit, train and retain the right people and we are in the best place possible to deliver ‘better insights, better outcomes’ for our clients.

External awards and commendations

The achievements of GIAA colleagues and teams and the impact of their work has been recognised by many external bodies.

2024 Audit and Risk Awards

- Our client team for the Ministry of Justice were finalists in the Audit Team of the Year

- Senior Audit Manager Gary Wilkin was a finalist in the diversity, equality and inclusion champion category, recognising our contribution to supporting greater inclusivity across the internal audit profession

Government Finance Function Awards

- Audit Manager Jeff Smith won the Iain Rolland Memorial Award for his outstanding contribution to Internal Audit at the prestigious Government Finance Function Awards 2025

Government Counter Fraud Awards

- Isabella Naylor and Maisie Wade were both nominated for Apprentice or Newcomer of the Year

- Sandra Simms was nominated for Member of the Year

Tackling Economic Crime Awards

- Our counter fraud and investigation team were shortlisted for the Outstanding Team Award

- This team was also nominated as part of an Outstanding Partnership award for a joint investigation with their DWP Economic Serious Organised Crime counterparts and the Met Police

- Maisie Wade was shortlisted in the Outstanding Young Professional category

Public Finance Awards

- Our counter fraud and investigation team were shortlisted at the Public Finance Awards in the category of Outstanding Fraud Prevention Detection and Recovery

Area of focus: our quality

Our priorities for 2024-25:

To continuously improve the QUALITY and impact of our audit, counter fraud and investigation work in a way that drives efficiency and more insight from everything that we do.

We will deliver…

Cross-government insight, benchmarking and reference to best practice throughout our audit, counter fraud and investigation work.

The progress we have made…

We have refreshed, revised and increased the number of our cross government products.

For 2024-25, we presented six full cross-government reports, nine opinion pieces and eight insights reports to our clients.

We will deliver…

Completion of membership of the Agency by all government departments, and the continued onboarding of other targeted arm’s length bodies (One GIA).

The progress we have made…

GIAA now provides internal audit services and/or support for the UK government including all ministerial departments and many non-ministerial departments, agencies and public bodies.

We have introduced an affiliate arrangement to bring internal auditors across government together through closer working, building stronger professional relationships to enhance the service and insight for our respective clients.

We have completed and closed our One GIA programme.

We will deliver…

Further implementation of the Risk Control Framework across government, (in collaboration with the Government Risk Profession), to strengthen the management of risks and second line assurance.

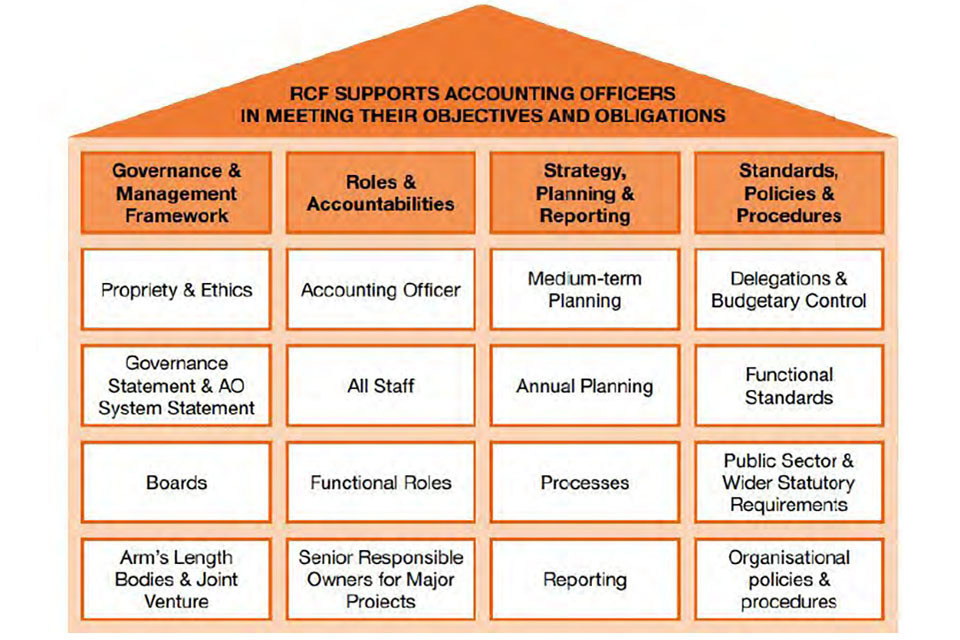

The progress we have made…

The Risk Control Framework (RCF) was published in 2023 in collaboration with HM Treasury Officer of Accounts and Risk Centre of Excellence. The RCF is being integrated into our client annual opinions.

Alongside HM Treasury, we continue to promote adoption and use of the RCF into audit planning and reporting, recognising its importance to deliver consistency in judgements and the need for a framework to be compliant with audit standards.

We will deliver…

Launching and embedding simplified reporting products that take less time to produce and communicate outcomes in a more impactful way.

The progress we have made…

In line with the new Global Internal Audit Standards, we have refreshed our reporting products, and they were implemented from April 2025.

We will deliver…

Implementation of an action plan from our Internal Quality Assessment to ensure the Agency continues to maintain its ‘generally conforms’ rating in its External Quality Assessment in 2025-26.

The progress we have made…

We have completed a Readiness Review as part of our preparations for our External Quality Assessment (EQA) which will commence in autumn 2025.

Feedback from the review has been incorporated into our EQA action plan.

We will deliver…

A clearer articulation of a future audit delivery model for government through a vision and strategy for the whole of the government internal audit function.

The progress we have made…

The HM Government internal audit function strategy was developed and published in March 2025. This strategy sets out how, over the next three years, the internal audit function will develop the diverse set of skills it needs to meet the changing demands of government through the delivery of high-quality, cost-effective services.

These areas of focus supports our vision of…

Elevating our IMPACT across government.

Excelling in QUALITY and professionalism

Inspired by INNOVATION.

What’s next for 2025-26?

2025-26 marks the 10th year of operation for GIAA. We now provide internal audit services and/ or support across all the UK central government departments, and we will continue to engage with non-ministerial departments, agencies and public bodies who express an interest in our service and support.

Our unique position working across government provides the opportunity to grow our programme of cross-government insight for the benefit of our all our clients. Throughout 2025-26 we will continue with the expansion of our cross-government programme.

From 1 April 2025, GIAA adopted the Global Internal Audit Standards in the Public Sector, and this will be one part of our continuing preparations for our External Quality Assessment that is scheduled commence in autumn 2025.

Case study: Maximising efficient delivery: combining ‘three-in-one’ audit fieldwork

Auditors were scheduled to complete three audits in one part of our client’s organisation, where the testing and fieldwork for each audit would involve visiting several sites at a time when our client was working to capacity. Auditors were keen to ensure our testing would not adversely impact on their delivery. With client agreement, we planned to combine the testing for all three reviews to ensure we covered everything during each site visit. This gave us the benefit of streamlining our testing as well as reducing the impact on the client.

Our client makes payments to eligible clients. One of the reviews covered the process to ensure client entitlement, another covered the application of a framework for end-to end processing and the third looked at the management of staff capability. As part of the site selection process, we focussed on offices where we were able to cover all three reviews during testing. We also ensured all regions were covered (our client has national coverage) and allocated audit resource based in those regions to complete the testing to minimise travel and costs.

Each audit review had a clear and distinct objective requiring fieldwork interviews, findings and research to inform the outcome. By combining the fieldwork for all three audits into a single, streamlined operation, we were able to provide our client with exceptional value. Our ‘three-in-one’ approach eliminated repetition, captured all necessary data accurately and by using locally based auditors, we were able to help develop knowledge across the team.

Through our efficient and effective work, we not only delivered tangible benefits for our client but also offered invaluable insight across their entire operation. By working actively to combine fieldwork, the success of these audits demonstrates our commitment to maximising efficiency and providing exceptional value to our clients.

Case study: Lessons learnt - exposing a ‘Man-in-the-Middle’ bank mandate fraud

GIAA’s specialist Counter Fraud & Investigation team (CF&I) was tasked with investigating a mandate fraud involving a payment of over £60,000 to a fraudster’s bank account.

The investigation focused on communication between a government organisation and an external company applying for funds on behalf of a client. Following the return of an initial payment by the bank, updated bank details were provided to the government organisation, who subsequently processed a substantial payment.

The fraudulent activity was uncovered when the legitimate external company contacted the government organisation to report a delay in receiving their expected payment.

The investigation revealed that whilst the government organisation had procedures for managing bank account changes, these controls were inadequate. As a result, the government organisation had failed to spot two different fraudulent email addresses used in correspondence. There was no evidence found to suggest collusion between individuals in the government organisation and the fraudster, or any breaches of the Civil Service Code or internal policies.

It was concluded that an unknown fraudster, posing as a representative from the external company, compromised the email service connecting the two organisations and executed a ‘man in the middle’ cyber-attack. This attack involved the interception of communications between two parties to deceive them into taking a specific action. This resulted in the mandate fraud and a payment sent to an unknown recipient.

In addition to conducting investigations, CF&I provides post-investigation support to help government organisations enhance their counter-fraud measures to prevent future incidents. While the organisation had implemented some measures in response to the fraud, CF&I identified further opportunities to improve relevant processes and controls and is supporting the implementation of these improvements. In addition, we are using our cross-government insight to support the organisation with producing a fraud risk assessment.

Area of focus: our financial position

Our priorities for 2024-25:

Implementing our programme of transformation for operational delivery that will ensure we balance our long term FINANCIAL POSITION.

We will deliver…

An optimum organisational design model that drives efficiencies, productivity and quality, including a revised senior structure and greater line management spans of control.

The progress we have made…

A revised senior civil servant (SCS) organisational structure was developed in 2024-25 and launched on 1 April 2025. This will support our evolution by facilitating more insight sharing across teams and enabling continuous improvement in the quality of our work strengthening our delivery of better insights, better outcomes.

Work has taken place to embed greater clarity and consistency of job roles for colleagues working at SCS and delegated grades.

Our work to establish an optimum organisation design future-proofs us and ensures we are in the best position possible to respond to our clients’ organisational changes and wider cross-government evolution.

We will deliver…

More flexible deployment of our resources, informed by a resource management capability that allows us to meet client demand and smooth the delivery of our audit work more throughout the reporting year.

The progress we have made…

We introduced our bespoke resource management system to dynamically identify and allocate resources to meet demand across the Agency earlier and upstream. This has resulted in a positive shift towards smoothing delivery.

We will deliver…

The second year of our efficiencies programme leading to a reduction in our costs, increased productivity, more streamlined processes, and further income generation.

The progress we have made…

The second year of our efficiencies programme has yielded progress regarding system configuration to support efficient use; and we have implemented a new audit planning tool that drives efficiency and improved management information including a real-time operational workforce plan.

We will deliver…

Embedding of our artificial intelligence tools (the Writing, Risk and Insights Engines) that offer a return on that investment through increasing our productivity as well as the quality and value for money of our output.

The progress we have made…

Use of our artificial intelligence (AI) tools has increased as has the take-up and confidence of using AI to complement audit delivery. The tools continue to be enhanced and improved to increase functionality and optimise productivity. A programme of engagement has helped highlight the opportunities and aided understanding of the benefits for us and our clients for using AI to assist with internal audit delivery.

The percentage usage for each of our AI engines is now:

- Writing engine – 72%

- Risk engine – 59%

- Insight engine – 64%

In total, 79% of our people have used at least one of our AI engines.

These areas of focus supports our vision of…

Excelling in QUALITY and professionalism Empowering PEOPLE to thrive, develop and deliver Inspired by INNOVATION Sustained on FIRM FOUNDATIONS.

What’s next for 2025-26?

Our AI tools continue to attract attention across government and further afield. Next year our data analytics team will continue to refine and develop our AI systems, including an engine to capture a client organisation’s changing risk profile.

We will continue to drive greater productivity through our resource management system. This system supports swifter allocation of people resources to meet client demand earlier. This benefits us by alleviating demand pressures later in the year and provides greater value for clients as they receive products earlier and can implement our recommendations sooner. Effective resource deployment also brings a further benefit, supporting our people to gain access to more varied client portfolios and wider career experience that provides our clients with greater insight. Our expansion of resource management over the next twelve months will bring even more opportunities for individual career development.

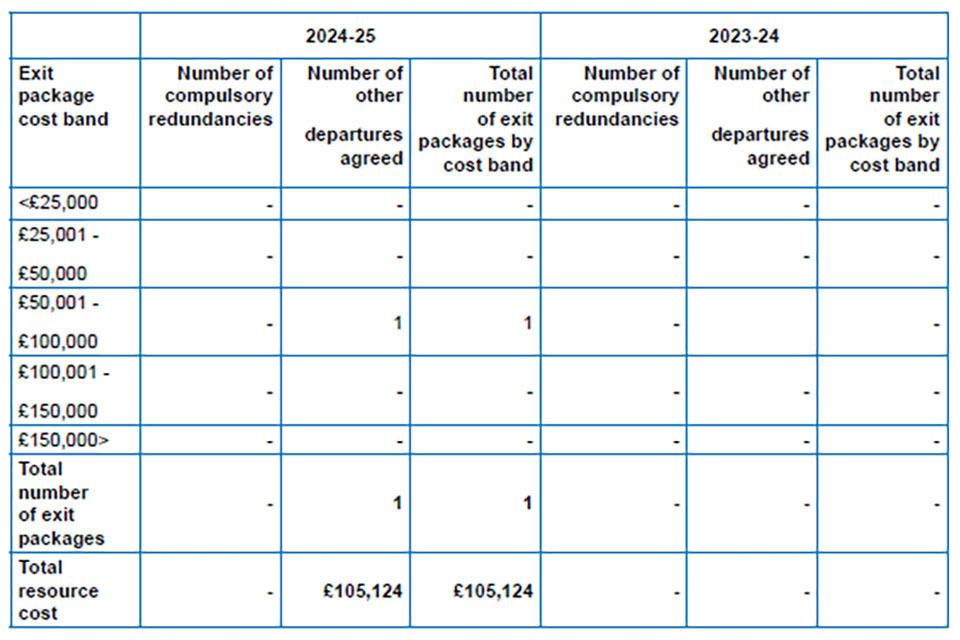

At the start of 2025-26 we ran a defined voluntary exit scheme (VES) to support our ongoing efficiencies programme, changing our ways of working to be increasingly automated and augmented where possible.

Case study: Enhancing Agility and Expertise: The Success of the Audit Response Team (ART)

Our Audit Response Team (ART) was established as one element of our strategic workforce plan. By creating an Agency-wide cadre of internal audit professionals it has been possible to respond to emerging resourcing issues, flexibly and far earlier. Beginning with a small pilot before wider deployment across GIAA, ART has quickly become a valuable asset in resolving resource challenges.

For individuals within the ART team, the opportunity to work across teams and government departments has proven to be a significant draw. This flexibility enables them to expand their career portfolio, develop new skills, and gain a deeper understanding of government operations. By adopting a matrix management structure, team members receive both line management support and task management guidance, allowing them to focus on delivering high-quality results efficiently.

The positive impact of ART extends beyond individual growth. We benefit from a more agile workforce, capable of responding quickly to changing demands and priorities. By deploying skilled professionals across different teams, we can enhance our expertise and provide a more comprehensive service to government clients. This collaborative approach fosters shared learning, leading to the continual development of auditors and the strengthening of knowledge across various government areas.

Over the last year our ART has grown to include over 50 internal audit professionals. The ART exemplifies the success of a flexible and collaborative approach to deploying people quickly to support teams. By prioritising agility and expertise, ART has not only benefited individuals within the team but has also contributed to the growth and effectiveness of the wider Agency and our government clients. The learning and expertise we gained through ART will be developed into an expanded Central Resource Team over the coming year. This will enable even greater sharing of insights, and more flexible resourcing across GIAA.

Case Study: Showcasing our ground-breaking work harnessing AI technology for internal audit

This year the GIAA showcased our work developing and applying AI technology for internal audit at the Chartered Institute of Internal Audit (CIIA) conference. Our Director of Innovation and Development, Iain McGregor, presented a session on the effective use of AI in internal audit, highlighting the innovative ways we apply AI to improve the efficiency and effectiveness of internal audit delivery. This was followed by our Chief Executive Harriet Aldridge setting out how we also lead the way with the development and delivery of the Environmental, Social and Governance agenda through internal audit, and our Data Analytics team expertly presented our AI engines for delegates, with real time demonstrations on our conference stand and answering technical questions.

The response to our presence at this prestigious conference was overwhelmingly positive. Internal auditors from across all sectors were astonished by our inventive application of AI. Our GIAA information stand was inundated with visitors eager to learn more about our AI engines and how they work. Auditors working in local authorities expressed interest in applying our writing and risk engines, and we even made a global impact, connecting with audit professionals from Korea, Norway, and Malta.

Attending the CIIA conference was just one aspect of our ongoing efforts to promote the potential of AI technology improving and enhancing internal audit delivery. Our data analytics team continues to respond to queries from across the UK government, UK public sector, and internationally, sharing our expertise and knowledge to support internal audit professionals and organisations optimise opportunities for more effective delivery.

Performance against our key performance indicators

We monitor the progress of our strategy and corporate plan through a suite of key performance indicators (KPIs) that are reported to and considered by the Executive Committee. For 2024-25, these KPIs aligned to our corporate plan focus areas: our people, quality and financial position.

These measures, targets, performance in 2024-25 and comparison to the prior year are set out in the following tables.

Managing our performance: our people

Our people measures

Measure

Employee engagement index, as measured through the Civil Service People Survey

Target 2024-25

We continually seek to maintain and improve levels of engagement across our workforce

Performance 2023-24

People survey engagement score: 62%

Performance 2024-25

People survey engagement score: 59% (target not met)

Measure

Average working days lost to sickness per member of staff

Target 2024-25

We actively seek to reduce sickness absence rates

Performance 2023-24

7.53 days

Performance 2024-25

8.74 days (target not met)

Measure

Level of staff attrition in the financial year

Target 2024-25

Achieve a year-on-year reduction in controllable staff attrition

Performance 2023-24

14.3%

Performance 2024-25

14.1% (target marginally met)

Our people survey

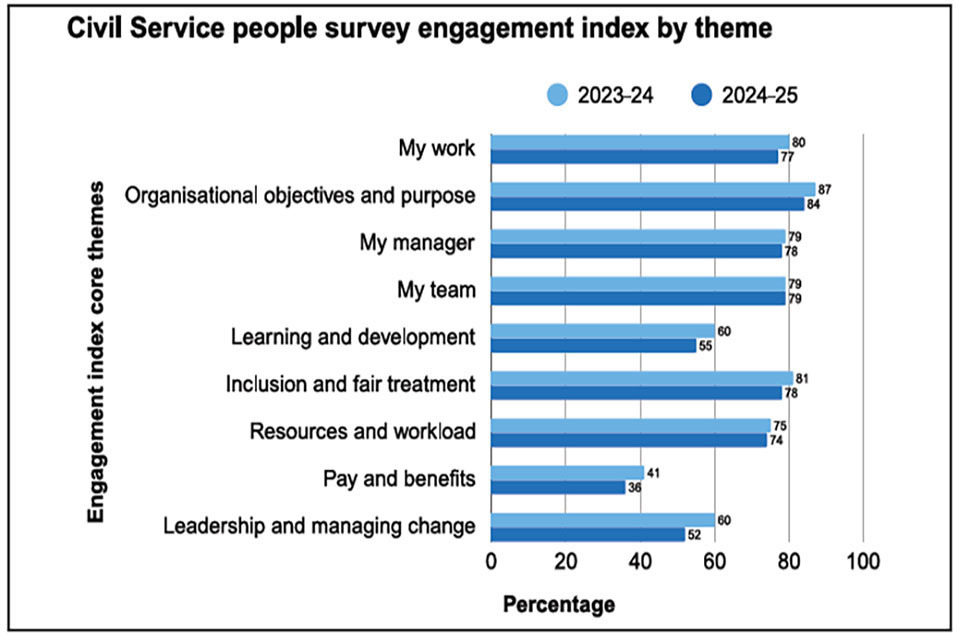

The Civil Service People Survey is an important measure of our people’s experience of working for GIAA. This survey is carried out annually across government and we use our Agency survey results to monitor levels of engagement and identify where areas of additional focus might be needed. Our response rate for the 2024 people survey was 86% – significantly higher than the average Civil Service response rate of 61%.

Our overall engagement index score assesses the extent to which our employees are committed to our goals and values and are motivated to contribute to our success. In 2024, our overall engagement score dropped by three percentage points to 59%. The Civil Service-wide engagement score is 64%. The change in our engagement score was anticipated as we underwent a programme of transformation that was required to balance our long-term financial position. This transformation programme will continue through 2025-26.

People survey engagement index core themes

Our overall engagement index score is drawn from nine core themes. (‘My work’, Organisational objectives and purpose’, ‘My manager’, ‘My team’, ‘Learning and development’, ‘Inclusion and fair treatment’, ‘Resources and workload’, ‘Pay and benefits’, ‘Leadership managing change’).

Each theme measures a different dimension of employee experience which are known to have a strong relationship with engagement levels at work. For our 2024 survey the index core themes measured the following changes from the previous year:

Graph 1: Civil Service people survey engagement

We have considered the results of the survey and identified some areas of focus that have fed into our corporate plan priorities for 2025-26. These included further developing the leadership and line management capability of our people, a renewed focus on engaging people through change, and further developing the breadth of experience of our people by providing more opportunities to work across client teams.

Individual teams have also developed plans to take forward actions in response to their team specific survey results.

Reduce the average working days lost (AWDL) through sickness

We have seen an increase in the number of AWDL through sickness. We operate robust procedures for managing absence and we support our people through periods of long term or serious illness with compassion and empathy. We continue to monitor absence rates closely and manage accordingly.

The level of staff attrition

Our staff attrition has shown a slight decrease from the previous financial year.

Managing our performance: our quality

Our quality measures

Measure

Results of semi-structured interviews with clients

Target 2024-25

80% of respondents awarded a score of 8 or more (out of 10) on their overall experience of working with GIAA.

Performance 2023-24

70.0%

Performance 2024-25

76.7% (Target not met)

Measure

Results of client satisfaction questionnaires (CSQs)

Target 2024-25

80% of respondents awarded a score of 8 or more (out of 10)

Performance 2023-24

79.7%

Performance 2024-25

81.0% (Target marginally met)

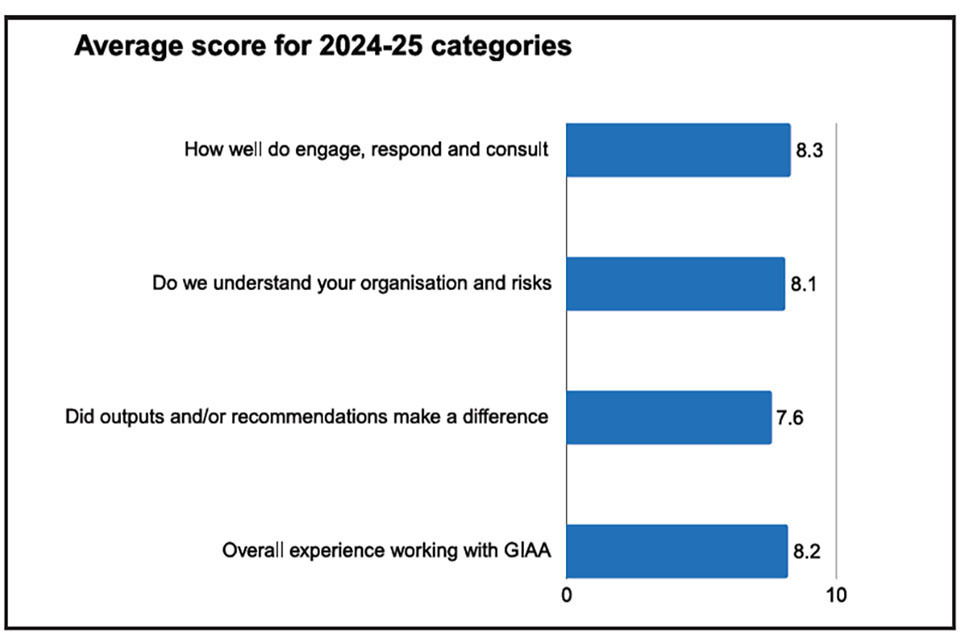

Semi-structured interviews with senior client stakeholders

We periodically conduct stakeholder interviews to capture clients’ experiences of our services. These follow a semi-structured format that help us to identify areas for improvement.

We conducted 30 such interviews in 2024-25. When asked to score their overall experience of working with us, 76.7% of interviewees scored this as 8 or more (out of 10).

In addition, 90% of interviewees positively rated the impact that we had on their business and all interviewees were positive about how well we responded and engaged.

Net promoter score

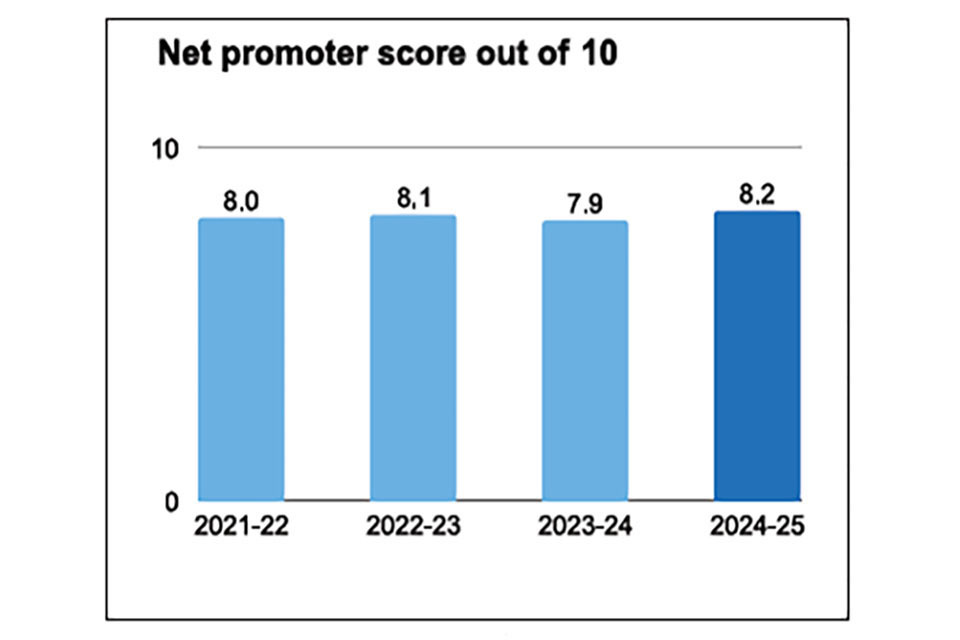

A Net Promoter Score (NPS) is a metric used to measure client satisfaction and enthusiasm. It is calculated by asking clients to score us and our products on a scale from 0 (low) to 10 (high).

For 2024-25, our NPS was 8.2, and increased slightly from the previous year when our NPS 2023-24 of 7.9 out of 10. A NPS is the likelihood that a client would recommend our services to others. The graph below shows the variation in our NPS over the last four years.

Graph 2: GIAA’s net promoter score over time

A NPS is calculated across the categories that were assessed in our semi-structured interviews.

- Engage, respond and consult: 29 responses averaging a score of 8.3

- To what extent do our people demonstrate an effective understanding of your department/organisation and risks: 29 responses averaging a score of 8.1

- Did our outputs and/or recommendations identify opportunities to the control environment and make a difference to you: 29 responses averaging a score of 7.6

- Overall experience working with GIAA: 30 responses, averaging a score of 8.2

Graph 3: Average score by semi-structured interview category

Internal audit client satisfaction questionnaires (CSQs)

Individual questionnaire surveys are undertaken to gather feedback from clients. Once an engagement is complete, relevant client contacts are asked to complete a CSQ. This is a short online questionnaire that asks the clients to rate how satisfied they were with our delivery of the engagement (on a scale from 0 = poor to 10 = excellent) under five performance categories: planning, engagement procedures, reporting, outcomes and recommendations, and professionalism and an overall rating of their satisfaction.

In 2024-25, we received 1,004 completed questionnaires, down from 1,034 in 2023-24, with 81.0% of clients declaring themselves satisfied with scores of 8 or better out of 10, a slight improvement on 2023-24 with 79.7% of clients declaring themselves satisfied. The return rate for CSQs was 45% in 2024-25, down from 50% in 2023-24.

Counter fraud and investigation client satisfaction questionnaires (CSQs)

Our counter fraud and investigation (CF&I) service collaborates closely with our internal audit colleagues, providing services for our clients to enhance their counter fraud response and ensure responsible stewardship of public funds.

For 2024-25, our counter fraud and investigation team issued 219 CSQs and received a return rate of 43.8%.

These CSQs demonstrated we met our key performance indicator (KPI) of scoring ‘8/10 or higher with overall levels of satisfaction with our CF&I services’.

In total 88.5% of CSQ responses received met this KPI, and the overall average score achieved for this KPI was 9.11/10.

Cross-government insights

We have revised and expanded the number of cross-government insights we provide for our clients. This year we presented six cross-government reports, nine opinion pieces and eight government insights reports to our clients, with subjects including Supplier Resilience, Efficiencies and Maintaining efficient control and assurance. For 2023-24, three thematic reviews were produced. Whilst we have increased the number of products and developed new formats to support our clients’ needs, we recognise we still have more to do. Anecdotal feedback from senior client stakeholders affirms our commitment to developing and providing more innovative and proactive cross-government insight.

Case study: Maximising sponsorship effectiveness: a comprehensive review of government-ALB relationships

One of our 2024-25 Insights Reviews was an evaluation of government departments’ implementation of the ‘Sponsorship Code of Good Practice for Arm’s Length Bodies (ALBs)’. The Code provides guidelines for departments to follow when working with ALBs (independent organisations sponsored by ministerial departments and in receipt of government funding).

Our review was able to provide assurance that most government departments were adopting one of the sponsorship models set out in the Code and that departments were largely positive about their sponsorship relationships with ALBs. However, we also identified several areas for improvement, such as providing clarity on individual sponsorship roles and responsibilities, with departments maintaining good levels of communication with their ALBs and ensuring sufficient departmental-level oversight of the full ALB population.

To address these issues, our review recommended that departments use the Sponsorship Code routinely to assess their sponsorship arrangements and that they establish proportionate sponsorship arrangements. We also recommended that departments implement appropriate departmental level oversight that ensures senior management visibility of performance and risk across the ALB population.

The review evaluated departments’ adoption of the Sponsorship Code against four risks:

- a lack of understanding of ALB roles and responsibilities

- failure to establish a proportionate approach to assurance

- failure to share skills and experience

- lack of mutual investment in relationships

Based on these risks, the review supported departments to identify an assurance rating across these four risks, as well as an overall opinion of the effectiveness of their implementation of the Sponsorship Code.

Overall, our review identified a total of 53 recommendations across departments. It highlighted the need for Cabinet Office oversight along with the appropriate departmental-level oversight to ensure that sponsorship arrangements were effective and in line with the Sponsorship Code. It also noted the importance of providing adequate support to departmental sponsor teams, particularly in areas such as finance, HR and commercial.

By implementing the Insights review’s recommendations, departments could improve their sponsorship arrangements and deliver better outcomes for the UK government. This would ensure that ALBs play their intended role in providing independent advice and delivering services on behalf of the government.

Case study: Building effective assurance mapping

This case study illustrates how our Insights team were able to apply their cross-government knowledge and internal audit expertise to support a UK government organisation implement effective assurance mapping.

Assurance mapping is a structured approach to help an organisation identify, assess, and document the sources of assurance they put in place to manage the significant risks to their, operational processes, or objectives. This consolidated view gives an organisation oversight that risks are being managed effectively, there are no gaps, and that assurance activity is proportionate. Assurance mapping by government organisations supports better use of public funds.

The challenge

Our client was developing an assurance framework to:

- provide visibility of statute, regulation and the government directives for each business area

- support business areas to map sources of assurance against their key business processes

- identify gaps or areas of weakness in their assurance framework

Our solution

Our Insights team drew on their knowledge working across government organisations to guide our client through the assurance mapping process. Working as a business partner, the team provided real time expert advice, with independent scrutiny and challenge as the team developed a practical assurance map that captured essential data. This information was transformed into an innovative dashboard, enabling senior leaders to review assurance efficiently and effectively so risk and controls could be challenged and explored with confidence.

Benefits achieved

This assurance mapping process delivered four significant benefits:

- improved reporting for accounting officers

- enhanced risk management and coordination of assurance providers

- more efficient allocation of resources

- greater confidence in service delivery effectiveness

The assurance map and innovative approach developed with our role as a ‘critical friend’ supporting our client, has received some excellent feedback from key stakeholders in government.

Head of the Risk Profession for the UK government, Clive Martin, commented,

The approach stands out for its technical coherence, integration of different elements such as the Risk Control Framework and the smart way in which you have liaised with the business. It’s among the best I have seen in the public sector.

Managing our performance: our financial position

Our financial measures

Measure

Total spend on third-party contractors

Target 2024-25

Achieve a year-on-year reduction in our use of third party contractors

Performance 2023-24

6% reduction in spend compared to prior year

Performance 2024-25

35% reduction in spend compared to prior year (Exceeded target)

Measure

Expenditure and forecast against budget

Target 2024-25

Year-end position to be within 1% of mid-year forecast

Performance 2023-24

2% underspend at year end compared to mid-year forecast

Performance 2024-25

4% underspend at year end compared to mid-year forecast (Target not met)

GIAA is primarily funded through the fees we charge our clients for internal audit, counter fraud and investigation and assurance services. We agree the level of services required for each of our clients, setting out the full detail of our services in a Memoranda of Understanding and confirming an appropriate fee.

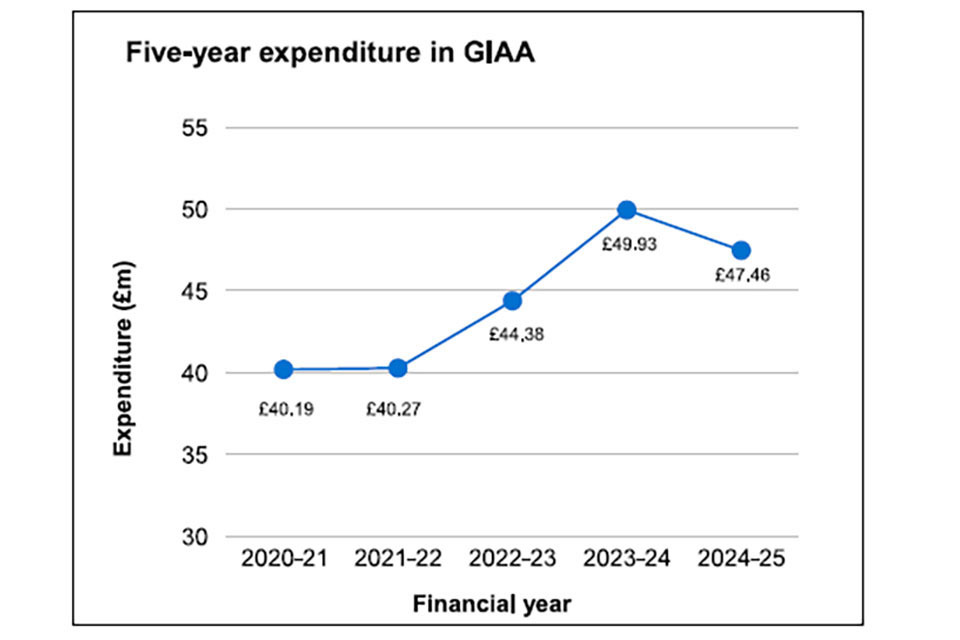

In 2024-25, we also received £2.1m of funding from HM Treasury, for legacy pension funding and a contribution to funding the Internal Audit Government Profession. HM Treasury funding has reduced materially from 2023-24 (£6.1m) when the Agency received the final HM Treasury funding that enabled the Agency to ‘form and mature’. The previous years’ funding also included monies for specific deliverables as part of our 2021 Spending Review settlement (SR21). We had always anticipated this decrease in funding and put in place a robust plan to ensure our long-term financial sustainability.

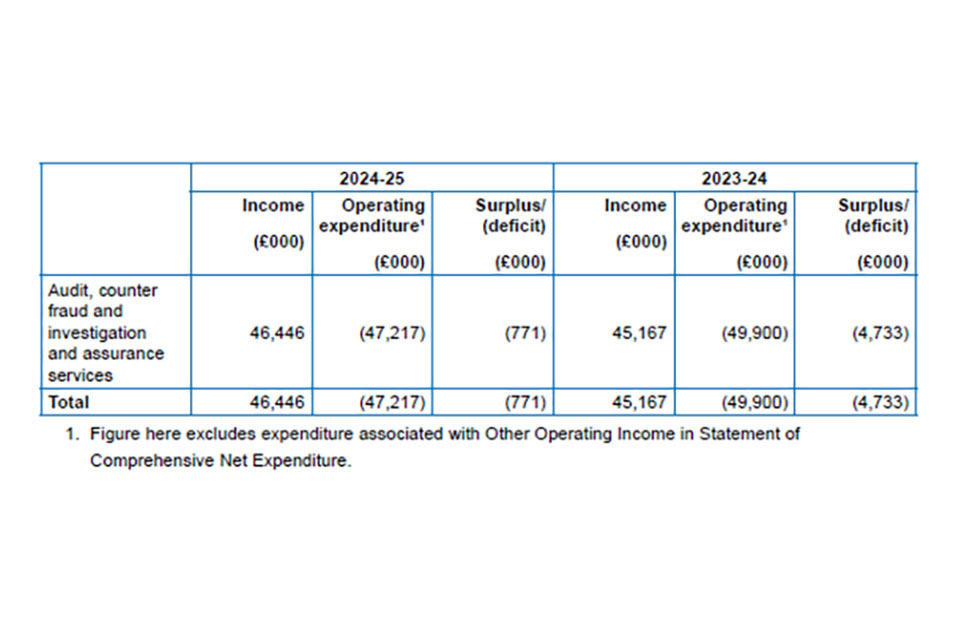

We are held to account by HM Treasury on our year-end position being within 1% tolerance against our mid-year forecast. Our year-end financial position for 2024-25 was a surplus of £1.3m versus the £0.5m deficit we were forecasting at the mid-year point. This surplus and movement is a consequence of:

- staffing forecast changes linked to supply and demand

- underspend on shared services including IT charges from HM Treasury

For 2024-25, we made significant changes to our ways of working, including putting in place measures to improve the consistency of our workforce productivity across the year rather than face a spike in demand for quarters three and four, and to progress our work using AI and technology to support more efficient and effective ways of working. This has enabled us to achieve a 35% reduction in total spend on third party contractors.

Further information about our operating costs and expenditure is provided in the Parliamentary Accountability and Audit Report (from page 81) and in the Financial Statements.

Key issues and risks

As with all organisations, we face risks in the delivery of our strategy and core functions. We actively manage our principal risks to make best use of public money, maximise our performance and achieve our objectives.

Outlined below are our principal risks, some examples of the actions we took to address those risks in 2024-25, and the assessment of the risk on 31 March 2025. These principal risks speak to an overriding primary risk that we fail to demonstrate the added value that we bring to government as a provider of internal audit and counter fraud services. The Board has committed to maintaining these principal risks into the next financial year as they continue to speak to our primary areas of concern and focus.

Principal risk

Embedding change. Key objective - ensuring we successfully transform the way we operate to deliver efficient services that offer value for money.

Activities to manage the risk

Creation of a specialist organisational change team to support a range of continuous improvement and change programmes. This provides a structured approach with additional focus on stakeholder engagement.

Trend

Stable trend. We recognise where we are in the change curve and have a number of changes nearing completion which will boost morale and confidence in the strategic direction.

Principal risk

Audit delivery, quality and impact. Key objective - delivering timely and high-quality services to our clients through continuous improvement.

Activities to manage the risk

Preparation for the External Quality Assessment (EQA) with a focus on compliance with our methodology. The audit delivery programme was brought forward to ensure our clients received assurances throughout the year. Our programme of cross-government insights was extended to a broader range of topics and a different product offer.

Trend

Stable trend. The EQA readiness review confirmed that our methodology was compliant with the new Global Internal Audit Standards but recognised more work was required to ensure the methodology is consistently followed. A robust workplan is in place to drive consistency and quality of our work.

Principal risk

Managing our financial position. Key objective - securing our long-term financial position within a challenging fiscal environment.

Activities to manage the risk

Continued with our efficiencies programme with a focus on time savings in the audit planning process and the use of our audit management system. Continued the roll out of our resource management system to aid in the flexible deployment of our people to meet business needs.

Trend

Increasing trend. In our first year of being fully fee funded (with the exception of some legacy Supply Funding) we have remained cautious in our approach to financial management to ensure that we continue to operate within our financial envelope. Following the delivery of the 2024-25 budget, we anticipate that the likelihood of this risk will decrease in coming years.

Principal risk

Skilled people. Key objective - improving the capability of our people to meet our clients’ expectations and requirements.

Activities to manage the risk

Development of a 10-year strategic workforce plan to address our current and future resourcing needs, aligned to client demands. This has included development of a Heads of Internal Audit rotation process, review of SCS and delegated grades, and development of an internal audit competency framework.

Trend

Stable trend. A number of critical initiatives will be taken forward in the next year to support the strategic workforce plan such as line management and leadership development and a refreshed learning and development offer. The progress made this year has been the foundation for the next stage of these initiatives.

Principal risk

Information governance. Key objective - securely managing the data and information we hold in line with legal and regulatory requirements.

Activities to manage the risk

Close working with the Government Security Centre who have provided expert advice throughout the year.

Creation of the Information, Data and Records Management programme to address legacy issues with the storage of management of the information we hold.

Trend

Stable trend. There have been no significant incidents, however given the nature of our work and how we operate across organisational boundaries, we have a minimalist appetite for control issues in this area. We recognise the complexity of the work involved here and its overlaps with wider security requirements.

More information about how GIAA undertakes its risks management activity can be found in the Governance Statement.

Additional performance information

Public Sector Equality Duty

In carrying out our functions, we are required by the Public Sector Equality Duty (PSED) to have due regard to and achieve the objectives set out in the Equality Act 2010 to:

- eliminate discrimination, harassment, victimisation, and any other conduct that is prohibited by or under the Equality Act 2010

- improve equality of opportunity between persons who share a relevant protected characteristic and persons who do not share it

- foster good relations between persons who share a relevant protected characteristic and persons who do not share it

Our Equality Report on progress made towards delivering our equality objectives in 2023-24 is available on our website (gov.uk/government/collections/public-sector-equality-duty reports). Our report for 2024-25 will be published in 2026. The report provides aggregated information relating to our employees, and a benchmark that enables us to measure progress and identify priority areas for further research and action.

We have made a number of improvements across GIAA to raise peoples’ awareness and understanding of their role in ensuring compliance with PSED including updating our intranet page with refreshed information, improving the usability of our equality impact assessment form and introducing a route to monitor and record PSED compliance.

Human rights

We are keen to ensure we are inclusive and accessible in all we do. We are committed to upholding the key human rights that intersect with employment relationships through workplace policies and practices. These are developed in collaboration with our workforce and official consultation channels to maintain the principles of dignity, fairness, respect and equality.

Our recruitment and wider employment policies are fully compliant with the Human Rights Act and the Equality Act 2010. We adhere to the Civil Service recruitment principles when attracting and recruiting staff, and we are a Disability Confident Employer. We continue this throughout our employee lifecycle, ensuring our policies and processes are inclusive and employees have the appropriate voice via multiple staff-led diversity networks and forums.

Anti-bribery and corruption

We are committed to upholding the highest standards of honesty and integrity in all our activities, and take the risk of fraud, bribery and corruption seriously, in line with our risk appetite. We have structures in place for the effective management of these threats.

Our people are required to complete mandatory training (provided by Civil Service Learning) on counter fraud, bribery and corruption. We have refreshed our strategy and policy for countering fraud, bribery and corruption in the past year and this is published on our intranet. These documents set out our expectations in terms of roles and responsibilities and what processes should be followed to report any concerns regarding fraud, bribery and corruption.

As internal auditors employed in the public sector, our colleagues conform to expectations outlined in the Ethics and Professionalism domain of the Global Internal Audit Standards when undertaking audit work. This states the principles and expectations governing behaviours and conducts and is underlined with the principles of integrity, objectivity, confidentiality and competency. Certified members of professional auditing bodies are required to annually complete ethics training to maintain their certificate to practice. Across our business, our people also belong to other professions e.g., counter fraud, finance, commercial, HR, all of which centre the importance of ethical behaviours.

Community and charity work

We recognise the benefits that community and charity work by our people can bring to the wider community and applaud our people for their individual and team efforts. Subject to operational requirements, we support our people who wish to undertake community or charity activities by providing five days per annum of paid special leave for volunteering activities.

Our people networks also provide a community and support for colleagues with a shared protected characteristic or common interest. These inclusive groups are run by volunteers for members and allies alike.

Sustainability report

The government has set out its long-term environmental and climate change ambitions, including the legal requirement to achieve net zero carbon emissions by 2050 (gov.uk/ government/publications/net-zero-strategy). Meeting climate change targets will need a significant transformation and we are committed to following best practice as a sustainable and responsible organisation, both in our capacity as an employer and as the primary provider of internal audit services to government.

In 2017, the Task Force on Climate-related Financial Disclosures (TCFD) published eleven recommendations for how organisations should disclose on their approach to climate change. The recommendations were structured around four thematic areas that represent core elements of how organisations operate: governance, strategy, risk management and metrics and targets.

This report brings together available information regarding sustainability against the headline targets set for government entities. It has been prepared in accordance with HM Treasury’s TCFD-aligned disclosure application guidance, which interprets and adapts the framework for the UK public sector. We have complied with the TCFD recommendations and disclosures for governance and risk management. We have however been unable to meet the recommended disclosures for metrics and targets due to the unreliability of the data provided by premises landlords. We intend to make disclosures for strategy in future reporting periods in line with the central government implementation timetable.

Our approach

Governance

The Board has ultimate responsibility for the consideration of, and response to, climate change and other environmental issues. We set out a commitment to develop our offices within the GIAA Strategy 2023-26, such that they would be ‘modern, smart and green’. The structure of our estate and the development of our estate’s strategy were key features of our annual business plans, with updates on activity reported to the Board at regular intervals.

The Audit and Risk Assurance Committee (ARAC) has a delegated responsibility from the Board for reviewing the management of risks. Throughout 2024-25, ARAC has continued to receive updates on the issues and opportunities from climate change, and through their role, have provided assurance to the Accounting Officer and the Board on the robustness of the approach.

The executive team is responsible for managing climate-related risks and opportunities on a day-to-day basis. The Business Committee, a sub-committee of the Executive Committee, holds responsibility for assessing our organisational progress on sustainability and throughout the year has received reports on arising climate-related issues and initiatives.

A focus this year has been on embedding sustainability considerations in our decision making. This has included additional sustainability questions in relevant tenders where appropriate and updating the template for committee papers to require the impact on the environment to be considered in any new proposals. Further information on our governance arrangements is set out in the Governance Statement.

Risk management

Managing risk is integral to the successful operation of our business. We operate an integrated risk management framework that is a core component of our governance and leadership. Consideration of climate related issues and opportunities within our risk management framework ensures that potential climate impacts are considered in our strategic planning and decision-making processes.

Identification, assessment and management: We held risk identification workshops to build a whole organisation view of the issues and opportunities from climate change. This considered physical risks, such as extreme weather events, as well as transition risks, such as policy changes. The results of this were discussed with the ARAC which helped develop our primary risks areas. The likelihood and impact of the risks materialising were assessed using the established risk scoring matrix. The identified risks are now incorporated into the newly developed corporate risk register, such that they are considered alongside other cross-organisational risks allowing us to prioritise and address these risks in conjunction with other business risks.

Risk mitigation strategies: We recognise the potential negative impact of climate change on our operations and are developing mitigation strategies to ensure we can minimise disruptions from climate events. A primary focus is also the impact that we can have on other government entities through our role as the primary provider of audit services to central government. Expert briefings have been provided to auditors and work is underway to develop an assurance offer to clients on carbon reporting and climate risk management assurance.

Further information on our risk management is set out in the Governance Statement.

Metrics and targets

There are three types of emissions included in the scope of public sector emissions reporting:

- Scope 1: emissions from fuel burnt in boilers or engines owned or controlled by the organisation

- Scope 2: emissions from electricity or heating purchased from suppliers

- Scope 3: other indirect emissions, such as emissions arising from business travel

As we occupy shared buildings and do not have any fleet vehicles, we have no scope 1 emissions to report. We are a minority tenant in the shared buildings and have no direct control over our water, energy and land use or our waste management.

We therefore do not collect this data or measure/report on our performance for scope 2 emissions. The key metrics we use to measure and manage our climate-related risks and opportunities therefore relates to our scope 3 emissions, i.e. from our business travel and use of consumables.

To review our progress in this area, we consider our performance over three financial years. We recognise that our performance during this period may not be representative of usual business, due to the impact of the Covid-19 pandemic. We are working to establish a more accurate baseline position to compare our performance against.

Greenhouse gas emissions

Table 4: Scope 3: business travel

| 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|

| Domestic travel (tonnes CO²e) | |||

| Air | 4.81 | 5.79 | 3.71 |

| Rail/ underground/ tram | 45.43 | 46.36 | 50.57 |

| Car (personal vehicle) | 10.46 | 9.60 | 7.54 |

| Hire car | 8.02 | 8.34 | 5.69 |

| TOTAL domestic travel | 68.72 | 70.09 | 67.51 |

| International travel (tonnes CO²e) | |||

| Air | 1.54 | 2.31 | 1.80 |

| Rail/ underground/ tram | 0.02 | - | - |

| TOTAL international travel | 1.56 | 2.31 | 1.80 |

| TOTAL business travel | 70.28 | 72.40 | 69.31 |

| CO2e tonnes per FTE | 0.15 | 0.15 | 0.15 |

| Expenditure on official business travel (£000s) | 543 | 711 | 637 |

| Expenditure (£000s) per FTE | 1.19 | 1.50 | 1.35 |

| Distance travelled – domestic flights (km) | 35,691 | 22,336 | 12,541 |

| Distance travelled – international flights (km) | 15,794 | 14,458 | 9,836 |

There has been no material change to our overall greenhouse gas emissions or our emissions from domestic business travel. Therefore, we are not on track to meet the headline or applicable sub target for the headline commitment ‘Mitigating climate change: working towards Net Zero by 2050’ from the Greening Government Commitments.

Our scope 3 emissions for business travel are predominately driven by domestic rail travel. Domestic air travel is primarily for our colleagues travelling to or from our office in Glasgow. International air travel conducted by our colleagues is limited. Of our international flights in 2023-24 and 2024-25, all were short-haul and economy. In 2022-23, 30% (4,682km) were short-haul, 70% (11,112km) was long-haul and all were economy.

We introduced this year a sustainable travel hierarchy, encouraging colleagues to consider public transport first and to choose more sustainable options for business travel. The revised travel policy also introduced tighter controls on the booking for air travel.

We do not own any vehicles. All vehicles are hired from a supplier via a Crown Commercial Services framework contract. In 2024-25, we hired 81 vehicles. Of these, 2.5% were Ultra-Low Emission vehicles. No Zero Emission vehicles were hired. We are seeking to increase this proportion through our travel policies and practices.

Minimising waste and promoting resource efficiency

Waste

Table 5: Total ICT waste recycled, reused and recovered (externally)

| 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|

| Total waste (tonnes) | 1.47 | 2.21 | 6.55 |

Our IT and digital services are provided by HM Treasury. The network is cloud based, with no on-premises data centres. Our ICT facilitates hybrid and remote working via the use of external networks and mobile tethering. The equipment, which is provided by HM Treasury has accredited green credentials.

ICT waste is re-used or recycled responsibly in line with regulations. HM Treasury uses an IT Lifecycle Management contract, which meets a number of external environmental accreditations. The increase in ICT waste in 2024-25 relates to a programme of technology refresh to support newer versions of the operating system and due to site closures. All ICT waste generated is either reused, recycled or recovered, and none of the ICT waste has been disposed.

We avoid single-use plastic in our offices, encouraging our people to bring in their own glasses and cups instead. Within our London office we have reused furniture from another government department.

Paper consumption

There has been little change in the reams of A4 paper purchased – 51 reams in 2024-25, compared to 52 in 2023-24. We have reduced the number of printers in our 10 Victoria Street office and have found that our people have become more accustomed to using electronic versions of documents that they would have printed previously.

Sustainable procurement

We predominantly procure goods and services through dedicated Crown Commercial Service frameworks, which include standardised contract terms that are aligned with the Greening Government Commitments. Whilst there are no standard contract terms or schedules specifically relating to sustainability, we are required to include a social value question in a tender pack which carries at least 10% of the total awarded mark during any procurement exercise.

One example of a social value theme that has been used is ‘fighting climate change’ which requires the bidder to demonstrate effective stewardship of the environment. This involves an understanding of additional environmental benefits in the performance of the contract, including working towards net zero greenhouse gas emissions and detailing any actions taken to reduce environmental impact whilst carrying out the contract.

We have also included sustainability considerations into our business case templates where approval to spend is required. Colleagues are encouraged to consider the impact on the environment of their proposal and to outline what options they have considered to minimise the impact.

Ongoing focus

We recognise that as sub tenants in the office space we occupy, we are limited in what is achievable and practical for us to influence in terms of energy use or waste management. We are therefore committed to addressing the environmental impacts where we have greater control over our actions.

Our estates, security, sustainability and health, safety and wellbeing strategy (2025-30) has a strategic pillar focused on ‘a greener estate that embraces technology’. Our delivery plan aims to focus on regional centres in well-located modern offices that embrace technology, that will in turn reduce unnecessary travel and improve our carbon footprint.

Our priorities going forward include:

- continuing to develop our capabilities to deliver impactful services to our clients on sustainability and environmental issues

- working closely with our landlords and the Government Property Agency as part of the development of our new estates strategy to deliver on their social and sustainability commitments