Future of manufacturing: a new era of opportunity and challenge for the UK - summary report

Published 30 October 2013

A new vision for UK manufacturing

Introduction by Sir Mark Walport and Sir Richard Lapthorne

Manufacturing in 2050 will look very different from today, and will be virtually unrecognisable from that of 30 years ago. Successful firms will be capable of rapidly adapting their physical and intellectual infrastructures to exploit changes in technology as manufacturing becomes faster, more responsive to changing global markets and closer to customers.

Successful firms will also harness a wider skills base, with highly qualified leaders and managers whose expertise combines both commercial and technical acumen, typically in science, technology, engineering or mathematics.

Constant adaptability will pervade all aspects of manufacturing, from research and development to innovation, production processes, supplier and customer interdependencies, and lifetime product maintenance and repair. Products and processes will be sustainable, with built-in reuse, remanufacturing and recycling for products reaching the end of their useful lives. Closed loop systems will be used to eliminate energy and water waste and to recycle physical waste.

These developments will further emphasise the key role of physical production in unlocking innovative new revenue streams, particularly as firms embrace ‘servitisation’ and manufacturers make use of the increasing pervasiveness of ‘Big Data’ to enhance their competitiveness.

In the public sector, policy frameworks that affect the manufacturing sector directly and indirectly will need to recognise the extended nature of value creation and the new ways it is being developed. Public planning cycles should match the timescales of firms’ own long term planning requirements. And it will be important that flows of highly skilled workers, patient capital, and support to promote critical mass in small and medium sized enterprises are all internationally competitive.

The implications for UK manufacturing firms and the UK government are substantial. Some businesses are already adapting and are world class, but many are not positioned to succeed in a future world where greater opportunities will be balanced by greater competition. The UK needs to radically change its approach to providing a constant and consistent framework within which all firms aspire to prosper.

A business-as-usual approach will not deliver that outcome. Other economies are already ahead, and catching up will require an adaptive capacity that the UK has not yet demonstrated. Achieving this is essential, as the future competitiveness and health of UK manufacturing will affect many other parts of the economy through its numerous linkages.

The key message is that there is no easy or immediate route to success, but action needs to start now to build on existing support, and to refocus and rebalance it for the future. Above all, policy design will need to address entire system effects. This Report sets out many areas where action is needed at both strategic and more detailed levels. However, the following should be particular priorities.

The quality and skills of the workforce will be a critical factor in capturing competitive advantage. It is essential that UK policy makers focus on the supply of skilled workers, including apprenticeship schemes, support for researchers, and the supply of skilled managers. Firms will need to pay much more attention to building multidisciplinary teams to develop increasingly complex products, and also innovative business models.

It will also be crucial to address the current image associated with manufacturing. Here government and industry should work together to further promote and market the opportunities for careers in manufacturing industries at all levels of education.

Financial challenges for the sector include a shortage of risk capital. This is particularly evident as a funding gap between research and early development and the funding for proof of concept that is usually required before the market steps in. There is also a shortage of funding for applied research and development in some areas such as the development of advanced green energy sources. So although there are excellent schemes for public support such as Knowledge Transfer Partnerships, funding of the Technology Strategy Board, and public private partnerships such as the Energy Technologies Institute, these are much smaller than in competitor nations. Addressing this mismatch should be a priority.

Recent years have seen a resurgence in the development of industrial policies by governments in the UK and overseas. In the UK, industrial policies have been developed in 11 sectors, led in most cases by groups from the public and private sectors, with many of these encompassing manufacturing industries. One specific development has been the creation of the Catapult Centres. In particular, the High Value Manufacturing Catapult provides a strong base on which to build substantial further effort. It is recommended that its funding is substantially increased, and used in part to encourage the greater involvement of smaller firms in particular.

Whilst specific initiatives are essential in areas mentioned above, more is needed. Recognition that the UK’s national infrastructure suffered from fragmented policy making led to the creation of Infrastructure UK (IUK). Manufacturing suffers from similar challenges and is no less strategic for the future strength and resilience of the UK economy. The Lead Expert Group of this Foresight project considers that a similar office to the IUK is needed for manufacturing. This would be responsible for helping government to formulate long term policies that would take into account the extended value chain associated with manufacturing industries.

It should be staffed by experts, preferably with substantial successful industry experience. They would consider all of the issues highlighted in this report, and develop and assist government with piloting new policies. A UK Office for Manufacturing would need to work closely with IUK, in view of the importance of infrastructure to manufacturing. It would also need to work closely with industry, particularly to improve skills and increase the ability of companies to innovate by working with relevant partners. Other countries including the United States and Australia have developed relevant offices from which the UK can learn. In summary, manufacturing is too important to leave to its own devices. The Lead Expert Group for this project, comprising academic and industry leaders commend this report to government, together with its associated analysis and evidence underpinning its conclusions.

Sir Richard Lapthorne and Sir Mark Walport

Preface

Rt Hon Vince Cable MP

It is surely unique in Europe, if not globally, for a government to commission a strategic look at the future of manufacturing as far ahead as 2050.

This report - involving some 300 leading business people, experts and policy makers from 25 countries - sets out a vision of manufacturing that is very different to what we recognise today. Clearly, both industry and government need to prepare for what will be considerable opportunities and challenges ahead.

The importance of manufacturing to the UK economy, as set out here, is incontrovertible. Manufacturing is no longer just about production, it is a much wider set of activities that create value for the UK and benefits for wider society. Manufacturing includes significant innovation. It creates jobs that are both highly skilled and well paid. It also contributes to the rebalancing of the economy, with its strong role on exports and import substitutions.

Through the government’s industrial strategy we are already working with business on long-range plans to strengthen advanced manufacturing sectors such as automobiles, aerospace, life sciences and energy supply chains. We are developing the UK’s ability to commercialise new technology and expand our skills base.

There are many UK manufacturing firms that are world class. Indeed, manufacturing leads other sectors in many areas, including productivity, exports and research and development. There is no room for complacency, however.

The analysis and advice contained in this report will help government to take its support for manufacturing to another level. My officials will be working with the project experts to work out next steps. I look forward to seeing how their conclusions help government and industry to harness the full potential of UK manufacturing.

Rt Hon Vince Cable MP

Project background

Project aim

This has been to take a long term and strategic look at manufacturing out to 2050, to:

- identify and analyse important drivers of change affecting the UK manufacturing sector

- identify important challenges and opportunities that lie ahead and which require action by government and industry

- advise how government policy needs to be refocussed and rebalanced so that it is better positioned to support the growth and resilience of UK manufacturing over coming decades

In so doing, a specific aim is to inform further development of the government’s industrial and sector strategies.

Who has been involved

The 2-year project has been run by the Foresight programme in the UK Government Office for Science, under the personal direction of the Government Chief Scientific Adviser: formerly Professor Sir John Beddington and, since April 2013, Sir Mark Walport. The Rt Hon Vince Cable MP, the Secretary of State for Business, Innovation and Skills, has sponsored the project and chaired an industry High Level Stakeholder Group (Annex C) which provided strategic advice. The project has based its analysis on the very best evidence. Throughout, it has been overseen by a multi-disciplinary Lead Expert Group (Annex D) drawn from business and academia, chaired by Sir Richard Lapthorne, Chairman of Cable & Wireless Communications plc. In addition, it has involved some 300 industry and academic experts, business leaders and stakeholders, from 25 countries. They have contributed to 37 peer-reviewed technical evidence papers and provided a wide range of insights and advice. Valuable international perspectives were provided at workshops held in Asia, Europe and the US.

The project report, on which this summary report is based, and all supporting material is available at: www.bis.gov.uk/foresight.

“This study is unique within Europe both in terms of its scope and its time frame which looks out to the year 2050. It will help Nissan to tune its product offerings and production processes to better meet likely demographic and market trends. I am very encouraged by the efforts of the UK government to support manufacturing and this report builds on the excellent automotive and aerospace industrial strategies recently published by the Department for Business, Innovation and Skills.” - John Martin, Senior Vice President - Manufacturing, Purchasing and Supply Chain Management, Nissan Motor Co. Ltd

1. Manufacturing matters

Clean room worker holding a CPU

Manufacturing is essential for long term economic growth and economic resilience. However, many of its characteristics are changing profoundly. Physical production processes are increasingly at the centre of much wider value chains.

A powerful contribution to the UK economy

Manufacturing is and must continue to be an essential part of the UK economy. Its benefits include:

- Absolute value: The contribution of manufacturing to UK Gross Domestic Product (£139 billion in 2012) is still significant and increasing over the long term.

- Research and Development (R&D): Manufacturing businesses are more likely to engage in R&D. 41% of manufacturing businesses with 10 or more employees allocated resources to R&D in 2010 compared with an average of 23% of businesses in other sectors. Throughout 2000-2011, 72-79% of total UK R&D expenditure was associated with manufacturing.

- Innovation: Manufacturers are more likely to innovate. In 2010, 26% of manufacturing businesses with 10 or more employees carried out process innovation compared with less than 14% for non-manufacturers, and 44% undertook product innovation (less than 26% for non-manufacturers).

- Productivity: The growth in total factor productivity(i) for manufacturing has been 2.3% per year between 1980 and 2009, compared with 0.7% per year for the UK as a whole.

- Exports: Manufacturing businesses are more likely to engage in exporting. UK exports of goods produced by the manufacturing sector totalled £256 billion in 2012, accounting for around 53% of all UK exports. In 2010, 60% of manufacturing businesses with 10 or more employees exported products and services compared with 26% of non-manufacturers.

- Highly skilled jobs: In 2011, remuneration in UK manufacturing was 10% higher in comparable occupations compared with the average across all industries, reflecting the high levels of skills required in modern manufacturing roles.

- Inter-industry linkages: Manufacturing performance affects other sectors through its wide range of input-output and other linkages.

- Economic resilience: Economies with strong, export-led manufacturing sectors typically recover from recessions faster than those without equivalent manufacturing sectors.

(i - Total Factor Productivity (TFP) is defined as the increase in output that is not due to an increase in the direct inputs used to produce goods and services (ie labour, physical capital and intermediate inputs). Rather it is the more efficient use of these inputs.)

A diverse sector with a context of historical shifts

The UK manufacturing sector is diverse, with activities ranging from aerospace, pharmaceuticals, chemicals and automotives to food and drink. It is characterised by a wide range of sizes of firm, with a disproportionate share of activity accounted for by a small number of large, often foreign owned multinational companies. Although most firms are small, with 87% of firms employing less than 20 employees in 2009, large firms generate most of the value added and dominate R&D expenditure. For example, firms with 250 or more employees created 88% of the total gross value in 2009 and the largest 10 R&D performers alone accounted for over a third of all manufacturing R&D.

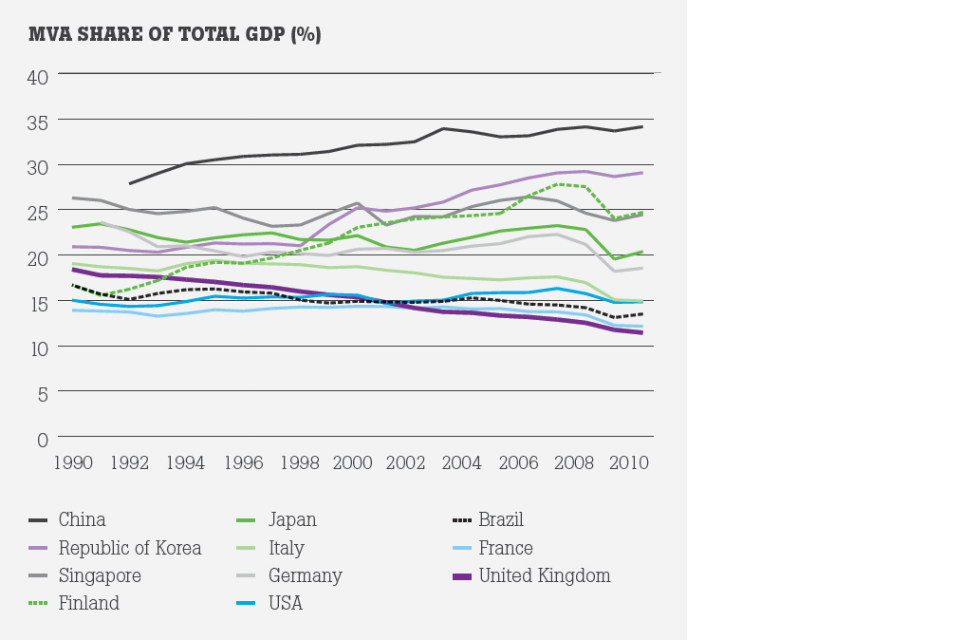

However, in recent years, the relative share of manufacturing in the UK economy has declined more rapidly than in other developed economies (Figure 1) while the service sector has grown at a faster rate. This growth of the service sector in the UK is consistent with growth in other developed economies including France and the US. This ‘deindustrialisation’ has also applied to UK manufacturing employment, with numbers reducing at a faster rate than in other developed economies, from close to 9 million people in 1966 to below 3 million in 2011.

Figure 1: Manufacturing share of GDP 1990-2010

Graph showing how the manufacturing share of UK GDP has declined more rapidly than in other developed economies

Variable performance relative to international competitors

UK manufacturing performance has been weak relative to international competitors in some key areas:

- expenditure on manufacturing R&D has been low, especially with regard to new products

- the level of investment in capital equipment has been relatively low for many decades

- the UK’s share of global manufacturing exports has fallen from 7.2% in 1980 to 2.9% in 2012

But there are also many outstanding individual firms, and some important areas of relatively strong performance for manufacturing as a whole:

- when total factor productivity is compared between the UK, the Netherlands, Spain, France, Italy and Germany, from 1980 and 2009, manufacturing performs best in the UK

- the fall in the UK’s share of goods exports has been accompanied by an increase in export intensity (manufacturing exports as a proportion of manufacturing output), which rose from about 30% in 1991 to around 47% in 2011; which is similar to France and higher than the US

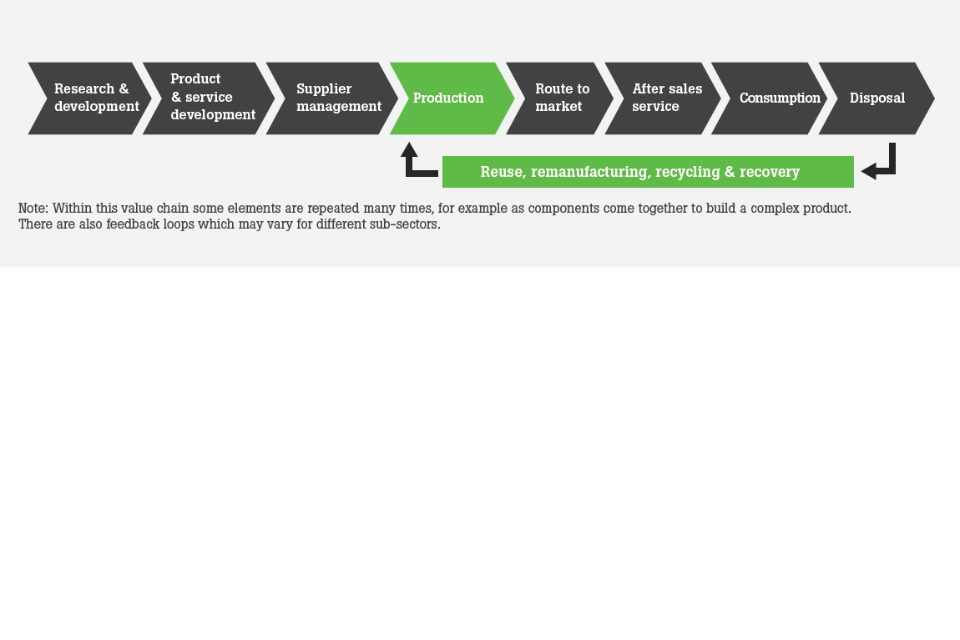

Figure 2: Simplified model of the manufacturing value chain

Figure showing the manufacturing value chain

Manufacturing is changing profoundly, creating major new sources of revenue and value beyond the production and sale of products

Manufacturing has traditionally been understood as the production process in which raw materials are transformed into physical products through processes involving people and other resources. It is now clear that physical production is at the centre of a wider manufacturing value chain. (Figure 2 and Box 1).

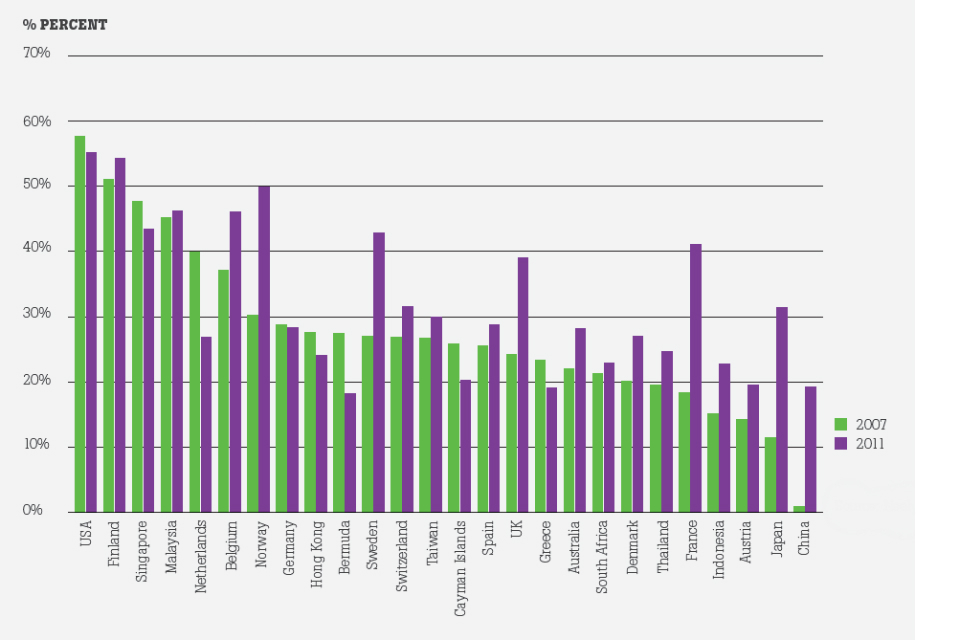

Manufacturers are increasingly using this wider value chain to generate new and additional revenue, with production playing a central role in allowing other value creating activities to occur. For example, 39% of UK manufacturers with more than 100 employees derived value from services related to their products in 2011, compared with 24% in 2007 (Figure 3). This typically involves supporting or complementing products, and offering outcome or availability based contracts for products. Not all manufacturing firms report service revenue separately, and there is no requirement for them to do so. However, in 2009 Rolls Royce reported 49% of its revenue from services, and Arcelor Mittal reported 29%.

Box 1: Recent definitions of manufacturing

| ‘The new era of manufacturing will be marked by highly agile, networked enterprises that use information and analytics as skilfully as they employ talent and machinery to deliver products and services to diverse global markets’ (McKinsey & Company, 2012). | ||

| ‘The application of leading-edge technical knowledge and expertise for the creation of products, production processes and associated services, which have strong potential to bring sustainable growth and high economic value to the UK. Activities may stretch from R&D at one end to recycling at the other’ (Technology Strategy Board, 2012). | ||

| ‘The world is in the midst of a paradigm shift in the 21st century - one that integrates diverse sets of ideas, products and services globally through the lens of highly complex, integrated and self-morphing resource webs… Highly talented skilled people are necessary to effectively and consistently apply cutting edge science and technology, systems thinking, smart services and processes, and supply chain excellence’ (Deloitte, 2013). |

Figure 3: Manufacturers offering services, 2007 & 2011 (100 or more employees)

Bar chart showing the percentage of manufacturers offering services in developed economies [Source: Neely, A. et al (2011)]

New sources of revenue and of value creation will transform manufacturing business models over time. They will draw on new sources of knowledge and closer, long term relationships with customers. Future sources of revenue for manufacturers will include:

- increasingly extensive packaging of services with products

- new sources of information on how products are used, drawing on embedded sensors and open data

- becoming a ‘factoryless goods producer’, capturing value by selling technological knowledge and leaving production to others

- becoming a ‘remanufacturer’ with end of life products remanufactured and returned to original specifications or better

- targeting ‘collaborative consumption’, where no one customer owns a product outright

- creating value from new forms of (competitive) strategic alliance within and across sectors

- exploiting new technologies more rapidly through greater operational capability coupled to entrepreneurial insight

2. Four key future characteristics of manufacturing and implications for government

Illustration of a fullerene molecule

Manufacturing is entering a dynamic new phase which will provide substantial opportunities for the UK. Looking ahead to 2050, this Foresight project has identified 4 key future characteristics of manufacturing. They have significant implications for both government and industry.

2.1 Faster, more responsive and closer to customers

What are the likely changes?

Technology will play a central role in driving change. Some of the value being created in 2050 will derive from wholly unanticipated breakthroughs but many of the technologies that will transform manufacturing, such as additive manufacturing, are already established or clearly emerging. Table 1 summarises some of the most important pervasive and secondary technologies including ICT, sensors, advanced materials and robotics. When integrated into future products and networks, these will collectively facilitate fundamental shifts in how products are designed, made, offered and ultimately used by consumers.

Mass personalisation of low-cost products, on demand: The historic split between cheap mass produced products creating value from economies of scale and more expensive customised products will be reduced across a wide range of product types. Technologies such as additive manufacturing, new materials, computer-controlled tools, biotechnology, and green chemistry will enable wholly new forms of personalisation. Direct customer input to design will increasingly enable companies to produce customised products with the shorter cycle-times and lower costs associated with standardisation and mass production. The producer and the customer will share in the new value created. For example, research at the University of Loughborough shows that customers might be prepared to pay an additional 10% for some degree of personalisation. Customisation is a significant opportunity for UK manufacturers targeting both the domestic market and other developed economies.

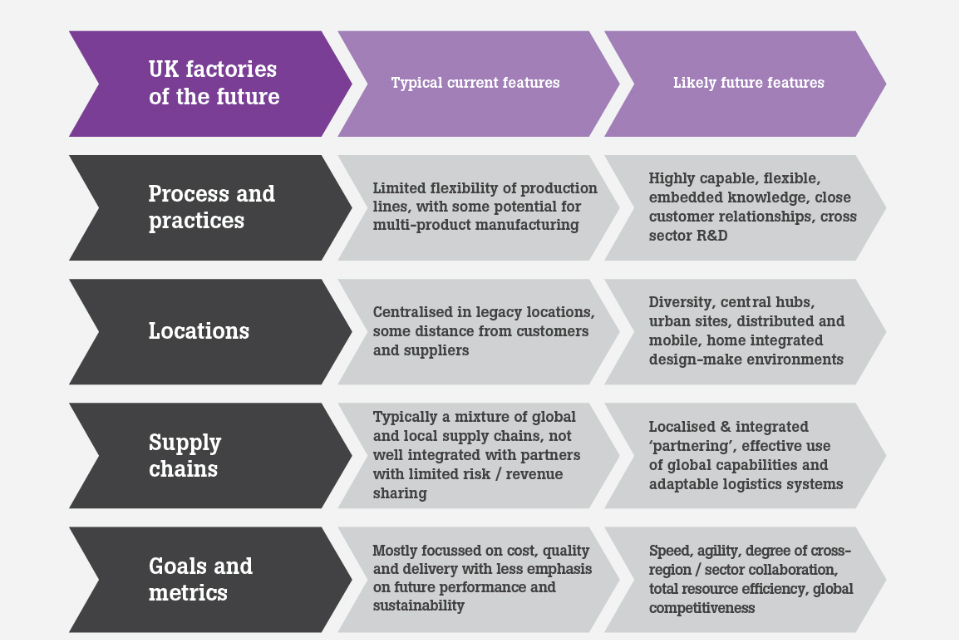

Distributed production: We will see a transformation in the nature of production itself, driven by trends such as new forms of modelling and additive manufacturing through to nanotechnologies and advanced robotics. The factories of the future will be more varied, and more distributed than those of today (Figure 4). The production landscape will include capital intensive super factories producing complex products; reconfigurable units integrated with the fluid requirements of their supply chain partners; and local, mobile and domestic production sites for some products. Urban sites will become common as factories reduce their environmental impacts. The factory of the future may be at the bedside, in the home, in the field, in the office and on the battlefield.

Digitised manufacturing value chains: Pervasive computing, advanced software and sensor technologies have much further to go in transforming value chains. They will improve customer relationship management, process control, product verification, logistics, product traceability and safety systems. They will enable greater design freedom through the uses of simulation, and they will create new ways to bring customers into design and suppliers into complex production processes.

“Looking to the future, we recognise that transformational change is required and emerging technologies present an opportunity to create a paradigm shift, allowing us to manufacture medicines faster, greener and at a lower cost. Manufacturing has become increasingly critical in the pharmaceutical sector and will require more agility to respond to patient needs, more flexibility to bring production closer to customers, as well as increases in efficiency and sustainability. This will underpin high quality standards and ensure new medicines are affordable for patients around the world. The prize is significant and it is imperative that industry and government work together to seize this opportunity and secure a leading position for the UK.” - Roger Connor, President of Global Manufacturing and Supply, GlaxoSmithKline plc

Table 1: Important pervasive and secondary technologies for future manufacturing activities

| Pervasive technology | Likely future impacts |

|---|---|

| Information and communications technology (ICT) | Modelling and simulation integrated into all design processes, together with virtual reality tools will allow complex products and processes to be assessed and optimised, with analysis of new data streams. |

| Sensors | The integration of sensors into networks of technology, such as products connected to the internet, will revolutionise manufacturing. New data streams from products will become available to support new services, enable self-checking inventories and products which self diagnose faults before failure, and reduced energy usage. |

| Advanced & functional materials | New materials, in which the UK has strong capabilities, will penetrate the mass market and will include reactive nanoparticles, lightweight composites, self-healing materials, carbon nanotubes, biomaterials and ‘intelligent’ materials providing user feedback. |

| Biotechnology | The range of biotechnology products is likely to increase, with greater use of fields of biology by industry. There is potential for new disease treatment strategies, bedside manufacturing of personalised drugs, personalised organ fabrication, wide availability of engineered leather and meat, and sustainable production of fuel and chemicals. |

| Sustainable/green technologies | These will be used to reduce the resources used in production including energy and water, produce clean energy technologies, and deliver improved environmental performance of products. Minimising the use of hazardous substances. |

| Secondary technology | |

| Big data and knowledge based automation | These will be important in the on-going automation of many tasks that formerly required people. In addition, the volume and detail of information captured by businesses and the rise of multimedia, social medial and the internet of things will fuel future increases in data, allowing firms to understand customer preferences and personalise products. |

| Internet of things | There is potential for major impacts in terms of business optimisation, resource management, energy minimisation, and remote healthcare. In factory and process environments, virtually everything is expected to be connected via central networks. Increasingly, new products will have embedded sensors and become autonomous. |

| Advanced and autonomous robotics | Advances are likely to make many routine manufacturing operations obsolete, including healthcare and surgery, food preparation and cleaning activities. Autonomous and near-autonomous vehicles will boost the development of computer vision, sensors including radar and GPS, and remote control algorithms. 3D measurement and vision will be able to adapt to conditions, and track human gestures. |

| Additive manufacturing (also known as 3D printing) | This is expected to have a profound impact on the way manufacturers make almost any product. It will become an essential ‘tool’ allowing designs to be optimised to reduce waste; products to be made as light as possible; inventories of spare parts to be reduced; greater flexibility in the location of manufacturing; products to be personalised to consumers; consumers to make some of their own products; and products to be made with new graded composition and bespoke properties. |

| Cloud computing | Computerised manufacturing execution systems (MES) will work increasingly in real time to enable the control of multiple elements of the production process. Opportunities will be created for enhanced productivity, supply chain management, resource and material planning and customer relationship management. |

| Mobile internet | Smart phones and similar devices are positioned to become ubiquitous, general purpose tools for managing supply chains, assets, maintenance and production. They will allow functions such as directed advertising, remote healthcare and personalisation of products. Linked technologies include battery technology, low energy displays, user interfaces, nano-miniaturisation of electronics, and plastic electronics. |

Figure 4: Likely features of factories of the future

Figure showing the likely features of factories of the future

Figure showing the likely features of factories of the future

What are the implications for government?

Improving the speed and co-ordination of the technology pipeline for UK manufacturing: given the pace of change in technological developments and international competition, the UK needs to strengthen the extended system that identifies and supports new technologies and their applications. The UK’s High Value Manufacturing (HVM) Catapult Centre, established in 2011, has a key role in the near term, and is an example of a step that the government has taken to develop a more systemic approach across research, innovation and industrial policy. Immediate priorities should be to scale up funding for the HVM Catapult Centre, to promote much stronger involvement of small and medium enterprises in the member centres, and to enhance the role it plays in connecting academic expertise to industry. Longer term, there is potential for the centre to support international collaboration between manufacturers, for example by establishing a presence in key emerging economies.

Greater leveraging of the UK’s intellectual assets: The UK’s education system has considerable strengths relative to international competitors. However it files fewer patents than countries such as US, Japan and Germany. This suggests the UK is not leveraging its intellectual assets as much as it will need to in the future. For example, there needs to be a shift in the in balance of funding towards applied research and in its commercialisation. There also needs to be increased effort to identify key areas (such as sensors and additive manufacturing), to develop technology roadmaps, and to guide policy.

Protecting intellectual property, reducing counterfeiting and avoiding cyber attacks: Digitisation increases the risks of objects being copied illegally. Technologies such as additive manufacturing may make it even harder to identify breaches. However, the same trends support innovation and new forms of value creation. Today’s regulatory and policy frameworks need to be reappraised to ensure they achieve the best balance between openness and the rights and obligations of intellectual property ownership in this changing environment. They also need to consider what further action needs to be taken to address the threat of cyber-attack, which increasingly threatens information rich products and services.

2.2 Exposed to new market

What are the likely future trends?

Patterns of global trade and investment will determine the relative importance of the countries to which the UK exports and from which it imports; the types of firms and sectors which will be involved in its trade; the future structure and performance of manufacturing within the overall balance of payments; the place of the UK in the global pattern of foreign direct investment (FDI) flows; and the conduct of R&D and investment in innovation.

Emergence of BRIC economies and the ‘Next-11’: BRIC economies (Brazil, Russia, India and China) are likely to become larger than the US by 2015 and the G7 by 2032. In addition, the ‘N-11’ economies(ii) are likely to become larger than the US and almost twice the size of the Euro area by 2050. By value, UK is low down the global list of exporters to China (24th) and India (21st). The UK is the world’s 10th largest goods exporter, with a 2.9% share of global manufacturing exports in 2012. However its share of imports to countries forecast to be in the top 30 economies by 2050 is generally disappointing and below this level. The UK’s relatively poor current placement in these markets will make it harder for it to benefit from their future growth.

(ii - Bangladesh, Egypt, Indonesia, Iran, Korea, Mexico, Nigeria, Pakistan, Philippines, Turkey and Vietnam.)

Continued importance of US and Europe for UK manufacturing exports: The UK exported to 226 different countries or territories in 2010. The US was the most important destination, accounting for 13% by value. In 2012, EU markets accounted for about 54% of total export value, with BRIC exports at 8%.

High-tech likely to remain an area of UK advantage: At 4.7%, the UK’s share of global high technology manufacturing exports is relatively strong. Current high-tech sectoral strengths include pharmaceuticals, aerospace, chemicals, and the automotive sector.

Changing levels of personal wealth, including larger and older populations in major markets: The global population with annual per capita expenditure between US$3,650 and US$36,500 (2005 prices), is estimated to more than double in size from 2 billion in 2012 to 5 billion in 203033. Asia’s share of the group will rise from 30% to 64%. There will be 3 billion more people in the world by 2050 with 97% of population growth taking place in developing regions. Populations in some major markets are growing significantly older, with the Asia-Pacific region having the oldest (Japan) and largest (China).

Risks to foreign direct investment into Europe may affect the UK: The UK has been a major recipient of inward FDI for manufacturing and remains in a good position to attract an above-average share of FDI coming into Europe. However, FDI flows into Europe, as a proportion of total available FDI, are likely to reduce due to competition from BRIC and other emerging economies.

Continued global fragmentation of the value chain: Fragmentation includes the outsourcing of functions and offshoring. It is driven by factors such as the costs and quality of labour and transport, security of provision, the opportunities created by trade liberalisation; the availability of data and information; and the integration of suppliers into product development processes. Many manufacturing value chains are likely to continue to fragment, with the operation of supply chains playing a major role in determining future changes.

“The international, ‘industrial systems’ view of manufacturing set out in this report points the way to creating and capturing value in a dynamic global economy. Meeting the implied challenges will require radical new approaches which cross traditional disciplinary and institutional boundaries.” - Professor Sir Mike Gregory, Head of the Institute for Manufacturing, University of Cambridge

Some onshoring of production back to the UK: Onshoring (or ‘reshoring’) is a recent trend typically involving the repatriation of production from low cost locations; investment in onshore production to enhance capability; and sourcing of components from onshore, rather than from overseas. This is typically in response to changing labour costs, higher transport costs, a need to be closer to the market, product quality concerns, and advantages of collocating R&D and production. There is little robust evidence about the scale of this trend so far (see Box 2 for illustrations). However, some underlying trends suggest it will become increasingly possible for the UK to compete with lower cost locations, on quality, delivery speed and customisation.

Increasing foreign ownership: If current trends continue, the foreign-owned manufacturing sector within the UK will account for a larger share of output (by 2020), GVA and employment (by 2015) than the UK-owned sector. The presence of multinational corporations (MNCs) will continue to help improve the performance of the UK’s largest firms, but the detail of the effects depends on the investment and production strategies of MNCs.

“The quickest-acting and highest-octane fuel for growth in any economy, is a blisteringly strong export performance. The challenge for UK manufacturing is to recognise what things we’re especially good at, embrace them and drive them forward, by investing time, money and skills in them. We should acknowledge our strengths, and play to them.” - Sir Richard Olver, Chairman, BAE Systems plc

Box 2: examples of UK onshoring

| John Lewis plc: During July 2013, the retailer emphasised its commitment to increasing sales of products manufactured in the UK by announcing a 2-year 15% growth target for all sales of goods in its shops that are made in the UK .In addition, it has increased its number of UK suppliers from 132 in 2012 to 207 in 2013. | ||

| Hornby plc: In November 2012 the UK model maker decided to return the production of 60% of its model paint brand, Humbrol, from China to the UK. This decision was taken to improve supply, and ensure high quality standards continue to be met, but from an easier location nearer to the Margate head office. | ||

| Laxtons Ltd: This spinning company, established in 1907, is now a design-driven yarn manufacturer. Like many British textile companies, production was offshored, but it has now returned to Yorkshire, reducing the firm’s carbon footprint and lead times and increasing its control over quality and raw materials. | ||

| Bathrooms.com: In July 2013, the online bathroom specialist confirmed that it was handing 50% of the contracts currently held by Chinese manufacturers to UK businesses in the Midlands, to decrease the time taken from design through to production from 4 to 6 months to 6 weeks. | ||

| Marks & Spencer plc: In October 2013, the retailer launched its ‘Best of British’ collection selling womenswear and menswear collections which emphasise British craftsmanship and quality, which feature a combination of British heritage, sourcing and production. This was part of a 3-year deal with the British Fashion Council to support domestic talent and increase its sourcing from the UK. |

What are the implications for government?

Enabling UK manufacturers to control global value chains: As manufacturing value chains continue to fragment globally, and new business models such as manufacturing services continue to develop, it will become increasingly important for manufacturers to create and operate value chains to maximise revenues. Government action in support of this needs to be agile and outward looking, and informed by a common view of developments which draws upon intelligence from BIS, Research Councils and the Technology Strategy Board. A recent example of such action is a funding competition launched by the Technology Strategy Board this year; this supports feasibility studies into new business models which in turn promote innovations in high value manufacturing.

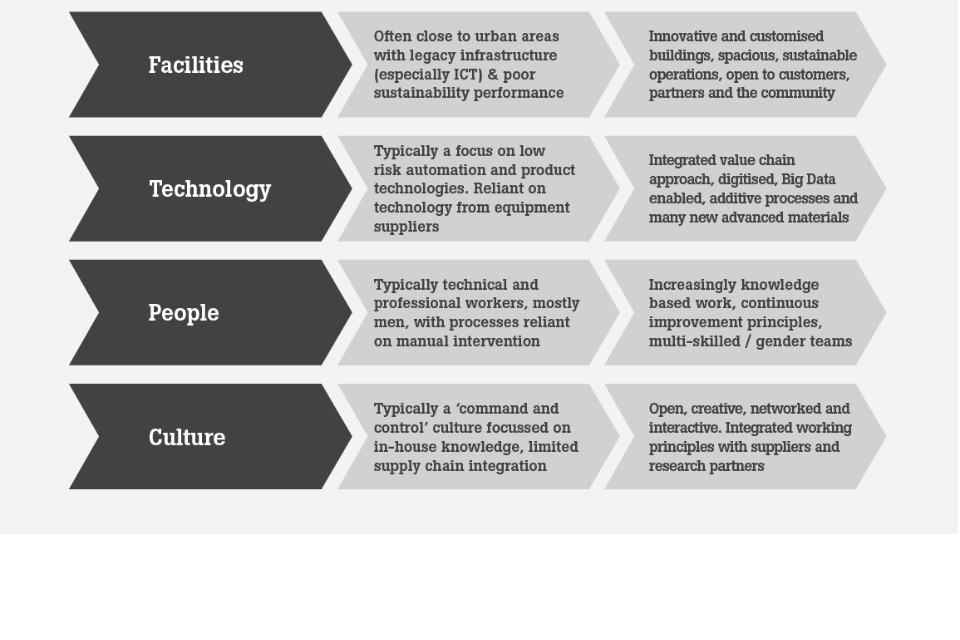

Figure 5: Product design/production and relationship to process maturity

Figure showing the product design/production and relationship to process maturity [Source: Pisano & Shih (2012)]

Promoting co-location of R&D with production to maintain and build an ‘industrial commons’ Products dependent on process-driven innovation, such as some drugs, nano-materials and some electronics applications benefit from the co-location of different parts of their production systems (Figure 5). Government has a major role to play, nationally and locally, in encouraging greater agglomeration and clustering of particular activities, including encouraging co-location of production alongside research and development.

Raising the UK’s export performance, particularly to emerging economies(iii): Products win export markets when they deliver value, rarity, and possess hardto- imitate attributes. Most exporting is done by firms with relatively high levels of productivity, so measures to raise this, for example by improving the quality of leadership and management, will be key. The role of UK Trade and Investment (UKTI) will also continue to be important and should be strengthened in markets offering the best potential for export growth. This includes the provision of advice and market-based intelligence to companies seeking to increase their exports or enter new markets, and support to businesses once they are operating in a market, for example in areas of language and culture. Beyond these measures, there is a need to understand much better what prevents the UK from having more exporting ‘superstars’ - firms which export 10 or more products to 10 or more destinations.

(iii - Industrial commons: The embedded knowledge and technology framework that enhances the efficiency, effectiveness, and productivity of the proprietary capital and labour that use it.)

Identifying ‘phoenix’ industries emerging from previous manufacturing activities: Established industrial regions typically possess important legacy assets such as specialised engineering skills, pre-existing personal networks, technical skills, and market knowledge. National and local policymakers will need to develop new mechanisms to identify and exploit these legacies to support phoenix industries, such as small and medium sized firms specialising in the production of high value sophisticated components for equipment manufacturers. Success will depend on strong local alliances, such as those behind specialised training and research programmes run by Sheffield University and other universities.

Keeping the UK attractive to manufacturing FDI: 3 attributes that make the UK attractive to overseas investors include quality of life, culture and language; the stable political environment; and technology and infrastructure. Priorities for attracting future FDI for manufacturing include the provision of high quality e-infrastructure and physical infrastructure (roads, in particular).

Ensuring a supply of patient capital: UK capital markets are characterised by an arms-length relationship between the providers and users of finance. An emphasis on short term returns by investors leads to management focus on short term movements in stock market prices, and the threat of takeover, with long term investment in new capital equipment, skills and training and R&D spend inhibited. These effects are damaging for manufacturing, which requires relatively high long term investment in terms of new capital equipment, R&D and skills. The institutional architecture which encourages impatience in corporate governance and the capital market must be addressed to support future UK manufacturing competitiveness.

2.3 More sustainable

What are the likely future trends?

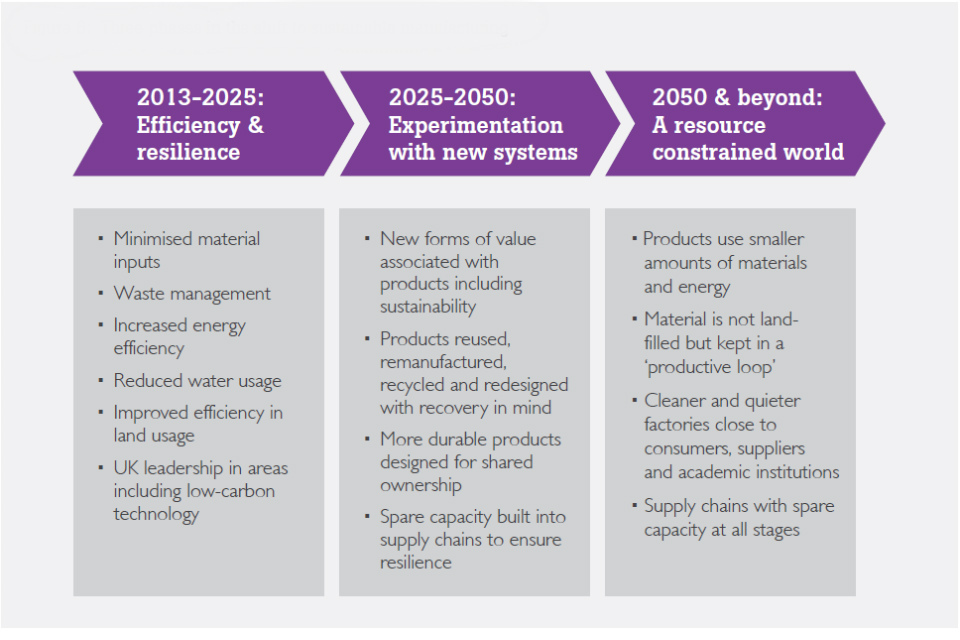

Participants at the project’s international workshops repeatedly emphasised the profound changes that environmental sustainability(iv) will have on production processes over the next four decades. Figure 6 outlines these in 3 broad phases.

(iv - The terms ‘sustainable manufacturing’ and the ‘drive towards sustainability’ are frequently used in the Foresight work. The definition of sustainability adopted here is that described in the widely cited Brundtland Report: ‘development that meets the needs of the present without compromising the ability of future generations to meet their own needs’.)

Volatility of supply: A growing global population and increased urbanisation (70% of the global population will live in urban areas in 2050) will increase demand for materials, water, energy and land. As a result, resources will be subject to greater competition, with potential disruptions in their supply. In most cases, prices will rise and they may also become more volatile. Those companies and nations that learn how to manufacture their products with less of these inputs will be more resilient to these effects.

Climate change and the increased vulnerability of global supply chains: Climate change will have a range of impacts including rising sea levels and extreme weather events. UK manufacturers will be affected by challenges such as the disruption of their international supply chains.

Greater use of regulation, potential ‘pricing of the environment’: Regulation is likely to focus increasingly on promoting resource productivity. For example, recent EU legislation aims to divert electrical equipment waste away from landfill. Over the period to 2050, national and international responses are likely to include tougher environmental standards for products and new ways to price natural resources and ecosystem services.

Figure 6: Three phases in the shift to sustainable manufacturing

Figure showing the 3 broad phases in the shift to sustainable manufacturing

Consumer pull for eco-products: Consumer demand for sustainable products which use less energy and fewer materials is growing, although it is not clear how far and fast demand will change. Unilever’s pledge to double turnover without increasing greenhouse gas emissions and Marks & Spencer’s Plan A to go ‘beyond compliance’ on the environment are examples of corporate responses.

Making robust products for ‘collaborative consumption’: ICT-based systems are facilitating new business models based on shared use of assets. This shifts the business model from ownership to access, incentivises manufacturers to provide robust products, and allows the creation of new service based revenue streams.

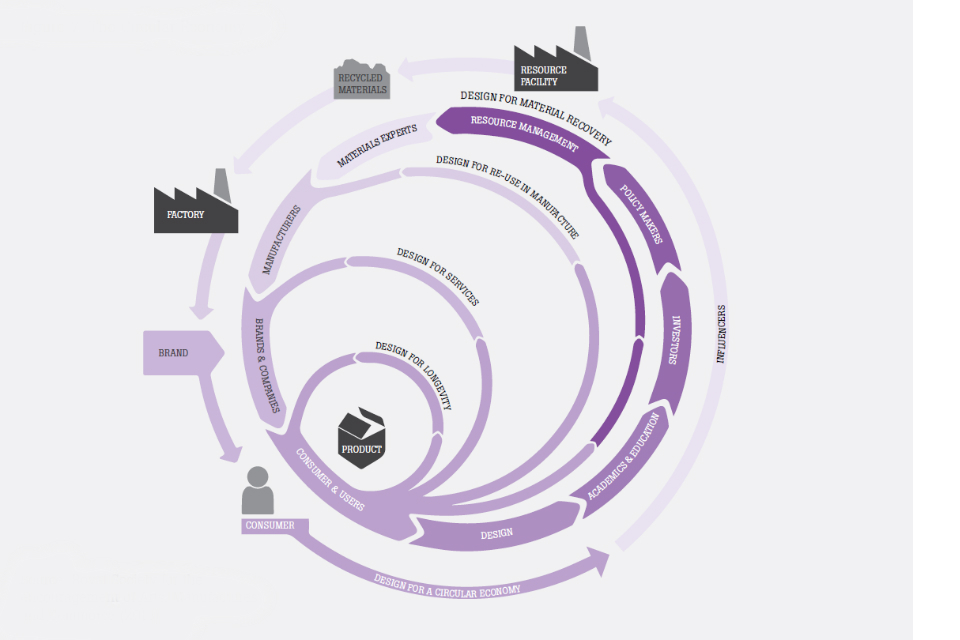

Emergence of a ‘circular economy’ in which end of life products are reused, remanufactured and recycled: Resource scarcity and higher costs for energy and waste disposal will shift manufacturing value creation to new models (Figure 7 and Box 3):

- reuse: redeploying a product without the need for refurbishment

- remanufacturing: returning a product to its original performance specification

- cascaded use: using a product for a lower value purpose, for example turning used clothes into pillow stuffing or redeploying computers within a business for less demanding applications

- recycling: extracting the raw materials and using them for new products

- recovery: re-using materials for a low value purpose such as road base or combustion to produce heat

Box 3: Examples of firms embracing the ‘circular economy’

| Caterpillar Inc: Caterpillar is a US manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric trains, with a strong UK presence. The business runs ‘Cat Reman’, a remanufacturing programme that returns products at the end of their lives to same as-new condition, and seeks new ways to reduce, reuse, recycle, and reclaim materials which once would have gone into a landfill. During 2012, Cat Reman took back over 2.2 million end-of life units for remanufacturing. | ||

| JC Bamford Excavators Ltd (JCB): JCB is one of the world’s top 3 manufacturers of construction equipment, based in the UK. Through the JCB Service Exchange, the business helps plant users to reduce owning and operating costs, with a comprehensive range of remanufactured parts for all its machines. Around 1,650 high quality parts, all remanufactured to original equipment manufacturer standards and protected by the same warranty conditions as new parts, are offered. With typical savings against new of 40-50%, the remanufactured parts can restore machines to their optimum condition at a more affordable price. Furthermore, remanufactured parts are upgraded to incorporate the latest technology. |

What are the implications for government?

Incentivising product and process efficiency: greater use should be made of well designed regulation, in particular drawing upon ideas from abroad. For example, effective energy reduction has been demonstrated by innovative schemes such as ‘Top-Runner’ in Japan where future product standards are set so that all products manufactured at a specific point in the future must be at least as good as the best performance of today. The government should consider developing top-runner schemes in the UK, for example relating to the energy usage of factories, and also procurement and waste policies.

Targeting R&D at improving resource efficiency and material substitution: the UK has world class capabilities in key areas of research in novel material design and development. Continued support for fundamental research should be complemented by programmes to develop rapid recycling and recovery technologies, with non-destructive removal of high value parts and materials from complex end-of-life products.

Supporting business models based on reuse remanufacturing and services: government should work with industry and others, for example in the UK such as the Royal Society for the encouragement of Arts, Manufactures and Commerce (RSA) and the Ellen MacArthur Foundation to accelerate the development and roll out of the ‘circular economy’. Lessons should also be drawn from overseas organisations such as the 2009 China ‘Circular Economy Promotion Law’.

Quantifying domestic reserves of critical materials: It is essential that the UK makes the most of any domestic supplies of key materials, where economically viable, such as sources of indium, widely used in the production of LCD displays and low-melting temperature alloys.

Figure 7: The Circular Economy

Figure illustrating the circular economy [Source: Royal Society for the encouragement of Arts, Manufactures and Commerce (2013)]

2.4 Increasingly dependent on highly skilled workers

What are the likely future trends?

Sustained future demand for manufacturing workers: UK manufacturing employment has declined significantly in the past (from around 9 million people in 1966 compared with less than 3 million in 2011). Any future declines will be much smaller, with around 170,000 fewer people in the sector projected by 2020 compared with 2010. However, there will be around 800,000 jobs to fill in the years up to 2020, as people retire or leave manufacturing.

An ageing population and the need to accommodate more older workers: Over the period to 2050, the UK will have an ageing population, with the number of people aged 65 years and over (ie of ‘traditional’ retirement age) set to increase, while the numbers of ‘traditional’ working age people are set to decrease. By 2030, 17% of the UK population will be aged between 60-74. There will be a number of challenges in making manufacturing attractive to older workers, particularly in sub-sectors with the oldest age profiles including manufacturing of machinery and fabricated metal products.

Science, technology, engineering and maths (STEM) qualifications: By 2020 there are expected to be an additional 80,000 managerial, professional and associate professional and technical positions in manufacturing. Overall, many jobs will require apprentice, degree and technician level STEM qualifications, especially in product design and development. Future demand is currently likely to exceed supply especially as, at present, only around a quarter of engineering and technology graduates work in manufacturing 6 months after graduation.

Demand for technical specialism combined with commercial and problem solving abilities: The precise mix of skills in demand for the factories of the future will vary by sub-sector (see Table 2), but new blends of skills will increase manufacturers’ ability to exploit new opportunities. These blends of high quality skills will allow developed economies such as the UK to increasingly compete in terms of the quality of their workforce.

A need to improve the perception of manufacturing amongst young people and women 68, 69 and to raise the quality of UK managers: Young people and women tend to have a negative perception of manufacturing, with 67% of girls aged 7-11 years indicated that they would not like a job in manufacturing compared with 44% of boys. In addition, the UK currently fares poorly on the quality of its managers: average scores for management practices in surveys of manufacturing in different countries show that Great Britain scores below the US, Japan, Germany, Sweden, and Canada, but is on a par with Australia, Italy and France. Strong leadership teams and distributed leaders in key positions throughout manufacturing businesses will be essential in the future.

The potential for human enhancement: By 2050 patterns of employment will be influenced by new forms of human enhancement and augmented capabilities. These may support mental performance and physical mobility, and help counter the effects of ageing.

What are the implications for government?

Increasing and diversifying the supply of manufacturing workers to avoid future shortfalls: There is a need to consistently reach out to young people in the education system to encourage them to study STEM subjects to keep their future options open; focussing on accessing and attracting international talent for example through ‘science visas’; and building and maintaining existing workforce capability for example by encouraging continual vocational education and training.

Equipping future workers with high quality skills that manufacturers will need: potential workers will need to be as high quality and ‘business ready’ as possible, to meet the need for new skills sets driven by changing business models, technology and other factors. Higher level skills, vocational training, apprenticeships and STEM qualifications will be critical as the manufacturing workforce shifts to include a greater proportion of managerial, professional and technical roles. Government will need to increase the scale and ambition of its programme of current initiatives to meet these future requirements.

Ensuring that manufacturers utilise future workers effectively: this will involve raising employer demand for skills to stimulate a supply which meets future needs as closely as possible; and employers designing jobs that exploit new skills and capabilities for competitive advantage.

“A common theme of all the future trends is the need for a highly talented, skilled and flexible workforce. We must do more to achieve a higher percentage of young people going into science and engineering and counter the current poor perception of manufacturing industries. Manufacturing local to your consumers to deliver exceptional value is a trend we already see in the food and drink sector. Understanding the complete value chain (eg from farm to fork) will enable businesses to deliver increased value to customers and consumers.” - Richard Martin, Chief Engineer, Nestle UK & Ireland

Table 2: Long term skill demands in selected manufacturing sub-sectors and technologies

| Sub-sector | Management skills | Professional Skills | Technical Skills |

|---|---|---|---|

| Aerospace | Capacity to negotiate complex global markets | Mix of technical and business skills required to manage complex projects and international supply chains involved in design and R&D | Engineering (electrical and mechanical)/ software (modelling and simulation); knowledge of advanced materials |

| Plastic and silicon electronics | Ability to bring new products to market and manage the transition from producing prototypes to higher volume production | Testing, prototyping and being able to implement new designs. Skills related to using plastic electronics | |

| Biotechnology/ Pharmaceuticals | Management of new product development | Need for scientists capable of working across boundaries of biology/genetics/ chemistry/ chemical engineering etc. | Technicians capable of working with the new production systems required to produce biotechnology products |

| New materials/ composites | Skills related to the commercialisation of new materials | Scientists and technologists are required to develop new composites applicable to sectors such as automotive and aerospace | Technicians will need to acquire the skills required to work with new materials in their manufacture |

| Nanotechnology | As a new embryonic technology there is a need for managers and professionals (especially scientists) across the manufacturing sector to identify how nanotechnologies can be incorporated in to products and processes | Higher level skilled technicians will be required in relation to the handling and use of nanotechnologies |

3. Three systemic areas for future government focus

Medical pills on a production line

As manufacturing evolves, policy makers will need new approaches which reflect the changing nature of manufacturing to ensure that the UK is a place where it thrives.

3.1 Taking a more integrated view of value creation in the manufacturing sector

Manufacturing is no longer just about ‘production’ - making a product and then selling it. Manufacturers are increasingly using a wider ‘value chain’ to generate new and additional revenue from pre and post production activities, with production playing a critical role in allowing these other activities to occur. New metrics are needed to capture the new ways in which manufacturers are creating value, and to assess the scale and location of important changes within the sector. One way forward would be to pilot the development of new metrics focussed on the value chain (Box 4). These will be critical in revealing key interconnections in the economy, understanding the important role of production in the manufacturing value chain, and helping to identify where in the value chain future policy intervention should focus to support manufacturers as they create and capture new and additional revenue streams. New metrics will also help in developing an understanding of how policies in other areas affect manufacturing.

“This report is very timely to prepare us for key opportunities and challenges and to ensure we use this changing manufacturing landscape to capture a larger share of global manufacturing than we currently enjoy in the UK.” - Juergen Maier, Managing Director, Siemens UK and Ireland Industry Sector

Box 4: New ways to measure manufacturing?

| The performance of the manufacturing sector is currently measured by classifying the output of manufacturing firms by the main type of economic activity in which they are engaged with the Office for National Statistics using the Standard Industrial Classification (SIC) system. This provides a limited and incomplete picture since it captures neither the wider manufacturing value chain nor the incorporation within the firm of pre- and post-production services which are increasingly important in competitive business models for manufacturing firms. | ||

| The Office for National Statistics collects limited data relating to the type of goods and services bought-in by firms, and to which broad sectors goods and services are sold. This allows them to construct supply-and-use and input-output tables for the UK which show in aggregate the flow of goods and services along the supply chain. However, it is not possible to use these data to measure which ‘core’ products also involve ‘manufacturing-dependent’ pre- and post-production goods and services. | ||

| Achieving this would require access to data relating to individual firm data, with information not only on what goods and services are bought-in and to whom output is sold but also on which plants and firms supply and purchase these goods and services. Such detailed information is not currently available. The ONS could lead a pilot looking at innovative ways to use existing and future potential data sources to develop finer grained models of activity in support of policy making. |

3.2 Targeting specific stages of the manufacturing value chain

Taking a more targeted approach to supporting value creation

Future industrial policies, informed by updated metrics (see Section 3.1), will need to complement strategic approaches to individual sectors by allowing for a wider variety of types of targeted interventions. This provides an opportunity for developing the current government approach to industrial strategy. New measures, tailored to specific requirements of manufacturing sub-sectors and the technologies upon which successful future business models will be built, should include, for example:

- Facilitating the emergence of challenger businesses. These exploit new business models and cross cutting approaches in technologies, across sub-sectors, to drive ‘disruptive growth’ in manufacturing. For example, support might focus on businesses with strong design capabilities specialising in additive manufacturing technology, which collaborate with others to work across manufacturing sub-sectors.

- Enhancing UK capabilities that cannot easily be relocated abroad. This is particularly important given the increasing ease with which manufacturing activities and the different elements of value chains can now be relocated around the world. Further promotion of R&D clusters and their co-location with production and the science base is 1 possible measure.

- Supporting the creation of new revenue streams from manufacturing services. For example this includes capitalising upon knowledge generated by sensors embedded in products.

- Helping manufacturers to expand their capabilities in remanufacturing and resource efficiency.

- Meeting these requirements will involve a move towards a coordinated systems based rationale for the design and delivery of the UK’s industrial policy.

A systems based approach for the future

Future approaches to policy depend strongly on recognising that manufacturing is part of an extended system, which requires a response from government that cuts across policy departments.

This requires a ‘systems based’ approach that takes full account of the linkage between science, technology, innovation and industrial policies.

The result is the need for more integrated coordination by government across policy domains and government departments, that makes it easier to anticipate the potential unintended consequences of policies, and to identify where intervention would achieve the greatest impact. Such an approach should help to avoid the adoption of selective policies based on narrow objectives that might inadvertently hold back sustainable growth, and which are more a feature of the current approach which devolves policy-making to different government departments with different roles and agendas.

The evidence collected by this project suggests that the greatest future need will be to remedy ‘systems failures’ that affect the rapid emergence and uptake of new, cross-cutting technologies.

The future policy system must ensure that the most valuable new technologies are not missed, and needs to work with researchers, industry experts and policy-makers so that government initiatives collectively support them. In practice, this will mean developing new ways to support emerging technologies, including sophisticated use of roadmapping to identify what is needed to support technological change.

3.3 Enhancing government capability in evaluating and coordinating policy over the long term

It is essential that institutional structures within government respond to changes in the manufacturing sector so that they can deliver the integrated systems approach which is advocated to enable more effective policy delivery and evaluation. This can be helped by promoting a better sharing of understanding and intelligence between the Department for Business Innovation and Skills and the Technology Strategy Board - in effect a shift in balance from sponsorship towards knowledge transfer.

A new institutional architecture can also help. A particular issue here is developing policy with a longer term perspective independent of the instabilities produced by the electoral cycle. Examples of where this has been achieved in other areas of policy include: an independent Bank of England to implement monetary policy, the National Institute for Health and Care Excellence (NICE) to advise the NHS on the take-up of new treatments, and the removal of ministerial discretion with regard to cases investigated by the Competition Commission. However, this has not generally been the case with regard to industrial policy.

In considering future industrial policy towards manufacturing and any related institutional reforms, it is recommended that close attention be paid to developments in other countries. These are consistent with the general arguments advanced in this section. These examples are of the US Advance Manufacturing National Programme Office (AMNPO) (see Box 5), the Australian Productivity Commission (APC), and the UK Independent Commission for Aid Impact (ICAI).

Building on insights from these examples there is a clear need for future government capability in evaluating and coordinating policy over the long term to be strengthened. The UK government should create an ‘Office for Manufacturing’, which would:

- regularly evaluate the effectiveness of industrial policies relevant to manufacturing

- identify relevant international best practice and highlight this to government

- ensure the collation and effective use of the new best practice metrics for manufacturing (see Section 3.1), also drawing in intelligence on manufacturing value chains from the wider public sector including Research Councils and the Technology Strategy Board

- advise on where cross government coordination can be strengthened and simplified

Box 5: Advanced Manufacturing National Programme Office, United States

| Charged with implementing a whole-of-government advanced manufacturing initiative, to facilitate collaboration across federal agencies and to convene private-public partnerships focused on manufacturing innovation. It is hosted by the National Institute of Standards and Technology, and is staffed by representatives from federal agencies with manufacturing-related missions and fellows from manufacturing businesses and universities. It was recommended by the Advanced Manufacturing Partnership Steering Committee and endorsed by the President’s Council of Advisers on Science and Technology. |

“These are incredibly exciting times for manufacturing in the UK. I am delighted to be playing my part in this Foresight project and ensuring that manufacturing continues to be a key growth engine in the nation’s economy for many years to come.” - Nigel Stein, Chief Executive, GKN plc

4. Conclusions

Industrial pipes

Preparing for the future

This Foresight report looks out to 2050 and describes the transformation which will occur in the manufacturing sector and the environment in which it operates.

These changes will present major opportunities for the UK to develop competitive strengths in new and existing areas, but they will also present considerable challenges and threats, not least through increases in global competition. It will be essential for government and industry to work together to forge new policy frameworks and develop measures so that manufacturing is able to fulfil its full potential for contributing to UK economic growth and prosperity, and in rebalancing the economy.

Together, the proposed measures put forward in this report build on the current industrial and sector specific strategies, emphasising that government will need to significantly strengthen its future approach to ensuring a strong and resilient manufacturing sector.

Government needs to act in 3 systemic areas to:

- exploit new forms of intelligence to gain sharper insights into the sector and where value is being created

- take a more targeted approach to supporting manufacturers, based on a system-wide understanding of science, technology, innovation and industrial policies

- adapt and build innovative new institutional capability for the future

Policies and measures also need to be developed to support manufacturing as it becomes:

- faster, more responsive and closer to customers

- exposed to new market opportunities

- more sustainable

- increasingly dependent on highly skilled workers

Further work

The work in preparing this report has revealed issues affecting not only manufacturing but industry in general in the UK. As immediate follow up, it is recommended the government commissions detailed comparative studies into:

- the role of institutional infrastructures and systems in supporting industry

- the need for increasing the availability and quality of long term (or patient) capital

- the role of a national belief in value creation in facilitating industrial success

Next steps

The report and its supporting evidence propose a wide range of specific insights and potential actions for the public and private sectors to explore. These will need to be considered in the round, and the UK will need to adapt if it is to avoid being left behind. Many examples of new support initiatives and policy development have been identified in competitor countries.

Annexes

Laser tool cutting a metal plate

A. References

All references are listed in the PDF summary report.

B. List of evidence papers

The evidence papers detailed below were commissioned by Foresight, Government Office for Science, London in 2013.

| Evidence Paper 1 | Foresight & Arup ‘The Future of Manufacturing International Perspectives Workshop’ |

| Evidence Paper 2 | Broadberry, S. & Leunig, T. ‘The Impact of Government Policies on UK Manufacturing since 1945’ |

| Evidence Paper 3 | Bryson, J.R. Clark, J. and Mulhall, R. ‘The Competitiveness and Evolving Geography of British Manufacturing: Where is manufacturing tied locally and how might this change?’ |

| Evidence Paper 4 | Chang, H. Andreoni, A. & Kuan, M. ‘International Industrial Policy experiences and the Lessons for the UK’ |

| Evidence Paper 5 | Deakin, S. ‘The Legal Framework Governing Business Firms and its Implications for Manufacturing Scale and Performance: The UK Experience in International Perspective’ |

| Evidence Paper 6 | Dickens, P. Kelly, M. & Williams, J. ‘What are the significant trends shaping technology relevant to manufacturing’ |

| Evidence Paper 7 | Driffield, N. ‘How attractive is the UK for future foreign direct investment?’ |

| Evidence Paper 8 | Driver, C. & Temple, P. ‘Capital investment: what are the main long term trends in relation to UK manufacturing businesses, and how do these compare internationally?’ |

| Evidence Paper 9 | Fothergill, S. & Gore, T. ‘The Implications for employment of the shift to high value manufacturing’ |

| Evidence Paper 10 | Grant, P. & Mason, T. ‘What impact will the development and, potentially, the commercialisation of new and advanced materials have on the future of manufacturing activities in the UK?’ |

| Evidence Paper 11 | Green, R. & Zhang, X. ‘What will be the future role of energy (including supply, distribution and security) in manufacturing activities?’ |

| Evidence Paper 12 | Hall, B. ‘What role will the protection of intellectual property play in the future?’ |

| Evidence Paper 13 | Hancke, B. & Coulter, S. ‘The German Manufacturing sector Unpacked: policies and future trajectories’ |

| Evidence Paper 14 | Hay, G., Beaven, R., Robins, I., Stevens, J. & Sobina, K. ‘What are the recent macro-economic trends and what do they tell us about the future?’ |

| Evidence Paper 15 | Homkes, R. ‘What role will leadership play in the future performance of manufacturing businesses?’ |

| Evidence Paper 16 | Hughes, A. ‘International Short-Termism, Impatient Capital and Finance for Manufacturing Innovation in the UK’ |

| Evidence Paper 17 | Kneller, R. ‘What are the constraints on potential UK exporters?’ |

| Evidence Paper 18 | Li, C. & Bascavusoglu-Moreau, E. ‘Knowledge spillovers in manufacturing firms and future sources of knowledge for innovation’ |

| Evidence Paper 19 | Livesey, F. ‘What is the public image of manufacturing and how might this change?’ |

| Evidence Paper 20 | Luger, M., Gil, N. & Winch, G. ‘What areas of infrastructure are important for the UK’s future competitiveness in manufacturing activities?’ |

| Evidence Paper 21 | McLaughlin, P. ‘What kind of system will encourage best practice principles in UK manufacturing activities?’ |

| Evidence Paper 22 | McNair, S., Flynn, M., Myerson, J., Gheerawo, R., Ramster, G. & Hamlyn, H. ‘What are the supply (workforce) and demand (product) implications of an ageing society?’ |

| Evidence Paper 23 | Moffat, J. ‘What are the recent micro-economic trends and what do they tell us about the future?’ |

| Evidence Paper 24 | Morton, B., Paget, G. & Mena, C. ‘What role does Government procurement play in manufacturing in the UK and internationally, and how this might change in the future?’ |

| Evidence Paper 25 | Peng, M. & Meyer, K. ‘Where are the future markets for manufacturing output?’ |

| Evidence Paper 26 | O’Sullivan, E. & Mitchell, N. ‘What are the key international approaches to understanding the future of manufacturing?’ |

| Evidence Paper 27 | Parker, D., Arendoft, A., Chapman, A. & Thompson, P. ‘What impact will the availability of materials and resources in the future have on the future manufacturing outlook in the UK?’ |

| Evidence Paper 28 | Pike, A., Dawley, S. & Tomaney, J. ‘How does manufacturing contribute to UK resilience?’ |

| Evidence Paper 29 | Ridgway, K., Clegg, C. & Williams, D. ‘What are the main trends shaping the factory of the future?’ |

| Evidence Paper 30 | Rowthorn, R. & Coutts, K. ‘Update of Prospects for the UK Balance of Payments’ |

| Evidence Paper 31 | Rowthorn, R. & Coutts, K. ‘De-industrialisation and the Balance of Payments in Advanced Economies’ |

| Evidence Paper 32 | Rowthorn, R. & Coutts, K. ‘Re-industrialisation: A Commentary’ |

| Evidence Paper 33 | Spring, M. ‘Which business models might ensure UK value from emerging sectors?’ |

| Evidence Paper 34 | Stehrer, R. ‘What will be the future role of BRIC countries in providing global manufacturing output?’ |

| Evidence Paper 35 | Tennant, M. ‘What are the business opportunities presented by the drive for sustainability?’ |

| Evidence Paper 36 | Wilson, R. & Hogarth, T. ‘What type of future manufacturing workforce will the UK need?’ |

| Evidence Paper 37 | Crafts, N. & Hughes, A. ‘Industrial policy for the medium-long term’ |

All of these evidence papers and the project report are available on www.bis.gov.uk/foresight

C. Industry High Level Stakeholder Group members

- The Rt. Hon. Vince Cable MP (Chair) Secretary of State, Department for Business Innovation and Skills

- Dr Will Barton Head of Manufacturing, Technology Strategy Board

- Prof. Sir John Beddington Former Government Chief Scientific Adviser, Government Office for Science

- Jeremy Bentham Vice President, Global Business Environment, Royal Dutch Shell

- Dr Tim Bradshaw Head of Industrial Policy, Enterprise and Innovation, CBI

- Dr Claire Craig Deputy Head, Government Office for Science

- Roger Connor President, Global Manufacturing and Supply, GlaxoSmithKline plc

- Caleb Deeks Head of the Growth and Productivity Team, HM Treasury

- Professor David Delpy Chief Executive, Engineering and Physical Sciences Research Council

- Ron Dennis Executive Chairman, McLaren Group Ltd

- Warren East Former Chief Executive Officer, ARM Holdings plc

- Mark Elborne President and CEO, General Electric Company UK & Ireland

- Ronnie Fisher Director, Specialties General Manager, Pentagon Chemical Specialties

- Mark Florman Chief Executive Officer, British Private Equity & Venture Capital Association

- Philip Greenish Chief Executive, The Royal Academy of Engineering

- Dr Siavash Mahdavi Chief Executive, Within Technologies Ltd

- Juergen Maier Managing Director, UK Industry Sector, Siemens plc

- John Martin Senior Vice President, Manufacturing & Supply Chain, Nissan Motor Company

- Richard Martin Chief Engineer for UK and Ireland, Nestlé UK Ltd

- Geoff Mulgan Chief Executive, Nesta

- Janice Munday Director of Advanced Manufacturing Services, Department for Business, Innovation and Skills

- Frances O’Grady General Secretary, Trade Union Congress

- Sir Dick Olver Chairman, BAE Systems plc

- Stephen Pattison Vice President, Public Affairs, ARM Holdings plc

- Professor John Perkins Chief Scientific Adviser, Department for Business, Innovation and Skills

- Jeremy Pocklington Director, Enterprise and Growth, HM Treasury

- Angus Robertson Chief Executive Officer, powerPerfector Ltd

- Rachel Sandby-Thomas Director General, Business & Skills Group, Department for Business, Innovation and Skills

- Ian Scott Group Supply Director, Mulberry Group plc

- Terry Scuoler Chief Executive Officer, EEF

- Nigel Stein Chief Executive Officer, GKN plc

- Lucy Thornycroft Head of Construction and Manufacturing, CBI

- Sir Mark Walport Government Chief Scientific Adviser, Government Office for Science

- Nigel Whitehead Group Manufacturing Director, Programmes and Support, BAE Systems plc

D. Lead Expert Group members

- Sir Richard Lapthorne CBE [Chair] Chairman of Cable & Wireless Communications Plc

- Professor Nicholas Crafts Professor of Economic History and Director of the ESRC Research Centre on Competitive Advantage in the Global Economy at the University of Warwick

- Professor Steve Evans Director of Research in Industrial Sustainability, Institute for Manufacturing, University of Cambridge

- Professor Anne Green Professorial Fellow, Institute for Employment Research, University of Warwick

- Professor Richard Harris Professor of Economics and Head of Economics, Finance and Accounting, Durham University Business School

- Professor Alan Hughes Director of the UK Innovation Research Centre and Margaret Thatcher Professor of Enterprise Studies (Emeritus) at the Judge Business School, University of Cambridge

- Professor Chris Lowe OBE Director of the Institute of Biotechnology, University of Cambridge

- Dr Hamid Mughal Director of Global Manufacturing, Rolls Royce Plc

- Professor Sir Michael Sterling Chairman of the Science and Technology Facilities Council