Freeport Programme in Wales clarification Q and A

Updated 28 October 2022

Applies to Wales

The bidding prospectus for the Freeport Programme in Wales sets out how ports can apply for Freeport status and further details on our proposals for the policy. With the publication of the bidding prospectus, the Welsh and UK governments launched the bidding process to select a Freeport location in Wales.

In the bidding prospectus we invited stakeholders to submit via email any questions they had about the Freeport policy and bidding process. This document aims to cover the key questions and themes that we received. Any potential applicants will be able to contact Freeports@gov.wales to request clarification on any of the content of the bidding prospectus until 13 October 2022. A summary of answers will be published online no later than 27 October 2022.

The successful location will subsequently be announced in early spring 2023 following a fair, open and transparent selection process.

The bidding period will close on 24 November 2022. We look forward to receiving bids from interested parties via the online portal by 6pm on Thursday 24 November 2022.

Q - In the English/Scottish Freeport prospectus there is a requirement around ‘simplified Planning zones’ and reference to Local Development Orders. Are you able to clarify/ confirm whether an LDO is a conditional requirement in the Welsh Freeport prospectus?

A - As stated in section 3.8.2 of the prospectus, it says that: ‘in addition to the national planning context, local authorities should consider the application of local placed based tools such as Simplified Planning Zones (SPZ) or Local Development Orders (LDO). Both Simplified Planning Zones and Local Development Orders can provide greater certainty to business by removing the need to apply for planning permission for developments covered by the order.’

Whilst there is no conditional requirement to include a SPZ or LDO as part of the application, we do encourage planning authorities to create a facilitative planning environment. It will be the applicant coalition’s responsibility to undertake their own analysis and legal advice to confirm if any LDO compiled as part of the bid may conflict with SPA/SAC site designation.

Clarifications 1 to 4 provided as part of the stakeholder event

1. How much flexibility is there for a Freeport to extend beyond the 45km boundary?

The Freeport model offers some flexibility, which applicants should consider best how to apply to their specific sites and geographies.

The Freeport outer boundaries should be no larger than a 45km circle, with no Freeport sites more than 45km apart.

We anticipate that all customs sites and tax sites associated with the Freeport will be contained within the Outer Boundary.

However, both governments will consider bids proposing customs sites and tax sites outside the Outer Boundary, where this can be supported by a clear economic rationale. This should include a compelling case being made for their relevance to the area within the Outer Boundary and a significant relationship between the activity in the proposed customs or tax sites outside the Outer Boundary, and the area within the Outer Boundary.

Bids judged to be designed simply to maximise the area contained within the Outer Boundary without clear economic rationale will fail the bidding process at the pass/fail stage. This flexibility also applied to the bidding process for Freeports in England. An example of which is Humber Freeport which has one site outside of the 45km boundary. In the case of Humber Freeport, a clear economic rationale was provided in support of this flexibility in the 45km boundary.

2. Can you outline the role of local authorities within the bid process?

We expect the relevant local authorities to:

- be part of the Freeport application coalition. Coalitions should include ports, local businesses, international businesses, academic institutions, and local authorities; and

- have discussed the fit with relevant development plans and policies (and the potential use of place-based planning approaches referred to above) as part of compiling the application.

Such cooperation will help to ensure development proposals progress smoothly through the planning system. Applications should demonstrate local authority support for commercial property development within tax and customs sites, to support their growth. Proposed development will be subject to local planning approvals where necessary.

Where there is more than one local authority on the governing body, a lead local authority will need to be identified.

When released, the seed funding will be issued to the lead local authority within the Freeport governance body.

The local authority will be accountable to the Welsh Government for the expenditure and management of Freeport seed capital funding.

Further information is included in the prospectus.

3. How can the Freeport demonstrate its commitment to ‘Fair Work’?

The Welsh Government believes a better deal for workers is essential to a fairer and more equal Wales. It is vital to the Welsh Government that our public policy interventions contribute to Fair Work and to our social partnership way of working. That is why the prospectus highlights the importance placed upon these principles. This includes the engagement of trade unions in a Workers Consultative Forum, which will form part of the local governance of a Welsh Freeport.

The appointed bidder should also engage with the Welsh Government to develop an Economic Contract in line with current Welsh Government policy. Applicants can, and should, act as examples to others and show how their business practices promote the principles of Fair Work and sustainability.

Applicants can also show how they comply with good practice in procuring goods and services in Wales, such as the ethical employment supply chains code of practice.

4. What happens if WG and UKG disagree on the best bid for a Freeport?

The Freeport Programme in Wales illustrates the benefits of collaboration on areas of mutual interest and both governments are committed to working together to jointly agreeing on the successful bid.

As with English and Scottish Freeports, a fair and open competitive process will determine where the policy should be implemented in Wales. Both governments will co-design the process for selection. Officials from both governments will jointly assess bids and both governments will have an equal say in all implementation decisions, including the final decision on the successful site(s).

Questions 5 to 7 relate to clarification and guidance regarding the role of transport and logistics providers

5. Is a wide range of companies, both large and SMEs, considered an integral part of any bid, even if individual companies are not necessarily members of the bidding consortium?

As stated in the prospectus both governments want Freeport applicants to form strong coalitions which will develop ambitious and deliverable proposals. These coalitions must include: a port (sea, air, or rail) and the local authority/authorities in which the Freeport is located.

Coalitions will also expected to include: local businesses; international businesses; academic institutions; Regional Economic Partnerships and local authorities. Whilst these organisations are not required to be part of a bidding coalition, bidding coalitions may wish to invite wider partners to demonstrate their support for a bid. This will support proposals to demonstrate how they will generate additional investment.

Once the site has then been selected, as a minimum, any Freeport governance body must include the port(s) involved - to ensure economic focus on port regions - and the local authority where the Freeport is located - to receive and be accountable for any regeneration funding and deliver key measures.

The Welsh and UK Governments therefore encourage applicants’ proposals to include representation from the following five groups of stakeholders if and where possible:

- any landowners who own land on which tax and customs sites are designated

- any operators of customs sites

- firms who do or will operate within customs and tax sites

- investors who do or will operate within customs and tax sites

- public sector bodies who do or will operate within customs and tax sites

6. Are there beneficial provisions for these companies within a Freeport area – e.g. through the taxation regime and/or the availability of grants?

Section 3 of the Prospectus details the specific design of a Freeport, including geography and economic levers offered to applicants as they would apply in Wales.

The Freeport offer for businesses in Wales is consistent with the model the UK Government has used for Freeports in England and that is used by the UK Government and Scottish Government for Green Freeports in Scotland.

7. Will there be funding available for the enhancements to the road and rail networks necessary to handle the increased levels of traffic resulting from the newly generated economic activity?

Bidders are encouraged to refer to section 2.1.14 - 2.1.16 when considering transport investment, to ensure alignment with Welsh Government transport policies.

As outlined in the prospectus, the successful applicant will have the opportunity to access seed capital funding of up to £25 million.

The amount of seed funding accessed will depend on the submission of an outline business case (OBC) and full business case (FBC), the quality of those business cases and the proposals strategic fit with the policy. Business cases will be approved by the Freeport Programme board with joint representation from the Welsh Government and the UK Government.

We expect that any funding provided will be matched or part-matched by private sector investment, local authority borrowing and co-funding from other public bodies where relevant. When released, the funding will be issued to the lead local authority within the Freeport governance body.

Each Freeport site has unique characteristics and needs. It is for the applicant coalition to clearly set out capital investments required on the site and to agree this with UKG and WG as part of the site designation process. We expect proposals to be focused primarily on land assembly, site remediation, and internal small-scale transport infrastructure to connect sites within the Freeport to each other, the immediate surroundings, or other economic assets within the Outer Boundary. These should embed transport strategies, sustainable transport and investment hierarchies. Proposals for spending seed capital on skills, digital and/or other infrastructure will only be considered in exceptional circumstances. Seed capital may not be spent on security infrastructure for customs sites.

Questions 8 to 11 relate to questions submitted on Investment Zones guidance

8. Number of Investment Zones – How many do you envisage in Wales and what will be the geographic spread?

9. How will The Well Being of Future Generations Act and the National Welsh Plan be incorporated into the decision-making around liberalising planning for Welsh Investment Zones?

10. Decision-making in Wales for Investment Zones – will this be a joint WG/DLUHC process on a 50/50 split as with Freeport? If a decision is split who will have the final say?

The UK Government announced on 23 September 2022 its intention to launch Investment Zones. Whilst we expect this offer to be UK-wide, how Investment Zones can operate in Scotland, Wales and Northern Ireland is subject to work with devolved governments.

In England, Investment Zones will benefit from tax incentives and planning liberalisation to speed up development and wider support for the local economy.

The UK and Welsh Governments are in preliminary discussions to understand the Investment Zone proposals, offer and potential implications for Wales in more detail. Any initiative that comes forward for Wales would need to align with our policies on fair work and the environment and generate additional investment.

11. Concern around economic displacement arising from the proximity of Investment Zones in nearby authorities in England e.g. Gloucestershire and West of England Combined Authority. We are concerned there is not sufficient time to properly consider this emerging relationship and the impact to the satisfaction required by the freeport application process. Has there been any consideration to extend the Freeport submission window to allow better choreographing between what applications to model and mitigate any negative economic effects and make adjustments?

There is currently no plan to extend the application deadline for the Freeport Programme in Wales.

The Freeport bidding period for Wales closes on 24 November 2022 at 6pm and we look forward to receiving bids from interested parties via the online portal.

Prospective bidders are required to explain how their choice of tax site locations will generate additional growth and minimise displacement of economic activity.

While the UK Government intends to announce full details of the English Investment Zone tax package in due course, given the timescales Freeport bids in Wales will not take account of potential Investment Zone impacts at this stage.

12. Recent Welsh Freeport briefing and DLUHC indicate conversations are progressing with Welsh Govt, can you provide an update?

The Freeport Programme in Wales illustrates the benefits of collaboration on areas of mutual interest and both governments are committed to working together to jointly agreeing on the successful bid.

13. Can you have more than three tax sites if you can make an economic case for it? If the primary custom site is a tax site, can you have three additional tax sites?

Freeport bids must include at least one port but can include multiple ports.

The ports do not need to be designated as tax or customs sites.

Bids must include at least one customs site, but there is no upper limit.

Bidders should aim for a single contiguous tax site of up to 600 hectares to benefit from the tax offer. However, they may define up to three single, contiguous areas between 20 and 200 hectares.

Where a custom site is also a tax site, this tax site will be included within the total of three tax sites and therefore only two further tax sites would be allowed.

14. Paragraph 3.1.19 (c) ‘We will consider submissions that make an economic case for an individual site that falls outside the 20-200 hectares guideline’. What are the components that would be required to justify a site larger than 200ha?

The bidding prospectus makes it clear that bidders should aim for a single tax site to benefit from the tax offer. However, where there is a clear economic rationale to do so, the Freeport bidder may define up to three single, individual areas as the location of the tax sites.

We will consider submissions that make an economic case for an individual site that falls outside the 20-200 hectares guideline.

We do not expect any specific methodology but would expect a case to be made in terms of delivering the objectives of the policy and in-line with the requirements of tax sites set out in the prospectus.

The total area of the individual sites within the Freeport must not exceed 600 hectares. Bids that do exceed 600 hectares will automatically fail the Freeports bidding process at the pass/fail stage.

15. Can you have part of a custom and tax site where the tax element is larger than the custom site (i.e. only part of the tax site is a custom site)?

A tax site can encompass all, or part, of the primary customs site and/or any additional customs subzones. Tax reliefs will apply to the entire tax site, including any part that is also part of the customs site.

The Freeports customs offer, which includes simplifications and duty suspension benefits, will only apply in the designated and HMRC-approved Freeport customs sites.

Freeport tax sites will therefore not automatically receive any relief from customs duties unless they are also designated and approved as a customs site.

Tax sites and customs sites are permitted to overlap wholly or in part. In such circumstances, any part of the tax site that is also within the customs site will be eligible for duty deferral, inversion and exemption, as well as the other tax reliefs applicable in the tax site. Any part of the tax site that is not also within the customs site will not be eligible for duty deferral, inversion and exemption; only for the other tax reliefs applicable in Freeport tax sites.

If a bidder would like customs benefits to apply in all or part of a tax site, that area will need to be secured and authorised as a customs site as well.

16. Paragraph 3.1.19 (e) states that Tax sites can be one single site containing multiple parcels of land split by a road, protected area or geographic feature (such as a river) so long as the parcels within the land can reasonably be considered one single site because geographic and economic interconnection between the sites can be demonstrated (e.g. travel between them is plausible)

a. If two sites are adjoined but the access points mean that some short travel on the road would be needed is that a reasonable interconnection?

b. Does a tunnel connecting the port with a parcel of land that is c 1.5km a part count as a reasonable economic interconnection?

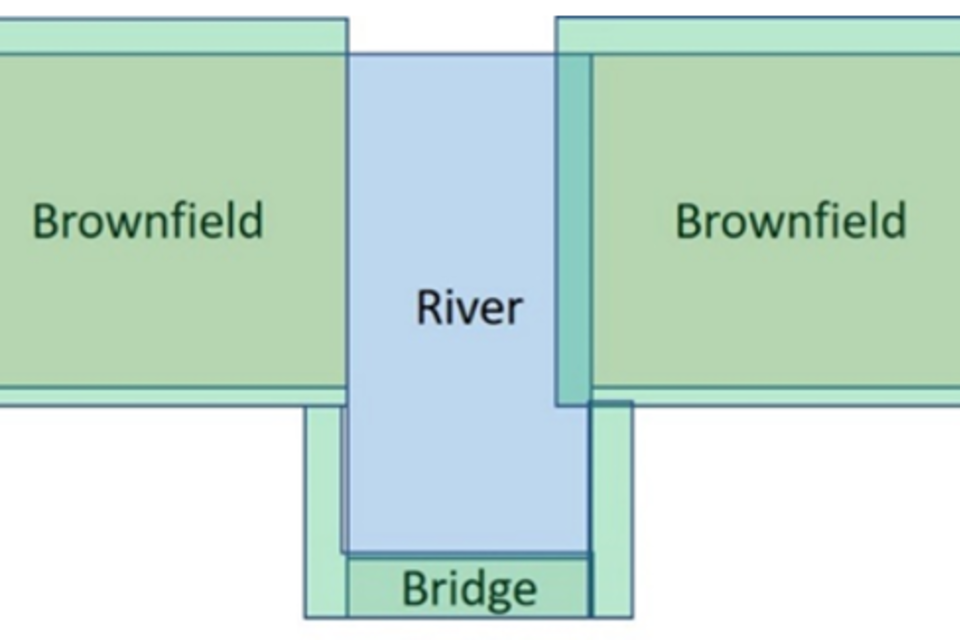

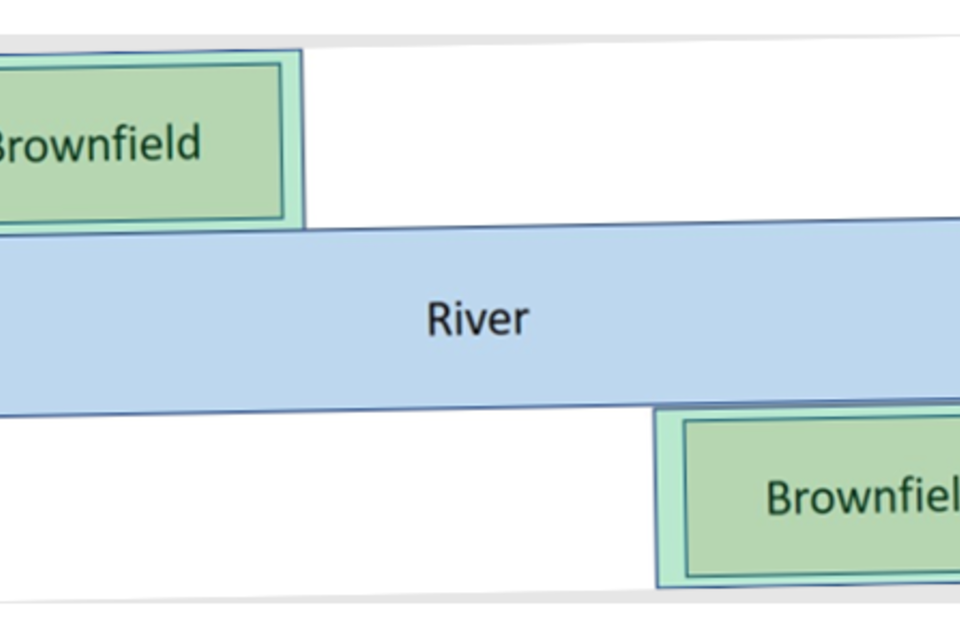

We are open to one single site containing multiple parcels of land split by a road, protected area or geographic feature (such as a river) so long as the parcels within the land can reasonably be considered one single site because geographic and economic interconnection between the sites can be demonstrated (e.g. travel between them is plausible).

To demonstrate reasonable economic connection, we would expect that travel between the sites takes place with reasonable frequency - for example, by road, bridge or ferry. A clear economic interconnection must be demonstrated between multiple plots claimed to be one single site. For example, two sites either side of a river with no direct economic linkage or travel between them should be considered as two separate sites. We cannot on the information provided confirm whether or not a tunnel connecting a port with a parcel of land would amount to a reasonable economic interconnection and it is for bidders to demonstrate such reasonable economic interconnection.

Bidders should ensure that the rationale and associated maps submitted with the Freeport bid provides a robust case to support statements relating to economic interconnection

17. Tax sites should be undeveloped and minimum 20 ha. If there are small areas of sites that have buildings in – should these be included or excluded from the site area?

Bidders can produce single, individual shapes which cut out or skirt round land which is not appropriate to be in a tax site to maximise coverage of appropriate underdeveloped land. We do not expect to see residential property or highly developed industrial land containing significant existing business activity covered by “underdeveloped” tax sites.

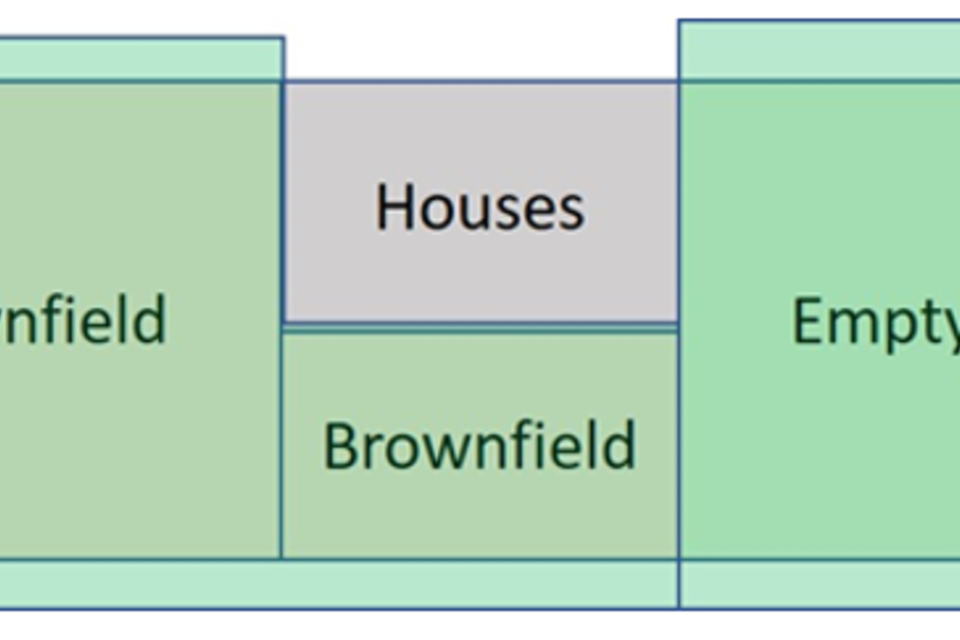

Tax site examples:

The following represent hypothetical examples of tax site proposals which may be accepted through the process. There may be other examples not captured below that could still be successful.

A single contiguous boundary shape which cuts out inappropriate land

One single site containing multiple parcels of land split by a road

One “single” site of two sites from the same industry with a transport connection, split by a river

Two single sites without interconnection, split by a river

18. In the case of a site that is a custom site and a tax site – how should buildings that are part of the customs be treated (in the context of the underdeveloped land and 20 ha min requirement)?

Customs site related buildings are counted towards the concept of development. However, if a Freeport bidder has a coherent proposal and can demonstrate that the site is underdeveloped even with the customs buildings on it, then it would not automatically exclude the site (i.e., if it’s a big empty space with a customs shed on it, that would not necessarily be too developed to be a tax site).

Freeport bidders may still choose to exclude buildings and opt to construct a customs building(s) within a tax site.

19. The bid prospectus suggests that tax sites must be for areas of under-developed land (or areas with buildings that are scheduled for relatively proximate obsolescence), but customs sites are likely to be run by port operators in ports. Can you clarify that these are guidelines and it is not intended that the substantial economic benefits of having customs and tax benefits operating together would be lost by separating out these sites?

Tax sites must be underdeveloped (as defined at paragraph 3.1.25 of the prospectus), and customs sites may be run by ports (but it is not a requirement of a customs site). This combination of requirements does not prevent tax and customs sites from being co-located, provided both are met.

20. Related to Q1.4 in the application (Please include any information that might assist the two governments to estimate the tax relief requirement of your bid). What information is expected/ anticipated?

For baselining purposes supporting information could include:

- list of properties, rateable values, and liability currently in tax relief area

- current ratepayers of each property

- forecast of additional properties planned within the area

For forecasting purposes, we ask bidders to supply information to help quantify the expected amount of activity giving rise to the qualifying tax relief.

21. Related to Q1.7 – can sites be included where landowners haven’t signed up and subject to CPO – if so, what evidence should be provided?

Where landowners haven’t signed up to the tax site or the local authority is proposing a CPO, additional assurances will be required from both governments after bidding stage but prior to that tax site being approved/designated.

This will be dealt with on a case-by-case basis but is likely to include:

- Full legal and technical advice on the CPO proposition

- A strategy setting out how you aim to secure the land using CPO where necessary and mitigations if it’s not achieved. This should include, but is not limited to:

- Commitment from LAs in devoting appropriate resources to the process that will enable officials to proceed at pace

- Evidence to provide assurance a decision for a resolution for a CPO will be taken in line with agreed milestones

- Evidence to demonstrate a clear understanding of the CPO process, including key personnel, timeframes and critical milestones

- Evidence to demonstrate a clear plan is in place should the CPO be unsuccessful (i.e. use of planning tools/ powers)

- Status of all documents required to commence the CPO process and where feasible, these documents shared in draft or final form

- Evidence to demonstrate that LA members have been engaged in the matter and support the overall Freeport proposition and proposed tax site vision

- A clear and credible delivery plan for the tax site, taking into account possible timescales of securing the land using a CPO. Please also set out the current planning permission status of the land and your plan if not already achieved, for achieving full planning permission.

Questions 22 and 23 relate to questions submitted on mitigation and displacement

22. Related to Q1.14 – what does mitigate mean in this context? Is the question about avoiding impacts or mitigating them if they do happen?

23. Related to Q3.10 – what other externalities (other than economic displacement) should be considered?

Where displacement may or will occur, bidders should present pragmatic proposals for how they will minimise the impacts. Whether that is avoiding impacts that prevent displacement or mitigating them where they do arise and mitigate its impacts where it occurs.

The most appropriate approach to doing so will be unique to the specific site context for each bid and bidders are best placed to determine how to make their case by considering factors such as the scale and likelihood of the anticipated displacement.

Bidders are therefore required to explain how their choice of tax site locations minimise displacement of economic activity from nearby deprived areas the assessment of which forms part of Criterion D (Deliverability of proposal effectively at pace).

The strongest proposals will demonstrate a pragmatic approach to maximising additionality, for example by having a strong strategy for and clear focus on attracting new investment, landowner commitments around avoiding displacement, and/or using a share of the retained rates to mitigate displacement effects where they occur.

The negative externalities, beyond displacement, that bidders should consider will depend on the specific character(s) of their sites and development plans; however, these might include - for example - environmental impacts or impacts on local transport infrastructure.

24. Related to Q3.11 – (Please explain how your proposals will: Deliver decarbonisation and environmental protection, ensure compliance with all applicable environmental regulations and standards; and if applicable, what further environmental standards will you stipulate and how will these be met). What standards are they envisaging?

In line with the prospectus; as a minimum

Freeport applications must outline how their proposals will comply with all applicable environmental regulations and standards, such as air and water quality, Sustainable Drainage Systems (SuDS), waste management, chemical treatment and handling; and any additional assessment of impacts on protected sites and species including mitigation.

Applicants must present an outline decarbonisation plan for the Freeport including how Freeport status will unlock decarbonisation opportunities for existing businesses and contribute to meeting net zero carbon emissions by 2050, including how they can facilitate decarbonisation of a Freeport following designation.

25. Where the note at the end of ‘4. Criterion E’ of Section 5 ‘Application’ reads ‘Applicants to note that question 3.9 is worth 40% of Criterion E’ – should this read Question 3.8?

Yes, this is an error and should read:

- Applicants to note 4.3 will be assessed using the supporting information provided at question 3.8.

This has now been corrected in the prospectus.

26. What is the ambition level of HMG with regard to customs and trade facilitations in the Freeport?

Successful bidders will need to work with HMT and HMRC to review and confirm the boundaries of their proposed tax sites, prior to approval and commencement of tax measures.

There are not currently any plans to allow the location of tax and customs sites to change once approved.

The Freeport can include multiple ports, multiple customs sites, and up to three tax sites of limited size, as part of a single Freeport bid.

Freeport customs sites can be located within existing port boundaries but must be a separately fenced area and cannot overlap with the port Temporary Storage-approved area.

Successful candidates will need the necessary authorisations from the Welsh Government and UK Government before they are permitted to operate.

The operator of a Freeport customs site is responsible for the control of movement of goods and the access of people in and out of the customs site. This will include ensuring that goods are only able to leave the Freeport customs site when permitted by HM Government.

Bidders should look to clearly demonstrate that the operators of the proposed sites have the capability to put in place measures to ensure they can carry out that responsibility.

Please use the following link which provides guidance on operating a Freeport Customs Site.

27. Can we meet with UKG and WG to discuss our proposals?

Bidders were invited to two joint Welsh and UK Government stakeholder events on 1 July and 5 October 2022, where there were opportunities to raise questions in an open forum. Until 13 October bidders were also invited to raise specific clarifications via the Freeports central inbox.

To ensure that potential bidders have equal access to information and consistent guidance, we are not offering meetings to discuss individual proposals.

28. Can regional partners who are engaged with Welsh Government officials and ministers, such as Enterprise Zones or City and Growth Deals support a bid?

There is nothing to prevent regional partners such as City and Growth Deal and Enterprise Zones Board Chairs or members being part of the wider stakeholder engagement in developing any Freeport proposal and providing evidence of their support.

City and Growth Deal and Enterprise Zone Board Chairs or members must not seek to advise or seek advice from officials or ministers on any particular Freeport bid in any contact they may have to avoid any actual or perceived bias conflicts of interest and to ensure equal treatment of bidders.

29. Do SIC codes form part of the 500 word limit for question 4.1?

Information on SIC codes will not count towards the word limit on question 4.1. You will be able to submit additional words in this response and they are not a separate entry.

30. Can you confirm whether the proposal can be submitted by any local authority or whether it has to be via our proposed accountable body?

Any of the local authorities included in the bid can submit the application, it does not have to be done by the accountable body.

31. Can we include Welsh Government owned assets, such as land, in our bid?

The Welsh Government agrees in principle the inclusion of land in its ownership in bid proposals. This also applies to Welsh Government owned or controlled entities. This is, however, entirely without prejudice to Welsh ministers’ rights as landowner/ owner to determine if, or how, any such land / assets contained within a successful bid will be used.