FCDO Services Annual Report and Accounts 2021 to 2022

Published 7 July 2022

-

Presented to Parliament pursuant to section 4(6) of the Government Trading Funds Act 1973 as amended by the Government Trading Act 1990

-

Laid in Parliament on 7 July 2022

-

Ordered by the House of Commons to be printed 7 July 2022

-

ISBN: 978-1-5286-3553-0

-

Crown copyright 2022. This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3. Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at www.gov.uk/government-publications

-

Any enquiries regarding this publication should be sent to us at FCDO Services, Hanslope Park, Milton Keynes, England, MK19 7BH FCDOServices.Comms@fcdo.gov.uk

Overview

The Overview section contains forewords by the Minister responsible for FCDO Services, the Chair of the FCDO Services Board and the Chief Executive Officer (and Accounting Officer). It also contains summary information about the organisation and a performance overview.

Foreword by Lord (Tariq) Ahmad of Wimbledon

For everybody working in the field of foreign affairs and development, the last twelve months have been intense, with many challenges across the world. I want to thank all staff across FCDO Services for their hard work supporting the objectives of the Foreign, Commonwealth and Development Office. The Foreign Secretary is grateful for the way the organisation has delivered its vital services which help protect and secure the diplomatic community at Post.

One thing FCDO Services always does well is plan for all eventualities. The organisation’s approach to the continuing impact of the pandemic saw the team step up and help the FCDO serve the public and deliver the objectives of the UK Government in the face of significant challenge. The pandemic ignored geographical boundaries and the impact was felt deeply in organisations like FCDO Services, which rely on being able to move supplies and staff quickly across borders.

The support in distributing the coronavirus vaccines to all parts of the diplomatic network has been a significant achievement for FCDO Services and I know FCDO staff, and our colleagues across government at Post, are very grateful to the teams who made this possible. This operation involved many parts of the FCDO Services family, and the expert knowledge of each of the team was called upon to make the deliveries possible.

The crisis in Afghanistan during the summer has been at the forefront of my mind, as someone who was deeply humbled in directly helping people get out of Afghanistan. As Minister of State for South Asia, I thank the FCDO Services team, who like so many across the FCDO, again showed its mettle in dealing with a situation which was almost unprecedented, even in the wider experience of the FCDO.

The support the organisation provided to the COP26 conference in Glasgow, and June’s G7 conference in Carbis Bay, Cornwall, ensured the world’s leaders were able to meet and discuss the important work of our governments securely and in confidence. The translation services were also vital to the success of the summits, and highlight the breadth of experience and support FCDO Services provides to its government partners.

The organisation has developed its structure to further enhance the services it provides, and I look forward to hearing more about the work it is doing for the FCDO and its partners. I wish all the team at FCDO Services success in the coming year.

Lord (Tariq) Ahmad of Wimbledon

Minister of State, FCDO

Foreword by Sir Simon Gass

In the last twelve months, FCDO Services has faced – and overcome – a range of challenges. The lingering effects of the COVID-19 pandemic made it more difficult to complete our overseas business, a tightening jobs market meant we had to work harder to attract the best talent, and increasing pressure on budgets in the public sector, combined with inflationary pressures towards the end of the year, caused our already slim margins to shrink further.

But the organisation has come through with a performance that is not only financially strong, but has also delivered the sort of public service that makes me proud to chair FCDO Services and which says more about the DNA of the organisation than any balance sheet. If difficult jobs need doing to support our country’s overseas and security footprint, our people are ready to go - without stopping to worry about the small print in a contract or calculating whether we could make more profit because the customer is desperate for the service.

Whether it’s dismantling sensitive equipment in Kabul as the Taleban close in on the city, working through weekends to deliver COVID-19 vaccines to British missions around the globe or building secure radar facilities on Benbecula, we will be there. If the overseas estate needs maintaining in difficult and even dangerous environments, if an international conference like COP26 needs protection from eavesdropping or if translation services are needed quickly and securely, we will also be there.

So I would like to thank all FCDO Services staff in the UK and across the globe for their contribution and commitment, not so much to ensuring the success of the business – though they do that – but more for the pride they take in supporting our country: people are far and away our best asset.

To help us cope with the pressures, this year FCDO Services worked on transforming its operating model. This was the culmination of 18 months of work to support our customers by removing duplication of work and enabling faster ways to create new products and services. The FCDO Services Board was involved in the process throughout, with the Steering Board ably chaired by Non-Executive Director Ann Tourle. We look forward to seeing the programme come to fruition when it goes live on the 1 April 2022.

With the increasing challenges facing staff, nearly two years of living with COVID-19 and significant organisational changes, we were not surprised that we saw a small drop in positive scores in our annual staff survey after successive years of gains. We will continue to invest in our staff and in their skills. The Board are strongly committed to building and maintaining a diverse and inclusive workforce that is representative of the diversity of the United Kingdom.

Finally, we were delighted to welcome a new Chief Executive Officer to lead the organisation. Mike Astell joined us in September taking over from Danny Payne and has got off to a flying start. I would like to thank them both for their efforts this past year in steering the organisation towards success. We also said farewell to Chief Operating Officer Claire Shepherd and Non-Executive Director Joy Hutcheon. We wish them all the best for the future and thank them for their service.

Sir Simon Gass, KCMG CVO

Chair, FCDO Services Board

Foreword by Mike Astell

FCDO Services, and the FCDO, remain in a period of stretch and high demand, while continuing to deliver the objectives of the Government. We plan our work closely with our partners, to ensure we are supporting them in the work which must take priority. The challenges the world faces continue to move at pace and, as an organisation, we need to be in a position to adapt quickly to these demands. I am grateful to staff at FCDO Services who have demonstrated their agility and commitment to deliver while the organisation navigates these challenges.

FCDO Services, and the FCDO, remain in a period of stretch and high demand, while continuing to deliver the objectives of the Government. We plan our work closely with our partners, to ensure we are supporting them in the work which must take priority. The challenges the world faces continue to move at pace and, as an organisation, we need to be in a position to adapt quickly to these demands. I am grateful to staff at FCDO Services who have demonstrated their agility and commitment to deliver while the organisation navigates these challenges.

The last year in particular has demonstrated the remarkable ability of FCDO Services’ staff to continue to deliver a vital service in the face of challenging circumstances. 2021/22 was when we began to live with COVID-19 and, though the world is still in the grip of the pandemic, we have learned how to balance the need to keep staff safe while ensuring we deliver for our customers. We ended the year by removing the crisis structure in place for COVID-19, though the conflict in Ukraine required an equally careful response.

FCDO Services continued to monitor the pandemic throughout the year and through each new variant. We continued to implement the strategy established in 2020 to Grow, Save, Innovate - adjusting our business model to reflect the new operating environment. We continued with our Business Continuity plan under Gold, Silver and Bronze leadership until March 2022 in response to the pandemic. I would like to give my heartfelt thanks to all those who have worked tirelessly for nearly two years to navigate the organisation through this period of unprecedented change.

In February, we saw President Putin launch an unprovoked assault on Ukraine. We responded quickly, embedding ourselves within the FCDO’s crisis response team to maintain services and support the crisis response across Europe and beyond. As a trusted member of the FCDO family, being able to anticipate and respond quickly to requests is critical, and as ever, our staff continue to go above and beyond in delivering vital support to Missions and delivering the broader HMG agenda.

Following extensive preparatory work undertaken in anticipation of the UK’s exit from the European Union, our teams have worked hard to embed the changes into our operations. Our hub in Frankfurt has played a central role to the work we have been doing for the FCDO and our Partners Across Government and has enabled our logistics teams to run our operations smoothly.

Our Digital Sensitivity Review work, to archive official government records, continues to gather significant pace across Whitehall and we are in an excellent position to deliver this work as an enduring cross-government service. In November, the team achieved a significant milestone in the first ever transfer of a digital artefact to The National Archives. I am also pleased to say the UK National Authority for Counter Eavesdropping (UK NACE) has had a successful year, gaining funding from the Treasury for Research and Development and agreeing a programme for the next three years. A Steering Board, overseen by the Cabinet Office, has been set up for governance of the programme to ensure it delivers value to HMG. I look forward to seeing both these teams expand in their areas of work and continue to deliver a first-class service to HMG.

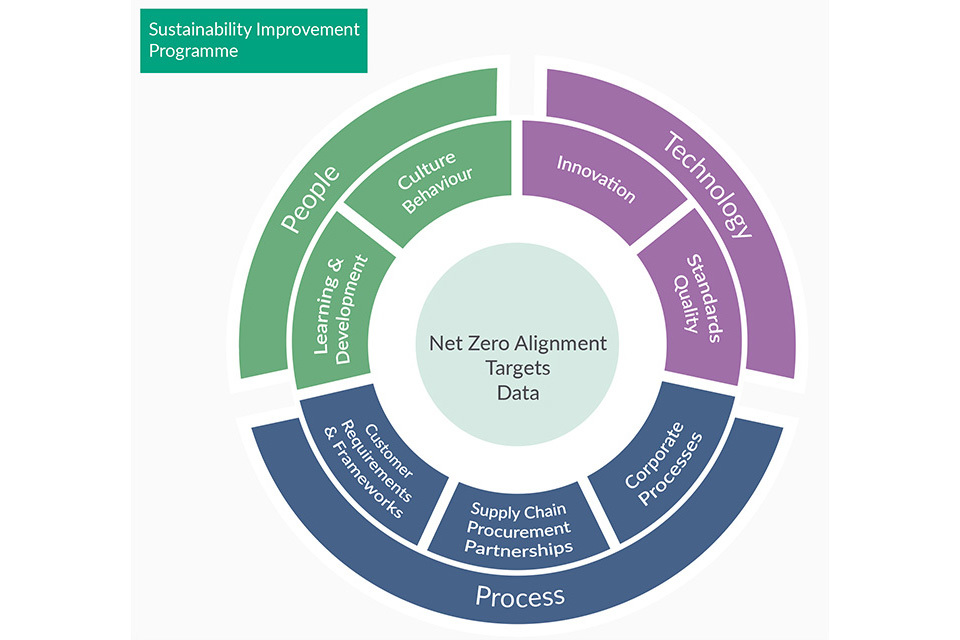

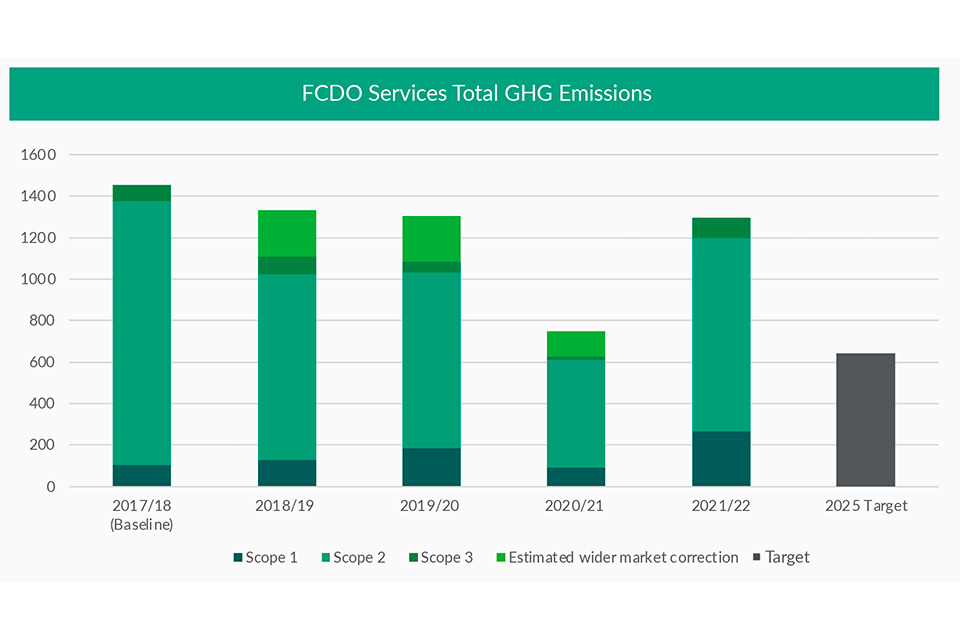

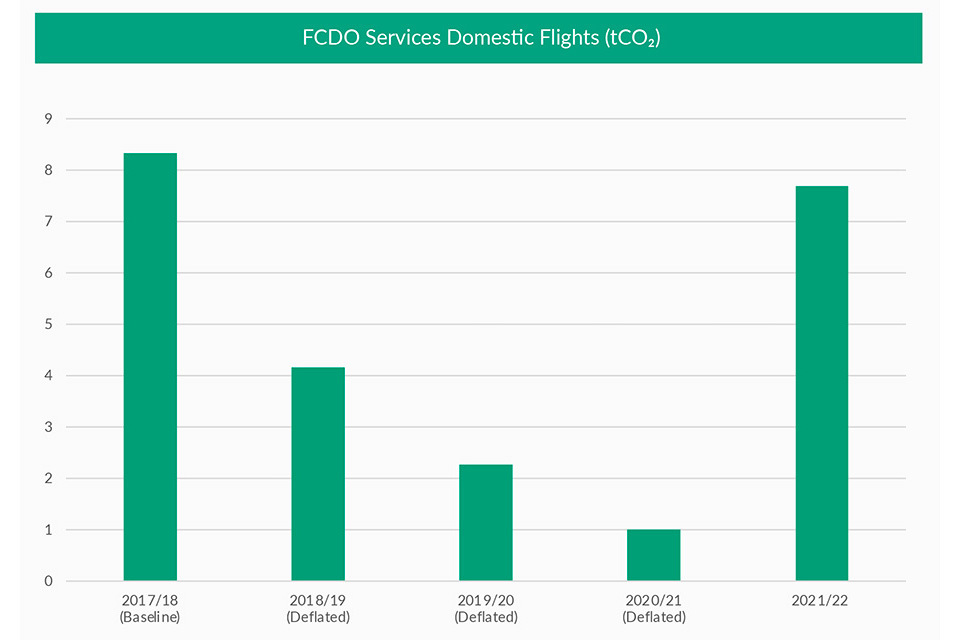

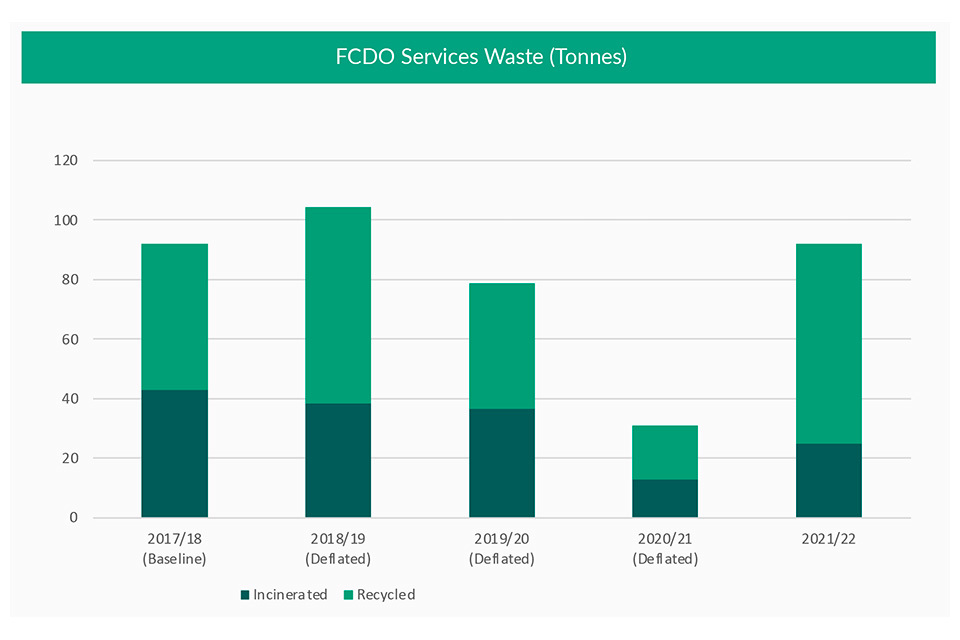

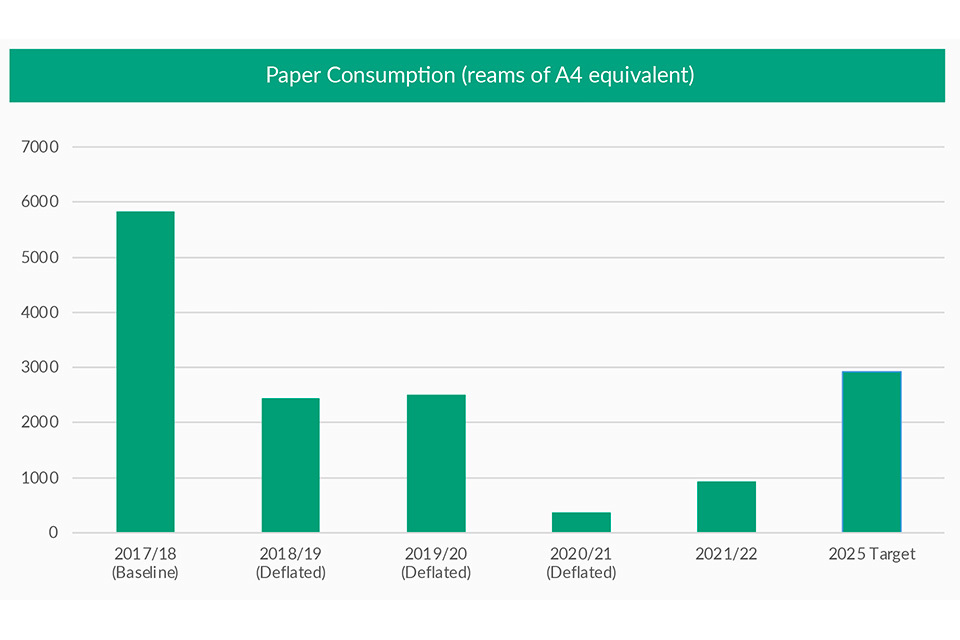

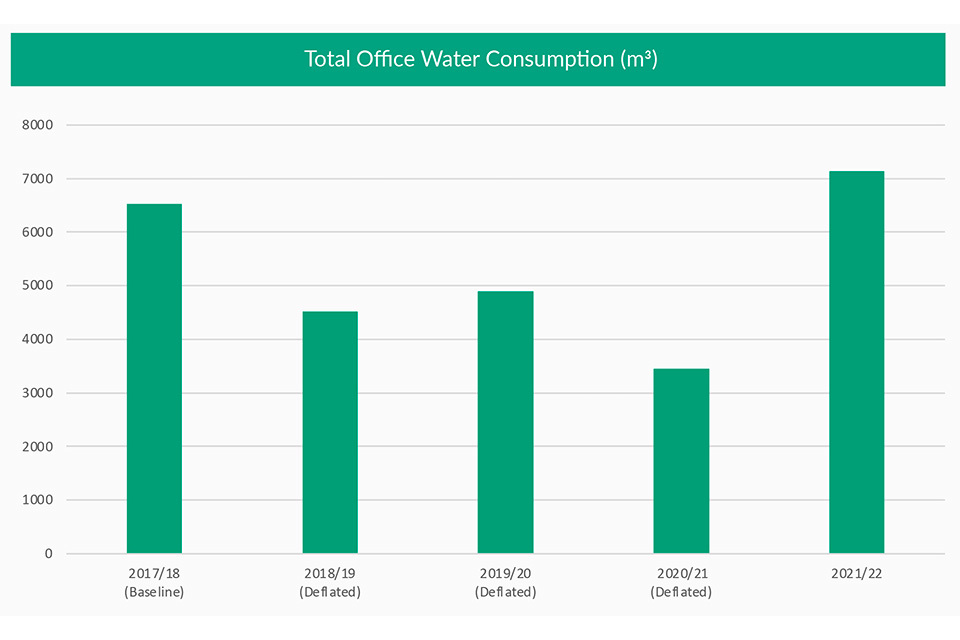

FCDO Services has increased its focus on sustainability in 2021/22 with the creation of a dedicated sustainability team to drive improvement. FCDO Services will maintain its stance under the FCDO umbrella, aligning with the FCDO’s ISO 14001 accreditation and collaborating with the FCDO towards delivery of Greening Government Commitments (GGC) 2021-25 targets and the FCDO’s Sustainability Action Plan 2020-25. We have developed a Sustainability Improvement Programme to engage across the organisation to ensure compliance, reviewing standards, processes and capabilities. Read more about this in the dedicated section later in this report.

Finally, there have been a number of changes to the senior leadership within FCDO Services this year. Firstly, we said farewell to Danny Payne who left FCDO Services after 13 years with the organisation, eight years as Chief Executive; we also said farewell to Claire Shepherd, Chief Operating Officer. I would like to thank Danny and Claire for their support, service and dedication to FCDO Services throughout their tenure. I would also like to extend a warm welcome to Tim Gall who has joined the Executive Board and FCDO Services Board as Chief Finance Officer on an interim basis while Yvonne Laird is on a period of leave until 2023, and to Melanie Johnson, who joins the Executive Board on an interim basis as Global Logistics Operations Director.

Mike Astell

Chief Executive Officer

Who We Are and What We Do

FCDO Services is an Executive Agency and Trading Fund, owned by the Foreign, Commonwealth and Development Office (FCDO). Our work supports diplomacy, defence and development for the UK Government and our global partners.

What we do

Our secure services underpin the diplomatic network. We provide services to embassies and high commissions and protect against terrorism and espionage.

- We support a wide range of highly secure government facilities, from design and construction, to providing ongoing maintenance and consultation.

- Within the digital sphere we provide data management and secure cloud hosting, IT advisory and professional managed services.

- Our secure logistics service, which includes our renowned Queen’s Messengers, delivers diplomatic mail around the world for the UK and other governments.

- Our services include provision of diplomatic and ministerial vehicles, regional technical support and protective security and translation and interpreting.

- We offer project management and consultation, testing, monitoring, product development, delivery and more.

The UK National Authority for Counter Eavesdropping (UK NACE) is part of FCDO Services and recognised as a national authority for technical security. Along with its partner National Technical Authorities – National Cyber Security Centre (NCSC) and Centre for the Protection of National Infrastructure (CPNI) – they protect UK assets from technical attack.

How we are organised

We operate on a global scale, working in more than 250 Missions across 168 countries.

Our staff are based in the UK and around the world, where they can offer the best support to customers. In the UK, staff are based at Hanslope Park, near Milton Keynes and at the FCDO’s London headquarters, King Charles Street. Overseas, staff are based at our regional hubs in the UK, Washington DC, Abu Dhabi and Bangkok, or at other Posts.

Our regional structure allows us to respond more quickly to customers, to build local supply chains and alter our approach based on the needs of each region. Each hub is led by a Head of Region.

Our Organisation

- Consultancy and Advisory Services

- Secure Disposals

- Global Logistics

- Diplomatic Vehicles

- Project / Programme Management

- Service Delivery

- Construction Management and Delivery

- Language Services

- Technical Security

- Counter Eavesdropping

- Inspection and Assessments

- IT Hosting

- Diplomatic Couriers

- Sensitivity Review Service

- Architectural and Design Services

Our Partners

- Home Office

- Cabinet Office

- Ministry of Defence

- Department for Business, Energy & Industrial Strategy

- Foreign, Commonwealth & Development Office

- Government Security

- UK Visas and Migration

- HM Revenue & Customs

- Canadian Government

- Australian Government

Performance Analysis

The Performance Analysis section outlines our strategic vision and our objectives, including how we measure performance.

Performance summary 2021-22

We are in our fourteenth year as a Trading Fund of the FCDO, providing vital support to diplomatic Missions and other government departments around the world.

Our strategies and objectives

| Our Purpose (Mission) | We provide trusted, secure and resilient services to support diplomacy, defence and development for the UK Government and our global partners. |

| Our Ambition | The organisation of choice for innovation in protecting the people, assets and data of the Government and its partners worldwide. |

| Grow our business | We will continue to build on our already strong relationship with the FCDO while developing opportunities with other partners as part of our Trading Fund status. We will continue to grow our revenues and diversify our client base through a sector approach. |

| Save resource | We will save by streamlining our business to reduce costs, and increase agility, scalability, productivity, sustainability, collaboration and teamwork. This will enable us to meet the demands of increasing competition. |

| Innovate for future growth | Innovate to develop an organisation fit to serve the future needs of our customers, creating compelling new products and driving increased digitisation and automation of our operations. |

Organisational goals

FCDO Services has a clear vision to be a trusted government partner that is agile in deployment and global in scale.

Every three years we produce a comprehensive corporate plan which lays out our ambition, mission and strategic plans, against the background political, economic and social environment, including financial forecasts for the period of the plan. This is revised each year to ensure it remains current.

Our strategic objectives for 2021/22 are to Grow, Save and Innovate. The restructure of our organisation to create a single, unified FCDO Services operating unit, will improve our ability to deliver on this.

New organisational structure

During 2021/22 we worked on a series of improvements to our internal structures to make it easier for us to work together and with our customers, also allowing FCDO Services to develop our range of services. Under the new structure, which will go live in April 2022, a number of areas have been restructured in a unified operating model covering operations and account management functions. The restructure, creating ‘One FCDO Services’, provides the basis for an even more customer-centric organisation, improving our operational excellence and providing greater empowerment to our staff to have more accountability, thus removing unnecessary delays for the customer.

The new structure also supports greater innovation in science and technology, enabling FCDO Services to further support our customers’ needs and support the Government’s ambition to strengthen the UK’s position as a science and technology superpower. The changes are part of our commitment to continuously improve our organisation based upon feedback we have received from our partners. We will continue to actively seek their views and listen to operational colleagues during the embedding of this new structure.

Measuring our performance

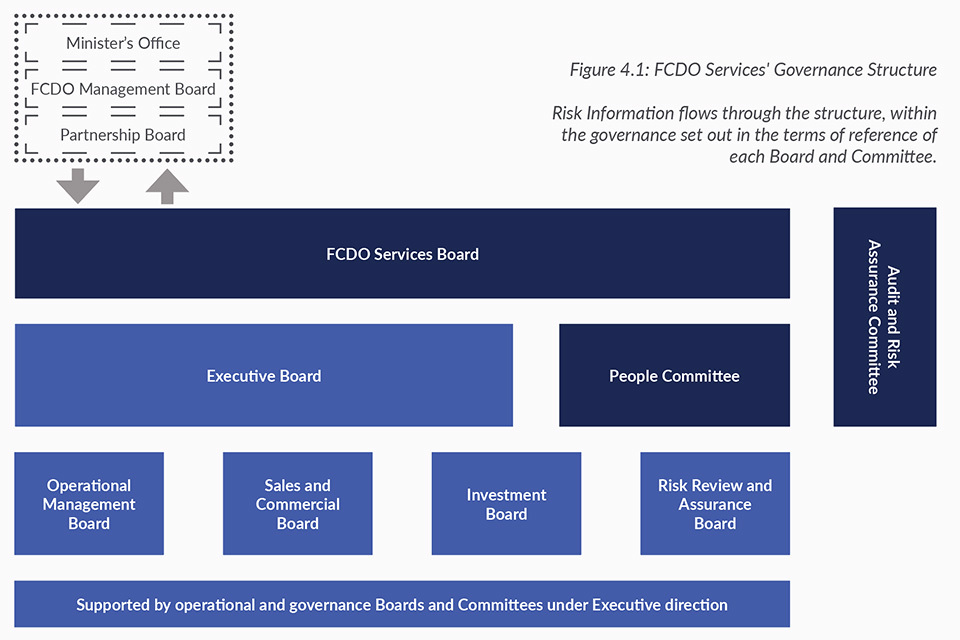

FCDO Services is accountable to the Secretary of State for Foreign, Commonwealth and Development Affairs via an appointed minister (Lord (Tariq) Ahmad of Wimbledon) and several boards which govern the organisation.

The Executive Board meets monthly to take ownership of day-to-day management and strategic leadership, ensuring FCDO Services is following its key strategic aims and policies. The Board receives regular reports detailing financial performance, sales and marketing plans, HR statistics and service delivery issues. This board is accountable to the main FCDO Services Board chaired by Sir Simon Gass. Separately, the Investment Board meets to ensure all spend and investment across the organisation is in line with our strategic goals and required in order to meet our Ministerial and organisational targets. A detailed explanation of our governance and oversight structures are set out in the Accountability Report.

The following performance targets were set for 2021/22.

| Ministerial target set | Achieved |

|---|---|

| 1. An in-year surplus in excess of 0.0% before interest, tax and dividend | 3.8% |

| 2. Return on capital employed (ROCE) of at least 6.5% (weighted average) | 11.6% |

| 3. Productivity ratio of at least 82%, measuring actual billable hours versus available billable hours | 82.5% |

| 4. In-year customer satisfaction rating average at least of 82 | 86.6 |

| 5. An average ‘Civil Service People Survey’ score for Employee Engagement of at least 61% | 61% |

In addition to these targets, we exceeded the ‘Civil Service People Survey’ target score set for “My Manager” of 65% by achieving 72%

Investing in our people

Much work was carried out through 2021/22 to enable structure changes under our major change programme, ‘One FCDO Services’, to go live in April 2022. This provides the basis for a more streamlined and efficient operating model, which is better for our staff and customers. The new structure will also enable more accountability and responsibility to staff, empowering them to make changes and decisions in the areas they know best.

Diversity and inclusion

The skills and commitment of our staff, who work around the world often in hazardous zones and go the extra mile to deliver, underpins our success as a business. As such, fulfilling our duty of care as an employer is central to all that we do. This includes creating a safe workplace that is diverse and inclusive, that looks after the wellbeing of all staff and enables them to give their best.

This year we undertook a comprehensive review of our approach to diversity and inclusion, including progress so far, and agreed a new organisational strategy and action plan for 2021-24. The plan takes a holistic approach and continues the focus on managing wellbeing and addressing staff under-representation. We are also working on a range of initiatives, including extending our outreach programme to attract more diversity and inclusion in apprenticeships and science, technology, engineering, and mathematics jobs.

Working through a pandemic

Managing the people impact of the pandemic continued to be a major priority during 2021/22, requiring considerable resource across the business. Throughout the period we ensured policies, guidance, learning and briefings were continually updated to reflect the changing circumstances and government guidance, while ensuring we remained aligned with the FCDO to ensure effective working arrangements. Work continues to return to ‘business as usual’ in a post-pandemic world, with increasing on-site attendance and smarter working, involving a degree of hybrid working.

Pay award

A key priority for the year was to continue the roll out of the pay flexibility award approved by the Cabinet Office and Treasury in 2018/19. The approach for the third and final stage (Skills Based Pay Structure (SBPS) and assessments) was agreed by the Executive Board with implementation from October 2021, with pay changes for some employees backdated to August 2020 in accordance with the award.

Annual skills assessments, using the skills identified in the role profiles, are being phased in for all employees in delegated grades (below SCS band) by 2022/23. SBPS will improve our ability to attract and retain employees, by recognising key job-related skills and enabling greater opportunity to progress within pay bands.

Recruitment

Recruiting skilled staff remains a challenge for the business due to the current competitive market. We undertook a deep dive review to look at recruitment and retention, and identified priority actions for ongoing continuous improvements and new ways to attract new employees.

Following a pause in apprenticeship recruitment in 2020, we welcomed 36 new starters in 2021 and we are aiming to recruit another 35 to start in 2022. This represents a significant investment to build our longer-term pipeline and includes a wide range of apprenticeships, such as our core technical engineering and IT programmes, and schemes in business administration, communications, finance and logistics.

Staff survey results

The Civil Service People Survey 2021 results reflected the trend across the civil service with less positive feedback than in the previous year. However, there was still strong positive results in some business areas and we still achieved both of our people based Ministerial targets for 2021/22 with Engagement at 61% (target 61%) and My Manager at 65% (target 65%).

Encouragingly, bullying, harassment and discrimination feedback improved slightly, although addressing this still remains an important priority within our Diversity and Inclusion strategy. The Executive Board have agreed key areas to focus on at a corporate level based on leading by example, and each area of the business will update its engagement action plans to address issues on the ground.

Leadership, management and career development

As part of our ongoing commitment to improving leadership and management across FCDO Services, we held our first leadership potential assessment centres in November 2021 and launched an Academy to support the development of high potential employees in March 2022.

We also launched a new leadership and management development framework in August 2021, which is accessible to all employees to support their career development.

We participated in the FCDO’s Leadership Initiative for Talent (LIFT) Programme aimed at developing talent in under-represented groups, we also partnered with a local college to run our first Chartered Management Institute levels 3 and 5 cohorts.

Following a successful pilot scheme last year, we have developed a new reverse mentoring programme, which will allow employees the opportunity to mentor leaders on organisational issues. The scheme will go live at the start of 2022/23.

Assessing our risks

The principal risks faced in achieving our ministerial targets and our corporate objectives are managed proactively within our Risk Management Framework, set out in detail in the Annual Governance Statement later in this report. The framework, and risk landscape of FCDO Services, is supported by a Risk Review and Assurance Board which meets monthly.

Additional oversight is provided by the Audit and Risk Assurance Committee, which meets quarterly. Effective identification and management of risk is fundamental to the success of the organisation; this is managed via a register of primary risks, reviewed and updated on a monthly basis.

Risks posed by the impact of COVID-19 upon our operational activities have been managed through careful crisis management and a sound Business Continuity Framework.

Business continuity

FCDO Services’ structured and comprehensive Business Continuity approach has continued to influence and support its delivery activities to customers and protect the wellbeing of staff.

Global pandemic restrictions presented challenges at times but our commitment and focus on maintaining an effective and robust Business Continuity structure has enabled resilience during critical times, this strategy will continue as we support customers and stakeholders impacted by the evolving crisis in Ukraine.

Over the past 12 months, we have maintained our ISO 22301 standard certification for Business Continuity and successfully transitioned to the 2019 version.

Ongoing dynamic planning, exercising and delivery will continue to underpin our commitment goals to our staff and customers through the coming year.

New finance and HR system

FCDO Services is introducing a new Finance and HR system (Hera) in July 2022. It utilises the latest Oracle cloud-based software and, once in place, will evolve alongside our organisation. This is an important business tool that should deliver significant improvements over the system it replaces. It will allow us to digitise and automate more of our business processes - to make them as efficient as possible, and parts of the system will be available for people to work ‘on the move’. Work has been progressing throughout 2021/22 to prepare the organisation for the changeover, in conjunction with the FCDO, which owns the Hera platform.

Health and safety

FCDO Services places the highest priority on keeping its staff, customers, contractors and delivery partners safe in their work.

Our newly launched Health and Safety policy contains clear objectives for high performance, underpinned by the mission statement ‘Safe by choice, not by chance’. We also launched a new Health and Safety reporting tool to help track any accident, incident or near-miss.

The policy launch provided supporting guidance to our staff about how they can all contribute to achieving our new health and safety objectives. Campaigns will continue throughout 2022 to promote the culture and behaviours that are the foundation of good safety performance. New key performance indicator objectives will measure our achievement.

We are focussed on working with our internal and external stakeholder relationships to engage in further efforts to keep projects, products and services safe, from design through to delivery. As the challenges of the pandemic extended, we continued to deliver effective COVID-19 risk controls into our business processes, providing dynamic and effective support for our delivery teams. These risk controls have been integrated into our refreshed processes for governance and assurance of health and safety arrangements in our activities.

Security

We have continued to enhance our security culture through uniting the work of our internal security teams. Collaborative working and a dedicated security education function has been established to support continuous aligned improvements. Performance and compliance monitoring and measurement influences both proactive and reactive security, governance, management and training across the organisation.

There has been, and will continue to be, a strong emphasis on cyber security in line with government requirements. The focus during this year has been to complete a comprehensive review of all systems which has resulted in a fully understood landscape in this complex arena. We will be working across the organisation to ensure we build and maintain our cyber defence and resilience.

We have retained ISO 27001 and Cyber Essentials Plus and have continued our implementation of the Information and Cyber Security Strategies. This is alongside the expansion of the full Project Governance Board to encompass the whole organisation which ensures security, technical and service standards are met.

In addition, we have updated and extended the capability of our Cyber Security Operations Centre along with internal reporting mechanisms to ensure risks are reported regularly and, working with colleagues across the organisation, establish action plans to reduce risks and issues found.

Risk management and governance, in conjunction with cyber defence and resilience, Security Health Checks and new major systems security initiatives, are contributing to safeguarding our customers, staff, information, technology and other assets proportionate to organisational risk. At the same time, our understanding of threat and opportunity has grown through sustained external engagement with the FCDO, Partners Across Government and industry specialists.

Personal data

There have been no significant lapses of protective security, or referrals to the Information Commissioner’s Office (ICO) in 2021/22.

Performance in responding to correspondence from the public

As a public organisation, FCDO Services is subject to the Freedom of Information Act (FOI) which creates a public “right of access” to information held by public authorities. Individuals also have the right to obtain a copy of their personal data held by the organisation as well as other supplementary information, known as a Subject Access Request (SAR). Under this Act, FCDO Services must provide answers to the public when they submit an FOI request. In the 12 months ending 31/3/2022, FCDO Services received 18 FOI requests and four SARs.

Modern slavery

FCDO Services recognises that it has a responsibility to take a robust approach to combat modern slavery. The organisation is absolutely committed to preventing modern slavery in its corporate activities, and to ensuring that its supply chains are free from the practice of modern slavery. We have policies in place that cover the use of agency workers and best practice on monitoring services provided to us by suppliers.

A full statement is reviewed and updated annually by the FCDO Services Executive Board and is made available on our website.

Ethics

Our Ethical Code sets the standards of behaviour and conduct expected of our people - employees and contractors.

The Ethical Code incorporates the Civil Service Code and its core values of integrity, honesty, objectivity and impartiality. The Ethical Code specifies:

- conduct

- declaration of gifts and interests

- how we work with our colleagues

- raising concerns

- respect at work

- how we handle information

- how we work to eradicate unethical practices from our organisation

- behaviour when undertaking procurement activities

Our Respect at Work policy, and mandatory training programme, ensures staff receive fair treatment and respect, no matter their background, and helps FCDO Services avoid discrimination in the workplace.

Whistleblowing, anti-corruption and bribery

FCDO Services is committed to ensuring high standards of conduct in all that it does. These standards are reinforced by the Civil Service Code and in Diplomatic Service Regulations (DSR) and Home Service Regulations (HSR). Our Raising a Concern policy is designed to make it easy for workers to make disclosures, without fear of retaliation.

Our highlights

In this section we focus on our work with the FCDO and our Partners Across Government. We look back at our achievements over the past year measured against our key strategic objectives: Trusted, Agile and Global.

Trusted

FCDO Services has built its reputation as a trusted service delivery organisation through years of dedicated support to government departments and key partners overseas. The last 12 months have seen the organisation continue to deliver existing and new projects and programmes for our partners in the UK and at Posts around the world, with critical services provided at the highest levels of security.

With the difficulties of delivering during the pandemic continuing to impact on our ways of working, our teams around the world displayed their trademark flexibility and professionalism in prioritising the customer. Our Technology and Operations teams have worked closely with other government departments to deliver highly secure IT infrastructure fit outs for government partners in Europe. This is in addition to the continued roll out of the Microsoft the Microsoft Office 365 programme for the FCDO, which has enabled much smoother working for our partners remotely and at Post.

Enabling the most effective means of communication in these difficult circumstances has been so important for our customers and we are proud to have been able to assist in this vital work.

The Sensitivity Review Service reached a landmark in their ongoing work to digitise the process of sending material to The National Archives, with the first fully digitised transfer. This is covered in more detail later in this chapter, and shows the incredible dedication of the team in developing ground-breaking AI technology to speed the process up for our customers.

Our relationship with the Ministry of Defence (MOD) has continued to grow, with the completion of the HYDRA programme’s construction work at Benbecula in the Outer Hebrides. The conclusion of the work on Benbecula was incredibly challenging and required careful planning and implementation. Managing the build of such an important project on a remote island during the pandemic added an additional layer of complexity, with engagement with the island community and protective infection-control measures essential to building confidence and success in the project. The next phase of the programme is already underway.

We are continuing to develop and improve the experience our customers have when working with us. Our new structure, which creates a single operating model, goes live on the 1 April 2022 and will make it easier for us to work together and with our customers, allowing us to develop our range of services. It will also give more accountability and responsibility to staff, empowering them to make changes and decisions in the areas they know best.

UK NACE

UK NACE continued to establish its position as a vital National Technical Authority during 2021. The team played a key role at G7 and COP26 events, enabling ministers and senior officials to negotiate effectively away from Whitehall.

UK NACE further developed its public profile, exhibiting at the Home Office’s Security and Policing conference in 2022, their first external outreach event, where they engaged with colleagues across the security landscape and continued to develop relationships with key stakeholders in industry and academia.

As a National Technical Authority, UK NACE has had an overwhelmingly positive impact on HMG security. Using the Understand, Detect and Protect methodology, we have invested in cutting edge research partnerships to comprehend the next generation of technical threats that HMG will face. We also provided expert field support to investigate and expose those who wish to harm the UK and engaged with the wider security profession and industry to embed best practice, policy and technical countermeasures to protect from increasingly sophisticated attackers.

The team made valuable contributions towards implementing the findings of the HMG’s 2021 Integrated Review and particularly the strand entitled ‘Strengthening security and defence at home and overseas’. UK NACE also contributed to the Government Functional Standard published by the Government Security Group (GSG), leading in the area of Technical Security, as well as the Home Office’s review of the Official Secrets Act. The GSG has overall accountability for government security and is a key stakeholder for UK NACE.

UK NACE continues to provide world class training to national and international partners through our Academy and strives to improve security culture and technical awareness around HMG’s High Threat Club. Our research team continue to sponsor an exciting portfolio of projects and are proud to work closely with a variety of leading industrial and academic partners in all corners of the UK.

Microsoft Office 365 expansion for the FCDO

In 2020, the Foreign and Commonwealth Office (FCO) merged with the Department for International Development (DfID). They become the Foreign, Commonwealth and Development Office (FCDO).

Case study

The FCDO identified Microsoft Office 365 as its primary platform to accommodate the merger of the two departments. The project required an agile approach to bring about rapid business change.

The FCDO engaged FCDO Services to deliver this critical part of their overall IT merger programme for them.

An agile approach

Our approach to project management helped us to deliver faster, with fewer issues. Instead of focussing everything on a one-off launch at the end of a project, we delivered the work in phases. This enabled us to test and gain feedback at key milestones from stakeholders and end users.

We brought together key colleagues from across the two legacy departments to assess requirements and problem-solve any issues. These stakeholders were key to ensuring the setup of MS Teams was fit for purpose.

Cross-organisation collaboration

Faced with remote working challenges due to the COVID-19 pandemic, we collaborated virtually using MS Teams and Microsoft Planner to achieve the project goals. It meant we were able to take advantage of the platform the project was set up to introduce, while quickly implementing changes.

We ran frequent cross-organisation ‘stand-ups’ and ‘show and tell’ meetings to facilitate open and productive discussions with FCDO colleagues. This enabled the project team to understand any changes proposed and efficiently face challenges we needed to overcome.

Quick wins

The project has brought video calling, instant messaging and other Microsoft Office applications right up to date, providing a better user experience for FCDO staff. These are tools which are used daily by staff across the organisation.

We migrated users from Skype for Business to MS Teams, and enabled access to it on approved mobile devices. There is now functionality to record and transcribe MS Teams meetings, with updated guidance and training to support users.

Fully embedding MS Teams in the new organisation has allowed more effective collaboration between ex-DfID and ex-FCO colleagues.

One of the key benefits has been the improved experience for external stakeholders and Partners Across Government when accessing the platform.

Project success

In just two months, our project team successfully accelerated the adoption and improved the functionality of Microsoft Teams across both organisations. All this was done while ensuring security and compliance standards were maintained.

The work completed in May 2021, with excellent feedback from our colleagues in the FCDO.

Quote from customer

“Moving to a single Office 365 tenant is a key step in enabling the FCDO organisation to work effectively. FCDO Services’ project and delivery capability has been key in achieving that success.”

Deputy Chief Digital Information Officer, FCDO

First digital transfer to The National Archives

On Wednesday 26 January 2022, the Foreign, Commonwealth and Development Office (FCDO) began to transfer its first born-digital records to The National Archives (TNA).

Case study

Government departments are obliged under the Public Records Act to transfer historical public records selected for permanent preservation to The National Archives (TNA), by an agreed timescale.

From the 1990s, FCDO files were stored in both a digital and paper format. These particular digital records were created on the FCDO’s original IT system in 1992, and are now available through TNA’s online catalogue on the Internet.

The Sensitivity Review Service

FCDO Services has been providing a records review service to the FCDO since 2017. The process includes selecting digital and paper files for permanent preservation and reviewing them for sensitivity, ready for transfer to TNA.

Our Sensitivity Reviewers examined all of the FCDO files before they were cleared. This involved analysing and redacting information as necessary to ensure documents were safe to publish.

The hybrid transfer

Hybrid records comprise both electronic and paper records, and the transfer in January this year included 286 paper files and their digital counterparts from the former FCO South Asia Department, known at TNA as FCO 37 1992. The material covered the UK’s political and economic relations with India, Pakistan, Bangladesh, Sri Lanka, Afghanistan, Nepal, Bhutan and the Maldives.

Following the usual post-transfer record keeping activity undertaken by TNA, the digital and paper documents have now been released to the public.

Future transfers

FCDO Services is supporting the FCDO and other government departments in meeting their statutory obligations. In addition to work on records review and transfer, the FCDO continues to face an increasing number of historical FOI requests which typically require us to support the FCDO in reviewing for sensitivity any records requested.

In the coming year, we expect to transfer three more hybrid series of files, and this number will rise sharply.

Quote from customer

“We are pleased to be working closely with FCDO Services on their review of FCDO records, and to benefit from their extensive knowledge and expertise in sensitivity reviewing records and providing us with the technical capability to transfer digital records to The National Archives.”

Head of Archives, Foreign, Commonwealth and Development Office.

Programme HYDRA – secure construction for the RAF

Programme HYDRA has created remotely operated secure radar stations for the Royal Air Force (RAF) to enable the release of RAF personnel from radar maintenance activity.

Case study

The RAF appointed FCDO Services as Principal Designer and Contractor for this multi-site programme in 2019, following previous success with Programme TARTARUS at Saxa Vord. Our role included Programme Management services for the design and construction of all HYDRA Phase One sites and we mobilised multidisciplinary teams to plan, manage and monitor the works.

We successfully delivered Remote Radar Head (RRH) Brizlee Wood (Northumberland) in 2020, Buchan (Aberdeenshire) in 2021 and works at RRH Benbecula (Outer Hebrides) commenced in May 2021. We achieved Initial Operating Capability in September 2021, following successful completion of a new secure compound with a tower to hold the radar and radome. Further works to install a new communications building and bespoke tall communications mast were completed in March 2022.

Benbecula is a small island of the Outer Hebrides in the Atlantic Ocean off the west coast of Scotland, and the team faced challenging logistics and weather conditions as well as strict COVID-19 restrictions on the island throughout delivery.

On the ground at Benbecula

Along with our Site Management team, an RAF Liaison Officer and our main contractor JRC were based on site and lived locally for the duration of the works.

Working on site in such a remote location involves careful and detailed planning at any time, and even more so during a global pandemic. We worked hard to establish good relationships with the local community and consulted with a number of island leaders, including local businesses and services.

Maintaining regular contact with local people was crucial for planning travel and accommodation logistics, deliveries to site and communicating our COVID-19 safety procedures. Our aim was to minimise disruption to islanders as far as possible and operate considerately.

COVID-19 protocols protected islanders and our workforce

In addition to the usual rigorous safety standards for a programme such as this, the HYDRA team developed and implemented detailed procedures and policy-compliant ‘COVID-secure’ environments at Benbecula, as it had previously across the other two RRH sites. These measures enabled work to continue safely on site throughout the pandemic, with all visitors to site following protocols and site operating procedures.

Having such careful controls in place meant that when an outbreak did occur on site, it was quickly identified and contained, and therefore didn’t impact the local island population. Despite the outbreak causing disruption at a critical phase of the works, our dedicated team and main contractors quickly made up for delays ensuring the programme was still completed on time.

Our Directors visited Benbecula during the build phase to see how the site was developing, and to gain more insight into what this complex programme involved. The visit enabled them to meet members of the programme team and to better understand some of the unique challenges that had to be overcome in order to complete the works on time.

Maintaining the standard

We were delighted to successfully complete this complicated infrastructure programme for the RAF, on time, and to a high standard, with excellent feedback from our customer. Our team expertly navigated the environmental challenges of the site location in the Outer Hebrides, and the challenges of COVID-19.

Pending planning permission, our programme team are embarking upon the delivery of works at RRH Neatishead (Norfolk) in the second and final phase of Programme HYDRA.

Quote from customer

“Following on so closely from the successful completion of the HYDRA works at the previous two sites, it is exceptional against the backdrop of COVID-19 and other significant challenges that HYDRA has been implemented at RRH Benbecula ahead of schedule and to such an exemplary standard.”

Group Captain, RAF

Delivering diversity and inclusion – for our people and our customers

As a global organisation, operating in ever-changing and uncertain times, we actively pursue opportunities to attract, develop and retain people with diverse backgrounds and talents. A diverse workforce enables us to deliver our organisational goals and objectives and exceed customer expectations.

Focus on

The impact of COVID-19

Our aim is to be a diverse and inclusive organisation that looks after the wellbeing of all our people.

As with most organisations the global pandemic has impacted progress towards achieving our aims. A key focus has been on supporting the mental health of our colleagues, recognising the impact of the pandemic on wellbeing. Last year’s Annual Report and Accounts included an article about the health and wellbeing support we provided to our people during the pandemic.

There has also been an impact on diversity and inclusion, both negative and positive. The negative includes a temporary reduction in recruitment numbers, and a decrease in school outreach and engagement from staff networks due to COVID-19 restrictions. This has delayed the implementation of some actions.

On the positive, the move to working collaboratively online provided an opportunity to reach a greater number of colleagues than events held solely at one location, enabling our overseas and travelling staff to be more included. The ability to work remotely has benefitted some staff with disabilities or underlying health conditions.

While some activities have been impacted by the pandemic, the organisation’s commitment to achieve its vision has not changed. We have made good progress on our journey, and acknowledge we have more to achieve.

Revised strategy

Our revised 2021–24 Diversity and Inclusion strategy was fully supported by the Boards. It was updated to ensure alignment to strategy updates from both the Civil Service and the FCDO which focus on inclusion for all, while recognising the different challenges faced by being an organisation operating in the STEM (Science, Technology, Engineering, and Mathematics) sector. Through our varied apprenticeship programmes and our outreach / early careers activities, we are working to address our most notable challenge - the size of the available diverse talent pipeline for entry to our technical and engineering roles.

We need to expand our thinking and continue to improve our recruitment processes and policies to fulfil our 2025 overall ambitions for gender, ethnicity and disability, ensuring we adhere to Civil Service principles.

Change should be led from the top

Our Executive Directors are visible and active champions across the four areas of our strategy (Inclusion, Attracting and Promoting Talent, Respect at Work and Wellbeing). The reverse mentoring scheme piloted by the Executive team received positive feedback and has now been launched across the organisation.

We ran an all-staff session as part of our ongoing strategy to overcome misconceptions about working internationally, and encourage a broader range of candidates. The session focussed on the realities of working internationally, covering different personal and family circumstances. For International Women’s Day 2022, the Executive team took the opportunity to demonstrate their ongoing commitment to gender equality by striking the #BreakTheBias pose.

Raising awareness

As part of our annual calendar, the Executive team, and representatives from the FCDO Services and FCDO Staff Networks, have supported a number of other key diversity dates, including Black History Month, Inclusion Week, International Day of Persons with Disabilities, Mental Health Awareness Week and International Day against Homophobia, Biphobia and Transphobia.

External speakers for these interactive online events were selected for their ability to be informative and inspirational role models, often able to speak from more than one diverse perspective and from a STEM background. Internal contributors have shared their powerful personal stories through blogs on our intranet. Our ongoing action plan addresses the topics raised by these awareness days.

Diversity benefits everyone

An increasingly diverse and inclusive workforce benefits our people and our customers. Research shows the positive impact of diversity on innovation, problem solving and customer relationships. Through our work we can positively impact diversity and inclusion for customers, by ‘designing for inclusion’ when planning, building and maintaining customer facilities.

An example is the refurbishment of the FCDO’s King Charles Street reception, where all visitors will now be able to use the same entrance. Previously, due to the restrictions of the historic building, there was a separate accessible entrance.

The FCDO’s Disability Inclusion and Awareness Network have also been working with our design team on modifications to the quadrangle in the main FCDO building in London to make it more inclusive.

Customer-Centricity

Focus on

Customer-centricity is often misunderstood. The common perception is that it is a strategy - a methodology organisations can roll out to their teams to improve customer satisfaction. In fact, it is better to think of customer-centricity as an output, a feeling that across all touch-points the customer has had a positive experience.

As an organisation working closely with a limited number of customers, we believe that in addition to the experiential components, there is a broader relationship element. This requires helping our customers with the challenges they face today, aligning to their long term strategies and anticipating and ultimately exceeding their expectations.

Over the last two years FCDO Services has been working to improve the customer experience, with a number of initiatives. As we move through 2022 and beyond, our desire to be considered customer-centric will continue to grow with the creation of a new Head of Customer Journey role. This role will look across the entire organisation to identify improvements that can be made to benefit the customer.

Improving the construction delivery customer experience

With over 70 active assignments at any time, FCDO Services’ teams work closely with customers to deliver a wide range of projects and services across the globe.

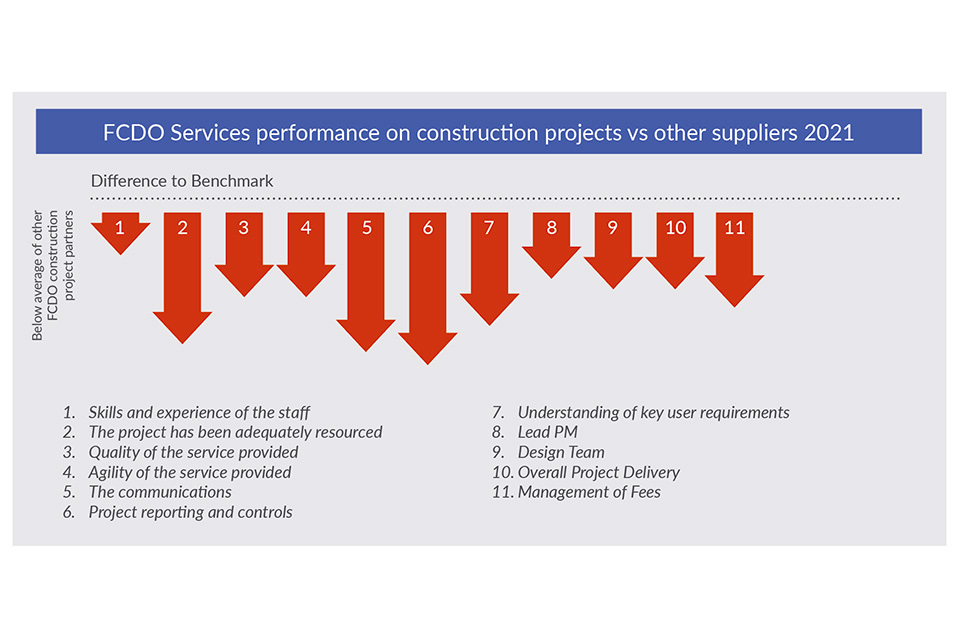

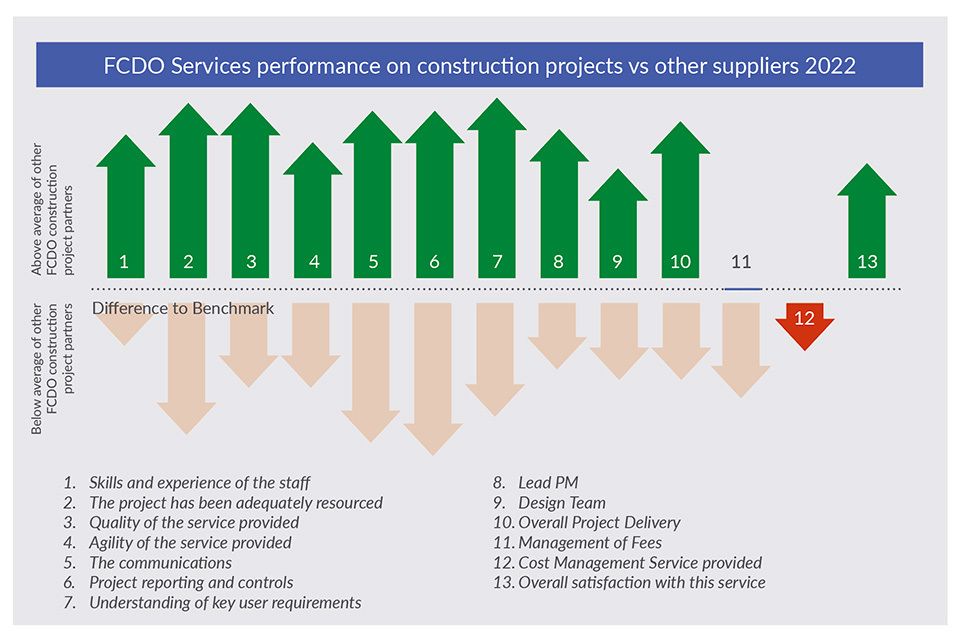

In late 2020, the FCDO indicated there could be improvements in the way that our Project Managers and internal teams work with the FCDO’s Project Directors. Following the feedback, our programme team began a series of improvements.

Over the 18 months which followed, and despite COVID-19 disrupting normal ways of working, our Engineering and Operations team identified opportunities to share best practice across different projects and began to make performance improvements, tracking against competitor benchmarks. In the latest results, FCDO Services has closed the gap in many key measures when compared to competitors, and overtaken all competitors in a number of areas where we are now regarded as the best performer.

The success of this improvement programme is down to the hard work of our team, and the FCDO has benefitted from a much improved construction experience that is better value for money.

Helping the FCDO’s need to reduce costs

As one of the largest embassies overseas, Washington DC hosts up to 460 staff across a number of departments and Partners Across Government. In early 2021 the corporate services team approached FCDO Services to evaluate and suggest opportunities for telephony efficiencies within the Mission. This had been highlighted as a disproportionately high cost by the management committee and they were keen to make savings. Our team used their expertise to identify technical telephony improvements that could be made and put forward recommendations to Post. These changes are expected to deliver hundreds of thousands of pounds of savings per annum in costs.

Supporting the Ministry of Defence

Following the 2015 Strategic Defence and Security Review, it was recognised that strong alliances and partnerships are of growing importance. This has driven a need to collaborate more closely with allies and there is an opportunity for FCDO Services to support this work through Project HERMES.

Still early in development, HERMES is designed to be a modular, scalable solution enabling the UK Government to work securely and collaboratively with its international partners and global industry. Our Technology and Operations team has worked tirelessly over the last 12 months to truly understand customer needs before developing a solution addressing and incorporating customer requirements that will remain future proof.

Results of surveys with FCDO Project directors on current and recently completed construction projects undertaken by FCDO Services and six other Principle Support Providers. Sample size of between 30 and 50 projects per chart.

Agile

Our partners rely on our ability to adapt our approach to best suit their needs, or to be agile in the way we deliver services. The areas in which we work require our teams to carefully plan our operations to account for a variety of possible situations, and the last year has seen many different challenges present themselves, often simultaneously.

Our completion of the vaccination delivery programme to our FCDO and HMG partners at Post was a cross-organisation effort, and hugely valued by our partners around the world. It was one of the most challenging logistical operations FCDO Services has undertaken, with the requirement to maintain a consistent temperature of the consignment at all stages of the delivery.

The pandemic has brought our crisis operations to the fore, with new delivery models needed to enable teams to deliver services seamlessly for the customer. Redesigning the way we deploy our staff at Post, combined with careful planning of work to maximise the ability of teams to manage multiple jobs in an area, meant we continued to provide our key services in the face of travel restrictions and COVID-19 pressures on the workforce.

In crisis situations, when the FCDO has to vacate an Embassy or Mission, FCDO Services is on hand to ensure all valuable technical assets are decommissioned as quickly as possible. In August 2021, the FCDO played a central role in HMG’s response to events in Afghanistan, including the government’s challenging and complex campaign to facilitate the departure of over 15,000 people from Afghanistan.

FCDO Services provided vital support and despatched a small team to drawdown the Embassy in Kabul within just a few hours. Given the deteriorating security situation in Kabul, this was an incredible effort by our staff, with more detail on this featured further on in this report. Our teams were also on hand to set up the new, temporary Embassy in Doha, ensuring a smooth transition for the consular team to enable them to continue their important work.

Our rapid response to the Ukraine crisis saw a command structure quickly established, with key staff from our Europe region working closely with FCDO teams to maintain support to embassies across the continent. Having close oversight and coordination of our operations is critical in planning and delivering our services, and our logistics operation has been central to providing regular support to key locations, including the British Embassy in Moscow among other regional centres. We are only able to do this because of the flexibility and dedication of our experienced staff who go above and beyond to help our FCDO and HMG colleagues.

Rapid response support for UKVI

UK Visas and Immigration (UKVI) required additional Biometric Enrolment Stations (BES) across Europe to support the Ukraine refugee crisis response.

Case study

Biometrics are physical characteristics which are used to identify individuals. These include fingerprint mapping and facial recognition. The Home Office needed to rapidly increase the number of biometric stations to enable the UK Government to deliver on its commitment to welcome Ukrainian refugees into the country.

Quick thinking saved weeks

On 7 March 2022, UKVI asked FCDO Services to confirm how many BES units we could prepare and urgently deploy to key locations in Europe.

The Secure Mobility Management team quickly identified seven potential BES units from our stocks. Five of these were used in the 2021 evacuation effort in Afghanistan, and had been kept configured in case of another incident.

As a direct result, the team quickly adapted the units to a new Visa Application Centre ID useable in Europe. Plus, they only needed to do minimal software patching to get them ready to go.

The remaining kits were built from spares we keep on hand. A standard BES build usually takes weeks, not days, but the team had regularly patched and updated the spares. This saved precious time, as the kits were essentially 75% complete already.

Cross team collaboration

The FCDO Services Helpdesk earmarked certificate-loaded Smartcards, needed as part of BES security, and allocated resources to configure them. These were passed to our Secure Mobility Management team for testing.

Next, the Application Support team confirmed the routing of the Visa applications was correct and that no technical issues were found.

Lastly, our Logistics team identified the best despatch route and transport method. They planned the fastest route out of Hanslope Park into Europe. This meant that the BES units could arrive on location in just two to three days, which the customer was happy with.

An agile response

Our teams worked extended days back to back, allowing FCDO Services to declare its operational readiness on 9 March. Given the standard BES build speed, this extraordinary two day turnaround was down to a monumental team effort.

Quote from customer

“Thank you for the mobilisation of resources at short notice to support us in our response to the Ukraine situation. Without your assistance we could not have put in place the routing or workarounds that are currently critical to our operational response.”

Head of Supplier and Casework IT, Cross Cutting Operations, Visas and Citizenship, UK Visas and Immigration

Technical upgrade of FCDO Services’ Remote Access Service (RAS)

The infrastructure supporting our RAS service was reaching the end of its working life. To continue delivering the same standard of service and maintain security compliance, we needed to upgrade the technology.

Focus on

RAS enables customers to securely access our hosted infrastructure services through a managed Windows device. The service includes supplying the hardware for our customers, as well as managing their access to the secure infrastructure.

In order to move to new technology, both the environment underpinning the service, and the end user devices (EUDs) needed to be updated.

Infrastructure upgrade

The technical upgrade began in 2020 just before the COVID-19 pandemic. We started by improving the infrastructure to give a more supportable solution for our customers.

Colleagues from our Secure Mobility Management (SMM) and Cyber Security teams collaborated to deliver the high and low level infrastructure designs. Our Hosting, Networks, Service Desk and Infrastructure teams contributed to the project, playing a vital role in delivering the upgrade.

Once the infrastructure was complete, a core team was established to ensure the solution was fit for purpose. Applications were uplifted and installed on the new environment, and tested to ensure a smooth transition.

The SMM Team was responsible for delivery. They had a clear understanding of the technology, the requirements and, most importantly, their customers.

Upgrading devices

The new infrastructure was complete and the next step was to upgrade the technology on customer devices. The pandemic heavily impacted this part of the project and we had to work around various challenges to finish the work.

End users were forced to work from home, so swapping devices took logistical planning. We created monthly usage reports to actively prioritise the most used devices and recover those not being used.

Customers had to send their old devices back before we could repurpose them for the next owner. Because of strict social distancing rules, we also had to carefully manage testing and device handovers.

Delivery around the UK and overseas added to delays. This required the team to be patient, continually checking that equipment had been sent and received.

A security report was produced in collaboration with the Chief Information Security Officer. It highlighted any migrations and vulnerabilities on the environment, so we could proactively monitor our endpoint security. Monitoring ensures we continue to modernise applications and keep our operating system as secure as possible.

Enhancements and benefits

The technical upgrade has meant that end users can take advantage of a wider array of devices. This enables them to use specialist applications with more suitable hardware. Some customers, particularly internal, have substantially benefited from moving to the cloud and to modern applications.

All of our customers now use the latest versions of their software, and devices have been brought up to date with the newest technology allowed. Some received a refresh of their hardware as well.

Device security has also been aligned to each customer’s standard operating procedures. This has driven a change in behaviour, with end users logging on more regularly to ensure the security of their device is as good as it can be.

Access to shared files has improved significantly and enhanced team productivity for many customers. As a result of the upgrade, we have even eliminated some of the user access issues they were experiencing previously.

The RAS upgrade has dramatically modernised the technology and infrastructure used, and increased our cyber resilience. It has transformed the way our customers work within the environment and enabled them to do so more efficiently. Increased stability and reliability means we receive fewer helpdesk calls on the new system versus the old.

Quote from customer

“I found the RAS2 upgrade to be extremely smooth and efficient. Despite just emerging from the first lockdown restrictions, the RAS2 team arranged for me to hand in my old Cirrus device and collect my new RAS2 device at our London office. A member of the team met me and walked me through the various security protocols, clearly explaining the differences between the two devices and the new features. Full support was available for using the new device and the team checked in by email to make sure there were no issues - which there weren’t. An excellent service – thank you.”

Head of Translation & Interpreting, FCDO Services

Our apprenticeship programme covers a diverse range of subjects

Global

The global model which underpins FCDO Services ensures we respond quickly to our customers’ demands, whenever and wherever they are in the world. We continue to provide critical and trusted local knowledge and intelligence to securely deliver projects and services in country.

Our regional structure is fundamental to the way we operate. It helps us better understand and flex to the current and future needs and priorities of the One HMG platform. Improvements to our regional model developed under the One FCDO Services programme will see closer alignment to customer needs and Regional Services’ teams taking full ownership of the relationship with FCDO and HMG customers at Post, providing a single point of contact for all FCDO Services delivery on the overseas platform. Through this we aim to drive efficiency in how we schedule and deliver activity and provide greater visibility and clarity to customers.

Even at the highest levels of security, the work we carry out for our customers and partners enables them to safely and securely support diplomacy, development and defence for the UK Government and friendly foreign governments.

Our ability to develop and deliver high quality estates and logistics projects, throughout the global challenge of the COVID-19 pandemic, has meant the UK’s diplomatic profile and defence has been increased in hard-to-reach and vital locations worldwide.

Global travel

Following an extended period of limited international travel in 2020 due to the pandemic, this year has seen our teams deploy extensively, while continuing to face challenges related to travel. Rapidly changing COVID-19 protocols from host countries and airlines require additional effort for our staff in planning and preparing for visits.

Our technical teams have been busy carrying out work across all parts of the globe. Whether it’s the structural improvements to the FCDO estate in Grenada (see case study in this section), or the fit-out of the relocated Embassy in Mexico, following the earthquake in 2017, our staff have travelled to locations across the FCDO’s network to conduct vital work.

In December 2021 we completed seismic strengthening and refurbishment works at the Ambassador’s Residence in Yangon. The project commenced in July 2019, and works continued throughout the military coup in the country. Our Clerk of Works remained on site throughout overseeing the works.

In the run up to Christmas 2021 we worked closely with several departments and agencies to deliver the COVID-19 booster vaccine to Posts across the globe. We share the story of this successful deployment in a case study later in the report. Our global reach, and local knowledge of conditions all over the world, enables us to support other government departments in times of crises.

International partners

We have continued to strengthen our ties with Global Affairs Canada (GAC), providing expertise to support our customer with their estates management function. This year has seen deployments to key and challenging locations in Kabul, Mexico City and Port au Prince where we supplied estates professionals embedded within GAC Missions to assist with the running and management of their estate. As part of the overall closure of the site, our Estates Manager played a critical role in supporting the shutdown of key estates infrastructure at the Canadian Embassy in Kabul.

We continue to work with the Australian Department of Foreign Affairs and Trade (DFAT) and last year we delivered a large consignment of classified logistics to their new Embassy in Vienna. Read the following case study for more information on the project.

Drainage works at the High Commission in St. George’s

The Foreign, Commonwealth and Development Office (FCDO) discovered drainage and sewerage issues at its estate in Grenada.

Case study

In December 2020, the FCDO found out that a drainage issue impacting its St. George’s estate was also affecting nearby properties. Given the severity of the issue, an immediate fix was needed.

They appointed FCDO Services to deliver a solution for them. We worked swiftly to provide a tailored approach and design solution that aligned to Post’s need. A new septic tank and storm drainage system was needed to resolve the drainage problem.

What the project involved

Our project manager worked closely with local design engineers to ensure they understood the project requirements. All the designs were then reviewed by our experts to confirm they were suitable for construction.

The storm drain design was light on detail initially, so we got one of our FCDO Services engineers to collaborate with the local engineer to ensure the designs captured the requirements successfully. Once approved, we ran a tender exercise and successfully commissioned a local construction company to deliver the new drainage system.

While the work was carried out on site, FCDO Services oversaw and quality assured the project. We held weekly virtual site meetings on Microsoft Teams with the engineers to inspect the work and deal with any issues.

Good communication key to success

These works were delivered by in-region project management staff in the Americas. This not only reduced travel costs, but also meant that the project team benefited from operating in the same time zone.

FCDO Services led regular stakeholder meetings to update them on progress throughout the project. Managed by our project manager, the design engineers also carried out regular site visits to confirm that the construction work was completed correctly.

Through ongoing and regular communication, the team ensured the works were delivered on time and to specification.

Two-phase project

The work was completed in two six-week phases. While we had unavoidable delays due to the pandemic, the first phase commenced in April 2021. This included the construction of the septic tank. The second phase, started in November 2021 and involved the construction of the storm drain.

In December 2021, the project was finally signed off following a site visit by our project manager and the locally based design engineer, to complete customer satisfaction.

Quote from customer

“FCDO Services did a great job. The installation has been very effective and has solved the original issue, ensuring our property no longer impacts on our neighbour’s premises. The team on-site were respectful and adhered to our rules and policies, particularly our Health & Safety guidance.”

Office Manager, British High Commission St George’s.

Classified Logistics for the Australian Government

FCDO Services has a long and trusted relationship with DFAT having delivered projects and services for the department since our earliest days as a Trading Fund.

Case study

In November 2021, DFAT opened a new Australian Embassy in Vienna, Austria. For the Embassy to be fully functional on opening, they needed to move 18 tonnes of classified material from Canberra to the new site in just three months.

With entry into and out of Australia being extremely difficult due to COVID-19 and Canberra under some of the strictest COVID-19 restrictions within Australia itself, this was a complex logistical task.

Door-to-door solution

The DFAT Security Infrastructure and Projects Section approached our Asia-Pacific regional team to provide a door-to-door logistics solution.

Our FCDO Services Logistics Planner in Canberra quickly responded, and supplied a proposal for how we could transfer the material for them in such a short period of time safely and securely.

Once accepted, the work started immediately to ensure the opening of the embassy could stay on track, with our regional team coordinating the works from Australia.

The project involved a packing and storage component to securely prepare the material, followed by the utilisation of our Queen’s Messenger Service. Finally the co-ordination of the freight’s secure unload on-site was performed by our dedicated Logistics team using secure FCDO Services vehicles.

The consignment travelled from Canberra to London, and then onwards from London to Vienna. With such a large consignment and irregular travel arrangements, good communication was crucial to ensure all parties were in place at the right time.

Impact of COVID-19

The pandemic continued to cause disruption this year. The Omicron lockdown in Canberra and Eastern Australia meant the logistics of shipping the consignment was made more difficult.

Maintaining health and safety standards, and efficiently navigating international COVID-19 quarantines, transit and border restrictions throughout the journey was critical.

Meeting such a tight deadline, in just three months from beginning to end, was no small feat. Our dedicated teams navigated these various challenges successfully and ensured all of the freight was delivered on time. This enabled DFAT to get their Vienna Embassy fully functional and opened as planned.

Quote from customer

“This shipment was complicated as it was required to be done in two stages. The FCDO Services in-country team performed extremely well with delivery completed on time. This allowed for the project to be delivered early. A huge thanks to the logistics team for their help. Looking forward to delivering the next project with the team.”

Security Infrastructure and Projects Section, DFAT

Global deployment of the COVID-19 booster vaccine

In the run up to Christmas 2021, the FCDO Services Logistics team supported the Foreign, Commonwealth and Development Office (FCDO) to deliver the COVID-19 booster vaccine to Posts across the globe.

Case study

The FCDO needed the boosters to arrive at Posts before Christmas for countries with a high prevalence of the Omicron variant in order for staff to be vaccinated in line with the accelerated UK rollout response. Logistically this was an enormous challenge. In order to speed up delivery timescales, a call for couriers was sent out to FCDO staff, with 170 people volunteering to be Casual Couriers.

Putting a framework in place

The Logistics team had the task of training the new couriers to ensure they understood their responsibilities and had the necessary information to fulfil their role successfully. It was crucial to carry this out as the security of the diplomatic bags is paramount at all times along with complying with the policies which must be observed in transit.

FCDO Services worked closely with several departments and agencies including the Ministry of Defence (MOD), the Department for Health and Social Care, and the UK Health Security Agency (UKHSA). Our drivers had to travel back and forth to Liverpool to collect the booster vaccines and bring them to Hanslope Park.

There, the team worked overnight to pack the booster shots, along with syringes needed to administer them, into Diplomatic Bags. From Hanslope Park the vaccines departed for one of three routes. Depending on their destination, they were either driven to King Charles Street in London to be given to Couriers, directly to airports to meet a plane, or sent across to our Frankfurt Logistics Hub.

Working against the clock