FCDO accounting officer system statement 2020

Published 8 February 2021

Statement of Accounting Officer Responsibilities

I am the Principal Accounting Officer for the Foreign, Commonwealth and Development Office (FCDO). This system statement summarises how I fulfil my responsibilities as an Accounting Officer, in accordance with HM Treasury’s (HMT) guidance set out in Managing Public Money and within the responsibilities and controls as set out in my delegated authority letter from HMT.

I was formally appointed as Accounting Officer for FCDO on the 2 September 2020 when the Treasury Officer of Accounts confirmed that Accounting Officer responsibilities for the estimate and spend of the Foreign and Commonwealth Office (FCO) and the Department for International Development (DFID) were transferred to me. This means that as well as being Accounting Officer for FCDO my remit will cover both legacy FCO and DFID until funding transfers to the FCDO by way of the Financial Year 2020/21 Supplementary Estimate in February 2021.

My department leads the Government’s work internationally, promoting the UK overseas, defending our security, projecting our values, reducing poverty and tackling global challenges. This System Statement summarises the accountability relationships and processes within my department, making clear who is accountable for what.

The Foreign Secretary and other departmental ministers have a duty to Parliament to account for, and be held to account for, the policies, decisions and actions of this department and its agencies. They look to me as the Department’s Accounting Officer to support them in making policy decisions and handling public funds, and to delegate appropriately within the department to deliver their decisions.

This statement describes the accountability system which is in place at 2 September 2020 and will continue to apply until a revised statement is published.

Sir Philip Barton

Permanent Under-Secretary

Foreign, Commonwealth and Development Office

January 2021

Scope of the System

The Foreign, Commonwealth and Development Office (FCDO) pursues our national interests and projects the UK as a force for good in the world. We promote the interests of British citizens, safeguard the UK’s security, defend our values, reduce poverty and tackle global challenges with our international partners.

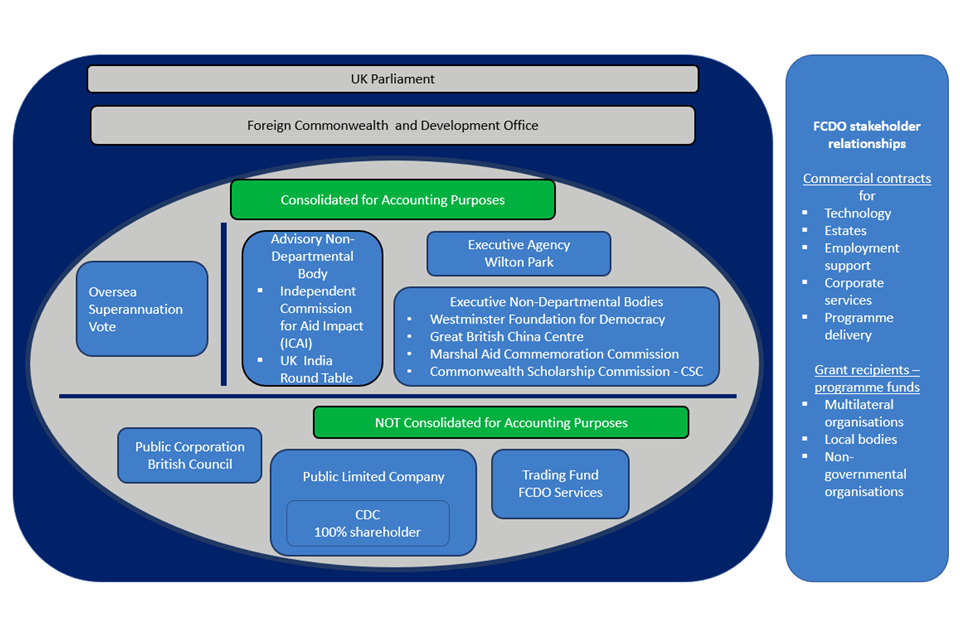

The FCDO is the sponsoring department for one executive agency, 4 executive Non-Departmental Public Bodies and 2 advisory Non-Departmental Public Bodies (NDPB). It also sponsors the British Council (a public corporation, NDPB and charity) and FCDO Services (which is a trading fund and an executive agency). FCDO is a 100% shareholder in a public limited company (CDC Group plc). FCDO operates an arm’s-length relationship for its shareholding meaning that day-to-day operations and investment decisions are independent of government.

FCDO works with the private sector, non-governmental organisations, overseas governments and other development actors including multilateral organisations. With this operating model, it can deliver at scale and flexibly across the globe including fragile and conflict-affected countries. FCDO uses a range of funding instruments to fulfil its policy objectives including grants, contracts and financial investments. FCDO’s accountability system includes an evidence-based business planning process, supported by governance, monitoring, audit, assurance and risk management processes.

Diagram 1 (below) shows the various parts of the system and how they are organised.

Diagram 1 shows the various parts of the system and how they are organised

System of accountability

The FCDO was launched on 2 September 2020 and will require a period of transition before the budget and control frameworks are fully integrated. A “twin track” for spend approval will be in operation for an interim period. This means that there will be “legacy FCO” and “legacy DFID” decisions that will require approval through existing functions.

The “twin track” approvals process means that FCDO will operate 2 separate budgets (reflecting the source of funds this financial year) until there is a Parliamentary process to merge them (the Supplementary Estimate process). Following this we will have an FCDO budget. The 2020/21 Accounts will be prepared against FCDO control totals (not DFID and FCO control totals). The current risk and control frameworks will remain in place for legacy DFID and legacy FCO respectively until that point. Maintaining current approval processes will provide consistency in line with this agreed approach and minimise disruption to the approval of essential business as usual investments during this interim period.

Governance

The FCDO’s governance structure is made up of a number of boards and committees, each with its own remit. At the top of the governance structure is the Supervisory Board, which is chaired by the Foreign Secretary and meets quarterly. The Supervisory Board provides strategic direction, oversight, support and challenge for the department with a view to the long-term health, reputation and success of the FCDO.

The Management Board, chaired by the Permanent Under-Secretary (PUS), ensures the organisation delivers departmental priorities and objectives set by Ministers. It also ensures rigorous management of performance, strategic risk and people and duty or care to staff. It also takes key decisions on changes in management approach. It is the highest official-level governance meeting and its membership includes all Directors General and relevant Directors with all Non-executive Directors invited to attend in an advisory capacity. The Management Board meets monthly.

Executive members of the Management Board meet weekly as the Executive Committee (ExCo). Reporting to the Management Board, ExCo takes decisions on strategic choices or challenges relating to sensitive or time-bound issues, day to day running of the department, emerging issues, risks or crises where early steers or a cross-departmental view, impact or action is required.

The Strategy Committee is responsible for making sure the department is fit for the future. It focuses on challenge and strategic oversight, recommending changes to the FCDO’s strategic direction, building strategic capability, assessing coherence and links into HMG strategy.

The Investment Committee is responsible for assessing whether the FCDO is spending on the right things for the best Value for Money.

The People Committee (PC) is responsible for making sure the FCDO has the best workforce to deliver. It works to enable the organisation to have the right people in the right roles at the right times to deliver its objectives and support the resilience and wellbeing of all FCDO staff.

The Delivery Committee assesses whether the FCDO is delivering what it said it would: achieving the desired effect as well as undertaking the planned activity, to high standards, across all areas of FCDO work including policy, programme and corporate.

The Audit and Risk Assurance Committee (ARAC) supports the Management Board and the PUS as Accounting Officer to review decisions and processes designed to ensure sound systems of internal control (including the overarching control framework(s) and related assurance mechanisms), risk management, financial reporting including internal controls over financial accounting, internal and external audit, arms-length bodies and counter-fraud and safeguarding. The ARAC is chaired by a Non-executive Director with suitable experience; challenges the executive; and promotes best practice across the FCDO but has no executive responsibilities. It reports to the Supervisory Board.

Programme management

During the interim period, the twin track approach will apply and all legacy FCO and legacy DFID programmes will follow the respective control frameworks associated with their initial funding channels.

Legacy FCO Programme Activity

Legacy FCO programme activity takes place within a framework set by a Policy Portfolio Framework, aligned with HMT guidance, IPA best practice and drawing on legacy DFID’s Smart Rules. Legacy FCO adopts a portfolio approach to its programme activity as mandated by HMT during the last SR period. Since 2016, a Portfolio Board consisting of ExCo members, chaired by the PUS, has set the strategic direction and risk parameters of the portfolio within the context of the legacy FCO’s wider objectives and activity. It recommended to the Supervisory Board the optimum spread of risk across legacy FCO’s policy programme portfolio and considers the largest (£10m+) and highest risk individual business cases.

The portfolio approach treats policy programme funds like an investment portfolio, focusing on alignment, accountability and scrutiny from a strategic and corporate perspective. It aims to:

- provide visibility of policy programme investments and the balance of risks represented by these

- ensure strategic decisions on the geographic and thematic spread of programme funds

- help make decisions about how programme investments fit in the overall balance of legacy FCO activities and spend

Legacy DFID Programme Activity

All legacy DFID programme activity and expenditure is designed around a set of ‘Smart Rules’ that set out the approval and management processes which spending teams should follow. The Programme Cycle Committee reviews the Smart Rules every 6 months and revises them when necessary. The Smart Rules are built on the principle of ‘empowered accountability.’ Each programme has a Senior Responsible Owner (SRO) who is accountable for programme delivery and is empowered to make day-to-day decisions. The Smart Rules and supporting documents make it clear that programme teams should proactively escalate concerns, major risks or significant changes in the operating environment.

Legacy DFID programmes are delivered within a governance framework that provides oversight from resource allocation, through programme design, to closure. It consists of 6 control points (Concept Note, Business Case, Formal Agreement, Delivery Plan, Annual Review, Project Completion Review); using standard templates wherever possible. The scope of this framework is applicable for all forms of programme expenditure.

Managing risk

Through the FCDO Management Board and Audit and Risk Assurance Committee (ARAC), there is an integrated board-level oversight of risk across the organisation. There is clear accountability for risk management during the transformation period from programme through to departmental/directorate levels. FCDO will also follow a twin-track approach to programme rules and accountabilities, whilst a harmonised framework is established. This means that the existing risk management frameworks will continue to apply under the delivery model defined by the Smart Rules for legacy DFID-funded programmes, and the Policy Portfolio Framework for legacy FCO-funded programmes.

Over the transformation period, we will define a risk appetite and framework covering the breadth of FCDO’s business and in line with HMG best practice. Our risk framework will underpin continuous improvement in risk management. To achieve best results, we will work across the 3 lines of the defence, draw on ARAC guidance and insights from audit reports, build links with planning and performance and make best use of management information systems.

Control and assurance framework

In FCDO, internal controls protect funds and assets from fraud, error or loss, and give assurance that risks are effectively addressed, and objectives achieved.

During the interim period, during which a single FCDO control framework is in design, the legacy FCO and legacy DFID control frameworks continue to operate to ensure that there is no weakening in the level of control and assurance over use of funds and resources and management of risk.

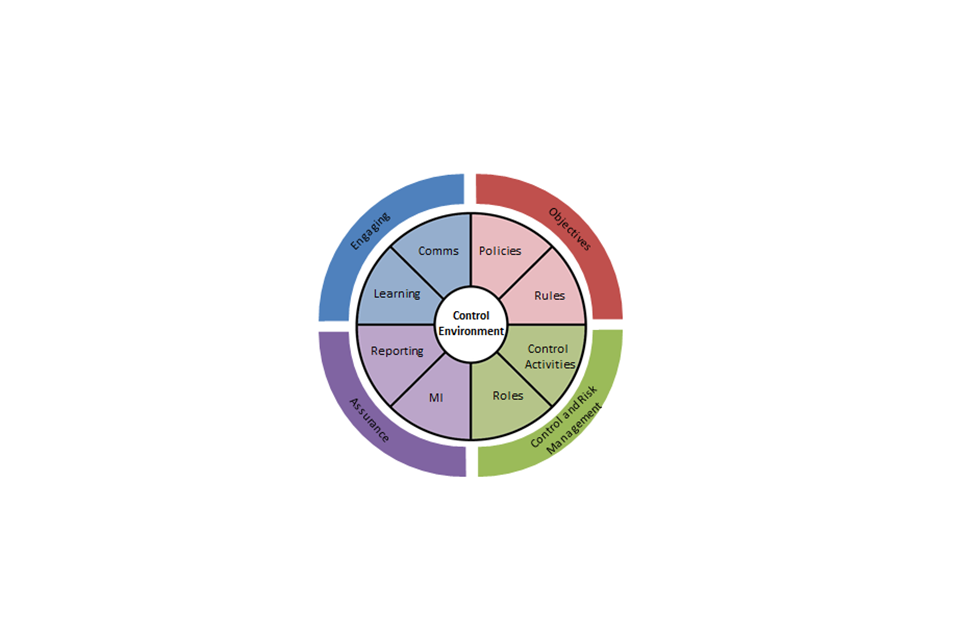

The legacy DFID Control and Assurance Framework applies to all legacy DFID staff and includes a series of inter-related components: the control environment; objectives; risk assessment; control activities; and monitoring and assurance activities. For corporate processes, the framework provides:

- clear rules, policies and guidance

- control and responsibility matrices

- management information

- robust assurance processes and tools

Figure 2 – Control and Assurance Framework

Figure 2 – Control and Assurance Framework

Although not framed in exactly the same manner, the legacy FCO rules, policies and guidance will also continue to apply during this interim stage until a new, single FCDO control framework is implemented.

Control environment

The legacy DFID control environment operates across the 3 lines of defence model setting out the roles, responsibilities and expectations of all staff to make sure it meets its objectives.

Figure 3 – Three lines of defence

| First line responsibilities | Second line responsibilities | Third line responsibilities |

|---|---|---|

| Identifies, assesses, controls, and mitigates risks | Alignment of strategic objectives with risk assessment and related responses | Provides independent, objective assurance |

| Applies internal controls and policies | Ensures the first line of defence is properly designed and operating as intended | Recommends improvements to the management of risk and control activities |

| Executes risk and control procedures on a day-to-day basis | Designs and implements risk management policies and procedures | Independent investigation of fraud and allegations of malpractice in first two lines |

| Responds to changes in risks / risk appetite | Provides methods and tools to support management of risk | |

| Implements corrective action to address deficiencies | Monitors compliance with risk and control policies | |

| Manages and supervises to ensure compliance and identify any breakdown in controls. |

- the first line of defence is fulfilled by front-line teams who own the decisions they take which reflect risk-based judgements

- the second line of defence sets the policy, procedures and guidance and monitors compliance through constructive challenge. Corporate departments support first line teams to build the capabilities they need to operate within the Control Framework

- the third line of defence provides independent oversight and scrutiny ensuring that the Framework remains appropriate and is adhered to. It is provided internally by the Internal Audit Department and the Audit Risk and Assurance Committee

Legacy FCO also operates a system based on a model of 3 lines of defence. The first line is supported through the twin pillars of clear guidance to line managers/budget holders with penalties for non-compliance, and an ERP system providing clear authorisation audit trails. Second line assurance is currently provided across a range of functions with arrangements varying by functional area. The third line is delivered by the Internal Audit Department (IAD) (including the Anti-Fraud & Corruption Unit (AFCU)), which reports to the FCDO Audit & Risk Assurance Committee (ARAC). Annual NAO audits of legacy FCO accounts and overseas Posts also support the third line.

Central second-line assurance in the legacy FCO is currently provided by the Annual Consolidated Certificate of Assurance (ACCA). This is a process at the end of each financial year, during which all Heads of Mission overseas and central Directors are required to confirm that they and their missions or directorates have followed policy and process guidance. Financial Performance and Compliance Indicators (FPCIs) and Key Performance Indicators (KPIs) are also used to monitor compliance and performance through the year.

Impact of Covid-19 on FCDO’s control framework

The impact of the Covid-19 pandemic on the legacy FCO and legacy DFID control frameworks is being actively managed and continues to be monitored. Where external context, fiduciary and safeguarding risks have increased due to enforced changed ways of operating, FCDO teams have been working closely with partners to ensure risks continue to be monitored and appropriate controls are in place. To support a timely response to the pandemic, new Covid-19 related spending was approved through humanitarian approval processes. The ongoing impact will continue to be managed to support FCDO and HMG objectives in line with FCDO’s duty of care and value for money commitments.

Counter fraud and corruption

The Director General for Finance and Corporate is FCDO’s Counter Fraud Champion. The Counter Fraud Champion sets the tone and oversees the fight against fraud and corruption by instilling an anti-fraud culture in the organisation. Responsibility to manage the risk of fraud resides at all levels within FCDO including assurance, programme delivery, policy and corporate functions.

The Control and Assurance Team is responsible for shaping the counter fraud and aid diversion framework ensuring governance, risk management and control and assurance processes are in place. The team currently operates across the legacy DFID portfolio providing direction and support to equip staff to have the capacity, capability and confidence to deliver their responsibilities, with legacy FCO Internal Audit providing support for legacy FCO staff.

The Internal Audit Investigation Team is an independent investigative unit that sits within the Internal Audit Department. It is responsible for leading and undertaking investigations including those related to sexual abuse, exploitation and harassment. It manages FCDO’s independent reporting hotline reportingconcerns@fcdo.gov.uk where all staff must report any potential misappropriation of FCDO funds.

Fraud Liaison Officers provide a link between individual offices/departments and the Internal Audit Investigation Team. This work includes supporting individual enquiries and increasing understanding and awareness of risks within the country office/ department.

The National Audit Office will be advised of all frauds as part of the routine reporting to the Departmental ARAC.

The Foreign Affairs Committee (FAC) should be advised of any material or “novel or interesting” fraud relating to the FCDO. Normally this should be as part of the PUS’s quarterly letter to the Chairman of the FAC. This communication should be considered in the public domain as Parliamentarians can discuss any communication sent to the them in public. In cases where confidentiality is required PUS approval should be sought for an oral briefing to the FAC. In any case as the NAO brief the FAC for the PUS’s autumn oral evidence session, and will be aware of all fraud cases, the FAC should be made aware of relevant cases before the oral evidence session.

Safeguarding

Safeguarding for FCDO means taking all reasonable steps to prevent harm, exploitation and abuse from occurring and to protect people (especially vulnerable adults and children) from that harm. FCDO continues to place a particular focus on preventing sexual exploitation, abuse and harassment (SEAH) across the twin tracks. Currently 22 FCDO staff, including the Safeguarding Unit, work full-time on SEAH. Clear expectations about FCDO staff conduct related to SEAH meeting the highest international standards were put in place from day 1 of the new organisation.

Teams and partners should escalate any concerns or credible suspicions of SEAH as they arise, reporting them through our independent reporting hotline or email address reportingconcerns@fcdo.gov.uk or +44 (0) 1355 84 3747. FCDO’s Safeguarding Investigations Team is accountable for ensuring an appropriate investigatory response to all reported concerns.

Preventing the abuse and exploitation of beneficiaries of FCDO-funded programmes starts at the design phase. It then runs throughout a programme’s lifecycle with several control points that provide opportunities to anticipate, identify and respond to safeguarding concerns, including the sexual exploitation and abuse or sexual harassment of beneficiaries.

FCDO is committed to improving safeguarding standards across the aid sector. FCDO aims to ensure that all those working to reduce poverty internationally take all reasonable steps to prevent harm, particularly sexual exploitation, abuse and harassment from occurring; listen to those who are affected; respond sensitively but robustly when harm or allegations of harm occur; and learn from every case.

FCDO will continue to convene regular meetings about safeguarding with partners, donors, representatives of vulnerable groups and other interested parties. FCDO will continue to fund and support initiatives to stop perpetrators, to build sector capability and adherence to internationally agreed safeguarding standards, and to support survivors and victims of SEAH. FCDO will adapt its approach as needed to emerging evidence and challenges such as COVID-19.

FCDO will continue to support the safeguarding work of all UK Government Departments who spend ODA based on the 2020 UK government ODA safeguarding strategy.

Audit and assurance

FCDO’s risk and assurance arrangements support the delivery and accountability requirements of the Accounting Officer and the Management Board, providing evidence-based assurance on the management of risks that threaten successful achievement of public service delivery objectives.

Internal Audit Department provides an important source of assurance to the Accounting Officer and to the Audit and Risk Assurance Committee. It is an independent function which reports outside the line management chain to the Accounting Officer, reviewing all FCDO’s activities periodically.

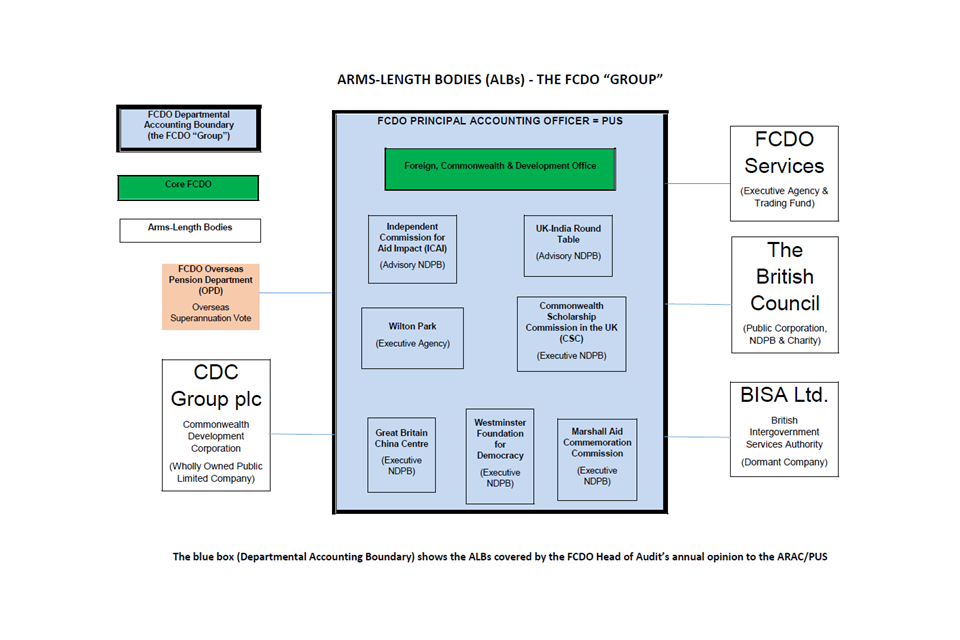

Diagram 2 (below) sets out the scope of the Internal Audit assurance and opinion.

Diagram 2 sets out the scope of the Internal Audit assurance and opinion

The National Audit Office (NAO) is the external auditor of the Core Department, the FCDO Group and other FCDO sponsored bodies (with the exception of CDC), and provides an additional line of independent assurance. The NAO is responsible, on behalf of Parliament, for holding the FCDO to account for its use of public money. The NAO audits the FCDO Group’s Annual Report and Accounts and provides a public audit opinion, as well as carrying out value for money studies and thematic investigations.

The Parliamentary International Development Committee (IDC), the Public Accounts Committee (PAC), Foreign Affairs Committee (FAC) and the Independent Commission for Aid Impact (ICAI) provide further scrutiny and independent oversight.

The IDC monitors FCDO’s policy, administration and spending, along with that of its associated public bodies. The IDC takes an interest in the policies and procedures of the multilateral agencies, contractors and non-government organisations to which FCDO contributes. The Committee consists of 11 Members of Parliament and sets its own programme and chooses subjects for inquiries.

The PAC scrutinises value for money (the economy, efficiency and effectiveness of public spending) and generally holds FCDO and its non-departmental bodies (NDPBs) to account for delivery.

The FAC examines the expenditure, administration and policy of the Foreign, Commonwealth and Development Office (FCDO) and other bodies associated with the Department and within the Committee’s remit, including the British Council.

An annual Governance Statement is included within the Annual Report and Accounts. It will cover FCDO’s corporate governance, risk management and internal control arrangements. This statement incorporates an evaluation on how well the arrangements have operated in practice based on assurance received from the Internal Audit Department and through the Statement of Assurance exercise and management information produced as part of FCDO’s in-year assurance activities.

Directors, Heads of Mission and Heads of Department will provide assurance that FCDO internal controls and corporate governance arrangements have been consistently applied within their business unit (or explain where these have not been so applied) through a twin track assurance process for 2020/21 following the twin track control frameworks. For legacy DFID business units, staff and spend, this will take the form of the annual Statement of Assurance exercise. Legacy DFID had been working on improving its management information reporting through the development of a series of dashboards and response analysis to strengthen the integrity of the information captured, and legacy DFID will use some of this in-year assurance for the legacy DFID elements of the FCDO assurance report. For legacy FCO teams, the Annual Consolidated Certificate of Assurance (ACCA) will be used to gain assurance that policy and process guidance has been followed, as referenced above.

Value for money

Value for money (VFM) in FCDO means that it works to maximise the impact of each pound spent to deliver FCDO’s objectives and priorities; to promote the interests of British citizens, safeguard the UK’s security, defend our values, reduce poverty and tackle global challenges with our international partners. FCDO has a responsibility to those living in extreme poverty and to the UK taxpayer to ensure that its actions maximise VFM.

FCDO implements strong VFM systems and processes in all aspects of its work, articulated through 4 levels of activity: strategic, portfolio, programme and administrative.

At a strategic level, FCDO works to improve all spend to influence the international system to amplify the impact of our and others’ programming. At a portfolio level, FCDO ensures its resources are allocated effectively, ensuring that portfolios are coherent and capitalise on synergies. At a programme level, FCDO ensures that the design, procurement, management, and evaluation of its interventions maximise impact. And at an administrative level, VFM means that our systems, cultures and behaviours empower staff to deliver more efficiently, whilst ensuring full accountability to the British taxpayer.

Relationships with Arm’s Length Bodies

Across the public sector, Arm’s Length Bodies (ALBs) are grouped into a number of classifications agreed with Cabinet Office and the Office of National Statistics (ONS). These include Executive Agencies, Non-Departmental Public Bodies, Non-Ministerial Departments, Public Corporations, and Non-Classified Government Entities. There are some ALBs that hold more than one classification, reflecting the particular delivery model adopted when it was initially set up. For instance, Trading Funds are an exceptional form of Executive Agency which are also classified by ONS as public corporations.

In the FCDO the Accounting Officer is responsible for one executive agency, 4 executive NDPBs and 2 advisory NDPBs. In addition, it sponsors the British Council (a public corporation, NDPB and Charity) and FCDO Services (which is a trading fund and an executive agency). FCDO is also a 100% shareholder in a public limited company (CDC Group plc). FCDO operates an arm’s-length relationship for its shareholding meaning that day-to-day operations and investment decisions are independent of government.

The FCDO’s role in the governance structure of NDPBs is that Ministers appoint NDPB board members, in accordance with the Commissioner for Public Appointments’ Code of Practice for Ministerial Appointments to Public Bodies. This gives the FCDO oversight of the individuals who will be governing each NDPB.

The PUS appoints the Accounting Officer for each of the NDPB’s with the exception of the FCDO Services where HMT makes the appointment. Each produces its own accounts. While NDPBs enjoy a certain level of autonomy over their own affairs, a Framework Agreement is in place to agree the conditions of expenditure of the grant-in-aid (GIA). They are signed by the Chair, Chief Executive or equivalent of the external body, and the Budget Holder and Director within the FCDO providing the funds.

The FCDO’s relationship with each NDPB is agreed and set out in a published Framework Agreement. This includes sections on funding levels, jointly agreed priorities, performance measures, engagement, financial controls and the governance framework. This formalises the relationship between FCDO and the NDPB and establishes accountability, responsibilities and monitoring activities. The Framework Agreement also sets out where the NDPB is held to account for delivering its priorities. The contents of the Framework Agreements are monitored annually.

Each NDPB has a sponsor team. This is a team within FCDO that is the primary contact for the NDPB and takes on the day to day responsibility for the NDPB’s relationship with the Department, and for monitoring the delivery of its policy/operational priorities. The overall aim is that the relationship between the sponsor team and the NDPB should be open and transparent, to ensure that information flows freely. The sponsor teams provide ALBs with advice on how to engage across government and with Ministers. They aim to facilitate relationships and contact for the ALBs with other Government departments and colleagues working in Posts outside the UK.

Sponsor teams have regular engagement with the senior management team of each ALB, and the FCDO is represented on the Board of Trustees for MACC, CSC, Wilton Park and the British Council and on the Board for the GBCC. Feedback is sought regularly from ALBs through regular meetings, to confirm that the relationship is on track and that any issues raised are being addressed. We work in partnership with the ALBs to manage any joint concerns.

Although the FCDO Board takes a risk-based approach to our ALBs; it is proportionate and based on current resources. The FCDO Head of Internal Audit has the right to review the audit committee agenda papers of each ALB (including audit reports and accounts) and has the right of access to attend if necessary. Risks are included on Directorate Risk Registers when appropriate, and information is shared with the ALB. The department tries to take a proportionate approach however this is dependent on circumstances.

The feedback from ALBs on this approach is generally positive, they recognise it is important to note and track risks, and to understand whether the risks impact on the sponsor relationship or FCDO priorities.

An assessment of each body against these categories is carried out at least once in every Parliament, as a precursor to producing the new framework agreements. This is designed to ensure that the framework agreements are tailored according to an up-to-date analysis of track record, strengths and weaknesses, and operating environment.

In February 2017, the Cabinet Office launched a Code of Good Practice for developing partnerships between departments and ALBs. The code sets out 4 overarching principles of good practice – Purpose, Assurance, Value and Engagement (PAVE) – as the starting point for bringing greater consistency to this relationship. The FCDO is engaging with its ALBs to fully align with the Code of Good Practice. This has included the use of the Cabinet Office Gap Analysis, which highlights where more work is needed to develop effective partnerships with the ALBs.

The previous Triennial Review process has now been replaced by Tailored Reviews in line with Cabinet Office guidance. Tailored Reviews are undertaken at least once in the lifetime of a Parliament. These reviews challenge the supposition that the body should continue to be required, as well as looking at the body’s efficiency in delivering the agreed objectives.

Advisory NDPB: UK India Round Table

The UK India Round Table is largely independent, it has 2 main functions: of providing advice and strengthening the bilateral relationship. The advisory body has no permanent personnel as it is only assembled on an ad-hoc basis. On this basis, there are no formal accountability relationships in place with the advisory body.

Advisory NDPB: Independent Commission for Aid Impact

The ICAI was established in May 2011. It provides independent evaluation and scrutiny of the impact and value for money of all UK Government ODA. It reports on its work to Parliament through the International Development Committee.

A Framework Agreement between FCDO and ICAI sets out the governance arrangements designed to ensure ICAI’s propriety and value for money while safeguarding its operational independence. The legacy DFID acting Permanent Secretary appointed the Head of ICAI’s Secretariat as the designated Accounting Officer for ICAI who is responsible for the safeguarding of public funds. FCDOs systems are used to make all payments for ICAI. ICAI is subject to FCDO’s control framework including review by FCDO’s Internal Audit Department. The most recent audit was completed in 2020. ICAI reports are considered in closed sessions of the FCDO ARAC.

On 16 December, the Foreign Secretary published his review on ICAI. As a result, ICAI’s remit will be enhanced to support Government learning whilst continuing to deliver independent evaluation and scrutiny. The report made 14 further recommendations to strengthen ICAI’s impact, and provide practical, action-oriented recommendations to support Government.

ICAI publishes its Annual Report and Accounts in June of each year.

Executive Agency: Wilton Park

Wilton Park is an Executive Agency of FCDO but is managed like an internal business unit. It is managerially separate but without the same level of legal separation as NDPBs. Wilton Park acts as an arm of FCDO and is responsible for undertaking particular executive functions of the Department.

Its principal objective is to support the delivery of the FCDO’s strategic priorities through convening foreign policy discussions. Wilton Park receives funding direct from the FCDO. In normal circumstances Wilton Park also derives approximately 60% of its income from charges for its services from FCDO departments, other government departments, foreign ministries, NGOs and business, however this has been affected by the Covid-19 pandemic.

The Chief Executive is appointed by the Permanent Under-Secretary as Accounting Officer (AO) for Wilton Park. The Communication Directorate in the FCDO is responsible for managing the overall relationship and the Director of Communication is the Senior Departmental Officer (SDO). Wilton Park’s accounts are consolidated within FCDO accounts and FCDO therefore obtain continuous sight of financial performance: monthly management accounts are shared with the FCDO’s SDO and Finance Manager.

The Wilton Park Board comprises of a non-executive Chair, Chief Executive, 4 non-executive directors and 3 senior HMG officials, one of whom is the SDO. It meets at least 4 times a year to oversee the leadership and direction of Wilton Park and ensure that effective arrangements are in place to provide assurance on risk management, governance and internal control. The Board has established an Audit and Risk Assurance Committee (ARAC) as a Committee of the Board, chaired by an independent non-executive member to provide independent advice. The ARAC meets at least 4 times a year and the outcomes of the ARAC are reported to the Board.

Public Corporation: British Council

The British Council is a registered charity, a public corporation and an NDPB of the FCDO. ONS have classified the British Council as a Public Non-Financial Corporation, with Cabinet Office classifying it as an NDPB. The Council was created by a Royal Charter which defines its charitable aims and specifies its purpose. It maintains operational independence from Government. However within the objects of the Charter and the Council’s charitable status, the Board of Trustees and the Foreign Secretary have defined the overall aim of the British Council as follows: to create international opportunities for the people of the UK and other countries and build trust between them worldwide.

The Management Statement and the Financial Memorandum (currently in the process of being updated) are the framework documents which define the relationship between the Council and Government. The delegated authority limits set by HMT are included the Financial Memorandum. The Foreign Secretary accounts for the activities and performance of the British Council in Parliament and he approves the amount of grant-in-aid to be paid to the British Council.

The appointment of the Chair and Chief Executive of the British Council are subject to the Foreign Secretary’s prior approval. The Chair and other Board members are responsible for ensuring that the British Council fulfils its aims and objectives set in agreement with the Secretary of State. The Foreign Secretary currently nominates one Trustee. The FCDO’s Permanent Under-Secretary as Principal Accounting Officer designates the British Council’s Chief Executive as Accounting Officer. As Accounting Officer, the Chief Executive is personally responsible for safeguarding the grant-in-aid funds for which he has charge, for ensuring propriety and regularity in the handling of those public funds; and for the day-to-day operations and management of the British Council.

As part of the 2019 Tailored Review recommendations, the sponsor team has formalised points of contact between senior FCDO officials and British Council opposites, and established the biannual Strategic Forum, which provides an opportunity for senior dialogue and discussion on high-level strategy plans and major decisions. This is in addition to the regular meetings between the sponsor team and British Council officials. Risk oversight measures within the framework documents are under review as part of the broader update to the documents.

Trading Fund: FCDO Services

FCDO Services is an agency of FCDO and has also been a trading fund since April 2008. As a trading fund it generates its own income to fund its activities. This takes FCDO Services outside of the Supply process as it receives no financial support from FCDO. FCDO Services is not a separate legal entity and remains part of FCDO. Ultimate responsibility for FCDO Services as an organisation rests with the Foreign Secretary, who delegates responsibility to an FCDO Minister. A Framework Agreement summarises the relationship between FCDO Services and FCDO in more detail. The FCDO Services Accounting Officer is appointed directly by HMT. The current post holder also holds the role of Chief Executive.

FCDO Services delivers a range of secure products and services; as well as protecting people, property, information and data assets for the FCDO, other UK government departments and the public sector; foreign governments; and international organisations closely linked to the UK. Their services include secure cloud technology, consultancy, cyber and technical security, monitoring, protective security, overseas technical support, secure logistics, estates and construction, translation and interpreting.

The FCDO holds an investment in FCDO Services, comprised of 100% of its Public Dividend Capital. As a public corporation FCDO Services is not included within the FCDO departmental boundary.

FCDO Services’ financial performance is measured against 2 key financial performance indicators: In year surplus before interest and Return on Capital Employed (ROCE). An annual statutory dividend is payable to the FCDO. The charge is calculated at a rate set by HMT on the average capital employed during the year.

Executive NDPB: Commonwealth Scholarship Commission

The Commonwealth Scholarship Commission in the UK (CSC) is an NDPB and was established by an Act of Parliament in 1959. The Foreign Secretary appoints up to 14 Commissioners and a chair following the Cabinet Office Public Appointments Code of Practice and the International Development Act 2002. The CSC manages the UK’s contribution to the Commonwealth Scholarship and Fellowship Plan, an international programme under which member governments offer scholarships and fellowships to citizens of other Commonwealth countries.

The Foreign Secretary is accountable to Parliament for the activities and performance of the Commission. The International Development Act 2002 sets out the responsibilities of the Foreign Secretary. The FCDO Permanent Under-Secretary is the Principal Accounting Officer with the CSC Chair designated Accounting Officer responsibilities for the CSC. This designation was made by the legacy DFID Permanent Secretary, as Principal Accounting Officer for legacy DFID’s accounts prior to the formation of FCDO.

The Commissioners oversee the running of CSC, taking decisions on its strategic direction and selecting scholars and fellows. The CSC has no employees, contracting out its secretariat and other management functions to 2 external bodies: The Association of Commonwealth Universities in the UK and the British Council overseas.

CSC’s governance, financial controls, assurance arrangements and performance monitoring mechanisms are set out in the Framework Document and an associated Financial Memorandum signed between FCDO and CSC in line with Cabinet Office guidance on NDPBs. FCDO’s Internal Audit Department carries out regular audits of CSC. The latest audit was completed in March 2020. A gap analysis tailored review of the CSC concluded and was agreed by Cabinet Office Public Bodies team in March 2020.

Executive NDPB: Westminster Foundation for Democracy

Westminster Foundation for Democracy (WFD) is an arm’s length body of the FCDO dedicated to supporting democracy around the world. Operating directly in over 40 countries, WFD works with parliaments, political parties, and civil society groups as well as on elections to help make countries’ political systems fairer and more inclusive, accountable and transparent. FCDO is the main sponsor of the Westminster Foundation for Democracy (WFD). The FCDO Permanent Under-Secretary is the Principal Accounting Officer with Accounting Officer responsibilities designated to the Chief Executive. Accounting Officer responsibilities are described in the Framework Agreement between FCDO and WFD.

Executive NDPB: Great British China Centre

The Great Britain China Centre (GBCC) is a non-departmental public body established in 1974 by FCDO to strengthen the UK-China relationship. The FCDO Permanent Under Secretary is the Accounting Officer for the Great British China Centre. The GBCC’s framework agreement outlines how relations are governed between the GBCC and the FCDO. This is not legally binding, but it is formally agreed by both parties and outlines good practice, including on cost controls.

Executive NDPB: Marshall Aid Commemoration Commission

The Marshall Aid Commemoration Commission (MACC) administers the British Marshall Scholarships, which finance young Americans of high ability to study for a graduate degree in the UK. FCDO is the main sponsor of the Marshall Aid Commemoration Commission. The FCDO Permanent Under Secretary is the Principal Accounting Officer with Accounting Officer responsibilities designated to the Marshall chair. Accounting Officer responsibilities are described in the Framework Agreement between FCDO and the Marshall Aid.

Overseas Superannuation Vote

FCDO, through its Overseas Pensions Department (OPD), is responsible for the administration and payment of pensions and related benefits to former expatriate colonial civil and public servants, including those derived from service and military capacity in former British India, Sudan and Egypt public service. OPD manages the schemes, which are closed to new members. OPD is also responsible for the formulation of HMG’s policy on overseas pensions and UK pension increase supplements.

The majority of pensions come from 2 policy initiatives by the British Government: a 1962 agreement to supplement the pensions paid to certain former colonial civil servants, and a 1970 announcement that the British Government would assume responsibility from overseas governments for the payment of pensions due to expatriate colonial civil servants who had mainly been appointed by, or on behalf of, the Secretary of State for the Colonies. The 103 pension schemes set up are covered under the following Acts of Parliament:

- Overseas Pensions Act 1973

- Pensions (Increase) Act 1971, as amended

- Hong Kong (Overseas Public Servants) Act 1996

- UK Police and Firemen Acts 1997

OPD is part of FCDO’s control and assurance framework and the National Audit Office audit its accounts.

Grants

Across the twin track, FCDO provides grant funding, through its overseas missions, country offices and central departments, to a wide range of organisations including Civil Society Organisations (CSOs), other governments and multilaterals. More information about our work through multilaterals can be found in the Multilateral Funding section below.

In December 2016, the Cabinet Office introduced government grants minimum standards to ensure that taxpayers’ money, awarded through government general grants, is spent as intended. The standards have been embedded in FCDO’s grant process and we gain assurance of compliance through the programme cycle and control framework which are well aligned with the standards. The FCDO is continuing to work with the Cabinet Office, including through the 2020/21 grant maturity assessment to strengthen our alignment with the standards as the new FCDO programme operating framework is developed.

All grants to CSOs are designed, approved, managed and closed in line with FCDOs programme cycle and the 6 control points outlined above. FCDO transfers responsibility for delivery of grant outputs and outcomes to grant recipients through formal grant arrangements. FCDO receives initial assurance that the recipient’s policies, procedures, processes and systems are robust through a due diligence assessment prior to issuing the grant letter. Assurance throughout the delivery of the grant comes from regular meetings with partners, using delivery plans to monitor finance, risk and results and, where applicable, through formal annual reviews. Project completion reviews are undertaken to provide final assurance that the grant has delivered against expected outputs and outcomes.

FCDO may engage a fund manager to manage larger grant schemes. In such cases, FCDO transfers responsibility for the selection process and management of grant awards in line with FCDO and wider government rules through a contract following a formal contracting procedure. FCDO officials will continue to provide policy direction and approve the final grant awards.

The FCDO has a grant-based relationship with BBC World Service (BBCWS), which is part of the BBC. The BBC is a sponsored body of the Department of Digital, Media, Culture and Sport (DCMS).

The BBC World Service is established under the same Royal Charter as the BBC’s UK services. The BBC Executive Board is accountable to the BBC Trust for the Service’s performance. The Foreign Secretary agrees, jointly with the BBC Trust the Service’s objectives priorities and targets, although editorial control rests entirely with the BBC.

The grant relationship is managed through regular meetings between officials in the FCDO and the BBC World Service. Responsibility in FCDO lies with the Director of Communication. Other meetings take place as required, at official level. The BBC provides quarterly financial and activity reports, and report annually to ministers on progress against targets and other metrics.

Major contracts and outsourced services

Contracting is an important part of FCDO’s delivery model providing access to world class expertise in specialist areas, whilst allowing operational flexibility. Across the twin track, FCDO tenders its contracts in accordance with the UK Public Contracting Regulations 2015 or Defence and Security Public Contracts Regulations 2011 as appropriate. This legislation requires authorities to observe the principles of equal treatment, non-discrimination and transparency. FCDO’s contracts are competitively tendered following a set of standard processes set out in the regulations with transactional activity being undertaken globally, regionally and locally.

If a contract is selected with a supplier as the best delivery route, FCDO requires maximum value for money throughout the life of the contract. Consideration is given to the programme design and requirements, the most appropriate public procurement route to ensure sufficient competition and value for money and quality, tender evaluation and the management and evaluation of the programme and contract to deliver the maximum impact for FCDO. In delivering UK AID, the effectiveness and value for money of FCDO’s partners are subject to scrutiny, both in advance and throughout delivery. FCDO looks for the right combination of technical and country expertise, ability to provide value for money, and capacity to mobilise and manage the programme as part of the tendering process.

FCDO responded quickly to help mitigate the impacts of COVID-19 on UK nationals and on the delivery of UK aid programmes and supply chains. UK nationals overseas were successfully repatriated bringing in commercial arrangements and infrastructure to enable flights to be sourced at pace and where need was identified. Our charter operation brought over 38,000 people back to the UK, on 186 flights, from 57 different countries and territories. In addition, more than 19,000 British passengers from 60 cruise ships were successfully disembarked, including 1,500 people on direct or supported charters. Staff worked around the clock to keep hubs and transit routes open and provide consular assistance to those most in need, enabling 1.3 million British nationals to return via commercial routes, of whom we estimate 132,000 were on flights directly assisted by HMG.

Greater flexibility was made available to aid programme SROs to maintain programme delivery and continued value for money, including appropriate amendments to payment schedules, milestones and working arrangements. Following the publication of Cabinet Office guidance on supplier relief, FCDO extended the supplier relief policy from UK based suppliers to suppliers globally and where essential services or aid needed to be maintained.

In addition, the FCDO has the following major contractual arrangements now in place:

-

healthcare for UK employees deployed overseas – A Healthcare Category Strategy has been completed. A key strategy outcome was the FCDO-led mobilisation and commencement of the ‘One HMG Healthcare’ contract on 1 October 2020. This strategically important contract offers improved medical service provision for approximately 26,000 ‘UK based’ staff and dependents during their deployments to our overseas platform, in pursuit of HMG objectives

-

estates (Design and Construction), Security – (Guarding, Equipment and Other Services) and Facilities Management - All 3 areas of essential services for FCDO operations and platform overseas have seen major commercial activity recently. A Construction Dynamic Purchasing System (DPS), creating a global platform for suppliers to sign up to undertake construction work for the FCDO, has been developed and will be in place in 2020 which will enable the FCDO to streamline procurement processes and develop the construction market and ensure there is sufficient competition and understanding of our needs in developing our estate, similarly a Global DPS has been put in place for facilities management

-

global travel – a major improvement project is ongoing for the FCDO’s Travel provision. Following close engagement with Crown Commercial Service to identify and appoint a new Travel Management Company in August 2020, the FCDO is currently implementing a new Global Travel solution. The first stage is the rollout for UK users in late 2020, followed by rollout to overseas regions in 2021. The Programme will see benefits from contract consolidation, improved travel management information and Duty of Care, along with forecast savings potential of up to £24m in our global travel expenditure, over the life of the new contract

-

St Helena Airport - the aim of the project is to deliver sustainable air services to St Helena by building an airport and associated infrastructure, thereby underpinning the St Helena Government’s drive towards increased financial self-sufficiency. Air services have been fully operational since October 2017, carrying 18,230 passengers up to March 2020. The COVID-19 pandemic has severely affected international air travel and tourism; which has had a knock-on effect to the island’s fledgling tourism industry. FCDO is working in partnership with the St Helena Government to re-establish air services when conditions permit, but the airport has meantime enabled access for charter flights and lifesaving medical evacuation flights

-

Security Awareness in Fragile Environments (SAFE) Training – a new contract has been awarded for this training provision. The contract, which commences on 1 January 2021, offers essential security awareness training for HMG staff deployed to fragile environments overseas. In the light of the COVID-19 crisis, the contract offers both flexible face-to-face and remote training options and is forecast to save participating departments more than £750k over the life of the contract in reduced course fees

Multilateral Funding

COVID-19 has demonstrated that a strong, well-functioning multilateral system is in the UK’s interests, and the creation of FCDO brings together our overseas efforts on aid and diplomacy so we can remain a champion of the international system and maximise our influence across the world.

Development and humanitarian multilaterals received around 30 to 40% of the UK’s Official Development Assistance (ODA) budget in core contributions in the last 5 years. In addition, bilateral programmes can use multilaterals to deliver projects (known as multi-bi programmes), accounting for around 20% of ODA. Multilaterals can mobilise significant resource and expertise including from other donors to deliver key outcomes that support the UK’s global force for good ambitions, expand our reach and influence, and support action to tackle global challenges that the UK cannot address alone.

The UK’s investment, through both assessed and voluntary contributions, and engagement in multilateral institutions gives us significant influence in driving reform and improvements to make multilaterals more efficient and transparent, and to shape the broader international system in line with UK values. Our investments must be clearly justified in relation to UK priorities, multilateral performance and value for money, and are regularly assessed to ensure they deliver results, remain cost effective and prove good value for money for UK taxpayers. At Board meetings and in committees, UK delegations work closely with other donors to hold multilateral institutions to account, ensure strong results and secure reform where desirable.

Investments, joint ventures and other assets

FCDO is increasingly making investments, which we call development capital, to create jobs, catalyse private sector investment and build markets in challenging regions. Long-term capital can demonstrate the financial viability of investing in the world’s poorest countries, reducing costs and risk for private investors. In this way, FCDO-supported investments can draw in multiples of the funds invested and put economic development on a sustainable footing.

CDC Group plc

Through the office of the Foreign Secretary, FCDO holds 100% of the issued share capital of CDC Group plc, which is a development finance institution. It invests in private sector businesses in Africa and South Asia to create jobs and make a lasting difference to people’s lives in some of the world’s poorest places.

As the UK’s development finance institution, CDC is FCDO’s principal partner on development capital. CDC brings needed capital to the poorest and most fragile countries to support businesses to thrive. CDC delivers development benefits alongside financial returns, demonstrating that investments in challenging environments can be commercially viable by building markets that generate investment opportunities for the long term. CDC has made pivotal investments across sectors including finance, mobile telecoms and infrastructure.

A Board of Directors governs CDC and is answerable to FCDO as shareholder. The Foreign Secretary appoints the Chair of the Board and 2 of the non-executive directors and agrees CDC’s Investment Policy. The Investment Policy sets 5 year objectives including instruments, geographies, excluded activities, reporting obligations and performance targets linked to financial returns and development impact. It also incorporates a Code of Responsible Investing which sets compliance standards for environmental, social and governance issues. Quarterly shareholder meetings are held to review results and progress against performance measures. CDC prepares and publishes annual audited financial statements to 31 December which are presented for approval by the shareholder at an Annual General Meeting, following normal company practice.

FCDO sets an overall profitability hurdle for CDC based on the financial return on its total portfolio and 2 performance hurdles targets for CDC which are equally weighted:

- financial return of the commercial risk total CDC portfolio

- development impact

CDC recycles all profits generated by returns on investments into new investments to deliver additional development impact. New legislation passed in 2017 enables FCDO to increase the level of financial support it can invest in CDC. FCDO currently has no plans to sell any of its shares in CDC.

Other investments

The department holds the UK interest in several International Financial Institutions which invest in and advise developing countries. FCDO’s strategy is to hold these investments for the long term.

FCDO also holds several development capital investments including investments in private equity funds, limited partnerships, companies limited by shares and debt. These investments are designed to achieve specific development aims across a sector or geographical location. The private equity funds and limited partnerships are for a fixed term and will exit the investments when they are wound-up at the end of their life. The debt instruments all have agreed schedules for repayment. For the companies limited by shares, the intention is to exit by selling shares at the end of the investment period set out in the business case.

As well as development capital investments the FCDO holds the UK government’s one third shareholding in INSTEX, a special purpose vehicle to facilitate legitimate trade between European companies and Iran as part of the continued efforts to preserve the Joint Comprehensive Plan of Action (JCPOA). The UK plus France and Germany (the E3) created INSTEX to function as a clearing and netting mechanism through which Iran can facilitate payments related to their exports without the need for a direct banking channel.

Given the added complexity of financial investments, FCDO’s Director, Finance and Delivery is responsible for all approvals prior to a business case submission to Ministers.