Evaluating the impact of British International Investment’s infrastructure portfolio: final report

Published 13 April 2022

Authors: René Kim, Zoë Sutherland, Sofie Verhoeven, Silvia Binet, Niclas Düring, Chris Barnett, Alberto Lemma and Leonie Beckmann.

Acknowledgements

This study was undertaken between September 2020 and November 2021.

The evaluation team would like to thank Suzanne Parkin (FCDO), Alex MacGillivray (BII), Zahir Dasu (BII) and the FCDO-BII Evaluations Steering Committee for their oversight and guidance throughout Phase 1 of the evaluation. We are also grateful to all of those who contributed to this analysis through interviews and consultations, with particular thanks for Pri Uttamchandani and Alar Cartan at BII for their input.

Disclaimer

This report has been prepared by the e-Pact consortium for the named client, for services specified in the Terms of Reference and contract of engagement. The information contained in this report shall not be disclosed to any other party or used or disclosed in whole or in part without agreement from the e-Pact consortium. For reports that are formally put into the public domain, any use of the information in this report should include a citation that acknowledges the e-Pact consortium as the author of the report.

This confidentiality clause applies to all pages and information included in this report.

This material has been funded by UK aid from the UK government; however, the views expressed do not necessarily reflect the UK government’s official policies.

‘Itad’ and the tri-colour triangles icon are a registered trademark of ITAD Limited.

Recommended citation

Kim, R., Sutherland, Z., Verhoeven, S., Binet, S., Düring, N., Barnett, C., Lemma, A., and Beckmann, L. 2022. Final Report: Evaluating the Impact of British International Investment’s Infrastructure Portfolio. e-Pact consortium: Itad, Steward Redqueen, Overseas Development Institute.

From 4 April 2022, CDC changed its name to British International Investment (BII).

Foreword

The Rt Hon Amanda Milling MP, Minister for Asia and the Middle East in February 2022

I am pleased to introduce this report, an independent portfolio-wide analysis of British International Investment’s (BII) investments in this sector, which provides a unique insight into BII’s infrastructure portfolio, published as part of the FCDO-BII Evaluation and Learning Programme.

Sustainable infrastructure is crucial for development. From transport systems to power generation facilities and water and sanitation networks, it provides the services that enable society to function and economies to thrive. The UK is committed to financing and delivering clean infrastructure that is reliable and honest, avoiding low and middle-income countries being left with bad and unsustainable debt.

The insights gleaned from this study reveal the scale and breadth of BII’s impact through its infrastructure investments across Africa and Asia. To date, across the portfolio, BII’s investments have reached 152 million consumers, or the equivalent of one in every twenty people living in Africa and South Asia; supported 3.5 million jobs (indirectly), and investments in renewable energy have contributed to 16 million tonnes of CO2 avoided.

It is very encouraging to note that the majority of BII’s investments are on track to deliver their intended impact. The evaluators have also highlighted several important recommendations for how BII can further enhance and understand the impact of their portfolio so that BII achieves an even stronger development impact.

Britain’s premier development finance institution was revamped as British International Investment (BII) in November 2021, with the official name change taking place on 4 April this year, and the launch of its new strategy from 2022-26. A critical part of BII’s new strategy is the vital importance of infrastructure in bringing large scale impact to enable business growth and benefit millions of people. This review provides an important and timely analysis of the impact of BII’s current investments in this sector. This not only provides accountability to the taxpayer for what has been achieved with the UK Government equity but also it provides important lessons for BII to deepen its impact as it embarks on its new five-year strategy.

Building on its portfolio of £5.2 billion BII’s new strategy will see it enter new markets in the Indo-Pacific and the Caribbean and form new partnerships with likeminded investors. I am confident that it will take on board the recommendations highlighted in this report, whilst also building on its experience to finance the critical infrastructure that will allow all countries to build back better. One such example is the recent partnership with DP World that will support the initial development of three ports across Africa with further logistics investments to follow. Trade enabled through the three initial ports will improve access to vital goods for 35 million people, support 5 million jobs, and add $51 billion to total trade by 2035.

BII will be central to the UK’s aim to deepen economic, development and security ties globally and bring more countries into the orbit of high-standard free-market economies, while delivering jobs and growth in both the developing world and the UK. BII will also continue to play a crucial role in delivering the UK’s commitments at COP26 to help developing countries take advantage of clean technology and grow their economies sustainably to meet the Paris Agreement.

I wish to thank the independent evaluators at Itad, Steward Redqueen, AidData and the Overseas Development Institute (ODI) for their work and look forward to overseeing this next phase of British International Investment.

The Rt Hon Amanda Milling MP, Minister for Asia and the Middle East

Acronyms and abbreviations

| Acronym | Definition |

|---|---|

| BI | Business Integrity |

| BRT | Bus Rapid Transit |

| C&I | Commercial and industry |

| CO2 | Carbon dioxide |

| DFID | Department for International Development |

| DFI | Development Finance Institution |

| DI | Development Impact |

| E&S | Environmental and Social |

| ESG | Environmental, Social and Corporate Governance |

| ESMS | Environmental and Social Management System |

| FCDO | Foreign, Commonwealth & Development Office |

| FTTH | Fibre-to-the-home |

| GDP | Gross domestic product |

| GHG | Greenhouse gas |

| GIIN | Global Impact Investing Network |

| GNI | Gross national income |

| GW | Gigawatt |

| HFO | Heavy fuel oil |

| ICT | Information and communications technology |

| IFC | International Finance Corporation |

| IMF | International Monetary Fund |

| IPCC | Intergovernmental Panel on Climate Change |

| IPP | Independent power producer |

| LCOE | Levelised cost of energy/electricity |

| MT | Metric tonne |

| MW | Megawatt |

| OECD | Organisation for Economic Co-operation and Development |

| PCAF | Partnership for Carbon Accounting Financials |

| PPA | Power Purchase Agreement |

| PPI | Private Participation in Infrastructure |

| SME | Small and medium-sized enterprise |

| T&D | Transmission and distribution |

| TA | Technical assistance |

| UNFCCC | United Nations Framework Convention on Climate Change |

Executive summary

Introduction and scope

The Foreign, Commonwealth & Development Office (FCDO) commissioned Itad, Steward Redqueen and the Overseas Development Institute (ODI), to evaluate British International Investment’s (BII) [footnote 1] investments in the infrastructure portfolio. The objective of this evaluation is to achieve a better understanding of the development impact (DI) of BII’s infrastructure portfolio. The analysis covers all current BII debt and equity investments in the infrastructure portfolio [footnote 2] and exits since 2011, and the underlying holdings of 15 infrastructure-focused funds that are in the core geographies of Africa and South Asia. Infrastructure assets held by generalist funds are not included in the analysis presented.

The first phase of this evaluation consists of a Portfolio Review and an Evidence Review, both of which are covered in this Formal Evaluation Report. The second phase will consist of a series of in-depth studies.

Methodology

This report synthesises the results of an Evidence Review and a Portfolio Review. In the Evidence Review, insights from existing literature and sources are summarised and, where possible, amalgamated into provisional evidence rules that allow estimation of ultimate impacts. In the Portfolio Review, information contained in available BII investment documents has been collated to form a single database of investee observations, to which data from 16 external sources has been added.

Where no direct observations were available, estimations of ultimate impacts per investment were made using evidence rules (developed from the Evidence Review) in combination with portfolio and external data. Analysis of outcomes and impacts achieved by the investments on this basis are included at portfolio level and thematically in this report. The non-financial value added that BII provides to its investees is captured through a high-level inventory of its activities in the areas of Business Integrity (BI), Environmental, Social and Governance (ESG) and Technical Assistance (TA) (BII Plus). Based on the observed and estimated impacts, we draw conclusions and recommendations on the first phase of the evaluation of the infrastructure portfolio. These findings are also a starting point for the second phase, in which BII aims to deepen its understanding of interventions in different sectors, countries and thematic areas.

Portfolio overview

Infrastructure currently makes up 28% of BII’s active portfolio. This Portfolio Review encompasses 14 direct equity investments, 25 direct debt investments and 15 infrastructure-focused fund investments. This scope covers US$2,345 million – of which US$1,743 million is in direct investments and US$602 million is in infrastructure fund investments – that BII has invested in infrastructure since 2007. In total, the 194 investee companies manage 295 assets. As per 31 December 2020 [footnote 3], a total of US$2,146 million [footnote 4] is still active. Total infrastructure commitments are US$3,352 million, of which US$1,936 million goes to direct investments and US$1,416 million goes to infrastructure funds. This scope excludes 54 investments that were made through 38 generalist funds with aggregate disbursements of US$157 million. Over the past 6–7 years, BII has substantially grown its infrastructure portfolio, primarily through direct investments. Below are some portfolio characteristics:

- in terms of sectors, by value, 70% of the portfolio is in Power, 22% in Information Communications Technology (ICT) and 8% in Transport. In Water, Sanitation and Hygiene (WASH), only one direct investment has been made but the sector is a strategic priority going forward

- in terms of regions, 66% of BII’s capital has been disbursed in Africa and 34% in Asia. Ten countries constitute 75% of disbursed capital. In six of those, BII has invested in two or more sectors

- in terms of investment product, 43% of the infrastructure portfolio is direct equity, 31% is direct debt and 26% is invested through infrastructure funds

Evidence Review

The Evidence Review identified over 450 studies through systematic online searches, of which 331 were of sufficient quality to be included. The strength of the evidence is rated based on the number of studies. Evidence rules were distilled where quality and homogeneity of evidence allowed it. In total, 22 evidence rules translate impact pathways into quantitative impacts, of which six were applied to investments in the BII portfolio [footnote 5]. They were used when there was not a more appropriate existing estimation methodology, and when the necessary BII monitoring data was available.

With reference to the BII Infrastructure Impact Framework, the evidence base is stronger for ultimate impacts and for some impact pathways than it is for outcomes. There is strong evidence linking infrastructure investments to four of the results in the impact framework (greater productivity, economic opportunity, standard of living and environmental sustainability) – three at ultimate impact level and one at outcome level. The evidence for these indicated a positive relationship between the investment and the result. There is more evidence available at outcome level for the Transport sector than for other sectors.

Development Impact across the portfolio

Portfolio aggregate development impact

By combining investment data, external sources and six evidence rules (see Section 4), we have estimated the aggregate outputs, outcomes and impacts of the BII portfolio across the infrastructure impact framework. Impacts have been estimated individually for all 295 assets in BII’s portfolio based on the development results of the investees. This does not account for BII’s contribution to investees’ results, and some large impacts are associated with small BII investments in which BII has a small effective stake. Across the portfolio, BII investees covered by the scope of this report [footnote 6]:

- reach 152 million consumers, or one in every twenty people living in Africa and South Asia

- support 3.5 million indirect [footnote 7] jobs, which is roughly equivalent to the working population of the Kampala metropolitan area

- generate US$17.6 billion of value added annually (i.e. contribution to GDP) [footnote 8], which is about the same as the GDP of, again, Kampala’s metropolitan area

The distribution of these impacts (portfolio total, not adjusted for number or size of investees, or BII attribution) [footnote 9] is largely in line with BII’s geographical and sectoral allocation. In summary, in terms of jobs supported and GDP impact:

- 65% of the impact comes from investees located in Africa

- 65% comes from fund investee companies [footnote 10] and 35% from direct investments [footnote 11]

- 50% of the impact of direct investments comes from equity investments and the remainder from debt

- 55% of the impact will come from greenfield and brownfield expansion projects once they become operational

- 55% of the impact comes from the power sector with the independent power producers (IPP) sub-sector being responsible for some 95% of the impact within the power sector [footnote 12]

- 40% of the impact of IPPs comes from renewable technologies

Portfolio impact pathways

The most frequent impact pathways in the portfolio are the provision of additional capacity, improved service delivery and reduced prices. IPPs that provide lower-cost energy than the average countrywide generation make the largest contribution to these pathways. Furthermore, BII’s investees reach an estimated two million households by providing connections to electricity and broadband [footnote 13]. BII contributes to the provision of cleaner capacity through investments in renewable energy assets, and it increases resource efficiency through the lowering of power distribution losses in its transmission and distribution (T&D) portfolio. Finally, climate smart infrastructure is an additional impact pathway part of BII’s infrastructure impact framework. However, no consideration linked to the climate resilience of the infrastructure assets was identified in the portfolio.

Performance against the DI thesis

The evaluation team has assessed the extent to which BII investments are on track to realise the DI thesis that was set at the time of making the investment. Almost all of the 39 direct and 15 fund investments [footnote 14] have been evaluated against their respective DI theses based on whether they: (i) had achieved the impact targets (within a reasonable range) as articulated in the DI thesis; and (ii) had a reasonable chance to reach the intended targets given the amount of time remaining until the intended DI target date.

Excluding nine investments which were too early to assess, 36 out of 45 investments (80%) are on track or have outperformed their DI thesis (with two excellent scores). One of the nine investments that is not on track is judged to be a failure. In aggregate:

- investments in Asia score better than in Africa: all nine underperforming assets are located in Africa, while five investments there have over-performed. In Asia, five of the fifteen investments are above expectations or excellent, and the remaining ten are as expected

- in summary, most Power investments are on track; seven are below expectations, two are above expectations, one is excellent, and the remaining ten are in line with expectations

- ICT investments score better than power investments: six are as expected, while two are above expectations

- transport investments show most variation: there was one failure, one above expectation and one excellent

- debt investments largely perform in line with expectations (13 out of 19), with five below and one above expectations. The performance of equity investments in contrast is much more heterogeneous, ranging from a single failure to two excellent ratings

- the 14 fund investments show little variation: one is below expectations, eight are as expected and five are above expectations

- given the long lead times of many infrastructure investments, it is too early to discern a clear trend over time: pre-2018 and post-2018 investments largely score the same

It seems that both under-performance and over-performance are mostly driven by internal factors like strategic fit and implementation skills. External macro-economic, geopolitical, and regulatory factors do explain some of the observed under-performance, especially in Africa.

BII’s value addition activities

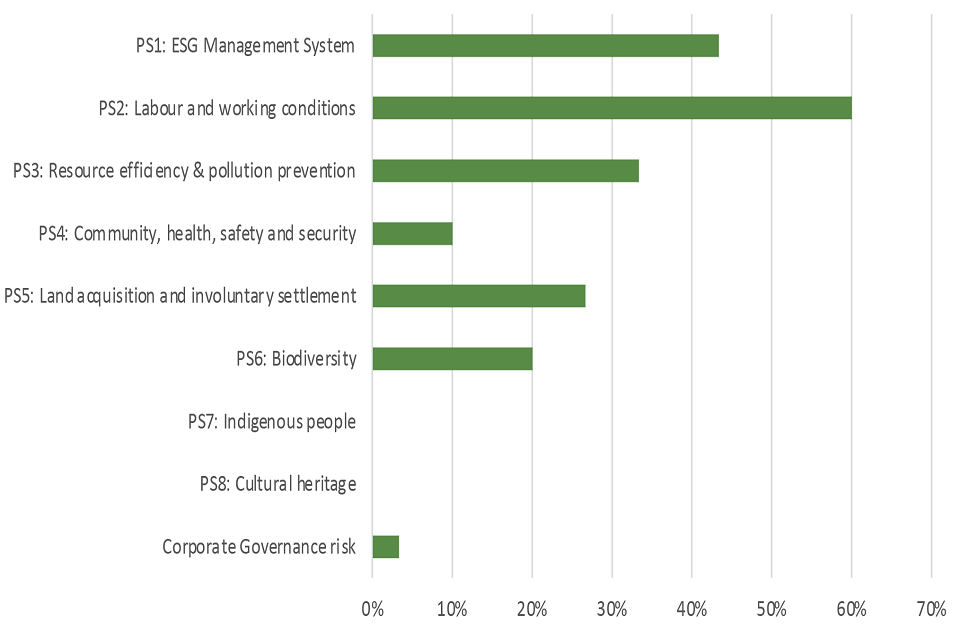

Because of the importance of BI and ESG aspects, especially in infrastructure, the report provides an overview of BII’s value addition activities, which is the second pillar of BII inputs besides capital. This pillar also includes value addition through technical assistance and support provided via BII Plus. Because the nature of these interventions is very investment specific, an evaluation of their effectiveness is beyond the scope of this Portfolio Review. BII’s main activities in these are as follows:

- the BII risk-based BI due diligence process was performed for all 39 direct investments. For 30 of these, BII’s BI team undertook more in-depth interventions to support investees. For funds, the main value-adding activities included annual BI reporting, training, ad hoc advisory and routine monitoring

- the BII ESG due diligence process was performed for all 39 direct investments and for 23 of these a more detailed process was conducted. Deal-specific interventions were made in nine investments. For funds, the focus was on improving environmental and social management systems (ESMS)

- ten investee companies in the home solar and C&I sub-sectors received technical assistance worth US$1.25 million. A similar amount went to the support of impact opportunities beyond BII’s portfolio

Portfolio evaluation based on themes

Theme 1: Geography

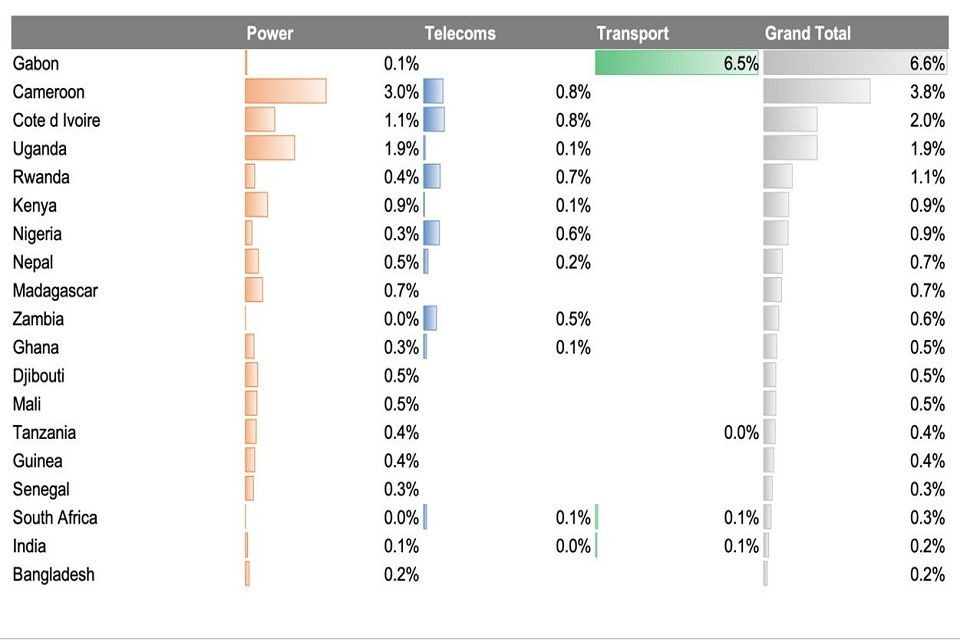

As referenced above, ten countries constitute 75% of all investment in the infrastructure portfolio, and six countries have substantial investments in two or more sectors. Ten countries make the greatest contribution to BII’s aggregate employment and GDP impact: India, Nigeria, Cameroon, South Africa, Côte d’Ivoire, Gabon, Kenya, Uganda, Bangladesh and Nepal.

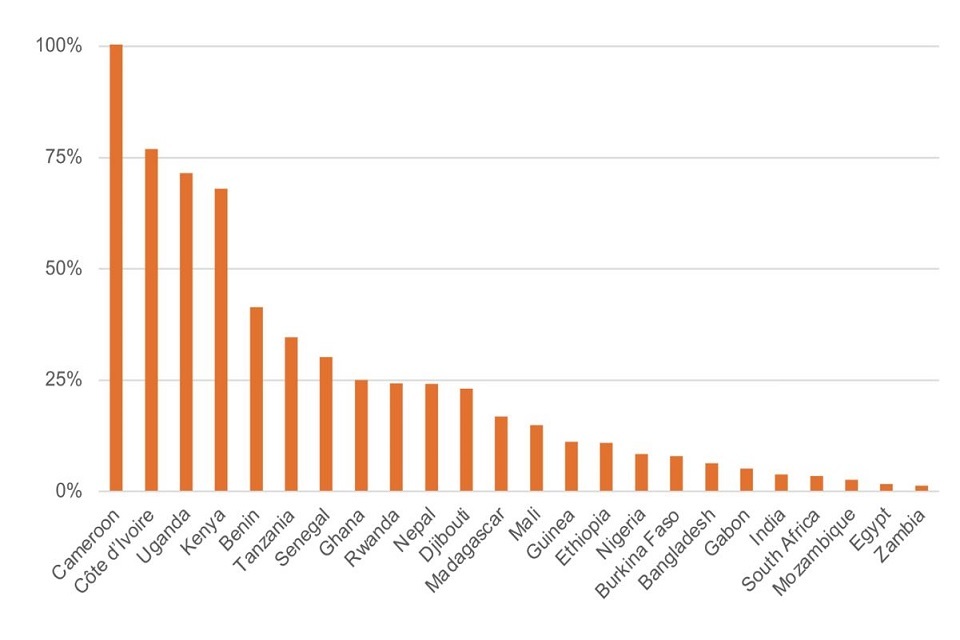

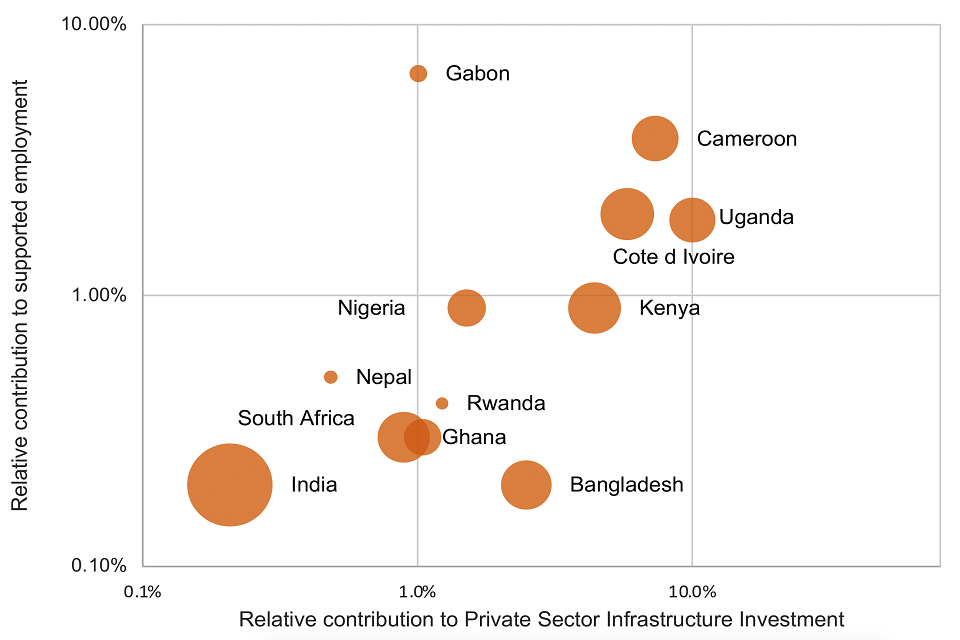

BII has categorised the African countries and Indian states into four categories. ‘A’ countries/states are the hardest to invest in, and ‘D’ countries/states are the easiest. More than half (53%) of BII’s investment is in A/B countries [footnote 15]. The share of GDP and employment impact of investee companies in A/B countries is 44% and 56% respectively, in line with the higher employment intensities in poorer countries. In terms of people reached, 65% are in A/B countries. Relative to the size of the country, BII investee companies make the largest impact contribution in Gabon, Cameroon, Ghana, Côte d’Ivoire and Uganda.

Theme 2: BII contribution to private infrastructure investment

Using data from the World Bank Private Sector database, we have determined BII’s relative contribution to private sector infrastructure (PPI) investment in all countries. Despite it being the largest destination of BII infrastructure investments, the sheer size of India renders BII’s relative contribution small (0.1% of private sector infrastructure investment). Conversely, BII plays an outsized role (around 10%) in Uganda and Cameroon.

BII’s relative contribution to private infrastructure investment tells only half the story. In general, more than 80% of private infrastructure investments in emerging markets come in the form of debt, whereas 69% of BII’s capital is direct equity or equity through fund investments. This observation is important from a development impact perspective. Whereas debt finance is typically used to finance the construction and operation of assets, equity investments are needed for the early and late development stages of projects; they are inherently riskier and require more intensive engagement from Investment Managers. In many emerging markets, and especially in Africa, the infrastructure gap is caused more by a lack of projects that can be financed than by a lack of finance. BII’s willingness to invest in the earlier development stages is therefore a significant source of development impact and demonstrates a willingness to take risks that other development finance institutions (DFIs) might not.

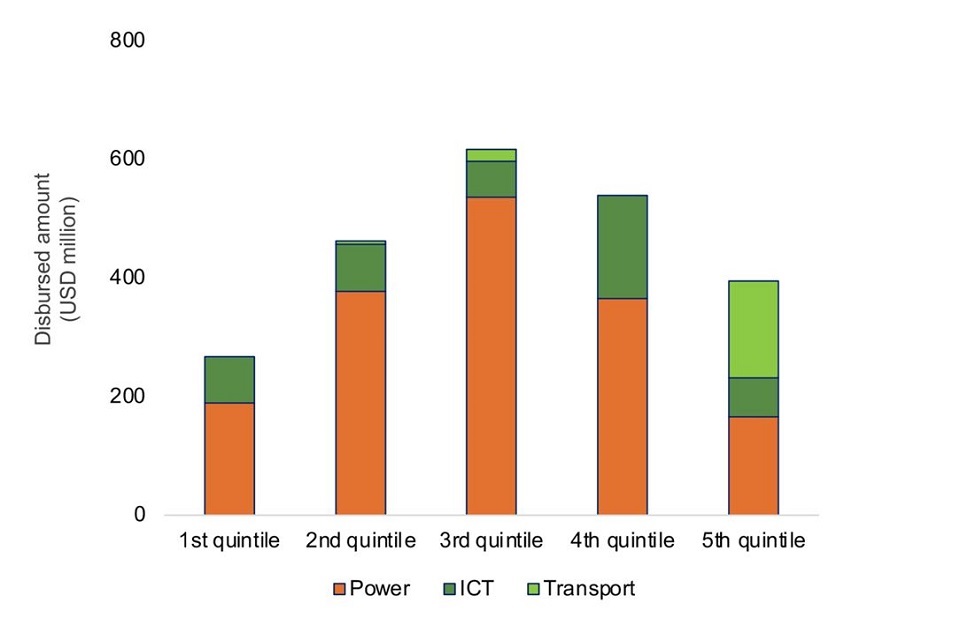

Theme 3: How BII targets investments by country needs

Countries differ widely in terms of their most pressing infrastructure needs in ways that are not adequately captured by the DI grid score that BII has used to rate investments since 2012. To evaluate how effectively BII has targeted these needs, we inferred the relative need of a country for a particular type of investment by ranking the country’s performance on indicators that are closely associated with that type of investment. All investments are subsequently grouped into quintiles based on their performance in the country on the chosen targeting indicator. It is worth noting that all countries in which BII is mandated to invest are already identified as being of greater need and that, therefore, this is an additional analysis of comparative need within the investment universe. Relative needs cannot always be inferred from country statistics, especially when the local context is important.

Power and ICT investments cover all quintiles, from large to relatively smaller requirements. However, Transport investments are mostly based in countries where the need for them is smaller. Given the substantial investments in power, and to a lesser extent ICT, that are made in countries that are in the first and second quintile of greatest need, we judge BII’s investment targeting for these sectors as reasonably effective from a DI perspective. Transport investments could be better targeted to include countries of greatest need, although the local context is often more important (especially for roads). The method presented here could be adapted to help BII more clearly target areas with the greatest need, while acknowledging that not all public needs can be resolved by the private sector.

Theme 4: Climate

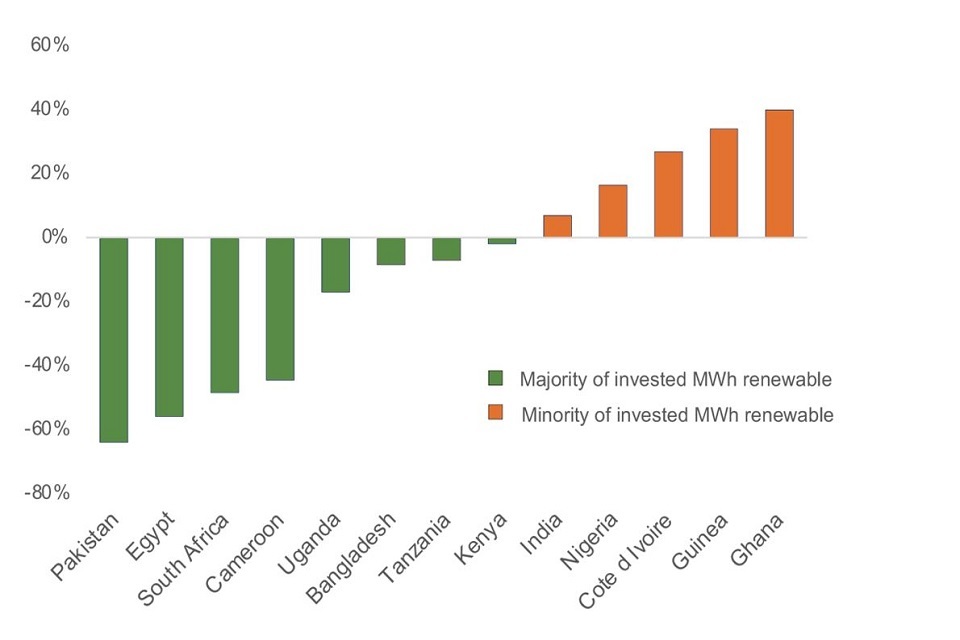

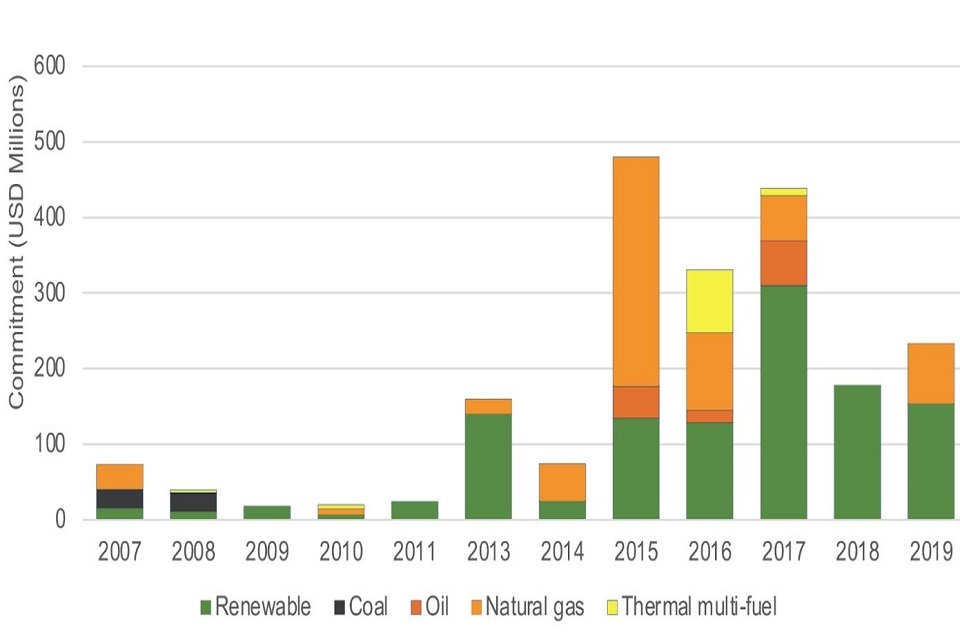

Over time, BII’s Power portfolio has been evolving towards renewable energy. About 48% of BII’s active IPP portfolio is in renewable energy.

Annual greenhouse gas (GHG) emissions of active operational IPP investments amount to 13.7 million tonnes CO2 equivalent. The emissions avoided by direct IPP investments are estimated by BII at 4.8 million tonnes. Including indirect investments, we estimate emission avoidance related to renewable IPPs to increase up to 13.7 million tonnes CO2 equivalent [footnote 16].

The bulk of emissions of the active portfolio comes from fund investments made before 2013, whereas most avoided emissions come from renewable investments made since 2015. This underscores the shift towards renewables. Using the attribution rules of the BII-signed Partnership for Carbon Accounting Financials (PCAF), BII-attributed GHG emissions and avoided GHG emissions have been calculated at 1.3 million and 0.5 million tonnes, respectively.

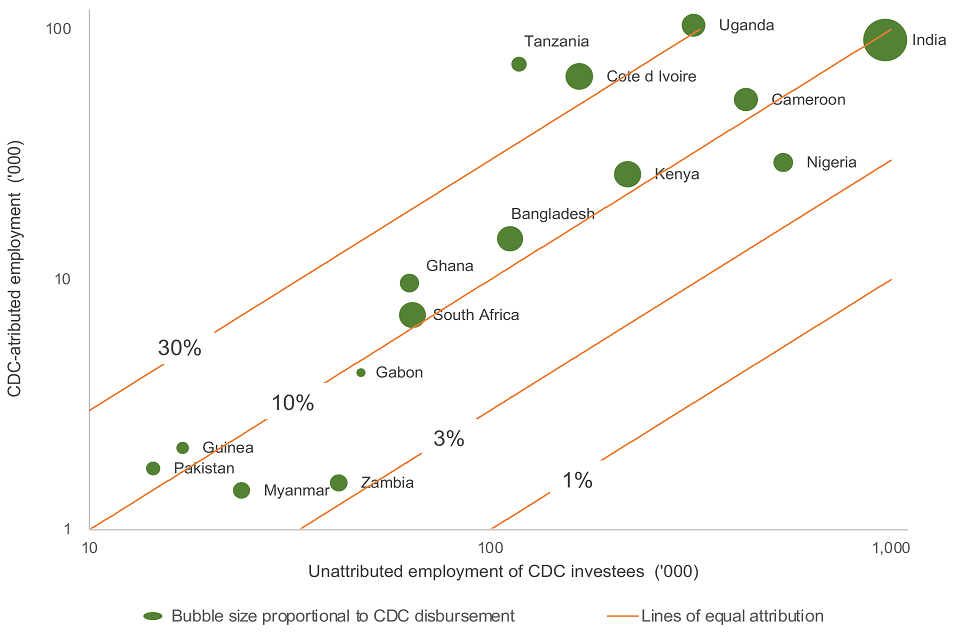

Theme 5: Attribution

The above-mentioned capital-based PCAF methodology can also be used to calculate the BII-attributed economic opportunity and standard of living impact. Based on this method, 13%-20% of the cumulative impacts of investees can be attributed to BII. This includes:

- 30.3 million of 152 million people reached by investees

- 515,000 of 3.5 million jobs supported by investees

- US$2.3 billion of US$17.6 billion of investees’ value added annually (i.e. contribution to GDP)

Using these attributed numbers, we can estimate the effectiveness per dollar of BII investment. We estimate that US$1,000,000 of BII infrastructure investment would support 156 jobs (ongoing while BII is invested) as well as US$1,000,000 of value added annually (i.e. contribution to GDP) [footnote 17] or equivalent to US$5 million in the case of a five year BII holding. This estimation indicates that each dollar invested by BII returns itself in the form of value added to the host country in just over one year.

Theme 6: Gender

Since 2018, BII has made a strong commitment to women’s economic empowerment, integrated gender into its work as a key cross-cutting area, and taken a leadership role in the 2X Challenge. However, across both BII’s internal data and the Evidence Review, there is relatively little evidence on how infrastructure investments lead to specific outcomes and impacts for women and men who are affected by the infrastructure itself. This does not suggest that infrastructure investments do not have a positive effect on women; the absence of evidence likely relates to the methodological challenges of establishing actual uptake of infrastructure services by individuals and therefore of assessing the impacts on affected individuals’ standard of living.

Based on the 25% of direct and indirect infrastructure investees that report on it, we estimate that direct women’s employment is about 15%, although this increases for solar home system investments based on reporting from three investments. There are six additional gender-related indicators that concern investees’ own operations, against which between 21% and 27% of direct infrastructure investees report. However, there are no gender indicators that are both systematically reported against across the infrastructure portfolio, and that relate to impact pathways, outcomes or ultimate impacts in the impact framework. Additionally, gender does not appear on the impact framework itself.

Four investee companies are qualified with the 2X Challenge criteria, with a further three investees having set gender targets, or developed programmes to improve women’s employment. BII has provided technical support to some investees to meet gender objectives and targets.

Recommendations

The following recommendations are made based on the implications of the high-level findings and are presented in the same order as the high-level findings (in Section 7.2) to which they relate. They focus on BII activities to measure and manage development impact within the infrastructure portfolio:

- BII could regularly update the Evidence Review with emerging evidence and the resulting evidence rules that have been extracted from the Evidence Review. We recommend that BII observes caution in the application of evidence rules, which are more appropriately used across the portfolio rather than at individual investment level.

- We suggest that BII annually reviews portfolio impact data and the extent to which external factors have changed, as well as the associated implications on the actual development impact.

- We propose that BII determine in which countries it has substantial influence, and how it might use that influence to maximise development impact. For a limited number of countries this could lead to a ‘country development approach’ document.

- In identifying and prioritising its potential for development impacts, we suggest that BII reconsiders how it determines the areas of greatest needs for the different types of infrastructure to inform its investment decision-making.

- We recommend that BII continuously determines how best to navigate the nexus between development impact and a Paris-aligned net zero pathway. BII uses its Guidance Note on natural gas investments. Because country installed stock, available technologies and cost levels of IPPs, T&D networks, country interconnections, electricity storage, and decentralised and off-grid solutions continuously change, so should BII guidance on these matters.

- We propose that BII formalises its approach to impact attribution and collects the necessary data from its investee companies. A first step could be to apply the PCAF methodology used for GHG emissions.

- We recommend that BII increases its active monitoring and management of the gendered outcomes and impacts of its infrastructure portfolio. We recommend an increased focus on collecting and using gender-disaggregated results data across investments that relate to the impact pathways, outcomes and/or ultimate impacts of the impact framework.

1. Introduction and scope

1.1. Background to the report

The Foreign, Commonwealth & Development Office (FCDO) commissioned Itad, Steward Redqueen and the Overseas Development Institute (ODI) to evaluate British International Investment (BII) [footnote 18] investments in the infrastructure portfolio. The purpose of this evaluation is for BII and FCDO to achieve a better understanding of the development impact (DI) of BII’s infrastructure portfolio. The principal evaluation objective is to generate findings, recommendations and learning on how, and in which contexts, BII’s investments into infrastructure deliver development outcomes and impact on people, environmental sustainability and, where feasible, overall economies.

‘Infrastructure’ encompasses a wide range of physical structures and networks that constitute the backbone of an economy. No country has ever achieved growth without it, and it makes important contributions to individuals’ standards of living [footnote 19] as well as the ability of countries to transition to a lower carbon economy. This makes the sector highly relevant from a DI perspective.

This report includes an analysis of BII’s infrastructure portfolio, which is divided into four sectors: Power; Information Communications Technology (ICT); Transport; and Water, Sanitation and Hygiene (WASH) in South Asia and Africa [footnote 20]. This report brings together the analysis conducted in Phase 1 of the evaluation, in particular a detailed analysis of the DI of the BII infrastructure portfolio, drawing upon BII’s own data and supplemented by extensive external data sources (a Portfolio Review), and a review of published literature on the DI of infrastructure investments (the Evidence Review). The subsequent second phase will consist of a series of in-depth studies.

1.2. Structure of the report

This report covers the following sections:

- Section 1: introduction and scope of the report, situating this Formal Evaluation Report within the context of the two-and-a-half-year evaluation

- Section 2: a brief overview of the methodology applied

- Section 3: an overview of the infrastructure portfolio composition

- Section 4: a summary of the results of the Evidence Review against the BII Infrastructure Impact Framework, including an outline of how the external literature was used to provide quantitative estimates of impact that were applied as ‘evidence rules’ in the Portfolio Review

- Section 5: an overview of results against the BII Infrastructure Impact Framework in terms of ultimate impacts and impact pathways, the assessment of investments’ performance against their DI theses, and a summary of BII’s value addition activities in areas of Environmental, Social and Corporate Governance (ESG), Business Integrity (BI) and BII Plus

- Section 6: analysis of the results of the Portfolio Review by theme, according to: geography, contribution to private infrastructure investment, targeting by country needs, climate, attribution of results, and gender

- Section 7: summary of findings and recommendations based on Phase 1 of the evaluation

2. Methodology

Summary

- this Evaluation Report concludes Phase 1 of the British International Investment’s (BII) infrastructure portfolio evaluation. The subsequent Phase 2 will focus on several deep-dive studies, which are yet to be determined.

- Phase 1 consists of a Portfolio Analysis and an Evidence Review

- from the Evidence Review we have extracted several evidence rules which have been used to estimate the impact of all investee companies and assets

- all direct and fund investments have been scored against their corresponding Development Impact Thesis.

- BII investee data has been used in combination with data from 16 external sources and the evidence rules, to determine the ultimate impact of the portfolio

- additional analysis has been performed for six themes

This evaluation consists of three phases: the Inception Phase, Phase 1 and Phase 2, each of which are designed to build upon the last phase, so as to incrementally develop the evidence base for the development impact of British International Investment’s (BII) infrastructure portfolio. Phase 1 draws on BII’s own data, external data sources and published literature, to establish the existing data and strength of the evidence related to the development impact of BII’s investments into infrastructure at portfolio level. Phase 2 will comprise a series of in-depth studies into specific investments (or clusters of investments) and the synthesis phase. It will include primary data collection, and will contain a greater depth of analysis into sampled investments.

Phase 1 comprises a Portfolio Analysis and Evidence Review. These two activities were designed on the same detailed and sector-specific versions of the BII Infrastructure Impact Framework. The Evidence Review research was focused on areas in which BII invests currently, or areas in which it intends to invest, in order to maximise synergies and opportunities to synthesise results between the two reviews. This report presents the analysis, conclusions reached and recommendations developed during Phase 1.

This methodology section consists of three sub-sections associated with the three main sets of analysis within Phase 1, the analysis of portfolio composition (as per Section 3), the Evidence Review (as per Section 4) and the analysis of development impact (as per Sections 5 and 6). The first sub-section explains how the overall portfolio composition analysis was conducted. The second sub-section outlines how evidence was searched for, reviewed and analysed in the Evidence Review. The third sub-section explains how data was collated and analysed to generate observed or modelled results of BII investments against the BII Infrastructure Impact Framework, and how the team assessed the performance of investments against DI theses.

2.1. Methodology for portfolio composition analysis

The Portfolio Review assesses the aggregate development impact of BII’s infrastructure portfolio by analysing BII data and documentation, the inclusion of relevant external data sources and through interviews with BII staff.

BII provided a dataset of all investments made that are within the scope of this evaluation, and this was analysed at the asset level. In total, the 194 investee companies manage 295 distinct infrastructure assets. These figures do not include the 54 investments that were made through 38 generalist funds. The variables in the dataset provided by BII included the country of operation of the investments, commitment and disbursement data, instrument type and investment status, as well as BII’s effective interest in the investment (for some fund investments). Additional sheets were provided with the number of direct jobs, and the percentage of those which are held by women (for a limited sample of investments). Additional data points were extracted from 652 Investment Committee papers, quarterly portfolio reviews and other investee-specific sources. The data was reviewed by the evaluation team and went through a fact-checking process with the relevant Investment Managers and the DI team. This dataset was used to conduct the analysis of portfolio composition presented in Section 3.

2.2. Evidence Review methodology

The Evidence Review used a modified rapid evidence assessment approach, which is a combination of rapid search and assessment of studies. The Evidence Review team developed search strings based on a detailed analysis of how the BII Infrastructure Impact Framework could be applied to each of the four sub-sectors: Power, Transport, ICT and Telecoms and WASH. The breadth of the Evidence Review was determined by the composition of BII’s portfolio, focusing on the types of investments that were most prevalent in BII’s dataset – and the expected results of those investments – using the impact framework.

The initial screening identified over 450 studies through systematic searches using Google and Google Scholar, applying the described search strings. These studies were subsequently reviewed for quality and relevance [footnote 21]. All publications that were made accessible through these searches (using the search strings) were included in the initial screening. This included journal articles and publications by multilateral development banks, development finance institutions (DFIs) and consultancies. The extent of the search process was determined by the resources available for the Evidence Review and is considered to be a comprehensive review of the available evidence, albeit not a comprehensive review of all published studies.

Following this, over 330 studies were included in the evidence base. The review also used existing studies (e.g. Eberhard and Dyson, 2020) for reference and for snowball search purposes. The Evidence Review then rated the evidence strength for each type of infrastructure impact on a strength rating which was based on number of studies conducted for each impact per infrastructure type. The direction of impact is based on the conclusion reached by the majority of the studies; if there was no clear majority then the evidence is deemed inconclusive. The strength of this approach is based on the breadth of the different studies that were included. The disadvantage is that it does not consider the differences in quality between the studies that passed the minimum quality threshold.

Developing evidence rules

The Evidence Review was also used to identify quantitative measures that would translate investment sums into estimated impacts. While reviewing the evidence, the team extracted data from high and medium quality studies that quantified the relationship between two variables. From a triangulation of these study results, we developed ‘evidence rules’ which could be applied to the BII’s portfolio to estimate outcomes and impact of BII investments based on sound external evidence. An overview of the evidence rules can be found in Section 3.

All evidence rules are based on a limited number of studies and mask a considerable degree of heterogeneity and different contexts. Each ‘rule’ is an estimate based on the available evidence rather than a rule per se and should be corrected when further and better evidence becomes available. Their application is meant to provide some guidance for where the portfolio stands in terms of ultimate impacts because in-depth studies are not possible for most assets.

2.3. Methodology for analysis of development impact across the portfolio

Analysis of achievement of DI across the portfolio, by theme and by sub-sector

To analyse the achievement of DI, the evaluation team used the dataset provided by BII, which was complemented by the data points extracted from the BII documentation that was reviewed (as described in Section 2.1), to which the team added further data from 16 external data sources. This expanded dataset was used to generate quantified estimates of the achievement of outcomes and impact across the BII infrastructure portfolio.

The external data sources used were: World Bank Development Indicators (WB-DI), World Bank Enterprise Survey (WB-ES), World Bank Private Participation in Infrastructure (WB-PPI), Population Reference Bureau, IRENA, Energy Information Administration, International Energy Agency, Lazard, IPCC, GSMA Mobile Connectivity Index, International Telecommunication Union, UNCTAD, WHO/UNICEF and Tower Xchange.

Use of external data sources in the analysis conducted against the BII Infrastructure Impact Framework

The evaluation team used the results of the above analysis and the evidence rules from the Evidence Review and the Joint Impact Model (https://www.jointimpactmodel.com [footnote 22]), to quantify the contribution of BII investees to impact pathways, outcomes and ultimate impacts in the impact framework. While macro-economic quantities like GDP contribution and employment can be inferred, it was not possible to get a detailed understanding of the end users that benefitted from the added infrastructure capacity. We plan to look at this more closely in an in-depth study by surveying consumers directly. For the largest sector, IPPs, we have expressed the (expected) power generation in the number of consumers that are reached, using residential power consumption as a fraction of the total power use and country-specific data on the average residential power use per capita.

The aggregate figures presented in Section 5.1 and 5.2 are either direct observations or modelled figures, obtained by combining investment data, external sources and six evidence rules (Table 2, Section 4.3). At the impact pathways level, figures are mostly collected from the latest available quarterly portfolio reports, supplemented by publicly available sources, and aggregated across sub-sectors. In addition, for three of the impact pathway indicators [footnote 23] results are estimated using country-specific data on the existing power generation stock to provide a more comprehensive picture beyond the data available in the investment documentation. At the outcome level, data is scarce, and the literature provides little evidence on the correlation between the impact pathways and expected outcomes. At the ultimate impact level, five out of the eight indicators are modelled [footnote 24].

Assessing performance against the DI thesis

The evaluation team assessed the extent to which BII investments are on track to achieve the goal of the DI thesis set at the time of making the investment. DI theses exist for all investments made since 2018 and for several investments that were made prior to 2018. Where DI theses did not exist, some were retrofitted by BII. For the pre-2018 investments where no retrofitted DI theses were available, the evaluation team distilled proxy DI theses based on the contents of the Investment Committee paper. The assessment uses the dataset described above. Interviews were also conducted with each Investment Manager to capture contextual information for each investment which was used to inform the assessment of its performance against the DI thesis.

Some 37 direct investments and 15 fund investments have been evaluated against their respective DI theses based on the extent to which they had reached the targets specified in the DI theses and whether they had done so in time. An investment is scored as excellent when it achieves more than 115% of its DI target and if it does so ahead of its target date (or the latest date in case of a range). An investment is scored as below expectations if it reaches less than 85% after its planned target date.

Table 1: DI performance scoring table

| Performance against target | Target reached after target date | Target reached before target date |

|---|---|---|

| > 115% | Above expectations | Excellent |

| > 85% and < 115% | As expected | Above expectations |

| < 85% | Below expectations | Too early to tell |

Some adjustments were made to this methodology to allow for COVID-related delays, where a DI thesis included more than one target, assessment at fund level (rather than asset level), and where an investment was exceptional in generating other impacts in its context or whether it was likely to achieve the aims of the DI thesis in reasonable amount of time. These adjustments were made based upon the review of data, documentation and based on discussions that were had with the evaluation team to ensure consistency in the application of the approach and to minimise the potential for subjectivity. The assessments and underpinning data points were shared with the BII investment teams, who provided additional information or updated data where it was relevant to do so, and which was taken into account in a revised analysis of each investment. Based on investment documentation and interviews with Investment Managers, a high-level analysis was conducted into the internal and external factors that explained the under or over-performance of investments. The aggregate results of the assessment of performance against DI theses are included in Section 5.3.

The evaluation team also captured a high-level inventory of BII’s non-financial value-added activities for the infrastructure portfolio in the areas of BI and ESG. The effectiveness of these activities has not been assessed in this evaluation.

Use of external data sources in the analysis by theme

The relative contribution to employment levels and the GDP of BII investees in the various countries has been determined by using the disaggregated ultimate impact results, broken down by country and then divided by the country’s labour force and GDP. The results are shown in Section 6.1.

The assessment of BII’s relative contribution to infrastructure investments made by the private sector in all the relevant countries, uses BII total infrastructure disbursements by country, divided by the total value of private sector infrastructure investment from the World Bank database. The results are presented in Section 6.2.

The assessment of BII targeting has been performed by identifying targeting indicators that were relevant for each sub-sector. For this analysis, we selected indicators that were (i) directly related to the nature of BII investments and DI theses; and (ii) for which comparable data is available across all the eligible countries. External data sources have also been used to establish the existing infrastructure, stock and services available in each relevant country. In most cases, the indicators that were used for the assessment of targeting, were the same as those that were used for the targeting analysis. The evaluation team then quantified the contribution of BII investees to the existing infrastructure stock and services and/or the progression of the targeting indicators over time. This analysis is presented in Section 6.3.

Greenhouse gas emissions (GHG) have been determined for the Independent Power Producers (IPP) investments based on IPCC data. GHG avoidance of renewable plants has been determined by comparing the amount of IPCC GHG emissions per kWh of renewable plants (which are not zero, because of production and construction) with the relevant country average emissions per kWh. For comparison, we have also applied the United Nations Framework Convention on Climate Change (UNFCCC) data that is used by DFIs. As will be shown in Section 6.4, the UNFCCC method leads to higher avoidance results because of the underlying assumption that renewable plants phase out the largest polluting plants, which may, but often may not, be the case. In line with the BII-signed PCAF methods, GHG emissions have been attributed to BII. The PCAF method is also applied to the other ultimate impact results. These can be found in Section 6.5.

3. Overview of portfolio

Summary

- infrastructure investments make up 28% of British International Investment’s (BII) active portfolio

- the scope of this evaluation encompasses US$2,345 million that BII has disbursed to 194 companies, which manage 295 separate infrastructure assets

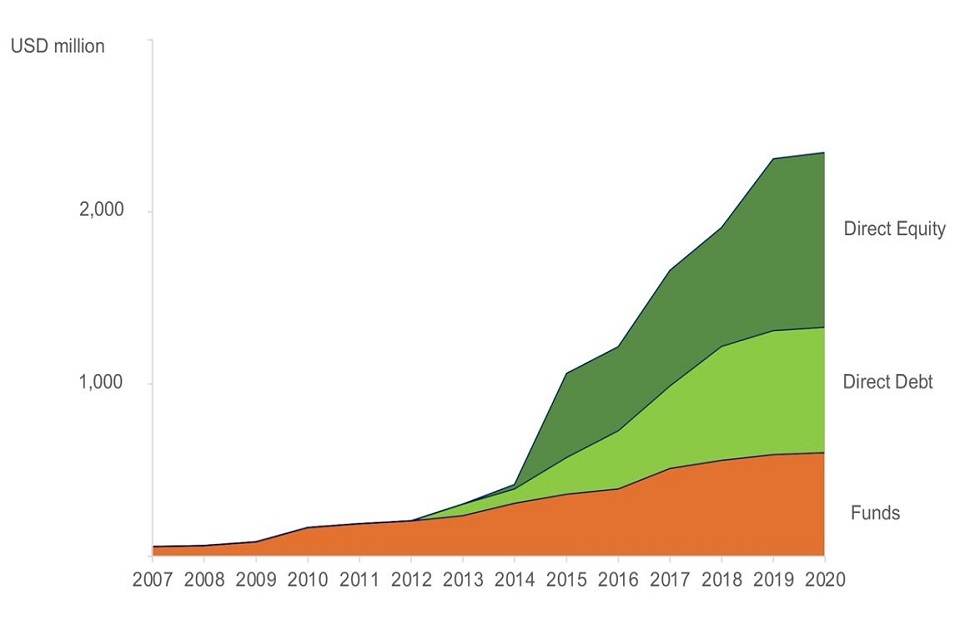

- the infrastructure portfolio has grown substantially over the past 6 years, from US$56 million in 2007 to US$2,345 million in 2020, largely due to 14 direct equity investments, and 25 direct debt investments. 43% of the infrastructure portfolio is made up of direct equity investments, 31% is direct debt investments and 26% is invested through infrastructure funds

- power is by far the largest sector (70%), and Independent Power Producers (IPPs) make up the bulk of investments in that sector, making up approximately three-fifths of the entire infrastructure portfolio. ICT and Transport represent 22% and 8% of the portfolio respectively. Water, sanitation and hygiene (WASH) is an area of strategic importance but is makes up a minor part of the current portfolio

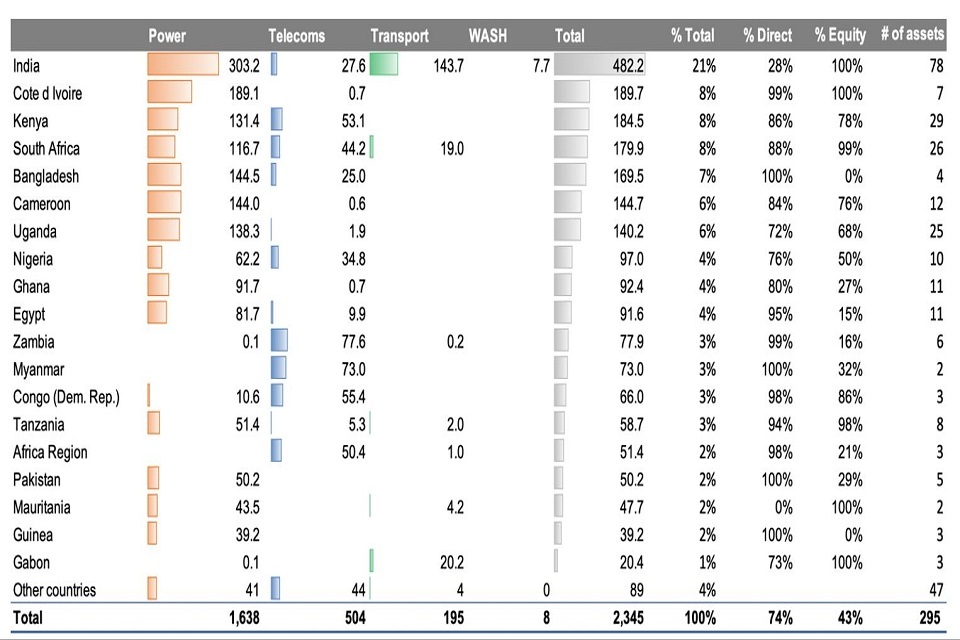

- ten countries receive 75% of the disbursed capital of the portfolio. The greatest amounts are invested in India, Côte d’Ivoire and Kenya. The concentration in these 10 countries seems to be driven largely by the size of each country’s economy, with larger countries offering better and/or more investment opportunities

3.1. Infrastructure investments within BII’s portfolio

Infrastructure currently makes up 28% of British International Investment’s (BII) active portfolio. This Portfolio Review encompasses 14 direct equity investments, 25 direct debt investments and 15 infrastructure-focused fund investments. This scope covers US$2,345 million that BII has invested in infrastructure since 2007 in 194 companies that manage 295 assets. As at 31 December 2020 [footnote 25], a total of US$2,146 million [footnote 26] is still active. Total infrastructure commitments are US$3,352 million, of which US$1,936 million is used for directs investments and US$1,416 million is used for infrastructure funds [footnote 27]. This scope excludes 54 investments that were made through 38 generalist funds, with aggregate disbursements of US$157 million.

Exhibit 1: Growth of BII infrastructure portfolio

Exhibit 1

As shown in Exhibit 1, BII has greatly increased its infrastructure portfolio over the past 6 years, largely due to direct equity investments and debt investments. In terms of investment products, 43% of the infrastructure portfolio is made up of direct equity investments, 31% is direct debt investments and 26% is invested through infrastructure funds.

3.2. Infrastructure portfolio composition

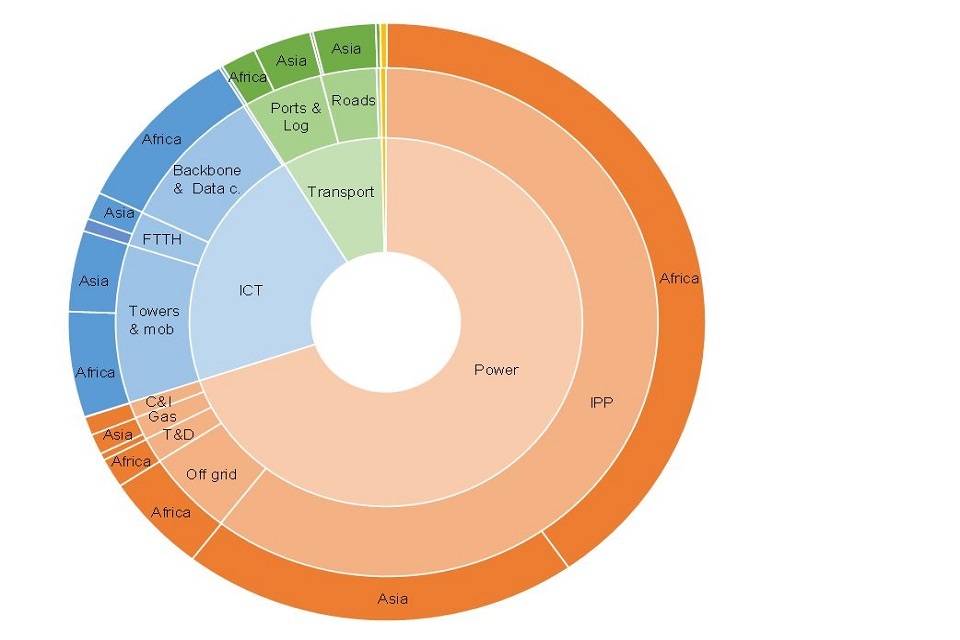

Exhibit 2 provides an overview of the infrastructure portfolio. The inner circle indicates that Power is by far the largest sector, whereas only a single direct investment has been made in WASH. The second circle shows the sub-sectors and the outer circle shows the geographic regions. By simultaneously looking at all three circles it becomes clear that, for example, more than a third of the entire portfolio is made up of African IPPs.

Power investments make up 70% of the portfolio, followed by ICT and Transport, which make up 22% and 8% respectively [footnote 28]. The IPP sub-sector alone constitutes over 60% of the entire portfolio. Investments in transmission and distribution (T&D), off-grid, commercial and industrial power (C&I) and broadband backbone investments have only been made in Africa, while the majority of all road investments have been made in India. Although the relative size of the WASH sector is negligible (0.3%), it is an area of strategic priority going forward. Africa and South Asia represent 66% and 34% of the disbursed portfolio respectively. A total of US$81 million (3.4%) of investments have been made through Catalyst Strategies, which focuses on shaping nascent markets, and takes a more flexible approach to risk in order to achieve impact. The disbursements of direct investments are US$1,743 million, which is equal to 90% of the total direct commitments.

Exhibit 2: BII infrastructure portfolio in terms of sectors, sub-sectors and geography

Exhibit 2

Exhibit 3 illustrates that in terms of countries, 75% of the capital has been disbursed to 10 countries. This seems to be driven largely by the size of the country’s economy, with larger countries offering better and/or more investment opportunities. The only large countries which are not among the largest investment destinations are Myanmar, Pakistan and Ethiopia. BII’s relative contribution to private infrastructure investments in all the countries is discussed in greater detail in Section 6.2.

Exhibit 3: Overview of investments by country and sector (US$ millions)

BII has more than US$10 million exposure to two or more infrastructure sectors in six of the top ten countries (India, Kenya, South Africa, Bangladesh, Nigeria, Egypt). Although complementarity between investments cannot be assumed a priori [footnote 30], these countries have the most potential for BII to achieve complementarity between its investments.

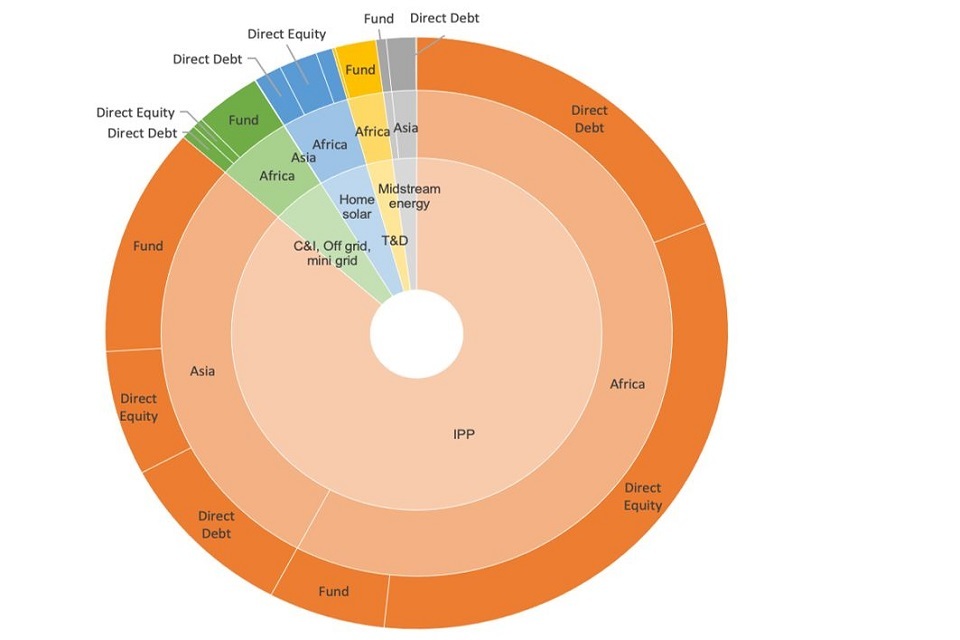

We divided the power deals (US$1,638 million) into five sub-sectors: (i) IPPs; (ii) commercial and industrial (C&I); (iii) off-grid and mini-grid; (iv) transmission and distribution (T&D); and (v) midstream energy. Exhibit 4 shows the prevalence of IPPs in BII’s Power portfolio: 87% of Power disbursements have been made in this sub-sector (this means 60% of the entire infrastructure portfolio). The remainder of Power sector disbursements went primarily to off-grid solutions, such as solar home systems, C&I customers, and mini-grid. The portfolio is mostly invested in Africa, with the exception of midstream gas assets, of which 74% are based in India and Bangladesh. Overall, India received the largest amount of Power investments (19%), followed by Côte d’Ivoire (12%) and Bangladesh and Cameroon (each 9%). Uganda received the greatest diversity of Power investments, with investments made in IPPs; captive/off-grid power; solar home systems, and transmission and distribution. Most Power investments are made through direct equity investments (42%) and direct debt investments (32%). Fund investments are relatively more prevalent in Asia than in Africa (41% and 19% respectively), primarily due to the India Infrastructure Fund I & II, and the Renewable Energy Asia Fund.

Exhibit 4: Power portfolio in terms of sub-sectors, geography and instrument

Exhibit 4

Exhibit 5 shows the Transport portfolio by sub-sector, geography and instrument. In the transport sector (US$195 million), investments into roads account for the largest share of disbursements (40%), followed by the logistics sub-sector (34%). The port sub-sector makes up 23% of disbursements with the remaining 3% in airports (which are not considered further in this report). Remarkably, almost 75% of the total amount in the Transport sector is invested in India (largely in toll roads) through the India Infrastructure Fund I and II as well as directly in the logistics company Ecom Express. The remaining 25% is invested in African countries. Most of the Transport deals have been made through funds, but there are three exceptions: Owendo port in Gabon (a co-investment with fund Meridiam), the conglomerate Grindrod, (exited in 2019) and the logistic solutions provider, Ecom Express Private Limited, in India.

Exhibit 5: Transport portfolio in terms of sub-sectors, geography and instrument

Exhibit 5

Investments in ICT, shown in Exhibit 6, amount to US$504 million and are balanced between mobile (TowerCos), and fixed infrastructure: fibre-to-the home (FTTH), internet service providers (ISPs), and backbone and data centres. From a geographical perspective, while tower investments are equally spread throughout Africa and Asia, backbone and FTTH deals are mostly located in Africa. Direct investments constitute 90% of the ICT portfolio. Until 2017, BII investments in ICT had been almost exclusively focused on towers and mobile access-related companies. In 2019, the outstanding amount was doubled and a significant change in sectoral focus took place, a change that was due to three direct equity deals: Liquid Telecommunications Holding Limited, WorldLink Communication and Frontiir. Liquid Telecommunications [footnote 31] alone constitutes about half of the ICT investments. It focuses on the backbone and data centres sub-sectors in Africa.

Exhibit 6: ICT portfolio in terms of sub-sectors, geography and instrument

Exhibit 6

4. Evidence Review

Summary

- in general, when the available evidence from the reviewed published literature is aggregated across all asset types and sectors, the evidence base is stronger for ultimate impacts and for some impact pathways, than it is for outcomes

- although there is frequently strong evidence that an infrastructure investment affects ultimate impacts, the exact causal pathway by which it causes those high-level impacts is not evidenced in the studies reviewed

- within the Power sector, there is more evidence available which links IPPs to the variables in the British International Investment (BII) Impact Framework than there is available for other asset types

- for Transport, there is strong evidence available which links investments into transport to ultimate impacts of economic opportunity, standard of living and environmental sustainability; for environmental sustainability, both positive and negative effects were found

- the evidence for ICT and Telecoms indicates positive impacts of broadband and backbone investments, particularly on economic variables, but the impact is unclear for data centres and telephony

- there is less evidence available which links water infrastructure investments with development impact; despite this, there is good evidence of its impact on GDP and employment

The Evidence Review component of the portfolio evaluation aimed to identify, assess and summarise the existing evidence base which links infrastructure to development impact. The team identified over 450 relevant studies, of which 331 were of sufficient quality to be included. Those that were excluded were done so because the study was either not sufficiently relevant or sufficiently robust to meet the inclusion criteria. The search for the studies was conducted to maximise the potential to combine the findings with investee-level data and external data sources to make quantitative estimations of development impact.

The summarised evidence indicates where there is a study that confirms the relationship between an investment in the given sector, and the variable in question (e.g. where a study answers ‘what is the impact of an investment of x in infrastructure sector y on variable z’). Therefore, the review indicates where there was available evidence that an infrastructure investment affected a variable, rather than providing evidence of the specific causal pathway through the impact framework.

The evidence was searched for by specific and relevant variables, and by asset type. In this section we firstly present an aggregated overview of the strength of the evidence, across all asset types and all sub-sectors. We then outline the strength of the evidence for each of the relevant ultimate impacts, outcomes and impact pathways in the British International Investment (BII) Infrastructure Impact Framework, broken down by sector. Finally, we provide an overview of how the Evidence Review was used to generate ‘evidence rules’ that were applied to the BII portfolio analysis.

4.1. Overview of evidence against BII’s infrastructure impact framework

In general, when the available evidence is aggregated across all asset types and sectors, the evidence base is stronger for ultimate impacts and for some impact pathways than it is for outcomes. Across all sectors, there is strong evidence linking infrastructure investments to four of the results in the impact framework (those are: greater productivity, economic opportunity, standard of living and environmental sustainability), one at outcome level and three at ultimate impact level. This evidence indicated a positive relationship between the investment and the result. There is more concrete evidence available at outcome level for the Transport sector than there is for other sectors.

In summary, significantly more evidence was found in the Evidence Review for second order impacts, such as GDP and employment. There is strong evidence to suggest that investments have positive impacts on these variables across all infrastructure segments. However, less evidence was found within the Review on intermediate impacts such as changes in prices, time and user volumes (which would fall under improved affordability, improved quality and reliability, and increased access in the BII Infrastructure Impact Framework).

‘Additional capacity’ was not included in the Evidence Review search strings as it was an assumed input at the start of each causal path explored; that is, it was assumed that an infrastructure investment led to additional infrastructure capacity. Having made that assumption, the Evidence Review then focused on whether this had an influence on the other variables included in the framework.

Section 4.2 unpacks the evidence base at sector and asset level, to allow for a more nuanced review of the strength of the evidence.

4.2. Strength of evidence for each sector

This section provides an overview of the strength and content of the evidence available for key variables by sector and asset type. The relevant studies are only referenced in this summary if the evidence base is considered to be strong. The strength of evidence is established by the number of studies found that link an investment in the asset type to the variable of interest.

For each sector, we present the overall strength of evidence aggregated at sector level, against the BII Infrastructure Impact Framework. We then summarise the strength of the evidence available by asset type for specific variables. These specific variables relate to the impact pathways, outcomes and ultimate impacts in the BII Infrastructure Impact Framework. There is often more than one variable that can be used to measure the result against (for an impact pathway, outcome or ultimate impact) the framework. We have related variables to specific boxes on the BII Infrastructure Impact Framework. We recognise that categorisations are open to interpretation and variables could be placed against different boxes in the framework; however, we consider the categorisations we have made to be logical and fit for purpose.

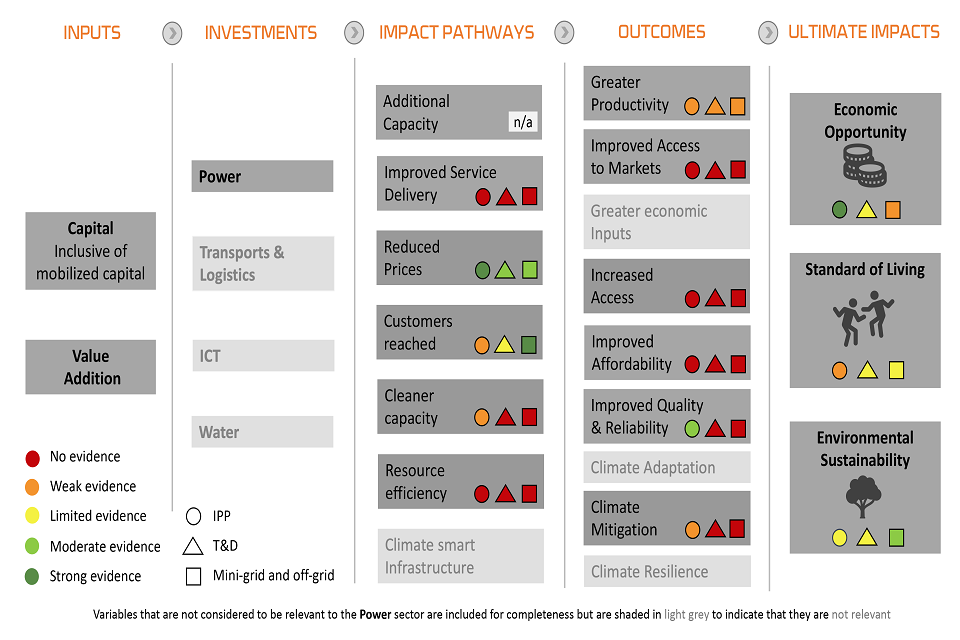

Power

An overview of the available evidence for the Power sector against the BII Infrastructure Impact Framework is presented in Exhibit 7. Variables that are not considered to be relevant to the Power sector are included for completeness but are shaded in light grey to indicate that they are not relevant. Exhibit 7 shows that there is more evidence available for two impact pathways for Power – reduced prices and customers reached – but no evidence for the three others; for the relevant outcomes, there is weak evidence available for productivity and moderate evidence available for improved quality and reliability for IPPs; for each of the ultimate impacts, there is stronger evidence available across asset types than for impact pathways and outcomes, linking Power investments to these ultimate impacts.

Exhibit 7: Summary of evidence for the Power sector against the BII Infrastructure Impact Framework

Exhibit 7

Independent power producers

For impact pathways, the team found that there was good evidence of the impact of IPPs on prices. However, all other evidence for impact pathways is limited or weak. Although the evidence base on the impact of IPPs on prices is strong (it is covered by 10 studies) [footnote 32], the evidence is unclear on the specific impact, and whether investments into IPPs increase or decrease prices. Additional power generation, especially from renewable technologies, does have a positive effect on power prices. Regarding reduced prices, there is weak evidence to indicate that additional IPP hydro investments will allow lower fuel subsidies (only one study). There is limited evidence linking IPP investments to customers reached, as measured by coverage, with two studies indicating that IPP investments lead to increased connection to the energy grid.

In terms of BII’s outcomes, there is moderate evidence to suggest that increased production of power can have a positive, but marginal, impact on reducing power outages (six studies), which is one measure of ‘improved quality and reliability’. However, there is significant variance in this data which makes it difficult to generalise. Additionally, there is limited evidence which points to the positive impact of IPP investments on productivity (two studies).

With regard to ultimate impacts, there is strong evidence linking IPP investments with economic opportunity, specifically GDP and employment. Strong evidence suggests that IPP investments have a positive impact on GDP, but the evidence does not clarify the causality. The team also found strong evidence that IPP investments have a positive impact on employment (11 studies) [footnote 33]. Under economic opportunity, there is weak evidence which suggests that IPP investments will result in a positive impact on impact on trade (two studies), although it is not clear if the impact on trade is positive or negative. Under the heading of standard of living, there is weak evidence which suggests that IPP investments will result in a positive impact on incomes (three studies) and no evidence from other variables under this impact type.

With reference to environmental sustainability, there is limited evidence linking IPP investments to results in emissions (three studies), which indicates how renewable energy IPPs lead to a reduction in GHG emissions, (i.e. through avoidance of emissions by adding renewable energy capacities rather than adding capacities which use fossil fuels).

Transmission and distribution

There are fewer high-quality studies linking T&D investments to impact than are available for IPPs. For BII’s impact pathways, the team found limited evidence from three studies, of the positive impact of T&D on customers reached. This evidence was measured by connections, which typically had a 1- or 2-year lag period. It found moderate evidence of reduced prices (six studies) as a result of T&D investments. At outcome level, there is limited evidence of the positive impact of T&D on productivity, based on two studies.

Most of the evidence that was found related to variables that are classified under ultimate impacts, although for all but one of these, the evidence was limited or weak. Under economic opportunity, there is limited evidence of the positive impact of T&D on net positive GDP benefits (four studies) and employment (three studies), and weak and/or inconclusive evidence on the effects on trade (one study). For variables associated with standard of living, the team found a moderate amount of evidence that T&D affects gendered outcomes (with five studies). However, the evidence was inconclusive as to whether the investments had a positive or negative effect on these gendered outcomes. The evidence on the impact on positive income effects (through energy price reduction) is limited (four studies); the evidence on health is weak but positive (one study); the evidence on educational impacts (such as the number of hours that children study each day) is also limited with three contributing studies, and neutral as to whether the T&D has a positive or negative effect on these impacts. For environmental sustainability, there is limited evidence of the positive impact of T&D on reduced CO2 emissions (four studies).

Mini-grid and off-grid

There is moderate evidence linking mini-grid and off-grid solutions to positive impacts; however, the evidence base is weak or limited for many of the variables of interest. For impact pathways, there is strong evidence linking mini-grids to customers reached, which suggests that they contribute to increased coverage, although there is no clear comparison with grid energy which would help to indicate which solution would most benefit consumers. There is also moderate evidence indicating that mini-grids generate power at a lower price than grid energy, depending on the source of the energy (nine studies). For BII’s outcomes, there is weak, inconclusive evidence linking these investments to productivity (one study). Under ultimate impacts, for economic opportunity the evidence base is limited but suggests that mini-grid and off-grid solutions have a positive impact on employment (four studies). Related to standard of living, there is limited evidence to suggest a positive impact on incomes through reduced energy/time costs (five studies), and weak evidence to indicate a positive impact on health outcomes (two studies) educational outcomes (two studies) and gender outcomes (three studies). Regarding environmental sustainability, the evidence is moderate and suggests a positive impact on GHG emission reduction (six studies).

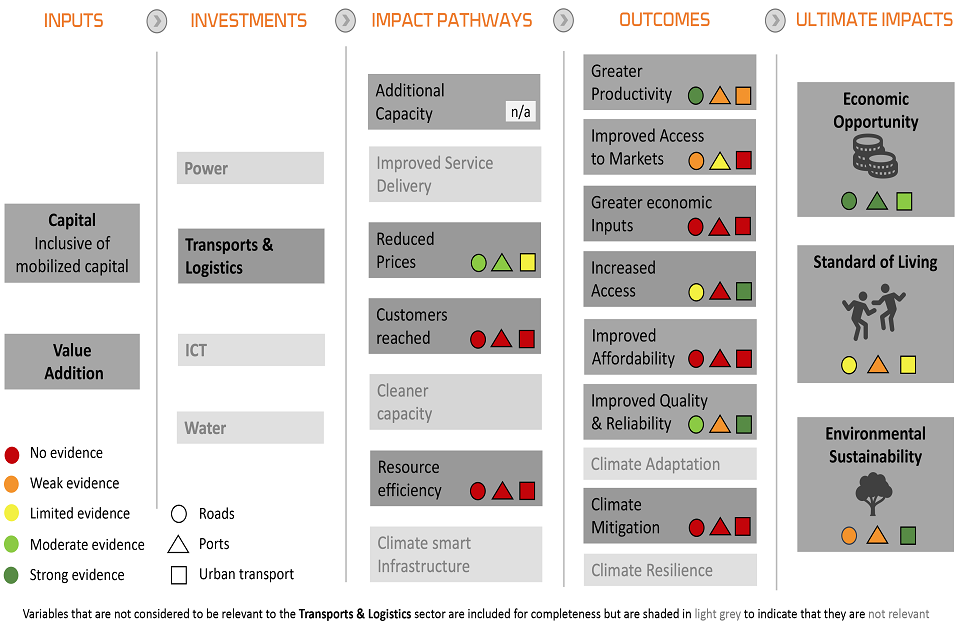

Transport

Exhibit 8 presents a summarised overview of the strength of available evidence against the relevant variables for Transport, based against the BII Infrastructure Impact Framework. At impact pathway stage, there is moderate evidence available on reduced prices; of the seven relevant outcomes, three of the outcomes have strong evidence for one asset type each, but the evidence is weak, limited or none was found, for the remaining four outcomes. Overall, there is strong evidence available for each asset type for each of the ultimate impacts.

Exhibit 8: Summary of evidence for the Transport sector against the BII Infrastructure Impact Framework

Exhibit 8

Roads

The team found good evidence linking investments in roads to a number of variables of interest. However, it is noteworthy that the studies that focus on developing countries primarily relate to rural roads, whereas BII’s investment strategy for roads is focused on toll roads. For impact pathways, there is moderate evidence of a positive relationship between roads and prices (seven studies). At outcome level, there is moderate evidence that road investments improve quality and reliability, by means of positive effects on transport time (six studies) and strong evidence that they improve productivity at micro and macro level (13 studies; however, this evidence is difficult to quantify as metrics vary considerably across the different studies). Some positive, but limited, evidence suggests that new roads increase access, this is measured by increased usage (five studies). There is weak evidence to suggest that road investments improve access to markets, when assessed by volumes of goods (one study).

For ultimate impacts, there is strong evidence that roads impact economic opportunity, with strong and positive evidence on their impact on GDP (18 studies) [footnote 34], and on trade (14 studies) [footnote 35]. There is moderate evidence of a positive relationship between roads and employment (six studies) [footnote 36]. For standard of living, there is strong positive evidence linking roads to incomes, household consumption and poverty reduction in relation to new, rural roads specifically (13 studies) [footnote 37]. Under Environmental Sustainability, there is weak evidence to suggest that road investments increase emissions (two studies).

Ports

Overall, there is good evidence to demonstrate the impact of ports on economic variables. However, there is weak evidence that ports affect the variables that are associated with people’s standard of living. For impact pathways, there is moderate evidence available on the positive impact of ports on price (eight studies). Under outcomes, limited evidence is available on the impact of ports on improved access to markets, when measured as the increase in volume of goods (four studies). The link between ports and improved quality and reliability (as measured by transport time) and productivity is only weakly evidenced by two studies for each factor, but despite this it indicates a positive relationship between the two factors. At ultimate impact level, there is strong evidence that ports affect economic opportunity, with strong evidence available of the positive impact on trade (10 studies) [footnote 38], on employment (16 studies) [footnote 39] and of increased port throughput capacity on local or regional GDP (23 studies) [footnote 40].

However, there is a lot of variability in the data relating to employment, making the relationship between ports and employment difficult to quantify. Regarding standard of living, limited evidence links ports to positive impacts on incomes (five studies) and no evidence was found linking ports to other measures of standard of living [footnote 41]. The impact of ports on environmental sustainability, as measured as emissions, is also weakly evidenced (one study) and inconclusive as to whether it is a positive or negative relationship.

Urban transport

For urban transport [footnote 42], good evidence links these investments to economic variables, however, there is limited or weak evidence on the results for end users. For impact pathways, the review found limited evidence that urban Transport investments have a positive impact on user price (three studies). At outcome level, the team found strong evidence that an increase in urban transport infrastructure leads to increased access, measured as user volume (11 studies) [footnote 43] and improved quality and reliability, measured as a reduction in travel time (14 studies) [footnote 44].

Weak evidence links urban transport to greater productivity (one study). Under ultimate impacts, there is moderate evidence of the positive impact of these investments on economic opportunity, indicated by moderate evidence of the positive impact on employment (eight studies) and GDP (nine studies; although incomparable data meant that the relationship of investments in urban transport with GDP could not be quantified). Regarding standard of living, there is limited evidence on its positive impact on household incomes (six studies), and weak evidence on its impact on health (one study) and education (two studies). In terms of environmental sustainability, the team found strong evidence linking an increase in urban transport infrastructure to a decrease in emissions (11 studies) [footnote 45].

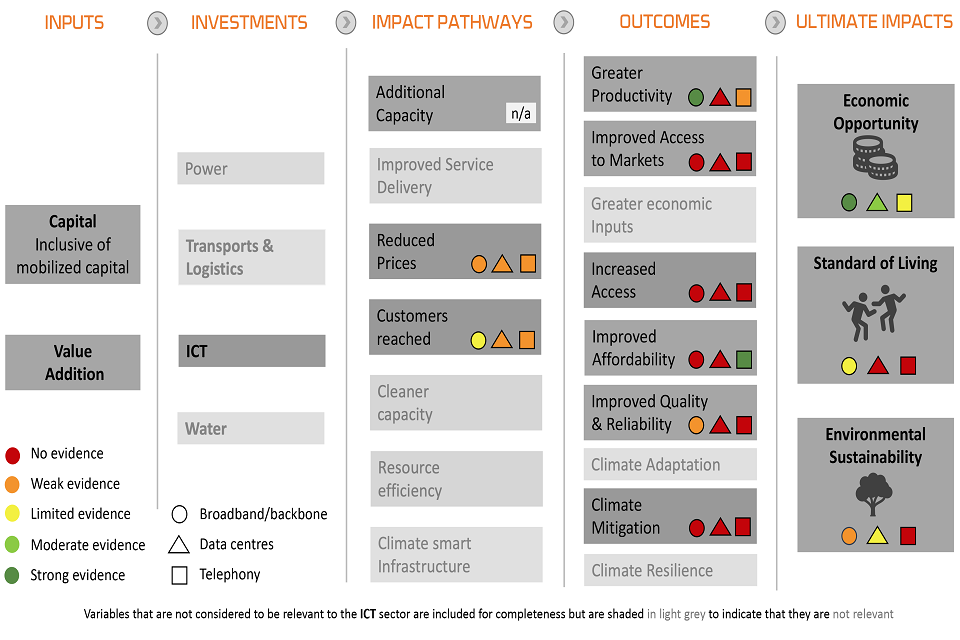

ICT and Telecoms

Exhibit 9 presents the ICT and Telecoms evidence, by asset type, summarised against the BII Infrastructure Impact Framework. There is evidence at impact pathway stage of the framework for both reduced prices and customers reached. At outcome level, there is either no evidence or it is weak evidence, with the exception of a strong evidence base on productivity for broadband/backbone and on improved affordability for telephony. At ultimate impact level, the evidence base is stronger for economic opportunity than it is for standard of living and environmental sustainability. Overall, the evidence for ICT and Telecoms indicates positive impacts of broadband and backbone investments, particularly on economic variables, but the impact is unclear for data centres and telephony.

Exhibit 9: Summary of evidence for the ICT and Telecoms sector against the BII Infrastructure Impact Framework

Exhibit 9

Broadband/backbone

In terms of impact pathways, the evidence linking internet to customers reached – measured by number of users – is limited, but indicates a positive relationship (five studies). The evidence is weak and inconclusive on the effects of broadband on price (two studies). Regarding outcomes, the evidence is strong on the positive impact of broadband penetration on productivity (11 studies) [footnote 46], and weak for the impact of broadband on improved quality and reliability when measured as speed (one study). At ultimate impact level, there is strong evidence on the impact of broadband on economic opportunity, with a positive relationship indicated on the effect of broadband penetration on employment (24 studies) [footnote 47], and GDP (23 studies) [footnote 48].

In relation to economic opportunity, there is moderate evidence suggesting a positive relationship between broadband and its effects on trade (seven studies). Related to standard of living, there is moderate evidence on the positive effect broadband has on income (seven studies), and weak evidence of the impact of broadband on education (two studies) and health (one study), suggesting a positive relationship. Regarding environmental sustainability, the evidence base is weak for the impact of broadband on emissions (one study).

Data centres

For data centres, there is good evidence of their impact on employment and growth, but limited or weak evidence in relation to all other variables. At impact pathway level, the evidence of data centres’ impact on price and customers reached (as measured by usage) is weak and inconclusive (one study each). At outcome level, the team did not find any evidence of the impact of data centres on the relevant variables. For ultimate impacts, there is moderate evidence of the positive impact of data centres on economic opportunity, by means of impact on employment (10 studies) [footnote 49] and GDP (seven studies). The team found no evidence linking data centres with impact on variables associated with standard of living. For environmental sustainability, there is limited evidence of the positive impact of data centres on emissions. Where more efficient data centres lower emissions (five studies), the evidence is unquantifiable.

Telephony