Estimating the impact of sanctions on Russia’s war efforts

Published 13 June 2025

Headlines

As of February 2025, the Foreign, Commonwealth & Development Office (FCDO) estimates that global sanctions have deprived the Russian state of at least $450 billion since February 2022 (when Russia invaded Ukraine). This includes:

-

an estimate of direct tax revenue that the state has forgone (eg tax losses) as a result of the widened discount on Russian crude oil compared to global benchmark oil prices: $154 billion

-

immobilised Russian sovereign assets in EU and other G7 institutions: approximately $285 billion

Key definitions

Urals crude oil: the reference oil blend conventionally used in Russian taxation as the primary benchmark price for Russian oil exports

Brent crude oil: a crude oil blend that serves as the global benchmark for oil prices.

Discount: the ‘discount’ is the difference in the price of Urals crude oil and Brent crude oil. Sanctions that affect Russia’s ability to sell oil lower the price of Urals crude oil relative to Brent, thus widening the discount. The discount is a key measure of how sanctions are affecting Russia’s ability to sell oil

MET: the Mineral Extraction Tax is levied on all minerals extracted in Russia in accordance with Russian tax legislation. It is a partial measure of the revenue that the Russian state directly earns from selling oil

Export duties: export duties are duties that the Russian state applied to foreign sales of crude oil, natural gas, and petroleum products (refined from crude oil), phased out for oil and petroleum products in January 2024

Current account balance: this is the trade balance of a country that includes the net flow (exports minus imports) of goods, services, income and current transfers

Counterfactual: this refers to what might have occurred without sanctions

Methodology

Sanctions have:

-

deprived the Russian state of $154 billion in oil tax revenues. The ‘discount’ on Urals crude oil compared to Brent crude oil has widened over the course of the war, likely due to sanctions that have made it harder for Russia to sell its oil internationally. We can calculate forgone Mineral Extraction Tax (MET) revenues and export duties (phased out for oil and petroleum products in January 2024) earned by the Russian state as a result of the widened discount (see figure 1)

-

deprived the Russian state of Russian sovereign assets worth $285 billion. The EU and other G7 institutions currently hold approximately $285 billion[footnote 1] of immobilised Russian sovereign assets

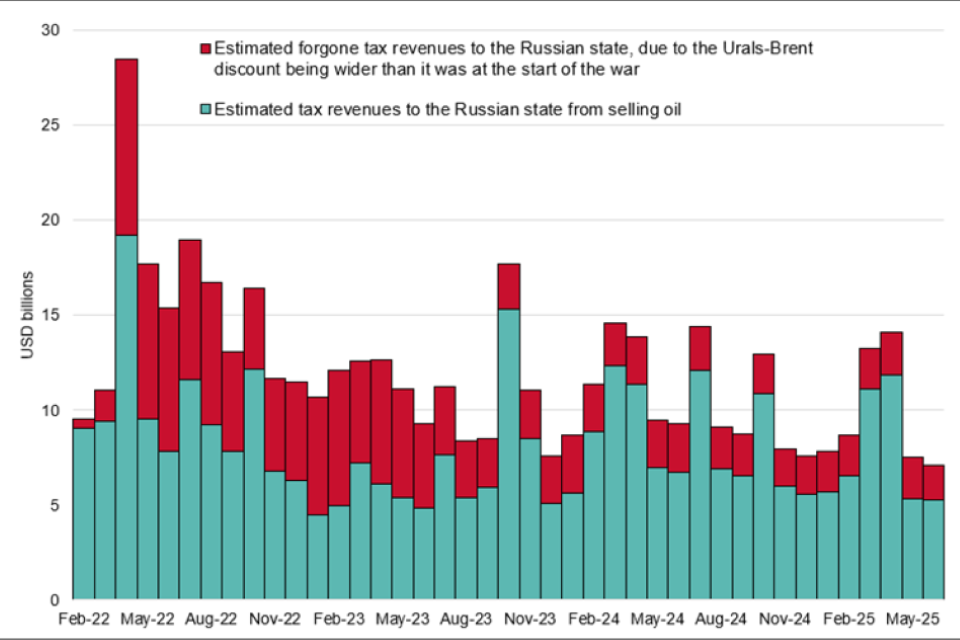

Figure 1: Forgone Russian oil tax revenue due to the widened discount on Urals oil

Figure 1 shows an image of a stacked column chart. The X-axis displays date (from February 2022 to June 2025 in 4-month intervals). The Y-axis displays Russian oil tax revenues in US$ billions (from 0 to 30). The columns contain 2 series. The turquoise series shows estimated Russian state oil tax revenues, which totals $335 billion over this period. The red series shows estimated forgone tax revenues to the Russian state (due to the Urals-Brent discount being wider than it was at the start of the war), which totals $154 billion over this period. The magnitude of the red series relative to the turquoise series decreases as time progresses (from left to right). There is no dominant trend in the turquoise series.

Figure 2: Breakdown of Russian assets and revenues deprived from the Russian state as a result of sanctions since February 2022

| Component of $450 billion figure | Value of Component in US$ billions |

|---|---|

| Component 1: Forgone oil tax revenues | 154 |

| Component 2: Immobilised Russian sovereign assets | 285 |

| Total of Components | 440 |

Limitations of the analysis

-

this is a conservative estimate of the revenues and assets deprived from the Russian state due to sanctions. This analysis only considers the direct impact of sanctions on state assets and tax revenues, and not on other areas of the economy

-

it is likely that the true effect of sanctions on Russian state revenues is much higher than estimated here. Hence it is fair to say that global sanctions have deprived the Russian state of at least $450 billion since Russia’s full-scale invasion of Ukraine in February 2022

-

examples of deprivations that are difficult to quantify accurately and therefore have not been included in figure 2 include:

-

Russian assets belonging to private individuals. $58 billion[footnote 2] frozen by REPO members, and £25 billion additional assets belonging to individuals frozen in the UK [footnote 3] [footnote 4]. As these are private assets, they are not considered to be ‘assets deprived from the Russian state’. However, in an extreme scenario, the Russian state may have the ability to appropriate private assets for the war effort

-

the overall reduction in total oil export revenues due to sanctions. We can only estimate the MET tax revenues forgone by the Russian state as a result of sanctions. However, Russia’s total oil and gas export revenues have likely also reduced. The overall export revenue forgone by Russia as a result of sanctions cannot be accurately measured, as there is no reasonable counterfactual to compare price and volume effects against

-

sanctions have also likely impacted Russia’s finances through non-discretionary spending. In particular, financing struggling companies using assets in the National Wealth Fund (NWF). The growth of the illiquid assets in the NWF represents the increase in state financial support for companies, such as Aeroflot and Russian Railways

-

-

this approach does not account for the direct effect of sanctions on the global oil market. It only calculates the reduction in revenues from the widening of the discount assuming prices and export volumes remain constant

-

the estimate assumes that global oil prices were not affected by sanctions. Although there is evidence that expected and actual sanctions have affected oil prices, it is hard to isolate the impact of sanctions. The global oil market is complex, driven by many supply and demand factors and other concurrent events which could affect prices

-

the estimate assumes that the quantity of oil produced and exported was not affected by sanctions. Though quantities supplied and demanded can be influenced by prices, it is challenging to isolate the impact of sanctions

-

-

Taken as the average exchange rate EUR/USD in March 2022 via Haver Analytics, when these assets were immobilised, to translate €260 billion into $285 billion, European Council. €183 billion of these assets are held as deposits in Euroclear. ↩