DWP accounting officer system statement

Updated 2 August 2021

Any enquiries regarding this publication should be sent to us at:

Permanent Secretary’s Office

4th Floor

Caxton House

6–12 Tothill Street

London SW1H 9NA

Print ISBN: 978-1-78659-347-4

Web ISBN: 978-1-78659-346-7

Section 1: Statement of Accounting Officer’s responsibilities

1.1 I am the Principal Accounting Officer for the Department for Work and Pensions. This system statement summarises how I fulfill my responsibilities as the Accounting Officer, in accordance with HM Treasury’s guidance set out in Managing Public Money, and within the responsibilities and controls as set out in my delegated authority letter from HM Treasury.

1.2 My Department is responsible for developing policy and delivering essential services on work, welfare, pensions and child maintenance. The Secretary of State for the Department for Work and Pensions and other departmental ministers have a duty to Parliament to account for, and be held to account for, the policies, decisions and actions of this Department and its agencies. They look to me as the Department’s Accounting Officer to support them in making policy decisions and handling public funds, and to delegate appropriately within the Department to deliver their decisions. This system statement summarises the accountability relationships and processes within my Department, making clear who has delegated accountability for what.

1.3 As Accounting Officer, I am personally responsible for safeguarding the public funds for which I have been given charge under the Department for Work and Pensions’ Estimate. Where I have appointed additional accounting officers, their responsibilities are also set out in this system statement.

1.4 The system statement covers the core Department and relationships with its public bodies and other arm’s length relationships. It describes accountability for all expenditure of public money through my Department’s Estimate, all public money raised as income, and major contracts and outsourced services.

1.5 This system statement describes the accountability system which is in place at the date of this statement and which will continue to apply until a revised statement is published.

Peter Schofield CB

Permanent Secretary and Principal Accounting Officer

July 2021

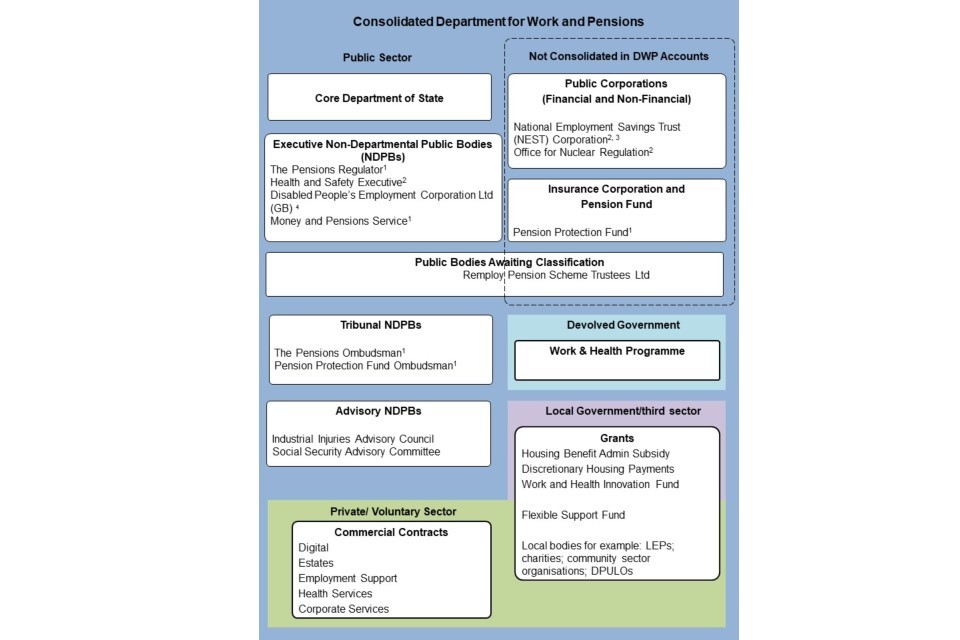

Section 2: Diagram showing all parts of the system

1 These bodies receive funding from the levies imposed on pension providers. A more detailed explanation of funding arrangements is to be found in section 4. The Pensions Ombudsman and Pension Protection Fund Ombudsman are separate statutory roles, supported by a single organisation called The Pensions Ombudsman

2 Receive additional funding from charging for work done

3 Following the Tailored Review NEST is exclusively a Public Corporation

4 In Members’ Voluntary Liquidation

Public sector

Core Department of State

Executive Non-Departmental Public Bodies (NDPBs)

- The Pensions Regulator [footnote 1]

- Health and Safety Executive [footnote 2]

- Disabled People’s Employment Corporation Ltd (GB) [footnote 4]

- Money and Pensions Service [footnote 1]

Not consolidated in DWP Accounts

Public Corporations (Financial and Non-Financial)

- National Employment Savings Trust (NEST) Corporation [footnote 2] [footnote 3]

- Office for Nuclear Regulation [footnote 2]

Insurance Corporation and Pension Fund

- Pension Protection Fund [footnote 1]

Public Bodies awaiting Classification

- Remploy Pension Scheme Trustrees Ltd

Tribunal NDPBs

- The Pensions Ombudsman [footnote 1]

- Pension Protection Fund Ombudsman [footnote 1]

Advisory NDPBs

- Industrial Injuries Advisory Council

- Social Security Advisory Committee

Devolved Government

- Work & Health Programme

Local Government / third sector

Grants

- Housing Benefit Admin Subsidy

- Discretionary Housing

-

Work and Health Innovation Fund

-

Flexible Support Fund

- Local bodies for example: LEPs; charities; community sector organisations; DPULOs

Private / Voluntary sector

Commercial Contracts

- Digital

- Estates

- Employment Support

- Health Services

- Corporate Services

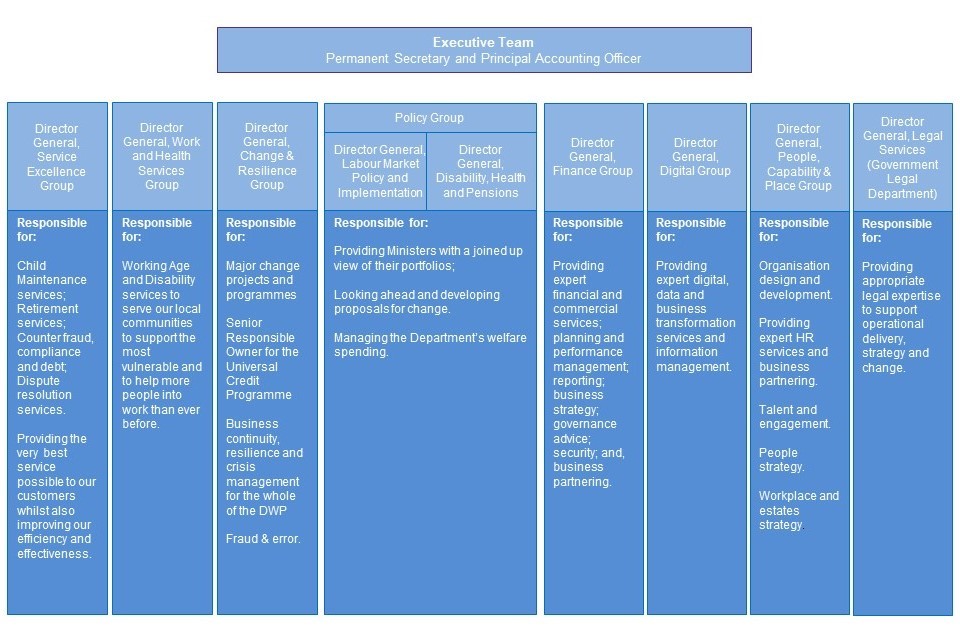

Section 3: Responsibilities within the core Department

3.1 The Executive Team is the senior decision-making body for departmental management and agrees the organisational structure, plans and resources that will deliver the Department’s agenda. The Executive Team maintains a strategic oversight of the Department’s major delivery commitments.

3.2 The Permanent Secretary, as Accounting Officer, issues letters of delegation to each director general setting out their spending authority in line with HM Treasury delegated authority controls and responsibilities. Letters of delegation are also issued to senior responsible owners of major change programmes.

3.3 At the end of the financial year, each director general provides the Accounting Officer with their assurance on the effectiveness of the controls that support their business activities and delivery of the Department’s policies.

3.4 The role and responsibility of each member of the Executive Team is set out below.

Executive Team

Permanent Secretary and Principal Accounting Officer

Director General, Service Excellence Group

Responsible for:

Child Maintenance services; Retirement services; Counter fraud, compliance and debt; Dispute resolution services.

Providing the very best service possible to our customers whilst also improving our efficiency and effectiveness.

Director General, Work and Health Services Group

Responsible for:

Working Age and Disability services to serve our local communities to support the most vulnerable and to help more people into work than ever before.

Director General, Change & Resilience Group

Responsible for:

Major change projects and programmes

Senior Responsible Owner for the Universal Credit Programme

Business continuity, resilience and crisis management for the whole of the DWP

Fraud & error.

Policy Group

Director General, Labour Market Policy and Implementation

Director General, Disability, Health and Pensions

Responsible for:

Providing Ministers with a joined up view of their portfolios;

Looking ahead and developing proposals for change.

Managing the Department’s welfare spending.

Director General, Finance Group

Responsible for:

Providing expert financial and commercial services; planning and performance management; reporting; business strategy; governance advice; security; and, business partnering.

Director General, Digital Group

Responsible for:

Providing expert digital, data and business transformation services and information management.

Director General, People, Capability & Place Group

Responsible for:

Organisation design and development.

Providing expert HR services and business partnering.

Talent and engagement.

People strategy.

Workplace and estates strategy.

Director General, Legal Services (Government Legal Department)

Responsible for:

Providing appropriate legal expertise to support operational delivery, strategy and change.

Senior governance board structure

3.5 The headings below sets out the structure of our senior boards and the lines of communication so that issues are escalated to the right audience.

Departmental Board

Forms the collective strategic and operational leadership of the Department, bringing together the Ministerial and Civil Service leaders with senior non-executives from outside government with a remit of performance and delivery.

Delivery Board

Offers external perspectives, expertise and challenge across the DWP agenda to collectively assure delivery of the department’s objectives.

Departmental Audit and Risk Assurance Committee

Provide an independent view as to the appropriateness, adequacy and overall value for money of the governance, risk, control and associated assurance processes that are in place in DWP and its arm’s-length bodies.

Nominations Committee

Advises on identifying and developing leadership and colleagues with high potential, our incentive scheme and succession planning.

Digital Advisory Committee

Provide independent expert advice enabling DWP and its arms-length bodies to explore the potential of digital design, data and emerging technologies securely to achieve outcomes prioritised by DWP.

Executive Team

Senior decision-making body for departmental management - agrees the organisational structure, plans and resources that will deliver the Department’s agenda. The Executive Team maintains a strategic oversight of the Department’s major delivery commitments.

Investment Committee

Executive oversight of the Department’s overall financial position, including: management of the in-year funding position, prioritisation, and scrutiny of multi-year plans.

Capacity Board

Agree and make decisions based on, the annual DWP workforce plan, strategic workforce planning, and have oversight and governance of the estates strategy to ensure there is a consistent and coherent view of the assumed workforce needs of the Department.

Service Transformation Board

Improving customer services so that they deliver better outcomes in a more effective and efficient way that reduces demand.

Change Portfolio Board

Ensures the Major Change Portfolio is managed in the most effective way possible and meets its stated objectives within agreed financial parameters.

Risk Assurance Board

Assurance that risks are being effectively and proportionately managed, both within each DG area and across the whole organisation.

Independent Assurance

National Audit Office

Audits our financial statements, conducts value-for-money studies and investigations reporting the results to Parliament.

Infrastructure and Projects Authority

DWP change programmes on the Government Major Project Portfolio.

Government Internal Audit Agency

Provides independent assurance directly to the Accounting Officer, the Executive Team, change programme senior responsible owners and also to the Departmental Board via the Departmental Audit and Risk Assurance Committee.

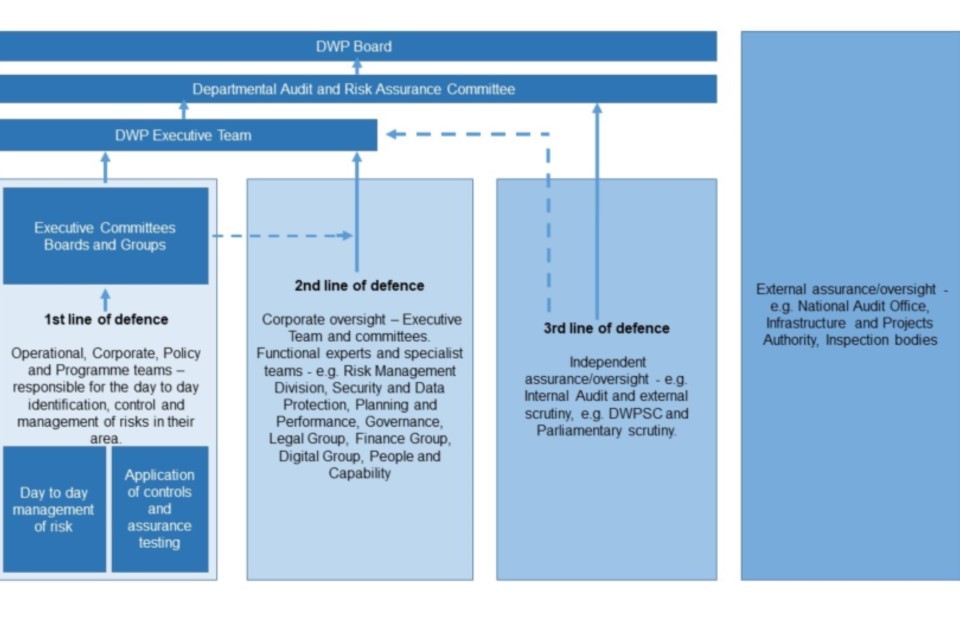

Risk management

3.6 Our system of internal control is designed to manage risk to a reasonable level, rather than to eliminate all risk of failure to achieve policies, aims and objectives. We continue to operate the three lines of defence model, as illustrated below, to provide continuous and reliable assurance on organisational stewardship and the management of significant risks to delivery of improved, cost effective services.

Three lines of defence model

| DWP Board, Departmental Audit and Risk Assurance Committee, DWP Executive Team, Executive Committees Boards and Groups | DWP Board, Departmental Audit and Risk Assurance Committee, DWP Executive Team | DWP Board, Departmental Audit and Risk Assurance Committee | |

|---|---|---|---|

| First line of defence | Second line of defence | Third line of defence | |

| Operational, Corporate, Policy and Programme teams – responsible for the day to day identification, control and management of risks in their area. Day to day management of risk. Application of controls and assurance testing. | Corporate oversight – Executive Team and committees. Functional experts and specialist teams - e.g. Risk Management Division, Security and Data Protection, Planning and Performance, Governance, Legal Group, Finance Group, Digital Group, People and Capability | Independent assurance/oversight - e.g. Internal Audit and external scrutiny, e.g. DWPSC and Parliamentary scrutiny. | External assurance/oversight - e.g. National Audit Office, Infrastructure and Projects Authority, Inspection bodies |

Our risk management framework is applied across the Department which means risks to DWP, project and/or local objectives will be regularly identified and managed using our four step cycle. This means that new risks may be identified, old risks managed out, and mitigating actions taken throughout the year.

Step 1 – Identify

What: Identify risks which threaten the achievement of objectives of the Department or Business Unit, or threaten its reputation.

Why: To identify risks which need to be mitigated/ reduced if the Department is to succeed.

How: At defined times, risks should be identified having regard to DWP risk categories.

Outputs: Defined times specified. At each time point, risks documented (on preliminary risk register) including both causes and consequences categorised into one of the DWP risk categories.

Step 2 – Assess

What: Assess the potential likelihood and impact of each identified risk.

Why: To prioritise risks for management attention and action.

How: Risks assessed for both inherent risk (before controls) and residual risk (based on known effectiveness of current controls activities) using consistent defined Corporate criteria.

Outputs: Documented and prioritised key risks (on a risk register) with inherent and residual risk scores, and a documented understanding of existing controls to mitigate risk and the effectiveness of those controls.

Step 3 – Address

What: Agree a strategy/approach for addressing key risks.

Why: To ensure risks are managed in an appropriate way.

How: Decide the most appropriate treatment for the risk to either prevent its occurrence or manage the impacts if it does occur (or both).

Outputs: Documented (on a risk register) strategy and owners for each risk, accountable for designing controls and mitigating activities (also documented on the risk register) to reduce inherent risk to an acceptable level in an agreed period of time.

Step 4 – Review and report

What: Regular risk reporting to management.

Why: To provide visibility to management of current managed/unmanaged risks.

How: Key risks captured on a risk register, showing assessed risk levels, mitigating actions, and risk indicators, all reviewed regularly to confirm accuracy and identify potential new emerging risks.

Outputs: Risks fully documented on risk registers, with owners and actions, including residual and target ratings. Reports to Executive management, summarising the key risks and risk portfolio of the Department as a whole.

3.7 Our focus on risk management within some of our governance bodies is to support greater engagement and assurance. Our Risk Assurance Board is part of our formal governance and is held monthly. The Executive Team identify the strategic risks facing the Department.

3.8 The Chief Risk Officer is responsible for ensuring sponsorship of risk management at executive level and across all senior forums in the Department, driving reviews and visibility of principal risks in senior leadership conversations, ensuring risks have robust mitigation plans to manage to target levels.

3.9 In 2019-20 the Risk and Control Assessment (RCA) programme was introduced by the Risk Management function, to provide assurance on the effectiveness of internal controls and risk management across the Department. The aim of the programme is to provide second line of defence assurance within each Director General (DG) business area supporting, informing and evidencing their annual Letter of Assurance (LoA). Reports are drafted for each DG, providing an assurance opinion at half year (October) and at the end of the financial year, to support completion of the LoA.

3.10 The DWP Group Chief Internal Auditor provides independent assurance directly to the Accounting Officer, the Executive Team and senior responsible owners and also to the Departmental Board via the Departmental Audit and Risk Assurance Committee.

3.11 We also work with external assurers such as the National Audit Office, for all aspects of departmental business, and the Infrastructure and Projects Authority, for independent assurance of our major projects and programmes.

Financial Assurance

Annually Managed Expenditure

3.12 All decisions that impact on Annually Managed Expenditure (AME) must be agreed with HM Treasury as set out in the Department’s delegated authority letter. The Policy Group Director General chairs our AME Board, which focuses on the proactive management of DWP AME. He also chairs the quarterly Senior Welfare AME Group with HM Treasury, in partnership with the DWP Finance Director General.

3.13 In addition, several programme boards with AME implications include HM Treasury representation, such as the Universal Credit Programme.

3.14 The welfare cap, assessed by the Office for Budget Responsibility, is designed to ensure that AME expenditure on designated aspects of spending is contained within a predetermined cap and margin. The current cap applies in 2022-23 with the next formal assessment being based on the forecast at the first fiscal event of the next Parliament.

Departmental Expenditure Limit

3.15 The Accounting Officer is responsible for the Departmental Expenditure Limits (DEL) funding allocated by Parliament. The three lines of defence model (see section 3.6) operated by the Department ensures that the Department does not overspend against the allocated control totals on resource, capital, admin and programme expenditure. This includes any additional controls or ring fences that are agreed by Parliament.

3.16 The Departmental Board and Executive Team support Ministers in allocating funds in accordance with HM Government’s priorities. The budgets are then delegated to Directors General, who are responsible for managing and reporting on their allocations and delivering against the agreed priorities. Directors General have the authority to delegate spending authority to senior colleagues in their directorates are supported by a team of finance business partners who advise them on the financial position of the department.

3.17 The Departmental Board, the Executive Team and its supporting committees help to ensure that there are clear lines of communication and allow risks to be escalated promptly. The structure of the senior governance boards and its committees is set out above in Section 3.6.

Shared Services Connected Ltd Letter of Assurance

3.18 Shared Services Connected Ltd (SSCL) was created as a joint venture in 2013, to provide shared finance, human resources and procurement services to the public sector.

3.19 To facilitate the delivery of these shared services, SSCL is also responsible for the build and implementation of the Single Operating Platform (SOP) as well as SOP hosting, infrastructure management support, application management support, contact centres, service management and performance management. From November 2020 the hosting of SOP moved from ‘on premise’ with Fujitsu to ‘cloud’ hosting using Oracle Cloud Infrastructure (OCI) with Fujitsu, Cintra and Oracle as the key subcontractors providing the associated IT services.

3.20 Government Shared Services (GSS), a part of the Cabinet Office, is responsible for managing the overarching framework agreement with SSCL on behalf of departmental customers such as the DWP and provides an annual Letter of Assurance (LoA) to all customers based upon the overall SSCL audit and assurance programme.

3.21 The GSS Letter of Assurance covering SSCL shared service provision to the Department incorporates content from various sources, including:

- the independent ISAE 3402 report prepared by Pricewaterhouse Coopers LLP (PwC), which provides an industry standard on the design and effectiveness of key controls operated by SSCL

- a programme of reviews jointly agreed by the SSCL Audit Committee and GSS also delivered by SSCL’s auditors, PwC, and

- the Cabinet Office Framework level review work provided by the Government Internal Audit Agency (GIAA) as well as a series of end-to-end audit reviews.

Management of interests

3.22 All of our employees are bound by the Civil Service Code – the framework on which the Department’s standards of behaviour are built. The consequences of failing to comply are serious and attract penalties up to and including dismissal. The DWP Standards of Behaviour Policy applies to employees at all grades.

3.23 Employees are generally mandated that their interests and activities outside of work must not create conflict of interest or potential for perceived conflict of interest with their official role and they must not bring the Department into disrepute. Employees are specifically instructed never to request special treatment from any client of DWP that would benefit their outside interests. Employees are also specifically required to consult their line manager and seek permission if they are proposing to take up a second occupation or any position with a non-political organisation (political activity is controlled under separate rules) if it could create a conflict of interests, or appear to create a conflict of interests. Further, employees must seek their manager’s written permission to take up any non-executive directorship during their employment with DWP.

3.24 A regular return from all staff is collected during the year to confirm a ‘Nil Return’ or, where appropriate, a positive declaration. Declarations from our most senior leaders, covering Ministers, the Executive Team, Non-Executive Directors and Special Advisors, are published in our Annual Report and Accounts.

Business Appointments

3.25 Permission is required if any employee wishes to leave the Department to accept a job offer made by a person, company or firm with whom the employee formed a relationship during the course of their official duties and this applies for up to 2 years after an employee has left our employment. Applications under these rules are considered by someone in a position to understand the potential issues arising from the applicant’s proposed outside appointment and judge the possible public perceptions should the appointment be taken up as proposed. This would normally be someone in the applicant’s line management chain.

3.26 Countersigned applications are scrutinised by our People, Capability and Place Group for assessment and action and to ensure consistent application, ahead of approval either unconditionally or with conditions, or rejection. The Department’s measures in each instance are proportionate to the grade and previous role(s) of the applicant.

3.27 In compliance with Business Appointment rules, the Department is transparent in the advice given to individual applications from senior staff, including special advisers. Advice given to senior civil servants at SCS1 and SCS2 regarding specific business appointments is published on GOV.UK.

3.28 The Advisory Committee on Business Appointments (ACOBA) considers applications from the most senior levels:

- Ministers

- permanent secretaries (and their equivalents)

- directors-general (and their equivalents)

3.29 Advice given by ACOBA regarding specific business appointments is published on GOV.UK.

Section 4: Relationships with public bodies

4.1 This section focuses on the Department’s relationships with its public bodies The Department sponsors 12 bodies, which perform a number of functions, including regulation of pensions and the nuclear industry, protection and safeguards for the public, as well as the provision of information and guidance. They are:

- Disabled People’s Employment Corporation (GB) Ltd (in Members’ Voluntary Liquidation)

- Health and Safety Executive (HSE)

- Industrial Injuries Advisory Council (IIAC)

- National Employment Savings Trust (NEST)

- Pension Protection Fund (PPF)

- Pension Protection Fund Ombudsman (PPFO)

- Remploy Pension Scheme Trustees Ltd (RPST)

- Social Security Advisory Committee (SSAC)

- Office for Nuclear Regulation (ONR)

- The Pensions Ombudsman (TPO)

- The Pensions Regulator (TPR)

- The Money and Pensions Service (MAPS) (formerly Single Financial Guidance Body)

4.2 In March 2021, the Director General, Disability, Health and Pensions was given responsibility for assurance on the governance and control arrangements for the bodies.

4.3 The Department’s Arm’s Length Body Partnership Division has responsibility for managing the day-to-day relationships with the bodies on behalf of the accounting officer to ensure adherence with the accounting officer’s financial management responsibilities. Our oversight approach is written into the framework documents that govern our relationships.

4.4 Public bodies operate independently, but are held to account by the Department. For the following bodies, the Permanent Secretary, as Principal Accounting Officer, has designated the chief executive of each organisation as its Accounting Officer. These are listed in the DWP Estimate, Part III, Note D:

- Health and Safety Executive

- The Pensions Ombudsman

- The Pensions Regulator

- The Money and Pensions Service (listed as Single Financial Guidance Body)

- Disabled People’s Employment Corporation (GB) Ltd (in Members’ Voluntary Liquidation)

4.5 Most of our bodies operate within our accounting boundary and are consolidated into the accounts of the departmental group. The exceptions are:

- National Employment Savings Trust

- Pension Protection Fund

- The Office for Nuclear Regulation

4.6 Our public bodies are independent entities, with their own boards who are responsible for delivery, performance management and ensuring that their risks are dealt with appropriately. There are a range of standard financial control arrangements in place to assure the Departmental Board that robust governance arrangements are in place for each public body, tailored as appropriate, including quarterly accountability reviews with the chief executives and finance directors. Our risk management approach is written into the framework documents that set out our relationship. Departmental officials attend the bodies’ own audit committee meetings and we encourage the sharing of risk management expertise – for example on cyber security. The Departmental Board receives a regular dashboard summarising the delivery, financial and risk management performance of our bodies.

4.7 We conduct an annual assurance assessment to provide assurance that we have a good overview of each body and this allows us to review our tailored partnership arrangements. Working together with the public bodies, these arrangements have assured us that we are broadly compliant with the Cabinet Office ‘Partnerships between departments and arm’s length bodies: code of good practice’ and we have agreed a plan for further improvements.

Section 5: Local funding arrangements

5.1 The DWP has services delivered by both local and devolved bodies. The Ministry of Housing, Communities and Local Government is the lead responsible department for maintaining the overall accountability system for local government. Within that system, the DWP has policy responsibility for Housing Benefit, Discretionary Housing Payments and Work & Health Unit Innovation Fund.

Housing Benefit

5.2 Housing Benefit (HB) is a DWP benefit and the DWP Accounting Officer is responsible for it. HB is an income-related benefit paid to people who are entitled to help with costs for their rent. Provisions in the Social Security Administration Act 1992 and other enactments set out the framework for entitlement within which local authorities deliver HB. As with all benefits, the HB subsidy is an annually managed expenditure (AME) cost.

5.3 HB is not delivered by DWP. We provide funding to local authorities to pay HB along with an administration subsidy which contributes towards the cost of its delivering. During the year we may also make additional payments to cover the administration of any new burdens arising from policy or procedural changes. We have in place assurance arrangements to satisfy ourselves that all LAs who deliver the benefit on our behalf are doing so in accordance with HB policy and guidance. This means paying the right amount to the right person at the right time.

5.4 LAs are accountable to the Ministry of Housing, Communities and Local Government. Annually, their finance directors (known as Section 151 Officers in England) sign declarations about the validity of the internal controls and these are also subject to independent audit.

Discretionary Housing Payments

5.5 Discretionary Housing Payments is a scheme that allows local authorities to make awards to people in need of further financial assistance with housing costs. Each local authority has overall responsibility for administering the scheme and making awards, taking account of the Department’s guidance.

5.6 The audit requirement for the expenditure is based on self-certification by the local authority that includes a certificate signed by the section 151 officer (section 95 officer in Scotland) on the accuracy of the claim. This certificate also confirms that the local authority maintains adequate records which may be subject to our verification.

5.7 Further assurance is provided through the Ministry of Housing, Communities and Local Government’s Accounting Officer, who is accountable for the core system by which local authorities manage their funds.

Work and Health Unit (WHU) Grant Funding

5.8 The cross-government Work and Health Unit was established to test, implement and evaluate different approaches to improve work and health outcomes for working-age people who have, or may acquire, long-term health conditions or disabilities.

5.9 In some cases, an initial lump sum may be awarded up front for local authorities and clinical commissioning groups that meet our criteria for start-up funding. The grant will cover actual costs only and will not include provision for profit. Further funding will not be provided until the trial designs have been evaluated and a decision has been made on which trials to progress to the next phase.

5.10 Only those trials that can deliver in terms of performance and value for money are taken forward. Funding is awarded after completion of a competitive, staged process for selecting areas to work with to design and deliver health-led employment trials. The exact arrangement is specific for each approach and is documented in a new grant agreement and ‘memorandum of understanding’ with each local authority, clinical commissioning group or external partner.

5.11 Besides funding via grant, there are also various contractual arrangements in place to support research and evaluation activity. Commercial and Finance Partners provide independent and professional advice throughout for both types of arrangements.

5.12 In cases where a particular organisation or project has a level of inherent risk which must be managed, a more hands on approach is taken to ensure minimal risk to both funding payments and delivery outcomes: payment schedules are designed to coincide with key review points and funding is linked to successful completion of milestones.

5.13 There are well-established internal governance arrangements attended by a wide spectrum of stakeholders (internal and external) which ensure that necessary safeguards and assurance levels are in place. In addition, there is a mandatory requirement to obtain clearance from HMT prior to the issue of any grant agreement. Further assurance may also be provided from other Government Departments such as MHCLG, who are accountable for the core system by which local authorities, clinical commissioning groups and local enterprise partnerships receive central government funding.

Section 6: Grants to private and voluntary sector bodies, and third party delivery partnerships

6.1 This section outlines the accountability arrangements for grants to third party delivery partners including local authorities and voluntary sector bodies, who support the delivery of departmental objectives.

6.2 The Director General, Finance has overall responsibility for providing assurance that financial controls are sufficient to mitigate financial risks in all areas including grants. A senior process owner leads on all aspects of grants including ensuring compliance with the Global Design Principles and Grants Standards.

6.3 The Department awards grants to a range of organisations across different sectors in order to help achieve delivery of departmental objectives including developing bespoke support for the benefit claimants who have particular challenges in getting into work, trialling new ways of moving claimants into work, providing pensions advice, providing support to disabled people through the Access to Work scheme amongst others.

6.4 The Department has a comprehensive grants framework which provides guidance on the end to end process for awarding grants. The Grants Approval Board has responsibility for ensuring that new schemes and grant extensions above £100,000 reflect best practice. This framework has been enhanced by incorporating the Cabinet Office’s Global Design Principles and Grants Standards. For the most significant grants, we use the Cabinet Office’s Complex Grants Advice Panel and fraud risk assessment resources to shape grant design.

6.5 The General Grants framework provides that a business case is reviewed including the value for money case, and a memorandum of understanding or grants agreement agreed setting out what will be delivered. All this should be overseen by a senior responsible owner who ensures that all appropriate governance arrangements have been adhered to.

The Flexible Support Fund

6.6 The Flexible Support Fund (FSF) enables our jobcentres to support locally identified claimant needs and which reflect the requirements of local labour markets.

6.7 The FSF has a clear framework within which our Jobcentre Plus district managers are free to operate to create effective local solutions making use of a Dynamic Purchasing System to ensure competition and value for money. Finance, and where appropriate, commercial business partners, provide professional advice. Grants from the fund to organisations are supported by written statements known as grant letters that describe the discretion they have around what the grant funding can be spent on.

6.8 A grant letter specifies the assurances required of the recipient. These include each partner organisation’s lead accountable body providing information and evidence of delivery of their aims and objectives, and assurance that it is meeting the required minimum requirements for outcomes, targets and indicators. A further statement is required setting out how the grant has been spent so that we can monitor and report expenditure.

6.9 Lead accountable bodies within each partner organisation are required to ensure that sound internal financial controls are in place with any partner that they may involve in the delivery of the specified minimum requirements agreed for the grant. This ensures that our funds are used solely to pay for the delivery of agreed objectives. Jobcentre Plus districts work with their lead accountable bodies to ensure grant conditions are met and that expected performance meets actual outturn.

6.10 In respect of ad hoc contracts, a minimum standards framework for Jobcentre Plus districts is in place to provide assurance that set provision and performance targets are being delivered appropriately.

6.11 Grants are made to a recognised lead accountable body within each partner organisation, which manages and is accountable for the use of the funds on behalf of the partnership. The body is responsible for working with other identified partners to distribute the funding. It must be a legal entity with auditable accounts, and must be determined as eligible for the fund based both on our financial viability and risk assessment, and evidenced by an incorporation document. The body is required to keep accurate financial records for audit purposes.

6.12 Prior to the award of a grant from the FSF, we undertake checks to assess and monitor the financial stability of our partners. Once assurance has been gained, we agree monitoring requirements with the lead accountable body before formally awarding a grant, and ensure value for money considerations are maintained during delivery. A performance management process identifies spend or activities outside that which the grant was awarded for, with district managers taking action if they find discrepancies. If necessary, district managers can write formally to the body to explain the need to recover, reduce, suspend or withhold future grant payments, although this action is very rare. Further recourse can include the sale of fixed assets funded by the grant where they are recovered. Allocated grant funding which remains unspent at the end of the grant period is repaid.

Section 7: Devolved Government

7.1 As part of the Government’s commitment to decentralising power, responsibility for designing, procuring and managing work and health equivalent programmes in the Greater Manchester Combined Authority (GMCA) and four London areas has been devolved. Funding has been transferred under Section 31 of the Local Government Act 2003, subject to contingent conditions. Joint governance arrangements have been established between DWP, London and GMCA authorities.

7.2 The providers in these local government partners will be paid a set delivery fee each month with the remainder of the funding being paid on the achievement of outcomes. These payments will be adjusted to take into account any under-performance, or changes in volume assumptions. In line with Government Commercial advice payment mechanisms for contracted suppliers were changed to either cover their full costs of service delivery or at least reduce their reliance of earned payment by results as a Covid relief measure, and are expected to revert to something closer to the original payment mechanism by the end of 2021.

7.3 In line with the Government Functional Standard for General Grants Guidance the aims and objectives for the grant are clearly defined and supported by Memorandum of Understanding between DWP, GMCA and each of the four London sub regions.

7.4 Grant funding payments are made in advance on a quarterly basis. Payments can only be made once a full set of approvals have been gained, including the DWP Senior Responsible Office/Budget Holder, Senior Finance Business Partner and currently also the Minister for Disabled People Health & Work.

7.5 The four Local Government Partner (LGP) authority groupings in London and GMCA provide quarterly assurance reports detailing actual expenditure, as well as an updated forward forecast. Quarterly returns are scrutinised to ensure a direct correlation between service delivery costs, achievement of outcomes, and future forecast including a performance profile and expected level of achievement against targets and indicators.

7.6 There are regular check point meetings to discuss progress against the pre-agreed schedule of expenditure, and an annual “deep dive” including face to face meetings between senior responsible officials from the LGPs and DWP. In advance of these meetings the LGPs are required to submit their forward performance and associated financial profiles together with the underlying assumptions and detailed rationale of how the profile will be achieved. Any decision to withhold or reduce the level of grant funding, due to accrued underspends, or lower than planned future expenditure forecasts, once agreed at Director level within DWP are ratified through the Joint Governance Board arrangements. Deep Dives have been held on a quarterly basis since autumn 2020, as part of our joint response to the uncertainties created by the Covid event.

Scottish Devolution

7.7 The Fiscal Framework, agreed by Scottish Government (SG) and Her Majesty’s Treasury (HMT), published February 2016, sets out the principles for funding and financing the devolution of welfare powers. The Fiscal Framework is underpinned by a number of formal agreements such as Agency Agreements, Service Level agreements and Data Share Agreements.

7.8 Agency agreements cover DWPs continued delivery of devolved benefits under business as usual for residents of Scotland and are subject to the same internal and external controls as the England and Wales caseload.

7.9 Service Level Agreements and Data Share Agreements detail arrangements for supporting Scottish Government’s replacement and new benefits (such as DWP’s data provision for Scottish Child Payment).

7.10 The financial arrangements for formal agreements documents the overarching principles which have been agreed to support financial recharges for Agency Agreements and Service Level Agreements. Financial summaries set out the financial arrangements in relation to the delivery by DWP of services to SG.

7.11 Memorandum of understanding are also in place which cover arrangements such as the Department granting Scottish Ministers authorisation to use Shared Services Connected Limited and Payment Exception Service contracts for the purposes of delivering relevant benefits within scope (eg Best Start Grant, Job Start Payment).

7.12 The Department established the Scottish Devolution Programme (SDP) in 2015 to support delivery and ensure a seamless, phased transition of the devolved welfare benefits to SG. The programme follows DWP programme management best practice and DWP Change Governance.

7.13 The programme, working with SG, established a quarterly Recharge Board, to agree DWP recharges to SG, and weekly finance meetings are held between DWP and SG officials. Funding for Annual Managed Expenditure (AME) benefit spend, and Departmental Expenditure Limits (DEL), devolved to Scotland, are transferred by HM Treasury to SG through block grant adjustments.

7.14 The DWP Accounting Officer is not accountable for devolved expenditure but directors can be called in front of the Scottish Select Committee to discuss DWP delivery performance.

Section 8: Major contracts and outsourced services

8.1 This section covers services supplied via commercial contracts.

8.2 The Department’s Commercial Directorate’s role is to ensure that DWP obtains maximum value from its commercial spend. This means that contracts are awarded with proper regard to public procurement rules, obtain the most competitive prices available and deliver the right goods and services that make a significant contribution towards the achievement of DWP’s objectives. The directorate also oversees the management of suppliers and contracts so that they continue to deliver best value, whilst adhering to the standards of probity and regularity expected by Parliament and the taxpayer.

8.3 For sourcing, DWP uses a standard operating model, aligned to Cabinet Office principles, in each of the five commercial categories. A risk-based approach is applied to differentiate between strategic and tactical contracts, directing the resource to higher risk contracts. The five commercial categories are:

- digital

- estates

- employment-related

- health services

- corporate services

8.4 Each category operates a Commercial Assurance Board (CAB) to ensure that procurement exercises are carried out properly, follow the correct procedures and guidance and deliver maximum value for money. The relevant category CAB reviews and assures relevant commercial activity over £100,000 at key stages in the contracting lifecycle, and provides approval to proceed to the next stage.

stage 1 – define business need and agree budget

stage 2 – market engagement and commercial strategy

stage 3 – procurement and selection

stage 4 – finalise contract

8.5 The relevant CAB provides assurances at key stages but does not provide funding approval. However, if a member of the board has the relevant delegated financial authority (DFA), the approval may be granted internally. If the relevant DFA is not held within the board, the appropriate authorisation must be in place for sign-off.

How governance is applied

8.6 All commercial activity over £100,000 is held on a category or programme tracker and is rated following the completion of a procurement risk segmentation tool to create the final categorisation.

8.7 Commercial activity is classified as high, medium or low risk. The categorisation once completed must be logged on the Department’s eProcurement system (currently known as Jaggaer) and is used to define the necessary governance applied to that commercial activity. Governance is then applied as follows:

- Commercial activity rated as high risk is subject to the full governance process. Scrutiny and approval is required at all 4 stages. New procurements valued at more than £10 million and in scope of Cabinet Office Controls will always fall into this category.

- For commercial activity rated as medium risk, the governance is defined by the Commercial Approval Board at the outset but is subject to a minimum of stages 1 and 4 approval. Contracts valued at more than £5 million and requiring ministerial approval will fall into this category as a minimum.

- Commercial activity defined as low risk is subject to light touch governance through the existing procurement process approval and delegated financial authority. The relevant category CAB will have visibility of all procurements requiring approval prior to signatory but will review as a below the line list by exception only. Pre-defined supplier call-offs or consumption from existing commercial vehicles are likely to fall into this category.

Scope of the Commercial Approval Board

8.8 For contracts with a value of less than £5 million, the relevant category Commercial Approval Board (CAB) has the authority to approve at key stages and provide approval to proceed to award the contract.

8.9 For contracts with a value of more than £5 million, the relevant category CAB has the authority to approve key stages 1-3. For stage 4, contract approval and award, the board supports existing governance by ensuring contract approval requests are robust and consistent and by making recommendation to approve to the minister.

8.10 Commercial activity with a value of more than £10 million may be subject to Cabinet Office controls. It is the relevant category CAB’s responsibility to validate that Cabinet Office are engaged at the earliest opportunity and are invited to seek appropriate assurance through a robust and transparent governance process. Departments may self-assure transactions in the value range £10m to £50m – provided the activity isn’t novel or contentious and we can provide evidence that it is managed in accordance with the Government Commercial Operating Standards.

8.11 Commercial activity with a value of more than £50 million will continue to be subject to HM Treasury approvals. Again it is the relevant category CAB’s responsibility to validate that HM Treasury are engaged at the appropriate point in the procurement. Investment Committee now have increased visibility of the commercial pipeline to ensure they have an opportunity to challenge/steer complex high risk procurements at an early stage – by exception.

Contract approval body by value

| Value | SRO (with appropriate DFA) | Commercial Approval Board | DWP minister | Minister for Cabinet Office | HMT |

|---|---|---|---|---|---|

| Below £100k | Yes | ||||

| £100k to £5m | Yes | ||||

| > £5m | Yes | ||||

| >£10m | Yes | Yes | |||

| >£50m* | Yes | Yes | Yes |

*Please note there are exceptions to the HMT threshold for example, Universal Credit contracts >£1m will need HMT approval.

*In the circumstances outlined at 7.13 Departments may self-assure in the range £10m-£50m

Contract Management

8.12 For contracts in live running, Commercial Directorate adheres to a category management operating model to ensure contracts are managed to gain maximum value for money and operate in line with HM Treasury delegated authority controls and responsibilities.

8.13 There are mechanisms in place for assessing the outcomes expected from the resources. Service levels and service credit regimes are well established. Financial service credits are applied when performance is below target (for example, volume, quality, speed of clearance, client service). Detailed targets form part of the contract and performance is reviewed constantly by dedicated regional and national performance management teams who report to a national performance director and account director. This performance review happens across operations, finance and commercial functions.

8.14 Open book reviews give the Department formal rights of access to review costs. In addition, the Department has direct access into provider financial ledgers to assure and check all costs independently.

8.15 All contracted spend and processes are considered for internal audit review through the Government Internal Audit Agency. There are formal audits undertaken on high risk DWP activities and remedial action plans are developed to address issues where appropriate.

8.16 The table below summarises the roles and responsibilities that ensure we get maximum value from contracts with providers.

| Role | Responsibility |

|---|---|

| Senior responsible owner | ensures a planned transition from the contract award stage to the contract implementation phase. |

| Senior contract owners | accountable for service delivery. Manage the day to day relationship with the supplier and are the major route for escalation of operational management issues. SCOs sign a statement of assurance and undertake a commercial challenge process. |

| Performance Manager | ensures delivery of contract outcomes and develops mechanisms to ensure that service quality and user satisfaction is captured and used to manage and improve performance. |

| Commercial Category Manager | defines clear contract management processes, completes and implements a contract management plan and ensures appropriate governance is in place including management boards, review groups and risk structures. |

| Contract Manager | ensures that payment mechanisms are documented, are clear and well understood by all parties, appropriate checks and authorisation processes are in place to pay invoices. Ensures payment changes after the contract is let are made using contractual provisions and demonstrate value for money. |

| Finance Business Partner and Finance Validation Teams | ensure that appropriate checks and authorisation processes are in place to pay invoices and provide scrutiny and challenge to providers’ costs, thereby systematically managing contractual risk, and taking appropriate mitigating actions and escalation as required by DWP’s risk management process. |

| Commercial Assurance Team | provides assurance that beyond their specific delivery obligations, suppliers are complying with general departmental and legal requirements such as whistleblowing (employees), complaint and redress processes (customer or client), The Modern Slavery Act 2015, data protection. |

8.17 The COVID 19 pandemic had a significant impact on the work of Commercial Directorate, with a huge demand for new products and services, together with supplier relief, whilst at the same time around 25% of our staff were redeployed to emergency front line duties assisting citizens to apply for Universal Credit. As a consequence we amended our processes to enable fast track procurement. However the four stage CAB governance process remained in place to ensure propriety and value for money, and CAB activity was extended to cover relief payments to suppliers.

Strategic Monitoring and Control

8.18 The Commercial Senior Leadership Team exercise overall control of the commercial portfolio and escalate major risks to the DWP Finance Group Executive Team and the DWP Executive Team.

8.19 For the past two years Commercial Directorate has been increasing focus on the effective in-life management of contracts and suppliers. In March 2021 we established a dedicated Supply Chain Management team that will:

- Be a Centre of Excellence for Supply Chain Management

- Develop and implement a Supply Chain Management Strategy and Framework

- Provide Specialist Complex Contracts Support to delivery teams

- Build Supply Chain Management capability across DWP

Process for approving all marketing and advertising spend

8.20 All marketing and advertising spend within the Department is subject to the Cabinet Office’s Marketing and Advertising spending controls. The purpose of these controls is to ensure that the Department and Government receive value for money in all marketing and advertising expenditure. These controls also ensure there is no duplication in communications activity or message delivery and that the approach is the most effective method to reach the appropriate audience.

8.21 A short business case is written, outlining the proposed costed activity and how it fits into the Governments overarching themes. This is submitted to the Cabinet Office at the end of each calendar year. Cabinet Office, along with Prime Minister’s Office, review all proposals across Government to ensure value for money, consistency of message and suitability.

8.22 The Ministerial Board approves the activities which will go ahead at the beginning of the calendar year. More detailed business cases are then developed by departments communication team.

8.23 All marketing and advertising requests to spend under this control must first be approved by the Director of Communications. Requests over £100,000 are also submitted to a DWP Minister for approval. A final decision is then made by the Cabinet Office Minister through Cabinet Office channels.

8.24 The approval given by the Cabinet Office Minister is for the relevant marketing and advertising activity, it is not a financial approval. Financial approvals are obtained through the budget holder and the DWP budget approval processes.

8.25 The Communications Directorate report on approved campaign activity on a quarterly basis to the Cabinet Office to ensure the objectives set are being met within the approved business case.

Process

October to December

PM / HMR narrative drafted

December

Initial bid for all comms activity

January

STAR chambers chaired by EDGC

GCS Ministerial Board

March to July

PASS cases submitted for approval

June

Quarterly reporting

-

These bodies receive funding from the levies imposed on pension providers. A more detailed explanation of funding arrangements is to be found in section 4. The Pensions Ombudsman and Pension Protection Fund Ombudsman are separate statutory roles, supported by a single organisation called The Pensions Ombudsman ↩ ↩2 ↩3 ↩4 ↩5

-

Receive additional funding from charging for work done ↩ ↩2 ↩3

-

In Members’ Voluntary Liquidation ↩

-

Following the Tailored Review NEST is exclusively a Public Corporation ↩