Delivering pensions guidance: January 2015 update

Published 12 January 2015

Foreword

At Budget 2014, I announced the most radical changes to pensions in almost a hundred years. From April 2015, anyone aged 55 and over will be able to access their defined contribution pension and use those savings as they choose. I believe it is right that people who have worked hard and saved throughout their lives can make the choices that are best for them.

In order to be empowered and informed to make those choices, I also announced that everyone affected would be entitled to free, impartial guidance on their options.

This service is being established by the government. The guidance will be provided by independent third parties, not pension providers or bodies with vested interests in selling financial products. It will carry a distinctive, recognisable brand so that users can be reassured that the guidance is credible, impartial and trustworthy. Today, the government is announcing that the new pension guidance service will be called Pension wise: Your Money, Your Choice.

I would like to thank the delivery partners that are working alongside the government and the stakeholders that have engaged with the government to help us make sure that we can create the best possible guidance service.

George Osborne, Chancellor of the Exchequer

Introduction

At Budget 2014, the government announced fundamental reform to how people are able to access their pension savings. From April 2015, everyone aged 55 and over, with defined contribution pension savings, will be able to access their pension savings flexibly, regardless of their total pension wealth.

The government has committed that every individual able to take advantage of the new flexibilities will be offered free and impartial guidance to allow them to make confident, informed choices about how to use their pension savings. The guidance service will equip and empower people, enabling them to navigate the options without making specific recommendations.

Significant progress has been made towards the goal of getting the service up and running in good time for April, when the new flexibilities take effect. The purpose of this update is to highlight this progress and set out further plans.

The government’s vision is that the pensions guidance service will help those considering accessing their defined contribution pension savings to:

-

ask the right questions, given their individual circumstances

-

understand their options in order to be able to make an informed next step

Announcements since Budget

In July we confirmed that:

-

the guidance service will be provided by organisations that are independent and have no actual (or potential) conflict of interest

-

until the service reaches maturity, overall responsibility for service design and implementation will remain within the Treasury, which will work with a range of organisations to deliver guidance to individuals

-

those firms that are likely to benefit from consumers who are better informed should help fund the delivery of the service. The government will establish a new levy on regulated financial services firms to pay for the service

-

the government will establish a new standards regime under the Financial Conduct Authority (FCA) for delivery partners and any future designated guidance providers, and give the FCA appropriate duties and powers to set standards and monitor compliance

The government made further announcements in October:

-

The Pensions Advisory Service (TPAS) will be the delivery partner for the telephone guidance channel

-

Citizens Advice England and Wales, Scotland and Northern Ireland will be the delivery partners for the face to face guidance channel

-

a team based in HM Treasury, bringing together people from across government, the telephone and face-to-face delivery partners and the Money Advice Service, is developing the service design as a whole and all the digital elements within it

Also in October, government amendments were introduced to the Pension Schemes Bill which provide the legislative framework for the guidance service. The Bill has passed through the Commons and is currently before the Lords.

In November, the FCA published a policy statement which confirmed:

-

the standards governing how delivery partners will deliver the guidance

-

the requirements on pension providers to ensure that their customers are made aware of the guidance and the way in which it can support their decision-making

New announcements

This update provides new details of the service and our plans, including:

-

the brand for the guidance service (below). This will be used by all delivery partners

-

the opportunity for people in our target group to register their interest in early access to the service as part of our piloting activities

Pensions Wise with Strap

Pension Wise: the service

Pension decisions can seem daunting. To engage and inform consumers, the guidance service needs to reflect and be responsive to individuals’ needs, and to the way in which the service is used. Ongoing research and user testing is a key part of developing (and then continuing to improve) the service. The guidance service needs to:

-

recognise that people may have a very limited level of understanding about pensions. Explaining what information to look for and where to find it and, for those who choose a telephone or face to face appointment, encouraging active preparation, will help consumers extract the greatest benefit from the service

-

use language that is as clear, simple and straightforward as possible, avoiding complicated financial terms that can confuse and embarrass people who do not understand them, but without avoiding the complex issues and ensuring people are made familiar with terms that might otherwise confuse them

-

cover the necessary ground without overwhelming consumers with information. Initial user research suggests that the optimum length of a session is about 45 minutes but this will be kept under review

-

offer tools that will help consumers understand what their choices mean, e.g. an indicative tax calculator

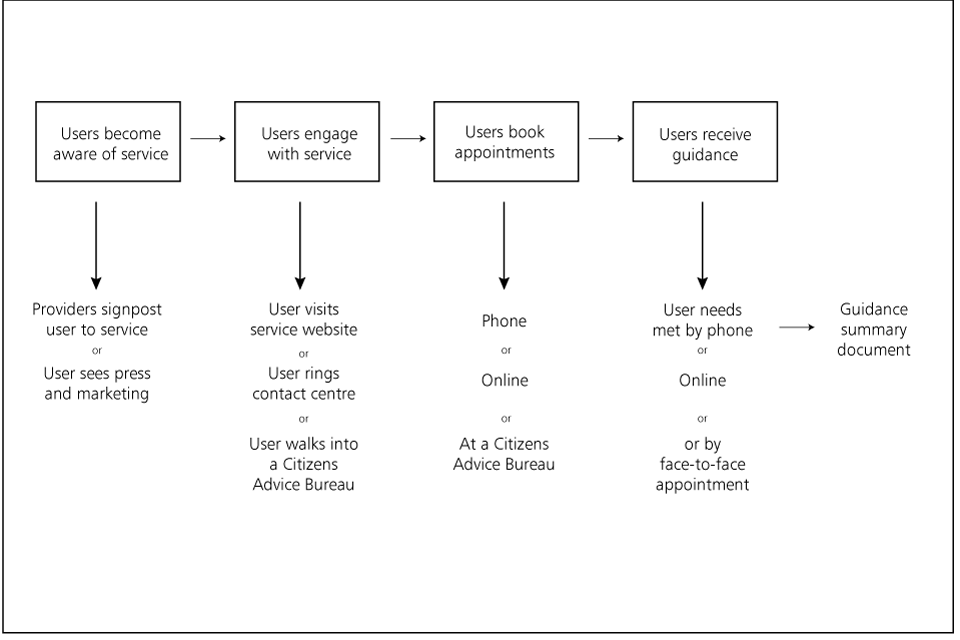

These and other considerations are informing the multi-channel guidance service that will be available in April. The customer journey through this guidance service, is illustrated in Chart 2.A below.

Pensions Wise Flowchart

Stage 1: awareness

Ensuring that people are aware of the guidance in the first instance is a key step. The government is legislating to place a statutory duty on the FCA to require pension providers to signpost individuals to the guidance service[footnote 1].

On 27 November 2014, the FCA published its near-final rules for delivering on this duty (among others that will underpin the guidance)[footnote 2]. The rule changes will mean that all relevant communications from pension providers to their customers about retirement must include a clear and prominent statement about the availability of the guidance. This statement must inform customers about the purpose of guidance, how they can access it, and the availability of different channels; and provide customers with a recommendation that they should seek guidance or advice. The FCA intends that this requirement will apply following Royal Assent of the Pension Schemes Bill in early 2015, ensuring that individuals seeking to take advantage of the new flexibilities from April are signposted to the service in good time.

HM Treasury, along with the FCA, DWP and The Pensions Regulator (TPR), has been working closely and constructively with the pensions industry, including via working groups convened by the Association of British Insurers (ABI) and the National Association of Pension Funds (NAPF), to help the industry prepare for these new requirements and to develop consistent and effective signposting messages.

As part of this work, an interim standardised letter is being developed by the Treasury in cooperation with the industry and the regulators, to be included in retirement packs and other communications sent to customers about accessing their pension savings. It will carry the Pension Wise brand. Drawing on behavioural insights expertise within the Treasury guidance team, the letter has been designed to ensure it effectively engages consumers.

The government welcomes the recent commitment from:

-

the ABI to continue supporting the development of the standardised letter, which they will ask their members to use

-

the NAPF to also continue to contribute to this work, which trust-based schemes will draw on to inform their communications with scheme members approaching retirement

The FCA and TPR will seek to ensure that information and materials to support signposting, including agreed templates, are made available to all pension providers and schemes, and the regulators will encourage them to make use of these in their customer communications to satisfy the new signposting requirements.

This programme of work will help to ensure providers and schemes are equipped to meet a robust minimum standard, and they are encouraged to go further where they see other opportunities to point their customers towards the service.

FCA Standards

The FCA has published its policy statement with near-final standards, which will:

-

ensure that the guidance is impartial, consistent, of good quality and engaging across the range of delivery channels

-

create consumer trust and confidence in the designated guidance providers and content of the guidance so that consumers actively use the service

-

ensure that the framework works for both contract-based and trust-based pension schemes

-

deliver helpful guidance for consumers that considers their retirement options and refers them to specialist advice or information where appropriate

In terms of content, the standards require that the guidance session must:

-

inform consumers of the scope, purpose and limitations of the session

-

the standards require that the guidance session must inform consumers about the pension entitlement and other personal and financial information that the designated guidance provider may request from them during the session

-

request information from the consumer about their accumulated pension pots

-

request information about the consumer’s financial and personal circumstances that is relevant to their retirement options

-

alert the consumer to other sources of information and advice as appropriate and at relevant points during the session

-

identify for the consumer and provide them with information about:

- the options relevant to the consumer;

- to the extent that they are relevant to the consumer’s options;

- the potential tax implications or debt obligations;

-

set out the next steps for the consumer

-

provide consumers with a record of their guidance session

The standards also require that individuals delivering guidance must:

-

have the skills, knowledge and expertise necessary for the discharge of the responsibilities, including good interpersonal skills (including listening skills and verbal communication skills); and

-

have knowledge that includes the following:

- the different types of pension schemes;

- the impact of fees and charges for both accumulation and decumulation pension products;

- the options available to consumers when accessing their pension savings;

- the factors relevant to the selection of options when accessing pension savings, including the impact of guarantees, special features, restrictions or conditions, protected rights, and exit charges;

- the tax treatment of pensions and income generally;

- the circumstances when a consumer may require further specialist help, for example debt advice, or regulated advice;

-

- other issues that are relevant to consumers considering their retirement options, for example long-term care needs, sustainability of income in retirement and life expectancy; and

- the conduct that a designated guidance provider may engage in

Alongside signposting, marketing will be an important element in raising awareness of the service. Marketing will be aimed at increasing consumers’ awareness that they have options and choices, and the opportunity to make a meaningful decision on how they take their pension; ensuring that they know where to go for free, fair, impartial and helpful information, and what the guidance service will (and will not) provide; and raising recognition of the guidance service so that consumers can recognise and avoid any fraudulent approaches posing as the guidance service.

The way that a service is framed and communicated can have a big impact on its effectiveness[footnote 3]. The guidance service team is working with the Behavioural Insights Team and with industry providers to test the best ways of signposting consumers to the guidance. Randomised control trials will examine the effectiveness of different styles, wording and placement of material, as well as the value of more consumer-friendly pension information (see below). These trials will help to inform the future regulatory landscape for retirement communications and the FCA will build on them with its work on behavioural testing.

Key information about consumers’ pension pots and options

It is important that consumers are not only aware of the guidance service, but have the information they need to make the most of the help that is offered. Access to clear, helpful information will also of course be important to consumers who do not wish to use the guidance service, or who go direct to regulated financial advice.

The FCA has clarified in its near-final rules that information about a customer’s pension pot must include, at a minimum, the current value of the pension fund and whether there are any guarantees or other relevant special features that apply to the pension. Building on this, the Treasury is intending, as part of its trials, to work with the industry to develop and test a short, simple, standardised product for communicating all the key information about an individual’s pension pot.

The government welcomes the FCA’s close interest in the outcome of the Treasury’s work in this area. The FCA regards some level of standardisation as desirable to encourage consumer engagement. It has committed that it will consider whether, following the planned review of its pensions and retirement rules in the first half of this year, a standardised pension information statement should be explicitly required in its rules.

In terms of ensuring individuals have appropriate high level information about the choices available to them, the government will work closely with the Money Advice Service as it develops and updates its leaflet ‘Your pension: it’s time to choose’, which providers are required to send out with wake up packs and other retirement communications. The government and the Money Advice Service will work together to ensure its content is appropriately aligned with that being developed for the guidance service.

Pension Wise

It is important that the guidance service has a brand and logo that are easily recognisable and convey the centrality of options and choice. The brand name and logo shown here do just that. The HM Government logo will be used to support the Pension Wise brand where appropriate to underline the credibility and impartiality of the service provided.

Pension Wise with HMG strap

Stage 2: contacting the service

Users of the service will be able to access it via the website, the telephone or a Citizens Advice Bureau. Whichever the channel used, users will get the best out of the session if they have had time to gather different types of information first. To allow them the time they need to gather information and prepare for their guidance, telephone and face to face guidance sessions will need to be booked. The importance of this preparation phase was noted by many respondents to the consultation earlier last year.

The online channel will be an easy and convenient first point of access to the service for most people. It is important, however, that everyone is able to access the guidance service, including those who are not able to use or are not comfortable using the internet. Phone and face to face guidance will be bookable via phone or (for the latter) by visiting a local Citizens Advice Bureau to make an appointment. All guidance users will be encouraged, where they can, to use the website material to help prepare for their appointment.

Telephone and face to face guidance sessions will initially be designed as a single session per consumer, though this will be kept under review. The service will provide reminders to people who have a booked an appointment, and, for telephone guidance, ways of ensuring that the consumer receiving the booked call can be confident that it is from the genuine guidance service.

Stage 3: guidance sessions

All guidance sessions, whether on the web, telephone or face to face, will meet the FCA’s standards, summarised in the above box. While HM Treasury is not formally a designated guidance provider, it is committed to complying fully with the FCA’s standards as appropriate for the web channel.

For many, the website will offer the most convenient and flexible way of using the guidance service. Consumers will be able to dip into the site before or after working through the ‘guidance journey’, and return to it as many times as they like. The website will meet the government’s digital by default service standard, ensuring that it is of a consistently high quality and creates a service that is easily improved, safe, secure and that fulfils user needs.

Consumers interested in early access to the service as part of our piloting activities can register their interest at: www.gov.uk/pensionwise. Participants for this piloting activity will be chosen to resemble as closely as possible our ‘priority group’, i.e. in the position of wanting to take a decision on their pension in the very near term, once the pension reforms take effect. The telephone and face to face appointments will cover the same material as the website guidance journey, but with the reassurance offered by a trained guidance specialist. Where consumers have needs that fall outside the guidance framework they will be referred to relevant third parties for further help.

The exact parameters of the telephony and face to face appointments are still being defined, but initial user research indicates an optimum length of session of around 45 minutes. This and other aspects of the guidance will continue to be tested across all three channels by the guidance team and the delivery partners - The Pensions Advice Service (TPAS), Citizens Advice (England and Wales), Citizens Advice Scotland, and Northern Ireland Citizens Advice Bureaux – over the coming period.

Fraud and scams

Helping consumers be alert to fraud and scams is an important part of creating confidence in making financial choices. There is already a lot of work being carried out to raise awareness of pension scams and the guidance service will fully support that. The Treasury is working with the FCA (which has recently launched ScamSmart) and with TPAS (which is working to help make sure people can identify scams), to help ensure consumers are equipped with the information they need to recognise and avoid illegitimate, fraudulent or other approaches not in their best interests.

The government has also introduced an amendment to the Pensions Schemes Bill that will make imitation of the Pension Wise service a criminal offence. This will ensure that those who see the Pension Wise brand can trust it, and that anyone who tries illegitimately to pass themselves off as providing the service will be breaking the law.

Stage 4: summary and action

Success for the guidance service will be determined by what constitutes success for the consumer; and what matters for the consumer is not only the experience of the guidance service per se, but what they do after having used the service.

To help consumers reflect on their choices and make an informed decision about what to do next, the guidance service will provide users with a summary document that will include a record of their options and what action they might choose to take. This document will not prescribe or rule out options, and it will not recommend particular products; the service offers guidance, not advice (though it will help consumers who wish subsequently to seek advice, identify how to go about this).

The guidance service will complement professional regulated financial advice and other services, pointing consumers to reliable sources of further help and information as needed and helping consumers recognise the value of further specialist help and advice. If, for example, a consumer wishes to find out more about annuity products, the service will direct him or her to the Money Advice Service’s annuity comparison table. Shopping around for a drawdown product may not be straightforward, so the guidance service will help consumers think about the right questions to ask firms offering them; and if a consumer wishes to look into financial advice, the service will direct them to the Money Advice Service’s financial adviser directory, currently under development. The guidance service will also serve those with other pressing needs, such as debt or social care, and direct them to the most appropriate organisation for information and support.

If users are dissatisfied with any aspect of the guidance service, they will be able to make a complaint via the website or by phone, regardless of the channel or channels the complaint related to. FCA standards require all guidance providers to have robust complaints handling arrangements in place. The complaints handling function will work with guidance providers to investigate each complaint, work with the complainant towards a timely resolution and, where appropriate, ensure that remedial action is taken.

If it is not satisfactorily resolved by the guidance service’s own complaints handling function, the Treasury will appoint an independent adjudicator to whom an individual can refer their complaint. The independent adjudicator, who will be entirely operationally independent from the guidance service, can consider the complaint and, if they determine that the level of service received was not of a sufficient standard, can recommend that remedial action be taken by the service.

The FCA, as part of its monitoring role for the guidance service, may request data from individual providers on, for example, the volume and nature of complaints received about them, and on the effectiveness of their resolution procedures.

Delivering the service

Ministers and officials have met, and will continue to meet, with industry and consumer groups to gather views on how the service can most effectively meet users’ needs. The government is grateful for the considerable input of partners and stakeholders, and looks forward to continuing to work with all interested organisations over the coming months.

Legislative framework

The government has introduced amendments to the Pensions Schemes Bill which provide the legislative framework for implementing the government’s commitments on the guidance service. The legislation:

-

places a duty on the Treasury to ensure provision of pensions guidance, including making grants to delivery partners

-

confers functions and designation on delivery partners

-

introduces a new criminal offence to prevent scammers impersonating the guidance service

-

provides for a levy on regulated financial services firms to fund the service

-

introduces the legislative framework for the Financial Conduct Authority’s standards regime with which delivery partners must comply – this includes the FCA’s powers to supervise compliance and make recommendations to guidance providers

-

places a duty on the FCA to require contract-based schemes to signpost their members to the guidance service

The Bill is currently before the Lords, and Royal Assent is expected in February, at which point all of the guidance provisions will take effect. The FCA has already published near-final standards and signposting rules and has committed to make these rules and standards shortly after Royal Assent. Complementing the provisions in the Bill, the government will introduce two pieces of secondary legislation: first, an amendment to the Regulated Activities Order to clarify that those providing guidance as part of the Pensions Wise service are subject to FCA standards and are not carrying on any regulated activity; and second, amendments to DWP’s existing Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 to ensure that trust-based schemes are subject to equivalent signposting requirements to contract-based schemes.

Costs

As the Chancellor announced in the budget, HM Treasury will bear the FY14/15 set-up costs of the Pension Wise service. The ongoing cost will be funded by an FCA administered levy on regulated financial services firms. The initial estimate of the cost in FY15/16 is £35m; this will be confirmed in March, in the FCA’s fees consultation paper. The operation of any service in its first year naturally carries a higher than usual degree of uncertainty. This is especially true here, given the number of people who have deferred a pension decision in FY14/15 and may wish to access the guidance alongside those coming up to that decision point during the year itself. Rather than incorporate a contingency element into the initial levy, HM Treasury has decided to cover any costs above the levy value itself in the first instance, and reclaim these from the subsequent year’s levy (consistent with the policy that the service should be funded by industry). This ensures both that the industry will only be asked to pay for what it can be said with confidence is required to fund the service, and that incentives to deliver an effective, efficient service, providing value for money, are fully aligned.

Next steps

Wherever possible, aspects of the service across all three channels will be tested, piloted and rolled out ahead of April. A simple landing page for the website has already gone live, and website users can now register their interest in the Pension Wise service, say what aspects of the service they are most interested in, and provide their input on the ongoing service design. Some of those registered will also be invited to participate in the ongoing programme of user testing, pilots and trials as the service is refined and developed, providing valuable feedback and insight.

A public pilot of the online guidance service is planned to start in February; this may be of particular interest to those who have deferred their pension choices since the Budget announcement, and who may welcome some initial information on their options. Again, the views and input of users will be valuable in ensuring that the service develops in the way that best meets consumers’ needs.

The contact centre, through which telephone and face to face appointments can be booked, will be available from March. Calls will be able to be made via both 0300 and 0800 numbers.

During the first few months of the service’s operations, there will be intensive monitoring of consumer feedback, the way in which the service is used, and any difficulties that consumers encounter. This information will be used to adapt and improve the service, which must be responsive and flexible from the outset. A formal service evaluation will be run in 2015 to check that the guidance service is working effectively, delivers value for money and meets user needs.

-

Via the Pension Schemes Bill, currently progressing through Parliament. ↩

-

The Department for Work and Pensions (DWP) has committed to follow the FCA approach in applying these requirements to trust-based schemes, which it will do by amending its existing Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 in early 2015. ↩

-

See Behavioural Insights Team (2014), EAST: Four simple ways to apply behavioural insights ↩