Crown Commercial Service Small and Medium Enterprises (SME) Action Plan

Published 25 January 2024

Crown Commercial Service’s SME Action Plan outlines how we will help government departments and their agencies meet the government’s aspiration to level the playing field for SMEs.

Objectives

Government has a commitment to obtain value for money and support small and medium-sized enterprises (SMEs) through procurement. Crown Commercial Service (CCS) understands the challenges and barriers, especially for smaller businesses, and is committed to tackling them.

Central government (CG) departments and CCS are supporting this commitment to SMEs through a range of shared measures:

Paying suppliers on time

- Government has a target of paying 95% of undisputed invoices within 5 days and all within 30 days

- We expect suppliers to comply with PPN 08/21

Increasing visibility of tenders and contracts

- all opportunities over £12,000 are published on Contracts Finder. In addition, SMEs can use the Find A Tender Service to search and apply for high value contracts which are above £138,760, including VAT.

Removing barriers to support SMEs

- the Cabinet Office SME advisory panel, made up of entrepreneurs and leading business figures, boasts a wide range of experience to remove barriers and level the playing field for SMEs. CCS uses this expertise to inform its SME working group and to ensure new procurements are structured to be as SME-friendly as possible.

- the CCS SME working group collates feedback from SMEs to discuss and look to remove issues and common barriers

- the Cabinet Office Small Business team works across CG departments and stakeholders to capture and improve the quality of spend data, oversee and publish SME action plans, ensure effective performance management, share best practice on SMEs, and ensure effective stakeholder management with SMEs

Measuring success

- SME spend data: government wants SMEs to benefit from CG spend, either directly or indirectly through the supply chain

- case studies: encouraging departments to share case studies about how they are working with SMEs

SME champions

- departments, including CCS, have appointed SME champions to lead on supporting SMEs and to lead on their own individual action plan

- the CCS SME champion also supports customers at their UK-wide small business supplier events to increase SME understanding of CCS and the opportunities available for SMEs through our agreements and what help and information is available to them

These measures are designed to make sure that more businesses, including smaller firms, will be able to supply goods and services to the public sector, while also making public procurement more transparent.

This Action Plan outlines how CCS will help government departments and their agencies meet the government’s aspiration to level the playing field for SMEs. It highlights the work that we are currently doing to support departments in achieving the overall aspiration.

Foreword from Richard Denney

CCS has a crucial role in the provision of common goods and services across CG and the wider public sector (WPS). SMEs have always been a key component of the commercial agreements we create, not only because of the Government’s aspirations to increase spend with them, but for the diversity that they bring to our supply chains and, more broadly, the economy.

As well as offering access to products and services in a compliant manner through the creation and provision of commercial agreements, CCS also provides access to supply markets.

As procurement policy adapts and evolves, that market access becomes increasingly concerned with the delivery of social value. There are many ways in which social value can be achieved and CCS recognises that SMEs are a crucial part of this picture. Supporting the growth of the SME sector can often, in itself, be a creator of social value. But more broadly, SME businesses can support greater localisation, reduce carbon footprints associated with delivery, create jobs, and deliver social good for communities in many other ways, helping levelling-up in the UK.

In creating this SME Action Plan, CCS is bringing together the existing practices that are in place to ensure that SMEs are properly represented in our agreements and supply chains. By February 2023, nearly six in ten suppliers on CCS agreements were SMEs and 16.1% of direct spend through these agreements was with SMEs. This is an improvement on the share of spend that went to SMEs when we last published our SME Action Plan (13.5% of spend went to SMEs then). In this Action Plan, as well as setting out the continued commitment of CCS to take positive action to make sure that the SME sector is well represented on our agreements, we also set out how we will work with our customers across both CG and the WPS to make sure that the proportion of spend with SMEs increases further and we build on this increase.

The government has committed to creating and maintaining more diverse supply chains, accessing the numerous benefits that result, such as improved resilience, access to innovation, and levelling up the country by sharing government procurement opportunities with more organisations. In addition, economic growth continues to be crucial to the prosperity of our nations, and SMEs will play a huge role in this. At CCS, we want to make sure that we continuously create opportunities for this to happen.

We look forward to implementing the benefits that procurement rules reform will bring. CCS stands ready to implement this new regime when it comes into force. At CCS, we will ensure the continuous creation of opportunities for SMEs when implementing procurement policies and procedure changes.

About our department

Department Overview

Established in April 2014, CCS is a trading fund and Executive Agency of the Cabinet Office. CCS is the biggest public procurement organisation in the UK. We use our commercial and procurement expertise to help buyers across CG and WPS (local authorities, NHS, police, education providers, and devolved administrations). The collective buying power of our customers, plus our procurement knowledge, means we can get the best commercial agreements in the interests of taxpayers.

CCS commercial agreements use competition among suppliers to increase quality and value. In 2021/22 we helped more than 19,000 customers achieve commercial benefits totalling over £2.8bn of public money by using our agreements. CCS is structured into three category groups to enable category expertise to best support customers.

CCS Structure (groups and categories)

Estates

- Construction

- Facilities Management

- Energy

- Estates Support Services

Corporate

- Financial Services

- Travel, Accommodation and Venues

- Fleet

- Professional Services

- HR and Workforce Services

- Outsourced Services

Technology

- Cloud and Hosting

- Network Services

- Hardware and Software

- Technology Services

- Digital Capability and delivery

CCS vision, purpose, goals, and strategy

The Crown Commercial Service (CCS) is an Executive Agency and Trading Fund of the Cabinet Office and a key constituent of the Government Commercial Function (GCF).

Our purpose is to help the UK public sector get better value for money from its procurement of goods and services.

Our ambition is to increase the value that we help the public sector achieve from procurement, by sustainably increasing the depth of our impact and the breadth of our coverage. We will aim to positively influence as much common goods and service public sector procurement spend as possible, aiming to bring half of the public sector’s total spend on common goods and services through CCS’s commercial agreements and achieve £10bn of commercial benefits for our customers.

Our vision is to be the provider of choice for public sector organisations seeking commercial and procurement solutions. CCS will be a customer focussed organisation trusted and admired by buyers and suppliers for our expertise and the quality of the service we offer and the solutions we provide.

We will achieve our vision and ambition, by addressing our three strategic priorities:

- extending our coverage and influence;

- deepening the value CCS adds; and

- enabling better outcomes.

Our organisational values shape and drive everything we do. We listen, respect, collaborate and trust in order to deliver with confidence.

Why CCS uses SMEs

CCS understands the benefit and value that using SMEs can have to support in achieving our strategy and objectives, which includes:

Improved Customer Engagement

SMEs:

- have flatter management structures and so can be more responsive to client needs, as decision makers are frequently in direct contact with operations / delivery

- bring an understanding of local culture in the areas in which they work, together with a bespoke, specialist service

- are often seen as more relatable to customers, particularly those in WPS

- offer more personalised customer service with a ‘hands on’ approach

- have the speed and agility to respond and engage with customers

Pricing

- have a track record of providing more competitive rates

Specialist Expertise

- are often subject matter experts with niche industry knowledge and specialist expertise of their sector and / or market

- can offer better support for customers with bespoke needs

- are often more agile and adept at driving innovation

- are often flexible, open to discussing alternatives, and able to provide rounded advice on the direction of the market and how different customer industries operate in the category

Diversity

- offer a wider choice of suppliers, locations and cultures

- offer a diversity of product and service, with innovation often present

Social Value

- environmental benefits - locality of SMEs, together with regional lots and delivery models, can help with carbon reduction

- many regional customers strongly prefer working with local companies and SMEs in order to support their own social value commitments

- provide value in local communities by creating jobs

Spend with SMEs through CCS agreements

The figures in this section are for direct and public sector commercial agreement spend (PSCA) and are accurate as of 3 February 2023.

CCS agreements are focused on helping customers to buy from SMEs directly, rather than in the supply chain, and because of that CCS’s spend data only represents direct spend. We know that in many commercial agreements, additional spend is awarded indirectly through the supply chain.

The supply chain data (known as indirect spend) is collected by our CG customers, in line with a central agreement with the Cabinet Office and is reported separately by the government. CCS recognises that as a result of winning new business, SMEs may grow and some organisations may no longer be classed as SMEs. As such, CCS’ methodology focuses on organisations that are classed as SMEs in each financial year.

Spend summary

| Financial Year | Total CCS Spend (Million) | Total Direct and PSCA spend (Million) | Total Direct and PSCA spend (Million) | Total Direct and PSCA spend (Million) | SME spend (Million) | SME spend (Million) | SME spend (Million) | Percentage of spend with SMEs |

|---|---|---|---|---|---|---|---|---|

| - | Total | CG | WPS | Total | CG | WPS | Total | - |

| 2017/18 | £13,069 | £6,387 | £5,017 | £11,405 | £731 | £516 | £1,246 | 10.9% |

| 2018/19 | £15,985 | £8,042 | £5,291 | £13,333 | £931 | £537 | £1,467 | 11.0% |

| 2019/20 | £18,6678 | £9,144 | £6,388 | £15,532 | £1,213 | £912 | £2,125 | 13.7% |

| 2020/21 | £22,804 | £13,314 | £6,636 | £19,951 | £1,561 | £973 | £2,534 | 12.7% |

| 2021/22 | £27,723 | £17,380 | £8,083 | £25,463 | £2,246 | £1,406 | £3,652 | 14.3% |

| 2022/23 Months 1 to 9 | £21,714 | £12,679 | £6,945 | £19,624 | £1,965 | £1,198 | £3,164 | 16.1% |

Spend analysis

In 2021/22 CCS showed continued progress to enable SMEs to participate in our commercial agreements with direct spend to SMEs reaching £3.65bn, meaning that 14.3% of spend through our agreements went directly to SMEs. This was an additional £1.1 billion (up 44%) directly compared to the previous year. CCS is committed to increase SME spend year on year through continuing to create agreements that are suitable for active SME participation.

In 2022/23 CCS has continued to make good progress and the proportion of direct spend going to SMEs after 9 months is tracking at 16.1%, as shown in the table above. If maintained at this level through to the end of the year, we expect around £4.9bn direct SME spend (growing from £3.65bn the previous year).

We continue to design our commercial agreements so that SMEs are able to benefit and that is why now around 58% of the suppliers on our commercial agreements are either micro (29%), small (19%) or medium (10%) enterprises (as of February 2023). Being successfully awarded to a CCS commercial agreement, enables SMEs to compete to win business from public sector customers who call off from CCS’ commercial agreements.

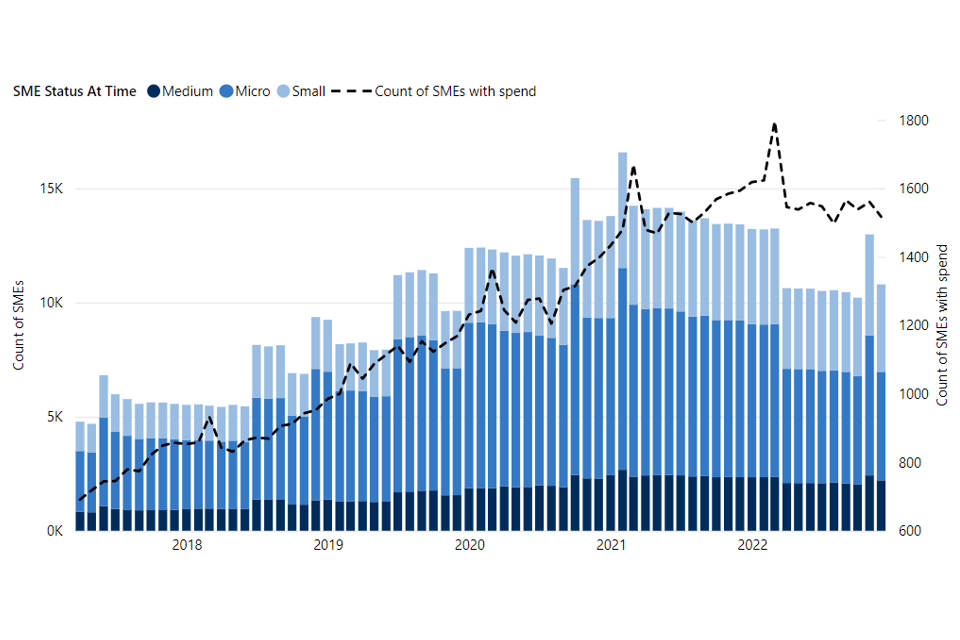

It is positive to see the number of SMEs on our agreements has risen from around 5,400 in April 2018 to around 6,000 in February 2023. Additionally, the SMEs with spend is also showing an upward trend over the past 5 years, increasing from about 800 in April 2018 to 1,500 in December 2022. However, this also shows that approximately only 25% of these suppliers are winning spend. This demonstrates that CCS is effectively increasing the diversity of its supply base, but that there is still more to do across government to make sure that these SMEs are awarded a greater share of the work.

SME Numbers Growth Over Time

SME Breakdown and SME Numbers With Spend

Some of the agreements in CCS show substantial spend being awarded to SMEs. The below tables summarise the areas of the largest SME spend between 1 April 2017 and 31 December 2022.

| Agreement | SMEs with spend | SME spend | Total supplier count with spend | Total spend |

|---|---|---|---|---|

| G-Cloud 12 | 1,444 | £1,450m | 1,906 | £3,511m |

| G-Cloud 11 | 1,028 | £1,107m | 1,364 | £2,802m |

| Provision of Clinical and Healthcare Staffing | 199 | £959m | 247 | £1,476m |

| G-Cloud 10 | 823 | £718m | 1,097 | £1,912m |

| Technology Products 2 | 23 | £698m | 51 | £3,420m |

| Public Sector Travel and Venue Solutions | 2 | £680m | 8 | £2,402m |

| National Clinical Staffing | 164 | £643m | 201 | £969m |

| G-Cloud 9 | 680 | £623m | 923 | £1,836m |

| Non Clinical Temporary and Fixed Term Staff | 131 | £598m | 183 | £1,219m |

| Digital Outcomes & Specialists 2 | 273 | £507m | 344 | £1,645m |

Our planned actions

For us to achieve our Action Plan objectives, alongside our wider strategic and corporate objectives, 8 key action areas have been established against which we will continue to drive and monitor our progress.

Action 1: SME champion and board sponsor

Our Senior Sponsor for SMEs is also the CCS sponsor for Social Value and for Voluntary, Community and Social Enterprises (VCSEs). As a result we will ensure that these three areas of focus are brought closer together. Work that we do to advance the prospects of SMEs also benefits VCSEs, and vice versa. Social Value is central to the proposition of VCSEs, and is also a key source of opportunity and sometimes challenge for SMEs. Maintaining board-level visibility of our plans and progress is crucial to our future success and will:

- Maintain board level visibility of, and engagement in our plans and progress

- Maintain visibility, energy and commitment with CCS to deliver positive change so that we continue to reduce barriers and create opportunity for SMEs

- Maintain alignment with Cabinet Office Policy and SME Crown Representative, and work with other departments to share, extend and embed good practices

Action 2: SME Working Group

CCS has created an SME Working Group which has been active since the start of 2020. The group has representatives from all category teams, policy and user research. The CCS SME board sponsor and representatives from the Cabinet Office Small Business Team also attend it.

The main purpose of this group is to support the implementation of the Action Plan which will be updated on an annual basis. We will also continue to promote the SME agenda across CCS. This group meets regularly and members are encouraged to champion SMEs’ use across their business areas. Members are responsible for reaching out to their wider teams to collate feedback, and initiatives and facilitate learning. Greater work will be undertaken across the group to share experiences, lessons learnt and provide suggested improvements for future activity.

The group’s ambition over the next year is to:

- Increase collaboration with other CCS working groups (Social Value, Supplier Relationship Management)

- Work collaboratively with the Transforming Public Procurement team at CCS to provide updates on the impacts of Procurement Reforms to SMEs

- Improve sharing of SME working group outputs with CCS colleagues

- Collate, publish and promote more SME case studies to raise awareness of what SMEs can achieve amongst public sector buyers and to share case study examples with other SMEs to help them promote themselves

- Provide consortia bidding guidance for SMEs wanting to provide CCS via a consortia. This guidance will complement forthcoming consortia principles and policy guidance being produced by the Cabinet Office

- Support the new cross government VCSE Commissioning Taskforce.

Action 3: Continued Simplification of CCS’s procurement process

What has been done so far - Public Sector Contract

The Public Sector Contract was designed so that buyers and suppliers can focus on building sustainable relationships that support the delivery of products and services that help meet the needs of citizens. The move also makes it easier for smaller businesses, who may lack the resources to read and digest many complicated terms and conditions, to supply goods and services to the government.

The key benefits to SMEs of the PSC are:

- we use the standard core terms across multiple commercial agreements

- the PSC is written in plain English

- the structure of the PSC encourages buyers only to use those elements that are relevant

This means that both suppliers and buyers do not need to acquire expensive legal advice every time CCS issues a contract opportunity.

CCS has recently published an updated version of the PSC and its Dynamic Purchasing System (DPS) agreement.

The major change was the capping of liabilities on GDPR (it was previously uncapped) further reducing the barriers for SMEs.

CCS is committed to the continual improvement of its processes and procedures. CCS is aware that we need to continue to develop the PSC. CCS will support the implementation of the new public procurement regulations in collaboration with the Cabinet Office. These aim to create a simpler and more flexible commercial system. They aim to open up public procurement to new entrants such as SMEs so that they can compete for and win more public contracts. CCS will aim to conduct supplier market engagement and explain to SMEs how to bid under the new regime.

Action 4: Improve Market Engagement and Access

Our category teams will continue to engage with the SME supplier community in a way that best suits their customers’ needs and this will vary by agreement. CCS will also continue to engage with SMEs through the Customer Experience Directorate (CxD) team working in the WPS.

The CCS SME working group is working with the Cabinet Office to provide written guidance on bidding as a consortium on CCS’ commercial agreements. Consortia bids offer SMEs the opportunity to work together to join commercial agreements. The guidance will increase understanding and provide clarity on navigating the procurement process when bidding as a consortium.

CCS colleagues can also request assistance from, or collaborate with the SME advisory panel, when designing their business cases for commercial agreements. The panel will give their feedback and advise what action CCS colleagues can take to reduce the barriers to SMEs doing business with the Government.

We worked with SMEs, industry representatives and the government’s Small Business Advisory Panel. We identified 12 significant barriers small businesses face and how Public Sector buyers can improve procurement methods to overcome them. Addressing these barriers makes it easier to do business with us, and we build stronger relationships. In turn, this drives innovation, maximises spending of the Public purse and increases diversity in our supply chain

1. Pre-Procurement Engagement

Pre-procurement engagement informs suppliers of new opportunities and helps to encourage SMEs to bid. It is an opportunity for them to give feedback on the scope and structure of the commercial agreement.

Through CCS’ new governance cycle, senior civil servants will ensure that new commercial agreements give regard to SMEs during the design stage of the commercial agreement. Senior colleagues will expect to see extensive pre-market engagement with all suppliers, including SMEs in ways that encourage SMEs to actively contribute, such as 1 to 1 calls or face to face sessions with SMEs to capture their feedback on a proposed commercial agreement and the associated timescales.

Recognising that SMEs may be reluctant to contribute at group supplier days either in person or online is key. By enabling SMEs to give honest and open feedback on the structure and scope of commercial agreements, SMEs will be better able to help shape and define the opportunities and make sure key factors that would enable greater SME participation are taken into account, for example considering regional lotting or the use of a DPS.

To better improve the process for SMEs, CCS will continually consider the best way to publish its pre-market engagement opportunities in one place which would be beneficial to smaller firms. One of the ways to keep updated on upcoming commercial agreements is through the ‘Upcoming Deals’ page on our website.

CCS will be piloting earlier engagement between category teams and Policy and Legal to reduce the likelihood of timescales shared with suppliers slipping and to reduce the likelihood of the time given to suppliers to bid being reduced

2. Procurement Design

Category colleagues will be encouraged to incorporate questions in the Award Questionnaire that ask bidders how they will deliver innovation in the design, delivery and implementation of the services across the public sector and what added value additional services they will provide. These questions will be reviewed by Sourcing colleagues, and the bid pack will be reviewed by the Commercial Agreement Approvals Board before publishing to ensure the approach’s consistency.

3. Post Procurement Engagement (Agreement Launch)

CCS will continue to provide detailed, robust and constructive feedback to bidders, which is of particular benefit to SMEs for them to understand where their responses may have fallen short and what they can improve upon in future bids.

Consideration needs to be given to the most appropriate way of communicating supplier contractual obligations to SMEs. Some SMEs like supplier day events and feel comfortable asking questions in an open forum to consolidate their own understanding. Others prefer a webinar or at least the opportunity for follow up 1 to 1 calls, potentially as part of a Supplier Relationship Management programme. CCS will continue to hold launch / onboarding / supplier day events to provide a summary of the commercial agreement and supplier’s obligations, on a 1 to 1 basis where possible.

CCS will also hold more knowledge sharing forums with buyers to educate them about barriers to doing business with SMEs and to enable them to change their behaviour where possible to encourage greater SME participation and likelihood of winning call off contracts.

4. Tools for smaller businesses

CCS is reviewing the use of modern slavery risk assessment tools for SMEs and VCSEs. The goal is to enable modern slavery risk management on CCS agreements to be much more of a manageable conversation between CCS and some segments of the supply base than it has been with the Modern Slavery Assessment Tool (MSAT). CCS would like to make the process more effective and straightforward and less overwhelming for SMEs and VCSEs. CCS recognises the desire of SMEs to receive help to implement recommendations to manage the risk of modern slavery.

5. Ongoing Supplier Relationship Management

CCS works with SMEs who have won call off contracts to produce case studies to help promote their success to customers and other SMEs.

Our aim is to increase the number of case studies shared in newsletters, social media and on our website to enable customers and other suppliers to see the great work our SMEs can do. It should be recognised that many SMEs do not have large teams behind them, so providing examples of other SME case studies and tailored guidance that explains what CCS’s Marketing team is looking for in a case study can be beneficial.

Action 5: Agreement Structure

As CCS seeks to develop its commercial agreements its main aim is to reduce costs to the taxpayer and part of that strategy is to structure our agreements in a way that encourages a more diverse supply chain. This is a key policy for the UK Government as set out in its National Procurement Policy Statement (PDF, 509KB) of June 2021.

When drafting business cases for the (re)procurement of a framework or DPS, CCS colleagues must state how SMEs and VCSEs could participate effectively in a market or supply chain. Business cases should detail proposals on how best to support SME participation. Category teams must demonstrate within their business cases that they have given due regard to SMEs when designing their new or replacement commercial agreement and that they have conducted supplier engagement, including SMEs. Category teams must liaise with CCS Policy colleagues ahead of the Commercial Agreement Approval Process to discuss and explain their approach to SMEs and obtain Policy approval to proceed with their procurement. Neither Policy, nor the Commercial Agreement Approval Board will approve a commercial agreement that does not enable bidding opportunities for SMEs.

CCS’s individual categories will continue to work with suppliers and customers to develop the best lotting structure for their commercial agreements to make sure that SMEs are not squeezed out of bidding. This is one of the key reasons CCS places so much emphasis on pre-market engagement.

Where there is a need, CCS is increasingly looking to have lots based on geographical regions, so that more local suppliers that don’t have a national reach are able to bid. This supports SMEs both directly and indirectly through the supply chain.

In addition, all suppliers are able to raise concerns with the Public Procurement Review Service if they consider that a commercial agreement does not give due regard to SMEs and/or is unfair. Suppliers raising concerns will remain anonymous and their names will not be published.

Action 6: Digitisation

CCS is currently digitising many aspects of its commercial agreements to improve the user journey and provide a simple and consistent user journey irrespective of category, spend type or sector. This standardised digital platform, using the same documentation across CCS, will make it easier to understand what the buyer wants and makes the bidding process easier and quicker

The key improvements we are carrying out that will benefit SMEs include:

- a common portal with documents that will become familiar to suppliers will speed up the bidding process

- building of contracts and E-signatures online supporting suppliers which don’t have that service in house

- digital filtering which will guide users to the right commercial agreement and the right lot for their needs

- this means SMEs won’t need to promote and signpost customers to them as the tool will guarantee the right route to buy will be taken

- standard catalogue and payment process to buy certain products giving SMEs a level playing field to bigger players in the market

- helps give SMEs the opportunity to advertise their products to be in the market

- the centralised payment process will give customers access to use a CCS credit card

This means SMEs don’t have to be registered with a merchant, which can be expensive as many take a rebate if you don’t have volume. CCS will put a payment provider in place that suppliers can onboard through and take the CCS rate, which will be negotiated down due to volume and provides a faster payment.

Action 7: Better systems

CCS is currently contributing to the development of new systems that will make it easier to conduct procurement activity across the whole of the public sector.

1. single sign on

- this will make sure our customers no longer need to remember multiple login IDs to access CCS services

2. central identification index

- this will create a consistent supplier identification across the public sector using Companies House, Dun & Bradstreet and other registry data sources

The programme team has already had engagement with over 1,100 SMEs as part of a survey.

Action 8: Greater Collaboration

CCS has a whole host of good practices but ensuring alignment and collaboration can enhance what we offer our customers.

Customer Experience Directorate (CXD)

The CxD team manages our relationships with a large number of public sector bodies across central government departments and wider public sector (WPS) organisations such as local authorities, NHS Trusts, universities, colleges, schools and housing associations. The CXD team operates a strategic account management approach with key CCS customers, giving visibility of their procurement needs and the policy priorities which inform them. We have created a “Feedback” feature in our Customer Relationship Management system which enables the CXD team to capture this information in a structured fashion.

This engagement has highlighted that ‘local first’ is key to many of our customers, in particular local authorities, who typically have it as a key element of their procurement strategies and are especially keen on increasing their own usage of SMEs in order to grow their local economy and as a mechanism for delivering Social Value within their communities.

CCS remains committed to using this customer insight in the development of all new and replacement commercial agreements and the “voice of the customer” forms a key part of the business case approval process. We will use this to ensure that each new agreement considers potential SME-friendly approaches where appropriate, such as regional lotting structures, as well as including provisions for enabling a greater focus on Social Value in contract award processes.

We welcome feedback, suggestions or queries and these can be submitted to smefeedback@crowncommercial.gov.uk