Group Payment Arrangements: CT630 and CT631 Notes

Published 12 August 2016

Please read all of these notes before you fill in the notice. These notes cover both the Closure Notice (form CT630) and the Apportionment Notice (form CT631).

1. How to read and use your CT630 and CT631 pages

The number of pages you receive depends on the number of participating companies and the number of payments made.

If you receive more than one page, you need to put them together as a set. The diagrams below show you the order in which you need to do this.

The group name and the participating companies appear on all the far left pages numbered 1, 2, 3 and such like.

Each participating company is numbered and the number is also shown on the far right of each sheet.

Pages 1/1A, 2/2A and so on, show the amount and effective date of each payment. The more participating companies that you have, and the more payments made, the greater the number of sheets you’ll get.

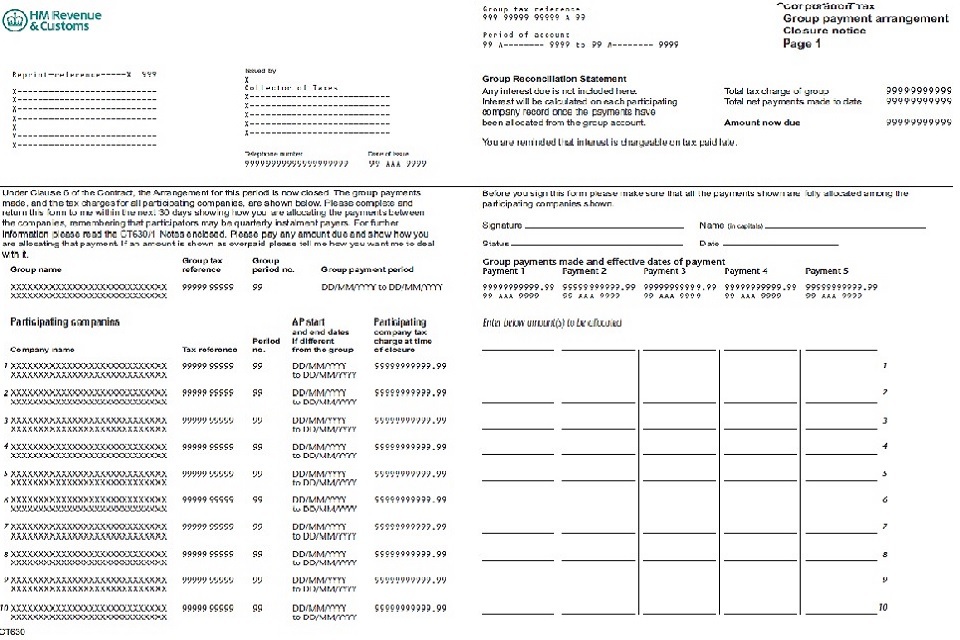

1.1 Page 1

Image showing page 1of CT630

1.2 Page 1A

Image showing page 1A of CT630

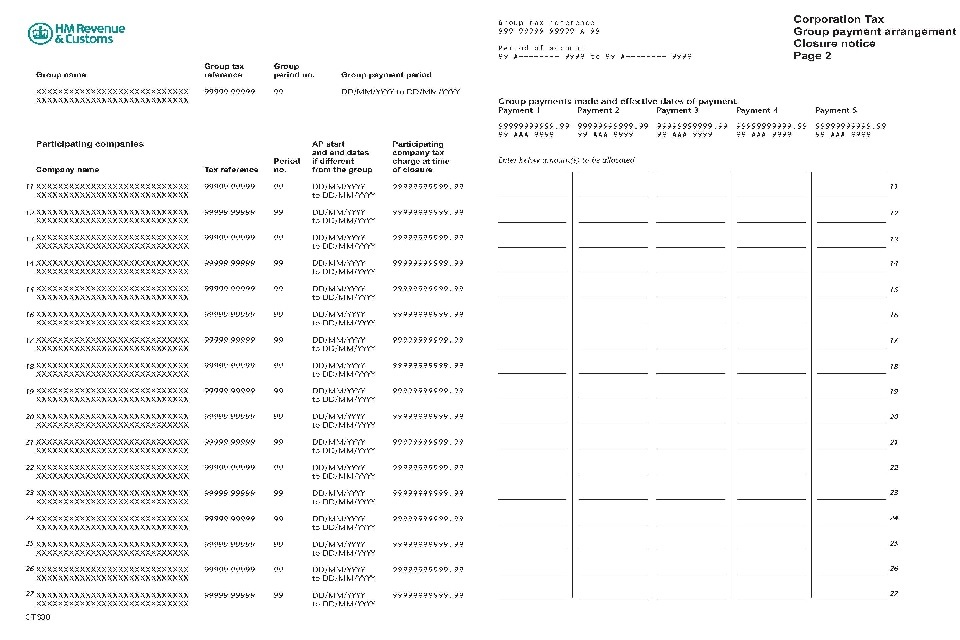

1.3 Page 2

Image showing page 2 of CT630

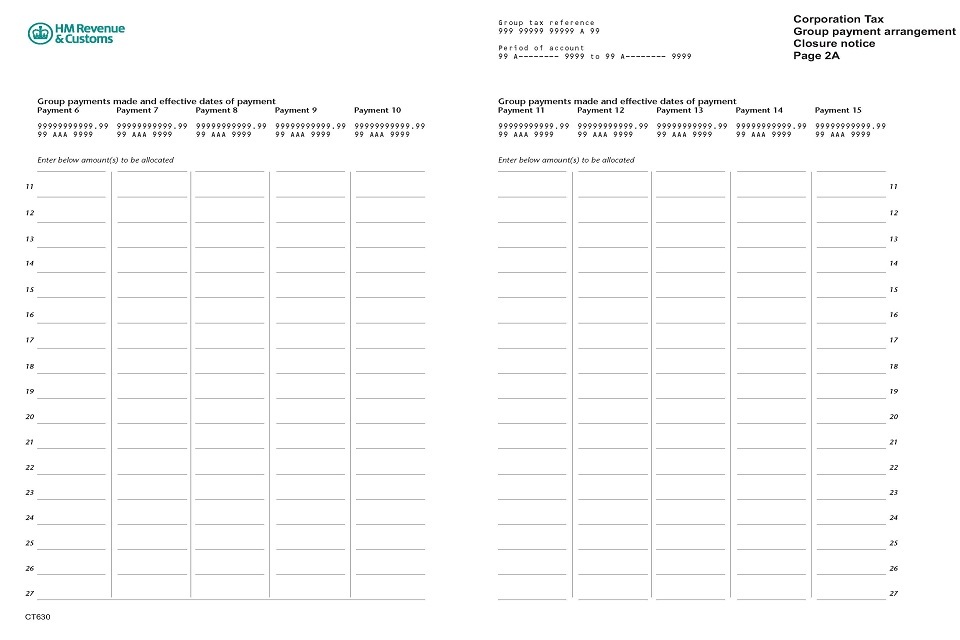

1.4 Page 2a

Image showing page 2a of CT630

2. Closure Notice form CT630

You need to tell us how you want to allocate each payment shown between the participating companies. When you tell us, please make sure that you fill in any boxes showing the apportionment clearly. If you don’t supply the information within 30 days of the date of this notice, or confirm the figures that you sent to us before we issued this notice, we’ll send you an Apportionment Notice showing you how we intend to allocate the payments for you.

3. Apportionment Notice form CT631

This shows you how we intend to allocate the group payments in the absence of your reply to the Closure Notice. If you don’t agree with the allocation and want to amend the apportionment you must tell us, within 30 days of the date shown on the Apportionment Notice, how you want us to allocate the payments.