Completing the Move to Universal Credit: learning from initial Tax Credit migrations

Published 15 August 2023

Applies to England, Scotland and Wales

This document is published alongside a new quarterly release of Move to UC official statistics.

Introduction

Universal Credit (UC) has streamlined and simplified the benefits system by combining 6 ‘legacy benefits’[footnote 1] into one single monthly payment, to better support people to find a job and to then progress in work. The Department is now focused on moving the remaining households on legacy benefits over to Universal Credit. As of March 2023, there were around 2.3m households remaining in scope for moving to Universal Credit[footnote 2]. Our approach for moving these households was outlined in the ‘Completing the Move to Universal Credit’ document, published in April 2022.[footnote 3]

In January 2023, we published ‘Learning from the Discovery Phase’[footnote 4]. This outlined our approach to managed migration, with a focus on small scale testing initially to maximise our learning and ability to iterate the service. The publication summarised the outcomes of the first 499 Migration Notices that were issued to claimants in May 2022, including the learnings and insight we had gained from that initial cohort.

In mid-2022, we began focusing our learning specifically on households that are solely in receipt of Working Tax Credit and/or Child Tax Credit, to support our plans to notify over 500,000 tax credit only households to move to Universal Credit by the end of the 2023/24 financial year. Following rigorous assessment of our readiness to expand, in April 2023 we began to incrementally increase the number of Migration Notices being issued. So far, this expansion activity has focused on single-claimant households claiming Working Tax Credit and/or Child Tax Credit. We have recently commenced small-scale testing of our approach for tax credit couple claims and plan to bring couples into scope in greater numbers from the autumn.

Overview

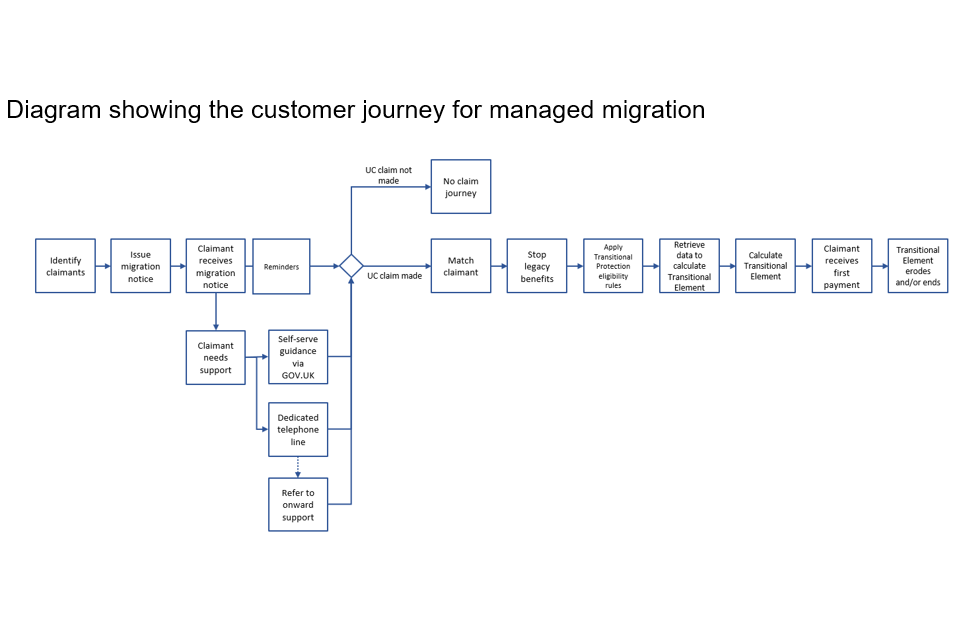

This document outlines the insight we have gathered through our work migrating tax credit claimants to Universal Credit so far and the associated improvements we have made resulting from our learning, covering 4 key areas of the claimant journey:

- The Migration Notice and reminders

- Support and contact for claimants

- The claim process

- Extensions and terminating legacy benefits

As outlined in our January 2023 publication, our learning has been developed through a programme of observation, research (both internal and commissioned through Ipsos), and analysis examining all aspects of the Move to UC process. This work includes in depth interviews with claimants and staff, analysis of migration data, claimant insight to assess the content design of Migration Notices and other products and assessment of telephony contact and claimant support services.

Our research continues to show that whilst every household’s circumstances are unique, the majority of the tax credit population thus far have been able to successfully make the transition to Universal Credit with minimal support.

This document is published alongside a new quarterly release of Move to UC official statistics.

Migration Notices and reminders

Throughout the process of moving tax credit claimants to Universal Credit, the importance of the Migration Notice to claimants is evident. Our research indicated that the Migration Notice is a central feature of the journey for claimants, and they refer to it at numerous times during the process of making their claim. It was therefore important that we look to improve the Migration Notice by providing clear, relevant and essential information to ensure that claimants feel well informed when going through the claim process.

The research made us aware of some key areas for improvement in the Migration Notice to maximise the likelihood that tax credit claimants engage with it, including:

- there is confusion that Universal Credit is only for people ‘out of work’, rather than also being for those ‘in work’

- there is a belief that they would be moved to Universal Credit automatically

- some individuals had recently renewed their tax credits so did not believe they would need to claim Universal Credit

- there is a belief by some claimants that they are not able to make a claim to Universal Credit if they have capital over £16,000.[footnote 5]

In response to this feedback, we have made changes and adjustments to the wording of the Migration Notice to make it clearer that moving to Universal Credit would not happen automatically. Additionally, we have added in further caveats about the need to apply even if claimants had recently renewed their tax credits and that no exception would apply if they had capital over £16,000.[footnote 6] We have also made changes both to the Migration Notice and across our wider communications to make clearer the fact that Universal Credit is for people in work as well as people who are out of work.

There are early indications from our initial testing that the changes to the Migration Notice have had a positive effect, prompting earlier engagement with Universal Credit.

Furthermore, our research and feedback from the dedicated Move to Universal Credit helpline showed that tax credit claimants were confused that they were receiving the Migration Notice from DWP, rather than HMRC. This led to some to questions as to whether the Migration Notice was genuine. To help give greater reassurance to claimants we have since incorporated the HMRC logo into the Migration Notice as well as the DWP logo. Other communication initiatives have also been progressed jointly in partnership with HMRC.

The changes made to the Migration Notice were also incorporated into the reminder letter which is sent in week 7, partway through the 3-month migration window. Our analysis shows that the reminder letter is effective at prompting people and encouraging people to claim, with an uplift in claims seen shortly after the reminder letter is issued. Feedback from claimants in research interviews also highlighted the importance of the reminder letter at prompting them to move forward or encouraging them to make a decision on claiming if they were undecided.

In addition to the feedback received from claimants receiving the Migration Notice, we are also collaborating with key external stakeholders through our Move to Universal Credit forums, seeking to utilise their insight to improve the move to Universal Credit customer journey. As part of this work, we shared the Migration Notice with these groups earlier this year and obtained a range of helpful feedback and suggestions, much of which has been taken on board. The most notable changes include signposting to independent support through Help to Claim (delivered by Citizens Advice, funded by DWP) and to Advice Local[footnote 7] and making clearer the need to renew tax credits as well as making the claim to Universal Credit.

Support and contact

A dedicated Move to Universal Credit helpline has been set up, with approximately 1 in 5 claimants actively contacting the helpline. Our analysis shows that tax credit claimants rarely require support when completing their claim; this is further supported by internal research with staff. Our findings overall therefore support the conclusion that tax credit claimants are more likely to be able to self-serve through the digital application system and make their transition to Universal Credit independently.

In response to this feedback, we have been looking at how best to improve our self-serve journey through a review of our digital resources and support provided for claimants.

The Move to Universal Credit content page[footnote 8] is provided on a short URL link in the Migration Notice. Through our research we saw that claimants do not always type the short URL but instead used online search engines, which directed them to the GOV.UK website related to Universal Credit, which currently doesn’t provide claimants with all the relevant information.

We therefore identified the following areas for improvement:

- better search engine optimisation is needed for the Move to Universal Credit content page

-

the GOV.UK website would benefit from having some additional information to enable managed migration claimants to understand what is relevant to them as well as better links to the short URL with the full guidance, namely:

- Information on managed migration eligibility rules.

- Information on special rules for claimants who are part of the managed migration process.

- A clearer call for claimants who are notified to move to Universal Credit that they must act soon.

We have begun the process of improving the Move to Universal Credit content page by changing the format and amending the title so that it is easier to find through a search engine. We are also making amendments to the GOV.UK website to address the areas identified above. These changes will be rolled out over the coming months.

Amongst tax credit claimants who do call the helpline, they often have questions on how to make a claim. To address this, we are looking at making further adjustments to the Migration Notice and reminder letter to include an explanation of the various steps involved in claiming.

Some claimants also used online benefit calculators to find out how much they might get on Universal Credit, or to work out if they were eligible. We continue to work with a range of stakeholder organisations to ensure that claimants are provided with helpful and accurate information to support their moves to Universal Credit.

Finally, in the early stages of the development of the service, outbound calls to claimants were tested amongst individuals who were near to their deadline but hadn’t yet made a claim. Amongst tax credit claimants, we found the response rate to be low and we believe this is due to these claimants being more likely to be in-work and unavailable. It may also be the case that individuals are less likely to answer unknown calls. We continue to monitor this approach and run different trials to determine the optimum time, channel and frequency of reminders for claimants.

The claim process

We continue to observe the trend outlined in ‘Learning from Discovery’ (January 2023), with some claims made rapidly at the outset, others being delayed (for example, following a reminder) and a large number being made immediately before the deadline. Our research into this pattern of behaviour has shown that individuals who claim straight away are more likely to be digitally literate and confident in their own abilities; they are often in work and are used to tasks of this nature. They are also concerned over delays in their payments so claimed early to avoid this.

We heard from some claimants that decisions to delay claims and then claim immediately before the deadline can be driven by people forgetting or having busy lives that make it difficult to get around to doing the application. However, some claimants are making an active decision not to claim straightaway, for example, waiting for their next benefit payment before applying, waiting due to a recent or imminent change of circumstances, saving up before applying in case of a delay to payment, or waiting for a family member or friend to support them with the application.

The online application was described as straightforward and easy to complete and some claimants expressed that before applying, they were nervous but were surprised about how easy it was to apply. There were some circumstances that made the online application more difficult, however. For example, those who were self-employed or had varying working hours struggled more with the application form as they had to input a lot of information about their earnings. The number of telephone claims however remain low with tax credit claimants and the majority appear to be comfortable with the digital service offered.

Most tax credit claimants applying for Universal Credit use the online method to verify their identification, with smaller numbers of claimants doing so face to face in a Jobcentre or by telephone. Claimants who did not use the online service were more likely to be frustrated with the process. This was mainly because the majority were in employment and it wasn’t always possible to make the appointments that they were assigned.

There is some evidence to suggest that claimants do not fully understand how transitional protection is calculated. We recognise this is one of the most challenging aspects to communicate to claimants as its inherent complexity derives from its comprehensive nature. That said, we are committed to going further to improve claimants’ understanding. We are addressing this issue through reviewing guidance on GOV.UK, testing transitional protection communications with claimants to gauge their understanding of key aspects such as erosion, and through regular discussions with our stakeholder community.

Evidence suggests that once the claim had been processed the online journal was generally well-received by claimants. Several positive elements were reported, including that it was straightforward and easy to use with fast response times. The ability to use their journal at any time of day rather than being required to call within working hours was particularly appreciated by claimants working standard hours.

The no claim process, deadline extensions and terminations

It is our aim to ensure everyone in scope for moving to Universal Credit is supported to make the transition smoothly. We are however seeing a consistent, if relatively small, proportion of tax credit claimants not making a claim to Universal Credit.

Having done a significant amount of research and analysis on this issue already, we continue to explore the reasons for this amongst tax credit claimants. Our findings so far show the following emerging themes:

-

some claimants who do not claim Universal Credit on receiving a Migration Notice are making a conscious decision not to claim. Where the amount they would receive was particularly small, some claimants did not see it as worthwhile to claim given the time they perceived would be needed to apply to Universal Credit and comply with subsequent requirements

-

some claimants believed they were not eligible for Universal Credit, as their circumstances had recently changed and their tax credits had already stopped. In some cases, this was emphasised by a recent increase in income

-

finally, there was a sense from some claimants that they felt a stigma attached to claiming Universal Credit as it combined in work and out of work benefits. Some claimants reported that they didn’t feel they needed Universal Credit as their income was sufficient and they believed that benefits should only be for those who really need them

We have been monitoring phone calls to DWP and HMRC and we have not at the time of publication received any direct contact from these claimants questioning why their benefits have been stopped. We will continue to observe the claim and termination rates and look at the numbers claiming during the one month ‘grace period’ which follows a claimants’ deadline, in which any claim to Universal Credit would be backdated and they would still be eligible for transitional protection where appropriate.

We are committed to doing everything we can to ensure that eligible claimants in scope for migration to Universal Credit make a successful claim and that if individuals choose not to do so, they are doing so fully informed. The improvements outlined in the Migration Notice section above, for example making clearer in the Migration Notice who Universal Credit is for, may help to better inform claimants.

Furthermore, we will be continuing communications activity in 2023 to raise awareness amongst tax credit claimants about the need to claim Universal Credit on receipt of their Migration Notice and to signpost to information and support to help prepare them in advance. We will also be issuing a supporting leaflet to all tax credit customers to further raise their awareness about the transition to Universal Credit.

Next steps

As outlined above, we are continually testing, learning, and adapting to carefully build and deliver a service that both meets user needs and is sustainable in the longer term. We have made a number of improvements to our approach for migrating claimants to Universal Credit and will continue to do so as we gain further insight.

As part of this, we will be undertaking further analysis to understand the experience of claimants who have been through the managed migration process. We will also be continuing to work closely with our stakeholder network in order to draw on their valuable insight to inform further improvements.

We aim to notify over 500,000 households claiming solely Working Tax Credit and/or Child Tax Credit of the need to claim Universal Credit by the end of the 2023/24 financial year (beginning April 2023 and ending March 2024).

By the end of the 2024/25 financial year, we plan to have completed the remaining moves of those on tax credits (including those on both Employment and Support Allowance and tax credits), all cases on Income Support and Jobseeker’s Allowance (Income Based) and all Housing Benefit only cases.

To support this activity, we will be issuing small numbers of Migration Notices to claimants of different legacy benefit households in the autumn to continue our learning and ensure we are in a position to safely and smoothly manage their transition to Universal Credit when we look to operate at greater scale for these groups.

Around 800,000 ESA cases (including those claiming both ESA and Housing Benefit) will remain after 2024/25, with the managed migration of these cases being delayed until 2028/29 as outlined in the 2022 Autumn Statement.

-

Child Tax Credit, Working Tax Credit, Housing Benefit, Income Support, Income-based Jobseeker’s Allowance and Income-related Employment and Support Allowance ↩

-

The figure is based on analysis of the DWP Legacy to UC (L2UC) database. This brings together data from (i) DWP benefits - Jobseeker’s Allowance, Employment and Support Allowance and Income Support, (ii) Housing Benefit from Local Authorities, and (iii) tax credits from HMRC. The figure only includes households on legacy benefits in scope of Move to UC. It includes Tax Credits both for Child and Working elements (excluding nil payments), Housing Benefit (excluding those in Supported/Temporary Accommodation) and income-based claims for both Jobseeker’s Allowance and Employment and Support Allowance. ↩

-

https://www.gov.uk/government/publications/completing-the-move-to-universal-credit ↩

-

https://www.gov.uk/government/publications/completing-the-move-to-universal-credit-learning-from-the-discovery-phase ↩

-

Tax credit claimants moving to Universal Credit, under managed migration can still apply for Universal Credit if they capital over £16,000. ↩

-

Tax credit claimants who have capital over £16,000 who normally would not meet UC entitlement conditions in relation to capital, will be able to be eligible for UC, and their capital (in excess of £16,000) will be disregarded for 12 assessment periods. ↩

-

https://www.gov.uk/guidance/tax-credits-and-some-benefits-are-ending-move-to-universal-credit ↩