Annual Report and Accounts 2019 to 2020

Published 14 July 2020

Annual report and accounts for the year ended 31 March 2020

Annual Report presented to Parliament pursuant to Section 25(4) of the Enterprise and Regulatory Reform Act 2013

Accounts presented to the House of Commons pursuant to section 6(4) of the Government Resources and Accounts Act 2000

Accounts presented to the House of Lords by Command of Her Majesty Ordered by the House of Commons to be printed on 14 July 2020.

Overview

About us

The CMA is an independent non-Ministerial government department, taking on our powers as the UK’s lead competition and consumer authority in April 2014. We employ around 840 people, who work mainly at our offices in London and Edinburgh, with smaller teams in Wales and Northern Ireland.

We adopt an integrated approach to our work, selecting those tools we believe will achieve maximum positive impact for consumers and the UK economy.

Governance

The CMA is funded by the taxpayer, reporting to Parliament through its annual plan and report. Our staff are civil servants.

We are governed by a Board, comprising the Chair, the Chief Executive, executive and non-executive directors, and two members of the CMA Panel. The Chief Executive, as the CMA’s Principal Accounting Officer, is responsible for the economy and efficiency of its handling of public monies.

Some functions of the CMA must be performed by members of the CMA Panel who have clearly defined responsibilities and act as fresh decision-makers between the two phases of market and mergers cases to avoid confirmation bias. Our governance structure helps us to maintain our reputation for fairness, independence, integrity, rigorous analysis, careful handling of sensitive information, and efficient use of public money.

Year in highlights (1 April 2019 - 31 March 2020)

Competition law enforcement

Decorative

7 Competition Act infringement decisions, resulting in £56m of fines imposed, and 10 company director disqualifications.

Our anti-cartel Cheating or Competing? campaign reached 29 million+ people across the UK, broadcast on 47 national radio stations

Consumer protection

Decorative

Consumer protection commitments secured from 29 companies in 4 investigations.

5 market studies and investigations:

- Digital markets

- Funerals

- Scottish legal services

- Online platforms/digital advertising

- Statutory audit

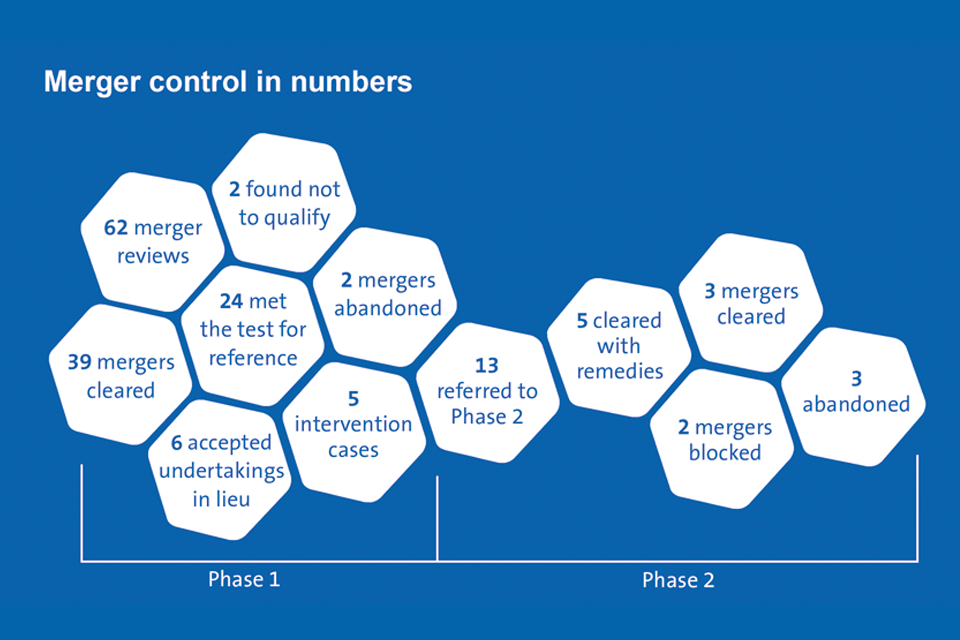

Merger control in numbers

Decorative

- 62 merger reviews

- 39 mergers cleared

- 24 met the test for reference

- 6 accepted undertakings in lieu

- 2 found not to qualify

- 2 mergers abandoned

- 5 intervention cases

- 13 referred to Phase 2

- 3 abandoned

- 2 mergers blocked

- 5 cleared with remedies

- 3 mergers cleared

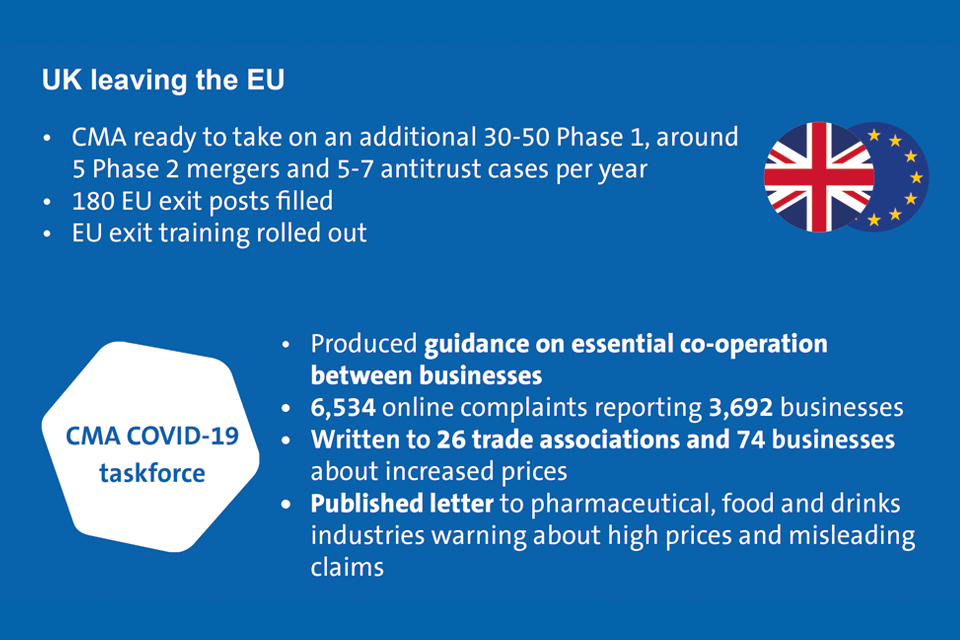

UK leaving the EU

Decorative

- CMA ready to take on an additional 30-50 Phase 1, around 5 Phase 2 mergers and 5-7 antitrust cases per year

- 180 EU exit posts filled

- EU exit training rolled out

CMA COVID-19 taskforce

- Produced guidance on essential co-operation between businesses

- 6,534 online complaints reporting 3,692 businesses

- Written to 26 trade associations and 74 businesses about increased prices

- Published letter to pharmaceutical, food and drinks industries warning about high prices and misleading claims

Chairman’s foreword

Andrew Tyrie

The CMA has responded to outside events in ways that it could not envisage a year ago.

In a few months, the CMA has transformed itself into a body that can address the urgent consumer problems caused by the present coronavirus crisis. This comes in what has been a remarkably busy year for the CMA, including preparations for the UK’s departure from the EU.

A whole institution is having to work at home without an office, and at the same time it has created a completely new function to deal with the crisis, while maintaining high levels of casework elsewhere. Many colleagues have played a direct role in the CMA’s emergency response to COVID-19; many more have stepped forward to give invaluable support to others across the CMA to keep the show on the road.

Early on during the pandemic, we set up the CMA’s COVID-19 taskforce to monitor market developments and gather evidence of harmful practices to enable us to intervene where we can, as quickly as we can. This included sending out warning letters, issuing guidance and a rolling programme of work and enforcement action.

In spite of the practical challenges of the crisis, and the urgent competition and consumer issues that coronavirus has raised, the CMA has largely managed to maintain business as usual, continuing to progress its significant caseload to protect UK consumers.

Throughout the year, the CMA has delivered a substantial volume of work to ensure effective enforcement of competition and consumer protection laws for the benefit of consumers. It has also reviewed a large number of mergers, with some significant successes.

In 2019/20, the CMA has issued seven decisions against companies for anti-competitive practices, imposing £56 million in fines (£29 million of which is recognised in the Trust Statement, with the remainder subject to appeal). In two separate cases concerning the supply of medicines, the CMA has secured millions of pounds in compensation for the NHS from pharmaceutical companies. The CMA has strengthened individual accountability for company compliance with competition law. In a significant increase on previous years, 10 company directors were disqualified during 2019/20 for competition law breaches, protecting the public from those who have shown themselves unfit to be directors. Strengthening individual accountability can have substantial deterrent effect, and can alter Board behaviour for the better.

In consumer protection law enforcement, the CMA has also secured important changes to ensure that consumers are treated fairly when shopping online, whether booking a hotel room, buying tickets for concerts or sports events or reading reviews when buying goods.

The CMA is grappling with shaping the future development of digital markets in a way that harnesses the benefits and minimises the harms. As digital markets continue to grow, competition in the UK appears to be getting weaker in some sectors, with some evidence of growing market concentration and rising profit margins and increased profitability. There has also been significant growth of new and rapidly emerging forms of consumer detriment, caused partly by the increasing digitalisation of the economy.

The CMA, on the government’s request, is leading the Digital Markets Taskforce, looking at how to implement the recommendations from the Jason Furman review of digital competition. Digital markets are global, and the public policy issues they raise are broad. The CMA has been working closely with its international counterparts, as well as UK regulators, to share expertise and put us all in a stronger position to tackle the challenges posed by the digital economy. The CMA has just published its market study and is also considering what enforcement action might be appropriate in this sector.

In consumer protection law enforcement, the CMA has used its range of tools to maximum effect to tackle this detriment.

However, there is only so much that the CMA can do with our existing powers; in many ways the UK has an analogue system of competition and consumer law in a digital age. That is why the CMA also needs updated duties and powers to bolster competition and consumer protection laws by making the regimes swifter, stronger and more flexible.

Even without such legislation, there is more that the CMA can do. As Andrea Coscelli and I set out in February [footnote 1], the CMA can listen more closely to consumers to identify what matters most to them. We can review how we decide which cases to investigate and which tools to deploy, explaining the reasons for our choices and how they will really benefit consumers. And we can be more visible and vocal on behalf of consumers, including calling for changes in policy or legislation where this is needed in consumers’ interests.

The CMA is an extremely hard-working institution, strongly committed to the public good. I won’t be at the CMA when the next Annual Report is written: so I would like to take the opportunity to thank all of those with whom I have engaged - many of whom have become friends - and all those who have contributed to its work. It will be for others to respond to the challenges that the CMA will face over the coming years - they will have my strong support.

Andrew Tyrie, CMA Chairman

Chief Executive’s review

Andrea Coscelli

The CMA has carried out a wide range of work this year to make a positive difference for consumers, businesses and the UK economy. This report gives a summary of our performance, highlighting some of our key work.

In line with HM Treasury guidance the Annual Report and Accounts is a slimmed down version because of the current situation arising from the pandemic. However, we are still providing full accounts and an overview of our performance.

Protecting vulnerable consumers

During 2019/20 the CMA continued to work to ensure as many consumers as possible, including the vulnerable, can access markets, get a good deal from traders and suppliers and be protected from unfair trading. There has been particular focus on ensuring that vulnerable consumers are not exploited.

In an innovative move, the CMA secured compensation from pharmaceutical companies for the National Health Service (and the public who depend on it as patients and fund it as taxpayers), following two separate investigations into alleged anti-competitive practices in the supply of medicines. Aspen agreed to pay the NHS £8 million as part of a wider package to resolve competition concerns in the supply of the vital life-saving medicine, Fludrocortisone, on which thousands of patients with Addison’s disease depend. Separately, investigations into the supply of nortriptyline, a drug relied on by thousands of patients every day to relieve symptoms of depression, also resulted in a payment to the NHS of £1 million, alongside fines totalling more than £3.4 million.

We continued our action to stop care home residents from being unfairly treated in the fees they are charged. Building on our successful work securing changes from three care providers on the fees they charge after a resident has died, we have now launched proceedings against a provider to secure refunds for residents who have been charged a compulsory upfront administration fee.

The CMA also continued its market investigation into the funerals sector. People mourning the loss of a loved one are often extremely vulnerable, and we’re very concerned about the substantial increases in funeral prices. Our initial work indicated problems that have led to above inflation price rises for well over a decade – both for funeral director services and crematoria services. The market investigation, launched at the end of March 2019, progressed throughout the year, and provisional findings are expected to be published later in the year. As a result of the COVID-19 pandemic, the industry has been under considerable pressure and has had to adapt rapidly to ensure that the bereaved can bury their loved ones in accordance with the rules on social distancing. There is some evidence that this has led to a change in the nature of the services currently being provided by the industry.

Legal services are critical to people and businesses, who can face costly legal fees at important moments in their lives. However, there are indications that the Scottish legal services sector may not be delivering good outcomes for consumers. After completing a research project to examine competition and regulation in Scottish legal services, the CMA recommended a series of measures including improving the information made available to people to make it easier for them to shop around when arranging their house purchase or dealing with a divorce. This is the first Scotland specific project since the expansion of our Edinburgh office in May 2018.

Going through or exploring potential fertility treatments can be a stressful and emotional experience, with people having to make decisions in challenging circumstances. Working in partnership with the Human Fertilisation and Embryology Authority, the CMA launched a project to deliver consumer law guidance for IVF clinics and accompanying advice for patients. This will help ensure that clinics provide all the necessary information on treatments to allow patients to make informed choices.

During 2019/20 we secured formal commitments from the University of Liverpool to change its student debt policies. The university had stopped students from graduating, receiving certificates or re-enrolling and accessing the university library and computing services, if they had non-tuition fee debts like outstanding accommodation fees. The changes secured by the CMA mean that students who were prevented from graduating will be allowed to do so, and future students will no longer be penalised in their academic studies for non-tuition fee debt.

Our merger control work also touches markets that particularly affect vulnerable consumers. The CMA required the unwinding of a merger of two suppliers of augmentative and assistive communication solutions to people with complex speech and language needs. We broke up Tobii’s purchase of Smartbox because of the very serious effects the deal would have for consumers such as less choice, less product development and higher prices.

Meanwhile, two of the UK’s largest lone worker protection services abandoned their merger following the CMA’s competition concerns. Send for Help and SoloProtect provide employees such as social workers, with personal alarm devices, connected to monitoring and response services, enabling them to get help if they are faced with danger. The CMA’s investigation raised concerns that the merger could result in customers paying higher prices or receiving lower quality services, which could have had an adverse impact on lone workers, including many working with vulnerable people.

Improving trust in markets

Everyone hates being ripped off and we all want to be sure that ‘what we see is what we get’ – whether we buy online or in person. To help ensure that markets can be trusted we prioritised cases in markets for everyday goods and services like groceries and housing; things that matter to consumers, so they can be reassured that competition is working in their interest. We used the full range of our powers to tackle anti-competitive behaviour.

The most meaningful way to restore confidence in markets is to make them work better in the interest of consumers. The CMA has continued to use its powers to impose fines for breaches of competition law, including and increasingly using director disqualifications; to protect consumers from mis-selling and unfair contract terms; and to take an approach to merger control that prevents harm to consumer’s interests.

The CMA stopped companies cheating through fixing prices, including imposing a £36 million fine [footnote 2] for a cartel in the construction industry (£11.5 million of which is recognised in the Trust Statement, with the remainder subject to appeal). We issued the fines to three construction firms for breaking competition law in supplying concrete drainage products for building projects. The CMA also secured the disqualification of company directors involved in the case.

Following a CMA investigation four Berkshire estate agents had a fine imposed [footnote 3] after they broke competition law by illegally fixing the minimum commission rates they charged their customers. The result was that local homeowners were denied the chance of securing the best possible deal when selling their property because they were unable to meaningfully shop around all their local agents for better commission rates.

The CMA is committed to ensuring and strengthening personal responsibility for company compliance with competition law, and we have injected new vigour in our application of the law providing for disqualification of company directors for competition law breaches – protecting the public from individuals who have shown themselves unfit to be directors. During 2019/20 the CMA secured an increase in the number of director disqualifications. In this year alone there were 10 disqualifications (compared with a total of four in all previous years combined). Two directors were granted limited permission to continue to act as directors of certain companies, subject to strict conditions. The CMA has also applied to the court for the disqualification of a further five directors in three contested cases – the first time we have done this.

During 2019/20 one of our key consumer enforcement investigations has been into leasehold property in England. This follows concern that leasehold homeowners have been unfairly treated and prospective buyers misled by housing developers. We found troubling evidence of potential mis-selling and unfair contract terms. We published a report in February 2020 outlining our findings and are now preparing to launch enforcement action and working with government to ensure that homeowners are protected in the future.

The CMA’s campaigns have continued to raise awareness amongst businesses about how to ensure their practices comply with the law, which is key in helping promote trust in markets. We asked companies in the travel and hospitality sector to ‘check in on their terms’ and change any potentially unfair deposit and cancellation terms and conditions. The ‘Cheating or Competing?’ campaign shines a light on illegal practices of price-fixing, bid rigging and market sharing. The hard-hitting message places the onus on business leaders to ensure their practices are fair and legal or risk the consequences.

Over the past year, we have taken tough action to protect consumers from the harmful effects of anti-competitive mergers. We believe a strong and independent system of merger control, which prevents harm to consumers’ interests can build further trust in markets. We blocked the Sainsbury’s/Asda merger after we found it would have led to increased prices, reduced quality and choice of products for millions of people in the UK. The CMA’s investigation found that, as well as affecting in-store customers, the merger would result in increased prices and reduced quality of service, such as fewer delivery options, when shopping online. It would also lead to motorists paying more at over 125 locations where Sainsbury’s and Asda petrol stations are located close together.

After an in-depth Phase 2 investigation the CMA blocked a merger between two cleaning chemicals firms to prevent potential price rises or a lower quality of service. Ecolab and Holchem, who completed their merger in November 2018, are two of the largest suppliers of cleaning chemicals to food and drink manufacturers in the UK. The merger would have created a new organisation which is much larger than any of its remaining competitors therefore it was likely to face limited competition from other suppliers.

During 2019/20 an offshore accommodation merger was abandoned after an in-depth CMA merger probe highlighted serious competition concerns. Prosafe abandoned its proposed deal with Floatel after the CMA provisionally found the merger may result in a substantial lessening of competition and customers may face higher prices, and/or lower quality. Both companies supply semi-submersible offshore accommodation support vessels to oil and gas companies.

The merger of receipt roll suppliers was abandoned after a Phase 1 CMA investigation raised competition concerns. We found that Iconex’s purchase of two rival receipt paper suppliers Schades and R+S could lead to less choice and higher prices. The companies manufacture and supply lightweight thermal paper rolls and labels used by many businesses, including shops, restaurants and banks to print receipts.

Promoting better competition in online markets

Consumers and businesses are increasingly shifting their trading online, with fewer ‘bricks and mortar’ industries. While such developments are offering huge new opportunities for businesses and benefits for consumers, they can lead to new problems which can be particularly costly for consumers.

We published our Digital Markets Strategy which sets out our aim to protect consumers whilst fostering innovation in the rapidly developing digital economy. A key part of this strategy was the launch of a market study into online platforms and digital advertising. It looks at market power of digital platforms and digital advertising in consumer-facing markets, the lack of consumer control over data, and competition in the supply of digital advertising. The final report was published in July 2020.

The CMA was also asked by government to lead a digital markets taskforce. The taskforce will provide government with expert advice on the functions, processes and powers needed to deliver on its objectives in the digital platform markets in a proportionate and efficient way. The work of the taskforce forms part of the CMA’s ongoing work under its Digital Markets Strategy, complementing and building on the work undertaken by the CMA’s digital advertising market study.

We are at the forefront of competition agencies around the world in exploring how technology is changing the business models and investment strategies of firms in the digital economy.

Making sure that we understand and address the challenges that the growth of the digital economy poses – for consumers, businesses and competition authorities – is vital. This year we hosted a digital event, bringing together leading experts from across the world to explore how to shape the future development of digital markets in a way that can harness the benefits and minimise the harm.

More than three-quarters of people are influenced by reviews when they shop online, and billions of pounds are spent every year based on write-ups of products or services. Fake and misleading reviews are illegal under consumer protection law and websites have a responsibility to ensure that this unlawful and harmful content isn’t advertised or sold through their platforms. Consumers need to know that online reviews can be trusted. In a win for online shoppers, following action from the CMA, Facebook and eBay committed to combatting the trade of fake and misleading reviews on their sites, taking action to remove groups, disable accounts and ban users, as well as introducing more robust systems for the future.

Meanwhile, the CMA continues to investigate the role and responsibilities of social media platforms. This follows the CMA securing formal commitments from celebrities to ensure they will clearly state if they have been paid or received any gifts or loans of products which they endorse. Influencers can have a huge impact on what their fans decide to buy. People could, quite rightly, feel misled, if what they thought was a genuine recommendation from someone they admired, turns out to be something they were paid to say.

During the year, the CMA secured changes from the majority of hotel booking sites operating in the UK. 25 firms, including big brands like TripAdvisor, Airbnb and Google, as well as major hotel chains, agreed to change how they display information where needed and signed up to the CMA’s sector wide principles for complying with consumer protection law. These principles include not giving a false impression of a room’s popularity and always displaying the full cost of a room upfront.

Meanwhile, the CMA continues to investigate suspected breaches of consumer protection law in the online secondary tickets market. This year this included telling ticket resale firm StubHub to make changes to its site after identifying problems that could mean it is breaking consumer law. Viagogo also addressed the CMA’s outstanding concerns about how it presents important information to its customers.

We are examining the practices of the major online console gaming subscription services run by Microsoft, Sony and Nintendo. This is the second consumer protection law investigation opened by the CMA following its report on the ‘loyalty penalty’, which we considered in response to a super-complaint from Citizens Advice. We are considering in particular whether the firms’ approach to automatically renewing subscription services complies with consumer protection law.

During 2019/20 the CMA carried out competition law investigations into the prevention of online discounting in the sale of musical instruments. Online sales of musical instruments have grown to around 40% of total sales, making it even more important that musicians have access to competitive prices online. The CMA fined Casio, the piano and keyboard supplier, £3.7 million for breaking competition law by preventing online discounting for its digital pianos and keyboards. Later in the year, the CMA fined the guitar maker Fender £4.5 million for similar practices in the supply of its guitars.

The CMA continues to investigate the comparison website ComparetheMarket in connection with its home insurance deals. Our investigation provisionally found that ComparetheMarket broke the law by preventing home insurers from offering lower prices elsewhere. This could result in people paying higher premiums than they need to. Over 20 million UK households have home insurance and more than 60% of new policies are found on price comparison sites. A final decision on this case is expected later this year.

Meanwhile, following an initial Phase I investigation by the CMA, the cashback website TopCashback abandoned its acquisition of Quido. TopCashback and Quidco are the two largest cashback websites in the UK and each other’s main competitor. These websites allow shoppers to receive money back on certain types of online shopping and enable retailers to advertise and promote cashback discounts. The CMA found that the merger would give rise to serious competition concerns with the merged company able to decrease the amount of cashback paid to shoppers and increase advertising prices for businesses.

Supporting economic growth and productivity

A strong economy is underpinned by markets that work effectively, where competition is driving innovation, efficiency and growth. In well-functioning competitive markets, businesses innovate and compete vigorously and fairly to attract customers’ business. Customers can make informed choices between suppliers on price, quality, innovation and service. This drives further competition and innovation in a virtuous circle. The CMA’s competition and consumer protection, interventions contribute to this working effectively.

This year, the CMA published its final report with recommendations to address serious competition problems in the UK audit industry. The statutory audit market should help underpin strong investment in the UK economy, but our market study published last April concluded that weak competition meant it was not working well. The CMA recommended the separation of audit from consulting services, mandatory ‘joint audit’ to enable firms outside the Big 4 - Ernst & Young, Deloitte, KPMG and PricewaterhouseCoopers - to develop the capacity needed to review the UK’s biggest companies, and the introduction of statutory regulatory powers to increase accountability of companies’ audit committees.

Following an in-depth CMA merger investigation that highlighted serious competition concerns, Illumina abandoned its anticipated $1.2 billion takeover of PacBio. Illumina and PacBio are both global suppliers of Next-Generation DNA sequencing systems to organisations across the world, including UK universities, laboratories and research institutes. DNA sequencing systems are vital to the study of genetic variation in humans and other species, for purposes such as essential disease research and drug development. The CMA provisionally found the merger would result in a significant loss of competition and would lead to a reduction in overall levels of innovation in the market. Illumina and PacBio decided not to continue with the deal before the CMA’s final report.

Meanwhile, Thermo Fisher abandoned its anticipated purchase of Gatan after an in-depth CMA merger probe highlighted serious competition concerns. Thermo Fisher supplies, among other things, high-tech electron microscopes used for scientific research. Gatan produces highly specialised “peripherals” or add-ons, such as filters and cameras, which are used in the operation of microscopes by customers including UK universities and research institutions. The CMA found in its provisional findings that that the proposed deal may result in a substantial lessening of competition in all the relevant markets in the UK, enhance Thermo Fisher’s already strong market position, and lead to higher prices or lower quality for customers using electron microscopes.

Over the past year, we started to assess the state of competition in markets across the UK and consumers’ experiences of those markets. In light of the COVID-19 outbreak, we will be postponing the work until later in the year and we expect to produce an initial report early next year.

The UK’s exit from the EU

At the end of the transition period, due on 1 January 2021, the CMA will take on responsibility for larger and more complex merger, cartel and competition enforcement cases that were previously reserved for the European Commission.

In 2019/20 we made substantial progress in ensuring that we have the necessary people, skills and infrastructure in place to take on this expanded role.

The UK’s exit from the EU presents both challenges and opportunities for the CMA. We remain committed to capitalising on these opportunities to secure continued good outcomes for UK consumers, and to play a bigger role in working internationally to promote competition and protect consumers – including working alongside competition and consumer agencies and policymakers across the world.

The CMA published guidance to explain how it will conduct its work during the transition period. This guidance is designed to explain how EU Exit affects the CMA’s powers and processes for competition law enforcement (‘antitrust’, including cartels), merger control and consumer protection law enforcement during the transition period, towards the end of that period, and after it ends.

The guidance also explains the treatment of ‘live’ cases, which are cases being reviewed by the European Commission or the CMA during, and at the end of, the transition period.

Over the past year, we have contributed to and advised on the government’s planning for various options for the creation of a domestic Subsidy Control regime. It is for the government to decide how this will be regulated in the future, including whether the CMA has a role to play in a new regime.

Response to COVID-19

The end of the 2019/20 reporting year saw the CMA’s emerging response to COVID-19. The pandemic demanded urgent and critical decisions by government to address exceptional issues of public health and wider public policy. The CMA acted quickly to ensure that its approach to enforcing competition law did not stand in the way of necessary co-operation between suppliers to maintain continuity of supply for essential goods and services. We published clear guidance for businesses across all sectors, setting out the conditions under which firms will be exempted from competition law enforcement during the pandemic. At the same time, the guidance emphasises that the CMA will not tolerate conduct which goes beyond what is necessary or which seeks opportunistically to exploit the crisis.

At the early stages of the pandemic, we were concerned that a small minority of businesses were exploiting the situation to take advantage of consumers, for example by charging inflated prices, making misleading claims about their products or refusing to respect consumers’ cancellation rights.

We set up the CMA’s COVID-19 taskforce to monitor market developments and gather evidence of harmful practices to enable us to intervene where we can, as quickly as we can.

We have deployed a range of options for dealing with the challenges identified to date, from warning letters, to published guidance and a rolling programme of work and enforcement action. We will also continue to advise the government on where further legislative change might be needed. We have worked closely with regulators, international and domestic partners including Trading Standards, Which? and Citizens Advice, to get the best possible understanding of the challenges facing consumers during the pandemic, and to come together to protect them.

Within our remit, we have also been advising government on the measures it takes in response to the pandemic, aiming to ensure policies protect competition and consumers, both in the short and longer term.

Risks, challenges and opportunities ahead

The COVID-19 pandemic and its impact on the economy will be the biggest challenge facing the CMA in the foreseeable future. We are still in the midst of the outbreak and the full impact of the crisis is yet to emerge.

What is clear is that the pandemic will adversely affect economic growth and productivity. The effects on markets will be wide-ranging and persistent. Experience tells us that such economic shocks can incentivise anti-competitive behaviour. The CMA will be vigilant to the risk of collusion, to mergers seeking to capitalise on the financial distress of firms, and to profiteering in the supply chain. Our role in restoring and promoting competition and innovation will be critical to ensure future growth, in what will be difficult market conditions for many sectors of the economy. The CMA’s work to assess the state of competition in markets will play an important role in this.

As the effects of the crisis change, and the immediate pressures subside, co-operation for positive short-term reasons can easily become harmful to competition and consumers, if it persists over the longer term. A key challenge for government will be to unwind the measures put in place to protect the economy and ensure security of supply, including exclusion orders and financial assistance, at the right moment. For its part, the CMA will continue to promote well-functioning, competitive markets as a critical ingredient in helping consumers, businesses and the wider economy to recover.

The pandemic has also brought challenges to the CMA’s ability to continue with its core business. We still have statutory deadlines on a large portion of our work. We have made changes to the way we work, for example by further improvements in the equipment and technology required for effective remote working, and re-deployed staff across the CMA to deal with this rapidly developing situation. CMA staff have risen to the challenge of dealing with this outbreak and I am proud to lead an organisation of such dedicated and adaptable people. However, those businesses providing us with information and involved in our investigations have also been impacted by the pandemic, seeking additional time to provide information and evidence to us. These challenges to the delivery of our core business may limit the number of major new projects we can launch in the coming months.

The CMA has continued to make the case for new statutory duties – to promote the consumer interest, and to carry out our work as swiftly as possible. And for those duties to be backed by new and improved powers that we need to do the job. We have advised government on the shape these duties and powers might take, building on the positions our Chairman set out in February 2019. We will continue to support government in this way, in anticipation of future consultation on reform of the competition and consumer regimes. We are also taking forward work on what more we can do to improve the robustness of the regimes without legislative reform, and we will announce more on this over the next year.

In February, the CMA set out how it will become closer to consumers. We will do this by engaging more closely with consumers to deepen our understanding of how existing markets are changing, new markets are emerging and of consumers’ experience and concerns. We will also look at the experience of small to mid-sized businesses, who are often not much better off than individuals in dealing with big, powerful companies. We will be working with Citizens Advice and other consumer bodies so we can understand the concerns of consumers first-hand. This is necessary so that our interventions deliver impact where it is most needed, and it is why we will engage more actively with consumers and businesses over the coming year. We will improve how we choose which problems to take on and do more to explain these decisions. The CMA will take every opportunity to explain how consumers benefit from competition and well-functioning markets. We will effect change through speaking up publicly as well as through enforcement.

It is an uncertain future for the UK. However, the CMA will continue to ensure our work protects consumers and that markets work well for them, businesses and the economy during this difficult time.

Andrea Coscelli, Chief Executive and Principal Accounting Officer, 09 July 2020

This year’s key moments

April

CMA blocks Sainsbury’s/Asda merger after finding it would lead to increased prices in stores, petrol stations and online.

CMA publishes report to address serious competition problems in the UK audit industry.

May

Apple commits to be clearer and more upfront with iPhone users about battery health and performance.

CMA secures the disqualification of 3 directors of office fit-out companies for their involvement in illegal cartel behaviour.

June

CMA clears PayPal/iZettle mobile payments merger.

July

CMA launches its digital markets strategy, setting out how it will continue to protect consumers in rapidly developing markets, while fostering innovation.

August

CMA orders Tobii to sell Smartbox after finding their merger could lead to a reduction in the range of assistive communication.

September

People booking hotels online can now do so with more confidence following a CMA probe of the sector

viagogo fixes concerns about the way it presents information in face of further legal action.

October

CMA imposes fines on 3 firms totalling more than £36 million for breaking competition law in supplying concrete drainage products for building projects.

Drug firm Aspen pays the NHS £8 million, to resolve competition concerns over the supply of a medicine.

November

HSBC and Santander agree to refund customers after they failed to comply with a legal order.

December

CMA publishes its online platforms and digital advertising update, uncovering new detail about how the sector’s biggest names operate.

CMA imposes fines on 3 Berkshire estate agents for illegally fixing the minimum commission rates they charged.

January

CMA fines Fender Europe £4.5 million for breaking competition law by preventing online discounting for its guitars.

Following CMA action, Facebook and eBay commit to combatting fake and misleading reviews on their sites.

February

CMA finds troubling evidence of potential mis-selling and unfair contract terms in the leasehold housing sector, and is set to launch enforcement action.

CMA develops guidance for IVF clinics in the UK to make sure they treat their patients fairly.

March

CMA launches a taskforce to tackle negative impacts within its remit of the COVID-19 pandemic.

CMA publishes its research project into competition and regulation in the Scottish legal services sector.

Performance summary

Where we spent our money in 2019/20

We incurred spending against parliamentary budgets for the year ending 31 March 2020 of £112.9 million.[footnote 4]

The significant areas of expenditure recorded include:

- £69.7 million on our business as usual activities of protecting consumers through effective enforcement, operating an effective and efficient merger regime, making markets work better, being a strong voice for competition; and

- £16.0 million on construction works fitting out the office space and other associated capital expenditure for our London headquarters move to Canary Wharf; and

- £18.2 million to cover essential spending on preparations for the CMA’s expanded role after the UK exited the EU (including the potential administration of the future Subsidy Control regime).

Detailed explanations of the significant variances between the outturn and Estimate are included in the Directors’ report: financial review

2019/20 was a challenging year from a funding perspective, as we continued to increase our staff resources in preparation for the UK leaving the EU and utilised part of our business as usual budgets to complete the construction works and fitting out the office space at the Cabot in Canary Wharf, while also delivering our commitments with regard to merger control and enforcement.

We have successfully delivered within our parliamentary budgets in 2019/20, with effective financial management decisions delivering an underspend in our resource budget, despite the additional pressures we have faced this year.

COVID-19

Like all organisations, we’ve had to act swiftly and effectively to manage our response to COVID-19. We enacted business continuity plans and put in place many actions quickly in order to mitigate risk and ensure that staff affected by COVID-19 have been supported and communicated with on an ongoing basis. On 20 March 2020, we took the decision to close all our offices across all nations, resulting in all our staff working from home.

The timing of COVID-19 and the UK’s lockdown has meant that we did not incur material expenditure in 2019/20, with most of this expenditure falling in the 2020/21 financial year. Our current spending includes the introductory costs of creating a specific COVID-19 taskforce focused on protecting consumers from opportunistic and anticompetitive behaviour resulting from the pandemic, additional costs for supporting staff with any equipment they need to work from home effectively, as well as other facilities management and associated specialist cleaning costs.

Fines and penalties income

We also collected £29.7 million from fines and penalties under the Competition Act, imposed on companies across a variety of sectors, showing the tangible effect of the CMA in curtailing anticompetitive practices, all of which goes directly to central government resulting in a direct benefit to the government’s finances. This is reported separately in the CMA’s Trust Statement.

Contingencies Fund Drawdown

We submitted a request for £14.7 million to HM Treasury to draw money from the Contingencies Fund (under section 5.14a of the Supply and Estimate Guidance manual). The funds were required to cover an expected shortfall in the net cash requirement amount, as a result of costs associated with the fitting out of the office space in Canary Wharf, before the additional funds requested in the Supplementary Estimate 2019/20 became available. The funds were repaid to the Contingencies Fund, in full, on 22 July 2019.

Corporate Governance Report

Directors’ Report

Statutory powers

The CMA is a non-Ministerial department. We derive our powers from the Enterprise and Regulatory Reform Act 2013.

Our functions include:

- Investigating mergers that have the potential to lead to a substantial lessening of competition

- Conducting studies and investigations into markets where there are suspected competition and consumer problems

- Investigating businesses and individuals to determine whether they have breached UK or EU competition law and, if so, to end and deter such breaches, and pursue individuals who commit the criminal cartel offence

- Enforcing a range of consumer protection legislation, tackling issues which suggest a systemic market problem, or which affect consumers’ ability to make choices

- Promoting stronger competition in the regulated industries (gas, electricity, water, aviation, rail, communications and health), working with the sector regulators

- Conducting regulatory appeals and references in relation to price controls, terms of licences or other regulatory arrangements under sector-specific legislation

- Giving information or advice in respect of matters relating to any of the CMA’s functions to the public, policy makers and to Ministers.

Pension liabilities

Past and present employees are covered by the provisions of the Principal Civil Service Pension Scheme (PCSPS). Further information on pension liabilities is in the Remuneration Report and note 3 of the financial statements.

Our staff

The CMA is committed to providing employees with information on matters that affect them and consulting employees regularly so that their views are incorporated into our governance and decision making. We provide weekly briefings that are delivered in person by senior staff in each local area which provide staff with important information on the organisation’s business (both internal and external) and its achievements and challenges. These weekly briefings are supplemented by a regular cycle of briefings from the Chief Executive and periodic meetings with the Chairman at an organisational and directorate-level. These provide an opportunity to engage with staff about key strategic, economic and operational issues facing the organisation, and update staff on the CMA’s performance against its strategic objectives and Annual Plan commitments. They enable staff to raise questions and issues of concern.

We are passionate about developing the people that work at the CMA and looking after their wellbeing and mental health. We are committed to creating a workplace that is completely free of bullying, harassment and discrimination as well as building a broader culture of respect. This remains a central theme of our Corporate Action Plan.

We have continued to provide information to staff on the impact of the UK’s departure from the European Union through our dedicated ‘hub’ on the intranet, blogs from the team and senior staff and the establishment and maintenance of an EU Nationals network.

Our approach to ensuring staff were kept informed during the COVID-19 pandemic and the steps we took to protect their wellbeing is covered in the COVID-19 section.

We have a Staff and Union Representative Executive (SURE) which is made up of Trade Union officials and Staff Forum members (our employee-elected representative group) who represent the interests of all employees. This group works with our management team to maintain good employment relations.

Our commitments to equality, diversity and inclusion

In May 2019, the CMA published its diversity and inclusion strategy which focused on three areas:

- Building a workforce that reflects and understands the public we serve

- Ensuring all colleagues feel valued and can contribute to our success

- Empowering our colleagues to succeed whatever their background.

During 2019, Amelia Fletcher was confirmed as the CMA Board champion for diversity and inclusion and in November 2019, we held our inaugural Wellbeing, Inclusion, Diversity and Equality (WIDE) Steering Group. This Group, chaired by Amelia Fletcher, brings together representatives from the diversity and inclusion networks, executive and senior directors, sponsors of the CMA’s network groups and the CMA lead for culture and change to drive collaboration and steer the strategic direction of activities in the CMA. A further meeting in January 2020 explored more joined-up ways of working to support career progression and inclusion and also discussed the shape and content of the CMA’s next strategic plan which will be published later in 2020.

The Board reviewed the CMA’s most recent Gender Pay Gap report for 2018/19 which showed a small gender pay gap for ordinary pay (mean and median) but noted it had decreased from the last year along with an increase in female representation within the Senior Civil Servant cadre at the CMA. The Board also advised on the executive’s plan of action to continue to improve the CMA’s gender equality and close our gender pay gap. Further information is available on the CMA’s published Diversity and Inclusion Strategy and in the staff report.

Auditors

Our Resource Accounts and the Trust Statement Accounts have been audited by the National Audit Office (NAO) and certified by the Comptroller and Auditor General who was appointed under statute and is responsible to Parliament. The notional cost of the audit is disclosed in note 4 of the CMA’s financial statements and relates solely to statutory audit work. The auditors did not undertake any non-audit work during the 2019/20 year.

The CMA Directors, including the Chief Executive, have taken all the steps necessary to make themselves aware of any relevant audit information and to establish that the CMA’s auditors are also aware of that information. In so far as we are aware, there is no relevant audit information of which the Comptroller and Auditor General, with support of the NAO, is unaware.

Accounting Officer

As Principal Accounting Officer, CMA Chief Executive Andrea Coscelli remains responsible, and with advice from the CMA Board, for ensuring that the CMA operates effectively and to a high standard of probity in relation to governance, decision-making and financial management. In April 2018, the Executive Director of Corporate Services, Erik Wilson, was appointed as Additional Accounting Officer with a specific responsibility for corporate and support services.

The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the CMA’s assets, are set out in Managing Public Money published by the HM Treasury.

Directors’ Report: financial review

Expenditure

How expenditure is presented

The CMA’s expenditure is reported on two different bases in this Annual Report and Accounts. The Statement of Comprehensive Net Expenditure presents net expenditure of £98.0 million. This compares to £75.0 million in 2018/19 (restated). This expenditure is calculated following accounting standards and guidance which are explained in more detail in note 1 and on a similar basis to those rules generally applied by private sector businesses.

The Statement of Parliamentary Supply presents a total expenditure £115.5 million and compares this with the budget presented to Parliament of £125.8 million. These figures are calculated in accordance with HM Treasury’s Consolidated Budgeting Guidance, which differs in several respects with the accounting basis above.

An overview of our expenditure

The Total Managed Expenditure (TME) of the CMA was £115.5 million, broken down by HM Treasury’s spending categories as set out in the table below.

| 2019/20 outturn (£000) | 2019/20 budget (£000) | 2018/19 budget (£000) | |

|---|---|---|---|

| TME | 115,495 | 125,769 | 119,726 |

| - Resource DEL | 95,292 | 95,969 | 94,126 |

| - Capital DEL | 17,574 | 19,800 | 23,100 |

| Total DEL [footnote 5] | 112,866 | 115,769 | 117,226 |

| - Resource AME | 2,629 | 10,000 | 2,500 |

| Total AME [footnote 6] | 2,629 | 10,000 | 2,500 |

The CMA is accountable to Parliament for its expenditure. Parliamentary approval for our spending plans is sought through the Supply Estimates presented to the House of Commons, specifying the estimated expenditure and asking for the necessary funds to be voted. The CMA draws down these voted funds in-year from the Consolidated Fund as required and within the scope of our Voted Estimates.

The Estimates include a formal description (‘ambit’) of the services to be financed. Voted money cannot be used to finance services that do not fall within the ambit. Our RDEL budget for 2019/20 was £96 million, including agreed funding priorities of £19.5 million to cover essential spending on preparations for the CMA’s expanded role after the UK exited the EU (including the potential administration of the future Subsidy Control regime) and £2.5 million to support the CMA’s property move to Canary Wharf.

Our CDEL budget for 2019/20 was £19.8 million, increased from our Spending Review 2015 settlement of £2.1 million, including funding of £17.2 million to complete the CMA’s property move to Canary Wharf and £0.5 million to develop an IT system for any potential UK government Subsidy Control regime.

Outturn

As set out in the Statement of Parliamentary Supply, the CMA’s 2019/20 RDEL outturn was £95.3 million, compared with a Supply Estimate of £96 million. Of this, £19.5 million was ringfenced to cover essential spending on preparations for the CMA’s expanded role after the UK exited the EU.

HM Treasury removed this ringfence in March 2020 recognising the CMA’s strong financial management to utilise its funding efficiently, but that at such a late stage in the financial year there may be little flexibility to react quickly to COVID-19 spending pressures. Ultimately COVID-19 did not have a material impact on the CMA’s Accounts in 2019/20 with most of this expenditure being incurred in the 2020/21 financial year.

This resulted in a small underspend in 2019/20 of £0.7 million, of which £0.4 million related to depreciation, a significantly smaller underspend compared to previous years, which reflected the CMA’s intention to effectively utilise the budget provided to the department to deliver our strategic objectives.

The CMA’s 2019/20 CDEL outturn was £17.6 million, compared with a Supply Estimate of £19.8 million. The main driver for the underspend of £2.2 million was savings in The Big Move project, found through strong financial control of fit-out costs and not needing to utilise £1.0 million of the project’s contingency budget. Further savings emerged as the department revised the split between RDEL and CDEL as the project progressed after the Supplementary Estimates.

The CMA’s 2019/20 RAME outturn was £2.6 million, compared with a Supply Estimate of £10 million. This is a demand led budget which is largely outside of the control of the department; the spending here is comprised of provisions in respect of legacy pensions, dilapidations and other costs.

Statement of Accounting Officer’s Responsibilities

As the CMA’s Principal Accounting Officer, in preparing the accounts I am required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by HM Treasury including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis,

- make judgements and estimates on a reasonable basis,

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts, and,

- prepare the accounts on a going concern basis.

Under the section 5 of the Government Resource and Accounts Act 2000, HM Treasury has directed the CMA to prepare for each financial year, resource accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the department during the year. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the CMA and of its net resource outturn, application of resources, changes in taxpayers’ equity and cash flows for the financial year.

I have taken all necessary steps to make myself aware of information relevant to the audit of the accounts that accompany this Annual Report, and to ensure that my auditors are informed. So far as I am aware there is no relevant information of which my auditors are unaware.

I confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and I take personal responsibility for the Annual Report and Accounts and the judgements required for determining that it is fair, balanced and understandable.

- Signed for and on behalf of the CMA, Andrea Coscelli, Chief Executive and Principal Accounting Officer, 06 July 2020

CMA Governance Statement 2019/20

In accordance with HM Treasury Guidance, this Governance Statement sets out the governance, risk management and internal control arrangements for the CMA.

CMA Board

The Board consists of the Chairman, Non-Executive Directors and Executive Directors (including the Chief Executive).

Led by the Chairman, it establishes the overall strategic direction of the CMA within the policy framework laid down under the Enterprise and Regulatory Reform Act 2013. It ensures that the CMA fulfils its statutory duties and functions and that it observes the principles of good corporate governance. The Board will have regard to any opinions and reports of the CMA Principal Accounting Officer and ensures that the CMA makes appropriate use of public funds.

The Board is the decision-maker on reserved matters. As set out in the CMA Rules of Procedure, it:

- decides whether to publish a market study notice and whether to refer a market for a phase 2 investigation

- considers the draft Annual Plan and consultation on the proposals

- is responsible for the annual performance and concurrency reports

- makes rules of procedure for merger reference groups, market reference groups, and special reference groups.

Some functions of the CMA must be performed by members of the CMA Panel. Members of the Panel have clearly defined responsibilities and act as fresh decision-makers in the second phase of market and mergers cases.

The CMA Board met 13 times in 2019/20. Board meetings were held in each month except in the month of August. In response to the developing COVID-19 pandemic, two extraordinary Board meetings were convened on 20 March and 27 March 2020. [footnote 7] Attendance of Board members at Board and committee meetings is set out in the table below.

The minutes from CMA Board meetings are published on the CMA website. In line with the CMA Conflicts of Interest policy, a register of the interests of Board members and their families is maintained and published online.

In the spring of 2020, the Board commissioned an external review of its performance. The outcome of the review, including any recommendations, was shared with the Board in June 2020.

Board membership

The Rt Hon Lord Tyrie (Chairman)

Andrew Tyrie was appointed as CMA Chairman in June 2018. He sits on the Cross Benches in the House of Lords. Andrew was MP for Chichester for 20 years. He served as Chairman of the Treasury Select Committee, Chairman of the Liaison Committee, and Chairman of the Parliamentary Commission on Banking Standards.

Dr Andrea Coscelli CBE (Chief Executive)

Andrea Coscelli was appointed as the Chief Executive of the CMA in July 2017, having been Acting Chief Executive since July 2016. Prior to taking up this role, Andrea was the CMA Executive Director, Markets and Mergers, in which he ensured strategic leadership of the markets portfolio and acted as a decision maker in important merger cases. Andrea is the CMA’s Principal Accounting Officer.

Andrea Gomes da Silva (Executive Director, Markets and Mergers)

Andrea Gomes da Silva was appointed as the CMA’s Executive Director, Markets and Mergers in March 2018, a role in which she ensures strategic leadership of the markets portfolio and acts as a decision maker in certain Phase 1 merger cases. Andrea was previously Senior Legal Director for Mergers, Markets and Regulatory Appeals at the CMA.

Dr Michael Grenfell (Executive Director, Enforcement)

Michael Grenfell is Executive Director, Enforcement, a role in which he leads the CMA’s activities enforcing competition law and consumer protection law. Michael joined the CMA in 2014 as the Senior Director of Sector Regulation and Concurrency, a post he held until his appointment to lead the CMA’s enforcement work in 2015.

Erik Wilson CBE (Executive Director, Corporate Services)

Erik Wilson was appointed as Executive Director, Corporate Services in September 2013. Erik ensures the CMA has first-class support functions, including governance and performance, people, capability and culture, organisational development, finance, internal communications and information technology. Erik is the CMA’s Additional Accounting Officer.

Kirstin Baker CBE (Panel Inquiry Chair, Non-Executive Director)

Kirstin Baker was appointed a Panel Inquiry Chair and Non-Executive Director of the Board in September 2018. She is a member of the CMA Audit and Risk Assurance Committee. Kirstin has had a long career in the civil service and was most recently HM Treasury’s Group Finance and Commercial Director. She was part of the senior team leading the Treasury’s response to the banking crisis and was awarded a CBE for this work in 2011. Earlier in her career she worked as a competition official in the European Commission and on public spending policy in the Treasury and the Scottish Government.

Martin Coleman (Panel Chair, Non-Executive Director)

Martin Coleman was appointed in October 2017, and appointed Panel Chair and Inquiry Chair in September 2018. He is a member of the CMA Remuneration Committee. He is currently Deputy Chair of the Office for Students, a trustee of Police Now and a fellow of Hughes Hall, University of Cambridge. He was the Global Head of Antitrust and Competition at Norton Rose Fulbright.

Cynthia Dubin (Non-Executive Director)

Cynthia Dubin was appointed in January 2019. She is a member of the CMA Audit and Risk Assurance Committee. She is currently on the Board of Directors of Babcock & Wilcox Enterprises, Inc. and the Chair of its Audit and Finance Committee and a member of its Governance Committee. She is on the Board of Hurco Companies, Inc. and a member of its Audit Committee. Cynthia was Chief Financial Officer for Pivot Power LLP in the UK, Finance Director and Board member for JKX Oli & Gas plc and Canamens Ltd, and was Vice President and Finance Director, Europe, the Middle East and Africa, for Edison Mission Energy. Earlier in her career she worked in banking with Irving Trust Company, advising on and lending to energy projects.

Professor Amelia Fletcher OBE (Non-Executive Director)

Amelia Fletcher was appointed in October 2016. She is a member of the CMA Remuneration Committee and became Chair from April 2019. Amelia is also the Chair of the Wellbeing, Inclusion, Diversity and Equality (WIDE) Steering Group. She is Professor of Competition Policy at the Centre for Competition Policy and Norwich Business School at the University of East Anglia, a member of the Enforcement Decision Panels at Ofgem, and a member of the Royal Economic Society Council and the expert advisory board to the National Infrastructure Commission.

Professor William Kovacic (Non-Executive Director)

William (Bill) Kovacic was appointed in July 2013. He is also a member of the CMA Remuneration Committee. Bill has been an adviser on antitrust and consumer protection issues to governments around the world since 1992. His previous roles include being Chair of the US Federal Trade Commission (FTC), Vice Chair for Outreach of the International Competition Network and General Counsel at the FTC. He is a Professor of Law and Policy and Director of the Competition Law Centre at the George Washington University Law School and is a visiting Professor at the Dickson Poon School of Law at King’s College London. Bill is co-editor of the Journal of Antitrust Enforcement.

Jonathan Scott (Non-Executive Director)

Jonathan Scott was appointed in October 2016. He chairs the CMA Audit and Risk Assurance Committee and is the CMA’s Senior Independent Director. He is a Non-Executive Member of the Press and Assessment Board of the University of Cambridge and chairs its Audit Committee.

Jonathan’s term as a Gambling Commissioner ended on 30 April 2020.

The Board is advised by the CMA’s General Counsel and Chief Economic Adviser who attend Board meetings in an advisory capacity. The Director of Finance and Security, the Senior Director Strategy, Communications, Nations and Regions, the Senior Director Policy, Advocacy and International and the Director of Executive Office and Performance also attend Board meetings.

Sarah Cardell (General Counsel)

Sarah Cardell was appointed as General Counsel in September 2013. Sarah ensures consistently high-quality legal work at the CMA, leading the CMA’s Legal Service as well as the Policy and International Directorate.

Dr Mike Walker (Chief Economic Adviser)

Mike Walker was appointed in September 2013. Mike advises on complex cases and ensures consistently high-quality advice from the CMA’s economists and CMA’s Data, Technology and Analytics Unit.

Board member attendance at Board and Committee meetings 2019/20

| Board member | Board meetings | Audit and Risk Assurance Committee (ARAC) | Remuneration Committee (RemCo) |

|---|---|---|---|

| Kirstin Baker | 12/13 | 4/4 | |

| Martin Coleman | 12/13 | 0/3 [footnote 8] | |

| Andrea Coscelli | 12/13 | 4[footnote 9]/4 | 3/3 |

| Cynthia Dubin | 12/13 | 4/4 | |

| Amelia Fletcher | 12/13 | 3/3 | |

| Andrea Gomes da Silva | 11/13 | ||

| Michael Grenfell | 12/13 | ||

| Bill Kovacic | 12/13 | 2/3 | |

| Jonathan Scott | 11/13 | 4/4 | |

| Andrew Tyrie | 13/13 | 4[footnote 10]/4 | 3/3 |

| Erik Wilson | 13/13 | 4/4 | 3/3 |

CMA Board and Executive Committees[footnote 11]

CMA Board

The CMA’s main decision-making body. It provides strategic direction and ensures that statutory duties and functions are fulfilled

The Board decides whether to launch market studies and initiate market investigations

Non-Executive committees

Audit and Risk Assurance Committee (ARAC)

Advises the Board and Chief Executive on internal control, audit, and risk assurance processes

Remuneration Committee (RemCo) Reviews SCS performance and awards pay and bonuses. Also advises the Board on non-SCS staff remuneration issues

Executive committees

Executive Committee (XCo)

Focuses on strategic issues, performance and delivery

Case and Policy Committee (CPC)

Oversees cases and projects, ensuring consistency of approach

XCo sub committees

Operations Committee (OpCo)

Oversees Corporate Services issues, including IT and information security, business support services, risk and business continuity

EU Exit Committee (EUEC)

Considers the potential outcomes and impacts of EU Exit on the CMA, and the CMA’s preparation for Exit

Pipeline Steering Group (PSG)

Considers proposals for initiating investigations under the CMA’s antitrust, cartel and consumer protection law enforcement powers

Steering and Advisory groups

Consider initial ideas and oversee project development

Independent decision-making forums

CMA Panel

Independent decision-makers who conduct phase two merger or market investigations and regulatory appeals

Panel members also serve on Case Decision Groups for CA98 cases and Case Management Panels for criminal cases

Board sub committees

The Board has two sub-committees: the Audit and Risk Assurance Committee and the Remuneration Committee. The Chairs of these sub-committees present updates on key issues at Board meetings, and the minutes of both committees are shared with the Board.

The Audit and Risk Assurance Committee

The Audit and Risk Assurance Committee (ARAC) is chaired by a Non-Executive Director, Jonathan Scott, and has two other non-executive members; Kirstin Baker, who is a qualified accountant, and Cynthia Dubin. ARAC’s remit covers all aspects of corporate governance, risk management and internal control within the CMA.

The Principal and/or Additional Accounting Officer (respectively the Chief Executive and/or the Executive Director for Corporate Services) attended all ARAC meetings. The CMA Chairman and Director of Finance and Security also attend ARAC. The National Audit Office (NAO) and Government Internal Audit Agency were also represented at each of these meetings.

ARAC advises the Principal Accounting Officer and the CMA Board on the appropriateness of the financial statements, whether they are fair, balanced and understandable, and the adequacy of audit arrangements (internal and external). It also has a key role on the implications of assurances provided in respect of risk and control, with a view to enabling the Board to assure itself of the effectiveness of our risk management system and procedures and our internal controls including business continuity and information technology.

ARAC, who held four meetings in 2019/20, focused on the CMA relocation project, improving the CMA’s risk management framework and continuous improvements in cyber security, conducting in depth reviews on cyber security and data assurance processes, and these areas will continue to be priorities for the committee, alongside the impact of EU Exit in the coming year. ARAC received regular updates on the CMA financial performance; reports of the Antifraud and Security Working Group; IT development and security; the CMA relocation project; and procurement and commercial improvements.

ARAC also worked closely with the CMA Head of Risk to ensure the appropriate assessment and treatment of risks as this continues to be an integral part of the governance of the CMA. This focused work on risk during the year resulted in improved risk reporting to ARAC, and the discussion of corporate and strategic risk is now also a standing item at Board meetings.

The Remuneration Committee

The Remuneration Committee (RemCo) is chaired by Non-Executive Director Amelia Fletcher. The purpose of RemCo is to review the performance and pay of all the Senior Civil Servant (SCS) staff members and to award pay and bonuses for that cadre in accordance with Cabinet Office and HM Treasury rules. RemCo also provides a strategic steer on pay and bonus issues relating to non-SCS staff.

RemCo met three times in 2019/20. As Principal Accounting Officer, the Chief Executive, Andrea Coscelli, attended all RemCo meetings along with the Additional Accounting Officer, Erik Wilson.

RemCo’s focus during 2019/20 was overseeing the SCS performance management process including objective setting and appeals, approving the 2019/20 SCS pay settlement and ensuring ongoing compliance with our SCS pay policy. During the year, RemCo received a performance rating appeal from one SCS member of staff. The appeal was considered in August by an independent committee formed of CMA panel members. The appeal was not upheld.

As the CMA continued to grow to take on more EU Exit-related work, RemCo considered the current SCS pay ranges, how these compared across similar organisations and the impact of Cabinet Office pay constraints on recruitment and retention.

Executive committees

Through the Statutory Authorisations, the CMA Chairman, acting on behalf of the Board, authorises staff to exercise our functions. The Board and two executive committees: the Executive Committee (as well as its sub-committees, the Operations Committee, the Pipeline Steering Group and the European Union Exit Committee), and the Case and Policy Committee have oversight of these functions.[footnote 12]

The Executive Committee

Under delegated authorities from the Board, the Executive Committee (XCo) is the overall decision-making body for performance and delivery. As set out in its terms of reference, XCo oversees and makes decisions relating to strategy, delivery and performance, portfolio and pipeline, finance and risk, staffing, organisational transformation, regime issues and reputation. It also makes decisions on matters relating to the Board, including preparing for and reviewing Board meetings. XCo is chaired by the Chief Executive, Andrea Coscelli. During the year, the terms of reference for XCo were updated to include the newly created role of Senior Director of Strategy, Communications, Nations and Regions as a member.

XCo also considers and approves recommendations from its sub-committees:

-

The Operations Committee (OpCo) ensures we have in place, and operate effectively, appropriate and robust procedures and business processes including in relation to business continuity, information security, finance and staff issues. During the year, the terms of reference for OpCo were revised to reflect a more focused role in providing oversight and assurance of CMA’s risk management framework to ARAC. OpCo is chaired by the Executive Director of Corporate Services, Erik Wilson.

-

The Pipeline Steering Group (PSG) considers proposals for initiating investigations or for preliminary work to such investigations under the Competition Act 1998, in connection with the cartel offence in the Enterprise Act 2002, under the CMA’s consumer protection law enforcement powers, recommending to the Board the initiation of market studies and for initiating projects under the CMA’s advocacy powers. During the year, the terms of reference for PSG were revised to update its status to a decision-making committee of XCo. PSG is led jointly by the Executive Director of Enforcement, Michael Grenfell, and the Executive Director of Markets and Mergers, Andrea Gomes da Silva.

-

The European Union Exit Committee (EUEC) considers the CMA’s policy objectives and the potential outcomes and impacts of EU Exit and oversees preparation for the CMA’s expanded role post-EU Exit. EUEC is led jointly by the Executive Director of Corporate Services, Erik Wilson, and General Counsel, Sarah Cardell. During the year, the terms of reference for EUEC were updated to include the newly created role of Senior Director of Strategy, Communications, Nations and Regions as a member.

The Case and Policy Committee

The Case and Policy Committee (CPC) guides the development of CMA policy across all delivery tools, and provides oversight of cases and projects, ensuring consistency of approach and offers advice on high level legal, economic or policy issues as they arise.

CPC is authorised to make decisions in relation to ongoing policies, cases and projects as appropriate under delegated authority from the Board. CPC is chaired by the Chief Executive, Andrea Coscelli, and its membership includes two Inquiry Chairs. During the year, the terms of reference for CPC were updated to include the newly created roles of Senior Director of Strategy, Communications, Nations and Regions and Senior Director of Policy, Advocacy and International as members.

CMA Panel

As set out in the Enterprise and Regulatory Reform Act 2013,[footnote 13] decisions on phase 2 merger inquiries, market investigations and regulatory appeals are made by independent groups drawn from the CMA Panel. Each group has at least three members and is led by an Inquiry Chair. Panel members may also be appointed to antitrust (Competition Act 1998) case decision groups.

The groups make their decisions independently of the CMA Board. The Board is kept informed about resourcing, efficiency, the application of CMA policy and the staff processes that support the work of the Panel.

Legislation requires that at least one Panel member sits on the CMA Board. The Panel Chair[footnote 14] and one of the Inquiry Chairs are currently members of the Board. Panel members who are also Non-Executive Directors do not take part in decisions to make market investigation references for any investigation on which it is anticipated they might form part of a phase 2 group.

The Panel Chair, Inquiry Chairs and Panel members are appointed through open competition for their experience, ability and diversity of skills in competition economics, law, finance and business, and public policy. As required by law, appointments to the CMA Panel are made by the Secretary of State for Business, Energy and Industrial Strategy for up to eight years.

More information about each of the Panel members is available on our website. Panel members’ interests are disclosed as part of the appointment process. A conflicts check is conducted, on a case-by-case basis, when Panel members are assigned to inquiries and, if necessary, a publication of the disclosure of interest would be made on the relevant case page.

CMA Panel members

Inquiry Chairs

Martin Coleman (Panel Chair, Inquiry Chair and Non-Executive Director)

See Martin’s biography in the board members section

Kirstin Baker CBE (Inquiry Chair and Non-Executive Director)

See Kirstin’s biography in the board members section

Stuart McIntosh (Inquiry Chair)

Stuart was appointed an Inquiry Chair in April 2018 having been a Panel member since October 2017. He is a member of the CMA’s specialist utility panel. Until June 2019, he was a member of the Financial Conduct Authority’s Regulatory and Competition Decisions Committees and the Payment Systems Regulator’s Enforcement and Competition Decisions Committee. He was also previously a member of Man Sat’s Board of Advisers, an executive Board Member and Group Director at Ofcom, and a senior adviser at KPMG.

Kip Meek (Inquiry Chair)

Kip was appointed an Inquiry Chair in November 2018. He is Chairman of Ascension Ventures and of A Million Ads and is an adviser (previously a Non-Executive Director) of the Wireless Infrastructure Group. He is a founder and director of the Communications Chambers and was a Senior Adviser for EE and BT. He was the founder and Managing Director of Spectrum Strategy Consultants, has been the Chairman of the Radiocentre and South West Screen and was the first independent chairman of YouView. He was previously a Board member of Ofcom.

Two Inquiry Chairs completed their terms in 2018 but they remained on the CMA Panel to complete outstanding casework: Anne Lambert[footnote 15] and John Wotton.[footnote 16]

Panel members

At April 2019, Panel members were[footnote 17]:

- Humphrey Battcock

- Robin Cohen