CIL Appeal 1859480 – 10 Jul 25 (Accessible version)

Published 15 October 2025

Appeal Decision

By redacted BA Hons PG Dip Surv MRICS

an Appointed Person under the Community Infrastructure Levy Regulations 2010 (as Amended)

Valuation Office Agency

Wycliffe House

Green Lane

Durham

DH1 3UW

Email: redacted@voa.gov.uk

Appeal Ref: 1859480

Planning Permission Reference: redacted

Address: redacted

Development: “Change of use of the existing buildings to provide new homes (Use Class C3), together with internal and external works to the buildings, landscaping, car and cycle parking and other associated works.”

Decision

I determine that the Community Infrastructure Levy (CIL) in this case should be, £ redacted (redacted) and dismiss this appeal.

Background

1. I have considered all of the submissions made by redacted on behalf of redacted of redacted (the Appellant) and redacted the Collecting Authority (CA), in respect of this matter. In particular I have considered the information and opinions presented in the following documents:-

a. Planning permission reference redacted dated redacted.

b. CIL Liability Notice redacted issued by the CA on redacted with CIL liability calculated at £redacted.

c. The Appellant’s request to the CA dated redacted for a Regulation 113 review of the chargeable amount.

d. The CA’s Regulation 113 review decision dated redacted.

e. The CIL Appeal Form dated redacted submitted by the Appellant under Regulation 114, together with documents and correspondence attached thereto.

f. The CA’s representations to the Regulation 114 Appeal dated redacted and the Appellant’s response to them dated redacted.

g. The further information provided by the CA dated the redacted following a request for additional information by the Appointed Person (AP) issued to both parties on the redacted.

h. The further information provided by the Appellant dated redacted in response to the AP’s request.

i. The Appellant’s comments received on redacted in response to the further information provided by the CA.

2. This appeal arises following a consent order issued by redacted on redacted following the Judicial Review of the CIL appeal decision issued under reference 1853388 in respect of this matter. redacted ordered that; “the Claimant’s appeal to the Defendant’s Appointed Person, made under reg 114 of the Community Infrastructure Levy Regulations 2010 (“the CIL Regs”), is remitted to be heard by an Appointed Person other than redacted”.

3. Within the Schedule of Reasons that accompany the Consent Order, two material errors of law are highlighted that were made by the original AP. The first being that the AP was incorrect to consider that planning permission is always required for film/TV use and that without such permission, it is incapable of falling within Use Class E. It is pointed out that whether a use falls within Class E requires consideration of the nature of the activities and whether they accord with the categories of activities set out in Use Class E. Specific consideration is required in respect of Use Class E(g), and whether the activities are such that they “can be carried out in any residential area without detriment to the amenity of the area by reason of noise, vibration, smell, fumes, smoke, soot, ash, dust or grit.” It is stressed these are, “matters of fact and degree for the decision maker, the burden of proof is on the claimant.”

4. The second error was that the AP incorrectly stated that for filmmaking use to be lawful, the claimant would have needed to apply for temporary permission under the Town and Country Planning (General Permitted Development) (England) Order 2015 (S.I 2015/596- “GPDO”). However, a temporary permission was not open to the Claimant given the buildings in question were “listed buildings” (GDPO Schedule 2 – Part 3- Class E- E1(g).

5. It is understood that both the Claimant and the Defendant have agreed the claim must be allowed and that the Appellant and the CA both retain their respective positions as stated in the original appeal, 1853388.

6. In my capacity as AP, after consideration of the aforementioned Consent Order, I requested further information from both parties pertaining to the activities that were carried out within the buildings to assist with deciding whether the activities could be carried out in any residential area without detriment to the amenity of that area by reason of noise, vibration, smell, fumes, soot, ash dust or grit.

7. Both parties have submitted further information for my consideration and this along with the representations submitted as part of the original appeal have been examined.

Grounds of Appeal

8. The Appellant made their Regulation 114 chargeable amount appeal on the basis that they consider the chargeable amount should be nil. The Appellant’s reasoning for this is that the Grade II Listed Buildings that exist on the site would fall to be classed as “in-use buildings” and as such their gross internal area (GIA) should be offset from the GIA of the proposed chargeable development in accordance with Schedule 1, Part 1, paragraph1(6) of the Regulations. The Appellant provided various documents as part of the original appeal in support of their view that the buildings were “in-use” and consider these demonstrate that both the requirement of having been in a lawful use and a continuous use for period of at least six months during the three years leading up to the date on which planning permission was granted have been satisfied.

9. Conversely, the CA opined that the Appellant had not provided them with sufficient information nor information of sufficient quality for them to determine whether the buildings were in a lawful continuous use for a period of six months during the required period and as such, in accordance with paragraph (8) Schedule 1 Part 1 they deemed the buildings to have been not “in-use”.

10. As part of this reviewed appeal, the Appellant has provided a further sworn statutory declaration from redacted, Director of redacted (redacted) dated redacted. Within this declaration redacted advises that his company redacted, entered into two agreements with redacted in respect of the subject buildings redacted and redacted. The agreements were an underlease dated the redacted to use the Application Buildings and surrounding land as production offices and a filming location for redacted months and a profit share agreement relating to business or commercial activities carried out at the Application Buildings.

11. The deponent advises that they paid 12 months’ rent on the redacted and were responsible for the electricity bills throughout the rental period. They advise their intention was to use the property throughout the 18 month term of the lease.

12. In addition, the deponent states the property was used for a wide variety of film and TV shoots over the lease period and was used throughout this period for redacted office and administrative work in connection with both filming at the property and general administration of the locations they manage and it is confirmed both buildings were used for this purpose (“save for very brief periods”). The deponent has provided some examples of the productions filmed within the subject buildings. These include; redacted produced by the redacted which was filmed between redacted and redacted. The Netflix productions of The redacted and The redacted are said to have been filmed during the relevant period as well as “numerous other films and TV shows” and commercials, though specific dates have not been provided for these.

13. The deponent provides further details of the activities that took place on site advising that the buildings were used to film “interior” scenes, for example meetings and discussions. They advise loud sound effects were not used and no large trucks were needed to transport props as these easily fitted in vans given their nature. Furthermore, many of the cast and crew used public transport to reach the site as it is within walking distance of at least two bus stops. It is advised filming was restricted to weekdays and ordinary office hours. It is stated that throughout the lease period, rooms within both buildings were used for either filming or administrative purposes save for very brief periods.

14. The Appellant asserts there can be no dispute that the use of the site for general administrative work would fall within the property’s lawful use under Class E(g)(i). They note there is no suggestion that this use could impact nearby residential amenity and the appeal should be allowed on this basis alone.

15. In respect of film making, the Appellant also considers this use to be lawful. The Appellant addresses the requirement in Class E(g) that film-making would be permitted as an industrial process, “being a use, which can be carried out in any residential area without detriment to the amenity of that area by reason of noise vibration, smell, fumes, smoke, soot, ash, dust or grit.” The Appellant interprets this caveat to mean an existing residential area rather than hypothetically impacting any residential area even if there is no residential development nearby. In addition, they consider that the caveat means the amenity of the particular area in question. The Appellant elaborates upon this point, by explaining any residential area experiences an element of background noise from traffic, pedestrians etc. so any disturbance would need to be noticeable above these. The Appellant states in this case there are no nearby residential areas that could be impacted as the buildings are located within a private campus. In addition the Appellant highlights that they have previously submitted details of larger scale film studios that were granted permission under Class E.

16. The Appellant reiterates that the buildings were only used for interior scenes such as offices and gyms and the buildings themselves were double-glazed reducing any possible noise disturbance. The Appellant also highlights the need for film sets to be quiet in order not to disturb the process and as such private and quiet locations are selected to minimise internal noise escaping and external noise entering.

17. The Appellant advises that the buildings were previously used as large scale offices with large car parks. The Appellant advised many of the cast and crew used public transport and the number of journeys to and from the site would have been far less than when it was occupied for offices.

18. The Appellant contends that the information they have provided more than satisfies the balance of probabilities test and that the submitted evidence shows that the buildings were in a continuous lawful use for the required period.

19. The CA has responded to the Appellant’s new evidence and opines that the Appellant has still not established the specific 6 month (or longer) continuous period of lawful occupancy that they are seeking to demonstrate. The CA considers that much of the Appellant’s evidence including its new declaration does not overlap in terms of dates. They note the original Regulation 113 review request stated that “the buildings were lawfully occupied for the 6 months period starting on the redacted” and that evidence submitted as part of the request e.g. electricity statements were confined to periods of redacted. The CA point to discrepancies pertaining to the duration of the underlease, noting it was for an redacted month term and dated redacted allowing use until redacted. However, other information suggests a shorter period of occupation e.g. rent only being paid for a redacted month period, payments under the profit share agreement only evidenced up until redacted and missing electricity bills with only redacted to redacted (with redacted omitted) having been provided.

20. The CA contend that the Appellant has still not demonstrated continuous use of the buildings opining that the new Statutory Declaration only provides details of general periods of occupation not specific dates and times and that these general periods do not amount to a continuous 6 month period. The CA notes the Appellant’s claim that there were very brief periods of time when the buildings were unoccupied, but note they have not provided dates and times for the CA and AP to review.

21. The CA highlight the Regulations are clear, the burden of proof lies with the Appellant. The CA conclude from the submissions that the buildings were unoccupied at times and when viewed with the CA’s evidence, the withholding of these dates suggests periods of time when the buildings were not occupied thus suggesting there was not lawful continuous use.

Decision

22. In reaching my decision I have had regard to the submissions provided by the respective parties in respect of both this appeal and the original appeal 1853388. In addition, I have had regard to the Consent Order approved by redacted on the redacted and the approved Schedule of Reasons.

23. As I understand it, the parties are in agreement with the GIAs, charging rates and rates of indexation adopted, with none of these items being cited as a source of dispute.

24. The parties also agree that the chargeable amount is required to be calculated in accordance with the provisions of Schedule 1 Part 1 of the Community Infrastructure Levy Regulations 2010 (as amended), the subject being a standard case.

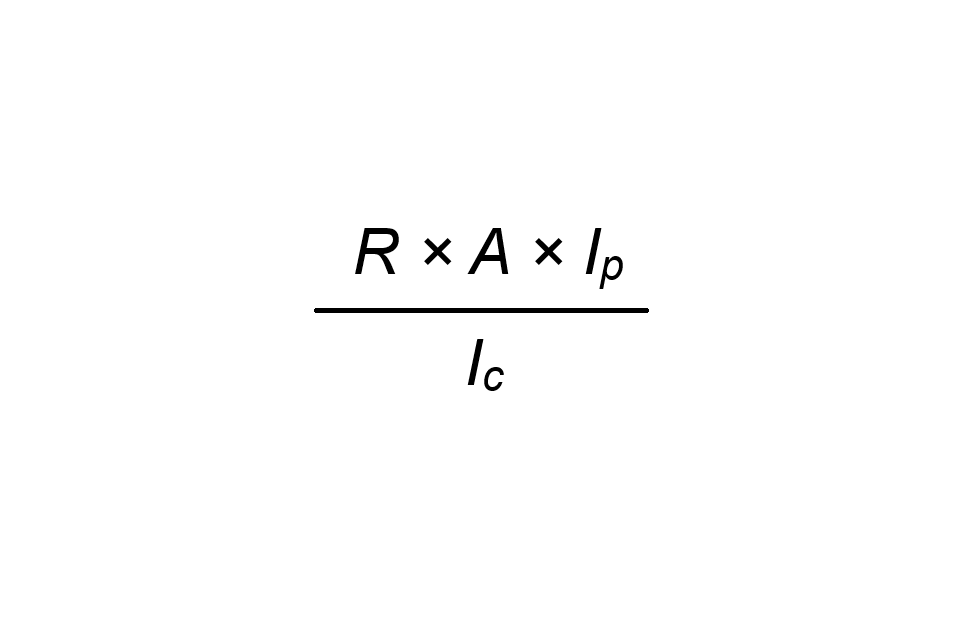

25. Paragraph (4), sets out the calculation of CIL for ‘standard cases’ where the amount of CIL chargeable at a given relevant rate (R) must be calculated by applying the following formula—

(R × A × IP) ÷ IC

where—

A = the deemed net area chargeable at rate R, calculated in accordance with subparagraph (6);

IP = the index figure for the calendar year in which planning permission was granted; and

IC = the index figure for the calendar year in which the charging schedule containing rate R took effect,

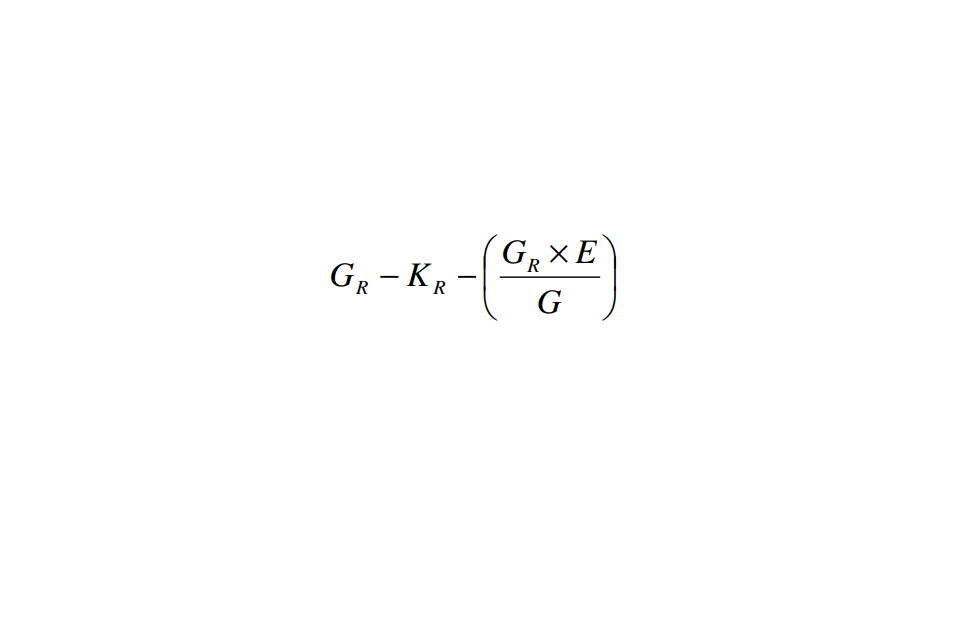

26. Paragraph (6) states that the value of A must be calculated by applying the following formula—

GR – KR – (GR × E ÷ G)

where—

G = the gross internal area of the chargeable development;

GR = the gross internal area of the part of the chargeable development chargeable at rate R;

KR = the aggregate of the gross internal areas of the following—

(i) retained parts of in-use buildings; and

(ii) for other relevant buildings, retained parts where the intended use following completion of the chargeable development is a use that is able to be carried on lawfully and permanently without further planning permission in that

part on the day before planning permission first permits the chargeable development;

E = the aggregate of the following—

(i) the gross internal areas of parts of in-use buildings that are to be demolished before completion of the chargeable development; and

(ii) for the second and subsequent phases of a phased planning permission, the value Ex (as determined under sub-paragraph (7)), unless Ex is negative, provided that no part of any building may be taken into account under both of paragraphs (i) and (ii) above.

27. In this case, I understand that the GIA of both the chargeable development and the existing buildings is redacted square metres (sq. m). If the existing buildings fulfil the criteria of “in-use” buildings as asserted by the Appellant the resultant CIL liability will be nil. However, if it is decided the buildings are not “in-use” as considered by the CA, the CIL Liability as stated in LN redacted at £redacted will stand.

28. Paragraph (10) of Schedule 1 Part 1 defines an “in use” building as a building which – “(i) is a relevant building, and (ii) contains a part that has been in lawful use for a continuous period of at least six months within the period of three years ending on the day planning permission first permits the chargeable development.”

29. Paragraph (8) of Schedule 1 Part 1 states that “Where the collecting authority does not have sufficient information, or information of sufficient quality, to enable it to establish that a relevant building is an in use building, it may deem it not to be an in-use building.”

30. As the subject buildings were situated on the relevant land on the day planning permission was granted, it is agreed they constitute relevant buildings. It is the lawful and continuous use of the subjects that requires consideration as outlined by (ii) of the “in-use” building definition.

31. Both parties agree that the lawful use of the buildings was Class E use- Commercial and Business Services. I understand that the buildings were used for the filming of TV shows, feature films and commercials as well as production offices and general administrative work.

32. In the original appeal, the CA highlighted that to fall within Class E (g) the use must be one that can be carried out in any residential area without detriment to its amenity. The CA considered that they did not have sufficient information to determine whether the activities related to commercial film making undertaken would not have been detrimental to a residential area especially with regards to noise. The CA acknowledge that some of the uses to which the buildings were put, e.g. general administrative work, would be considered lawful under Class E assuming it was not ancillary to a non-permitted use. The CA opine that if there were sustained periods when the buildings were used for commercial filmmaking and ancillary uses only, rather than for permissible uses, this would not constitute a lawful continuous use.

33. Within the submissions for this appeal, the Appellant provided a Statutory Declaration that provided more detail about the nature of the film making activities and the times of day they occurred. The CA acknowledge this further detail and consider it useful in determining the extent to which there were activities on site and how much noise they may have created. The CA offers no further opinion as to whether they now accept the use of film making to fall within Class E (g) and as such be considered lawful.

34. The Appellant maintains the view that the use of the buildings for film-making purposes falls within Class E(g) and as such was lawful without the need for any permitted development rights. In addition, they note that the statutory declarations provided evidence the properties were being used for general administrative purposes that they consider would indisputably fall within Class E.

35. As outlined above, the Appellants submissions as part of this appeal address the caveat within Class E of the Town and Country Planning (Use Classes) Order 1987 (as amended) that the use must be capable of being, “carried out in any residential area without causing detriment to the amenity of that area by reason of noise, vibration, smell, fumes, smoke, soot, ash, dust or grit.” They argue the use for film making was of a nature that would not harm the amenity of any residential area and are of the view there is no residential area in close proximity to disturb.

36. In terms of the lawful use of the buildings, there is no question that an office use of the building would be described as lawful. When considering whether the use of the buildings for film making was lawful, I have considered the caveat within Class E (g) and the definition of industrial process within the Use Classes Order. “Industrial Process” means a process for or incidental to any of the following purposes:- (a) the making of any article part of any articles (including a ship or vessel a film, video or sound recording);” Film making would be a lawful use of the subject buildings provided that it could be carried out in any residential area without detriment to its amenity. Both parties agree that noise appears to be the only amenity harm factor that would be a possible issue in this case.

37. The Appellant has advised that they consider there are no residential areas close to the property and as such, the use of the buildings would not cause a detriment to the amenity of any residential area. The CA considers the caveat to relate to “any” residential area rather than the subject and state they do not consider they have enough information to determine whether noise would have caused a detriment. Looking at the location of the buildings in question, I note there are a number of residential properties in a proximity that I consider could be impacted by the use of the subjects as filming locations and this point does need to be examined regardless of whether we are to consider the subject area only as argued by the Appellant or “any” residential area as opined by the CA.

38. For noise to cause amenity harm in planning terms, that noise has to be excessive or constant. From the Statutory Declaration provided I do not consider the activities described would have generated excessive or constant noise that would have impacted any residential area, with the deponent stating activities were limited to normal office hours on weekdays only. It is however noted that the electricity invoices provided throw doubt upon this claim as they show periods where large amounts of electricity were consumed at night and on weekends. There is no indication that any of the activities described would have caused any of the other eight amenity harm factors cited. I am however concerned that if the buildings were regularly used throughout the night and at weekends for filming there could have been some amenity harm from noise to the surrounding residents. There is not sufficient information about the type of activities and when they were carried out to allow me to make this judgement and the information that has been provided is contradictory. I, therefore, conclude that the Appellant has not fulfilled the burden of proof required to demonstrate the use as a filming location was lawful.

39. As part of the original appeal, the Appellant provided information (including an underlease, profit share agreement, electricity bills and statutory declarations) that they considered demonstrated the buildings were “in-use” for a continuous period of at least six months within the three years up to the date planning permission was granted. The CA made comment upon the various pieces of information and concluded that it did not have sufficient information or information of sufficient quality to enable it to establish that the relevant buildings were “in-use” for a continuous period as required within the CIL regulations.

40. Planning permission redacted was granted on redacted. We are therefore required to consider the period from the redacted until redacted. Both parties agree that CIL Form 1 that accompanied the planning application dated redacted stated that the buildings had not been occupied for their lawful use for six continuous months within the previous thirty six month period.

41. The Appellant addresses this point explaining that redacted took up occupation of the buildings with effect from redacted. The Appellant provided a copy of the underlease, a profit share agreement and electricity bills and accounts in support of their position. The CA considered these documents but maintained the liability stated in LN redacted was correct in their 113 review.

42. The CA opine the underlease only demonstrates a right to occupy not actual occupation and they note it also relates to the surrounding land meaning the subject buildings may not have been used. Furthermore, they state that the electricity bills provided also relate to the wider redacted site not just the offices in question and note invoices from redacted and redacted are missing. The CA also considered that for five of the nine months, the electricity usage was low for buildings of the size of the subjects and although there are months of larger consumption, this doesn’t support continuous use.

43. The CA also points to documents provided during the planning process and post the planning decision that stated the buildings were vacant, this included an economic case report dated redacted and Affordable Housing letters from redacted and redacted. Documents pertaining to the financial viability of the development are also raised by the CA and they argue these documents all make clear CIL is deemed chargeable on the development based upon the site’s long term vacancy. These documents include Viability Review prepared by redacted dated redacted , Viability Response prepared by redacted dating from redacted, Assessment of Financial Viability prepared by GLA Viability Team dated redacted, redacted Response dated redacted and the S106 agreement signed by all parties on redacted. In addition the CA highlights that their records show that no business rates were paid during the period under consideration and that the buildings were in receipt of vacant listed building exemption. The CA have provided notes from Council officers who visited the site four times during redacted and each time officers concluded that the site was vacant.

44. As part of the original 114 appeal, the Appellant provided signed statutory declarations made by redacted the director of redacted and redacted the director of redacted. Both declarations confirm there was use of part of the buildings and surrounding land during this period although no details have been provided of exactly when and for how long. redacted has stated, “Throughout the period at least one room within each building was occupied and used on the above basis, save for very brief periods. There were some months where the Properties were used more, which explains the variations in the amount of electricity used. However, I can confirm that the Properties were in use throughout the period and were not only used for a few days per month.”

45. As part of this current appeal, the Appellant has provided a further sworn Statutory Declaration by redacted. Within this he states; “The Property was used for a wide variety of film and TV shoots over the lease period. In addition, the property was used throughout the period for redacted office and administrative work.” redacted also states that; “I confirm that throughout the lease period, rooms, within both buildings were occupied and used, either for filming or administrative purposes, save for very brief periods.” I understand the lease period was for an redacted month term that commenced in redacted until redacted, thus covering the relevant period.

46. In addition, the Appellant highlights a profit share agreement was in place and electricity bills (spanning the period redacted to redacted, (with the omission of redacted) have been provided to support their position.

47. The CA’s stance is that the Appellant has not evidenced a continuous six month period of lawful use during the required period. They state the underlease only proves a right to occupy the building not that the right was exercised. In addition the CA has highlighted a suite of documents that were submitted during the planning application process to include; application form (redacted, cover letter (redacted) Planning Statement (redacted), Economic Case Report (redacted), Affordable Housing Offer Letter (redacted) and Affordable Housing Offer Letter (redacted) as well as financial viability documents dating from between redacted and redacted and also the S106 document signed by all parties on the redacted, all stating that the buildings had been vacant. The CA rejected the Appellant’s explanation that these documents were only a narrative to the planning application and should not be able to override sworn statutory declarations. The Appellant argued the documents refer to the cessation of the use as large office buildings and not smaller parts of the building being used at a later date. The CA also raised queries over the payments received under the profit share agreement in respect of the deviation in payment dates and wide variations in sums received which they suggest points to various levels of usage across the period.

48. The CA have also provided details from site visits undertaken by members of the Council all of which described the site as vacant. The Appellant rebuts these claims stating that the site and buildings were large and a cursory inspection would not have identified the use. The CA contend that the Appellant appears to be alleging only part of the buildings may have been occupied and have not provided further explanation as to which parts. The CA considers these details would be required within the context of Paragraph 1 (8) of the CIL Regulations.

49. In addition, the CA advise business rates have not been received in respect of either building during the relevant period, both having benefitted from vacant listed building exemption.

50. The CA notes the content of the new Statutory Declaration submitted as part of this appeal and comments it only provides details of general periods when activities were said to have occurred rather than specific dates e.g. January – February redacted rather than actual dates. The CA contend that even assuming shoots took place throughout the entire month, it does not amount to a continuous six month period. The CA points out that the other dated evidence centres on periods within redacted and does not span the entire period of the underlease as spoken to within the Statutory Declaration.

51. A vast amount of information has been provided by both parties in this case and neither party’s information is wholly compelling. The discrepancies within the planning documents versus the evidence submitted as part of the CIL appeal process submitted by the Appellant causes me some concern as does the reliance of the CA upon external inspections.

52. I was inclined to place significant weight upon the Statutory Declarations provided as part of the Appellant’s evidence. However, I have noted contradictions between the statements of redacted and redacted. redacted within his sworn declarations of both the redacted and redacted states “the Property was used for a wide variety of film and TV shoots over the lease period. In addition, the Property was used throughout the period for redacted offices and administration work.” The lease period referred to is redacted months as defined by the underlease which commenced on redacted until redacted. However, redacted Statutory Declaration dated redacted states, “when the Application was submitted the Site had not been occupied for 6 months.” Here, redacted is referring to the subject planning application which I understand from the decision notice was submitted on redacted.

53. The electricity statements provided by the Appellant span redacted to redacted (with the omission of redacted). This period is within the term of the underlease and also within the period when redacted states the buildings were vacant. As noted by the CA, these invoices relate to the wider redacted site not just redacted. The Appellant advises this is because there are two separate buildings but the electricity was supplied under one account and described as redacted for ease. They state redacted is the only other building on site and this is not included within the lease so the tenant would not pay for electricity consumed within this building. The invoices show wide variations in levels of consumption spanning from redacted kw to redacted kw. It is also noted that some of these invoices show significant consumption both during the night and on non-business days. This contradicts redacted declaration of the redacted where he states; “Filming took place only during ordinary office hours on weekdays.”

54. The contradictions between the declarations of redacted and redacted, especially when considered alongside the contradictions suggested by the electricity invoices and planning documents casts significant doubt upon the accuracy of redacted statement to the extent that I do not consider I have been provided with sufficient information or information of sufficient quality to enable me to establish the buildings were “in-use” during the period between redacted and redacted.

55. The legislation requires us to consider a continuous six month period between redacted and redacted. I recognise that the buildings could well have been occupied for the requisite six month period both pre and post the date of the planning application and have reviewed the evidence to seek proof of this.

56. I have also considered the Appellant’s contention that the underlease and profit share agreement demonstrate the buildings were in continuous use arguing that the commerciality of these arrangements is dependent upon the use of the buildings by the tenant. However, I agree with the CA here. The documents show a right to occupy the site and receive a share of profits generated from the use and I acknowledge them to be commercial arrangements. However, they do not document any actual use of the buildings and when and how often any use occurred.

57. redacted states these buildings were used thought the period between redacted and redacted yet aside from the electricity statements for only part of this period and photos of vacant rooms, nothing has been provided to support an active use of the building. These are sizeable office buildings and I am of the view that given their size and the nature of the activities claimed, it is not unreasonable to expect the Appellant to be able to readily supply proof of continuous occupation. The use as claimed by the Appellant would have generated other invoices. It would not be unreasonable to expect the Appellant to have been able to provide some of the following to support their case; water bills, telephone/internet bills, payment of business rates, invoices for refuse removal from the site. Furthermore, it would be reasonable to expect evidence of use of the address by the occupier i.e. business insignia/stationary, deliveries to the occupier at the site, testimonies of staff who worked on the site during the period in question and photographs of the site in active use, none of which has been provided.

58. The Appellant has cited the case of R (Hourhope) V Shropshire Council [2015] PTSR 933 in support of their position noting that this case allows for the interruption of use to a property and whether the property has ceased to be “in use” depends upon an assessment of the length and reasons for the interruption and the intentions of those who have previously and may in future use the building. In this case both parties acknowledge the evidence provided shows there have to have been interruptions within the use of the building during the relevant period. However, I have not been provided with details of the length nor the reasons for the interruptions to allow an assessment to be made regarding when or if there was in fact continuous use of the buildings during the relevant period.

59. Considering the evidence in its totality, I concur with the CA, the evidence provided is not sufficient nor of sufficient quality to prove continuous use and as such I deem the buildings not to have been in use. The amount of information provided is not enough to support the period of occupation claimed and does not contain sufficiently clear detail as to the periods of occupancy. The contradiction between the Statutory Declarations also creates confusion as does the contradiction between the Appellant’s case and the documents that supported the planning application and their Regulation 114 appeal. The utility bills provided relate in the main to the period when redacted and the planning statements state the properties to have been vacant. Despite the Appellant claiming use up until redacted, bills relating to this period have not been submitted.

60. Both parties have made a request for costs both claiming the other has acted unreasonably. Given the outcome of this appeal I do not consider the CA to have acted unreasonably and conclude they have sought only to seek further unambiguous evidence from the Appellant to assist them in reaching an informed decision.

61. Whilst I have not found in favour of the Appellant on this occasion, I have not found their actions unreasonable. They have exercised their right to the appeal process and have engaged with its process. I do not find it appropriate to award costs to either party in this case.

62. Based upon the totality of evidence available to me, I determine that on this occasion the Appellant has not provided “sufficient information, or information of sufficient quality” and I am unable to establish that the relevant buildings were “in-use.” Consequently, I deem the subject buildings not to have been in use and dismiss this appeal. The CIL charge is confirmed at £redacted (redacted).

redacted

redacted BA Hons, PG Dip Surv, MRICS

RICS Registered Valuer

Valuation Office Agency

10 July 2025