CIL Appeal 1848107 1848129 1848133 – 02 Oct 24 (accessible version)

Published 24 October 2025

Appeal Decision

By redacted BSc (Hons) MRICS

an Appointed Person under the Community Infrastructure Levy Regulations 2010 as Amended

Valuation Office Agency

Wycliffe House

Green Lane

Durham

DH1 3UW

e-mail: redacted@voa.gov.uk

Appeal Refs: 1848107, 1848129 and 1848133

Planning Permission Ref: redacted

Proposal: Demolition of the existing building and phased redevelopment to provide new buildings for office, culture & innovation hub, retail, food and beverage uses with cycle parking, hard and soft landscaping and associated works and plant, each phase being an independent act of development in accordance with application Ref redacted

Location: redacted

Decision

I determine that the Community Infrastructure Levy (CIL) payable in this case should be as follows:

| Phase | Mayoral CIL | Borough CIL |

|---|---|---|

| 1 | £0 | £0 |

| 2 | £0 | £0 |

| 3 | £redacted

|

£redacted

|

Reasons

1. The VOA received three CIL appeals in respect of this development, relating to Phase 1, Phase 2 and Phase 3. These appeals have been considered together and the outcome of all three appeals has been reported within this single decision.

2. I have considered all of the submissions made by redacted of redacted on behalf of redacted (the Appellant) and by the redacted, the Collecting Authority (CA) in respect of this matter. In particular I have considered the information and opinions presented in the following documents:

a) Planning decision ref redacted dated redacted ;

b) Approved planning consent drawings, as referenced in planning decision notice;

c) Four CIL Liability Notices dated redacted and redacted;

d) Three CIL Appeal forms dated redacted, including appendices;

e) Representations from CA dated redacted; and

f) Appellant comments on CA representations, dated redacted.

3. Planning permission was granted by the Secretary of State under application no. redacted on redacted, following his decision to call in the planning application made to the council under reference redacted. The decision grants full planning permission for ‘Demolition of the existing building and phased redevelopment to provide new buildings for office, culture & innovation hub, retail, food and beverage uses with cycle parking, hard and soft landscaping and associated works and plant, each phase being an independent act of development in accordance with application Ref redacted.’

4. The planning permission granted work to be carried out in phases. Phase 1 comprised only demolition with no new build. Phase 2 comprised the construction of the basement and ground floor, totalling redacted m² of gross internal floorspace. Phase 3 comprised the construction of the remaining floors, totalling redacted m² of gross internal floorspace.

5. The CA issued a CIL liability notice for Phase 2 and 3 on redacted. Following a query into the areas adopted, they subsequently issued revised liability notices for Phase 2 and 3 on redacted. No liability notices were issued in respect of Phase 1.

6. The liability notices are summarised below. The charges shown are subject to indexation at a rate of redacted for Mayoral CIL and redacted for Borough CIL.

| Phase | Date | Reference | Chargeable Area | Mayoral Rate | Borough Rate | Total |

|---|---|---|---|---|---|---|

| 2 | redacted |

LN redacted

|

Office: redactedRetail: redactedOther: redacted

|

£redacted£ redacted£ redacted

|

£redacted£ redacted£0 |

£redacted

|

| 2 | redacted |

LN redacted

|

Office: redactedRetail: redactedOther: redacted

|

£redacted£ redacted£ redacted

|

£redacted£ redacted£ redacted

|

£redacted

|

| 3 | redacted |

LN redacted

|

Office: redactedRetail: redactedOther: redacted

|

£redacted£ redacted£ redacted

|

£redacted£ redacted£0 |

£redacted

|

| 3 | redacted |

LN redacted

|

Office: redactedRetail: redactedOther: redacted

|

£redacted£ redacted£ redacted

|

£redacted£ redacted£0 |

£redacted

|

7. The Appellant requested a review under Regulation 113 on redacted. The CA responded on redacted, confirming their view that the CIL Liability notices were correct. They also confirmed their view that they did not consider a Liability Notice necessary for Phase 1.

8. On redacted, the Valuation Office Agency received three CIL appeals made under Regulation 114 (chargeable amount), one for each phase of the development. The appeal form for Phase 1 and 2 proposed a CIL charge of Nil. The appeal form for Phase 3 proposed that the CIL liability should be £redacted. This was calculated by deducting the GIA of the existing building and adopting a nil rate for the flexible retail under the redacted CIL charge.

9. The Appellant’s grounds of appeal can be summarised as follows:

a) The CA should have issued a Liability Notice in respect of Phase 1;

b) The existing building was in lawful use and therefore the GIA of this building should be deducted from the chargeable area;

c) The area shown as “retail” on the liability notices is flexible commercial space and should be charged at Nil rate for Borough CIL; and

d) The appellant should be awarded the costs of making the appeals.

10. The CA has submitted representations that can be summarised as follows:

a) There is no requirement to issue a liability notice in respect of a development which is not liable to CIL;

b) A temporary planning permission is not sufficient to satisfy the in-use building test. The building GIA could only be deducted if it were in use as a redacted during the relevant period;

c) The area shown as retail does fall under the definition of “large retail development” and is therefore chargeable; and

d) The application for costs should be refused.

Liability Notice for Phase 1

11. The appellants argue that the CA should have issued a liability notice for phase 1, which would record the GIA of the existing building for the purposes of being used as “demolition credit” in phase 2 and 3. They state that a liability notice is required under Regulation 65 (1) which states “The collecting authority must issue a liability notice as soon as practicable after the day on which a planning permission first permits development.”

12. The CA argue that no liability notice is required for a development that is not liable to CIL. They point out that Regulation 65(9) states “A liability notice issued in respect of a chargeable development ceases to have effect if liability to CIL would no longer arise in respect of that chargeable development.” Therefore, it would be illogical to require the issue of a Liability Notice that would have no effect.

13. Both the CA and the appellant agree that if a Liability Notice were issued in respect of Phase 1, it would be for £0 (nil).

14. The appeal for Phase 1 was made against Regulation 114. Regulation 114 states:

“(1) A person who has requested a review under regulation 113 and—

a) is aggrieved at the decision on the review; or

b) is not notified of the decision on the review within 14 days of the review start date, may appeal to the appointed person on the ground that the revised chargeable amount or the original chargeable amount (as the case may be) has been calculated incorrectly.”

15. In this case, both parties agree that the chargeable amount should be £0 (nil). The calculation of the in-use building credit would have no impact on the charge at Phase 1 and therefore this aspect is addressed only on the Phase 2 and Phase 3 appeals.

16. As there is no disagreement on the chargeable amount, I dismiss the appeal in respect of Phase 1.

In-use buildings

17. The CIL Regulations Part 5 Chargeable Amount, Schedule 1 defines how to calculate the net chargeable area. This allows “the gross internal areas of parts of in-use buildings that are to be demolished before completion of the chargeable development” to be deducted from “the gross internal area of the chargeable development”.

18. In this definition, “Building” does not include

(i) A building into which people do not normally go;

(ii) A building into which people go only intermittently for the purpose of maintaining or inspecting machinery; or

(iii) A building for which planning permission was granted for a limited period;”

19. “In-use building” is defined in the Regulations as a relevant building that contains a part that has been in lawful use for a continuous period of at least six months within the period of three years ending on the day planning permission first permits the chargeable development.

20. “Relevant building” means a building which is situated on the “relevant land” on the day planning permission first permits the chargeable development. “Relevant land” is “the land to which the planning permission relates” or where planning permission is granted which expressly permits development to be implemented in phases, the land to which the phase relates.

21. Schedule 1 (9) states that where the collecting authority does not have sufficient information, or information of sufficient quality, to enable it to establish whether any area of a building falls within the definition of “in-use building” then it can deem the GIA of this part to be zero.

22. On the date that planning permission was granted, the former redacted building existed on the relevant land. The appellants and CA agree that the GIA of this building is redactedm².

23. The building had a temporary planning permission under reference redacted, granted on redacted for ‘Temporary change of use of part of the existing ground floor redacted (Sui Generis) to storage (Use Class B8) for a period of 1 year.’

24. The CA consider that as the definition of building excludes ‘a building for which planning permission was granted for a limited period’ it should exclude the subject property as planning permission for storage use was only granted for a temporary period. Therefore, the demolition offset would not be available unless lawful use as a redacted could be demonstrated.

25. The appellants dispute this interpretation and state that the definition refers to buildings that were granted temporary permission, rather than temporary uses of permanent buildings. They argue that the building meets the definition of “in-use building,” being a building that had been in lawful use for the relevant period and should therefore be deducted.

26. The appellants have provided the legal opinion of redacted and redacted dated redacted, updated redacted, to support their view. The CA support their view with legal advice from redacted dated redacted.

27. The legal advice from both parties refers to Regulation 2(1) which states that ‘“planning permission granted for a limited period” has the same meaning as in TCPA 1990’. S.72 of the Town and Country Planning Act (TCPA) 1990 states:

“1) Without prejudice to the generality of section 70(1), conditions may be imposed on the grant of planning permission under that section—

(a) for regulating the development or use of any land under the control of the applicant (whether or not it is land in respect of which the application was made) or requiring the carrying out of works on any such land, so far as appears to the local planning authority to be expedient for the purposes of or in connection with the development authorised by the permission;

(b) for requiring the removal of any buildings or works authorised by the permission, or the discontinuance of any use of land so authorised, at the end of a specified period, and the carrying out of any works required for the reinstatement of land at the end of that period.

(2) A planning permission granted subject to such a condition as is mentioned in subsection (1)(b) is in this Act referred to as “planning permission granted for a limited period.”

28. The legal advice from both parties also refers to the definition of building, which is defined under the Planning Act 2008 act as having the same meaning as under TCPA 1990. TCPA 1990 defines building as “building” includes any structure of erection, and any part of a building, as so defined, but does not include plant or machinery comprised in a building.’

29. The CIL regulations themselves do not give a definition of the word “building” aside from that shown at paragraph 18. It has therefore been established when considering CIL appeals to consider the dictionary definition.

30. The Shorter Oxford English Dictionary, 6th Edition provides the definition of “building” as “A thing which is built; a structure; an edifice; a permanent fixed thing built for occupation, as a house, school, factory, stable, church, etc.” An alternative dictionary definition is “a structure with a roof and walls, such as a house or factory.”

31. The appellants counsel argue that words used in CIL regulations should be given their natural and ordinary meaning, having regard to their particular context, and bearing in mind that statutory provisions for taxation ought, in general, to be strictly construed. They state that this view is supported by the case of Gardiner v Hertsmere BC 2022.

32. Adopting this approach, the appellants consider that the words “a building for which planning permission was granted for a limited period;” includes only buildings that were granted permission for a temporary building, and not temporary uses of existing buildings. They opine that any other interpretation would be importing additional words into the definition and that if the regulations meant “buildings or uses for which planning permission was granted,” it could have said this.

33. The CA’s counsel comment that the cases of R(oao Heronslea (Bushey 4) Limited v SOS HCLG 2022 and R(Gardiner) v Hertsmere BC 2022 sets out that a purposive approach should be taken to construing the meaning of the CIL Regulations. As such, they have considered the purpose of the CIL Regulations, which was set out in the Planning Act 2008 as ensuring that the costs incurred in supporting the development of an area can be funded by owners/developers without making development economically unviable. They further refer to the case of R (Giordano Ltd) v Camden Borough Council 2020 which states the purpose of the CIL Regulations is to ensure that funding for necessary infrastructure is fairly borne.

34. Adopting this approach, the CA argue that the purpose of the exclusions (i) and (ii) to the definition of building are to exclude buildings which have no existing and ongoing infrastructure requirements. Therefore, exclusion (iii) ““a building for which planning permission was granted for a limited period;” should also be considered as a building with no continuing burden on infrastructure.

35. In my opinion, the phrase “a building for which planning permission was granted for a limited period” is unambiguous. I consider that it should be taken in its literal meaning and applied to buildings where the planning permission for that building was granted for a limited period. I do not accept that this should also apply to permanent buildings for which a temporary use has been granted.

36. The CA argue that a purposive interpretation should be adopted. I do not accept that this is necessary in this case and I consider it reasonable to adopt a strict reading of the words.

37. I have accepted that the building with a temporary permission for a particular use can be construed as a building within the CIL Regulations. I therefore turn to the consideration of lawful use.

38. The appellants state that the temporary permission was implemented and the storage use commenced redacted until redacted – a period of redacted months and redacted days, which fell within the relevant three year period before planning permission was granted on redacted. Evidence has been supplied in the form of a statutory declaration by redacted of redacted, alongside a plan and photographs of the area in use.

39. The CA have not argued that that the building was not in lawful use and in light of the evidence before me, I consider that part of the ground floor of the existing building was in lawful use during the relevant period. The Regulations state that an in-use building is a relevant building that contains a part that has been in lawful use for a continuous period of at least six months within the period of three years ending on the day planning permission first permits the chargeable development. I am therefore satisfied that this condition has been met and the entirety of the existing building can be accepted as an “in-use building.”

Retail Space

40. The chargeable development includes redactedm² of flexible commercial space, of which, redactedm² falls within Phase 2 and redactedm² falls within Phase 3. The CA have charged this space under the Borough CIL charge at the “2022 Zone A Large Retail” rate of £redacted plus indexation.

41. The Borough CIL charging schedule 2022 includes two retail categories. ‘Large retail development’ is chargeable at £redacted and ‘Other retail’ is chargeable at nil. The charging schedule includes an asterisk following ‘Large retail development’ that leads to the following footnote:

‘*Retail includes such uses as shops selling consumer goods, including food and essential items, to visiting members of the public, premises for the provision of financial and professional services, a café or restaurant, and gymnasium. It will also include related sui generis commercial uses such as pubs or drinking establishments, takeaways, cinemas, betting shops, launderette, and car showrooms. Large retail development includes:

- Superstores/supermarkets/shopping mall/shopping centre/shopping arcade which are shopping destinations in their own right, with over 280m2 of retail space, with or without a dedicated car park; or

- Retail warehouses which are large stores specialising in the sale of household goods (such as carpets, furniture, and electrical goods), DIY items and other ranges of goods catering for mainly car-borne customers.’

42. The flexible commercial space provides retail/restaurant/café/drinking use. The appellants argue that this does not comprise a superstore, supermarket, shopping mall, shopping centre, arcade or retail warehouse and therefore does not meet the definition of ‘large retail.’

43. The CA argue that the charging schedule includes broad development types and that the footnote indicates what retail and large retail development includes, rather than a comprehensive definition. They point out that the footnote in the 2021 charging schedule was amended from the 2014 version so that “is defined as one of the following” was amended to “includes.” They suggest that this amendment was with the intention of broadening the definition. They also refer to the Examiners report in 2014 which emphasises the importance of the 280m² threshold.

44. The CA state the size of retail being above 280m² is sufficient for it to qualify as large retail. In the event that this argument is rejected, they suggest that the area could be considered a shopping centre, defined as a “shopping destination in their own right.”

45. In my opinion, the phrasing of the footnote does not suggest that any retail with a floor area of over 280m² should automatically be construed as “large retail development.” The word “or” after the first bullet point leads me to believe that the retail use must fall under the categories in either the first bullet point, or the second one.

46. Neither party appear to argue that the property comprises a retail warehouse, therefore it must be considered whether the flexible commercial space falls within the definition of “superstores/ supermarkets/ shopping mall/ shopping centre/ shopping arcade which are shopping destination in their own right, with over 280m² of retail space.” The CA suggest that of these categories, the retail area would most likely fall under the definition of shopping centre.

47. Shopping centre is defined in the Cambridge dictionary as “a group of shops with a common area for cars to park” or “a large building or group of buildings containing a lot of different stores.” The Collins dictionary defines it as “a purpose-built complex of shops, restaurants, etc, for the use of pedestrians” or “the area of a town where most of the shops are situated.”

48. The plans for the subject property show that the redacted have space on the basement, ground and first floor. The remainder of the basement is ancillary space. The remainder of the ground floor is classed as flexible use, split into a potential five units, plus the office lobbies and a service bay. The remainder of the first floor comprises one flexible use unit (possibly a first floor of one of the ground floor units) and a facilities management room. Floors redacted to redacted comprise almost exclusively office use. Floor redacted and redacted has both office use and a flexible use unit with a terrace, believed to be intended as a restaurant.

49. The appellants describe the redacted as “a redacted sqm GIA cultural and innovation hub,” which is not classified as retail space. Therefore, the retail space comprises a total of redactedm² of retail/ restaurant/ café/ drinking use, across potentially five units on the ground floor and one on the redacted.

50. The appellants further argue that condition 60 of the planning permission restricts the total retail use to redactedm² and therefore even if the space is accepted as large retail, the GIA should be capped at redactedm², rather than the full redacted m².

51. The CA reject the appellants argument regarding condition 60. The condition relates to retail premises under Use Class E(a) which is limited to display or retail sale of goods, whereas the definition of large retail includes “such uses as shops selling consumer goods, including food and essential items, to visiting members of the public, premises for the provision of financial and professional services, a café or restaurant, and gymnasium. It will also include related sui generis commercial uses such as pubs or drinking establishments, takeaways, cinemas, betting shops, launderette, and car showrooms.” They therefore consider that the full redactedm² should be treated as large retail.

52. In my opinion, 20 floors of offices with around five retail units on the ground floor and one upper floor restaurant does not comprise a shopping centre under any normal definition of the word and would not constitute a shopping destination in its own right. I therefore conclude that the flexible space should be classed as “other retail” and charged at Nil, as per the Borough charging schedule.

Calculation of Chargeable Amount

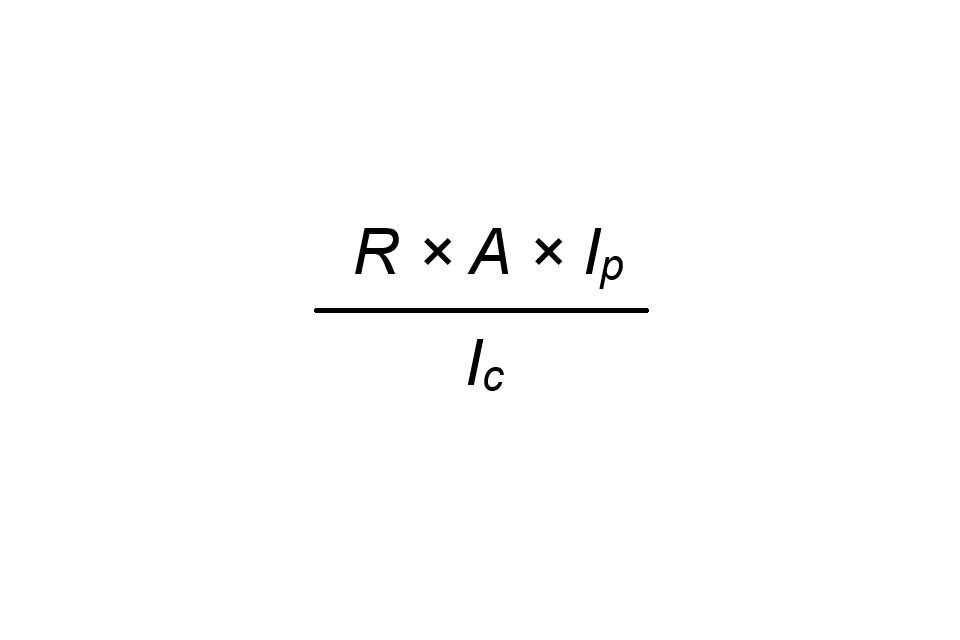

53. The CIL Regulations Part 5 Chargeable Amount, Schedule 1 provides guidance on the calculation of the chargeable amount. This states:

“(4) The amount of CIL chargeable at a given relevant rate (R) must be calculated by applying the following formula—

(R × A × IP) ÷ IC

where—

A = the deemed net area chargeable at rate R, calculated in accordance with subparagraph (6);

IP = the index figure for the calendar year in which planning permission was granted; and

IC = the index figure for the calendar year in which the charging schedule containing rate R took effect.”

Phase 1

54. I have dismissed the appeal in respect of Phase 1 on the grounds that both parties agree that the Community Infrastructure Levy (CIL) payable should be NIL.

Phase 2

55. The deemed net chargeable area must be calculated in accordance with paragraph (6) which states:

“(6) The value of A must be calculated by applying the following formula—

GR – KR – (GR × E ÷ G)

where—

G = the gross internal area of the chargeable development;

GR = the gross internal area of the part of the chargeable development chargeable at rate R;

KR = the aggregate of the gross internal areas of the following—

(i) retained parts of in-use buildings; and

(ii) for other relevant buildings, retained parts where the intended use following completion of the chargeable development is a use that is able to be carried on lawfully and permanently without further planning permission in that part on the day before planning permission first permits the chargeable development;

E = the aggregate of the following—

(i) the gross internal areas of parts of in-use buildings that are to be demolished before completion of the chargeable development; and

(ii) for the second and subsequent phases of a phased planning permission, the value Ex (as determined under sub-paragraph (7)), unless Ex is negative, provided that no part of any building may be taken into account under both of paragraphs (i) and (ii) above.

(7) The value Ex must be calculated by applying the following formula—

EP − (GP − KPR)

where—

EP = the value of E for the previously commenced phase of the planning permission;

GP = the value of G for the previously commenced phase of the planning permission; and

KPR = the total of the values of KR for the previously commenced phase of the planning permission.”

56. The following table shows the relevant G and GR figures for Phase 2.

| CIL | Description | GIA m² |

|---|---|---|

| Mayoral | Office (GR) | redacted |

| Mayoral | Retail (GR) | redacted |

| Mayoral | Other (GR) | redacted |

| Borough | Office (GR) | redacted |

| Borough | Retail and other (GR) | redacted |

| Both | Total (G) | redacted |

57. The value of KR is nil in all instances as no part of the original building is to be retained.

58. The following table shows the relevant E figures for Phase 2.

| CIL | Description | GIA m² |

|---|---|---|

| Both | Value of E in phase 1 (EP) | redacted |

| Both | Value of G in phase 1 (GP) | 0 |

| Both | Value of KR in phase 1 (KPR) | 0 |

59. I have used the above figures to calculate that the Community Infrastructure Levy (CIL) payable in respect of Phase 2 for both Mayoral CIL and Borough CIL is Nil.

Phase 3

60. The following table shows the relevant G and GR figures for Phase 3.

| CIL | Description | GIA m² |

|---|---|---|

| Mayoral | Office (GR) | redacted |

| Mayoral | Retail (GR) | redacted |

| Mayoral | Other (GR) | redacted |

| Borough | Office (GR) | redacted |

| Borough | Retail and other (GR) | redacted |

| Both | Total (G) | redacted |

61. The value of KR is nil as no part of the original building is to be retained.

62. The following table shows the relevant E figures for Phase 3.

| CIL | Description | GIA m² |

|---|---|---|

| Both | Value of E in phase 2 (EP) | redacted |

| Both | Value of G in phase 2 (GP) | redacted |

| Both | Value of KR in phase 2 (KPR) | 0 |

63. I have used the above figures to calculate that the Community Infrastructure Levy (CIL) payable in respect of Phase 3 as follows:

| Chargeable Area | Mayoral CIL | Borough CIL |

|---|---|---|

| Office | £redacted

|

£redacted

|

| Retail | £redacted

|

£0 |

| Other | £redacted

|

£0 |

64. On the basis of the evidence before me, I determine that the Community Infrastructure Levy (CIL) payable in this case should be as follows:

| Phase | Mayoral CIL | Borough CIL |

|---|---|---|

| 1 | £0 | £0 |

| 2 | £0 | £0 |

| 3 | £redacted

|

£redacted

|

Award of costs

65. The appellants have requested an award of costs on the grounds that the CA have acted unreasonably. The state that the CA have adopted an approach to the meaning of the words “in-use building” that is wrong in law and gave no justification at the time of the Regulation 113 appeal for acting contrary to Counsel’s advice.

66. The CA reject that costs should be awarded. They refer to the Planning Practice Guidance which gives guidance on “unreasonable” behaviour, one element of which is “acting contrary to, or not following, well-established caselaw.” They argue that the main argument in this case is one which is not subject to any caselaw and as both sides are supported by Counsel advice, the actions could not be considered unreasonable.

67. Regulation 121 gives the appointed person authority to make orders as to the costs of the appeal. Guidance on awarding costs states that costs will normally be awarded where the following conditions have been met:

- a party has made a timely application for an award of costs;

- the party against whom the award is sought has acted unreasonably; and

- the unreasonable behaviour has caused the party applying for costs to incur unnecessary or wasted expense in the appeal process – either the whole of the expense because it should not have been necessary for the matter to be determined by the Appointed Person, or part of the expense because of the manner in which a party has behaved in the process.

68. In my opinion. the CA have not acted unreasonably. The arguments put forward in this case are unique and not settled by precedent. The CA sought legal advice and provided their counsel opinion as part of their representations and I consider this sufficient to prove that they acted reasonably in reaching their opinions. I therefore deny the request for an award of costs.

redacted

redacted BSc (Hons) MRICS

Valuation Office Agency

2 October 2024