Building Digital UK Annual Report and Accounts 2024 to 2025

Published 23 October 2025

Building Digital UK Annual Report and Accounts 2024 to 2025

For the period 1 April 2024 to 31 March 2025

Presented to the House of Commons pursuant to section 7 of the Government Resources and Accounts Act 2000

Ordered by the House of Commons to be printed on 23 October 2025

HC 1351

© Crown copyright 2025

ISBN 978-1-5286-5976-5

E03443981 10/25

1. Joint Foreword from the Chair and the Chief Executive Officer of Building Digital UK

Building Digital UK plays a pivotal role in leading two of the government’s most transformative infrastructure programmes. Every connection we deliver unlocks opportunity, drives innovation, and ensures that people can benefit from the digital age, regardless of where they live or work.

The impact of the faster broadband and mobile coverage we’re delivering is vast. People in rural areas can access more job opportunities as they can now work remotely, elderly people can get higher quality healthcare through virtual NHS consultations, while small businesses can reach new markets and drive sales by moving online. Our mission to end the digital divide has never been more critical to achieving the government’s Plan for Change, with our work directly enabling economic growth and breaking down barriers to opportunity across every corner of the United Kingdom.

Performance Against Our Targets

This year has been defined by strong progress against our core objectives. Most notably, we achieved our overarching coverage targets for both Project Gigabit and the Shared Rural Network a year ahead of schedule. In October 2024, the independent website ThinkBroadband reported that over 85% of UK homes and businesses had access to a gigabit-capable connection. This figure rose to 87% by March 2025, representing a significant step towards the Government’s ultimate goal of 99% coverage by 2032.

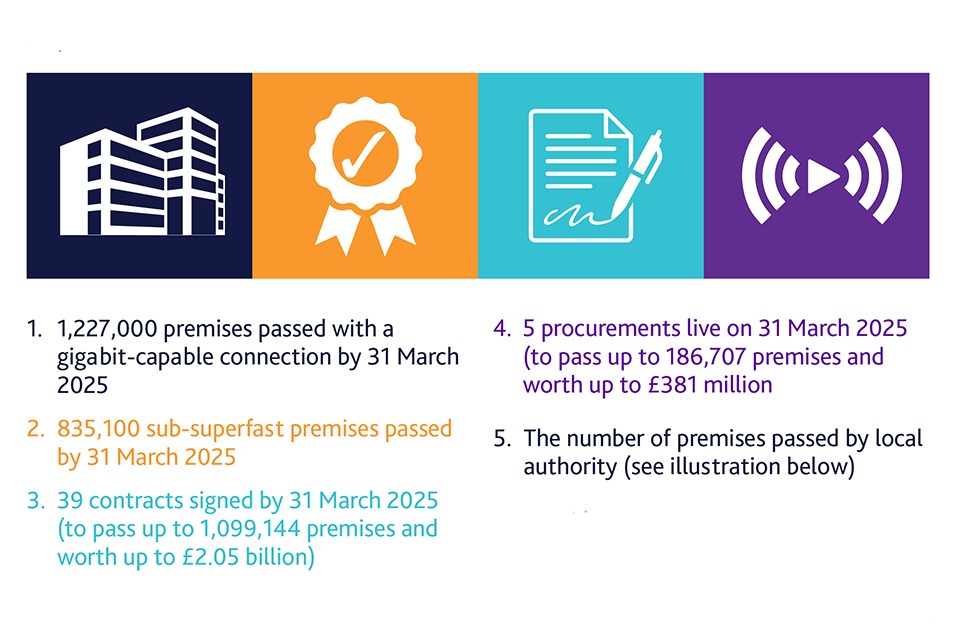

During 2024 to 2025, we passed 152,700 premises with gigabit-capable broadband bringing our cumulative total to over 1.2 million premises. This includes 47,400 premises that previously received speeds below 30 Mbps, directly benefiting those stuck with the slowest speeds. In December 2024, Ofcom reported that 4G coverage now reaches over 95% of the UK landmass, up from 91% when the programme started in March 2020.

Our success has been built on strong partnerships across government, industry, and local authorities. By March 2025, we had signed Project Gigabit contracts covering nearly all of England and Wales, as well as our first contracts in Scotland, with a combined value of over £2 billion , demonstrating both the scale of government investment and industry confidence in our approach.

Responding to Market Challenges

The telecommunications sector has faced significant economic headwinds during 2024 to 2025, with several alternative network providers experiencing financial difficulties. These market conditions have required us to be more agile in our approach, continuously monitoring supplier performance whilst maintaining our commitment to value for money. We have successfully implemented alternative delivery arrangements where needed, ensuring that coverage commitments to communities remain on track despite wider market volatility

Our response to these challenges demonstrates the importance of BDUK’s role as both market facilitator and safety net, ensuring that essential infrastructure deployment continues even when commercial conditions become difficult. This approach has proved particularly valuable in maintaining momentum towards our coverage targets whilst protecting public investment.

Looking Ahead: Opportunities and Challenges

The June 2025 Spending Review provided BDUK with £1.9 billion capital investment through to 2029-30, to cover existing commitments and new Project Gigabit contracts (particularly in Scotland), confirming government commitment to completing both Project Gigabit and the Shared Rural Network. Whilst the target date for 99% gigabit coverage has been revised from 2030 to 2032, this new timeline allows us to maintain quality and value for money whilst adapting to evolving market conditions.

We recently announced that BDUK will be integrated into the Department for Science, Innovation and Technology (DSIT). The decision continues DSIT’s growth into the UK Government’s department of digital delivery, helping to accelerate innovation and drive economic growth across the country. The move additionally reinforces BDUK’s critical role in the department’s objective of creating a modern digital government and presents significant opportunities to align our delivery expertise with the department’s broader innovation and technology objectives.

HM Treasury’s ten-year infrastructure pipeline also provides clarity and confidence for industry partners whilst ensuring that government investment delivers maximum economic and social benefits. Ensuring we can manage this transition without impacting on our programme delivery will take significant management attention and effective collaboration with all involved.

However, challenges remain. The complex nature of deploying infrastructure in the most remote areas of the UK requires continued innovation in our delivery approaches. We will continue to adapt our programmes as required. For example, the revised approach to our Total Not Spots programme, focusing on areas where people live, work, and travel, demonstrates our commitment to maximising public benefit whilst managing delivery complexity.

Essential to Government Missions

BDUK’s work remains essential to delivering the government’s core missions. By connecting businesses to gigabit-capable broadband, we are directly supporting economic growth and productivity improvements across all sectors. Our focus on rural and hard-to-reach areas ensures that the benefits of digital connectivity reach every corner of the UK, breaking down geographical barriers that have historically limited opportunity and growth.

We would like to thank BDUK staff for their ongoing dedication to our mission, and our Board members for their invaluable guidance and support. Furthermore, we recognise the crucial role of our partner suppliers, who we look forward to working with as our delivery ramps up in parallel with progress on their commercial rollout.

Dean Creamer CBE

Chief Executive Officer

Building Digital UK

Lesley Cowley OBE

Chair

Building Digital UK

2. Performance report

Performance Overview

This section provides key information about BDUK and its purpose, a summary of our objectives and performance against them between 1 April 2024 and 31 March 2025 and the impact and managements of our key risks.

For additional detail on performance or accountability, see the performance analysis and accountability report sections of the annual report and accounts.

2.1 About Building Digital UK

BDUK’s mission is to ensure that homes and businesses across the UK can access fast and reliable digital connectivity. We are responsible for the rollout of gigabit-capable broadband and the expansion of mobile coverage in hard-to-reach areas of the UK.

BDUK is part of the Department for Science, Innovation and Technology (DSIT). For this financial year our reporting is consolidated in the DSIT Annual Report and Accounts.

We work closely with colleagues in the Digital Infrastructure directorate of DSIT to support the telecommunications sector, providing funding to improve digital connectivity in places that might otherwise be left behind by commercial plans.

BDUK is responsible for two major programmes:

-

Project Gigabit: A major government programme to deliver gigabit-capable broadband to homes and businesses across the UK. The programme supports the government’s ambition for nationwide gigabit broadband coverage by 2032[footnote 1],

-

Shared Rural Network (SRN): A joint investment with the UK’s mobile network operators to improve mobile connectivity in rural parts of the UK.[footnote 2] The programme is expanding 4G coverage, ensuring that more than 95% of the UK’s landmass will have coverage from at least one operator, and increasing the areas where all operators deliver coverage.

Our work to improve broadband and mobile coverage will help to bridge the digital divide and unlock the benefits of cutting-edge connectivity for their families, businesses and communities across the UK.

Delivering BDUK’s mission is a shared effort. Our partnerships across government, industry, local councils, devolved administrations, regulators, consumer groups and citizens ensure that investment and delivery are targeted effectively and provide the best value possible.

Our Chief Executive Officer (CEO) is both the Accounting Officer and the Senior Responsible Owner for our two major programmes. The CEO is accountable to the Secretary of State, Minister of State and DSIT’s Principal Accounting Officer, and is advised and challenged on strategy, delivery and risk management by BDUK’s Board.

Prior to April 2025, as a part of the Government Major Projects Portfolio (GMPP), Project Gigabit and the SRN were subject to regular scrutiny by the Infrastructure and Projects Authority (IPA).

BDUK’s work is underpinned by four core values: Embracing Challenges, Delivering Excellence, Working Together and Respecting Differences.

Outcome of Spending Review 2025

The June 2025 Spending Review provided BDUK with £1.9 billion capital investment up to 2029-30 to continue delivery of both the Project Gigabit and SRN programmes. Project Gigabit continues to target 99% gigabit coverage across the UK; however, the government has revised the target date for this from 2030 to 2032, and we will refresh our delivery plans as a result. The SRN will continue to work with industry to deliver 4G coverage to the most remote areas of the UK.

Challenges

To deliver both Project Gigabit and the SRN, BDUK must continually monitor and respond to wider macroeconomic, resource and financial pressures. We are working closely with our industry partners to ensure delivery remains on track and value for money is maintained.

For Project Gigabit, the highly competitive market has helped drive the expansion of coverage across the UK, but it remains dynamic, affected by the same macroeconomic issues as found across other infrastructure sectors.

BDUK continues to monitor suppliers’ commercial plans. Where these change, we respond wherever possible to make sure homes and businesses are not left behind. We have also taken action to put in place alternative delivery plans in instances where suppliers have been unable to fulfil their commitments to BDUK.

The main challenge for the SRN programme remains the complex nature of building sites in very rural and hard-to-reach areas, in particular securing local authority planning permissions but also delivery of power and transmission connections while maintaining value for money and meeting the programme delivery timelines and licence obligations. To deal with these challenges, BDUK is heavily dependent on the Home Office, and Mova (the SRN delivery partner) who have the direct contracting relationships with critical suppliers (e.g. power and transmission suppliers).

The mobile network operators (MNOs) and BDUK have undertaken a significant amount of work to review the portfolio of SRN sites to reflect feedback from local communities and stakeholder groups. BDUK has since reached an agreement with the MNOs to focus on delivering sites that represent the best value for money, with the most benefits to communities and reducing the impact on landscapes. On 30 June BDUK communicated the details of the agreement publicly and this was welcomed by key stakeholders such as the John Muir Trust, Scottish Land and Estates and the Highlands Council.

The recent Spending Review allocated funding for the SRN, to continue work with industry to deliver 4G coverage beyond 95% of the UK’s landmass. The level of funding allocated at the Spending Review is based on the work with the MNOs to confirm this more targeted scope for the programme going forward. The construction phase of the programme will conclude as planned in 2027.

2.2 Performance summary and key achievements

2.3 Project Gigabit[footnote 3]

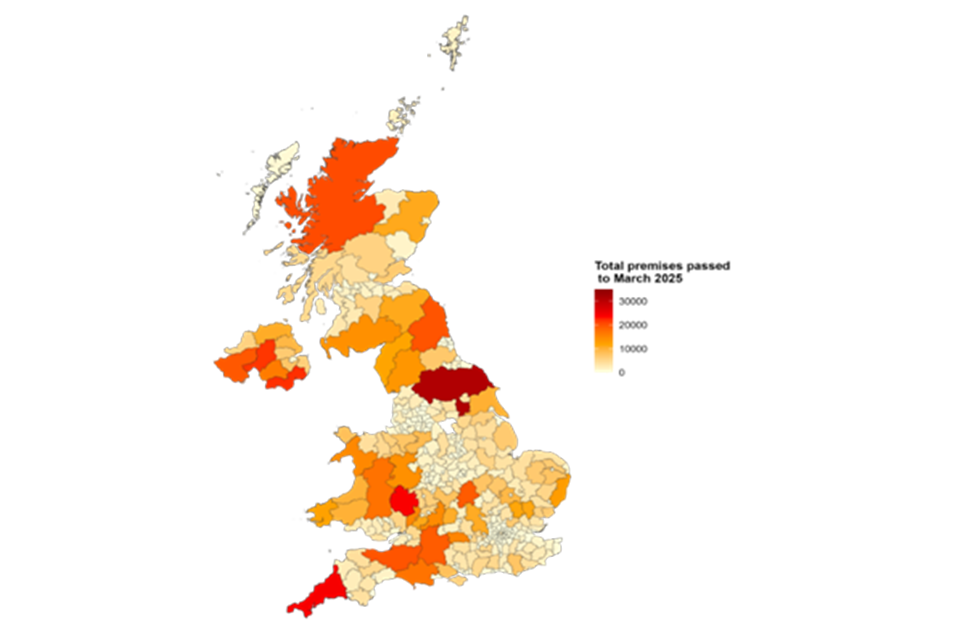

2.4 Project Gigabit premises passed map

Notes:

-

Map indicating the total number of premises passed by BDUK interventions in each local authority district area up to March 2025.

-

Local authority district areas in London have been combined into a single unit, and the premises passed by BDUK have been summed.

Project Gigabit was launched in April 2021, building on successful legacy programmes such as the Superfast, Local Full Fibre Networks and Rural Gigabit Connectivity programmes.

BDUK has achieved its interim target for 85% of the UK to have gigabit coverage by December 2025 and continues to work towards the target of nationwide coverage by 2032.

Project Gigabit contracts now account for the majority of our delivery, with most contracts signed and build underway. Meanwhile, delivery through Superfast contracts and GigaHubs is winding down and vouchers are being utilised more selectively to help fill smaller coverage gaps, complementing wider Project Gigabit rollout.

For the year ended 31 March 2025, we achieved the majority of our objectives set out in our Corporate Plan 2023 to 2026. In October 2024, as a result of commercial and subsidised delivery, gigabit broadband coverage of UK premises reached 85%, achieving Project Gigabit’s target over a year ahead of schedule[footnote 5]. By the end of March 2025 over 87% of UK homes and businesses had access to a gigabit-capable broadband connection[footnote 6]. More detail on how we performed against our objectives is included in the performance analysis section further below.

2.5 Project Gigabit delivery

A premises is counted as passed by Project Gigabit when it is possible to access a gigabit-capable service for the supplier’s standard price and be connected in the supplier’s standard timescale.

We count both directly subsidised premises as well as uncommercial premises that were not directly funded but received connections because of nearby BDUK-funded projects. As a result, all premises passed figures are estimates based on a combination of raw supplier data and modelled figures.

Project Gigabit’s number of premises passed for previous financial years has been updated to account for new higher quality data from vouchers suppliers. We have also made minor methodological changes to improve the consistency of how we count premises across our interventions (that is, we now count both premises that we have directly subsidised as well as premises that we have not directly paid for, but which were delivered en route to subsidised premises).

For all of our interventions, we also exclude counting premises that we believe would have been commercially delivered or that were delivered by another supplier before our subsidised supplier. More information can be found in our quality and methodology report and bulletin[footnote 7]. Details of the number of premises delivered under each Project Gigabit contract have been published in BDUK’s performance data: April 2024 to March 2025

Table 1 shows that in the year ended 31 March 2025, we passed 152,700 premises with gigabit-capable broadband. We delivered more premises in the year ended 31 March 2025 compared to the previous year (150,100 in the year ended 31 March 2024) and we expect the number of premises passed to increase as more Gigabit contracts move from their planning phases into delivery.

Table 1: Premises passed (rounded to nearest 100) against the Corporate Plan 2024 to 2025 minimum trajectory [footnote 8].

| April 2024 to March 2025 | April 2023 to March 2024 | April 2022 to March 2023 | April 2021 to March 2022 | Before April 2021 | |

|---|---|---|---|---|---|

| Actual premises passed by BDUK interventions | 152,700 | 150,100 | 162,500 | 148,900 | 612,700 |

| Cumulative minimum target premises passed for BDUK interventions | 1,100,000 to 1,200,000 | 1,050,000 to 1,100,000 | 935,000 | 742,000 | 600,000 |

| Cumulative actual premises passed by BDUK interventions | 1,227,000 | 1,074,200 | 924,100 | 761,600 | 612,700 |

Source: BDUK Delivery Performance Annual Information as of August 2025

Note: Totals may not sum due to rounding.

2.6 Delivery by intervention

Project Gigabit uses four interventions:

-

Gigabit contracts: Subsidies in the form of Gigabit Infrastructure Subsidy contracts awarded to suppliers to build gigabit-capable infrastructure to premises not reached by commercial build plans.

-

Superfast contracts: Contracts targeted at sub-superfast premises under the Superfast Broadband Programme, either extended to deliver gigabit-capable infrastructure, or delivering this as part of the original contract.

-

Gigabit Broadband Voucher Scheme: Small grants worth up to £4,500 each, which can be claimed by eligible residential and business customers in target areas to cover the additional costs of a supplier extending gigabit-capable infrastructure to their premises.

-

GigaHubs: Grants to connect local public services in hard-to-reach areas, such as schools, libraries, and GP surgeries. We are not actively developing new projects given the coverage now being provided through other mechanisms.

Table 2 shows the contribution each of our interventions has made to deliver gigabit-capable coverage.

Table 2: Premises passed by intervention (rounded to the nearest 10)[footnote 9]

| Intervention Approach | Total | Premises passed between April 2024 and March 2025 | Premises passed between April 2023 and March 2024 | Premises passed between April 2022 and March 2023 | Premises passed between April 2021 and March 2022 | Before April 2021 |

|---|---|---|---|---|---|---|

| Superfast | 793,590 | 33,820 | 60,640 | 89,230 | 94,080 | 515,830 |

| Vouchers | 353,900 | 55,740 | 78,590 | 73,090 | 51,540 | 94,950 |

| Gigabit contracts | 73,740 | 62,760 | 10,830 | 160 | 0 | 0 |

| Hubs | 5,720 | 380 | 80 | 50 | 3,300 | 1,910 |

| Total | 1,227,000 | 152,700 | 150,100 | 162,500 | 148,900 | 612,700 |

Source: BDUK Management Information as of August 2025

Note: Totals rounded to the nearest 100. Totals may not sum due to rounding

Case study: Project Gigabit transforms homes and businesses in Grantchester

CityFibre’s Project Gigabit contract in Cambridgeshire has brought faster, more reliable broadband to Grantchester, one of the first areas in the county to benefit from the rollout. Both residents and businesses are already seeing the difference.

The first household to connect was that of Josh Newman, a filmmaker and lecturer. Previously limited by slow speeds, his family often struggled with unreliable service. Thanks to Project Gigabit, the upgraded service has been transformative. Josh said, “We can now rely on the internet for everything - from smoother Teams calls for my wife’s work, to faster uploads for my filmmaking, and easy streaming for the kids. Before, we had to plan around our unreliable broadband - now we have what we need when we need it.”

Local business The Grantchester Green Man pub and rooms has also reaped the benefits. Slow connections holding back their operations were often frustrating. Manager Jules Gibson said: “Taking a full fibre connection has really boosted business for us. Processes that were a pain before are now smooth and efficient. Even stock management is much easier, and that has a positive effect on how many customers we can serve.”

By enabling residents like Josh to work and create more effectively, and businesses like The Green Man to run more efficiently, Project Gigabit is helping rural communities thrive in a digital world.

2.7 Rurality of our subsidies

Rural premises are often far from the nearest viable broadband infrastructure, making their delivery too expensive for most suppliers. As a result, whilst Project Gigabit is a nationwide programme, a large number of the premises outside suppliers’ build plans sit in rural locations.

The Superfast programme showed how building out a fast and reliable broadband network to rural communities helps tackle digital exclusion and rural poverty. Further information on the evaluated benefits of our programmes are accessible through our online Research Portal[footnote 10]

Between April 2024 and March 2025, we passed 135,900 rural premises through our interventions. This means that 89% of premises benefiting from our subsidies were rural, compared to 20% of all premises in BDUK’s premises base in the UK being classed as rural.

Table 3: Rural premises passed (rounded to nearest 100)[footnote 11]

| Total | Premises passed between April 2024 and March 2025 | Premises passed between April 2023 and March 2024 | Premises passed between April 2022 and March 2023 | Premises passed between April 2021 and March 2022 | Before April 2021 | |

|---|---|---|---|---|---|---|

| Rural premises | 988,200 | 135,900 | 137,100 | 144,200 | 127,000 | 444,000 |

| % of premises passed by BDUK in the period | 81% | 89% | 91% | 89% | 85% | 73% |

Source: BDUK Management Information as of August 2025

Note: Totals may not sum due to rounding

Case study: ‘Magic’ in East Yorkshire

Colin Walker runs an equestrian centre in the tiny hamlet of Willitoft in East Yorkshire, surrounded by farmland and miles from the nearest town. For years his internet came via a four-mile copper line from Bubwith, offering little more than frustration.

“Without internet, you’re left behind,” Colin said. “We couldn’t stream, do online banking, or run our business properly.”

That changed when he spotted a Quickline engineer in the village. “It felt like winning the lottery,” he laughed. “I asked straight away - where do I sign?”

Thanks to Project Gigabit, Colin now enjoys fast, reliable broadband. Customers can book riding lessons online, security cameras connect to his phone, and Netflix streams without a hitch.

Colin said. “It’s given us access to the world. It’s like magic.”

2.8 Project Gigabit across the Union

Project Gigabit covers areas across the UK and we work closely with the devolved administrations on its delivery in Scotland, Wales and Northern Ireland.

Scotland

By 31 March 2025, over 81% of premises in Scotland had access to a gigabit-capable connection. [footnote 12] During the financial year April 2024 to March 2025, we passed 34,700 premises in Scotland.

In May 2025 it was confirmed that Scotland would benefit from BDUK’s largest call-off contract to date. Awarded under a cross-regional framework agreement, this provides up to £157 million to connect up to 65,000 premises across central and northern Scotland.

The Scottish Government is the lead organisation for managing local and regional procurements in Scotland. In February 2025, it was announced that the Scottish Government had awarded the first contract for Scotland covering premises across the Borders and East Lothian area, with a second contract covering Aberdeenshire, Dundee and Moray Coast announced in July 2025. A further procurement covering the Orkney and Shetland Isles is also under way.

Significant change in the commercial coverage in Scotland has resulted in some changes to planned procurements. In Fife, Perth & Kinross, the Scottish Government has halted a regional procurement in the area and has undertaken further market engagement prior to relaunching the procurement process. Additionally, eligible premises in Dumfries and Galloway will be added into the cross-regional framework rather than a separate procurement being undertaken.

Wales

There has been a significant improvement in the rollout of gigabit-capable broadband in Wales in recent years, with gigabit coverage increasing from 58% in January 2023, when market engagement started in Wales, to over 80% by 31 March 2025[footnote 13]. During the financial year April 2024 to March 2025, we passed 10,700 premises in Wales.

BDUK is the lead organisation for delivering Project Gigabit contracts in Wales. Wales is covered by two call-off contracts under the cross-regional framework awarded to Openreach in summer 2024. These two contracts will address 68,000 premises in Wales through a mix of directly subsidised premises and non-subsidised premises delivered en route to them.

Northern Ireland

Northern Ireland remains the most connected part of the Union, with over 96% of premises able to access a gigabit-capable connection by 31 March 2025. [footnote 14] During the financial year April 2024 to March 2025, we passed 5,500 premises in Northern Ireland.

The Northern Ireland Executive is the lead organisation for managing procurements in Northern Ireland. The Northern Ireland Department for Economy launched a procurement for over 10,000 premises under Project Gigabit in 2024. The outcome is expected to be announced in 2025.

Table 4: Premises passed by nation and region (rounded to nearest 100)[footnote 15]

| Country Region | Total | Premises passed between April 2024 and March 2025 | Premises passed between April 2023 and March 2024 | Premises passed between April 2022 and March 2023 | Premises passed between April 2021 and March 2022 | Before April 2021 |

|---|---|---|---|---|---|---|

| All UK | 1,227,000 | 152,700 | 150,100 | 162,500 | 148,900 | 612,700 |

| England | 853,400 | 101,800 | 96,000 | 95,200 | 97,700 | 462,700 |

| North East | 32,400 | 7,000 | 5,600 | 4,000 | 4,500 | 11,300 |

| North West | 66,100 | 11,300 | 8,100 | 4,500 | 4,300 | 37,900 |

| Yorkshire and the Humber | 85,000 | 13,300 | 10,200 | 6,000 | 7,800 | 47,700 |

| East Midlands | 89,200 | 10,200 | 13,600 | 7,100 | 10,100 | 48,100 |

| West Midlands | 89,000 | 11,400 | 9,900 | 9,500 | 7,900 | 50,400 |

| East of England | 157,200 | 15,600 | 10,500 | 21,600 | 25,700 | 83,700 |

| London | 9,200 | <50 | 100 | 300 | 300 | 8,600 |

| South East | 159,300 | 9,600 | 14,000 | 21,000 | 21,300 | 93,400 |

| South West | 165,900 | 23,400 | 24,000 | 21,200 | 15,800 | 81,500 |

| Northern Ireland | 127,400 | 5,500 | 20,300 | 38,300 | 31,000 | 32,200 |

| Scotland | 123,300 | 34,700 | 28,400 | 20,000 | 7,200 | 33,000 |

| Wales | 122,700 | 10,700 | 5,400 | 8,900 | 13,000 | 84,700 |

Source: BDUK Delivery Performance Annual as of August 2025

Note: Totals may not sum due to rounding

Case Study: Royal Dornoch’s digital transformation drives golf tourism

Highland Broadband’s broadband upgrade at Royal Dornoch Golf Club in May 2024, exemplifies how digital infrastructure transforms rural businesses and supports the government’s mission to break down barriers to opportunity.

The club’s investment in an upgraded broadband service was a critical part of their ambitions to grow the business. Neil Hampton, general manager at Royal Dornoch, said that thanks to the “stunning” speeds provided by Highland Broadband, the club is in the perfect position to meet the burgeoning global interest in golf and the growing number of international visitors inspired by events such as the Scottish Open.

The prestigious club on the Dornoch Firth has benefitted from the upgrade through the Gigabit Broadband Voucher Scheme. Having access to a new service has enabled 24/7 international bookings and real-time course management systems.

“If the internet went down right now, suddenly the whole business stops,” Hampton explained. The club forecasts a 30% rise in advance bookings for 2026, driven by growing international interest in Scottish golf tourism.

Royal Dornoch’s success perfectly demonstrates how investment in reliable broadband is transforming opportunities for businesses across the country and creating a lasting economic impact whilst supporting local businesses and attracting international visitors to rural communities.

Sub-superfast premises passed

Project Gigabit has a specific spending objective to prioritise sub-superfast premises for gigabit-capable connectivity where practical.

A proportion of our interventions are therefore aimed at premises without access to a superfast connection (<30 Mbps). During financial year April 2024 to March 2025, 47,400 premises previously receiving speeds below 30 Mbps were passed by our interventions. As we approach nationwide availability of Superfast broadband (98% coverage according to Ofcom’s Connected Nations Report December 202416), the proportion of premises that BDUK subsidises with previously <30 Mbps connection speeds is likely to decrease.

Table 5: Sub-superfast premises passed by BDUK subsidies (rounded to nearest 100)

| Total | Premises passed between April 2024 and March 2025 | Premises passed between April 2023 and March 2024 | Premises passed between April 2022 and March 2023 | Premises passed between April 2021 and March 2022 | Before April 2021 | |

|---|---|---|---|---|---|---|

| Premises passed by a BDUK intervention that previously had a connection of <30 Mbps | 835,100 | 47,400 | 62,700 | 97,400 | 97,900 | 529,600 |

| % of premises passed by BDUK in the period | 68% | 31% | 42% | 60% | 66% | 86% |

Source: BDUK Delivery Performance Annual as of August 2025

Note: A data tables and definitions annex supporting Project Gigabit delivery data used in this report is available online at GOV.UK [footnote 18]

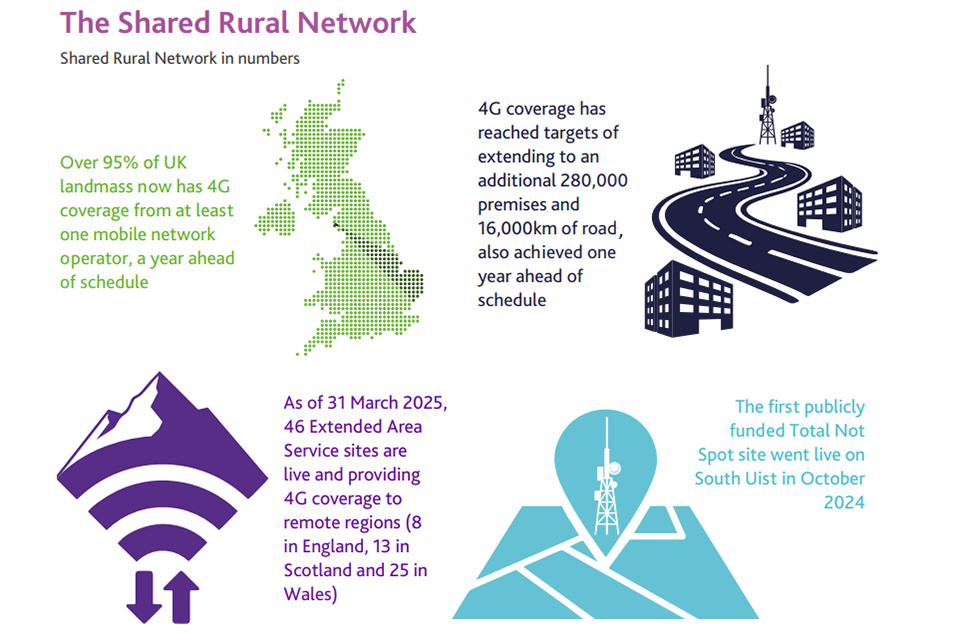

2.9 The Shared Rural Network

The Shared Rural Network in numbers [footnote 19] [footnote 20]

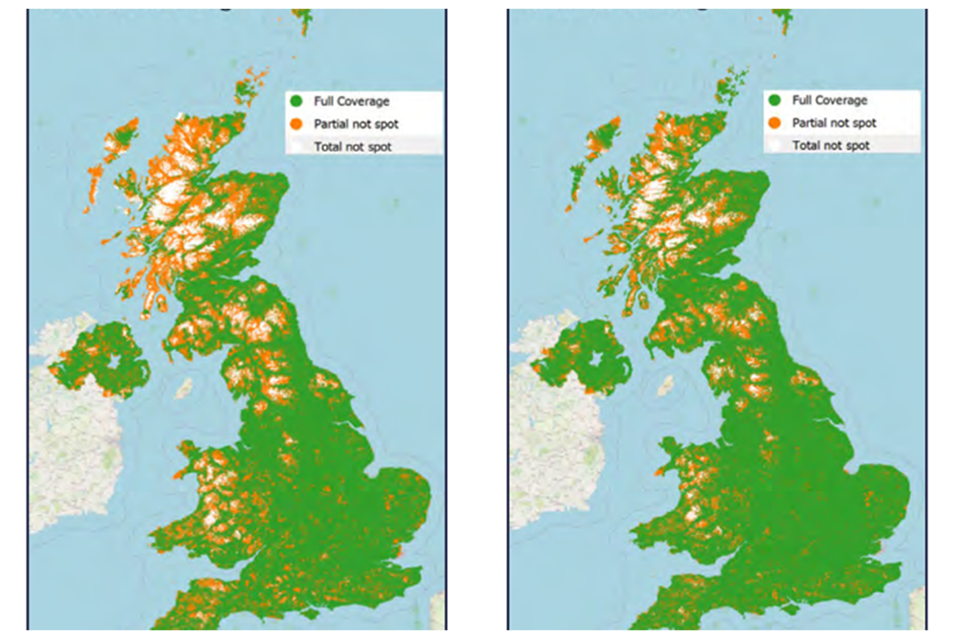

The maps below from Ofcom show how 4G coverage has improved since the start of the programme as more rural locations have benefitted from increased 4G coverage.[footnote 21]

Through the SRN programme, we are working with the UK’s mobile network operators (MNOs) - EE, VMO2 and VodafoneThree - to upgrade existing masts, as well as building new masts, to cover areas with no or partial mobile connectivity.

The SRN programme has already achieved its primary coverage targets over a year early, thanks to the completion of the industry funded Partial Not Spots element of the programme. Over 95% of UK landmass now has 4G coverage from at least one MNO, and the SRN has provided coverage to an additional 280,000 premises and 16,000km of roads.

The SRN programme is split between public and privately funded elements, underpinned by the MNOs’ spectrum licence obligations. In line with the six-year capital funding period, the MNOs’ legally binding spectrum obligations for the SRN, which are still yet to be met, must be achieved by January 2027 and the programme will continue to deliver coverage improvements up to that point. Having achieved the overarching objectives of the SRN programme, government and the MNOs have since worked together to agree a revised plan to target remaining deployment of infrastructure in places where the benefit will be felt the most.

The SRN will help those who live and work in rural communities to achieve their full potential and enable those that visit to have access to vital services, through improved mobile connectivity.

The SRN consists of three separate parts:

-

To tackle Partial Not Spots, areas where there is currently coverage from at least one, but not all, mobile operators, the four mobile network operators are investing in a shared network of new and existing masts. This UK-wide intervention is now complete.

-

The government is upgrading Extended Area Service (EAS) masts being built as part of the Home Office’s Emergency Services Network (ESN). These masts will become usable by all four mobile network operators, improving connectivity in hard-to-reach places across Great Britain.

-

The government is also funding new masts to be shared by the four mobile network operators in Scotland to tackle Total Not Spots, areas where there is currently no coverage from any mobile operator.

All the work undertaken as part of the programme is regulated by Ofcom, with regular reporting throughout the life of the programme to ensure agreed obligations and targets are met. The programme was designed with Ofcom and the MNOs to develop coverage obligations that reflect the desired coverage outcomes.

The MNOs are incentivised to deliver through these legally binding obligations, with a range of measures available to Ofcom to enforce them, including the power to issue fines for up to 10% of turnover. Under these obligations, MNOs have committed to meet certain coverage thresholds, assessed by Ofcom. The first of these was 88% geographic coverage of the UK (through the Partial Not Spots element of the programme) by the end of June 2024, achieved by all MNOs in early November 2024. As of 31st March, the second coverage requirement is 90% geographic coverage of the UK in January 2027, to be delivered through coverage uplifts resulting from the Total Not Spots and Extended Area Service parts of the programme[footnote 22].

The SRN Programme team has acted on recommendations from a National Audit Office report (January 2024), the Public Accounts Committee (May 2024) and the National Infrastructure and Service Transformation Authority Gateway 0 Review (January 2025). Significant progress has been made against recommendations in all areas; in June 2025 BDUK agreed a revised, targeted delivery portfolio for the TNS project with the MNOs, the portfolio focuses on sites with the best value for money, with the most benefits to communities and reducing the impact on landscapes. As a result of the agreement, BDUK now have improved access to management information to effectively monitor delivery progress and cost changes across the project lifecycle.

Shared Rural Network delivery

We achieved all our 2024-2025 objectives for the programme. More detail on how we performed against our objectives is included in the performance analysis section further below.

We have worked with our partners to improve 4G coverage in rural areas throughout the country. The table below shows that 4G coverage across the UK reached 96% in January 2025, an increase from 91% in March 2020 when the SRN agreement was signed and confirming that the programme has delivered the overarching 95% coverage target a year ahead of its target date of December 2025.

Table 6: Mobile coverage across the UK and nations, 2020 to 2023[footnote 23]

| January 2020 | January 2021 | January 2022 | January 2023 | January 2024 | January 2025 | |

|---|---|---|---|---|---|---|

| UK 4G landmass coverage | 91% | 91% | 92% | 92% | 93% | 96% |

| England 4G landmass coverage | 97% | 97% | 98% | 98% | 98% | 99% |

| Scotland 4G landmass coverage | 80% | 81% | 82% | 83% | 85% | 90% |

| Wales 4G landmass coverage | 89% | 90% | 90% | 91% | 92% | 96% |

| Northern Ireland 4G landmass coverage | 97% | 97% | 97% | 97% | 97% | 98% |

SRN Delivery in focus – the first Total Not Spot site goes live

In November 2024 the first SRN Total Not Spot site was switched on in South Uist in the Outer Hebrides, delivering 4G to areas that previously did not have mobile broadband coverage.

The publicly funded mast provides coverage from all mobile network operators, significantly improving connectivity for those who live, work and travel to the area. The villages of Balivanich, Grimsay, Liniclate, across almost the entirety of Benbecula, as well as more than 30km of the A865 and other smaller roads and tracks have been provided with coverage. In addition, those working in and passing through the waters of The Little Minch between South Uist and Skye also benefit from connectivity provided by the site.

Telecoms Minister Chris Bryant said: “For too long, island communities in Scotland have struggled to get online while on the go. This milestone for the Shared Rural Network means vast swathes of Uist are now covered by 4G for the first time, boosting productivity for local businesses and safety for those in remote areas.”

Investment in our programmes

The table below shows the capital spending on our interventions and programmes this year with a comparison to last year. The prior year figures have been restated to correct the Gigabit vouchers and Gigabit contract spend totals and align with the comparative information for 2023-24 disclosed in the financial statements.

Table 7: BDUK capital spend by intervention and programme

| £ million | 2023 to 2024 (restated) | 2024 to 2025 |

|---|---|---|

| Fixed Broadband | ||

| Gigabit Vouchers | 56.8 | 72.3 |

| GigaHubs | 2.6 | - |

| Superfast Extension | 0.2 | 1.0 |

| Gigabit contracts (GIS) | 32.2 | 180.5 |

| Total Project Gigabit spend | 91.8 | 253.8 |

| Superfast | 1.6 | 1.2 |

| Mobile | ||

| Shared Rural Network | 3.3 | 13.8 |

| Total Capital spend | 96.7 | 268.8 |

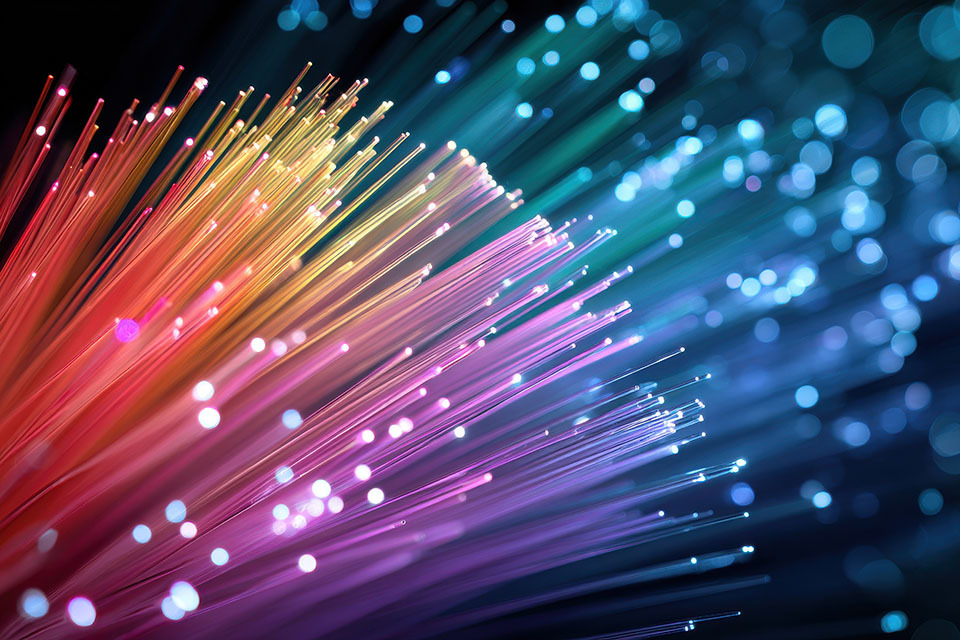

2.10 Risks

Our delivery plan is challenging, not least as we are operating in a dynamic market environment making our programmes particularly vulnerable to macroeconomic pressures outside of our control.

We have a well-established Audit and Risk Assurance Committee in line with appropriate guidelines, and a programme of internal audit has been delivered by the Government Internal Audit Agency (GIAA) acting as internal auditors. Both the GIAA and the National Audit Office (NAO) attend the BDUK Audit and Risk Assurance Committee. More information on risk management in BDUK is covered in the Accountability Report.

The principal strategic risks we face, and the steps we have taken to mitigate against them, are included in the following table. These are based on both the risks we faced during the year and those we have identified for the year ahead.

| Risk | Key mitigations |

|---|---|

|

Project Gigabit delivery of 99% gigabit coverage by 2032 There is a risk that BDUK will not achieve its target of 99% gigabit-capable connectivity by 2032 due to supplier challenges, funding constraints, market conditions or deployment complexities. Failure to meet this target would impact government commitments, and result in reduced economic and social benefits. |

- Close engagement with key delivery partners, particularly with the highest dependency. - Held suppliers to account for delivery of Gigabit contracts in line with targets and milestones. - Reviewed opportunities across the range of routes to market, such as voucher projects in parallel with contract award. - Monitored indicators of contracted suppliers’ and key sub-contractors’ financial resilience, capacity and capability. - In-life contract and supplier management to ensure suppliers deliver against their commitments. - Technical assurance of the technology used by suppliers to ensure the network meets appropriate standards. - Used efficient processes for moving premises into new contracts or other mechanisms in the event of supplier failure. - Undertook regular Open Market Reviews to monitor commercial build and plans and took appropriate action in the procurement process/contract life. |

|

Shared Rural Network (SRN) delivery commitments There is a risk that BDUK is unable to deliver the programme and value for money by January 2027 due to complex delivery challenges associated with very rural areas. BDUK does not have direct contracting relationships with power and transmission suppliers and therefore relies on grant recipients to deliver outputs to necessary timescales. |

- Continued to work with Mova and the mobile network operators (MNOs) on delivering their plans in a way that focuses remaining delivery of the programme on delivering recognisable public benefits and represents value for money. - Continued assurance of SRN costs to ensure they align with industry standards and provide value for money. - Reviewed how BDUK monitors grant recipient management of these key dependencies and agreed associated reporting mechanisms to identify where issues might be arising. |

|

Demonstrating the benefits, value and impact of programmes There is a risk that BDUK’s interventions do not deliver intended benefits, or that we are unable to effectively evidence their value, efficiency or impact. |

- Dedicated Analysis and Evaluation team to evaluate Project Gigabit and Shared Rural Network programmes, with a strategy aligned to Green Book Principles. - Environmental and social value criteria incorporated into procurement and programme design and reported via Government Major Projects Portfolio. - Requirements for suppliers to provide data on infrastructure usage, uptake and delivery quality. |

|

Ability to attract, retain and enable the people we need to deliver There is a risk that we are unable to retain, develop, and enable a workforce with the right skills, experience, and behaviours to deliver our objectives and adapt to changing delivery needs. |

- Used the People Board every other month, which focuses on decision-making for BDUK people matters, to discuss and address key capacity issues. - Development of strategic workforce plan to support prioritisation and identify skills gaps. - Identification of automated solutions to support with scaling up. - Continuous improvement to BDUK’s operating model to ensure effective management of our programmes and other competing priorities. |

2.11 Performance analysis

This section provides a detailed analysis of BDUK’s performance between 1 April 2023 and 31 March 2024.

2.12 Performance against BDUK’s Corporate Plan objectives for the year ended 31 March 2025

This section sets out BDUK’s performance in the year ended 31 March 2025 against the associated objectives and sub-objectives outlined within our Corporate Plan 2023 to 2026.

The objectives support our mission to ensure that homes and businesses across the UK can access fast and reliable digital connectivity.

BDUK’s objectives for 2024 to 2025

Results key for the tables below:

-

Achieved (A) - BDUK has fully achieved the measure set out in its Corporate Plan.

-

Partially Achieved (PA) - BDUK has made good progress towards achieving the measure set out in its Corporate Plan.

-

Not Achieved (NA) - BDUK has not achieved the measure set out in its Corporate Plan.

Project Gigabit objectives

Objective 1: Deliver gigabit-capable connectivity to homes and businesses outside suppliers’ commercial rollout plans

1.1 We will provide gigabit-capable connectivity to an increasing number of premises and drive delivery of Project Gigabit targets through:

-

Delivering on existing Gigabit contracts, Superfast contracts, voucher projects and GigaHub projects

-

Setting up future delivery by managing Gigabit procurements

| 2024 to 2025 Measure | Result |

|---|---|

| Subsidise gigabit-capable connectivity to between a cumulative 1.1 to 1.2 million homes and businesses. | Achieved |

| Award the majority of Gigabit contracts in England in line with our quarterly published pipelines and exercise robust contract management, supporting our suppliers to deliver on their contracted milestones. Support the launch of procurements across Scotland, Northern Ireland and Wales in line with our quarterly published pipelines. Develop voucher projects for premises not within the scope of Gigabit contracts. | Achieved |

| Award and sign our first cross-regional Gigabit contract. | Achieved |

Summary of performance

By March 2025, we passed 1.23 million premises, achieving our target of subsidising connectivity to 1.1 to 1.2 million premises. More detail on our interventions and delivery results are included in the Project Gigabit delivery section further above.

We achieved our objective to award the majority of Project Gigabit procurements in England, with contracts signed for all procurements in the pipeline for England by December 2024. This included awarding and signing our first cross regional framework agreement.

In the devolved administrations, we awarded call offs covering a significant part of Wales under the cross regional framework and launched procurement for a call off covering Scotland which was awarded in April 2025. The first local and regional procurements in Scotland and Northern Ireland were launched during 2024 to 2025, with further procurements in Scotland in progress.

1.2 We will monitor and evaluate our interventions for efficiency and effectiveness to support our strategic decision-making

| 2024 to 2025 Measure | Result |

|---|---|

| Monitor the benefits of our gigabit-capable build as part of the longer-term Project Gigabit evaluation programme, including publishing a final Superfast report, a second GigaHubs impact report and the first outputs from our final full Local Full Fibre Networks legacy programme evaluation | Partially achieved |

| Research and develop new interventions which could be deployed if required | Achieved |

Summary of performance

Under the voucher scheme terms and conditions, suppliers are required to report against their delivery on a quarterly basis. We regularly meet with strategic suppliers to discuss delivery performance and future opportunities.

In the past year we have continued with the evaluation of all BDUK programmes and have published several reports on the impact and benefits of our programmes, including:

-

The final “Superfast Broadband Programme Evaluation” report

-

“Early Process Evaluation of Gigabit Contracts” report

-

In-house research on the digital divide and the impact of connectivity on rural schools and farmers

These are accessible through our online Research Portal with all our previous research and evaluation[footnote 25]. Evaluation of Hubs and Vouchers is ongoing; with an interim impact evaluation report for each to be published later in 2025. Soon we will also publish our Evaluation Plans for every live evaluation contract – this includes Project Gigabit, Shared Rural Network, Hubs and Local Full Fibre Network Programme. The last of these was procured in November 2024 and has been scoping and developing the work required to deliver reports in early 2026.

Over the 2024 to 2025 period BDUK also used stakeholder engagement and analysis to develop an expansion to the Gigabit Broadband Voucher Scheme. An initial trial extends their availability beyond rural areas and into urban areas, to address coverage gaps in towns and cities. This was announced on 31st March 2025 and launched to initial areas in April.

Shared Rural Network objectives

Objective 2: Improve mobile internet connectivity for people living, working and visiting remote regions by delivering the SRN programme

2.1 We will work with our partners to provide 4G mobile coverage to more remote regions across the UK.

| 2024 to 2025 Measure | Result |

|---|---|

| Collaborate with our partners to ensure that the programme is on track to deliver 4G mobile coverage to 95% of the UK geography by the end of 2025. | Achieved |

| Review and respond to the findings of the quarterly reports produced by the programme’s independent assessor. | Achieved |

Summary of performance

BDUK achieved its 4G mobile UK coverage target a year ahead of schedule, with Ofcom noting UK 4G coverage to be over 95% in its Connected Nations Report in December 2024.

We continue to review and respond to independent assessor recommendations on a quarterly basis. The most recent report was received in May 2025 and focussed on planning, power and transmission challenges as well as reporting requirements to increase oversight of the TNS project. BDUK and mobile network operators have worked together and agreed updated reporting requirements will be provided as part of the new revised, targeted TNS plan.

2.2 We will work with our partners to upgrade infrastructure through the Extended Area Service (EAS) element of the programme. Driving even more benefits from existing government investment.

| 2024 to 2025 Measure | Result |

|---|---|

| Mobile network operators to provide 4G mobile coverage to people in remote regions from a cumulative 20 sites. | Achieved |

| Home Office to upgrade a cumulative 72 Emergency Services Network (EAS) sites for hand-over to mobile network operators to make operational for commercial use. | Achieved |

Summary of performance

The programme achieved the objective of providing 4G coverage to remote regions through the EAS project from 20 sites in October 2024, five months ahead of schedule. As of 31st March 2025, the EAS element of the SRN had 45 sites live providing 4G coverage to remote regions, with 8 in England, 13 in Scotland and 24 in Wales.

In December 2024 the programme also achieved its target to upgrade 72 EAS sites for hand-over to mobile network operators. Work has continued to hand over more sites and by the end of the 2024-2025 period 100 sites had been handed over for commercial use.

2.3 We will work with our partners to build new infrastructure through the Total Not Spots (TNS) element of the programme.

| 2024 to 2025 Measure | Result | |

|---|---|---|

| Engage with mobile network operators to receive their finalised target portfolio of sites to reach the 1% Total Not-Spot (TNS) 4G coverage target. | Partially Achieved | |

| Mobile network operators to prepare the first TNS pilot site for launch. | Achieved |

Following the programme’s achievement of its overall objective of 95% UK landmass coverage from at least one MNO, BDUK and mobile network operators have undertaken significant work to focus the remaining TNS project in a way that maximises public benefit, targeting delivery of coverage in areas where people live, work or travel, and walking and hiking routes. This approach also addressed feedback from local communities and interest groups who were concerned about impact of new masts in areas of natural beauty.

The outcome was an agreement between BDUK and mobile network operators to re-shape the project to a portfolio which focused on delivering maximised benefits whilst reducing costs, under a revised budget of up to £150 million. BDUK and mobile networks operators agreed the revised, targeted delivery portfolio, prioritising new mobile infrastructure for areas where it will have the biggest positive impact where people live, work or travel. As a result of BDUK and MNOs agreeing a revised targeted delivery portfolio, meaning far fewer masts, the 1% TNS 4G coverage target is now revised to 0.2%

The first TNS mast in South Uist in the Scottish Hebrides went live in October 2024. At end of March 2025, MNOs had accessed a further 3 sites with 1 site in build. We expect the second TNS mast located in Islay to go live in September 2025.

Operational objectives to support our delivery

Objective 3: Make BDUK a great place to work, inspiring and empowering our people to perform at their best

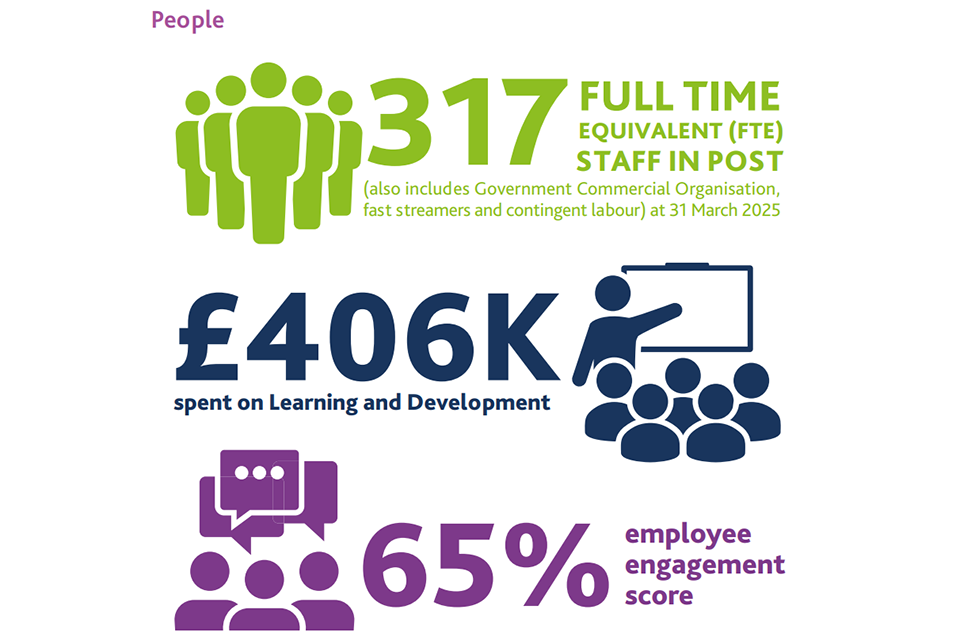

3.1 We will strengthen our capability and capacity by developing our workforce by developing our workforce to ensure we have the right people in the right roles, at the right time, and retaining existing expertise through better employee engagement and a commitment to the wellbeing of staff.

| 2024 to 2025 Measure | Result |

|---|---|

| Improve our employee engagement (as tracked in the annual Civil Service People Survey) from 68% in 2023 | Not Achieved |

| Improve our learning and development theme score (as tracked in the annual Civil Service People Survey) from 65% in 2023. Launch a new talent and leadership programme, and enable all staff to undertake training in line with a personal learning and development plan. | Partially Achieved |

| Implement changes to our organisational structure and processes to optimise delivery as our programmes enter new phases. | Achieved |

Summary of performance

Our employee engagement score in the annual Civil Service People Survey dropped from 68% to 65% in 2024 to 2025. The last three years have seen unrelenting change for BDUK as we transitioned to operating as an executive agency under DSIT Sponsorship from DCMS whilst continuing to deliver our programmes. Although our target to improve this score was not achieved, our score compares favourably to the Civil Service benchmark figure of 64%.

Our learning and development theme score in the Civil Service People Survey also dropped, reducing from 65% to 59%. Although this also sits above the Civil Service benchmark figure of 56%, the target to improve this score was not achieved. A High Performance Leadership programme was launched in February 2024, with its first cohort completing the training in August the same year. A new talent and development programme for middle management was launched in June 2025 and a target has been set for BDUK to build a talent pipeline in 2025-2026.

Implementation of changes with a focus on supporting processes to optimise programme delivery was carried out though the 2024-2025 period, including changes to team structures. This is ongoing and we continue to scope opportunities for digitisation and automation to support efficient working.

3.2 We will strengthen our commitment to develop a positive culture, with clear values to support respect, diversity and inclusion.

| 2024 to 2025 Measure | Result |

|---|---|

| Improve our inclusion and fair treatment theme score (as tracked in the annual Civil Service People Survey) from 84% in 2023 | Not Achieved |

| Implement a new diversity and inclusion strategy, publish gender pay gap reporting for the first time and improve in areas of low representation. | Achieved |

Summary of performance

In the 2024 Civil Service People Survey, we saw a percentage decrease in the inclusion and fair treatment theme score to 81% from 84% the previous year, meaning that our target to improve this score was not achieved.

We re-launched an updated diversity and inclusion strategy in January 2025, with the aim to build a collaborative culture that promotes diversity and inclusion and to retain a diverse range of people. The strategy includes specific actions that sit under core ‘pillars’ of diversity, inclusion and data. We have will continue to implement the actions within the strategy.

In July 2024, The Civil Service gender pay gap statistics were published, with BDUK’s figures separated from those of our sponsor department for the first time[footnote 26]. Our mean and median gender pay gaps (5.6% and 5.9%) both sit below the overall Civil Service averages (mean 7.4%, median 8.5%) – whilst this is positive, we will continue to work to address any difference in pay between genders. We also saw improvement in some areas of low representation with a small increase in the percentage of women in senior grades. In 2024 48.2% of those at SCS level were women compared to 47.9% in 2023 and of those with a known ethnicity, the percentage who are from an ethnic minority background reached a record high of 16.6%.

Objective 4: Provide excellent financial management, supported by strong governance and risk frameworks

4.1 We will plan and manage resource and capital expenditure to ensure that our spending is efficient and protects value for money for taxpayers.

| 2024 to 2025 Measure | Result |

|---|---|

| Operate within delegated funding limits and in line with DSIT requirements. In doing so, develop robust medium-term financial plans, which accord with government standards regarding regularity, propriety, feasibility and value for money. | Achieved |

| Continuously review supplier cost data through all stages of our interventions to ensure it is in line with the agreed funding envelope and providing value. | Achieved |

| Pay 90% of undisputed and valid invoices within 5 days and 100% within 30 days, in accordance with government prompt payment guidelines. | Not Achieved |

Summary of performance

We stayed within our Delegated Expenditure Limits (DEL) in 2024 to 2025, meeting our objective. BDUK has operated across the year within its delegated funding limits, retaining accurate and realistic forecasts. Our medium-term financial plan is currently being reviewed following the outcome of the government’s 2025 Spending Review.

Table 9: BDUK Resource funding

Resource DEL

| (£ million) | 2024 to 2025 Budget | 2024 to 2025 Supplementary Estimates | 2024 to 2025 Outturn | Variance to Supplementary Estimates | Percentage Variance |

|---|---|---|---|---|---|

| Programme resource | 47.8 | 49.9 | 45.7 | -4.2 | -8.4% |

| Total resource DEL | 47.8 | 49.9 | 45.7 | -4.2 | -8.4% |

Table 10: BDUK Capital funding by programme

Capital DEL

| (£ million) | 2024 to 2025 Budget | 2024 to 2025 Supplementary Estimates | 2024 to 2025 Outturn | Variance to Supplementary Estimates | Percentage Variance |

|---|---|---|---|---|---|

| Superfast | 7.0 | 1.9 | 1.2 | -0.7 | -36.8% |

| Project Gigabit | 461.8 | 303.1 | 278.7 | -24.4 | -8.1% |

| Shared Rural Network | 87.1 | 45.0 | 30.6 | -14.4 | -32.0% |

| Total capital DEL | 555.9 | 350.0 | 310.5 | -39.5 | -11.3% |

Notes to tables:

-

2024 to 2025 Budget figures are based on SR21 and were included in the Corporate Plan 2023 to 2026

-

2024 to 2025 Supplementary Estimates figures are based on the Supplementary Estimates revision during the year

-

2024 to 2025 Outturn figures are based on actual spend and subject to change following the NAO audit.

-

Variance is based on difference between Supplementary Estimates and Outturn

-

Figures include capital budget transfers to other government departments

Supplementary Estimates

Our budget was revised at Supplementary Estimates[footnote 27] which reduced our capital budget from £555.9 million to £350.0 million. We transferred £41.5 million capital to other government departments to deliver BDUK priorities, including: £4.1 million to the Department for Education to deliver GigaHubs in schools; £17.9 million to the Northern Irish Government and £2.7m to the Scottish Government to deliver Superfast Extension premises; and £16.8 million of capital to the Home Office to fund Shared Rural Network delivery. A total of £205.9 million capital was also released to HM Treasury as this was not required for BDUK delivery in 2024 to 2025.

Our resource budget increased from £47.8 million to £49.9 million. £2.7 million was transferred to the Home Office to delivery Shared Rural Network priorities. An additional £1.3m of budget was delegated to BDUK at Supplementary Estimates for amortisation and to cover DSIT-funded priorities within BDUK and £0.8m RDEL for one-off transition costs.

Resource spending

RDEL spend was £4.2 million below budget. Primarily savings came from reduced business expenses, such as travel and subsistence, reducing our usage of third-party professional services and consultancy costs and lower IT costs resulting from budget underspends and deferred initiatives. Supplier and market challenges contributed to a rise in bad debt write-offs.

Capital spending

Capital spend was £39.5 million below budget, primarily due to reprofiling Project Gigabit procurements to adapt to increased commercial coverage. The surplus funding was released at the earliest opportunity to HM Treasury to be used elsewhere across government. Our forecasting accuracy has increased significantly over the 2024 to 2025 financial year, with our final outturn representing less than 3% variance from our capital forecast at the mid-year point (11% from the Supplementary Estimates budget).

Performance of other financial measures

We achieved our objective to continuously review supplier cost data. We do this as part of our ongoing business operations, carrying out checks to ensure value is maintained from the point of contract signature and any risk to value attrition is mitigated by challenging supplier on cost and commercial assumptions where appropriate. Changes in contracts are reviewed against existing baseline metrics in the contract and the should cost model to mitigate risk of value attrition. Actual costs submitted in monthly reports by suppliers are checked at invoice level (with a material sample) and any costs not found eligible are rejected. Final true ups at the end of the build phase also will ensure that only eligible costs are claimed by the supplier and any underspend can be clawed back.

To ensure that BDUK is able to track delivery and forecast against agreed funding in greater detail, new processes to track supplier performance were implemented in 2024 to 2025. Whilst this resulted in outturn with low variation across Project Gigabit, we seek to improve upon variations within Project Gigabit contracts in 2025 to 2026.

In accordance with government prompt payment guidelines, we aim to pay 90% of undisputed and valid invoices within five days and 100% within 30 days. In the year ended 31 March 2025, we paid 76% of invoices within five days and 98% within 30 days (annual average rate). Our rates are below our target, but we are working within the business to address issues wherever possible to improve our performance.

4.2 We will build on solid foundations to continuously improve governance and compliance and risk management, embedding best practice across the organisation.

| 2024 to 2025 Measure | Result |

|---|---|

| Ensure effective counter fraud controls are in place and tested for Gigabit contracts. | Partially Achieved |

| Continuously improve our risk management approach, with a focus on ensuring decisions are made consistently in line with risk appetite. | Achieved |

| Develop and implement a clear approach to assurance (including subsidy control) for ‘in life’ delivery of Project Gigabit and Shared Rural Network (SRN). | Achieved |

Summary of performance

A proposal outlining fraud measurement and ongoing engagement in fraud controls for Project Gigabit contracts has been developed, building on our learnings from the established measures in place for the vouchers scheme. This fraud and error process will develop a more accurate and tailored fraud and error figure and monitor any changes as the scheme matures. Cross-functional engagement is ongoing to finalise this methodology.

BDUK has implemented the 2024 Risk Development Plan, delivering improvements across risk identification, monitoring and reporting and embedding enhancements to reporting and our central risk management tool. We have a refreshed Risk Maturity Plan for 2025, identifying aims informed by independent assessment and Risk Centre of Excellence tools. BDUK is now well established with the Risk Centre of Excellence and GIAA as a risk mature organisation, and we are regularly connected with colleagues in organisations keen to learn from our approach.

We have also implemented a new assurance checkpoint for Project Gigabit in-life that strengthens cross-functional alignment at key decision points. This proportionate approach is informed by BDUK’s risk appetite, ensuring assurance involvement is a targeted step in the contract change control process. The updated process is currently in implementation. Has been utilised effectively during the year and will be reviewed again for further improvement in 2025 to 2026

In SRN we have strengthened assurance around Grant Claims processes and refined our approach to evaluating sites for build based on value for money and delivery of benefits.

4.3 We will build trust through providing strong service levels and transparent reporting.

| 2024 to 2025 Measure | Result | |

|---|---|---|

| Develop a new approach for reporting our progress by publishing official statistics on a regular basis, providing transparency and insight for the general public. | Not Achieved | |

| Respond to 90% of ministerial correspondence within 20 working days, and complaints within 20 working days, in line with our complaints procedure. | Partially Achieved |

Summary of performance

In 2024 to 2025 we published delivery data as part of the annual Performance Report with a statement of voluntary compliance with the Code of Practice for Statistics. The target was not met due to the prioritisation of the release of the premises-level contract data (Premises in BDUK plans), which was released as management information, due to a perceived public interest in greater transparency of where the programme is headed rather than where it has been. This data has been used by industry commentators to provide insights on gigabit build progress in the UK. It has also been used by individuals interested in whether Project Gigabit will deliver to their home or business. Official statistics focused on where BDUK has already delivered were published in July 2025 and will be published quarterly thereafter.

BDUK does not control the system for processing ministerial correspondence; we work closely with our sponsor department to ensure that correspondence allocated to BDUK is responded to in a timely fashion. During the 2024 to 2025 reporting year, BDUK handled 210 pieces of ministerial correspondence, returning 70% of cases to DSIT within 16 days from the date of receipt to allow for responses to be processed by the department.

BDUK’s performance against meeting the 20-working day target for responding to ministerial correspondence is wrapped into DSIT’s overall figures. The most recent data published by the Cabinet Office relates to the period of 1 January to 31 December 2024. During this period, 44% of ministerial correspondence sent to DSIT was responded to within 20 working days. DSIT’s performance against correspondence improved from 2023-24, however significant investment in resource and digital tools has been undertaken to improve these figures further for 2025 to 2026. The performance figures for January to March 2025 will be published in 2026.

BDUK has autonomy over the system for handling complaints. During the 2024 to 2025 period we responded to ten complaints within 20 working days meeting our service level agreement.

Since our timeframe for responses to complaints met the target but the percentage of ministerial correspondence did not, this target has been partially achieved.

Objective 5: Develop practical digital solutions to support programme delivery and transform how we use data

5.1 We will develop, maintain and support digital and data services to strengthen operational delivery of our programmes.

| 2024 to 2025 Measure | Result |

|---|---|

| Complete delivery of the data backbone – a platform which aims to provide seamless access to reliable data across the organisation. This will enable consistent data-driven decision making. | Achieved |

| Develop technology solutions that address business requirements. This includes exploring the use of advanced artificial intelligence (AI) services to boost efficiency and support predictive modelling, and ongoing support for complex ingestion pipelines such as supplier financial models. | Partially Achieved |

| Enhance our data culture, encouraging an environment of ‘data first’ thinking and practice through the implementation of a coordinated strategy and workstreams. This includes educating staff on how to realise the benefits of the new data backbone platform and how to use it. | Achieved |

Summary of performance

In the previous year we began delivery of the BDUK Data Backbone project, aiming to establish coordinated and homogenised data as a service to the whole of BDUK. An opportunity to improve how data is stored, governed and used across the business, the work aimed to increase resilience against data losses, data corruption and security vulnerabilities. The Data Backbone has now been fully implemented and is being embedded with a focus on key benefit realisation as part of its benefits strategy.

Our Digital, Data and Technology (DDaT) team continues to deliver on priority digital solutions addressing BDUK’s requirements. Our digital portfolio has delivered tangible benefits. Optimisation efforts have generated over £2 million in savings across digital and data operations and halving our cloud carbon footprint. Further investment in AI and automation will enable us to achieve additional reductions in 2025-26.

A culture of ‘data-first’ thinking within BDUK remains a priority, ensuring that data becomes central to our decision-making processes. A new data strategy was approved in July 2024 and a new data ownership model adopted shortly after we continue to embed these. In March 2025 BDUK’s Data Board was relaunched with updated Terms of Reference focusing on data ownership and governance.

2.13 Corporate Performance

In our third year as an executive agency, we embedded our governance structure and processes, with a continued focus on ensuring appropriate workforce capability and capacity to support the delivery phase of our major programmes. The year ended 31 March 2025 has also been a year of change as we finalised elements of our transition from DCMS to DSIT, including changing HR systems.

People

Table 11: BDUK FTE levels

| At 31 March 2025 | |

|---|---|

| Full-time equivalent staff[footnote 28] | 317 |

Our People Survey results

The People Survey acts as a benchmark across government to track our employees’ experiences working at BDUK. Compared to the previous year, in 2024 the response rate decreased from 99% to 97%. Our overall engagement score decreased by three percentage points this year from 68% to 65% (1% higher than the Civil Service Benchmark). Our most improved score was in Pay and Benefits from 25% to 34% following a pay uplift for BDUK staff, however it remains our lowest scoring category. BDUK has experienced a third year of considerable change, and whist this is reflected by a drop in scores in most categories, figures for the most part remain similar or above equivalent scores for wider DSIT and the Civil Service.

Engagement with key stakeholders

It is important that we continue to have strong engagement with the public, parliament, local authorities, and suppliers.

We have continued to publish regular updates on the progress of our programmes. With the majority of our local and regional contracts in delivery, this year most of the contracts awarded were under our cross-regional framework which currently covers 18 areas around Great Britain. The dynamic nature of the market has also impacted delivery, resulting in a small number of contract terminations, however BDUK is working to put alternative plans in place where this is the case. New contract awards and updates to existing contracts have been marked through media announcements and social media content. We also continue to work closely with all contracted suppliers, supporting them with their external communications, including correspondence to residents and businesses, websites and digital tools, and community publicity.

We continued to meet and produce regular newsletters for local councils and partners and send bulletins to key stakeholders including colleagues in the devolved administrations and other government departments to keep them up to date with BDUK news and developments. BDUK also ran exhibition stands at key stakeholder conferences such as Connected Britain and Connected North, as well as supporting contracted suppliers with attendance at public-facing events.

Under the terms of the Shared Rural Network’s grant agreement, our delivery partner for the Shared Rural Network, Mova, is responsible for leading the engagement with stakeholders, keeping them abreast of its progress and facilitating the installation of new masts across Scotland. We support Mova with its engagement, which has included working with the John Muir Trust coalition and meeting with the Highland Council to discuss the programme.

To keep parliamentarians well informed of our progress, we held quarterly MP surgeries in Westminster where all MPs were invited to talk with BDUK officials about Project Gigabit and the Shared Rural Network in their constituency. These events continue to serve as a valuable forum, with an average of 25 MPs registered for each session.

We endeavour to respond to Freedom of Information (FOI) requests within the target of 20 working days. Our performance is measured and reported on by the Cabinet Office as part of DSIT’s performance. In 2024, DSIT responded to 81% of cases within the 20-day deadline. [footnote 29] There was no further breakdown to measure BDUK’s response rates.

2.14 Sustainable development report

We are committed to protect the environment and enable sustainable practices. The sub-sections below explain how we are doing this.

Sustainable procurements and social value

All procurements and contracts incorporate requirements in line with environmental, social and governance best practice in ethical sourcing.

All suppliers have included their commitment towards achieving Net Zero by 2050 and provided a Carbon Reduction Plan (CRP)[footnote 30], which is a mandatory requirement for high value contracts. Suppliers are also required to re-confirm compliance with these standards annually.

There are five social value criteria that were considered ahead of tender which also form requirements within each contract. Local authorities determined the relevant category(s) for their area to be weighted in for the procurement selection process. To note, some contracts contribute to more than one social value category. See table below for a summary of areas BDUK contracts are contributing towards.

Table 12: Social value proportion in Project Gigabit contracts

| Social value category | Contracts covering social value 2024 to 2025 |

|---|---|

| Covid-19 recovery | 2 |

| Tackling economic equality | 29 |

| Fighting climate change | 17 |

| Equal opportunity | 11 |

| Wellbeing | 12 |

For the SRN programme, the grant agreement with the MNOs has a requirement for annual social, economic and environmental reporting by the MNOs on matters such as management of supply chains; maintaining workplaces standards and promotion of skills and training; and consideration of environmental protection. As the TNS project in Scotland progresses there is increased focus on minimising environmental disbenefits, including by prioritising sites that can be connected to the electricity grid and have access to renewable energy sources, and are located away from areas of natural beauty.

Social value in focus: Project Gigabit investment supports skills and employment in Greater Manchester

Daniel Brown from Bolton, 34, is now thriving in a new role with Streetwise Traffic Management thanks to an Openreach training course enabled by investment through Project Gigabit.

Daniel was unsure of his next steps after losing his previous job due to ill health, but a jobs fair at Bolton Job Centre in February changed everything. He signed up for a five-week Sector-based Work Academy Programme (SWAP) delivered by Openreach.

The course, part of the wider investment in digital infrastructure under Project Gigabit, provided Daniel and others with vital training in roadworks, signing, lighting, and guarding - skills directly linked to the rollout of full fibre broadband across the UK.

“This job has changed my life,” said Daniel. “I’ve gained confidence, new qualifications, and a routine again. My mental health has improved, and I feel part of something with purpose.”

Supporting climate adaptation and environmental improvements

We completed our first climate risk assessment (adaptation for 2°C or 4°C scenarios) as part of our business case and spending review justifications in early 2025. As BDUK plays a temporary role (funding infrastructure with no ownership) we see climate risk responsibility predominantly with suppliers’, albeit of direct interest to us. We will continue to monitor climate risks over the duration of the programmes. The top three risks identified by the sector are: dependencies/cascading failures; flooding; and extreme weather.

Our work complements the prevention principles in the Environmental Principles Policy Statement. Where possible we inform and/or learn from suppliers best practice options and limitations as part of build, design and operation. This includes our environmental resource guide which had 301 unique page views this performance year. We are also refining how we monitor climate-related risks associated with our programmes and assessing what our priorities are and how we may action them in any future environmental sustainability strategy. We refreshed our environmental literature review to support additional work on evaluations.

We continue to review improvements in the services and delivery of our programmes with environmental and net zero benefits in mind. Some examples include:

Staff lunch and learn, including list of relevant sustainability and environmental development training:

-

GMPP quarterly reporting on environmental and social value aspects

-

Sharing learnings on climate risks and resilience of networks with DI policy, Go Science, includes input into National Adaptation Programme (NAP3) on telecoms risks and mitigations

-

Collaborating with Digital Connectivity Forum31 and Ofcom

-

Reviewing the initial data report on UK digital sector environmental impacts (commissioned by DCMS and DSIT)

-

Our latest gigabit vouchers evaluation found evidence that gigabit upgrades reduced carbon emissions by a net of 7,600 tonnes over three years due to decreases in travel to work times and energy usage in the workplace. This equates to approximately 0.14 tonnes per prem over the three years.

2.15 Sustainability disclosures [footnote 33]

BDUK occupies eight building estates across the UK, each hosted by other government departments or private landlords. We have an average of 317 staff and operate a hybrid working model, which means our portion of occupancy is relatively low. For example, our largest occupancy sites are in London (approximately 50 desks) and Manchester (approximately 24 desks). We have not disclosed other sites based on scale.