Building Digital UK annual report and accounts 2022 to 2023

Published 21 November 2023

1. Foreword from the BDUK Chair and Chief Executive

Building Digital UK became an executive agency on 1 April 2022. The publication of our first Annual Report and Accounts marks an important milestone for the organisation. This year, our focus has been on accelerating the current delivery of our two digital infrastructure programmes, Project Gigabit and the Shared Rural Network, while establishing a new governance structure and approach that will enable us to achieve our goals.

We exceeded our Project Gigabit delivery target for the year, passing 162,600 premises with gigabit-capable broadband. In total, we have now delivered gigabit connectivity to 929,700 premises in mostly hard-to-reach communities across the UK. We are proud of these figures, but it is seeing the difference that our work makes to people’s lives that highlights the importance of what we do. From enabling a small rural business to grow, to transforming education in village schools, we have seen the tangible impact our programmes are delivering for people across the country.

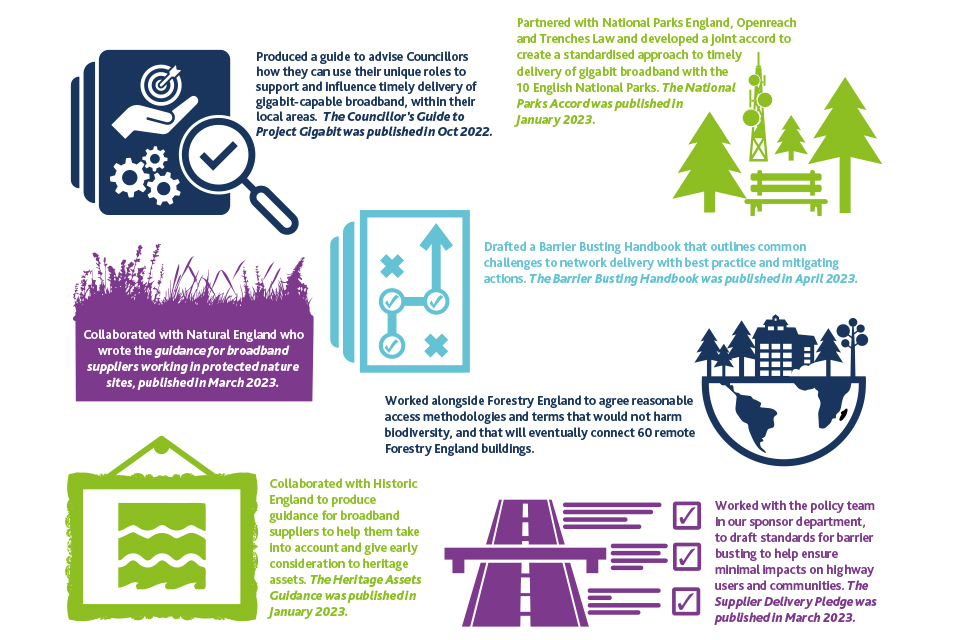

This year, we awarded our first local and regional contracts for Project Gigabit. These contracts will form the cornerstone of our delivery of nationwide gigabit broadband by 2030, targeting the remote and rural communities with poor broadband connectivity, and levelling up the UK’s digital infrastructure. The Prime Minister and Secretary of State announced our first contract in North Dorset in August 2022, and we signed a further seven during the year, supporting suppliers with almost a quarter of billion pounds of investment. We have also made excellent progress in laying the groundwork for future delivery, launching 19 new procurements in England this year, while working with the devolved administrations to survey and identify the areas we will need to reach in Wales, Scotland and Northern Ireland.

When it comes to our Shared Rural Network programme, this year the UK’s four mobile network operators have focused on upgrading and expanding their network of phone masts to reduce the ‘not-spots’ in 4G coverage that frustrate and hinder opportunities in rural locations. A key site sharing agreement was signed between the Home Office and mobile network operators; and this year also saw significant work on the first government-funded site, in Lockerbie, which was made available to the mobile network operators in February, and fully activated in April 2023 - a landmark achievement and the first of more masts planned over the coming years.

While we have made excellent progress, we cannot shy away from the challenges of operating in a dynamic marketplace. This year, we have begun to see how our programmes and partners can be affected by prevailing economic headwinds. To deliver, we must navigate wider macroeconomic, resource and financial challenges with our key stakeholders. Our work requires significant ongoing collaboration with local councils, devolved administrations and the private sector. Our relationships will be key as we work together to achieve many of our shared, ambitious objectives.

Looking inwards, our transition to an executive agency has enabled us to strengthen our governance and assurance frameworks. A new board of non-executive directors is in place, and it was pleasing to see our scores for Leadership and Managing Change in the 2022 People Survey increase by 10 percentage points. Overall, we saw positive trends in eight of the 10 areas reported. There is still room for improvement though, and we have put in place a new People Strategy to help us deliver our objective of making BDUK a great place to work for everyone.

This year we have been managing our transition to a new sponsor department, and we recognise that this will take some time. We have established productive relationships with new colleagues in the Department for Science, Innovation and Technology (DSIT), and we will continue to work closely with them, and other key stakeholders across the public and private sector, to transform the UK’s digital infrastructure.

We know the positive and transformational impact that fast, reliable connectivity can have on individuals, families and businesses. It can kickstart a local economy, bringing the best digital access as well as improved job and training prospects. It is this huge and lasting positive change that makes us so very proud to lead this organisation - we have already achieved much, but there is still so much more to do.

Simon P. Blagden CBE

BDUK Chair

Dean Creamer CBE

BDUK Chief Executive Officer

Friday 17 November 2023

2. Performance Report

2.1 About Building Digital UK

BDUK is an executive agency with a mission to ensure that homes and businesses across the UK can access fast and reliable digital connectivity. We are responsible for the rollout of gigabit-capable broadband and the expansion of mobile coverage in hard-to-reach areas of the UK.

During the year our sponsor department was the Department for Digital, Culture, Media and Sport (DCMS) and our reporting is consolidated in the DCMS Annual Report and Accounts. At the end of the year, we moved to a new sponsor department, the Department for Science, Innovation and Technology (DSIT).

We work closely with colleagues in the Digital Infrastructure directorate of our sponsor department to support the telecommunications sector, providing funding to improve digital connectivity in places that suppliers will not reach through their commercial plans alone.

BDUK is responsible for two major programmes:

- Project Gigabit: A £5 billion programme to deliver gigabit-capable broadband to homes and businesses across the UK. The programme will support the government’s target to ensure nationwide gigabit-capable broadband by 2030, making sure that people have the same access to fast and reliable connectivity wherever they live, work and study.

- Shared Rural Network: A £1 billion joint investment with industry, the Shared Rural Network brings mobile broadband to rural communities across the UK. Developed by the UK’s four mobile network operators[footnote 1] and government, the programme will deliver 4G coverage to 95% of the UK[footnote 2] by December 2025. The programme is making progress to meet this target, and further coverage improvements in hard-to-reach areas will continue to be delivered until the start of 2027, enabling rural businesses and communities to thrive.

We work with other government departments, regulators, the private sector and public bodies to deliver these programmes.

Project Gigabit and the Shared Rural Network support the government’s levelling up agenda to reduce regional inequalities. Our work to improve broadband and mobile coverage will help to bridge the digital divide and enable people across the UK to enjoy the advantages of cutting-edge connectivity for their families, businesses and communities.

Our programmes will level up largely rural and remote communities, transforming them into places where people have more confidence to settle, raise their families and start successful businesses. Improvements to digital infrastructure will create and support thousands of high-paid, high-skilled jobs, generate opportunities for innovators and wealth creators, provide greater access to online services, and improve people’s homelife with greater access to streaming services and the ability to stay connected with their loved ones.

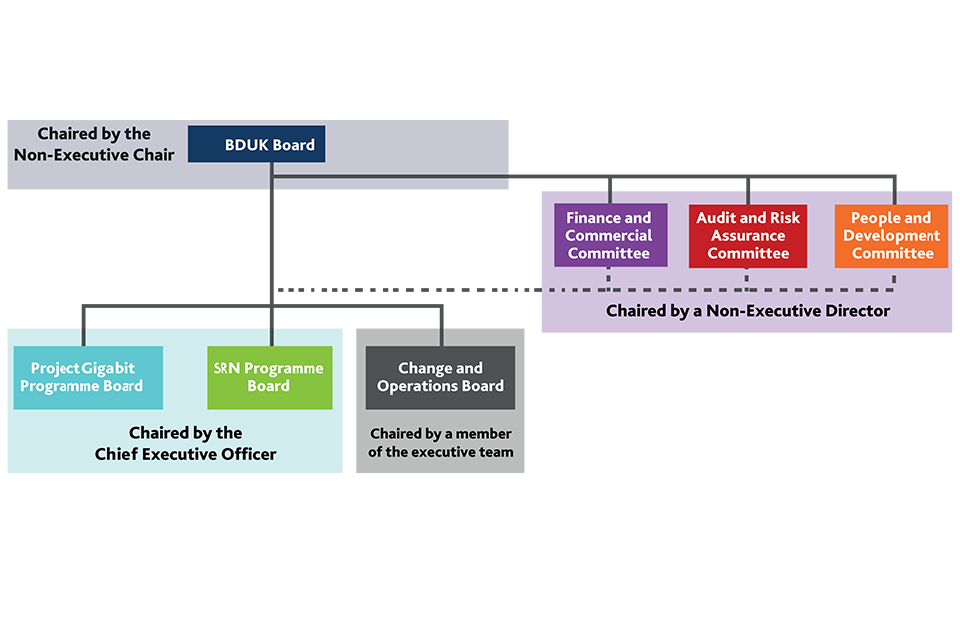

Our Chief Executive Officer (CEO) is both the Accounting Officer and the Senior Responsible Owner for our two major programmes. The CEO is held to account by the Secretary of State, Minister of State, and DSIT’s Principal Accounting Officer, and is advised and challenged on strategy, delivery and risk management by BDUK’s Board. As a part of the Government Major Projects Portfolio (GMPP), Project Gigabit is subject to regular scrutiny by the Infrastructure and Projects Authority (IPA). The Shared Rural Network is below the GMPP threshold but is subject to regular assurance from the sponsor department.

To achieve our goals, our work is underpinned by four core values: Embracing Challenges, Delivering Excellence, Working Together and Respecting Differences.

Challenges

While we will continue to push ahead to deliver our objectives and meet the government’s targets, we remain ever mindful of market challenges and economic headwinds.

The speed, scale and timing of Project Gigabit means BDUK is seeking to subsidise suppliers to build gigabit-capable infrastructure in hard-to-reach areas while suppliers’ own commercial build is constantly expanding and changing. To ensure we only subsidise build where it is needed, and so meet our obligation to secure value for money, we invest time and effort to carefully consider suppliers’ commercial build plans and then adjust our interventions as necessary. We are confident that by continuing to work closely with the market, we are putting ourselves in the best position to achieve our goals, while balancing the trade-off between pace and our obligation to secure value for money.

The key challenge facing the Shared Rural Network is the difficulty of locating sites in very rural and hard-to-reach areas. This can present problems in relation to acquisition (such as landowner agreements and gaining planning permission), access, power solutions, construction, and transmission. We work closely with our delivery partners to support in resolving these issues where possible. In addition, we work with the Home Office, Digital Mobile Spectrum Limited (DMSL)[footnote 3] and the mobile network operators to ensure appropriate commercial agreements are in place to deliver our objectives.

To deliver, both Project Gigabit and the Shared Rural Network, we must navigate wider macroeconomic, resource and financial challenges with our partners. The market remains dynamic, with changes to inflation, interest rates, supply and labour costs causing uncertainty for commercial and subsidised delivery. Higher costs of materials and resources will impact suppliers’ delivery while lower consumer appetite for more expensive connections and higher borrowing rates may dampen some investors’ enthusiasm for the digital infrastructure market. We will continue to anticipate future scenarios and develop contingencies to ensure successful digital delivery.

2.2 Performance overview and key achievements

This section provides a summary of BDUK’s performance between April 2022 and March 2023.

Project Gigabit

Project Gigabit in numbers[footnote 4]

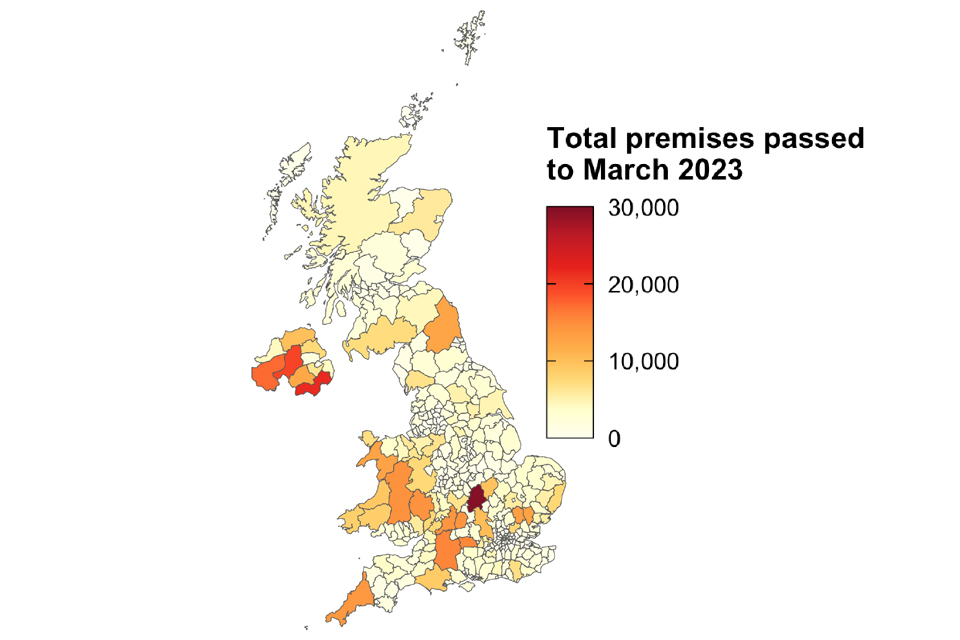

Project Gigabit premises passed map

Notes

- Map indicating the total number of premises passed by BDUK interventions in each local authority district area up to March 2023.

- Local authority district areas in London have been combined into a single unit, and the premises passed by BDUK have been summed.

Project Gigabit was launched in March 2021, building on successful legacy programmes such as the Superfast, Local Full Fibre Networks and Rural Gigabit Connectivity programmes. The government has committed £1.2 billion to Project Gigabit until the end of 2024 to 2025, out of a total budget of £5 billion over the lifetime of the programme.

Our interventions aim to deliver gigabit-capable connectivity to at least 1.56 million premises[footnote 5] across the UK in hard-to-reach areas by the end of 2025. Combined with suppliers’ commercial build, this will support the government’s target for 85% of UK premises to have access to gigabit-capable broadband by the end of 2025, and then nationwide coverage by the end of 2030.

During the year, three of our four interventions[footnote 6]: Superfast contracts, the Gigabit Broadband Voucher Scheme and GigaHubs, continued to provide coverage to more homes and businesses across the UK. The majority of our future delivery will come through large scale Gigabit contracts, the majority of which are in procurement. These contracts will typically take at least three years to provide coverage for tens of thousands of premises, and so we expect delivery to continue to build in the forthcoming years. Our latest Corporate Plan 2023 to 2026 includes more detail on our delivery profile up to December 2025.

We have achieved all of our objectives for Project Gigabit set out in our Corporate Plan 2022 to 2023. We signed our first contract in North Dorset on 25 August 2022, and a further seven during the year, from Cornwall to Cumbria and Northumberland. These contracts will see suppliers bring gigabit-capable broadband to up to 147,000 hard-to-reach homes and businesses, and represent an investment of up to £247.7 million. We also launched a further 19 procurements worth up to £953.1 million and relaunched the Gigabit Broadband Voucher Scheme with an increase in voucher value.

Our Corporate Plan 2022 to 2023 set the objective of meeting an initial milestone of passing at least 110,000 premises over the course of the year. Our minimum target trajectory - the minimum number of premises BDUK needs to pass to reach 1.56 million by the end of 2025 - suggested that we would need to reach 75,000 premises through our Superfast contracts and 35,000 through the vouchers scheme in 2022 to 2023. Our actual delivery has surpassed this milestone, as our interventions passed 162,600 premises (93,500 through Superfast and 69,000 through vouchers).

In 2021, BDUK was set the target of reaching 1.56 million hard-to-reach premises with gigabit-capable broadband. This figure was based on 5% of total UK premises as recognised in Ofcom’s April 2021 Connected Nations report. By March 2023, we had passed 929,700 premises with gigabit-capable connectivity through our interventions. This includes 865,400 that are part of Ofcom’s dataset, and a further 64,300 premises such as apartments in multiple dwelling units that are not included in Ofcom’s figures.

We updated our minimum target trajectory in our Corporate Plan 2023 to 2026.

Project Gigabit delivery

The table below shows our delivery in 2022 to 2023 saw a slight increase from that of 2021 to 2022, as Superfast contracts and vouchers continue to deliver in large numbers. We anticipate the scaling down of legacy programmes in 2023 to 2024, with our delivery ramping up again in 2024 to 2025 and beyond, as more Gigabit contracts are awarded.

Table 1: Premises passed against the Corporate Plan 2023 to 2026 minimum trajectory

| By end March 2021 | April 2021 to March 2022 | April 2022 to March 2023 | April 2023 to March 2024 | April 2024 to March 2025 | April 2025 to December 2025 | |

|---|---|---|---|---|---|---|

| Minimum target premises passed for BDUK interventions | 600,000 | 142,000 | 133,000 | 125,000 | 200,000 | 360,000 |

| Actual premises passed by BDUK interventions | 612,200 | 154,900 | 162,600 | |||

| Cumulative | ||||||

| Cumulative minimum target premises passed for BDUK interventions | 600,000 | 742,000 | 875,000 | 1,000,000 | 1,200,000 | 1,560,000 |

| Cumulative actual premises passed by BDUK interventions | 612,200 | 767,100 | 929,700 |

Source: BDUK Management Information as of August 2023

Delivery by intervention

Project Gigabit utilises four main interventions; Gigabit contracts, Superfast contracts, Gigabit Broadband Voucher Scheme and GigaHubs. The table below shows the contribution each of our interventions has made to deliver gigabit-capable coverage:

Table 2: Premises passed by intervention (rounded to nearest 100)

| Intervention approach | Premises passed by 31 March 2021 | Premises passed between April 2021 and March 2022 | Premises passed between April 2022 and March 2023 | Total |

|---|---|---|---|---|

| Superfast | 524,300 | 102,900 | 93,500 | 720,800 |

| Vouchers | 86,600 | 48,900 | 69,000 | 204,400 |

| Hubs* | 1,300 | 3,200 | <50 | 4,500 |

| Gigabit contracts (active from 2022-23)** | 0 | 0 | 0 | 0 |

| Total | 612,200 | 154,900 | 162,600 | 929,700 |

| Minimum target premises passed for BDUK interventions | 600,000 | 142,000 | 133,000 | 875,000 |

Notes:

*Hubs actual figures shown as <50 delivered.

**Gigabit contracts - A small number of premises were passed by suppliers delivering Gigabit contracts in 2022 to 2023 (fewer than 200). A portion of these are still subject to further governance and testing and will be reported as part of future performance reports.

Source: BDUK Management Information as of August 2023

Gigabit contracts

These interventions are subsidies in the form of large contracts, awarded to suppliers to build gigabit-capable infrastructure to premises not reached by their commercial build plans. We signed eight contracts in 2022 to 2023, with delivery beginning in earnest in 2023 to 2024.

Case study: Fibrus makes first connections in Staveley

In May 2023, broadband provider Fibrus announced that the first homes had been connected as part of the new £108 million gigabit-capable broadband scheme to improve connectivity in rural Cumbria.

Fibrus was awarded the Project Gigabit contract for Cumbria in November 2022, with a remit for the provision of full-fibre broadband to around 60,000 premises in the area. It took just six months for residents in Staveley to experience the benefits of the fastest broadband on the market thanks to new technology provided by Fibrus. All newly connected properties in Staveley are now using cutting edge technology which offers broadband speeds of up to 2Gbps.

(Left to right) Emma Gavin, Fibrus Senior Trading Manager, Maxine and Keith Brown, Libby Bateman, Fibrus External Stakeholder Manager (Image: Fibrus Broadband)

Superfast Contracts

We are also delivering through legacy contracts under the Superfast programme, either extended to deliver gigabit-capable infrastructure, or delivering this as part of the original contract. Through these contracts, 93,500 premises were passed across the UK in 2022 to 2023.

Case study: delivering for a remote island

The Isle of Jura, an Inner Hebrides island off the west coast of Scotland, is one of the UK’s most sparsely populated areas. Not only is Jura very hard to reach in geographic, logistical and commercial terms, it also presents a very challenging physical environment for engineers to build fibre infrastructure.

As of April 2023, a BDUK voucher-funded Openreach Fibre Community Partnership on Jura has made excellent progress, delivering more than 100 gigabit-capable connections. This was only made possible by investment from BDUK and the Scottish Government to build the underlying infrastructure, including submarine fibre cables that were deployed to Jura in 2014. This brought superfast broadband to around half of the island’s 217 premises, the first step in delivering full-fibre gigabit connectivity to an entire very remote rural island.

Gigabit Broadband Voucher Scheme

Vouchers are small grants which can be claimed by eligible residential and business customers in target areas to cover the additional costs of a supplier extending gigabit-capable infrastructure to their premises. We relaunched the scheme in December 2022, aligning eligibility for vouchers with our Gigabit contracts and increasing their value to £4,500 each, so that harder to reach premises were brought in scope. A total of 69,000 premises were passed through the voucher scheme in 2022 to 2023.

Case study: Gigabit Broadband Voucher Scheme in action: Elvington Scout Group

Elvington Scout Group, based near York, helps children and young adults reach their full potential, and develop skills including teamwork, time management, leadership, initiative and self-motivation.

Since April 2023, thanks to the Gigabit Broadband Voucher Scheme, the Scout group can now access a fast, reliable broadband connection. What’s more, independent internet service provider Fibre and Communication Technology Company (FACTCO) is providing the Scout Hut with two years of full-fibre broadband free of charge, with broadband speeds up to 30 times faster than before.

Cub Scout Erin McEwan-Wright, eight, is one of 85 scouts who benefit from the full-fibre connection. She said: “I use my iPad for Times Table Rockstars which helps me learn my times tables. I also use my laptop for playing horse games; the quicker the internet is, the quicker I can feed and groom my horses!”

Deputy Group Scout Leader Tracy McEwan says that having fast and reliable internet is vital for the Scout Hut and the Elvington community. She added: “With several badges dedicated to Scouts using the internet safely, managing cyberbullying, protecting themselves online and other tips and tricks, relying on quality internet is crucial. We also rely on the internet to download large files, such as videos, and not waiting for downloads saves us a lot of time.”

GigaHubs

GigaHubs are grants to connect local public services in hard-to-reach areas, such as schools, libraries, and GP surgeries. In 2022 to 2023 we limited the GigaHubs pipeline to existing projects only due to limited evidence on the effectiveness of this intervention relative to the Gigabit contracts now coming on line. Further details are included in the performance against our objectives section.

Case study: Blandford Library - connecting a community

Blandford Library in Dorset is a hub for the whole community, and much more than simply a place to borrow books. Already a valued and important local resource, it has been boosted still further with a gigabit-capable broadband connection made possible by Project Gigabit funding. In July 2022 we went to Blandford to find out more.

The library, sitting right at the heart of the community, hosts digital skills and computer basics courses, and provides computers and high speed wifi for public use. Its facilities prove incredibly popular. Improved connectivity at Blandford means the village now has a Digital Champions Programme, working to improve local digital skills. This in turn has made online services like booking doctors appointments or filling in job applications much more accessible for local people.

Before gigabit-capable broadband, systems at Blandford were slow and often dropped out or did not load at all. This would have a knock-on effect on the public computers, as users often had limited time to complete work and faced infuriating buffering issues.

Since the broadband upgrade, the library has been able to offer a range of digital services including a computer basics course. This course is delivered by the library’s Digital Champion and teaches the community online skills that are essential to keeping them connected online. It no longer takes half an hour to start up a computer and people are not limited by problems with technology.

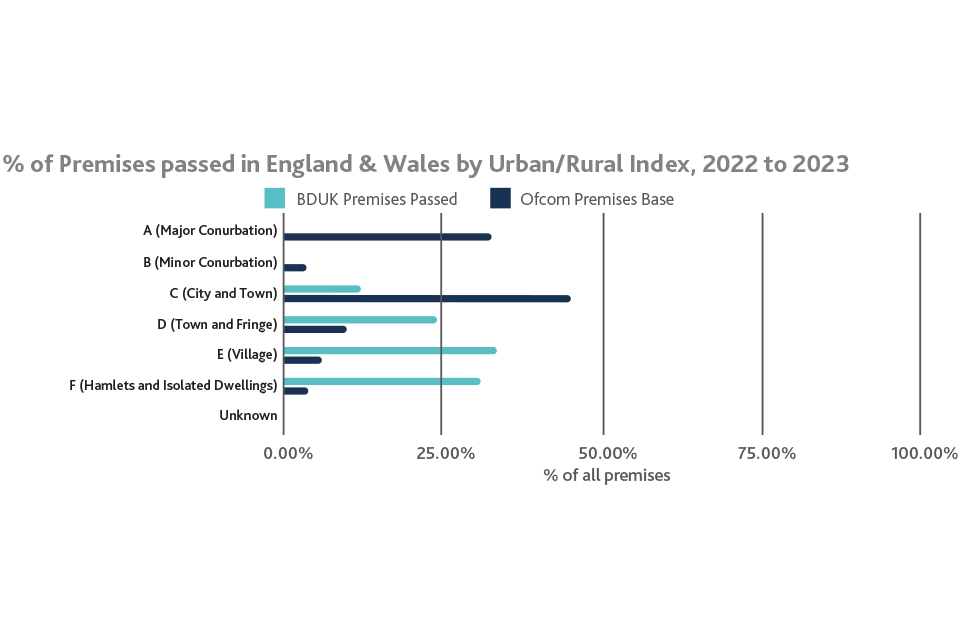

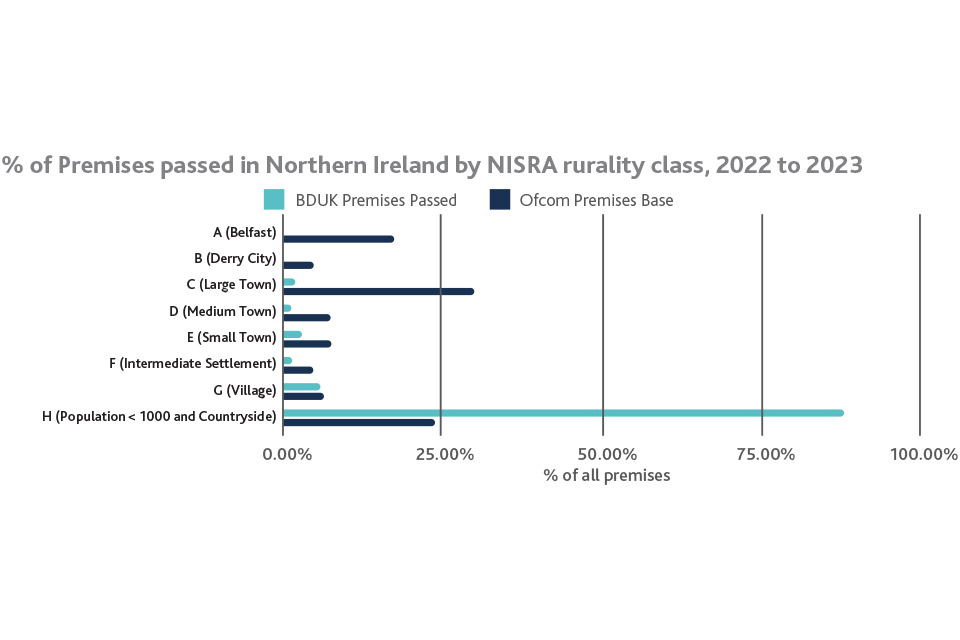

Rurality of our subsidies

Project Gigabit is central to rural livelihoods and rural growth, now and in the future. The programme delivers on the digital connectivity ambitions in the government’s Levelling Up white paper[footnote 7] and we work regularly with the Department for Environment, Food and Rural Affairs to support fair and equitable policy outcomes for rural areas[footnote 8] across England, as well as devolved administrations for rural policy in Northern Ireland, Scotland and Wales.

Project Gigabit’s initial contracts have been focussed on predominantly rural areas (for example in North Dorset and Cumbria), while our vouchers exclusively target rural premises outside of suppliers’ commercial build plans.

Between April 2022 and March 2023, we passed 146,000 rural premises through our interventions. This means 90% of premises benefiting from our subsidies were rural, compared to 23% of premises across the UK.

Table 3: Rural premises passed (rounded to nearest 100)

| Premises type | Premises passed by 31 March 2021 | Premises passed between April 2021 and March 2022 | Premises passed between April 2022 and March 2023 | Total premises passed to March 2023 |

|---|---|---|---|---|

| Rural premises | 451,600 | 134,700 | 146,000 | 732,300 |

| % of premises passed by BDUK in the period | 74% | 87% | 90% | 79% |

Source: BDUK Management Information as of August 2023

The proportion of our interventions used for rural premises has increased this year. Suppliers continued to build out Superfast contracts towards increasingly rural premises which made up a greater proportion of Project Gigabit’s overall delivery. The vouchers scheme is, by design, targeted at rural premises only.

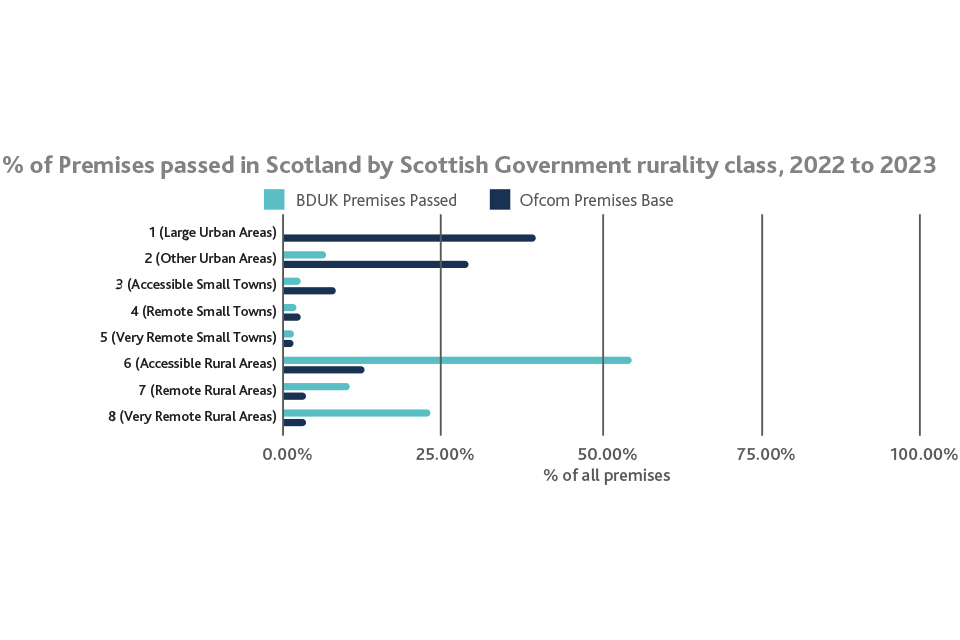

The distribution of interventions across rural areas in the UK in 2022 to 2023, against the proportion of premises in those areas, is available in the charts below. These charts show that while the largest proportion of UK premises are based in large towns and cities, we have predominantly provided coverage to premises in the more rural parts of the UK.

Rurality of premises passed by BDUK interventions across the nations between April 2023 and March 2023

Source: BDUK Management Information as of August 2023, Office for National Statistics (ONS), Northern Ireland Statistics and Research Agency (NISRA), Scottish Government

The government has identified that alternative options are likely to be required to provide connectivity to some Very Hard to Reach premises. The Digital Infrastructure team in DSIT calculate there to be approximately 100,000 rural and remote premises that will require an alternative intervention. In December 2022, the government launched an Alpha Trials programme to deploy Low Earth Orbit satellite infrastructure for broadband provision in Very Hard to Reach areas for the first time. We will continue to work with DSIT colleagues to ensure Very Hard to Reach premises are able to benefit from improved connectivity.

Project Gigabit across the Union

Northern Ireland remains the most connected part of the Union, with almost 91% of premises able to access a gigabit-capable connection by the end of March 2023. Meanwhile, 27,600 homes and businesses in Scotland and Wales received a gigabit-capable connection thanks to our voucher scheme, as well as the Scottish Government’s Reaching 100 (R100) programme and the Welsh Government’s Superfast Cymru programme continuing to roll out gigabit-capable infrastructure across the two nations. We are the lead organisation for delivering Project Gigabit contracts in England and Wales, while we work with the devolved administrations of Scotland and Northern Ireland, who manage procurements in their respective territories.

Table 4: Premises passed by nation and region (rounded to nearest 100)

| Nation / Region | Premises passed by 31 March 2021 | Premises passed between April 2021 and March 2022 | Premises passed between April 2022 and March 2023 | Total premises passed to March 2023 |

|---|---|---|---|---|

| All UK | 612,200 | 154,900 | 162,600 | 929,700 |

| Scotland | 32,900 | 6,700 | 18,200 | 57,800 |

| Wales | 84,400 | 13,400 | 9,400 | 107,300 |

| Northern Ireland | 32,600 | 32,600 | 40,400 | 105,600 |

| England | 462,300 | 102,200 | 94,500 | 659,000 |

| By region: | ||||

| North East | 11,600 | 4,200 | 4,000 | 19,800 |

| North West | 37,900 | 4,300 | 4,200 | 46,400 |

| Yorkshire and the Humber | 47,900 | 7,600 | 4,400 | 59,900 |

| East Midlands | 51,300 | 16,100 | 12,100 | 79,500 |

| West Midlands | 46,500 | 6,300 | 9,900 | 62,800 |

| East of England | 86,900 | 25,100 | 16,900 | 128,900 |

| London | 8,600 | 300 | 300 | 9,200 |

| South East | 92,500 | 24,600 | 22,400 | 139,400 |

| South West | 79,100 | 13,700 | 20,300 | 113,100 |

Source: BDUK Management Information as of August 2023

Sub-superfast premises passed

A core part of our strategy is to ensure that some of the premises with the poorest broadband connections are among the earliest to benefit from Project Gigabit. We have a specific spending objective to prioritise sub-superfast premises for gigabit-capable connectivity where practical. A significant proportion of our subsidies are therefore aimed at premises without access to a superfast connection (<30Mbps). In 2022 to 2023, 99,300 premises previously receiving speeds below 30 Mbps were passed by our interventions. The majority of these were delivered through our Superfast contracts, which specifically target premises with sub-superfast connections. We have also seen vouchers continue to have an impact in these areas.

Table 5: Sub-superfast premises passed by BDUK subsidies (rounded to nearest 100)

| Premises passed by 31 March 2021 | April 2021 to March 2022 | April 2022 to March 2023 | Total premises passed to March 2023 | |

|---|---|---|---|---|

| Premises passed by a BDUK subsidy that previously had a connection of <30 Mbps | 533,400 | 98,700 | 99,300 | 731,400 |

| % of premises passed by BDUK in the period | 87% | 64% | 61% | 79% |

Source: BDUK Management Information as of August 2023

Note: Download the data tables and definitions annex supporting Project Gigabit delivery data used in this report.

The Shared Rural Network

Shared Rural Network in numbers

Through the Shared Rural Network (SRN) programme, we are working with the UK’s four mobile network operators (MNOs) to upgrade existing masts, as well as building new masts to cover areas with no or partial mobile connectivity.

This programme will see MNOs collectively increase 4G mobile phone coverage throughout the UK, so 95% of the UK geography will have coverage from at least one operator by the end of 2025. The programme is making progress to meet this target, and further coverage improvements in hard-to-reach areas will continue to be delivered until the start of 2027.

The Shared Rural Network will help those who live and work in rural communities to achieve their full potential through improved mobile connectivity and increased 4G mobile coverage throughout the UK.

The programme is delivered in two parts:

-

Phase one - The first phase will see the four MNOs collectively invest over £532 million in a shared network of new and existing phone masts. This will help tackle Partial Not Spots, which are areas where there is currently coverage from at least one, but not all, mobile operators.

-

Phase two - The second phase, running in parallel, will see the government invest over £500 million to go even further to significantly reduce Total Not Spots, which are areas where there is currently no coverage from any mobile operator. As part of this government-funded element of the programme, there will be upgrades to Extended Area Service (EAS)[footnote 9] masts being built as part of the Home Office’s Emergency Services Network.

All the work undertaken as part of the programme is regulated by Ofcom, with regular reporting throughout the life of the programme to ensure agreed obligations and targets are met. We have worked with Ofcom and the MNOs to develop coverage obligations that reflect the government’s mobile coverage ambitions and the coverage outcomes of the programme.

MNOs will be incentivised to deliver through these legally binding obligations which carry a maximum fine of up to 10% of their annual turnover if they fail to comply. Compliance with these obligations will be assessed by Ofcom in 2024, by when each operator has committed to have reached 88% geographic coverage of the UK (Partial Not Spots), and 2027 when each operator has committed to have reached at least 90% geographic coverage of the UK (Total Not Spots). Progress towards these outcomes will be published in the regular Ofcom Connected Nations reports.

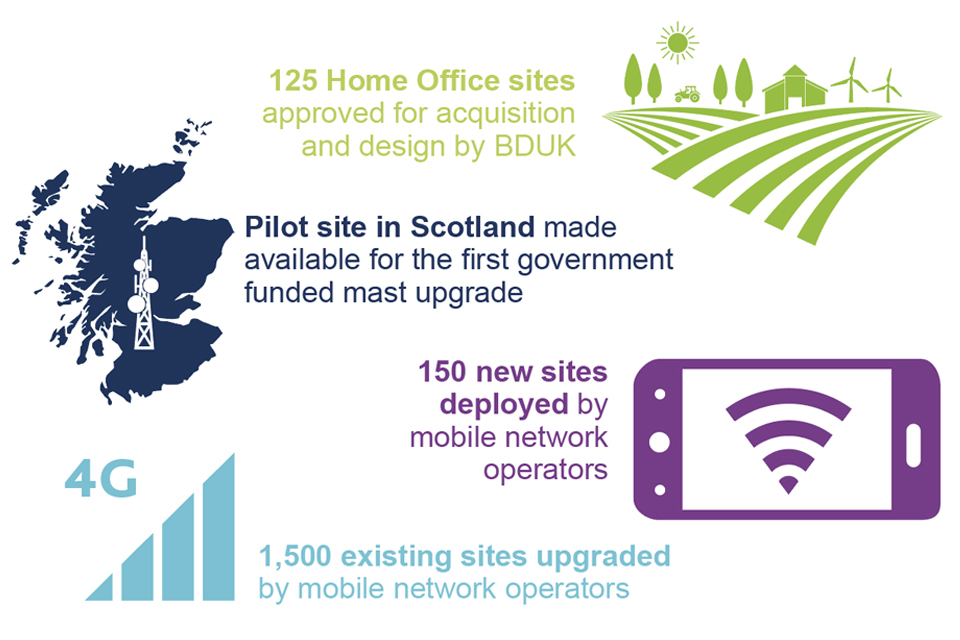

Extended Area Service (EAS) sites

This year, 125 EAS sites have been approved for acquisition and design, putting them on the path to be upgraded so that all four MNOs can use them. The Master Site Sharing Agreement between the Home Office and MNOs was signed in December 2022. Following this, the first pilot site in Lockerbie went live at the start of April 2023. This is the first fully activated 4G government funded site.

Two commercial site sharing agreements which would enable upgrades on some sites were delayed following advice from the Home Office from a delivery and commercial perspective. Both site share deals have been reprofiled and we are working to conclude agreements by the end of March 2024.

Total Not Spots delivery

We oversaw work conducted by the MNOs and DMSL that focussed on finalising contracts for the acquisition, design and build of sites under the programme.

A challenge has been that the transmission and off-grid power procurements failed due to non-compliant bids; accordingly the MNOs have reverted to a “direct award” approach with their existing transmission suppliers. DMSL and the MNOs are also revisiting their approach and strategy for off-grid power and are going to the market to seek more sustainable power solutions.

Table 6: Mobile coverage across the UK and nations, 2020 to 2023[footnote 10]

| January 2020 | January 2021 | January 2022 | January 2023 | |

|---|---|---|---|---|

| UK 4G landmass coverage | 91% | 91% | 92% | 92% |

| England 4G landmass coverage | 97% | 97% | 98% | 98% |

| Scotland 4G landmass coverage | 80% | 81% | 82% | 83% |

| Wales 4G landmass coverage | 89% | 90% | 90% | 91% |

| Northern Ireland 4G landmass coverage | 97% | 97% | 97% | 97% |

Investment in our programmes

The table below shows the capital spending on our products and programmes this year with a comparison to last year.

Table 7: BDUK capital spend by product

| £ million | 2021 to 2022 | 2022 to 2023 |

|---|---|---|

| Vouchers | 35.5 | 39.1 |

| Hubs | 7.8 | 0.9 |

| Superfast Extension | - | - |

| Gigabit contracts (incl. technology) | 4.6 | 3.0 |

| Total Project Gigabit spend | 47.9 | 43.0 |

| Shared Rural Network | - | 1.0 |

| Superfast | 3.6 | 1.4 |

| Legacy Programmes (LFFN / RGC)[footnote 11] | 21.8 | (1.4) |

| Total Capital spend | 73.3 | 44.0 |

Investment in Project Gigabit

Project Gigabit is a £5 billion programme, spending £43 million across all interventions in 2022 to 2023 - including our first payments to suppliers for design and build of our Gigabit contracts areas.

We have driven value for money in our Gigabit contracts this year, using the latest available supplier data to refine our intervention areas. This minimises the extent to which public money competes with commercial build plans, and can instead be focussed on the homes and businesses that need it most.

Listening to the market: Essex procurement

A key aspect of our approach with Project Gigabit is to work closely with the market to ensure public subsidy is only used where it is needed. An example of how we have adapted our plans as a result of this is our market engagement in Essex, which revealed significant planned commercial deployment of gigabit-capable broadband, leaving only a limited number of disparate premises eligible for subsidy. This was positive news because it meant that more premises would be connected without the need for public subsidy, but the market also showed limited interest in bidding for what would be smaller-sized procurements in these areas. Rather than take forward a gigabit procurement, we pursued alternative interventions such as the Gigabit Broadband Voucher Scheme.

Investment in the Shared Rural Network

The total investment in the Shared Rural Network will be £1 billion (£532 million from the four mobile network operators and £500 million from the Government). Grant funding of £1 million was provided in the year to 31 March 2023, in addition £3.2 million was made available to the Home Office.

All four nations stand to benefit from coverage uplifts in 4G thanks to the Shared Rural Network, with Scotland seeing the biggest improvements. Due to its challenging geography, Scotland currently has the lowest geographic coverage in the UK and for this reason around 75% of the government’s funding for the programme will be directed at improving coverage here. The Total Not Spots part of the programme attracts funding of £301 million, all of which will be spent in Scotland, to provide coverage in areas where there are currently no operators at all.

Risks

Our delivery plan is challenging, not least as we are operating in a dynamic market environment and our programmes can be affected by macroeconomic pressures.

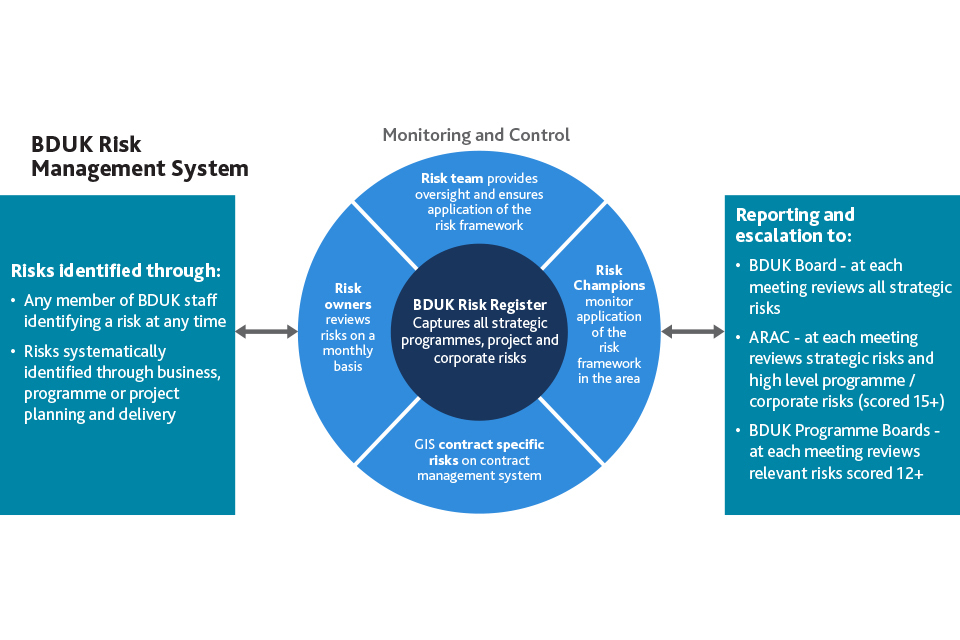

In 2022 to 2023, we built on the improvements we have made in risk maturity, enabling us to understand the risks we face and where we need to take action in the face of a changing risk profile.

We established an Audit and Risk Assurance Committee in line with appropriate guidelines, and a programme of internal audit has been delivered by the Government Internal Audit Agency (GIAA) acting as internal auditors. Both the GIAA and the National Audit Office (NAO) attend the BDUK Audit and Risk Assurance Committee. More information on risk management in BDUK is covered in the Accountability Report.

The principal strategic risks we face, and the steps we have taken to mitigate against them are included in the following table. These are based on both the risks we faced during 2022 to 2023 and those we have identified in our Corporate Plan 2023 to 2026.

Table 8: Strategic risks faced by BDUK with key mitigations

| Risk | Mitigations | |

|---|---|---|

| Project Gigabit supplier engagement and delivery: There is a risk that suppliers do not deliver within the timescales that are required because of insufficient market capacity, willingness or interest to enter into contract, or the possibility of supplier insolvency. This could result in missing delivery targets and reputational damage. | - We continued to use and further develop a multi-intervention strategy using various types of procurement and working with multiple suppliers. This made significant progress during the year. - We set-up our Gigabit contracts in order to ensure accountability for delivery is clear, and developed an approach to contract management which will work closely with suppliers and hold them to account. - We stress tested our delivery plans to ensure we were aware of areas for improvement. - We sought and implemented opportunities to accelerate the procurement pipeline, wherever possible, to ensure delivery to target. - We actively engaged suppliers through the Project Gigabit procurement and contract management processes. - We maintained up-to-date knowledge of market capacity and pinch-points, to target intervention accordingly. |

|

| Demand-led gigabit delivery: There is a risk that we miss demand-based delivery targets and activities because suppliers are slow to complete voucher-supported builds or there is a limited appetite for vouchers. | - We relaunched the vouchers scheme in December 2022 to enhance the offer for suppliers. This included increased voucher values and a new funding platform. - We increased structured encouragement and interaction with local communities to drive demand. |

|

| Shared Rural Network delivery: There is a risk that the Shared Rural Network fails to reach its 95% UK coverage target by 2025 due to the complexity of delivery. | - We continued and enhanced close partnership working with the mobile network operators to deliver clear plans for UK coverage. This included senior level engagement. - We worked with our partners to improve governance and assurance processes to manage a programme where delivery responsibility is across several organisations. |

|

| Macroeconomic pressures: There is a risk to BDUK delivery if our suppliers (either Project Gigabit or Shared Rural Network related) face challenges due to inflation, supply chains or the wider funding environment. This could impact on the ability of BDUK to deliver within agreed funding envelopes. | - We closely monitored supplier financial stability and delivery, and set up the mechanisms for doing so during Gigabit contract delivery. - We identified the need to work with partners across government to create the best possible conditions for success. - We used our multi-intervention and multi-supplier strategy to reduce the reliance on single routes to market. - We developed clear and proactive contingency plans to address supplier failure events. |

|

| Data: There is a risk of difficulties in the acquisition, processing and analysis of key and high quality data sets, leading to the information needed being slow to be available or of poor quality. This could result in poor or slow decision making due to an insufficient evidence base. | - We began a programme of work to implement improved data architecture. - We increased and maintained the number of suppliers using the national rolling Open Market Review, our mechanism for receiving data about gigabit build plans across the UK. - We built our data analysis capability to continue to improve the insight we get from data sources. |

|

| Planning and resources: There is a risk of not having the right resources in the right places to deliver objectives because of the continued pressure on public finances, ineffective planning processes, and difficulty in recruitment and retention. | - We continued to make the case to maintain BDUK’s funding position and investment needed to deliver. - We implemented a progressive and engaging People Strategy which addresses challenges around culture, skills and retention, and helps reduce staff turnover in order to maintain expertise and grow talent. - We maintained an integrated plan to ensure resources are aligned to priorities. - We were proactive in our use of ‘surge’ capacity if needed to ensure time- limited technical areas are addressed. |

2.3 Performance analysis

This section provides a detailed analysis of BDUK’s performance between April 2022 and March 2023.

Performance against BDUK’s Corporate Plan 2022 to 2023 objectives

This section sets out BDUK’s performance in 2022 to 2023 against the objectives and sub-objectives outlined in our Corporate Plan 2022 to 2023. The objectives support our mission to ensure that homes and businesses across the UK can access fast and reliable digital connectivity.

BDUK’s objectives for 2022 to 2023

Reporting against all objectives and measures in the Corporate Plan

In the Corporate Plan 2022 to 2023, sitting below our five key strategic objectives, we set out specific sub-objectives, measures and milestones to achieve. This is the framework we use to analyse our performance. Included below are our results and analysis.

Results key for the tables below:

-

Achieved (A) - BDUK has fully achieved the measure set out in its Corporate Plan 2022 to 2023

-

Partially Achieved (PA) - BDUK has made good progress towards achieving the measure set out in its Corporate Plan 2022 to 2023

-

Not Achieved (NA) - BDUK has not achieved the measure set out in its Corporate Plan 2022 to 2023

Objective 1: Deliver gigabit-capable connectivity to premises outside of commercial suppliers’ plans

1.1 BDUK will deliver at least 110,000 premises passed through its subsidies. Key stakeholders including suppliers, local bodies, and other government departments will be engaged and a challenging pipeline of procurements, hubs and vouchers projects developed and implemented.

| 2022 to 2023 Measure | Result | |

|---|---|---|

| Maintain a voucher, hubs, procurements and Superfast delivery pipeline. Launch and conclude procurements in line with our quarterly published pipelines to build future years’ delivery. |

Achieved |

|

| Ensure at least 110,000 premises are passed including: At least 75,000 premises passed with gigabit-capable connections using Superfast contracts. At least 35,000 premises passed using vouchers and hubs. |

Achieved | |

| Launch open market reviews to gather supplier data for all non-urban Phase 3 Intervention Areas in England and undertake Public Reviews with Wales and Scotland. | Achieved |

Summary of performance

162,600 premises were passed by the end of March 2023. Of these, 93,500 premises were passed through Superfast and 69,000 were passed through vouchers[footnote 12], exceeding the targets set out for each product in the Corporate Plan 2022 to 2023.

We launched 19 procurements this year, with quarterly updates published to keep key stakeholders informed. We surveyed the market, launching a rolling National Open Market Review which revealed that suppliers were going even further than previously anticipated in delivering their commercial build plans. This led us to change the timings of some procurements, and in some cases relaunch a small number of procurements, to protect public money from the risk of subsidising commercial build plans.

In the devolved administrations, we identified procurement areas in Wales, the first of which was finalised and launched in summer 2023 as part of our cross-regional procurement, while the final mapping and review of eligible premises is taking place in Scotland and Northern Ireland prior to procurements starting during the course of 2023 to 2024.

Public Reviews for all areas in England and Wales were completed by the end of 2022 to 2023. The Public Review for Wales was launched in April 2022 and completed in November 2022. In Scotland, the Public Review was conducted between March 2023 and April 2023. Our National Open Market Review continues to take place every four months.

1.2 BDUK will review and evaluate its products for efficiency and effectiveness.

| 2022 to 2023 Measure | Result | |

|---|---|---|

| Perform reviews on the effectiveness and value for money of hubs and vouchers, recommending ways BDUK can improve these schemes. | Achieved | |

| Launch the Project Gigabit evaluation programme to evaluate the long-term benefits of BDUK’s gigabit-capable build. | Achieved |

Summary of performance

We completed the first reviews for vouchers and hubs in Spring to Summer 2022, with their findings used to optimise these interventions. We agreed with relevant stakeholders to switch to annual reviews, meaning there was no requirement for a second review in 2022 to 2023.

This year we limited the Hubs pipeline to existing projects only due to limited evidence on the effectiveness of this intervention. We are committed to delivering our current projects, including schools projects in collaboration with the Department for Education, but we believe our alternative interventions will provide the most effective means to meet our strategic objectives in the future. We will continue to assess the situation, conduct further evaluation of Hubs, and adapt our strategy as needed.

We have put a project plan in place for the evaluation of Project Gigabit, and outlined its scope.

Objective 2: Improve mobile internet connectivity by delivering the Shared Rural Network programme

2.1 BDUK will work in collaboration with the Home Office on delivery of the upgrade of the Extended Area Services (EAS) sites, including completing any outstanding commercial agreements and procurements, supporting supplier engagement, and proactively working together to accelerate the upgrade of EAS sites through the BDUK Gateway approval process.

| 2022 to 2023 Measure | Result |

|---|---|

| Sign the Master Site Sharing Agreement (MSSA) between the Home Office and the MNOs. | Achieved |

| Oversee the completion of the Home Office’s transmission procurement.[footnote 13] | Achieved |

| Make the first EAS pilot site available to the MNOs for pilot deployment. | Achieved |

| Agree outstanding commercial agreements to enable the MNOs to deploy kit on EAS sites (and incorporate any necessary changes into the MSSA). | Not Achieved |

Summary of performance

The Extended Area Service (EAS) project focuses on upgrading masts used solely by the Home Office’s Emergency Services Network (ESN) to enable them to be used to deliver commercial mobile coverage too.

The Master Site Sharing Agreement , a framework within which the Home Office and all four mobile network operators (MNOs) will operate to deliver the project, was signed in December 2022. The Home Office’s procurement for transmission solutions was finalised in July 2022. Following this, the first pilot site in Lockerbie was made available to MNOs in February 2023, and the upgrade was completed at the start of April 2023. It is the first of more planned mast upgrades across Scotland, to improve 4G coverage in the local area, and give customers more choice.

Two site share agreements are outstanding and need to be completed so that upgrades can be enabled on Airwave sites and S4GI[footnote 14] sites. Following Home Office and commercial advice, these were reprofiled in the plan and new milestones have been set for completion by the end of March 2024 and included in our [Corporate Plan 2023 to 2026](https://www.gov.uk/government/publications/bduk-corporate-plan-2023-to-2026]. The delay is not currently impacting delivery timelines.

2.2 BDUK will provide oversight and challenge to Digital Mobile Spectrum Limited (DMSL) on their delivery of the Total Not Spots part of the programme, in order to progress procurements, procurement awards, and begin site acquisition.

| 2022 to 2023 Measure | Result |

|---|---|

| Oversee the Acquisition, Design and Build / Managed Solution procurement award and the finalisation of the underpinning contracts. | Achieved |

| Oversee the transmission and off-grid power procurement award and finalisation of the underpinning contracts. | Not Achieved |

| Oversee the start of formal radio site acquisition | Achieved |

Summary of performance

We oversaw work conducted by the MNOs and DMSL in their delivery of the Total Not Spots project. This work focussed on finalising underpinning contracts for Acquisition, Design and Build in June 2022, with the contract award notice published in July 2022, and the start of formal radio site acquisition which began in November 2022.

Unfortunately, the transmission and off-grid power procurements failed due to non-compliant bids. The MNOs have reverted to a “direct award” approach with their existing transmission suppliers. DMSL and the MNOs are also revisiting their approach and strategy for off-grid power and are going to the market to understand the availability of sustainable products (solar, wind, biofuels) that will be environmentally greener and mitigate against the costly use of their existing generator solutions.

Objective 3: Empower and inspire our people to perform at their best in a transformed BDUK

3.1 BDUK will strengthen its capability and capacity by recruiting roles into a Target Operating Model and retain existing expertise through better employee engagement and a commitment to the wellbeing of staff.

| 2022 to 2023 Measure | Result |

|---|---|

| Increase the number of people brought into roles from the Target Operating Model. | Achieved |

| Ensure employee engagement (as tracked in the annual Civil Service People Survey) improves in 2022 to 2023. | Not Achieved |

| Implement succession planning for critical roles and ensure BDUK staff have career pathways. | Achieved |

| Reduce turnover from 2021 to 2022 benchmark. | Not Achieved |

Summary of performance

We succeeded in increasing the number of roles we brought into our Target Operating Model. As at 31 March 2023, we had 304.7 civil servants, fast streamers, Government Commercial Organisation staff and contingent labour. Recruitment has been successful in attracting skilled people to fill critical roles and the use of surge resources has also been beneficial in short term technical areas. This is despite our staff turnover increasing from 16% to 22.2%, which follows trends also seen in the rest of government. We are working with our new sponsor department, DSIT, on addressing this, including through making our middle management grades more open for progression.

Our employee engagement score in our first year as an executive agency was 66%, as measured by the 2022 to 2023 Civil Service People Survey. This is one percentage point below the score received in 2021 to 2022, but still compares favourably with other departments, particularly given the downward trend of this metric across government[footnote 15]. Out of 105 organisations that partake in the survey, our 66% engagement score was in the top 40. Our response rate equated to 90% which featured in the top 10. Our other core People Survey metrics improved strongly and are detailed in the Corporate Performance section.

Succession and critical role planning discussions have taken place with the executive and senior leadership teams, and BDUK has continued to encourage staff to uptake professional training to help them manage career pathways. In the 2022 to 2023 People Survey, 85% of BDUK staff reported that they were able to access the right learning and development opportunities, up from 72% the previous year. A new approach to talent, focused on retention and upskilling existing staff, is being piloted in 2023 to 2024.

3.2 BDUK will strengthen its commitment to respect, fairness and diversity and inclusion.

| 2022 to 2023 Measure | Result |

|---|---|

| Offer work placements through the summer diversity and autism exchange programmes. | Achieved |

| Deliver training to improve the culture of BDUK. | Achieved |

| Successfully implement hybrid working. | Achieved |

Summary of performance

In Summer 2022, we took part in the Civil Service Summer Diversity Internship Programme. We were able to place an intern who worked in the Programme Management function with us for eight weeks.

Encouraging diversity: Summer Diversity Internship

During Summer 2022, we welcomed an intern to our Programme Management team. For eight weeks they were managed by one of our Product Managers, who first discussed the intern’s expectations from the role and then set the framework for the internship. As well as assigning experience in operations, the Product Manager focused on developing the intern’s skills and enlisted the help of colleagues across BDUK to help the intern understand how these skills could be transferable across different sectors of the civil service and into other industries. At the end of the internship, the Product Manager encouraged the intern to apply for civil service roles and gave feedback and tips on workplace behaviours and interview skills.

After analysing results from an abrasive behaviours, bullying, harassment and discrimination survey launched in Q4 2021 to 2022, we rolled out universal training to tackle workplace issues throughout 2022 to 2023, including training from the Advisory, Conciliation and Arbitration Service (ACAS). Feedback from this training indicates it has proven successful in improving BDUK’s culture, with our Inclusion and Fair Treatment scores in the 2022 to 2023 People Survey moving up from 83% in 2021 to 85% in 2022. We have committed to rolling this out to new joiners.

The majority of staff are working at least two days per week in one of our offices, with our HQ in Manchester and hubs in London, Cardiff, Darlington and Edinburgh.

3.3 BDUK will establish reporting systems for the new executive agency and set up the systems and processes it needs for operational autonomy, including:

-

Strengthened change governance, so change to the business is as efficient as possible.

-

Strengthen BDUK’s governance of continuous improvement activities.

| 2022 to 2023 Measure | Result |

|---|---|

| Finalise implementation of the financial accounting system for BDUK. | Achieved |

| Strengthen organisational capability by implementing a full Change Initiation Gateway framework. | Achieved |

| Undertake a review of the Target Operating Model. | Achieved |

Summary of performance

We delivered the new financial accounting system, and the BDUK Finance team is working closely with DCMS, DSIT and the NAO to ensure that we are exemplifying best practice and documenting key accounting policies and activities. The final audit of our new approach took place in Summer 2023.

We completed an annual review of our change management process, proposing changes to the terms of reference. Our governance for change and transformation now has a clearer delivery and financial control framework, allowing for better benefit realisation tracking. The changes have worked well and been received positively by our employees, with BDUK’s People Survey result for Leadership and Change seeing a 10 percentage point increase in 2022 to 2023, up to 63% from 53% the previous year. 52% of BDUK employees believe change is managed well within the organisation, up from 35% in the previous survey.

While a review of the Target Operating Model was undertaken this year, our move from DCMS to DSIT will impact the organisation and further work is ongoing to manage this change. Our Transformation and Change team is putting robust plans in place for a successful transition.

We are also developing our Target Operating Model through the lens of steady state delivery. As our major Project Gigabit intervention, Gigabit contracts, moves from procurement into management of contract delivery, our focus will need to adapt and our organisational design and functions will need to change.

Objective 4: Provide excellent financial management, supported by strong governance and risk frameworks

4.1 BDUK is an efficient organisation that protects value for money for taxpayers. We will plan and manage resource and capital expenditure to ensure that BDUK spend is within the funding available in 2022 to 2023.

We will deliver value for money through our subsidy contracts by challenging supplier data and claims, as well as interrogating pricing.

| 2022 to 2023 Measure | Result |

|---|---|

| Operate within delegated funding limits and in line with DCMS requirements. | Achieved |

| Carry out assurance assessments on all programmes. | Achieved |

Summary of performance

BDUK stayed within its delegated funding limits in 2022 to 2023. We spent less than we had previously expected in the 2021 Spending Review (SR21). The tables below show further detail on the variance between our budgeted spending and outturn.

Table 9: BDUK Resource funding

| (£ million) | 2022 to 2023 Budget | 2022 to 2023 Supplementary Estimates | 2022 to 2023 Outturn | Variance |

|---|---|---|---|---|

| Programme resource | 40.0 | 36.3 | 34.0 | (2.3) |

| Administration resource | 1.0 | - | - | - |

| Total resource DEL | 41.0 | 36.3 | 34.0 | (2.3) |

Table 10: BDUK Capital funding by programme

| (£ million) | 2022 to 2023 Budget | 2022 to 2023 Supplementary Estimates | 2022 to 2023 Outturn | Variance |

|---|---|---|---|---|

| Superfast | 7.0 | 4.3 | 1.4 | (2.9) |

| Project Gigabit | 157.3 | 48.5 | 43.0 | (5.5) |

| Shared Rural Network | 18.3 | 1.2 | 1.0 | (0.2) |

| Legacy Programmes | - | - | (1.4) | (1.4) |

| Total capital DEL | 182.6 | 54.0 | 44.0 | (10.0) |

Notes to tables:

- 2022 to 2023 Budget figures are based on SR21 and were included in the Corporate Plan 2022 to 2023

- 2022 to 2023 Supplementary Estimates figures are based on the Supplementary Estimates revision during the year

- 2022 to 2023 Outturn figures are based on actual spend

- Variance is based on difference between Supplementary Estimates and Outturn

Supplementary Estimates

At the time the 2022 to 2023 budget was published in the Corporate Plan 2022 to 2023 a capital underspend relative to SR21 was expected. However, with adjustments only viable at Supplementary Estimates[footnote 16] during the year, the SR21 budget was used. This budget was revised at Supplementary Estimates which reduced our capital budget from £183 million to £54 million. This included a return of funding to HM Treasury at Supplementary Estimates of £105 million as a result of our revised delivery profiles. Our resource budget was reduced from £41 million to £36 million.

Resource spending

We spent less on resources than budgeted due to a number of factors, including recruitment controls during the summer resulting in both delays to recruitment and increased attrition affecting the pay outturn. Non staff related underspends included a reduction in bad debt write-offs thanks to the quicker identification of debt and recovery of debts. There were also delays in the DCMS stages of the procurement process for contracts requiring less technical consultancy support, coupled with delays in Project Gigabit contract mobilisation. Further delays will be mitigated during the transition to DSIT.

Capital spending

Capital spend was lower than budgeted primarily due to reprofiling Project Gigabit procurements to adapt to increased commercial coverage. The original budgeted figures are based on the SR21 settlement, driven by our modelling of expected delivery at the time. The continued strong performance of the market meant that we decreased the size of the intervention areas for many procurements, and reprofiled the timings of others. In addition to this, launching our initial procurements in 2021 to 2022 later than planned had a knock on effect in 2022 to 2023, with the contract delivery only then beginning in the final quarter. As the majority of our spend is on subsidising build, and is paid only after suppliers begin work on delivering their contracts, BDUK has spent less than expected in 2022 to 2023.

BDUK’s delivery is also exposed to broader market risks. These include consolidation, the availability of capital, and - in the worst case - supplier failure. We regularly review these risks and model their uncertainty and impacts as part of our internal forecasting.

The lower than budgeted spend on the Shared Rural Network is due to revisions to the delivery profile from both DMSL and the Home Office respectively. At Supplementary Estimates, £3.2 million was transferred to the Home Office and therefore removed from budgets. The remaining £14.1 million was returned to HM Treasury at the same time, reflecting the intention to repurpose this funding into future years without impacting delivery of the programme.

We will work with delivery partners to assess Shared Rural Network forecasting assumptions in terms of stability and sensitivity, mindful of dependency on data from our partners and external risks. We have raised awareness of this through our Audit and Risk Assurance Committee and Internal Audit review for 2023 to 2024.

We continue to refresh our financial forecasts on a quarterly basis, and work with DSIT and HM Treasury to ensure our latest delivery forecasts stay fully costed.

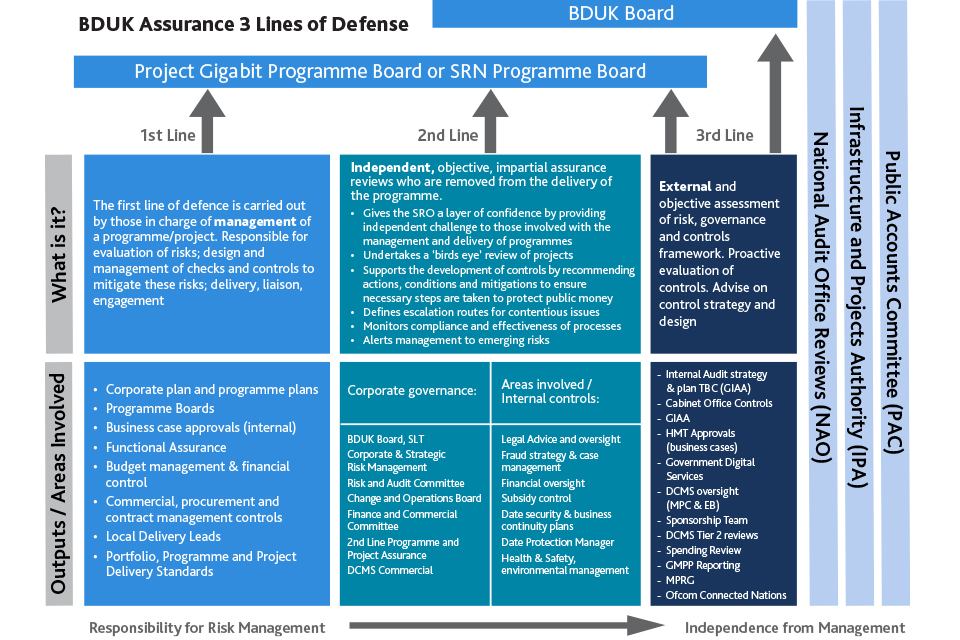

We have assessed our assurance practices, to make sure value for money stays at the core of our programmes. Further information about our assurance activities is included in the Accountability Report.

4.2 BDUK will develop, implement and continuously improve governance, embedding best practice across the organisation.

This includes legal compliance (such as subsidy control and counter fraud), as well as building a comprehensive, efficient and effective approach to the management of risk.

| 2022 to 2023 Measure | Result |

|---|---|

| Establish the BDUK Board, with full permanent membership, and the BDUK Audit and Risk Assurance Committee. | Achieved |

| Introduce and embed a refreshed risk management framework and counter-fraud strategy for BDUK. | Achieved |

| Review BDUK’s assurance and deliver an organisation-wide Integrated Assurance and Approvals Plan, including establishing a new internal audit function. | Achieved |

Summary of performance

The BDUK Board, Audit and Risk Assurance Committee, and Finance and Commercial Boards were all in place by the end of Q2 2022 to 2023, therefore establishing the non-executive led governance for BDUK as an executive agency. Full recruitment of non-executive directors is complete, with the new board formally taking up their positions from 1 January 2023. The new board has proved a valuable asset for BDUK, becoming fully involved with the strategic direction of BDUK and providing scrutiny and oversight to ensure BDUK is effectively managing risk.

We introduced an updated BDUK Risk Management Framework at the end of Q2 2022 to 2023. Several further updates to the framework were made throughout the year. Risk improvement work was validated by phase two of the Government Internal Audit Agency (GIAA) audit, which we received in April 2023.

Our Counter-Fraud Strategy was approved by the Chief Financial Officer, and a supporting action plan has now been developed. This demonstrated a step change in how BDUK considers fraud risk, and a shift in our focus from a narrow view on the BDUK vouchers product to a more holistic view across all areas of BDUK.

Internal Audit arrangements were put in place with GIAA, and new assurance processes have been implemented as a result of an assurance activities review. This was completed by the end of Q2 2022 to 2023. Further changes will be made as required on an ongoing basis. A BDUK-wide Integrated Assurance and Approvals Plan is in place and was developed in discussion with the Infrastructure and Projects Authority (IPA). This is now seen as complete, although our assurance work will always be in continuous improvement.

Further detail on governance and internal control is included in the Accountability Report.

Objective 5: Build practical digital solutions to solve BDUK’s delivery challenges

5.1 BDUK will create and / or deliver digital tools and platforms to strengthen operational delivery of our subsidies. This includes the development of our platform that allows for the collection, triage, and analysis of delivery data from suppliers. This supports decision making throughout the organisation, identifying potential Intervention Areas as well as opportunities to optimise the mix of subsidies.

| 2022 to 2023 Measure | Result |

|---|---|

| Develop the platform that allows for the efficient collection, triage, and analysis of delivery data from suppliers. | Achieved |

| Strengthen digital platforms to manage the processing of payments to suppliers. | Achieved |

Summary of performance

Delivery data

BDUK made substantial progress in supporting and enhancing Project Gigabit’s dataflows. By uploading complex documents into the storage cloud we have been able to analyse more information and improve our subsidy, budget and intervention analysis. We aim to continually improve this delivery to make it faster, more efficient, and better integrated with key business processes.

Alongside this, we collected and triaged new datasets from suppliers. Examples include top-up values for vouchers in Scotland, and further Ready for Service data for the entire voucher programme. This new delivery data further enhances BDUK’s understanding of voucher performance.

Our new data team is key to these activities. We have enhanced our data architecture to speed up and automate data analysis. This produces important outputs such as a view of all premises in the UK and their broadband status, and cross-subsidy comparison trackers to avoid instances of double subsidy. This work automates what would otherwise be lengthy manual data manipulation, bringing improved efficiency and reliability to inform BDUK’s decision making.

Funding platform

We developed, tested and launched a new funding platform to make it more efficient and straightforward for suppliers to claim and receive payments for delivery of voucher projects. Work was also underway to develop the platform to administer the Shared Rural Network grant.

The vouchers platform went live in December 2022. By the end of January 2023, 50 suppliers had been moved across to the new platform, with all suppliers following by the end of March 2023. In the same month, a comprehensive review of the funding platforms security configuration was completed to bolster platform security. Additionally, a robust architectural security review commenced in April 2023, ensuring the identification and mitigation of all potential security risks.

Access to the funding platform was temporarily suspended from 20 February 2022 until 27 February 2023 while essential maintenance work was undertaken. We suspended access after identification of an issue that required urgent resolution. The platform underwent extensive testing to mitigate the risk of future outages.

The funding platform to facilitate the administration of the Shared Rural Network grant went live in June 2023. This platform incorporates a four step process for reviewing and approving grant claims and will help ensure we meet the government’s aim to reduce the risk of error in grant management.

2.4 Corporate performance

BDUK became an executive agency on 1 April 2022, and in our first year as an arm’s length body we have transformed how we operate and put in place a new governance structure, including a new chair, board, and non-executive directors. In February 2023, our sponsor department changed from DCMS to DSIT as part of wider machinery of government changes.

We have managed this double transition with creativity and confidence. We have focused on building up our digital and data capabilities, in particular in improving the way BDUK ingests and analyses the data we receive from our nationwide market survey. We have also retained and built on our existing commercial and delivery focused talent base, with over a third of the organisation undertaking professional qualifications.

People

People in numbers

Across all grades and roles, our employees continue to show professionalism, efficiency and effectiveness in delivering our programmes, each playing a part in ensuring homes and businesses across the UK have access to great connectivity.

Table 11: BDUK FTE levels

| At 31 March 2023 | |

|---|---|

| Full Time Equivalent staff[footnote 17] | 304.7 |

While we are scaling up our programmes for delivery, we are also focused on building and retaining our talent base. To do this, we launched over 100 recruitment campaigns in 2022 to 2023 and spent £335,000 on learning and development for current employees.

The importance of data to our organisation is central. Effective and efficient data and technology processes allow us to offer better solutions for connecting premises, through harnessing the information collected through our market surveys to ensure we are building the right areas for our interventions. In 2022 to 2023, we created five new roles in the Digital, Data and Technology function to help us use our large datasets more efficiently and effectively. Increasing the capacity of the Digital, Data and Technology function also had the benefit of allowing us to relaunch our funding platform on time, making it easier and more secure for suppliers to access payments for our subsidies.

Our People Survey results

The People Survey, conducted in Q2 2022 to 2023, acts as a benchmark across government to track our employees’ experiences working at BDUK. Our overall engagement score fell by one percentage point this year, replicating a wider decrease in engagement across government. However, there were significant increases across almost every theme.

In particular, our most significant improvements were in the following areas:

Learning and development increased from 53% to 59%. This was largely driven by positive responses to employees being able to access the right learning and development opportunities, with employees also reporting that training undertaken in the 12 months prior to the survey has helped them to improve their performance. In 2022 to 2023, we invested £335,000 in learning and development across all functions.

Leadership and change increased from 53% to 60%. There was a significant increase in employees feeling that change was managed well within BDUK, with this result following the introduction of our new change management processes. The majority of our people now believe that changes made within BDUK are usually for the better.

Organisational objectives increased from 83% to 92%. Our people’s understanding of both our objectives, and how their work contributes towards them, rose significantly in this year. This follows our move to an executive agency and the publication of our first Corporate Plan, clearly setting out BDUK’s objectives in detail.

In 2022 to 2023, our People Survey scores fell in questions related to pay and benefits. The biggest decline was in employees thinking they were paid adequately to reflect their performance. This metric fell across the Civil Service and is largely outside of our immediate control.

Engagement with key stakeholders

Public

BDUK has made significant progress in keeping the public up to date with our programmes. This year, we awarded eight contracts to six suppliers, and have celebrated these through media announcements. We have worked closely with all contract suppliers, supporting them with their external communications, including letters and emails to residents and businesses, websites and digital tools, posters, fliers and community presentations.

We also produced quarterly newsletters for local councils and partners, held four virtual meetings with local councils and sent regular bulletins to key stakeholders including colleagues in the devolved administrations and other government departments, to keep them up to date with BDUK news and developments.

We endeavour to respond to Freedom of Information (FOI) requests within the target of 20 working days. Our performance is measured and reported on by the Cabinet Office, as part of DCMS’ performance. In 2022, DCMS responded to 69% of cases within the 20 day deadline. There was no further breakdown to measure BDUK’s response rates.

Our new communications strategy has also made the documents we produce more easily accessible and understandable for readers outside government and the digital infrastructure industry. We have continued to publish quarterly Project Gigabit progress updates, enhancing these with useful infographics as well as case studies to show how our delivery is benefitting people and communities across the UK.

Parliament and local authorities

BDUK gave evidence to the Public Accounts Committee twice during the year, in June 2022 and January 2023. Actions arising from these meetings have been completed, as set out in the Treasury Minute responses published in June 2023. The next update will show that reporting on plans beyond 2025 has also now been completed, as we set these out to the committee in a letter in November2023.

A Written Ministerial Statement is issued when we publish a Project Gigabit progress update. We proactively write to individual MPs at the point when we launch a procurement that will benefit their constituency, and again when we sign a contract. In 2022 to 2023, we hosted our first MP drop-in event in parliament, which we now offer on a quarterly basis. This has allowed MPs to raise their concerns for connectivity in their local areas, and provided a platform for us to proactively update MPs on the delivery of our programmes in their constituencies, and across the UK.

We aim to respond to correspondence from MPs and members of the public within 20 working days. We coordinate correspondence through our sponsor department; they are responsible for passing correspondence to us and supplying our responses to the relevant party. In the financial year 2022 to 2023, we received 198 items of ministerial correspondence (letters where a response was required and provided by a minister), answering 53% on time. We also received 130 items of treat official correspondence (an official replies), answering 74% on time.

Our sponsor department faced a number of challenges, including changes at ministerial level and additional work taken on during the year. This adversely affected our correspondence response rates but we are working closely with sponsorship colleagues and have developed our internal processes to improve our performance. We are moving in a positive direction by answering 88% of ministerial correspondence on time during the last quarter of the financial year.

We also regularly engage with local authorities across the UK, working with them to assist our understanding of where commercial build is unlikely to reach, as well as linking them up with our suppliers to assist in getting approvals for the necessary street works. Local and devolved administrations also work with BDUK to provide “top-ups” to our subsidies, helping them reach even further.

Suppliers

Suppliers are building the networks that we subsidise, alongside their extensive programme of commercial build plans. We hosted a “supplier day” in October 2022, providing information to suppliers about the benefits of and outlook for our contracts, and answering any questions they might have. We plan to offer these sessions on an ongoing basis.

BDUK is aligned with the government policy of building a competitive digital infrastructure market. In 2022 to 2023, we added 11 suppliers to sign up to our Dynamic Purchasing System - designed for smaller suppliers to access our local contracts, to give 20 suppliers in total on the system at the end of the year.

To improve oversight, we are also working on ways to further improve engagement with our suppliers, including our board reviewing supplier feedback.

2.5 Sustainable development report

We are committed to protect the environment and enable sustainable practices. The sub-sections below explain how we are doing this.

Greening Government Commitments 2021 to 2025

Our offices in Manchester and London are based within the DCMS estate, so we mirror the DCMS commitment to embed sustainability into our activities and work towards the Greening Government Commitments, reducing and improving the impact our operations have on the environment. This commitment includes reducing water consumption, greenhouse gas emissions and waste.

Our sustainability disclosures are included in tables further below. This information is either derived from the BDUK accounts (for cost of various items where BDUK pays directly for these) or apportioned costs from the DCMS accounts. For DCMS/BDUK locations, DCMS has provided measures for amounts used (e.g. distance/CO2 etc) and apportioned an appropriate percentage to BDUK.