HC349_GCA_Annual_Report_and_Accounts_2019-2020

Published 23 June 2020

Presented to Parliament pursuant to Section 14 and Paragraph 15 of Schedule 1 to the Groceries Code Adjudicator Act 2013.

Ordered by the House of Commons to be printed 23 June 2020

HC 349

© Crown copyright

ISBN 978-1-5286-1851-9

SECTION A: PERFORMANCE REPORT

1.Overview

This section of the annual report explains the role and purpose of the Groceries Code Adjudicator (GCA). The Performance Analysis sets out how the GCA has performed during the year against its statutory reporting requirements and strategic objectives, along with other significant activities.

1.1 Foreword from the Groceries Code Adjudicator

This is my final report after seven years in office and 10 years of the Groceries Supply Code of Practice (the Code).

I leave the GCA in the knowledge that by working with the sector, I have shifted the regulated retailers from practice-based compliance to enduring culture change, driving effective compliance risk management at all levels in every regulated business. This should ensure that breaches don’t happen and that if they do, they are quickly picked up and put right.

The feedback I get from suppliers, the survey results and the tone and scope of the conversations I have with the retailers themselves all underline how far we have come since June 2013. I am stepping down this year in the strong belief that I have achieved all that I set out to do when I took the job which some described as “an impossible task.”

I believe my success has come from the unique way I established of working with the retailers. I have taken a collaborative approach which should also be at the heart of healthy supplier – retailer relationships. I have had more than 300 meetings with retailers’ Code Compliance Officers (CCOs) over the past seven years to take up issues I was hearing from suppliers and ensure retailers were making progress in putting things right. I have also met the chairs of the retailers’ audit committees (or their equivalent) every year. I have many examples of my engagement with the audit chairs transforming a retailer’s approach to Code compliance.

My collaborative approach with the retailers I regulate is not a soft touch, quite the contrary. It enables tough, honest conversations and prompt remedial action. All the regulated retailers have supported my approach and have worked hard to achieve progress. In this way and by focusing on themes rather than individual cases, I have ensured retailers improve for the benefit of the widest possible supplier base.

It has been hard work getting the information I need from suppliers. Few contact the office with issues but they do talk to me if I go to them. Suppliers appreciate the work I do, they acknowledge and are grateful for the progress made but don’t seem to sense they have a role in helping everyone to get there! It means I need to go to where suppliers are, ask questions and read between the lines to learn what is happening. This is why the annual survey of suppliers which I started in 2014 has been so important in helping me to gather the information I need. The latest survey closed on 29 March, so this report covers both the 2019 and 2020 results.

The survey has been key to measuring progress and focusing retailers’ attention on the main issues. Retailers continue to support the survey with 70% of suppliers responding having heard about it from the retailers they supply: participation has grown over the years to a new record of over 1,600 responses in 2020.

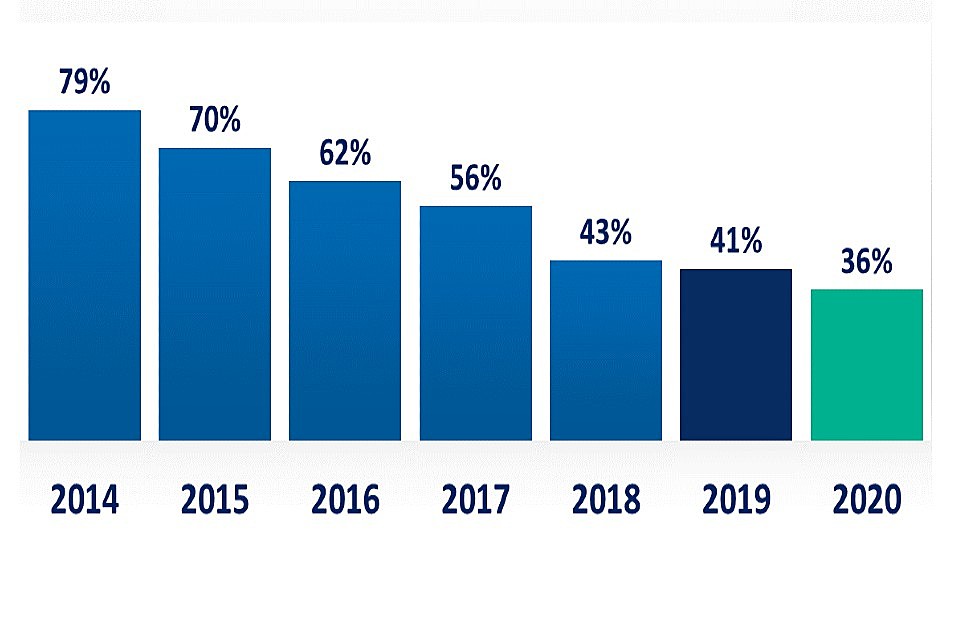

Both the 2019 and 2020 surveys continued to tell a very positive story. In 2020 36% of suppliers responding reported having experienced a Code-related issue in the last 12 months, down from an initial 79% in 2014. This percentage has fallen every year: it is a crude measure as each of those suppliers may have experienced many issues in 2014 and just one or two last year but I am pleased suppliers are still indicating progress by retailers overall during a period that includes first-time results for three additional retailers.

Graph showing that the number of issues reported by suppliers has dropped from 79% in 2014 to 35% in 2020.

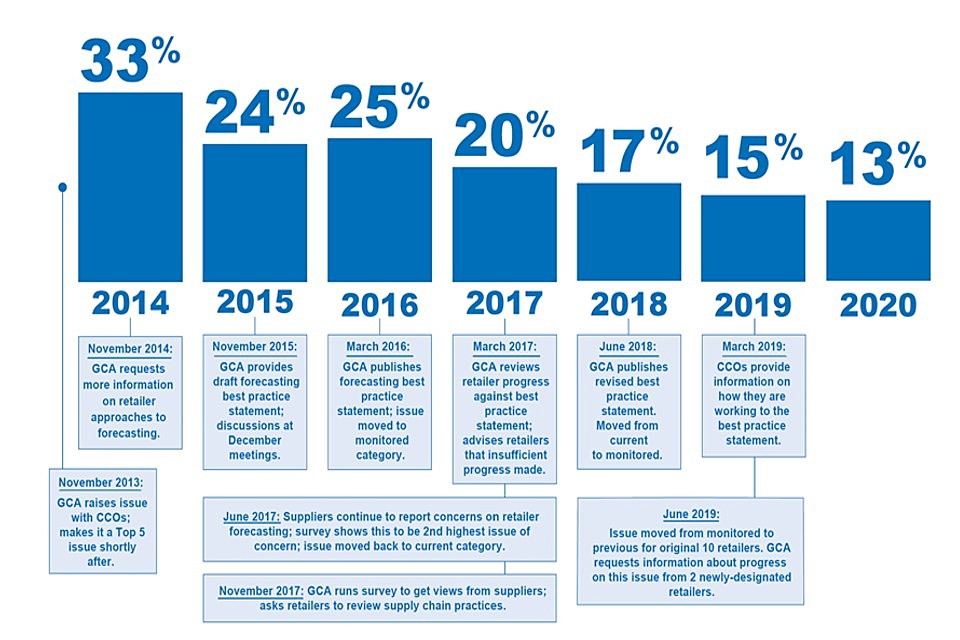

In both the 2019 and 2020 surveys, suppliers reported a decline in issues experienced in relation to every paragraph of the Code and there has been spectacular improvement since 2014 on every one of the Top Issues I have worked on with retailers.

Nine bar charts all showing a decrease in the number of reported issues by suppliers across a variety of Code paragrpahs.

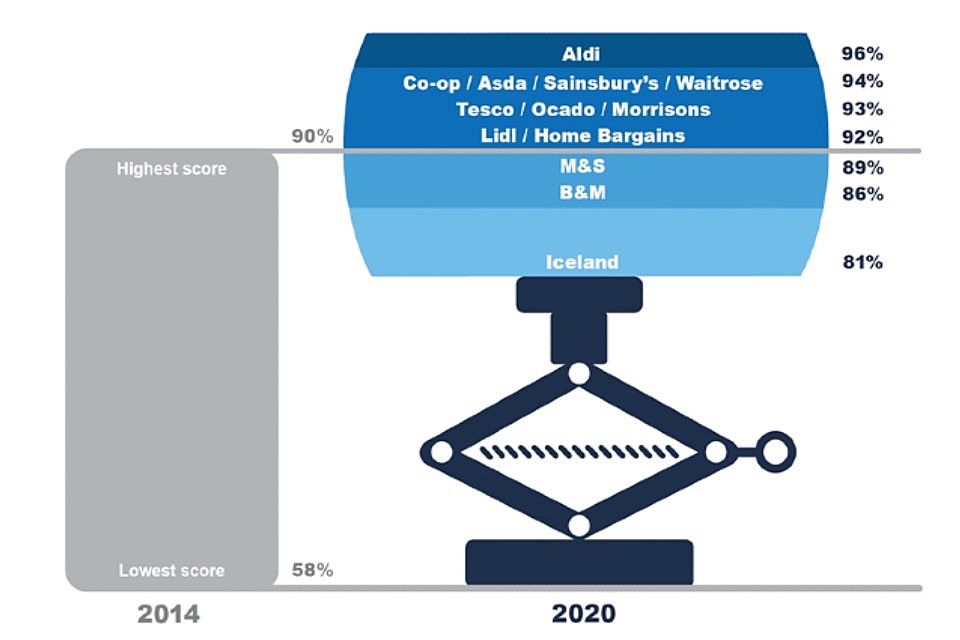

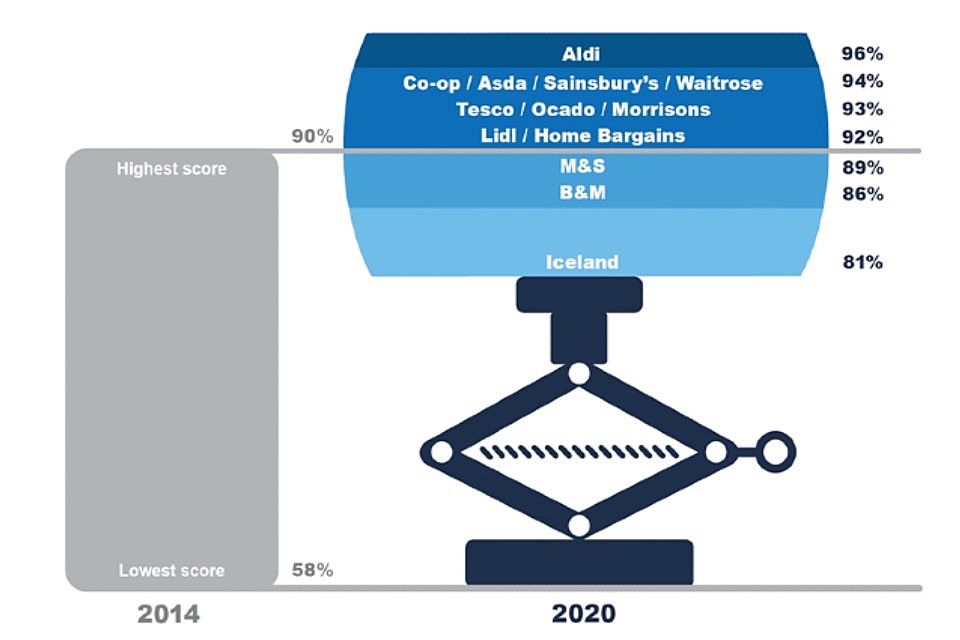

From the very first survey in 2014, suppliers have scored the retailers they supply based on their perceptions of those retailers’ overall Code compliance. The percentage reported as complying with the Code consistently well and mostly in 2014 ranged from 58% to 90%. Now it is extremely tight at the top. In 2020 only three of the 13 regulated retailers are below 90%, the best score in 2014: nine are between 94% and 92%. This squeezing of performance into significantly higher levels of compliance is testament to the effectiveness and impact of my collaborative approach. Aldi Stores Limited should be particularly congratulated for having held the top spot every year for seven years and the efforts to improve made by all retailers is clearly demonstrated in this graphic (below).

Chart showing how the retailer's compliance with the Code has improved since 2014.

Each retailer receives an individual report breaking down the survey information which is specific to them by sector and by issue so they can each take action on areas where they are concerned either that they are at risk of breaching the Code or are causing inefficiency to themselves or to suppliers. I am particularly pleased to report that it was the retailers that told me they wanted a survey in 2020, even though I was not going to be in post to prioritise or make progress on areas of concern. They want to know that suppliers are experiencing progress as well as using their specific results to point to areas where they may need to do more.

There have been several significant events over the past seven years in response to which I have intensified my engagement with a retailer. These have most often resulted in a case study where the reported Code breach is promptly and clearly accepted as having happened; is rectified across all affected suppliers, and processes are put in place to prevent any recurrence. Publishing the case study means that other retailers and suppliers can all learn promptly from it. I have also carried out two investigations and I acknowledge these have been game changers for securing better Code compliance across the sector.

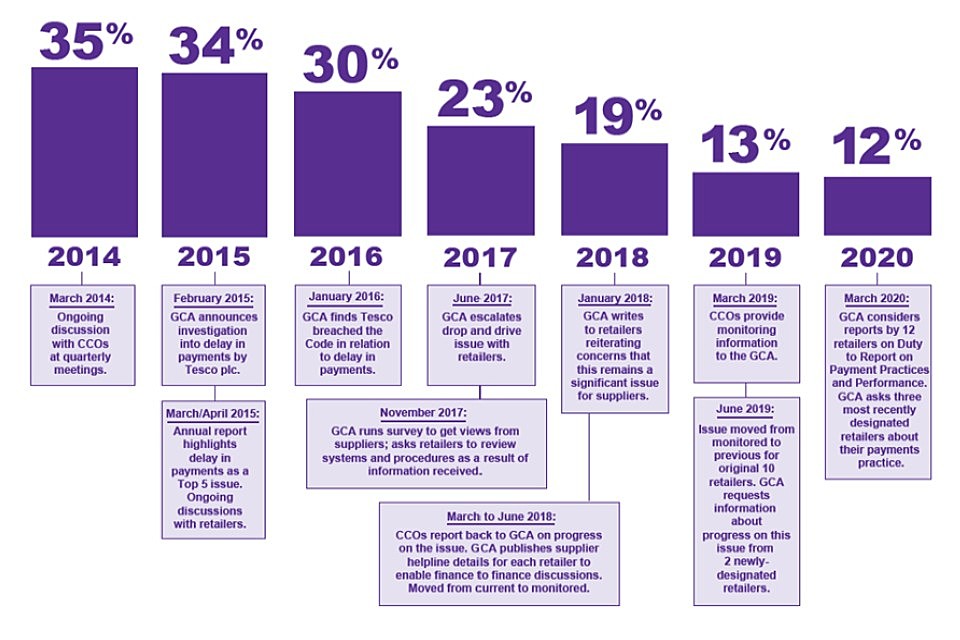

The investigation into Tesco plc in 2015 enabled me to understand in great detail the many different ways that payments to suppliers were being delayed and to apply my findings about these to all retailers. This has resulted in the percentage of suppliers experiencing the issue of delay in payments falling from 35% in 2014 to 12% in 2020. Importantly it ensured that pricing errors are now fixed quickly, that suppliers retain money when it is not established that it is due and that all retailers now have a dedicated helpline for finance-to-finance resolution of outstanding money queries.

The second investigation, which was into Co-operative Group Limited (Co-op) showed how vital it is that Code compliance is embedded into every regulated business. The root causes of the breaches I identified by Co-op showed the extent to which the retailer had failed proactively to take charge of its own Code compliance.

Last year I spent eight months working with Co-op as it implemented the recommendations made as a result of my investigation. Co-op has demonstrated a huge amount of progress in embedding the Code and I have enjoyed working with the Co-op team to ensure that they understood the issues and implemented actions that would prevent the same or similar problems recurring in future. This progress has been recognised by suppliers that have ranked Co-op joint second in the 2020 league table, up from tenth in 2019 – the year I reported on my investigation – and ninth in 2018.

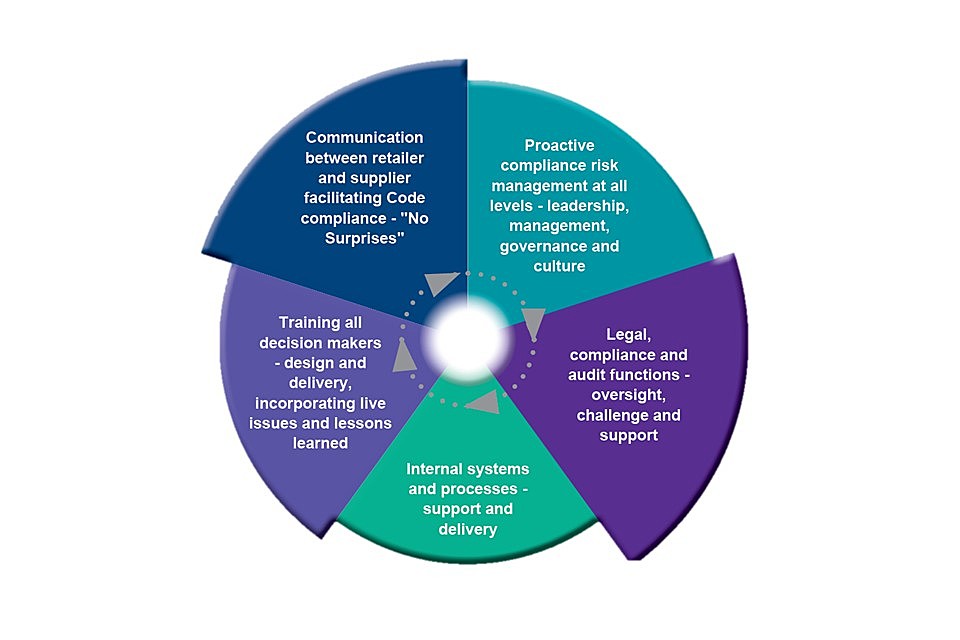

In parallel I worked with each of the regulated retailers to encourage them to take a whole-organisation approach to Code compliance. I wanted to ensure proactive compliance risk management was applied at all levels in each business and was reflected consistently in governance, audit, systems and processes, training and communications with suppliers.

Circular diagram showing how retailers are expected to embed Code compliance into all areas of their business.

I asked them to report to me on how they were each putting their compliance management thinking into their overall governance structures, their legal, compliance and audit functions, as well as their internal systems and processes. In addition I wanted to know how they were designing training that upheld compliance and were delivering it to the right people. And of course I have kept up my message that retailers should have the right conversations with their suppliers and listen to them to identify where change may be needed.

This approach was all about minimising the likelihood of future breaches and ensuring prompt correction and learning whenever mistakes occur, as they will from time to time. All retailers learned a lot from this exercise and almost all made changes to one or more aspects of their business as a result.

When I first took this job in 2013, I worked solidly with retailers on what I call Go / No Go areas: stopping specific reported practices which may have broken the Code.

A three ringed target. The words Go/No Go areas sit in the centre.

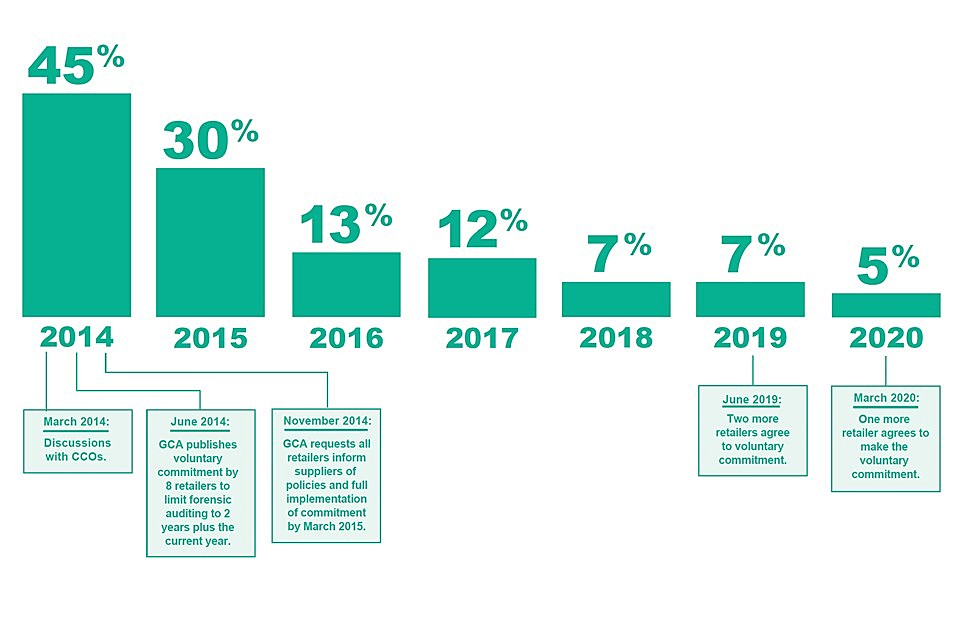

A lot of quick wins followed, such as the voluntary commitment I secured that responded to the problem of forensic auditing. I am delighted that now 12 of the 13 regulated retailers have agreed to limit the auditing of suppliers’ trading accounts in search of missed claims to the current year plus two. Only J Sainsbury plc has declined to do so despite repeated requests.

As my relationships with retailers developed, my focus shifted to reviewing systemic issues and practices. I chose to focus on just a limited number at a time to make progress across the sector on the issues that mattered most to suppliers. This is how my Top Issues came into being and in this way, I tackled drop and drive as a contributing factor to delay in payments; and outsourcing to third parties without sufficient controls, for example consultants working on range reduction activity, as highlighted in the case study published in 2017 about Asda Stores Limited

In my final year as GCA the conversation has been firmly focused on ensuring every one of the regulated retailers can demonstrate to me that they have embedded controls within their business.

Suppliers also need to play their part. They need to be Code Confident: Know the Code, Get Trained and Speak Up. The proportion of suppliers that stated in the survey that they had been trained has never topped the half-way mark, with the 2020 results standing at 47%. However, the 13 training providers listed on the GCA website have been busy and I am delighted to report that issues raised with my office over the past year have almost all been relevant to the Code. Rarely now do we have to respond pointing out that the issue is not something I can assist with. Similarly, when I am at supplier events the discussions tend to be about potential breaches, indicating good Code understanding.

I took this job to make a difference. I believe the evidence shows I have done that:

- We have seen an increase, not a decrease in competition in the sector as three more retailers have exceeded £1 billion turnover of groceries and been designated by the Competition and Markets Authority (CMA).

- The original 10 regulated retailers are now exemplars among businesses for paying on time. The Duty to Report on Payment Practices and Performance results submitted to the Department for Business, Energy & Industrial Strategy (BEIS) cover all invoices, not just groceries, so are only a guide. The original 10 retailers notably paid between 93%-100% of all their invoices on time, whereas only 13% of all the suppliers to those retailers achieved the same level of prompt payment.

- There is stronger and more effective communication between retailers and suppliers - a significant change, the value of which has been apparent in the current Coronavirus crisis and the resultant need to maintain very efficient supply chains.

- Working between retailers and suppliers has become more efficient, for example the business practices implemented in response to inconsistencies arising as a result of drop and drive have eliminated masses of paperwork as well as reducing time wasted on challenges.

- Suppliers feel more able to challenge the retailers to get the best joint solutions – no longer is the response “how high?” when the retailers ask them to jump.

- Fresh produce suppliers have been growing in size and are confident under the protection of the Code to work closely and on longer contracts with retailers.

- Consumers have benefitted from an increase in innovative products on the supermarket shelves, created by a growing number of speciality suppliers which the retailers are welcoming to increase differentiation.

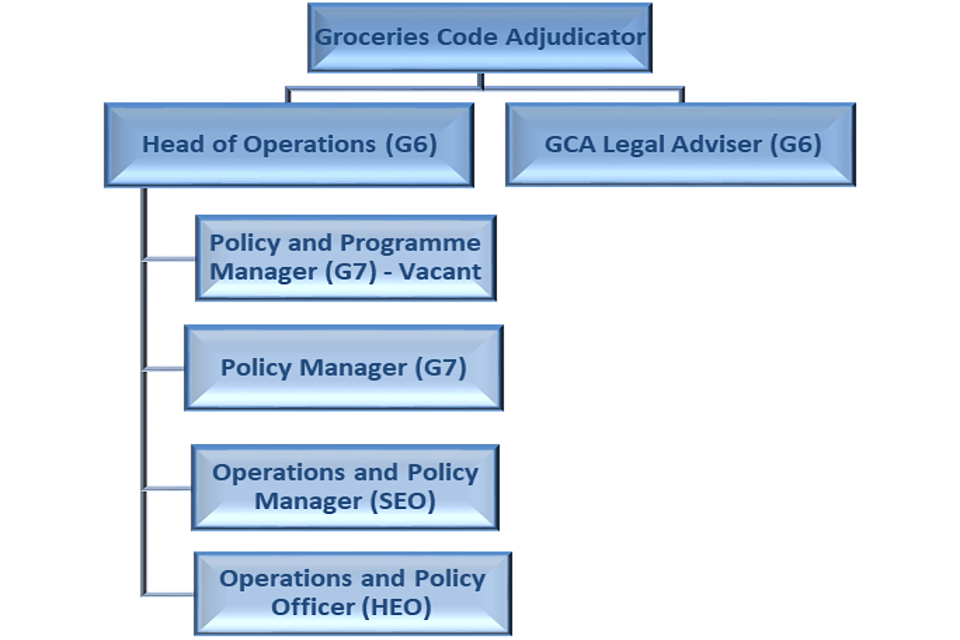

I have enjoyed the role, have been lucky to have such a wonderful team over the past seven years and am particularly grateful to my Legal Adviser, Helen Gordon-Lee and my Operations and Policy Manager, Jenny Hendricks, who have both been with me the whole time. I have had three very different but invaluable Heads of Operations who have at times coped with considerable workload, especially during investigations when they get minimal amounts of my time. We have all enjoyed seeing the progress that has been made and receiving thanks from suppliers that frequently tell us that the way that retailers behave is unrecognisable from what it was seven years ago.

I strongly believe that the Code, combined with the changes in culture and behaviour I have encouraged over the past seven years, provided the foundations for the excellent reaction of the groceries supply chain to the Coronavirus emergency. The regulated groceries retailers and their suppliers overwhelmingly responded with the best interests of the consumer at the heart of everything they did in response to this enormous challenge and there has been a high level of communication between them throughout. With this in mind, I offered on 23 March to remain in post for a few months beyond the end of my term of office in June. This will I hope enable me to deal realistically and fairly with any issues arising as a result of decisions taken during the emergency, consistent with my interpretation of the Code and the additional material I published during that period, allowing my successor to focus on the future.

My successor will take office at a good time. The initial work of the GCA is largely done. The success of regulation under the model I have adopted is however prompting growing calls for the role of GCA and the scope of the Code to be extended, whether further up the supply chain or to more retailers. My successor is bound to have new ideas but I hope will continue the initiatives that have worked. I wish the next GCA every success.

Christine Tacon

Groceries Code Adjudicator and Accounting Officer

21 May 2020

A year at the GCA

A year at the GCA. 1 office move, 1 additional retailer, 10 years of the Code, 68 retailer meetings, 79 supplier one-to-ones, 46 trade association and supplier meetings and 3 international engagements.

1.2 Groceries Code Adjudicator: Working for fairness in the groceries supply chain

Establishing the Groceries Code Adjudicator

The Groceries Code Adjudicator (GCA) was established on 25 June 2013 by an Act of Parliament. It was set up to ensure supermarkets treat their direct suppliers lawfully and fairly.

The appointment followed a 2008 report setting out the findings of the Competition Commission Market Investigation into the groceries sector. The Competition Commission found that while the sector was broadly competitive, some large retailers were transferring excessive risk and unexpected costs to their direct suppliers. This could discourage suppliers from investing in quality and innovation; small businesses could fail and ultimately, there could be potential disadvantage to consumers.

Following the Commission’s recommendation, the Government introduced the Groceries (Supply Chain Practices) Market Investigation Order 2009 (the Order) which includes a requirement to comply with the Code. The Code was designed to regulate the relationship between the regulated retailers and their direct suppliers. The regulated retailers each have a UK annual groceries turnover of more than £1 billion. At the commencement of the Order in February 2010, there were the following 10 regulated retailers:

- Aldi Stores Limited (Aldi)

- Asda Stores Limited, a subsidiary of Wal-Mart Stores Inc (Asda)

- Co-operative Group Limited (Co-op)

- Iceland Foods Limited, a subsidiary of the Big Food Group (Iceland)

- J Sainsbury plc (Sainsbury’s)

- Lidl UK GmbH (now Lidl GB Ltd) (Lidl)

- Marks & Spencer plc (M&S)

- Tesco plc (Tesco)

- Waitrose Limited, a subsidiary of John Lewis plc (Waitrose)

- Wm Morrison Supermarkets plc (Morrisons)

The regulated retailers had some time to set up a voluntary Ombudsman. When the self-regulatory approach did not progress, the GCA was established on a statutory basis by the Groceries Code Adjudicator Act which came into force on 25 June 2013 (the GCA Act).

Christine Tacon – the first Adjudicator – was appointed on 25 June 2013 and is responsible for monitoring and encouraging compliance with and enforcing the Code. Her second term of office ends on 24 June 2020. In response to the uncertainty created as a result of COVID-19 and particular pressure placed on groceries supply arrangements during the early stages of the pandemic, the GCA offered to extend her term for a short period, specifically to deal with any issues arising as a result. As at year-end, this was under consideration by the Secretary of State for BEIS.

The GCA is funded by a levy on the regulated retailers. The levy methodology is reviewed each year and is subject to the consent of the Secretary of State for BEIS.

Suppliers, trade associations and other representative bodies are encouraged to provide the GCA with information and evidence about how the regulated retailers are treating their direct suppliers. All information received is dealt with on a confidential basis and the GCA has a legal duty to preserve anonymity. Suppliers are also urged to undertake training on the Code and to follow the latest developments and GCA announcements.

In 2016 the Government carried out a statutory review of the GCA’s performance and effectiveness and at the same time called for evidence on the extension of the GCA’s powers. The results of the review published in July 2017 concluded that the GCA is regarded as an ‘exemplary modern regulator with an international reputation’.

Following the call for evidence in 2016, Ministers decided not to extend the remit of the GCA. The CMA was asked to assess whether more groceries retailers should be regulated by the GCA. The following retailers have since been designated under the Order:

- On 1 November 2018 the CMA designated Ocado Group plc (Ocado) and B&M European Value Retail S.A. (B&M). In November 2019, following a structural change Ocado Retail Ltd was designated and Ocado Group plc has subsequently been de-designated. This report accordingly refers to Ocado for both Ocado Group plc and Ocado Retail Ltd unless it is important in the context to specify which.

- On 3 September 2019, the CMA designated TJ Morris Limited (trading as Home Bargains).

GCA powers

At a supplier’s request the GCA must arbitrate in disputes and may also do so following a request from a regulated retailer. Arbitration awards are binding and may include compensation.

The GCA can launch investigations where she has reasonable grounds to suspect the Code has been broken. If a breach of the Code is found, the GCA can make recommendations, require regulated retailers to publish details of any breach and in the most serious cases impose a fine. The GCA power to fine a retailer up to 1% of its UK turnover came into force on 6 April 2015. To date, the GCA has carried out two investigations, the first into Tesco and the second into Co-op.

Under the Code the regulated retailers are obliged to deal fairly and lawfully with groceries suppliers across a range of supply chain practices. These include: making payments on time; no variations to supply agreements without notice; compensation payments for forecasting errors; no charges for shrinkage or wastage; restrictions on listing fees, marketing costs and De-listing. This list is not exhaustive and full details are available on www.gov.uk/gca. Suppliers protected by the Code are those directly supplying a designated retailer with groceries for resale in the UK, including overseas suppliers.

The Code does not cover issues such as price setting, the relationship between indirect suppliers and the regulated retailers, food safety or labelling. These issues are outside the GCA’s remit.

The way the GCA works

The GCA encourages suppliers to bring Code-related issues and evidence to its attention in order to inform decisions and actions. The GCA also gathers information from retailers, trade associations and others. The stronger the evidence base, the greater the justification for action.

As a small regulator the GCA must effectively prioritise its activities. When considering whether to launch an investigation and other activities, the GCA applies the following four prioritisation principles, which are set out in its statutory guidance:

| Impact: | The greater the impact of the practices raised, the more likely it is that the GCA will take action. |

| Strategic importance: | Whether the proposed action would further the GCA’s statutory purposes. |

| Risks and benefits: | The likelihood of achieving an outcome that stops breaches of the Code. |

| Resources: | A decision to take action will be based on whether the GCA is satisfied the proposed action is proportionate. |

The GCA must carry out its statutory functions set out in the GCA Act. In setting the direction for the GCA, the Adjudicator has developed an approach that fits the resources available and the outcomes the GCA was set up to deliver. It is a modern regulatory approach, with collaboration and business relations at its core and is delivered through a three-stage process. When Code-related issues are raised, the GCA follows the stages set out below.

| Stage 1: Will make retailers aware of issues reported by suppliers. |

|---|

| The GCA will consider whether the issue raised appears to be more than an isolated occurrence. If so, it will be raised with the regulated retailers’ CCOs for their own action. In some circumstances if they are judged to have significant impact and confidentiality can still be maintained, the GCA will also raise single incidence issues with CCOs. |

| Stage 2: Will request that the CCOs investigate the issue and report back to the GCA. |

|---|

| The GCA will raise the issue with the relevant CCO or all CCOs either if the issue is widespread or to protect the confidentiality of the supplier(s) experiencing the issue. CCOs will be expected to look into the issue and identify if any action needs to be taken within their organisation. This could include making improvements to systems and processes in order to reduce the risk of the issue occurring or recurring. Depending on what the CCO finds and the action the retailer has taken, the GCA may issue advice clarifying or interpreting the relevant provisions of the Code for the retailer and others to follow. Where a regulated retailer or retailers accept a breach of the Code has taken place and sufficient action has been taken to resolve it, the GCA may publish a case study on the GCA website. |

| Stage 3: May take formal action if the practice continues. |

|---|

| If the GCA continues to hear of suppliers experiencing the same issue then the outcome may be to publish more formal guidance and/or launch an investigation. |

Through this process the GCA ensures that issues are raised with and promptly considered by the regulated retailers and that any necessary action is agreed and taken as swiftly as possible. This is an efficient way to deal with current groceries sector practices that may not be consistent with the Code. The GCA believes that this collaborative approach has a dual benefit. It significantly reduces the cost of regulating the retailers and it delivers results more quickly.

The GCA does not act as a complaint-handling body, nor can it advise on individual disputes where a supplier seeks a view on whether a regulated retailer has breached the Code. This is because the GCA may later be asked to arbitrate in the same dispute between the supplier and the regulated retailer. Or the GCA may later launch an investigation into the practice raised by the supplier if it becomes apparent that it is a systemic issue experienced by a number of suppliers and of significant impact. Providing a view on individual cases could compromise or appear to compromise the GCA’s objectivity later on. Instead, the GCA encourages suppliers to approach CCOs directly because they can deal with issues quickly and, where needed, discreetly.

The ultimate goal of the GCA is to promote a stronger, more innovative and more efficient groceries market through compliance with the Code and as a result, to bring better value to consumers. The GCA is working with suppliers and the regulated retailers to respond to issues rapidly and relies on suppliers and others to bring evidence of non-compliance quickly to the GCA to achieve this goal.

More information is available on the GCA website

2. Performance Analysis

2.1 Statutory Reporting Requirements

The GCA’s key performance indicators are set out in the GCA Act as statutory reporting requirements. There are four statutory reporting requirements on which performance is measured and the performance against these objectives is set out in the table below.

| Disputes referred to arbitration under the Order |

|---|

| The GCA accepted appointment as arbitrator in one dispute in the reporting period. There are no ongoing arbitrations at the end of the reporting period. |

| Investigations carried out by the GCA |

| There were no new investigations launched during the reporting period. |

| Cases in which the GCA has used enforcement measures |

| No new enforcement measures were used. There was ongoing monitoring of Co-op as a result of the recommendations made in the report of the investigation published on 25 March 2019. This monitoring was completed in this reporting year. |

| Recommendations that the GCA has made to the CMA for changes to the Code |

| The GCA has made no recommendation to the CMA for any change to the Code. |

2.2 Strategic Objectives

In addition to the statutory reporting requirements, the GCA also monitors its performance against four strategic objectives:

- Promoting the work of the GCA

- Providing advice and guidance

- Acting on supplier issues and information

- Improving the culture of Code compliance

The GCA considers that these objectives remain fit for purpose.

Objective 1: Promoting the work of the GCA

In June 2019 over 200 people attended the GCA annual conference at Church House, Westminster. The GCA welcomed Ocado and B&M to the conference for the first time as regulated retailers; YouGov reported on the largest ever response to the survey; and the GCA provided a review of the year and a forward look. Attendees also heard from Michael Hutchings, Independent Chair of the Supply Chain Initiative. After the main conference, the GCA and her team held 19 supplier one-to-one meetings while retailer CCOs attended a networking event at which they heard directly from suppliers about issues they had experienced. There will be no conference in June 2020 because the current Adjudicator’s term of office is due to end on 24 June. Although she has offered a short additional period in which to resolve any issues arising as a result of COVID-19, it will be for her successor to set the agenda for the future. The 2020 survey results are reported here because results were received before year end, again leaving future event planning to the next GCA.

Once again over the past year, the GCA and her team have attended a variety of events for groceries suppliers. The GCA attended over 30 supplier events during the year, including three retailer-hosted groceries sector supplier briefings, substantially exceeding the commitment to attend one event a month. This enabled the GCA to promote her work directly to suppliers and provided an opportunity for suppliers to share directly with the GCA their experiences of working with the retailers. In total, the GCA held over 70 one-to-one meetings with suppliers and delivered more than 30 presentations.

The GCA has also continued to promote her Code Confident message directly to suppliers, as well as the importance of being trained in the Code. Good training is an important tool to encourage and give confidence to suppliers to challenge retailer behaviour on Code-related issues, which could include raising issues with CCOs to get them fixed and reporting issues to the GCA to help her decide what to work on.

The GCA continues to receive lots of interest from overseas regulators and direct suppliers and engages with them as part of her overall awareness-raising programme. The GCA has attended three international engagements in addition to events attended across the UK. This included presenting to the Houses of the Oireachtas’ Joint Committee on Agriculture, Food and the Marine, presenting to the Supply Chain Initiative and meeting the Australian Food and Grocery Council.

The GCA also regularly engages with trade associations. In 2019/20 the GCA attended 10 trade association-hosted events, 13 representatives from trade associations attended a meeting at the GCA office and numerous trade association magazines carried articles about the GCA.

This year the Code reached a major milestone: on 4 February 2020 the GCA marked 10 years since the Code came into force, launching the seventh annual survey to coincide with this important anniversary. On the same day, the GCA also hosted a meeting with organisations that provide training on the Code to share an update on her work and progress on Code compliance and to hear from the training providers about what Code-related issues suppliers were raising with them.

Objective 2: Providing advice and guidance

The GCA has continued to provide advice and guidance that responds to concerns raised by suppliers. This includes providing a variety of information through her website. The GCA is the independent regulator of the groceries sector, not an advisory or complaint-handling body. The GCA cannot advise on individual disputes where a supplier seeks a view on whether a regulated retailer has broken the Code because she may later have to determine the issue or dispute as an impartial decision maker.

The GCA website, YouTube channel and regular newsletter continue to play an essential role in raising awareness and keeping suppliers up to date. This year the GCA has particularly concentrated on developing these communication channels. In this reporting period, four newsletters were published and sent to over 1,200 subscribers. The GCA has added several new pages to her website including one that pulls together in one place all the information relating to Code-related issues on which she has taken action since 2013. The GCA also published a series of bite-size videos on her YouTube channel in which she speaks about specific aspects of the Code. Many of the videos by the retailers’ CCOs have also been refreshed, introducing suppliers to the CCO role and the individuals in each business.

The GCA encourages all suppliers to use this information when they have an issue in order to make sure they understand the Code before raising it.

In July 2019 the Adjudicator hosted her first webinar. Webinars have proved a popular and successful means of communicating with suppliers and other organisations with an interest in the Code. They enable the GCA easily to reach this audience regardless of where participants are based. The GCA has hosted a total of six webinars during the reporting year, providing regular updates on her work and giving participants an opportunity to ask questions.

The GCA also maintains on her website a published list of companies and individuals that provide training on the Code, retailer CCOs and supplier helpline details.

Objective 3: Acting on supplier issues and information

The GCA gathers information about supplier issues from a wide range of sources. In addition to the annual survey, the GCA hears about issues from direct and indirect suppliers, trade associations, other bodies and the media, as well as from the retailers themselves from their annual compliance reports and CCO progress reports made to her under business as usual. These give the GCA vital information to inform her current and future action. In order to ensure the GCA meets her duty to preserve the confidentiality of those who provide her with information, the GCA does not publish statistical information on issues raised. A table summarising issues raised throughout the GCA’s term is included as an Appendix to this report.

In 2019 and 2020 the GCA maintained its practice of commissioning an annual survey of the groceries sector. The 2019 survey was open from 18 February 2019 to 23 April 2019 and the 2020 survey was open from 4 February 2020 to 29 March 2020. Both sets of results are covered in this report. The 2019 survey was the first to include the experience of direct suppliers to Ocado and B&M and the 2020 survey was the first to include the experience of direct suppliers to TJ Morris. YouGov presented the 2019 results at the GCA conference in June 2019. The results of the 2020 survey will be shared with regulated retailers and published on the GCA website in late June 2020.

In order to achieve a high number of responses, the GCA renewed efforts to promote the survey including placing adverts and articles in numerous trade publications, distributing a variety of publicity materials and encouraging regulated retailers to publicise the survey to their suppliers. There was a record 1,628 responses to the survey in 2020, with 1,480 responses received from direct suppliers.

The survey remains one of the most important activities that the GCA undertakes each year. Asking suppliers about their experiences and opinions provides valuable information about current issues being experienced by direct suppliers to the regulated retailers and shows the progress being made towards still greater Code compliance.

The GCA continued to have regular meetings with CCOs throughout the year. These are used to raise issues across all regulated retailers as well as with individual retailers. In some circumstances the GCA will raise issues outside the usual meeting round, for example where there is some urgency for the CCO to look into them or the GCA decides to intensify the collaborative approach with a particular retailer. Regulated retailers report back on issues raised at these meetings in their regular progress reports. In many instances, this engagement leads to further work within the retailer to consider how it can make improvements including making changes to their systems and processes to minimise the risk of issues occurring or recurring, all of which benefit the wider supply base.

In previous years, the GCA has identified on an iterative basis up to five areas to focus on where suppliers believe that the regulated retailers’ practices may breach the Code, known as ‘Top Issues’. In this reporting period, all Top Issues were categorised as previous, meaning they had been closed as an issue in their own right because the GCA’s position or interpretation of the Code had been made clear. The GCA no longer considered that ongoing monitoring or active work on the issue was merited.

The GCA has nonetheless worked with retailers in this reporting period on pallets and crates. Following concerns raised by suppliers about retailer requirements that they use particular crate and tray suppliers and pay associated charges either to those companies or to retailers as handling charges, the GCA has worked with the original 10 designated retailers to understand their processes in this area.

Objective 4: Improving the culture of Code compliance

The GCA continues to emphasise the need for cultural and behavioural change in regulated retailers and considers that good progress has been made in this area. Compliance risk management is regularly raised in conversations with chairs of retailer audit committees as well as on visits to retailer headquarters. Suppliers report that the behaviour of regulated retailers has changed significantly since the GCA was appointed.

As well as providing regular feedback through CCO meetings, the GCA uses her monitoring role and collaborative approach to encourage retailers to look at specific business practices raised by suppliers or identified by the GCA as possible areas of Code compliance risk.

As a direct result of the investigation into Co-op, the GCA has worked with each retailer on buying alliances and other similar arrangements they may have, to ensure that they have each considered how the Code could apply to these different arrangements.

The findings made by the GCA as a result of the investigation also set the scene for further risk management work with each of the regulated retailers to ensure they are taking a proactive approach to embedding Code compliance at all levels in their respective business.

As part of this exercise, announced at the GCA conference in June 2019, the regulated retailers (with the exception of TJ Morris due to the timing of designation) considered in detail how their practices, systems and behaviours are designed to meet their obligations under the Code.

The areas regulated retailers considered were:

-

Compliance risk management: how Code compliance risk management operates in the organisation, including:

- How the retailer monitors compliance with the Code, tracks issues and identifies trends;

- How issues are reported and escalated;

- How GCA feedback is escalated;

- How and when issues are discussed, including ensuring that issues are discussed regularly at senior level so that improvements can filter throughout the organisation;

- How lessons are learnt from issues and where relevant action taken across the organisation; and

- Who is involved in compliance risk management, including which individuals or teams manage the risks and the relevant committees and boards that discuss Code compliance.

-

Legal, compliance and audit functions: how each retailer’s legal, compliance and audit functions support Code compliance, including: how these functions work together to develop or oversee any changes to policy that could affect Code compliance.

- Internal systems and processes: what systems and processes each retailer has in place which could result in outcomes that affect Code compliance including:

- Assessing current systems and processes against compliance with the Code e.g. whether IT systems deliver outcomes which comply with the retailer’s policies;

- Considering what processes each retailer has in place to enable it to identify changes to systems and processes across the organisation that may affect Code compliance; and

- Considering how staff access relevant guidance on systems and processes, including any standardised templates. All guidance, policy and process documents should be adequate to equip buyers to perform their roles and identify any Code-related issues.

-

Training: how each retailer ensures that employees are adequately trained in the Code, including: who should be trained and that this covers all staff who have the ability to apply charges or otherwise affect a supplier’s commercial arrangements with the retailer. Training may be tailored for staff according to their different levels of supplier engagement. Training should be carried out in a way that ensures staff understand and can apply it. This could include face to face, interactive sessions with time for Q&A; some form of assessment to test knowledge with follow up if required; and incorporating examples of supplier issues raised in the organisation and how these were dealt with. Training should also be reviewed and updated as new information becomes available, for example from the GCA or from internal teams.

- Communication with suppliers: how each retailer communicates with suppliers including: How it makes sure suppliers are aware of decisions that may affect them by giving them clear and detailed information. There should be a clear record of decisions that affect suppliers and communications should be capable of being tracked. The retailer may also have considered the channels it uses to communicate with suppliers, such as information on websites, newsletters, webinars, events or conferences as well as supplier portals.

Several retailers have made or are in the process of making improvements to their systems and processes as a result of this exercise.

The GCA also encouraged retailers further to improve their annual compliance reports and met retailers’ audit chairs to discuss generic themes arising from all the annual compliance reports as well as priorities for her final year in office. This included continuing to encourage some retailers to report more comprehensively in their published annual reports and accounts. The GCA also asked retailers to ensure they were capturing any issues raised by suppliers throughout their business that could engage the Code, in order to enable retailers to capture the broadest range of useful supplier information.

2.3 Annual Survey

In 2019 and 2020 the GCA maintained its practice of commissioning an annual survey of the groceries sector. The 2019 survey was open from 18 February 2019 to 23 April 2019 and the 2020 survey was open from 4 February 2020 to 29 March 2020 - both sets of results are covered in this report.

These sixth and seventh GCA surveys were carried out by YouGov and were designed to build on the GCA’s understanding of current supplier concerns in the sector and to measure continuing progress towards Code compliance. Important elements of the survey are measuring whether and to what extent regulated retailer behaviour improved in the year and gathering more detailed information about supplier views on compliance with the Code.

The 2019 survey was the first to include direct suppliers’ experience of working with Ocado and B&M and the 2020 survey was the first to include their experience of supplying TJ Morris. YouGov presented the 2019 results at the GCA conference in June 2019.

Participants

The regulated retailers again supported the GCA survey by sending information about it to their direct suppliers, including those based overseas. In the 2019 survey there was a total of 1,556 responses, including 1,417 received from direct suppliers, 114 from indirect suppliers and 25 from trade associations. There was a record number of responses in 2020. A total of 1,628 respondents took part, including 1,480 direct suppliers, 118 indirect suppliers and 30 trade associations.

The percentage of suppliers stating they had experienced issues at any stage during the previous 12 months that could be breaches of the Code fell to a record low, with 36% experiencing issues in 2020; down from 41% in 2019, 43% in 2018 and 79% in 2014.

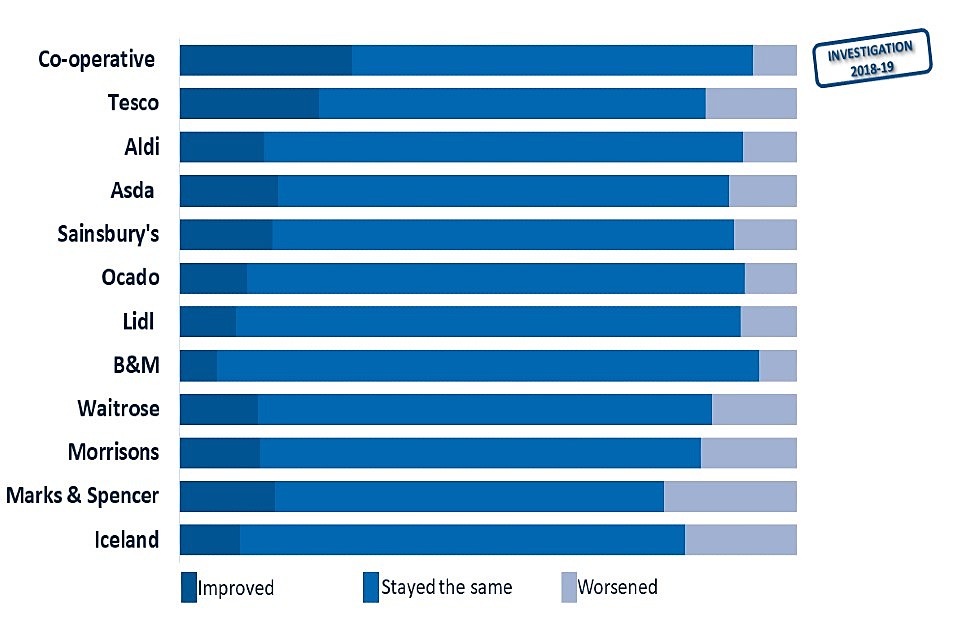

In 2019 those surveyed reported seven retailers as having improved their Code-related behaviour overall in that year. In 2020 this was the case for six retailers (Table 1). In both years Co-op was the most improved. This strong progress was clearly a result of the enhanced engagement with the GCA associated with the investigation that took place during 2018 and 2019.

Table 1: Changes in regulated retailer practice over the past 12 months ranked by net improvement score

Co-op is the most improved retailer. Tesco is second.

Suppliers’ overall assessment of retailers’ compliance with the Code

Since the first annual survey in 2014, suppliers have provided an overall assessment as to how well they believe each retailer complies with the Code. In the first year the percentage scores for mostly or consistently complying with the Code ranged from 58% to 90%. In 2020, 10 of the retailers achieved a score of 92% or above (Table 2).

Direct suppliers continue to identify Aldi as the retailer most compliant with the Code, placing it top of the overall league table for the seventh consecutive year.

Table 2: Suppliers’ overall assessment of retailers’ compliance with the Code

Chart showing how the retailer's compliance with the Code has improved since 2014.

In the 2019 survey results, B&M followed by Iceland were assessed by their suppliers as being the retailers least likely to comply with the Code. In the 2020 survey results, Iceland was assessed as the retailer least likely to comply with the Code followed by B&M. However, as with Iceland in 2017 and 2018, suppliers again reported no significant specific Code-related issue in relation to either retailer. The GCA has again worked with B&M and Iceland to seek to understand why suppliers ranked them in this way.

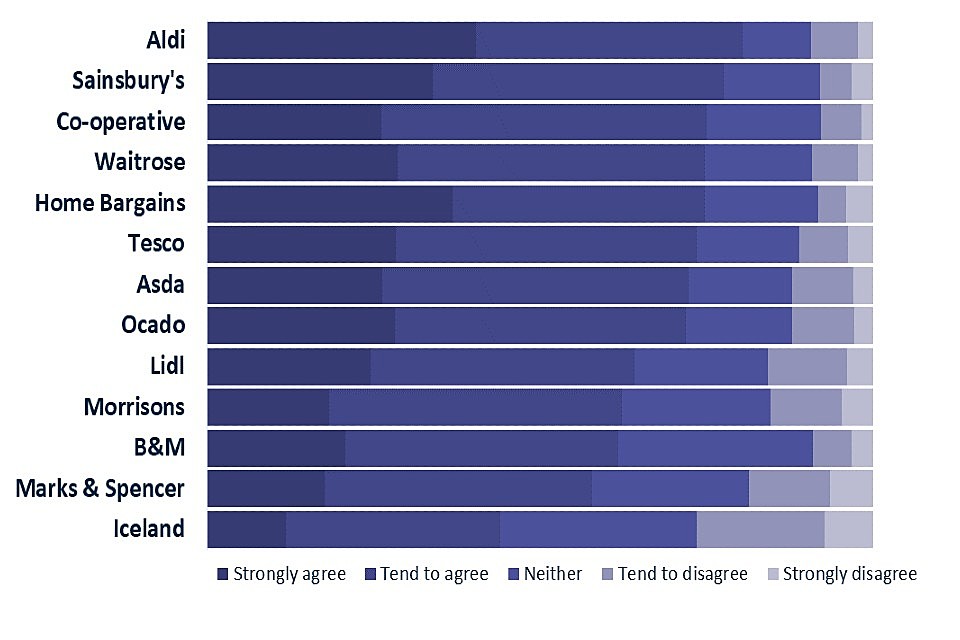

Partly as a result of this work with Iceland, the GCA in 2018 introduced a new question to the survey asking whether suppliers believed the retailers they supplied conducted trading relationships fairly, in good faith and without duress. The 2020 results are set out in Table 3.

Table 3: Suppliers’ perception as to whether retailers trade with them fairly, in good faith and without duress ranked by combined positive scores

Table 3. Aldi is top of the table, followed by Saindbury's and Co-op.

Using data to drive better behaviour

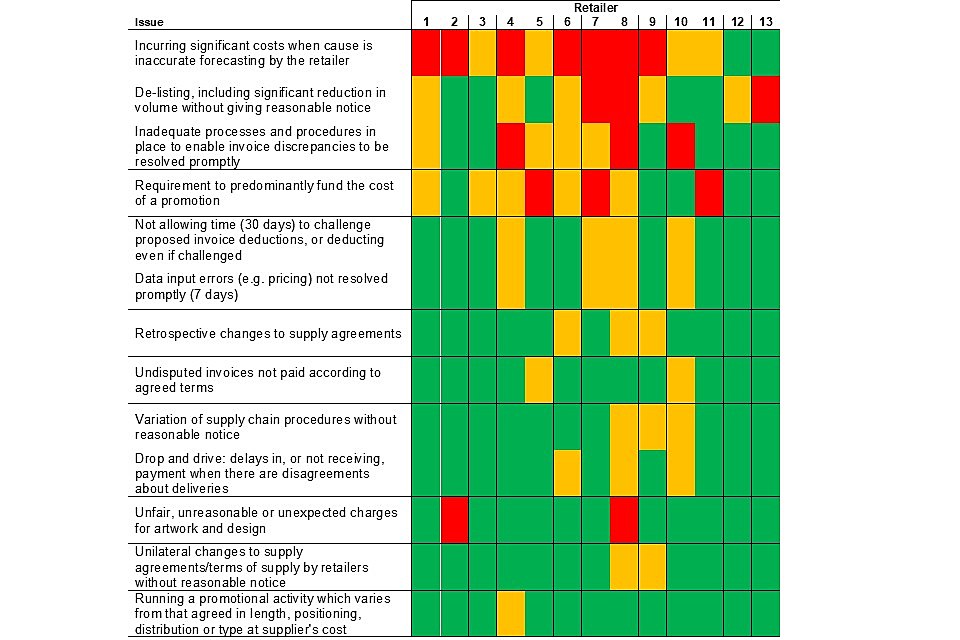

As well as measuring overall performance, the survey focuses on specific Code-related issues by retailer. Table 4 shows the most striking results for 2020. The retailers are anonymised and presented in no particular order, and the issues are listed in the order they were most mentioned by suppliers. The results are colour coded to show where retailers are performing well, could do better and need improvement. Table 4 below shows the main issues on which improvement could be made.

This information enables the GCA effectively to encourage regulated retailers to improve their performance in particular areas even if their overall rating is good. It also provides valuable insight for the CCOs.

Table 4: Specific Code-related issues by retailer as reported by suppliers

Table 4. Main issues for retailers are related to forecasting, De-listing and delays in payments.

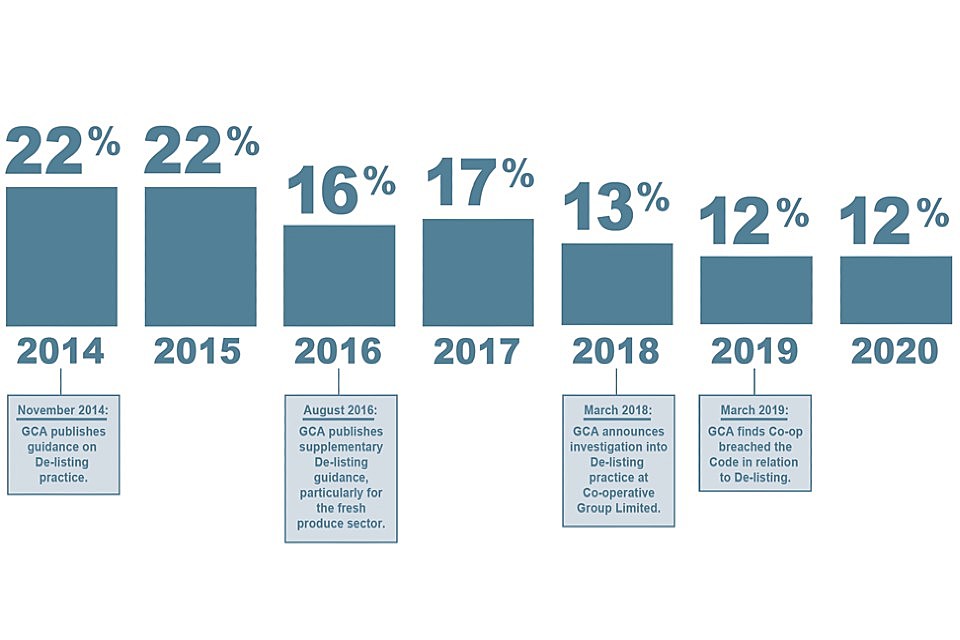

Code-related issues

The annual survey identifies the most common Code-related issues experienced by suppliers. In both 2019 and 2020 these were: No compensation for forecasting errors/not preparing forecasts with due care, Delay in payments and Not meeting duties in relation to De-listing. Each of these issues, however, was reported at a record low, at 15%, 13% and 12% respectively in 2019, with further decreases in 2020. These results are shown in Table 5.

Table 5: Code-related issues experienced by suppliers

Table 5. shows problems with forecasting, delays in payments and retailers not meeting their duties in relation to De-listing were the most reported issues by suppliers.

Training

The GCA continued to promote to suppliers the importance of training so that they could become Code confident. The 2018 survey had shown a rise in the percentage of direct suppliers undertaking training, at 49%, increased from 39% in 2017. The 2019 and 2020 surveys showed this remained at a similar level, at 47%.

Raising an issue with the GCA

The percentage of direct suppliers responding that felt they had a good or fair understanding of the Code declined slightly but still remained at a relatively high level, exceeding 70% in both 2019 and 2020. There was a slight decline in the percentage of suppliers saying they had good or fair awareness of the GCA’s role and responsibilities, at 73% in 2019 and 67% in 2020.

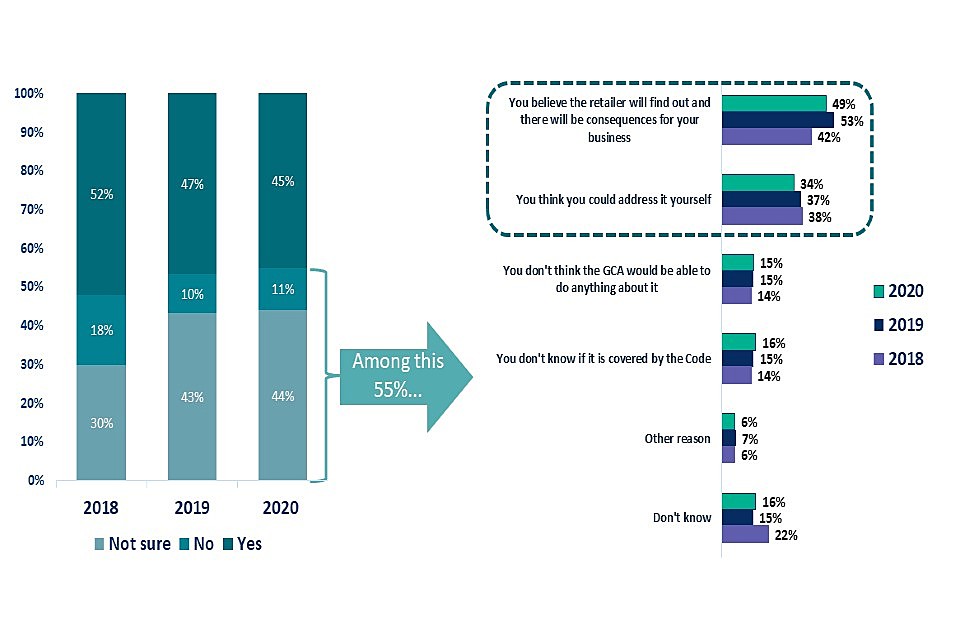

The percentage of suppliers that said they would not raise an issue with the GCA or were unsure whether they would do so rose from 48% in 2018 to 53% in 2019 and 55% in 2020. In the 2020 survey, the suppliers that said they would not raise an issue with the GCA or were not sure if they would indicated the reasons for this were a fear the retailer would find out and there might be adverse consequences or that they could simply address the issues themselves (Table 6). Encouragingly, the percentage of suppliers that said they would not raise an issue fell significantly, from 18% in 2018 to 10% in 2019 and 11% in 2020.

Table 6: Would you raise an issue with the GCA?

Table 6. Gives a visual of the text written above.

The GCA has continued to work hard to reassure suppliers that they can bring issues to her confident that their identities will be protected. At all public engagements the GCA offers suppliers the opportunity of one-to-one meetings during which the duty to maintain supplier confidentiality is reiterated.

2.4 Significant Activities

GCA investigation into Co-operative Group Limited – progress towards following GCA recommendations

On 25 March 2019 the GCA published the report of the investigation into Co-op. You can read the full report online.

In January 2020 the GCA published her view on the progress made by Co-op towards following the recommendations set out in the report. The GCA concluded that Co-op had taken appropriate action to meet each of the requirements and was no longer required to report formally against the recommendations. The published summary is set out below.

| Requirements of Co-operative Group Limited to enable me to monitor its compliance with my recommendations (paragraph 59 of the report of my investigation) | GCA view as of 9 December 2019 |

|---|---|

| I required Co-op to provide a detailed implementation plan within four weeks of the publication of the report of my investigation setting out how it would comply with my recommendations. | I consider that Co-op has met this requirement. |

| I required a response from Co-op to the recommendations on a quarterly basis. | I moved monitoring of Co-op compliance with my recommendations to business as usual. |

| Recommendations | |

| Recommendation 1: Co-op must have adequate governance to oversee and manage its compliance with the Code. | I consider that Co-op has an appropriate approach to following this recommendation. |

| Recommendation 2: Co-op legal, compliance and audit functions must have sufficient co-ordinated oversight of Co-op systems to ensure Code compliance. | I consider that Co-op has an appropriate approach to following this recommendation. |

| Recommendation 3: Co-op IT systems must support Code compliance. | I consider that Co-op has an appropriate approach to following this recommendation. |

| Recommendation 4: Co-op must adequately train on the Code all employees who make decisions which affect a Supplier’s commercial arrangements with Co-op. | I consider that Co-op has an appropriate approach to following this recommendation. |

| Recommendation 5: Co-op must in any potential De-listing situation communicate with affected suppliers to enable Co-op to decide what is a significant reduction in volume and reasonable notice. | I consider that Co-op has an appropriate approach to following this recommendation. |

GCA position statement on current supply arrangements

On 17 March 2020 in response to the considerable challenges faced by retailers and their suppliers in working together to ensure people have access to food and other essentials during the COVID-19 outbreak, the GCA published a position statement on current supply arrangements. The statement is set out below in full.

The GCA is aware of the considerable challenges facing retailers and suppliers as they work together to ensure customers have access to food and other essentials during the COVID-19 outbreak.

The GCA is also aware of co-ordinated work across government to respond to the situation. Nothing in this position statement is intended to interfere with that in any way.

The GCA is nonetheless able to offer the following guiding principles to assist retailers and suppliers deliver continuity of supply to consumers, as far as this remains possible given significant pressures on staffing and some customer buying habits:

- Nothing in the Groceries Supply Code of Practice (the Code) requires any regulated retailer to break any other legal requirement. The Code should be read compatibly with all other legal obligations placed on regulated retailers.

- The GCA cannot offer a view as to whether current circumstances amount to force majeure.

- From a practical point of view, retailers will want to agree a way with suppliers to meet the most pressing objectives of the situation as it develops. The GCA would expect all parties to work together constructively to achieve this.

- Examples include effective communication on both sides, and an appreciation that e.g. reasonable notice provisions in the Code will need to be considered in light of the rapidly changing situation. Notice periods may need to be short to address challenges at the earliest possible opportunity. Suppliers should not wait to raise issues with retailers.

GCA letter to retailers about payment terms

On 26 March 2020 the GCA published a letter sent to all regulated retailers about payment terms. The letter is set out below in full.

Dear CCO,

Payment terms

As you know, the Code covers delay in payments and your business has over the time I have been GCA worked hard to improve performance, but one of the areas in which I am frequently asked to intervene is in relation to payment terms, which are not covered by the Code.

I have always resisted saying anything about them as a result. In the current groceries supply situation, however, cash flow is critical for many of your suppliers.

Some retailers already pay small suppliers within 14 days and have recently accelerated those payments still further, which is appreciated. Anything else you are able to offer your suppliers to help them through this extremely difficult time would be very welcome.

Yours sincerely,

Christine Tacon

2.5 GCA action relating to particular paragraphs of the Code

The GCA has continued to monitor and encourage compliance with the Code by regulated retailers. This section of the report summarises activity since the GCA was established in relation to eight practice-specific paragraphs of the Code and other issues raised by suppliers.

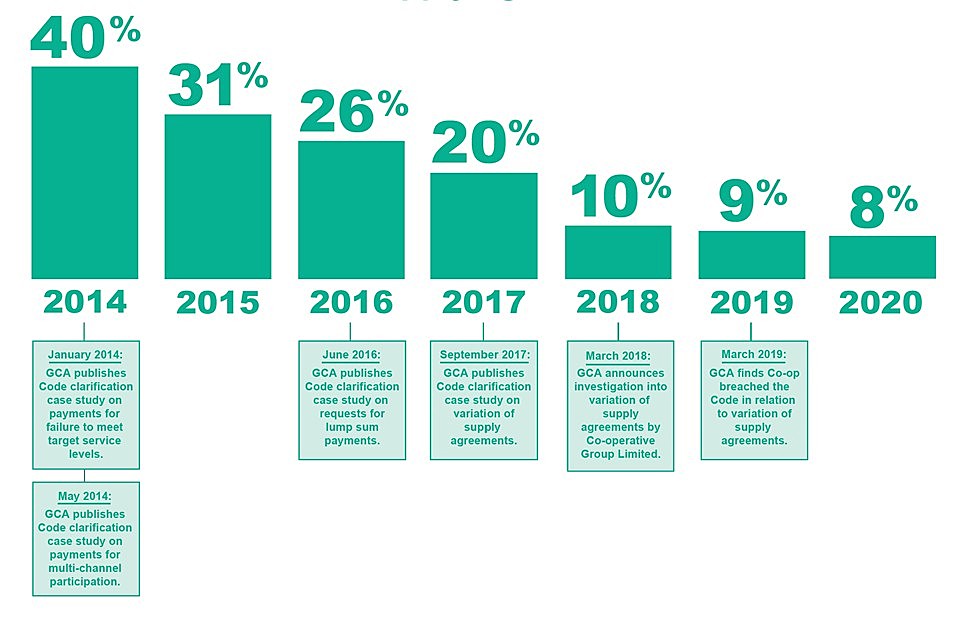

Paragraph 3 – Variation of supply agreements

The Code sets out that a retailer must not vary a supply agreement retrospectively unless the parties have already agreed what can be changed and in what circumstances. For prospective unilateral variations to supply agreements, retailers must provide suppliers with reasonable notice. The GCA has published a number of Code clarification case studies that relate to variation of supply agreements.

In January 2014, the GCA published a case study about a retailer seeking supplier payments for failure to meet target service levels. This clarified that requesting supplier payments for failure to meet target service levels not set out in the relevant supply agreement was not consistent with paragraph 3 of the Code.

In June 2016, the GCA published another case study clarifying paragraph 3 of the Code. A different retailer had requested lump sum payments from suppliers which were not supported by the supply agreement. The GCA noted that while retailers retained the right to vary a supply agreement unilaterally, there must be provision for this in the supply agreement and reasonable notice must be given to the supplier.

In September 2017, the GCA published a further case study on paragraph 3 of the Code. This related to another of the retailers implementing a project to deliver cost price savings and range reductions which resulted in variation of supply agreements. In this case the variation took the form of retailer requests to suppliers to make significant financial contributions to keep their business with the retailer, with very little time allowed to agree to the proposed changes. The GCA concluded that the retailer had made unilateral variations to supply agreements or had made variations without reasonable notice being given.

In March 2018 the GCA launched an investigation into Co-op. The report of that investigation published in March 2019 set out the GCA’s findings as to how Co-op had broken the Code. The GCA made five recommendations to the retailer designed to ensure breaches of paragraph 3 did not happen again in future.

The annual survey asks suppliers if they have experienced an issue with variation of supply agreements in the past 12 months. As shown in Figure 1, the percentage of suppliers that have experienced an issue has declined each year, with only 8% of suppliers experiencing this issue in 2019/2020.

Suppliers report problems with retailers varying supply agreements has dropped from 40% in 2014 to 8% in 2020.

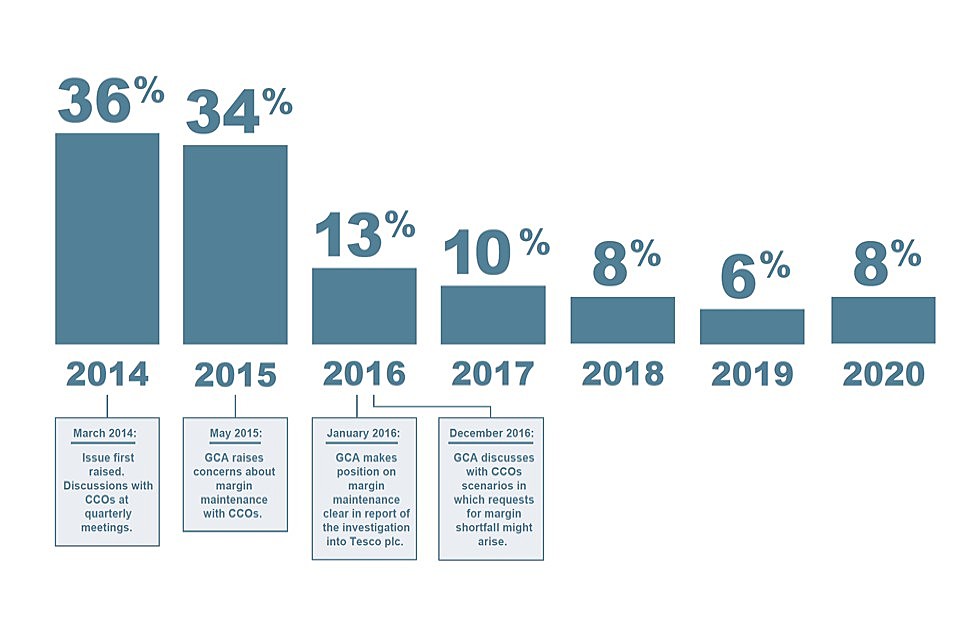

Margin maintenance

The report of the investigation into Tesco identified a number of practices occurring as a result of a focus on hitting budgeted or aspirational margin targets. Suppliers provided information to the GCA that other regulated retailers occasionally engaged in this practice.

The GCA made clear in the report of the investigation into Tesco how the Code will be interpreted and that unilateral deductions made in order to satisfy an unachieved aspirational margin target are unreasonable. The GCA set out that requests for margin maintenance must be unambiguously supported by the supply agreement. Since the GCA issued the report of the investigation into Tesco, it has been listening to suppliers on this issue. The GCA wrote to all retailers in November 2016 requesting information about practices that related to margin made on a particular product and the impact of those practices on suppliers. The responses from retailers showed that their practices were generally compliant with the Code and feedback from suppliers indicated that margin maintenance was less of an issue for them.

In 2017 the GCA decided to move this issue to the previous category. It was nonetheless made clear to retailers that as the issue had been explored and the GCA had promulgated a clear interpretation of the Code in this area, if the GCA found evidence of the practice reoccurring it may indicate the collaborative approach had been effectively exhausted, making further regulatory action likely. The 2019 and 2020 annual surveys continued to show that this was not a significant area of concern to suppliers, with only 6% of suppliers in 2019 and 8% in 2020 stating they had experienced an issue.

Suppliers report problems with margin maintenance reducing from 36% in 2014 to 8% in 2020.

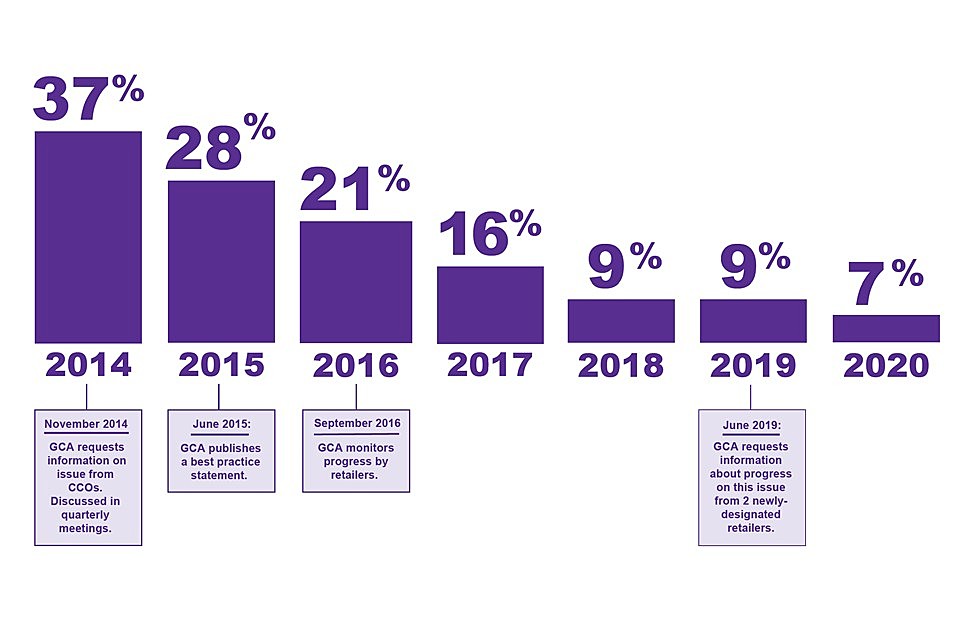

Paragraph 5 – No delay in payments

The report of the investigation into Tesco stated clearly for the benefit of all in the sector how the GCA interpreted the practices found to have taken place in relation to delay in payments. Some of the practices that might lead to delay in payments are unilateral deductions relating to drop and drive disputes, duplicate invoices, alleged short deliveries, unknown or unagreed items; current and historic promotion fees. Further practices that might lead to delay in payments include delays in paying entire invoices where only part of an invoice is disputed, not paying in the period set out in the supply agreement, the length of time taken by the retailer to resolve an issue, and depot and retailer haulier practices.

The interpretation of the Code set out in the report of the investigation into Tesco is a clear statement of the GCA’s view as to what is and is not Code-compliant behaviour and as such, is the regulatory standard required to be met by all regulated retailers. This makes clear that suppliers should be given at least 30 days to challenge any proposed deduction and where this is challenged, a retailer is not entitled to deduct the disputed sum from the supplier’s trading account until the query is resolved. Data input errors should be resolved promptly and in particular, pricing errors should be resolved within seven days of notification by the supplier.

Delay in payments remained the number one concern highlighted by suppliers in the 2018 survey, as it was in 2017, and continued to be an issue reported directly to the GCA by suppliers. In particular, the GCA continued to hear that not all retailers had adequate systems and processes in place fully to demonstrate compliance with the GCA’s interpretation of the Code on delay in payments as set out in the report of the investigation into Tesco. Recurring themes involving delay in payments included the persistence of unilateral deductions and the practice of holding back entire invoices while one element is queried, as well as too much time taken to resolve disputes. As a result of the Tesco investigation, the GCA recommended the retailer set up a single point of contact for suppliers to resolve queries and went on to suggest that an effective way to do this would be to set up a supplier helpline to handle payment disputes without involving its buying teams. To facilitate finance-to-finance conversations between retailers and suppliers the GCA asked all retailers to explain what arrangements they have in place for a supplier helpline or other means to enable disputes and queries to be handled without the involvement of commercial teams and publicised these arrangements on its website.

The GCA continued to monitor retailer compliance on this issue and provided retailers with examples of practices reported by suppliers where delays in being paid could arise. In particular, the GCA escalated the issue of drop and drive (see separate issue under Previous Top Issues) and all retailers who engage in it explained the actions they are taking to minimise the risk of breaches of the Code arising as a result of that practice. The GCA gathered more detailed feedback from suppliers about delay in payments in a mini survey.

Following continuing progress on this issue as reported by suppliers in the 2018 annual survey and taking into account the GCA’s engagement and clarity with retailers on the issue, it was decided to move delay in payments to the monitored category.

In July 2018, the GCA wrote to the ten original regulated retailers setting out how progress on this issue would be monitored and asked for retailer responses to be provided in March 2019. The GCA assessed this information together with the results of the 2019 annual survey and determined that this issue could be moved to previous. This means it has been closed as an issue in its own right because the GCA’s position or interpretation of the Code has been made clear and the Adjudicator no longer considers that ongoing monitoring or active work on the issue is merited.

The GCA has read with interest the regulated retailers’ submissions to BEIS made under the Duty to Report on Payment Practices and Performance, which applies to 12 of the 13 regulated retailers. This information, especially when compared with that submitted by suppliers shows the regulated retailers now lead the way on paying on time.

Suppliers report problems with delays in payments dropping from 35% in 2014 to 12% in 2020.

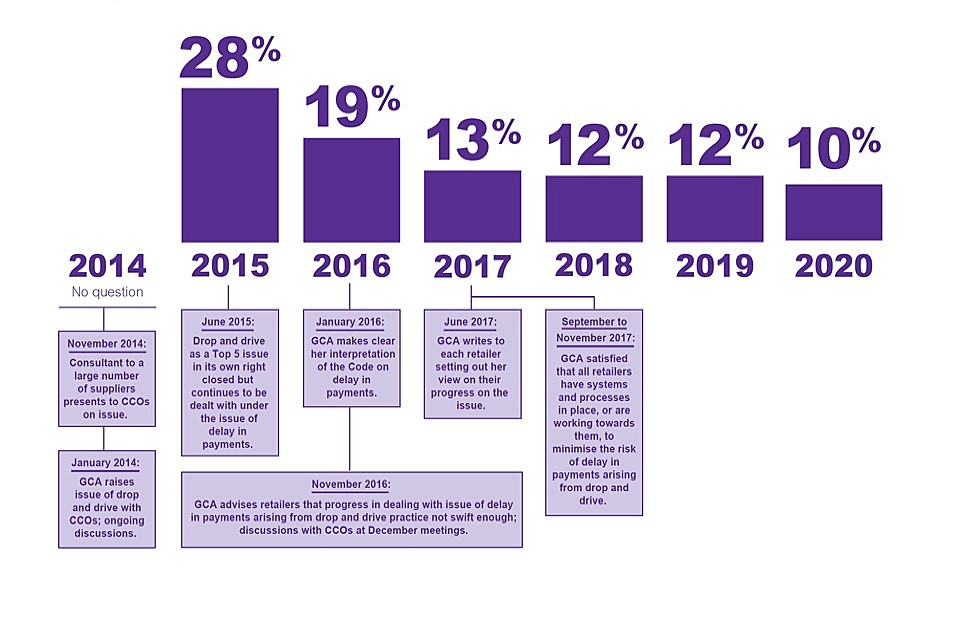

Drop and drive

Suppliers reported that they experienced problems where there was a disparity between what suppliers said they had delivered and invoiced, and what the relevant regulated retailer said had been received. In some cases retailers appeared to make automatic deductions from invoices for alleged shortages. These deductions were difficult to challenge, depending on the haulage method and particularly where no proof of delivery had been issued.

Suppliers informed the GCA that this was a major issue for them. There appeared to be different patterns of deductions among retailers in respect of the same suppliers; and varying error rates being recorded despite suppliers using the same processes with each retailer.

Drop and drive continues to be considered as an example of a practice which can lead to delay in payments.

The GCA received more information on this issue from retailers and suppliers. While some progress had been made on this issue, it was clear that some retailers’ progress in responding to supplier concerns had been too slow and the GCA accordingly escalated its concerns on drop and drive.

The GCA intensified its collaborative engagement and in May 2017 wrote to all regulated retailers setting out its view on their progress in actively managing the risk of breaches of the Code occurring under paragraph 5 (no delay in payments) arising from the practice of drop and drive.

The GCA received detailed responses from those retailers whose progress on tackling delay in payments arising from drop and drive was causing most concern. The GCA was satisfied that based on the information provided by retailers and the updated evidence received from suppliers, that all retailers that carry out drop and drive appeared to have adequate systems and processes in place to minimise the risk of delay in payments arising. For example, some retailers chose to implement good faith receiving for suppliers as a commercial solution to drop and drive issues.

Retailers have continued to make progress on the issue and many have implemented new operational and supply chain practices as a result. Supplier feedback has been that these systems are delivering benefits in terms of greater certainty about payments and better supply chain management. The GCA expects all retailers to continue to focus on this issue and continues to monitor what suppliers say about drop and drive. The 2019 and 2020 annual surveys continue to show that fewer suppliers are experiencing this issue year on year.

Suppliers report issues with drop and drive have reduced each year from 38% in 2015 to 10% in 2020.

Forensic auditing

Under the Limitation Act 1980, contracting parties are able to make claims against one another going back up to six years. The GCA heard this was being used proactively by some regulated retailers to make claims against suppliers for historic invoicing errors or omissions. Suppliers were being asked for significant sums of money with the burden of proof falling on them to show that alleged discrepancies were not valid claims. It was noted that the documentary audit trail was often complex and difficult to piece together after a long period of time. Suppliers reported that deductions would be applied with little or no notice.

In 2014, eight out of the original ten regulated retailers signed up to the GCA’s voluntary commitment to limit the auditing of suppliers’ trading accounts in search of missed claims to no more than the current and previous two financial years, on a reciprocal basis with those suppliers. In 2019 three additional retailers also made the voluntary commitment, followed by another retailer in 2020. Each of those retailers which signed up has set out how it would implement the voluntary commitment on a continuing basis. The GCA continues to monitor what suppliers say, particularly in relation to Sainsbury’s, the only regulated retailer which has not signed up to the voluntary commitment.

Suppliers report problems with retailers conducting forensic audits has dropped each year from 45% in 2014, down to 5% in 2020.

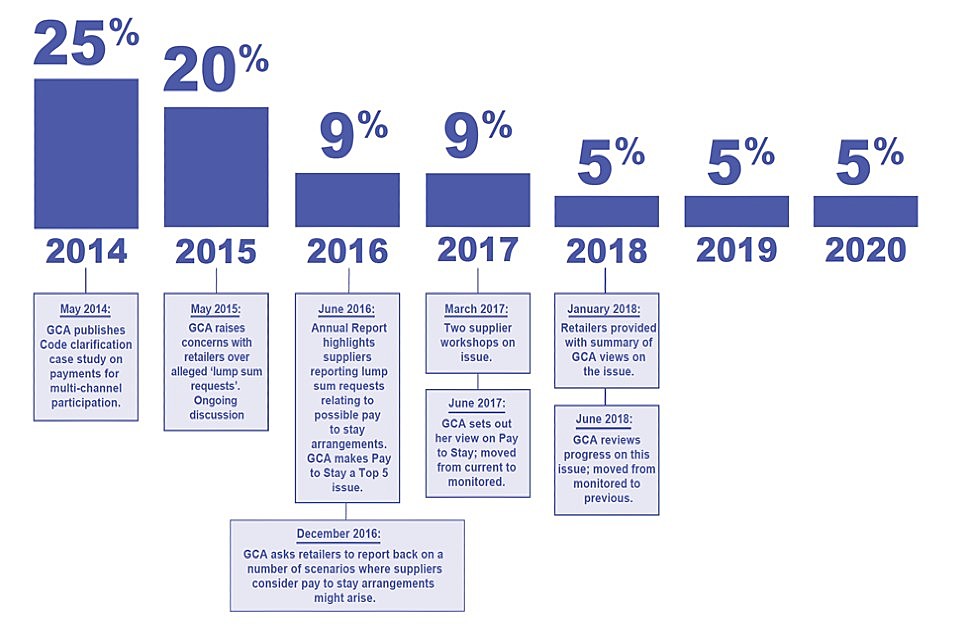

Paragraph 9 – Limited circumstances for payments as a condition of being a supplier (pay to stay)

Suppliers raised concerns about potential pay to stay arrangements. The terminology has been used informally in the context of lump sum payments being requested or required and the supplier feeling they would experience detriment if they refused. A GCA Code clarification case study on requests for lump sum payments made by one retailer highlighted instances where payments were requested for the first half of the financial year and suppliers felt they would suffer a detriment if these payments were not made. The GCA was also informed about other payments that suppliers might make to retailers which those suppliers saw as contributions they had to make in order to do business with the retailer, such as to participate in social events or marketing initiatives, payments made immediately prior to or at the time of a tender not as part of the tender or bidding process and payments to secure exclusivity.

The GCA sought views from retailers on their practices in a range of circumstances and also from direct suppliers in one-to-one meetings and workshops arranged specifically to discuss pay to stay. Examples were raised in each context that retailers clearly saw as normal commercial negotiations but suppliers saw differently. The GCA clarified the meaning of pay to stay and what behaviours are not considered to be Code compliant. The GCA emphasised that retailers needed carefully to consider when making any request for lump sum payment, not only what the payment was for and the basis for it in the supply agreement, but also how it would appear to the supplier and how payment was documented to provide clarity about the arrangement.

Following the GCA’s annual survey 2017 and what was reported to the GCA by suppliers and retailers on the issue of pay to stay, the GCA moved it to the monitored category as it was not a major issue reported in the survey.

The GCA continued to monitor feedback from suppliers on this issue and in December 2017 informed all retailers that although the issue of pay to stay appeared to be of less concern to suppliers now, some suppliers still reported they felt pressured, for example, to agree to a promotion in order to keep their business with a retailer. The GCA effectively saw this as a pay to stay arrangement. The GCA advised retailers that accordingly, in seeking to manage their compliance risk, retailers should avoid these differences in understanding wherever possible, whether by avoiding lump sum payments altogether or by clear communication between the retailer and supplier about what any money paid is for. The GCA also urged retailers to ensure that their training was properly updated. Following further monitoring of progress on this issue again in summer 2018 the GCA moved it to the previous category. Pay to stay has remained an issue for 5% of suppliers responding each year since 2018.

Suppliers report issues surrounding pay to stay have decreased from 25% in 2014 to 5% in 2020.

Paragraph 10 – Compensation for forecasting errors

Suppliers experiencing issues with forecasting reported difficulties communicating with buying teams, retailers not taking enough responsibility for forecasts after they have been set and often making last-minute changes, little or no engagement when sales are not meeting forecasts, and inadequate retailer systems which do not take into account known or past issues. Suppliers reported that the accuracy of regulated retailers’ forecasts was poor and that significant variations occurred between forecasts made and orders placed, sometimes at very short notice. In some cases, suppliers had been charged for non-delivery against orders when they had only been given an annual target and were then penalised for not meeting a 99% service level on each order, regardless of its variation from average. Suppliers also reported being left with significant amounts of stock through no fault of their own and that it was unclear how to seek compensation for inaccurate forecasting.

In 2015 the GCA reviewed the forecasting approach of the regulated retailers to assess their compliance with the Code. In March 2016 the GCA published a statement of best practice which the retailers should work towards, intended to promote better working practices by the retailers.

One year on, the GCA asked the retailers to provide information on their progress towards the best practice set out in the statement. Following monitoring, the GCA was unconvinced that sufficient improvements had been made. Forecasting was the second highest issue of concern to direct suppliers reported in the 2017annual survey. For these reasons the issue was moved back to the current category.

The GCA continued to receive feedback from suppliers about this issue in workshops and from training courses held by third parties. The GCA wrote to retailers in October 2017 to give feedback on their progress and launched a mini survey to learn more about supplier experiences. In December 2017 the GCA reported to retailers at a high level the outcome of the mini survey and noted some recurring themes raised by suppliers.

In January 2018 the GCA wrote to retailers again and expressed its view that there would almost always be some circumstances in which compensation was appropriate as a result of a forecasting error, so a blanket exclusion in a supply agreement would be unlikely to be Code compliant. Because suppliers might be unlikely to ask for compensation, the GCA asked retailers to consider the extent to which they might offer it. The GCA also expressed its view that the due care test, as set out in paragraph 10(1)(a) of the Code, was unlikely to be met by a retailer that provided no way for a supplier to contribute to the forecasting process, whether collaboratively in reaching agreed volumes to be ordered or by ensuring suppliers could raise questions and queries if a forecast seemed to them to be inaccurate or to have resulted in an excessive order.

Taking into account these points, the GCA published a revised statement of best practice in June 2018, which also addressed the issue of promotions (see separate Top Issue). The GCA noted that retailers were looking at their systems, processes and staff training to ensure these are all consistent with the best practice statement. In July 2018, the GCA wrote to the original ten designated retailers setting out how progress on this issue would be monitored and asked for retailer responses to be provided in March 2019.

The GCA assessed this information together with the results of the 2019 annual survey and determined that this issue could be moved to previous. This means it has been closed as an issue in its own right because the GCA’s position or interpretation of the Code has been made clear and the Adjudicator no longer considers that ongoing monitoring or active work on the issue is merited.

The GCA has been working with the additional regulated retailers on this issue.

Suppliers report problems with forecasting reducing each year from a high of 33% in 2014 down to 13% in 2020.

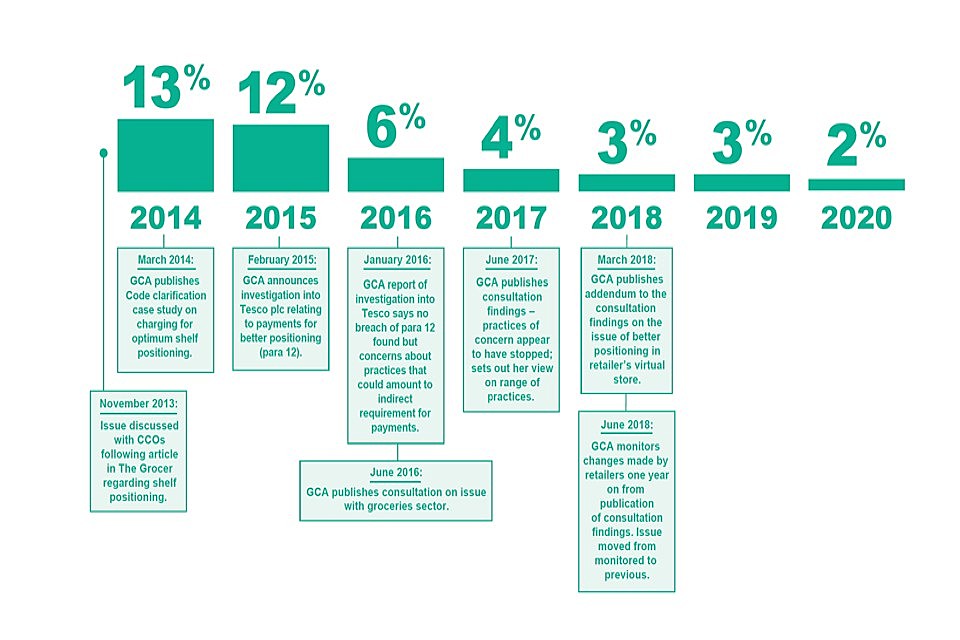

Paragraph 12 – No payments for better positioning of goods unless in relation to promotions

During the investigation into Tesco, the GCA was concerned to find evidence of practices that could amount to an indirect requirement for payments to be made by suppliers to secure better positioning or an increased allocation of shelf space. These practices included large suppliers negotiating better positioning and increased shelf space in response to requests for investment from the retailer, as well as paying for category captaincy and to participate in range reviews. No breach was found but the GCA determined to look into the issue across all regulated retailers.

The GCA consulted with the groceries sector on the proper scope of indirect requirements for payment to secure better positioning of goods or increased shelf space within a store. The GCA published its response in February 2017, noting that the practices that had caused concern appeared to have stopped and making clear what it considered to be Code compliant behaviour for the future.

Formal monitoring was carried out in February 2018 to evaluate the most recent supplier information and to identify whether retailers had decided to make any changes as a result of the GCA’s published consultation response. At the same time, the GCA also considered the issue of better positioning of goods in relation to retailers’ sales from their virtual stores, asking all retailers to provide information about their practices. In March 2018 the GCA issued an addendum to the conclusions published following the consultation on paragraph 12 of the Code. This made clear that the GCA will consider physical and virtual positioning of groceries in the same way when interpreting the Code and that retailers should consider whether their activities in relation to groceries for resale online are compliant with the Code. Retailers are expected to make clear on their websites where goods not on promotion appear more visible to customers as a result of advertising paid for by a supplier or any payment received from a supplier to secure more space or better positioning.

Following the GCA’s annual survey 2018 and feedback by suppliers that this was not an issue of significant concern, the GCA moved it to the previous category. The 2020 annual survey showed that only 2% of suppliers experienced this as a significant issue during the previous year.

Suppliers report that requests for payments for better positioning have dropped from 13% in 2014 to 2% in 2020.

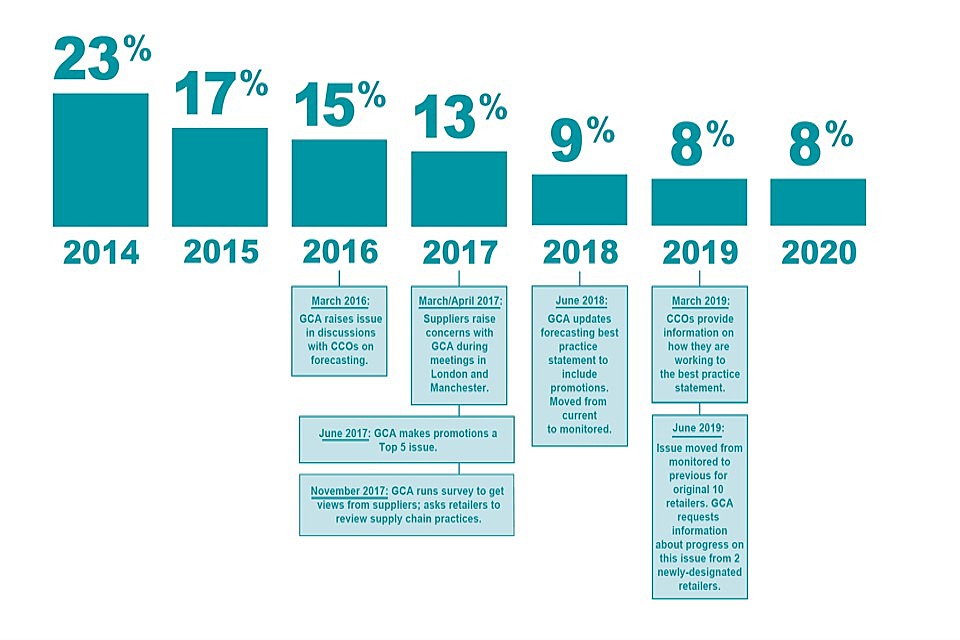

Paragraph 13 – Promotions

Suppliers reported forecasting in relation to promotions in particular was poor and that it led to overbuying at promotional prices or had the impact of suppliers predominantly funding the cost of a promotion. Suppliers were also concerned about a number of poor practices such as not adhering to timelines agreed for promotional activity, buyers not activating promotions in stores and failure to deliver on agreed promotional activity.