From £5k start-up to global exporter: Leeds businesswoman breaks into North American markets

Yorkshire’s Tilz Prosperitas is ready to deliver to Europe and take on new clients in the US and Canada thanks to flexible finance following government referral.

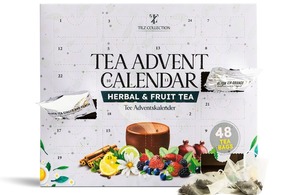

Founded by Leeds businesswoman Tayo Adebisi, Tilz Prosperitas – an e-commerce business specialising in gift sets and Advent calendars – has secured trade loans worth up to £200,000 following an Export Assist referral from UK Export Finance (UKEF) – the government’s export credit agency. The financing, brokered by Dynamic Funding, will enable the business to meet demand from Europe and expand sales into North America.

The business started in 2017 when Tayo launched her online store and flagship brand TilzCollection with just £5,000 capital. Within four years, turnover had reached £3 million. But the Covid pandemic created cash flow challenges, making it difficult to pay suppliers on time, ship goods promptly, and develop new products.

After several banks declined funding applications, the West Yorkshire Combined Authority referred Tayo to Moustafa Elgendy, International Trade Adviser at the Department of Business and Trade, and Alissia Deane, UKEF’s Export Finance Manager for West Yorkshire. After talking through the best finance options with Tayo, Alissia connected the business to Dynamic Funding, who brokered two trade finance loans worth up to £200,000.

With the new funding in place, Tilz Prosperitas is ready to fulfil holiday season orders from established clients across the Netherlands, Germany, France and Spain, while preparing to supply a major US supermarket chain and expand into Canada. The company also plans to diversify beyond seasonal products and explore markets in Australia, China and Mexico.

Alissia Deane, UKEF Export Finance Manager for West Yorkshire, said:

Trade finance can be the key that unlocks international growth for British exporters, especially for smaller businesses. Tilz Prosperitas is a perfect example of how the right financial backing can help UK companies seize opportunities in multiple markets simultaneously.

We’re particularly pleased to support a female-led business breaking into competitive sectors like retail and e-commerce across Europe and North America.

Tayo Adebisi, Founder and CEO of Tilz Prosperitas, said:

When I started TilzMart with £5,000 eight years ago, I never imagined we’d be supplying major retailers across Europe and North America. The pandemic taught us how crucial flexible finance is for growth - we had the orders but couldn’t bridge the gap between paying suppliers and receiving payments.

This funding has been transformational, allowing us to confidently take on larger contracts and expand into new markets.

Alex Kourti, Dynamic Funding, said:

Tilz Prosperitas perfectly illustrates why we at Dynamic Funding are passionate about supporting exporters, who traditional lenders may not fully understand.

It’s brilliant to see her business now confidently fulfilling orders across multiple continents - that’s the kind of British export success story we’re proud to help make possible.

By working with partners like Dynamic Funding, UKEF is increasing the range of flexible financing accessible to smaller businesses, reducing missed opportunities for exporting and promoting growth under the government’s Plan for Change.

Over the last financial year, UKEF provided a record £14.5 billion in new financing, helping over 667 UK companies to export and grow and supported up to 70,000 jobs.

This announcement has been made alongside the Regional Investment Summit, a landmark event which brings together business leaders and major investors with policymakers, regulators, regional mayors and other local leaders to showcase the breadth and depth of opportunities to invest, expand and create jobs right across our nations and regions.