Technical adjustment to the Business Rates Retention system in response to the 2023 Revaluation and central list transfers

Updated 19 December 2022

Applies to England

Scope of the consultation

Topic of this consultation:

This consultation covers proposals for an updated technical adjustment to the Business Rates Retention (BRR) system in response to the forthcoming 2023 business rates revaluation and transfers from local lists to the central list.

Scope of this consultation:

This consultation seeks views from local government, local government representatives and sector experts, on:

The proposed technical adjustment to the BRR system:

- whether the technical adjustment to the BRR system in response to the 2023 business rates revaluation should be based on the 2017 adjustment,

- whether you support the proposed update to the technical adjustment formula,

- whether you agree with the proposal not to modify the adjustment at this point to take into account changes in reliefs and if you have any suggestions on how to do so.

Further amendment to reflect transfers from local lists to the central list:

- whether the technical adjustment should be further adjusted to mitigate transfers of ratepayers from local lists to the Central List,

- whether the proposed further modification in response to the central list transfers adequately safeguards affected authorities’ financial positions.

Geographical scope:

These proposals relate to England only.

Impact assessment:

Since the government does not envisage that the proposals within this consultation document will have an impact on business, no impact assessment has been produced.

Basic information

Body/bodies responsible for the consultation:

Local Government Finance Directorate within the Department for Levelling Up, Housing and Communities.

Duration:

This consultation will last for 4 weeks from 2 to 30 September 2022.

Enquiries:

For any enquiries about the consultation please contact BRRSA@levellingup.gov.uk.

How to respond:

You may respond by completing an online survey.

Alternatively, you can email your response to the questions in this consultation to BRRSA@levellingup.gov.uk.

If you are responding in writing, please make it clear which questions you are responding to.

Written responses should be sent to:

BRR Operations Team – Local Government Finance

Department for Levelling Up, Housing and Communities

2nd Floor, Fry Building

2 Marsham Street

London

SW1P 4DF

When you reply it would be very useful if you confirm whether you are replying as an individual or submitting an official response on behalf of an organisation and include:

- your name

- your position (if applicable)

- the name of the local authority or organisation you are responding on behalf of (if applicable)

- an address (including postcode)

- an email address, and

- a contact telephone number

Technical adjustment to the Business Rates Retention system

Summary

1. The next Business Rates Revaluation will apply from 1 April 2023. Revaluations make necessary updates to reflect changes in the value of rateable property, resulting in increases or decreases to ratepayer bills. At the local authority level, overall bills will increase or fall depending upon whether rateable values in that area have performed above or below the average.

2. Local authorities administer the business rates system and retain a portion of the rates they collect through the Business Rates Retention System (BRRS). Revaluations create turbulence in the BRRS outside the control of local authorities. The government indicated at the outset of the BRRS that at Business Rates Revaluations it would adjust each local authority’s top-up or tariff, to ensure that, as far as practicable, a local authority’s retained income is no more, or less than it would have been had the revaluation not taken place.

3. The government developed a technical adjustment to the BRRS to mitigate the impact of the last revaluation in 2017; and this methodology largely achieved the stated policy intention. At that time the government said that it would keep the methodology under review, and this consultation presents the government’s proposals, ahead of the 2023 Revaluation, following a review of the existing methodology’s effectiveness supported by further modelling and engagement with sector experts.

4. Separately, the government has announced that certain hereditaments will be moved from local lists to the central list, from 2023-24. The changes will be made to coincide with the 2023 Revaluation and, following consultation, the government has committed to ensure that, as far as practicable, authorities’ income from the rates retention scheme will not be adversely impacted by the movement of property to the central rating list.

5. The government seeks views on its proposals; principally on the updated technical adjustment methodology and the adjustment to the methodology to apply for the purposes of central list transfers, but also their effects on local authorities. It welcomes views in particular from councils, their representative groups and sector experts.

Background

6. The BRRS was designed to allow local authorities to keep an amount of their own rates income, above which a proportion of any growth in the authority area would be retained, subject to a levy, until a reset of the system. Revaluations create change in the BRRS outside the control of local authorities. It is government policy to ensure that, as far as practicable, this disruption is removed from the system, smoothing local authority income across a Revaluation.

7. The first such technical adjustment to the BRRS was at the 2017 Revaluation. In advance of the Revaluation, the government consulted[footnote 1] on its proposed amendment of local authority income via top-ups and tariffs. Put simply, the methodology added a factor to an authority’s top-up or tariff value to add back an estimate of the loss, if any, or to subtract an estimate of the gain, seen by the local authority, from the Revaluation. A worked example is shown in table 1 below.

Table 1:

| Pre-Revaluation (£) | Post-Revaluation (£) | |

|---|---|---|

| LA’s Baseline Funding Level | 500 | 500 |

| LA’s share of business rates income | 700 | 750 |

| Tariff (-) /Top Up (+) (Of which adjustment factor) | -100 (0) | -150 (-50) |

| LA’s retained income | 600 | 600 |

| Income above BFL | 100 | 100 |

8. A simple, pound-perfect example is shown in table 1 above, where a tariff authority gains via a hypothetical Revaluation, an extra £50 in income. This income is stripped out by the Adjustment Factor (-£50), resulting in adjustment of the authority’s income back to its previous £600 figure.

9. In practice, the government does not believe it is possible to measure a pound-perfect adjustment to mitigate changes in non-domestic rating income arising from the revaluation alone. Instead, the government’s aim is to be as close to this as is practicable by using proxies, derived from gross rates payable and non-domestic rating income, to compare the local authority’s rateable value before and after the revaluation.

10. As in 2017, the government proposes to make the technical adjustment sequentially in three stages using published data: an initial adjustment in year 1 made on draft rating list data and 2021-22 national non-domestic rates return 3 (NNDR3) data; a further adjustment in year 2 using updated rating list and NNDR3 data, coupled with a one-off adjustment for the difference compared to the year 1 adjustment; finally, in year 3 the one-off adjustment will be removed, giving the final revaluation adjustment value. The cycle then re-starts for the 2026 Revaluation. This is shown in table 2.

Table 2:

| Year 1 | Year 2 | Year 3 | Year 1 | |

|---|---|---|---|---|

| 23/24 | 24/25 | 25/26 | 26/27 | |

| Revaluation adjustment | Initial revaluation ‘ongoing’ adjustment. | Updated ongoing adjustment using new data and one-off adjustment for year 1 using new data. | Ongoing adjustment continues. Removal of one-off adjustment. | Cycle continues as per year 1 for next revaluation. |

| Revaluation data used | Draft list data, late 2022 | List data as at 01/04/23 | List data as at 01/04/23 | Draft list data, late 2025 |

| BR outturn data used | NNDR3 21/22 | NNDR3 22/23 | NNDR3 22/23 | NNDR3 24/25 |

11. For example, a local authority may have a £50 gain (as seen in table 1) removed via the year 1 revaluation adjustment. In year 2, the revised revaluation adjustment based on updated NNDR3 data for 22/23, and the 01/04/23 list data shows that that adjustment should have stripped out a £75 gain in year 1. Therefore, in year 2, the local authority would have an ‘ongoing’ revaluation adjustment of - £75 added to their tariff (cf. - £50) plus a one-off adjustment for year 1 of - £25 would also be added to the tariff for year 2. This means the authority’s adjustment for year 2 would be - £100, and the overall tariff would be - £200. In year 3, the one-off adjustment would be removed, so the adjustment would be - £75 and the authority’s new tariff - £175. This is exemplified in Table 3 below.

Table 3:

| - | Year 1 (£) | Year 2 (£) | Year 3 (£) |

|---|---|---|---|

| LA’s BFL | 500 | 500 | 500 |

| In-year share of BR income (actual with new data) |

750 (775) |

775 (775) |

775 (775) |

| Tariff (-) /Top Up (+) (Of which adjustment factor) (Of which one-off) |

-150 (-50) (0) |

-200 (-75) (-25) |

-175 (-75) (0) |

| LA’s retained income (actual with new data) |

600 (625) |

600 (575) |

600 (600) |

| Income above BFL (actual with new data) |

100 (125) |

100 (75) |

100 (100) |

12. From 2023, Revaluations are set to occur every three years. The government intends for its updated methodology to be used initially for the 2023 Revaluation, then continuing on a three-year cycle. It will continue to keep the methodology under review.

The technical adjustment

13. The government is proposing to model the 2023 adjustment on the 2017 Revaluation adjustment, which was broadly accepted by the sector and achieved the best estimate of the change in local authorities’ income across the Revaluation. The government considers that the 2017 methodology is a good starting point, and there are several aspects of the adjustment’s mechanics, and data sources for that methodology that the government proposes to replicate; these are set out in Annex A.

The formula

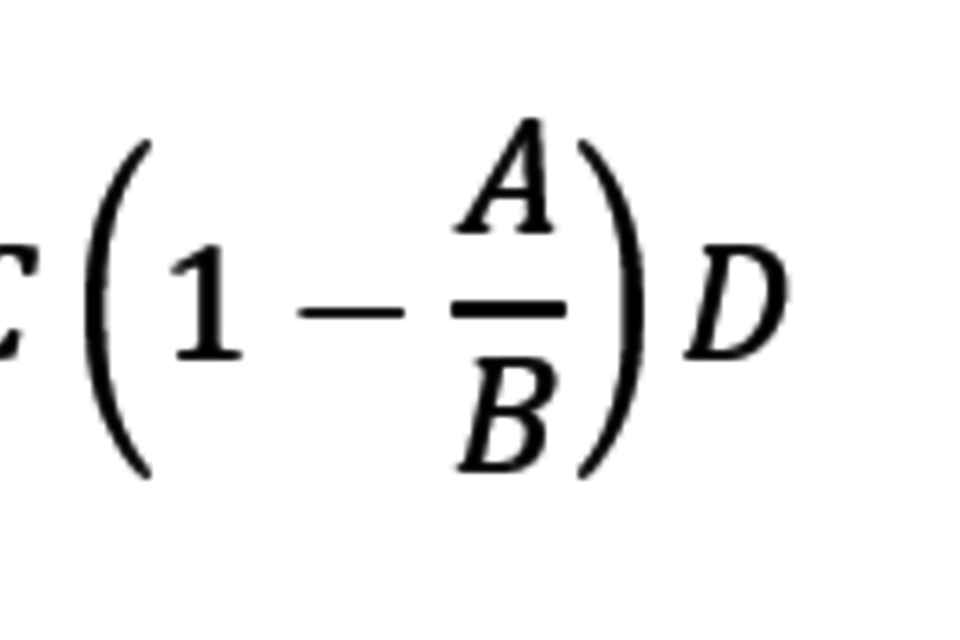

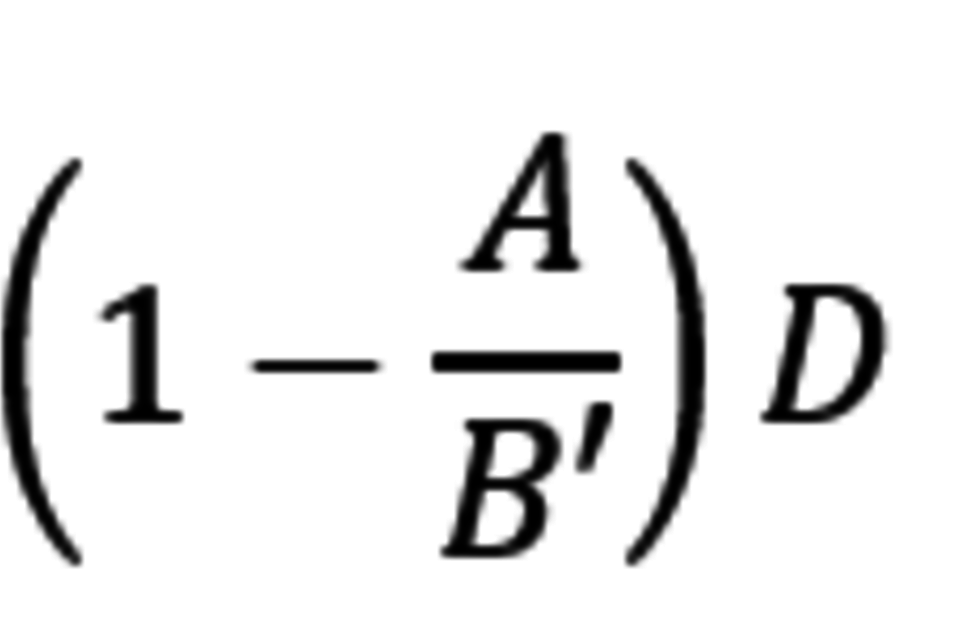

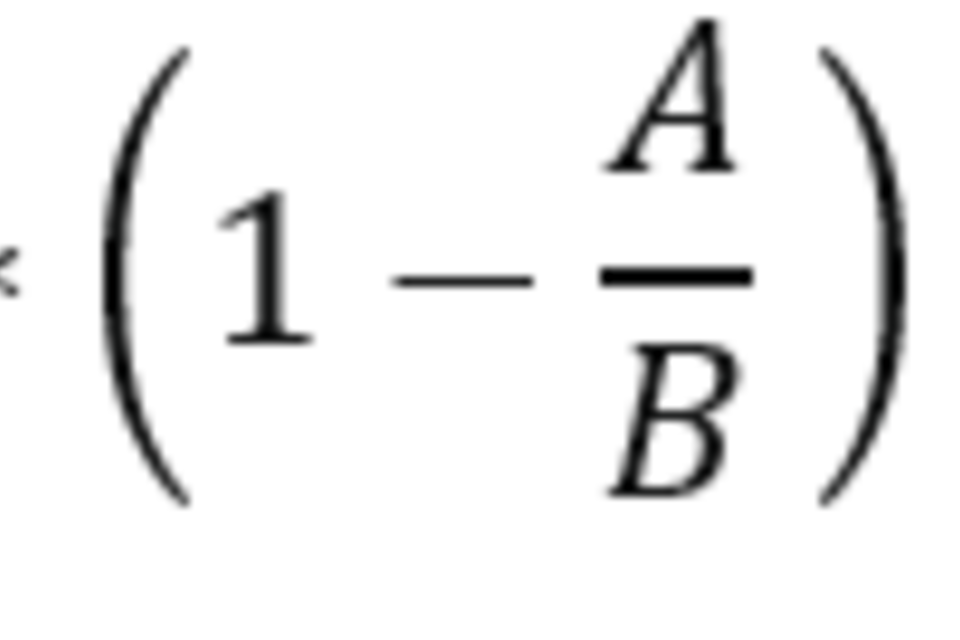

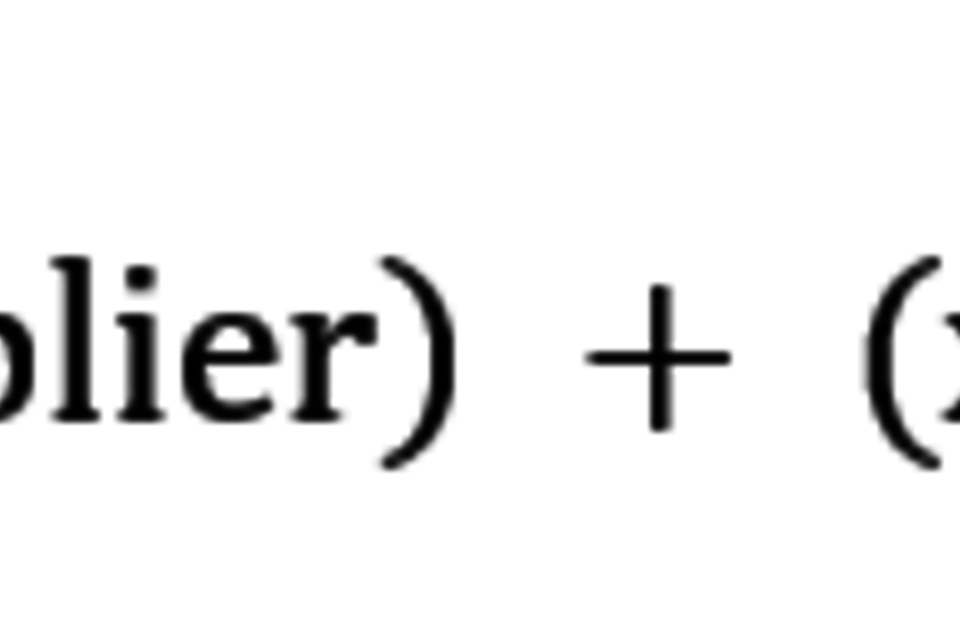

14. The 2017 approach took a proxy of each individual local authority’s non-domestic rating income and multiplied this amount by a proxy of the change in their income at the Revaluation, all adjusted for the authority’s share of income (for major precepting authorities this is the combined shares of their billing authorities’ income). The resulting figure, J, was added to an authority’s top-up or tariff.

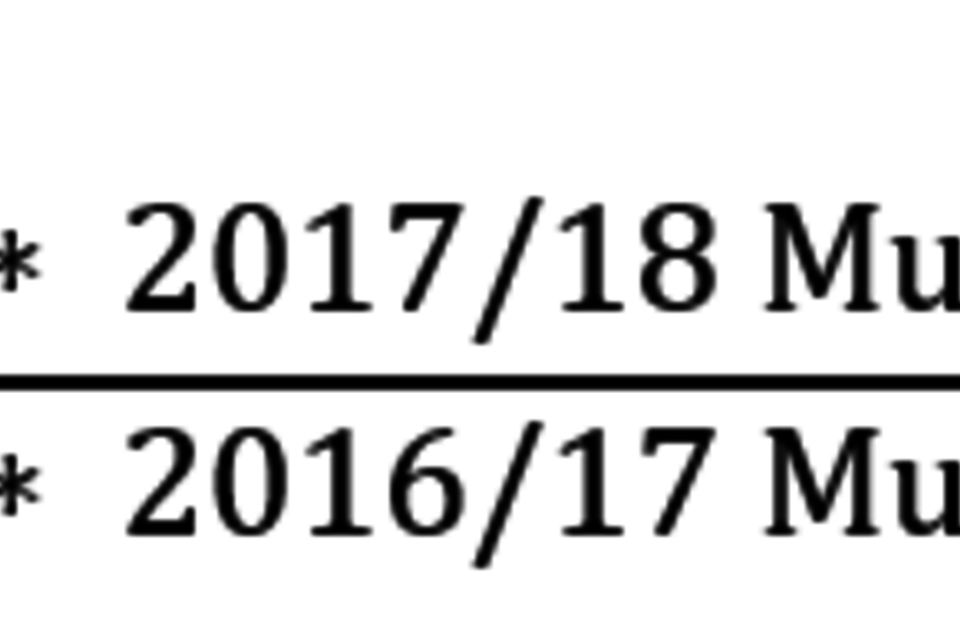

J = C(1-A/B)D

J=NNDR income (1-(2017 RV * 2017/18 Multiplier)/(2010 RV * 2016/17 Multiplier))* BR Retention % share

To note, the 2017/18 Multiplier does not include the appeal adjustment or inflation

15. The proxy for income C was taken from the latest available outturn data and was crudely gross rates payable, adjusted for reliefs, accounting adjustments (including a measure of ongoing provisions) and disregarded amounts. The proxy used for the revaluation change A/B was calculated using pre- and post-revaluation RVs and multipliers (excluding the appeal adjustment and inflation); this proxied the revaluation change via change in gross rates payable, at local authority level.

16. In 2017, no further modification of the proxy was made for other factors which could change at a different rate to the revaluation adjustment prediction at local authority level meaning the gross rates payable proxy would not capture the entire change perfectly. The Government concluded that change in gross rates, adjusted as described above, represented the best available proxy of revaluation change, and that reliefs and other factors were sufficiently included in the revaluation adjustment via the income proxy, C.

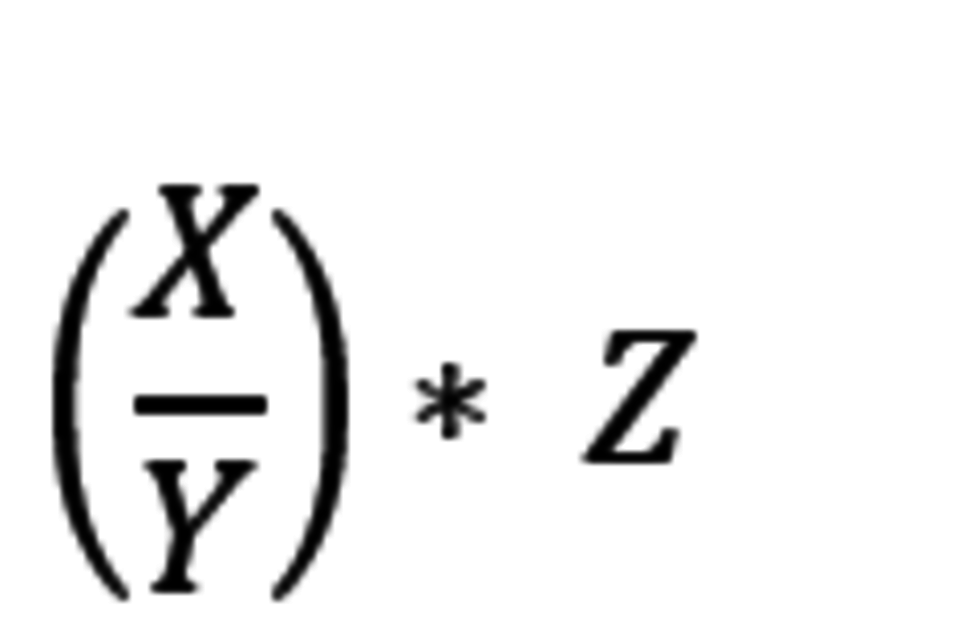

Measurement of provisions in C

17. The adjustment included a measure of appeals outstanding in the system in the measurement of C. (In this context, “appeals” is taken to include backdated alterations to the list from Checks, Challenges and VO alterations). Given that appeals can come through at different times and that in some years this may be significantly higher or lower than others, the measure of provisions for appeals that was used in 2017 took a measure of the local authority’s ‘steady state’ provisions. This was intended to give the most accurate estimate of how much its income would be reduced each year to make the provisions required given its latest available estimate of probable RV change and assuming no future change. It was calculated as:

(X/Y)* Z

Where:

X = the total provision held on each local authority’s collection fund for the alteration of lists and appeals (as per their closing balance for the year)[footnote 2]

Y = the sum of the multipliers for the duration of the list up to and including the year of the data used

Z = the multiplier for the year

18. The government proposes not to change the treatment of provisions in the value of C, as it still considers this gives the best estimate of the actual reduction in a local authority’s annual income anticipated due to future appeal loss, based on available data, and therefore the best measure of its pre-revaluation income.

19. As in 2017, business rates income which sits outside of the core system and is disregarded from non-domestic rating income, for example amounts retained in designated areas, is not included within the technical adjustment. The regulations which calculate the amount of income to be disregarded provide for adjustments for revaluation years where required[footnote 3].

Question 1: Do you consider that the 2017 technical adjustment to the business rates retention system for the Revaluation is the right place to start? If not, please give your reasoning.

The impact of outstanding appeals

20. The government has reviewed the 2017 revaluation adjustment and believes that improvements should be made to more appropriately take account of outstanding appeals. The government proposes to do this for the 2023 adjustment and seeks views on its proposed update to the formula.

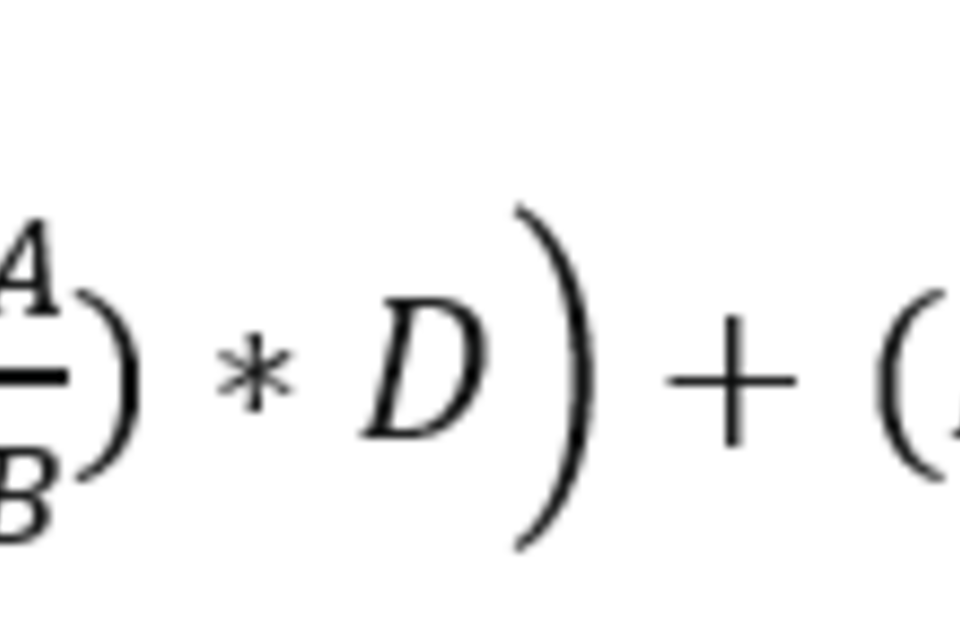

21. In 2017, the formula used a proxy value of B which did not factor in outstanding appeals, leading to an artificially low revaluation effect in the adjustment methodology. B took a local authority’s 2010 list RV and multiplied it by the 2016/17 small business multiplier, however for authorities with outstanding appeals relating to the 2010 list at the point of the 2017 revaluation, B was artificially high.

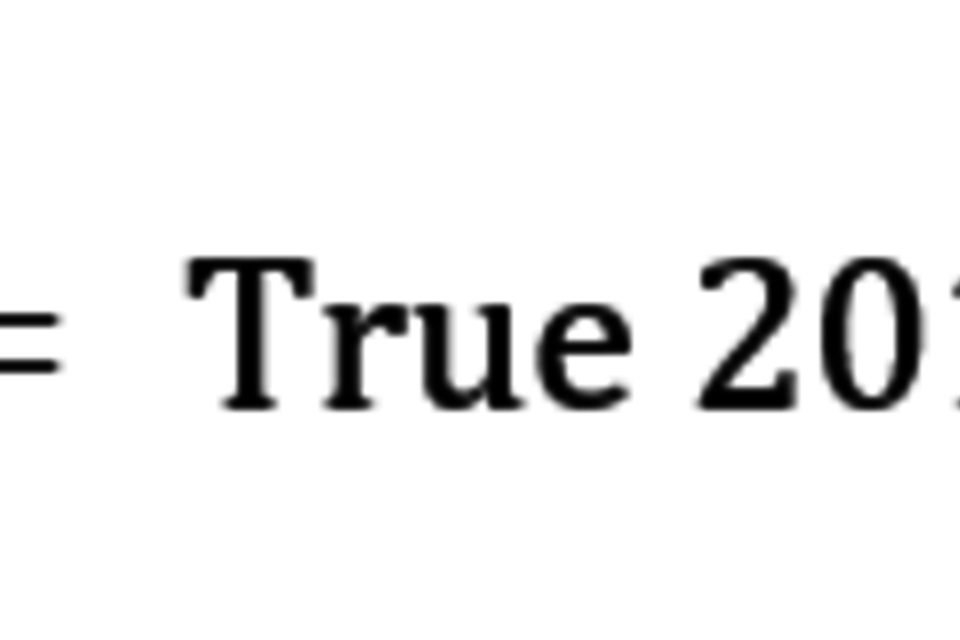

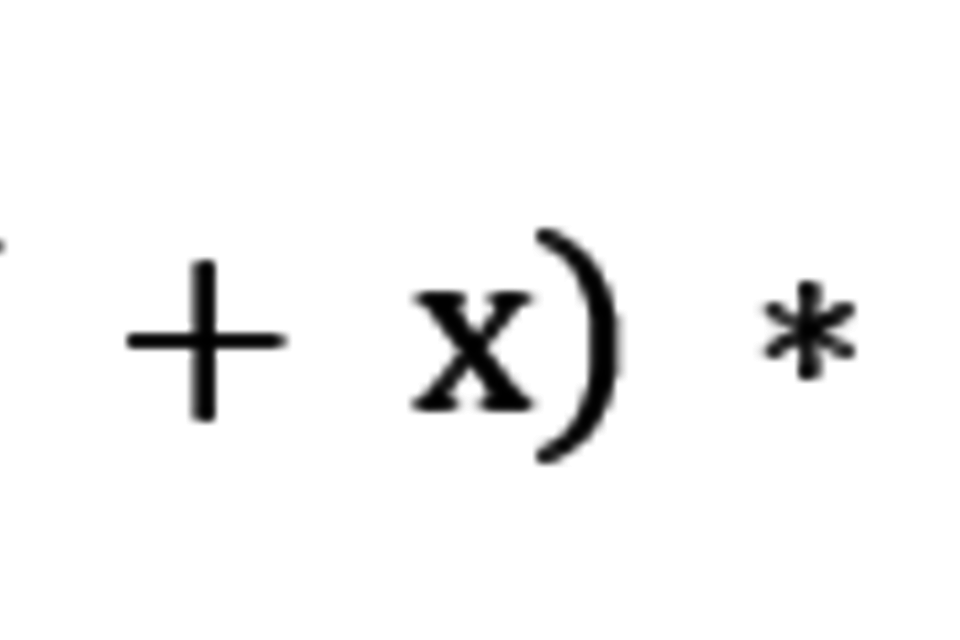

22. The government considers that this led to local authorities with outstanding appeals being overcompensated through J. Re-arrangement of the formula for J, shows that this overcompensation is proportional to the amount of the unsettled appeals. The value used for 2010 RV is artificially high due to unsettled appeals on the 2010 list within an LA:

2010 RV = True 2010 RV + x

B is therefore:

B = (True 2010 RV + x) *2016/17 Multiplier

Where is the (positive) amount of RV that will be lost to appeals when all 2010 appeals are resolved. This then gives the formula:

J = NNDR income (1-(2017 RV 2017/18 Multiplier)/((True 2010 RV+x) *2016/17 Multiplier))BR Retention % share

23. An authority with yearly steady state provisions before a Revaluation of £50,000 would benefit by a similar amount of additional income built into the system. This is not rectified over future years but continues to increase in line with the change in the multiplier.

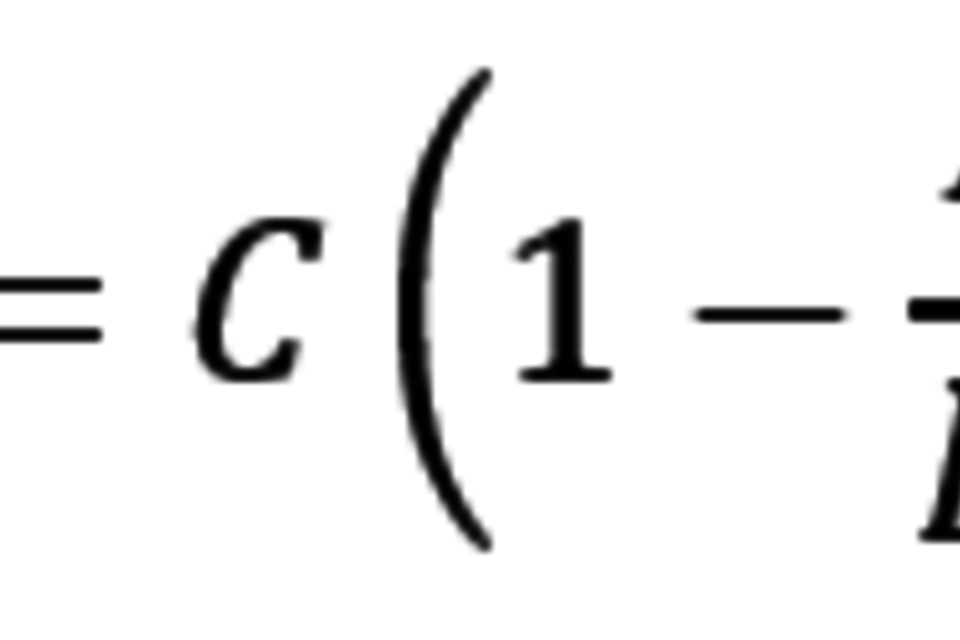

24. This issue can be resolved by reducing the value of B by the value of the ongoing, steady state provisions figure (as the proxy for outstanding appeals). This means that the proxy captures the ‘real’ revaluation effect on income that would be experienced had the local authority resolved its outstanding appeals, so that, as far as is practicable, growth in the system post-revaluation is not inflated by the adjustment. The updated formula, using the new list RVs and multipliers is:

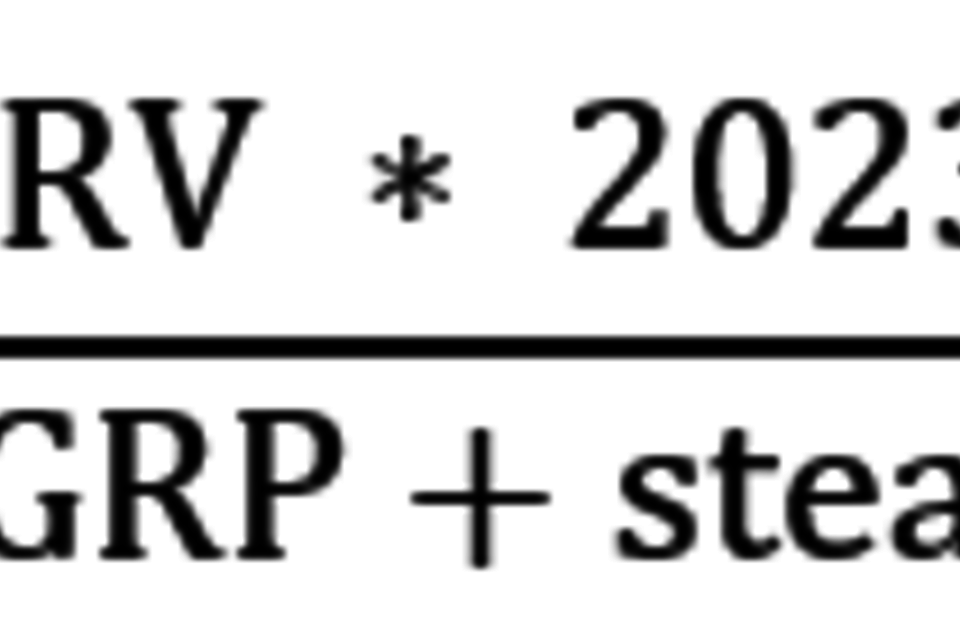

J=C(1-A/B’)D

J=NNDR income (1-(2023 RV * 2023/24 Multiplier)/((2017 RV * 22/23 Multiplier)+ongoing provisions)) * BRR % share

To note: The 2023/24 Multiplier does not include the appeal adjustment or inflation. Ongoing provisions are negative so reduce the value of 2017 RV * 2022/23 multiplier (essentially gross rates payable). For more detailed information on the derivation of the numbers, including lines to be used from the current NNDR3 form, see Annex B.

25. The government considers that the updated formula as described above more appropriately reflects the impact of outstanding appeals and better removes the impacts of a Revaluation from local authority income. This will mean that growth following the Revaluation more accurately reflects real growth in the local area, removing distortions from unresolved appeals in the 2017 list. The updated methodology does not remove any additional income that resulted from the treatment of appeals in the 2017 adjustment but is designed to ensure that income is not inflated due to outstanding appeals following the 2023 revaluation adjustment. The government therefore proposes to adopt the update in the 2023 adjustment methodology.

Question 2: Do you support the proposed change to the formula? If not, please give your reasoning.

The treatment of reliefs

26. Reliefs are a core part of business rates tax policy. They reduce non-domestic rating income and are a key component of the BRRS, through compensation. It is therefore important to consider the impact of reliefs in the technical adjustment. In 2017, the government considered the impacts of reliefs in the technical adjustment and concluded that the proxy for revaluation change A/B and inclusion of reliefs in the proxy for income, C, was sufficient to account for changes in relief.

27. As part of reviewing the technical adjustment, the government has revisited this. It was found that using the updated treatment of outstanding appeals factor, B’, also increases the revaluation effect felt by reliefs in C. This means a more positive prediction of relief post-revaluation (ie. an increased revaluation effect leads to an increased prediction of relief). This in turn reduces the likelihood, and impact, of any underestimation of changes in reliefs awarded across the revaluation. However, the government has considered whether any further adjustment would be appropriate or proportionate and whether there are any issues that prevent an adjustment from being made. These considerations are given below.

28. Are changes in reliefs an inherent part of the BRRS to be borne by LAs: Local authorities are expected to manage their share of changes in reliefs funded via tariffs/top-ups year-on-year, whether the relief increases or decreases. It is difficult to extricate where changes in reliefs across a revaluation result specifically from revaluation-related changes in property use or eligibility, versus normal year-on-year fluctuations. There is a question as to whether we should make further changes to the adjustment to capture such change or whether this should be borne by authorities. This is also linked to the materiality of such changes.

29. Would an adjustment be material: An amendment to the methodology for changes in reliefs should only be made if it produces a material effect. At this stage it is not possible to predict the scale and proportionality of changes in relief for LAs; it may be possible to make an informed decision once we begin to see data coming through on reliefs in 2023-24, though this would include all relief change, whether resulting from the revaluation or usual fluctuation.

30. Availability of Data: Data timing means that any adjustment to the methodology for changes in relief could not be made until year 3 unless an additional data collection was done in time for year 2. NNDR3 2023/24 data would be more accurate but would mean further adjustment in year 3 to all 3 years of the revaluation cycle. This would complicate the adjustments already necessary and could result in much more uncertainty and volatility. LAs could either gain or lose due to a further adjustment for relief changes in year 3, but they would get all three years’ worth of gains/losses, in year 3.

31. Introduction of unnecessary complexity/volatility: Adjusting the methodology for changes in reliefs would increase the already highly complex nature of the system. The system will already be more complicated due to shorter revaluation cycles from 2023, so there will already be a revaluation adjustment in every year. Adjusting for reliefs would introduce additional complexity making the changes more difficult to understand. It could also increase the risk of error. This is a particularly important consideration if adjusting for reliefs would not make a material impact.

32. It is not yet clear how, if it were deemed to be desirable and material, such an adjustment could be made. To make such an adjustment, a robust methodology must be developed and tested. The government would welcome views from the sector on the basis upon which an adjustment could be made.

33. Having considered the above, the government is minded not to further amend the technical adjustment to measure changes in reliefs. It is also not yet clear how such an adjustment could be made. However, as it is not known at this stage the extent of the changes in reliefs resulting from the 2023 Revaluation, the government intends to keep this under review.

Question 3: Do you agree that we should not further amend the adjustment to take into account changes in reliefs at this stage but rather keep this under review as changes in reliefs become clearer? If not, please give your reasoning.

Question 4: If you disagreed with question 3, what are your suggestions for updating the technical adjustment to better take into account changes in reliefs?

Amendment to the technical adjustment for transfers to the central list

34. On 16 August 2021 the government consulted[footnote 4] on a proposal to transfer certain rateable properties from local lists to the Central List to coincide with the Revaluation in 2023.

35. The consultation paper set out the government’s position that revaluations should not affect local authorities’ income from the business rates retention scheme and undertook that, as far as practicable, transfers of property from local to central lists taking place alongside the 2023 Revaluation should leave authorities’ income unaffected.

36. On 6 May, following the end of the consultation period, the government confirmed that it would transfer some properties from local lists to the Central List at the 2023 Revaluation. It reconfirmed[footnote 5] that it would work with the sector on the adjustments needed to ensure that, as far as practicable, authorities’ income from the rates retention scheme would not be adversely impacted by the movement of property to the central rating list.

Impact of central list transfers

37. The effect of transferring properties to the Central List at the 2023 Revaluation will be to reduce the value of property on local rating lists. In turn, this will reduce the business rates income that authorities collect locally following the Revaluation.

38. Because the technical adjustment to tariffs and top-ups outlined above is designed to deal with post-Revaluation changes to income – including reductions to income – it might be supposed that the formula will automatically deal with reductions caused by Central List transfers, as well as reductions caused by the Revaluation itself.

39. However, modelling indicates that, whilst the technical adjustment will go some way to compensate authorities for Central List transfers, they will, generally, be financially worse-off than if property had not been transferred. This is because these networks generally do not benefit from any relief.

40. Because the government’s aim – reiterated in the 6 May announcement – is to ensure that, as far as practicable, local authorities are not financially disadvantaged by Central List transfers, we are minded to further modify the technical adjustment as it applies to authorities subject to Central List transfers. This modification will ensure that, as far as practicable, authorities will have the same income post-Revaluation as they would have had if there had been no Central List transfers.

Question 5: Do you agree that the standard technical adjustment should be adjusted to safeguard, as far as practicable, the financial position of those authorities who will see property transferred to the Central List at the Revaluation?

The modified technical adjustment

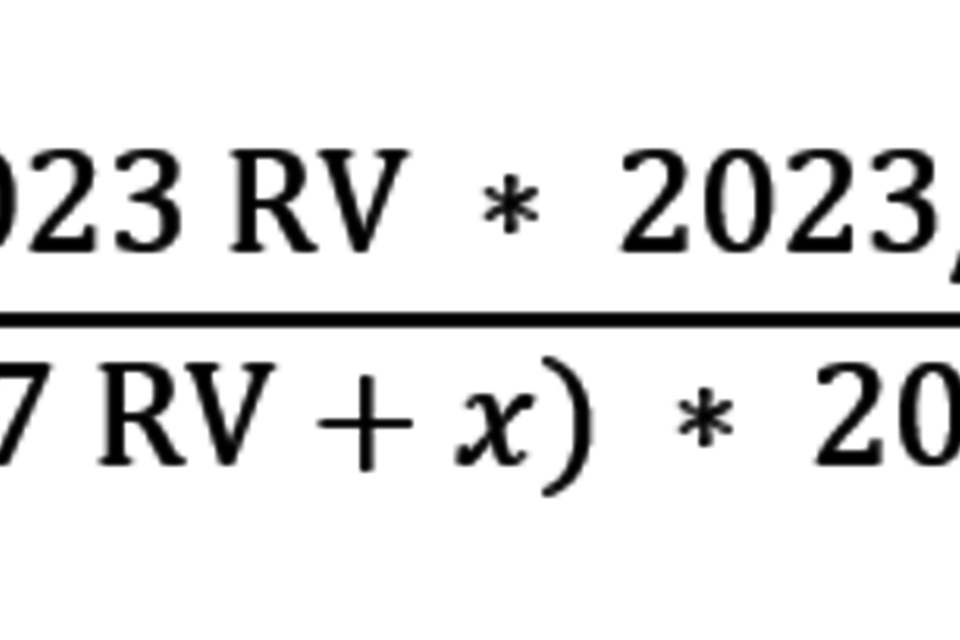

41. The 2017 technical adjustment formula added a value J to an authority’s existing tariff, or top-up, calculated as:

(C * (1-A/B ) * D)

where A, B, C and D have the meanings set out in paragraphs 14-24.

42. For those authorities subject to Central List transfers we propose to:

a. adjust the value of C to exclude the (2022/23) value of the network property being transferred; and

b. Exclude from the value of B’, the gross rates payable (in the last year of the 2017 List) on the property to be transferred, ‘b’.

c. Having calculated the value of J using the modified values of B and C, as proposed above, we will then add back the authority’s share of the sum excluded from C (see below the updated equation). This will effectively reduce the new tariff or increase the new top-up and give the authority the retained income that it would have had if property had not been transferred to the Central List.

(C*(1-A/B)*D)+(D*b)

43. The proposed modified technical adjustment will apply to both billing and major precepting authorities affected by Central List transfers.

Question 6: Do you agree that the proposed modification will adequately safeguard the position of local authorities who will see property transferred to the central list? If not, please give your reasoning and what you would do differently.

Practical considerations

44. Excluding from the value of B’, the gross rates payable on the property to be transferred (see paragraph 42b above), should be relatively straightforward. We will simply take the rateable value of relevant networks from the 2022-23 Rating List and multiply it by the appropriate 2022-23 multiplier.

45. Adjusting the value of C to strip out the 2022-23 rates income of any property transferred to the central list (see paragraph 42a above); and adding-back a relevant authority’s share of that income in the final calculation (see paragraph 42c above), will also require additional information from billing authorities.

46. This is because the contribution that a property makes to an authority’s aggregate non-domestic rating income under the business rates retention scheme depends on the reliefs awarded to that property and any allowance made in respect of that property for bad debt, or provision against future losses. Data collection forms (NNDR1s and NNDR3s) only collect aggregate data and, therefore, the Government is not in a position to calculate the adjustment to be made to C without further information from billing authorities.

47. As explained in paragraphs 10 and 11 above, in order to calculate the new tariff and top-ups for 2023/24, we will use data from the draft rating lists and from the 2021/22 NNDR3. In respect of 2024/25, tariffs and top-ups will be adjusted on the basis of data from the final rating lists and 2022/23 NNDR3s.

48. It is already too late to amend the 2021/22 NNDR3 to collect the data we need to make the necessary modifications to the values of B and C. Instead, we propose to do a one-off data collection in late-October, targeted at those authorities who will see properties transferred to the Central List. This will collect data on the 2021/22 collectible rates due in respect of the properties to be transferred. In simplified form, it will seek information on the Gross Rates Payable, reliefs awarded, if any, and any bad debt allowance and/or provision made in respect of the property. From this we will be able to make the necessary calculations for the provisional tariff or top-up to be applied in 2023/24.

49. We will collect similar information from same authorities as part of the 2022/23 NNDR3. This will be appropriately amended to capture the information we require at a property level.

Annex A: Aspects of the mechanics and data sources for the 2017 methodology that the government proposes to replicate

a. Adjustment of tariffs and top-ups as per ‘J’

To preserve the growth incentive and minimise turbulence, we intend to strip out any gains or losses resulting purely from the revaluation as far as possible, by adjusting LAs’ tariffs or top-ups – BFLs will remain unaffected. We propose to do this by adding a factor J to tariffs or top-ups to increase or reduce their value, or change from top-up to tariff or vice-versa where appropriate.

b. Use of a proxy for the measurement of the change in non-domestic rating income.

As we are unable to measure the exact change between LAs’ income between 31 March 2023 and 1 April 2023, as a starting point we propose to use a proxy similar to that used in 2017 – change in gross rates payable. This proxy for revaluation change, A/B, would then be applied to a proxy measure of each LA’s non-domestic rating income, C, measured as per the last day of the current list, on 31/03/23. Whilst the gross rates proxy itself doesn’t include an adjustment for the change in reliefs at a revaluation, reliefs are included within the measurement of non-domestic rating income, C, and therefore the latest estimate of reliefs in the local area is taken into account.

c. Use of draft list data for year 1 followed by adjustments in years 2 and 3

The impact of the revaluation on retained income will in fact continue to change for many years to come due to backdated appeals, so it is necessary to pick a point at which we are measuring the revaluation effect. The obvious point is 1 April 2023 – i.e. we will be adjusting based on the picture of the revaluation factor as it is seen on 1 April 2023. Obviously that data will not be available at the time of the 2023/24 provisional, or final, settlement. In order to give LAs certainty, we propose to use draft revaluation data for 2023/24, which we anticipate being published in the Autumn and included in the provisional settlement. As in 2017, we then propose to make a ‘one-off’ adjustment to reflect the data as at 1 April 2023 in 2024/25 to adjust the 2023-24 amount and to make an ongoing adjustment for 2024/25, in time for the 2024/25 provisional settlement. A final adjustment in year 3 will then strip out the one-off adjustment from 2024/25, leaving the final revaluation adjustment for that year only. The cycle will then re-start following the next revaluation.

d. Use of latest available outturn data for year 1, followed by adjustment for year 2

The latest data that will be available to calculate the measure of NDR income at the time of the provisional settlement for 2023/24 will be NNDR3 2021/22 data. This data can be uprated to be used as a 2022/23 equivalent for year 1, but ideally 2022/23 data would be used. Once we have collected NNDR3 2022/23 data in late 2023, we propose to update the data used in the revaluation adjustment for the 2023/24 one-off adjustment, and also for the ongoing adjustment from 2024/25, alongside the final revaluation 2023 list data adjustment. Due to late audits it is possible that at the time we publish data for use in either year in time for the provisional settlement that certified NNDR3 data from some LAs may not yet have been submitted, in which case we would use provisional NNDR3 data. We would propose not to adjust the revaluation data in year 3 based on changes between provisional and certified NNDR3 2022/23 data, given the low proportion of changes and their scale, though we acknowledge this could be proportionally higher at individual LA level.

e. Exclusion of the appeals adjustment from the revaluation adjustment factor

In making the revaluation adjustment, we propose to use a notional multiplier. This notional multiplier will exclude the appeals adjustment amount ‘built-in’ to the new multiplier to cover estimated appeals for those predicted on the 2023 list. Excluding this amount from the multiplier results in a reduction in tariff or increase in top-up over the course of the new list – in effect it means that the revenue from the appeal adjustment is left with local government. This gives LAs additional income via the system to pay for the cost of making provisions for the new list. Our methodology assumes that this amount is sufficient for LAs to make this provision.

Annex B: Detailed background to the updated calculation

This section provides further information on the details of the proposed updated technical adjustment, including the calculation of C and B.

Calculation of A/B’

The consultation details that we propose to update the formula as below, where the value of B is adjusted to B’, to remove the impact of outstanding appeals, as measured by the steady state provisions amount:

J=C(1-A/B’)D

J=NNDR income (1-(2023 RV * 2023/24 Multiplier)/((2017 RV+x) * 2022/23 Multiplier))* BRR % share

The calculation of B’ as given above is equivalent to the expanded formula so that:

B’ = ((2017 RV + x) * 2022/23 multiplier)) (Formula 1)

is equivalent to

B’ = (2017 RV * 2022/23 multiplier) + (x * 2022/23 multiplier) (Formula 2)

From the above, B’ can be calculated as 2017 gross rates payable (GRP), plus the steady state provisions – as per Formula 2. The steady state provisions should be a negative figure. This can be shown as:

J=NNDR income (1-(2023 RV * 2023/24 Multiplier)/((2022/23 GRP+steady state provisions)))* BRR % share

The 2023/24 multiplier is not yet known, and it will not be the actual value for 2023/24, but an adjusted multiplier, which is the adjusted multiplier following the Revaluation, before accounting for the appeals adjustment (see Annex A(e)), and inflation.

The 2023 RV will be the RV in the local authority area, post-Revaluation.

The calculation of C

In the technical adjustment, C is a proxy measure of the authority’s income, adjusted as necessary. The figure will be derived from the 2022/23 NNDR3, though in year 1 this amount will, as described in the consultation (para 10), use NNDR3 2021/22 data, as NNDR3 2022/23 data is not available until mid-late 2023.

In practice, C, will be based on an authority’s NNDR income. This will be adjusted to remove the impact of one-off provisions, as detailed in para 17. The actual provisions measure counted in C will be the steady state provisions figure, as shown below. Additionally, to remove the impact of reliefs that are funded by means of s.31 grant or central share deductions, (and do not therefore impact an authority’s income), we will ‘add back’ these reliefs to the NNDR income – thus increasing the value of C.

The calculation of C will be (example given for 2021/22 equivalent data with the relevant data cells from NNDR3 2021/22 for year 1, in the absence of NNDR3 2022/23):

the sum of (A) to (S) minus (T) plus (U)

Where:

The values of (A) to (U) (given for the equivalent data from NNDR3 2021/22 for year 1, in the absence of NNDR3 2022/23 data) will be:

| (A) NNDR Income for 2021/22 | Part 1, line 11 |

|

(B) Small Business Rate Relief (SBRR) (amount due to authority as a result of doubling and threshold changes) (where the values of “A” and “Y” are as set out in cols. G and H of Sch. 4 to SI 2013/737 (as amended)) |

((Part 3, lines 8 – 8a + 12 – 12a) * -A) + ((Part 3, line 11 – 11a) *-0.5) + Y |

| (C) SBRR on existing properties where 2nd property is occupied | (Part 3, lines 8a + 11a + 12a) * -1 |

| (D) Relief to other ratepayers | (Part 3, lines 41 + 42) * -1 |

| (E) Relief to new empty properties | Part 3, line 47 * -1 |

| (F) Relief to long-term empty properties | Part 3, line 48 * -1 |

| (G) Retail relief | Part 3, line 49 * -1 |

| (H) Flooding relief | (Part 3, lines 50 + 51) * -1 |

| (J) In-lieu of transitional relief | Part 3, line 52 * -1 |

| (K) Rural rate relief | (Part 3, lines 53 + 54) * -1 |

| (L) Local newspaper relief | (Part 3, lines 55 + 56) * -1 |

| (M) Supporting small business relief | (Part 3, lines 57 + 58) * -1 |

| (N) Discretionary scheme relief | Part 3, line 59 * -1 |

| (P) Pub relief | Part 3, line 60 * -1 |

| (Q) Expanded retail discount | (Part 3, lines 61 + 62) * -1 |

| (R) Nursery relief | (Part 3, lines 63 + 64) * -1 |

| (S) Covid additional relief fund relief | Part 3, line 65 * -1 |

| (T) Losses on appeals | Part 2, lines 6 + 7 + 8 + 9 |

| (U) Provision for appeals | Part 5, line 22b (col. 5) / sum of small business rating multiplier from 2017/18 to 2022/23 * 0.499 (ie the 2022/23 small business multiplier) |

Annex C: Summary of consultation questions

Question 1: Do you consider that the 2017 technical adjustment to the business rates retention system for the Revaluation is the right place to start? If not, please give your reasoning.

Question 2: Do you support the proposed change to the formula? If not, please give your reasoning.

Question 3: Do you agree that we should not further amend the adjustment to take into account changes in reliefs at this stage but rather keep this under review as changes in reliefs become clearer? If not, please give your reasoning.

Question 4: If you disagreed with question 3, what are your suggestions for updating the technical adjustment to better take into account changes in reliefs?

Question 5: Do you agree that the standard technical adjustment should be adjusted to safeguard, as far as practicable, the financial position of those authorities who will see property transferred to the Central List at the Revaluation?

Question 6: Do you agree that the proposed modification will adequately safeguard the position of local authorities who will see property transferred to the central list? If not, please give your reasoning and what you would do differently.

About this consultation

This consultation document and consultation process have been planned to adhere to the Consultation Principles issued by the Cabinet Office.

Representative groups are asked to give a summary of the people and organisations they represent, and where relevant who else they have consulted in reaching their conclusions when they respond.

Information provided in response to this consultation may be published or disclosed in accordance with the access to information regimes (these are primarily the Freedom of Information Act 2000 (FOIA), the Environmental Information Regulations 2004 and UK data protection legislation. In certain circumstances this may therefore include personal data when required by law.

If you want the information that you provide to be treated as confidential, please be aware that, as a public authority, the Department is bound by the information access regimes and may therefore be obliged to disclose all or some of the information you provide. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the Department.

The Department for Levelling Up, Housing and Communities will at all times process your personal data in accordance with UK data protection legislation and in the majority of circumstances this will mean that your personal data will not be disclosed to third parties. A full privacy notice is included below.

Individual responses will not be acknowledged unless specifically requested.

Your opinions are valuable to us. Thank you for taking the time to read this document and respond.

Are you satisfied that this consultation has followed the Consultation Principles? If not or you have any other observations about how we can improve the process please contact us via the complaints procedure.

Personal data

The following is to explain your rights and give you the information you are entitled to under UK data protection legislation.

Note that this section only refers to personal data (your name, contact details and any other information that relates to you or another identified or identifiable individual personally) not the content otherwise of your response to the consultation.

1. The identity of the data controller and contact details of our Data Protection Officer

The Department for Levelling Up, Housing and Communities (DLUHC) is the data controller. The Data Protection Officer can be contacted at dataprotection@levellingup.gov.uk or by writing to the following address:

Data Protection Officer

Department for Levelling Up, Housing and Communities

Fry Building

2 Marsham Street

London

SW1P 4DF

2. Why we are collecting your personal data

Your personal data is being collected as an essential part of the consultation process, so that we can contact you regarding your response and for statistical purposes. We may also use it to contact you about related matters.

We will collect your IP address if you complete a consultation online. We may use this to ensure that each person only completes a survey once. We will not use this data for any other purpose.

Sensitive types of personal data

Please do not share special category personal data or criminal offence data if we have not asked for this unless absolutely necessary for the purposes of your consultation response. By ‘special category personal data’, we mean information about a living individual’s:

- race

- ethnic origin

- political opinions

- religious or philosophical beliefs

- trade union membership

- genetics

- biometrics

- health (including disability-related information)

- sex life; or

- sexual orientation.

By ‘criminal offence data’, we mean information relating to a living individual’s criminal convictions or offences or related security measures.

3. Our legal basis for processing your personal data

The collection of your personal data is lawful under article 6(1)(e) of the UK General Data Protection Regulation as it is necessary for the performance by DLUHC of a task in the public interest/in the exercise of official authority vested in the data controller. Section 8(d) of the Data Protection Act 2018 states that this will include processing of personal data that is necessary for the exercise of a function of the Crown, a Minister of the Crown or a government department i.e. in this case a consultation.

Where necessary for the purposes of this consultation, our lawful basis for the processing of any special category personal data or ‘criminal offence’ data (terms explained under ‘Sensitive Types of Data’) which you submit in response to this consultation is as follows. The relevant lawful basis for the processing of special category personal data is Article 9(2)(g) UK GDPR (‘substantial public interest’), and Schedule 1 paragraph 6 of the Data Protection Act 2018 (‘statutory etc and government purposes’). The relevant lawful basis in relation to personal data relating to criminal convictions and offences data is likewise provided by Schedule 1 paragraph 6 of the Data Protection Act 2018.

4. With whom we will be sharing your personal data

DLUHC may appoint a ‘data processor’, acting on behalf of the Department and under our instruction, to help analyse the responses to this consultation. Where we do we will ensure that the processing of your personal data remains in strict accordance with the requirements of the data protection legislation.

5. For how long we will keep your personal data, or criteria used to determine the retention period.

Your personal data will be held for two years from the closure of the consultation, unless we identify that its continued retention is unnecessary before that point

6. Your rights, e.g. access, rectification, restriction, objection

The data we are collecting is your personal data, and you have considerable say over what happens to it. You have the right:

a. to see what data we have about you

b. to ask us to stop using your data, but keep it on record

c. to ask to have your data corrected if it is incorrect or incomplete

d. to object to our use of your personal data in certain circumstances

e. to lodge a complaint with the independent Information Commissioner (ICO) if you think we are not handling your data fairly or in accordance with the law. You can contact the ICO at https://ico.org.uk/, or telephone 0303 123 1113.

Please contact us at the following address if you wish to exercise the rights listed above, except the right to lodge a complaint with the ICO: dataprotection@levellingup.gov.uk or

Knowledge and Information Access Team

Department for Levelling Up, Housing and Communities

Fry Building

2 Marsham Street

London

SW1P 4DF

7. Your personal data will not be sent overseas.

8. Your personal data will not be used for any automated decision making.

9. Your personal data will be stored in a secure government IT system.

We use a third-party system, Citizen Space, to collect consultation responses. In the first instance your personal data will be stored on their secure UK-based server. Your personal data will be transferred to our secure government IT system as soon as possible, and it will be stored there for two years before it is deleted.

-

The government consulted on the proposed adjustment for the 2017 Revaluation as part of the 2017-18 local Government finance Settlement Technical consultation. ↩

-

For the 2017 Revaluation this was the closing balance on the 2010 list. For the 2023 Revaluation this will be made using the 2017 list closing balance values, as determined through the NNDR3 2022-23 form (see Annex B). ↩

-

For example, designated area regulations: 2013/107, 2014/98, 2015/353, 2016/317, 2017/318, 2017/471, 2018/213 and 2021/404; and renewable energy regulations 2013/108 and 2017/1132. ↩

-

Business rates revaluation 2023: the central rating list - summary of responses and government response ↩