Consultation on the review of the Fraud Compensation Levy ceiling

Updated 10 March 2022

Applies to England, Scotland and Wales

Introduction

1. This consultation concerns a proposed change to the Fraud Compensation Levy (FCL) ceiling for the levy year 2022 to 2023 onwards. A full description of the FCL, and the Fraud Compensation Fund (FCF) to which it relates, is at paragraph 12.

About this consultation

Who this consultation is aimed at

2. We would expect this consultation to be primarily of interest to those affected by the FCL, including occupational pension scheme trustees and managers, and sponsoring employers of pension schemes. However, the government welcomes views from all interested parties.

Purpose of the consultation

3. The purpose of this consultation is to seek views on the proposed change outlined in paragraphs 25 to 29.

Scope of the consultation

4. This consultation concerns the levy regulations which apply to England and Wales, and Scotland. It is envisaged that Northern Ireland will make corresponding regulations.

Duration of the consultation

5. The consultation period begins on 1 November and runs until 10 December 2021.

How to respond to this consultation

6. Please send your consultation responses to the following address:

FCL Consultation Team

Department for Work and Pensions

ALB Partnership Division

1st Floor

Caxton House

Tothill Street

London

SW1H 9NA

You can also reply by email:

Email: fraudcompensationfund.consultation2021@dwp.gov.uk

Government response

7. The government will consider the responses it has received and then publish a response on the GOV.UK website. Where a consultation is linked to a statutory instrument, as in this instance, the government response should be published before or at the same time as any related instrument is laid.

How we consult

Consultation principles

8. This consultation is being conducted in line with the revised Cabinet Office consultation principles published in March 2018. These principles give clear guidance to government departments on conducting consultations.

Feedback on the consultation process

9. We value your feedback on how well we consult. If you have any comments about the consultation process (as opposed to comments about the issues which are the subject of the consultation), including if you feel that the consultation does not adhere to the values expressed in the consultation principles or that the process could be improved, please address them to:

DWP Consultation Coordinator

Legislative Strategy Team

4th Floor

Caxton House

Tothill Street

London

SW1H 9NA

Email: caxtonhouse.legislation@dwp.gov.uk

Data protection and confidentiality

10. For this consultation, we will publish all responses except for those where the respondent indicates that they are an individual acting in a private capacity (for example. a member of the public). All responses from organisations and individuals responding in a professional capacity will be published. We will remove email addresses and telephone numbers from these responses but, apart from this, we will publish them in full.

11. For more information about what we do with personal data, you can read the Department for Work and Pensions (DWP) Personal Information Charter.

Background

12. The Pension Protection Fund (PPF) was established by the Pensions Act 2004 in order to protect members of eligible defined benefit occupational pension schemes and the defined benefit element of hybrid schemes. The PPF will pay compensation where an employer has a qualifying insolvency event and there are insufficient assets in the scheme to pay benefits at PPF compensation levels.

13. The PPF’s responsibilities under the Act include the operation of the FCF. The FCF provides compensation to occupational pension schemes where there has been scheme asset reduction, which is attributable to an offence involving dishonesty, and where the employer has become insolvent or is unlikely to continue as a going concern. This includes both defined benefit and defined contribution pension schemes. The FCL recovers from eligible occupational pension schemes the costs of compensation paid from the FCF.

14. Amendments to the Occupational Pension Schemes (Fraud Compensation Levy) Regulations 2006 (S.I. 2006 No. 558), (“the FCL regulations”) are required to allow the FCL ceiling to be raised.

15. In November 2020, the High Court (in The Board of the PPF v Dalriada Trustees Ltd[footnote 1]), clarified that pension liberation schemes[footnote 2] , if they satisfied specified criteria, were eligible to make a claim on the FCF.

16. There are insufficient assets within the FCF to meet claims arising from that judgment in the short term. The Compensation (London Capital & Finance plc and Fraud Compensation Fund) Act 2021 received Royal Assent on 20 October 2021. This Act, in so far as it affects the FCF, provides the Secretary of State with a power to make a loan to the Board of the PPF. The PPF, acting in its capacity as manager of the FCF, will use the loan, along with any assets in the FCF, to meet these potential claims. Consultees may wish to note that the Act does not change, and was not intended to change, the structure of either the FCF or the FCL. The loan will be repaid via the FCL.

17. Regulation 3(3)(b) of the FCL regulations specifies the maximum levy that may be imposed on eligible pension schemes. It is currently £0.75 per member. The government proposes to increase this ceiling, so that the FCL rate for such schemes can be set by the PPF at an appropriate level.

18. Regulation 3A of the FCL regulations, inserted by the Occupational Pension Schemes (Master Trusts) Regulations 2018 (S.I. 2018 No. 1030), (“the Master Trust regulations”) introduced a lower maximum levy (£0.30 per member) applicable to Master Trusts. The government proposes that the FCL ceiling for Master Trusts will be lower than other occupational schemes.

19. The amendments proposed above will allow the PPF the ability to set the FCL at levels that will enable it to repay the loan provided by the government by 2030 to 2031. The government considers this period a reasonable one over which to effect recovery. The loan is expected to cover 122 schemes[footnote 3] and amounts to approximately £250m over the period from 2021 to 2025. Paragraphs 25 to 29 provide further information.

20. A number of suggestions have been made by commentators about how the FCL might be adapted in the future. Paragraphs 21 to 24 set out the government’s position on some of these suggestions.

21. One suggestion is that schemes that maintain robust governance systems, and are therefore unlikely to call on the FCF, should be exempt from payment of the FCL. There is a widely accepted principle that the pensions industry should meet the costs of protecting the pensions sector, rather than spreading the costs to all taxpayers, who do not all benefit from the provision of occupational pensions. Although the government believes that the risk of future frauds has been reduced, it is unrealistic to believe the risk has been completely eliminated. It follows that all occupational pension schemes, however well-governed, derive benefit from the existence of robust fraud compensation arrangements, which increase the level of consumer confidence in pension saving. Furthermore, a shift in the burden of the FCF to the taxpayer could disincentivise pension schemes from taking thorough precautions against fraud and dishonesty, in the expectation that any future FCF deficit would not lead to an additional cost on eligible schemes. For these reasons, the government intends to maintain a system whereby the costs of the FCF are met by occupational pension schemes through the FCL.

22. Another suggestion is that the FCL should be restructured, so that it is no longer based on the number of members in each occupational pension scheme. This suggestion is often made on the basis that Master Trusts with large numbers of members, or small pots, or both, are disadvantaged by the current member-based structure. The aim has been to set the FCL ceiling at a substantially lower level for Master Trusts than other schemes to reflect their particular characteristics. There are no plans to alter this arrangement, which is expected to mean that the FCL burden to be absorbed by Master Trusts is substantially lower than the burden to be absorbed by most other schemes. The Impacts section provides further information.

23. Some commentators have called for a fundamental review of the FCL, in the light of the increased fiscal demands that the Dalriada judgment will place on the FCF. The government believes that the FCL and FCF continue to work broadly as intended. Consequently, it has no plans for a fundamental review in this area. The government will give further consideration to this possibility over the medium term, alongside ongoing monitoring of the FCL ceiling.

24. The government is also aware of a suggestion that it is unfair for schemes that did not exist at the time when the pensions liberation fraud was perpetrated to share the burden of higher levy costs following the Dalriada judgment. The design of the FCF is such that it will always be the case that some occupational pension schemes will come into existence, and therefore be liable for the FCL, after a fraud eligible for compensation has come to light, particularly given the length of time that can elapse before a fraud is confirmed. Exempting such schemes from the requirement to contribute to the FCF would add complexity to what is intended to be a levy system that is simple to understand and operate. It would also mean that a smaller number of occupational pension schemes would need to shoulder the cost burden of addressing historic frauds. Finally, it would mean that the robustness of the fraud compensation arrangements, from which all schemes derive benefit, would be diminished by limiting coverage. The government does not believe that these outcomes could be justified.

Proposed change

25. This section sets out the government’s proposal for adjusting the FCL ceiling for 2022 to 2023 and onwards. This will allow the FCL rates to be reset, at levels that will enable the loan the government intends to make to the PPF to be repaid by 2030 to 2031.

26. This proposed change would mean that the loan to facilitate the higher level of expenditure from the FCF, projected for the period to 2025 would be repaid by 2030 to 2031. The government believes that this would strike an appropriate balance between recovery over a period that is not unduly lengthy and limiting the impact on pension schemes.

27. The FCL levy ceiling under the proposed change would provide for levy rates to be set by the PPF not exceeding £0.65 per member for Master Trusts and £1.80 per member for other eligible occupational schemes. For illustrative purposes the draft regulations are annexed.

28. The effect on revenue and the impact of the proposed change as set against the baseline is explained in the impacts section below.

29. The government does not believe that preserving the current levy ceiling is a realistic option and so it is not consulting on such a possibility. No change would mean that the levy rates set by the PPF would be limited to the current levy ceiling. The result would be that the higher level of expenditure enabled by the loan described in paragraph 16 above would not be recovered in full until approximately the 2040s. This would be an unreasonable length of time for the FCF to be in deficit and would be contrary to the tenets of government accounting. Although the government is not consulting on a ‘no change’ option, it is including information about the current position in the impacts section below to facilitate a baseline comparison with its proposal.

Impacts

30. The government has considered the impacts of its proposed change on employers, pension schemes and members.

31. DWP estimates that if the FCL rates were to remain unchanged, the FCF would be in a deficit position exceeding £250m by 2025. The proposed change sees a substantial increase in levy revenue, alongside a loan to provide short to medium term financing to cover FCF expenditure. The aim is to recover the loan of approximately £250m and eliminate the levy deficit by 2030 to 2031.

32. The aggregate additional impact has been calculated by comparing the proposal to the current position.

33. The following table sets out expected revenue for the years 2021 to 2031 at the current rates charged by the PPF (£0.30 per member for Master Trusts and £0.75 per member for all other occupational pension schemes).

FCL revenue (£m) across all schemes shown by scheme type [footnote 4]

| FCL levy revenue (£m) | Occupational Defined Benefit and Hybrid | Occupational Defined Contribution (excluding Master Trusts) | Authorised Master Trusts |

|---|---|---|---|

| 2021/22 | 9.0 | 1.2 | 5.4 |

| 2022/23 | 9.0 | 1,3 | 5.9 |

| 2023/24 | 9.0 | 1.3 | 6.4 |

| 2024/25 | 9.0 | 1,4 | 6.9 |

| 2025/26 | 9.0 | 1.5 | 7.4 |

| 2026/27 | 9.0 | 1.6 | 7.8 |

| 2027/28 | 9.0 | 1.8 | 8.3 |

| 2028/29 | 9.0 | 1.9 | 8.8 |

| 2029/30 | 9.0 | 2.1 | 9.3 |

| 2030/31 | 9.0 | 2.2 | 9.8 |

Source: DWP internal analysis. Rounded to the nearest £0.1m.

34. The following table sets out DWP’s estimate of the impact of additional levy costs if levy rates were set at the proposed ceiling of £0.65 per member for Master Trusts and £1.80 per member for other occupational pension schemes in each year for the period 2021 to 2031.

Additional FCL revenue (£m) across all schemes shown by scheme type [footnote 5]

| Additional FCL levy revenue (£m) | Occupational Defined Benefit and Hybrid | Occupational Defined Contribution (excluding Master Trusts) | Authorised Master Trusts |

|---|---|---|---|

| 2021/22 | Nil | Nil | Nil |

| 2022/23 | 12.5 | 1.8 | 6.9 |

| 2023/24 | 12.5 | 1.9 | 7.5 |

| 2024/25 | 12.5 | 2 | 8.1 |

| 2025/26 | 12.5 | 2.1 | 8.6 |

| 2026/27 | 12.5 | 2.3 | 9.1 |

| 2027/28 | 12.5 | 2.5 | 9.7 |

| 2028/29 | 12.5 | 2.7 | 10.3 |

| 2029/30 | 12.5 | 2.9 | 10.9 |

| 2030/31 | 12.5 | 3.1 | 11.4 |

Source: DWP internal analysis. Rounded to the nearest £0.1m.

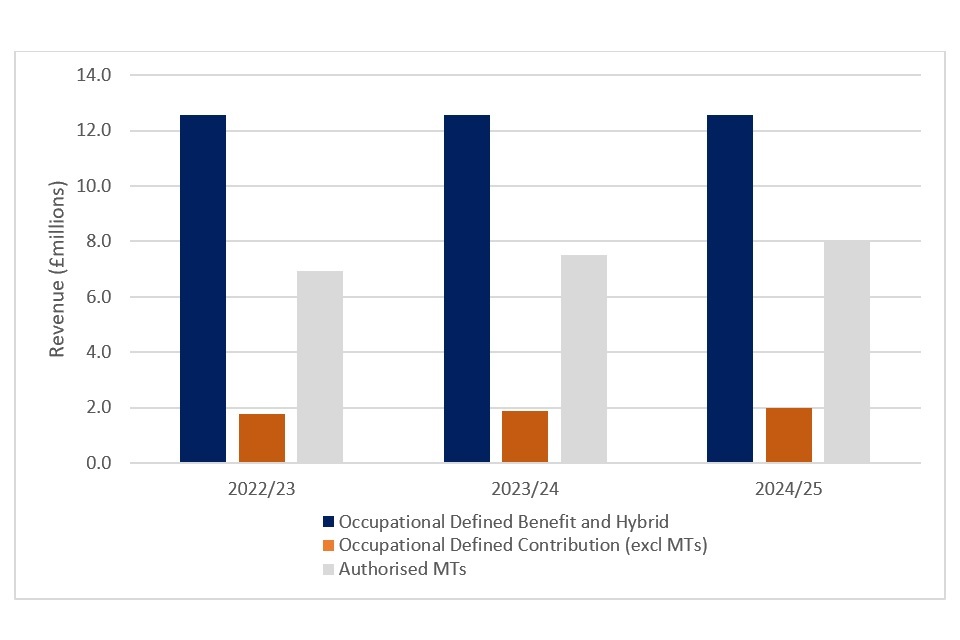

35. The following chart below presents these additional FCL impacts from 2022 to 2025.

Additional FCL levy revenue across all schemes shown by scheme type from 2022 to 2025 [footnote 6]

Source: DWP internal analysis. Rounded to the nearest £0.1m.

36. The government is interested in understanding more about how pension schemes may absorb these costs or whether they may choose to pass on these costs to members of their scheme or to employers who enrol their employees into the scheme.

Consultation questions

37. With regard to the proposed change set out in paragraphs 25 to 29.

Question 1

Do you support the proposed change? Please indicate why you support, or do not support the proposed change.

Question 2

What is the impact to your scheme or business of raising the FCL under the proposed change?

Question 3

How will your scheme respond to an increase in the FCL? For example, would it be absorbed by the scheme, passed on to members, or employers?

Forward look

38. The government plans to introduce changes to the FCL ceiling by amendment regulations effective for the levy year 2022 to 2023.

Draft regulations

Statutory instruments

The Occupational Pension Schemes (Fraud Compensation Levy) (Amendment) Regulations 2022

2022 No. [#]

Pensions

| Made | [1st] March 2022 |

| Laid before Parliament: | [8th] March 2022 |

| Coming into force: | [1st] April 2022 |

The Secretary of State for Work and Pensions makes the following Regulations in exercise of the powers conferred by sections 189(4), 315(2), 315(5) and 318(1) of the Pensions Act 2004[footnote 7] and section 38(2) of the Pension Schemes Act 2017[footnote 8].

In accordance with section 317(1) of the Pensions Act 2004, the Secretary of State has consulted such persons as she considers appropriate before making these regulations.

Citation and commencement

1. These Regulations may be cited as the Occupational Pension Schemes (Fraud Compensation Levy) (Amendment) Regulations 2022 and come into force on 1st April 2022.

2. These Regulations extend to England and Wales and Scotland.

Amendment of the Occupational Pension Schemes (Fraud Compensation Levy) Regulations 2006

3. In regulation 3(3) of the Occupational Pension Schemes (Fraud Compensation Levy) Regulations 2006[footnote 9] (the fraud compensation levy), for sub-paragraph (b) substitute —

“(b) not exceed —

(i) in the case of a Master Trust scheme within the meaning of section 1 of the Pension Schemes Act 2017, 65 pence per member, and

(ii) in any other case, £1:80 per member.”

Amendment of the Occupational Pension Schemes (Master Trusts) Regulations 2018

4. In regulation 23 of the Occupational Pension Schemes (Master Trusts) Regulations 2018[footnote 10] (fraud compensation) omit paragraph (2)(c).

Signed by authority of the Secretary of State for Work and Pensions

Name

Parliamentary Under Secretary of State

Department for Work and Pensions

Address

Date

Explanatory note

(This note is not part of the Regulations)

These Regulations make amendments to two Statutory Instruments: SI 2006/558 the Occupational Pension Schemes (Fraud Compensation Levy) Regulations 2006 and SI 2018/1030 the Occupational Pension Schemes (Master Trusts) Regulations 2018.

Regulation 3 amends SI 2006/558 to set out the maximum fraud compensation levy that may be raised in any one financial year. It sets a maximum fraud compensation levy for authorised Master Trusts of 65 pence per member and increases the maximum fraud compensation levy from 75 pence to £1:80 per member, for all other occupational pension schemes.

Regulation 4 removes Regulation 23(2)(c) from SI 2018/1030 the Occupational Pension Schemes (Master Trusts) Regulations 2018.

The fraud compensation levy is paid by all occupational pension schemes and is used to fund the Fraud Compensation Fund, which makes payments to certain schemes that have lost money due to fraud. A full impact assessment has not been published for this instrument as it amends an existing statutory levy regime and has a negligible impact on civil society organisations or the private sector.

-

[2020] EWHC 2960 (Ch) ↩

-

Pension liberation scheme fraud involves members being persuaded to transfer their pension savings from legitimate schemes to fraudulent schemes with promises of high investment returns or access to a loan from their pension scheme before age 55 without incurring a tax charge. ↩

-

The majority of the frauds that affected these schemes occurred during the period 2010 to 2014. The government believes that the risk of such frauds occurring in the future has been reduced substantially. ↩

-

Source: DWP internal analysis. Rounded to the nearest £0.1m. ↩

-

Source: DWP internal analysis. Rounded to the nearest £0.1m. ↩

-

Source: DWP internal analysis. Rounded to the nearest £0.1m. ↩

-

2004 c. 35 ↩

-

2017 c. 17 ↩

-

SI 2006/558 ↩

-

SI 2018/1030 ↩