Making Work Pay: Strengthening Statutory Sick Pay

Updated 4 March 2025

Presented to Parliament by the Secretary of State for Work and Pensions by Command of His Majesty

October 2024

CP 1168

Crown copyright 2024

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk

Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/consultations/making-work-pay-strengthening-statutory-sick-pay

Any enquiries regarding this publication should be sent to us at ssp.team@dwp.gov.uk

ISBN 978-1-5286-5198-1

E03204748 10/24

Ministerial foreword

Businesses and working people in Britain deserve a secure, supportive working environment that will in turn boost growth and productivity. This government is committed to fair work, in which good employers and good employees thrive.

Our Plan to Make Work Pay will support more people to stay in work, make work more family-friendly and improve living standards. This will put more money in working people’s pockets to spend, boosting economic growth, resilience and conditions for innovation.

The pandemic exposed just how precarious work and life is for those on acute low incomes. No one should be forced to choose between their health and financial hardship, which is why we plan to strengthen Statutory Sick Pay, so it provides a safety net for those who need it most.

The current Statutory Sick Pay system fosters economic insecurity at work. Our commitment to remove the Lower Earnings Limit will ensure that all employees have access to Statutory Sick Pay and the peace of mind that this brings when they need to take time off work due to illness. No one should feel forced to struggle through work when they are too unwell to do so. By removing the waiting period and making Statutory Sick Pay available from day one, we are providing security to those who need it most.

Strengthening Statutory Sick Pay is an important part of a much bigger picture, and it is important we work in close partnership with employers and workers to get this right. Our Plan to Make Work Pay brings an opportunity for sustained economic growth, improving the prosperity of our country and the living standards of our people.

So that this plan works effectively, we will consult with businesses, workers and civil society on how to put our plans into practice.

This Consultation, the Employment Rights Bill, and the wider Plan to Make Work Pay, are important milestones in the journey to achieving our missions to kickstart economic growth and break down barriers to opportunity.

We will work together to build a world of work that is fair, secure, and prosperous for this and the next generation.

Alison McGovern, Minister for Employment

Executive summary

1. This consultation forms part of government’s commitment to strengthen Statutory Sick Pay, as part of the Plan to Make Work Pay, an ambitious agenda to ensure workplace rights are fit for a modern economy, empower working people and deliver economic growth.

2. Through the Employment Rights Bill, which was introduced earlier this month, the government has committed to ensure Statutory Sick Pay is strengthened for those who need it most, by removing the existing requirements to serve waiting days and extending eligibility to those earning below the Lower Earnings Limit.

3. The changes introduced within the Bill will mean that for some lower earners, including those earning below the Lower Earnings Limit, their rate of Statutory Sick Pay will be calculated as a percentage of their earnings instead of the flat weekly rate. This consultation seeks your views on what this percentage should be, to ensure it provides a fair earnings replacement when these employees need to take time off work.

4. We welcome all views, in particular from:

-

Employers and employer/business representative organisations

-

Members of the public and employees

-

Interested Trade Unions, stakeholders and representative organisations

5. You can respond on behalf of an organisation or as an individual. The easiest way to respond to this consultation is to fill in this online form but you can also email ssp.team@dwp.gov.uk

6. The government will use the responses gathered to inform the percentage rate of earnings, to establish a fair earnings replacement which takes into account the views of employees, employers and Trade Unions.

7. Rates of SSP are currently the same across the UK. The proposed changes in this consultation apply to England, Wales and Scotland only. Decisions relating to changes to the SSP arrangements in Northern Ireland rest with the devolved administration. However, we welcome views on the proposals from Northern Ireland individuals and employers which will then be shared with the Department for Communities.

Strengthening Statutory Sick Pay

The Plan to Make Work Pay

8. Sustained economic growth is the only route to improving the prosperity of our country and the living standards of our working people.

9. The Plan to Make Work Pay sets out an ambitious agenda to ensure workplace rights are fit for a modern economy, empower working people and contribute to economic growth. This plan was developed through close engagement with businesses and trade unions and that same spirit of partnership runs through the heart of everything the government is doing.

10. The Next Steps to Make Work Pay document, published earlier this month, emphasised our commitment to delivering this plan in full, with work to take place over multiple delivery phases. The first phase of delivery includes the passage of our Employment Rights Bill, and a targeted package of consultations. These consultations are seeking views on several areas to inform the government’s next steps, with the potential to bring changes through the Employment Rights Bill, including on how to apply the measures on zero hours contracts to agency workers.

11. In recognition that no one should be forced to choose between their health and financial hardship, the government has committed to strengthening Statutory Sick Pay (SSP) by extending SSP eligibility to those earning below the Lower Earnings Limit (LEL) to make it available to all employees and removing the waiting period so that SSP is paid from the first day of sickness absence. Together, these changes will help ensure all employees can access SSP when they need to take time off work due to illness.

12. We are committed to working with employers, trade unions and other stakeholders to support the wellbeing of working people and their long term physical and mental health. Strengthening SSP is an important part of this commitment.

Statutory Sick Pay

13. Statutory Sick Pay (SSP) is the minimum statutory payment an employee is entitled to for periods where they are unable to work due to illness. It is both administered and paid entirely by employers and is payable for up to 28 weeks per period of sickness absence.

14. The government has identified 2 key priorities to be addressed in strengthening SSP:

a. Waiting Period – Currently, SSP is not payable for the first 3 qualifying days (days on which an employee is contracted or scheduled to work) of a sickness absence, which are referred to as ‘waiting days’. This means employees can feel forced to come to work when they are unwell, increasing presenteeism and reducing overall productivity.

b. Lower Earnings Limit – SSP is also not currently payable to those who earn less than the Lower Earnings Limit (currently £123 per week). There are currently between 1 and 1.3 million individuals who earn below the LEL, meaning they do not have access to SSP, and do not benefit from a minimum level of financial support from their employer during times of sickness.

15. The Employment Rights Bill, which the government laid in Parliament earlier this month, addresses these issues as part of the Plan to Make Work Pay, bringing benefits for both employees and employers.

Removing the Waiting Period

16. If people feel unable to take time off work when they are unwell, infectious diseases can spread and the whole workforce can suffer. For example, we know that up to 33% of influenza-like illnesses are contracted in the workplace.[footnote 1] Enabling employees to take the time off they need to recover from short-term illnesses can reduce the overall rate of sickness absence, increase business productivity, and help protect our health system. Recent analysis showed that 43.6 productive days on average were lost due to presenteeism per employee per year, an increased cost of around £25 billion compared to 2018.[footnote 2]

17. Employees with long-term health conditions, for example mental health, musculoskeletal and fluctuating conditions, will sometimes require time off work to manage their condition to prevent it from worsening. In the UK, there are around 15.9 million working-age people with a long-term health condition, including 10.5 million disabled people whose condition reduces their ability to carry out day to day activities.[footnote 3] It is important that people feel supported to manage their condition whilst remaining part of the labour market, and that employers recognise the valuable contribution that they make.

18. The workplace should support its employees to thrive. Removing the waiting period can also better support flexible return arrangements following illness, as SSP will be payable from the first day of incapacity. Employees who feel supported by their employer in sickness as well as health are likely to remain in their roles for longer, reducing business spending on recruiting and upskilling members of staff. For example, Oxford Economics finds that the loss of an employee across 5 key sectors (IT, Legal, Accounting, Media, Retail) carries an average financial impact of £30,614.[footnote 4]

Removing the Lower Earnings Limit

19. For an employee to be eligible to receive SSP they must earn at least the Lower Earnings Limit, currently £123 per week. This means up to 1.3 million employees are excluded from SSP, with a disproportionate impact on those working in low paid, part-time or multiple jobs. Women and young people will particularly benefit from removing the LEL.

20. To change this, the Employment Rights Bill repeals the exclusion on employees earning below the LEL from being entitled to SSP. These changes will mean that all employees who are otherwise eligible for SSP, regardless of their earnings, will receive sick pay when they need to take time off due to illness. This potentially delivers benefits to employees and employers alike as those on the lowest incomes who currently work when unwell (and are therefore less productive) will now be able to take time off to recover properly.

21. However, as many of those earning below the LEL also earn less than £116.75 per week, it would be inappropriate and unfair to pay them the flat rate of SSP as they would then receive more in sick pay than through their normal earnings. The fairest way to achieve the right balance is to ensure employees are paid a certain percentage of earnings up to the flat weekly rate. This consultation seeks your views on what this percentage of earnings should be.

22. We are proposing to introduce a taper to the current SSP rate, whereby an employee is entitled to a certain percentage of their average weekly earnings or the current SSP flat rate, whichever is lower. It is important that this percentage strikes the right balance between providing the financial security that employees need, retaining the incentives to return to work when appropriate, and balancing the costs to businesses.

Options for the percentage rate

23. The government is consulting on what the percentage rate should be. We intend, following this consultation, to specify the percentage rate in law and will seek to make this change through government amendment to the Employment Rights Bill.

24. We have outlined some examples for you to consider when responding. These examples are illustrative and are not specific government proposals, or choices to select from. Rather, they set out the broad costs for employers and potential impacts on low earners. They range from 60% of earnings, which is the lowest rate our internal modelling suggests would not leave employees worse off, to 80% of earnings, as proposed in the 2019 Health is Everyone’s Business consultation.

Impact on employees

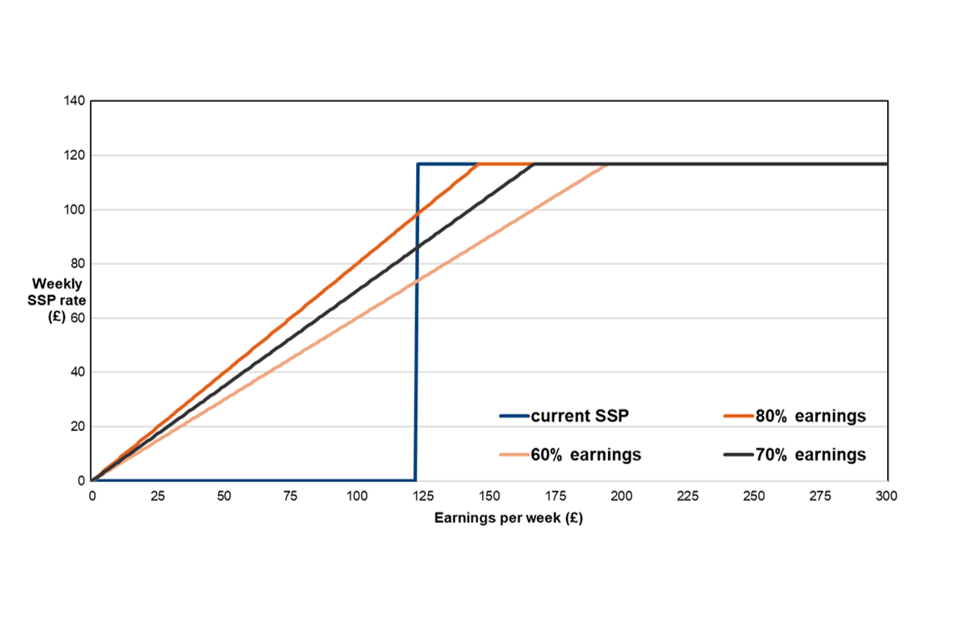

25. The percentage rate will only affect people earning below a certain amount per week, as it will always be capped at the flat weekly rate. As shown in Figure 1, if the percentage rate is 80%, an employee earning £100 per week would receive £80 per week in SSP, while an employee earning £150 would be paid the flat rate of £116.75. Depending on the percentage rate set, some employees who currently earn just above the LEL may see a reduction in their weekly SSP entitlement as they would no longer qualify for the flat rate. For example, an employee earning £125.00 per week would receive £75 per week in SSP if the percentage rate is set at 60%, compared to £116.75 currently.

Figure 1: Weekly rate of SSP where it is a % of earnings or £116.75, whichever is lower

26. Internal modelling based on earnings and patterns of sickness absence suggests that overall, employees would not be worse off with a proportionate rate of 60% or above. This is because, while the percentage rate may be lower than the current flat rate, the removal of waiting days offsets any potential loss for most short-term absences. This is based on a model that simulates employee earnings and sickness absence patterns to estimate SSP entitlement pre- and post-reform. In practice, some employees that earn just above the LEL and have longer sickness absences could notionally receive a lower entitlement of SSP than they would under the current system.

27. Table 1 sets out the number of employees who could nominally receive less per week than under the current SSP system, and the weekly earnings range of these employees. It includes the amount of time it takes for an employee earning £123 per week working five days per week to be entitled to less SSP under the percentage rate compared to their current entitlement (the ‘break-even’ point), and our internal estimate of the overall number of employees who we would expect to receive less over the course of their sickness absence (0). The actual number of employees impacted depends on the rate set, individual’s earnings, the duration of sickness absence and whether employees are subject to occupational sick pay schemes.

Table 1 – Comparison of Illustrations on Impact on Employees

| Illustration | Maximum estimated number of employees who could receive a lower weekly rate | Weekly earnings range of employees affected | Estimated number of employees who would receive less SSP overall | Break-even point |

|---|---|---|---|---|

| 60% earnings | 1,300,000 | £123 to £195 | 0 | 2 weeks |

| 70% earnings | 500,000 | £123 to £167 | 0 | 3 weeks |

| 80% earnings | 300,000 | £123 to £146 | 0 | 4 weeks |

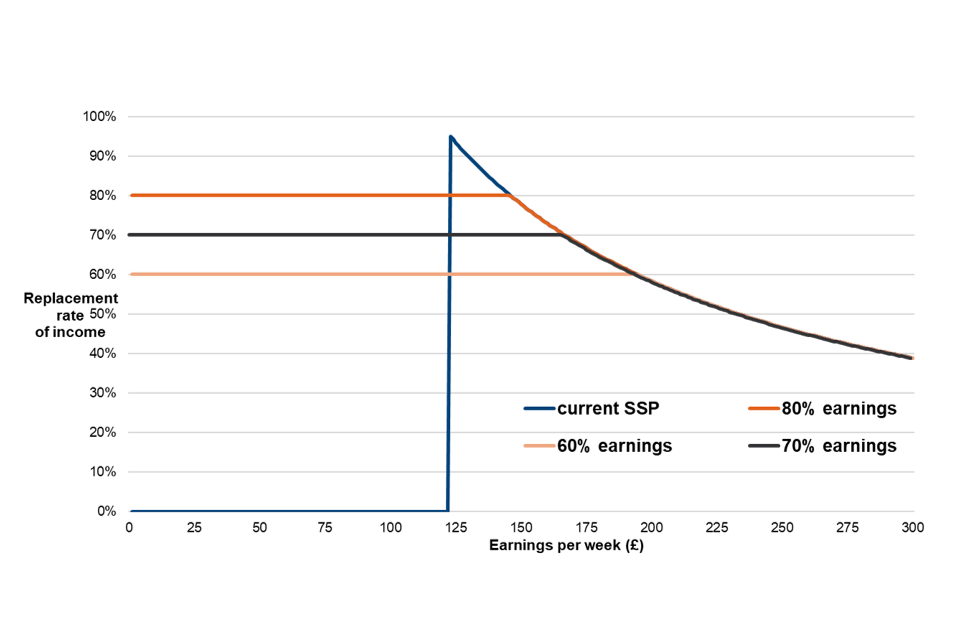

28. Broadly speaking, the lower the percentage of earnings, the more incentive there is for those on sick leave to return to work when able to do so. This reduces the risk of absenteeism and means the replacement rate better reflects the percentage a full-time employee would receive in SSP (see Figure 2 below). This also reduces the likelihood of someone with multiple low-paid jobs earning a higher replacement rate in sick pay than an employee in a single job full-time. For example, an employee working 2 jobs and earning £125 per week in each job would currently receive £116.75 in each job (a total of £233.50 with a 93% earnings replacement rate). Under the new SSP system they could receive up to £200 per week at 80% of earnings. By comparison, an employee earning £250 in one job would be entitled to the flat rate of £116.75, a replacement rate of just under 47%.

29. A higher percentage rate is more likely to be effective in reducing presenteeism, particularly when combined with the removal of the waiting period. It reduces the potential for people earning above the current LEL to “lose out” (as per Table 1) compared to their current rate of sick pay. It would also provide a higher replacement rate of earnings for people on the lowest incomes and at most risk of financial precarity – providing a greater safety net for those who need it most.

Figure 2: Income replacement rate at a percentage rate or £116.75, whichever is lower

30. Under the requirements of the Public Sector Equality Duty (PSED) the department has undertaken an Equality Analysis of the proposals to strengthen SSP (removing the existing requirements to serve waiting days and extending eligibility to those earning below the Lower Earnings Limit). This will be published shortly.

Impact on business

31. Each of these illustrative models, and all other possible variations, will have a financial impact to employers as a result of removing the waiting period and the LEL. It is worth noting that most of this impact arises from the removal of the waiting period. On its own, removing the waiting period is estimated to cost around £1.02 billion (£36 per employee). Setting a lower percentage rate could help mitigate the cost to employers of removing the waiting period by reducing the SSP rate which is payable to those earning just above the LEL. More generally, the lower the percentage rate, the lower the overall estimated cost.

32. Where we have included an estimate of business cost (Table 2), we have used an internal DWP model using information from the Family Resources Survey 2022/2023 and DWP Employee Survey 2023. Full details of context, methodology and background to the analysis provided in this document is published within the Regulatory Impact Assessment

Table 2 – Comparison of Illustrations on Impact on Business

| Current system | 60% earnings | 70% earnings | 80% earnings | |

|---|---|---|---|---|

| Total costs | £0.65 billion | £1.04 billion | £1.06 billion | £1.07 billion |

| Per employee | £23 | £37 | £37 | £38 |

33. It is important to highlight that the costs to business are an estimate and represents only a very small proportion of total employer spending. SSP costs to business currently are around 0.06% of total spending on wages annually by businesses. This increases to around 0.09% of total spending on wages as a result of the proposed reform options to SSP. The impact on businesses of these changes is difficult to predict, and the impact may be different depending on the sector and type of work. Table 2 shows the estimated costs of the illustrative models, which range from £37 to £38 per employee. These changes may therefore only have a small impact on employers overall.

34. Currently, small and micro businesses pay around 60% of the annual SSP cost to employers and make up around 47% of businesses. Given 60% of the additional costs to businesses will be borne by 47% of the population, there will be a disproportionate burden on small and micro businesses.

Next Steps

35. The commitments to remove the Lower Earnings Limit and remove the waiting period are key steps to strengthen Statutory Sick Pay to provide a safety net for those who need it most. These reforms are important priorities to get Britain moving forward, in turn creating the right conditions for sustained economic growth. However, the government notes that many stakeholders are keen to see further reform of the SSP system.

36. The Plan to Make Work Pay is not a short-term fix. In transforming the world of work, this government is dedicated to providing the security of a long-term plan, and we understand that measured, systemic change takes time. Throughout this process, we will work in partnership with businesses to provide the support they need to in turn boost the health and wellbeing of their employees. We are committed to building our understanding of how these SSP changes impact employers and how they support employees.

37. In strengthening SSP, we are committed to working closely with employees, stakeholders and businesses to develop and implement a system that is fair, supportive and effective, kickstarting economic growth and breaking down barriers to opportunity.

38. The government will use the views gathered during this consultation to inform a decision on the earnings replacement rate for those earning below the current rate of SSP.

Your Views

This consultation asks you to suggest where the government should set the percentage rate. You do not need to select from the illustrations set out in the consultation, although you may do so. Please put forward any figure you believe represents a fair replacement rate for those earning below the current rate of SSP. The government is not consulting on what the SSP flat (currently £116.75 per week) rate should be.

1. Which of the following best describes how you are responding to this consultation. Are you responding?

- As a member of the public / employee

- As or on behalf of an individual business or employing organisation

- As or on behalf of an employer/ business representative organisation

- As or on behalf of an interested Trade Union, stakeholder, or other representative organisation

- Other (please specify)

2. Thinking about employees earning below the current weekly rate of Statutory Sick Pay (£116.75 per week), what percentage of their average weekly earnings should they receive through the Statutory Sick Pay system?

Number must be between 0 to 100

3. Why do you think the percentage rate of earnings should be set to this level?

There is no minimum word limit for this question, however we strongly encourage a maximum limit of 500 words. Given the volume of responses expected, submissions exceeding this recommended length may not be read in their entirety.

How to respond

Please submit your responses via this online form. If you have issues, please contact ssp.team@dwp.gov.uk.

If you would prefer to respond via email or post, please send your response to ssp.team@dwp.gov.uk or:

The Statutory Sick Pay Team

Department for Work and Pensions

Caxton House

Tothill Street

London

SW1H 9NA

Duration

The consultation will be open until 4 December 2024.

How we consult

Consultation principles

This consultation is being conducted in line with the revised Cabinet Office Consultation Principles published in March 2018. These principles give clear guidance to government departments on conducting consultations.

Feedback on the Consultation Process

We value your feedback on how well we consult. If you have any comments about the consultation process (as opposed to comments about the issues which are the subject of the consultation), including if you feel the consultation does not adhere to the values expressed in the consultation process or if the process could be improved, please address them to:

DWP Consultation Coordinator

4th Floor

Caxton House

Tothill Street

London

SW1H9NA

Freedom of Information

The information you send us may need to be passed to colleagues in the Department for Work and Pensions, published in a summary of responses received and referred to in the published consultation report.

All information contained within your response, including personal information, may be subject to publication or disclosure if requested under the Freedom of Information Act 2000. By providing personal information for the purposes of the consultation exercise, it is understood that you consent its disclosure and publication. If this is not the case, you should limit any personal information provided or remove it completely.

If you want the information in your response to the consultation to be kept confidential, you should explain why as part of your response, although we cannot guarantee to do this.

To find out more about the general principles of Freedom of Information and how it is applied within DWP, please contact the central Freedom of Information Team:

Email: freedom-of-information-request@dwp.gov.uk

The central FOI team cannot advise on specific consultation exercises, only on Freedom of Information Issues. Read more information about the Freedom of Information act.

Personal Information Charter

DWP always protects personal information under our Personal Information Charter.

-

Edwards, C. H., Tomba, G. S., & de Blasio, B. F. (2016). Influenza in workplaces: transmission, workers’ adherence to sick leave advice and European sick leave recommendations. The European Journal of Public Health, 26(3), 478-485. ↩

-

Health_and_business_July24_2024-07-30-150125_xyeb.pdf (svdcdn.com) ↩

-

A08: Labour market status of disabled people - Office for National Statistics (ons.gov.uk) ↩