Interest on Lawyers' Client Accounts Scheme

Updated 12 February 2026

Applies to England and Wales

Foreword

England and Wales is one of the world’s foremost legal services jurisdictions. Our legal sector contributes billions to the economy each year, employing hundreds of thousands of people across the country. It also supports the economy more widely, giving companies the confidence to do business. This success is underpinned by English and Welsh law, our independent judiciary, and our world-renowned commercial courts. We are also leading the way in legal innovation, with lawtech pioneers in digital dispute resolution and AI-driven legal services.

Maintaining our reputation for excellence in legal services, and our status as one of the most attractive jurisdictions for business, depends on the success of the whole justice system. While our commercial and international legal services flourish, other parts of our system face severe pressures. This Government inherited a criminal and civil system in crisis, where years of underinvestment have taken their toll – with crumbling court buildings, delays in the county courts and tribunals, and significant barriers to accessing justice for many people and businesses.

Since taking office, we have made it our mission to rebuild public confidence in our justice system and are proud of the progress we are making. We are backing this ambition with billions of pounds in additional investment into our courts, prisons, legal aid, and legal support services over the course of this Parliament. But we must go further to ensure its long-term sustainability.

Law firms thrive when the system is strong, so it follows that they should contribute to strengthening justice. We are carrying out this consultation to understand how the legal profession can help support our shared goal: a justice system that is fair, accessible, and fit for purpose.

It seeks views on a proposal to introduce an Interest on Lawyers’ Client Account Scheme (ILCA) as a way for the legal sector to contribute more to the justice system it relies on. Currently, many firms retain interest generated on client accounts as income. We believe that unearned income could be better invested in strengthening our justice system. This is a tried and tested idea, with similar schemes operating successfully for decades in countries like the United States, Canada, Australia, and France. These models have delivered measurable impact by funding access to justice and legal aid services.

We are committed to getting this right and working with the legal sector to ensure the approach taken is designed in a way that is proportionate – and I encourage anyone with an interest to make their views known so we can best strengthen the justice system for a more sustainable future.

Rt Hon David Lammy MP

Deputy Prime Minister, Lord Chancellor and Secretary of State for Justice

Executive summary

This document sets out the Government’s proposals to raise funds through an Interest on Lawyers’ Client Accounts Scheme (ILCA) in England and Wales.

Under the Government’s proposal, a proportion of the interest earned on lawyers’ client accounts in England and Wales, including Third Party Managed Accounts, would be remitted to Government. We are also considering whether individual client accounts should be included within the scope of the scheme to avoid creating a loophole, and to ensure that the impacts of the scheme are fairly balanced across the full range of law firms and clients. Firms would retain a portion of the remaining interest, which would continue to be subject to existing sectoral rules on client interest and any agreement reached between law firms and their clients. Law firms would be required to hold client money in accounts that meet stipulations set out under the scheme. A scheme administrator would be established to ensure the smooth running of the scheme. The proposal is expected to open up a crucial source of funding to support and enhance the delivery of services in our justice system.

The Government welcomes views from legal service providers and practitioners, regulators, professional bodies, clients and consumer groups, the banking sector and companies providing client money accounts or third party managed accounts for legal firms, actors in the advice sector, and all those with an interest in the proposal.

Introduction

This paper sets out proposals for consultation on an Interest on Lawyers’ Client Accounts Scheme (ILCA) scheme which would be used to fund important justice work, and to help keep our justice system on a stable footing, both now and in the future. The consultation is aimed at legal service providers and practitioners, regulators, and professional bodies, in England and Wales, companies providing client money accounts or third party managed accounts for legal firms, clients and consumer groups, actors in the advice sector, and all those with an interest in the proposal.

A Welsh language consultation paper will be made available at https://consult.justice.gov.uk/

Our initial equalities assessment indicates that equalities client groups, including women, ethnic minorities, and disabled people are not likely to be particularly affected. The proposals are likely to lead to additional costs for businesses in the legal services sector, and the consultation seeks more information to inform an impact assessment on any final scheme design.

Copies of the consultation paper are being sent to:

- Legal Services Board, and the legal service regulators

- Financial Conduct Authority

- The Law Society

- Bar Council

- Chartered Institute of Legal Executives

- Chartered Institute of Trademark Attorneys

- Chartered Institute of Patent Attorneys

- Association of Costs Lawyers

- The Society of Licensed Conveyancers

However, this list is not meant to be exhaustive or exclusive, and responses are welcomed from anyone with an interest in or views on the subject covered by this paper.

Background

Client fund interest schemes in other jurisdictions

Client fund interest schemes are well established and an accepted part of doing business in several jurisdictions. These schemes typically remit 100 percent of the interest generated on some client accounts to fund public purposes such as access to justice.

These schemes first emerged in France in 1957, with the creation of the Caisse Autonome des Règlements Pécuniaires des Avocats (CARPA), which was initially introduced to guarantee the secure handing of client funds. Under CARPA, lawyers must deposit client funds into accounts managed by regional scheme bodies affiliated with regional Bar Associations. The scheme bodies determine the interest rates applicable on their account in negotiation with the financial institutions holding the accounts. Interest generated is first used to cover CARPA’s operational costs, with the remainder financing legal aid, police custody assistance, and professional training and social programmes for lawyers.

In the 1960s, similar schemes (which vary in their design) began emerging in Australian States and Territories in response to banking regulation changes that allowed banks to retain the interest accrued on client accounts. In Victoria, firms are required to hold their pooled client accounts with an approved bank, and interest is paid to the Public Purpose Fund which supports regulation of the profession and provides grants, through organisations like the Victoria Law Foundation, for law reform, legal research, and community legal education.

Similar successful schemes have also been introduced across the United States and Canada. In British Columbia and Ontario, firms must use banks meeting eligibility criteria, including paying interest rates comparable to those offered to similar non-scheme customers (the “Best Customer” or “Comparable Rate” standard). In British Columbia, funds are allocated through grants by the Law Foundation of British Columbia to five areas: legal aid, legal education, legal research, law reform, and law libraries. In Ontario, 75 percent of revenue goes to Legal Aid Ontario, with the remainder funding legal education, research, and law libraries through the Law Foundation of Ontario. In the US., scheme details vary by state, but the American Bar Association reports that over 90 percent of funds nationwide support legal aid offices and pro bono programmes[footnote 1].

Types of client account in England and Wales

Many legal service providers in England and Wales handle client money when discharging their services, particularly in areas where they act as intermediaries in financial transactions. For example, solicitors or licensed conveyancers are authorised to receive and hold sums of money on behalf of their client in property conveyancing transactions. Similarly, in probate and estate administration, firms may temporarily hold funds from a deceased person’s estate before distributing them to beneficiaries. In litigation, solicitors might hold settlement funds or security for costs in client accounts, which are required to be kept separate from the firm’s own money in the office account. The client accounts would normally accrue interest depending on how long the funds are held.

Legal service providers use different types of client accounts to manage client funds. The most common type is the provider holding funds on trust in a pooled client account into which they deposit money from multiple clients. In certain cases, such as for high value transactions, for probate, or at the client’s request, they may place client money in a designated individual client account under the client’s name. Another option is for clients to place their money directly into a Third Party Managed Account. Under this arrangement, the legal service provider does not hold the funds; instead, an FCA-regulated TPMA provider holds the funds on behalf of both the legal service provider and the client.

Regulation of client accounts

Different rules apply across the regulated legal professions in England and Wales regarding how interest earned on client money in client accounts is handled.

Most client funds in England and Wales are subject by the rules set by the Solicitors Regulation Authority (SRA), under which firms must account to clients for a “fair sum” of interest earned on client money. The term “fair” is not explicitly defined in the SRA Accounts Rules, leaving legal service providers with flexibility on the sum returned. Legal service provider may agree in writing with clients to a different arrangement, provided the client is given sufficient information to give informed consent.

The Council for Licensed Conveyancers (CLC) and the Institute of Chartered Accountants in England and Wales (ICAEW) (probate practitioners) mandate returning interest to the client, unless the client has given informed written consent to a different arrangement.

CILEx Regulation (legal executives) rules state that ‘the proper proportion’ of interest must be accounted to clients unless it is under a de minimis amount that CILEx may set. The Master of the Faculties (notaries) requires that interest be paid to clients where appropriate dependant on specified circumstances.

The Intellectual Property Regulation Board (IPReg) does not impose a specific rule on interest payments, instead relying on broader principles that client money must be safeguarded and handled in the client’s best interests.

Barristers, regulated by the Bar Standards Board (BSB), and costs lawyers, regulated by the Costs Lawyer Standards Board (CLSB), are generally prohibited from holding or managing client money.

TPMAs are often used as an alternative to traditional client accounts and are regulated by the Financial Conduct Authority. Legal service providers must ensure that clients are fully informed of how their money will be held, their rights to dispute payments, and their entitlement to refunds. While money held in a TPMA is not typically considered “client money” under most regulators’ rules, clients retain beneficial ownership and may still be entitled to interest or refunds depending on the terms of the arrangement (although TPMA providers will typically retain the interest generated.)

Use of client account interest by law firms

The Ministry of Justice commissioned research in 2024 (a survey of 604 legal service providers) to understand what firms do with the interest from their pooled client accounts and how reliant they are on those funds. The full report is available at https://consult.justice.gov.uk/. In summary:

- 33 percent of providers surveyed always remitted all interest from pooled client accounts, 53 percent partially or sometimes, and 23 percent (not mutually exclusive) used interest to cover costs. 55 percent set a de minimis threshold above which they returned interest to clients (mode of £20).

- Providers reported a general sense that clients for the most part did not expect to receive any interest back, often due to short-term holding of funds.

- 92 percent of providers responded that they were not reliant on interest on client accounts for the sustainability of their business. Also, 94 percent said losing the interest would have little/no impact on their firm.

- 89 percent of providers had not made and/or were not planning to make changes to their use of client interest in response to higher interest rates; and

- 4 percent of providers used interest for pro bono/charitable activities.

Interest on Lawyers’ Client Account Scheme

1. Introducing an Interest on Lawyers’ Client Account Scheme (ILCA)

Scheme purpose

The Ministry of Justice is responsible for a wide range of functions, including courts and tribunals, prisons, probation, and legal aid. Funds raised through the ILCA scheme will help strengthen the justice system.

At this stage, we do not propose designating the scheme’s income for specific access to justice projects, or endowing it to grant-making bodies, as is the case in some other jurisdictions. This is because core justice services in England and Wales require sustained investment across multiple areas. Given this context, earmarking ILCA income for narrow purposes to begin with could limit its beneficial impact. Instead, the funds can be directed to the areas of greatest need within the justice system.

Firms in scope

The proposed scheme would apply to funds held in all client accounts pursuant to activities undertaken by legal service providers in England and Wales who are regulated under the Legal Services Act 2007. This is irrespective of the provider’s legal structure (such as Limited Liability Partnerships, Limited Companies, and Alternative Business Structures) or the domicile of the client whose funds are being held. Under this proposal, a proportion of the interest generated within these client accounts would be remitted to Government.

Accounts in scope

The application of client account schemes varies across jurisdictions. Those in the US, British Columbia, Australia, and Ontario typically target pooled accounts only. These accounts aggregate deposits from clients which by themselves would be either too small in amount or held for too short a duration to generate net interest for the client. Lawyers in these jurisdictions will generally advise clients on placing their funds into a separate interest-bearing account that is outside the scope of the schemes when it is likely that it could generate interest net of any expenses[footnote 2]. Whereas in France, lawyers are obliged to place all client funds into CARPA. What these schemes have in common is that they remit 100 percent of the interest generated on the applicable accounts.

We are consulting on a scheme design that is a middle ground between these international approaches. We are considering whether firms and clients should be able to retain some of the interest generated on their funds in pooled accounts. However, for fairness, we want to ensure that the scheme cannot simply be avoided through directing client funds into individual client accounts.

Therefore, we are considering applying the scheme to client funds held in both pooled accounts and individual accounts. This would apply where the provider is directly holding money on trust in an account offered by a bank or building society, but also where a provider enters into arrangements with a client to use a Third Party Managed Account. Client funds in relation to all “reserved legal activities” under the Legal Services Act 2007 would be in scope of the scheme. However, we welcome views on whether any other services undertaken by legal service providers involving client money should also be included. Furthermore, we recognise that there are many reasons why clients may have an individual named account set up on their behalf, and welcome views on whether there are cases where such accounts should be out of scope.

Questions:

-

Do you have any views on the proposed scope of the scheme?

-

Aside from reserved legal activities, is there other work undertaken by legal service providers that includes holding client money? Should this be in or out of scope of the scheme?

-

Are there other account types used for holding client money that should be in scope of the scheme?

-

Are there any types of individual account used for holding client money that should not be included in scope of an ILCA scheme? And why?

Interest remitted on pooled accounts

Internationally, the standard practice for client interest schemes is to remit all the interest earned on pooled client accounts to the scheme. If the proposed ILCA scheme did the same, individual clients would not necessarily lose out on significant interest. This is because these pooled accounts typically hold small, short-term deposits that are often below firms’ repayment thresholds. Allocating all interest to the scheme would provide certainty for both clients and firms and maximise funding for public investment. However, there is a risk this could prompt firms to recover account maintenance and transaction costs from clients that might currently be funded by the interest secured on the account. This might raise concerns about fairness and could increase the overall cost of legal services.

To balance these considerations, we propose that the scheme remits to government 75 percent of the total interest generated on pooled client accounts. We believe this approach strikes a balance between generating meaningful revenue for the benefit of the justice system and leaving a sufficient percentage of interest, which can be returned to clients where applicable. However, we welcome the views of respondents on whether a higher proportion, such as 90 percent or 100 percent interest, should be remitted to the scheme to help better achieve the objective of supporting an effective justice system.

Interest remitted on individual accounts

We propose that the scheme remits to government 50 percent of the interest generated on individual client accounts. In contrast to pooled client accounts, individual accounts are often used for larger, longer-term work, such as for probate, property, or corporate transactions, which can generate more interest for clients. Also, the administrative costs of setting up accounts for individual clients is higher for firms (and for clients) than maintaining a general pooled account.

The proposed rate of 50 percent, while lower than the 75–100 percent range we are consulting on for pooled accounts, should provide for a fair contribution to the scheme while reducing incentives for firms to redirect client funds to individual accounts to minimise participation in the scheme. This rate aims to ensure clients can retain a meaningful share of interest on substantial deposits, recognise the higher administrative burden on firms, while securing meaningful scheme income for the justice system.

Question:

5. We propose that the scheme retains a higher proportion of interest generated on pooled client accounts (75–100 percent), and a lower rate of 50 percent of interest on individual client accounts. Do you have any comments on these rates?

Treatment of remaining interest

While the proposed scheme would introduce requirements on legal service providers to facilitate the proper functioning of the scheme (see section 2 below), it is not intended to override the existing regulatory regime for the legal sector on client interest. We believe legal service regulators are better placed to make client interest rules for firms that account for wider considerations such as ethical obligations and client protections. We propose that legal service regulators would continue to set rules on client account interest for legal service providers after the ILCA scheme secures its share, including how any remaining interest should be handled or how much should be returned to clients. For most firms, under current rules, this would mean the remaining interest would continue to be governed by the Solicitors Regulation Authority’s requirement to account a “fair sum” to clients. Similarly, providers of Third Party Managed Accounts would remain subject to the Financial Conduct Authority’s rules.

Question:

6. Do you foresee any difficulties with keeping in place the existing rules on client interest, for the interest not secured by the scheme?

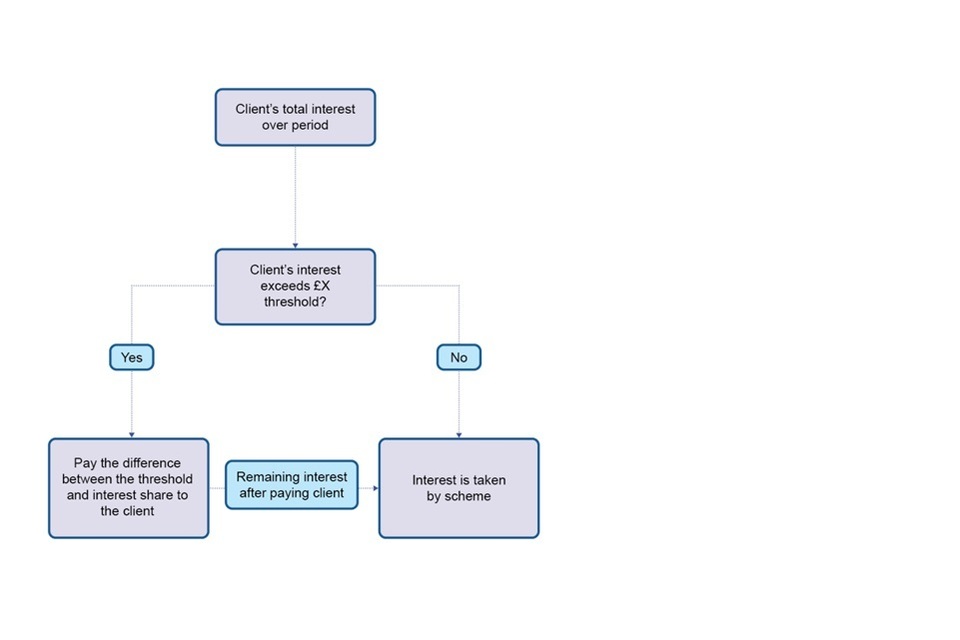

Alternative interest model

An alternative to the scheme retaining a flat percentage of all client account interest would be to adopt a threshold-based approach. Under this model, clients would receive a proportion of the interest generated on their funds above a specified threshold, while interest below that threshold would be remitted to the scheme. The rationale behind this approach would be to ensure that clients with substantial balances or long-term deposits benefit directly from the interest earned, aligning with principles of fairness and proportionality. It would also allow the scheme to continue capturing small amounts of interest that would otherwise be administratively inefficient to allocate to individual clients.

However, we are not proposing to proceed with this model because the administrative burden and complexity would be disproportionate to its benefits. Implementing a threshold system would require law firms and/or financial institutions to calculate interest on a client-by-client basis, track when thresholds are met, and allocate payments accordingly. This could significantly increase operational burdens in comparison to the flat-rate approach and create a higher risk of calculation errors or fraud. To manage these risks, additional oversight and enforcement mechanisms would be necessary, adding further cost and complexity to the scheme.

Client interest expectations

Limited evidence indicates that many clients are unaware that interest is earned on client accounts and often do not expect to receive it[footnote 3]. The proposed rates for the ILCA scheme aim to give clients access to interest generated on their funds when it is significant. As part of this consultation, we seek the views of clients of legal services (and organisations such as consumer groups) as to their experience and expectations around interest generated on their funds, and what impact the scheme may have on clients.

Questions:

7. For legal work undertaken on your behalf as a client, have you received (or are you expecting to receive) interest on your funds?

8. If yes to the previous question, how much interest have you received/are expecting to receive?

9. Are there any impacts of the proposed scheme on clients that we have not considered?

2. Scheme requirements, process, and impacts

Requirements on firms

International client account schemes typically operate on an automatic interest remittance model, where interest earned on pooled client trust accounts is collected directly by the financial institution and sent to a designated public fund.

Most jurisdictions with a scheme, such as France and Victoria, have a scheme administrator negotiate client account interest rates directly with financial institutions that are approved to hold client funds. In France, CARPAs agree the rate with the financial institution holding its account, while in Victoria, the Legal Services Board contracts with a small group of scheme-approved banks and negotiates the rate payable on client accounts. In Ontario, firms can place client funds in any chartered bank, provincial savings office, or registered trust corporation provided it signs an agreement with the Law Foundation of Ontario to remit interest under a “Comparable Rate” standard that ensures it pays interest equivalent to what they offer their most favoured commercial customers.

We propose that interest due to the scheme is collected directly from client accounts, as is common in other jurisdictions. This approach has proven effective elsewhere and would reduce the administrative work and compliance risks for law firms.

Regarding where client money can be held, we suggest introducing a legal requirement for legal service providers to meet the scheme’s core requirements which includes only using client accounts that provide certain features (see box below). To support market competition and diversity in the banking sector, we do not propose mandating the use of particular banks or financial institutions. Firms would retain their flexibility to choose where to hold client money, provided the scheme requirements are met.

Requirements on legal service providers

Collection capabilities: Periodically (frequency to be determined), the appropriate interest must be sent from the client account to the scheme administrator.

Interest frequency: The client account used must calculate interest daily and credit it to the account periodically (frequency to be determined).

Comparable interest rate: The client account used must offer a rate of interest that is comparable to other interest-bearing accounts the bank offers with similar balances, risks, and features.

Monitoring: The legal service provider must provide account information as the scheme administrator requires to perform its monitoring and enforcement activities (more on monitoring and enforcement in section 4).

Administrator accounts: We may also require that the client account used must be with a provider that is able to host an administrator account within the same bank/institution into which scheme money would be deposited (more information is in section 3).

We have focused the requirements on what would enable the scheme to function effectively, while minimising burdens on account providers and therefore making it easier for firms to find suitable products.

We are considering using a “Comparable Rate” approach to account interest. Broadly, interest on scheme accounts would be calculated at rates comparable to those offered on similar commercial accounts by the same bank/institution. This approach balances flexibility and fairness. It avoids imposing centrally set rates that may not be reflective of the business conditions, while helping to keep interest levels on client accounts reasonable. We seek views on what the relevant factors underpinning a comparable rate standard should be. Examples of relevant factors behind a comparable rate could include account balances, how long the funds are expected to be held, and the risk factors of depositors.

We seek views on the best way to collect interest for the scheme. One option is to require legal service providers to ensure interest is paid to the scheme at the required frequency, for example through manual transfers. Another option is to require providers to only use client accounts that automatically remit interest directly to the scheme. Automation could reduce compliance burdens and checks, but we want to understand whether account providers can offer this functionality.

We do not propose introducing any legal obligation on client account providers themselves to offer accounts with these specifications. The technology to provide accounts with these features should be common, and we expect that the market would develop and offer these products to compete for legal sector business. However, we feel it is important to retain the discretion of client account providers not to offer these products if, for example, they do not have customers providing legal services.

Questions:

10. For legal service providers: how easy or difficult do you find it currently to open pooled or individual client accounts?

11. For client account providers (including Third Party Managed Account providers): are there any benefits or challenges foreseen with introducing banking products with the specified criteria proposed?

12. For client account providers: Would you be able to offer client accounts that could automatically transfer the appropriate amount of interest to the scheme? How would they work?

13. By what process should a “comparable rate” of interest on client accounts be determined?

14. We propose that interest is credited to client accounts, and collected by the scheme, periodically (such as monthly or quarterly). What should that frequency be?

15. Are there other account criteria for the accounts that would be recommended to make the scheme work as intended?

Firm flowchart

Once client funds have been placed within a suitable account that meets the scheme criteria, interest would be credited to the account periodically, and the proportion of interest owed would be transferred from the client account to the scheme’s administrator. The remaining interest in the account can then be managed by the provider as normal.

-

Client money is deposited in an account that meets the scheme specifications

-

The account generates interest daily, which is credited to the account periodically

-

Periodically, a proportion of the interest generated on the account is transferred to the scheme administrator

-

The remaining interest is left in the account to be managed as usual by the provider (subject to existing sectoral regulations in place governing the management of client accounts and the interest generated)

Questions:

16. Do you foresee any practical difficulties with the proposed process for legal service providers?

17. Do you have any suggestions for changes that could improve how the model works for legal service providers?

18. Do you have any other thoughts on the intended scheme process for legal service providers?

Impact on legal service providers

The Government will undertake and publish relevant analysis on the impacts of an ILCA scheme following the consultation, based on the final scheme design. To feed into that analysis, we seek further information on how legal service providers already treat client account interest, and views on how the scheme as proposed may affect them.

We seek views on the operational and financial implications for legal service providers of different sizes and practice areas. In designing the ILCA scheme, the Government is keen that it is affordable for firms of different sizes, and fair to those that provide different types of legal services. Smaller providers, for example, generate less client account interest than the largest providers and therefore would remit less interest under the proposed scheme. However, they also typically operate with smaller profit margins. Likewise, legal service providers offering conveyancing services may generate more client account interest than those specialising in litigation. The direct impact of the scheme on firms may vary depending on whether their policies already return all the interest to clients, or only that above a de minimis amount.

The proposed scheme may also introduce indirect, administrative costs to legal service providers. These could include updating company policies and procedures and moving their client accounts to a bank that meets the scheme requirements. We seek views on what those additional costs might be on providers and how they might be minimised.

Questions:

19. At your firm, how much interest is typically generated on a single client’s funds including:

a. On one client’s funds in a pooled client account; and b. On one client’s funds in an individual client account.

20. What proportion of your firm’s turnover is client account interest?

21. What does your firm currently do with client account interest?

22. How would the scheme, as proposed, affect your firm?

23. What indirect/administrative costs may the scheme place on your firm and how can we limit them?

Impact on legal aid providers

We recognise the concerns raised by some legal aid providers regarding the potential impact of an ILCA scheme on the sustainability of legal aid services. Stakeholders have suggested that the proposed changes could result in a reduction in the volume of legal aid work, or in some cases, providers ceasing to offer legal aid services altogether. Several providers also noted that they rely on the interest accrued on client accounts and income from private work to cross-subsidise their legal aid services and offset rising business costs.

In response to these concerns, this consultation aims to gather evidence on how an ILCA scheme might affect legal aid providers. We are particularly interested in understanding how the loss of interest might influence service delivery, staffing, and the overall viability of continuing to offer legal aid services.

Questions:

24. Does your firm conduct legal aid work?

25. If yes to the previous question: a. What proportion of your firm’s turnover is derived from legal aid work? b. Would the proposed scheme impact your provision of legal aid services, and to what extent?

3. Scheme administration

The scheme would be overseen and governed by a scheme administrator. We propose the following roles for an administrator:

General Administration:

- Managing the relationship with the legal services sector and the account providers (banks/third party managed account providers) involved in the scheme.

- Handling communication for the scheme including, providing guidance and managing relevant correspondence.

Finance:

- Managing the money collected from accounts by the scheme.

- Responsible for scheme’s accounting and budgeting.

- Adhering to transparency obligations on scheme income.

- Potentially operating a network of administrator accounts, one with each account provider, into which scheme money would be deposited once collected.

Monitoring and enforcement:

- Monitoring client account transactions to check for compliance.

- Working with regulatory authorities to safeguard against and report noncompliance and fraud.

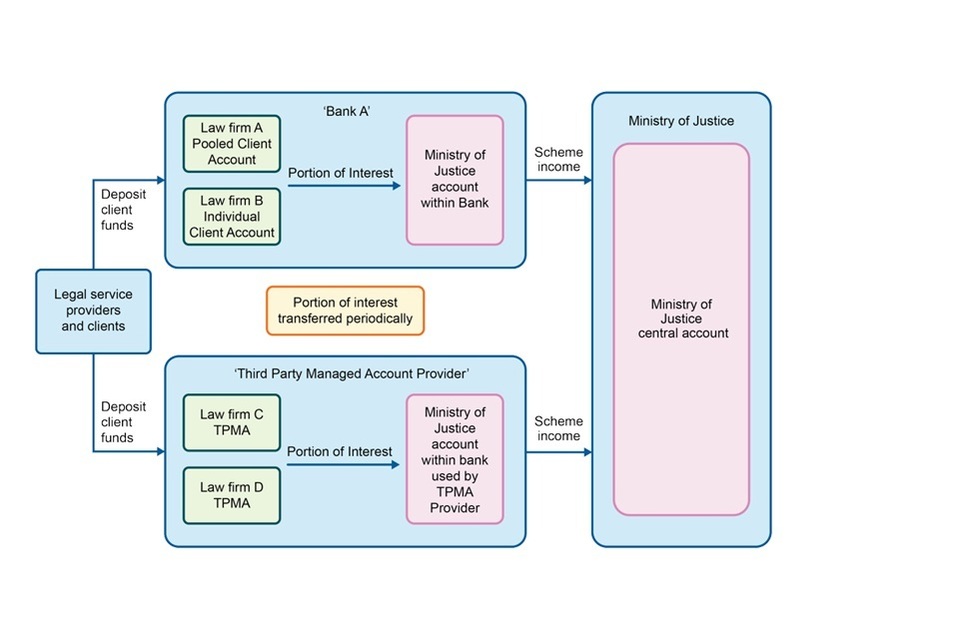

We propose that the scheme would be administered by the Ministry of Justice. Delivering the scheme “in-house” ensures timely implementation and minimises unnecessary complexity and cost to the public purse. This model also reflects the Government’s commitment to increase the delivery of services “in-house” without setting up new bodies where feasible. However, we may consider whether another body should take on this responsibility on behalf of the Ministry of Justice in future.

The scheme administrator would be responsible for managing the money collected from client accounts, for which we are considering two different models. The first model includes the scheme administrator opening its own administrator account with each bank/institution hosting client accounts for legal service providers. Under this approach (see diagram below), scheme interest collected from client accounts within that institution would first be moved to the administrator’s account within that same institution. Then funds would be transferred from the administrator accounts to a central account periodically. By spreading the scheme’s interest across a network of administrator accounts in this way, the administrator would reduce the financial and security risks that might occur with holding the scheme’s income within one financial institution. And it might facilitate a stronger relationship with the scheme administrator and client account providers.

Alternatively, we are considering a more direct model whereby the appropriate interest from all applicable client accounts is remitted directly to one, central scheme account (see diagram below). This would potentially minimise burdens on client account providers, who would not have to host administrator accounts. And it could help ensure a greater supply of qualifying client accounts are available in the market.

We seek views on how a scheme administrator might be most helpful to legal service providers and client account providers involved in the scheme, and whether this would facilitate any functions in addition to those proposed.

Questions:

26. Do you envisage circumstances in which you would need the scheme administrator to assist you?

27. For client account providers: what are your views on the two proposed models for managing scheme interest: multiple administrator accounts across institutions versus a single central account?

28. We propose that the Ministry of Justice initially administers the scheme. Do you think there is a more suitable organisation to take on this role in future, and why?

29. Do you have any other comments on the proposed roles of the scheme administrator?

4. Monitoring and enforcement

The scheme administrator would be responsible for overseeing the scheme. Appropriate sanctions, to be set out at a later date, would be in place for providers that do not adhere with scheme requirements, as well as any necessary mechanisms for appeals. However, most legal service providers in England and Wales are already subject to reporting requirements on client accounts. These include maintaining accurate accounting records of client transactions and obtaining an annual accountant’s report that can be reviewed by regulators. The Government is keen to use existing sectoral reporting practices in the administration of this scheme wherever possible, to reduce duplication and avoid additional burdens on providers.

We therefore seek views on what reporting activity on client funds providers already undertake, and how we might ensure a robust yet proportionate approach to monitoring compliance with the scheme.

Questions:

30. What reporting activity do you already undertake on client accounts and client account interest?

31. How might we ensure that an approach to monitoring and enforcement is proportional and effective?

Equalities Assessment for ILCA scheme

Section 149 of the Equality Act 2010, the Public-Sector Equality Duty (PSED), provides that:

“A public authority, must in the exercise of its functions, have due regard to the need to-

(a) eliminate discrimination, harassment, victimisation and any other conduct that is prohibited by or under this [the 2010] Act;

(b) advance equality of opportunity between persons who share a relevant protected characteristic and persons who do not share it;

(c) foster good relations between persons who share a relevant protected characteristic and those who do not share it.”

Paying ‘due regard’ needs to be considered against the nine “protected characteristics” under the Equality Act 2010 – namely race, sex, disability, sexual orientation, religion and belief, age, marriage and civil partnership, gender reassignment, pregnancy and maternity.

Equalities Considerations

Direct Discrimination

The proposed ILCA scheme is not directly discriminatory as it does not treat people less favourably on account of a protected characteristic. It would apply uniformly to all affected parties without reference to any protected characteristic.

Indirect Discrimination

Based on the data currently available, we consider that the proposed ILCA scheme is unlikely to cause indirect discrimination. It is not expected to result in a particular disadvantage for people with a protected characteristic when compared with people without. Despite this, where there could be uneven impacts, we have assessed them below.

If legal service providers were to pass the costs of the scheme onto clients, civil legal services claimants from an Asian/Asian British background could be disproportionately affected. This is because this group comprises 14 percent of all civil legal services claimants[footnote 4] but comprise around 9 percent of the population in England and Wales[footnote 5]. Those on lower incomes (including younger people under the age of 29, and those from minority ethnic groups) could also be more sensitive to those cost changes. This is because younger people are likely to be on lower incomes compared to older people[footnote 6] – and because a negative pay gap exists between individuals from a minority ethnic background when compared to individuals from a White ethnic background[footnote 7].

Despite the above, that risk of indirect discrimination is expected to be minimal. This is because many law firms currently do not return any interest, or only partial interest, to clients whose funds are deposited in pooled accounts. And because pooled client accounts are used normally for smaller transactions, the sum of interest generated per client is likely to be small. Many clients with individual accounts, typically used for larger transactions that can generate more interest, such as for corporate transactions, are also more likely to have greater financial capacity to absorb any costs. However, we welcome further information on these points as part of the consultation (see section 1 questions 7–9, and section 2 questions 19–21.)

If legal aid provision were reduced because of the scheme, those more likely to use those services, including younger people under 44 (81 percent of recipients), men (68 percent), and disabled people (20 percent) could be particularly affected. We seek views on the impacts of the proposed scheme on legal aid providers (see section 2 questions 24 and 25), which we will consider carefully.

Discrimination Arising from Disability & Duty to Make Reasonable Adjustments

We do not consider there to be a risk of discrimination arising from disability as a result of the scheme. We will continue, however, to monitor any potential impacts and ensure that reasonable adjustments are made where appropriate to support users with disabilities.

Harassment and Victimisation

We do not consider there to be any risk of harassment or victimisation arising from these proposals.

Advancing Equality of Opportunity

The scheme is unlikely to directly advance equality of opportunity. However, the scheme aims to raise income to strengthen the justice system, which could benefit groups facing barriers to justice (such as ethnic minority and disabled clients).

Fostering Good Relations

The scheme has no foreseen impact on the relations between those who share certain characteristics and those who do not. We do not consider that there is scope within the scheme to create any such relevant measures.

Your views are important

We seek your views and evidence on equalities considerations. We will review the above equalities assessment following feedback to this consultation, to inform the final design of an ILCA scheme.

Questions:

32. What do you consider to be the proposed ILCA scheme’s equalities impacts on individuals with protected characteristics (if any)?

33. Is there further evidence (including data, or case studies in other jurisdictions) you can share that could inform our equality analysis for the proposed scheme?

34. Are there forms of mitigation in relation to equality impacts that we should consider?

Contact details/How to respond

You can respond online to the consultation.

Alternatively, please send your response by 9 February 2026 to:

Additional Funding Team

Ministry of Justice

102 Petty France

London SW1H 9AJ

Email: Additionalfundingconsultation@justice.gov.uk

Complaints or comments

If you have any complaints or comments about the consultation process you should contact the Ministry of Justice at the above address.

Extra copies

Further paper copies of this consultation can be obtained from this address and it is also available on-line at https://consult.justice.gov.uk/.

Alternative format versions of this publication can be requested from additionalfundingconsultation@justice.gov.uk.

Representative groups

Representative groups are asked to give a summary of the people and organisations they represent when they respond.

Confidentiality

Information provided in response to this consultation, including personal information, may be published or disclosed in accordance with the access to information regimes (these are primarily the Freedom of Information Act 2000 (FOIA), the Data Protection Act 2018 (DPA), the General Data Protection Regulation (UK GDPR) and the Environmental Information Regulations 2004).

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals, amongst other things, with obligations of confidence. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the Ministry.

The Ministry will process your personal data in accordance with the DPA and in the majority of circumstances, this will mean that your personal data will not be disclosed to third parties.

Consultation principles

The principles that Government departments and other public bodies should adopt for engaging stakeholders when developing policy and legislation are set out in the Cabinet Office Consultation Principles 2018 that can be found here.

-

American Bar Association: Model Rules of Professional Conduct - Rule 1.15; British Columbia Law Society Trust Accounting Handbook: Trust-Accounting-Handbook.pdf; Law Society of Ontario FAQ: Frequently asked questions about separate interest-bearing trust accounts (SIBA) - Lawyer, Law Society of Ontario ↩

-

Pye Taitt report; Consumer research undertaken on behalf of the SRA ↩

-

Civil Court User Survey – Ministry of Justice, (2015) ↩

-

Ethnic group, England and Wales - Office for National Statistics ↩

-

Earnings and hours worked, age group: ASHE Table 6 - Office for National Statistics ↩

-

Ethnicity pay gaps: adjusted pay gaps - Office for National Statistics, (2023) ↩