Consultation on indexation and equalisation of GMP in public service pension schemes

Updated 22 January 2018

1. Summary

1.1 Background

On 6 April 2016 the government introduced the new State Pension (nSP), designed to radically simplify pension provision, while ensuring that pensioners have security in retirement. This simplification removed layers of complexity from the system, harmonised the rate of National Insurance contributions paid by employees and employers and is promoting private saving by giving people a better understanding of the amount of support they can expect to receive from the State when they reach State Pension age (SPa). Among the layers of complexity that are being removed is the Additional State Pension (AP) – a complex earnings related element of the old state system.

With the removal of the AP the government needs to consider how public service pension payments for a specific group of members should be increased in future. Specifically, those who were in ‘contracted-out’ employment during the period 6 April 1978 to 5 April 1997, accrued a guaranteed minimum pension (GMP) from their public service pension scheme and expect to reach SPa post-December 2018. If the government does not take action, an inequality in the payment of public service pensions between men and women may be introduced and there will also no longer be a mechanism to provide fully indexed pension payments.

Under the arrangements that previously applied the public service pension and the AP system worked in tandem, providing a mechanism that fully indexed and equalised pension payments (state pension and occupational pension) of public servants, in line with commitments made to these members by previous governments. However, with the removal of the AP, this mechanism no longer works. An estimated 2 million members of the public service schemes with GMPs who reach their SPa up until 2040 may be affected.

The impact of no longer receiving a fully indexed GMP will vary significantly across the affected public service employees. In extreme cases the cumulative losses could have an estimated value of £18,000[footnote 1]. However, for the majority of those who lose, the government expects the impact to be lower. Many individuals are likely to benefit from transitioning to the new State Pension; analysis from the Department for Work and Pensions estimates that by 2030 almost 80% of UK pension scheme members with GMPs accrued between 9 April 1978 and 5 April 1988 who transition to the new State Pension will receive higher State pension payments than under the old system over their lifetime[footnote 2].

On 1 March 2016, the government announced that public service pensioners reaching SPa after 5 April 2016 and before 6 December 2018, would have the GMPs earned in public service fully indexed by the public service pension scheme. This eased the transition to the new State Pension for a group who would have been likely to lose, and ensured that men and women reaching SPa in that period continued to receive equal pension payments.

1.2 Purpose of the consultation

This consultation aims to consider two issues. Namely:

- How best to avoid the introduction of unequal payments to men and women in the public service schemes that will result from the abolition of AP. There are legal requirements[footnote 3] to pay men and women equal pensions in respect of pensionable service after 16 May 1990, and the old arrangements were designed to deliver equalisation by way of increases to AP

- Whether, following the introduction of the new State Pension, the public service pension schemes should pay full indexation on GMP earned while a member of a public service pension scheme, for someone who reaches SPa after 5 December 2018

The consultation is therefore chiefly concerned with those who reach State Pension age after 5 December 2018. The government has overall responsibility for policy on the indexation of public service pensions and for how such pension schemes are provided; this consultation is being carried out in that role.

The government is conducting this consultation with an open mind regarding the two key questions set out above. In order to guide decision making, there are a set of key tests against which each of the methods proposed in this consultation document should be considered:

- does the policy proposal ensure that affected members are at least as well off as they would have been, had the nSP not been introduced

- does the policy proposal consider fairness to taxpayers in general

- does the policy proposal avoid the unequal payments to men and women that would otherwise result from the abolition of AP, and minimise future legal risk to the public service pension schemes

- is it cost-effective and does it minimise future fiscal risk to public service pension schemes from data and administrative errors

- is the policy proposal a long-term solution that supports the government’s principles of transparency and greater understanding of pension saving

The government is separately consulting on a method by which private sector pension schemes can address the inequalities inherent in guaranteed minimum pensions.

1.3 Options

This consultation will examine the options open to the government to avoid introducing an inequality for payments to men and women reaching SPa after 5 December 2018, who accrued a GMP as a member of a public service pension scheme. In addition, it will consider whether it should meet the past commitments made to public service employees regarding full indexation of their public service pensions, including the GMP, in light of the wider gains many will receive from the transition to the new State Pension. In doing so, the government will consider the practicability and cost-effectiveness of various options open to it.

The options the government are considering include those summarised below.

Case-by-case

This method compares the total income received by the pensioner from public and state pension provision under the old and new system. Where the member has lost financially, the member would be compensated up to the value of the loss of indexation only. This method does not provide full indexation to all members.

To equalise the benefit, this method would then repeat the same calculation for an equivalent, theoretical member of the opposite sex. The scheme would then pay the higher of the male or female benefit to the affected individual. The Government Actuary’s Department (GAD) estimate this would increase liabilities for the public service pension schemes by around £1.5 billion. This is equivalent to increasing schemes’ total liabilities by 0.15%[footnote 4]. It is however very administratively complex, would continue for decades and would require significant investment in administrative systems for all public service pension schemes.

Full indexation

The second method, full indexation for those attaining SPa after 5 December 2018, is a continuation of the current policy announced on 1 March 2016 (see the paragraph before section 1.2), which requires the public service pension schemes to directly meet the cost of indexing the GMP. This also prevents inequalities being introduced between men and women by the abolition of the AP. By fully indexing the GMP it ensures that no individual is worse off as a result of no longer in effect receiving indexation on their GMP through the AP. However, because this policy applies to all individuals it would mean that a large number of individuals would be compensated when they were already better off as a result of the transition to the new State Pension. GAD estimate this policy would increase liabilities for public service pension schemes by around £5 billion. This is equivalent to increasing schemes’ total liabilities by around 0.5%. Full indexation is administratively much less complex than case-by-case as it is a continuation of current government policy.

Conversion

The final option, conversion, converts the GMP into a scheme benefit, equating £1 of GMP to £1 of scheme benefit. This method has a similar outcome to full indexation, but public service schemes would no longer need to abide by existing GMP legislation for these members. It has a similar cost to full indexation and is likely to involve some administrative complexity to complete the conversion but should be significantly simpler in the longer term for schemes.

Other methods

The government is also interested in views on solutions other than the three above that would address the indexation and equalisation issues brought about by the introduction of the new State Pension.

1.4 Who is in scope

Serving and former public sector employees from the major workforces will be affected, including:

- the armed forces

- the fire and rescue services

- the police force

- the judiciary

- local government workers

- the NHS

- teachers

- civil servants

There may also be a number of wider public service and public sector organisations that are affected, either because their pensions are ‘official pensions’ as defined in s. 5(1) of the Pension (Increase) Act 1971 (‘PIA 1971’) or because, historically, their pension scheme has, through its own scheme rules, followed the treatment of the major public service pension schemes regarding the indexation of GMPs.

The government also understands that some private sector occupational pension schemes may be affected. Such schemes include those whose Trust Deeds and rules explicitly require them to follow the indexation treatment of the public service pension schemes, including the provisions of the PIA 1971 and the Social Security Pensions Act 1975 (‘SSPA’). The government is interested in understanding more about the private sector pension schemes who mirror the public service schemes for GMP purposes in order to understand how the proposals set out in this consultation might affect them.

Question 1

Which pension schemes (public and private) follow the PIA 1971 and SSPA and therefore may be affected by a policy change?

1.5 Aim and scope of the consultation

The government will consider the consultation responses and decide how best to achieve its aims in relation to each of the possible methodologies set out below in this document. We are particularly interested to hear from:

- bodies within the scope of this policy

- public service employers and their representative bodies

- current and former members of public service pension schemes and their representatives

- wider public sector employers who may be impacted by a change in indexation arrangements

- private sector employers and trustees of private sector pension schemes who may be impacted by a change of policy

- members of the academic community with expertise in this area

- pensions, pay, remuneration and HR professionals, including pension scheme administrators, in both the private and public sectors

- anyone else who may be affected by this consultation

In this document, public service pensions are official pensions as defined in s. 5(1) of the PIA.

In this document, the public sector is defined in a wide sense according to the Office of National Statistics definition.

1.6 Data quality and analysis

It has not historically been necessary for the public service pension schemes to hold GMP data on their active and deferred members who are below GMP age. As a consequence, the data held directly by the public service pension schemes on GMPs is incomplete. Generally[footnote 5], only when schemes are required under legislation to deduct the GMP amount from the public service pension for the purposes of indexing, have schemes extracted the necessary data from Her Majesty’s Revenue and Customs (HMRC). As a result, the estimated impacts quoted here, including numbers affected by any change, are uncertain. Over the course of the consultation, HM Treasury will work with HMRC, the Government Actuary’s Department and the major public service pension schemes to ensure that the estimates are improved where possible.

1.7 Devolution

The policy decision taken would apply to all public service pension schemes in Great Britain to which sections 59 and 59A SSPA apply.

The Northern Ireland Executive will need to determine if and how they wish public service pension schemes in Northern Ireland to address provision of indexation of the GMP following the introduction of the new State Pension and equalisation of payments to members of public service pension schemes in Northern Ireland. To date GMP in Northern Ireland schemes has been treated in the same way as the schemes in Great Britain. Indexation of GMP is applied in an identical manner under an equivalent direction by the Department of Finance made under s.69 of the Social Security Pensions (Northern Ireland) Order 1975.

1.8 Confidentiality

Information provided in response to this consultation, including personal information, may be published or disclosed in accordance with the access to information regimes. These are primarily the Freedom of Information Act 2000 (‘FOIA’), the Data Protection Act 1988 (‘DPA’) and the Environmental Information Regulations 2004.

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals with, amongst other things, obligations of confidence. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information you have provided we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on HM Treasury.

HM Treasury will process your personal data in accordance with the DPA and in the majority of circumstances this will mean that your personal data will not be disclosed to third parties.

1.9 Consultation principles

This consultation is being run in accordance with the government’s consultation principles.

1.10 How to respond

This consultation will run for 12 weeks and will close on 20 February 2017. Responses should be sent by email to gmpconsultationresponse@hmtreasury.gsi.gov.uk with the subject heading ‘Consultation on indexation and equalisation of GMP in public service pension schemes’.

Alternatively, please send responses by post to:

Consultation on indexation and equalisation of GMP in public service pension schemes,

Workforce, Pay and Pensions Team,

HM Treasury,

1 Horse Guards Road,

London

SW1A 2HQ

When responding please say if you are a business, individual or representative body. In the case of representative bodies, please provide information on the number and nature of people you represent.

2. Background

2.1 Previous system

The previous State Pension system had two tiers. The first tier – the basic State Pension – consisted of a level of pension provision to which anyone who met the basic qualifying conditions had access and provided a minimum level of retirement income. The second tier – the Additional State Pension (AP) – provided further pension income, related to employees’ earnings levels.

It was possible for individual pension schemes to contract-out of the AP, leading to both the employer and employee receiving a National Insurance rebate. For an individual to be contracted-out between 6 April 1978 and 5 April 1997 the occupational pension was required to have a value of at least the guaranteed minimum pension (GMP). An individual’s AP is then adjusted to take account of the GMP.

The precise rate at which men and women built up GMPs is complex. This “GMP accrual rate” is related to the length of assumed working life which has differed between men and women[footnote 6]. In particular the definition of working life used for the purposes of determining GMPs is longer for men than women (reflecting the unequal SPas for men and women at that time). This means that GMP has accrued at a slower rate for men than for women. Box 2.A shows how GMP accrual rates are calculated for an illustrative male and female.

To determine the amount of GMP someone has built up, their relevant GMP accrual rate was applied to their “contracted-out earnings” for each year that GMP accrued. Someone’s “contracted-out earnings” is their income within the National Insurance contributions thresholds, i.e. the earnings band between the Lower Earnings Limit (or LEL) and the Upper Earnings Limit (UEL).

The different GMP accrual rates for men and women therefore mean that a man and woman with identical employment histories will have different amounts of GMP. Based on the illustrative man and woman in Box 2.A and assuming an employment history equivalent to band earnings half way between the LEL and UEL throughout the period over which GMP accrued, leads to the GMP amounts (in current terms and rounded to the nearest £100) set out in Table 2.A.

Table 2.A: Example GMP amounts in current terms for a male and female with an equivalent employment history

| Male | Female | |

|---|---|---|

| Pre-88 GMP | £1,300 | £1,500 |

| Post-88 GMP | £800 | £900 |

| Source: Government Actuary’s Department (GAD) |

An example of how the GMP accrual rate is derived

2.2 Equalising and indexing the GMP prior to 6 April 2016

There are general requirements under the Pension Schemes Act 1993 (PSA 1993) that apply to the calculation and indexation of GMPs earned under contracted-out, defined benefit occupational pension schemes. The general requirements for indexation vary, depending on: when the GMP accrued; whether the GMP age has been reached; and whether the GMP has come into payment.

Once GMP age has been reached, the rate at which GMP is indexed under the PSA 1993 (regardless of whether the GMP is in payment) depends on the period over which the GMP accrued:

- if GMP accrued prior to 5 April 1988 (the ‘pre-88 GMP’) – there is no requirement under the PSA 1993 on the occupational pension scheme to provide price protection

- if GMP accrued between 6 April 1988 and 5 April 1997 (the ‘post-88 GMP’) – occupational pension schemes are required to provide price protection up to 3% per annum by s. 109 of the PSA 1993

Alongside this, the State also paid increases on the AP built up by the member when contracted-out, when they reached State Pension age. These increases were also linked to prices. To ensure the member didn’t receive payment twice (once on the GMP and again on the AP)[footnote 7], a contracted-out deduction (broadly equivalent to the value of the GMP including any uprating paid by the occupational pension scheme under s109 of the PSA) was deducted from the AP before it was paid. Any surplus left after this deduction was paid by the State to the pensioner as part of their State Pension. It is this payment that is no longer made under the new State Pension. This payment is considered by many to be, in effect, indexation of the GMP.

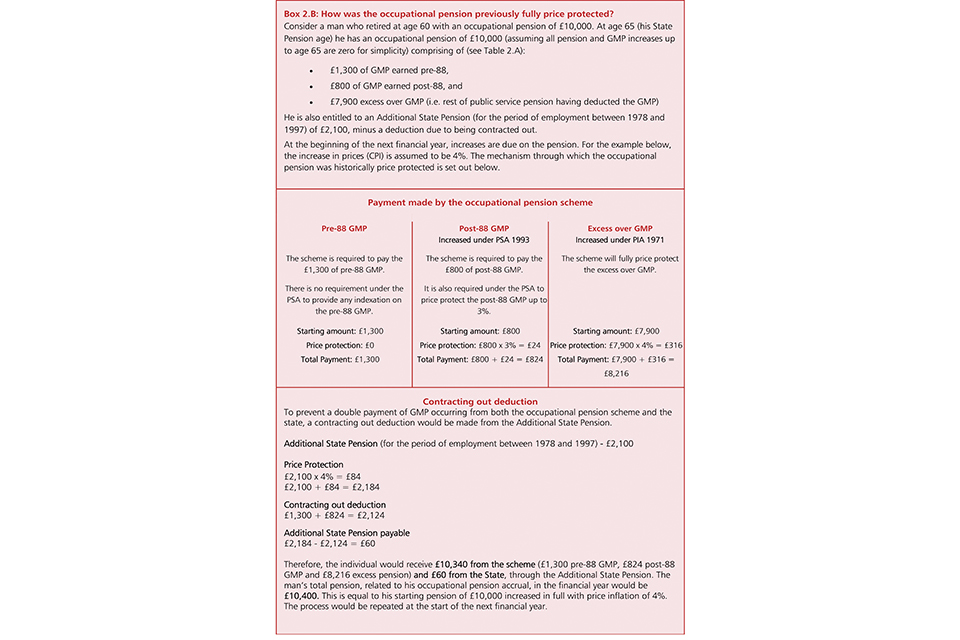

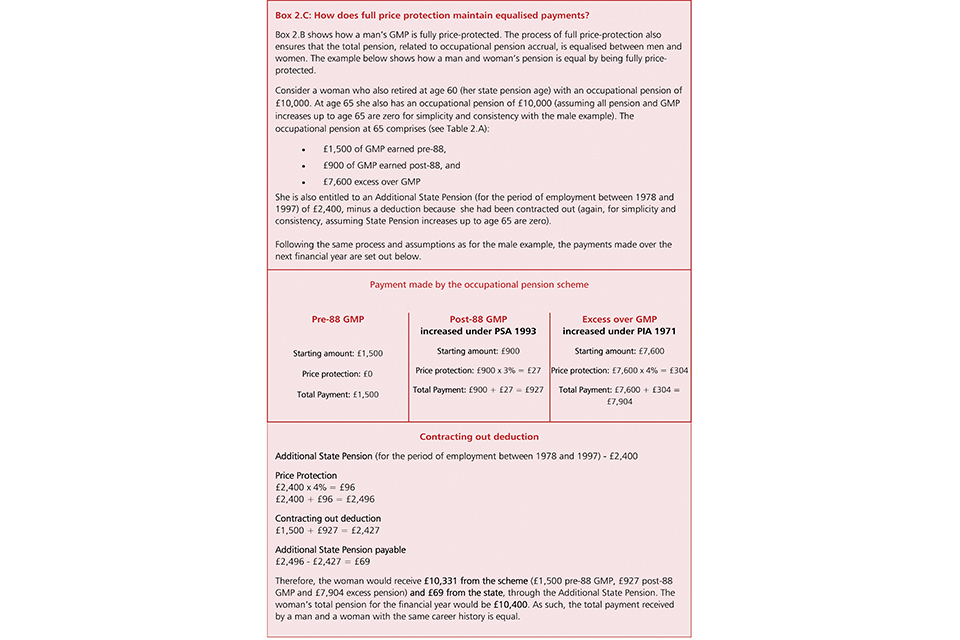

There are also special legislative provisions relating to the indexation of GMPs earned by public service pension scheme members, as set out in the SSPA, to ensure that such a GMP is indexed by no more but no less than the movement in prices. For example, s59 of the SSPA requires the GMP to be deducted from the scheme pension before the scheme indexes the pension under the PIA. Further, s59A also provides for the GMP to be indexed by the scheme where the GMP is not in effect being fully indexed through the AP. Box 2.B provides an example of how the mechanism has worked to provide a fully indexed public service pension payment. Box 2.C provides a further example setting out how this mechanism also provided for a fully equalised payment.

While occupational schemes are required in legislation to index the post-88 GMP, there is no requirement under general occupational pension legislation for the State to provide increases on the GMP. However, as indicated above, as a result of the commitments given by previous governments since the time GMPs were first planned and which were reflected in legislation such as the SSPA (as amended), public servants have a right to full indexation of their public service pensions, including the GMP element[footnote 8]. Some of these commitments were made by government when introducing legislation that would index GMPs in the way outlined in Boxes 2.B and 2.C.

How was the occupational pension previously fully price protected?

How does full price protection maintain equalised payments?

For example, on 20 May 1975, Mr Alec Jones (Minister for Social Security) gave assurances to the House of Commons that the GMP of public service schemes will receive price increases:

will nevertheless provide a guaranteed minimum pension which will receive the cost of living increases under the bill.

On 14 December 1978, Mr Eric Deakins, (Minister in the Department for Health and Social Security) spoke of the Social Security Pensions Act 1975:

the intention in 1975, at the time of the passage of the Pensions Act, was in no way to depart from the principle that all official pensions are to be fully price-protected

section 59(5) was intended to take account of the fact that increases on the notional additional component will be paid by my department as part of the ‘new State pension scheme’[footnote 9], and that those increases will normally be sufficient to cover inflation proofing of the GMP…

Historically, for public servants, because both the GMP and the AP were indexed by the same percentage (as set out in the legislation governing State and public service pensions) the approach set out above and in Box 2.B and Box 2.C led to, effectively, a member of a public service pension scheme receiving a combined payment that was the equivalent of a fully indexed public service pension, including the GMP element. Further, this ensured that, through the combination of the public service pension payment and AP payment, the member received a payment equalised for the effect of the GMP.

After 5 April 1997 the GMP ceased to accrue and this part of the contracting out system was replaced by the Reference Scheme Test[footnote 10].

2.3 Providing for full indexation

In some cases, the system described above did not deliver full indexation for public servants and therefore did not provide a fully equalised pension in payment. Such cases included where the member lived abroad in a country that did not have a reciprocal social security agreement with the UK and therefore the member did not receive increases on their UK State Pension.

In such circumstances, and in order to meet the government’s commitments on indexation, the Treasury direction, made under s. 59A of the SSPA, has provided for the equivalent of the lost indexation on the AP by requiring the public service scheme to fully index the whole public service pension including the GMP.

2.4 Impact of the introduction of the nSP

The introduction of the nSP and abolition of the AP removed the mechanism described above that provided public servants with fully indexed and equalised benefits overall. This impacts members of a public service pension scheme with a GMP earned in a public service pension scheme in two ways:

- they will no longer receive, in effect, indexation of their GMP through the indexation received on the AP

- the previous mechanism designed to avoid unequal payments on account of gender will no longer apply

Our current best estimate is that this could affect approximately 2 million public servants reaching State Pension age over the next 25 years. Beyond 2040, the number of members reaching State Pension age with a GMP will be declining and, in particular, we expect there to be very few members with a pre-88 GMP coming into payment beyond that date[footnote 11]. The government also expects that, beyond 2050, there will at most be only a very small number of public servants reaching SPa with a post-88 GMP (most likely individuals with a survivor’s GMP). This assumption is based on the earliest date members might join the workforce and could accrue post-88 GMP and current plans for increases in State Pension age.

It is possible to determine the maximum amount of GMP (in 2016-17 prices) that could be accrued for members of public service pension schemes who will reach SPa after 5 December 2018.

Those maximum GMP amounts have been derived by considering members of public service pension schemes who:

- are born on 6 December 1953

- worked and had band earnings above the UEL throughout the entire period that GMP accrued

- reach SPa and start to draw their GMP at their State Pension age on 6 March 2019

The maximums (rounded to the nearest £100) are set out in Table 2.B below.

Table 2.B: Maximum GMP (current terms) for those reaching SPa after 5 December 2018

| Male | Female[footnote 12] | |

|---|---|---|

| Pre-88 GMP | £3,000 | £4,500 |

| Post-88 GMP | £1,900 | £3,000 |

| Source: Government Actuary’s Department (GAD) |

If, from GMP age, GMP increases were only provided under the PSA 1993 requirements, a public service pensioner would receive no increases on their pre-88 GMP and increases up to 3% on their post-88 GMP. Table 2.C sets out the estimated value of the cumulative losses, based on the illustrative maximum GMP amounts set out in Table 2.B.

When considering these estimates is it important to note the following:

- actual losses will depend on future price inflation levels and the estimates are highly dependent on the assumed level of inflation – to illustrate this dependency Table 2.C sets out the estimated losses for different levels of CPI

- they assume average projected life expectancy. Actual losses will depend on length of life. Further, these losses do not emerge uniformly over the period during which GMP is paid. Rather, those that live the longest will have the greatest losses as the effect of lost indexation accumulates over retirement

- these estimated losses are sensitive to assumptions made on inherited rights. In the table below inherited rights are assumed to be 50% of the pre- and post-88 GMP for male members and 50% of the post-88 GMP for female members. Total losses below include losses for the member and any potential dependant who could inherit the GMP

- these estimated losses depend on the actuarial assumptions adopted to calculate them – they are based on the current SCAPE[footnote 13] discount rate of 2.8% above CPI with other assumptions in line with the latest actuarial valuations of the public service pension schemes

- these estimated losses are in respect of the illustrative members described in section 2.4 (in the paragraph before Table 2.B), in particular these illustrative members accrued GMPs throughout 1978 to 1997 – the estimated loss for a particular individual will depend on their full earnings history, age and gender and will be lower for those with smaller GMPs

- actual and estimated losses per pound of accrued pre-88 GMP will generally be much higher than actual and estimated losses per pound of accrued post-88 GMP because legislation requires indexation on the post-88 GMP be paid up to a maximum of 3% by the occupational scheme whereas there is no requirement under the 1993 Act to index the pre-88 GMP

Table 2.C: Estimated cumulative GMP loss from indexation (current terms) based on maximum GMP amounts in Table 2.B (including inherited rights)

| Loss / CPI assumption | Male | Female |

|---|---|---|

| 1% | £6,000 | £9,000 |

| 2% | £13,000 | £18,000 |

| 3% | £19,000 | £27,000 |

| Source: Government Actuary’s Department (GAD) |

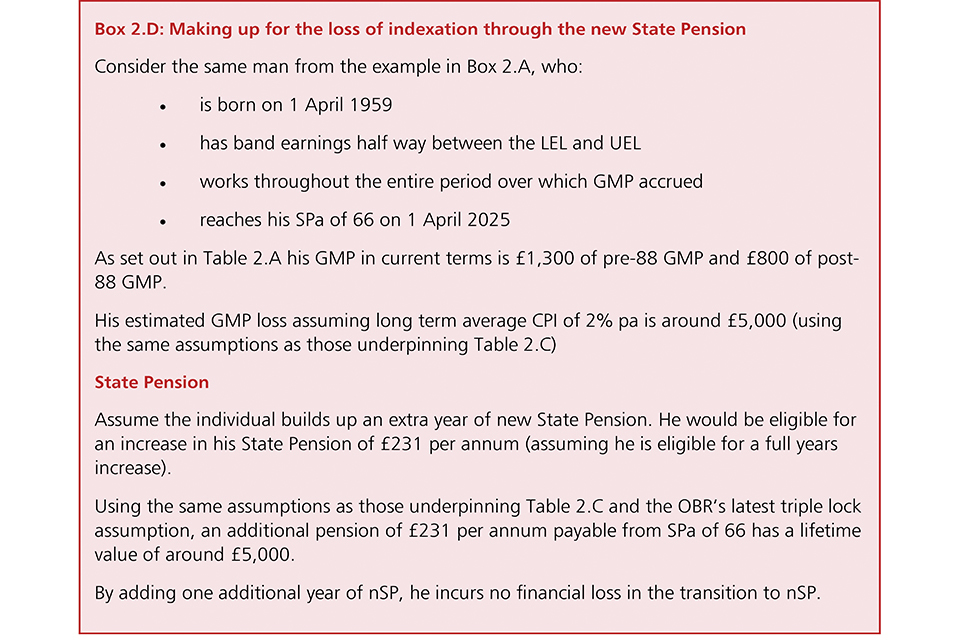

However, this analysis ignores any gains a member may make in the transition to the new State Pension. Many members of public service pension schemes will be better off under the new State Pension system than under the old State pension system. This is because they will make up for estimated losses from their scheme pension that may arise from the abolition of the Additional State Pension by building up extra new State Pension, which could not have been built up under the previous State Pension arrangements. An example illustrating this is set out in Box 2.D below (this is a purely illustrative example to show how one could make up for a loss in indexation):

Making up for the loss of indexation through the new State Pension

The government estimates that an individual would need to add one additional year of new State Pension (that could not have been built up under the previous State Pension arrangements) and have that fully indexed by the triple lock to make up for an estimated indexation loss of £5,000. Where an individual has a larger GMP, their estimated loss would be larger and they would therefore need to add further years of new State Pension in order to make up for their estimated loss. A woman losing, for example, £18,000 would need to add an additional 4 years of new State Pension and have that fully indexed for life in order to make up for losses from no longer receiving full indexation on their GMP. Many public servants who are still in work after April 2016 will build up additional new State Pension.

The scope members have from 2016-17 to add new State Pension qualifying years from paying National Insurance contributions (including in some circumstance voluntary National Insurance contributions) and through National Insurance credits will depend on an individual’s circumstances.

Interim solution

On 1 March 2016 the government announced it would continue to price protect the GMP of public servants who reach SPa between 6 April 2016 and 5 December 2018 (when State Pension ages are equalised). This eases the transition to the nSP for those less able to build up nSP and continues the government’s approach of using the Treasury direction under s. 59A of the SSPA to ensure that past indexation commitments are met and public service pension payments to men and women remain equalised.

Individuals who reach SPa between these dates will have their GMP price protected by the public service pension schemes for life.

This will lead to the GMP of over 100,000 members of public service pension schemes being fully price protected and pension payments continuing to be equalised.

The government’s estimate of the total liability associated with this policy is £0.5 billion across the major public service pension schemes. Set in the context of the total liability for all public service schemes, this is around a 0.05% increase in total liabilities.

2.5 Policy intent

The government, with its overall responsibility for public service pensions policy and provision, intends to bring forward a policy change and any necessary legislation needed in order to prevent an inequality being introduced for public service pension payments to men and women.

The government is considering how to meet the past commitments of previous governments to fully price protect public service pension payments including the GMP of all affected members of public service pension schemes. In particular, given a significant proportion of the affected group will receive higher payments under the nSP system than under the old (analysis from the Department for Work and Pensions estimates that by 2030 almost 80% of UK pension scheme members with GMPs accrued between 9 April 1978 and 5 April 1988 who transition to the nSP will receive higher State pension payments than under the old system over their lifetime), the government is considering whether it is in the public interest to provide indexation payments on the GMP element of scheme pension to all, or only to those individuals who do not gain in the transition to the nSP and would suffer some financial loss over their lifetime.

3. Solutions to indexation and equalisation of the GMP

The two problems being considered in this consultation are complex and closely linked. The government would like to address these two issues in a single policy solution. Key to this will be whether it is in the public interest to use public funds to provide indexation on GMPs earned during membership of a public service pension scheme for all members transitioning to the nSP, including those who, overall, will receive a higher income in retirement than under the old system.

To provide indexation to all members is estimated to cost the public purse around £5 billion over the next forty years. This amount would increase the total liabilities of the public service pension schemes by around 0.5%. Were the government to provide equal payments to men and women only to the extent that this is required under the Equalities Act 2010[footnote 14] and pay scheme GMP indexation (above that required under the PSA) only to those who overall would receive a lower income across scheme and State Pension than expected before the transition to nSP, costs to the public purse might be considerably lower – perhaps by 70%. It is therefore reasonable for the government to ask these difficult questions relating to the property right to full indexation which members of public service schemes have as a result of the past commitments of previous governments.

The remainder of this consultation considers three broad policy options for addressing the joint challenge of indexation and equalisation of scheme pension to take account of the GMP:

- case-by-case calculations

- extension of the interim solution

- conversion of the GMP to scheme benefit

These options each have different outcomes for members of public service pension schemes. All three avoid the introduction of unequal benefits. However, while option one would provide a payment to offset the loss of AP indexation only to those who are worse off in the transition to the nSP, options two and three will provide all members with a payment equivalent to the loss of indexation on the AP.

As set out in the first chapter, we would ask respondents to the consultation to consider each of these options against the following tests:

- does the policy proposal ensure that affected members are at least as well off as they would have been, had the nSP not been introduced

- does the policy proposal consider fairness to taxpayers in general

- does the policy proposal avoid the unequal payments to men and women that would otherwise result from the abolition of AP, and minimise future legal risk to the public service pension schemes

- is it cost-effective and does it minimise future fiscal risk to public service pension schemes from data and administrative errors

- is the policy proposal a long-term solution that supports the government’s principles of transparency and greater understanding of pension saving

3.1 Case-by-case approach

This method takes into consideration any gains made from the transition to the nSP when applying indexation to the public service pension scheme. Where the member has lost financially, the member will be compensated up to the value of the loss of indexation only. This method does not provide full indexation to all members.

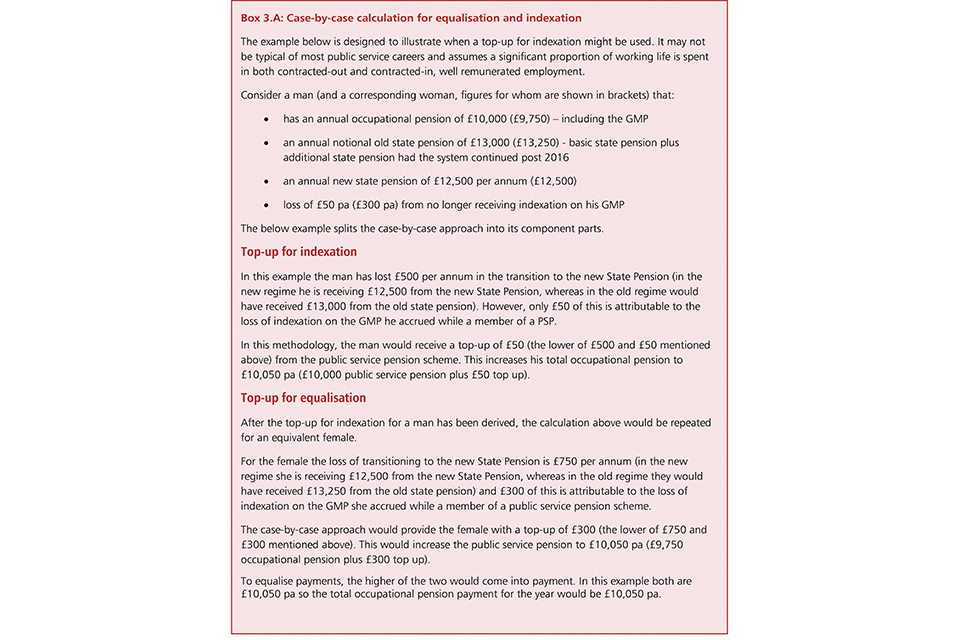

The case-by-case approach considers combined payments from both the State Pension and the public service pension schemes before topping up the public service pension to allow for the loss of indexation through the abolition of AP. A further top up may also be required to avoid unequalised payments between men and women. Therefore the approach could be viewed in two stages: top-up for the loss of indexation and a top-up for equalisation.

Top-up for indexation

The first stage of the case-by-case approach would estimate, on an annual basis, whether the member is expected to receive a higher or lower income in any single year from the combination of their nSP and public service pension than under the old system.

For those members who have a lower income under the new system, a top-up amount is derived which compensates for the loss of indexation on the AP only (i.e. it will not compensate for other losses in the transition to the nSP). A value for this payment is derived by the scheme.

Top-up for equalisation

A similar calculation is then done for a theoretical member of the opposite sex. This calculation determines what the member would have been entitled to, were they the opposite sex. A second top-up amount is derived.

Whichever of the two top-up amounts is higher, for a male or female, is then paid to the member. These two stages are then repeated on a yearly basis.

Box 3.A presents an illustrative calculation for a single year, where the losses a member experiences from no longer receiving indexation on the AP is compensated for. This approach would reduce the amount the scheme has to pay compared to providing full indexation as it recognises and accounts for the gains made by the member in the transition to the new State Pension. The calculation in Box 3.A would be repeated for this individual on a yearly basis.

An example illustrating when a top-up for indexation might be used

3.2 Costs and implementation – case-by-case

The Government Actuary’s Department estimate the increase in liabilities is 30% of the total cost of full indexation (i.e. around £1.5 billion). All other things being equal this would increase employer contributions to the schemes. Following government policy on employers meeting the costs of employment, these costs would fall to the public service pension scheme and therefore to scheme employers. This estimate, which is approximately a 0.15% increase in the total liabilities of the public service pension schemes, is based on a long-term assumption for CPI growth of 2% per annum. Whilst other factors are relevant, the estimate is most sensitive to this assumption.

In order to deliver this option, the government expects some legislative changes would be needed. Government would need to consider what form any additional payment would take and provide for such a payment in legislation, including in the regulations setting out scheme rules. The Treasury have the power to make an order making consequential, incidental or supplementary provision in connection with the reform of the state pension. This power extends to making amendments to primary legislation, and so could be used to amend the primary legislation governing the indexation of public service pensions[footnote 15].

Administratively, this policy would require public service pension schemes to undertake a significant and ongoing project to run calculations on an annual basis and amend the value of the pension in payment each year depending on the outcome of those calculations. This would make it difficult for members of such schemes to track the payments they could expect over time or predict future payments. The development of a system to deliver this would be a significant undertaking for each scheme and would require GMP data for each member to have been reconciled as part of the Scheme Reconciliation Service[footnote 16].

The data required to equalise the payments is available via the HMRC GMP Checker. This tool provides, at a member level, the GMP of the member and the opposite-sex GMP of an equivalent member with the same service history[footnote 17]. However, schemes currently have no administrative process in place to request data from the GMP Checker on an annual basis, compare the results or adjust the member’s benefit. As such, this would require a wholly new process to be implemented and invested in at scheme-level. In addition, the government would need to consider further administrative updates to the GMP Checker, including to allow bulk queries of the GMP Checker and an extension of current capabilities in relation to opposite sex calculations for those with service only before May 1990.

The complexity of the calculation and the administrative process is greatly increased where the calculation takes into account the new State Pension gains made by a member. In particular, a broad range of assumptions are needed in order to estimate the value of the old State Pension the member would have received. This would require public service pension scheme administrators to keep track of historical social security rules for four or five decades after the policy had changed. This would add significant complexity to the work of pension administrators and goes against one of the core principles of moving to the new State Pension – simplicity.

In addition, to calculate the level of new State pension a member is receiving, public service schemes would require access to DWP records (or agree a situation in which DWP transfer the information). That would require further burdensome administrative changes that are in tension with the government’s wider aims of decoupling the State and occupational pension scheme provision.

Question 2

Do you consider the case-by-case method to be an appropriate method to ensure that the abolition of AP does not create new gender inequality?

Question 3

Does the case-by-case method adequately honour the previous commitment by government to fully index the GMP of public service scheme members?

3.3 Wider options

If the government wanted to continue the general approach outlined in sections 2.2 to 2.3 for those reaching SPa after 5 December 2018 there are two options available. This first is to extend the interim solution introduced for those reaching SPa after 5 April 2016 and before 6 December 2018. The second is to convert the GMP into scheme benefit on a trivial basis. Both these options result in members of public service pension schemes with a GMP receiving indexation on the GMP from the scheme in all cases, including where they can otherwise expect to gain financially in their transition to the new State Pension.

As a result, no member of the public service pension schemes with a GMP would lose any indexation in the transition to the new State Pension. Based on DWP analysis, by 2030 almost 80% of those UK pension scheme members with GMPs who transition to the new State Pension are expected to receive higher State Pension payments than under the old system over their lifetime. As such, a large proportion of affected members could receive a higher income over their lifetime under the new system than under the old system.

3.4 Extending the interim solution

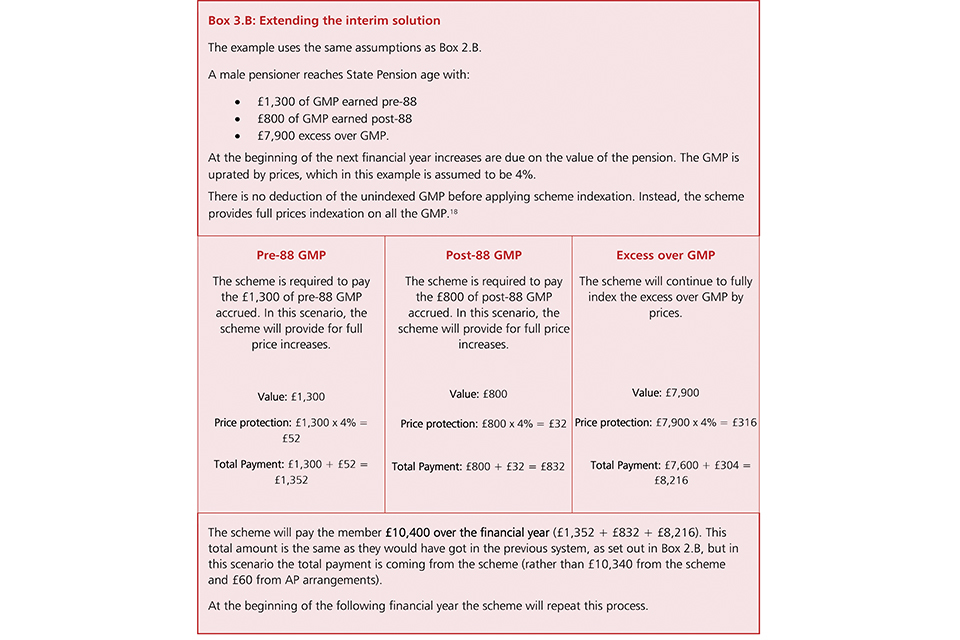

Extending the interim solution would mean that for those reaching SPa after 5 December 2018 the public service pension scheme would provide full indexation of the GMP accrued while in employment, for the members’ lifetime and that of any surviving dependent or spouse entitled to a pension. The example in Box 3.B sets out how this would work.

In order to deliver this option, the government expects some legislative changes would be needed. Government would need to consider what form any additional payment would take and provide for such a payment in legislation, including in the regulations setting out scheme rules.

An example of extending the interim solution

Footnote[footnote 18] included in Box 3.B.

3.5 Costs and implementation – extending interim solution

The Government Actuary’s Department estimates the increase in liabilities of providing full indexation to be in the region of £5 billion. This is an uncertain figure, which is dependent on a range of assumptions including the long-term rate of CPI inflation.

As with the costs of case-by-case these costs would be met by scheme employers and would, all other things being equal, lead to an increase in the employer contribution rates paid.

Administratively, the government believes this is one of the least complex options under consideration. Prior to April 2016, there existed a range of scenarios in which the public service pension scheme would provide full indexation to members where the Additional State Pension uprating rules did not apply or work. This option would widen the scope of the original policy and therefore, while a significantly higher number of members would need to be processed in this way, the administrative tools to deliver this policy exist currently.

It is, however, worth noting that public service pension schemes would continue to be required to administer all legislation related to GMP under this methodology for the next four or five decades. That would lead to significant, ongoing administrative burdens for schemes, despite having little or no impact on the payment to the member.

According to analysis published by the Department for Work and Pensions, by 2030 almost 80% of those reaching State Pension age with a GMP accrued between 1978 and 1987 will gain in the transition to the new State Pension. These estimates exclude gains from the introduction of the triple lock indexation of the basic State Pension from 2011 which are included in the new State Pension Starting Amount. Under this model, such members would receive payments from the State through the new State Pension that would make up for losses from no longer receiving indexation of the AP and also receive indexation through the public service pension scheme on their GMP. For those members, total income from the public service pension and from the State Pension would exceed that which would have been paid to the member under the old system.

Question 4

Do you consider full indexation to be an appropriate method to avoid the unequal pension payments to men and women that the abolition of the AP would otherwise lead to?

Question 5

Do you consider full indexation to be an appropriate method through which to meet past indexation commitments to men and women in employment in the public services between 1978 and 1997?

3.6 Conversion of the GMP

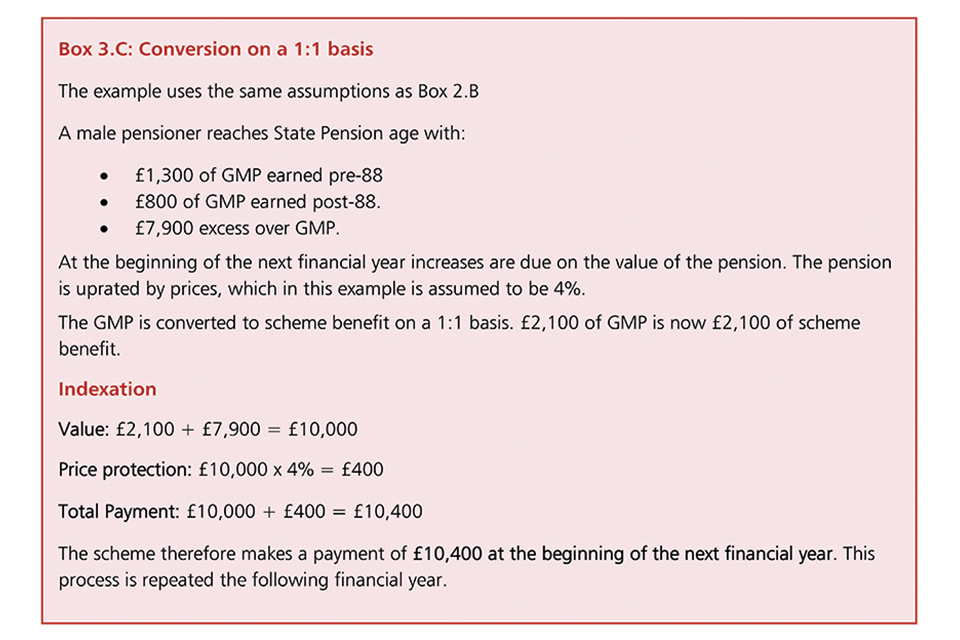

An alternative methodology is conversion of the GMP into an ordinary scheme benefit on a 1:1 basis. This would apply to all active and deferred members of the schemes who reach State Pension age after 5 December 2018. This would not apply to those members already in receipt of their public service pension who reach or have reached SPa prior to 6 December 2018 and who already have fully indexed and equalised pension benefits through a combination of the State Pension and scheme pension.

For the member the 1:1 method is equivalent to the public service pension effectively providing full indexation of the GMP. GMP therefore becomes a scheme benefit, i.e. each £1 of GMP becomes £1 of scheme benefit. This approach would ensure no member loses any indexation in the transition to the new State Pension and, as with full indexation, those who can expect to gain financially in the transition to the new State Pension receive a higher income than they would have expected prior to the introduction of the nSP. Box 3.C sets out how this method would work.

Rather than convert on a 1:1 basis, the government could choose to convert on an actuarially equivalent basis as set out in the government’s other consultation on this issue “Consultation on the GMP equalisation methodology”, which is in respect of pension schemes outside the public services.

The government, as the responsible authority for public service pension schemes, does not consider the option set out in the other consultation viable for the majority of the public sector. While the method would equalise the pensions of public servants, it would not fulfil the government’s obligations to index the occupational pensions of public servants.

Though government is considering whether it needs to maintain the rights to full indexation of the GMP, it does not believe an actuarially equivalent conversion method for equalisation of the GMP such as DWP are consulting on would be sufficient to identify and compensate for the losses for those who do not gain in the transition to the nSP. It is for private sector employers to conclude if they are meeting any commitments to index scheme pensions they may have previously made, whether directly as an employer or through the pension scheme rules.

An example of conversion on a 1:1 basis

3.7 Costs and implementation – conversion

Where conversion is done on a 1:1 basis, the increase in liabilities are broadly equivalent to providing full indexation and therefore the cost to public service employers could be broadly similar to those for full indexation. The Government Actuary’s Department estimate that this increase in liabilities would be in the region of £5 billion.

As with full indexation, these costs would fall to the public service pension scheme and all other things being equal would increase the cost of employer contributions to the schemes.

Converting the GMP would require public service pension schemes to undertake a once and done programme of work to convert all GMPs to a scheme benefit. Converting on a one-to-one basis would be less burdensome on administrators but would still be a significant undertaking and would require, at a member by member level, data to have been reconciled as part of the HMRC-led Scheme Reconciliation Service.

The tools to undertake this exercise do not currently exist and would need to be developed by the scheme administrators, supported by the government. This would need to be undertaken over the next two years, in order to allow the scheme administrators to commence a rolling programme of work that ensured those reaching SPa on or shortly after 6 December 2018 had their GMP converted first. The government would also need to consider how to treat those in receipt of an occupational pension but below SPa under this model. In the long-term, conversion would reduce administrative complexities by removing the need to track the GMP or follow GMP legislation, for example in relation to GMP increments for those individuals who reach SPa after 5 December 2018.

Question 6

Do you consider conversion on a 1:1 basis to be an appropriate method to avoid the unequal pension payments to men and women that the abolition of the AP would otherwise lead to?

Question 7

Do you consider conversion on a 1:1 basis an appropriate method through which to meet past indexation commitments to men and women in employment in the public services between 1978 and 1997?

Question 8

Under this methodology, how should government treat those in receipt of a public service pension but below SPa?

Question 9

Do you agree that conversion on an actuarial equivalent basis does not meet past indexation commitments to men and women in employment in the public services between 1978 and 1997?

Question 10

Which of the three policy options outlined in section 3 best match the tests set out in the third paragraph in section 1.2?

4. Wider considerations

4.1 Alternative solutions

The government recognises there may be alternative solutions to deliver the government’s objectives in relation to indexation and equalisation of the GMP. For example, the implementation of a time-limited ‘full indexation’ approach, (i.e. an extension of the interim solution), paired with removal of the 3% cap on indexation on post-88 GMP.

The government is interested in views from respondents to this consultation on whether there are alternative options not considered in the main body of this consultation document which would meet the government objective of avoiding the unequal pension payments to men and women that the abolition of the AP would otherwise lead to, and which at a minimum, protects those who lose out in the transition to the new State Pension, as a result of no longer receiving, in effect, indexation on their GMP.

Question 11

What are the alternative methodologies the government could consider?

4.2 Impact on the wider public sector and private sector

The government recognises that, for some private sector organisations and wider public sector organisations, the way any of these policy options are implemented is relevant in determining whether it would impact on their pension scheme. We are keen to hear from such organisations and representatives of their scheme members and pension fund trustees. We wish to understand: how their rules align to those of the public service pension schemes; whether the government should take action to avoid a read across, and if so what specific actions they feel the government could take to avoid direct implications for their pension schemes, including which policy options would be expected to directly require changes to such schemes.

Question 12

How could the delivery of any of the policies in the consultation impact wider public sector or private sector schemes who are not ‘official pensions’ under the PIA 1971?

Question 13

If wider public sector or private schemes who are not ‘official pensions’ are impacted by any policy set out in the consultation, why were the pensions designed to mirror official pensions originally?

Question 14

Should the government take action to avoid any read across between private sector schemes and any policy announced?

Question 15

Are there actions the government could take to restrict the impact on wider public sector or private sector pension schemes who are not ‘official pensions’ under the PIA?

Question 16

Why should government allow for members of schemes whose rules mimic/mirror those in the public services, to be deprived of the benefit of those rules?

4.3 Wider GMP issues

The government is also interested in understanding whether there are wider issues relating to the GMP that should be considered as part of this consultation on indexation and equalisation of the GMP. Views from consultees on such issues are welcome.

Question 17

Are there wider issues relating to the GMP that are not mentioned here and which should be considered when the government decides its policy?

5. Summary of questions

Question 1: Which pension schemes (public and private) follow the PIA 1971 and SSPA and therefore may be affected by a policy change?

Question 2: Do you consider the case-by-case method to be an appropriate method to ensure that the abolition of AP does not create new gender inequality?

Question 3: Does the case-by-case method adequately honour the previous commitment by government to fully index the GMP of public service scheme members?

Question 4: Do you consider full indexation to be an appropriate method to avoid the unequal pension payments to men and women that the abolition of the AP would otherwise lead to?

Question 5: Do you consider full indexation to be an appropriate method through which to meet past indexation commitments to men and women in employment in the public services between 1978 and 1997?

Question 6: Do you consider conversion on a 1:1 basis to be an appropriate method to avoid the unequal pension payments to men and women that the abolition of the AP would otherwise lead to?

Question 7: Do you consider conversion on a 1:1 basis an appropriate method through which to meet past indexation commitments to men and women in employment in the public services between 1978 and 1997?

Question 8: Under this methodology, how should government treat those in receipt of a public service pension but below SPa?

Question 9: Do you agree that conversion on an actuarial equivalent basis does not meet past indexation commitments to men and women in employment in the public services between 1978 and 1997?

Question 10: Which of the three policy options outlined in section 3 best match the criteria set out in the third paragraph in section 1.2?

Question 11: Are there alternative methodologies the government could consider?

Question 12: How could the delivery of any of the policies in the consultation impact wider public sector or private sector schemes who are not ‘official pensions’ under the PIA 1971?

Question 13: If wider public sector or private schemes who are not ‘official pensions’ are impacted by any policy set out in the consultation, why were the pensions designed to mirror official pensions originally?

Question 14: Should the government take action to avoid any read across between private sector schemes and any policy announced?

Question 15: Are there actions the government could take to restrict the impact on wider public sector or private sector pension schemes who are not ‘official pensions’ under the PIA?

Question 16: Why should government allow for members of schemes whose rules mimic/mirror those in the public services, to be deprived of the benefit of those rules?

Question 17: Are there wider issues relating to the GMP that are not mentioned here and which should be considered when the government decides its policy?

-

Based on a CPI assumption of 2%. ↩

-

If they, as an overall group, are comparable to the totality of members of contracted out DB schemes during that period. ↩

-

In Barber v Guardian Royal Exchange the European Court of Justice found that occupational pensions are deferred pay, and so pension payments between men and women must be equal. Section 67 of the Equalities Act 2010 gives effect to this at the domestic level. The legal requirements relating to the terms on which members of an occupational pension scheme are treated do not apply in respect of pensionable service before 17 May 1990. ↩

-

On a SCAPE basis. ↩

-

When members are transferred out of the scheme, the scheme obtains the GMP of the individual. ↩

-

The number of complete tax years in the members’ working life from the tax year when the member reaches age 16 to the tax year before the member reaches GMP age (age 60 for a women and age 65 for a man). Section 14 of the Pension Schemes Act 1993 provides the full details. ↩

-

Though the member was contracted-out, they maintained an entitlement to Additional State Pension minus a deduction because they were contracted-out. ↩

-

This continued previous entitlement to full indexation of the public service pension under the Pensions (increase) Act 1971. ↩

-

This reference to new State Pension refers to what was then the new State Pension in 1975, rather than the nSP as at April 2016. ↩

-

Detailed in section 12B of the Pension Schemes Act 1993. ↩

-

Individuals with only a post-88 GMP receive indexation up to 3% from the pension scheme and, as such, will be negligibly affected by the introduction of the nSP where CPI remains under 3%. ↩

-

The relative differences between male and female GMP amounts are much more significant in Table 2.B than in Table 2.A. This is because the amounts in Table 2.A are in respect of a man and woman who are both younger than GMP age, so do not include GMP deferment increments of 1/7th per cent a week. ↩

-

The government has developed a methodology for setting contributions in the absence of a fund of assets and this is called the Superannuation Contributions Adjusted for Past Experience (SCAPE) methodology. The discount rate used in this valuation methodology is called the SCAPE discount rate. ↩

-

See the footnote to [para 1.7] above. ↩

-

See s. 53 of the Pensions Act 2014. ↩

-

HMRC launched the scheme reconciliation service to help pension administrators reconcile their records for contracted-out members against HMRC records. ↩

-

For those members with service post-1990 only. As such, some development of the GMP Checker would be needed to deliver this for those with service before 1990. ↩

-

Note, this is different to the methodology of the interim solution, which was provided for under the powers in s59A of SSPA 1975. ↩